-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

Yamini Jindal, “Policy Imperatives for India's Integration into Electronics GVCs,” ORF Issue Brief No. 561, July 2021, Observer Research Foundation.

Introduction

Amid increasing globalisation, recent years have witnessed significant shifts in the way global producers and traders interact. As firms look to capitalise on factor endowments[a] and competitiveness, global production and trade networks have evolved to structure around global value chains (GVCs), wherein the different stages of the production process are fragmented globally. Nearly three-fourths of current international trade is dominated by intermediate (raw materials, parts and components, or services for businesses) and capital goods that firms utilise to produce final products.[1]

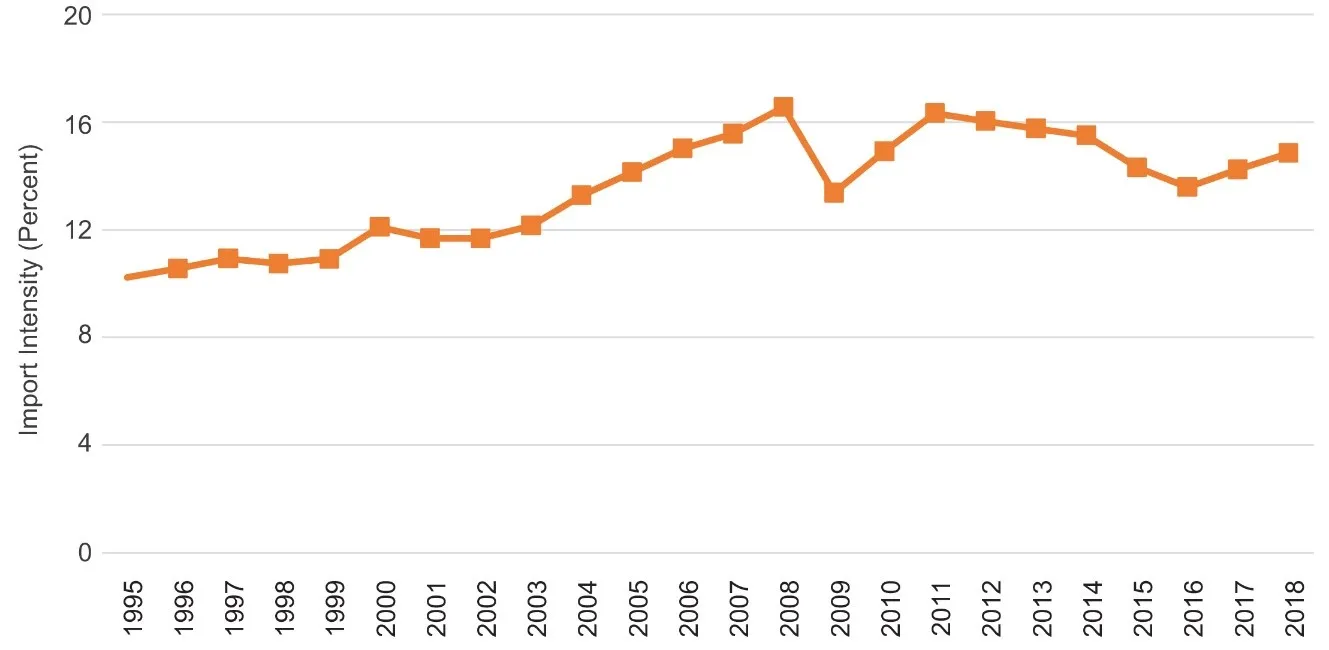

However, since 2011, the pace of GVC expansion has slowed, as evidenced by the decreasing global import intensity of production (see Figure 1). The trade in intermediate goods against each dollar of global output has reduced, indicating the declining use of imported inputs in domestic manufacturing. This is largely on account of structural factors, including rising digitilisation, growing servicification of manufacturing,[b] and rising wages in major outsourcing destinations in Asia.[2]

Figure 1: Global Import Intensity of Production (1995-2018)

Recent years have further clouded the prospects of GVC expansion as growing trade tensions between the US and China, which is a key hub for many GVCs, have raised concerns about production outsourcing strategies.[5] China’s GVC centrality[c] has grown substantially in recent years, as the country is a source and a destination of value addition. With the principal production networks in the electronics industry having shifted away from the US and South Korea, and gravitated towards China and its territories (Taiwan and Hong Kong), the latter have emerged as the primary buyers and suppliers of electronic products and components.[6] In 2020, China, Hong Kong, and Taiwan manufactured and assembled approximately 70 percent of the world’s electronics products;[7] and Taiwanese companies, such as Pegatron, Foxconn, Wistron, and New Kinpo, drove almost three-fourths of the global electronics manufacturing services (EMS) market, with Foxconn alone accounting for more than 50 percent of global EMS revenue.[8]

As such, the vulnerabilities emerging from the economic dependence on China have influenced policymakers around the world to deliberate on reconfiguring or relocating existing GVCs.[9] This sentiment was reaffirmed amid the disruptions caused by the COVID-19 pandemic. For instance, pandemic-induced disruptions had significant impacts on global electronics GVCs as China is the main manufacturing hub for key electronics products and components.[10]

Given the overreliance of many critical manufacturing GVCs on Chinese inputs and the adverse impact of Chinese factory closures during the pandemic, the global focus is now on identifying vulnerabilities, reducing GVC concentration, and diversifying supply chains. India is well-positioned to leverage this opportunity, particularly in electronics GVCs, due to a supportive domestic policy environment and a favourable geopolitical climate. This brief assesses India’s current participation in electronics GVCs and appraises its existing policy framework that can enhance the country’s integration into electronics GVCs.

Decoupling from China: Advantage India

Amid the global headwinds against China—largely driven by the US-China trade war and intensified by the COVID-19 pandemic—several like-minded economies have partnered to establish resilient and sustainable supply chain interdependencies. For instance, India, Japan, and Australia have proposed the Supply Chain Resilience Initiative (SCRI),[11] which aims to enhance supply chain resilience to enable sustainable and inclusive growth in the Indo-Pacific region. Given their shared interests, India, Japan, and Australia hope to reconfigure their supply chain dependencies on China by sharing best practices on GVC resilience and organising investment promotion and buyer-seller matching events to provide stakeholders with potential diversification opportunities.

The SCRI has been largely conceptualised around the three countries’ geostrategic concerns vis-à-vis China. In 2020, India and China engaged in a military standoff along the border in Ladakh,[12] while Japan’s ties with China have worsened in recent years over territorial disputes in the East China Sea.[13] Meanwhile, Australia’s trade relations with China have deteriorated since 2018 when China imposed trade sanctions on Australian exports[d] and, in response, Australia cancelled two memorandums of understanding with China’s National Development and Reform Commission in 2020.[14] Consequently, in 2021, China indefinitely suspended bilateral talks with Australia under the China-Australia Strategic Economic Dialogue.[15]

Although geopolitical considerations appear to have nudged countries to consider relocating their supply chains from China (as opposed to the traditional economic drivers of competitive advantages[e]), the success of such reconfigurations is contingent on the provision of a conducive policy environment in the new destination country. To encourage a shift away from China, it is crucial that countries compensate the lead firms and their supply chain partners. For instance, at the height of the initial COVID-19 outbreak in 2020, Japan announced a US$2.2 billion economic stimulus package to help Japanese manufacturing firms relocate from China.[16] Of the US$2.2 billion, US$2 billion was earmarked for firms considering shifting production activities to Japan and the remaining for those interested in reconfiguring their manufacturing bases to other countries (such as Vietnam, Thailand, Myanmar, India, and Bangladesh).[17],[18] Similarly, Australia announced a dedicated Supply Chain Resilience Initiative worth US$107.2 million,[19] to work with the domestic industry to identify supply options that are crucial in addressing vulnerabilities in domestic and international supply chains for critical products.

As companies look to disentangle their electronics supply chain dependency on China and diversify their electronics manufacturing bases, India has an opportunity to emerge as a favoured destination for global electronics in the post-COVID-19 world. This largely stems from the thriving domestic demand, structured policy support for the electronics sector, and ongoing efforts to ease doing business in the country. For instance, the production linked incentive (PLI) scheme for large scale manufacturing implemented in 2020 has led three of Apple Inc’s contract manufacturers (Foxconn, Wistron and Pegatron) to set up manufacturing bases in India.[20],[21]

India also enjoys the additional advantage of trust as compared to its global competitors, which will aid its integration into electronics GVCs. Given that the focus is on making GVCs more reliable and less disruptive, and as digitalisation is increasingly embraced, there is a need for information and communication technology (ICT) products to be sourced from ‘trusted’ providers. India has an advantage here, evidenced by the implementation of the Trusted Electronics Value Chain Certification Scheme, [f],[22] which will formally recognise ICT product providers’ adherence to industry standards.

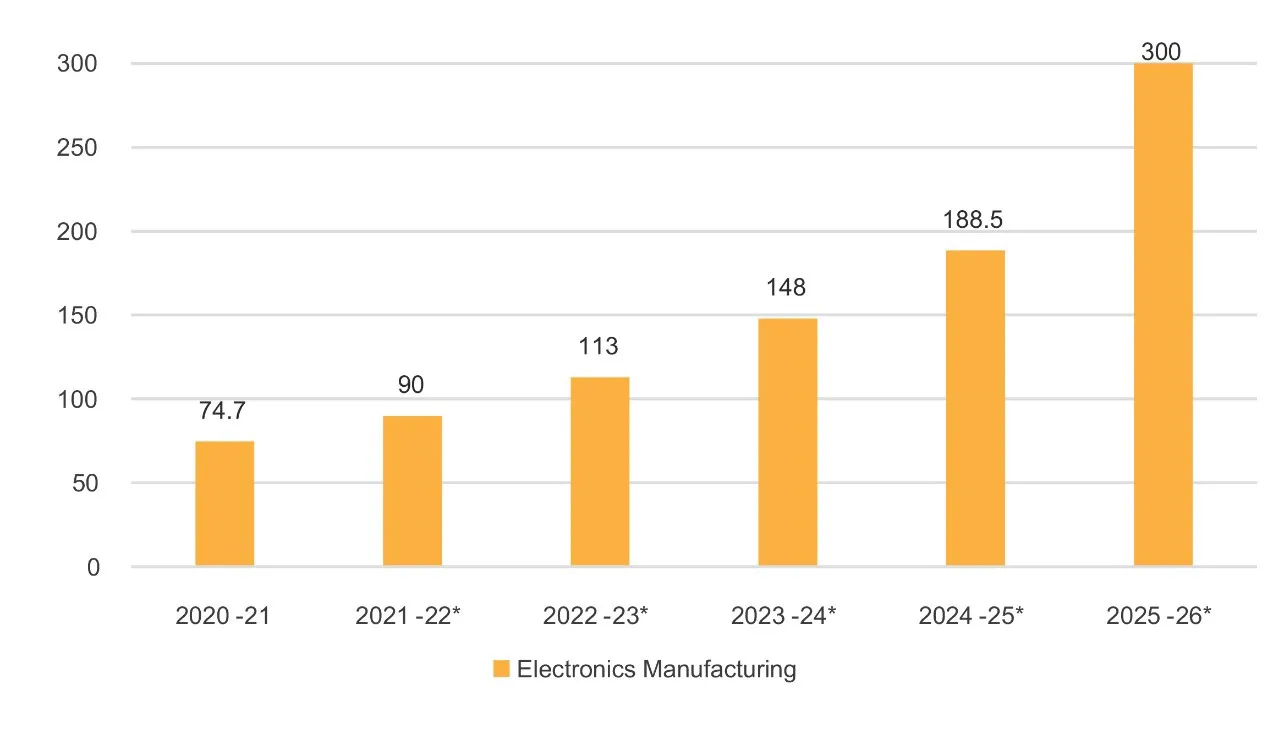

The Indian government’s Atmanirbhar Bharat strategy aims to transform the country into a global design and manufacturing hub, with electronics manufacturing as a priority pillar. India’s electronics system design and manufacturing (ESDM) sector has experienced substantial growth in recent years due to several structured policy interventions—electronics production increased from US$25 billion in 2014-15 to US$75 billion in 2020-21, growing at a compound annual growth rate of 25 percent.[23] India is now aiming to attain an electronics manufacturing capacity worth US$300 billion by 2025-26, as part of its planned US$1 trillion digital economy (see Figure 2).

Figure 2: India’s Domestic Electronics Manufacturing

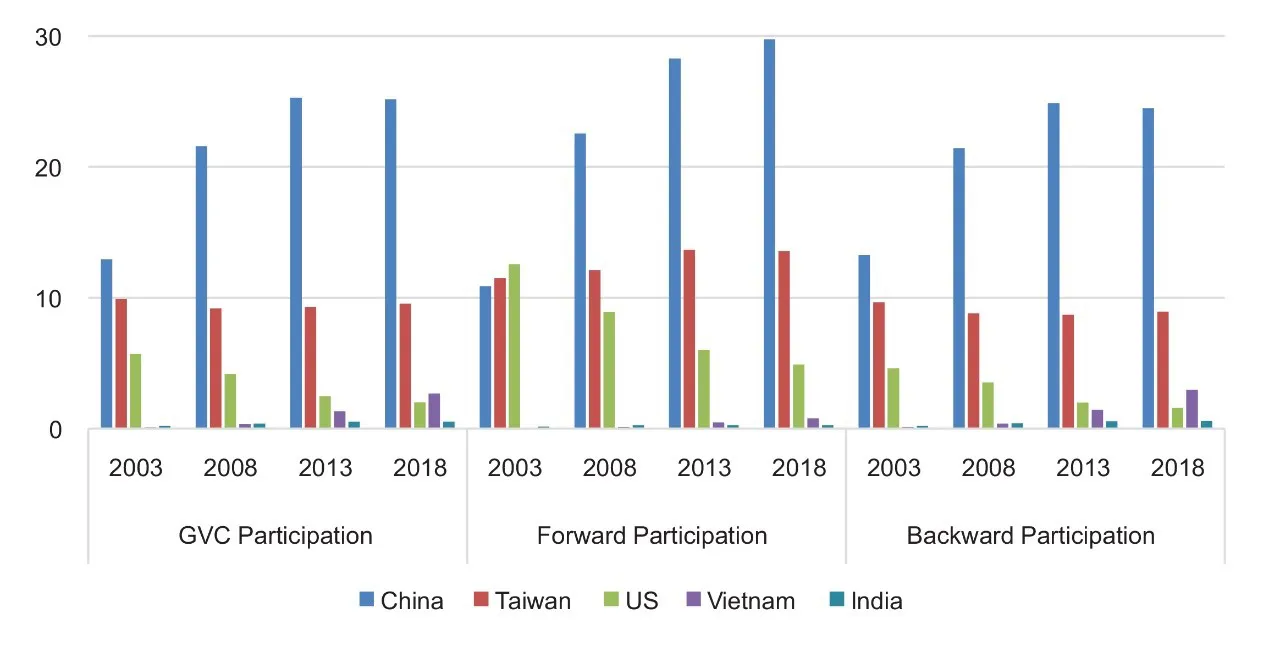

While the goal is ambitious, the government appears to recognise that GVCs will have a crucial role in expanding electronic manufacturing in the country. In 2018, India accounted for approximately 0.53 percent of the total value created by electronics GVCs (see Figure 3), substantially lower than China (25.18 percent), Taiwan (9.55 percent), the US (2.01 percent), and Vietnam (2.68 percent). However, India’s electronics GVC participation has steadily increased since 2014, when the country’s total GVC value creation was 0.44 percent.[25]

Figure 3: Electronics GVC Participation (India and Major Global Electronics Players, 2003-18)

This growth can arguably be attributed to the dedicated policies for the electronics sector and interventions under the Make in India strategy, such as the Phased Manufacturing Programme (see Table 1).[27]

Table 1: Policy Framework for India’s Electronics Industry

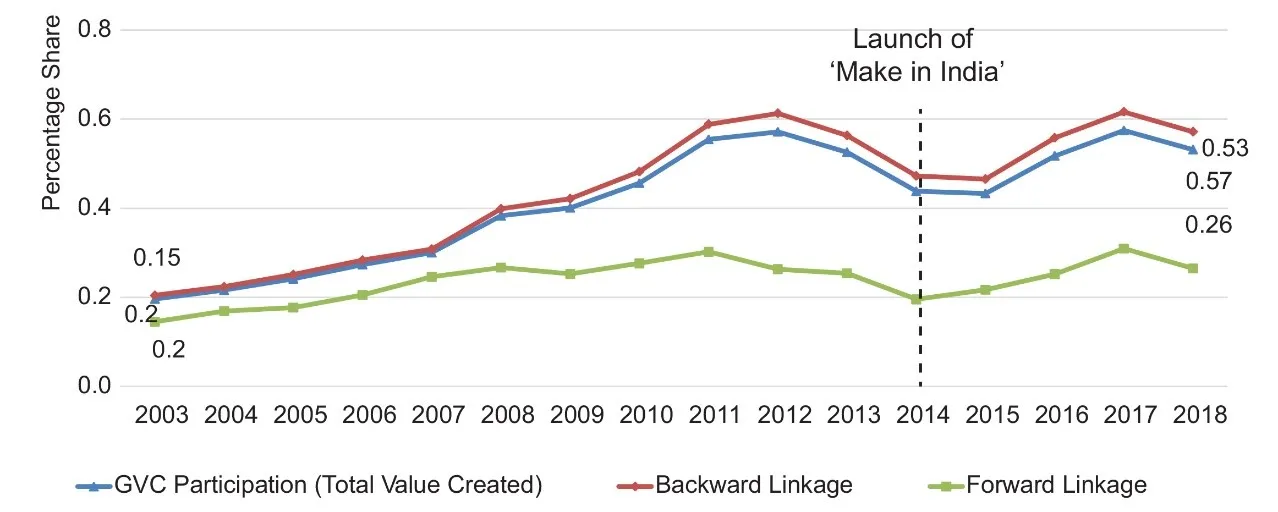

India’s backward participation in electronics GVCs was higher than its forward participation over the 2003-2018 period (see Figure 4). This indicates that the value-added of imported intermediate goods by India that are embodied in the electronics industry’s exports (i.e., backward GVC participation/linkage) is higher than India’s domestic value-added embodied in foreign exports (i.e., forward GVC participation/linkage).[28] As such, India interacts more as a ‘buyer’ than as a ‘seller’ in the electronics GVCs, thereby constraining its domestic value-addition prospects.

Figure 4: India’s Participation in Electronics GVCs (2003-18)

Policy Interventions

To catapult the integration into electronics GVCs, India must ‘broaden’ as well as ‘deepen’ its electronics supply chains. To broaden the supply chains, efforts are already underway to widen the scope of electronics products manufactured in India, evidenced by the diversified nature of the fiscal schemes implemented to promote electronics manufacturing. For instance, the PLI schemes for large-scale electronics manufacturing and IT hardware incentivise the domestic manufacturing of mobile phones, electronic components, laptops, tablets, all-in-one personal computers and servers.[30],[31] Both schemes incentivise manufacturers based on their realised production levels,[g] and have to some extent levelled the playing field for domestic electronics manufacturers in relation to foreign manufacturers by addressing the cost disabilities.[h]

Further, the government intends to deepen the supply chains by building an electronics ecosystem. The objective is to facilitate the manufacturing of final electronics goods and to enable the domestic viability of components and assemblies manufacturing; distribution, testing, and packaging; and designing activities. The comprehensive programme for the development of semiconductor and display manufacturing, announced in December 2021, is an example of the ecosystem-led approach, targeting all critical aspects, including semiconductors[32] and display fabs,[33] packaging,[34] and designing.[35]

The Ministry of Electronics and Information Technology (MeitY) has also introduced several interventions to support the scalability and competitiveness of India’s electronics sector, with a much-needed focus on enhancing the country’s electronics export capacities. These interventions have been implemented under the aegis of the 2019 National Policy on Electronics, which aims to position India as a global ESDM hub by encouraging and driving domestic capabilities to develop core components and create an enabling environment for the industry to compete globally.[36]

Some of these notable interventions that could foster India’s integration into electronics GVCs are listed below. These policies have been carefully designed to address industry-specific needs and enable the building of a robust electronics manufacturing ecosystem in India.

Infrastructure development is crucial to attract global electronics manufacturers and their supply chains. In an acknowledgment of the importance of infrastructure linkages, the government notified the Modified Electronics Manufacturing Clusters (EMC 2.0) Scheme in April 2020.[37] Aimed at making India a global electronics manufacturing hub, the scheme provides support for the creation of quality infrastructure and common facilities and amenities. The scheme is designed to attract large-scale electronics manufacturers to set up production bases in India and serve as anchor units to bring their suppliers in such clusters and provides financial assistance for the creation of industry-specific facilities.[i]

The EMC 2.0 scheme supplements existing policies for electronics infrastructure development, including EMC[j] and Modified Special Incentive Package Scheme,[k] with several projects already underway.[l],[38] Together, these schemes are likely to enable India’s integration into electronics GVCs by strengthening supply chain responsiveness, consolidating suppliers, decreasing the time to market, and lowering logistics costs. As of December 2021, two applications under EMC 2.0 have been approved with a project cost of INR 1410.84 crore, including central financial assistance of INR 681.08 crore. These EMCs are poised to attract an investment of INR 18,910 crore and potentially employ 44,560 persons.[39]

Foreign direct investment (FDI) plays a vital role in enhancing a country’s integration into GVCs.[40] Lead firms tend to invest in foreign markets with which they have trade linkages as this lowers their costs of entry into the host country. Lower entry costs coupled with high switching costs drive the lead firms to bring their suppliers to the host country. As such, FDI is an important aspect of India’s integration into electronics GVCs.

India currently permits 100 percent FDI under the automatic route for electronics manufacturing (except from countries that share a land border with India), subject to the applicable laws, regulations, and other conditions.[41] However, leveraging the FDI route may raise concerns over domestic value addition, thereby clouding India’s prospects of actively participating in electronics GVCs. While India’s mobile manufacturing industry has seen an influx of foreign lead firms, the industry’s ability to effectively raise the domestic value addition is constrained by the reliance on imported inputs.[42],[43] Therefore, for FDI to efficiently promote India’s GVC participation, it is important to encourage global brands to co-locate in India alongside their supply systems, and enhance the linkages between foreign lead firms and domestically-owned suppliers.

Serving as a key determinant of market access, standards play a crucial role in the uninterrupted functioning of GVCs.[44],[45] Lead firms rely on globally acceptable standards to mitigate regulatory compliance and to ensure quality control in their GVC operations. India has already notified the ‘Electronics and Information Technology Goods (Requirement of Compulsory Registration) Order, 2012 to create an institutional mechanism to mandate standards for electronic products.[46]

The order, currently applicable to 63 product categories,[47] establishes certain aspects for mandatory compliance to curb the import of substandard and unsafe electronic goods, thereby strengthening conformity assessment procedures[m] nationwide. For instance, manufacturers must register with the national standards body, the Bureau of Indian Standards (BIS), only after their products are tested at BIS-recognised labs. The BIS’s standard development process abides by internationally accepted standardisation practices,[48] and complies with the World Trade Organisation’s Technical Barriers to Trade Agreement[n] on the good practice for preparation, adoption and application of standards.

Fostering an integration into GVCs necessitates enhancing forward participation in the electronics GVCs—i.e., increasing India’s domestic value-added embodied in foreign exports of electronics and related products.[49],[50] By leveraging economies of scale, this export-driven channel of GVC participation builds competitiveness, services foreign demand, and enables faster and sustainable GVC engagement. The government is proactive in enhancing India’s forward linkages in GVCs by supporting scalability and building export competitiveness of India’s electronics products. Indeed, nearly 40 percent of India’s US$300 billion electronics production target is expected to be exported.[51] To achieve this, policy support in the form of PLI schemes are designed considering specific defined export outcomes. For instance, over 60 percent (INR 6.5 lakh crore, or US$84 billion) of the production under the PLI for large scale electronics manufacturing is likely to be contributed by exports.[52] Similarly, over 37 percent (INR 60,000 crore, or US$8 billion) of the production under the PLI for IT hardware is likely to be contributed by exports.[53]

India’s ESDM sector faces substantial cost disabilities (ranging from 10 percent to 22 percent) in relation to China and Vietnam, which are inhibiting the country’s exporting capabilities.[54] This is largely on account of high logistics costs, inadequate availability of quality utilities (for instance, power), high debt costs, and limited research and development and design abilities. To mitigate these cost disabilities, the government has implemented a channelised policy support system. It includes incentives that are production-linked (PLI schemes) and capital expenditure-linked (for instance, the Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors[55] provides a 25-percent financial incentive on capital expenditure for the manufacturing of identified electronics goods).

In addition, the government has introduced a flagship export promotion scheme, the Remission of Duties and Taxes on Exported Products, which refunds the embedded central, state and local duties, and taxes paid on inputs by exporters.[o],[56] Notably, this scheme is consistent with WTO provisions.[p]

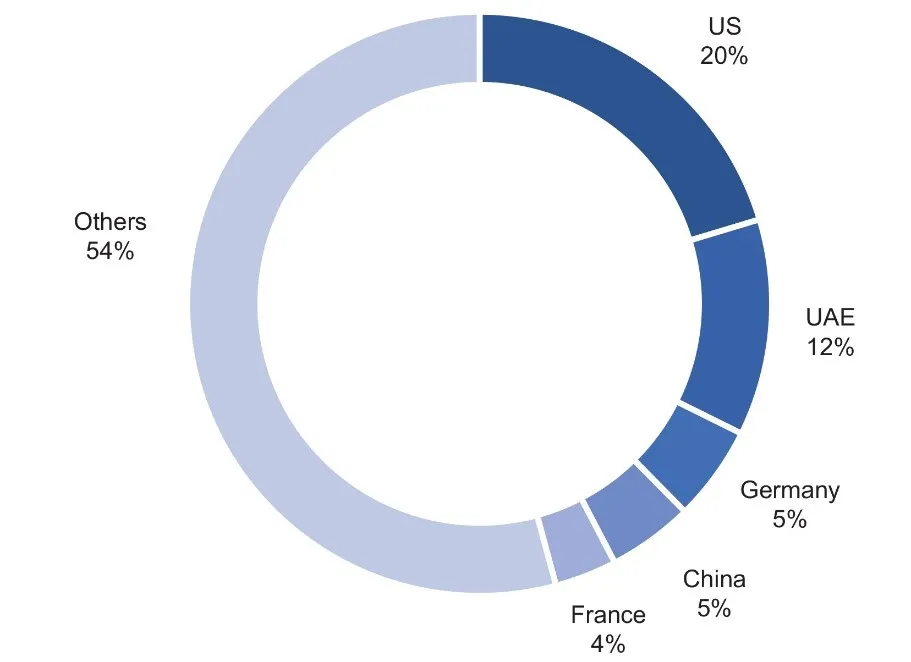

India also recognises the importance of diversifying export destinations to maximise its participation in electronics GVCs. In 2020, about 46 percent of India’s electronics exports was concentrated in five markets—the US, UAE, Germany, China, and France (see Figure 5). Going forward, export promotion councils, such as the Electronics and Computer Software Export Promotion Council, will be crucial in expanding India’s export destinations. However, they need to reform their operating dynamics and move beyond the traditional and limited role of organising buyer-seller meets and participating in international events.[57] New roles may include understanding electronics GVC linkages; identifying and minimising technical barriers to trade that affect market access in existing and new markets; mobilising investment from lead firms by leveraging India’s large market size to attract them to invest in local capabilities and domestic suppliers; and supporting and promoting exports, particularly from domestically-owned electronics manufacturers through focussed interventions and initiatives.

Figure 5: India’s Electronics Exporting Destinations (% Share, 2020)

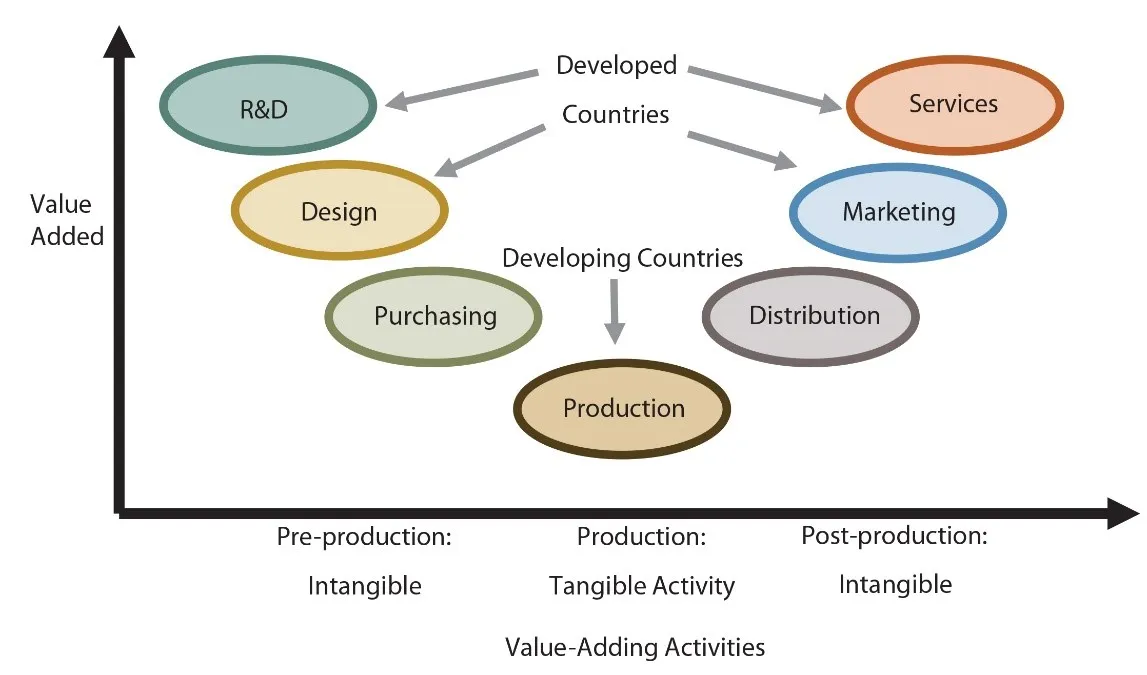

For electronics products, the R&D and designing stages contribute high value-addition as compared to the other stages in GVCs (as evidenced by the smile curve of GVCs, see Figure 6).[q]

Figure 6: Smile Curve of GVCs

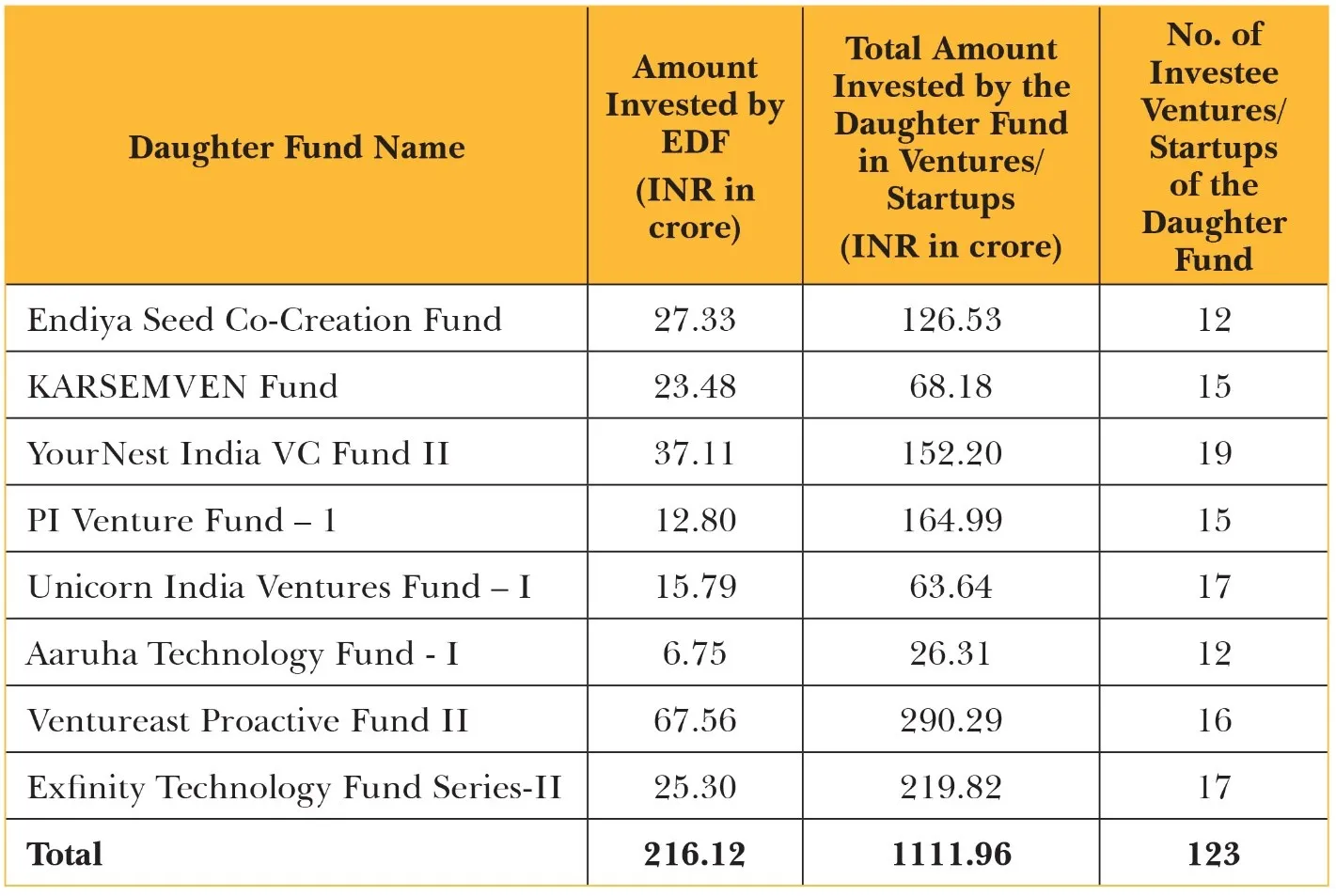

Given the importance of building a vibrant domestic ecosystem of innovation and market-driven R&D, India established the Electronics Development Fund (EDF) in 2015.[61] The EDF is set up as a ‘fund of funds’[r] to participate in professionally-managed ‘daughter funds’[s] that provide risk capital to companies developing new electronics and IT-related technologies. As of December 2021, EDF has invested in eight domestic daughter funds with investments in 123 ventures/startups (see Table 2). These startups majorly working in the areas of robotics, drones, Internet of Things, autonomous cars, healthtech, cyber security, artificial intelligence, and Machine Learning.

The government has also implemented the design linked incentive (DLI) scheme for the design for semiconductors, a critical component of all electronics products.[62] The DLI scheme offers financial incentives and design infrastructure support across the various stages of the development and deployment of semiconductors for integrated circuits, chipsets, system on chips, and systems and intellectual property cores.

Table 2: EDF: Daughter Funds Details

Conclusion

The comprehensive policy package established based on the needs of the electronics sector can further the goal of integrating India into electronics GVCs. Given the focus on adopting an ecosystem-led approach, these policies also aim to holistically expand the electronics supply chains in the country.

While these policy interventions are a step in the right direction, certain areas need more attention to enable sustainable GVC participation. One such area is promoting domestic champions. While global lead firms are indispensable to provide momentum to India’s electronics GVC integration, establishing domestic champions is critical for resilient GVC participation. Existing policy mechanisms, such as the PLI schemes, facilitate the establishment of domestic champions. Another key area is export promotion. The adoption of an export-oriented lens is necessary to deepen India’s electronics GVC integration, as nearly 80 percent of electronic exports come from GVCs.[64] In this regard, it is crucial to diversify export markets, identify and address market access barriers, and promote WTO-compliant export incentive mechanisms. Finally, a stable policy regime is critical as it serves as a growth enabler for long-term strategic investments by reducing operational risks.[65] To facilitate stability, policy interventions should encompass a reasonable implementation time frame, provide flexibility for adjusting to market realities and extreme events like COVID-19, and must mitigate any areas that could lead to policy uncertainties.

Endnotes

[a] Factor endowments means inputs for production/manufacturing—land, labour, capital, and so on.

[b] Servicification (or servitisation) of manufacturing refers to increasing the value addition of services in manufacturing.

[c] GVC centrality is computed as the average of forward and backward centrality. Forward centrality measures a country’s importance as a seller of value added in intermediate products to produce the exports of a specific partner. Backward centrality measures a country’s importance as a buyer of value added in intermediate products to produce its own exports.

[d] China, which is Australia’s largest trading partner, imposed tariffs on over a dozen key industries, including wine, barley, and coal. As a result, Australia is estimated to have foregone export revenue of around US$4.9 billion between July 2020 and February 2021.

[e] Competitive advantages refer to advantages in terms of factor endowments and cost efficiencies.

[f] It is a voluntary scheme. The Standardisation Testing and Quality Certification Directorate, under the Ministry of Electronics and Information Technology, will certify ICT products through its laboratories that have national/international accreditation and recognition in testing and calibration.

[g] The PLI Scheme for Large Scale Electronics Manufacturing extends an incentive of 4 percent to 6 percent on incremental sales (over base year) of goods manufactured in India (mobile phones and related components), for five years. After the success of the first round, a second round of the scheme was approved, extending incentives of 5 percent to 3 percent on incremental sales of goods (over base year) for four years. Similarly, the PLI for IT Hardware extends an incentive of 4 percent to 2 percent / 1 percent on net incremental sales (over base year) of goods manufactured in India (Laptops, Tablets, PCs and Servers) for four years.

[h] Understood as the percentage difference in the average selling price of an electronic product that is manufactured domestically and that of the same product (including all import duties) when imported. The difference can be because of multiple factors, including taxes, working capital costs, wages, and electricity and water costs.

[i] Such as financial assistance of up to 50 percent of the project cost, subject to a ceiling of INR 70 crore per 100 acres of land for setting up of EMC projects; up to 75 percent of the project cost, subject to a ceiling of INR 75 crore for common facility centres; and for development of ready built factory sheds and plug and play facilities (ready facilities in terms of building, utility provision, road connectivity, and ready clearances to commence operations) in at least 10 percent of the saleable or leasable land area.

[j] The EMC Scheme was notified in October 2012. It provides financial assistance of up to 50 percent of the project cost, subject to a ceiling of INR 50 crore for every 100 acres of land for greenfield EMC, and 75 percent of the cost of infrastructure, subject to a ceiling of INR 50 crore for common facility centres, thereby creating world-class infrastructure for attracting investments in the ESDM sector.

[k] The Modified Special Incentive Package Scheme was announced in July 2012 to offset disability and attract investments in the ESDM industries. The scheme provides incentives for investments on capital expenditure: 20 percent for investments in special economic zones (SEZs) and 25 percent in non-SEZs.

[l] As of December 2021, MeitY has received 50 applications, 46 of which are for setting up of greenfield EMCs and four for CFCs in brownfield clusters in 19 states across the country. Nineteen greenfield EMCs and three CFCs are accorded approval.

[m] Technical procedures such as testing, verification, inspection, and certification that confirm that products fulfil the requirements laid down in regulations and standards.

[n] The Technical Barriers to Trade Agreement aims to ensure that product requirements and standards (on safety, quality, health and so on) and compliance procedures related to requirements (such as, testing, inspection, and accreditation) are not unjustifiably discriminatory and do not act as barriers to trade.

[o] The scheme has been in effect since 1 January 2021.

[p] The previous export promotion scheme, Merchandise Exports from India Scheme, was challenged by the US at the WTO for being an ‘export subsidy’ policy. Export subsidies provide an unfair competitive advantage to recipients, and WTO rules as defined under the WTO Agreement on Subsidies and Countervailing Measures expressly prohibit them. The WTO Agreement on Subsidies and Countervailing Measures disciplines the use of subsidies, and it regulates the actions countries can take to counter the effects of subsidies.

[q] Smile curve is a graphical illustration of how value-added varies across the different stages or functions of an industry or product’s value chain.

[r] Fund of funds is an investment strategy in which a fund invests in a portfolio of funds rather than investing in stocks, bonds, and other securities.

[s] Daughter funds are created to park allocation from the fund of funds.

[3] World Bank, “GDP at Current Prices”, World Bank Open Data, https://data.worldbank.org/indicator/NY.GDP.MKTP.CD

[4] OECD, “OECD TiVA 2021 edition”, https://www.oecd.org/sti/ind/measuring-trade-in-value-added.htm

[5] Felbermayr, Gabriel, Marina Steininger, Erdal Yalcin, “Economic implications of a protectionist US trade policy”, VOX EU CEPR, November 22, 2017, https://voxeu.org/article/economic-implications-protectionist-us-trade-policy

[7] Fortune Business Insights, “Electronics Manufacturing Services (EMS) Market Share & COVID-19 Impact Analysis,” Fortune Business Insights, July 2021, https://www.fortunebusinessinsights.com/electronic-manufacturing-services-ems-market-105519,

[8] GlobeNewswire, “EMS and ODM Market to Reach USD 734.40 Billion By 2026,” GlobeNewswire, June 11, 2019, https://www.globenewswire.com/news-release/2019/06/11/1867175/0/en/EMS-and-ODM-Market-To-Reach-US$-734-40-Billion-By-2026-Reports-And-Data.html

[9] Trinh Nguyen. “Is Vietnam Eating into China’s Share of Manufacturing?.” Carnegie Endowment for International Peace, 18 June, 2020, https://carnegieendowment.org/2020/06/18/is-vietnam-eating-into-china-s-share-of-manufacturing-pub-82094

[10] Ibid.

[11] Ministry of Commerce and Industry, Government of India, 2021, https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1714362#:~:text=The%20SCRI%20aims%20to%20create,if%20needed%2C%20in%20due%20course.

[12] Daniel S. Markey, “Preparing for Heightened Tensions Between China and India,” Council on Foreign Relations, April 19, 2021, https://www.cfr.org/report/preparing-heightened-tensions-between-china-and-india

[13] Adam P. Liff, “China, Japan, and the East China Sea: Beijing’s ‘Gray Zone’coercion and Tokyo’s response,” Brookings Institute, Washington DC:, December 2019, https://www.brookings.edu/research/china-japan-and-the-east-china-sea-beijings-gray-zone-coercion-and-tokyos-response/

[14] The Strait Times, Australia passes law that can scrap China Belt and Road accords, 8 December, 2020, https://www.straitstimes.com/asia/australianz/australia-passes-law-that-can-scrap-china-belt-and-road-accords

Wickes, Ron, Mike Adams, and Nicolas Brown, “Economic coercion by China: The impact on Australia’s merchandise exports,” Institute for International Trade Working Paper (2021): 4, https://iit.adelaide.edu.au/ua/media/1479/wp04-economic-coercion-by-china-the-effects-on-australias-merchandise-exports.pdf

[15] France 24, “China shuts down channel for diplomatic dialogue in ongoing row with Australia,” Taiwan News, July 5, 2021, https://www.taiwannews.com.tw/en/news/4196776

[16] Bloomberg, “Japan to Fund Firms to Shift Production out of China,” Bloomberg, April 9, 2020, https://www.bloomberg.com/news/articles/2020-04-08/japan-to-fund-firm-to-shift-production-out-of-china

[17] Business Insider, “Japan offers $221 million as ‘China-exit’ subsidy for Japanese companies,” Business Insider India, September 4, 2020, https://www.businessinsider.in/international/news/japan-offers-221-million-as-china-exit-subsidy-for-japanese-companies/articleshow/78103567.cms

[18] Takako Gakuto, “Japan adds India and Bangladesh to ‘China exit’ subsidy destinations,” Nikkei Asia, September 4, 2020, https://asia.nikkei.com/Economy/Japan-adds-India-and-Bangladesh-to-China-exit-subsidy-destinations

[19] Department of Industry, Science, Energy and Resources, Australian Government, “Meeting our needs in times of crisis,” October 1, 2020, https://www.industry.gov.au/news/meeting-our-needs-in-times-of-crisis

[20] Ministry of Commerce and Industry, Government of India, 2020, https://www.pib.gov.in/PressReleasePage.aspx?PRID=1710134

[21] Ministry of Electronics and Information Technology, Government of India, April 1, 2020, https://www.meity.gov.in/writereaddata/files/production_linked_incentive_scheme.pdf

[22] Ministry of Electronics and Information Technology, Government of India, “Trusted Electronics Value Chain Certification Scheme,” https://www.stqc.gov.in/trusted-electronics-value-chain-certification-scheme

[23] Government of India, $300 BN Sustainable Electronics Manufacturing & Exports By 2026, Volume 2, 2022, https://static.pib.gov.in/WriteReadData/specificdocs/documents/2022/jan/doc20221247801.pdf

[24] ICEA (2022). $300 BN Sustainable Electronics Manufacturing & Exports By 2026. Available at: https://static.pib.gov.in/WriteReadData/specificdocs/documents/2022/jan/doc20221247801.pdf

[25] OECD, “OECD TiVA 2021 edition”, https://www.oecd.org/sti/ind/measuring-trade-in-value-added.htm

[26] OECD, “OECD TiVA 2021 edition”, https://www.oecd.org/sti/ind/measuring-trade-in-value-added.htm

[27]Ministry of Electronics and Information Technology, Government of India, 2017, https://www.meity.gov.in/writereaddata/files/Notification%20dated%2028.04.2017_PMP_Mobile%20Handsets%20%26%20parts%20thereof.pdf

[28] OECD, Guide to OECD’s Trade in Value Added (TiVA) Indicators, 2018 edition,” OECD Publishing, December 2019, https://www.oecd.org/sti/ind/tiva/TiVA2018_Indicators_Guide.pdf

[29] OECD, “OECD TiVA 2021 edition”, https://www.oecd.org/sti/ind/measuring-trade-in-value-added.htm

[30] Ministry of Electronics and Information Technology, Government of India, 2020, https://www.meity.gov.in/writereaddata/files/production_linked_incentive_scheme.pdf

[31] Ministry of Electronics and Information Technology, Government of India, 2020, https://www.meity.gov.in/writereaddata/files/PLI_for_IT_Hardware_Notification_dated_03032020.pdf

[32] Ministry of Electronics and Information Technology, Government of India, 2021, https://www.meity.gov.in/writereaddata/files/Notification%20Scheme%20for%20setting%20up%20Semiconductor%20Fabs%20in%20India.pdf

[33] Ministry of Electronics and Information Technology, Government of India, 2021, https://www.meity.gov.in/writereaddata/files/Notification%20for%20Scheme%20for%20setting%20up%20Display%20Fabs%20in%20India.pdf

[34] Ministry of Electronics and Information Technology, Government of India, 2021, https://www.meity.gov.in/writereaddata/files/Notifications%20Compound%20Semiconductor%20ATMP%20Scheme.pdf

[35] Ministry of Electronics and Information Technology, Government of India, 2021, https://www.meity.gov.in/writereaddata/files/Notification%20DLI%20Scheme.pdf

[36] Ministry of Electronics and Information Technology, Government of India, 2019, https://www.meity.gov.in/writereaddata/files/eGazette_Notification_NPE%202019_dated%2025022019.pdf

[37] Ministry of Electronics and Information Technology, Government of India, 2020, https://www.meity.gov.in/writereaddata/files/modified_electronics_manufacturing_clusters_scheme.pdf

[38] Ministry of Electronics and Information Technology, “Annual Report 2021-22,” MeitY, 2022, https://www.meity.gov.in/writereaddata/files/MeitY_AR_English_2021-22.pdf.

[39] Ministry of Electronics and Information Technology, “Annual Report 2021-22,” MeitY, 2022, https://www.meity.gov.in/writereaddata/files/MeitY_AR_English_2021-22.pdf.

[40] Qiang, Christine Zhenwei, Yan Liu, and Victor Steenbergen, “An Investment Perspective on Global Value Chains,” World Bank Publications, 2021, https://openknowledge.worldbank.org/handle/10986/35526

[41] Ministry of Commerce and Industry, Government of India, 2020, https://pib.gov.in/PressReleasePage.aspx?PRID=1606894

[42] Chidambaran G. Iyer, “Mobile Phone Manufacturing in India: A study of few characteristics”, CDS Working Paper No. 502. Centre for Development Studies, 2021, https://cds.edu/wp-content/uploads/2014/10/WP502.pdf

[43] Sunil Mani, “History does matter: India’s efforts at developing a domestic mobile phone manufacturing industry”, CDS Working Paper No. 489, Centre for Development Studies, Thiruvananthapuram, 2019, https://cds.edu/wp-content/uploads/WP489.pdf

[44] Kaplinsky, Raphael, “The role of standards in global value chains,” World Bank policy research working paper 5396 (2010), https://openknowledge.worldbank.org/bitstream/handle/10986/3880/WPS5396.pdf?sequence=1&isAllowed=y

[45] Ray, S Ray, Saon, and Smita Miglani. India’s GVC integration: An analysis of upgrading efforts and facilitation of lead firms. ICRIER No. 386. Working Paper, 2020, https://icrier.org/pdf/Working_Paper_386.pdf

[46] Ministry of Communications and Information Technology, Government of India, 2012, https://www.crsbis.in/BIS/app_srv/tdc/gl/docs/gazette_notification_2012_10_03.pdf

[47] Ministry of Electronics and Information Technology, Government of India, 2021, https://www.meity.gov.in/writereaddata/files/CRO2021-and-ammenment.pdf

[48] BIS, “Review of BIS Annual Report 2018-19,” BIS, 2020 https://www.bis.gov.in/wp-content/uploads/2020/03/ReviewStatementofBISAR201819.pdf

[49] Rashmi Banga, “Linking into global value chains is not sufficient: Do you export domestic value added contents?” Journal of Economic Integration. 29(2), 267-297, 2014, https://www.e-jei.org/upload/JEI_29_2_267_297_2013600043.pdf

[50] Smita Francis, “Industrial Policy Challenges for India: Free trade agreements and global value chains.”, Routledge, 2019, https://www.routledge.com/Industrial-Policy-Challenges-for-India-Global-Value-Chains-and-Free-Trade/Francis/p/book/9780367731373#

[51] ICEA (2022). $300 BN Sustainable Electronics Manufacturing & Exports By 2026. Available at: https://static.pib.gov.in/WriteReadData/specificdocs/documents/2022/jan/doc20221247801.pdf

[52] Press Information Bureau, Government of India, 2021, https://pib.gov.in/FactsheetDetails.aspx?Id=148581

[53] Ministry of Electronics and Information Technology, “Annual Report 2021-22,” MeitY, 2022, https://www.meity.gov.in/writereaddata/files/MeitY_AR_English_2021-22.pdf.

[54] ICEA (2021). Increasing India’s Electronics Exports and Share in GVCs. Available at: https://static.pib.gov.in/WriteReadData/specificdocs/documents/2021/nov/doc202111221.pdf

[55] Ministry of Electronics and Information Technology, Government of India, 2020, https://www.meity.gov.in/writereaddata/files/scheme_for_promotion_of_manufacturing_of_electronic_components_and_semiconductors.pdf

[56] Ministry of Commerce and Industry, Government of India, 2021, https://static.pib.gov.in/WriteReadData/specificdocs/documents/2021/aug/doc202181701.pdf

[57] Government of India, “Increasing India’s Electronics Exports and Share in GVCs,” Volume 1, 2021, https://static.pib.gov.in/WriteReadData/specificdocs/documents/2021/nov/doc202111221.pdf

[58] ITC Trade Map, Trade Map, https://www.trademap.org/Index.aspx

[59] Fernandez-Stark Karina and Gary Gereffi, 2019, “Global value chain analysis: A primer”, In Handbook on global value chains (pp. 54-76), Edward Elgar Publishing, https://gvcc.duke.edu/wp-content/uploads/Duke_CGGC_Global_Value_Chain_GVC_Analysis_Primer_2nd_Ed_2016.pdf

[60] Baldwin, Richard, Tadashi Ito and Hitoshi Sato, 2014, “The Smile Curve: Evolving Sources of Value Added in Manufacturing”, http://www.uniba.it/ricerca/dipartimenti/dse/e.g.i/egi2014-papers/ito.

[61] Ministry of Electronics and Information Technology, Government of India, 2021, https://www.meity.gov.in/writereaddata/files/Notification%20of%20Policy%20for%20EDF_English.pdf

[62] Ministry of Electronics and Information Technology, Government of India, 2021, https://www.meity.gov.in/writereaddata/files/Notification%20DLI%20Scheme.pdf

[63] Ministry of Electronics and Information Technology, “Annual Report 2021-22,” MeitY, 2022, https://www.meity.gov.in/writereaddata/files/MeitY_AR_English_2021-22.pdf.

[64] ICEA (2021). Increasing India’s Electronics Exports and Share in GVCs. Available at: https://static.pib.gov.in/WriteReadData/specificdocs/documents/2021/nov/doc202111221.pdf

[65] Ibid.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Yamini Jindal is a Policy Advisor in the Ministry of Electronics and Information Technology. Her research areas include cross-border trade modelling global/regional value chains electronics ...

Read More +