This article is part of the series Comprehensive Energy Monitor: India and the World

This article is part of the series Comprehensive Energy Monitor: India and the World

Nuclear energy accounted for about

1.1 percent of primary energy (not including biomass energy used by households) in India,

1.6 percent of generation capacity and

2.8 percent of power generation in 2021. The installed capacity for nuclear power generation was

6,780 MW (megawatt) from

22 reactors. This includes the 700 MW pressurised heavy water reactor (PHWR), unit 3 of the Kakrapar nuclear power plant (KAPP) that was synchronised with the grid in January 2021. 15 more such units are expected to follow in fleet mode. Nuclear power plants of capacity

8,700 MW are under construction.

Capacity Addition Targets

In 2004, the target set for nuclear power capacity was

20,000 MW by 2020. In 2007, the Government stated that this target could be doubled with the opening up of international cooperation through the

123 nuclear agreement that was to be signed with the United States in 2008. In 2009, the NPCIL (Nuclear Power Corporation of India Limited) said that it aimed for a capacity of

60,000 MW by 2032 including

40,000 MW of PWRs (pressurised water reactors) and 7000 MW of PHWRs all powered by imported uranium. Projections in the draft energy policy of 2017 are more modest with

12,000 MW nuclear power capacity in 2022 and

34,000 MW in 2040 even under the ‘ambitious’ scenario. In 2021, the government stated in the Parliament that nuclear power generation capacity would increase to

22,480 MW by 2031. This figure was reiterated in the

Parliament in 2022. India’s targets for nuclear power generation capacity addition have been described as aspirational by experts from the Department of Atomic Energy (DAE). One of the key reasons why India’s targets for nuclear power generation capacity remain aspirational is the difficulty in mobilising investment.

Economics

According to the CEA (central electricity authority), the capital cost of a PHW nuclear power plant in India is about

INR 117 million (INR11.7 crore)/MW in 202122 and

INR 142 million (INR14.2 crore)/MW in 2026-27. Other estimates are higher at

INR 160 -25 million/MW (INR16 -25 crore/MW). The average capital cost of nuclear power is in the same range as that of

large hydro-power projects or LNG (liquefied natural gas) liquefaction plants but it is far more difficult to raise capital for nuclear power plants as they are exposed to unique risks (low probability but high-risk events such as natural disasters, terrorist attacks, nuclear proliferation problems). In addition, there are issues like long lead times, risk of construction problems, delays and cost overruns and the possibility of future changes in policy or technology. Globally escalating costs and delays of new nuclear projects have devastated the industry, forcing two of its powerhouses,

Westinghouse and

Areva, into bankruptcy. This has increased preference for low carbon sources like solar power. But the capacity adjusted (80 percent capacity factor) capital cost of nuclear power is

INR 250 million/MW (INR 25 crore/MW) while the capacity adjusted (25 percent capacity factor) capital cost of solar power is

INR 300 million/MW (INR30 crore/MW) according to NPCIL. The International Energy Agency (IEA) makes a similar argument stating that nuclear power will remain the dispatchable low-carbon technology with the l

owest expected costs in 2025. The value adjusted levelised cost of electricity (

VALCOE) of nuclear power is lower than that for solar or wind especially when the life of nuclear plants is extended. VALCOE incorporates information on both costs and the value including estimates of energy, capacity and flexibility to provide a more complete metric of competitiveness for power generation technologies. VALCOE of electricity from

intermittent sources like wind and solar increases as the share of electricity from these sources increases while the VALCOE of nuclear power decreases as its share of electricity supplied to the grid increases. The life of a nuclear plant is greater than

60 years (close to 100 years) and that of solar plants is about 20 years which adds to the economic value of nuclear power plants. Moreover, the system integration cost of nuclear plants is US

$2/MWh compared to about US

$43/MWh for renewable generators. The cost of electricity generated by nuclear power plants compares well with electricity from other sources. In fact, the tariff for firm (dispatchable) electricity from Tarapur Atomic Power Station (TAPS 1&2), the oldest nuclear power generator in India, is about INR2/kWh (kilowatt hour). This is lower than the lowest tariff of solar power which is intermittent. The cost of power from newer plants like Kudankulam is in the range of INR

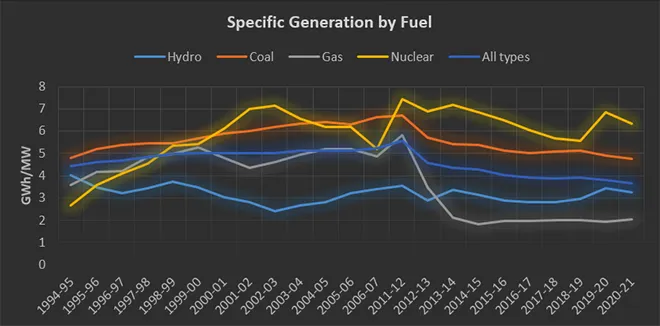

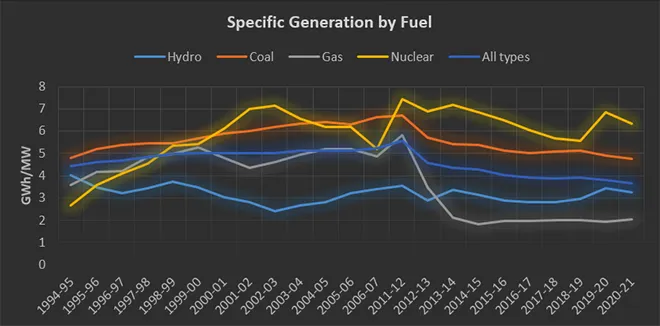

4-6/kWh comparable to power from some thermal power plants and also comparable to a hybrid solar-pumped hydropower combination. In India, specific generation, a parameter that signals economic efficiency of power generation (gigawatt hours of power generated for a megawatt of capacity) was highest for nuclear power at

6.35 compared to

4.74 for coal-based power, the second highest in 2020-21. The specific generation of nuclear power has been consistently higher than the average specific generation value over the last two decades.

Carbon Emission Reduction

According to NPCIL, the land footprint of nuclear power is at least

20 times smaller than that of solar energy. The average lifecycle greenhouse gas (GHG) emissions from solar is

50 grams/kWh compared to

14 g/kWh for nuclear power. Globally, the use of nuclear power has reduced CO

2 emissions by about

60 gigatonnes, or nearly two years’ worth of emissions over the past

50 years. Without nuclear power, emissions from power generation would have been almost

20 percent higher. Institutions such as the IEA that favour nuclear power for decarbonisation argue that the world risks a

steep decline in nuclear power in developed countries that could lead to billions of tonnes of extra carbon emissions. According to the IEA, without new nuclear power, the

energy transition will become more difficult and more expensive. But sceptics of nuclear energy point to the risks of nuclear energy citing well-known accidents from Three Mile Island in the US, Chernobyl in Russia and Fukushima in Japan. Nuclear reactors generate radioactive waste that remains dangerous for hundreds of thousands of years and the first deep geological disposal facility for nuclear waste is still on the drawing board.

Small Modular Rectors

In 2019, for the first time in history,

non-hydro renewables like solar, wind and biomass generated more electricity than nuclear power plants globally. Global nuclear power generation peaked in 2006 and there were fewer reactors operating around the world at the end of 2021 than

30 years ago. Even in China that is building several nuclear power generators, renewables generated more than

twice the electricity than nuclear power in 2021. The general perception that large nuclear reactors are too expensive and too dangerous have resulted in support for

small modular reactors (SMRs) around the world and also in India. Since the 1950s, when nuclear power generation was established, the size of the reactors has increased from

60 MW to more than

1,600 MW, with corresponding economies of scale in operation. SMRs generally have a capacity of

300 MW or less and are designed with modular technology using module factory fabrication, pursuing economies of series production and short construction times. There have been many hundreds of smaller power reactors built for naval use (

up to 190 MW thermal) and as neutron sources, yielding enormous expertise in the engineering of small power units.

SMRs are much less likely to

overheat, in part because their small cores produce far less heat than the cores in large reactors. Innovative designs in SMR technology can also reduce other engineering risks, like coolant

pumps failing. SMR has far fewer moving parts than traditional reactors, lowering the likelihood of failures that could cause an accident. Building smaller reactors is also expected to lead to mass-manufacturing which reduces cost and lead times. India’s nuclear industry which consists mostly of

small reactors did not necessarily result in lower costs.

Out of India’s 22 nuclear power reactors,

18 have a capacity of less than 300 MWe which means that most are “small” reactors. The small size of India’s nuclear reactors has meant that India’s total nuclear power capacity is low compared to the number of nuclear power reactors. The ten largest nuclear islands of China consist of 43 nuclear reactors with total capacity of

45,600 MWe. All the reactors in these nuclear islands have capacity of 1000 MWe barring the oldest reactor that has a capacity of

600 MWe. With double the number of reactors compared to India, China has more than 6 times the nuclear capacity of India. South Korea has 24 nuclear power reactors, just two more than that of India, but the total nuclear power capacity of

South Korea is 23,150 GWe, more than three times that of India. India’s small reactors have not necessarily meant lower costs, nor have they meant fewer experts employed per reactor. It has in fact reduced the contribution of the nuclear sector to overall power generation and consequently not contributed substantially to reduce carbon-di-oxide emissions. It also

increased the tariff for nuclear power as costs cannot be spread over larger capacity. The assumption that additional costs incurred by SMRs can be offset through economies of

mass production remains to be tested because as of 2022, there are no mass orders for SMRs. Overall, SMRs may not be the means to achieve India’s ambitious targets for nuclear power.

According to

media reports, the Niti Aayog has recommended changes to the Atomic Energy Act 1962 to allow foreign investment in its nuclear power industry and mobilise greater participation by domestic private firms. If private investment materialises, India may move closer to its targets for nuclear power generating capacity. However, it remains to be seen how the fundamental incompatibility between

India’s civil liability law and international conventions are resolved.

Source: Central Electricity Authority

Source: Central Electricity Authority

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

This article is part of the series

This article is part of the series

PREV

PREV