Introduction

There is a broad consensus among economists that climate change is a product of both market and policy failure.[1] That the cost of emitting greenhouse gases (GHGs) is not reflected in the price of goods and services, and allows ‘free-riding’ on climate as an input for economic activity is indicative of an egregious market failure.[2] It perpetuates the linkage between fossil fuel consumption and economic growth.[3] Further, poor incentives for potential innovators and the inadequacy of public infrastructure, energy networks, and finance have impeded investments in research, development and deployment of clean technology. Among public policy failures, fossil fuel subsidies and a distortionary tax system are most consequential.[4]

Effective climate change policies will be instrumental in reversing the trend. Carbon pricing is considered a cost-effective measure to internalise the externalities associated with CO2 emissions and maximise emission reduction per dollar at the lowest possible cost to producers, consumers, and taxpayers.[5] Putting a price on carbon internalises the social cost of carbon, and compels companies to adjust their investment portfolio and production methods while encouraging consumers to alter behavioural patterns.[6] It embodies a laissez faire ideology offering a market-friendly mechanism that allows firms and consumers the flexibility to choose between the costs of cutting emissions and the benefits accrued from continuing to emit—and this ensures maximisation of environmental benefit at the least cost.[7]

The idea of a price internalising externalities dates back to a century ago when the economist Arthur Pigou argued in ‘The Economics of Welfare’ (1920), that individuals (and firms) will continue to take actions with little regard to the costs imposed or benefits conferred on others, unless the cost to individuals incorporate a social cost of an act. A Pigouvian tax on carbon, therefore, ensures that the cost of emitting GHGs is reflected in the price of the commodity or service.[8]

A carbon price is deemed as an effective tool to incentivise future investment, consumption and innovation towards sustainable and climate-friendly pathways, and support a sustainable pandemic recovery. In 2021, approximately USD 84 billion was recorded in carbon pricing revenue, almost 60-percent higher than in 2020, as a result of higher carbon prices, increased auctioning from emissions trading, and revenue from new instruments. Moreover, carbon pricing can be a useful fiscal tool and a prominent source of augmenting government revenues.[9] Typical carbon pricing policies allocate government revenues in three ways: investment in climate-related clean technologies, general budget, and income tax cuts or rebates.[10] Estimates suggest that investments in sustainable industries can generate jobs three times of the full-time jobs from government spending in fossil fuels.[11] In the context of developing economies, these investments become particularly critical for supporting vulnerable sectors and communities to adapt to climate change and achieve just transitions.[12] Pre-emptively, designing effective domestic climate policies inclusive of carbon pricing mechanisms—such as the EU Carbon Border Adjustment Mechanism—can also help offset the implications of border tariffs. This idea is increasingly being considered among developed nations as a protectionist strategy to avoid carbon leakage.

This paper seeks to explore the increasing role of carbon pricing as an effective instrument in climate policy. Carbon pricing, within an integrated policy mix, has been propounded as a cost-effective and efficient tool to achieve both economic and environmental benefits. In the case of India, the relevance of carbon markets has been underlined by the recent Energy Conservation (Amendment) Bill, 2022 which is momentous in its scope, empowering the government to establish a carbon credit trading scheme and laying the ground for a formal carbon market that can be instrumental in India’s pathway towards a net-zero economy by 2070.[13]

The paper aims to understand the landscape of global carbon pricing mechanisms, primarily carbon tax and emission trading systems, and draw on the global knowledge and experience to arrive at a suitable decarbonisation strategy for India using national carbon markets. The rest of the paper delineates the different approaches to pricing carbon; reviews the current global carbon pricing landscape; and outlines the measures undertaken by India to put an implicit price on carbon. It concludes with a proposed approach to a carbon pricing framework that would be most favourable to India.

I. Approaches to Carbon Pricing

There are different approaches to determine the most appropriate rate of carbon tax and is often based on the policy objectives and goals of the tax regime in a given jurisdiction. The tax rate could be determined using an abatement approach—which is the level of carbon emission reduction the country hopes to achieve—or the social cost of carbon approach which translates into the dollar value of damages incurred from emitting each additional metric ton of greenhouse gases. It could also be determined using the revenue approach, where the tax rate is based on the revenue considerations of the regulating authority or by simply following a benchmarking approach where the tax rate is linked with the rate in neighbouring jurisdictions, among trading partners or competitors.[14]

Carbon pricing mechanisms are predicated on the basis that profit-making firms will continue to cut emissions to the point where the marginal abatement cost is lower than the social cost of carbon. To put this into perspective, the marginal abatement cost for an entity is the marginal cost of reducing each additional unit of emission and is contingent on various factors including the pace of low carbon technological innovation, cost of compliance, as well as the ability of firms and consumers to substitute low-carbon products for high-carbon ones.[15] The social cost of carbon for an entity is the marginal damage cost of a unit of emissions and presents the economic value associated with one extra unit of greenhouse gas in the atmosphere.[16]

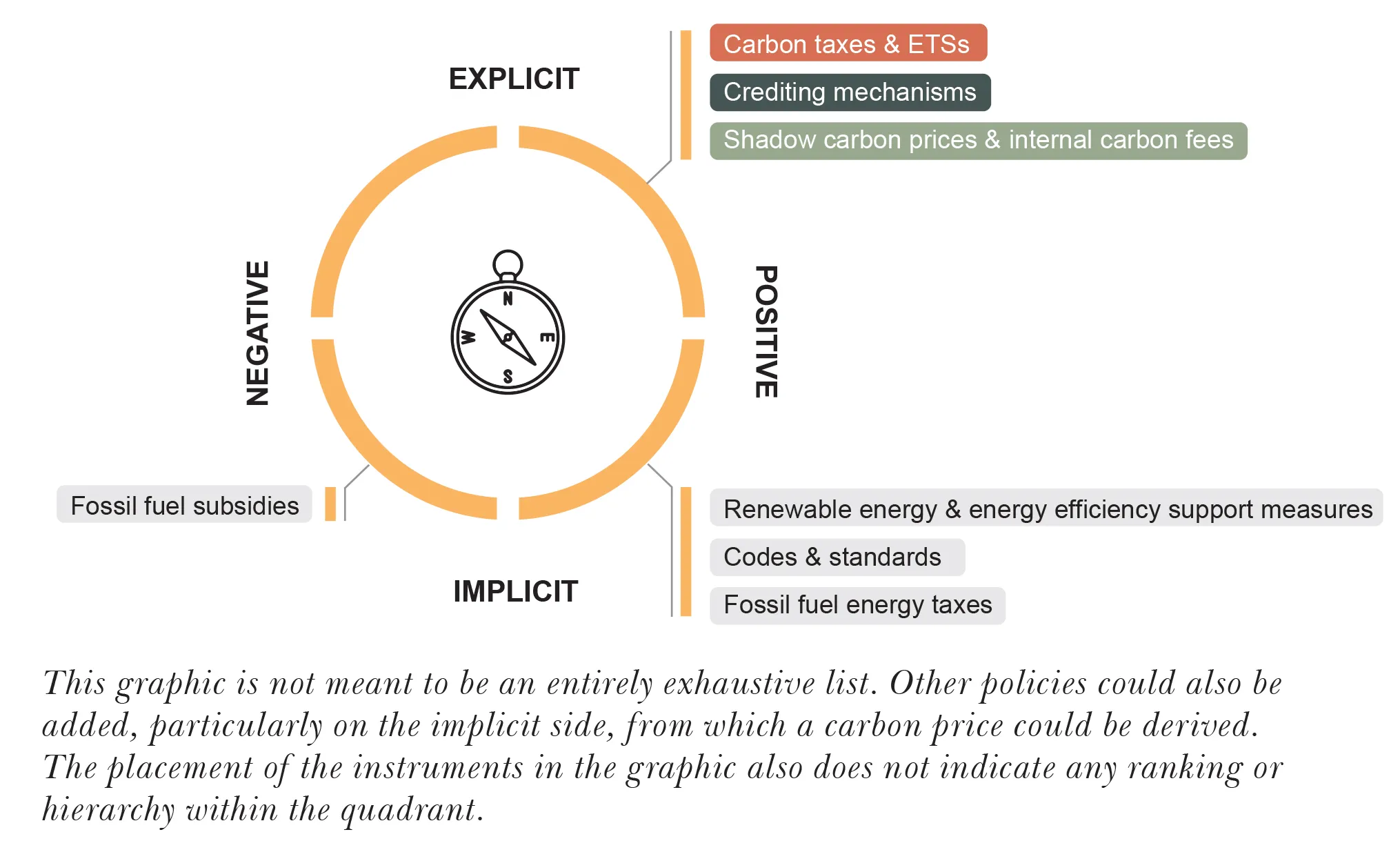

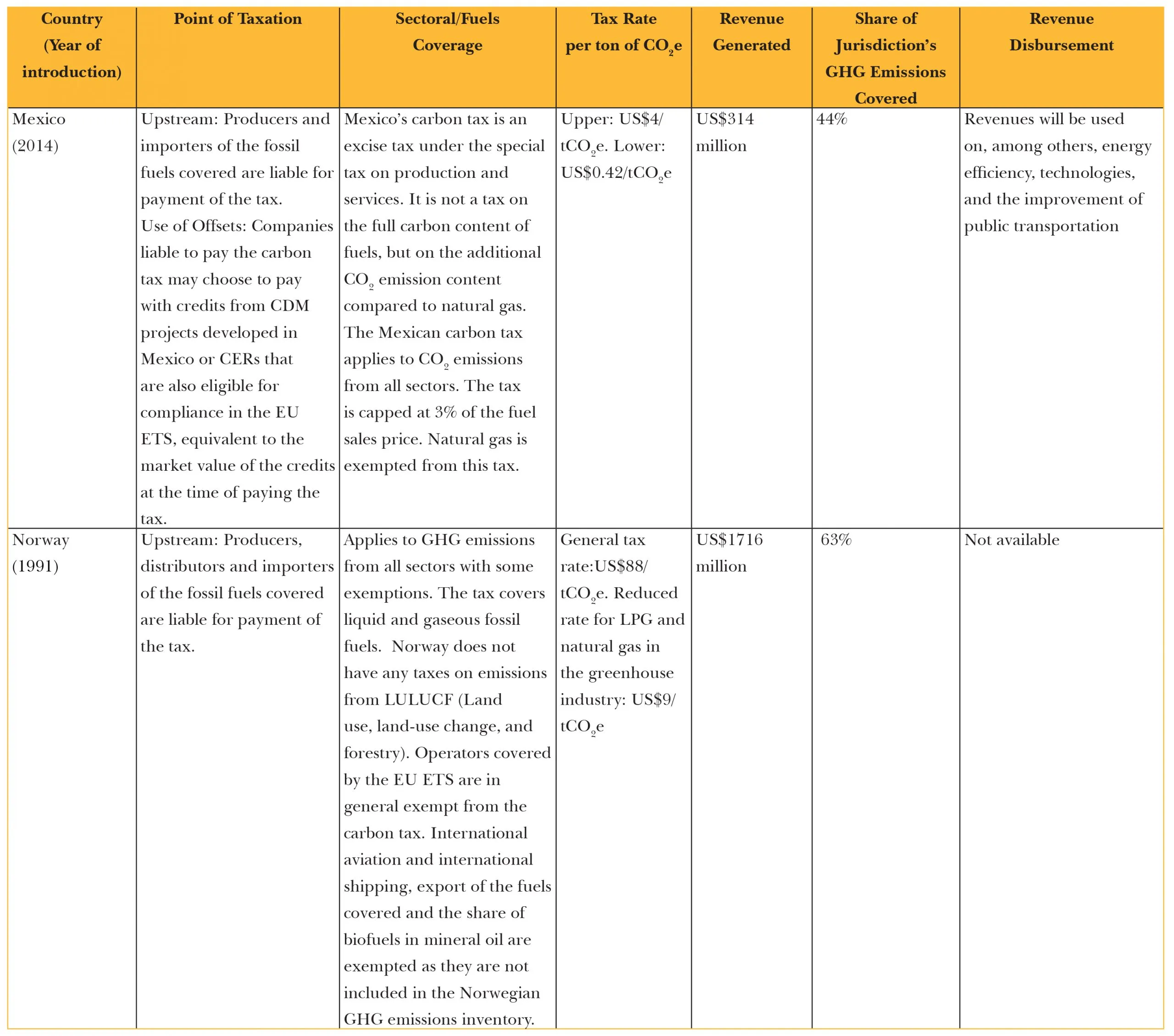

A range of policy instruments, market or valuation based, can be leveraged to price carbon which can effectively lead to a carbon reduction pathway. These can be classified as an explicit or an implicit carbon pricing strategy, and include carbon tax, cap-and-trade scheme, emission reduction credits, clean energy standards, and fossil fuel subsidy reduction.

Figure 1.[17]

Source: The World Bank: State and Trends of Carbon Pricing 2021

Source: The World Bank: State and Trends of Carbon Pricing 2021

1. Explicit Carbon Pricing

Explicit carbon pricing is usually mandated by the government and imposes a price on the carbon content. It acts as a market signal for producers and consumers to move towards cleaner sources of production and consumption and encourage a more cost-effective carbon mitigation pathway. These can be achieved through carbon taxes and/or an ETS (emission trading system or cap-and-trade) which holds emitters responsible for their actions; carbon credits which creates a reward-like system for reducing carbon emissions; or via internal shadow pricing leveraged by companies to guide decision-making on investment. Contingent on the design, they render various benefits such as augmenting government revenues, creating green industries and jobs, encouraging low-carbon investment, enhancing energy efficiency and security, and improving air quality.[18]

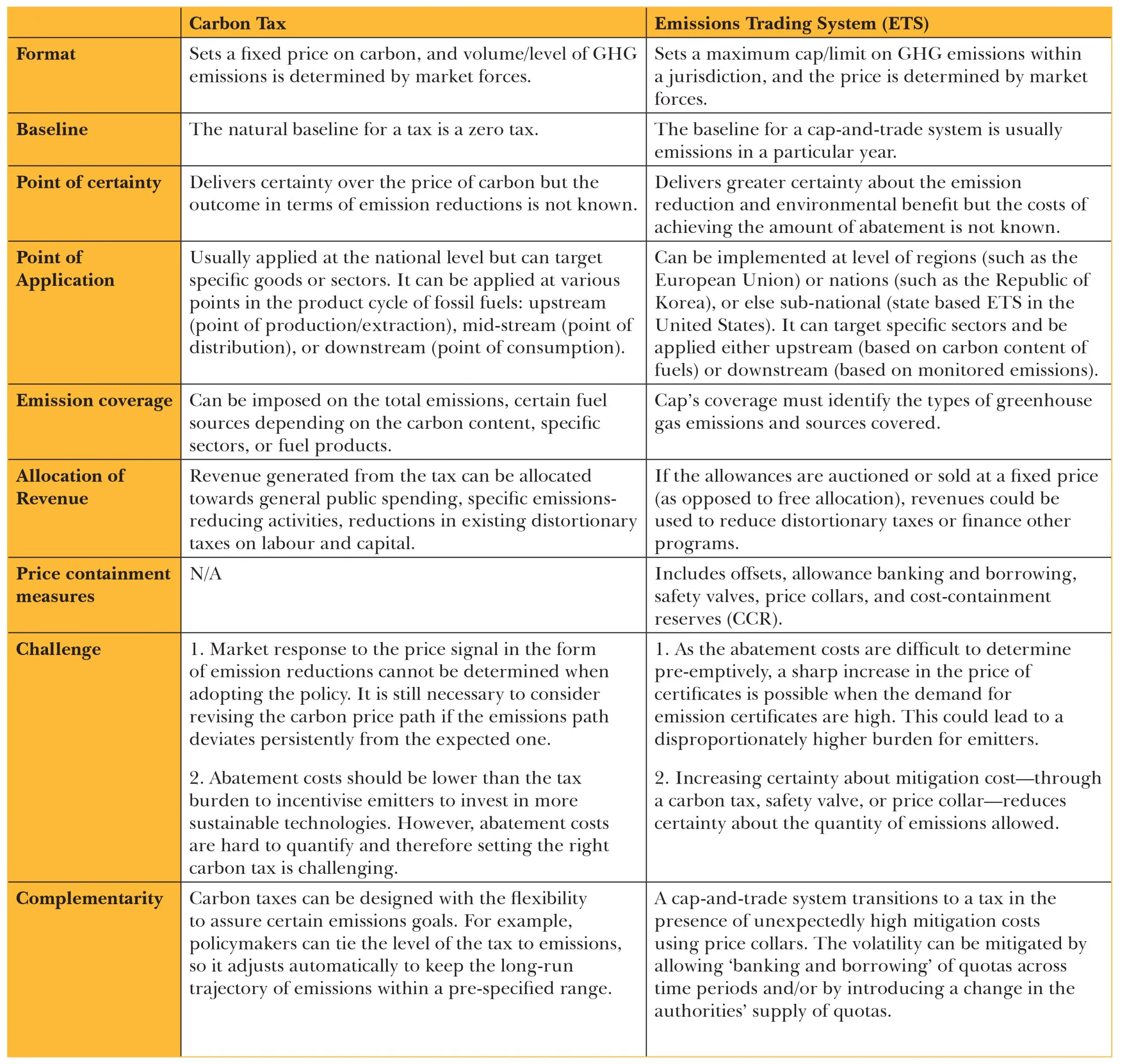

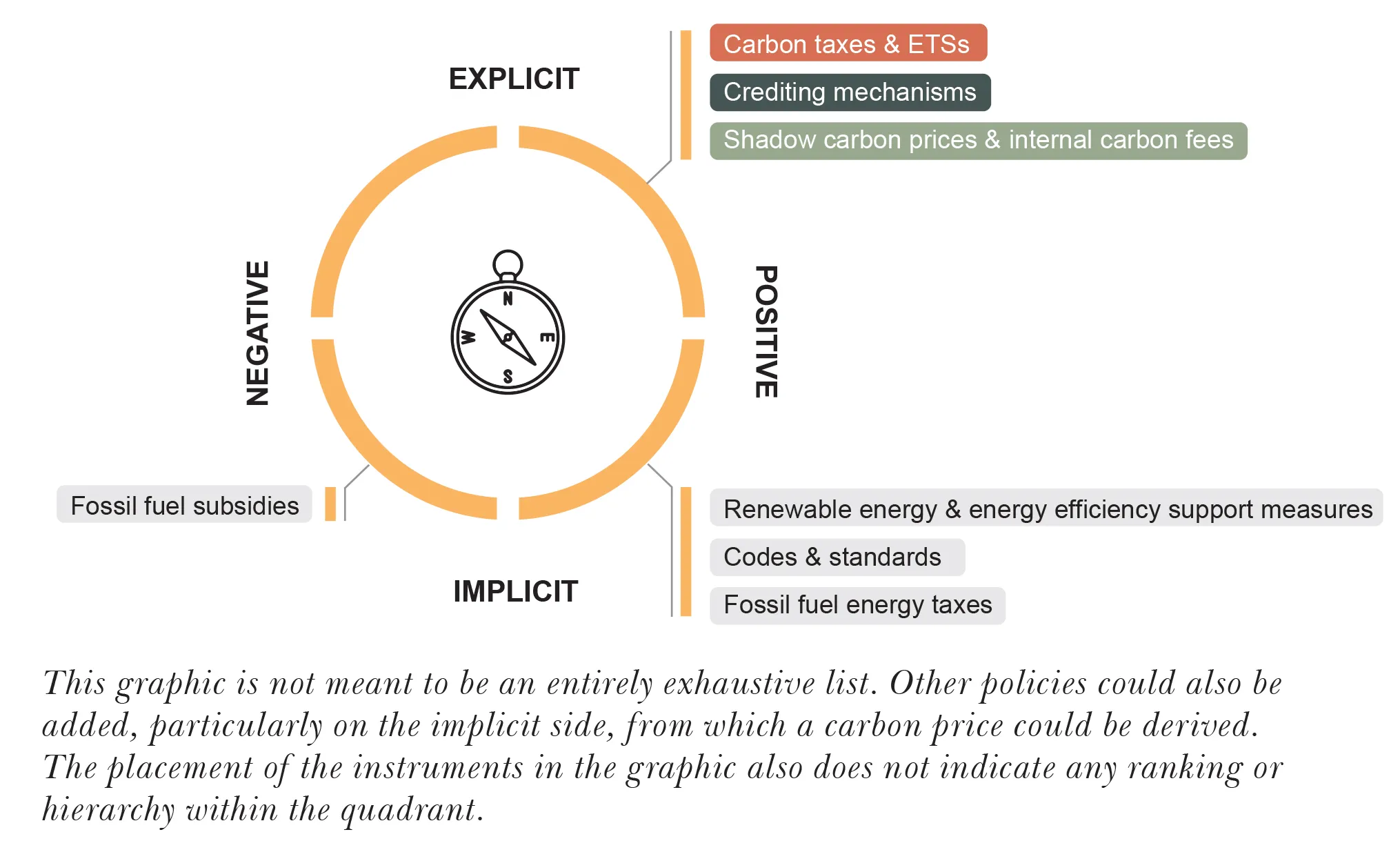

a. Carbon Tax

A carbon tax imposes a fixed price on carbon (CO2 equivalent on GHG emissions) while the quantity of emission reduction is left to the market forces. The objective is to increase the cost of fossil fuel and provide an incentive for investments in fuel-switching strategies and energy-efficient technologies.[19] It can be applied at different points in the product cycle of fossil fuels, upstream (point of production/extraction), mid-stream (point of distribution), or downstream (point of consumption).[20]

Considerations across price, emission coverage, point of taxation, allocation of revenue generated from the tax towards general public spending or specific emissions-reducing activities, and harmonisation across boundaries beyond the jurisdiction of the tax should be built into the design and reviewed periodically.[21] However, it is important to note that the market response to the price signal in the form of emission reductions is difficult to determine and estimate.[22]

Carbon taxes have the potential to generate substantial fiscal revenues and the effectiveness of the instrument depends on the amount and use of the tax revenue. By reducing the existing distortionary taxes on labour and capital, it can help cushion the blow for low-income households and offset some of the policy’s social costs. Part of the revenue should also be channelled to fund research and development of climate-friendly technologies and desirable sustainability-linked programs.[23]

b. Emission Trading System (ETS)

In a cap-and-trade model, the government sets a limit (cap) on permissible emissions for different sectors in a particular compliance period and allowances are either auctioned or allocated as per criteria.[24] A hybrid approach of freely allocating emission allowances and auctioning is common in ETS markets. While the quantity/volume of emissions is regulated, the price is determined by the market supply and demand. During the compliance period, firms with lower abatement costs can sell their allowances in secondary markets to firms with higher abatement costs.[25] This allows emissions reductions at the least possible cost. Eventually, at the end of the compliance period, the allowances are to be surrendered to the government. Various factors should be considered in the design: the size and level of the emission cap, sectoral coverage, the scope of the cap’s coverage, point of taxation, whether to freely distribute or sell (auction) allowances, revenue distribution and management, monitoring, measurement and verification of emissions and allowances, cost containment measures, and impact on international competitiveness.[26]

Similar to the carbon tax, the revenues generated from selling allowance certificates will augment fiscal revenues and can be used to reduce distortionary taxes or finance investments in clean-tech programs. Free allocation of allowances, on the other hand, allows the risk of potential “grandfathering” i.e., transferring the wealth, equivalent to the value of the allowance, to existing firms instead.[27] In an ETS, high or volatile allowance prices can undermine the efficacy of the policy. Therefore, certain cost containment measures are often undertaken by the government to prevent emission costs from overshooting or dipping beyond a threshold to avoid cost uncertainly and ensure economic stability and the competitiveness of firms. These include: offsets, allowance banking (reserve units to use in a future compliance period) and borrowing (using units allocated for a future compliance period), safety valves, price collars, and market stability reserves.

An offset provision allows regulated entities to offset their own emission reduction with credits from emission reduction measures outside the scope of ETS coverage and can link the cap-and-trade system with an emission-reduction-credit system. Banking and Borrowing allows firms to trade their emissions across time horizons by allowing transfer of allowances to a future period (banking) or permitting future period allowances to be utilised pre-maturely. This allows firms the flexibility to prioritise across time frames to create the most cost-effective path to carbon reduction. Banking and borrowing define caps on cumulative emissions rather than on an annual basis. A safety valve is a price ceiling that puts an upper limit on the cost of tradable allowance with the government offering additional allowance at a predetermined trigger price. However, this measure can lead to aggregate emissions overshooting the emission cap. A price collar combines the ceiling of the safety valve with the price floor which sets minimum price for auctions or with the government agreeing to purchase allowance at a predetermined price. Cost Containment Reserve (CCR), a volume-based measure, transfers unallocated allowances to a reserve and these are removed or injected into the market if the number of total allowances in circulation is over or under a predetermined threshold. However, without careful planning, increasing certainty of mitigation cost through these containment measures can reduce certainty of the quantity of emissions abated.[28]

Table 1. Carbon tax Vs. the ETS

Note: Both systems internalise the cost of carbon by setting a price on emissions but differ in their approaches.

Note: Both systems internalise the cost of carbon by setting a price on emissions but differ in their approaches.

Source: Author’s own.

c. International Crediting Mechanisms/ Baseline and Credit system

According to Article 6 of the Paris Agreement (Article 12 of the Kyoto Protocol), industrialised countries with emission reduction targets (Annex B Party) can purchase certified emission reduction (CER) credits from developing countries, each credit equivalent to one tonne of CO2, to provide offsets if they are unable to comply with their Kyoto targets.[29] Emission credits are available to emitters who successfully reduce emissions below the designated limit; they can then trade and sell these credits in the international market. This is also referred to as the baseline and credit system which offers flexibility for an international cap-and-trade mechanism.[30]

The Clean Development Mechanism is the international standardised emissions offset instrument governed by the United Nations Framework Convention on Climate Change (UNFCCC) to facilitate the trade on the global scale. However, given the growing popularity of the carbon credit market, many independent (such as the Gold Standard, Verified Carbon Standard) and domestic standards (California Compliance Offset Program, Australia Emissions Reduction Fund, Republic of Korea Offset Credit Mechanism) have gained prominence and are dominating the market.[31]

d. Internal Carbon Prices

Corporations worldwide have started to acknowledge the critical role of incorporating climate risks and opportunities in their risk assessment frameworks and consider carbon price to be an effective instrument in guiding capital allocation and investment decision-making. Therefore, internal carbon pricing is being used voluntarily by companies and organisations as a pre-emptive move to safeguard against future shocks, measure exposure associated with climate related physical and transition risks, as well as prospective government regulations pertaining to carbon pricing. It is commonly done via shadow carbon pricing where a hypothetical carbon cost is associated with each ton of CO2 emissions. This helps identify and integrate climate-related risks and opportunities in the broad long-term strategies of a company and dictate capital allocation and investment decision-making processes by relying on an implicit price which is based on the offsets required to achieve internal carbon neutrality objectives.[32]

2. Implicit Carbon Pricing

There are certain mandates or government policies that do not directly put a price on emitting carbon but set uniform performance standards for GHG abatement. They seek to address climate objectives of reducing GHG emissions by setting technology and performance-based standards as well as gradually eliminating fossil fuel subsidies to make energy-intensive products more expensive compared to their sustainable/renewable counterparts.

a. Command-and-Control Regulations

Conventional environmental policy employs technology and performance-based standards to control emission levels and protect environment quality. Technology-based standards require firms to use certain energy-efficient processes, equipment or procedures with no fixed targets on the volume of emission reduction. Meanwhile, performance-based standards specify permissible levels of pollutant emissions or allowable emission rates and leave the processes of emission reduction at the discretion of regulated entities.[33] By the very nature of such standard-based policy, given higher costs as well as poor incentives for the development and adoption of environmentally and economically superior technologies, the approach is limiting in its scope and impact. Incorporating market-based instruments within its fold can thus help overcome non-cost-effective outcomes.

b. Clean Energy Standards

A clean energy standard (CES) is a market-based and technology-neutral approach to encourage the power sector to switch to non- or low-emitting sources of energy. The industrial and commercial power consumers are mandated to meet a certain percentage of their power requirements from clean energy sources as a means to phase down dependence on fossil fuels. Given the challenging politics around pricing carbon, clean energy standards are often viewed as a cost-effective and politically palatable alternative to pricing carbon in the electricity sector. Firms that overachieve the clean energy standard targets or thresholds can receive energy saving certificates which can be traded in the energy exchange. This system is analogous to an ETS and relies on the market principles to reduce the energy intensity of high-carbon-emitting sectors in the most cost-effective and efficient manner.[34]

c. Eliminating Fossil Fuel Subsidies

Many countries provide heavy subsidies to fossil fuels to support their growth and development objectives. This becomes particularly critical for nations where innovation and growth in the renewable sector has yet to pick up pace. However, gradual elimination of fossil fuel subsidies can be an effective way to achieve an optimal price for the fuel as well as provide incentives for energy efficiency and fuel-switching technologies (comparable to implementing an explicit carbon price).[35] Fossil fuel subsidies are often termed as a “government failure”, exacerbating the conditions of a market failure. For some years now there has been a significant degree of agreement on phasing out these subsidies, while targeting support for the poor. A G20 Leaders’ summit in 2009 noted, “The economic and climate benefits of fossil fuel subsidy reform could be significant. Inefficient fossil fuel subsidies encourage wasteful consumption, reduce our energy security, impede investment in clean energy sources and undermine efforts to deal with the threat of climate change.”[36]

II. Global Carbon Pricing Mechanisms: A Review

Globally, 68 carbon pricing instruments (CPIs), including taxes and emissions trading systems (ETSs), are operating while three more are scheduled for implementation in the short term.[37] As this paper’s objective is to inform a national carbon pricing mechanism for India, the scope is limited to reviewing only carbon tax and ETS mechanisms. The selection of global carbon pricing mechanisms for review is purposeful to ensure representation from diverse geographies and varying timeframes of implementation to help identify best practices and learning opportunities.

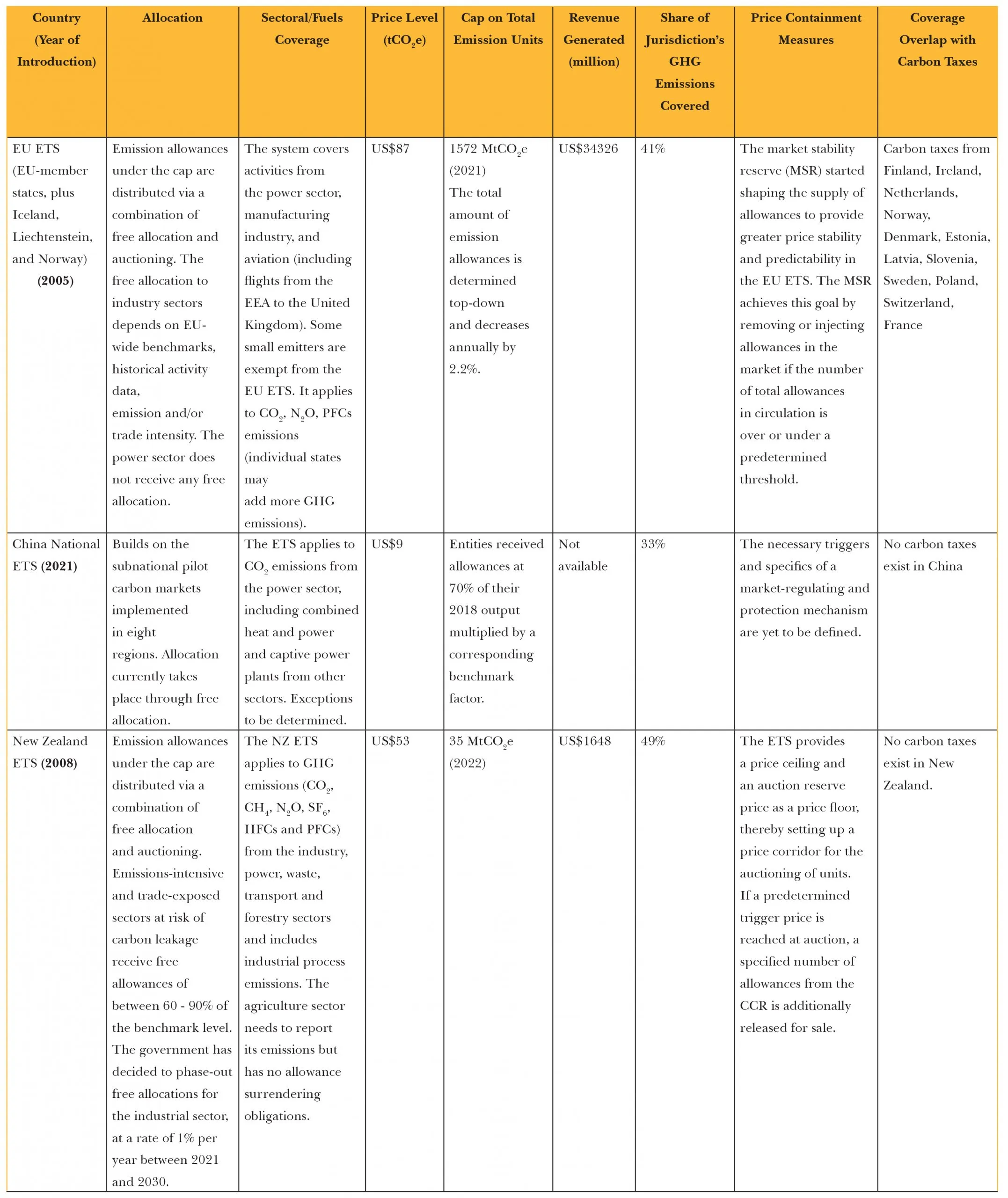

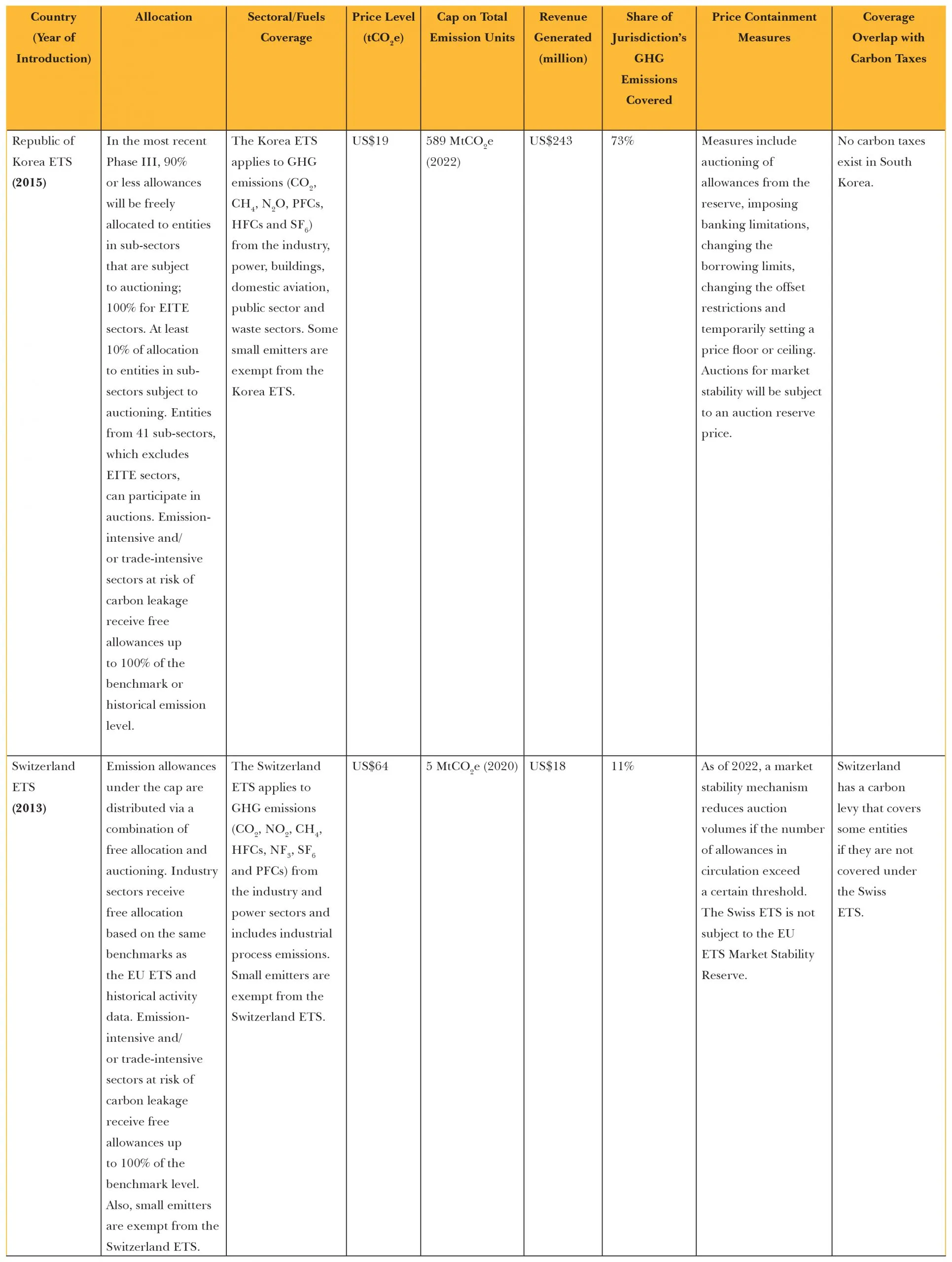

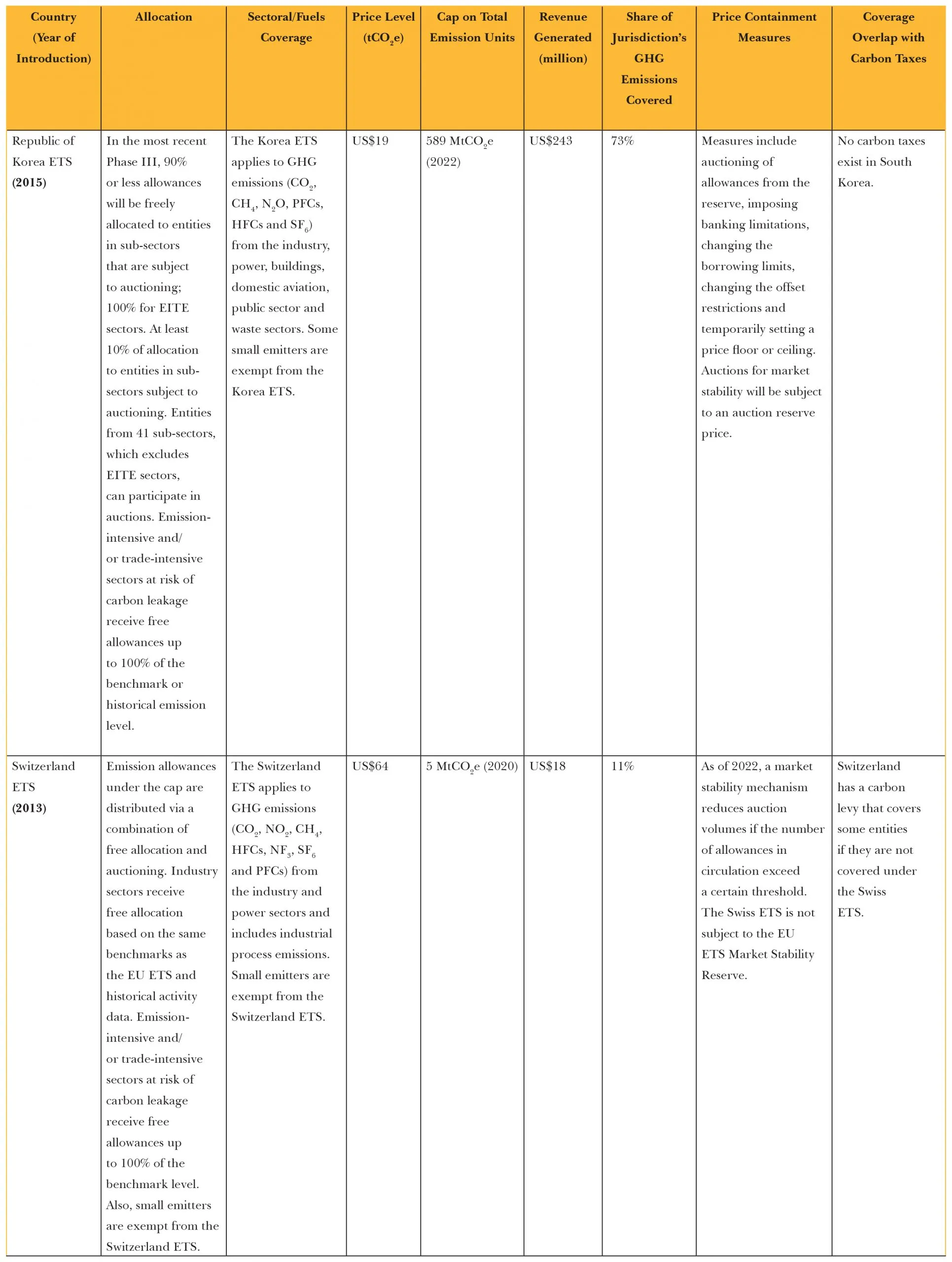

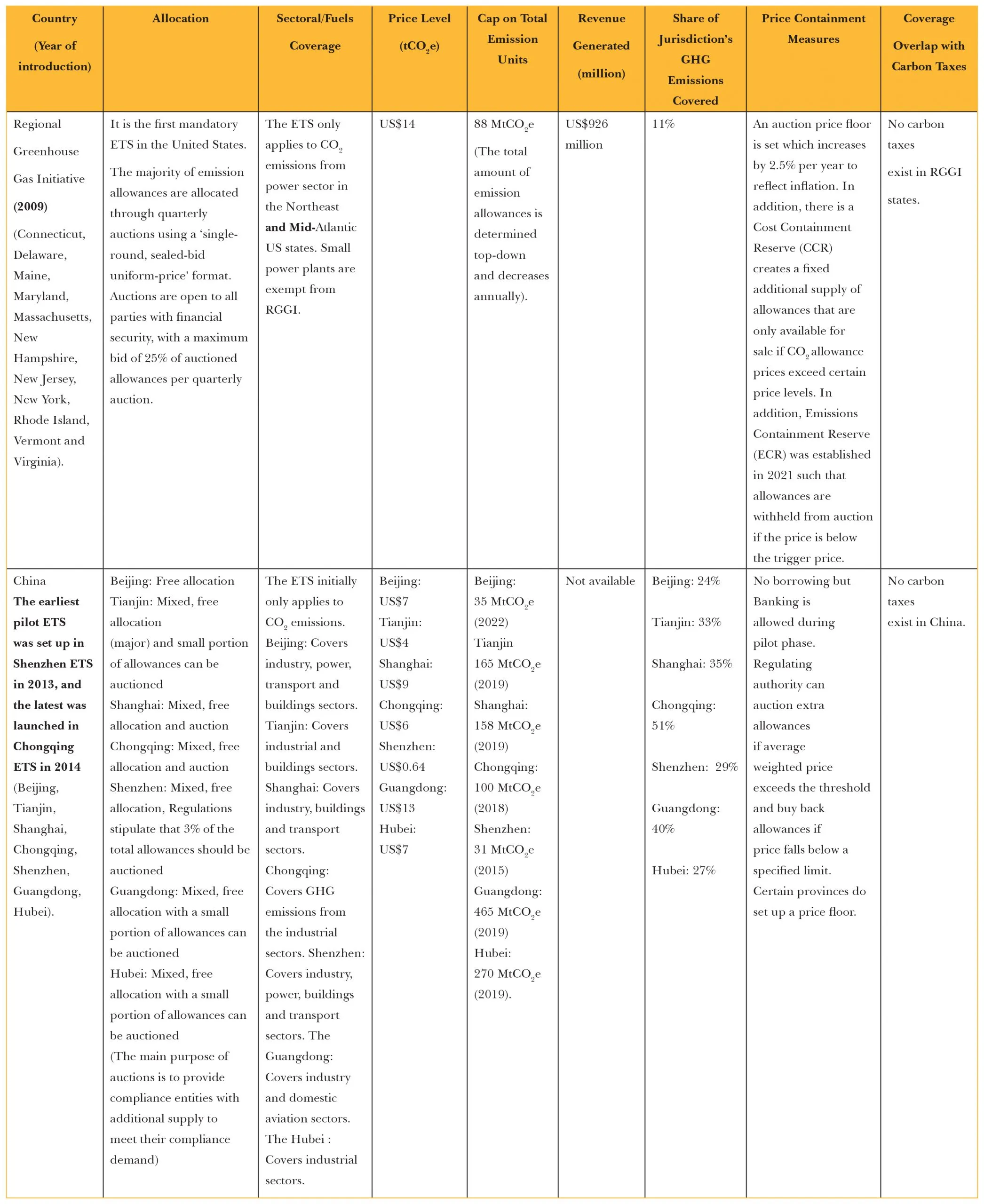

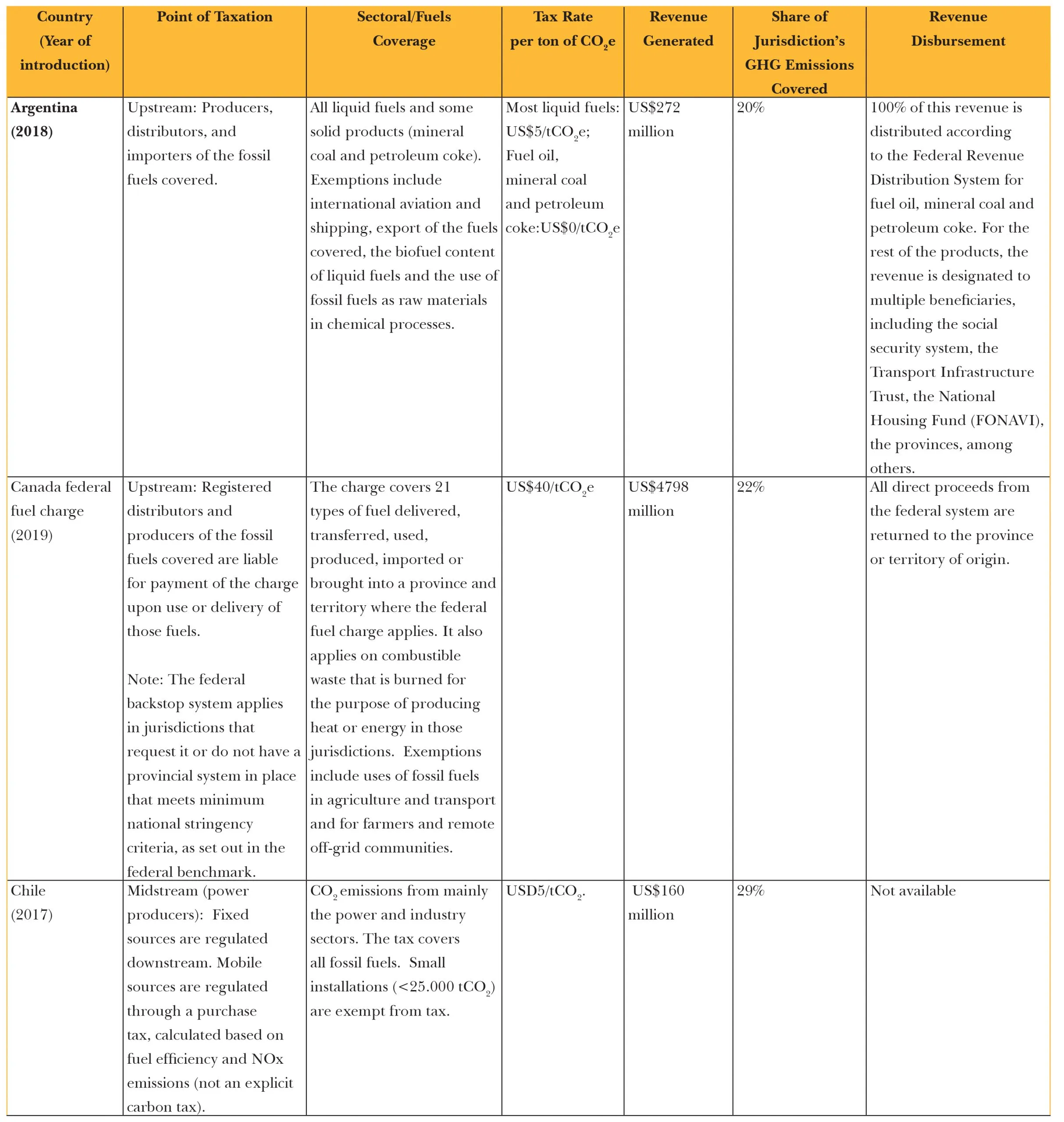

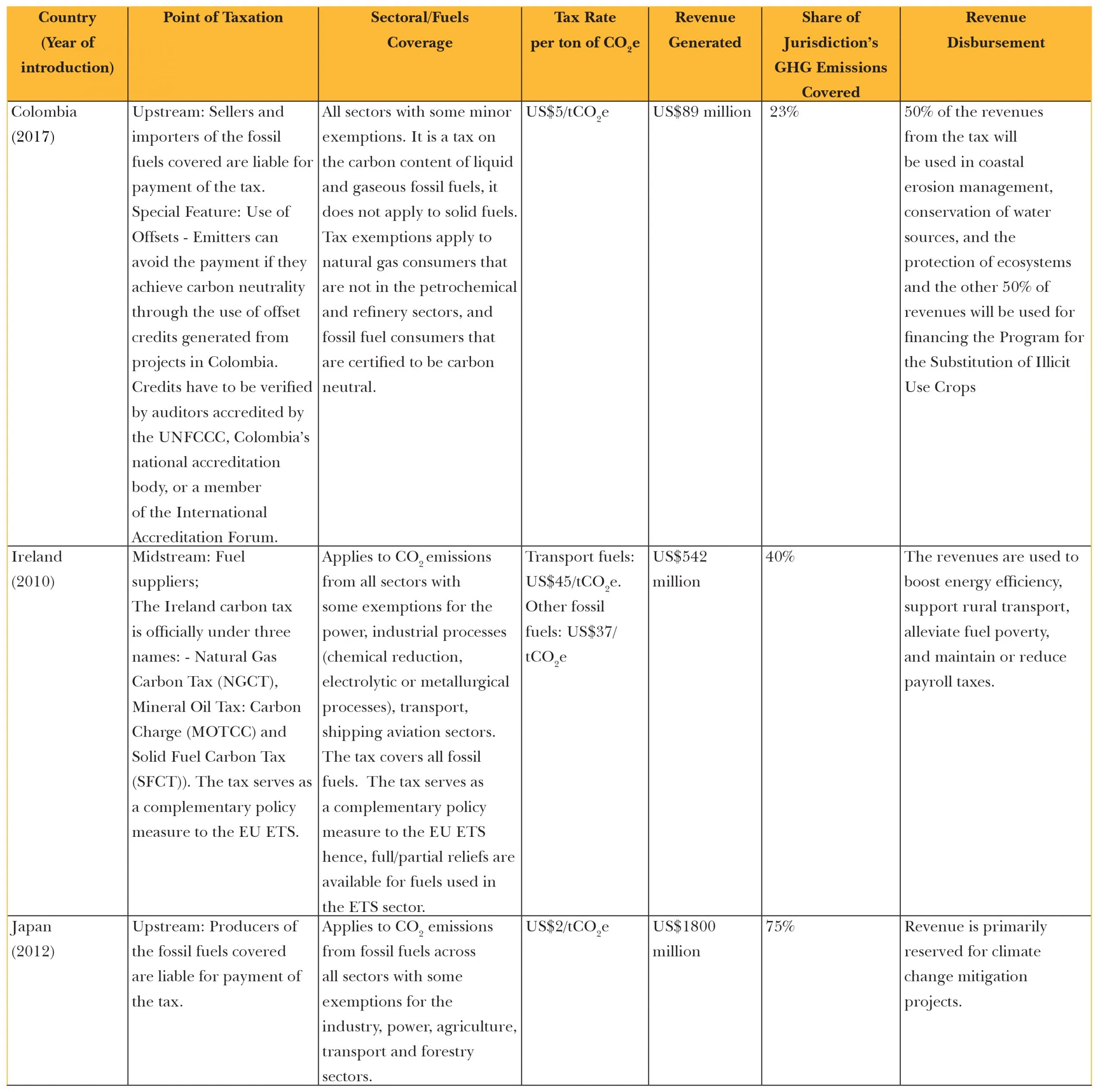

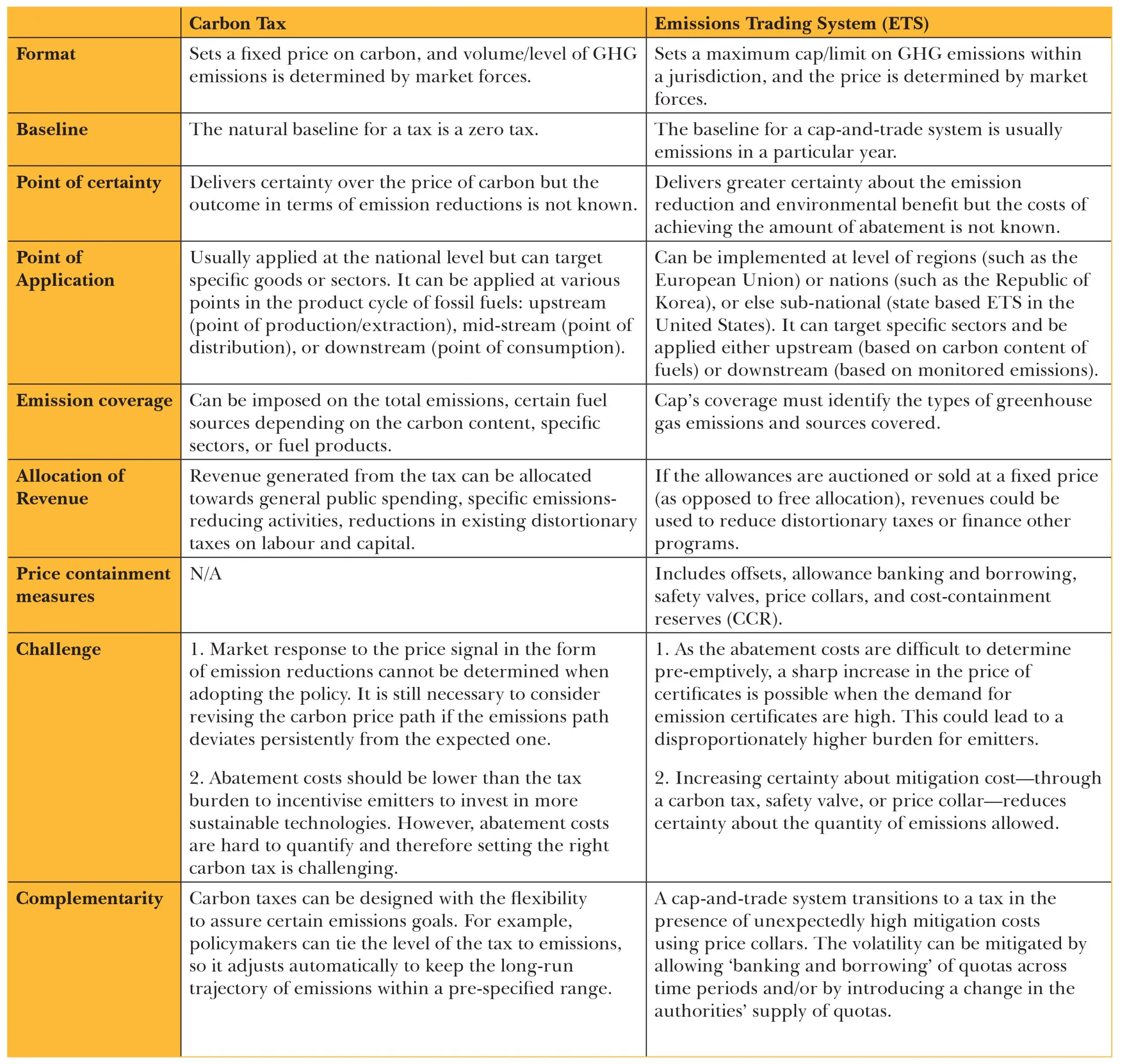

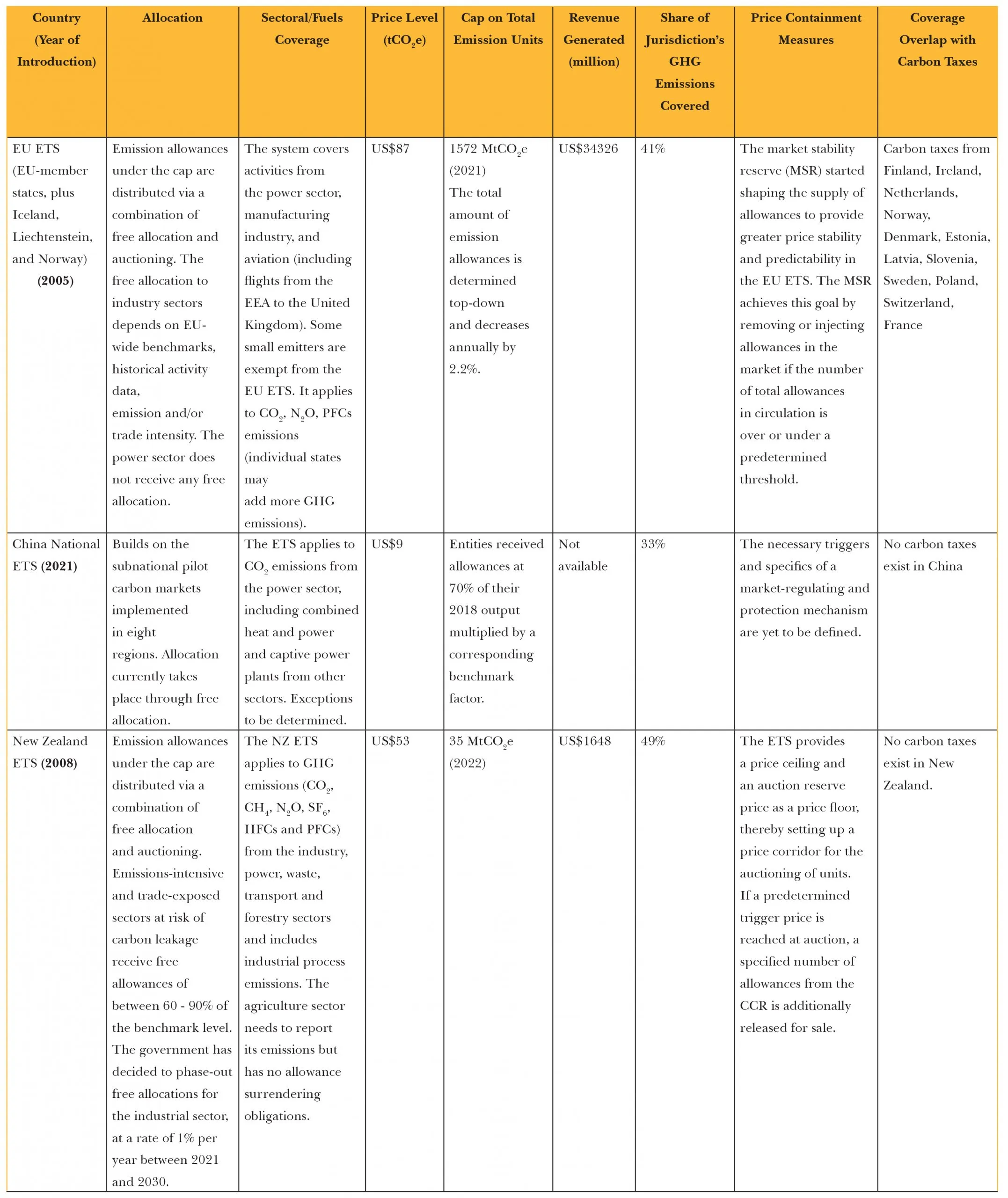

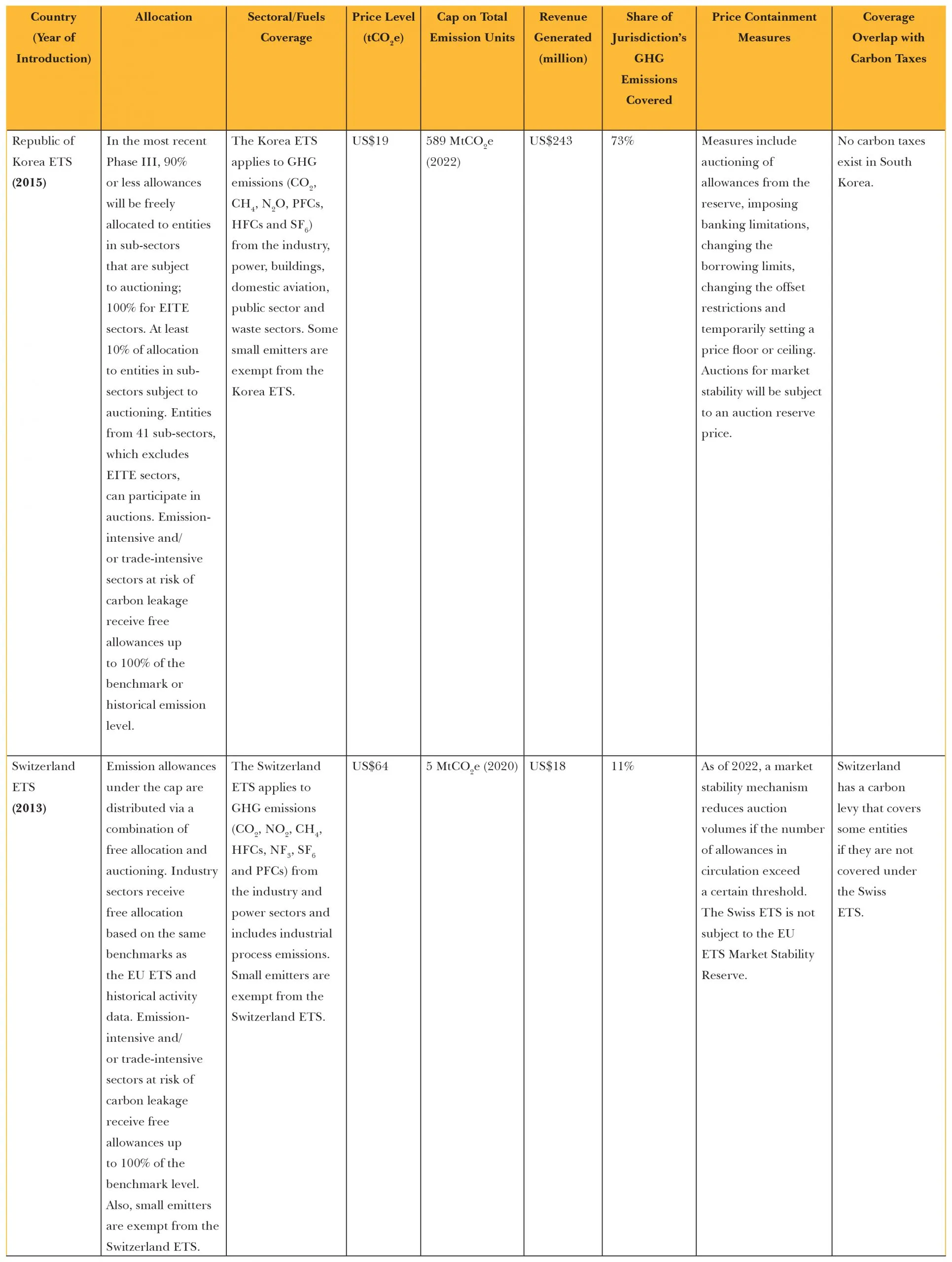

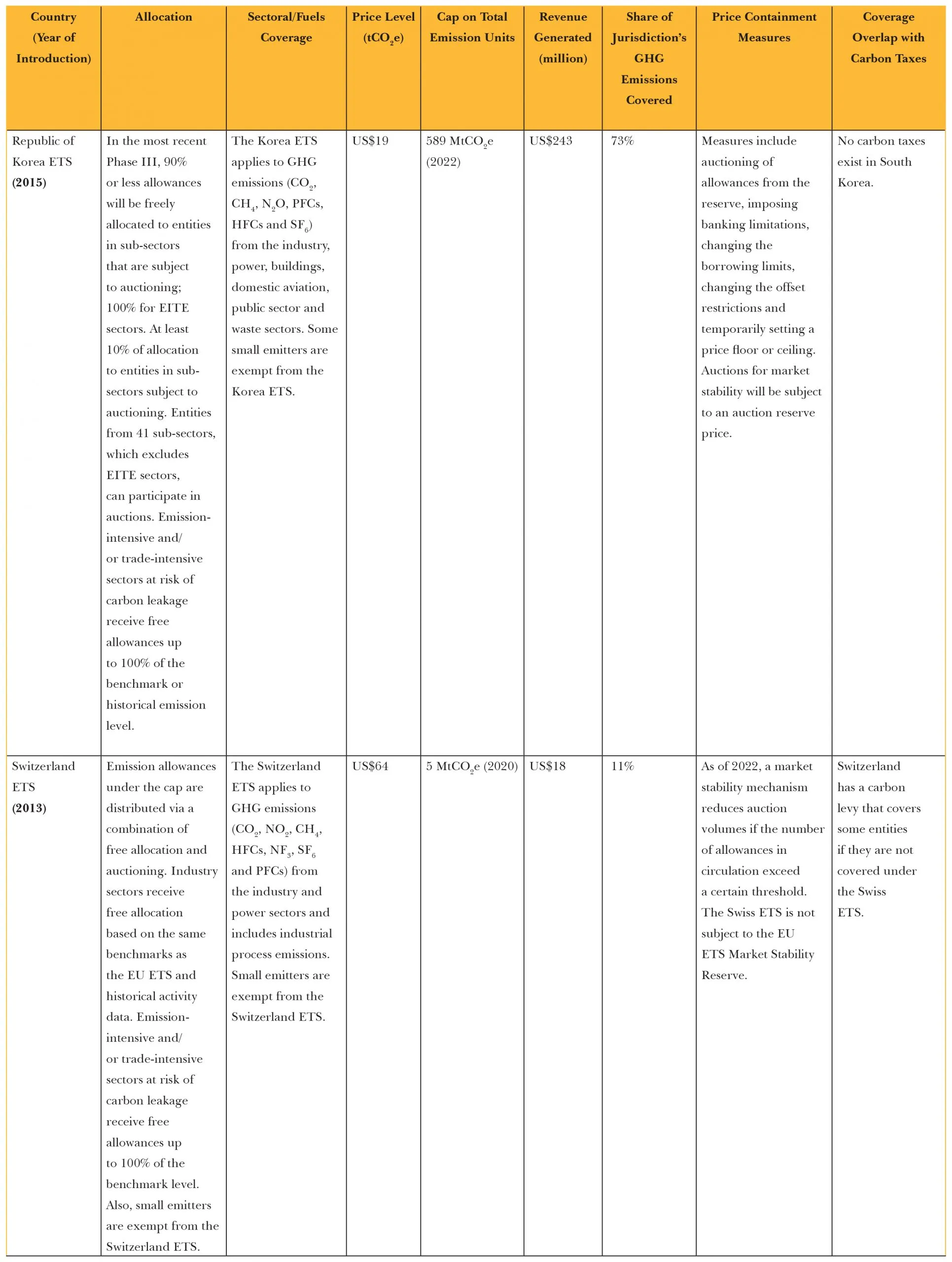

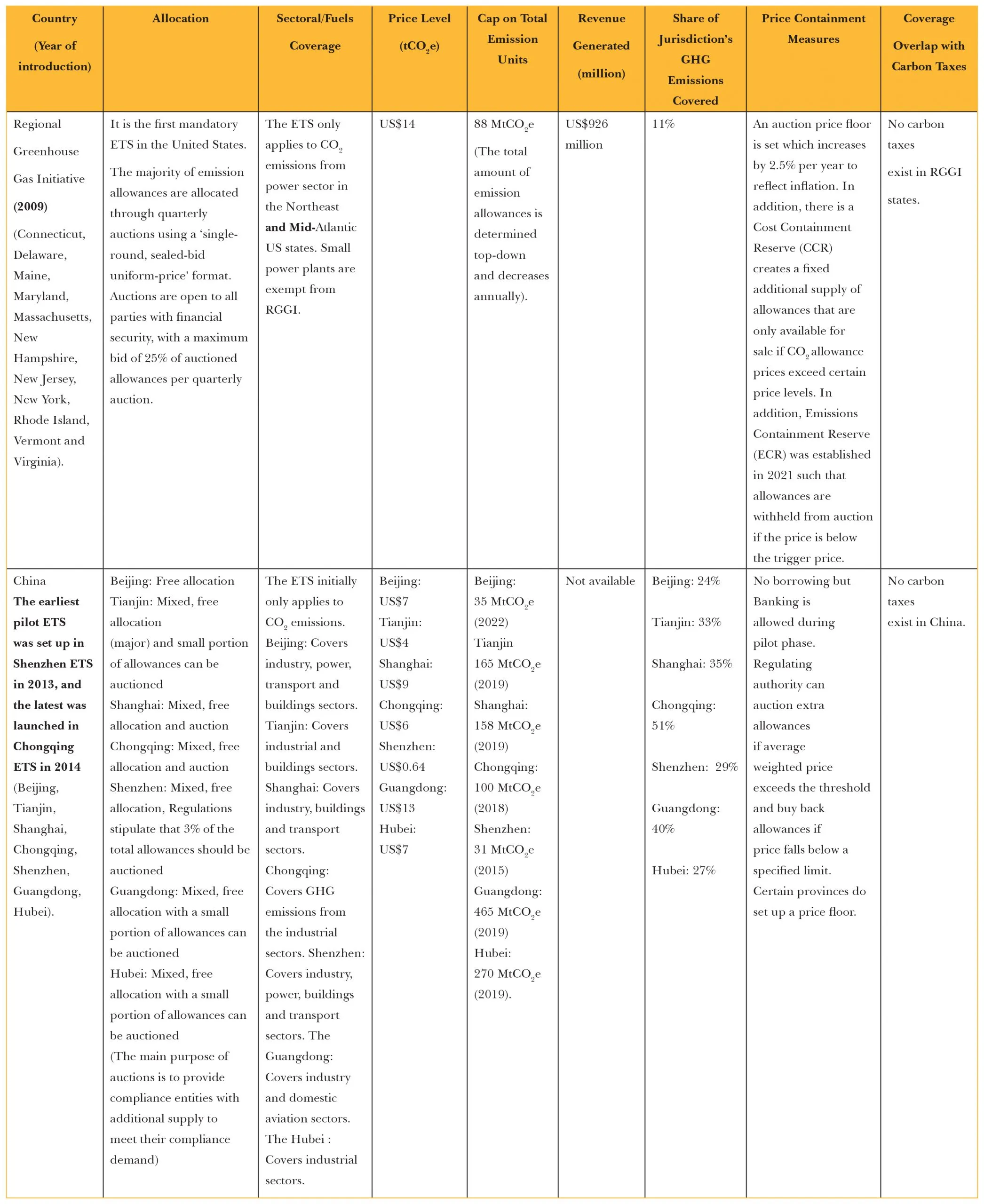

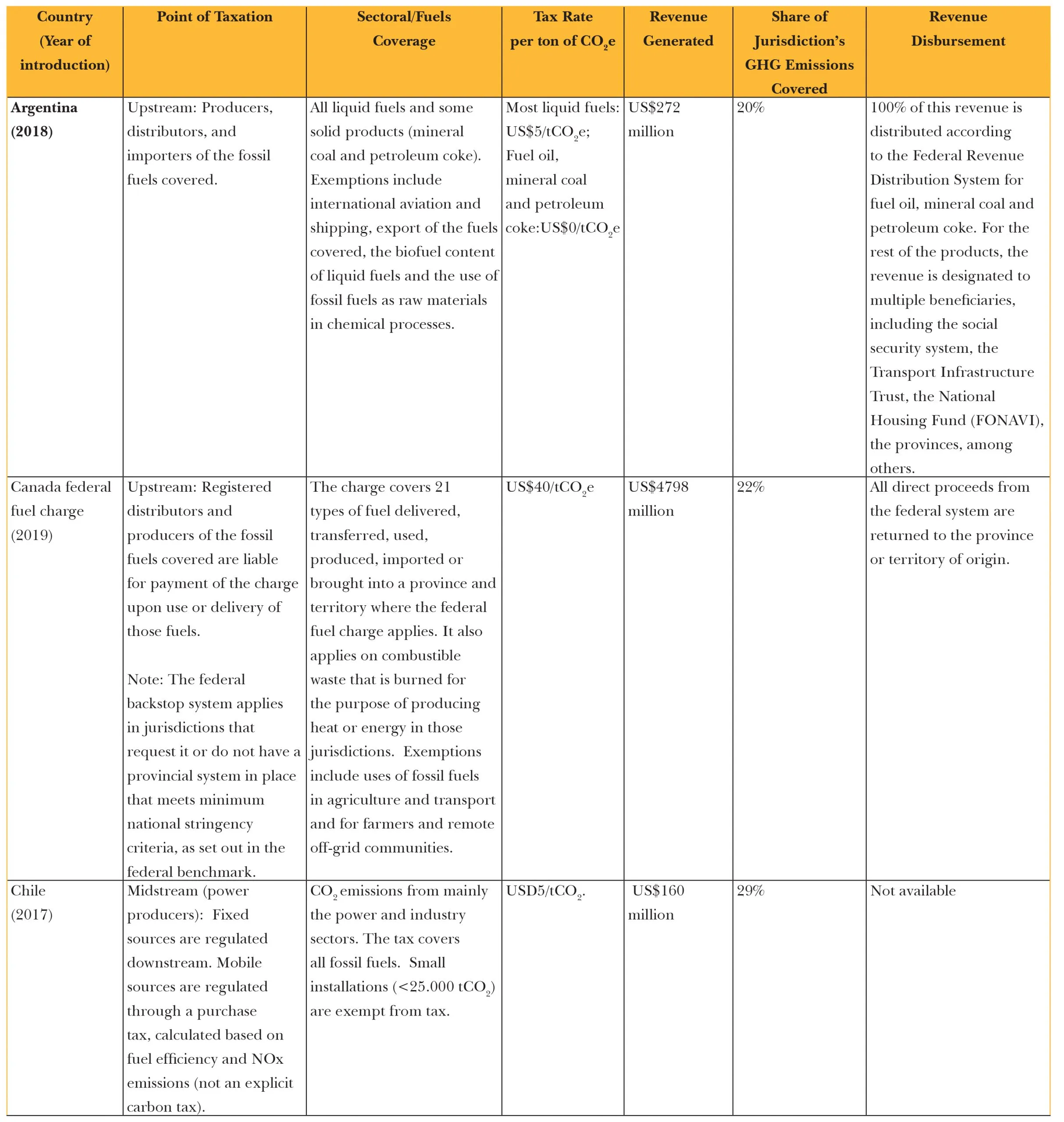

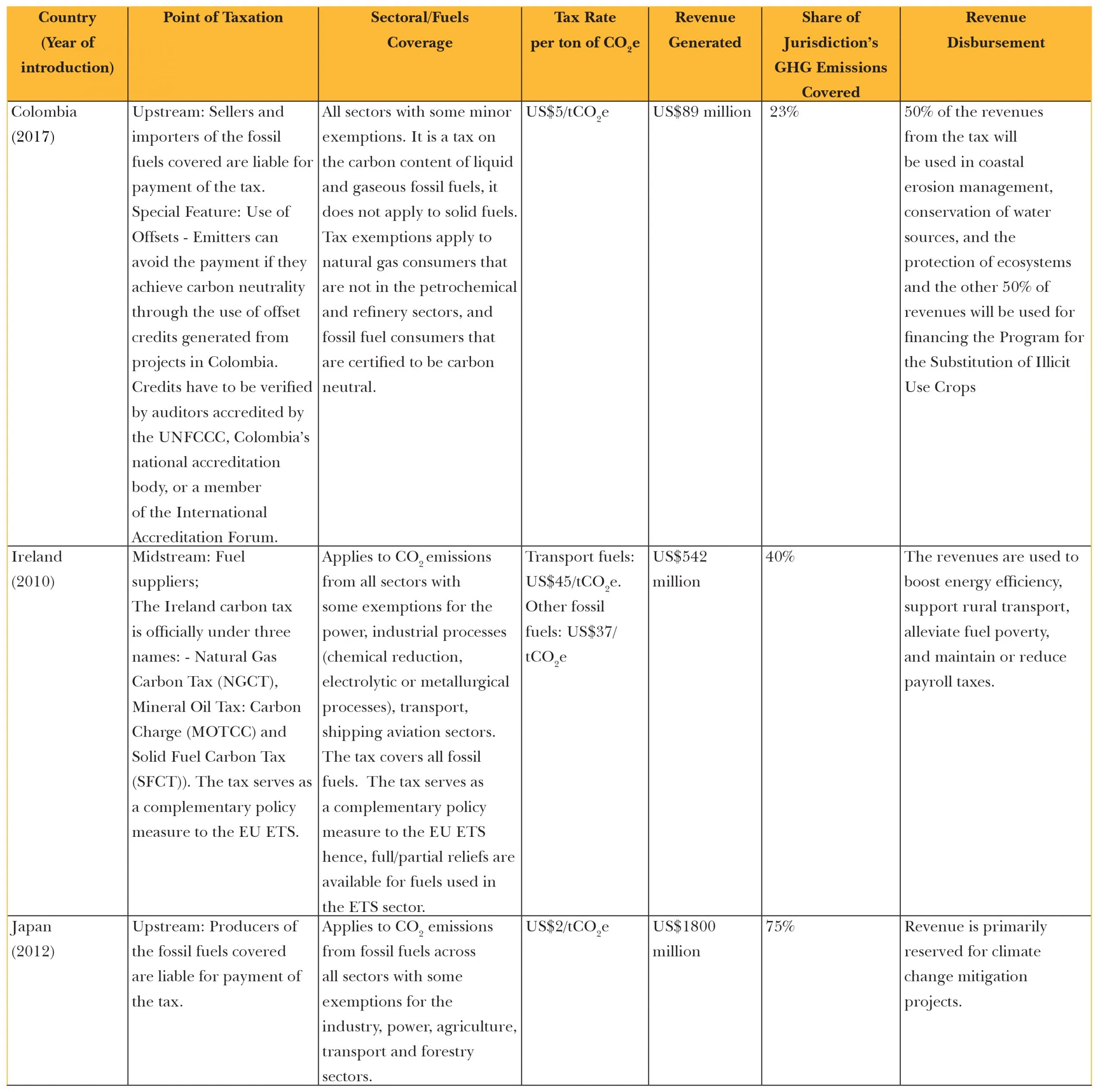

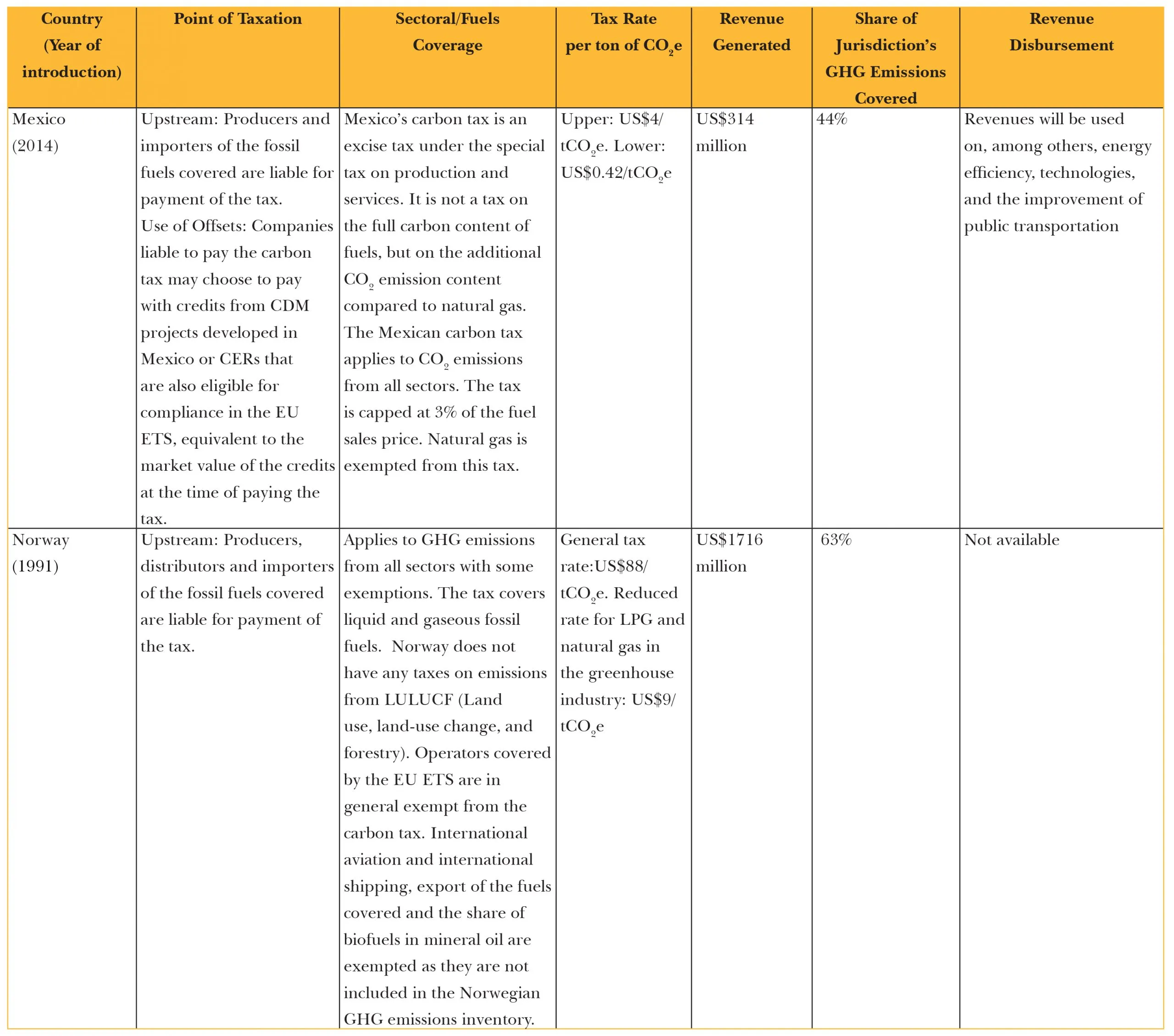

Tables 2 and 3 present a tabular comparison of supranational, national, and subnational level ETS systems of the European Union, China, New Zealand, Republic of Korea, Switzerland, United Kingdom, Regional Greenhouse Gas Initiative and China’s seven provinces- Beijing, Shanghai, Tianjin, Chongqing, Shenzhen, Guangdong, and Hubei. Table 4 presents a tabular comparison of international carbon tax systems of Argentina, Canada, Chile, Columbia, Ireland, Japan, Singapore, South Africa, Mexico and Norway.

Countries were selected to cover carbon pricing policies that varied in their sectoral coverage, point of taxation, allocation approaches, price containment measures, revenue redistribution and exemption mandates. Data for all three tables were sourced from the World Bank Carbon Pricing Dashboard.

Table 2. Review of Global Emission Trading Systems (Supranational and National)[38]

Note: tCO2e = ton (t) of carbon dioxide (CO2) equivalent (e); GHG = Greenhouse gas emissions; N20 = Nitrous oxide

Note: tCO2e = ton (t) of carbon dioxide (CO2) equivalent (e); GHG = Greenhouse gas emissions; N20 = Nitrous oxide

PFCs = Perfluorochemicals; MtCO2e = Metric tons of carbon dioxide equivalent; CH4 = Methane; NF3 = Nitrogen Trifluoride SF6 = Sulphur Hexafluoride; HFCs = Hydrofluorocarbons

Source: World Bank Carbon Pricing Dashboard

Table 3. Emission Trading System (Sub-National)

Note: tCO2e = ton (t) of carbon dioxide (CO2) equivalent (e); GHG = Greenhouse gas emissions; MtCO2e = Metric tons of carbon dioxide equivalent

Note: tCO2e = ton (t) of carbon dioxide (CO2) equivalent (e); GHG = Greenhouse gas emissions; MtCO2e = Metric tons of carbon dioxide equivalent

Source: World Bank Carbon Pricing Dashboard

Table 4. Review of Global Carbon Tax Mechanisms

Note: tCO2e = ton (t) of carbon dioxide (CO2) equivalent (e); GHG = Greenhouse gas emissions; MtCO2e = Metric tons of carbon dioxide equivalent; ktCO2e = kilotonnes of carbon dioxide equivalent

Note: tCO2e = ton (t) of carbon dioxide (CO2) equivalent (e); GHG = Greenhouse gas emissions; MtCO2e = Metric tons of carbon dioxide equivalent; ktCO2e = kilotonnes of carbon dioxide equivalent

Source: World Bank Carbon Pricing Dashboard

III. Implicit Carbon Pricing in India

India does not impose an explicit carbon pricing mechanism but puts an implicit price on carbon through a series of measures and schemes that will be described in the following paragraphs:

1. Perform, Achieve and Trade (PAT) Scheme

The PAT scheme (Perform, Achieve and Trade), introduced in 2012, is the flagship programme of the Bureau of Energy Efficiency (BEE), Ministry of Power, Government of India. The scheme holds some degree of resemblance with the market-based emission trading system (ETS) where certain energy-intensive industrial production units, identified as designated consumers (DC), with threshold energy consumption are allotted Specific Energy Consumption (SEC) reduction targets over a cycle of three years.[39] The units that exceed the targets are awarded Energy Saving Certificates (ESCerts), each equal to one metric tonne of oil (MTOe),[40] as an incentive to implement energy-efficient technologies and overachieve these targets. DCs that are unable to meet these targets can purchase the difference in ESCerts from the units that have exceeded their targets. The ESCerts can be traded on two power exchanges, namely, Power Exchange Indian Limited (PXIL) and Indian Energy Exchange (IEX).

Failure to comply, either by their own actions or by buying the energy saving certificates, would result in the imposition of a prescribed penalty linked to the degree of non-compliance. The BEE has rolled out six PAT cycles as of 31 March, 2020 covering 1,073 DCs across 13 sectors including energy-intensive sectors of Aluminium, Cement, Chlor-Alkali, Fertiliser, Iron and Steel, Paper and Pulp, Thermal Power Plant, Textile, Railways, Refineries, and Electricity Distribution Companies (DISCOMs), Petrochemicals, and Buildings.[41] In the financial year 2018-2019, the PAT scheme was responsible for nearly 63 percent of all energy efficiency savings and is projected to avoid almost 70 million tonnes of CO2 by March 2023.[42] However, the monitoring, reporting and verification (MRV) framework under PAT is not directly geared towards reducing CO2 but the potential unit of energy saved (expressed in tonnes of oil equivalent).[43] The ambition and long-term effectiveness of the PAT scheme has been questioned over issues of equity, leniency in targets, high transaction costs, low trading prices of EScerts, and rising energy prices which would have incentivised energy savings even in the absence of the PAT scheme.[44] The Centre for Science and Environment (CSE), in an analysis of the PAT scheme for thermal power plants, noted that the value of one ESCert was approximately INR 700 while INR 4,020 in investment was necessary for reducing energy equal to one TOE.[45]

2. Emission trading scheme on an air pollutant, i.e., respiratory solid particulate matter (RSPM)

This is an innovative emission trading scheme on respiratory solid particulate matter, the first particulate trading system in the world. The scheme has been piloted in industrial clusters of three polluting states of Gujrat, Maharashtra, and Tamil Nadu. It is an attempt to shift away from the conventional command and control regulation. It mimics the EU-ETS model where pollution targets are set for areas based on ambient air quality standards and permits are allocated which can be traded, after verification, based on the gains and shortfalls from compliance. The scheme relies on a continuous emission monitoring system (CEMS) for setting the baseline and verification purposes. CEMs is an intrinsic element in the scheme’s design as it provides real-time information and helps avoid issues pertaining to spot checking and/or spurious reporting by third party auditors.[46]

For example, the Surat ETS began with two months of mock-trading, before its official launch in September 2019, to gain stakeholder support and allow capacity building. Eighty percent of the permits were allocated for free and the balance of 20 percent was auctioned via the Gujrat Pollution Control Board (GPCB) through the National Commodities and Derivatives Exchange Limited e-market.[47] Similar to the PAT Scheme, industries have the financial incentive to invest in pollution-curbing technology. Over-achieving targets provides the opportunity to earn profits through the trading of emission permits at the National Commodities and Derivatives Exchange.[48] A preliminary analysis of the pilot program found a 29-percent reduction in particulate matter from current levels, an increase in average industry profits, and fall in costs of reducing particulate emissions.[49] However, the long-term benefits of the pilot program are yet to be seen.

3. Carbon Cess

In 2010, India introduced a carbon cess to be levied on coal, lignite, and peat in the form of an excise duty. The revenue from the cess was intended to feed into a National Clean Energy Fund to finance clean-energy projects and research. From 2010–11 to 2017–18, only 35 percent of the money collected from the cess was transferred to the Fund, of which almost half remained unutilised.[50] In 2017, with the introduction of the GST Compensation Cess, the carbon cess was abolished and the money collected through this new mechanism was instead reserved for compensating states for any revenue losses under GST. CO2 emitting products such as coal, kerosene, naphtha, lubes and LPG are included in GST with exceptions for five petroleum products, i.e., petrol, diesel, natural gas, ATF and crude oil. These are instead subjected to excise duties and VAT. While the cess on the consumption of coal and high level of excise and value added taxes on petrol and diesel are not referred to as carbon taxes, they are considered and expected to perform the role of implicit carbon taxes. However, the tax rates do not correspond with the carbon footprint of the fuels and thus fail to provide the right price signals to producers and consumers to reduce consumption and switch to low carbon-emitting sources of energy.[51]

4. Renewable Purchase Obligations (RPO) and Renewable Energy Certificates (REC)

In India, certain obligated entities such as electricity DISCOMS, open access consumers and captive power producers have to purchase a percentage of their electricity from renewable energy (RE) sources. These are termed as renewable purchase obligations (RPO) and are mandated by the Electricity Act (2003). The State Electricity Regulatory Commission is responsible for fixing the minimum RPO for each state. Due to the variable nature of RE sources, obligated entities may find it difficult to procure green power to meet their RPO targets. They can instead purchase renewable energy certificates (RECs) on the national energy exchanges such as Indian Energy Exchange (IEX) and Power Exchange of India Limited (PXIL) to meet their RPO targets without actual procurement of RE-generated power.[52] The RECs is a useful instrument in overcoming the geographical disparity in renewable energy production and incentivising electricity generation from RE sources beyond the RPO state limits.[53] However, the enforcement and compliance with RPO remains weak and is a persisting obstacle to India’s ambitions of expanding renewable energy production and procurement.

5. Excise taxes on Diesel and Petrol

Over the years, India has moved from a carbon subsidisation regime to a significant carbon taxation regime.[54] Even though India does not have an explicit carbon tax on fuels including petrol and diesel, these products are subjected to steep excise duties and VAT. As of May 2020, India had the highest taxes on petrol and diesel in the world which comprised over 69 percent of the pump price for the two fuels.[55] However, the high taxes on petrol and diesel are on account of the Centre’s revenue requirements as opposed to environmental considerations and do not account for the carbon footprint of the fuels. As a result, distorted price signals have failed to incentivise users of diesel and petrol to switch to low carbon-emitting sources of energy.[56]

IV. The Case for an Explicit Carbon Pricing Mechanism in India

Despite the ambitious commitments made by India on climate action at COP26, its growing economy will continue to demand higher levels of fossil fuel consumption and, consequently, the country could see a corresponding rise in GHG emissions. India’s energy and industry-related CO2 emissions are projected to more than double from 2020 to 2050, with the share of fossil fuels in primary energy declining from 72 percent to only 69 percent in the same period. Without additional policies and disruptive technological changes, GHG emission intensity will not be reduced relative to their current levels due to growth in output.[57] Well-designed policies, such as carbon pricing, if adapted to suit India’s unique emerging and development identity framework, can be a useful lever in the portfolio of instruments and strategies adopted to mitigate and adapt to climate change.

However, its popularity remains weak, given the ‘Pigouvian’ nature of carbon pricing (as explained in the first section of this paper). There are various challenges in pricing carbon which are a combination of political, economic and cultural dynamics. Given that carbon pricing posits “diffused benefits and concentrated costs”, with costs incurred in the short-term and benefits accrued in the longer run, citizens are often sceptical of environmental policies.[58] This makes it difficult to garner the necessary political support essential to engender systemic changes to conventional policy frameworks. In addition, carbon-intensive industries will continue to oppose lest their profits reduce as a result; households will do too, to safeguard their disposable incomes.[59] Policies that are formulated according to specific contexts and are effectively implemented can help offset these challenges, as can a rigorous communication strategy.

India has undertaken various approaches for pricing fuels such as subsidies, and administered and market pricing (as discussed in the previous section). However, weak enforcement and primarily low prices undermine the effectiveness of the policy instruments. Moreover, while the focus has been on energy efficiency, expanding renewable capacity and making coal consumption expensive, none of the instruments are carbon-denominated and do not bear a direct link to CO2 equivalent. Therefore, carbon pricing can be a useful mechanism to build a common carbon currency for establishing a clear price signal, creating fungibility of credits across schemes, and developing strong incentives for decarbonisation.[60]

In light of the Energy Conservation (Amendment) Bill, 2022, the following section outlines the near-term carbon pricing strategies that India can adopt with regards to a carbon tax and an emission trading mechanism. These strategies can help the country realise its Nationally Determined Contributions (NDC) under the Paris Agreement and the 2030 climate commitments made in Glasgow in 2021.

1. Carbon Taxes

India does not follow a uniform approach in pricing fuels and the tax rate and its coverage under the GST are not determined by the carbon content or emission rate but instead by social, political and revenue considerations. As an example, the price of imported natural gas is different from that prescribed for domestically produced natural gas. The tax rate is lower for fuels such as coal which have a larger carbon footprint in comparison to natural gas, for example, which has a far lower carbon footprint. While coal is included in the GST base, other high-polluting fossil fuels such as petrol, diesel and crude are excluded from its purview.[61] Nearly INR 52,000 crore of GST compensation was due to the states as of September 2021, which is telling of the Centre’s tardy disbursement record and states’ apprehension to exclude these fuels from the GST base in order to maintain their revenue stream.[62] These fuels are, however, subject to a significantly high excise duty and the VAT, both of which vary across states. However, the taxes are not linked to the degree of carbon emissions nor the carbon content in the fuels.[63]

India’s legislative framework under the GST regime lays a strong ground to address these anomalies and incorporate all fossil fuels under its ambit by setting a uniform tax rate and an additional levy contingent on the quantum of carbon emissions instead of usage. International practice, as discussed in the previous sections, dictates the same premise with certain exemptions depending on the sector and trade exposure. The tax should be upstream, implying an imposition only at source for producers and importers of fossils fuels. Similar to experiences of other countries as depicted in Table 4 exemptions should be granted for fuel usage in the farm/agriculture sector and remote off-grid communities (as done in Japan and Canada), companies or sectors that have a strong trade exposure (such as in South Africa), units with installations below a certain threshold (such as in Chile) and also where carbon-emitting fuels are used as a feedstock for manufacturing, e.g. fertilisers (such as in Argentina).

Since diesel and petrol already suffer a heavy tax burden, limiting government’s ability to impose additional taxes will result in the burden being borne by coal and other fuels. In a study by Shakti Sustainable Energy Foundation and Ernst & Young LLP, the price of carbon tax should reach USD 35 per tonne of CO2 emissions to achieve 33- to 35-percent reduction in emission intensity by 2030.[64] Given India’s COP 26 commitment to reduce the carbon intensity of the nation's economy by 45 percent by 2030, the price on carbon will have to be even higher. Availability of substitute clean fuels and green technologies as well as increase in capacity and deployment of renewable sources of power are critical factors for compliance and effectiveness of the carbon tax. The carbon price will have to be gradually increased and aligned with the maturity of decarbonisation technologies. Indeed, government funding for R&D in India remains weak and investment in technologies like carbon, capture and storage (CCS), and green hydrogen are important to develop viable and economically competitive alternatives.[65]

A carbon tax that is incremental in nature will help augment fiscal revenues, improve the tax-GDP ratio, and generate additional funds which can be utilised for offsetting the burden of the tax on low-income groups as well as facilitate greater investments in green and environmental projects. Revenue recycling is another critical aspect for generating greater acceptability and adoption as well as ensuring effectiveness of the tax mechanism. The following are some examples: Japan reserves its carbon revenues for climate mitigation projects and to boost renewable energy and energy-efficient technologies; Ireland transfers revenues to the general budget to reduce payroll taxes and alleviate fuel poverty; Singapore uses its revenues to support schemes such as the Resource Efficiency Grant for Energy, Investment Allowances for Emissions Reduction and Energy Efficiency Fund; Colombia uses 50 percent of the revenues from the tax towards adaptation projects in coastal erosion management, conservation of water sources, and the protection of ecosystems; Mexico has a strong focus on improving public transportation in addition to boosting energy efficient technology; and Denmark uses its revenues to both subsidise energy efficient investments as well as reduce taxes on labour. In addition, a tier of the revenue transfer from the Centre to the States can be linked to measurable and traceable metrics such as the area expanded under forest cover, share of renewables in the energy mix, fossil fuel replacement strategies including e-mobility, increased ethanol blending, and use of biofuels, amongst others, to ensure greater compliance and enforcement.

With efficiency and equity considerations built into the tax design, political communication becomes an important lever to enhance wider acceptability and drive compliance, the lack of which, as seen in the experience of Australia, led to the abolition of the carbon tax two years after introduction in 2012.[66]

2. Emissions Trading System (ETS)

India’s PAT Scheme—given its functional mechanism with DC (designated consumers)-specific targets, issuance, normalisation factor, trading, among other design features—lays a solid foundation to evolve into a full-fledged emissions-based cap-and-trade system. A phased approach to expand its aperture into a more functional ETS market could prove useful using simulations (a mock carbon market) or pilots (a small-scale carbon market). Mexico conducted simulation exercises among certain enterprises before entering the operational phase of its three-year pilot in 2020. China presents a befitting example: it piloted ETS models in eight provinces, allowing learnings and best practices from these programs to inform the design of its national ETS market that was eventually launched in 2021.

In the past, India has demonstrated serious commitment to explore cap-and-trade schemes to achieve its ambitious NDCs and signed up to the World Bank’s Partnership for Market Readiness (PMR) to pilot new market-based mechanisms (MBMs) in Waste and MSME sectors. It also set up an integrated data management and registry for GHG emissions.[67] A part of the funding was apportioned to expand and strengthen the scale and scope of existing market-based approaches including the PAT mechanism and the Renewable Energy Certificate (REC) scheme.[68] The World Resource Institute’s carbon market simulation covering about 50-60 percent of India’s total industry-related emissions across 30 to 40 large businesses as well as the emission trading scheme on RSPM in India are laudable attempts and could set a precedence for scaling and implementing more ambitious ETS pilot programs in India.[69]

India’s federal structure provides an ideal framework to develop ETS pilot programs across states with inter-state trading built into its design to enhance cost-competitiveness and efficiency gains. Such pilot projects are ideal to engage with relevant stakeholders and build readiness among industries, develop a bottom-up approach to designing and testing different models, and identifying and understanding operational challenges during the post-pilot phase.[70]

In its current form, the PAT Scheme covers 1,072 designated consumers, consuming 50 percent of primary energy, in 13 sectors.[71] The ETS should aim at a wider coverage, including more sectors and industries above a certain threshold, to maximise potential gains from trade and reduce overall transaction costs. The cap should aim to set reasonably ambitious targets on absolute ambitions or intensity of emissions per unit of GDP, subject to growth rate of the economy. Defining targets over time frames can be useful for industries to undertake transition planning pre-emptively. As an example, the EU ETS has already declared that its emission cap will decrease annually by 2.2 percent between 2021 and 2030.[72] Emission allowances can be freely allocated with a small portion earmarked for auctioning to set the stage for increasing the latter’s percentage over the years. Many emerging economies follow a similar template, such as Korea, where 90 percent or less allowances are freely allocated to entities in sub-sectors that are subject to auctioning and 100 percent for EITE sectors (emission-intensive and/or trade exposed sectors at risk of carbon leakage receive free allowances up to 100% of the benchmark or historical emission level).

For trading purposes, the ESCerts should be converted into carbon-denominated allowances based on carbon intensity benchmarks.[73] Deploying price containment measures in the ETS design can help incorporate greater flexibility and price predictability. These include establishing a price corridor, i.e. introducing a price floor and a price ceiling, as done by countries like the Republic of Korea and New Zealand. Another popular measure to contain price volatility is to have a Cost Containment Reserve (CCR) which allows the regulator to release a fixed additional supply of allowances if the sale of CO2 allowance prices exceeds a certain price threshold, also called the trigger price, as practiced in the ETS markets of Regional Greenhouse Gas Initiative, Republic of Korea and the European Union. Banking and borrowing unused emissions as well as the use of offsets which allows regulated businesses to buy emissions reduction credits from outside the market, can help provide greater flexibility to business owners, again a measure which finds its place in the Korea ETS with certain control features.[74]

While useful, these cost containment measures can result in trade-offs such as failure to realise the overall carbon emissions targets, lower overall efficiency gains from trade, and reduced predictability in the timing of achievement of emissions reduction targets. Therefore, careful planning is essential using rigorous quantitative modelling and analysis from the data collected via the pilot projects. Establishing a GHG emissions inventory and a strong MRV (Monitoring, Reporting and Verification) system is a pre-requisite for the success of the ETS scheme and therefore capacity building efforts should be deployed by governments for this purpose.[75]

Conclusion

The Energy Conservation (Amendment) Bill, 2022 underscores the willingness of the Indian government to explore the imperative of a formal carbon market to achieve carbon neutrality. Both the GST regime and the PAT scheme provide a well-functioning machinery which India can leverage to build upon a strong carbon pricing framework using a combination of both a carbon tax and an emission trading system.

To be sure, carbon pricing in itself is not a silver bullet; complementary measures along with carbon pricing will help accelerate the path to carbon reduction. An optimal portfolio of policy instruments which includes carbon pricing, fossil fuel taxes, renewable energy subsidies and technology and performance-based standards along with investment in green technologies and revenue recycling to protect vulnerable communities should form the basis of a cost-effective and equitable carbon pricing policy design.[76]

While India should not feel compelled to imitate or adopt western policy frameworks given the country’s unique economic and social pre-conditions, carbon pricing has proven to be an effective mechanism for many developing economies, including Republic of Korea, China and South Africa, to achieve significant carbon reduction and realise their national climate targets. In the context of India, it can help meet its ambitious current and future climate goals, offer emission reduction at the lowest possible cost, and accelerate progress on the Sustainable Development Goals (SDGs).[77]

Global climate policy groups have been debating the inception of a Climate Club, popularised by William Nordhaus in his 2015 paper ‘Climate Clubs: Overcoming Free-riding in International Climate Policy’, seeking to establish an international target carbon price (incremental in nature), amongst other mandates, to which all member countries must comply.[78] While the world is a long way to institutionalising a framework of such scale and scope, there is broad consensus to include carbon pricing as a prominent tool in the international climate policy architecture. The current G20 Troika, led by three developing countries – Indonesia, India and Brazil, presents a unique and apposite moment to push forward a global carbon pricing framework built with a redistributive mechanism[79] and aligned with the principles of Common but Differentiated responsibilities (CBDR) and the Just Transition Declaration. It is clear that carbon pricing is primed to become and remain the mainstay of the global climate policy architecture and designing domestic carbon policies and pre-emptive strategies that align with global policy trends will hold India in good stead in an increasingly decarbonising future.

Mannat Jaspal is an Associate Fellow with ORF’s Geoeconomics Studies Programme.

Endnotes

[1] Alex Bowen, “The case for carbon pricing”, Grantham Research Institute, Centre for Climate Change Economics and Policy, January 1, 2011

[2] Rob Jackson, Pierre Friedlingstein, Corinne Le Quéré, Robbie Andrew, Pep Canadell, Glen Peters, Sam Abernethy, “Global Emissions Rebound to Pre-COVID Levels”, Scientific America, November 11, 2021.

[3] Virender Kumar Duggal, “Carbon Pricing”, Asian Development Outlook 2021: Financing a Green and Inclusive Recovery, 2021

[4] Alex Bowen, “The case for carbon pricing”, Grantham Research Institute, Centre for Climate Change Economics and Policy, January 1, 2011

[5] Maria Hofbauer Pérez and Carla Rhode, “Carbon Pricing: International Comparison”, ifo DICE Report, 2020

[6] Virender Kumar Duggal, “Carbon Pricing”, Asian Development Bank

[7] Michael Greenstone and Ishan Nath, “Put a Price on It: The How and Why of Pricing Carbon”, U.S. Energy & Climate Roadmap, EPIC University of Chicago

[8] Michael Greenstone, “Put a Price on It: The How and Why of Pricing Carbon”

[9] The World Bank, “State and Trends of Carbon Pricing 2022”

[10] Michael Greenstone, “Put a Price on It: The How and Why of Pricing Carbon”

[11] The World Bank, “State and Trends of Carbon Pricing 2021”

[12] The World Bank, “State and Trends of Carbon Pricing 2022”

[13] Muskaan Malhotra and Dhruvak Aggarwal, “Decoding the New Amendments to the Energy Conservation Act”, Council on Energy, Environment and Water, 23 August, 2022.

[14] Shakti Sustainable Energy Foundation & EY, “Discussion Paper on Carbon Tax Structure for India”

[15] Alex Bowen, “The case for carbon pricing”, Grantham Research Institute, Centre for Climate Change Economics and Policy, January1, 2011

[16] J. Stiglitz et Al., “A Social Cost of Carbon Consistent with a net-zero Climate Goal”, Roosevelt Institute, The Grantham Research Institute on Climate Change and the Environment

[17] The World Bank, “State and Trends of Carbon Pricing 2021”

[18] Maria Hofbauer Pérez and Carla Rhode, “Carbon Pricing: International Comparison”

[19] Virender Kumar Duggal, “Carbon Pricing”, Asian Development Bank

[20] Joseph E. Aldy and Robert N. Stavins, “The Promise and Problems of Pricing Carbon: Theory and Experience”, Journal of Environment & Development, 2012

[21] E. Narassimhan et al., “Carbon Pricing in Practice: A review of the Evidence”, The Center for International Environment & Resource Policy, Climate Policy Lab, The Fletcher School Tufts University, 2017

[22] Virender Kumar Duggal, “Carbon Pricing”, Asian Development Outlook 2021: Financing a Green and Inclusive Recovery, 2021

[23] Joseph E. Aldy and Robert N. Stavins, “The Promise and Problems of Pricing Carbon: Theory and Experience”, Journal of Environment & Development,2012

[24] Joseph E. Aldy and Robert N. Stavins, “The Promise and Problems of Pricing Carbon: Theory and Experience”, Journal of Environment & Development,2012

[25] E. Narassimhan et al., “Carbon Pricing in Practice: A review of the Evidence”, The Center for International Environment & Resource Policy, Climate Policy Lab, The Fletcher School Tufts University, 2017

[26] E. Narassimhan et al., “Carbon Pricing in Practice: A review of the Evidence”, The Center for International Environment & Resource Policy, Climate Policy Lab, The Fletcher School Tufts University, 2017

[27] Joseph E. Aldy and Robert N. Stavins, “The Promise and Problems of Pricing Carbon: Theory and Experience”, Journal of Environment & Development,2012

[28] The FASTER Principles for Successful Carbon Pricing: An approach based on initial experience, OECD and the World Bank Group,2015

[29] United Nations Climate Change, Mechanisms under the Kyoto Protocol.

[30] Virender Kumar Duggal, “Carbon Pricing”, Asian Development Outlook 2021: Financing a Green and Inclusive Recovery, 2021

[31] The World Bank, “State and Trends of Carbon Pricing 2021”

[32] The World Bank, “State and Trends of Carbon Pricing 2021”

[33] Joseph E. Aldy and Robert N. Stavins, “The Promise and Problems of Pricing Carbon: Theory and Experience”, Journal of Environment & Development,2012

[34] Kathryne Cleary, Karen Palmer and Kevin Rennert, “Clean Energy Standards”, Resources for the Future, 2019.

[35] Joseph E. Aldy and Robert N. Stavins, “The Promise and Problems of Pricing Carbon: Theory and Experience”, Journal of Environment & Development,2012

[36] G20 Leaders Statement: The Pittsburgh Summit.

[37] The World Bank, “State and Trends of Carbon Pricing 2022”

[38] The World Bank, “Carbon Pricing Dashboard”.

[39] Kaushik Ranjan Bandyopadhyay, “Emission Trading in India: A Study of Two Schemes”, Asian Growth Research Institute,2016

[40] Tanushree Chandra, “Pricing carbon: Trade-offs and opportunities for India”, ORF, 2021

[41] Bureau of Energy Efficiency, Ministry of Power, Government of India.

[42] Muskaan Malhotra and Dhruvak Aggarwal, “Decoding the New Amendments to the Energy Conservation Act”, Council on Energy, Environment and Water, 23 August, 2022.

[43] Kaushik Ranjan Bandyopadhyay, “Emission Trading in India: A Study of Two Schemes”, Asian Growth Research Institute,2016

[44] Tanushree Chandra, “Pricing carbon: Trade-offs and opportunities for India”, ORF, 2021

[45] Parth Kumar, “Energy Conservation Amendment Bill 2022: It all boils down to targets for industries”, DownToEarth, August 10, 2022.

[46] Kaushik Ranjan Bandyopadhyay, “Emission Trading in India: A Study of Two Schemes”, Asian Growth Research Institute,2016

[47] M. Greenstone et al., “The Surat Emissions Trading Scheme”, Energy Policy Institute, University of Chicago

[48] Nikhil Ghanekar, “Explained: How Surat's Emissions Trading Scheme Works To Reduce Air Pollution”, IndiaSpend, July 26, 2021.

[49] M. Greenstone et al., “The Surat Emissions Trading Scheme”, Energy Policy Institute, University of Chicago

[50] Tanushree Chandra, “Pricing carbon: Trade-offs and opportunities for India”, ORF, 2021

[51] Shakti Sustainable Energy Foundation & EY, “Discussion Paper on Carbon Tax Structure for India”

[52] CEEW Centre for Energy Finance, “What are RPOs and RECs?”, March 23, 2021.

[53] Tanushree Chandra, “Pricing carbon: Trade-offs and opportunities for India”, ORF, 2021

[54] The Economic Survey of India 2014-15, “From Carbon Subsidy to Carbon Tax: India’s Green Actions”, Ministry of Finance, Government of India.

[55] Sumant Banerji, “69%! India now has highest taxes on petrol and diesel in the world”, Business Today, May 6, 2020.

[56] Shakti Sustainable Energy Foundation & EY, “Discussion Paper on Carbon Tax Structure for India”

[57] S. Paltsev et Al., “Economic Analysis of the Hard-to-Abate Sectors in India”, MIT Joint Program on the Science and Policy of Global Change, September, 2021.

[58] C. Hepburn and D. Klenert, “How can we make carbon pricing work?”, World Economic Forum, August 3, 2018.

[59] Tanushree Chandra, “Pricing carbon: Trade-offs and opportunities for India”, ORF,2021

[60] J. Cornillie et Al., “Towards more reliance on carbon pricing in India”, European University Institute, School of Transnational Governance, January, 2021

[61] Shakti Sustainable Energy Foundation & EY, “Discussion Paper on Carbon Tax Structure for India”

[62] Mannat Jaspal, Promit Mookherjee, “Budget 2022: Enabling finance for green growth and innovation”, Observer Research Foundation, January 28, 2022.

[63] Shakti Sustainable Energy Foundation & EY, “Discussion Paper on Carbon Tax Structure for India”

[64] Shakti Sustainable Energy Foundation & EY, “Discussion Paper on Carbon Tax Structure for India”

[65] J. Cornillie et Al., “Towards more reliance on carbon pricing in India”, European University Institute, School of Transnational Governance, January, 2021

[66] C. Hepburn and D. Klenert, “How can we make carbon pricing work?”, World Economic Forum, August 3, 2018

[67] Shubhangi Gupta and Ashwini Hingne, “From Theory to Practice: How a carbon market simulation can help design a successful carbon market in India”, WRI India, May 6, 2021.

[68] Partnership for Market Readiness, “India to Pilot Carbon Pricing Instruments with $8 Million PMR Support”, March 27, 2017.

[69] Shubhangi Gupta and Ashwini Hingne, “From Theory to Practice: How a carbon market simulation can help design a successful carbon market in India”, WRI India, May 6, 2021.

[70] Shubhangi Gupta and Ashwini Hingne, “From Theory to Practice: How a carbon market simulation can help design a successful carbon market in India”, WRI India, May 6, 2021.

[71] “National Carbon Market” Report,Bureau of Energy Efficiency, Ministry of Power, Government of India

[72] Varun Agarwal and Ashwini Hingne, “Five Key Design Decisions for an Effective Carbon Market in India”, WRI India, June 8, 2021.

[73] “National Carbon Market” Report,Bureau of Energy Efficiency, Ministry of Power, Government of India

[74] Varun Agarwal and Ashwini Hingne, “Five Key Design Decisions for an Effective Carbon Market in India”, WRI India, June 8, 2021.

[75] “National Carbon Market” Report,Bureau of Energy Efficiency, Ministry of Power, Government of India

[76] The World Bank, “State and Trends of Carbon Pricing 2021”

[77] Tejaswini Kulkarni and Ashwini Hingne, “Five ways in which Carbon Markets can boost India’s climate efforts”, WRI India, April 23, 2021.

[78] William Nordhaus, “Climate Clubs: Overcoming Free-riding in International Climate Policy”, American Economic Review, 2015.

[79] Mannat Jaspal, “Green Multilateralism: Partnerships, Finance, and Innovation: 2021 India-Germany-EU Dialogue”, Observer Research Foundation, February 17, 2022.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PDF Download

PDF Download

PREV

PREV