-

CENTRES

Progammes & Centres

Location

26 August, Malé: The Bank of Maldives yesterday announced the suspension of foreign transaction allowances for cards linked to Maldivian Rufiyaa (MVR) accounts and limited foreign transactions to USD 100 on standard or gold credit cards.

For a second, everyone froze, quickly followed by sheer panic. From the single mother barely sustaining her SME, reliant on Chinese imports for every single bead and brush, to the Bangladeshi waiter fearful for his wages, to the shopkeeper, and the construction company owner who are barely keeping up with the rising cost of imports, to anyone with a child studying abroad… no one was happy, some were angry, more were petrified.

The Bank reversed its decision within hours. By then, the damage was done, the panic had set in, and whether the Bank chose to reverse or not, people understood just how dire the situation was.

It is hard to say what was worse: the Bank’s initial abrupt announcement or the clearly politicised pressure to revoke the announcement.

The country’s vulnerability has been laid bare, exposing the fragility of an economy buffeted by political pressures and short-sighted decision-making.

Yesterday’s panic was the surfacing of a very palpable sense of looming financial crisis here in the Maldives. The country’s vulnerability has been laid bare, exposing the fragility of an economy buffeted by political pressures and short-sighted decision-making. It was a dangerous sign to send to investors; that the banking sector, including the central bank, is so susceptible to political pressure will not invite investor confidence. It was also a dangerous signal to the public: politicised financial decisions are not trustable.

At the heart of this crisis lies a troubling pattern: short-sighted political manoeuvres that prioritise immediate gains over long-term economic stability. This approach has not only jeopardised the nation’s fiscal health but has also set the stage for a potential economic meltdown that could rival or even surpass the challenges faced by our regional neighbours. The predicament is not merely a result of global economic turbulence post-COVID, but also a consequence of a political culture that consistently prioritises short-term gains over long-term stability.

Despite warnings from international financial institutions and local financial experts, successive administrations have pursued expansionary fiscal policies, inflating both the state payroll and subsidies. The previous administration’s strategy of borrowing to service existing debt, coupled with escalating expenditure to unsustainable levels, has driven the fiscal deficit to unprecedented heights.

Government after government is treating every day like an election night by trying to curry favour with voters while abusing state resources.

The current administration came in promising to curtail public expenditure, criticising the previous administration’s abuse of state resources. However, the state payroll is skyrocketing, and President Muizzu has been unable to bring in the much-needed dollars via negotiation or policy.

Government after government is treating every day like an election night by trying to curry favour with voters while abusing state resources. The consequences of prioritising electoral popularity over sound financial management, and the reluctance to implement necessary but potentially unpopular reforms are becoming increasingly apparent. The Maldives now faces a perfect storm of high public debt, dwindling foreign exchange reserves, and a vulnerable economy overly dependent on tourism.

The Maldives’ political landscape is littered with promises of economic reform. However, the gap between these promises and the reality on the ground has only widened, leaving the country in an increasingly precarious economic position.

Successive governments have announced ambitious reform agendas. President Ibrahim M. Solih pledged to restructure debt during his campaign and rescinded this when in government. President Muizzu guaranteed increased foreign investment, but nearly a year into his government, there is no sign of any improvement in the investor climate.

The consequences of this are severe. Each unfulfilled promise also erodes public trust in the government’s ability to manage the economy effectively.

The Maldives’ current economic trajectory bears concerning resemblance to the path trodden by our neighbour in the lead-up to its economic crisis. Despite the proximity of this cautionary tale, there appears to be a reluctance among Maldivian policymakers to heed the lessons it offers.

Sri Lanka’s economic meltdown was the result of years of economic mismanagement, excessive borrowing, and ill-timed policy decisions. The island nation faced a perfect storm of dwindling foreign exchange reserves, unsustainable debt levels, and a collapse in tourism revenues due to the COVID-19 pandemic. The result was a full-blown economic crisis, marked by severe shortages of essential goods, spiralling inflation, and political instability.

Protesters gather in a street leading to the Sri Lankan President’s official residence Pradeep Dambarage via Getty Images

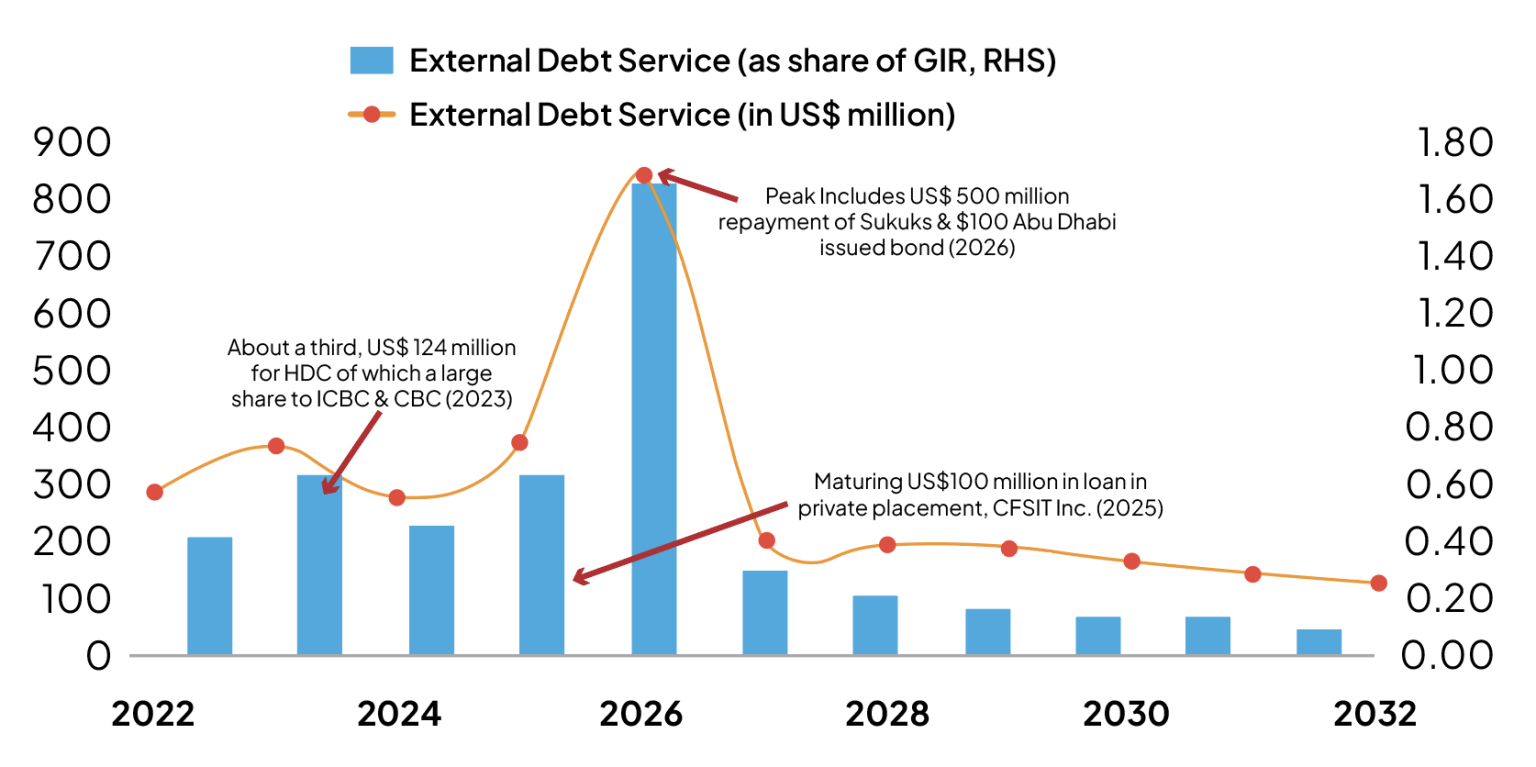

On street cafes and at home, Maldivians are commenting on these parallels. Like Sri Lanka, the Maldives has accumulated significant levels of external debt. Both countries are extremely vulnerable to external shocks. And in both cases, there has been a tendency towards populist economic policies that prioritise short-term political gains over long-term fiscal sustainability. And like Sri Lanka before its crisis, there’s a reluctance to seek timely assistance from international financial institutions.

It is tempting to view the Maldives’ situation as fundamentally different, pointing to its higher GDP per capita and its strategic importance to India and China. This exceptionalism leads to dangerous complacency and is borne from a false sense of security: that India will, or can bail the Maldives out, time and time again, or that China will offer concessions on the loans.

By ignoring the warning signs and failing to take corrective action, the Maldives risks sleepwalking into a crisis of its own.

As the Maldives teeters on the brink of economic crisis, the need for a comprehensive and bold approach to reform has never been more urgent. The way forward requires a delicate balance between addressing immediate economic necessities and implementing long-term structural changes.

First and foremost, there must be a recognition at the highest levels of government that business as usual is no longer an option. The country needs a new economic paradigm that prioritises fiscal sustainability, economic diversification, and resilience to external shocks. This will require political courage to implement reforms that may be unpopular in the short term but are crucial for long-term stability.

Implementing these reforms will require political leaders to balance the imperatives of economic stewardship with the realities of democratic politics.

Addressing corruption and improving governance are also critical. Strengthening institutions, enhancing transparency in public procurement, and improving the business environment can help attract investment and boost economic growth. These measures are a prerequisite for public trust in goverImplementing these reforms will require political leaders to balance the imperatives of economic stewardship with the realities of democratic politics.nment, which will be crucial for maintaining social stability during the reform process.

It will necessitate building broad-based support for reform, communicating effectively with the public about the challenges and opportunities ahead, and demonstrating tangible progress in improving economic outcomes.

After yesterday, there is no longer any point in trying to hide the gravity of the situation from the public, fearing panic will be worse than the truth. Rather than soothing platitudes, what the public deserves is for the government to, quite simply, tell the truth.

Yesterday’s squall was but a prelude to the fiscal tsunami brewing. National disasters are not just when the earth shakes or when lives are lost. The potential threat to livelihoods is also a matter of national disaster, and Maldivians deserve leaders who will face the crisis with fortitude and prudence, and will deal with it in a transparent and democratic manner.

Maldivians know what’s coming. Maldivians are savvy people in matters of the heart and home. And what is a financial crisis, if not a matter of the heart and the home?

This commentary originally appeared in The Maldives Policy Think Tank.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Eva Abdulla, Chairperson of The Maldives Policy Think Tank, is the former Deputy Speaker of the Maldives, and was a three- term elected member of ...

Read More +