Introduction

India’s micro, small, and medium enterprises (MSME) sector is a key driver of economic growth—it generates employment and promotes entrepreneurship, contributing to the country’s economic and social development. The MSME sector has created 111 million jobs and employed 36 million people in manufacturing nationwide, according to data from the 73rd National Sample Survey (NSS) conducted in 2015-16.[1] Importantly, MSMEs are key to generating employment in rural areas and providing opportunities for equitable development.

Table 1: Sector-wise Distribution of MSMEs in India (in millions)

| Sector |

Estimated Number of Enterprises |

| |

Rural |

Urban |

Total |

| Manufacturing |

11.414 |

8.25 |

19.665 |

| Electricity |

0.003 |

0.001 |

0.004 |

| Trade |

10.871 |

12.164 |

23.035 |

| Other Services |

10.2 |

10.485 |

20.685 |

| Total |

32.488 |

30.900 |

63.388 |

Source: Ministry of Micro, Small, and Medium Enterprises[2]

Between 2014 and 2019, the MSME sector grew at a sustained 10 percent and had a 30 percent share of the national GDP.[3]

Table 2: Share of MSME Gross Value Added in India’s GDP

| Year |

Total MSME

GVA (US$ mn)

|

Total GVA (US$ mn) |

Share of MSME in GVA (%) |

All India GDP (US$ mn) |

Share of MSME in All India GDP (in %) |

| 2014-15 |

499,797 |

1,572,890 |

31.80 |

1,703,398 |

29.34 |

| 2015-16 |

554,724 |

1,719,960 |

32.28 |

1,880,803 |

29.48 |

| 2016-17 |

615,284 |

1,907,416 |

32.24 |

2,103,940 |

29.25 |

| 2017-18 |

695,012 |

2,120,218 |

32.79 |

2,338,219 |

29.75 |

| 2018-19 |

785,130 |

2,342,090 |

33.50 |

2,592,975 |

30.27 |

Source: Ministry of Micro, Small, and Medium Enterprises[4]

Still, despite its importance, inadequate access to credit is a recurrent issue for India’s MSME sector. The government has introduced several initiatives to provide capital to MSMEs—such as the Emergency Credit Line Guarantee Scheme, launched during the COVID-19 pandemic to bolster the sector; the Credit Guarantee Trust Fund for MSMEs, which provides collateral-free loans to MSMEs through banks, financial institutions, and non-banking financial companies (NBFCs); and the Pradhan Mantri Mudra Yojana, which provides small loans to non-farm and non-corporate micro and small enterprises—but a significant credit gap persists. Various sources have estimated the credit gap at around INR 25 trillion (US$342.5 billion).[5],[6] Government programmes appear to be unable to bridge this credit gap, which is a serious impediment to the growth of the MSME sector and the Indian economy. However, the development of new technologies, such as the Open Credit Enablement Network (OCEN), can help bridge the credit gap to boost the MSME sector.

Boosting MSMEs through Technological Advancements

India’s OCEN is an innovative platform that standardises and simplifies access to credit from multiple lenders. It aims to promote financial inclusion, reduce costs, and foster competition among lenders while ensuring responsible lending practices. OCEN empowers borrowers and streamlines lending operations, ultimately democratising financial services, and enhancing access to credit for individuals and businesses.

Understanding OCEN's structure involves grasping the underlying components of India Stack, which, when combined with embedded credit, can streamline lending for MSMEs.

India Stack

An application programming interface (API) is a software interface that allows applications to communicate and transmit data. It is a collection of software code that enables applications to communicate without user intervention. India Stack refers to a collection of open APIs that enable the large-scale movement of data, information, and money. It is the world's largest set of open APIs. Rapid technological and business innovation on top of the API stack can aid financial and social inclusion. India Stack provides the base infrastructure for developers and technology companies to innovate and create products.

India Stack is a groundbreaking digital infrastructure that has transformed the way services are delivered in India. It can be broadly classified into three layers—identity, payments, and data. At the heart of India Stack is Aadhaar, a biometric-based digital identity system that has provided over one billion Indians with a unique and verifiable identity. This foundational component has not only improved access to government services but has also facilitated financial inclusion by enabling individuals to open bank accounts and access digital financial services easily. Another critical element of India Stack is the Unified Payments Interface (UPI), which has revolutionised digital payments in India. UPI allows seamless and instant money transfers between bank accounts through mobile phones, making it a ubiquitous and user-friendly payment solution. Additionally, India Stack includes the electronic know-your-customer (e-KYC) system that simplifies customer verification processes for businesses, and DigiLocker, where individuals can securely store and access their documents and certificates. As such, India Stack has paved the way for a digital revolution in India, fostering financial inclusion and simplifying administrative processes.

India Stack’s data layer focuses on data governance systems as per the Data Empowerment and Protection Architecture (DEPA). DEPA aims to grant individuals control over their data, democratise access, and ensure secure data portability among service providers. DEPA's institutional structure introduces a novel entity called consent managers, responsible for facilitating user consent management. These consent managers operate without direct access to user data, ensuring they remain 'data blind'. Instead, they act as intermediaries for encrypted data transfers. An account aggregator is a consent manager for financial data and is a regulated entity under the purview of the Reserve Bank of India. Its primary function is to facilitate secure digital access for individuals to their financial information held by a financial institution. Notably, no data can be shared without the individual's explicit consent.

India’s fintech ecosystem underwent a revolutionary transformation with the introduction of India Stack. The OCEN represents the next phase of this evolution, where digital lending is unbundled through the development of specialised frameworks. OCEN aims to reshape the lending landscape by enabling more efficient and targeted lending practices.

Embedded finance

Embedded finance integrates financial services into non-financial platforms, with significant potential to develop credit products for MSMEs in India. It encompasses embedded payments, enabling seamless transactions within apps and websites, and embedded credit, facilitating loan acquisition and repayment on the same platform. This ‘plug-and-play’ approach enhances customer experience, positively impacting key metrics such as revenue and sales while offering financial service providers a new channel for product promotion and customer acquisition.

Embedded finance is a fast-growing feature in the fintech space and is being incorporated by incumbent financial services providers like banks, NBFCs, and new fintech startups. It is estimated to reach a global market size of US$606 billion by 2025.[7]

Table 3: Types of Embedded Finance

| Types |

Example |

| Embedded credit |

Vyapar, an accounting app, provides credit to MSMEs on their platform in India by embedding loan products.[8]

Flipkart and Rupifi partnered to provide MSMEs and kiranas with the embedded buy now pay later feature on the Flipkart Wholesale platform.[9]

Udaan, an Indian B2B marketplace, offers credit via financing partners on its platform.[10]

|

| Embedded payments |

Ride-sharing apps like Uber and Ola allow payments through their applications after the completion of a ride by integrating mobile wallets and UPI.[11]

Similarly, food delivery apps like Zomato and Swiggy allow users to pay for orders on their platforms without switching apps.[12]

|

| Embedded Insurance |

Amazon Pay offers auto insurance on its platform. The process is completely digital and quick.[13]

Thimble is an insurtech company that provides APIs for embedded insurance for micro businesses.

Tesla provides insurance services to buyers on its platform.

|

Embedded credit, a type of embedded finance, can transform credit access for Indian MSMEs by integrating lending as a feature within digital platforms. For instance, to address the challenge of acquiring short-term credit, a possible solution is to incorporate embedded credit infrastructure into B2B e-commerce platforms, allowing retailers to access credit options conveniently during checkout. The ‘buy now pay later’ model is one such example that is becoming popular in India.[14] Similarly, accounting, logistics, HR, and payroll platforms can now provide in-context credit products to MSMEs (which will be an added source of revenue for the platform).

Digital platforms have the advantage of a wider reach, and, as such, traditional financial institutions should use these avenues to distribute their services and learn more about customer behaviour and requirements. This will enable banks to develop tailor-made products for MSMEs and improve their underwriting capabilities. As a result, financial institutions can acquire and retain customers efficiently and improve the unit economics of their services. This will lead to greater bank and technology partnerships, creating an environment of innovation for financial products. Additionally, banks, NBFCs, and small finance banks are uniquely positioned to manage regulatory, credit, and compliance risks. Businesses that use customer-facing digital platforms like mobile apps, websites, or even desktop apps are incentivised to incorporate embedded financial products onto their platform because they can leverage their customer database to provide customised financial solutions. This customisable approach, which is possible through the seamless integration of financial services and analytics from businesses’ customer datasets, is one of the core benefits of embedded finance.

Embedded finance has the potential to provide affordable, customised, and accessible financial services to large audiences from various economic and social demographics. It is an integral mechanism of the digital India vision and India Stack, which aims to improve and democratise digital transactions.

The coupling of embedded finance with digital public infrastructure (DPI) has the potential to significantly impact MSME lending and reduce the credit gap. By integrating financial services directly into existing digital platforms and leveraging public infrastructure, such as digital identity systems and open banking frameworks, MSMEs can gain easier access to credit, streamlined loan application processes, and enhanced creditworthiness assessments, ultimately bridging the financing divide for small businesses and fostering economic growth.

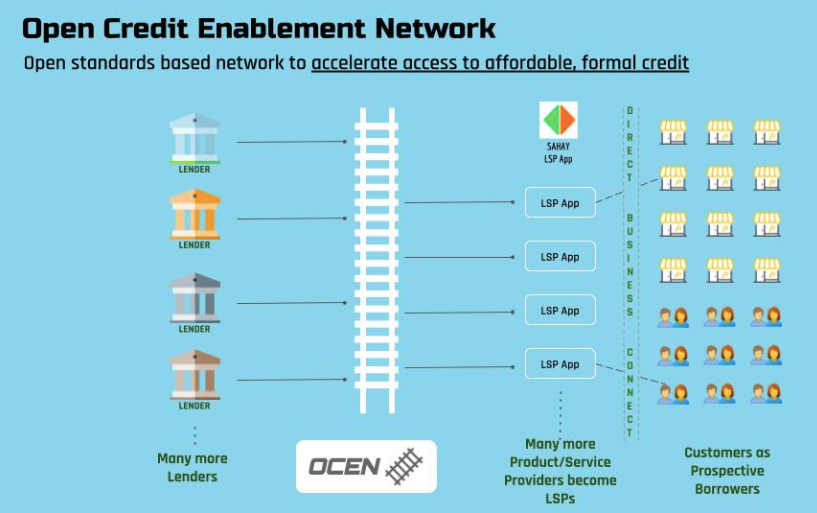

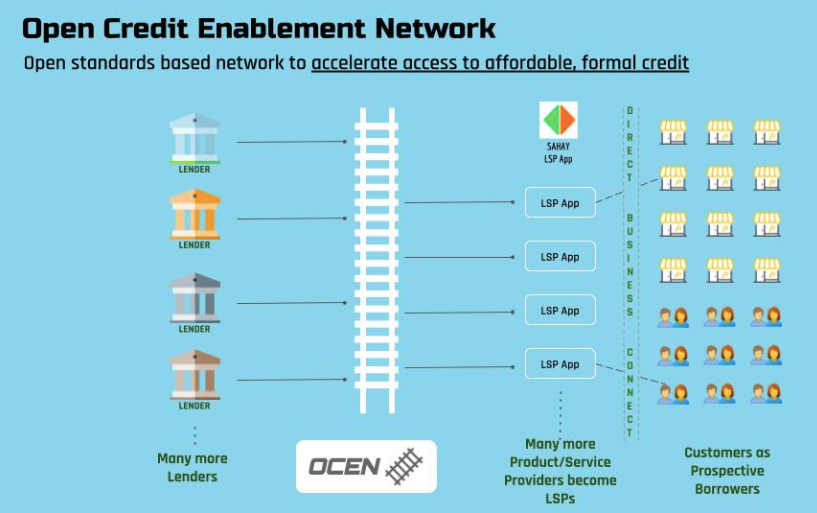

The Open Credit Enablement Network

The OCEN framework was launched in 2020 for loan service providers (LSPs), lenders, and account aggregators.[15] OCEN is an attempt to democratise access to credit and enable financial inclusion by using the principles of embedded finance and the digital infrastructure of India Stack. It acts as a common language to connect lenders and mediators to create financial products that can be scaled.

Banks and NBFCs are typically restricted by one-size-fits-all credit products. As a result, identifying and acquiring new customers accounts for a significant portion of the operating costs in the lending value chain. Furthermore, the costs of document verification, underwriting, and physical payment collection add to the overall lending cost. Consequently, banks and NBFCs face challenges lending to borrowers with smaller loan requirements as it is economically unviable. Indian MSMEs typically have small loan requirements and are thus excluded from conventional credit channels.

Furthermore, lending is a balance-sheet-based operation that relies on analysing and collateralising borrowers' assets. This creates barriers for MSMEs and banks because small businesses that do not meet these requirements increase the risk of banks' lending operations. Due to this, MSMEs are generally offered higher interest rates and stricter repayment schedules. These are not ideal conditions for MSMEs because most of these firms lack structured documentation and data. These impediments make it difficult for banks to provide small-size loans to MSMEs, and most MSMEs are forced to work with informal moneylenders and microfinance institutions, which are both costly and inefficient.

OCEN potentially accelerates financial inclusion by reimagining the lending value chain and empowering technology ecosystem participants to embed loan products on their platforms. It essentially creates the building blocks for a credit cycle and allows non-financial service providers to become fintech-enabled marketplaces. For instance, a logistics company can provide loan products to MSMEs by incorporating the standardised OCEN framework. MSMEs will not have to apply for credit outside of the logistics platform.

LSPs act as digital agents for borrowers, ensuring their interests by providing access to affordable credit and low interest rates. LSPs act as a go-between for borrowers and lenders, assisting lenders in developing better financial products for their customers. Accounting apps, tax and legal filling apps, neo banks, payment gateways, supply chain financing apps, and agri-tech platforms can consider adopting the OCEN framework to become LSPs. For instance, if Udaan, a B2B marketplace for manufacturers and retailers in India, adopts the OCEN framework and integrates a loan product via a bank partnership on its platform, it will become an LSP in addition to being an e-commerce platform. LSPs facilitate lending and are not lenders.

Figure 1: The OCEN Framework

Source: Sahamati[16]

The OCEN framework provides several benefits to borrowers, especially MSMEs. First, it gives MSMEs access to credit products on the platform they use for daily business activities. Additionally, interest rates for loans could also decrease for MSMEs as banks reduce their cost of customer acquisition. This also allows for the construction of tailored credit products based on MSMEs’ real requirements and activities. Tailored credit products largely eliminate the problem of under-borrowing, since MSMEs can access credit on LSPs for specific products and services.

Banks also benefit from the OCEN framework as they can reduce their cost of operation by communicating directly with the customer base aggregated by the LSPs. This allows them to reach customers that were either not fit for their underwriting models or were out of reach. Therefore, the LSP platform becomes an additional avenue for banks to acquire customers. LSPs also help banks retain customers as LSPs develop and maintain relationships with the borrowers via their service offerings. LSPs also benefit from this arrangement as credit product integrations help them sell more products and services, allowing them to retain more customers. The added functionality could also potentially give them a competitive advantage over competitors that have not adopted the latest innovations.

The Future of OCEN and MSME Lending

In the past decade, India has adopted a distinct strategy for economic growth by promoting the creation of DPIs like the UPI. These initiatives not only foster financial inclusion and developmental objectives but also inspire entrepreneurs and startups to develop innovative products that drive social and economic progress. By leveraging DPIs, businesses can easily develop financial products without constructing intricate backend infrastructure. This essentially allows them to utilise flexible DPIs without reinventing systems for identification, verification, and payments.

Embedded finance and OCEN allow for the true democratisation of credit products for MSMEs on a previously unimaginable scale. The flexibility and customisability of embedded finance aid in meeting the specific credit requirements of MSMEs. Most MSMEs require small loans, flexible loan repayment terms, and frequent access to credit. Due to the costly underwriting process and small loan size, these requirements are unsuitable for most banks. These prerequisites, however, are not required for embedded credit products and OCEN, which remove the barrier of access, cost, and time for lenders and borrowers.

Although it is still in its early stages, OCEN can improve MSMEs’ access to credit. These innovations have the potential to greatly benefit the MSME sector by providing low-cost, tailored credit solutions for businesses. OCEN acts as a catalyst for embedded credit, which is expected to boost company revenue. New features such as ‘buy now pay later’ and collateral-free loans can be used on such platforms as well.

The ecosystem has already begun to create new opportunities for LSPs to lend to MSMEs. For instance, Indian MSMEs use accounting, tax, and invoicing apps, which can be leveraged and converted into LSPs by integrating loan products on their platforms. As such, MSMEs can access quick, customisable, and tailored loans.

However, there are a few obstacles that must be overcome. Despite India’s success in internet penetration,[17] many micro-enterprises still do not use the internet and digital products that require internet connectivity. This places them outside the scope of innovations in the digital lending environment. Moreover, trust in digital products is still an obstacle in rural India.[18]

From an infrastructure point of view, UPI often encounters transaction failures,[19] which is an impediment for businesses. It also impacts the trust in the infrastructure, especially in small businesses that use it for the first time and may prefer cash transactions. Reported Aadhaar data breaches have also raised data privacy concerns.[20] However, these data leaks have had no direct consequence on MSME lending.

There is also a need to focus on financial literacy programmes for MSME entrepreneurs that cover financial products, processes, and institutions. Banks and LSPs must structure awareness programmes for entrepreneurs to help them understand the benefits of in-context and cash-flow-based lending over collateral-based lending.

India has already established itself as a global leader in digital finance, and the OCEN, in conjunction with embedded finance, has the potential to have a significant impact on the MSME sector and financial inclusion. It allows firms to innovate and develop new financial products to serve various market segments, such as MSMEs, and assist people and businesses. The level and scale of innovation are immense, as small businesses can apply for instant micro-loans on WhatsApp.[21] These advancements are possible due to the development of citizen-centric DPI. DPI can potentially increase productivity and transparency in the public-private ecosystem and improve inclusivity and development at scale.

An OCEN for the G20’s Emerging Economies and Beyond

India’s G20 presidency and its place in the Troika[a] is an opportunity to support an inclusive model like OCEN for MSMEs. This model can help developing countries establish a digital governance structure in a cost-effective and accessible manner.

The OCEN framework could be an effective way to empower MSMEs in several emerging economies in the G20 and elsewhere. The fundamental building blocks for such a framework are internet penetration and smartphone ownership.

Emerging economies in the G20, including Indonesia, Mexico, and Türkiye, exhibit similar characteristics to the Indian economy in terms of internet penetration, smartphone ownership, and the significant contribution of their MSME sectors to the overall economy. MSMEs contribute about 60.5 percent to Indonesia's GDP[22] and approximately 52.8 percent to Türkiye’s GDP.[23] Brazil boasts a vibrant MSME sector, contributing a substantial 27 percent to its GDP,[24] while South Africa demonstrates an even more robust presence, with its MSMEs accounting for 40 percent of the country’s GDP.[25] These figures underscore the significance of MSMEs in driving economic growth and innovation within their respective regions. With Indonesia, India, and Brazil forming the current G20 Troika, the forum can focus on the key drivers in emerging market economies, including boosting MSMEs through DPIs. However, countries must establish protocols like India Stack to initially construct the necessary data, payment, and identity infrastructure that is vital for facilitating frameworks like OCEN.

India’s leadership in DPI offers unique lessons and digital solutions for all countries. This is especially relevant for emerging economies, which face similar challenges as India, including barriers to internet access, connectivity, and digital literacy. India could help emerging economies in the G20 by providing insights and learnings on the impact of DPI on MSME development. It is also a unique opportunity to promote and encourage countries to focus on digital and scalable infrastructure to tackle specific problems. The OCEN is one such innovation that holds immense potential for countries that rely heavily on MSMEs for growth and employment. Apart from promoting frameworks like the OCEN, India must also encourage countries to strengthen their internet penetration and infrastructure, which is essential for the functioning of digital public goods.

India can also facilitate a multilateral collaborative model for distributing DPI development responsibilities among G20 stakeholder groups based on expertise, resources, and activities. The model could emphasise collaboration in the innovation process, focusing on knowledge-sharing and allowing each actor to focus on their distinct strengths. To frame the collaborative model within a multilateral context, responsibilities such as funding, implementation, innovation, and oversight must be distributed among nations based on their capabilities. The collaborative model encourages centralised learning and knowledge-sharing in its design, and it succeeds by capitalising on the G20's organisational capacity and commitment to digital inclusion.

Conclusion

India's achievements with DPI, illustrated by India Stack, offer an inspiring model for empowering MSMEs worldwide, particularly in emerging economies. MSMEs, being catalysts of economic growth and employment, are at the forefront of advancing both social and economic development.

Integral to India's DPI success is its robust hard infrastructure, facilitating increased internet accessibility and mobile ownership. India boasts some of the world's most affordable mobile data plans, extending the reach of digital benefits and maximising the potential of a resilient, soft DPI. Internet accessibility and smartphone ownership are essential prerequisites for the successful development and employment of DPI in other nations.

The African Union’s inclusion as a permanent G20 member will strengthen the grouping and amplify the Global South's voice. It also presents an opportunity to promote the use of DPIs to help numerous African nations achieve their development goals, marking a significant step towards global cooperation and progress.

India's role in the G20 is an opportunity to share insights, experiences, and best practices in harnessing DPI to strengthen MSMEs. Through the strategic use of DPIs, emerging economies can usher in a new era of equitable access to credit, promote financial inclusion, and chart a course toward economic prosperity and innovation on a global scale.

Endnotes

[a] The G20 Troika comprises the past, current, and incoming presidencies.

[1] Government of India, Ministry of Micro, Small, and Medium Enterprises, Annual Report 2020-21.

[2] Government of India, Ministry of Micro, Small, and Medium Enterprises, Annual Report 2020-21

[3] Government of India, Ministry of Micro, Small, and Medium Enterprises, Annual Report 2020-21

[4] Government of India, Ministry of Micro, Small, and Medium Enterprises, Annual Report 2020-21

[5] International Finance Corporation, “Financing India’s MSMEs: Estimation of Debt Requirement of MSMEs in India,” Washington DC, IFC, November 2018.

[6] Reserve Bank of India, Report of the Expert Committee on Micro, Small, and Medium Enterprises, June 25, 2019.

[7] Aaron Byrne, “How banks are staking a claim in the embedded finance ecosystem”, EY, June 5, 2023.

[8] Garima Bora, “Vyapar partners with FinBox to offer credit to 900,000 MSMEs,” ET Online, May 30, 2022.

[9] Rupifi and Flipkart Wholesale.

[10] Salman SH, “B2B e-commerce start-up Udaan’s digital lending arm ties up with Northern Arc,” Financial Express, April 27, 2022.

[11] “Ola introduces payments via Unified Payments Interface (UPI) for rides!,” Ola, August 23, 2017.

[12] Bhumika Khatri, “Swiggy Rolls Out UPI Driven Digital Payment Solutions For Its Delivery Partners,” In42, March 19, 2018.

[13] Abhik Sengupta, “Amazon Pay Introduces Car and Bike Insurance in India,” Gadgets360, July 23, 2020.

[14] “India leads world in future intent to use ‘Buy Now Pay Later’ services”, The Times of India, March 31, 2022.

[15] Aditya Damani, “An OCEN of opportunities,” The Economic Times, June 25, 2021.

[16] “OCEN & Account Aggregators will change digital lending in India”, Sahamati, August 4, 2020.

[17] “India to have 900 million active internet users by 2025, says report,” The Economic Times, June 3, 2021.

[18] “Poor training, skills affect digital trust of Indian enterprises”, Business Standard, September 16, 2022.

[19] Ashwin Manikandan, “Surging UPI failure rates worry banks,” The Economic Times, October 21, 2020.

[20] Zack Whittaker, “India’s farmers exposed by new Aadhaar data leak,” TechCrunch, July 14, 2022.

[21] “Loan in 30 seconds for WhatsApp users, no documents, application form needed; how to apply, ” DNA, June 15, 2022.

[22] OECD (2022), "Indonesia", in Financing SMEs and Entrepreneurs 2022: An OECD Scoreboard, OECD Publishing, Paris.

[23] OECD (2022), "Turkey", in Financing SMEs and Entrepreneurs 2022: An OECD Scoreboard, OECD Publishing, Paris.

[24] OECD (2022), "Brazil", in Financing SMEs and Entrepreneurs 2022: An OECD Scoreboard, OECD Publishing, Paris.

[25] OECD (2022), "South Africa", in Financing SMEs and Entrepreneurs 2022: An OECD Scoreboard, OECD Publishing, Paris.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV