-

CENTRES

Progammes & Centres

Location

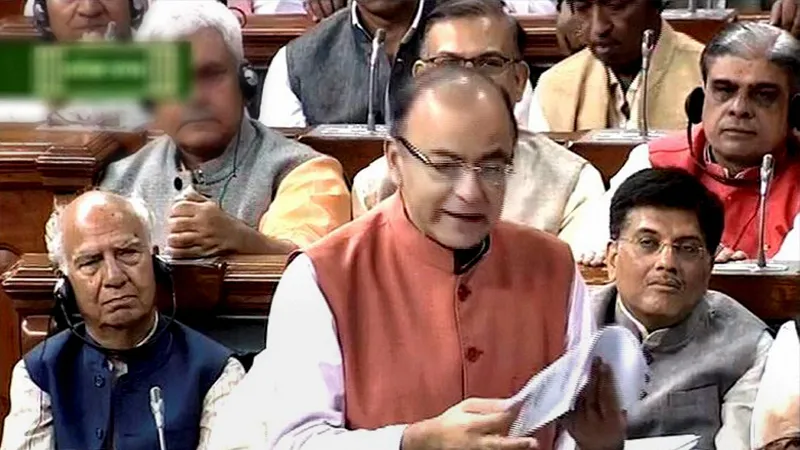

To someone who has watched many Budget speeches over the years, Finance Minister Arun Jaitley’s presentation of the Budget 2016 seemed like another ‘business as usual’ speech, but peppered with sops here and there. It could have been a UPA Budget because there was a distinct ‘pro-poor’ touch to it.

Jailtley has proved to be a stickler for adhering to the fiscal deficit target of 3.5 per cent which has earned him plaudits from conservative economists. Many have, however, pointed out that India needs higher public expenditure to revive the economy and hence a wider fiscal deficit could have been allowed.

Farm sector was expectedly the focus. After all, there have been hundreds of suicide in the recent past and the negative to half per cent agricultural growth is disastrous for a sector that employs 52 per cent of the population. Two failed monsoons and crop damage due to unseasonal rains has made agriculture the most hazardous occupation. It is small wonder that young men do not want to remain in villages tilling the soil and want to migrate to cities in search for jobs. But tall promises like ‘doubling farmers’ incomes by 2022’ seem unlikely to be fulfilled given the state of agricultural stress.

That 5500 villages have been electrified by the NDA government in the last one year looks good on the score card because it will provide employment but what is the power supply like? Unless the power supply is regular, no small scale industrial units can run in villages to create jobs. Rs. 20,000 crore has been promised for irrigation which was long due and hopefully will make a difference to the drought prone areas. Similarly enhancing credit by Rs 9 lakh crore should improve the liquidity situation of farm households and help in debt relief. Some of these promises one has heard before under different governments--so how come the farmers are still poor and indebted?

The finance minister has addressed the important problems in the health sector and has raised the insurance cover of poor families to Rs 1 lakh but he has not promised to make primary health centres better equipped with doctors, nurses and medicines. If public hospitals and district health centres remain in the pathetic state that they are in, the Rs 1 lakh insurance cover will not be enough because patients will have to go to private healthcare where they will be fleeced.

Similarly the quality of education and the need for digital education have been emphasized as in previous budgets. All these gestures are in the right direction and by making them the NDA government has somewhat refuted its pro-business, right wing image. On the other hand its distinct pro-poor stance could be a clever political move.

Small scale, SC, ST and women entrepreneurs have been included in this budget but haven’t all previous finance ministers paid court to this section of the population? According to Budget 2016, Rs 500 crore in investment for SC, ST and women will produce 25000 entrepreneurs!

What is different in this budget is the large amount of Rs 250,000 allocated to state run banks’ recapitalization. It reflects the present scary situation the Public Sector Banks are in. Jaitley also emphasized that the government is strongly behind the state run banks. It was reassuring to hear that!

Pinching a bit more money from the rich by taxing them a little more is a norm followed by many former Finance ministers and Jaitley has continued the tradition by imposing a cess of 15 per cent on people earning more than 1 crore a year. Similarly gold jewellery is being taxed by 1 per cent more –as if it will make any difference to the rich ladies who come with bags full of money to jewellery shops! Even dividends beyond Rs 10 lakhs are going to be taxed at 10 percent but if the rich are not taxed then who should be?

A good move has been to reduce the multiplicity of taxes and 13 levies will be abolished. Simplifying the tax structure is important for India as many tax reform committees have pointed out. He has also attempted to increase the tax base by making penalty for not paying taxes tougher.

As for the corporate sector, big bang reforms have been absent. Private investment needs a boost because of the low level of profit in the corporate sector. But instead we have to wait for the next monetary policy announcement! Like at the time of the last Budget, the Bankruptcy Bill remains to be passed by the Parliament.

Blaming the external environment for falling export growth seems credible enough because even China’s export growth has fallen by 11 per cent in January 2016. So sit tight till the next global recovery!

Absent was a well thought out game plan for increasing employment --something which this government should be worried about. Employment in the formal sector has hardly grown in the last twenty five years and is the cause for discontent among the youth. Skill development as expected has been emphasized but is it enough? Even though the FDI figures are impressive this year, job creation has not increased.

Unsurprisingly infrastructure projects and the MNEREGA have been refurbished. Rs 2.2 lakh crore have been allocated to improving roads and railways as well as rural infrastructure. If successfully completed, this will attract investment and create jobs.

Various tokenisms like LPG connection for poor women who have to cook without gas and expose themselves to the much known fact of damaging fumes, are present. Allowing 100 per cent FDI in food processing should attract EU members who have well developed food processing industries. This could generate jobs and also save India’s huge production of fruits and vegetables.

Clean energy has been championed in the Budget and clean energy cess on coal has doubled to Rs 400 per ton and good that SUVs and luxury cars have become more expensive.

The lawyer in Jaitley took over towards the end and he detailed multiple schemes for adhering to the law regarding undeclared income and dispute resolution. It was dull listening!

On the whole it was a budget with few new ideas and even regarding the new schemes announced, people will have to watch their implementation and outcome carefully in the future.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Jayshree Sengupta was a Senior Fellow (Associate) with ORF's Economy and Growth Programme. Her work focuses on the Indian economy and development, regional cooperation related ...

Read More +

David Rusnok Researcher Strengthening National Climate Policy Implementation (SNAPFI) project DIW Germany

Read More +