-

CENTRES

Progammes & Centres

Location

Though the Budget has increased financial incentives to the RE industry, it does not reflect an unambiguous focus on the energy transition of the country

This article is part of the series Comprehensive Energy Monitor: India and the World

The budget wish list from the energy industry was monopolised by the renewable energy (RE) sector. The electric vehicle (EV) industry wanted full customs duty exemption for import of hybrid storage products. This wish for lower import duties for batteries was reiterated by project developers in the solar industry. Solar companies participating in the production linked incentive (PLI) programme of the government wanted high import duties on finished equipment but lower duties on components implying assembly of modules rather than full integrated manufacture. The solar and wind industries wanted the 30 percent limit on interest deduction to be increased so that the companies can help India fulfil its COP26 commitments but also improve India’s ease of doing business rankings. Reduction in the tax rate under goods and services tax (GST) for batteries and tax relief for hybrid RE projects was another item reiterated by many RE companies. Increase in budgetary allocation for transmission and financial incentives for research and development (R&D) in solar module and battery manufacture was another common wish from RE industry leaders. Tax rebate, accelerated depreciation, interest intervention, subsidies to promote uptake of RE were amongst terms that appeared in almost all RE industry wish lists. The India hydrogen alliance the newest industry body amongst RE sectors wanted extension of tax benefits applicable to the infrastructure sector to green hydrogen-related activities including 100 percent accelerated depreciation benefits on new investments in green hydrogen technologies and tax deductions of income and profits of green hydrogen production entities. The alliance also wanted lowest possible duties and taxes on import of components required to manufacture electrolysers and offtake guarantees for hydrogen components such as electrolysers and low-interest loans for the setting up of green hydrogen system demonstration and production facilities.

Tax rebate, accelerated depreciation, interest intervention, subsidies to promote uptake of RE were amongst terms that appeared in almost all RE industry wish lists.

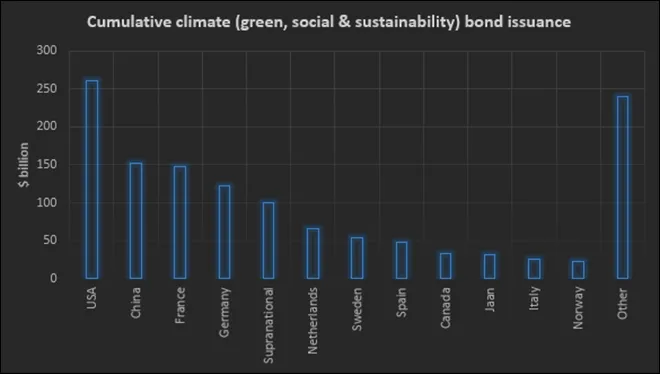

To a large extent, the specific items in the wish list of the RE industry were not addressed in the Budget speech, described as the shortest in history. However, the budget did substantially increase financial incentives to the RE industry along with broad policy support. The additional funding of INR195 billion (over US$ 2.6 billion) to the PLI programme could potentially facilitate domestic manufacture of high efficiency solar modules towards meeting the ambitious goal of 230 GWp (gigawatt peak) installed capacity for solar by 2030. Green bonds to be issued as part of the overall market borrowings of the government in 2022-23 will mobilise resources for green infrastructure. Studies have found that investors are willing to accept weaker returns from green bonds and that it provides issuers (the Indian government in this case) to raise green ambitions. To improve the eco-system for EVs, the government stated that it will encourage the private sector to develop a sustainable and innovative business model for battery swapping given the constraints of space in urban areas for charging stations. Experience on battery swapping is mixed. Tesla’s battery swap trial in North America in the early 2010s was not well received and eventually abandoned, but battery swapping remains quite successful in China. India could replicate China’s success. The government’s goal of promoting public transport in urban areas along with special mobility and zero-fossil fuel zones will complement EVs in reducing carbon dioxide (CO2) emissions. To address the problem of stubble burning, the budget proposed co-firing 5-7 percent biomass in thermal power plants that is expected to reduce CO2 emissions by 38 MT (million tonnes) or about 1.6 percent of India’s annual emissions in 2020. The budget also proposed four pilot projects for coal gasification and conversion of coal into chemicals required for the industry. This may not be appreciated by the climate activists fundamentally opposed to fossil fuels but deploying coal-bioenergy gasification systems with carbon capture and storage (CBECCS) will provide the opportunity to simultaneously address India’s carbon reduction and urban clean air quality problems and also enhance India’s energy security through increase in the use of domestic fuels. The promise of more efficient trains will contribute overall energy efficiency. The absence of any concession for the nascent hydrogen industry in the budget is surprising given the presence of large players in the sector and more importantly their effort in promoting their wish list prior to the budget.

Experience on battery swapping is mixed. Tesla’s battery swap trial in North America in the early 2010s was not well received and eventually abandoned, but battery swapping remains quite successful in China.

Many commentators have hailed the budget as one that had energy transition at its heart. This is probably because the terms associated with the energy transition such as clean energy, storage, batteries, and clean mobility are used throughout the Budget speech rather than be confined to a section on climate change or sustainability. But the budget does not do justice to the label of an energy transition budget. Though the budget offers several incentives to the RE industry, it does not reflect an unambiguous focus on the energy transition of the country. As articulated in the budget speech, the ‘parallel track’ on which the budget aims to put India on are: (i) Improving prospects for the marginalised and unemployed and (ii) pushing for investment in modern infrastructure (Gatishakti) to ready India for its 100th anniversary as an independent country. The latter, creating a shining India for the future, receives far greater attention than the former, creating a better life for millions in the present. Energy transition is one of the many means to achieve that goal of a shining India in 2047. As a cog in the wheel of Gatishakti and a facilitator of Atmanirbhar Bharat Abhiyaan or self-reliant India, the energy transition may achieve less than what it is projected to. The RE industry, dominated by the private sector is understandably leveraging these dominant narratives to seek protection at the supply end with high import duties for cheaper imports and protection at the demand end through a guaranteed market such as the PIL programme. The RE industry will prosper but whether this will contribute to a climate resilient India is uncertain. The embrace of self-reliance could potentially increase the cost of the energy transition and as economists have pointed out may also condemn Indian economy to mediocrity. Decarbonisation of the economy through an energy transition is one of the many objectives for India and mediocre growth is definitely not one of them even if that means lower carbon emissions as the year 2020 has shown.

Source: Climate Bonds Initiative

Source: Climate Bonds Initiative

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Akhilesh Sati is a Programme Manager working under ORFs Energy Initiative for more than fifteen years. With Statistics as academic background his core area of ...

Read More +

Ms Powell has been with the ORF Centre for Resources Management for over eight years working on policy issues in Energy and Climate Change. Her ...

Read More +

Vinod Kumar, Assistant Manager, Energy and Climate Change Content Development of the Energy News Monitor Energy and Climate Change. Member of the Energy News Monitor production ...

Read More +