-

CENTRES

Progammes & Centres

Location

India is seeing a shift towards greater financial inclusion and women's empowerment. Policies supporting this trend can create a more equitable financial landscape.

This article is part of the series — International Women's Day

Women's financial inclusion is pivotal for India's economic growth, reflected in savings rates and the contribution to the national economy. The participation of women in the formal banking sector not only enhances household savings but also leads to more diversified and stable investment patterns. Despite this, a significant gender gap remains in financial inclusion and bridging this gap could significantly impact India's economy by potentially increasing GDP; estimates suggest that US$ 770 billion could be added to India's GDP by 2025 by advancing women's equality in financial domains.

Women's propensity to save more diligently and allocate their savings towards family and future-oriented expenses significantly impacts how these savings translate into productive capital. Men's savings, while also significant, may differ in how they are utilised. The propensity for men to invest in what might be considered unproductive capital—such as luxury items or short-term consumption goods—does not contribute as directly to long-term economic growth. While discretionary spending by men can stimulate certain sectors of the economy, investments in human capital, health, and education (as typically prioritised by women) have more profound and lasting impacts on the economy's productive capacity.

The propensity for men to invest in what might be considered unproductive capital—such as luxury items or short-term consumption goods—does not contribute as directly to long-term economic growth.

One key aspect of the investment in human capital is where women allocate a substantial portion of their savings towards the education and healthcare of their children. This investment serves as a foundation for building a skilled and healthy workforce, fostering long-term economic growth. Moreover, women's savings align with sustainable economic development, as they often prioritise spending on necessities like nutrition, education, and healthcare, thereby, enhancing living standards and contributing to overall financial stability. Additionally, women play a crucial role in promoting entrepreneurship by channelling their savings into starting or expanding small businesses. This not only creates job opportunities but also introduces innovative solutions to market needs, highlighting the pivotal role of women's savings in productive capital formation and economic advancement.

In the Indian context, the implications of higher savings rates, particularly concerning women, present a nuanced scenario. Positive outcomes include increased capital formation and fostering economic growth as savings are directed towards productive assets. For women, this could be instrumental in supporting initiatives such as entrepreneurship and education, enhancing their economic participation. However, challenges emerge, notably the risk of reduced consumption in the short term, potentially impacting women-specific economic sectors reliant on consumer spending. Ensuring the optimal use of women's savings in India requires a focus on efficient mobilisation and allocation, leveraging financial markets and institutions. Government policies with a gender-sensitive approach are pivotal in encouraging women's participation in productive investments.

Positive outcomes include increased capital formation and fostering economic growth as savings are directed towards productive assets.

Digital enablers and saving trends

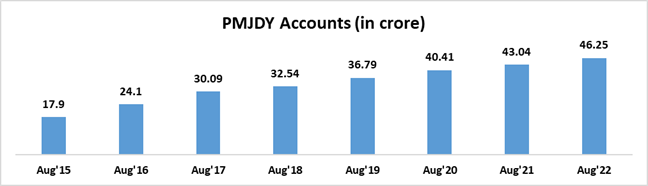

India's digital infrastructure is crucial in enabling women’s savings to be channelled into productive capital and investments. With initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY), which significantly increased the number of bank accounts among the low-income and female population, and the widespread adoption of mobile banking and payment systems, India has laid the groundwork for transforming savings into investments more efficiently. The PMJDY accounts have witnessed a remarkable three-fold growth, escalating from 147.2 million in March 2015 to 462.5 million in August 2022 (55.59 percent being held by women, and 66.79 percent located in rural and semi-urban areas), indicating a continuous and substantial increase in the number of accounts.

Figure 1: PMJDY Accounts (in tens of million, INR)

Source: Ministry of Finance, Government of India

For example, the Unified Payments Interface (UPI) system has also revolutionised digital payments, making it easier for women to engage in financial transactions and investments. These digital platforms not only provide women with better access to financial services but also offer a pathway for their savings to contribute to economic growth through investments in small businesses, real estate, and other productive assets. However, despite the significant overall growth of UPI transactions in India, reaching 260 million users as of 2023, specific challenges faced by women in embracing digital payments require attention for inclusive growth—less than 30 percent of women utilise UPI. Hence, assisted onboarding to enhance UPI adoption among women to potentially overcome usage barriers will be crucial.

Table 1: Key trends in women’s savings patterns in India

| Trend | Retirement Savings Decline | Growth in Financial Investments | Diversification in Investment Avenues |

| Study/Source | Bankbazaar.com, 2023 | Reserve Bank of India, 2022-23 | Economic Survey of India, 2022-2023 |

| Key Finding | A notable decline in women's participation in retirement planning in India, dropping from 68 percent in 2022 to 57 percent in 2023. | A steady increase in bank deposits and investments in Post Office Small Savings Schemes and Mutual Funds among Indian households. | An increasing number of women are actively moving beyond traditional savings methods, investing in share markets, fixed deposits, other stocks and mutual funds, and even virtual digital assets. |

| Analysis | This points towards a gender disparity in financial planning for the future, indicating a potential area where women's saving behaviours could be strengthened through targeted financial education and inclusion efforts. | This general trend suggests a growing propensity to save and invest, with specific initiatives aimed at increasing women's participation in these financial mechanisms. | This shift, facilitated by digital advancements, is attributed to greater financial independence and reflects women's broader participation in the financial market. |

Source: Authors’ own, data compiled from multiple sources

Understanding the nuanced differences in saving and investing behaviours between women and men emphasises the pivotal role of gender-specific financial conduct in shaping broader economic outcomes. Empowering women's roles as investors through well-designed policies and financial products becomes imperative for promoting sustainable and inclusive economic growth. Finally, the macroeconomic analysis of saving propensities in India also underscores the significance of considering socio-economic, cultural, and access-related factors. Despite persisting traditional roles and challenges, there is a discernible shift towards greater financial inclusion and women's economic empowerment. Policies and initiatives that bolster this positive trend can help amplify a more equitable landscape in India’s financial spheres.

Soumya Bhowmick is an Associate Fellow at the Observer Research Foundation

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Soumya Bhowmick is a Fellow and Lead, World Economies and Sustainability at the Centre for New Economic Diplomacy (CNED) at Observer Research Foundation (ORF). He ...

Read More +