Background

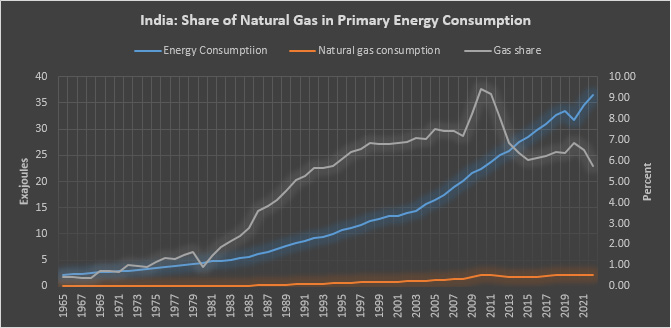

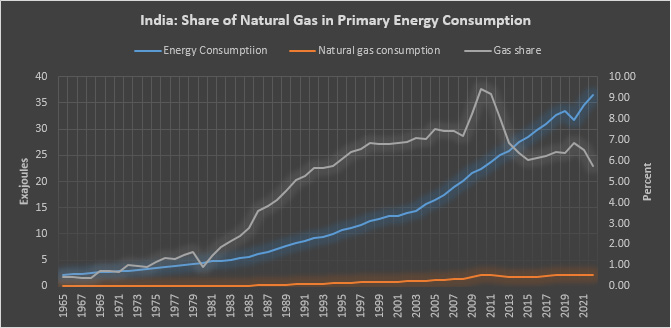

In 2016, the Government of India (GOI) announced that India would increase the share of natural gas in its primary energy basket from 6.14 percent in 2016 to 15 percent by 2030 and become a “gas-based economy”. Since the announcement, the share of natural gas in India’s primary energy basket (commercial energy, not including energy derived from unprocessed biomass) increased marginally to 6.83 percent in 2020 but has since fallen to 5.7 percent in 2022. The share of natural gas in India’s primary energy basket was 9.43 percent in 2010 when domestic gas production substantially increased. If the current trend continues, the probability of India becoming a gas-based economy by 2030 is low.

Trends in Production and Consumption

India’s natural gas consumption in 2022-23 was about 164.3 million metric standard cubic meters per day (mmscmd). To increase consumption to 600 mmscmd by 2030, the annual growth rate in consumption has to be more than 10.5 percent, which is not an impossible target. In the period 2008-2018, natural gas consumption in China grew by over 13 percent. Behind this double-digit growth rate for natural gas consumption in China was an annual average economic growth rate of over 8 percent, regulatory reform for transparency and flexibility along with focused policy mandates. India has implemented progressive policies in the gas sector, but production and consumption trends in the last decade are not very encouraging.

To increase consumption to 600 mmscmd by 2030, the annual growth rate in consumption has to be more than 10.5 percent, which is not an impossible target.

In India, net domestic production of natural gas declined from 108.94 mmscmd to 92.23 mmscmd, demonstrating an annual average decline of about 1.6 percent in 2012-13 to 2022-23. Import of LNG (liquified petroleum gas) increased from 39.24 mmscmd in 2012-13 to 72.07 mmscmd in 2022-23, representing an annual average growth of about 6.2 percent. In the same period, consumption of natural gas increased from 148.18 mmcsmd to 164.30 mmscmd, showing an annual average growth of about 1.3 percent. Peak domestic production of 143.61 mmscmd was in 2010-11 while peak consumption of 175.74 mmscmd as well as peak LNG import of 92.84 mmscmd were in 2019-20 prior to the pandemic.

Sector-wise growth trends

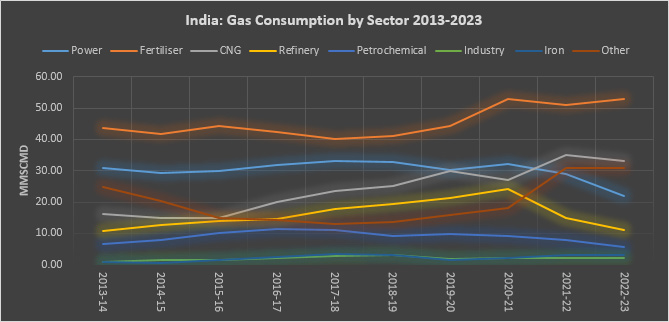

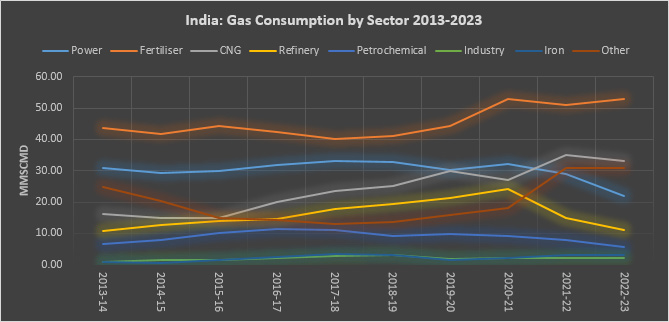

In the '70s and '80s, natural gas consumption grew at double-digit rates annually, typical of a new consumption segment, starting from a small base. In the 1990s and 2000s growth in consumption of natural gas slowed down to an annual average of 6-7 percent. In the 2010s and 20s, consumption growth fell to an annual average of around 1 percent. In the decade ending in March 2023, natural gas consumption by the power sector fell by an annual average of 3.7 percent from 30.92 mmscmd in 2012-13 to 22 mmscmd in 2022-23. Consumption of compressed natural gas (CNG) supplied to domestic and transportation segments made up for the decline in consumption by the power sector, recording an annualised growth of 8.2 percent in the same period. While consumption growth in the industrial and sponge iron segments remained robust at 12 percent and 16 percent respectively, consumption in the refining segment grew only by an annual average of just 0.1 percent in the decade ending in March 2023 and consumption growth in the petrochemical segment fell by an annualised rate of 1.9 percent in the same period.

Consumption of compressed natural gas (CNG) supplied to domestic and transportation segments made up for the decline in consumption by the power sector, recording an annualised growth of 8.2 percent in the same period.

In 2013-14, the power sector accounted for 23 percent of natural gas consumption, but by 2022-23, its share had fallen to about 13 percent. If natural gas is promoted as a fuel for providing power at short notice with costs reflected in tariffs, the offtake of gas for power generation may increase. However, a decline in the cost of battery storage solutions that can also provide power at short notice to make up for intermittency in renewable power generation is likely to reduce the attractiveness of gas as fuel for power generation. The share of the fertiliser segment in natural gas consumption increased marginally from 32 percent in 201-14 to 33 percent in 2022-23. India plans to stop the import of urea by 2025 which means demand will shift to natural gas (feedstock for urea production). This could potentially increase the consumption of imported liquefied natural gas (LNG) by the fertiliser segment.

Source: Petroleum Planning & Analysis Cell (PPAC)

The share of CNG in natural gas consumption increased from just over 16 percent in 2013-14 to 33 percent in 2022-23. CNG consumption has potential for growth in the future but it is dependent on the availability of domestic gas at regulated prices and investment in infrastructure. The unified tariff (UFT) policy introduced by the Petroleum and Natural Gas Regulatory Board (PNGRB) in April 2023 could facilitate growth in CNG consumption as it aims to create a single, consistent and fair tariff structure for natural gas transport across the country. The UFT policy will apply to a network of 21 pipelines, representing around 90 percent of pipelines in operation or under construction. The unified tariff is a fixed charge determined by the PNGRB and based on the levelized cost of service of the entire pipeline network, and is revised periodically to reflect the changes in pipeline costs and utilisation. The zonal factor is variable and depends on the tariff zone. There are three tariff zones: the first up to 300 kilometres (km) from the gas entry point, the second between 300 km and 1,200 km and the third beyond 1,200 km. The zonal factors for the three zones are 0.25, 0.5 and 1.0 respectively. The zonal tariff, corresponding to the fee paid by the shipper to the pipeline operator for the transport of gas, is calculated by multiplying the unified tariff by the zonal factor. A stable, competitive and transparent pricing regime enabled by UTF will benefit domestic production and demand and in addition attract investment in gas infrastructure. The suggestion from the Energy Transition Advisory Committee (ETAC) to develop strategic gas storage could also strengthen the country’s energy supply security and reduce price volatility both of which could potentially boost demand for natural gas. The government is reported to be studying the prospect of developing gas storage with a capacity of 3-4 bcm (billion cubic meters). The share of petrochemicals and refining segments in natural gas consumption in 2022-23 was lower than that in 2013-14. The sector is dependent on imported LNG and high volatility in the price of imported LNG contributed to the decline in natural gas by these sectors. The availability of substitutes at more certain price prospects also contributed to the reduction in natural gas consumption by the refining and petrochemicals segments.

Takeaways

Notwithstanding the attractiveness of natural gas as a bridge fuel for India, gas faces stiff competition from coal in terms of affordability and energy security (availability of domestic coal) and from solar and wind in terms of environmental acceptability. In the context of emissions, it is well established that natural gas scores over coal and oil. Coal-to-gas switching is generally seen as the means to rapid reduction in CO2 emissions. Typically, natural gas emits 50-60 percent less CO2 when combusted in an efficient power plant compared to emissions from a typical coal plant. Considering only tail-pipe emissions, natural gas used as fuel for transportation emits 15-20 percent less emissions than petrol when burned in a modern vehicle.

The fact that LNG supply chains produce more emissions per unit of gas than pipeline gas because of the additional energy required for liquefaction is used to strengthen the case against gas.

But there is the environmentalist argument that gas is not necessarily carbon-free and investment in gas supply chains would lock in emissions and create new path dependencies that would only extend the life of fossil fuels. The conclusion is that facilitating natural gas use is inconsistent with the goal of decarbonisation and it would potentially create stranded assets. The fact that LNG supply chains produce more emissions per unit of gas than pipeline gas because of the additional energy required for liquefaction is used to strengthen the case against gas.

Despite these shortcomings, gas has contributed to emission reduction. Prior to the pandemic, natural gas contributed to a 1.7 percent fall in global emissions on account of coal to gas switching in the United States and Europe. In the US, coal to gas switching was driven by the price competitiveness of gas over coal and in Europe coal to gas switching was driven by high carbon prices. In India, coal’s cost competitiveness is not likely to be eroded by natural gas, especially when most of it is imported. Carbon prices, even if implemented are not likely to be high, as India already imposes excessive taxes on fossil fuel consumption. It appears that India will need more than six months to become a gas-based economy.

Source: Statistical Review of World Energy 2023

Lydia Powell is a Distinguished Fellow at the Observer Research Foundation.

Akhilesh Sati is a Program Manager at the Observer Research Foundation.

Vinod Kumar Tomar is a Assistant Manager at the Observer Research Foundation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV