-

CENTRES

Progammes & Centres

Location

At a time when it is facing Western sanctions and a proxy war on oil prices, Russia sprang a huge surprise early this month by signing a gas deal with Turkey. The deal will enable Russia to pump natural gas into a Turkish hub, near the Turkey-Greece border and from there into the southern EU market.

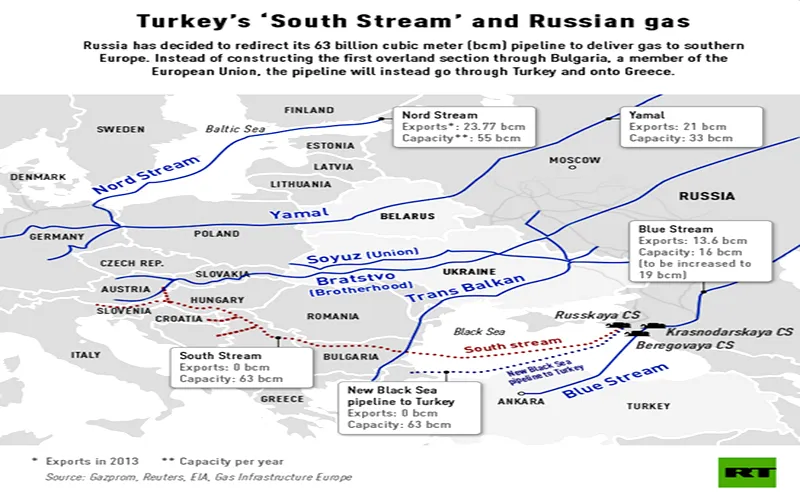

In early December this year, Russia sprang a huge surprise by signing a gas deal with Turkey that will enable Russia to pump natural gas into a Turkish hub, near the Turkey-Greece border and from there into the southern EU market. President Putin has said that Russia is ready to build a new pipeline under the Black Sea to meet Turkey’s growing gas demand. Russian gas supplies to Turkey will be raised by 3 billion cubic meters via the already operating Blue Stream pipeline at a reduced price for Turkish customers by 6 percent from January 1, 2015.

Turkey, playing the role of facilitator, will cement energy ties with Russia, at time when the latter is facing Western sanctions and a proxy war on oil prices. Global oil prices have plunged to less than USD 60 a barrel, drastically reducing Russian revenues and undermining Russia’s export earnings. A NATO member and a perennially waiting candidate for EU membership, Turkey’s energy alliance with Russia is a signal of Turkey’s pivot towards Eurasian integration and flexible multipolarity.

Earlier, Turkey had rejected joining any sanctions regime against Russia. American silence on the Russia-Turkey gas deal is significant. It hobbles American objectives of undermining Russia and scuttles the chances of the Qatar-EU gas pipeline that was supposed to go through Syria and Turkey. On December 1, 2014, Russia announced that it was abandoning the South Stream project because the European Union had decided that it did not want it, having championed it earlier as a new route for Russian gas to the EU.

Russia has accused EU of bad faith in all aspects of the South Stream negotiations and construction process. The creeping restrictions and conditionality’s imposed retroactively by the EU, contributed to Russia’s decisively turning its back on the South Stream. The 3,600 kilometer long South Stream was to be completed by 2016. Russia’s Gazprom owns 50 percent of it - along with Italy’s ENI (20 percent), French EDF (15 percent) and German Wintershall, a subsidiary of BASF (15 percent). The USA and EU had opposed this project mainly because it was a seen as a vehicle for cementing Russian influence over southern Europe and for bypassing Ukraine, via which Russian gas flows into central and northern Europe.

Russian effort to build an alternative route to the line going through Ukraine, stems from recent political developments in Ukraine, secession of Crimea and the overthrow of the Russia-friendly government and installation of a Western sponsored government. Russian-Ukraine relations have gone steadily downhill. The recent outbreak of internal hostilities has thrown Ukraine into turmoil, impelling the search for an alternative Russian gas route.

It was also about calling the EU’s bluff. The EU assumed that it could change the legal framework by interpreting the Third Energy Package (TEP) in new and creative ways, to overload the already onerous and cumbersome restrictions. The EU’s assumption that it could act with impunity and involve itself in training, arming, and equipping of neo-Nazis in Ukraine and staging a coup to frustrate Ukraine’s integration into the Eurasian Customs Union. Then the EU sanctimoniously assumed that it could impose sanctions on Russia believing that Russian desperation on the TEP, Ukraine, sanctions, Russia paying for developing the project, but let Europe control the physical infrastructures, revenues, and other critical aspects will bring Russia to its knees. The EU’s bluff has boomeranged badly.

Russia will now build a pipeline under the Black Sea into Turkey and pump the same amount of gas South Stream had planned. Gazprom’s biggest customer is Germany and the second biggest is Turkey. Russia is also building a unified gas distribution network that can deliver natural gas to any hub close to Russia’s borders. Turkey will also benefit further since Russia has agreed to build Turkey’s nuclear power infrastructure. Turkey could also be a full member of the Shanghai Cooperation Organization (SCO) soon. Thus, a Eurasian Economic zone with energy connectivity and the Chinese overland New Silk Routes is being crafted, further diluting American and European influence and hegemony.

Meanwhile, in another theatre, the east Mediterranean, two Turkish warships entered with an accompanying survey vessel in early November, to start prospecting 40 nautical miles off the Cyprus coast, even as an Italian-Korean consortium began drilling offshore in Cyprus’ EEZ. Cyprus and Israel have also commenced joint military exercises in the region. Russia too joined in and began its naval exercises east of Cyprus, making the east Mediterranean an active hotspot of regional energy, political and maritime competition. The east Mediterranean region includes Cyprus, Israel, Jordan, Lebanon, Syria and Palestine, with Greece and Turkey to the north and Egypt to the south.

A 2010 US Geological Survey report estimated recoverable natural gas of 122 trillion cubic feet (tcf), equal to 3,455 billion cubic metres (bcm), as also oil reserves of 1.7 billion barrels in this basin. This gas potential is huge and Israel has been active in developing this potential. Israel announced its most significant gas find in 2010, in a field named Leviathan, which has estimated reserves of 22tcf. With this and earlier discoveries, Israel will be self-sufficient in gas for several decades and could even be able to export. In 2011, Cyprus discovered gas in the Aphrodite field which has reserves of about 5 tcf. A small gas field is also offshore off Gaza; there are also indications of gas offshore from Lebanon and Syria. The region, however, is volatile with many pending disputes. The Israel-Palestine issue and unresolved Israel-Lebanon problems have stymied any development of the Gaza offshore field. Lebanon has contested Israel’s exploration in areas it considers its own EEZ. The Cyprus issue, with Turkish occupation of northern Cyprus in 1974, effectively dividing the island, has been the cause of bad blood between Turkey on one side and Cyprus and Greece on the other.

The Syrian civil war has complicated the regional scenario even further and halted development of Syria’s oil and gas potential. Syria’s allies, Russian and Iran have propped up the Bashar al-Assad regime to protect their respective strategic interests. Israel finds itself bereft of its traditional friendly relations with Egypt and Turkey, the US in a retreat mode and Russia and Iran extending their reach into the region. Encouraged by the EU, keen to reduce dependence on Russian gas, Israel and Cyprus had planned to export gas via and undersea pipeline into Greece and then onto Europe. This plan has fallen off the table because the pipeline has to pass through Turkish EEZ which Cyprus does not want. Nor does it want the pipeline to go directly via Turkey, the logical route, given Turkey’s role as an important consumer, regional hub and NATO member. Israel’s option, therefore, is to divert the gas to its domestic market, Palestine and Jordan, creating a regional grid and interdependence that might eventually help political Israel-Palestine reconciliation.

Rosneft, Russia’s largest oil producer, signed a deal during President Putin’s recent visit to India to supply 10 million tonnes of oil to Essar. Russia is also exploring an oil-for-goods deal with Iran. It is clear that energy is driving geo-politics in Eurasia and the east Mediterranean as the price of oil is pushed southwards by the US and its ally Saudi Arabia, in their strategy to weaken Russia and Iran. Russia’s riposte to this policy is to pivot eastwards and south, lessening its dependence on the European market. East Mediterranean gas too can be tapped as a supply source by India for its burgeoning energy needs. India has good relations with all countries in the region and could explore energy tie-ups to access gas. India can become a player in the geo-politics of energy as an important consumer and good relations with the countries in this region.

(The writer is a Distinguished Fellow at Observer Research Foundation, Delhi)

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Pinak Chakravarty was a Visiting Fellow with ORF's Regional Studies Initiative where he oversees the West Asia Initiative Bangladesh and selected ASEAN-related issues. He joined ...

Read More +