-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

Read | Great walls: Addressing domestic barriers to climate action projects in India

Introduction

Over the past year, the world has been subject to a number of tumultuous events. The most significant of these has undoubtedly been the election of Donald Trump as the President of the United States. There are many far reaching implications to the unexpected proceedings of November 8, 2016, but perhaps the most concerning are Mr. Trump’s views on climate change. The 45th US president has unequivocally stated his belief that climate change is not caused by human actions. He has also reiterated a number of times that he intends to withdraw the United States from the Paris Accords.

As the United States vacates its leadership position on climate change, new players are stepping up to take its place. China and India have emerged as the best hope for the world to meet the goals set forth in the Paris Agreement, with both nations currently over performing on their promises to cut carbon emissions [i].

India, in particular, has made a significant push towards ensuring that its economic transition is not reliant on fossil fuels. India’s renewable energy capacity has grown from 27 GW in 2000 to about 93 GW in December 2016 [ii] It is expected that the capacity will grow to 175 GWs by 2022 [iii]. If successful, India will have increased its renewable energy capacity by 600 percent in the span of two decades.

Despite these successes, India’s low carbon transition remains a complex matter with many moving parts. There are several issues that need to be addressed if India wishes to successfully meet its future energy demands while continuing to hold to the promise of a low carbon economic transition.

The majority of these issues are related to India’s power sector. In order to successfully complete a low carbon transition, India must address the financing of renewable energy projects, inefficiencies in the coal sector, and the incorporation of alternative fuel sources. India’s urban transitions must also be addressed, including limiting its urban sprawl, solving its haphazard approach to the transportation sector, and addressing its inadequate waste management processes.

India’s economic and demographic transition

India is in the midst of several transformations which are expected to directly impact its power sector and urban areas. Already home to 1.25 billion people, India will soon overtake China as the most populous nation in the world [iv]. Half of the country’s population is under the age of 26 and by 2020, India will be the youngest country in the world, with an expected median age of 29 [v].

The economic structure of the country is changing as well, with a concerted attempt being made to shift away from India’s traditional dependence on the agricultural and services sectors. The current Indian government has implemented specific policies – such as the ‘Make in India’ and ‘Skill India’ initiatives, designed to aid in the development of the manufacturing sector. Intended to shift low-skill jobs away from the agricultural sector and bring India’s sizeable informal economy into the fold [vi], the initiatives have been widely lauded.

The policies are expected to have significant consequences for India’s energy future, however. The amount of energy demanded by the industrial sector is expected to rise annually by 4.4 percent and make up more than 50 percent of all energy consumption in India by 2040 [vii].

India’s urban population is expected to more than double by 2030. Its cities will be asked to hold more than 300 million more people [ix], which will accelerate the use of modern fuels, lead to a rise in appliance and vehicle ownership, and provide an uptick in demand for construction materials, all of which are expected to increase greenhouse gas (GHG) emissions.

A younger populace, in conjunction with a shift away from the agricultural sector, has understandably led to an increase in India’s urbanisation rate. India’s urban population is expected to more than double by 2030 [viii]. Its cities will be asked to hold more than 300 million more people [ix], which will accelerate the use of modern fuels, lead to a rise in appliance and vehicle ownership, and provide an uptick in demand for construction materials, all of which are expected to increase greenhouse gas (GHG) emissions.

The urban transition also means that there will be a move away from the use of biomass fuels, currently being used for heating and cooking fuel in almost 65 percent of Indian households as of 2013. Electricity and oil are expected to make up more than 60 percent of the energy used in these households by 2040 [x].

As of 2013, India made up only 5.7 percent of the world’s energy demand, despite having 18 percent of the world’s population. The upcoming shifts in India’s demographics, economic structure and urban makeup are guaranteed to increase India’s energy consumption rapidly, however. Already below the world average with an electrification rate of 78.7 percent [xi], it is estimated that the country’s power system needs to quadruple in size to keep pace with the 600 million new electricity consumers that will be added by 2040. This will require India to add an additional 900 GW of new capacity, as projected by the International Energy Agency (IEA) under its New Policies Scenario [xii].

In order to meet projected energy demands, India has set ambitious targets to expand its capacity. Having outperformed its 5-year capacity targets by 15 percent, it seems that India is on its way to meeting short term demands [xiii]. India has also reiterated its commitment to a low carbon path towards energy with plans to expand its renewable energy capacity to 175 GW in the medium term.

The challenge of an Indian low carbon transition

India’s power sector – A brief overview

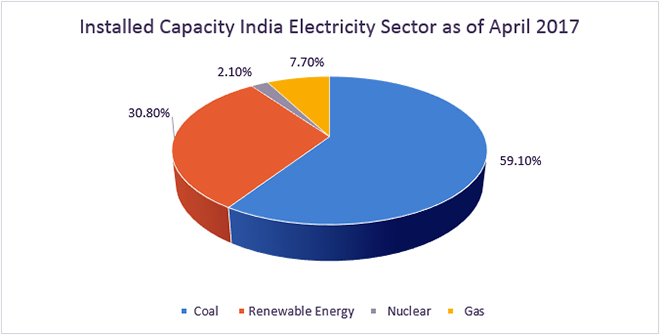

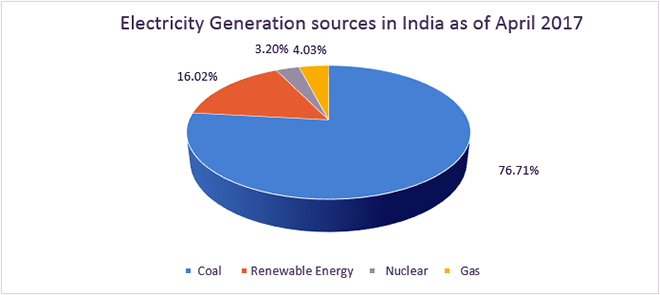

Indian electricity is powered by four sources – coal, renewable energy, natural gas and nuclear energy. Close to 60 percent of India’s power generating capacity comes from coal. Renewable energy accounts for approximately 30 percent of capacity with natural gas and nuclear energy making up the remaining 10 percent.

Actual electricity generation differs from installed capacity due to the intermittency of power from renewable energy sources and distribution and transmission related issues. Coal is once again dominant, accounting for approximately 77 percent of electricity generated. Approximately 16 percent of electricity generated comes from renewable energy sources with the remaining 7 percent split between natural gas and nuclear energy.

As of 2015, power generation in India accounted for 44 percent of domestic GHG emissions [xiv]. India must take decisive steps in regards to its power sector, in order to drive future growth while limiting carbon emissions.

Challenges in renewable energy

Renewable energy is perhaps the key to ensuring India’s low-carbon transition. India has ambitious plans in this regard and aims to have 40 percent of total installed capacity come from renewable energy by 2040 [xv]. A significant portion of this will come from solar and wind, which is expected to account for 340 GW of installed capacity by 2040[xvi].

There are issues that come into play when reaching for these goals, however. The main sources for renewable energy are solar plants, wind farms and hydropower dams, all of which require significant investment. India hopes to attract $100 billion per year [xvii] to fund its investments in renewable energy. However, there are many hurdles that need to be jumped in order to procure investments for renewable energy projects.

Renewable energy projects have certain conditions associated with them, which tend to dissuade short term investors. Requiring large scale upfront investments, renewable energy projects tend to attract long term investors (i.e. Pension Funds, Insurance Funds and Sovereign Wealth Funds) who are willing to wait for 20 years in order to start seeing positive returns. These long-term investors should find the guaranteed, predictable, currency-risk hedged returns associated with renewable energy projects attractive. It has been difficult, however, to bring such investors on board for a number of reasons. Some of these can be attributed to issues that affect renewable energy investments worldwide and some are specific to India and other emerging economies.

One of the major issues that discourages long-term investors worldwide are the Basel-III norms. Usually an investment is made using a mix of the investors’ own money and bank-financed debt. The Basel-III norms, which are a set of international banking macro-prudential regulations, place restrictions on the amount of debt that a bank can loan for long-term “risky” projects. This puts severe financial stress on investors who either must place all of their own money into the project or take out loans at substantially higher rates as compared to similarly risked projects [xviii]. Given these circumstances, investors tend to be leery of investing in renewable energy projects.

In addition to global barriers to investment for renewable energy investments, there are also problems specific to India. International sovereign wealth and pension funds tend to have risk-averse mandates which limit their appetite for what they view as regulatory uncertainty in India [xix]. These regulatory risks can manifest themselves in various forms, from changes in the tax codes, to a lack of protection for policy change regarding power purchase contracts, to a lack of enforcement when it comes to upholding said purchase agreements [xx].

Additionally, concerns about the legal system also tend to dissuade investors. India is currently ranked 172 out of 190 countries when it comes to enforcement of contracts [xxi]. Oftentimes contractors and vendors sign on to agreements, with no intention of honouring the contract because they know that it will not be enforced in court. A common tactic used by contractors and vendors in India is to press for renegotiation of contracts for infrastructure projects by using the threat of extended delays and cost overruns [xxii].

A third significant concern that investors seem to have centres on the delays inherent in Indian infrastructure projects. A simple example of the delays can be illustrated by showing the bidding process put into place by the Indian government. India is currently using the Swiss Challenge bidding process [xxiii] for infrastructure projects which enforces an 18-month open period before a bid can be awarded. An additional 8-12 months are usually required for financial close, leading to actual construction beginning a projected 30 months after the bid opens – double that of the Australian bid process [xxiv]. The long lead up time is problematic for investors as a number of regulatory, legal or currency related changes can occur during the period thereby affecting the profitability of the project.

Another issue that affects investors is a lack of built-up capacity for the analysis of Indian renewable energy projects. When making investment decisions, investors want to acquire as much information as possible. They like to know what the value of comparable companies are; the amount similar companies have been bought for in the past; and how much value their investment can provide based on projections. Investors also like to have choices when making their investment decisions – they want to look at three or four possible projects in a particular sector and judge them against each other in order to make the best possible investment. While sources such as the International Renewable Energy Agency (IRENA) marketplace exist for other geographies, when it comes to assessing India renewable energy projects investors tend to have very limited information. The best source of information regarding investments in Indian renewable energy lists only 20 projects and was last updated five years ago [xxv].

Challenges faced by the Indian coal sector

Coal remains India’s largest non-renewable energy source with 125.9 billion tonnes of recoverable coal available within its geographic boundaries [xxvi]. With a current capacity of 205 GW [xxvii], 60 percent of India’s power generation capacity is coal-based. Actual power generation numbers are even higher with 76 percent of India’s electricity in 2015 coming from coal.

Coal will continue to play a large part in the energy mix for India moving forward. Based on current projections, coal demand will be two and a half times current demand by 2040, resulting in India becoming the second-largest coal producer as well as the largest coal importer in the world [xxviii]. While coal’s electricity generation share is expected to drop from 77 percent to 60 percent by 2040 [xxix], the amount of actual coal burned will more than double in absolute terms. More than a third of Indian carbon emissions are directly linked to coal [xxx], and as such it is important that reducing inefficiencies in the sector are prioritised.

Although it is abundantly available, the quality of Indian coal is subpar when compared to other international traded coals [xxxi]. The energy content of Indian coal allows it to generate only 50 percent to 66 percent of the energy that other grades of coal can generate. Indian coal also happens to have high ash and low sulphur content which have been shown to lead to higher GHG emissions.

Although it is abundantly available, the quality of Indian coal is subpar when compared to other international traded coals.

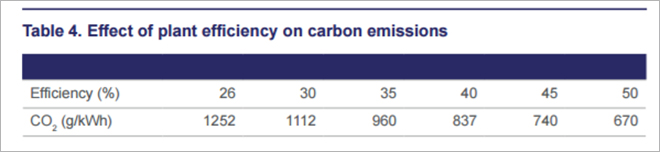

Almost all Indian coal plants can be classified as “subcritical” [xxxii]. Operating at an average efficiency of 28 percent, Indian coal plants produce 146 percent of the emissions produced by average global coal plants [xxxiii]. The quality of coal and the technology used by Indian plants has led to India ranking as the third least efficient coal-fired power generation nation [xxxiv].

Another source of inefficiency in the coal sector originates from the amount of energy that is consumed by the power plant itself when generating power. Referred to as auxiliary power consumption, Indian coal plants on average consume 8.7 percent of the power that they generate. This rate is three percentage points higher than the auxiliary power consumption of European coal plants [xxxv]. The 8.7 percent average also hides high variability between Indian coal plants, with certain plants having a much larger auxiliary power consumption rate and subsequently emitting even more fruitless greenhouse gases.

Challenges faced by the Indian natural gas sector

As stated in the previous section, India is heavily dependent on coal for a substantial portion of its electricity generation. Taking into account the high carbon content and inefficiencies associated with the use of coal, alternative thermal power sources could help facilitate India’s low carbon transition. Considering its relatively low rates of carbon emissions along with declining costs across the industry, natural gas is a viable alternative option.

With 52.58 trillion cubic meters of proven reserves [xxxvi], natural gas makes up a sizeable proportion of India’s available non-renewable energy sources. Natural gas production has grown rapidly over the past 35 years for India, increasing from 150 million cubic feet per day in the 1980-1981 to 5 billion cubic feet per day in 2010-2011. Approximately 45 percent of India’s natural gas production is currently being used for power generation [xxxvii]. India also imports an additional 2 billion cubic feet per day of natural gas, most of which is supplied by Qatar. Despite its significant reserves and imports, natural gas does not play a big role in India’s power sector, contributing to just 4 percent of India’s electricity generation in 2015 [xxxviii] for a variety of reasons.

Natural gas has largely been unable to establish a foothold in India, due to the lack of built up pipeline infrastructure. India currently has a natural gas pipeline network of about 15,000 km [xxxix]. The United States in comparison has a natural gas pipeline network of almost 500,000 km [xl]. Simply put, there is no way for natural gas to reach its intended consumers, no matter how much is produced. The infrastructure issues also carry over to the importation of natural gas, as there are only three terminals available for natural gas imports to be brought into the country, limiting India to a maximum of 2.56 billion cubic feet per day [xli]. While India has engaged with Iran and its neighbours in the hopes of building a transnational natural gas pipeline, regional political strife has not allowed any project to get past the initial discussion stages [xlii].

In addition to end consumer delivery issues, natural gas in India also has a pricing issue. Despite a dramatic fall in global natural gas prices, electricity generated from natural gas plants in India continues to cost double of what is generated by coal plants [xliii]due to taxes and transportation costs. This has led to Indian natural gas plants currently operating at 25 percent of their capacity with several gas plants now considered stranded assets by the Indian government [xliv].

Challenges faced by the Indian nuclear energy sector

Incorporating nuclear power into the energy mix has long been an ambition for the Indian government and it is easy to see why given its emission-free nature and consistent output [xlv]. The current administration has reiterated its commitment to nuclear power with plans to grow capacity to 63 GW by 2032 and supply 25 percent of all of India’s electricity through nuclear power by 2050 [xlvi].

These ambitions stand in stark contrast with India’s current nuclear power capabilities, however. With 22 reactors providing an installed capacity of 6.7 GW, nuclear power makes up little more than 2 percent of India’s electricity capacity [xlvii]. The amount of energy generated from nuclear power happens to be marginally higher, making up 3.20 percent of total electricity generated in 2016. [xlviii] There have been a number of barriers that have prevented India from scaling up its nuclear power capabilities.

One of barriers for the nuclear sector is the cost of electricity generated by nuclear power plants in India. A unit of nuclear power currently costs 45 percent more than solar power and close to 100 percent more than coal[xlix], leaving it an economically unviable alternative for consumers. While the nuclear power sector in India is currently publicly owned, the higher consumer prices associated with nuclear power continue to act as a deterrent for private sector entry into the market.

Another barrier of entry into the Indian nuclear energy sector stems from the lack of domestic manufacturing capability. The inherent complexity and stringent safety requirements in the building of nuclear power plants requires a reliable supply chain of components, as well as stability in the capacity and costs of materials. India’s current manufacturing capabilities only allow for construction of reactors with a capacity of 700 MWs, leading to a reliance on foreign suppliers for any large-scale projects [l].

A third issue affecting the nuclear energy sector world-wide, ties into the issue of safety and the perceived risks that are associated with nuclear power plants. Large scale disasters such as Fukushima and Chernobyl have eroded public confidence in nuclear power plant safety mechanisms. While the perceived public risk is often much higher than the objective risks that are calculated [li], the political ramifications associated with the building of nuclear power plants tend to act as a disincentive for both nuclear energy corporations and regulators.

The chief barrier to the scaling up of nuclear power, however, is the start-up costs associated with nuclear power plant construction and the resulting financing requirements. With cost estimates for new power plant construction ranging anywhere from $2 billion to $9 billion [lii], nuclear power faces many of the same investment barriers associated with renewable energy, as well as additional nuances specific to the sector. One such disincentive comes in the form of stringent legal clauses in India which hold investors liable for all costs associated in a disaster scenario.

Large construction delays, cost overruns, the possibility of a large-scale catastrophe, and extensive start-up costs have made nuclear a high-risk proposition for any investor regardless of the country.

Issues within the electrical grid structure

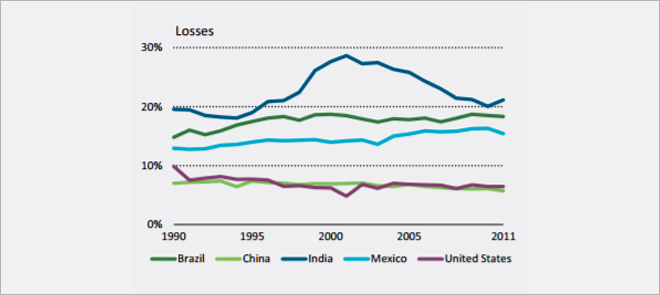

The inefficiencies that are prevalent within other parts of the India power sector, can also been seen in India’s electrical infrastructure. In 2012, India generated 1130 TWh of electricity, making it the third-largest electricity producer in the world after China and the United States. India’s electricity consumption during that period, however, was only 870 TWh, which meant that 23 percent of the electricity that was generated during the year was lost [liii]. This served to further exacerbate the coal and natural gas sectors inefficiency issues leading to increased levels of GHG emissions.

The major reason for these inefficiencies in power delivery is power theft. This is often accomplished by the illegal tapping of existing lines, through meter fraud and unmetered usage by end-consumers. The consequences of power theft include increased usage of coal and natural gas for power generation resulting in increased carbon emissions.

India’s urban transition troubles

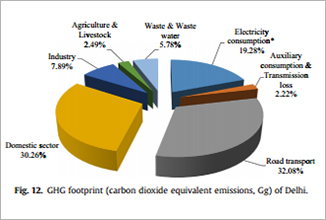

While the power sector is responsible for close to half of the greenhouse gases that are emitted by India [liv], it is important to not be myopic with regards to the climate change mitigation in the Indian context. Additional man-made sources of Indian carbon emissions include the transportation sector which accounts for 10 percent of emissions as well as industrial manufacturing process which makes up 9 percent of emissions and solid waste processes which produce 3.5 percent of Indian greenhouse gases [lv]. The majority of these non-power emissions occur in large urban areas and can be reduced if proper planning is in place. India is about to go through a transformative period in relation to its urban areas which, if managed properly, could play a vital role in fulfilling India’s ambitions for low carbon growth.

One of the major influencers in high GHG emissions from the transportation sector is usually the “sprawl” of a city and the resulting transportation requirements [lvi]. A city with larger boundaries will result in greater travel requirements for residents which consequently leads to greater transport related GHG emissions. This holds especially true for cities lacking adequate public transportation systems. More compact cities, however, tend to have less per capita consumption, regardless of their population [lvii]. Globally, high population cities tend to emit less greenhouses per capita, largely due to their density and developed public transportation sector.

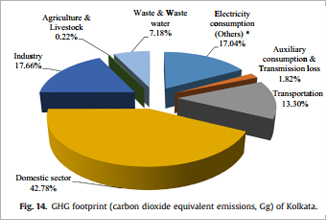

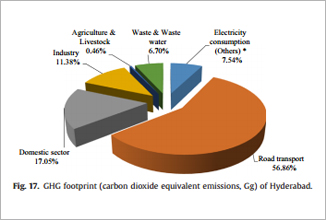

When examined on a granular level, trends in Indian cities mirror global archetypes with regards to urban area GHG emissions. The transportation sector makes up almost 30 percent of GHG emissions in the seven largest Indian cities, making it by far, the dominant non-power related contributor to GHG emissions [lviii]. Transportation based GHG emissions for larger Indian cities with established public transportation systems tend to be on the lower side, while the rapidly expanding IT oriented cities (Bangalore and Hyderabad) tend to have a larger percentage of their GHG emissions originating from the transportation sector.

Waste & waste water make up the second-largest contribution to pure non-power based GHG emissions, ranging from 3.72 to 8.46 percent of Indian city GHG emissions [lix]. It should be noted that a significant portion of GHG emission contributions from the Industry Sector could be because of industrial processes. Information on GHG emissions because of industrial processes is currently unavailable on a granular level for the seven largest Indian cities, unfortunately.

|

|

|

|

Opportunities for a low carbon transition

While the major sources of carbon emissions in India have been identified, and the issues that could prevent India from effecting a meaningful low carbon transition have been discussed, it is important that the opportunities that are available to India are also examined.

In the renewable energy field, possible opportunities to increase funding include the use of financial instruments, increased government incentives and wholesale policy changes eradicating many of the legal and bureaucratic roadblocks. Newer plant technology and updated methodologies could provide opportunities to reduce emissions from the coal sector. Investing in infrastructure and domestic capabilities in both the natural gas and nuclear energy sectors could also give India the opportunity to use cleaner alternative energy sources in the future.

Careful management of India’s urban transition and the use of recapture technologies in the waste & waste water sector could also provide the opportunity for India to successfully achieve its ambitions of a low carbon transition.

Renewable energy opportunities

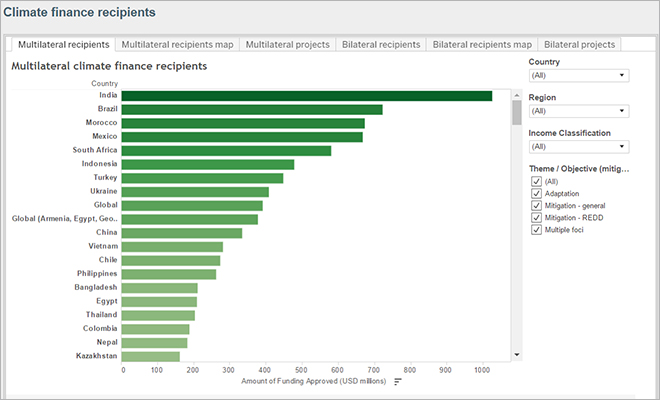

As has been previously discussed, the main issue facing renewable energy in India is funding. One of the well-publicised sources for renewable energy funding is international public funding. India has been successful in tapping into this source and has gained access to a number of different multilateral and bilateral streams. While there are conflicting reports on the amounts, funding for renewable energy varies between $1 billion and $2 billion depending on the source [lx]. These numbers, however, pale in comparison to the $100 billion per year that India hopes to procure, so a scaling up of multilateral and bilateral funding for renewable energy projects is a must.

Another potential way to bypass investment hurdles associated with renewable energy projects in India comes from special climate finance instruments such as green bonds. While still nascent in their development, green bonds have shown significant potential globally and have already been brought into the Indian market [lxi]. Unfortunately, there have been instances of green financial products and instruments (especially green bonds) being used to fund projects weakly linked to actual renewable energy projects. Green bonds also do not do much in terms of attracting international investment, as political and currency risk is still applicable when investing in renewable energy products through bonds.

The Indian government has taken a number of steps in order to incentivise investments in the renewable energy sector, but could do more. The steps that have been taken include tax breaks, accelerated depreciation, and partial guarantees on investments for entrepreneurs [lxii]. Additionally, the Indian government has also put forth legislation which requires distribution companies to obtain a certain portion of their electricity from domestic renewable energy companies [lxiii]. There have also been discussions on the viability of government sponsored currency hedging facilities for investors [lxiv].

However, in the end, there is no question that the government must do more to find methods by which investors can see reduced, or more transparent, risks associated with renewable energy projects. Policies bypassing outdated legal doctrines, restructuring of the distribution companies and new flexible power purchase agreements are all necessary to increase the flow of private capital for renewable energy projects. Partnerships with ratings agencies, with public sector agencies and companies, local authorities, and so on, must also be strengthened so that returns can be made more predictable and thus the projects themselves can appear more attractive. A revamping of the government bureaucracy to prevent extended delays, along with capacity building and socialisation measures for both international and domestic investors, should also help to bring about more investments in renewable energy projects.

Coal sector opportunities

Barring a quantum leap in technology, coal will remain the dominant part of India’s power mix for the foreseeable future. For India to continue to develop and grow while also keeping to the promises it has made in its INDC, it is imperative that there is a shift towards clean coal.

One of the first steps that can be taken involves the scaling up of investments in coal plant technology that burns coal with greater efficiency and generate fewer carbon emissions i.e. Super Critical and Ultra Super Critical plants. There have been policy mandates by the Indian government which have forced 40 percent of new coal plants that are being built, to be of a higher quality [lxv]. While this is a start, the government must also start to consider shuttering plants with old technology and building Ultra Super Critical plants in its place. Although the process will require costly upfront investments, future returns and dividends both economic and carbon based will make it worthwhile. A commitment towards the improvement of auxiliary power consumption rates across the country can also put a sizeable dent in the amount of greenhouse gases that are being emitted.

A reduction in carbon emissions from coal plants can also be brought about using a process that is termed coal washing. Coal washing reduces impurities and improves coal quality, reducing the amount of coal that needs to be burned to achieve energy benchmarks. Coal washing has been identified as a key technology for investment by the Indian government, but it has fallen short of the targets that it has set for itself in the past [lxvi]. It would behove the Indian government to make a more concerted effort to bring coal washing technology into the mainstream for both economic and environmental reasons.

Natural gas opportunities

Given current and foreseeable low costs and its relatively environmentally friendly nature, natural gas is an obvious area of investment for the Indian government. In order to capitalise on the opportunities natural gas provides, there are a number of steps that can be taken by the Indian government.

Currently, the domestic natural gas pipeline is restricted to the Northern and Western portions of the country. The Indian government has implemented a five-year plan to double the Indian gas pipeline infrastructure, with expansion focused on the geographical areas of the country that are currently underserviced [lxvii].

There are also plans to quadruple the capacity of natural gas regasification terminals which will effectively quadruple the amount of gas that can be imported into the country [lxviii]. Aggressive measures can still be taken on the infrastructure front, however, to truly make natural gas a large portion of India’s power mix. A powerful step that the Indian government can take to bolster its natural gas infrastructure is to allow privatisation of certain parts of the industry to accelerate the build-up of infrastructure.

The pricing issues associated with natural gas must also be addressed. The current price of Indian natural gas needs to be brought down by reduced taxation as well as subsidisation of certain costs (transportation), in order to make it competitive with coal.

Nuclear energy opportunities

The current climate for Nuclear Energy is fraught with uncertainty. On March 31st, 2017, Westinghouse filed for bankruptcy due to design issues and cost overruns related to two U.S. based projects [lxix], throwing the future of the APR1000 plant prototype into question. The EPR reactor prototypes, widely used in France, have faced huge delays and design flaw issues in their most recent projects [lxx]. These issues, combined with stringent liability laws, have limited India’s options in the nuclear energy field somewhat. There are still certain opportunities that India can avail itself of, however.

A potential panacea for all of India’s nuclear energy-related issues comes in the form of the domestically designed Advanced Heavy Water Reactors (AWHR). Fuelled by thorium instead of uranium, AWHR reactors are an attractive option given the vast reserves of thorium present in India. The reactors are still in the process of being developed, however, and will require an extended timeline to be implemented given the 15-year process required in producing certain key materials [lxxi]. In the best-case scenario, large scale deployment of AWHRs will only be possible by the 2040s.

A potential panacea for all of India’s nuclear energy-related issues comes in the form of the domestically designed Advanced Heavy Water Reactors (AWHR). Fuelled by thorium instead of uranium, AWHR reactors are an attractive option given the vast reserves of thorium present in India.

The most realistic option for the scaling up of nuclear energy in India lies with the Pressurised Heavy Water Reactors (PHWR) prototype. More than 66 percent of Indian nuclear energy is currently generated from nuclear power plants using the PWHR prototype. An additional four reactors are expected to be completed by the end of 2017, pushing the share of nuclear energy generated by PHWR’s up to 76 percent. Despite their dominance in the Indian nuclear energy sector, there are issues associated with the prototype, chief among them the limited amount of power generated by each reactor (700 MWs) and the limited energy efficiency of the uranium used to fuel the reactor.

Despite these issues, the Indian government has announced plans to commission an additional 10 power plants using the PHWR prototype. It is not clear how the government plans to finance the reactors yet. The expected costs of the projects, as quoted by government officials [lxxii], also seem optimistic when compared to recently built PHWR plants [lxxiii].

Tackling transmission and distribution inefficiencies

As discussed previously, India needs a more efficient power distribution infrastructure. There are multiple structural inefficiencies in the current set-up, as have already been discussed. The Indian government is currently taking steps to combat both issues, having rolled out a $4-billion programme to combat energy theft nationwide [lxxiv] and investing in studies on how to best deal with grid transmission issues [lxxv].

In order to achieve its energy goals while maintaining a low carbon transition, the Indian government needs to place a larger focus on reducing technical inefficiencies and transmission losses. Steps that could be taken in order to make the distribution system more efficient include heavy investment in smart grid projects, increasing inter-regional capacity, and separating electricity infrastructure for agricultural and non-agricultural users. If India can deliver electricity to end users efficiently, while curbing power theft, energy demands and subsequently carbon emissions will be lower.

Managing India’s urban transition

India’s rapid urbanisation gives the country an excellent opportunity to mitigate transportation and solid waste related emissions through careful planning. One solution aimed at managing future urban sprawl that has been implemented by the Indian government has been the use of urban master plans for all Indian cities. The central government has made it a legal requirement for all Indian cities and towns to file a legal document mapping the growth of the urban centre over the next 20 to 25 years on a Geographic Information System (GIS) platform.

While this is an important step in managing urban sprawl, there are more concrete steps that can be taken. One possibility could include the passing of legislature requiring urban centres to obtain construction approval from an urban climate committee. Another policy solution aimed at reducing the urban sprawl could be the commissioning of architects and urban planners familiar with green strategies to manage future urban centre construction.

The government has also put forth ambitious plans for the expansion of its public transport systems. Studies regarding the viability of shifting the current public transport systems to an electricity-driven system are currently underway by the Indian government, although further work needs to be done on the impact this will have on reducing emissions. Additionally, a regional rapid rail transit spanning almost 100 kilometres across the states of Delhi and Uttar Pradesh, as well as a city-based light rail transit system in Delhi, are in their beginning stages. A possible fantastical solution that has been proposed to the Indian government has been the construction of a national hyper loop rail.

Although these solutions will help in mitigating future carbon emissions, further solutions are required. Stricter road code polices and the enforcement of said road code policies could help with transport related emissions while also providing co-benefits in the form of air pollution reduction. The capture and use of the methane gas produced by sewage plants and landfills can significantly reduce GHG emissions while also providing the co-benefit of generating electricity [lxxvi]. In order to fund these projects, matchmaking services between growing cities and investors seeking climate friendly infrastructure projects could be built.

Conclusion

As can be seen, there are several challenges that India still faces as it attempts to conduct its low carbon transition. These challenges include, but are not limited to, obtaining funding for renewable energy projects, resolving inefficiencies in the coal sector, building capacity and infrastructure in the natural gas and renewable energy sectors and proper management of India’s upcoming urban transition.

It should be acknowledged that India has many opportunities to help conduct the transition as well. Policy shifts designed to increase private capital funding for renewable energy projects, technological shifts aimed at solving the inefficiencies in the coal sector, and updated methodologies for the management of urban sprawl in India’s growing cities could be the key to ensuring that India is the first emerging economy in the world to manage a successful low carbon economic transition.

In acknowledging the complexities associated with India’s low carbon transition, it is also important to contextualize the transition against India’s broader development goals. India, with a GDP per capita of $1,598 [lxxvii] and 12.8 percent of its population living in extreme poverty [lxxviii] is still very much an emerging economy and as such, should prioritise social development and economic growth.

Despite the importance of meeting broader development goals, an impending demographic shift, rapid urbanisation and a shifting economic makeup, India has made a substantial commitment to upholding its global moral obligations. As of 2016, India generates a higher percentage of its power from renewable energy than the United States. According to the IEA’s New Policies Scenario[lxxix], India will continue to remain below the world average in carbon emissions per capita for the next 35 years. Through both its actions and words, India has shown that it remains committed to a low carbon transition despite its development and economic needs. It remains to be seen whether the rest of the world will follow in India’s footsteps.

An earlier version of this piece was published by the Organisation for Economic Co-operation and Development (OECD) in May 2017. It can be found here.

Endnotes

[i] Harvey, Chelsea. 2017. “Trump may not be able to halt the world’s climate progress — thanks to China and India.” Washington Post.

[ii] International Energy Agency. 2015. India Energy Outlook. International Energy Agency.

[iii] Government Of India. n.d. “Intended Nationally Determined Contribution.”

[iv] United Nations Population Division. 2015. “World Population Prospects: The 2015 Revision.”

[v] Thomson Reuters. 2016. “India’s Demographic Dividend.” Thomson Reuters. 7 July.

[vi] Business Standard . 2016. “Impact of Make in India Programme .” Business Standard , 16 March.

[vii] International Energy Agency. 2015. India Energy Outlook. International Energy Agency.

[viii] Kumar, Manish. 2016. “India’s Challenge of Disordered Urbanisation.” The Hindu.

[ix] Ibid.

[x] International Energy Agency. 2015. India Energy Outlook. International Energy Agency.

[xi] World Bank. n.d. Private Participation in Renewable Energy Database. http://ppi-re.worldbank.org/snapshots/country/india.

[xii] International Energy Agency. 2015. India Energy Outlook. International Energy Agency.

[xiii] Central Electricity Authority. 2016. “National Electricity Plan 2016.”

[xiv] Ministry of Enviornment, Forest and Climate Change. 2015. “India First Biennial Update Report to the United Nations Framework Convention on Climate Change.”

[xv] Government Of India. n.d. “Intended Nationally Determined Contribution.”

[xvi] International Energy Agency. 2015. India Energy Outlook. International Energy Agency.

[xvii] Office of the Chief Economist, Australia. 2015. “Coal in India 2015.”

[xviii] Mintz and Levin. 2012. “Renewable Energy Project Finance in the U.S.: An Overview and Midterm Outlook.”

[xix] Srivastava, Moulishree. 2013. “India is a high risk market due to regulatory issues: Colin Dyer.” livemint.com.

[xx] Davis, Henry. 2008. Infrastructure Finance: Trends and Techniques.

[xxi] International Finance Corporation. 2011. Doing Business 2011: Making a Difference for Entrepeneurs.

[xxii] Insights On India. 2016. “ Renegotiation of PPP contracts becomes a reality.” Insights on India.

[xxiii] Times of India. 2016. “Swiss Challenge method gets panel nod.” Times of India.

[xxiv] Department of Infrastructure and Regional Development – Australia. 2008. “National Public Private Partnership Guidelines.”

[xxv] World Bank. n.d. Private Participation in Renewable Energy Database. http://ppi-re.worldbank.org/snapshots/country/india.

[xxvi] Ministry of Coal – Government of India. 2016. Coal Reserves. http://coal.nic.in/content/coal-reserves.

[xxvii] McHugh, Liam. 2016. “What’s Driving India’s Coal Demand Growth.” World Coal Association.

[xxviii] International Energy Agency. 2015. India Energy Outlook. International Energy Agency.

[xxix] Ibid

[xxx] Srivastava, Moulishree. 2013. “India is a high risk market due to regulatory issues: Colin Dyer.” livemint.com.

[xxxi]Ministry of Coal – Government of India. 2016. Coal Reserves. http://coal.nic.in/content/coal-reserves.

[xxxii] Central Electricity Authority. 2016. “National Electricity Plan 2016.”

[xxxiii] Office of the Chief Economist, Australia. 2015. “Coal in India 2015.”

[xxxiv] DNA India. 2015. India 3rd Least efficient coal-fired power generating nation. March.

[xxxv] CSE India. n.d. “Thermal Power in India.”

[xxxvi] Central Intelligence Agency. 2016. The World Factbook – Natural Gas Proven Reserves .

[xxxvii] Rice University and Harvard Kenedy School. 2013. “Natural Gas in India: Difficult Decisions.”

[xxxviii] Central Electricity Authority. 2016. “National Electricity Plan 2016.”

[xxxix] Ministry of Petroleum and Natural Gas. n.d. “Natural Gas Scenario in India.”

[xl] Energy Information Administration. 2007. About U.S. Natural Gas Pipelines. https://www.eia.gov/pub/oil_gas/natural_gas/analysis_publications/ngpipeline/index.html.

[xli] Maratime Explorer. 2014. “Gas Infrastructure Lags in India.” Maratime Explorer.

[xlii] Rice University and Harvard Kenedy School. 2013. “Natural Gas in India: Difficult Decisions.”

[xliii] Chakraborty, Debjit and Singh, Rajesh Kumar. 2016. “India’s Top Utility said to seek end to imported-gas supply deal.” Bloomberg, 5 August.

[xliv] Sharma, Shardul. 2016. “India Allocates Imported Gas to Nine Power Plants.” Natural Gas World, 5 September.

[xlv] Mohan, Aniruddh. n.d. “The Future of Nuclear Energy in India.”

[xlvi] World Nuclear. 2017. “Nuclear Power in India.” world-nuclear.org. January. http://www.world-nuclear.org/information-library/country-profiles/countries-g-n/india.aspx.

[xlvii] Central Electricity Authority. 2016. “National Electricity Plan 2016.”

[xlviii] Government of India. 2016. Growth of Electricity Sector in India from 1947-2016. New Delhi: Government of India.

[xlix] The Hans India. 2016. Cheaper Renewable Energy outpaces nuclear energy. 20 March .

[l] Mohan, Aniruddh. n.d. “The Future of Nuclear Energy in India.”

[li] Anni Huhtala and Piia Remes. 2014. Dimming Hopes for Nuclear Power: Perceptions of Risk as Shadow Cost. Government Institute for Economic Research.

[lii] Union of Concerned Scientists. n.d. Nuclear Power Cost. http://www.ucsusa.org/nuclear-power/cost-nuclear-power#.WN5tiNJ97s0.

[liii] Office of the Chief Economist, Australia. 2015. “Coal in India 2015.”

[liv] Ministry of Enviornment, Forest and Climate Change. 2015. “India First Biennial Update Report to the United Nations Framework Convention on Climate Change.”

[lv] Ibid.

[lvi] Sridhar, Kala Seetharam. 2010. “Carbon Emissions, Climate Change, and Impacts in India’s Cities.”

[lvii] The World Bank. 2010. “Cities and Climate Change: An Urgent Agenda.”

[lviii] T.V. Ramachandra, Bharath H. Aithal, Sreejith K. 2015. “GHG footprint of major cities in India.” Renewable and Sustainable Energy Reviews.

[lix] Ibid.

[lx] Climate Funds Update. 2016. Climate Fund Recepients.

[lxi] Vijayakumar, Sanjay. n.d. “Understanding Green Bonds and greener way of financing.” The Hindu.

[lxii] Indian Renewable Energy Development Agency. 2011. “Investment Opportunites – Indian Renewable Energy Sector.”

[lxiii] Ibid.

[lxiv] Climate Policy Initiative. 2015. “Reaching India’s Renewable Energy Targets Cost-Effectively: A Foreign Exchange Hedging Facility.”

[lxv] Central Electricity Authority. 2016. “National Electricity Plan 2016.”

[lxvi] Ibid.

[lxvii] Petroleum and Natural Gas Regulatory Board. n.d. “Vision 2030: Natural Gas Infrastructure in India.”

[lxviii] Ibid.

[lxix] Lee, Jan. 2017. “Westinghouse Bankruptcy: The End of Nuclear Power? .” TriplePundit. 3 April.

[lxx] Mohan, Aniruddh. n.d. “The Future of Nuclear Energy in India.”

[lxxi] Ibid.

[lxxii] Busvine, Douglas. 2017. “Foreign Suppliers urged to step up as India backs own nuclear design.” Reuters International, 18 May .

[lxxiii] Mohan, Aniruddh. n.d. “The Future of Nuclear Energy in India.”

[lxxiv] Reuters. 2014. “India to invest $4 billion to tackle power theft.” The Times of India, 21 November.

[lxxv] International Energy Agency. 2015. India Energy Outlook. International Energy Agency.

[lxxvi] Environmental Protection Agency. n.d. “Methane Capture and Use.” https://www3.epa.gov/climatechange/kids/solutions/technologies/methane.html.

[lxxvii] World Bank Group. 2015. “Ending Extreme Poverty and Sharing Prosperity: Progress and Policies.”

[lxxviii] Ibid.

[lxxix] International Energy Agency. 2015. India Energy Outlook. International Energy Agency.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.