INTRODUCTION

Indian Railways (IR) has come a long way from its humble beginnings in April 1853, when the first train on the Asian continent ran from Bori Bunder to Thane, covering 34 km in the erstwhile Bombay Presidency. The train carried 400 passengers—the elite of Bombay—in 14 carriages. The very first commercial run of a railway train in India was, thus, a passenger-carrying event.

Today, IR carries 22.2 million passengers daily (almost equal to the population of Australia) in its 13,229 passenger trains across a network of 67,368 km through the length and breadth of the country.[1] Additionally, another 9,221 freight trains carry more than three million tonnes of freight daily.[2] IR is currently one of the four railway systems in the world with an annual output of more than one billion tonnes of freight. With such a humongous transport output, the cost of its various services must be carefully calculated for the industry to maintain a robust financial health.

The gross earnings of IR in 2016–17 was INR 1.65 trillion (USD 24.34 billion), including passenger earnings and freight earnings of INR 462.6 billion (USD 6.85 billion) and INR 1.04 trillion (USD 15.44 billion), respectively.[3] The actual breakups of the IR traffic receipts are given in Table 1.

| Table 1: Gross Earnings of Indian Railways (2016–17)[4] |

| Sector |

Revenue (in INR billion) |

% of total earnings |

| Freight |

1,043.39

(USD 15.37 billion) |

63 |

| Passenger(Non-Suburban) |

435.91

(USD 6.42 billion) |

26 |

| Passenger (Suburban) |

26.9

(USD 0.4 billion) |

2 |

| Sundry |

103.68

(USD 1.53 billion) |

6 |

| Other Coaching |

43.12

(USD 0.64 billion) |

3 |

| Total |

1,652.3 (USD 24.34 billion) |

100 |

| Source: Tabulated by the authors, based on the statistics from Indian Railways Year Book 2016–17. |

The total working expense of IR for the year 2016–17 was INR 1.59 trillion (USD 23.43 billion), while its net traffic receipt was INR 62.62 billion (USD 0.92 billion).[5]

FREIGHT BUSINESS VIS-À-VIS PASSENGER BUSINESS

Traditionally, freight operations make up the major part of IR’s earnings, while passenger fares account for only about 30–35 percent of its total revenues. IR’s fare per passenger-kilometre (PKM) is one of the lowest in the world, while its fare per tonne-kilometre (TKM) of freight is one of the highest in the world. Freight business has thus subsidised passenger movement for years. In India, the cargo and logistics industries cost about 14 percent of GDP as compared to the global benchmark of eight to nine percent.[6] Since IR’s freight fares are not competitive with other modes of transport, it loses its share in the logistics sector. Therefore, IR’s revenue model needs urgent change to avoid a possible financial derailment.

Historically, IR’s finances have been heavily dependent on freight revenue as the passenger business of IR has never risen beyond 35 percent of its total earnings (Table 2).

| Table 2: Breakup of IR’s Revenue Shows Heavy Dependence on Freight Earnings |

| Year |

% of revenue from freight |

% of revenue from passenger |

% revenue from other sources |

| 1970–71 |

61.2 |

29.2 |

9.6 |

| 1980–81 |

61.2 |

31.3 |

7.5 |

| 1990–91 |

69.2 |

26.0 |

4.8 |

| 2000–01 |

66.0 |

29.7 |

4.3 |

| 2010–11 |

66.5 |

27.2 |

6.3 |

| 2016–17 |

63.0 |

28.0 |

9.0 |

| Source: Indian Railways Year Book 2010–11[7] and Indian Railways Year Book 2016–17.[8] |

To understand the dynamics of IR’s revenue model, one must study the share of total train kilometres, which includes both freight and passenger trains. As seen in Table 3, the share of passenger train kilometres has increased by about 11.5 percent since 1970–71. Since the same network runs both freight trains and passenger trains, a steady increase in the passenger train kilometres means a proportional decline of freight train kilometres. Increased passenger train kilometres impedes freight business, the major source of revenue for IR. Across India, key routes served by passenger trains have become the busiest, with line capacity utilisation of more than 100 percent in some sectors.[9] IR’s route length has increased by a mere 12.7 percent over the last four decades. In the same period, the total TKM carried has increased by 380 percent (from 127.36 billion in 1970–71 to 620.09 billion in 2016–17) and the total PKM by 870 percent (from 118.12 billion in 1970–71 to 1,149.84 billion in 2016–17).[10] The situation calls for urgent rationalisation of passenger fares to reduce the stress on IR’s finances.

| Table 3: Freight and Passenger Train Runs Show Steady Drop in IR’s Freight Business |

| Year |

Total passenger + freight train km (in million) * |

% of freight train kilometres |

% of passenger train kilometres |

Route Length (km) |

| 1970–71 |

427 |

47.3 |

52.7 |

59,760 |

| 1980–81 |

457 |

43.5 |

56.5 |

61,240 |

| 1990–91 |

561 |

43.7 |

56.3 |

62,367 |

| 2000–01 |

658 |

39.7 |

60.3 |

63,028 |

| 2010–11 |

949 |

38.8 |

61.2 |

64,460 |

| 2016–17 |

1,091 |

35.8 |

64.2 |

67,368 |

| *Suburban train kilometres are not considered since suburban networks do not compete in intercity movements. |

| Source: Indian Railways Year Book 2010–11[11] and Indian Railways Year Book 2016–17.[12] |

IR’S PASSENGER FARES: POLITICALLY SENSITIVE, OPERATIONALLY CRITICAL

The concept of social responsibility has always been a part of the passenger business in IR. As the number of passenger trains increased over the years, creating a rational fare composition gained more importance in the total structure of passenger fare–freight fare regime of IR. Fixing these fares has become a sensitive and vital issue for a succession of national governments. Passenger services and fares have an emotional connect with the masses and, therefore, have become a handy political tool to appease the vote banks. At the same time, inept handling of either the fares or the services can potentially cause widespread turmoil—in both rural and urban areas—and destabilise governments. Consequently, over the years, socio-political stakes have hijacked the process of passenger fare structuring, rendering it a victim of populist governance, where political sensitivities have taken precedence over the operational criticality of passenger fares.

Table 4 shows the change in IR’s passenger fares since the turn of the century, revealing how this issue has been dealt with by successive governments.

| Table 4: Class Fare for a Journey of 500 km (in INR) |

| Year |

First AC |

Two tier AC |

Three tier AC |

Chair Car |

Sleeper Class |

Second Class |

| 2000 |

1,541 |

771 |

482 |

323 |

166 |

107 |

| 2001 |

1,541 |

771 |

482 |

323 |

166 |

107 |

| 2002 |

1,613 |

830 |

519 |

404 |

185 |

116 |

| 2003 |

1,613 |

830 |

519 |

404 |

185 |

116 |

| 2004 |

1,613 |

830 |

519 |

404 |

185 |

116 |

| 2005 |

1,613 |

830 |

519 |

404 |

185 |

116 |

| 2006 |

1,325 |

749 |

519 |

404 |

185 |

116 |

| 2007 |

1,325 |

749 |

519 |

404 |

185 |

116 |

| 2008 |

1,239 |

721 |

519 |

404 |

185 |

108 |

| 2009 |

1,215 |

707 |

509 |

396 |

182 |

106 |

| 2010 |

1,215 |

707 |

509 |

396 |

182 |

106 |

| 2011 |

1,215 |

707 |

509 |

396 |

182 |

106 |

| 2012 |

1,365 |

782 |

509 |

396 |

182 |

106 |

| 2013 |

1,465 |

852 |

589 |

466 |

222 |

129 |

| 2014 |

1,492 |

868 |

600 |

475 |

227 |

131 |

| 2015 |

1,711 |

996 |

688 |

545 |

261 |

150 |

| 2016 |

1,711 |

996 |

688 |

545 |

261 |

150 |

| 2017 |

1,711 |

996 |

688 |

545 |

261 |

150 |

|

cells denote increase in fares and cells denote increase in fares and

cells denote decrease in fares cells denote decrease in fares

|

| Source: Mumbai Rail Vikas Corporation (MRVC). |

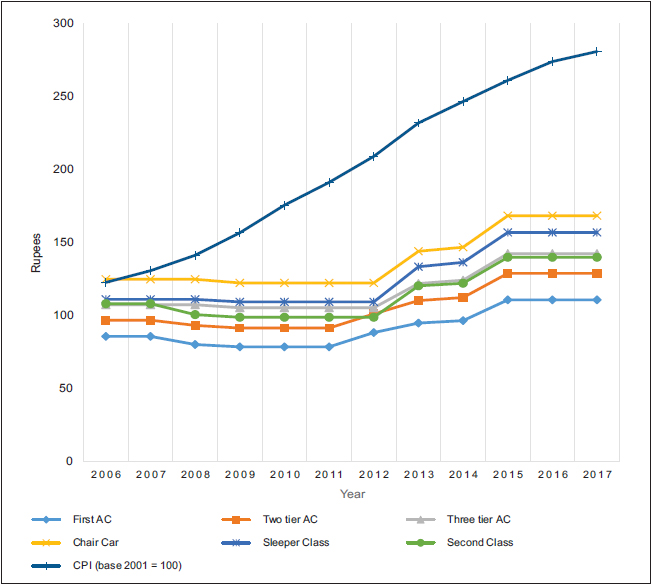

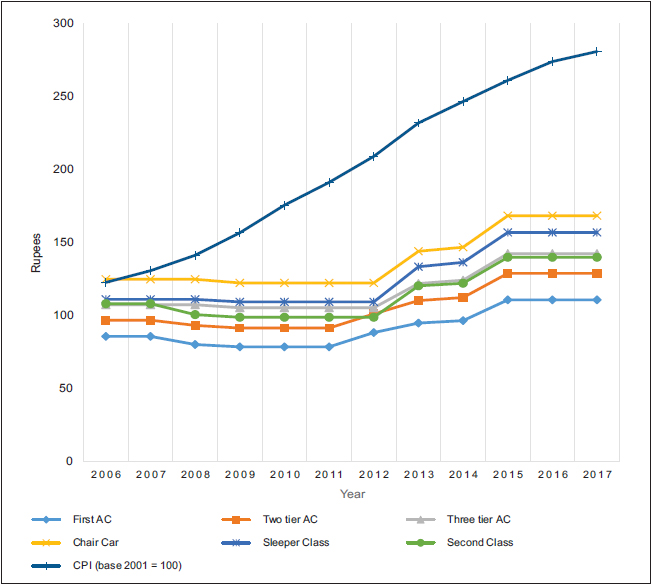

Table 5 depicts the train fares (normalised to 2001 as base) vis-à-vis the Consumer Price Index (Base 2001 = 100).

| Table 5: Class Fare for a Journey of 500 km (Normalised to 2001 = 100) Vis-à-vis Consumer Price Index (Base 2001 = 100) |

| Year |

First AC |

Two tier AC |

Three tier AC |

Chair Car |

Sleeper Class |

Second Class |

CPI

(base 2001 = 100) |

| 2006 |

86 |

97.1 |

107.7 |

125.1 |

111.4 |

108.4 |

123 |

| 2007 |

86 |

97.1 |

107.7 |

125.1 |

111.4 |

108.4 |

131 |

| 2008 |

80.4 |

93.5 |

107.7 |

125.1 |

111.4 |

100.9 |

141.6 |

| 2009 |

78.8 |

91.7 |

105.6 |

122.6 |

109.6 |

99.1 |

157 |

| 2010 |

78.8 |

91.7 |

105.6 |

122.6 |

109.6 |

99.1 |

175.9 |

| 2011 |

78.8 |

91.7 |

105.6 |

122.6 |

109.6 |

99.1 |

191.5 |

| 2012 |

88.6 |

101.4 |

105.6 |

122.6 |

109.6 |

99.1 |

209.3 |

| 2013 |

95.1 |

110.5 |

122.2 |

144.3 |

133.7 |

120.6 |

232.2 |

| 2014 |

96.8 |

112.6 |

124.5 |

147.1 |

136.7 |

122.4 |

246.9 |

| 2015 |

111 |

129.2 |

142.7 |

168.7 |

157.2 |

140.2 |

261.4 |

| 2016 |

111 |

129.2 |

142.7 |

168.7 |

157.2 |

140.2 |

274.3 |

| 2017 |

111 |

129.2 |

142.7 |

168.7 |

157.2 |

140.2 |

281.2 |

|

cells denote increase in fares and cells denote increase in fares and

cells denote decrease in fares cells denote decrease in fares

|

| Source for CPI (base 2001 = 100): Labour Bureau, Government of India[13]. |

Table 5 shows the ups and downs in rail fares of different classes against the corresponding consumer price index (CPI) in the country (both normalised to base 2001 = 100). As evident, inflation was not factored in when passenger fares were revised. At the same time, IR’s working expense increased from INR 427.59 billion (USD 6.3 billion) in 2004–05 to INR 1.59 trillion (USD 23.43 billion) in 2016–17. The current expenses include a massive human resource bill of INR 1.15 trillion (USD 16.98 billion).[14]

Additionally, the fare structure does not take into account the substantial reduction in the percentage of population living below poverty line—55 percent in 1973[15] to 22 percent in 2010[16]—or the steady rise in per capita income, which, as of 2016–17, had reached INR 82,269 (USD 1,211.82).[17]

Figure 1: Class Fare for a Journey of 500 km (Normalised to 2001=100) Vis-à-vis Consumer Price Index (base 2001=100)

The rail passenger fares must reflect such national economic changes. After decades of being a victim of fare politics, IR finally seems to have realised the need to change public perception towards ticket prices. In 2016, for the first time in the chequered history of the organisation, IR’s website and rail tickets carried a message: “Are you aware that 43% of your fare is borne by the common citizens of the country?” While there has been no study to measure the psychological or behavioural impact of this message on passengers, this unprecedented gesture clearly indicates that IR acknowledges its fare structure as not entirely sound.

FLEXI PRICING

To minimise the mounting losses, IR rolled out the “Flexi Pricing” scheme in September 2016 for 142 high-demand premium and superfast trains such as the Rajdhani, Shatabdi and Duronto services. Amongst the AC travellers, the fares of these premium services were already on the higher side.

Under this scheme, the tickets were sold with a slab-wise escalation in the fare structure.[18] As seen in Table 6A and Table 6B, the first 10 percent seats in the general quota are sold at normal fare, the next 11–20 percent at 110 percent of the base fare, the next 21–30 percent at 120 percent of the base fare and so on.

| Table 6A: Fare Structure for Rajdhani and Duronto Category of Trains |

| Charges % of berths |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

| Second Class (2S) |

1X |

1.1X |

1.2X |

1.3X |

1.4X |

1.5X |

1.5X |

1.5X |

1.5X |

1.5X |

| Sleeper Class (SL) |

1X |

1.1X |

1.2X |

1.3X |

1.4X |

1.5X |

1.5X |

1.5X |

1.5X |

1.5X |

| Three tier AC (3A) |

1X |

1.1X |

1.2X |

1.3X |

1.4X |

1.4X |

1.4X |

1.4X |

1.4X |

1.4X |

| Two tier AC (2A) |

1X |

1.1X |

1.2X |

1.3X |

1.4X |

1.5X |

1.5X |

1.5X |

1.5X |

1.5X |

| First AC (1A) |

1X |

1X |

1X |

1X |

1X |

1X |

1X |

1X |

1X |

1X |

| X = Base Fare |

| Source: http://pib.nic.in/newsite/PrintRelease.aspx?relid=149606 |

| Table 6B: Fare Structure for Shatabdi Category of Trains |

| Charges % of berths |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

| Chair Car (CC) |

1X |

1.1X |

1.2X |

1.3X |

1.4X |

1.5X |

1.5X |

1.5X |

1.5X |

1.5X |

| Executive Car (EC) |

1X |

1X |

1X |

1X |

1X |

1X |

1X |

1X |

1X |

1X |

| X = Base Fare |

| Source: http://pib.nic.in/newsite/PrintRelease.aspx?relid=149606 |

Reservation Against Cancellation and Waiting List seats, too, are sold at 150 percent of base fare. The present limit of berths set aside for tatkal quota in these trains are operated as per existing guidelines, with no additional levy of “tatkal charges.” As it is, the berths assigned under the tatkal quota are booked at 1.5 times the base fare for all classes (2S, SL, 2A, 3A and CC) except 1A and EC. Premium tatkal quota was cancelled in all of these 142 services.

The introduction of the Flexi Pricing scheme resulted in additional passenger revenue of INR 6.71 billion (USD 99 million)[19] between its inception (in September 2016) and November 2017, from about 150,000 passengers that travelled in the selected trains.[20] However, this generated an increase of only 1.5 percent in IR’s revenue from passenger business. Against this increased revenue, the statistics indicated a drop in occupancy in these trains. For example, data for the Mumbai–Delhi Rajdhani Express shows that while 8,256 passengers travelled in the 2AC coaches between 1 July 2016 and 31 July 2016, the number fell to 7,124 for the corresponding period in 2017.[21]

This decrease in occupancy is because cost escalation of tickets under the Flexi Pricing scheme have put them in direct competition with air travel, which is not only faster and more comfortable but also has an aspirational value. The passenger amenities offered in air travel are far better than those in rail travel. As the increased rail prices for the upper classes start matching air fares, commuters start switching to flights. Typically, IR’s 2AC class fares have a close competition with domestic airfares. Any upward revision in their fares can prove counterproductive.

For example, a 2AC ticket from CSTM (Mumbai) to HWH (Kolkata) in Duronto has a base fare of INR 2,977, and if this ticket is booked one month in advance—considering 20 percent seats are already booked—its value after addition of the flexi fare comes to INR 4,625 (base fare: 2,977 + dynamic fare: 894 + GST: 199, Superfast charges: 45 + Reservation Charges: 50 + Catering charge: 460).[22] The flexi fare will increase sizeably with the increase in occupancy, which will raise the value of this ticket even higher. On the other hand, Mumbai–Kolkata air tickets are available in the range of INR 3,500–4,500 a month in advance of the journey date (as per ticket fares obtained from www.makemytrip.com on 14 March 2018). Moreover, while the train journey from Mumbai to Kolkata takes about 26 hours, air journey takes two-and-a-half hours. Passengers will thus prefer flights for travelling from Mumbai to Kolkata.

Thus, trains selected under Flexi Pricing are running partially empty. The negative passenger growth rate witnessed in IR in the past year can also be further attributed to this scheme. The total number of passengers carried by IR has reduced from 8.4 billion in 2013–14 to 8.11 billion in 2016–17.

HAS FLEXI PRICING SOLVED THE DEEPER ISSUES OF IR’s FINANCES?

Despite the under-occupancy, trains earmarked under the Flexi Pricing scheme are delivering enhanced revenue. But is that the ultimate objective? The objective, ideally, should be to not only maximise IR’s profits but also ensure that trains run with optimum capacity utilisation, providing maximum service to the people.

Additionally, such a slab-wise upward spiralling fare structure is not ‘flexi’, but merely increases at ‘fixed’ percentages of ticket sales. In ‘flexi’ pricing, one would tend to think that the fares are dynamic, i.e. they fluctuate bi-directionally. In periods of less demand, commuters will expect the prices to fall. However, under the existing Flexi Pricing scheme, the fares keep rising until they hit the ceiling of 50 percent increase from the base price of the ticket.

Fare rationalisation is long overdue in IR’s passenger business. The Flexi Pricing scheme, however, only suggests an appetite for increased revenue at the expense of IR’s primary objective, to offer cost-effective passenger transport alternatives for both short- and long-distance travel to all classes of citizens. Why else would a scheme that allows for under-occupancy and, therefore, underutilisation of a national asset be accepted just because it earns more money for the government?

Recently, a six-member committee reviewed the Flexi Pricing scheme, a year after its implementation.[23] The committee completed its review within a month’s time and suggested an alternative plan to reduce the burden on the passengers of premium trains. A few of their recommendations include passengers paying more for trains with smaller travel times, premium charges for overnight trains, discounts on trains arriving at odd hours, differential pricing for preferred berths, e-auctions on popular trains and higher fares in peak demands.[24]

All these recommendations are piece-meal solutions to the deep and complex issue of increasing passenger fares. Since the committee was appointed to review the Flexi Pricing scheme, its recommendations do not take a holistic view of IR’s passenger business. The bulk of passengers travelling in IR are the ones who use the Sleeper Class and the Second Class.

Another proposal being considered is the voluntary waiver of subsidy by passengers while purchasing tickets. Taking a cue from the petroleum ministry’s similar appeal to its LPG customers, IR is thinking of starting a “Give-It-Up” campaign to increase its passenger revenue.[25] However, since most commuters who travel in IR’s lower classes are from the poorer sections of society, it is unlikely that they will be willing to give up the subsidy. The scheme will also paint IR as a weak organisation, unable to take any bold, practical decisions which will serve the dual purpose of not only keeping it in good financial health, but also fulfil its social obligations.

PASSENGER REVENUE OF INDIAN RAILWAYS: CONFUSION PREVAILS

The current Flexi Pricing scheme has had its immediate impact on IR’s revenue from passenger ticket sales. However, the scheme comes across as a knee-jerk political reaction to the declining financial health of the organisation, instead of a well-planned attempt at price rationalisation. Through the Flexi Pricing scheme, IR has silently allowed a marginal improvement in its passenger revenue without the government having to bite the bullet and make any announcement for fare revision. Moreover, it has resulted in IR’s premier passengers shifting to air travel.

Table 7 shows the breakup of non-suburban passengers according to different classes for the year 2015–16. It considers figures from the year 2015–16, when the Flexi Pricing scheme was yet to be implemented.

| Table 7: Non-suburban Passengers for the Year 2015–16[26] |

| Class |

No. of Passengers (million) |

% |

Earnings (INR million) |

% |

| AC First Class |

2.54 |

0.07 |

4536.2 |

1.09 |

| AC Sleeper |

25.92 |

0.71 |

33,410.3 |

8.01 |

| AC 3 Tier |

84.48 |

2.32 |

84,373.7 |

20.23 |

| Executive Class |

0.96 |

0.03 |

1,276 |

0.31 |

| AC Chair Car |

26.52 |

0.73 |

13,663.6 |

3.28 |

| First Class (Mail and Exp) |

0.33 |

0.01 |

144.1 |

0.03 |

| First Class (Ordinary) |

4.18 |

0.12 |

154.7 |

0.04 |

| Sleeper Class (Mail and Exp) |

322.19 |

8.83 |

128,730 |

30.86 |

| Sleeper Class (Ordinary) |

11.01 |

0.30 |

1,393.2 |

0.33 |

| Second Class (Mail and Exp) |

987.63 |

27.07 |

98,040.2 |

23.51 |

| Second Class (Ordinary) |

2,182.73 |

59.83 |

51,358.4 |

12.31 |

| Total |

3,648.49 |

100 |

417,080.4 |

100 |

| Source: Indian Railways Year Book 2015–16. |

For ease of understanding, all the AC and First-Class segments can be clubbed together as one section: Upper Class. The other segments will be the Sleeper Class and the Second Class, as given in Table 8.

| Table 8: Non-suburban Passengers for the Year 2015–16 |

| Class |

No. of Passengers (million) |

% |

Earnings (INR billion) |

% |

| Upper Class |

144.9 |

3.97 |

137.56

(USD 2.03 billion) |

32.98 |

| Sleeper Class |

333.2 |

9.13 |

130.12

(USD 1.92 billion) |

31.19 |

| Second Class |

3,170.3 |

86.89 |

149.4

(USD 2.2 billion) |

35.82 |

| Total |

3,648.5 |

100 |

417.08

(USD 6.14 billion) |

100 |

| Source: Tabulated by the authors, based on the statistics from Indian Railways Year Book 2015–16. |

Each of the three segments make for approximately one-third of the passenger revenue generated by IR, although the range of the volume of passengers travelling in each section varies tremendously.

Due to the large volumes of passengers in Second Class and Sleeper Class, a fractional increase of fares in this segment can lead to much higher revenues than the big fare hikes made in the Upper Class. The higher volume of passengers of the Sleeper Class, especially in Second Class, pays a pittance compared to the passengers of Upper Class or any other mode of mechanised transport in the country. This largely untapped catchment of Sleeper and Second-Class passengers provides IR an opportunity to generate much larger passenger revenues with only a nominal increase in their base fares.

The average distance travelled by passengers and the average fare charged in each of these three categories is given in Table 9.

| Table 9: Non-suburban Passengers for the Year 2015–16 |

| Class |

Average Distance Travelled (in km) |

Average Fare Charged (in INR) |

Average fare per kilometre (INR/km) |

| Upper Class |

726.7 |

949.14

(USD 13.98) |

1.30 |

| Sleeper Class |

866.4 |

390.53

(USD 5.75) |

0.45 |

| Second Class |

190.4 |

47.12

(USD 0.69) |

0.25 |

|

Calculations based on the following formulae:

Average Distance Travelled = Total Passenger Kilometre/Total Passengers

Average Fare Charged = Total Earnings/Total Passengers

Average Fare/Km = Average Fare Charged/Average Distance Travelled

|

| Source: Tabulated by the authors, based on the statistics from Indian Railways Year Book 2015–16. |

The average fare charged per kilometre for the Second Class and Sleeper Class are a meagre INR 0.25 and INR 0.45, respectively. The NITI Aayog report, “Reviewing the Impact of ‘Social Service Obligations’ by Indian Railways”, shows that the profit-making 3AC class maintains the total Upper-Class segment at a “no profit no loss” situation whereas the Sleeper Class and Second-Class segments lost INR 330 billion (USD 4.86 billion) in 2014–15.[27] This figure of ‘passenger coaching losses’ under IR’s social service obligations amounted to INR 395.65 billion (USD 5.83 billion) during the year 2016–17 (including suburban losses of INR 53.89 billion i.e. USD 790 million).[28]

As IR’s public message stated, 43 percent of the fare of every ticket sold is paid by the common citizens of this country. IR must, therefore, consider tuning the passenger fares in a way that they are in line with a reasonable subsidy for its commuters. Since the Upper Class has already achieved the “no profit no loss” breakeven point, the fares of the other two segments should be revaluated to reduce passenger business losses.

ONWARD JOURNEY

IR can consider reducing the 43 percent subsidy on tickets to 35 percent as an initial step towards fare rationalisation. Based on this subsidy rate, the average fare/km per passenger can be calculated as given in Table 10.

| Table 10: Non-suburban Passengers for the Year 2015–16 |

| Class |

Average Distance Travelled

(in km)

|

Average Fare Charged

(in INR) |

Average fare per kilometre (INR/km)

(Current subsidy of 43%)

[A]

|

Average fare per kilometre (INR/km)

(Considering a subsidy of 35%)

[B]

|

Difference to be paid by commuters per kilometre

(INR/km)

[B – A]

|

| Upper Class |

726.7 |

949.14 |

1.30 |

NA* |

NA* |

| Sleeper Class |

866.4 |

390.53 |

0.45 |

0.515 |

0.063 |

| Second Class |

190.4 |

47.12 |

0.25 |

0.285 |

0.035 |

| *Upper Class has not been considered since they are running at “no profit no loss.” |

| A subsidy of 43 percent results in fare/km per passenger of INR 0.45 for SL Class. Thus, the fare/km per passenger without any subsidy is INR 0.789. For a subsidy of 35 percent, i.e. the passenger paying 65 percent of the ticket price, the fare/km per passenger will be INR 0.515. This is an increase of INR (0.515 – 0.45) = INR 0.063, i.e. a marginal increase to 6.3 paisa/km per passenger. Similar calculations for 2S Class gives an increase of 3.5 paisa/km per passenger at a subsidy rate of 35 percent. |

| Source: Tabulated by the authors, based on the statistics from Indian Railways Year Book 2015–16. |

This nominal increase of fare of 6.3 paisa/km per passenger and 3.5 paisa/km per passenger in the Sleeper Class and Second Class respectively has the potential to generate an annual revenue of INR 41.18 billion (USD 610 million). The calculations are given in Table 11.

| Table 11: Non-suburban Passengers for the Year 2015–16 |

| Class |

Average Distance Travelled

(in km)

|

Average Fare

Charged

(in INR)

|

Passenger Business Revenue before Reduction in Subsidy

[A]

(INR in billion)

|

Passenger Business Revenue after Reduction in Subsidy from 43% to 35%

[B]

(INR in billion)

|

Increase in Revenue

[B – A]

(INR in billion)

|

| Upper Class |

726.7 |

949.14 |

137.56

(USD 2.03 billion) |

137.56*

(USD 2.03 billion) |

0* |

| Sleeper Class |

866.4 |

390.53 |

130.12

(USD 1.92 billion) |

148.67

(USD 2.19 billion) |

18.55

(USD 270 million) |

| Second Class |

190.4 |

47.12 |

149.4

(USD 2.2 billion) |

172.03

(USD 2.53 billion) |

22.63

(USD 330 million) |

| Total |

– |

– |

417.08

(USD 6.14 billion) |

458.26

(USD 6.75 billion) |

41.18

(USD 610 million) |

| *Upper Class has not been considered since they are running at a “no profit no loss.” |

| Considering a subsidy rate of 35 percent, as seen in Table 9, SL Class passengers pay INR 0.515/km and 2S passengers pay INR 0.285. Thus, total revenue from SL is INR 0.515/km per passenger x 866.4 (average distance travelled) x 333.2 million passengers = INR 148.67 billion. Similar calculation for 2S Class gives a revenue of INR 172.03 billion. |

| Source: Tabulated by the authors, based on the statistics from Indian Railways Year Book 2015–16. |

The Flexi Pricing scheme has generated an additional revenue of 1.5 percent over the revenue collection registered before the implementation of the scheme. However, as seen in Table 11, a marginal subsidy reduction in fares for lower classes will translate into an additional annual revenue of INR 41.18 billion (USD 610 million), an increase of 9.87 percent in the passenger revenue of IR.

Instead of applying the Flexi Pricing scheme to select trains, which only has an immediate impact and comes at the cost of occupancy, it would be prudent for IR to apply a fare hike of 6.3 paisa/km per passenger for the Upper Class of all trains. This marginal increase will translate into an additional revenue of INR 6.64 billion (USD 98 million). The Flexi Pricing scheme managed to earn similar revenues through fare hikes of up to 50 percent on select services. A minor increase in Upper Class fares across all trains is more acceptable than raising fares of premium services and losing this segment of commuters, who are the likeliest to take up air travel. Such a step of fare rationalisation will also prevent under-occupancy of trains.

CONCLUSION

Despite fluctuations in the economy, a sound policy by IR in fixing a reasonable subsidy for its passengers is crucial to ensuring good financial health of the organisation. Such a marginal reduction in the passenger fare subsidy will also be politically palatable, as the decision could be presented as not an “increase” in the base price of tickets but a “reduction” in government subsidy. Even under the exploitative Flexi Pricing scheme, the base prices of the tickets have been left untouched and the “dynamic fare” has been introduced separately.

In the past, governments have successfully reduced subsidies in the petroleum and power sector to generate higher revenues, factoring in the inflation in the country. A similar proposal must be executed in the IR passenger business. To successfully improve its passenger revenue, IR can “reduce the subsidy” by increasing base fares by a few paisa per kilometre. Since the ticket prices will remain at a competitive advantage over airfare, the scheme will also allow IR to retain its Upper-Class passengers, who are currently shifting to other modes of transport.

This paper pertains to the pricing of non-suburban passenger tickets only. In the case of suburban passengers, the cost of tickets for passengers is only 37 percent, and the rest is subsidy. Therefore, a suitable subsidy ratio must also be fixed for suburban services, and the fares must be marginally raised every year for stable earnings.

With the implementation of the Seventh Pay Commission, up to 68 percent of IR’s total revenue will be consumed for salaries and pension fund, putting a severe strain on plan outlays for capital expenditure and other operational and maintenance costs. Therefore, generating a stable and significant revenue from passenger travel through such well-planned fare rationalisation has become much more of an imperative. For decades, freight business has been the “earning” member of IR, and passenger business has been the “dependent”. Such an economic relationship between the two cannot change overnight, but it can gradually transform. While IR must be financially self-sufficient, it must also fulfil its social obligations as an organisation. The right balance between such compelling roles can only be achieved by taking nuanced but necessary steps towards rationalising passenger fares.

Ameya Pimpalkhare is Associate Fellow and Paresh Rawal is Consultant in ORF Mumbai. The authors thank Mr Vivek Sahai, Distinguished Fellow, ORF Mumbai and former Chairman of the Railway Board, for his help in the completion of this brief.

ENDNOTES

[1] Indian Railways Year Book 2016-17, Directorate of Statistics and Economics, Ministry of Railways (Railway Board), Government of India, 2018.

[2] Ibid.

[3] Ibid.

[4] Ibid.

[5] Ibid.

[6] Cargo and Logistics Industry in India, The Associated Chambers of Commerce and Industry of India and Resurgent India, Market Analysis, New Delhi, 2016.

[7] Indian Railways Year Book 2010–11, Directorate of Statistics and Economics, Ministry of Railways (Railway Board), Government of India, 2012.

[8] Indian Railways Year Book 2016–17, op. cit.

[9] Indian Railways – A Lifeline of the Nation – A White Paper, White Paper, Ministry of Railways, Government of India, 2015.

[10] Indian Railways Key Statistics (1950–51 to 2013–14), Directorate of Statistics and Economics, Ministry of Railways (Railway Board), Government of India, 2015.

[11] Indian Railways Year Book 2010–11, op. cit.

[12] Indian Railways Year Book 2016–17, op. cit.

[13] “Previous Years/Months Index Numbers”, Labour Bureau, Government of India.

[14] Ibid.

[15] “State-wise Number and Percentage of Population Below Poverty Line (BPL) in India,” Datanet India, n.d., accessed 18 March 2018,

[16] “State-wise Number and Percentage of Population Below Poverty Line (BPL) (Based on Tendulkar Methodology) in Rural and Urban Areas of India (2004-05 and 2011-12),” Datanet India, n.d., accessed 18 March 2018.

[17] “National Accounts Statistics 2017,” Ministry of Statistics and Programme Implementation, n.d., accessed 18 March 2018.

[18] “Introduction of Flexi Fare system for Rajdhani/Duronto and Shatabdi trains,” Press Information Bureau, Government of India, 7 September 2016, accessed 18 March 2018.

[19] “Railways earned additional Rs 671 crore through flexi fare,” The Economic Times, 5 January 2018, accessed 18 March 2018.

[20] P. Vasanth Kumari, “Railways defends surge pricing, says it’s flexi-pricing,” The Times of India, 10 September 2016, accessed 18 March 2018.

[21] Vedika Chaubey, “Premium trains run empty,” The Hindu, 2 October 2017, accessed 18 March 2018.

[22] “IRCTC Next Generation e-Ticketing System,” Indian Railway Catering and Tourism Corporation, n.d., accessed 16 March 2018.

[23] “Committee to Review Flexi Fare Scheme,” Press Information Bureau, Government of India, 7 February 2018, accessed 18 March 2018.

[24] “Pay more for lower berths and during festivals: Railway panel,” The Economic Times, 16 January 2018, accessed 18 March 2018.

[25] Shine Jacob, “Railways’ new ‘Give it Up’ campaign: Soon, forgo train ticket subsidy,” Business Standard, 7 July 2017, accessed 18 March 2018.

[26] Indian Railways Year Book 2015–16, Directorate of Statistics and Economics, Ministry of Railways (Railway Board), Government of India, 2017.

[27] Bibek Debroy, Kishore Desai, “Reviewing the Impact of ‘Social Service Obligations’ by Indian Railways,” NITI Aayog, 2016, accessed 18 March 2018.

[28] Indian Railways Year Book 2016–17, op. cit.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PDF Download

PDF Download

PREV

PREV