A Greek tragedy is waiting to happen in Europe. Greece will probably have to leave the euro zone and go back to its old currency which has been the drachma since the time of Alexander the Great. But fearing the exit, thousands of Greeks have been withdrawing their euros from banks. There is fear of capital flight which can be disastrous for an economy already burdened with a huge debt.

Greece’s bailout is being worked out by the European Commission, the IMF and the European Central Bank. The Greek government is going to the polls again next month in order to have a workable, unified coalition that can decide about the crisis which has led to a huge rise in unemployment. Already Greece and Spain have 20 per cent unemployment, but for their youth it is more than 50 per cent.

Greece’s problems, which started in 2009, are casting a deep shadow on world stock markets and India is also feeling the impact. The BSE Sensex took a deep plunge though it has recovered recently. The rupee has been falling in terms of the dollar during the last few weeks touching an all-time low of Rs 56.38 to a dollar but has recovered slightly after the RBI’s assurance of its intervention to rectify the situation. Since the beginning of the crisis, foreign institutional investors (FIIs) have been fleeing emerging market countries like India and going to safer places like the US or Canada.

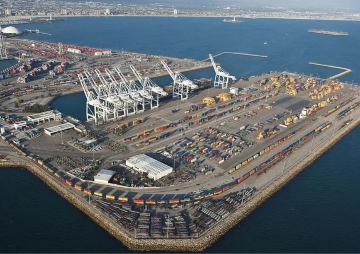

The withdrawal of around 43 per cent of the investment funds from Indian markets in the last one year has been partly responsible for the rupee going down because it created a vacuum in the supply of dollars. This has been exacerbated by an increase in the demand for dollars from importers as exports have been outpaced by imports and the trade deficit has widened to $13.4 billion in April. India’s current account deficit stands at $185 billion (2011-2012), an unsustainable 4.3 per cent of the GDP.

Exporters have benefited from the falling rupee but costs have gone up for industry as all imported inputs are costing more. Oil imports will cost more and India imports around 80 per cent of its requirements. Students’ fees, tourist expenditure and servicing of India’s short-term debt by the corporate sector will be much higher. Around $137 billion debt repayment by the corporate sector is due in the next 12 months. There would be more problems for the Indian industry which is going through a bad patch as is evident from the industrial growth which shrank by 3.5 per cent in March.

How did the Greek crisis happen? Many Eurozone members (17 countries using the euro) blame it on the socialist government which was in power under President George Papandreou. The government went about in a ’profligate’ manner, increasing spending on pension funds and wage hikes and not worrying about the size of the budget deficit which kept on increasing. It began borrowing from the market to bridge the fiscal deficit at increasingly high interest rates. Finally, it led to a very high, unmanageable sovereign debt and landed the government in a terrible crisis.

Austerity measures were applied at the behest of the European Central Bank. There were huge protests in the streets of Athens as it led to big expenditure cuts. Since the crisis hit the Greek economy, there have been many bailout packages but none of the conditionalities that came with the packages has been acceptable to the Greek people. Germany, the most successful country of the EU today, has been insisting that the Eurozone crisis should be solved with the application of higher taxes and austerity measures. Others want Greece to have more labour reforms and wage freeze. The problem of high labour costs, low productivity, higher pension funds, low taxes and generally weakening of the export sector have been blamed for Greece’s problems. Greece also did not have the option of devaluing its currency in order to regain competitiveness and instead faced recession.

It has been very difficult for the Eurozone to manage the 17 economies that are members because while there is the European Central Bank in Frankfurt, there is no central fiscal policy or fiscal union. It also does not have a system of fiscal transfer to members. Thus, unlike in India, which is also a federation of 28 states, the weaker states are not getting a bigger amount of revenue sharing.

How the 17 Eurozone members manage their revenue collection and expenditure is up to the government of each member country. Some are managing well and sticking to the norm of 3 per cent fiscal deficit which means they are effectively controlling government expenditure and are keeping costs low while others have not been able to do so and are borrowing heavily to bridge the budget deficit. Greece is not alone in its problems of high debt because Spain, Portugal, Ireland, Slovenia and Italy are also in a similar situation. Most of the beleaguered countries in Europe are facing resentment against austerity measures from the public and it led to the return of Socialist rule in the recent French elections.

According to famous economist J.M. Keynes, more public spending in times of recession generates jobs and incomes and creates demand. It would require pump-priming the economy as too much austerity may throttle the demand - which is what is happening in Europe. The EU’s lower demand for goods and services is impacting the exports of important partners like India. This in turn is resulting in industrial slowdown. The Eurozone crisis will affect India’s service exports also especially when the time comes for renewing contracts.

Industrial growth is vital for India’s GDP growth which in turn is very critical for creating jobs for our youth. Industrial slowdown has been accompanied by high inflation though it has moderated from its previous double-digit level. But the Rs 7.50 per litre petrol price hike will lead to an increase in inflation because of a rise in transportation costs. High inflation will be disastrous for exports and for the wellbeing of the common person as it will result in the poor getting poorer.

Greece’s problems are clearly affecting the entire world, including India. Unless a proper package acceptable to the Greek government is offered, no headway can be made. In such a situation, cracks will appear in the Eurozone and Greece will have to quit it. It can then devalue its currency vis-à-vis the dollar and boost exports again. But a huge loss of hundreds of billions of euros will have to be borne by those Eurozone members who have underwritten the Greek debt. Spain, Portugal and Italy could be next to quit the Eurozone.

(The writer is a Senior Fellow at Observer Research Foundation)

Courtesy: The Tribune

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV