Quick Notes

India’s Oil Imports: Trends in Diversification

Background

In the pandemic year 2020-21, over

84% of India’s petroleum product demand (crude oil and petroleum products) was met with imports. Gross petroleum imports of about 239 million tonnes (MT) of value US

$77 billion accounted for over 19% of India’s total imports in 2020-21. In 2019-20, over

85% of petroleum product demand was met with imports. Gross petroleum imports of over 270 MT of value US$119 billion accounted for 25% of India’s total imports. This is a substantial increase compared to 2006-07, when oil imports of about

145 MT accounted for about 77% of consumption.

In the early 2000s, the growing volume of crude oil imports was seen to be associated with two key external risks for India’s

energy security. The first was the volume risk, which originated from the fact that most of the global conventional oil reserves and most of India’s

oil imports were concentrated in the Persian Gulf. It was assumed that the political and social volatility in the Persian Gulf region increased the possibility of deliberate oil supply disruptions by state or non-state actors. The second was the price risk, which was the probability of a dramatic increase in the price of oil in the international market on account of, amongst other things (a) instability in

oil producing regions (b) reduction in supply on account of policies adopted in producing countries (c)

international sanctions against oil procurement from specific countries. Volume risk in oil supply was prioritised over the price risk and addressed with

strategies such as diversification of oil import basket and acquisition of equity oil assets around the world.

Source: Ministry of Commerce & Industry

Source: Ministry of Commerce & Industry

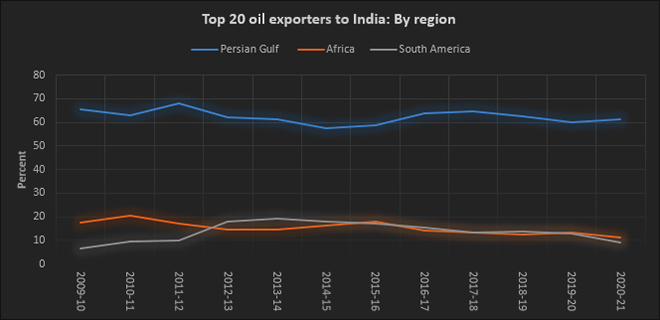

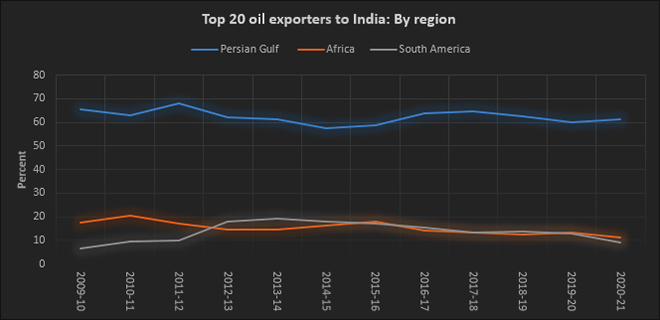

Diversification of oil import sources

In 2006-07, India sourced crude oil from

27 countries and in 2020-21 India sourced crude oil from

42 countries. However, this cannot be interpreted as an increase in diversification of oil import sources. The

top 20 sources of India’s oil imports consistently accounted for over

95% of India’s oil imports and the

top 10 countries accounted for over

80% in the last 15 years. The share of Persian Gulf countries in India’s crude imports has remained at around

60% over the last 15 years. The share of imports from Africa has decreased from about

17% in 2009-10 to about

13% in 2019-20, and the share of South American countries has increased from about 6% to about 12% in 2019-20. Countries from the Persian Gulf, Africa, and the South America have accounted for over 80% of India’s top 10 oil importers. The dominance of relatively cheaper suppliers from these regions indicates that crude sourcing decisions are optimised at the refinery level rather than at the country level. Essentially, refinery economics rather than geopolitics influenced decisions on sourcing crude.

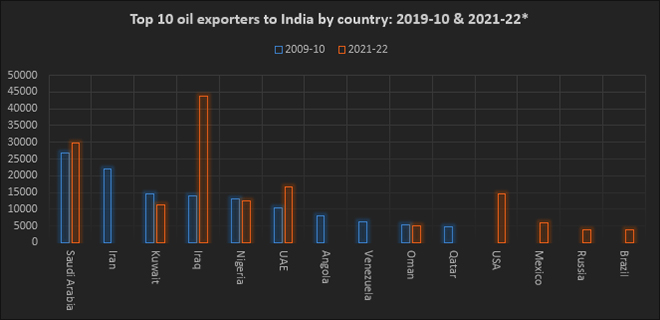

Source: Ministry of Commerce & Industry; * 2021-22 (April 2021 to January 2022)

Source: Ministry of Commerce & Industry; * 2021-22 (April 2021 to January 2022)

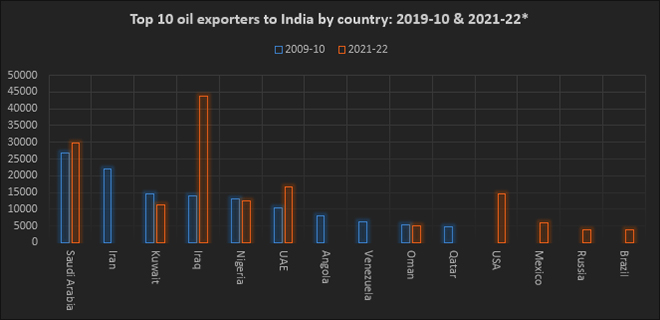

Recent trends in India’s crude import basket

The top oil exporter to India in 2020-21 was Iraq followed by

Saudi Arabia. Iraq’s share in India’s imports increased from about

9% in 2009-10 to over 22% in 2020-21. Though Saudi Arabia lost its long-held position as the largest source of India’s oil imports to

Iraq in 2017-18, Saudi Arabia’s share has remained steady between

17-18% of India’s imports over a decade. Interestingly,

the USA that was not among the top 20 oil exporters to India a decade ago, it was the 18

th largest exporter in

2017-18, 9

th largest in 2018-19, 7

th largest in 2019-20, and

4th largest in 2020-21. Apart from the fact that crude oil exports from the USA were

illegal until 2015, USA was also a large net importer of crude oil. With the growth in production of shale oil, the USA is now not only a net exporter of crude oil but also the

world’s largest producer. The entry of the USA as India’s 4

th largest source of oil imports breaks the trend of Saudi Arabia, Iraq, Iran, Kuwait, the UAE, Nigeria, and Venezuela dominating India’s top five oil import sources for over two decades.

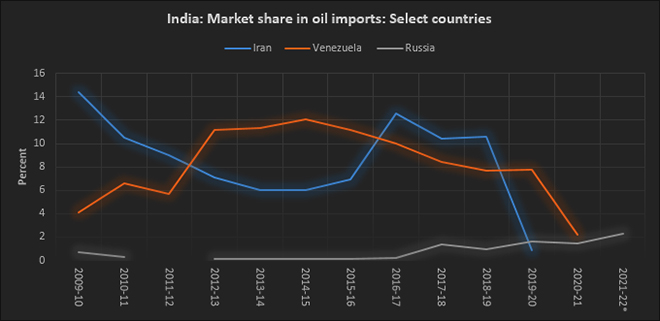

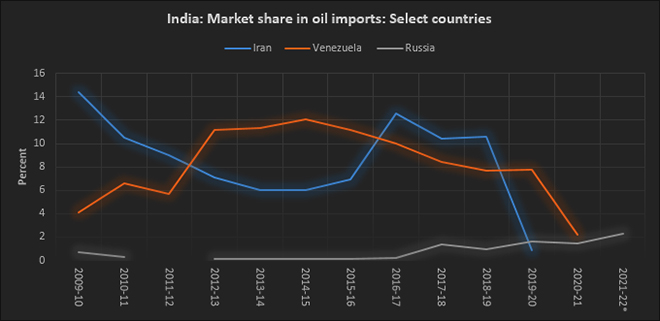

Oil imports from Iran and

Venezuela, two countries that are subject to Western sanctions have managed to remain in the list of India’s top 10 oil importers over the last decade, but their share has varied. The

share of Iran, that was the second largest exporter of crude to India in 2009-10, fell to about 6% in the early 2010s. The share improved to about

10% in the late 2010s but in 2019-20, Iran’s share was

less than 1%. Since 2020, Iran was no longer among the top 20 oil importers. Venezuela’s share improved from about 4% in the early 2010s to over

12% in the mid-2010s. Since then, Venezuela’s share has fallen and in 2020-21 it was just over 2%. Both Iran and Venezuela were not among the

top 20 oil importers for India in 2021-22.

Russia, the country to come under Western sanctions in 2022, is not a large source of India’s oil imports but it has remained in India’s long portfolio of oil importers for over a decade. Russia’s share in India’s crude imports was less than

1% until 2017-18 when Russia started featuring among India’s top 20 oil import sources with a share of about

1.4%. In 2021-22 (April to January), Russia’s share in India’s oil importers was

2.3%, which put Russia among India’s top 10 sources of oil imports.

Issues

The context that called for

diversification of oil import sources was one of supply insecurity. Supply disruptions in the

Persian Gulf was a high-impact event to which high-probability was attached and diversification of supply sources was seen as the rational response, given that countries in the region account for over

60% of India’s oil imports. Though oil supply disruptions in the Persian Gulf is a high-impact event even today, the probability of occurrence is not as high as it was assumed to be in the era of the war against terrorism. More importantly ‘

demand insecurity’ and the consequent competition amongst oil exporters to gain market share in India, one of the few large growth markets for oil around the world, is influencing diversification more than supply-insecurity. The competition for oil markets has been introduced for the first time in several decades, oil exporters from the western hemisphere notably the

USA and Russia, amongst the top 10 oil exporters to India. Geopolitical sanctions may introduce minor short-term aberrations in India’s oil import basket, but this cannot alter longer-term economic trends.

Source: Ministry of Commerce & Industry; * 2021-22 (April 2021 to January 2022)

Source: Ministry of Commerce & Industry; * 2021-22 (April 2021 to January 2022)

Monthly News Commentary: Oil

Oil Demand Picks up but threat of Pump Price increases

India

Demand

According to Fitch Ratings, transportation fuel demand shows

signs of improving to pre-pandemic levels from FY23 as visible from petroleum product sales for the OMCs (oil marketing companies), which increased between 8% -11% during the nine months ended December of fiscal 2021-22 from a year earlier as demand rebounded from a pandemic-induced fall. The OMCs incurred marketing inventory losses in 3QFY22, driven by the excise duty cut in November 2021, as the fuel inventory in their pipelines and retail outlets were priced at higher rates. According to the World Oil Outlook 2021, flagship publication by Organisation of Petroleum Exporting Countries (OPEC), oil demand in India is expected to reach around 11 million (mn) barrels per day (bpd) by 2045 as compared to about 4.9 mn bpd in 2021. According to Fitch Ratings, strong refining margins and the likely inventory gains arising from increasing oil prices are expected to offset the moderate marketing margins of Indian OMCs and continue to support their standalone credit profiles (SCP). With the Indian economy continuing to recover, diesel and gasoline refining margins are likely to remain healthy in the near term, although diesel spreads may narrow a little as the peak winter heating demand reduces.

Indian state fuel retailers' sales slowed in January from the previous month after partial lockdowns in several states to stem the spread of coronavirus, preliminary sales data showed, indicating slower industrial activity. The state retailers sold about 5.6 million tonnes (mt) of gasoil in January, a decline of 12.75% from December and of 6.85% from a year earlier, the data showed. Gasoil accounts for about two-fifth of refined fuel consumption in India and is directly linked to industrial activity. Since the start of this year, several states in the country have imposed varying degrees of restrictions including weekend curfews to contain infections caused by the highly transmissible Omicron variant of the coronavirus. Gasoline sales in January were at 2.2 mt, declining by 12.3% from December and by 5.4% from a year earlier, the data showed. State retailers - Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL), and Hindustan Petroleum Corp (HPCL) - control about 90% of India’s fuel stations.

As international oil prices near US$93 per barrel for the first time in seven years,

India said it strongly prefers responsible and reasonable pricing and has conveyed serious concerns over crude oil price volatility. India is 85% dependent on imports to meet its oil needs and domestic petrol and diesel prices are linked to international oil rates. However, for over the last three months, despite a spurt in international oil prices, petrol and diesel prices have not been changed ahead of elections in crucial states like Uttar Pradesh and Punjab. According to Minister of State for Petroleum and Natural Gas, the government has been taking up the issue, bilaterally with crude oil-producing countries with the OPEC and with heads of other international fora to convey India's serious concerns over crude oil price volatility, and India's strong preference for responsible and reasonable pricing for consumer countries.

LPG

Large price gap between domestic LPG (liquefied petroleum gas) cylinders and commercial gas cylinders are resulting in rise in diversion of domestic cylinders for commercial purposes.

The 14.2kg domestic gas cylinders are being heavily diverted to commercial use due to the huge pricing gap between 14.2kg domestic gas cylinders and 19kg commercial gas cylinders. A 14.2kg domestic gas cylinder in Delhi is priced at INR899.50, while 19kg commercial gas cylinder is priced at INR1,907. The large price gap of INR1,007.5 is being exploited by unscrupulous marketers who are using it as an opportunity to earn money by diverting domestic cylinders for commercial use. Distributors are selling the domestic cylinders with a profit of INR200-250 to unauthorised agents, who in turn refill commercial cylinders and sell these directly to restaurants, eateries, tea stalls between INR1300-1550, which is much below the authorised rate of INR1907 for a commercial gas cylinder.

Retail Prices

Deloitte Touche Tohmatsu India expects the nation’s biggest fuel retailers to sharply raise pump prices after state elections end next month, adding pressure on the government and the central bank to take steps to contain inflation. Deloitte expects companies to increase prices by INR8-9 (11-12 cents) a litre to make up for a shortfall in sale price by 10 March when the election process winds down. Despite a surge in international prices, IOC, BPCL, and HPCL -- which together control more than 90% of the domestic market -- have frozen gasoline and diesel rates for over three months, coinciding with elections in five states. While state-run fuel retailers are technically free to align prices with global rates, they often freeze rates in the run-up to polls fearing public backlash over higher prices. When the increase eventually happens, the government is likely to absorb some of it by cutting taxes and let the consumers bear the rest. Increase in oil prices pose a problem for the government by impacting disposable incomes in a nation where private consumption accounts for some 60% of gross domestic product.

The Petroleum Ministry has expressed

disappointment over fewer allocation for new fuel retail outlets (petrol pumps). In a letter to BPCL, the industry coordinator for public sector oil companies, the Ministry has asked why the draw of lots was conducted for less than half of the envisaged number of petrol pumps. According to the Ministry, there is a need to set up many more fuel retail outlets due to construction of new roads, highways, e-ways, and economic corridors. It also reiterated the obligation of oil companies to set up petrol pumps at remote areas to improve accessibility to consumers. The mandate to set up fuel retailing outlets in rural and low volume areas is also on new licensees, that have been allowed access to India’s growing market under liberalised terms. Five percent of the total outlets that new licensees need to set up have to be in rural areas within five years from commencing operations. The Ministry has asked BPCL to submit a proposal for fresh advertisement on behalf of the industry, indicating OMC-wise numbers of locations in the proposal. However, this is not the only front where OMCs are battling with respect to fuel retail outlets. In another communication, the ministry asked public sector OMCs to comply with a Rajasthan High Court directive, asking them to consider a revision of margins payable to fuel pump operators. The order was in context of a plea by the Rajasthan Petroleum Dealers Association, seeking a hike in dealer margins. The OMCs have been made the competent authority to decide on the revision.

HPCL will set up its own chain of multi-channel retail stores at its petrol pumps as the nation’s third-largest fuel retailer looks to give a push to non-fuel retailing. As part of this, HPCL has opened two more convenience stores under the brand name 'HaPpyShop'. The first retail store under the brand name HaPpyShop was opened at the company’s petrol pump at Nepean Sea Road in Mumbai in September 2021 and the store has been a huge hit amongst the residents of the locality. In addition, the online store at Madurai was also inaugurated marking the entry of HaPpyShop in purely online format also. With a refreshing appearance and layout, the Stores are equipped with advanced technology to provide a seamless shopping experience to customers in the nearby areas. Along with the experience of physical stores, they have the option of online shopping with a door delivery model. Customers will be able to browse and shop the merchandise on HPCL’s 'HP Pay App’ (available on App Store and Play Store) and have goods delivered to their homes. HPCL has also started marketing branded packaged drinking water under the name 'Paani@Club HP’ at its petrol pumps across the country adding another offering in the customer convenience.

Refining

Rajasthan Chief Minister (CM) inaugurated and laid foundation stones of projects worth around

INR2.75 bn in Barmer and sought the Centre’s help for the oil refinery project. The CM appealed to the Centre for requisite cooperation in setting up the oil refinery in Barmer. The CM said earlier no one had imagined that a refinery and power plants could be set up in the Thar desert, but it has become a reality.

Production

Vice President (VP) of India called for increasing indigenous production of crude oil through strong R&D efforts to ensure energy security of the country. The VP was delivering the convocation address at the first convocation ceremony of the Indian Institute of Petroleum and Energy (IIPE), in Visakhapatnam. The VP said there should be more focus on increasing domestic exploration of petroleum, harnessing the full potential of renewable sources, and aiming for excellence and innovation in the energy industry. The VP said that India was the world’s third-largest consumer of crude oil and yet import-dependent for more than 80% of its needs. IIPE, a dedicated university for petroleum research, was recognized as an Institution of National Importance in 2017 through an Act of Parliament. The VP called upon IIPE and other energy institutes to bridge the supply gap of skilled manpower for the petroleum sector and build stronger industry-institute linkages with the prominent market players.

India’s production of crude oil, which is refined to produce petrol and diesel, continued to

decline in December 2021, with lower output from ONGC (Oil and Natural Gas Corporation) leading to a near 2% drop data showed. Oil production in December 2021 was 2.51 mt, down from 2.55 mt a year earlier and a target of 2.6 mt. The output was, however, higher than 2.43 mt production in November 2021. ONGC produced 3% less crude oil at 1.65 mt in December due to delays in mobilising equipment at western offshore fields. Oil India Ltd (OIL) produced 5.4% more crude oil at 2,54,360 tonnes. India is 85% reliant on imports to meet its crude oil needs as domestic output is insufficient to meet the demand. During April-December - the first nine months of the current fiscal year - crude oil production fell 2.63% to 22.3 mt. ONGC produced 4% less oil at 14.6 mt.

Transport

India’s crude oil imports in December hit their highest level in a year as strong demand prospects in the world’s third-largest oil consumer and importer prompted refiners to stock up. Crude oil imports last month rose 7.1% versus November to 19.65 mt, data from the Petroleum Planning and Analysis Cell (PPAC) showed. However, imports were down 4.1% compared with a year earlier and were 5% higher from December 2019 before the onset of the pandemic. The relatively high imports corresponded with the country’s oil demand scaling a nine-month peak last month, with gasoline sales hitting an all-time high. Reliance Industries Ltd, owner of the world’s biggest refining complex, last month imported 1.14 mn bpd of oil, a decline of about 8% from November. Oil product imports fell 2.9% to 3.88 mt from a year earlier, while exports jumped 30.6%. Of the 6.13 mt of exports in December, diesel accounted for 3.21 mt. Asia’s third-biggest economy imports and exports refined fuels as it holds surplus refining capacity.

Rest of the World

World

Kuwait’s Oil Minister Mohammad Al-Fares said

global demand for oil is continuing to recover amid positive conditions and upbeat global financial indicators. Dangers including rising inflation and new COVID-19 variants necessitate caution going forward, although Omicron effects “could be minor as the vaccine rollout expands”. OPEC+, a grouping of OPEC and allies, decided to stick to its planned output increase of 400,000 bpd from March after a short meeting.

Barclays bank raised its average oil price forecasts by US$5 per barrel for this year, aided by extremely tight inventories, shrinking spare capacity, and a relatively mild effect of COVID-19 infections on demand. The bank raised its 2022 average price forecasts to US$85 and US$82 per barrel for Brent and West Texas Intermediate (WTI), respectively and said the risks to the price outlook were skewed to the upside, on elevated geopolitical risks amidst shrinking spare capacity. Brent crude futures were trading at about US$88 a barrel, while the US (United States) WTI crude CLc1 was at US$86, gaining on the back of supply fears amidst tensions in Eastern Europe and the Middle East. The impact of the surge in Omicron cases on demand has been limited so far, the bank noted and said its demand estimates for 2021 and 2022 have increased 170,000 bpd and 180,000 bpd, respectively.

Africa

Namibia aims to fast track the development of its first oilfield to have production by 2026 following a significant offshore discovery by Shell. Shell said the exploration well off the coast of the southern African country had shown "encouraging" results with the presence of a working petroleum system with light oil. As per the Ministry of Mines and Energy, it was too early to provide exact volumes of oil encountered at the Graff-1 well or whether the new discovery was sufficient to be a standalone project or will require further exploration in the area.

Petrol prices in Sudan jumped by 46 Sudanese pounds to 408 pounds (93 cents) per litre, while diesel prices also increased by 44 pounds to reach 390 pounds per litre. There were repeated fuel price hikes last year as Sudan completed a process of phasing out subsidies on fuel, which is now meant to follow global prices.

Energy giant

Shell has made a new oil discovery in its exploration well in the Orange Basin offshore Namibia. The well in question is the Graff-1 well located in Block 2913A in the Orange Basin which Shell operates. Its partners in the block are QatarEnergy and the national oil company of Namibia NAMCOR. QatarEnergy farmed into the block as well as block 2914B back in April of last year. Shell has a 45% interest in Block 2913A, with Qatar Petroleum holding 45% while NAMCOR holds the remaining 10%. Shell claimed that the results from the well were encouraging and that it established the presence of a working petroleum system with light oil. NAMCOR said that the Graff-1 deep-water exploration well made a discovery of light oil in both primary and secondary targets. The well was drilled using the Valaris-owned DS-10 drillship. The Graff-1 well has proved a working petroleum system for light oil in the Orange Basin, offshore Namibia, 168 miles from the town of Oranjemund. Drilling operations started in early December 2021 and were safely completed in early February 2022.

Nigeria’s government plans to amend its newly-signed oil law to ask parliament for an 18-month extension to keep its long-standing regime of subsidising imported petrol. The law signed by President Muhammadu Buhari last August contains a provision for elimination of fuel subsidies within six months. However, labour unions have rejected government’s planned hike in pump prices, threatening nationwide protest and urging authorities to speed up work on upgrading the country’s four refineries, which have been poorly maintained for decades. Many view low petrol prices as one of the few benefits of living in an oil-producing country where graft and inefficiency are ingrained. Nigeria, Africa’s largest oil exporter, however imports virtually all its fuel, a sore point for its government. In November, the government said subsidy would be eliminated by mid-2022 and replaced with 5,000 naira (US$12) in monthly payments for up to 40 mn people, heeding World Bank’s call to scrap the payment to cut its deficit, forecasted at 3.42% of gross domestic product this year.

Middle East / OPEC+

OPEC said

world oil demand might rise even more steeply this year as the global economy posts a strong recovery from the pandemic, a development that would underpin prices already at a seven-year high. Tight oil supply has also given impetus to booming energy markets, and the report from OPEC also showed the group undershot a pledged oil-output rise in January under its pact with allies. In the report, OPEC said it expected world oil demand to rise by 4.15 mn bpd this year, unchanged from its forecast last month, following a steep rise of 5.7 mn bpd in 2021. OPEC took an early view that the effect of the Omicron Coronavirus variant would be mild, and the report said it has not had as negative an economic impact as previous COVID-19 waves. The report also showed higher output from OPEC as the group and allied non-members, known as OPEC+, gradually unwind record output cuts put in place in 2020. OPEC+ has aimed to raise output by 400,000 bpd a month, with about 254,000 bpd of that due from 10 participating OPEC members, but production has increased by less than this as some producers struggle to pump more. The report showed OPEC output in January rose by just 64,000 bpd to 27.98 million bpd. Seven of the 13 OPEC members had a drop in output, among them Venezuela, Libya, and Iraq. Top exporter Saudi Arabia boosted output by 54,000 bpd according to the report, but Saudi Arabia told OPEC it made a larger increase of 123,000 bpd that brought its production to 10.145 mn bpd.

Kazakhstan has asked the foreign companies operating its main oilfields to supply the domestic market so it can boost its refining industry and tackle the rising fuel prices that led to violent protests in January. According to Kazakhstan Energy ministry, Kazakhstan can’t ramp up domestic refining without supplies from the foreign-led consortia operating its Tengiz, Kashagan, and Karachaganak oilfields. The fields currently export all of their output. Kazakhstan was rocked by a rare flare-up of protests in January that were initially triggered by fuel shortages and rising prices. As part of its plan, the Energy Ministry is proposing to double capacity at its Shymkent refinery, which can currently process around 120,000 barrels of oil per day.

Iraq has already scheduled some oil shipments for loading in March due to projections of strong demand, Ali Nizar, deputy head of Iraq’s State Organization for Marketing of Oil (SOMO), said. Nizar said it was still too early to say if prices will exceed US$100 per barrel, as some analysts have forecast. Oil prices hit a seven-year high just above US$89 a barrel. Nizar said that Iraq's average oil exports are expected to rise to 3.3 mn bpd in February, from 3.2 mn bpd in January.

USA & N America

The United States

(US) crude exports are ramping up due to increasing demand from Asia and Europe, and recovering the US production from the lows of the Coronavirus pandemic. Surging worldwide demand, supply outages, and international political tension have stoked worries around crude supplies, boosting oil prices to the highest levels in seven years, with some predicting crude could even reach US$100 per barrel. That has brought in more buyers of the US oil, increasing exports and decreasing domestic crude stockpiles. The US seaborne crude exports have increased in recent weeks and are close to 3 mn bpd so far this month. That's just under the 3.2 mn bpd average in crude exports in December, which was the strongest month since February 2020. Exports have helped reduce crude stockpiles in the US Gulf Coast to as low as 220.3 mn barrels, which was a two-year low. Increased vehicle traffic means lighter barrels from the US, which produce a higher volume of gasoline, are attractive to buyers. The IEA said it expects worldwide gasoline demand to rebound to 26.3 mn bpd - just 1% lower than 2019’s consumption. Supply hiccups from countries like Libya, which had temporary production outages starting in December, shifted the US exports to countries in Europe. In December, the US shipped around 2.3 million barrels of crude to Italy, up from 1.6 mn in November. Crude output from major US shale formations is due to rise to 8.54 mn bpd in February, the highest since March 2020, according to the Energy Information Administration. Of that, the Permian Basin's output is set to reach 5.1 mn bpd, also a record.

South America

Brazilian state-run oil company Petroleo Brasileiro SA

(Petrobras) produced 2.704 mn bpd of oil equivalent in the fourth quarter (Q4), up 0.8% from the same period the previous year, it said. Petrobras' crude production came in at 2.151 mn bpd, up 0.7% from the fourth quarter of 2020. The company attributed the mostly flat performance to scheduled stoppages on high-production platforms and the start of the Buzios field production-sharing agreement, although these factors were partially offset by the ramp-up of the Carioca floating production storage and offloading platform (FPSO). Petrobras lowered its 2022-2026 production outlook to reflect production-sharing agreements involving the Atapu and Sepia oilfields. Exports of oil and derivatives showed a decrease of 17.7% year-on-year to 701 barrels of oil equivalent per day. The oil company sold 463 mn bpd of gasoline domestically in the fourth quarter, up 20.1% in annual terms. Domestic diesel sales came in at 790 mn bpd, 16.7% higher than the previous year.

Canada’s CGX Energy and parent Frontera Energy

discovered an oil and gas reservoir off the coast of Guyana and said drilling on a second well could begin later this year. Its Kawa-1 well found approximately 177 feet (54 meters) of hydrocarbon-bearing reservoirs based on an initial evaluation of logging data, the company said. It did not disclose the size of the potential find. CGX said the Kawa-1 results suggested the presence of oil and gas, but warned it may be required to seek additional financing to continue drilling. Costs associated with the well had risen to between US$115 mn and US$125 mn, it said. Final well cost estimates and additional results of the discovery will be disclosed in the future, the company said. Guyana produces about 120,000 barrels per day of crude from an offshore project controlled by a consortium that includes Exxon Mobil, Hess Corp and China’s CNOOC Ltd.

Asia Pacific

T

he Japanese government is planning to hold a meeting regarding rising crude oil prices, Chief Cabinet Secretary Hirokazu Matsuno said. The Ministers are expected to discuss the effectiveness of the government's measures it has implemented so far and possible further actions to curb soaring prices, Matsuno said. The Japanese government has provided a gasoline subsidy for oil distributors.

Japan’s Industry Minister Koichi Hagiuda said

the government will implement for the first time its oil industry subsidy program, which is aimed at curbing petroleum fuel prices starting following a recent surge in oil prices. The nation’s average regular gasoline retail price was 170.2 yen (US$1.5) per liter, reaching its highest level in over 13 years and topping the 170-yen threshold required to launch the subsidy scheme introduced in November, Hagiuda said. Under the program, a subsidy of 3.4 yen per litre will be paid to 29 oil distributors and importers for a week with the aim of keeping them from sharply raising their prices of gasoline, diesel oil, kerosene and fuel oil. The subsidy framework will be effective until the end of March. The Japanese oil industry has blamed a series of petroleum-related taxes for the country’s high fuel prices. According to the finance ministry, taxes account for over 50% of the retail gasoline price per liter before a 10% consumption tax is levied as of the second quarter of 2020.

China’s crude oil imports could rebound by 6-7% this year, reversing 2021’s rare decline as buyers step up purchases for new refining units and to replenish low inventories, analysts said. Robust demand from China, which accounts for a tenth of the global crude trade, would help underpin global oil prices, keeping supplies tight amid forecasts for a jump in crude prices to US$100 a barrel or more. Demand recovery, however, is not expected until the second half of the year as China continues to combat COVID-19 outbreaks and limit production by smaller refiners. For 2022, crude oil imports into China look set to grow by 600,000-700,000 bpd, offsetting last year’s 590,000 bpd fall to match or beat 2020’s record volume of 10.85 mn bpd, analysts at FGE, Rystad Energy and Energy Aspects said. Brent and West Texas Intermediate futures, are already at 7-year highs near US$90 a barrel as investors look beyond the demand hit from the Omicron variant. Demand is set to recover later in the year, driven by new refining capacity at integrated petrochemical producers, in particular Zhejiang Petrochemical Corp and Jiangsu Shenghong Petrochemical. East China-based Zhejiang Petrochemical, the country’s single-largest refiner, aims to operate its newly built 800,000-bpd crude units at full rates this year. That will represent an increase of 280,000 bpd versus 2021.

China found three independent oil refiners evaded fuel tax and punished a unit of a state oil major for irregular crude oil trade following months of investigations, part of a broader clampdown to consolidate its massive refining sector. Under a drive to rein in surplus refining capacity and cut carbon emissions, Beijing last year introduced measures such as cutting import quotas and slapping a hefty tax on imports of blending fuels. That has led to China’s first annual fall in crude oil imports, the world’s largest, in two decades. The clampdown is also set to result in a shrinking market share of the small independent refiners in China’s oil imports, while allowing state refiners such as Sinopec Corp to reclaim market dominance. The companies, Panjin Beifang Asphalt Fuel Co, Liaoning Bora Biological Energy Co and Panjin Haoye Chemical Co Ltd, were found to have evaded fuel consumption taxes on the refined oil products they sold, the Provincial Tax Service of Liaoning said. Liaoning province, an oil hub in the country’s northeast, found three independent refiners evaded fuel taxes and said it will prosecute the personnel involved.

News Highlights: 16 – 22 February 2022

National: Oil

India expects fuel demand to grow 5.5% in the next fiscal year

21 February: India’s fuel demand is likely to grow 5.5% in the next fiscal year beginning 1 April, initial government estimates show, reflecting a pick-up in industrial activity and mobility in Asia’s third largest economy after months of stagnation. India’s fuel consumption in 2022-23, a proxy for oil demand, could rise to 214.5 million tonnes (mt) from the revised estimates of 203.3 mt for the current fiscal year ending March 2022, according to government forecasts. Local demand for gasoline, used mainly in passenger vehicles, is expected to rise by 7.8% to 33.3 mt, while gasoil consumption was slated grow by about 4% to 79.3 mt, the data showed. Consumption of aviation fuel would likely increase by nearly 50 percent to 7.6 mt, compared with the revised estimate of 5.1 mt for the year ending March 2022. Demand for petcoke, a better-burning alternative to coal, could increase 2.8% to 14.8 mt, while demand for liquefied petroleum gas, used as cooking fuel, is estimated to grow 4.5 percent to 29.7 mt, PPAC (Petroleum Planning and Analysis Cell) said.

RIL delays 21-day crude unit shutdown to September

17 February: Reliance Industries Ltd

(RIL), operator of the world’s biggest refining complex at Jamnagar in western India, has deferred a maintenance shutdown of a crude unit at its export-focussed plant to September from March. The refiner had earlier planned to shut a crude unit at its 704,000 barrels per day (bpd) refinery for about three weeks in March. The refinery has two equal size crude units. The maintenance turnaround now has been delayed to September, sources said. Traders said that shutdown has been deferred to take advantage of robust cracks for the refined fuels. Asia’s complex refining margins are averaging at US$7.37 so far in February, the highest since March 2018, according to Refinitiv data. RIL’s Jamnagar complex comprises two complex refineries with combined capacity to process about 1.4 million bpd.

National: Coal

Government plans digital infrastructure to support coal mines operations

20 February: Government aims to build digital infrastructure and introduce

new technologies to help current and future coal mines operations. The step is focussed at cutting down on import of dry fuel. The objective is to implement new technologies and build digital infrastructure to support current and future ramp-up for the mines, according to the government's draft technology road map for the coal sector. The roadmap also includes multi-speed backbone information technology and infrastructure system that allows rapid deployment of new technologies. To reduce dependency on imports, it is critical for Coal India Ltd (CIL) to reach the one billion tonnes target, thereby embarking on a technological transformation journey, it said. India has total coal reserves of 344.02 billion tonnes. Commercial primary energy consumption in India has risen to 700% in the past four decades. Major factors for the increase in demand for energy are expanding economy, rising population, and the improvement of quality of life.

National: Power

Aadhaar cards may be linked to power connections in Tamil Nadu

21 February: Tamil Nadu Generation and Distribution Corporation (TANGEDCO) will be seeking the State government’s

approval to link power connections to Aadhaar cards. This will help identify those taking advantage of the electricity subsidy by taking multiple connections for a single residence. TANGEDCO said that if the power connections are linked with Aadhaar, then it would be easy to identify those having multiple connections for a single premise and enjoying undue subsidy.

NTPC surpasses 2020-21 electricity generation of 314 billion units

19 February: NTPC Ltd said it surpassed the maximum annual electricity generation of 314 billion units achieved in 2020-21 on 18 February. Last year, the generation was 270.0 billion units till 18th February, indicating improved performance and an increase in demand for power in the current year, it said. NTPC Korba (2600 MW plant) in Chattisgarh is the top performing thermal power plant in Idia with 94.32 percent plant load factor (PLF or capacity utilisation) between April 2021 and January 2022, according to the CEA (Central Electricity Authority) data. The total installed capacity of the company is 67,832.30 MW having 23 coal-based, 7 gas-based, 1 hydro, and 19 renewable energy projects. Under JV, NTPC has 9 coal-based, 4 gas-based, 8 hydro, and 5 renewable energy projects.

No power bills for farmers for next 5 years: Shah

16 February: Union Home Minister Amit Shah said in Dibiyapur, in Auraiya district (80 km from Kanpur), that if the

BJP was re-elected to power, farmers in UP (Uttar Pradesh) would not have to pay electricity bills for the next five years.

National: Non-Fossil Fuels/ Climate Change Trends

SJVN CMD inaugurates river diversion of 66 MW Dhaulasidh Hydro Power Project

16 February: SJVN Ltd Chairman and Managing Director (CMD) Nand Lal Sharma

inaugurated the river diversion arrangement of 66 megawatt (MW) Dhaulasidh Hydro Electric Project at Hamirpur, Himachal Pradesh. He appreciated that the construction activities at various components, excavation works at power house, stripping works at right and left banks, construction of office building and bachelor accommodation are in full swing. The 66 MW Dhaulasidh Hydro Electric Project is a run-of-river scheme on river Beas at Dhulasidh, Dist Hamirpur, Himachal Pradesh. On completion, it will add 304 million units of energy in 90% dependable year. He said that the project will lead to the overall upliftment of the area with infrastructure development and generation of direct and indirect employment. Currently, SJVN has a portfolio of over 16,400 MW and is executing multiple projects in hydro, thermal and solar in India, Nepal, and Bhutan.

International: Oil

Sri Lanka seeks US$35 mn to pay for urgent diesel imports

21 February: Sri Lanka is trying to arrange a payment of US$35 million for a shipment of 40,000 tonnes of diesel with just a few days of stocks left, Energy Minister Udaya Gammanpila. Reserves in the Indian Ocean nation, which typically spends about US$450 million each month on fuel imports, dwindled to US$2.36 billion by the end of January. Ceylon Petroleum Corporation (CPC) has begun to ration distribution in an effort to prepare for the crisis, by issuing just about half of what is typically released to pumping stations, the Minister said. CPC is also seeking at least 710,000 barrels of 500 ppm gasoil for delivery in Colombo during March.

Libya’s NOC announces opening of Tahara oilfield

21 February: Libya’s National Oil Corp

(NOC) announced the opening of a new oilfield named Tahara and said it should eventually produce 14,000 barrels of oil and 6 million cubic feet of natural gas per day. The field is being operated by Arabian Gulf Oil Co (AGOCO), a subsidiary of the NOC, in the Hamada area of western Libya. AGOCO said the field might be able to produce higher output of 40,000 barrels per day (bpd) with additional wells. Libya is exempt from production limits agreed by the Organization of the Petroleum Exporting Countries and allies (OPEC+) as the country struggles to recover from years of instability. The NOC said port closures had reduced Libya’s output by 100,000 bpd and the country's total production was 1.1 million bpd.

IEA’s Birol again urges OPEC+ to narrow gap between oil targets and output

16 February: The Organization of the Petroleum Exporting Countries

(OPEC) and their allies, known as OPEC+, needed to narrow the gap between their oil production targets and actual output, the International Energy Agency's (IEA) head Fatih Birol said. OPEC+ oil producers have raised their output target by 400,000 barrels per day (bpd) each month since August as they unwind production curbs. However, they have repeatedly failed to hit those targets as some producers struggle to restore output. The IEA in its last monthly report said the gap between the target and output in January had widened to 900,000 bpd.

International: Gas

Qatar’s LNG production capacity to reach 126 mt a year by 2027: Emir

22 February: Qatar’s Emir Sheikh Tamim bin Hamad al-Thani said that Qatar’s liquefied natural gas

(LNG) production capacity will rise to 126 million tonnes (mt) a year by 2027. Al Thani touted a carbon capture facility Qatar is building - the biggest in the Middle East - he said, which will isolate and store 2.5 mt of carbon per year in four years. By 2030, the facility will isolate 9 mt per year. Meanwhile, Iran’s President Ebrahim Raisi said Iran has high capacity for gas production for domestic use and exports and will play an important role in international markets.

China approves new LNG receiving terminal in Fujian province

16 February: China’s National Development and Reform Commission

(NDRC) has approved natural gas company Hanas Group’s plan to build a receiving terminal for liquefied natural gas (LNG) in the southeastern province of Fujian. The terminal, estimated to cost 5.26 billion yuan (US$829.8 million), will have an annual receiving capacity of 5.65 million tonnes of the super-chilled fuel, the NDRC said. The terminal, to be built in Meizhouwan port of Fujian province, will have one berth and two storage tanks each sized 200,000 cubic meters. Based in the city of Yinchuan in the northern region of Ningxia, Hanas Group is engaged in piped-gas distribution, natural gas liquefaction and power generation.

International: Coal

China’s daily output of coal rebounds to over 12 mt

21 February: China’s coal output returned to more than 12 million tonnes (mt) per day as of 20 February, the National Development and Reform Commission (NRDC), a level equal to the average daily production of the fourth quarter of last year. Daily coal output in January and early February was affected by the Chinese New Year holiday. The National Development and Reform Commission (NRDC) did not give a figure for January output. Production and supply of coal in China's main production areas of Shanxi, Shaanxi and Inner Mongolia are expected to stabilise as the weather warms up, the NDRC said. Authorities have ordered coal miners to run at maximum capacity to tame red-hot coal prices and prevent a recurrence of September's nationwide power crunch that disrupted industrial operations and added to factory gate inflation.

Australia’s biggest coal-fired power plant to shut in 2025

17 February: Origin Energy said it plans to shut the Australia’s biggest coal-fired power plant in 2025, seven years earlier than scheduled, as an influx of wind and solar power has made the plant uneconomic to run. Origin’s announcement to quit coal-fired power follows moves by its rivals to accelerate the closure of their coal-fired plants, all struggling with sliding power prices which have hurt plants that don't have the flexibility to switch off when there is surplus energy.

International: Power

Norway’s Statkraft posts strong earnings on power price surge

17 February: Statkraft, Norway’s largest power producer and one of Europe’s largest producers of renewable energy, posted booming core earnings in the fourth quarter on the back of surging power prices.

The increase was driven by substantially higher Nordic power prices and high Norwegian hydropower generation, offsetting losses at its trading unit because of market volatility, Statkraft said. The benchmark Nordic system power price soared after a cold, dry winter and surging fuel and carbon markets last year, averaging 96.26 euros per megawatt hour in the fourth quarter of last year, up from €13.76/MWh for the same period of 2020. The Norwegian government is subsidising record-high power bills this winter, though much of it will be financed from the state’s revenue from petroleum and power production, including its Statkraft dividend.

UK electricity capacity auction clears at highest ever price

16 February: Britain’s auction to ensure enough electricity capacity for 2022/23 cleared at a record high of 75 pounds (US$101.70) per kilowatt (kW) per year, National Grid said. Britain launched its power capacity market in 2014, offering to pay providers for making supplies available at short notice. Britain usually holds auctions for power capacity about four years in advance of the delivery date and another auction for a smaller amount of capacity around a year before delivery. In early 2020, the power capacity auction for 2020/21 cleared at just 1 pound/kW/year when the UK wholesale power prices were a lot lower. A total of nearly 5 gigawatts (GW) of capacity was procured in this auction, with nearly 3.4 GW from gas-fired plants, a provisional auction document showed. Some 516 megawatts (MW) was procured from demand-side response providers, or firms that guarantee to cut industrial demand, 411 MW from coal, 385 MW from battery storage and the rest from other sources. About 65% of the capacity procured in the auction was from existing power assets, the auction results showed, including one coal unit at Uniper’s Ratcliffe plant in Nottinghamshire. Utilities such as Centrica, SSE, E.ON were among other winners of agreements.

International: Non-Fossil Fuels/ Climate Change Trends

Zambia firm starts producing fuel from used tyres, plastic

22 February: The used tyres and plastic containers that litter the back streets of cities and towns in Zambia might be an eyesore, but for one company they are also an opportunity to make fuel that could slash the nation's energy import bill while cleaning up its trash. The project by Zambia’s Central African Renewable Energy Corporation currently processes 1

.5 tonnes of waste to make 600-700 litres of diesel and gasoline per day on a pilot basis. Plastic and rubber are made of long chains of hydrocarbons that can be heated and broken down into something resembling crude oil -- which, in the case of plastic and synthetic rubber, is what they were to begin with.

EU countries to ask top diplomat to increase climate action

21 February: European Union

(EU) foreign ministers will call on the bloc’s top diplomat to scale up efforts on climate change this year to help clinch tougher emissions-cutting goals from individual countries, a draft document due to be adopted said. Nearly 200 countries agreed at last year’s COP26 climate summit in Glasgow, Scotland, to set tougher emissions reduction targets in time for the next UN climate conference this November. The EU struck climate deals last year including an US$8.5 billion agreement with the United States and other countries to help South Africa phase out coal faster - a deal seen as a possible blueprint for climate funding in other countries.

US, Germany clash over role of nuclear energy in green transition

18 February: Germany and the United States (US) clashed over whether nuclear power should be part of the energy mix as rich countries race to cut emissions to limit the impact of global warming. The US Special Climate Envoy John Kerry said that cutting emissions fast required some reliance on nuclear energy, adding that without carbon capture technology relying on gas as a stop-gap fuel amounted to ignoring the root cause of the climate crisis.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: Ministry of Commerce & Industry

Source: Ministry of Commerce & Industry Source: Ministry of Commerce & Industry; * 2021-22 (April 2021 to January 2022)

Source: Ministry of Commerce & Industry; * 2021-22 (April 2021 to January 2022) Source: Ministry of Commerce & Industry; * 2021-22 (April 2021 to January 2022)

Source: Ministry of Commerce & Industry; * 2021-22 (April 2021 to January 2022)