In the last week of October 2020, the Union Government stated that taxes on petrol and diesel will be increased to mobilise additional revenue for Covid-19 relief. Even if there is no immediate change in retail prices as clarified by oil companies, the likelihood of a tax increase after the festive season is high given that there is uncertainty over oil demand revival following the lockdowns in European countries in the short term. The IEA (International Energy Agency) does not see a revival of demand until late 2021, even with a successful vaccine.

Source: Petroleum Planning & Analysis Cell (PPAC) Various reports

Source: Petroleum Planning & Analysis Cell (PPAC) Various reports

Since 2015, the Union Government has used the reduction in crude prices to increase taxes and effectively keep the retail prices of petrol and diesel within a narrow band. If the fall in global crude oil prices in the last five years were fully passed through to consumers, the retail price of refined products would have been lower by Rs 0.50/litre (l) for every $1/b reduction in crude prices. In other words, every $1/b reduction in crude price is an opportunity to increase taxes by Rs 0.50/l. The notable issue here is that the burden of tax increase, so far, has fallen more on diesel than on petrol. In March 2014, a litre of diesel was cheaper than petrol by about Rs 15/l on average across the country. Taxes accounted for 31 percent of the retail price of petrol and about 19 percent of the retail price of diesel respectively.

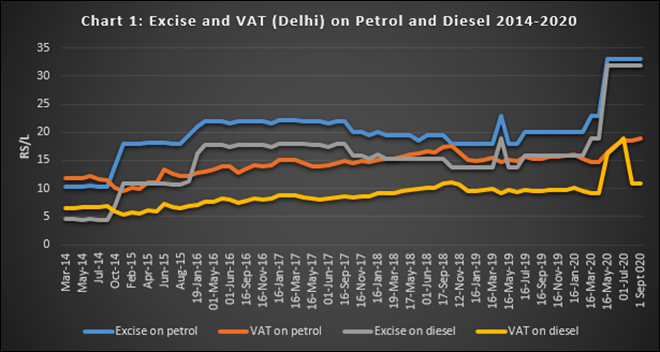

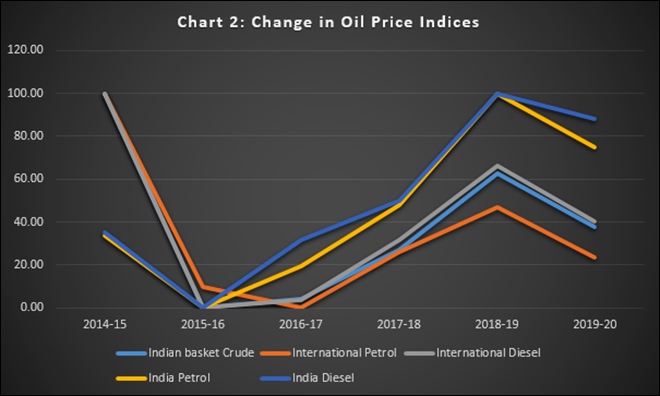

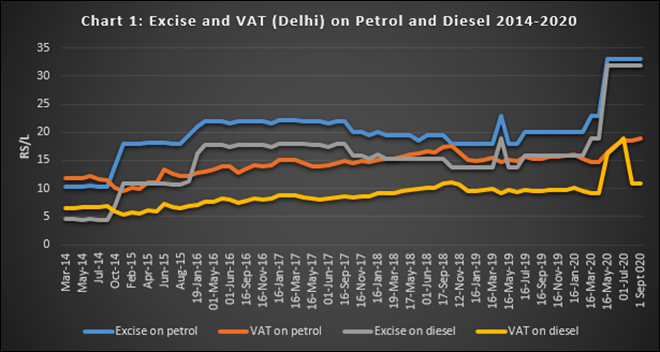

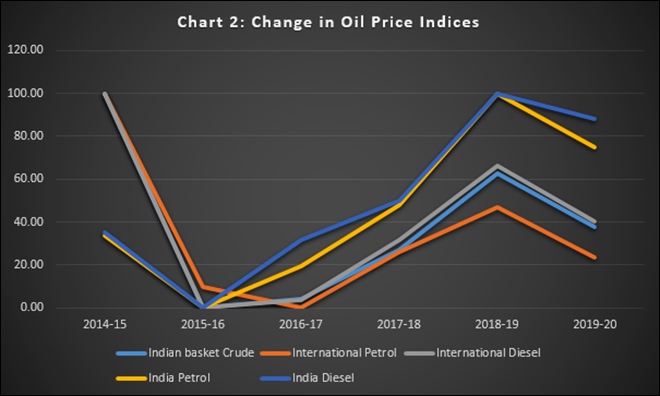

In June 2020, the tax component on petrol and diesel was at 69 percent and 58 percent respectively. The retail price of diesel exceeded the retail price of petrol in Delhi and the discount on the price of diesel was less than a rupee or two compared to the retail price of petrol across the country. Excise (Union tax) on petrol increased by over 200 percent from about Rs 10.38/l in March 2014 to Rs 32.98/l in September 2020. For diesel, the increase was a more dramatic 600 percent in the same period from Rs 4.58/l to Rs 31.83/l (chart 1). Increase in value added tax (State tax) was far less steep in most States. For petrol, VAT increased by roughly 60 percent from Rs 11.9/l to about Rs 18.94/l and for diesel VAT increased by about 68 percent from Rs 6.41/l to Rs 10.8/l in the same period in Delhi. The fall in the price of crude (Indian basket) was a modest 28 percent from $84.16/b in 2014-15 to $60.47/b in 2019-20 (chart 2).

Source: PPAC calculated from various reports

Source: PPAC calculated from various reports

India is not exceptional in taxing petroleum products. The OPEC (Organisation of Petroleum Exporting Countries) has pointed out that OECD (Organisation for Economic Co-operation and Development) members took 49 percent of the revenue from a litre of oil sold in 2018 in taxes while OPEC earned only 31 percent from the crude used. Among OECD countries, the UK earned the most tax at 61 percent while the USA earned the least at 20 percent.

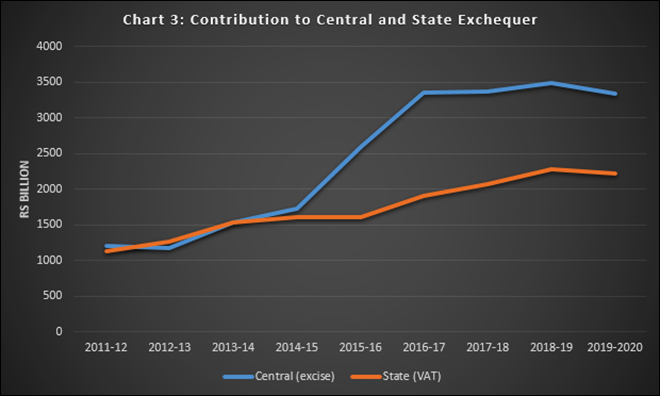

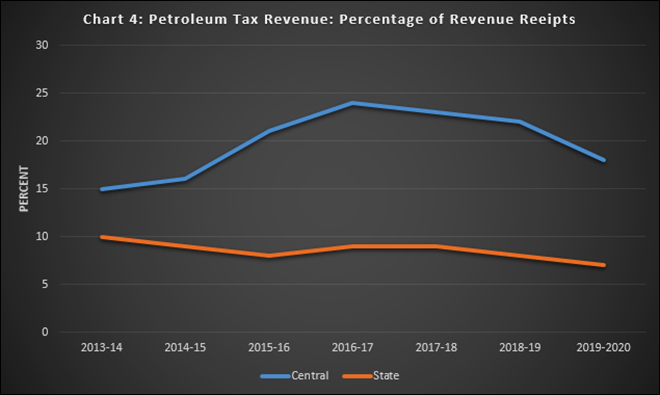

Growth in Tax Revenue

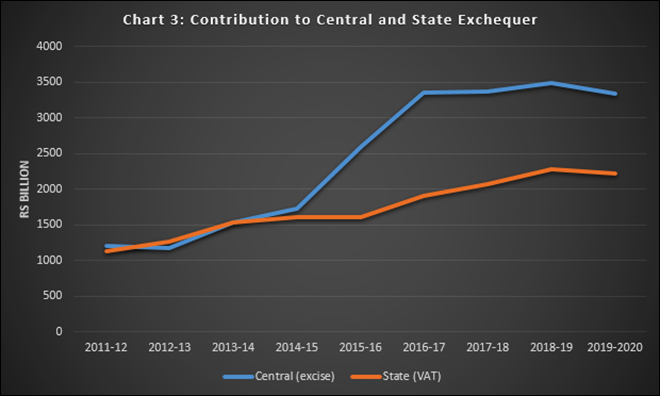

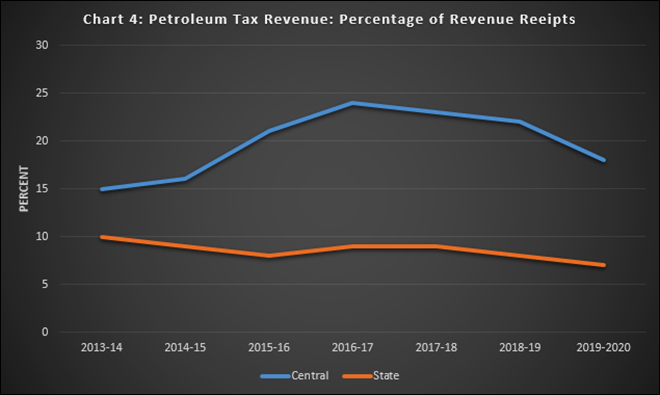

The importance of tax revenue from the petroleum sector in India has substantially increased after the introduction of the goods and services tax (GST). On average, petroleum taxes contributed over 2 percent of GDP during in the last decade. Excise duty from petroleum products alone now contributes 85-90 percent of all excise collected by the Union Government, accounting for roughly 24 percent of indirect tax revenue in 2018-19. Excise revenue from petrol and diesel increased by over 94 percent from about Rs 1720 billion to about Rs 3343 billion from 2014-15 to 2019-2020 for the Union Government. For the State Governments the increase in VAT revenue was about 37 percent from Rs 1605 billion to Rs 2210 billion (chart 3&4).

Source: PPAC, Various Reports

Source: PPAC, Various Reports

Economists and environmentalists who have advocated rationalisation of excise on diesel to reduce the perverse incentive to consume diesel (in high end passenger vehicles for example) and also to reduce pollution, could not have asked for more. But this is an unusual time of economic stagnation and an increase in excise on diesel and petrol may have unintended consequences.

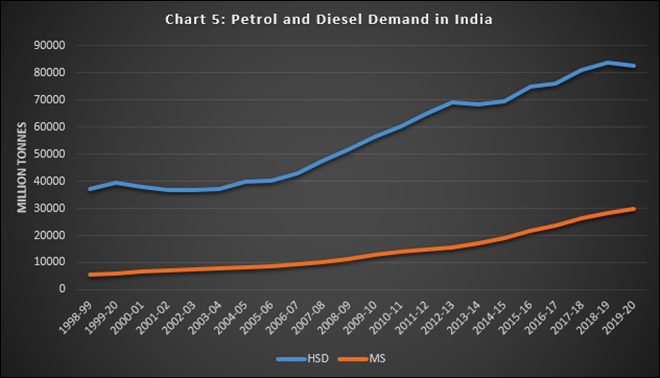

Economic impact

In India, growth in demand for diesel has closely tracked growth in the index of industrial production (IIP). When excise on refined petroleum products was reduced as part of the stimulus package after the financial crisis in 2008-09, economic growth picked up along with IIP, which translated into growth in demand for diesel. In 2014-15 to 2017-18 when the retail price of diesel averaged about Rs 54/l, demand grew at about 9 percent per year closely tracking IIP whereas demand for petrol grew at about 3.5 percent.

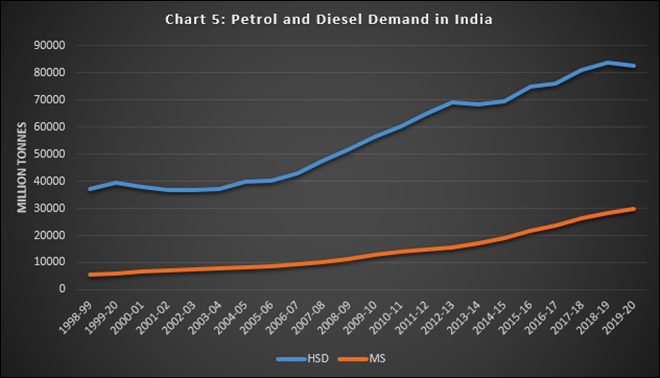

Not surprisingly, diesel demand is expected to slow down during the current financial year (2020-21) on account of the nationwide lock-down and slow economic recovery. In fact, diesel demand growth started faltering before the lockdown on account of the increase in retail prices. In 2019-20, diesel demand fell by 1 percent compared to the previous year while petrol demand continued to grow by over 5 percent (chart 5). The fall in demand for diesel was consistent with the 0.7 percent fall in IIP for 2019-20. Given the strong correlation between IIP and diesel demand, higher retail prices is likely to further dampen demand for diesel. As in the case of electricity, the fall in demand for diesel is likely to be greater in industrialised states than in less industrialised states as studies have indicated.

Source: PPAC, Various Reports

Source: PPAC, Various Reports

Another less known fact is that India ranks low in affordability of petrol notwithstanding the claims of high subsidies to oil. In 2017-18, a litre of petrol cost about 25 percent of average daily per person gross domestic product (GDP) in India. Within India, there were large variations in the affordability of petrol. In Bihar, an average person had to spend 94 percent of daily state domestic product to buy a litre of petrol and in UP over 50 percent. In China this was about 4 percent, Vietnam 8 percent and Pakistan 17 percent.

As the retail price of petrol increases, affordability will decrease unless there is a substantial increase in economic output. The case of two wheelers that use petrol is particularly important. Two wheelers, which had a market share of about 81 percent in India in 2019-20, are economic enablers for millions of workers and also for those who are self-employed. Increase in the price of petrol will adversely affect their prospects and slow down the revival of economic activity.

Environmental Impact

Empirical literature observes that tax increase on petroleum is regressive, slightly more than the market-related price increase. However, it is also an instrument for reducing consumption externalities such as pollution. In 2018, average implicit fuel excise tax on energy-related CO2 emissions from road transport in India was estimated at about €79.6/tonne CO2. This is higher than €43.6/tonne CO2 in the USA or €67.4/tonne CO2 in China.

Source: PPAC

Source: PPAC

Studies have shown that small tax increases can substantially improve the environment but as with other public interventions, energy price increases can undermine equity objectives, posing an equity-efficiency trade-off familiar to economists. Though the equity or distributional impact is estimated to vary between and within countries depending on social, geographic, climatic, economic conditions as well as the pattern of energy use in households, there is consensus that poor households suffer more from energy price increases as they tend to spend a larger share of their income to buy energy and energy services.

Marrying a regressive carbon tax with progressive redistribution of revenues among poor households is the recommended policy intervention to correct this trade-off. Applied to the current Indian context, recycling the implicit carbon tax to provide direct income support for workers from low-income households who have lost jobs on account of Covid-19 is the best possible use of the oil tax revenue. If the objective is to please the market instead, the revenue has to be used to bridge the fiscal deficit.

Taxing oil to death

Increase in the price of petrol and diesel will facilitate not only a reduction in consumption but also a shift towards alternative fuels. The removal of the tax incentive that favoured consumption of diesel in personal vehicles has already initiated a shift towards petrol vehicles. Without the tax arbitrage that goes against refined petroleum fuels, competitiveness of alternative transportation fuels such as natural gas and to some extent even electricity would be lower. Continued increase of taxes on refined petroleum fuels along with strong policy support for alternative fuels will eventually destroy demand for petroleum. Petroleum is the goose that is currently laying golden eggs of revenue. Before the golden eggs kill the goose, the government must either reduce its dependence on golden eggs or find other birds that can lay them.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: Petroleum Planning & Analysis Cell (PPAC) Various reports

Source: Petroleum Planning & Analysis Cell (PPAC) Various reports Source: PPAC calculated from various reports

Source: PPAC calculated from various reports Source: PPAC, Various Reports

Source: PPAC, Various Reports Source: PPAC, Various Reports

Source: PPAC, Various Reports Source: PPAC

Source: PPAC PREV

PREV