Drivers of green energy adoption by discoms

The Electricity Act 2003 (EA 2003) established a framework for increasing the offtake of power generated from variable renewable energy (RE) sources by authorising state regulatory commissions (SERCs) to specify that a percentage of the total consumption of electricity in the area of a distribution licence should be RE based. In addition to the provision for grid connectivity from the source of generation to the consumer and open access for all generators enabled by EA 2003 provide the legal and regulatory framework for RE adoption along with competition between retail suppliers.

Resource endowment

RE adoption by state distribution companies (discoms) is difficult to quantify accurately as power consumption (as opposed to generation) by fuel (coal, natural gas, nuclear, hydro, wind, solar, small hydropower, biomass and others) state-wise is not readily available. If RE-based power generation including large hydro is used as a proxy for RE adoption, “hydro-rich” states like Himachal Pradesh, Uttarakhand, Sikkim, Arunachal Pradesh, Karnataka, Manipur, Meghalaya, Mizoram and Nagaland come out on top, as large hydro power accounted for 100 percent of power generation in each of these states in 2022-23. States that are not hydro-rich, such as Tripura had the lowest share of RE generation at 0.10 percent of total generation, followed by Bihar at 0.52 percent and Chhattisgarh at 0.52 percent in 2022-23.

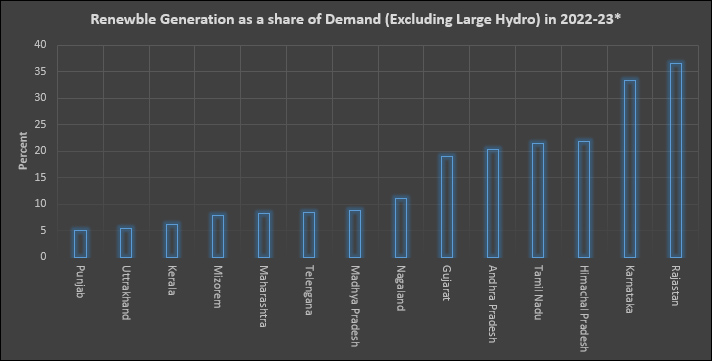

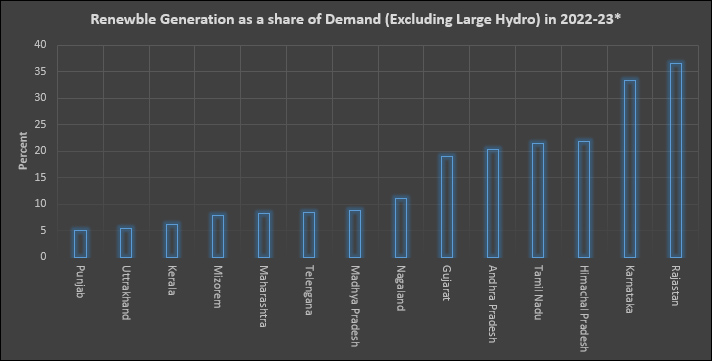

If generation from large hydro is excluded (as it depends on resource endowment rather than on policy or cost-based RE adoption), Rajasthan, Nagaland, Karnataka and Gujarat come out on top. In 2022-23, over 38 percent of power generation in Rajasthan and Nagaland was from RE sources (excluding large hydro), followed by Karnataka at 34 percent and Gujarat at 31 percent. Tripura and Sikkim, with 0.10 percent of RE generation (not including large hydro) have the lowest share of RE, followed by Bihar and Arunachal Pradesh at 0.52 percent and Jharkhand at 0.94 percent.

Regarding RE (including large hydro) as a percent of state electricity demand in 2022-23, Sikkim was far ahead of other states as it generated more than 10 times its electricity demand from RE, all of it derived from large hydropower. Arunachal Pradesh and Himachal Pradesh also generated 3-4 times their electricity demand from hydropower. Tripura had the lowest share of RE meeting demand at 0.31 percent, including large hydro. It was followed by Delhi at 0.56 percent and Bihar at 0.65 percent in 2022-23.

If large hydro is excluded, “RE rich” states come out on top. In 2022-23, Rajasthan generated over 36 percent of electricity demand from RE sources followed by Karnataka at 33 percent and Tamil Nadu at over 21 percent. As in the case of hydro power, the key driver of higher RE generation in these states is favourable wind speed and solar insolation. In addition to Gujarat, Andhra Pradesh, Maharashtra, Telangana, Punjab, Madhya Pradesh and Kerala, these states are among the states classified as “RE rich”. On average, India’s RE-rich states have a higher share of RE generation than most countries internationally. The states with the lowest RE share in demand (not including large hydro) are the same as those in the case of RE including large hydro. Overall resource endowment (water, sun, wind) appears to be strongly corelated with RE generation and adoption.

Operational model and financial status

As of 2022-23, the ownership and operating model of electricity distribution companies do not seem to influence RE adoption. Discoms of the three top-performing states in 2022-23 were state owned discoms, though some had enlisted the services of a distribution franchisee (DF). DFs are expected to source power from the distribution licensee which limits choice over source of power. The financial status of the discoms too does not seem to influence RE generation. The discoms of Rajasthan and Tamil Nadu are rated poorly on financial sustainability and economic efficiency in the annual integrated rating of power distribution utilities brought out by the Ministry of Power (MOP) for 2021-22. The three DFs under the discom of Rajasthan are ranked 19th, 29th and 39th out of 57 distribution companies with C and C- ratings while the discom of Tamil Nadu is ranked 49th with a C- rating and a cautionary “red card” indicating precarious financial status. The DFs under the discom of Gujarat however are ranked among the top 10 distribution companies with an A+ rating.

Policy

SERCs that were set up as mandated by EA 2003, imposed renewable purchase obligations (RPOs) on discoms to purchase a certain percentage of electricity from RE sources. With the amendment of tariff policy in January 2016, SERCs were required to reserve a minimum percentage for the purchase of solar energy to reach 8 percent of total consumption of energy, excluding hydropower, by March 2022 or as notified by the central government from time to time. In July 2018 the central government notified the long-term growth trajectory of RPOs for solar as well as non-solar RE, uniformly for all states and union territories, reaching 21 percent of RPO by 2022 with 10.5 percent for solar based electricity. RPO share beyond 2021-22 as per MOP order dated 22 July 2022 is expected to touch 43 percent of total energy consumption by 2030. For 2022-23 the total RPO target including hydro purchase obligation (HPO) is 24.61 percent.

On compliance of RPO targets, “hydro-rich” states score better than “RE rich” states. In 2022-23, Sikkim led the rankings with 88.4 percent RPO compliance followed by Himachal Pradesh at 78.2 percent and Uttarakhand at 60.4 percent. Among “RE-rich” states Karnataka had the highest compliance of 46.7 percent, followed by Kerala at 36.3 percent and Andhra Pradesh at 28.5 percent. RPOs are complimented by RE certificates (RECs), a tradable market-based instrument introduced in 2010-11. RECs facilitate compliance with RPO mandates and serve as a channel for alternative valuation for low-carbon electricity generation.

The “must-run” status accorded to solar and wind projects in line with EA 2003 by the Indian Electricity Grid Code 2010 (EGC 2010), a technical directive to maintain grid stability added to the attractiveness of investing in RE-based power generation in “RE-rich” states. The “must-run” status, accelerated depreciation, waiver of interstate transmission (ISTS) charges, RPOs that were enforced by SERCs and long-term power purchase agreements of up to 25 years added to the attractiveness of the market for RE based power with predictable, relatively stable and long-term returns. India’s ambitious targets for RE capacity addition also attracted low-cost finance from multilateral development banks that substantially improved the competitiveness of RE projects. These, along with a slew of upstream incentives such as the notification of competitive bidding guidelines for the procurement of solar and wind power under EA 2003; priority lending status for RE projects; green energy corridor (GEC) for installing transmission lines and sub-stations and procurement of electricity from 2500 megawatt (MW) ISTS grid-connected wind power projects with up to 20 percent blending with solar PV power through a transparent process of bidding makes RE generation, procurement, and consumption attractive for distribution companies.

Overall, the key drivers of RE adoption by discoms are resource endowment (“RE-rich” and “hydro-rich”) and government policy push. In other words “nature” and “nurture” (financial and non-financial subsidies and incentives) are key to RE adoption by discoms. This raises some questions over the progress of market-oriented reforms in the electricity distribution sector.

Source: Monthly Reports from Central Electricity Authority & Grid-India; *states with share > 5 percent

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV