-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

Hari Seshasayee, “US Secondary Sanctions and Petroleum Imports: Safeguarding India’s Energy Security,” ORF Issue Brief No. 532, April 2022, Observer Research Foundation.

Introduction

Over the past few years, India’s petroleum value chain has undergone a transformation. While remarkable, the change has received little attention from the country’s scholars of foreign policy.

In 2016, Iran and Venezuela constituted 21.8 percent of India’s total oil imports, as the third and fourth-largest suppliers of the country’s oil.[1] India enjoyed a cordial relationship with both countries, and the oil ministers of the three made frequent visits to Tehran, Caracas, and New Delhi. The oil relationship went beyond trade to include strategic investments—for instance, India’s flagship national oil company, ONGC Videsh Limited (OVL), made investments in multiple oil projects in Iran and Venezuela.

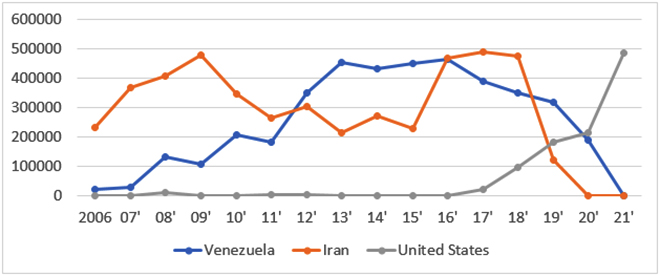

Yet, by 2021, India’s oil imports from both countries had slid to zero (see Figure 1). The reason for the complete halt was US secondary sanctions. They present the latest disruptions to India’s petroleum value chain, at a time when the country is grappling to maintain its energy security.

Figure 1: India’s oil imports from Venezuela, Iran, and the US, 2006–2021 (in quantity, bpd)

Sources: Trade Map and UN Comtrade

Perhaps even more crucial was the seemingly unintended consequence of these US sanctions: as India’s oil imports from Iran and Venezuela dropped to zero, the US quickly increased its crude oil exports to India. The US has since become India’s fourth-largest supplier of oil, and India is the US’s largest export market globally for crude oil.[2]

Yet another dimension has been added to the disruption in India’s oil value chain: Western sanctions on Russia, following its invasion of Ukraine in late February. Although Russia accounted for only 0.5 percent of India’s total oil imports from 2010 to 2020,[3] the sanctions have had an indirect impact on global oil prices, which soared to USD140 per barrel before stabilising at just over USD100 at the time of writing this brief. To be sure, however, India continues to lift Russian oil, albeit in small quantities.

This brief examines the disruptions to the petroleum value chain at a global scale, highlighting the case of US secondary sanctions and their impact on India’s petroleum imports. It offers specific recommendations to reduce the risk of future disruptions to India’s energy supply.

Occasional Disruptions in the Global Petroleum Value Chain

No other commodity in human history has seen the kind of disruptions to its value chain as petroleum. Ten events have caused a supply disruption of at least 2 million barrels per day (bpd): the 1956 Suez Crisis; the 1967 Six-Day War; the 1973-74 oil embargo; the 1979 Iranian Revolution; the 1980 Iran-Iraq War; the 1990-91 invasion of Kuwait; Iraq’s 2001 oil export suspension; the 2002 Venezuela oil strike; the 2003-11 Iraq War; and the drone strikes on Saudi Aramco’s facilities in 2019.[4] Of these, the 1973 oil embargo caused the biggest increase in global oil prices (231 percent), and the 2019 drone strikes in Saudi Arabia resulted in the largest oil supply loss (5.7 million bpd). In April 2020, the Saudi-Russia oil price war—in essence, a disagreement on production cuts between the two largest oil exporters in the world—caused oil prices to plunge to negative territory in an unprecedented crash.

These disruptions can affect oil-producing nations just as much as oil importers. India is no exception, as the world’s third-largest oil importer and consumer after only China and the United States. Due to the lack of adequate domestic petroleum reserves, India has always been heavily dependent on other countries, importing roughly 85 percent of its oil needs.

Following the 1973-74 oil embargo, India’s Ministry of External Affairs (MEA) noted in its annual report that the country “has also been severely hit by the energy crisis brought about by unprecedented increases in oil prices.”[5] Despite India’s non-aligned stance during the Cold War—not formally aligning with the US nor with the Soviet Union—and its overtures to oil-producing nations in West Asia, the MEA asserted that the conflict between the US and West Asian states had “introduced an element of uncertainty if not anxiety in the region.”[6]

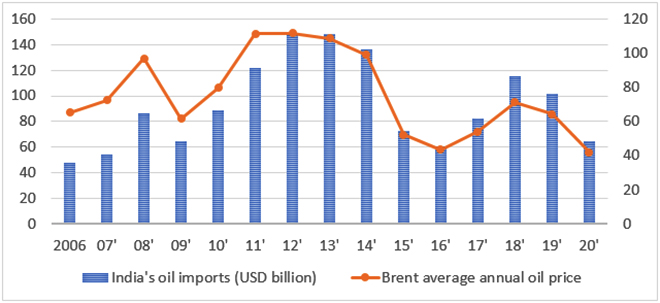

Such increases in global oil prices are often a burden on India’s finances, since government-owned companies account for a large majority of oil imports. When the average annual Brent crude oil price peaked at USD111.67 per barrel in 2012,[7] India’s oil imports too reached a record USD 148.75 billion—a massive 8.13 percent of gross domestic product (GDP). Similarly, when the average annual price of Brent fell to a 16-year low of USD41.96 per barrel in 2020, India’s oil imports fell to USD64.57 billion, or a far lower 2.65 percent of GDP (see Figure 2).[8]

Figure 2: Global oil prices vs. India’s oil imports

Source:Trade Map for India’s oil imports; U.S. Energy Information Administration for Brent annual price[/caption]

The Challenge in US Secondary Sanctions

The latest disruption to India’s energy security is presented by the unilateral sanctions that the US imposed on two major oil supplying nations—Iran and Venezuela—in 2019 and 2020. A foremost question is how these US secondary sanctions affect India.

The US imposes two types of sanctions: primary and secondary. Primary sanctions are levied directly against individuals or entities in specific countries, such as what has been witnessed in Venezuela. Entities from Venezuela, such as the national oil company Petroleos de Venezuela S.A. (PdVSA), face primary sanctions that prohibit PdVSA from doing business with US citizens or entities. Secondary sanctions are more complicated: If foreign entities engage with actors targeted by primary sanctions, the US Department of State or the Treasury Department can “select from a ‘menu’ of access restrictions of varying severity to impose on the foreign person” such as the “denial of export licenses or loans from U.S. financial institutions, and in the most severe cases may include designating the foreign person as an SDN [Specially Designated Nationals].”[9] The most stringent secondary sanctions can even cut out access to the US financial system and the use of the US dollar—this can ring the death knell for any company engaging in international trade.

The impact of secondary sanctions may be indirect, and often unpredictable, but the threat remains real and potentially perilous. In the recent case of Venezuela, the US sanctioned numerous entities in 2020 that engaged in or facilitated oil trade with Venezuela, including subsidiaries of Russia’s government-owned oil company, Rosneft, and maritime firms like Cyprus-based Caroil Transport Marine Ltd and Panama-based Trocana World Inc.[10] Given their deep ties to the US and also to international trade, these sanctioned entities steer clear of Venezuela and no longer act as intermediaries between Venezuela and their potential buyers.

Amidst the threat of US secondary sanctions, Indian companies, both public and private, have remained cautious and watchful. As a result, India’s oil relationship with Iran and Venezuela has changed considerably over the past decade. Although New Delhi has varying degrees of engagement with both countries, by 2021, both have reached the same conclusion: a complete break in oil exports to India. The following paragraphs examine each case in detail.

1. Iran: Iran is a historical partner, and shared a land border with pre-independence India. India-Iran relations run deep, and include regular visits and exchanges at the level of heads of government, as well as security cooperation between both countries’ National Security Advisers. The bilateral trade basket is diverse, including oil, agricultural products, pharmaceuticals, machinery and fertilisers; investments include those in strategic sectors such as Iran’s Shahid Beheshti Port at Chabahar, which India is developing to improve connectivity between Iran, Afghanistan, and India. Iran’s share of India’s total oil imports reached a peak of 16.60 percent in 2007.[11]

Yet, US sanctions have repeatedly determined the quantity of India’s oil imports from Iran. In the 2006-2010 period, Iran was India’s second-largest supplier of oil (behind only Saudi Arabia), accounting for 14 percent of total oil imports.[12] After an escalation in US sanctions against Iran in 2010, and more stringent application of secondary sanctions, the West Asian country’s share in India’s oil imports fell to an average of only 7 percent between 2011 and 2020.[13] Sanction waivers from Washington DC always decided how much oil would flow from Iran to India. One example of the impact of US sanctions on India’s oil imports from Iran is the experience of India’s largest private oil company, Reliance Industries Limited (RIL), which has deep commercial linkages with the US. RIL stopped buying Iranian oil in April 2010, resuming imports only in April 2016 for a brief period, before halting it again in October 2018. Due to the threat of US secondary sanctions after the US stopped granting waivers, India’s oil imports from Iran dropped considerably in 2019, before coming to a complete standstill in 2020.

2. Venezuela: The case of Venezuela—more than 15,000 km from India—is considerably different from that of Iran. While diplomatic relations have remained cordial, they have a far more recent history in comparison to the India-Iran relationship; unlike the case of Iran, too, Venezuela has little additional strategic impetus to offer India besides oil. It is no surprise that the business of oil drives the India-Venezuela relationship, while politics remains secondary. Only after the visit of Venezuela’s then-president Hugo Chávez in 2005 did the bilateral relationship experience some momentum. By 2008, India started importing reasonably large quantities of Venezuelan oil.

Venezuela, however, is unlike any other oil supplier for India: it is home to the world’s largest petroleum reserves at 303 billion barrels of oil—more than the oil reserves in Europe, Africa, and Central Asia combined.[14] The large majority of these reserves are in the form of ultra-heavy crude, which is more difficult to refine but sold at a considerable discount. The complementarity with ultra-heavy crude is key to understanding the India-Venezuela oil trade.

Heavy crude—characterised as sour, denser oil containing more sulfur and nitrogen—goes through a more complex refining process to remove contaminants like sulfur through dilution with light oils like naphtha or with the use of high-pressure hydrocracking technologies. As a result of Venezuela’s ultra-heavy crude, the country’s Merey blend is usually priced at a massive discount of 15 percent in comparison with the Brent oil price. Few refineries in the world have the ability to process large quantities of ultra-heavy crude; it happens that two of these refineries are in India, and are owned by private companies RIL and Nayara Energy (previously known as Essar Oil, owned by a Russian consortium led by Rosneft since 2017). These two account for practically all of India’s oil imports from Venezuela. Both companies import Venezuelan oil at bulk, discounted rates, refine the crude oil into finished products like petrol or diesel, and sell them at much higher rates either within India, or for export to international buyers in the US and Brazil.

In 2015, at the peak of India’s oil imports from Venezuela, the latter made up 11.42 percent of India’s total oil imports. Between 2012 and 2016, 11 percent of India’s oil came from Venezuela. However, US sanctions on the Andean nation first implemented in 2019, and escalated in 2020, have set back India-Venezuela ties; India’s oil imports from Venezuela quickly fell from 350,000 bpd in 2018 (prior to US sanctions) to just 191,000 bpd in 2020 post-sanctions, before halting altogether in 2021.

There is little doubt that the threat of US secondary sanctions on Iran and Venezuela are a dampener for India’s energy security. The cessation of oil imports from Venezuela is a massive loss of opportunity for India’s private oil companies, RIL and Nayara Energy, which used to generate sizeable profits from importing Venezuelan oil, refining it and selling finished products like petrol and diesel at a far higher cost. Both private companies have invested considerably in upgrading their refineries to handle the extra-heavy Venezuelan crude. Since October 2020, neither company has imported any oil from Venezuela. Many of India’s public oil companies are also tuned to refine Iranian medium-to-heavy grades of crude. Since late 2019, they too have ceased all imports of Iranian crude since the US stopped granting waivers to India.

Since much of India’s oil industry is made up of government-owned companies, the Government of India has a massive stake in this regimen of US sanctions. In the early 2000s, India used the Asian Clearing Union (ACU)— which consists of central banks and monetary authorities of Iran and a network of South Asian countries—to facilitate direct payments for trade, including the import of Iranian oil. After then US President Barack Obama’s visit to India in 2010, the US pressured India to stop using the ACU to settle payments for Iranian crude. New Delhi then worked out another mechanism, a “rupee-rial” system with India’s UCO Bank to pay for Iranian crude without any exposure to the US Dollar—while the rest of the payment was made in Euros, through the Turkey-based Halkbank.

Besides these rather complicated financial methods, the Government of India has already tried to make some systemic changes to shield the country from such supply disruptions. In response to a question raised in Parliament regarding additional US commercial sanctions imposed on Iran in 2014, India’s then Minister of State for External Affairs General (Retired) VK Singh stated that “Indian oil companies continuously engage in diversifying their crude oil purchase basket to eliminate dependence on any particular country or region.”[15] In late 2020, after Joe Biden was elected US president, India’s oil minister Dharmendra Pradhan stated that India is keen to resume oil imports from Iran and Venezuela under a new US government that may be more amenable to lifting or at least adjusting sanctions on both countries.[16] At the time of writing this brief, there has been no change in US sanctions policy against Venezuela nor Iran.

Policy Recommendations

Supply disruptions to India’s petroleum value chain—much of which is dependent on foreign countries—can be a serious threat to the country’s energy security given the sheer size and scale of India’s petroleum industry. Moreover, the country’s economic growth is largely driven by oil, which is used in individual and commercial transportation, as an industrial fuel, and also in numerous allied industries such as fertilisers and petrochemicals, as well as in pharmaceuticals. Although India can do little, if at all, to stop disruptions to global oil markets, or even against unilateral US sanctions on major oil exporters such as Venezuela and Iran, there are several ways of safeguarding its energy security.

First, and perhaps most significant, is the establishment of sufficient Strategic Petroleum Reserves (SPR), which can act as India’s defense against any energy security emergency. The Indian Strategic Petroleum Reserves Limited (ISPRL), a government entity responsible for building strategic crude oil reserves in order to “ensure energy security” and “serve as a cushion during any supply disruptions,” currently holds 5.33 million metric tons (MMT) of crude oil in underground rock caverns across the east and west coasts of the country in Visakhapatnam, Mangalore, and Padur.[17] These SPRs, however, remain insufficient, and can supply scarcely 9.5 days of India’s total oil needs in case of an emergency. An additional investment of USD4.5 billion to USD6 billion would be required to bring India’s SPRs to last up to the 90 days of emergency oil stocks that is recommended by the International Energy Agency (IEA).[a] This should be manageable in the medium term and the ISPRL could set a target of achieving these emergency stocks by 2035.

Second, in the specific case of US sanctions on Iran and Venezuela, India’s public and private oil companies can coordinate lobbying efforts, along with diplomatic support from the Government of India, to receive specific waivers from Washington. Indian companies have been actively lobbying in Washington DC since 2009 to ensure compliance with US sanctions policy and obtain waivers to continue oil imports in some form from Iran and Venezuela. Their results have been mixed: while lobbying facilitated oil imports from Venezuela during 2019 and much of 2020 through diesel swaps, as well as waivers to import Iranian oil for the majority of the 2010s, the last two years have seen a complete cessation of imports from Iran and Venezuela despite continued lobbying efforts. If Indian oil companies combine their lobbying efforts, with coordinated support from India’s diplomatic missions and the government in New Delhi, they stand a greater chance of receiving waivers from US secondary sanctions for doing business with Iran and Venezuela, under the grounds that these oil imports are imperative to India’s energy security and economic development.

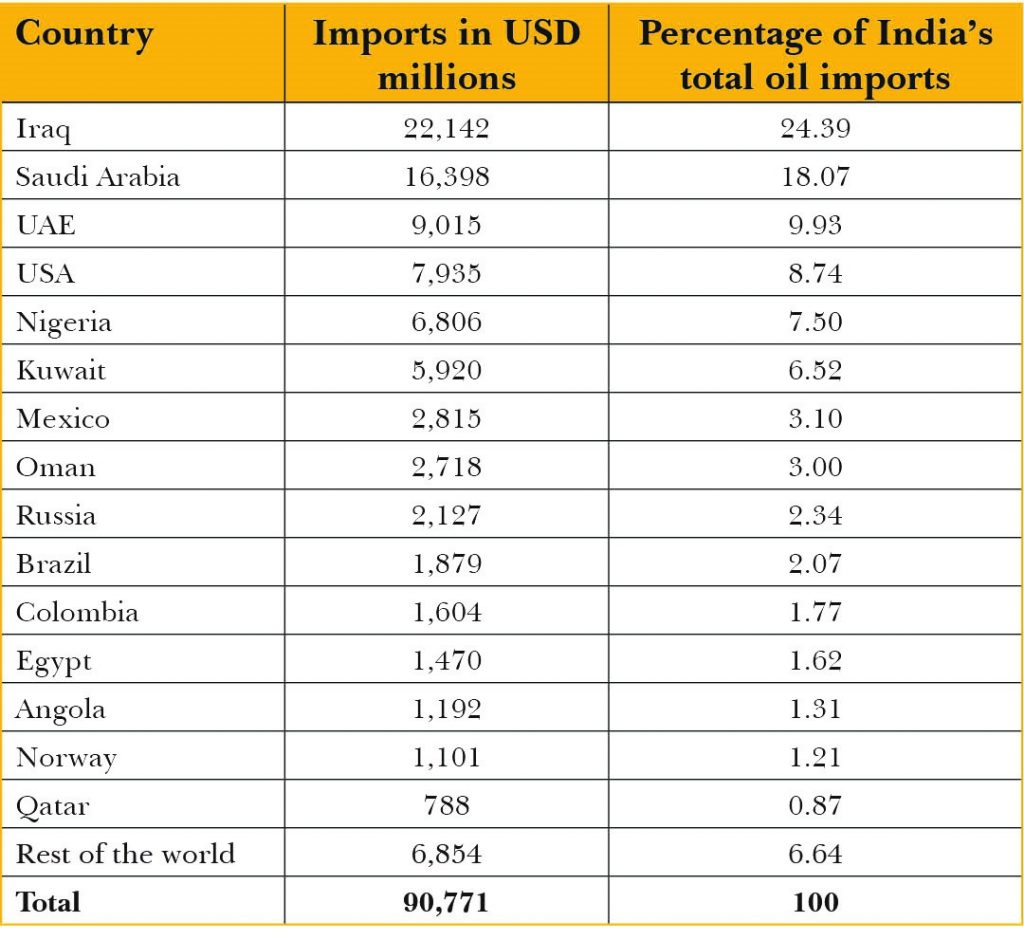

Third, India must continue to diversify, in all respects, regarding its energy security policy. This includes diversification of oil import sources to expand to relatively new suppliers, such as the US, Canada and Guyana, as well as oil exporters in Africa and Latin America. This will help reduce the country’s dependence on West Asia, which supplies upto two-thirds of India’s oil needs. Already, from 2006 onwards, an increasingly large share of India’s oil imports are coming from Africa, ranging from 14 percent to 23 percent of India’s total oil imports in any given year; between 12 percent and 20 percent come from Latin America. This diversification allows India to keep a reliable basket of suppliers in case of supply disruptions in certain markets. For example, India can buy more US and Canadian heavy crude when sanctions affect imports from Venezuela, or buy more African light and medium crude to substitute oil supplies from Iran.

Table 1: India’s oil imports, by country, 2021-22

Source: Ministry of Commerce and Industry, Government of India, April 2021 to January 2022, https://tradestat.commerce.gov.in/eidb/

India must also diversify its energy mix to include a higher share of renewables, which are domestic, reliable sources of energy. India must continue to invest in and promote renewable energies in order to achieve the ambitious target set in the National Energy Policy of a nearly 10-fold increase for renewables in the energy matrix from 266-terawatt hours (TWh) in 2012 to 2602 TWh in 2040.[18]

Even as India increases its mix of renewables, petroleum remains one of the most affordable sources of energy and it will maintain its place at the core of India’s energy security policy, along with other fossil fuels like coal. As a result, even in the most ambitious estimates from the Government of India—to increase the share of renewables and clean energy—petroleum would still account for a significant 25 percent of India’s total primary energy supply by 2040. In more specific terms, India’s oil import demand would increase from the current 200 million tons to between 350 million and 465 million tons by 2040.[19]

Another estimate from the government think tank, NITI Aayog, shows that even in the “maximum energy security” calculations, the country’s import dependence in oil would decrease only from 79 percent in 2032 to 72 percent by 2047—still a long shot from energy independence.[20] Other, less optimistic calculations put India’s oil import dependence at upto 95 percent by 2047, when oil alone will account for 19,789 TWh of energy supply.[21]

The Road Ahead: US Secondary Sanctions on Russia?

At present, India’s energy security remains in the balance. Far more needs to be done by the Government of India and the country’s private sector to ensure a more equitable and independent energy matrix that can withstand any uncertainties in global oil markets. To be sure, however, India is more prepared today than it was two decades ago: the country has diversified its oil import sources considerably to buy more oil from Africa and the Americas, and there has been a concerted effort to increase the share of renewables and clean energy.

Even as India safeguards itself from future disruptions to its energy security by diversifying its oil import sources and increasing its SPRs, the threat of US secondary sanctions looms on the horizon. While imports from Venezuela and Iran nosedived to zero due to US sanctions over the past few years, the threat has expanded to another area key to India’s foreign policy –Russia. The Russian invasion of Ukraine has resulted in harsh sanctions levied by the US and European countries on Russia. In addition to excluding Russia from SWIFT (the primary network used by banks globally to track and manage finances), the US and UK have imposed sanctions targeted at Russia’s oil and gas sector, the mainstay of the Russian economy. Could this possibly affect India’s long-standing relationship with Russia, a country that India depends on for nearly two-thirds of its arms imports?[22]

India will have to continue walking this tightrope to balance its two most strategic relationships – with the US and Russia. In the long term, however, the answer to true strategic autonomy for New Delhi may lie in two drastic imperatives, as outlined by Admiral Arun Prakash, India’s former Chief of Naval Staff: “The ‘de-Russification of the armed forces’ and the genuine ‘indigenisation of India’s defence technological and industrial base’.”[23] Whether India recalibrates its geopolitical calculus to inch away from Russia and edge closer to the Quad will depend on how decisively it addresses both these issues. Regardless, it will take years to substitute defence imports from Russia with another country, or even with indigenous production. In the short term, India will be bound by its dependency on Russia, particularly in defence but also in oil and gas, through either trade or investments.

As highlighted during Russian Foreign Minister Sergey Lavrov's visit to New Delhi on 1 April 2022, India is likely to continue importing Russian oil at highly discounted rates. This can be explained by two factors: first, Indian companies have invested USD16 billion in Russia's oil and gas sector.[24] As a result, companies like OVL, Indian Oil Corporation, and Bharat Petroleum Corporation Ltd, which operate in Russian oil fields, often also handle the export of oil from Russia to India. Second, and perhaps more importantly, while India's imports of Russian oil may grab headlines, the volumes remain negligible. India was only Russia's 18th largest oil export destination in 2021, and Russian was India's 15th largest supplier of oil in 2020.[25] Although India may be buying Russian oil at heavy discounts, the value remains small and is dwarfed by Russian oil exports to Europe and China.

A question that the Geopolitical Intelligence Services group, a think tank in Liechtenstein, asked recently is whether sanctions regimes have endgames. It argues that sanctions have “universally failed to achieve their objectives.”[26] Yet, as shown in the case of India’s wind-down of imports from Venezuela and Iran due to the US secondary sanctions, these sanctions “impose real costs on many intended and unintended victims, including the international economic system.”[27]

Going forward, the Government of India could consider devoting a small section of its bilateral relationship with the US to study and eventually negotiate possible solutions to avoid secondary sanctions, particularly when it impacts India’s energy security. This could be in the form of a team within the MEA or India’s diplomatic missions in the US dedicated to the issue of balancing secondary sanctions while maintaining its strategic relationship with the US. This could further strengthen India’s energy security without causing any friction in the India-US bilateral relationship.

Hari Seshasayee specialises in India’s foreign policy and the political economy of Latin America. He is a trade adviser at ProColombia, a Colombian government agency, and a Global Fellow at the Woodrow Wilson Center. He can be reached at [email protected] and tweets at @haricito. The views expressed in this paper are solely the author’s, and do not reflect the opinions of the Colombian government.

Endnotes

[a] Authors’ calculations based on current estimates of the Government of India to set up 5.33 million tons of SPRs at a cost of Rs 4098.35 crore. Actual costs would vary based on actual prices of oil, types of crude procured, and transport and storage costs, and could range between US$ 4.5 billion and US$6 billion based on geopolitical events and oil price fluctuations.

[1] “Trade Map,” International Trade Centre.

[2] Hari Seshasayee, “Oil: A New Chapter in U.S.-India Relations,” The Wilson Center, February 10, 2022.

[3] “Trade Map,” International Trade Centre.

[4] Dan Murtaugh, “The oil market's reaction to Saudi Arabian attack in five charts,” Bloomberg Markets, September 16, 2019.

[5] “1974-75,” Ministry of External Affairs, Government of India.

[6] Ministry of External Affairs, Government of India, Annual Report 1974-75

[7] “Europe Brent Spot Price FOB,” U.S. Department of Energy.

[8] Note: Calculations based on Trade Map and World Bank.

[9] Jason Bartlett and Megan Ophel, “Sanctions by the Numbers: U.S. Secondary Sanctions,” Center for a New American Security, August 26, 2021.

[10] Jason Bartlett and Megan Ophel, “Sanctions by the Numbers: Spotlight on Venezuela,” Center for a New American Security, June 22, 2021.

[11] Calculations based on Trade Map (www.trademap.org), when Iran accounted for US$25.70 billion of India’s total oil imports of US$225.55 billion in 2018.

[12] “Trade Map,” International Trade Centre.

[13] “Trade Map,” International Trade Centre.

[14] “Statistical Review of World Energy 2021,” BP, July 2021.

[15] “Q NO.840 SANCTIONS ON IRAN,” Ministry of External Affairs, Government of India.

[16] PTI, “India keen on US allowing resumption of oil supplies from Iran, Venezuela: Pradhan,” Economic Times, December 2, 2020.

[18] “Draft National Energy Policy,” NITI Aayog, Government of India, June 27, 2017.

[19] “Draft National Energy Policy,” NITI Aayog, Government of India, June 27, 2017.

[20] “India Energy Security Scenarios 2047,” NITI Aayog, Government of India.

[21] “India Energy Security Scenarios 2047,” NITI Aayog, Government of India.

[22] PTI, “Indian military cannot operate effectively without Russian supplied equipment: CRS report,” Economic Times, October 27, 2021.

[23] Arun Prakash, “An ‘atmanirbhar’ India can look the world in the eye,” Indian Express, March 21, 2022.

[24] Utpal Bhaskar, "No immediate plans to invest in energy assets in Russia: OIL," LiveMint, February 25, 2022.

[25] “Trade Map,” International Trade Centre.

[26] Stefan Hedlund, “Do sanctions regimes have endgames?,” Geopolitical Intelligence Services AG, January 7, 2022.

[27] Stefan Hedlund, “Do sanctions regimes have endgames?”

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Hari Seshasayee is a visiting fellow at ORF, part of the Strategic Studies Programme, and is a co-founder of Consilium Group. He previously served as ...

Read More +