-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

Image Source: Renewable Energy: Market and Policy Environment in India

Introduction

India's significant economic growth over the last decade has led to an inexorable rise in energy demand. Currently, India faces a challenging energy shortage. To grow at 9 per cent over the next 20 years, it is estimated that its energy capacity must increase by approximately 5.8 per cent per year. While more than 70 per centi of India's energy is generated from coal based plants, by the end of March 2012, 12.26 per centii of India's energy installed capacity was from renewable sources. This number is expected to increase to 17.12 per cent by March 2017. India's renewable energy market relies heavily on incentives provided by government programmes. This paper outlines the potential of renewable energy in addressing India's energy supply and access; it identifies challenges and provide a discursive overview of the various market and policy instruments developed to scale up renewable energy generation.

1. BACKGROUND

1.1 Potential and Achievements of Renewable Energy in India

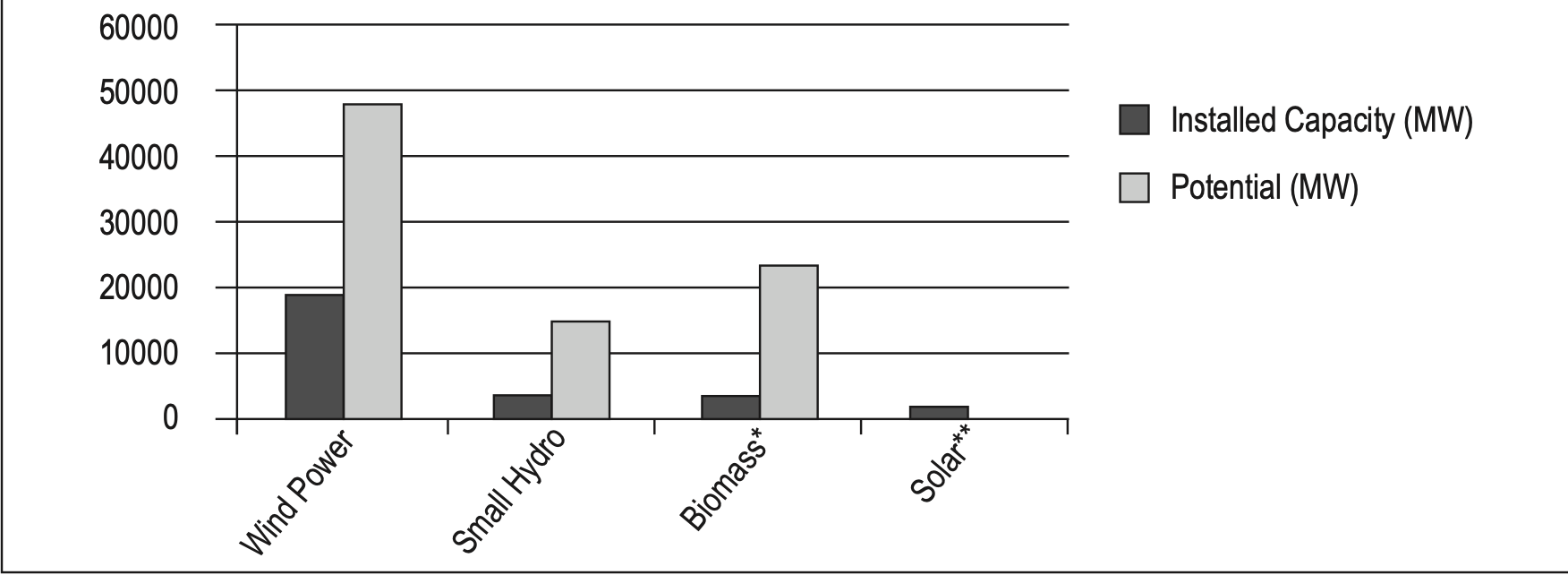

India has significant potential for harnessing renewable energy sources, as it possesses the natural resources and the geographical and climatic conditions necessary to support the promotion of solar, wind, biomass and small-scale hydroelectric energy technologiesiii (Fig. 1). While the wind sector has already been able to harness the economies of scale, development of solar energy is arguably still in its nascent stage.

Fig. 1: Cumulative Achievements (as on 31.03.2013) and Estimated Potential of Renewable Energy

*Inclusive of bagasse cogeneration, waste to energy; **Potential estimated at 20-30 MW per square kilometre of land area

Source: Installed Capacity: Ministry of New and Renewable Energy, Achievements; Potential: Strategic Plan for the New and Renewable Energy Sector for the period 2011-17, MNRE, February, 201)

1.2 Planned Growth of the Renewable Energy Sector

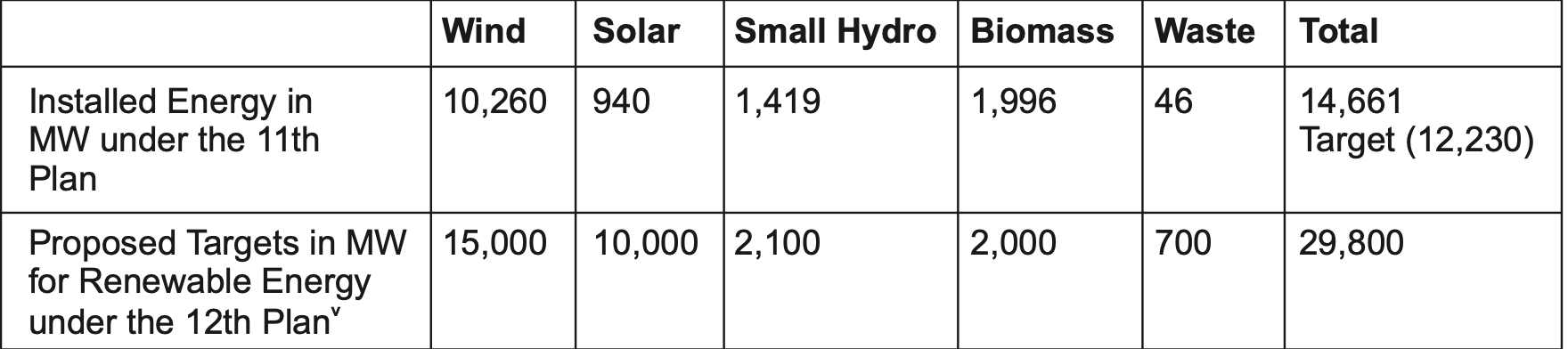

The target for power generated from renewable energy in the 11th Five Year Plan was 12,230 MW. However, renewable energy contributions reached 14,661 MW by the end of the plan period, with 10,260 MW wind and 1,996 MW biomass power as highest contributors (Table 1).iv

Table 1: Installed Power from Renewable Energy-11th Plan Achieved and 12th Plan Targets

Source: Government of India, MNRE, Lok Sabha Question, Starred Question No. 199 (August 24, 2012)

For the current 12th Five Year Plan the government has proposed installation of 29,800 MW of renewable energy capacity over the next five years (2012-2017).vi The wind and solar sectors will play a particularly important role in this growth. Actual power generated through renewable energy sources has exceeded annual targets quite regularly in the past few years, and the cumulative achievement of nearly 29 GW of installed grid interactive power until June 2013, is certainly significant (Table 2).

|

Table 2: Installed Grid Interactive Power from Renewable Sources |

||||

|

Renewable Energy Programme/Systems |

Target for 2013-14 |

Deployment during June, 2013 |

Total Deployment in 2013-14 |

Cumulative achievement |

|

Wind Power |

2,500 |

247.90 |

512.00 |

19564.95 |

|

Small Hydro |

300 |

15 |

54 |

3686.25 |

|

Biomass Power |

105 |

- |

- |

1264.80 |

|

Bagasse Cogeneration |

300 |

- |

- |

2337.43 |

|

Waste to Power (Urban) |

20 |

- |

- |

96.08 |

|

Industrial |

- |

- |

- |

- |

|

Solar Power (SPV) |

1100 |

- |

73 |

1759.44 |

|

Total |

4325.00 |

262.90 |

566.00 |

28708.95 |

Source: Ministry of New and Renewable Energy

2. Challenges of Capacity Addition in the Renewable Energy Sector

With millions of Indians unable to access electricity, and many others under-electrified (households consuming less than 50 kWh per month), India currently faces increasing oil import dependency, poor infrastructure and supply side production inefficiencies. The State Power Utilities (SPUs) are incurring transmission and distribution (T&D) losses, which were as high as 25.6 per cent in 2009-2010vii and there is lack of private investment (both domestic and foreign) in the power sector.viii Simultaneously, for the period 1998-99 to 2009-10, the average cost of supply per unit of electricity has increased from 263 paisa per kWh to 478 paisa per kWh, which is an annual growth rate of 7.4 per cent. These systemic issues have fallout effects on the renewable energy sector. There are of course well documented problems specific to the sector as well, including:

2.1 Financial constraints:

The potential profitability of renewable power projects in the long term is essential for attracting financial investments. Due to high installation costs and the unpredictability of future returns, renewable energy projects might seem less attractive for investments.

In terms of tariffs, electricity generated from renewable energy sources has not achieved grid parity and is consequently linked to higher costs of purchase.

Distribution companies (DISCOMs) have already accumulated massive financial losses across the board, and there is uncertainty about their own financial viability.

The application process for the Clean Development Mechanism (CDM) appears to be less efficient for Indian projects, and now the carbon markets do not provide much comfort to investors/lenders.

2.2 Technical constraints:

• Potential large scale project developers, investors and lenders are risk averse owing to the possibility of getting locked into a technology that becomes less efficient as better technologies become available in the future. This sort of inter-temporal discounting owing to inherently behavioural and technological reasons is not easy to measure and counteract.

For renewable energy sources, specific conditions of the installation location (sufficient solar radiation or wind potential) must be guaranteed.

Generated energy requires adequate infrastructure that allows an effective evacuation into the grid as well as storage facilities for grid discipline and reliable power distribution. India's energy/grid infrastructure is currently operating at maximum capacity and demands further development.

2.3 Policy constraints:

Subsidy support for fossil fuels amounted to INR 81,094 crores in 2010-2011,ix camouflaging their actual production and consumption costs.

Sanctions in case of non-compliance with renewable energy policies are not well understood by a large number of stakeholders.

The implementation of the single window clearances system for small scale entrepreneurs of renewable energy projects is time consuming and inefficient.

The land acquisition process for renewable energy installations, which generally require vast areas, is both complex and time consuming.

3. Status of Market and Policy Incentives for Renewable Energy

2011 marked the first year in which global investments in renewable energy exceeded those for fossil fuel power plants. Simultaneously, India's financial investments in renewable energy have increased. In 2011, investments in renewable energy installations reached Rs. 66 billion, with a year on year growth rate of 52 per cent.x However, the inflows into the sector are very clearly a function of the policy environment. There are multiple central and state level incentives for such investments as outlined below.

3.1 Tax Benefits

The Indian Government provides different tax benefits for renewable energies which encompass indirect taxes such as sales tax exemptions or reductions, Excise Duty exemptions and Custom Duty exceptions. In terms of direct tax benefits, renewable energy project developers are exempt from income tax on all earnings generated from the project in its first 10 years of operation.xi The Government also provides Accelerated Depreciation (AD) as a direct tax benefit which allows solar energy project developers to claim 80 per cent of the costs in the first year itself (this tax benefit was also applicable to wind energy projects until recently).

3.2 Renewable Energy Certificates (REC)

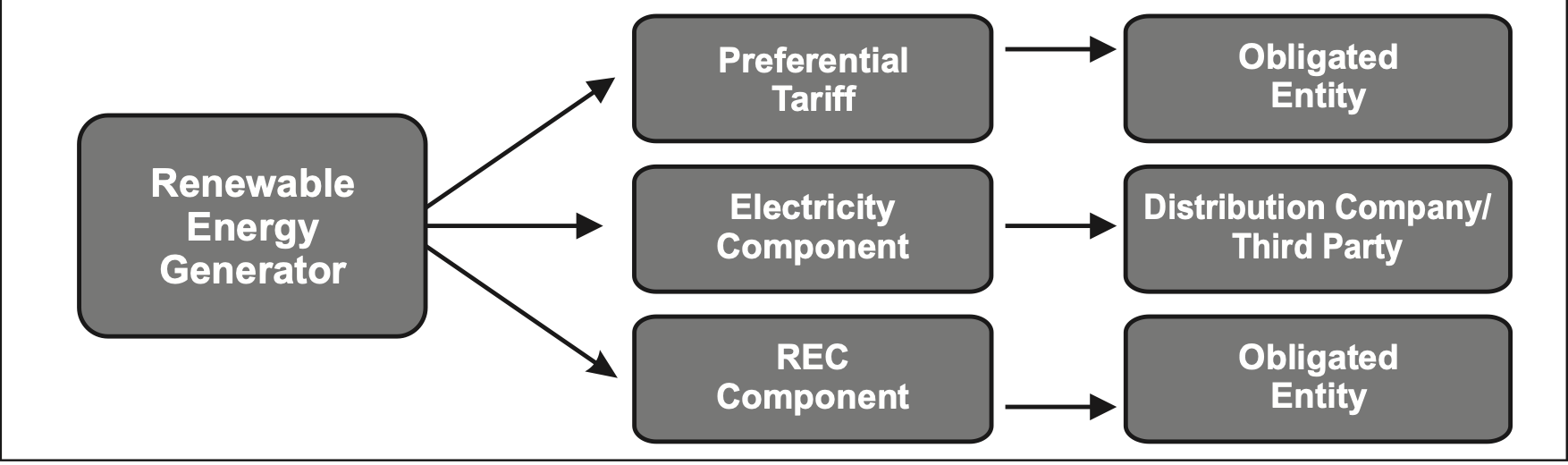

The Energy Conservation Act of 2003 authorises the State Electricity Regulatory Commission (SERC) to specify Renewable Purchase Obligation (RPO) which allocates a proportionate share of energy procured from renewable sources to various stakeholders including distribution companies, open access consumers and captive power producers. A market based mechanism, Renewable Energy Certificates (RECs) was introduced to enhance renewable energy by levelling the interstate divergences of renewable energy generation and the requirement of the obligated entities to meet their RPOs. With the first trading session held in March 2011xii this instrument is designed to enhance the competitiveness of renewable energy sources in the electricity market.

Under the REC mechanism two alternatives exist for renewable energy producers: they can offer renewable energy at preferential tariffs, or they can offer electricity and the cost for 'environmental attributes' related to renewable energy separately. These environmental attributes are than exchanged as RECs (Fig. 2).xiii

Fig. 2: Renewable Energy Certificate Mechanism

Source: S.K.Soonee, Minaxi Garg, Satya Prakash (2010): 'Renewable Energy Certificate Mechanism in India’ xiv

Recently, the Central Electrification Authority (CEA) indicated that during 2011-12 the share of renewable energy of the total electricity generated in India was 5.5 per cent.xv Just as the potential for generating electricity through renewable energy varies significantly between states,

|

RPOs set by State Electricity Regulatory Commission (SERC) also differ on a State to State basis. Tamil Nadu and Karnataka have already reached a RPO level of more than 10 per cent, while many states do not exceed 2 per cent.xvi While the REC component is transferred to another state, the electricity component is consumed in the host state. RECs are exchanged within the range of a floor price (minimum) and a forbearance (maximum) price determined by the CERC (Table 3). Table 3: RECs from 1st April 2012 until 2015 compared to prices for period before |

||

|

Non-solar REC (Rs./ Mwh) |

Solar REC (Rs./ Mwh) |

|

|

Forbearance Price |

3,480 (3,900) |

13,690 (17,000) |

|

Floor Price |

1,400 (1,500) |

9,880 (12,000) |

Source: CERC (2011)xvii

The above stated prices for the two types of RECs will remain valid until FY2015, while the significantly higher numbers in brackets indicate prices for FY 2012. The recent price cuts—proportionally higher for solar RECs than for non-solar RECs—are intended to increase the attractive-ness of the REC trading mechanism. On the other hand, the down pricing may discourage investments in new renewable energy projects.

Distribution companies, obligated to buy costlier electricity from renewable sources, may be financially compelled to pass the price increase on to the final consumers. So far, however, CERC estimates the impact of RPOs on consumer prices as insignificant.xviii State Electricity Regulatory Commissions are individually responsible for administering punishment in case of non-compliance with the CERC mandated RPOs.xix Therefore most of the states (besides Andhra Pradesh and West Bengal)xx have set the maximum REC price as penalty fee when their specific RPO is not achieved. However, there is little evidence that the compliance mechanism is actually enforced.

In India's federal structure, State governments are in charge of implementing certain policies mandated by the central government. In response to the National Solar Mission, Gujarat introduced its own Solar Policy in 2009 with an objective of deploying 500 MW of solar power by March 2014. Due to unexpected interest from project developers the state government allotted PV projects up to 968.5 MW. Before the originally commissioned deadline of December 2011, 132 MW of PV projects (approximately 14 per cent) were deployed. Thereafter lower tariffs have been initiated, resulting in a commissioned capacity of 654.81 MW by May 2012.

Despite Gujarat's obligation to meet the high RPO target of 1.00 per cent set by the central government, the state is currently the leading surplus state due to its solar policy. Other surplus states are Rajasthan and Karnataka which launched their state solar policies in 2011. Notably, Orissa and Madhya Pradesh—without an explicit state policy—have allocated solar projects to meet the state specific RPOs and could successfully install a surplus capacity of solar energy. Uttar Pradesh, with an ambitious RPO target of 1 per cent and lacking a state solar policy, perhaps has the largest capacity gap to fill.

3.3 Clean Energy Cess

The Clean Energy Cess was introduced in 2010 by the Indian Government to levy the amount of INR 50 to every tonne of national or imported coal. This “coal tax” was estimated to generate an amount of INR 3,249xxicrores for FY 2011-2012 and was estimated to reach approximately INR 3,864xxiicrores in FY 2012-2013. The money collected flows into the National Clean Energy Fund (NCEF) which aims to fund projects on clean energy projects.xxiii The NCEF provides project funding up to 40 per cent of the total costs, through the Indian Renewable Energy Development Agency (IREDA).

Over FY 2010-2011 the generated tax income was INR 1,067 crores and by the end of 2012 fifteen projects amounting to a total of INR 1,974 crores have been recommended for NCEF funding by an inter- ministerial group. While guidelines for project funding requirements under the NCEF have been released, no performance evaluation of the fund has taken place so far. In 2012 the 5 per cent custom levy on imported coal has been withdrawn by the government to further cope with the country's energy demand.

3.4 Generation Based Incentives (GBI)

The Ministry of New and Renewable Energy (MNRE) has initiated Generation Based Incentives (GBI) for wind and solar energy, respectively. These long term contracts provide rewards for producers of renewable energies, intended to increase their competitiveness with conventional energy producers and to stimulate further investments in renewable energy.

3.4.1 Generation Based Incentives for Wind Energy

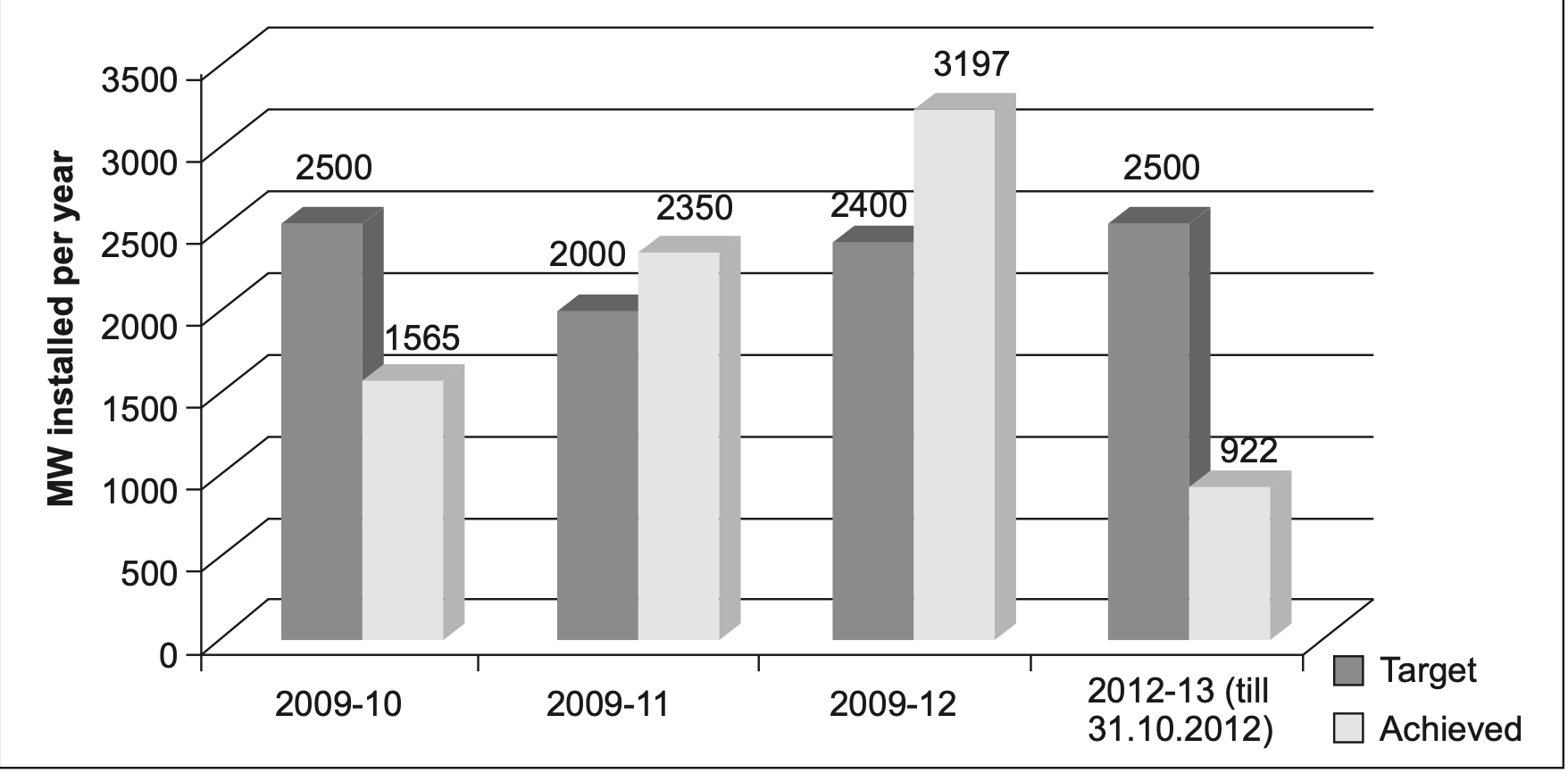

During the first half of this fiscal year, India added only 60 per cent of the targeted 1,402.66 MW wind power capacityxxiv (Fig. 3). The decrease can be attributed to the removal of the previously mentioned . Accelerated Depreciation and GBIs for the installation of wind power, which functioned as incentives for further investment. Until March 2012 the government had provided INR 0.5xxv per unit to wind generated energy fed into the grid, for 4-10 years. The GBI scheme for wind energy expired with the 11th Plan and was re-instated in the Union Budget in 2013. As mentioned before, Accelerated Depreciation (AD) which enabled wind installation developers to claim 80 per cent depreciation has been withdrawn. Approximately 70 per cent of wind installation projects have benefited from it. From April 2012, depreciation was explicitly restricted to an income tax for wind energy at the amount of 15 per cent,xxvi and the wind manufacturing industry can additionally claim 20 per cent tax deductions.

Fig. 3: Targets and Achievements of Wind Power Generation

Source: Annexure of Lok Sabha, Question No.105 from 30.11.2012 regarding Development of Renewable Energy Sources

Wind power potential and its generation vary among the states (Table 4). While Tamil Nadu has been generating the highest proportion of India's wind capacity with around 40 per cent by March 2012, followed by Gujarat (17 per cent) and Maharashtra (15 per cent), generally, energy generated from wind power has been concentrated on the states located in coastal areas. Due to the overall estimated wind potential, there is still scope for additional deployment of wind installations in Tamil Nadu, Gujarat, Karnataka, Rajasthan, Maharashtra and Andhra Pradesh (Annexure 1).

Table 4: State-wise addition to wind power generation from April 2002 to March 2012

|

Up to March’ 2002 |

2002 -03 |

2003 -04 |

2004 -05 |

2005 -06 |

2006 -07 |

2007 -08 |

2008 -09 |

2009 -10 |

2010 -11 |

2011 -12 |

Total |

||||

|

Andhra Pradesh |

93.2 |

0.0 |

6.2 |

21.8 |

0.45 |

0.80 |

0.0 |

0.0 |

13.6 |

55.4 |

541 |

245.50 |

|||

|

Gujarat |

181.4 |

6.2 |

28.9 |

51.5 |

84.60 |

283.95 |

616.36 |

313.6 |

197.1 |

312.8 |

789.9 |

2966.30 |

|||

|

Karnataka |

69.3 |

55.6 |

84.9 |

201.5 |

143.80 |

265.95 |

190.30 |

316.0 |

145.4 |

254.1 |

206.7 |

1933.50 |

|||

|

Kerala |

2.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

8.5 |

16.6 |

0.8 |

7.4 |

0.0 |

35.10 |

|||

|

Madhya Pradesh |

23.2 |

0.0 |

0.0 |

6.3 |

11.4 |

16.40 |

130.39 |

25.1 |

16.6 |

46.5 |

100.5 |

376.40 |

|||

|

Maharashtra |

400.3 |

2.0 |

6.2 |

48.8 |

545.10 |

485.30 |

268.15 |

183.0 |

138.9 |

239.1 |

416.5 |

2733.30 |

|||

|

Rajasthan |

16.1 |

44.6 |

117.8 |

106.3 |

73.27 |

111.75 |

68.95 |

199.6 |

350.0 |

436.7 |

545.7 |

2070.70 |

|||

|

Tamil Nadu |

877.0 |

1333.6 |

371.2 |

675.5 |

857.55 |

577.90 |

380.67 |

431.1 |

602.2 |

997.4 |

1083.5 |

6997.60 |

|||

|

Others |

3.2 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

3.20 |

|||

|

Total |

1665.7 |

242.0 |

615.2 |

1111.7 |

1716.17 |

1742.05 |

1663.32 |

1484.9 |

2349.2 |

2349.2 |

3196.7 |

17351.50 |

|||

Source: MNRE (http://mnre.gov.in/file-manager/UserFiles/wp_installed.htm)

3.4.2 GBIs for Solar Energy

For small grid solar projects below 33kV, GBIs are provided for bridging the gap between a base tariff of INR 5.5 (by 2010-2011, with an annual escalation of 3 per cent) and the tariff determined by the Central Electricity Regulatory Commission (CERC). The CERC tariff for the fiscal year of 2012 accounted to INR 10.39 per kWh.xxvii The targets for capacity addition are outlined in Table 5.

Table 5: JNNSM Capacity Addition Target of the National Solar Mission

|

Segment |

Target for |

Cumulative Target for Phase II (2013-17) |

Cumulative Target |

||||||||||||

|

1 |

Utility Grid Power including rooftop |

1,100 MW |

10,000 MW |

20,000 MW |

|||||||||||

|

2 |

Off Grid Solar Applications |

200 MW |

1,000 MW |

2,000 MW |

|||||||||||

|

3 |

Solar Collectors |

7 million sq mt |

15 million sq mt |

20 million sq mt |

|||||||||||

Source: Ministry of New and Renewable Energy, xxviii India

To scale up capacity, MNRE can take advantage of the decreasing prices for solar energy over the recent years, which has led to lower GBI contributions from the MNRE in Phase II and is estimated to account for around INR 2-3xxix from the CERC draft tariff for solar technology of 8.75 per kWh for 2013-2014 (INR 7.78 respectively accelerated depreciation). GBIs in Phase I were payable for a period of 25xxx years, GBIs in Phase II is payable for a period of 12xxxi years as indicated in the JNNSM Policy for phase II.

3.5 The Partial Risk Guarantee Fund

The Partial Risk Guarantee Fund (PRGF)—established in the context of the Framework for Energy Efficient Economic Development (FEEED)—aims to reduce the risk perception related to investments towards energy efficiency projects, by providing commercial banks with partial guarantees of risk exposure against loans. This instrument as outlined in the MNRE Strategic Plan for the period of 2011-2017, will receive policy emphasis. So far, the PRGF has not been operationalised.

3.6 Viability Gap Funding

Financial returns from projects that require long gestation periods or high investments into infrastructure may not appear attractive for investors. Therefore the JNNSM adopted the schemes released by the Ministry of Finance in 2006 for PPPs in infrastructure to fund viability gaps by providing 20 per cent of the total project costs. In addition the Government or its agencies will be able to contribute another 20 per cent of the project costs, if required. In phase II of the National Solar Mission, solar project developers will bid for Viability Gap Funding (VGF) in Rs/MW with a selection process on a minimum cost basis. For applying a long term perspective to the selection process the JNNSM phase II draft mandates the development of specific performance parameters.xxxii VGF would theoretically reduce the cost of financing as capital costs would be partially provided. VGFs have already been discussed in the NSM policy for phase 1, but not been implemented so far.

Off-grid Renewable Energy

Approximately 75 million households or about 80,000-90,000 villages have no access to energy, with a majority of 94 per cent (or 71 million households) living in rural areas of the country.xxxiii Continuing supply constraints are a problem. Renewable energy provides an alternative to expensive grid extension. A total renewable energy capacity of 18,655 MWxxxiv had been installed by the end of 2010, while the share of off-grid renewable energy generated accounted for a nominal 460 MW equivalentxxxv in the same year. By December 2012 the off-grid capacity grew by 57 per cent to an amount of 803 MW equivalent (Table 6).

Table 6: Growth in Deployment of Off-grid power

|

S.No |

Resources |

Cumulative Achievements |

Cumulative Achievements |

Cumulative Achievements |

|

1. |

Biomass Power / Cogen.(non-bagasse) |

274 MW |

357.75 MW eq |

426.04 MW eq |

|

2. |

Biomass Gasifier |

128 Mw eq |

148.89 MW eq |

155.59 MW eq |

|

3. |

Waste-to-Energy |

68 Mw eq |

93.65 MW eq |

113.60 MW eq |

|

4. |

Solar PV Power Plants |

3 MW eq |

18.28 MW eq |

106.33 MW eq |

|

5. |

Aero-Generators / Hybrid Systems |

1 MW |

1.50 MW eq |

1.74 MW eq |

|

Total |

460 MW eq |

620.07 MW eq. |

803.30 MW eq |

Despite the pressing need of electrifying remotely located households in India, incentivising off-grid installations is still in an evolving area and requires further policy innovations. The National Solar Mission Phase I suggested renewable energy vouchers/stamps, capital and interest subsidy, Viability Gap Funding and Green Energy Bonds as instruments to achieve a flexible funding approach and to incentivise the 200 MW targeted capacity. By December 2012 an off-grid capacity of 106 MW equivalentxxxix Solar Photovoltaic (PV) was installed.

4.1 Recent Policy Initiatives in Off-grid

Given that market-based and micro credit schemesxl achieved only limited success for enhancing grid penetration in remote areas, there is a strong case for scaling off-grid installations to implement the targeted capacity. The MNRE has set a goal of deploying a supplementary off- grid capacity of 2,000 MW under the National Solar Mission by 2022.

Recent policies that may further enhance off-grid deployment include:

MNRE intends to provide up to 90 per cent subsidy for effectively replacing fuel and kerosene as energy sources with renewable energy in off-grid areas, as part of the upcoming National Solar Mission Phase II. With a wider coverage area, the new scheme is intended to renew the Remote Village Electrification scheme.

In 2012 the Forum of Regulators (FoR) has sanctioned introduction of the REC mechanism for off-grid generated energy, which will allow obligated entities to buy off-grid renewable energy to meet their RPOs. In fact, to encourage channelling of funding towards off-grid renewable projects, the following new initiatives have been taken:

(i) A Joint Liability Group (JLG) to enable a small group of 4 to 10 local entrepreneurs to avail loans for non-farming activities which could be applied for micro-grid installations. About 3.3 lakh Joint Liability Groups have been receiving funding until March 2012 amounting to INR 2,800 crores in total. By synthesizing business and social potential this initiative aims to enable local entrepreneurial undertakings to create new enterprises which simultaneously have positive effects on boosting the local economy and meeting social needs.

(ii) Since December 2012 India's Top 500 companies are obliged to channel 2 per cent of their profits towards Corporate Social Responsibility (CSR) projects currently amounting to estimated INR 6,750 crores in the first year. These CSR funds provide a huge funding potential for off-grid solutions; 10 per cent of the estimated amount of INR 6,750 crores, at a Capital Expenditure Grant of 50 per cent could fund the installation of 65MW of solar PV capacity (equivalent to serve 300,000 households). Private sector financial resources could be allocated to make up for insufficient funding from the public sector side. Guidelines need to be developed and distributed for efficient disbursement of the available funding consolidated.

5. Conclusions

In recent years, various policy-driven instruments characterised by ambitious targets have been used in order to enhance renewable energy uptake. But despite a multitude of renewable energy policies and financing mechanisms, actual implementation is lagging. Funds have not been delivered; projects have been commissioned but not finally deployed; penalties and enforcement of penalties are both traditionally weak. We have the following recommendations in this regard:

Simply setting ambitious renewable energy targets without adequate implementation and firm institutional enforcement will not work. Stronger mechanisms/penalties to enforce the implementation of targets have to be developed. In this context, the government might consider strengthening its REC system by charging the obligated entities higher forbearance price if they do not meet their specific RPOs. Additionally, since the financially stricken DISCOMs are a vital part of the REC mechanism, their liquidity is prerequisite for the functioning of the instrument.

National Solar Mission and State-specific solar policies have successfully contributed to meeting or achieving a surplus of the RPO percentage for solar energy in individual states. States with a high solar potential should further develop state policies and set explicit solar targets.

High installation costs and long gestation periods due to land acquisition and approval procedures for renewable power installations discourage financial investments. Financial instruments such as Viability Gap Funding and the Partial Risk Guarantee Fund that provide immediate support for project developers and reduce the initial costs and risk should therefore be prioritised.

Exhaustible resources of fossil fuel and volatile market prices contribute to energy insecurity in India. Since subsidies to the energy sector in India are unlikely to abate, fossil fuel subsidy reforms are required in addition to policy transition in order to usher in energy alternatives, which are not only sustainable but also assist in improving India's fiscal balance.xli

Targeting grid parity of renewable energy prices will foster their competitiveness. This could be further supported through direct (bundling concept) or indirect subsidies (coal cess) for clean technologies, and through research and technology developments. For improved affordability and access, incentives for off-grid solutions require further development.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Vivan was a visiting fellow at ORF, where he supports programmes on the ‘new economy’. Previously, as the CEO of ORF’s Global Governance Initiative, he ...

Read More +

Andrea Deisenrieder is working as Research Associate at the Institute of Development Strategy in Munich where she has been involved in various consulting projects and ...

Read More +