In recent years, Chinese investors have increasingly engaged in venture capital funding globally, including in Germany. Startups can benefit, because the provided capital can help them grow, and knowledge and contacts of investors can give them the wherewithal to expand into the Chinese and global markets. In addition, startups can get access to hundreds of millions of Chinese customers through Tencent’s WeChat app or Alibaba’s digital trade platform. The opportunities, however, must be weighed against potential risks not only for individual startups but for Germany, overall, as a (digital) business location in the medium- to long-term. In particular, investments have to be considered in the context of the current global competition around digital technologies, where activities of Chinese tech giants are increasingly perceived to be associated with the strategy of the country’s leadership.[60] The German government has responded to the identified risks by applying more scrutiny to investments, improving information exchange and coordination with other EU member states, and passing reforms of the competition law. Beyond that, the overall focus is to remain open to foreign investments and support German startups in their efforts to grow globally.

As China has long-term strategies, some foresight exercise can guide long-term policy action. While German startups see many opportunities in China’s market and want to join the “gold-rush atmosphere”, one key question is whether—and under which conditions—German startups will have a fair chance to make it big in the Chinese market, let alone become global players. Independent of whether they are physically present in China, or use digital platforms or apps as digital distribution channels to reach Chinese customers, startups rely on being part of the ecosystems of tech giants like Alibaba or Tencent, or support from local partners such as investors or their contacts. Therefore, startups need to adapt to the rules set by Chinese gatekeepers, and to the political conditions in the country in general. Eventually, startups are confronted with difficult questions, for instance whether they will censor online content, or disclose data of their users on request by Chinese authorities. As a consequence, German startups are likely to have similar experiences as US tech companies, which have struggled to comply with values that are fundamentally at odds and came to realise that they can no longer be politically neutral.[61]

In contrast, Chinese tech giants quickly and aggressively expand into German and European markets. There is a long way to go for them to conquer international markets and what is visible is only the beginning of the international journey of Chinese digital giants.[62] This raises another set of key questions: How much market power could they attain in the medium to long term? And while Chinese tech giants expand their market presence, will they play by German rules? Or will they try to pursue their own interests, knowing that they have the Chinese government‘s support and the possiblity to disrupt market access for German companies as a means of pressure?

Not unlike what is visible in other industry sectors, there is no level playing field in the startup economy. And the competition is not purely of economic nature, but also about political power and the ability to influence the discourse and norms regarding digital technologies. With their growing international reach, Chinese tech companies can shape the economic affairs of many states and businesses like their US counterparts have done previously. However, Chinese values and norms permeating their technology are largely incompatible with those of German and European societies. The stakes are high, and the question must be addressed whether access to the Chinese market is worth the risks in the long term.

(The author thanks the anonymous reviewer for their valuable comments, and Vinia Datinguinoo Mukherjee for her excellent editing.)

About the Author

Sabrina Korreck is a Senior Fellow at ORF.

Endnotes

[a] Venture capital is a form of private equity financing; typically, venture capital is provided to technology-oriented startups with high growth potential.

[b] Behind Japanese Softbank with 970 million Euro, Singaporean Temasek with 713 million Euro, US Insight Venture Partners with 681 million Euro, and Singaporean GIC with 427 million Euro.

[c] Fintech startups use technology to provide financial services; insurtech startups are one type of fintech that focus on insurance services.

[d] No expansion in Asia is being planned as of yet.

[1] Stephan Scheuer and Miriam Schröder, “Alibaba aquires German data startup in new stage of European expansion,” Handelsblatt, January 9, 2019.

[2] The data includes only funding rounds with disclosed investors. dealroom.co, “Shortage of later stage venture capital in Germany: more acute due to Corona crisis,“ March 2020.

[3] Caspar Tobias Schlenk, “Ant Financial plant Europa-Expansion,“ Capital, January 18, 2021.

[4] IT Finanzmagazin, “Chinesisches Venture Capital für Startup-Szene in Europa – Interview mit Hub-CEO Patt,“ August 24, 2020.

[5] Helene Fouquet and Giles Turner, “Huawei scouts Europe for tech startups to secure supply chain,” Bloomberg, January 31, 2020.

[6] Stephan Scheuer and Miriam Schröder, “Alibaba aquires German data startup in new stage of European expansion,” Handelsblatt, January 9, 2019.

[7] Tobias Weidemann, “Konkurrenz aus China kommt: JD.com und Alibaba greifen den deutschen Onlinehandel an,“ t3n, July 24, 2018.

[8] Stephan Scheuer, “Xiaomi plant Europazentrale mit Hunderten Mitarbeitern in Deutschland,“ Handelsblatt, February 17, 2021.

[9] E&Y, “Chinesische Unternehmenskäufe in Europa: Eine Analyse von M&A-Deals 2006-2019,“ February 2020.

[10] Paolo Cervini, Mark J. Greeven, “Digital China is coming to Europe,“ LSE Business Review, April 24, 2018.

[11] CB Insights, “The complete list of Unicorn Companies,“ as of January 24, 2021.

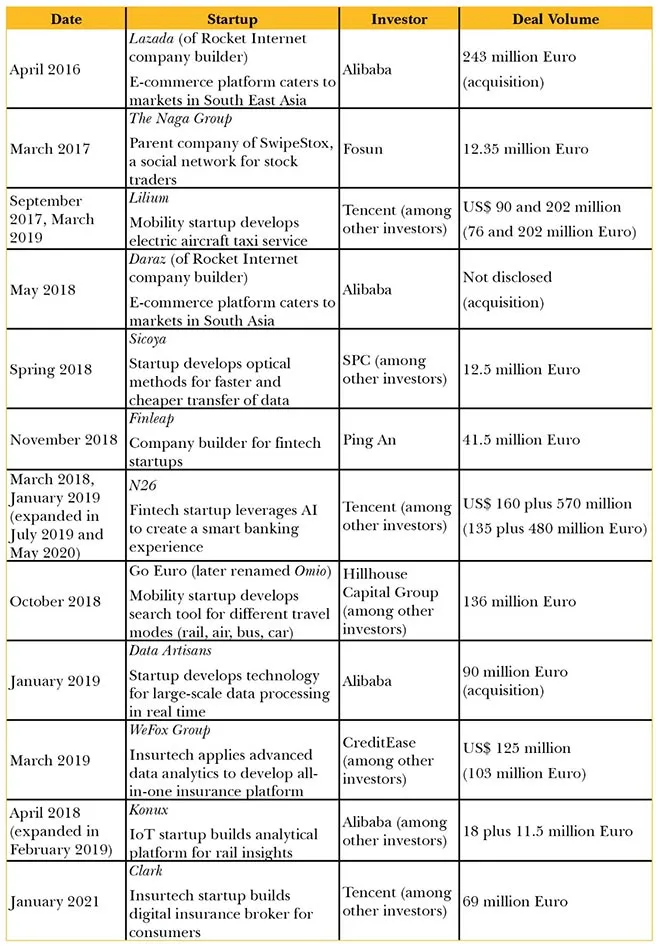

[12] Sources: Wirtschaftswoche, “Swipestox: Hohes Investment für Hamburger Fintech,” March 31, 2017, https://gruender.wiwo.de/swipestox-chinesischer-investor-setzt-auf-steigende-kurse/ ; Johannes Steger, “Was hinter der Verkaufstour von Rocket Internet steckt,“ Handelsblatt, May 9, 2018, https://www.handelsblatt.com/unternehmen/it-medien/daraz-deal-mit-alibaba-was-hinter-der-verkaufstour-von-rocket-internet-steckt/21256336.html ; Marie Mawad, “Tencent backs German startup’s high-speed flying jet taxi,” Bloomberg Quint, September 5, 2017, https://www.bloombergquint.com/technology/tencent-backs-german-startup-behind-high-speed-flying-jet-taxi ; Ingrid Lunden, “Lilium raises another $240M to design, test and run an electric aircraft taxi service,” TechCrunch, March 23, 2020, https://techcrunch.com/2020/03/22/lilium-raises-another-240m-to-design-test-and-and-run-an-electric-aircraft-taxi-service/ ; Karsten Seibel, “Deutsche Start-ups brauchen China,“ Welt, November 7, 2018, https://www.welt.de/print/welt_kompakt/webwelt/article183415780/Deutsche-Start-ups-brauchen-China.html ; Carla Neuhaus, “Chinesen kaufen sich in Berliner Fintech-Szene ein,“ Tagesspiegel, November 19, 2018, https://www.tagesspiegel.de/wirtschaft/ping-an-beteiligt-sich-an-finleap-chinesen-kaufen-sich-in-berliner-fintech-szene-ein/23654460.html ; t3n, “Neobank sammelt weitere 92 Millionen Euro ein,“ May 8, 2020, https://t3n.de/news/neobank-n26-sammelt-92-millionen-1276092/ ; Romain Dillet, “N26 raises $160 million from Tencent and Allianz,” TechCrunch, March 20, 2018; Romain Dillet, “GoEuro raises $150 million for its travel aggregator,” TechCrunch, October 2018; Stephan Scheuer and Miriam Schröder, “Alibaba aquires German data startup in new stage of European expansion,” Handelsblatt, January 9, 2019; Steve O’Hear, “Wefox Group, the Berlin-based insurance tech startup, raises $125M Series B led by Mubadala,“ TechCrunch, March 5, 2019; Pauline Schnor, “Alibabas überraschendes Millioneninvestment in Konux aus München,“ Gründerszene, February 13, 2019; Susanne Schier, “Versicherungsmanager Clark sammelt 69 Millionen Euro Kapital ein – Tencent steigt ein,“ Handelsblatt, January 11, 2021.

[13] German Private Equity and Venture Capital Association, Internet Economy Foundation and Roland Berger GmbH, “Venture capital, fueling innovation and economic growth,“ June 2018.

[14] dealroom.co, “Shortage of later stage venture capital in Germany: more acute due to Corona crisis,“ March 2020, https://blog.dealroom.co/wp-content/uploads/2020/03/Berlin-Capital-FINAL.pdf .

[15] Romain Dillet, “N26 raises $160 million from Tencent and Allianz ,” TechCrunch, March 20, 2018, https://techcrunch.com/2018/03/20/n26-raises-160-million-from-tencent-and-allianz/ .

[16] Susanne Schier, “Versicherungsmanager Clark sammelt 69 Millionen Euro Kapital ein – Tencent steigt ein,“ Handelsblatt, January 11, 2021.

[17] Marie Mawad, “Tencent backs German startup’s high-speed flying jet taxi,” Bloomberg Quint, September 5, 2017, https://www.bloombergquint.com/technology/tencent-backs-german-startup-behind-high-speed-flying-jet-taxi ; Ingrid Lunden, “Lilium raises another $240M to design, test and run an electric aircraft taxi service,” TechCrunch, March 23, 2020, https://techcrunch.com/2020/03/22/lilium-raises-another-240m-to-design-test-and-and-run-an-electric-aircraft-taxi-service/ .

[18] Lisa Hegemann, “Startups in China: Wie deutsche Unternehmer Fernost erobern,“ t3n, September 28, 2017, https://t3n.de/magazin/deutsche-startups-china-242762/ ; Bundesverband Deutsche Startups, „China: Mission des deutschen Startup-Verbands,“ https://deutschestartups.org/community/internationale-beziehungen/china/ .

[19] IT Finanzmagazin, “Chinesisches Venture Capital für Startup-Szene in Europa – Interview mit Hub-CEO Patt,“ August 24, 2020, https://www.it-finanzmagazin.de/fosun-europe-innovation-hub-china-110359/ .

[20] Pauline Schnor, “Alibabas überraschendes Millioneninvestment in Konux aus München,“ Gründerszene, February 13, 2019, https://www.gruenderszene.de/automotive-mobility/alibaba-investment-konux?interstitial_click .

[21] Carla Neuhaus, “Chinesen kaufen sich in Berliner Fintech-Szene ein,“ Tagesspiegel, November 19, 2018.

[22] Carla Neuhaus, “Chinesen kaufen sich in Berliner Fintech-Szene ein,“ Tagesspiegel, November 19, 2018.

[23] Florian Kolf and Stephan Scheuer, “Alibaba plant den Angriff auf Amazon,“ Handelsblatt, May 15, 2019.

[24] Kristin Shi-Kupfer and Mareike Ohlberg, “China’s digital rise: Challenges for Europe,” Mercator Institute for China Studies, April 2019, https://merics.org/sites/default/files/2020-06/MPOC_No.7_ChinasDigitalRise_web_final_2.pdf .

[25] Thomas S. Eder, Rebecca Arcesati and Jacob Mardell, “Networking the “Belt and Road” – The future is digital,” Mercator Institute for China Studies, August 28, 2019, https://merics.org/de/analyse/networking-belt-and-road-future-digital .

[26] Thomas S. Eder, Rebecca Arcesati and Jacob Mardell, “Networking the “Belt and Road” – The future is digital,” Mercator Institute for China Studies, August 28, 2019, https://merics.org/de/analyse/networking-belt-and-road-future-digital .

[27] Frank Specht, “Angst vor dem Ausverkauf: Deutschen Techfirmen droht Übernahme aus dem Ausland,“ Handelsblatt, March 27, 2019.

[28] Felix Lee, “Zur Kooperation gezwungen,“ taz, February 26, 2019, https://taz.de/Kommentar-Alibaba-expandiert/!5576722/ .

[29] The Federal Goverment of Germany, “In parallel, in opposition, in partnership?“ Ocotber 1, 2020, https://www.bundesregierung.de/breg-en/news/eu-china-relations-1795092 .

[30] Manoj Joshi, “Invest, acquire, dominate: The rise and rise of China tech,“ Observer Research Foundation, November 2019, Occassional Paper No. 223, https://www.orfonline.org/wp-content/uploads/2019/11/OP223.pdf

[31] Andrea Shalal, “Germany risks losing key technology in Chinese takeovers,“ Reuters, April 11, 2018.

[32] Phillipp Mattheis, “Reich werden im Kommunismus,“ Handelsblatt, October 26, 2014.

[33] Paolo Cervini, Mark J. Greeven, “Digital China is coming to Europe,“ LSE Business Review, April 24, 2018, https://blogs.lse.ac.uk/businessreview/2018/04/24/digital-china-is-coming-to-europe/ .

[34] Ming Zeng, “Alibaba and the Future of Business: Lessons from China’s innovative digital giant,“ Harvard Business Review, September-October 2018, https://hbr.org/2018/09/alibaba-and-the-future-of-business .

[35] Ming Zeng, “Alibaba and the Future of Business: Lessons from China’s innovative digital giant,“ Harvard Business Review, September-October 2018, https://hbr.org/2018/09/alibaba-and-the-future-of-business .

[36] Hong Shen, “China’s tech giants: Baidu, Alibaba, Tencent,“ Konrad Adenauer Stiftung (Ed.): “Digital Asia: Insights into Asian and European Affairs,“ pp.33-41, February 27, 2019, https://www.kas.de/en/web/politikdialog-asien/single-title/-/content/digital-asia-8 .

[37] IT Finanzmagazin, “Chinesisches Venture Capital für Startup-Szene in Europa – Interview mit Hub-CEO Patt,“ August 24, 2020, https://www.it-finanzmagazin.de/fosun-europe-innovation-hub-china-110359/ .

[38] Ming Zeng, “Alibaba and the Future of Business: Lessons from China’s innovative digital giant,“ Harvard Business Review, September-October 2018, https://hbr.org/2018/09/alibaba-and-the-future-of-business .

[39] Stephan Scheuer, Effy Zhang, “Tencent will in Europa zehn Millarden Dollar investieren – Fokus auf deutsche Hightech,“ Handelsblatt, December, 23, 2019.

[40] Manager Magazin, “Alibaba investiert 26 Milliarden in Cloud-Sparte,“ April 20, 2020, https://www.manager-magazin.de/digitales/it/alibaba-steckt-mehr-als-26-milliarden-euro-in-cloud-sparte-a-1306386.html .

[41] Alibaba Cloud, “Die globale Infrastruktur von Alibaba Cloud,“ https://www.alibabagroup.com/en/ir/pdf/160614/15.pdf .

[42] Stephan Scheuer, Effy, Zhang, “Tencent-Topmanager: Deutschland ist der wichtigste Markt außerhalb Chinas,“ Handelsblatt, December 22, 2019.

[43] Peggy Hollinger, “Flying taxi start-up raises $240m from existing investors led by Tencent,” Financial Times, March 23, 2020, https://www.ft.com/content/9eb5fcfe-6bda-11ea-89df-41bea055720b .

[44] Stephan Scheuer, Effy, Zhang, “Tencent-Topmanager: “Deutschland ist der wichtigste Markt außerhalb Chinas,“ Handelsblatt, December 22, 2019.

[45] Stephan Scheuer and Miriam Schröder, “Alibaba aquires German data startup in new stage of European expansion,” Handelsblatt, January 09, 2019.

[46] See, for instance: Wirtschaftswoche, “Übernahmefantasien treiben Aktien von Zalando in die Höhe,“ January 3, 2019.

[47] Tobias Weidemann, “Konkurrenz aus China kommt: JD.com und Alibaba greifen den deutschen Onlinehandel an,“ t3n, July 24, 2018.

[48] Axel Gautier and Joe Lamesch, “Mergers in the Digital Economy,“ CESifo Working Paper No. 8056, 2020.

[49] Katharina Grimm, “Angriff auf Amazon – übernimmt Chinas Handelsgigant Alibaba Zalando?“ Stern, December 12, 2019.

[50] Florian Kolf and Stephan Scheuer, “Alibaba plant den Angriff auf Amazon,“ Handelsblatt, May 15, 2019.

[51] Focus, “Alibabas Pläne für den europäischen Markt – Steht Zalando vor der Übernahme?“, March 12, 2019.

[52] Federal Ministry for Economic Affairs and Energy, “Minister Altmaier: More comprehensive and proactive screening of investments in security-sensitive sectors,“ press release, April 8, 2020.

[53] Federal Ministry for Economic Affairs and Energy, “Minister Altmaier: More comprehensive and proactive screening of investments in security-sensitive sectors,“ press release, April 8, 2020.

[54] Federal Ministry of Economic Affairs and Energy, “Altmaier: Mit dem GWB-Digitalisierungsgesetz schaffen wir neue Wettbewerbsregeln für große Internetunternehmen und entlasten den Mittelstand,“ press release, September 9, 2020.

[55] dealroom.co, “Shortage of later stage venture capital in Germany: more acute due to Corona crisis,“ March 2020, https://blog.dealroom.co/wp-content/uploads/2020/03/Berlin-Capital-FINAL.pdf.

[56] Federal Ministry for Economic Affairs and Energy, “Zukunftsfonds startet mit 10 Mrd. Euro: “Setzen damit den Benchmark in Europa“,“ press release.

[57] Federal Ministry for Economic Affairs and Energy, “Gründungsoffensive: KfW und Bund starten Venture Debt-Finanzierung für innovative Unternehmen in der Wachstumsphase,“ press release, March 27, 2019.

[58] German Accelerator, „Who we are“, https://www.germanaccelerator.com/about-us/ .

[59] Next Step, „Ready to expand your business in Asia?“, https://nextstepasia.de .

[60] Stephan Scheuer, Effy Zhang, “Tencent will in Europa zehn Millarden Dollar investieren – Fokus auf deutsche Hightech,“ Handelsblatt, December, 23, 2019.

[61] Jacob Helberg, “Silicon Valley can’t be neutral in the U.S.-China cold war,” Foreign Policy, June 22, 2020.

[62] Hong Shen, “China’s tech giants: Baidu, Alibaba, Tencent,“ Konrad Adenauer Stiftung (Ed.): “Digital Asia: Insights into Asian and European Affairs,“ pp.33-41, February 27, 2019, https://www.kas.de/en/web/politikdialog-asien/single-title/-/content/digital-asia-8 ; Paolo Cervini, Mark J. Greeven, “Digital China is coming to Europe,“ LSE Business Review, April 24, 2018, https://blogs.lse.ac.uk/businessreview/2018/04/24/digital-china-is-coming-to-europe/ .

PDF Download

PDF Download

PREV

PREV