If consumers can choose their retail electricity supplier in India, will they choose and pay for electricity derived from renewable energy (RE) supplied by a private distribution licensee (DL) or distribution franchisee (DF)? Currently, there are provisions for consumers to opt for RE electricity through monopoly distribution companies (discoms) or DFs. The results so far are not encouraging, as the uptake of RE power and the number of consumers signing up for RE power are small. However, if distribution is delicensed, there is potential for dedicated suppliers of green electricity to emerge, offering RE energy products and services that are tailored to meet consumer preferences. DFs and DLs dedicated to providing RE power can use the green tariff route to offer clean power to commercial and industrial consumers (C&I) who must purchase RE power, and also to domestic consumers who want to contribute towards decarbonising the electricity sector. The green tariff option carries lower transaction costs compared to purchasing RE power through green power exchange or opting for procuring RE power directly from RE generators using the open access (OA) provision or setting up captive rooftop solar generators.

Framework

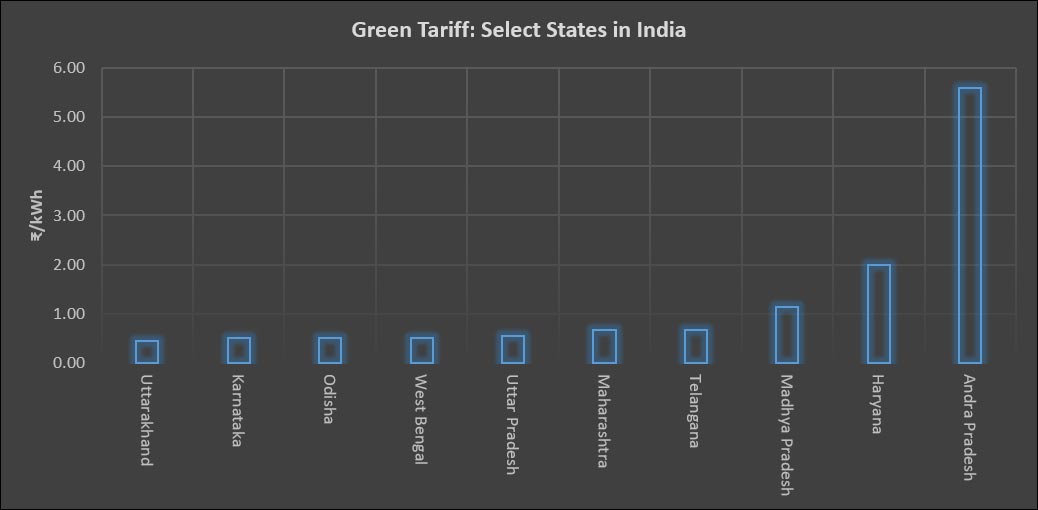

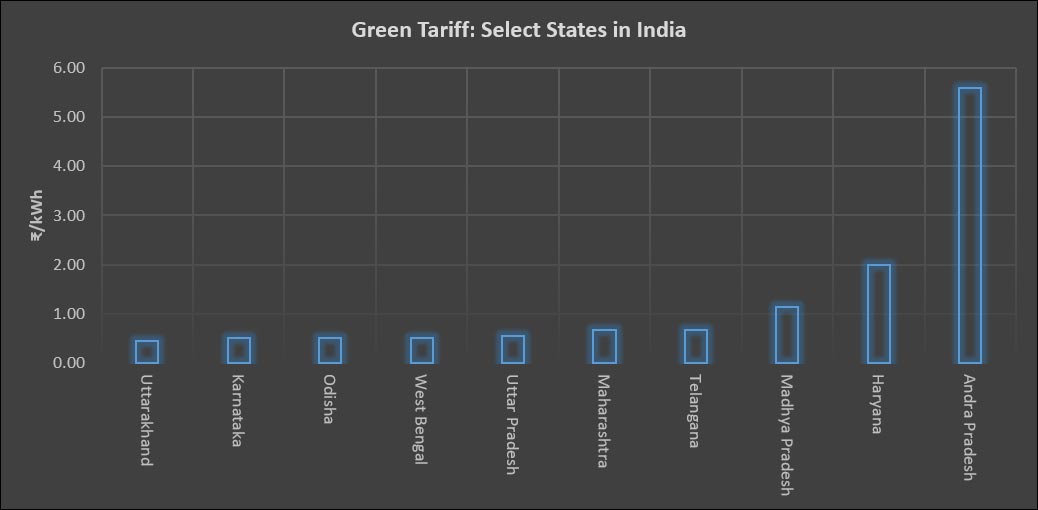

Green premium tariff is not new, as states like Andra Pradesh introduced it almost 15 years ago. Karnataka, Maharashtra, Gujarat and Uttar Pradesh also offer green tariff, but the offtake of RE power facilitated by green tariff remains less than 0.5 percent. In all states that have green tariffs, the tariff is higher than the average retail tariff of electricity which is probably among the key reasons for limited interest in RE power offtake.

Karnataka, Maharashtra, Gujarat and Uttar Pradesh also offer green tariff, but the offtake of RE power facilitated by green tariff remains less than 0.5 percent.

In 2022, the Ministry of Power (MoP) introduced the ‘electricity (promoting RE through green energy open access rules [GEOAR]), 2022’. As per the new rule, any consumer with a contract demand of 100 kW (kilowatt) or more can purchase “green” energy from their discom upon payment of pre-determined tariff. For determining the green tariff rate, states must, in line with the GEOAR 2022 rules, take into account only (i) average pooled power purchase cost of the RE (ii) the cross-subsidy sur charges at 20 percent of average cost of supply and (iii) service charges (reasonable margin of INR0.25/kWh [kilowatt hour]). The MOP is directing all state electricity regulatory commissions (SERCs) to adopt the rules. If GEOAR 2022 proves to be a driver of RE power adoption, it may facilitate private distribution companies to offer RE power to consumers when competition is introduced in electricity retail.

Green power adoption

Two private electricity suppliers, Tata Power and Adani Electric in Mumbai offer consumers the option of using 100 percent RE power facilitated through green tariff. According to Tata Power, 27,000 consumers have switched to green power, and in November 2023, a special festival drive enlisted 6274 consumers to opt for RE power. Of the total, 3576 consumers are said to be in the 1-100 kWh category. Tata Power claims that the supply of 270 million kWh of green electricity reduced carbon emissions by 200,000 tonnes annually. The green premium charged was INR0.66/kWh over and above the normal tariff. This is half of INR1.33/kWh green tariff calculated as per regulations. Tata Power has 762,000 consumers in Mumbai and those who have opted for RE power account for just over 3 percent of the total. This is not an encouraging number, but it may be too early to come to a conclusion.

On 12 November 2023, Adani Electricity Mumbai claimed that 3 million households and establishments, comprising over 12 million entities were powered entirely by “clean” renewable energy sources for 4 hours. In 2023, Adani Electricity said that it met up to 38 per cent of its consumers’ electricity requirements from RE power. The RE power was sourced from Adani’s own generation assets. This is a slightly different model of RE power adoption compared to that of Tata Power, as the decision to switch to RE power happened at the supply end rather than the demand end. Adani Electricity offers green tariff to its customers in Mumbai, but details on how many consumers have switched is not readily available.

Issues

Green pricing programmes are likely to attract C&I customers (compliance market) as well as affluent urban households (voluntary market). Green pricing provides an independent option that is voluntary and market-based to complement the carbon compliance market, including renewable purchase obligations (RPOs). In the absence of green tariff, customers that are willing to pay for RE power may lack the means to buy RE power. Opting for green tariff signals economic validation of consumers’ ideological and emotional preference for RE power.

It is likely that in a delicenced electricity market green pricing programs will be adopted by some of the DFs and DLs to differentiate their service offering of a commodity like electricity. Green tariff is likely to remain the simplest among the many ways available for electricity customers to access RE power without investing in roof-top solar systems that carry prohibitive up-front costs, or directly buying unbundled RE power through OA provisions which carries high transaction costs.

Green power marketing by DFs and DLs will effectively seek to develop a customer-driven market for RE power.

In a delicensed downstream electricity market, DFs and DLs are likely to indulge in green power marketing through instruments like green tariff partly to increase offtake of their own RE generation assets (as in the case of Adani Electricity Mumbai), or to meet their RPO. Green power marketing by DFs and DLs will effectively seek to develop a customer-driven market for RE power. Demand for green power is equivalent to the voluntary provision of public goods (clean air, lower carbon emissions). The experience of the DLs in Mumbai suggest that green marketing in a competitive environment is not likely, on its own, to provide a large market for RE power. This is especially true if green power commands a premium price in an extremely price sensitive market like India. Though customers respond positively to survey questions on their preference for RE power, they are likely to hesitate when they are asked to pay for RE power. Even affluent consumers are likely to have strong incentives to `free-ride' and therefore will not contribute siginificantly to the provision of public goods.

There are a number of studies on consumers' willingness to pay (WTP) for green power in mature electricity markets in North America and Europe. Many of the surveys conclude that even when 80-90 percent of those surveyed respond that they care about the environment only about 20 percent confirm WTP for green power. Most of those who demonstrate WTP for green electricity are well educated and have high incomes. When applied to India, the share of those who demonstrate WTP in surveys among residential consumers may be much lower and those who actually pay for green power may be even lower. From a policy perspective, the delicencing of the retail electricity sector is not likely to drive adoption of green power but it could be one of the many options for promoting RE power adoption.

Source: Mercom India Research; Note: only the green premium energy charge that is over and above regular electricity tariff is shown; final green tariff may be higher when fixed charges are included.

Lydia Powell is a Distinguished Fellow at the Observer Research Foundation.

Akhilesh Sati is a Program Manager at the Observer Research Foundation.

Vinod Kumar Tomar is a Assistant Manager at the Observer Research Foundation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV