-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

Gopalika Arora, “Mobilising Private Finance for Ecosystem-Based Adaptation Through Nature-Based Solutions,” Issue Brief No. 756, November 2024, Observer Research Foundation.

Introduction

The impacts of climate change are becoming increasingly evident, and societies are facing massive threats from rising temperatures, erratic rainfall patterns, and frequent extreme weather events. Additionally, natural resources are deteriorating at an alarming rate, and human-induced biodiversity loss is escalating.[1] Approximately 40 percent of the planet’s land is already degraded, and more than half of the world’s Gross Domestic Product (approximately US$44 trillion) is at immediate risk due to nature loss.[2] By 2030, this loss of natural capital could reduce global GDP by 2.3 percent annually (to US$2.7 trillion), with poorer countries bearing the brunt of this decline due to their low adaptive capacity, dependence on climate-sensitive sectors, and already fragile ecosystems.[3] These issues are exacerbated by the impact of changing weather patterns on natural ecosystems.

This necessitates ecosystem-based approaches that can provide cost-effective and sustainable solutions to complement national and subnational adaptation interventions.[4] In this context, nature-based solutions can be used to harness the benefits of nature to address climate change, biodiversity loss, and land degradation while making headway towards sustainable development.

Recent studies reveal that halting nature loss and investing in nature-positive outcomes can unlock new business opportunities worth up to US$10 trillion annually and generate 395 million jobs by 2030.[5] Despite this potential, integrating nature considerations into corporate decision-making is still at a nascent stage. Therefore, there is an urgent need to unlock finance to arrest and reverse the loss of natural assets and thus accelerate the transition to a net-zero and nature-positive future.

Ecosystem-Based Adaptation: The Rise of Nature-Based Solutions

The IPBES Global Assessment Report,[6] the IPCC AR6 report,[7] and the Global Adaptation Commission Report[8] have highlighted the critical role of natural ecosystems in reducing vulnerability to climate-related extreme events and other economic, social, and environmental shocks and disasters. In this regard, nature-based solutions[a] are being viewed as strategic and cost-effective approaches. These solutions also have the potential to tackle both climate mitigation and adaptation challenges in a cost-effective way while providing additional benefits (amounting to US$170 billion annually) through various ecosystem services.[9]

Losses from climate-induced disasters reached a decade high of US$45 billion in the first quarter of 2024.[10] Nature-based solutions (NbS) like preserving healthy mangrove forests and coral reefs have the potential to reduce these costs while serving as economically viable alternatives that can prevent the damage caused by ecosystem destruction. NbS is estimated to prevent US$57 billion in annual flood damages.[11] Additionally, a cost-benefit analysis of conserving peatlands in Indonesia demonstrated that every dollar invested in conservation yielded a return of US$19 in avoided fire damage.[12] NbS are also being actively integrated into adaptation strategies as they have the potential to reduce socio-economic exposure and sensitivity and support adaptive capacity.[13] Other than their crucial contributions to climate-change mitigation and adaptation, well-designed and well-implemented NbS can provide a range of co-benefits, such as economic development, ecosystem protection, land restoration, and food and water security.[14]

Persisting Funding Gaps

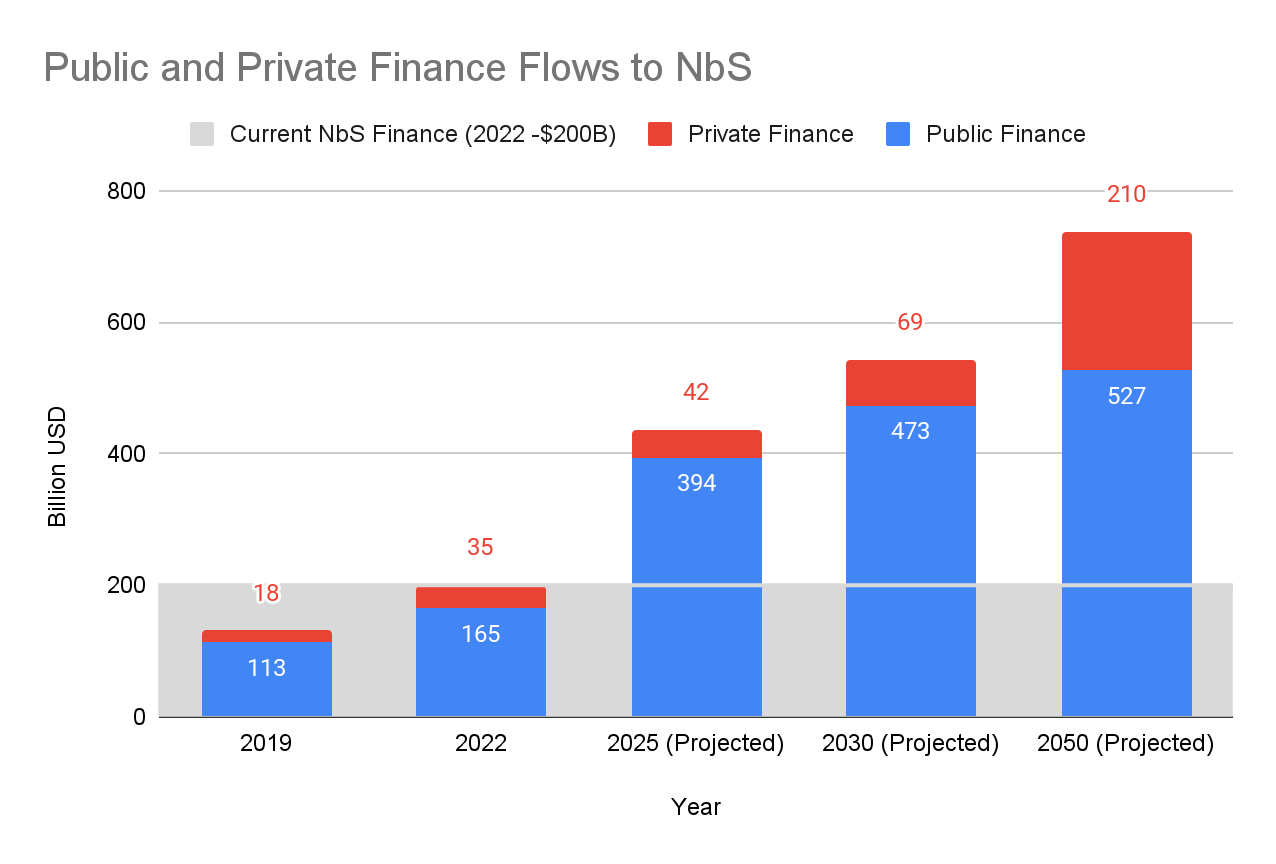

To be sure, there is increasing international recognition and commitments through initiatives like the Sendai Framework,[15] the Convention on Biological Diversity,[16] the United Nations Convention to Combat Desertification (UNCCD),[17] the Bonn Challenge,[18] and the Paris Agreement under the United Nations Framework Convention on Climate Change.[19] Investments in NbS, however, remain insufficient. According to the 2023 State of Nature Finance Report, annual financial flows to NbS in 2022 amounted to approximately US$200 billion, which represents only a third of the funding required by 2030 to meet climate, biodiversity, and land degradation targets.[20]

The public sector dominated this investment, contributing 82 percent (US$165 billion), mostly for biodiversity and landscape protection. For their part, the private sector contributed a disproportionately low share, at 17 percent (US$35 billion), with a focus on sustainable supply chains, biodiversity offsets, and payments for ecosystem services. Although private investments in NbS have nearly doubled from the 2019 levels (US$18 billion), there is a vast gap that needs to be filled to achieve the Rio-aligned goals by 2030 and 2050[21] (see Figure 1). This underscores the need for robust strategies to mobilise private finance for NbS on a larger scale.

Figure 1: Public and Private Finance Flows to NbS, Current and Projected

Source: Author’s own, using data from SFN (2021)[22] and SFN (2023)[23]

Private-sector investments in sustainable interventions including NbS remain limited. Despite NbS having been defined by the IUCN for over a decade and gaining traction following the Paris Agreement and the Convention on Biological Diversity, its understanding and adoption among investors and stakeholders remains low. These challenges are exacerbated because of the public-good nature of NbS, which provides benefits and co-benefits that cannot be restricted to specific users.[24] Another challenge is the high upfront capital investment required in the initial stages of NbS projects.

The success of these projects also relies on the commitment and coordinated efforts of all stakeholders, including project developers and local communities. Additionally, NbS investments often clash with investor preferences for immediate returns and shorter gestation periods. The uncertainties and high risks associated with NbS projects, coupled with a lack of evidence for their economic, environmental, and social returns, further deter investment.[25] Unlike sectors such as agriculture, which have well-defined revenue streams, projects like mangrove restoration may not generate traditional income,[26] though they can yield multiple benefits and positive externalities such as landslide prevention and reduced flood risks, which are often overlooked in economic assessments.[27] Quantifying the outcomes of NbS requires complex methodologies, sophisticated techniques, and resources, which further contributes to the high costs and perceived risks associated with NbS investments.

While advancements have been made in assessing climate risks, evaluating nature risks is more complex due to local factors. Additionally, there is a lack of transparent and publicly available data on the impacts and benefits of NbS at national and sub-national levels, which are critical for informed project development, investment strategies, and policy formulation.[28] This issue is exacerbated by the absence of universal definitions, metrics, and widely accepted risk and reporting frameworks for NbS investments. The lack of standardisation complicates the evaluation of project outcomes, creating inconsistencies across the market.[29] Consequently, investors struggle to identify sectors in which impact can be effectively measured. The information gaps and lack of standardisation also make the sector vulnerable to greenwashing, undermining trust and slowing the progress of NbS projects.

Despite efforts to accelerate project development, there is no comprehensive pipeline of NbS projects categorised by sector. These projects are often localised, making them difficult to replicate and scale.[30] The current volume of NbS projects is insufficient to meet the demand, and existing initiatives often require additional development and aggregation for scalability.[31] Additionally, the lack of skills and expertise within the project-development community, the financial sector, and other relevant stakeholders hinder the scaling up of NbS to attract investment.

Another hurdle to private investment is the absence of institutional arrangements and policies for NbS. Without concrete policies and programmes focused on NbS, private financiers are unlikely to invest. There is also the lack of an integrated approach to govern these solutions. NbS often include a range of activities across landscapes and jurisdictional boundaries. Effective NbS governance requires coordination and collaboration among different stakeholders across sectors.[32] For instance, implementing nature-based approaches for effective storm-water drainage across watersheds necessitates collaborative decision-making involving various levels of governance and multiple ministries.[33]

Recommendations

Despite their ecological and socio-economic potential, nature-based solutions continue to receive critically low funding from the private sector. This issue is driven by the high perceived risks and information asymmetry. The following paragraphs discuss potential avenues for mobilising private sector finance for NbS.

Promoting Accessible Data-Sharing, Standardised Metrics, and Innovative Tools

There is a need to establish universal definitions, specific metrics, robust data-collection methodologies, and transparent disclosure tools to effectively measure the impacts of NbS projects. While certain carbon-specific metrics and standards exist, a comprehensive methodology to compare NbS projects and impacts, especially those related to biodiversity, is lacking. The language of policy, standards, and metrices also needs to be harmonised across jurisdictions and geographies to ensure a system-wide alignment and to eschew any greenwashing concerns.

Improving data availability, accessibility, and quality is also crucial. Current NbS data sources are fragmented and inconsistent across platforms. Initiatives such as the ‘Guidelines for Nature-Based Solutions Data’ by Nature4Climate and the OpenEarth Foundation[34] are steps in the right direction; however, comprehensive data and information management systems are required for transparent reporting and regular updating of data. A dedicated common platform for data dissemination would be beneficial. Coordinated and collaborative efforts among different stakeholders like government agencies, research institutions, and the private sector are essential to ensure the development and implementation of effective data standards for NbS.

Establishing robust disclosure and reporting frameworks is another crucial requirement to attract investments towards Nbs. Initiatives like the Taskforce for Nature-related Financial Disclosures (TNFD)[35] and the Science-Based Targets Network (SBTN)[36] help investors understand the environmental impact of their investments and set nature- and climate-related targets. However, these initiatives currently do not assure the quality of NbS projects. Investors must engage and build on these taskforces and networks to create international standards and common metrics appropriate for NbS markets.

Innovative Financial Instruments and Mechanisms

Nature finance represents a small fraction of the sustainable finance market, presenting a significant missed opportunity. Bridging the financing gap for NbS in developing economies will require looking beyond traditional funding sources. An array of innovative financial instruments and mechanisms has emerged to fund the conservation of natural capital, from debt-based instruments and grants to risk management mechanisms.

Debt-based mechanisms like Sustainability-Linked Bonds (SLBs) are gaining traction as effective instruments to finance NbS. Unlike other thematic bonds such as green and blue bonds, SLBs are forward-looking performance-based instruments that are based on achieving certain predetermined environmental indicators, rather than being tied to a specific project. This offers greater flexibility in using the proceeds compared to other bonds that are restricted to funding specific “green projects”;[37] a notable example is Uruguay’s 2022 SLB issuance linked to its Nationally Determined Contributions (NDCs) goals for GHG emissions, and native forest maintenance.[38] However, as of July 2023, SLBs still represented a small portion of the sustainable debt market, making up only 4 percent of issuances.[39]

Another emerging instrument for mobilising private finance for NbS is debt-for-nature swaps. These swaps allow countries to convert their debt into investments in nature conservation and other social interventions and development projects. Since the first swap in 1987 between Bolivia and Conservation International, over 30 countries have implemented similar swaps, restructuring US$2.5 billion in debt and releasing US$1.2 billion for conservation projects.[40] Historically, these transactions have been relatively modest in size and total volume; however, recent swaps in Belize and Ecuador indicate a trend towards larger-scale transactions.[41]

Innovative financing mechanisms such as blended finance are essential to address the perception of NbS as being high-risk. Blended finance has already proven to be effective in leveraging development finance to attract additional investment for sustainable development in emerging economies. It can similarly enhance the bankability of NbS projects by strategically deploying public capital as technical assistance, guarantees, or as first-loss capital, thereby reducing perceived risks for private investors.[42] Blended finance funds can also aggregate smaller NbS projects into a larger portfolio, thereby diversifying risk and enabling larger-scale investments.

Well-Functioning Carbon Markets

Carbon is a crucial source of income for NbS projects.[43] The global carbon market currently covers almost one-fifth of global emissions and is valued at nearly US$850 billion annually as of 2023.[44] Despite this, there has been minimal investment in NbS sectors.[45] Voluntary Carbon Markets (VCM), valued at nearly US$2 billion, can play a significant role in mitigating this phenomenon.[46] VCM certify credits from forestry, agriculture, and wetlands, with forestry activities providing most NbS credits. The introduction of nature and biodiversity credits into the VCM has further increased interest in financing NbS. However, these markets remain underdeveloped. Blue economy credits are still at a nascent stage, limited to mangrove conservation and restoration projects. Carbon markets are fragmented across different jurisdictions and sectors, reducing transparency, increasing transaction costs, and decreasing market efficiency.[47] Therefore, industry-wide efforts to enhance carbon market functionality are essential to make NbS a viable asset class.

NbS is a relatively novel concept. Despite recent efforts to integrate natural capital considerations into private-sector investment portfolios, financial institutions and the private sector often lack the necessary skills and tools to accurately assess the risks and returns of NbS projects and to structure investments effectively. Training and knowledge resources are limited, necessitating capacity building in identifying nature-related interventions, improving reporting and disclosure, supporting NbS-related innovative financial instruments and formulating related policies. The private sector needs to enhance its internal capacity to establish relevant frameworks to bridge existing knowledge gaps. Fostering transdisciplinary, bottom-up processes and maintaining continuous, creative dialogue among key stakeholders and communities is crucial. This approach can further lead to collaborative knowledge creation, innovative solutions, and the sharing of best practices. Establishing a common platform that contains a repository of NbS projects and other related data for diverse stakeholders would facilitate funding, raise awareness, and promote wider adoption of NbS. This platform could also feature successful case studies, types of financial instruments available, and the role of blended finance in NbS transactions.

Conclusion

The international policy discourse is increasingly recognising NbS as cost-effective measures for addressing a multitude of environmental and social issues, including disaster risk reduction, climate change mitigation and adaptation, food and water security, and biodiversity protection. These solutions present a growing array of investment opportunities. However, private finance flows into NbS initiatives remain inadequate due to market and information failures. Challenges in measuring the effectiveness of NbS contribute to high uncertainty regarding their cost effectiveness compared to alternatives. The key outcomes from implementing the recommendations in this brief include a focused NbS project pipeline, a strong business case and understanding of the business viability of these projects, and closing the knowledge gap to unlock large-scale financing.

This brief first appeared in the volume, Funding Our Future: Unlocking Resources for Adaptation Financing, which can be accessed here:

Endnotes

[a] Nature-based solutions are defined as “actions to protect, sustainably manage, and restore natural and modified ecosystems that address societal challenges effectively and adaptively, simultaneously benefiting people and nature.” The concept is rooted in finding innovative and economically viable solutions to manage natural resources in a way that balances the benefits to both nature and society. See: https://iucn.org/sites/default/files/2022-11/nbs-in-gbf-targets-brief-november-2022.pdf

[1] Kahrić Adla et al., “Degradation of Ecosystems and Loss of Ecosystem Services,” in One Health: Integrated Approach to 21st Century Challenges to Health, ed. Joana C. Prata, Ana Isabel Ribeiro and Teresa Rocha-Santos (Academic Press, 2022): 281-327, https://www.sciencedirect.com/science/article/abs/pii/B9780128227947000083

[2] United Nations Convention to Combat Desertification, Chronic Land Degradation: UN Offers Stark Warnings and Practical remedies in Global Land Outlook 2, https://www.unccd.int/news-stories/press-releases/chronic-land-degradation-un-offers-stark-warnings-and-practical, 2022

[3] United Nations Development Program, “The Destruction of Nature Threatens the World Economy. It’s Time to Outlaw It as a Serious Financial Crime,” https://www.undp.org/blog/destruction-nature-threatens-world-economy-its-time-outlaw-it-serious-financial-crime#:~:text=The%20impact%20of%20losing%20wild,%242.7%20trillion%20annually%20by%202030

[4] Nalau Johanna and Susanne Becken, “Ecosystem-Based Adaptation to Climate Change: Review of Concepts,” Research Report No 15, August 2018 , https://www.researchgate.net/profile/Johanna-Nalau/publication/328039160_Ecosystem-based_Adaptation_to_Climate_Change_Review_of_Concepts/links/5bb4174fa6fdccd3cb845cb8/Ecosystem-based-Adaptation-to-Climate-Change-Review-of-Concepts.pdf

[5]World Economic Forum, “395 Million New Jobs By 2030 if Businesses Prioritize Nature, Says World Economic Forum,” July 14, 2020, https://www.weforum.org/press/2020/07/395-million-new-jobs-by-2030-if-businesses-prioritize-nature-says-world-economic-forum/

[6] IPBES, Summary for Policymakers of the Global Assessment Report on Biodiversity and Ecosystem Services, November 2019, CERN European Organization for Nuclear Research, 2019, https://www.ipbes.net/global-assessment

[7] Intergovernmental Panel on Climate Change, Summary for Policymakers. In: Climate Change 2023: Synthesis Report. Contribution of Working Groups I, II and III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change, Geneva, Switzerland, IPCC, 2022, https://www.ipcc.ch/report/ar6/syr/downloads/report/IPCC_AR6_SYR_SPM.pdf

[8] Global Commission on Adaptation, Adapt Now: A Global Call for Leadership on Climate Resilience, September 2019, Washington DC, World Resources Institute, 2019, https://files.wri.org/s3fs-public/uploads/GlobalCommission_Report_FINAL.pdf

[9] International Union for Conservation of Nature, “Nature-based Solutions,” https://iucn.org/our-work/nature-based-solutions

[10] AON, “Q1 2024 Global Catastrophe Recap,” May 1, 2024, https://www.aon.com/reinsurance/getmedia/cafb9fbd-881e-4f39-be8a-e447d7557943/20242504-q1-2024-catastrophe-recap.pdf

[11] International Union for Conservation of Nature, “Nature-based Solutions,”

https://nbi.iisd.org/wp-content/uploads/2022/02/M2_Block-3_Valuation-Example-Peatland-Indonesia-1.pdf

[13] Nathalie Seddon et al., “Understanding the Value and Limits of Nature-based Solutions to Climate Change and Other Global Challenges,” Philosophical Transactions - 375, no. 1794, January 27, 2020, https://royalsocietypublishing.org/doi/10.1098/rstb.2019.0120

[14] X Hou-Jones et al., Nature-based Solutions in Action: Lessons From the Frontline, Bond, July 2021, https://www.bond.org.uk/wp-content/uploads/2022/03/bond_-_nbs_case_studies_-_v4.pdf.

[15] United Nations Convention to Combat Desertification, “Nature for Resilience,” https://www.undrr.org/implementing-sendai-framework/sendai-framework-action/nature-resilience#:~:text=The%20Sendai%20Framework%20for%20Disaster,practices%20as%20drivers%20of%20risk.

[16] Convention on Biological Diversity, Kunming-Montreal Global Biodiversity Framework, December 2022, Montreal, Conference of the Parties to the CBD, 2022, https://www.cbd.int/doc/decisions/cop-15/cop-15-dec-04-en.pdf.

[17] United Nations Convention to Combat Desertification, “Land Degradation Neutrality,” https://www.unccd.int/land-and-life/land-degradation-neutrality/overview.

[18] Salome Begeladze, Bonn Challenge and Forest Landscape Restoration: understanding synergies and identifying opportunities across Rio Conventions, International Union for Conservation of Nature, https://unece.org/fileadmin/DAM/timber/meetings/2019/20191216/2019-10-belgrade-rioconv-begeladze.pdf

[19] United Nations Framework Convention on Climate Change, “The Paris Agreement,” UNFCCC, https://unfccc.int/process-and-meetings/the-paris-agreement

[20] Nathalie Olsen et al., State of Finance for Nature: The Big Nature Turnaround – Repurposing $7 trillion to combat nature loss, Nairobi, United Nations Environment Program, 2023, https://www.unep.org/resources/state-finance-nature-2023.

[21] “State of Finance for Nature: The Big Nature Turnaround – Repurposing $7 trillion to combat nature loss”

[22] Ivo Mulder and Aurelia Blin , State of Finance for Nature: The Big Nature Turnaround – Tripling investments in nature-based solutions by 2030, Nairobi, United Nations Environment Program, 2021, https://www.unep.org/resources/state-finance-nature-2021

[23] “State of Finance for Nature: The Big Nature Turnaround – Repurposing $7 trillion to combat nature loss”

[24] World Bank, Mobilizing Private Finance for Nature, 2020, Washington DC, World Bank Group, 2020, https://thedocs.worldbank.org/en/doc/9167816013046308500120022020/original/FinanceforNature28Sepwebversion.pdf.

[25] Chris Knight, Nature Based Solutions – a Review of Current Financing Barriers and How to Overcome These, World Wide Fund for Nature, 2022, https://www.wwf.org.uk/sites/default/files/2022-06/WWF-NBS-Public-Report-Final-270622.pdf

[26] Aaron M. Ellison et al., “Mangrove Rehabilitation and Restoration as Experimental Adaptive Management,” Frontiers in Marine Science 7, May, 15, 2020, https://doi.org/10.3389/fmars.2020.00327.

[27] Nathalie Seddon et al., “Understanding the Value and Limits of Nature-based Solutions to Climate Change and Other Global Challenges”

[28] Finance Earth, A Market Review of Nature-Based Solutions: An Emerging Institutional Asset Class, Green Purposes Company, 2021, https://finance.earth/wp-content/uploads/2021/05/Finance-Earth-GPC-Market-Review-of-NbS-Report-May-2021.pdf.

[29] Valeria López-Portillo et al., “5 Barriers That Hinder Green Financing”, World Resources Institute, November 2, 2022, https://www.wri.org/update/5-barriers-hinder-green-financing.

[30] Nathalie Seddon et al., “Understanding the Value and Limits of Nature-Based Solutions to Climate Change and Other Global Challenges”

[31] “Nature Based Solutions – a Review of Current Financing Barriers and How to Overcome These”

[32] Valeria De Los Casares and Marc Ringel, Nature-based Solutions for Climate Adaptation in the European Union: Part II: Analysing Governance and Financing barriers, European Chair for Sustainable Development and Climate Transition, September 2023, https://www.sciencespo.fr/psia/chair-sustainable-development/wp-content/uploads/2024/07/sciencespo-chair-sustainable-development-wp-part-II-barriers-for-diffusion-of-nbs.pdf.

[33] Pat Dale et al., “A Conceptual Model to Improve Links Between Science, Policy and Practice in Coastal Management,” Marine Policy 103, May 2019: 42-49, https://doi.org/10.1016/j.marpol.2019.02.029.

[34] Mariana Ceccon, “Nature4Climate and OpenEarth Foundation Introduce New NbS Guidelines for Data Sharing,” Nature4Climate, https://nature4climate.org/nature4climate-and-openearth-foundation-introduce-new-nbs-guidelines-for-data-sharing/#:~:text=OpenEarth%20Foundation%20and%20Nature4Climate%20announce,solutions%20(NbS)%20for%20monitoring%2C.

[35] Task-Force on Nature related Financial Disclosures, “Recommendations of the Taskforce on Nature-related Financial Disclosures,” TNFD Glonal, September 2023, https://tnfd.global/wp-content/uploads/2023/08/Recommendations_of_the_Taskforce_on_Nature-related_Financial_Disclosures_September_2023.pdf?v=1695118661

[36] SBTi, “Standard Operating Procedure (SOP) for Development of SBTi Standards,” December 14, 2023, https://sciencebasedtargets.org/resources/files/SBTi-Procedure-for-Development-of-Standards_V1.0.pdf.

[37] Alejandra Padin-Dujon and Ben Filewod, “What Are Sustainability-linked Bonds and How Can They Help Developing Countries?,” The London School of Economics and Political Science, November 29, 2023, https://www.lse.ac.uk/granthaminstitute/explainers/what-are-sustainability-linked-bonds-and-how-can-they-help-developing-countries/

[38] Kate Moreton, Uruguay’s Experiment in Sovereign Sustainability-linked Bonds, Columba Threadneedle Investments, December 2022, https://docs.columbiathreadneedle.com/documents/Uruguay’s%20experiment%20in%20sovereign%20sustainability-linked%20bonds.pdf?inline=true

[39] Organization for Economic Co-operation and Development, Green, Social, Sustainability and Sustainability-linked Bonds in Developing Countries: The Case for Increased Donor Co-ordination, Paris, OECD Publishing, 2023, https://www.oecd.org/dac/green-social-sustainability-bonds-developing-countries-donor-co-ordination.pdf

[40] United Nations Development Program, (Re)orienting Sovereign Debt to Support Nature and the SDGs: Instruments and their Application in Asia-Pacific Developing Economies, Bangkok, UNDP Bangkok Regional Hub, 2023, https://www.undp.org/publications/reorienting-sovereign-debt-support-nature-and-sdgs-instruments-and-their-application-asia-pacific-developing-economies

[41] World Economic Forum, “Climate finance: What Are Debt-for-Nature Swaps and How Can They Help Countries?,” WEF, April 26, 2024, https://www.weforum.org/agenda/2024/04/climate-finance-debt-nature-swap/

[42] PricewaterhouseCoopers, Accelerating Finance for Nature: Barriers and Recommendations for Scaling Private Sector Investment: The case for a Nature Finance Accelerator, PricewaterhouseCoopers International Limited, May 2023, https://www.pwc.com/gx/en/nature-and-biodiversity/nature-fin-accelerator-mode.pdf

[43] “State of Finance for Nature: The Big Nature Turnaround – Repurposing $7 trillion to combat nature loss”

[44] BloombergNEF, “The Untapped Power of Carbon Markets in Five Charts,” September 16, 2022, https://about.bnef.com/blog/the-untapped-power-of-carbon-markets-in-five-charts/.

[45] David Landholm et al., Unlocking Nature-based Solutions Through Carbon Markets in the United States of America: Technical Report, Climate Focus, 2022, https://climatefocus.com/wp-content/uploads/2022/12/Unlocking-Nature-based-Solutions-USA-Technical-Report.pdf.

[46] Boston Consulting Group, “The Voluntary Carbon Market Is Thriving,” BCG, https://www.bcg.com/publications/2023/why-the-voluntary-carbon-market-is-thriving

[47] Chris Staples and Kerry Liebenberg, Navigating the Risks of Greenwashing in the Voluntary Carbon Market, International Swaps and Derivatives Association, 2024, https://www.isda.org/a/I9wgE/Navigating-the-Risks-of-Greenwashing-in-the-Voluntary-Carbon-Market.pdf.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Gopalika Arora is an Associate Fellow at the Centre for Economy and Growth in New Delhi. Her primary areas of research include Climate Finance and ...

Read More +