In a move that can hamper the growth of renewable energy, a few state electricity regulators are mulling to curtail the concessions offered to consumers who install mini, micro or small power grids to produce power by using the abundant and clean renewable resources. The proposed move aims at tweaking the net metering policy with the introduction of a ‘net billing’ mechanism that will reduce the concessions offered to consumers only to up to a maximum limit set by the regulator.

In its draft Grid Interactive Rooftop Renewable Energy Generating Systems Regulations 2019, which is open for public consultations up to 18 November, as well as the explanatory memorandum thereto, the Maharashtra Electricity Regulatory Commission (MERC) has presented an illustration of the net billing mechanism that will significantly alter the complexion of the existing net metering policy. The draft has proposed to set a cap of 300 units on the renewable component. For example, in a billing period, if the consumption is 850 units and renewable energy generation is 500 units, then the first 300 units generated will be ‘net out’ against consumption. The consumer shall be billed for 550 units, after 300 units are ‘netted out’ from the total of 850 units generated. The balance, i.e., 200 units (500 – 300) shall be purchased by the DISCOM. In a scenario where power generation exceeds consumption, the consumer will be strapped with a bill for any differential in the units with the offset being 300 units. Thus, if the consumption is 250 units and renewable energy generation is 500 units, only 50 units (300 – 250) will be considered as “banked energy” in subsequent billing periods. The balance generation, i.e., 200 units (500 – 300) shall be purchased by the DISCOM.

Under the existing net-metering arrangement, if the units of electricity exported to the grid exceeds the import of units, the difference is carried forward to the next billing period as ‘credited’ units. In a reverse scenario where electricity units consumed from the grid are more than the units fed to the grid from the renewable system, the bill would be raised after taking into account the credited units of electricity. At the end of each financial year, unadjusted net credited units of electricity limited to 10 percent of total units generated during the year are purchased by the DISCOM at the approved power purchase price. Under the proposed policy, in either of the two scenarios, the difference is sought to be capped at 300 units.

The MERC has admittedly drafted this policy revision on the basis of the recommendations made in the “Report on Metering Regulation and Accounting Framework for Grid Connected Rooftop Solar PV In India” released by Forum of Regulators (FoR) in April 2019. The Forum consists of Chairperson of Central Electricity Regulatory Commission (CERC) and chiefs of State Electricity Regulatory Commissions (SERCs). As such, several states, including Gujarat and Madhya Pradesh, are also reported to have begun considering such a policy transition.

A typical net metering diagram

Net metering was introduced by various states to make distributed renewable energy more accessible and economical. Despite the benefits of the net metering policy that not only reduces the load on the already stretched grid power, but thereby also assists the country in reducing greenhouse gas emissions, its implementation has not received desired traction. Many states have expressed reluctance in encouraging rooftop solar PV and other renewable energy options, as they fear their DISCOMs losing out on their profitable customer base. MERC’s explanatory memorandum, too, endorses this concern. It explains, “…increased GRPV penetration may result in loss of revenue derived from sales to subsidising categories, and other consumers might have to bear the burden for compensating the DISCOMs. The variability of solar generation might also put grid stability at risk and may pose challenges to the state load despatch centres when more and more Grid-connected Rooftop Solar PV (GRPV) projects are connected to the grid.” Hence, the memorandum explains, there is a need to “modify and balance the regulatory framework to facilitate scaling up to the next level of GRPV installation, in order to achieve the national target of 40 GW.” It, however, does not explain the reasons for capping the renewable power and grid power difference at 300 units and how such a limit will help in achieving the country’s renewable energy aspirations.

Limiting the export-import difference can potentially rob the net-metering policy of its biggest attraction, i.e. to ensure savings on electricity bills and also reduce the consumers’ dependence on the highly erratic grid power supply in many cities and towns across India. For consumers, such a limit will also extend the breakeven period and the time taken to accrue return on investment. Certain stakeholders view this policy revision to halve the consumer benefit and double the breakeven period, which is generally about four years. It will impact the financially distressed SMEs and dent the sector’s job generation potential.

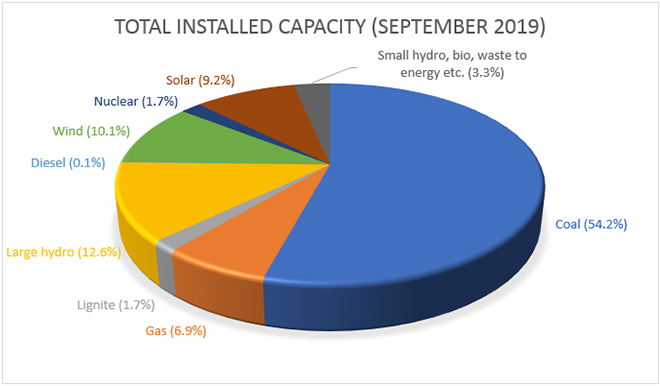

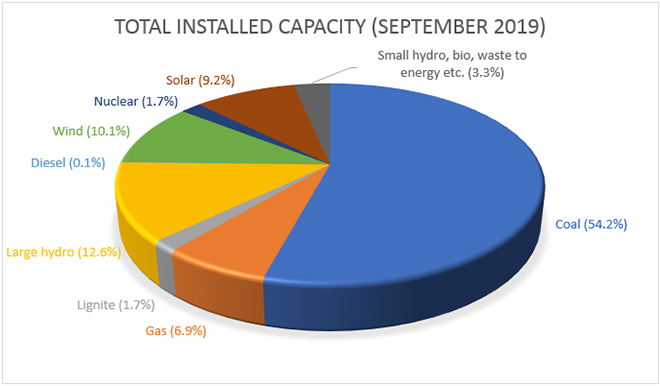

According to the Mercom’s India Solar Project Tracker, renewable resources (including large hydro) contributed 130.68 GW to the national energy mix, i.e. 35.7 percent of India’s total installed power capacity. Large hydropower projects contributed 10.1 percent of the country’s total installed power generation capacity. Nearly 10.1 percent (36.9 GW) of the overall installed power capacity mix came from wind, while the share of solar grew from 8.73 percent at the end of June to 9.2 percent at the end of September 2019. Other renewable sources including small hydropower and biomass contributed 3.3 percent of the total installed power capacity.

In Maharashtra, till December 2018, around 266 MW of grid-connected rooftop solar PV (GRPV) systems have been installed, with the Maharashtra State Electricity Distribution Company Ltd. (MSEDCL) registering a bulk of them. MNRE data on grid-interactive renewable power state-wise installed capacity released on 10 October 2019, shows that of the 2,238.32 MW total rooftop solar installed national capacity, Gujarat leads the way with 402.62 MW followed by Karnataka at 221.26 MW. Maharashtra is in the third place with 213.21 MW. It has been reported that 60 percent installed rooftop solar capacity of Maharashtra comes from the key cities including Mumbai Metropolitan Region, Pune, Nagpur, Nashik and Aurangabad.

SOURCE: MERCOM India Research, MNRE and Ministry of Power statistics

SOURCE: MERCOM India Research, MNRE and Ministry of Power statistics

According to a study, ‘Estimating the rooftop solar potential of Greater Mumbai’ conducted in 2017 by ORF, IIT Bombay, Bridge to India and IEEE Bombay chapter, Mumbai alone has the potential to generate 1.72 giga watt peak (GWp) rooftop solar power. This means solar energy can take care of half of Mumbai’s power needs, which has an annual demand of around 3.4 GW. Currently, the city generates only 5 MWp solar energy, merely 0.3% of its estimated potential.

As trends suggest, urban areas will fuel India’s rooftop solar dream, while rural areas will mainly account for the other key renewable sources such as small hydro, wind, biomass etc. Any hasty revision of the net metering policy by states will surely arrest the growth of renewable energy India – particularly rooftop solar.

While India still has an installed renewable energy capacity of only around 80 GW, the government has initiated efforts to achieve 175 GW capacity (without taking into account large hydro) by 2022. Of this, 62.5 percent, i.e. 100 GW is expected to come only from solar projects – both ground-mounted and grid-connected – in 60:40 ratio. Addressing the 17th International Renewable Energy Agency (IRENA) council meet in Abu Dhabi in June 2019, MNRE secretary Anand Kumar revealed India’s even more ambitious plan to set up 500 GW of renewable energy capacity by 2030.

The Economic Survey 2018-19 estimates that India will need an additional investment of USD 80 billion in renewable plants for up to 2022. Investment up to 2030 is pegged at around USD 250 billion – giving an annualised investment opportunity of over USD 30 billion for at least the next decade. The public exchequer cannot solely meet this voluminous requirement. Therefore, any move that disincentivises off-grid renewable energy generation will come at a cost too heavy to bear.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

SOURCE: MERCOM India Research, MNRE and Ministry of Power statistics

SOURCE: MERCOM India Research, MNRE and Ministry of Power statistics PREV

PREV