Quick Notes

India’s Energy Security: Plea for a Retrospective View

Background

The concept of energy security as it was used and interpreted in India and elsewhere was based on the epistemological assumption that energy will remain

scarce, expensive and unreliable. The energy security strategies of India designed to address these ‘threats’ were therefore offensive in nature as they sought to maximise benefits in relation to other actors (nations). These strategies were responses to

political interpretations of the threat or non-linear responses to the perceived threats, a process that is defined as securitisation in international relations theory.

The energy context of 2023 amplifies the threat perception. Unpredictable moves by

Russia are seen as a threat to the price of fossil fuels particularly oil & gas that meet at least a third of India’s energy needs.

Control of critical supply chains of

renewable energy (RE) by China are framed as a threat to the RE ambitions of India and the rest of the world. Looming economic recession is seen as a

threat to energy demand growth that underpin investment in energy supply. Climate change, seen as the mother of all threats is expected to

destroy the World as we know it if we don’t transition to a low carbon energy system. A review of the perceived threats to India’s and the World’s energy security in the past suggest that reality rarely meets expectations.

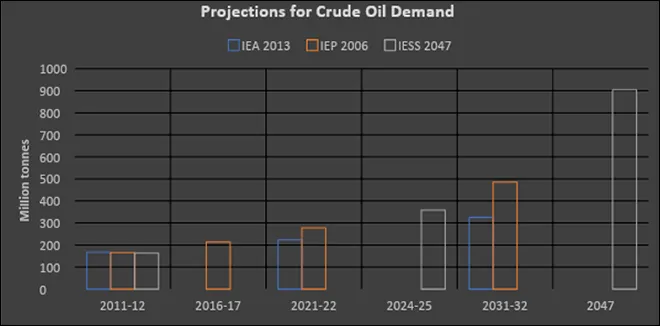

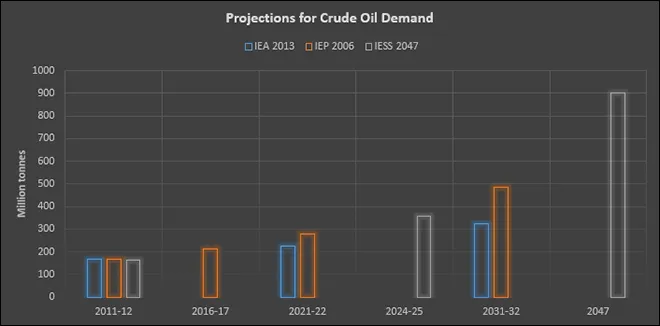

Source: Reports as indicated; IEA: International Energy Agency; IEP: Integrated Energy Policy; IESS: India Energy Security Scenarios, Planning Commission

Source: Reports as indicated; IEA: International Energy Agency; IEP: Integrated Energy Policy; IESS: India Energy Security Scenarios, Planning Commission

A look into the Past

In the last three decades, a number of

government and

non-government agencies proposed strategies to build an energy secure India and an energy secure World. The proposed strategies were responses to the threat of

scarcity and uncertainty in securing energy resources derived from a wide range of academic theories. One was to build relationships with oil producing countries and to make

equity investments in energy resources of producing countries, primarily oil & gas producing countries based on realist approaches of international relations theory. The recommendation to

invest in institutions such as regulatory bodies was from rational choice theories that argue that norms and regular practices build the basis for stability and security in economic relations. The recommendation to liberalize the sector and allow the market to set the price of energy was derived from

liberal economic theories which see the market as the best means of mediating imbalances in supply and demand of scarce resources such as energy. The recommendation to strengthen maritime forces in order to secure sea lanes of transport of energy was derived from

critical theories that saw energy primarily as a weapon of national security.

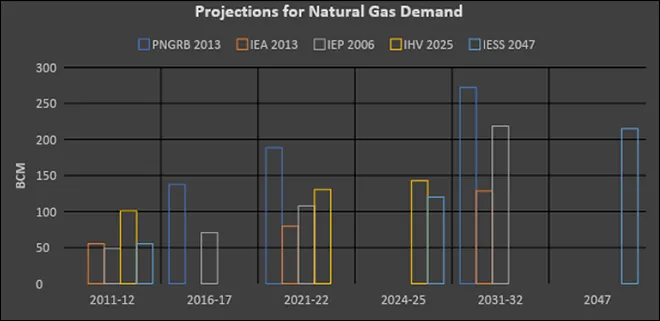

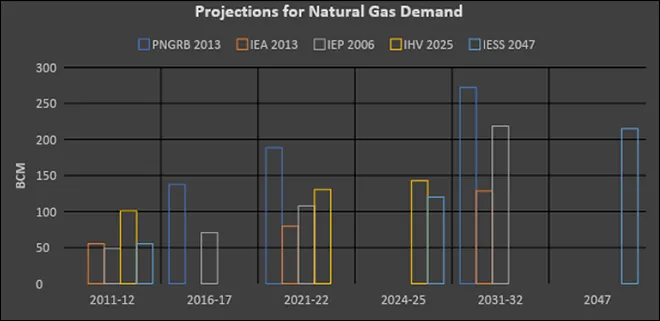

Source: Reports as indicated; PNGRB: Petroleum & Natural Gas Regulatory Board; IEA: International Energy Agency; IEP: Integrated Energy Policy; IESS: India Energy Security Scenarios, Planning Commission; IHV: India Hydrocarbon Vision

Econometric models

Source: Reports as indicated; PNGRB: Petroleum & Natural Gas Regulatory Board; IEA: International Energy Agency; IEP: Integrated Energy Policy; IESS: India Energy Security Scenarios, Planning Commission; IHV: India Hydrocarbon Vision

Econometric models that were used for energy planning in India were also based on the premise that energy resources will remain scarce, expensive and unreliable. They forecast energy demand as a function of the growth rate of gross domestic product (GDP) and then proceeded to recommend ways and means to secure scarce, expensive and unreliable energy resources in the light of

exponential growth in demand for energy. The cornucopian assumption of uninterrupted growth and progress were embedded in these strategies.

Ideas on global energy security that emerged from the West amplified threat perceptions. Most portrayed China and to a lesser extent India as part of the threat. The unprecedented

energy demand from India and China was perceived to unsettle the global energy order hitherto dominated by the United States. Until the early 2000s, the

United States was a large and growing oil market, the ultimate dream of OPEC (oil producing and exporting countries) producers. Oil imports of the United States were equal to the total imports of China and Japan. The United States was the only player others needed to interact with as it had sufficient market and military power to induce change in the energy system if necessary.

China and India were depicted as actors that could not be more different from the United States. Their demand was supposed to be growing at a time of scarcity and constraints on resource use because of climate change and was therefore seen to

be ‘challenging’ rather than ‘driving’ the global market. China and India were not part of the institutions that coordinated cooperation among countries working to ensure their energy security. The new

‘energy silk-road’ between oil producers in the Middle East and oil consumers in Asia was framed as an “unwelcome nexus” by the industrialized world. Some saw a

resource war materialising between India and China primarily in the context of oil. Studies also argued that India will face an

absolute coal scarcity around 2020 as India’s geological reserves of coal were supposedly over-estimated.

Few if any of these threats have materialised. Energy resources

are anything but scarce today. Despite the volatility in commodity prices in general and energy prices in particular due to geopolitical action, the spectacular

high prices forecast for oil and other resources have not materialised. The assumption that oil supply from the Persian Gulf will remain

uncertain and undependable has also proved inaccurate. In place of supply insecurity, we have oil exporting countries from the region searching for demand security from growing economies like India. A resource war between India and China has not materialised as predicted and India is not facing absolute coal scarcity. China is leading the Word in renewable energy capacity installations.

The current trends that contradict predictions may reverse or change course but they present an opportunity for India to revisit the underlying assumptions of scarcity and uncertainty that are embedded in its energy security strategies. India’s energy forecasts assume that underlying

structural relationships in the economy will vary gradually. In reality discontinuities and disruptive events have changed underlying economic and behavioural relationships. Assumptions about human behaviour may also prove to be inaccurate. Strategies and forecasts are captive of the time of strategizing. The time of strategizing was a time of

high energy prices and perceived scarcity. The supply-oriented strategies that place energy in the context of scarcity seem to be misplaced in the current context. Strategies of building special relationships with oil producers or those of making equity investments in hydrocarbon resources have contributed almost nothing to reducing India’s exposure to oil price volatility or facilitated a reduction in the oil intensity of its economy. The focus on gross primary energy rather than useful energy appears to have marginalised the

importance of energy efficiency. The assumption of a direct correlation between energy and GDP is also proving to be inaccurate. The strategy of pursuing

all possible strategies recommended by experts on energy security seem to have achieved little more than scattering India’s resources and capabilities. There is a need to indulge in retrospective analysis of India’s energy forecasts and energy security strategies. But it will not be easy as audits that look into the past to ask “what have we done?” will be seen as a threat to existing efforts to forecast ways and means to a better future. Planning for an unknown and probably unknowable future that will supposedly solve all of humanity’s problems is far more exciting than gloomy look into the past.

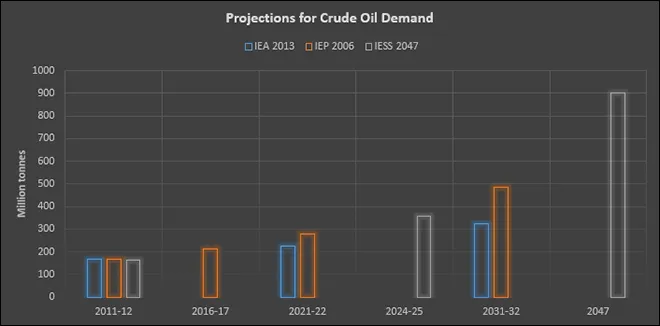

Source: Reports as indicated; IEA: International Energy Agency; IEP: Integrated Energy Policy; IESS: India Energy Security Scenarios, Planning Commission; IHV: India Hydrocarbon Vision

Source: Reports as indicated; IEA: International Energy Agency; IEP: Integrated Energy Policy; IESS: India Energy Security Scenarios, Planning Commission; IHV: India Hydrocarbon Vision

Monthly News Commentary: Coal

Coal Block Auctions Progress despite Concerns

India

Coal Block Auctions

After successful auction of 64 coal mines in first five tranches, Union coal ministry organized an investors’ conclave in Indore and

launched the process for auction of 133 coal mines under 6

th round of commercial auctions. Of the 133 coal mines, 71 are new and 62 mines are rolling over from earlier tranches of commercial auctions. Additionally, eight coal mines under 2

nd attempt of 5

th round of commercial auctions are also being launched where single bids were received in the first attempt. According to the ministry, the list of mines has been finalized post detailed deliberations. Mines falling under protected areas, wildlife sanctuaries, critical habitats, having forest cover greater than 40 percent, heavily built-up area etc. have been excluded. The block boundaries of some of the coal mines where there was presence of dense habitation, high green cover or critical infrastructure etc. have been modified based on comments received during stakeholder consultations to enhance bidders’ interest and participation in these coal blocks. Coal India Limited (CIL), had in May this year decided to import coal as its shortage was reported in many states. As per the reports, the decision to import coal was taken for blending on government-to-government basis and supply to thermal power plants of state generators and independent power producers.

E-auction

Coal India Ltd is targeting 50 million tonnes (MT) sales through the e-auction route in the second half of the current fiscal. The coal behemoth had sold around 30 MT via e-auction in the first six months of the 2022-23 financial year. Coal India’s e-auction sales were at 108 MT in 2021-22. In the July-September quarter of the current fiscal, the miner had sold 10.36 MT of coal via e-auction, and the average realisation was INR6,061 (US$73.4) per tonne. The Maharatna PSU sold 141 MT of the dry fuel through the fuel supply agreement in the three months that ended on 30 September 2022 with an average realisation of INR1,413 (US$17.1) per tonne.

Imports

India’s steel ministry has asked the finance ministry

for a waiver of import tax on coking coal among a slew of raw materials, as it scrambles to fill a shortage of steelmaking ingredients. The proposal to scrap levies ranging from 2.5 percent to 7.5 percent in the world’s second-biggest producer of crude steel comes ahead of the national budget for 2023-24 set to be unveiled in February. Imports of coking coal meet about 85 percent of India’s annual requirements of about 50 to 55 MT. Australia is India’s top supplier, and a free trade pact between New Delhi and Canberra that takes effect from 29 December allows duty-free imports of coking coal by India.

Demand

Facing a power crisis, Rajasthan government has again requested Chhattisgarh to expedite the process for making its captive mines operational. Rajasthan government stated that the

desert state require at least 15 rakes of coal a day to keep 4320 Megawatt (MW) thermal power generation units operational to ensure uninterrupted and affordable electricity to its close to 80 million (mn) consumers.

After facing a prolonged coal crisis, thermal power plants in Rajasthan are getting a breather as coal from Parsa East-Kanta Basan (PEKB) block in Chhattisgarh has resumed reaching them. With four rakes per day being transported to Rajasthan currently, the situation at the power stations has normalized. The central government had allotted to Rajasthan a 15 mtpa (million tonnes per annum) coal block in PEKB in Chhattisgarh and another of 5 mtpa capacity in Parsa, also in Chhattisgarh, in 2015.

Reserves in the first phase of PEKB coal block were exhausted this year. The first phase of mining on 762 hectares of land in the PEKB block was allotted to Rajasthan Rajya Vidyut Utpadan Nigam Limited (RRVUNL) in 2007, and mining, which started in 2013, has been completed. Disruption of coal supply from Chhattisgarh had plunged Rajasthan’s power plants into a crisis, forcing RRVUNL to purchase coal at higher prices and causing holes in the pockets of consumers. While 23 rakes of coal are required daily to operate all the power plants in Rajasthan at full capacity, the state is currently receiving 17 rakes daily, which is sufficient to meet the present demand.

NTPC Ltd said it has begun dispatching coal through rakes from its Talaipalli mines to Lara Super Thermal Power Project (LSTPP) in Chhattisgarh. The track length from Talaipalli to Lara is 65 kilometres. The government is trying to make the country less dependent on other countries for coking coal. The

government is working on a 'coking coal project' to diversify the sources of iron ore. Recently, the government approved a pact between India and Russia regarding cooperation on coking coal. The government aims to establish a coal gasification plant with an annual capacity of 100 MT. India currently imports coking coal from countries like Australia, South Africa, Canada and the United States.

The Central University of Jharkhand (CUJ) and the Central Coalfields Ltd (CCL) signed a Memorandum of Understanding

(MoU) to form a research and development (R&D) centre on clean coal mining. The R&D centre would deal with various aspects of technological research and its application to increase coal production while reducing its carbon footprint.

Despite India being bullish on green energy options as it aims to achieve net-zero emissions by 2070, the geo-political situation triggered by the Russia-Ukraine war has led to supply chain constraints, rising energy prices and pushing inflation to highest-ever levels in several countries. All these factors combined together have compelled India to continue to depend on coal-based thermal energy. Recently, Union Finance Minister Nirmala Sitharaman said that uncertainties in the energy sector are an area of concern for the government. She noted that like many other nations,

India too will have to rely more on coal in the near future due to global uncertainties and supply chain disruptions. She said that India’s plan to shift to renewable energy has received a jolt and therefore ways to reduce coal dependency and return to eco-friendly energy resources, need to be devised. Greenpeace India’s Lead for climate and energy campaign Avinash Kumar gave a realistic perspective to India’s growing dependence on coal despite its aggressive green energy push. Kumar further informed that in the light of the fact that coal is increasingly becoming economically unviable and the cost of renewables continues to drop, there is a need to phase out of coal soon. India’s dependence on coal can be gauged from the fact that owing to the shortage of the fossil fuel in thermal plants, Coal India Limited, the country’s largest producer, was in June this year, forced to import 8 MT of coal for this fiscal. It was for the first time in the 50 years of Coal India’s existence that the public sector undertaking was asked to import the dry fuel.

Prices

CIL has been given freedom to pass mine closure costs on to consumers, but has not taken any such step yet. The miner had produced 622 MT of coal in 2021-22 and was pursuing a target of 700 MT in the current fiscal. Coal India had closed underground mines for reasons of unviability in the past, but with the implementation of technology, these mines may be revived. As a result of unprecedented demand for coal, the world’s largest miner is actively considering reviving some discontinued mines. Coal India proposes to reopen 30 discontinued mines having estimated mineable reserves of around 600 MT.

Rest of the World

China

Mongolia is ramping up efforts to export coal to energy-hungry China, despite global efforts to end the use of the polluting fossil fuel. Mongolia already sends 86 percent of its exports to China, with coal accounting for more than half the total, and is upgrading its infrastructure in the hopes of selling even more to its southern neighbour. China is the world’s largest polluter and has pledged to achieve carbon neutrality by 2060. To that end, it is building out its renewable power grid to prepare for a move away from coal. Government want Mongolia to surpass the record 37 MT sent in 2019 and to keep supplying China with a steady stream of coal well into the next decade, Deputy Mining Minister Batnairamdal Otgonshar said. Batnairamdal is pushing for Mongolia to invest heavily in coal, and new railways to connect to China’s ports and processing plants. The value of Mongolia’s coal exports jumped to US$4.5 billion (bn) in the first nine months of 2022, almost triple what they were over the same period last year. With a population of just 3.3 million, Mongolia has little heavy industry and does not by itself consume much coal compared to its southern neighbour.

Rest of Asia and Asia Pacific

Indonesia aims to establish a coal fund agency and start collecting a coal levy in the first quarter next year, to help ensure supply security for domestic power plants and industries, Energy Minister Arifin Tasrif said. The plan to set up the agency follows a coal supply crunch at local power plants that forced the world’s largest thermal coal exporter to temporarily halt exports at the start of the year. The government plans to collect the levy from coal companies based on their output and proceeds will be used to pay the gap between the coal market price and the price cap set for a domestic market obligation (DMO). Indonesia has put a price cap of US$70 per tonne for coal sales to power plants and a US$90 per tonne cap for local cement and fertiliser companies, and other industries.

National Australia Bank (NAB), the country’s second-biggest lender, said it was

targeting an effective zero exposure to thermal coal mining by the end of this decade as part of its plan to achieve net zero by 2050. NAB expects to have an effective zero exposure to thermal coal mining by 2030 except for any residual performance guarantees to rehabilitate existing coal mines.

Nippon Steel Corporation, the world’s No.4 steelmaker, is looking to buy more stakes in coking coal mines to secure stable supply of the key steel-making ingredient.

Japan’s biggest steelmaker already owns stakes in several coking coal mines and iron ore mines, procuring about 20 percent of the 27 MT of its annual import of coking coal and the 58 MT in iron ore import from those holdings. For the steelmaker, more urgent need is to invest in coking coal mines than iron ore projects, as Western sanctions on Russia over the invasion of Ukraine have squeezed an already-tight supply of commodities such as metallurgical coal. Nippon Steel has no plan to invest in thermal coal mines.

Vietnam has increased its coal power target for 2030 under a revised draft energy plan, while renewables goals were scaled back, in a potential blow to rich nations' funding initiatives for cleaner energy. The latest plan backtracks on a draft released that would have slowed the growth in coal use by the end of this decade. A meaningful drop in coal capacity would come only in 2045. Vietnam, one of the world’s top 20 coal users, has seen protracted wrangling among competing government interests over its power development plans for this decade, and there may be further changes in the weeks and months ahead, Vietnam-based investors said. Under the government’s latest baseline scenario, coal would remain Vietnam's most important source of energy until 2030 with more than 36 gigawatt (GW) of installed capacity and up to 11 new coal-fired power plants to be built in coming years, up from about 21 GW in 2020 and 30 GW in 2025. Coal use has been rising globally since Russia’s invasion of Ukraine in late February sent prices of other fossil fuels surging.

Indonesia, the Asian Development

Bank (ADB) and a private power firm are teaming up to refinance and retire early the first coal-fired power plant under a ground-breaking new carbon emissions reduction project that moves from concept to reality. The 660 MW Cirebon 1 power plant in West Java would be refinanced in a US$250-300 mn deal on condition that it be taken out of service 10 to 15 years before the end of its 40- to 50-year useful life under a memorandum of understanding (MOU), ADB said. The agreement is the first under the ADB’s Energy Transition Mechanism (ETM), an initiative to blend private investment funds, public finance and philanthropic donations to buy up or refinance coal power plants in Southeast Asia to retire them early as the region shifts to renewable energy sources.

Europe

London-listed

Contango Holdings plans to start exporting thermal coal early next year from its Zimbabwe mine following requests from customers in Europe and Asia, the company said. Zimbabwe’s neighbour South Africa saw an eight-fold increase in coal exports to Europe during the first half of 2022, after the European Union banned coal imports from Russia as part of sanctions for its invasion of Ukraine. Coal prices had started rising even before the conflict as some European countries switched away from expensive natural gas to coal, despite global commitments to move away from the polluting mineral. Contango owns 70 percent of the Lubu project in western Zimbabwe’s coal-rich Hwange district. The company’s main focus is supplying its low-sulphur coking coal to the southern African ferro alloy and industrial markets, but it has found current prices of thermal coal - used in electricity generation - attractive.

In this part of

northeastern Czech Republic, huge piles of coal are stacked up ready to sell to eager buyers and smoke belches from coal-fired plants that are ramping up instead of winding down. Demand for brown coal — the cheapest and most energy inefficient form — used by Czech households jumped by almost 35 percent in the first nine months of 2022 over a year earlier. The region is part of the Upper Silesian Coal Basin, a large industrialized area straddling the Czech-Polish border with rich deposits of coal and factories producing steel, power and the type of coal used for steel-making that date to the 19

th century.

News Highlights: 7 – 13 December 2022

National: Oil

Fuel demand in India hits eight-month peak in November amid festivals

9 December: India’s fuel demand climbed to an eight-month high in November, government data showed, as festivals and a pick-up in industrial activity boosted sales in the world’s No. 3 oil consumer. Consumption of fuel, a proxy for oil demand, was 2.4 percent higher than the previous month, and rose 10.2 percent year-on-year to 18.84 million tonnes in November, according to the data from Indian oil ministry's Petroleum Planning and Analysis Cell (PPAC). Retail sales always peak during October-November, when the nation of 1.4 billion celebrates major festivals of Dussehra and Diwali. Sales of diesel, which account for about four-fifth of India’s refined fuel demand, were up 19.1 percent from 2021 at 7.76 million tonnes, while sales of gasoline, or petrol, rose 8.1 percent at 2.86 million tonnes, the PPAC data showed.

LPG connections up to 325 mn: Oil Minister

8 December: Number of liquefied petroleum gas

(LPG) connections increased from 140 mn in 2014 to 325 mn this year. Of these, 96 mn connections were provided under Pradhan Mantri Ujjwala Yojana (PMUY), Oil Minister Hardeep Singh Puri said. To create awareness and improve LPG usage among PMUY beneficiaries, the government and Oil Marketing Companies organised LPG panchayats, social media campaigns and public events across the country, he said. Highlighting the steps taken by the government to encourage LPG consumption, he said a subsidy of INR200 on 14.2 kg refill up to 12 refills per year had been given for 2022-23, in addition to the options of 5 kg Double Bottle Connection and swap from 14.2 kg to 5 Kg, upto three free refills under Pradhan Mantri Garib Kalyan Package from April to December 2020. The PMUY was launched in 2016. Despite rise in international prices, he said, the government maintained a lower gas price. Responding to concerns on decline in refills under PMUY, he said, the consumption by beneficiary was three cylinders per household but it had actually increased to 3.69 cylinders per household.

National: Gas

ONGC to invest INR21.5 bn on drilling 53 exploratory wells in Andhra

12 December: Oil and Natural Gas Corporation

(ONGC) proposes to drill 53 exploratory wells in Andhra Pradesh- 50 in Godavari on-Land PML (Petroleum Mining Lease) Block of KG Basin and three in CD-ONHP-2020/1 (OALP-Vi) Block Of Cuddapah basin with an investment outlay of INR21.50 bn. Andhra Pradesh State-Level Environment Impact Assessment Authority (SEIAA) in a meeting held cleared two separate proposals put up by the ONGC for environmental clearance. According to ONGC, it proposes to carry out the onshore exploration of 50 wells during 2021-'28 in Godavari on-land PML block of KG basin in East and West Godavari Districts of AP based on the geological and geophysical studies. These wells will be converted to development wells and connected to the nearest Early Production System (EPS)/ Gas Collecting Station (GCS) if proved commercially viable, it further said. ONGC proposes to carry out the prospecting and exploration drilling in the CD-ONHP-2020/1 block of Cuddapah basin falling in Kurnool, Anantapur and YSR Kadapa districts of AP, it said in another proposal adding based on the geological and geophysical studies the three exploratory locations are planned to be drilled during the period 2021-24. ONGC currently produces 4.4 million standard cubic feet of gas and over 700 tonnes of oil from KG Basin per day.

India to step up gas imports to address summer power demand

7 December: India has asked state-run firms to increase imports of natural gas in anticipation of higher power demand next summer, three government sources said, aiming to avoid repeating a power crisis in April that was its worst in more than six years. While the share of natural gas in India’s power generation was just 1.5 percent this year, down from 3.3 percent in 2019 due to limited local availability and high global prices, the authorities see it as a crucial stop-gap power source for crunch times, especially when intense summer heat drives up air conditioning use. The Indian government has asked the country’s largest gas distributor, GAIL (India) Ltd, to increase supplies to power plants during the summer months. India’s largest power producer NTPC Ltd has also been asked to have up to 2 gigawatt (GW) of gas-fired power plants - more than half of its capacity - ready to produce at full capacity if needed next year to address peak summer demand.

National: Coal

Higher output could boost Coal India’s spot sales: Chairman

12 December: Coal India Ltd will increase spot auctions of the fuel in the coming months, the chairman of the world’s biggest coal miner said, as the company’s rising output has left them with enough fuel to meet increasing demand from non-utility power plants. An increase in spot auction sales, which offer higher margins than its mainstay long-term contracts, will help Coal India to build off its record profit from this year and maintain a share price, which has climbed 25 percent since April and outpaced a 5.9 percent rise in the broader Nifty index. However, with output growing by 16.7 percent this fiscal year, putting the company on track to achieve its annual production target for the first time in 16 years, Coal India was able to boost sales on electronic spot auctions - which offer higher margins than long-term contracts. Chairman Pramod Agrawal said Coal India intends to extensively partner with private companies to achieve its goal of producing 1 billion tonnes by March 2026, and by increasing the capacity of its existing mines and opening new mines. The company plans to outsource to private companies mining and development of about 200 million tonnes of coal annually in four years, he said.

Government issue allocation orders for 6 coal blocks

12 December: The government said it has issued allocation orders to the

successful bidders for six coal mines which were put on sale for commercial coal mining. The successful bidders got the vesting orders from Coal Secretary Amrit Lal Meena. Of the said blocks, one coal mine is fully explored and the remaining mines are partially explored. The Peak Rated Capacity (PRC) of fully explored mine is 1.89 million tonnes per annum (MTPA). Total geological reserve of six coal mines is 2,302 million tonnes and the blocks are likely to generate an annual revenue of INR1.3 bn and will attract capital investment of INR2.83 bn. With the allocation of these six coal mines, a total of 45 allocation orders have been issued till date with cumulative PRC of 85 MTPA.

India’s November thermal coal imports at nine-month low as local output soars

9 December: India’s thermal coal imports fell to the lowest levels in 9 months during November, data from consultancy Coalmint showed, mainly due to a rise in domestic coal production. The country imported 10.83 million tonnes of thermal coal in November, the Coalmint data showed, compared with 12.03 million tonnes in October and 9.45 million tonnes (MT) in November 2021. Imports fell mainly due to higher production by Coal India Ltd, which accounts for 80 percent of India’s coal output. The world’s largest coal miner has seen output increase by a sixth to 412.6 MT during the first eight months of this financial year, putting it on track to meet annual production targets for the first time since at least 2010. Imports of coking coal — used mainly in steelmaking — fell to 4.56 MT from 4.95 MT in October and 5.3 MT in November 2021. India is the world’s second-largest importer, consumer and producer of coal, and counts Indonesia, Australia, South Africa, Russia and United States as its major suppliers.

Over 13 mt of illegally mined coal: Meghalaya HC

8 December: The

Meghalaya High Court (HC) said over 13 million tonnes (MT) of coal was illegally mined, transported and discovered which the State sought to pass off as coal mined prior to the imposition of the ban on coal mining. The court said Justice Katakey report on the reassessed coal available at depots across four districts – East Jaintia Hills, West Khasi Hills, South Garo Hills and South West Khasi Hills stated that 19,54, 250 MT of coal was available in the State as compared to a September report by Chief Secretary DP Wahlang who stated that 32.56 MT of coal was available for auction. The HC issued a contempt order against East Jaintia Hills Superintendent of Police (SP) after a report revealed illegal mining of coal being carried out in the district.

National: Power

All-India electricity demand may grow 7 percent to 1.4k bn units in FY23: ICRA

13 December: The

all-India electricity demand is expected to grow 7 percent to 1,480 billion units (BU) in the ongoing financial year, according to the ratings agency ICRA. In the preceding 2021-22 fiscal, the all-India power demand was at 1,380 BU, the ratings agency said. The estimates are based on the fact that all-India electricity demand increased 10.6 percent year-on-year in first eight months of FY23, amid a severe heat wave in north and central India, it said.

Over 4 million consumers apply for Delhi government’s electricity scheme subsidy

13 December: More than 40 lakh of the

national capital’s 57.60 lakh domestic power consumers have applied for subsidies under the Delhi government's free electricity scheme, government data showed. The data also showed 47 lakh consumers received subsidies when consumers didn't need to apply for the scheme. The Delhi government revamped its subsidy scheme to make it mandatory for domestic consumers to apply to avail of the benefit. Chief Minister (CM) Arvind Kejriwal had earlier announced that from October, only those consumers who apply for power subsidy would get it. 40,28,915 consumers have applied for the subsidy. These include 9.88 lakh consumers of BSES Yamuna Power Limited, 18.28 lakh BSES Rajdhani Power Limited consumers and 11.28 lakh Tata Power Delhi Distribution Limited consumers. Another 13,882 consumers under the New Delhi Municipal Council area have also applied. More than 37 lakh consumers had opted for subsidy up to 15 November. The last date to apply for the subsidy was earlier set at 31 October. Over 35 lakh consumers had applied for the scheme by the last date, which was later extended to 15 November. Of the 47 lakh consumers who received subsidies earlier, nearly 30 lakh used free electricity up to 200 units per month. The government provided 50 percent subsidy (up to INR800) to around 16-17 lakh consumers with monthly consumptions of 201-400 units. Any consumer who fails to apply for the subsidy can get it from the next bill cycle after submitting an application. For the current financial year, the Delhi government has set aside INR32.50 bn for the subsidy scheme. The amount earmarked for the scheme in 2021-22 was INR30.90 bn.

MSEDCL spots 175 power theft cases worth INR36 mn

12 December: The Maharashtra State Electricity Distribution Company Limited

(MSEDCL) has unearthed 175 power theft cases worth INR35.6 mn across Pune regional division of. The MSEDCL said that a large number of power thefts that were exposed involved industrial and commercial consumers. The investigation has revealed that in four cases there was large-scale electricity theft. According to the rules, if these customers do not pay the amount of electricity bill within the prescribed period, action will be taken against them as per Electricity Act 2003. The MSEDCL said that depending on the power theft amount after the assessment, these consumers are given a deadline to pay the amount, which could vary from consumer to consumer.

Plants on maximum load as Punjab opts for power banking

11 December: The

power plants in Punjab are running on maximum load as the state power utility has been "banking power with other states". The demand in the state has witnessed a slight jump as compared to last year. In Punjab, 12 out of 15 thermal units were operating, including three of the four units at Ropar thermal plant and three available units at Lehra Mohabbat plant, generating 1,013 MW of power. In the private sector, all three independent power producers (IPPs) were generating 2,958 MW of power - 674 MW at Rajpura thermal plant, 1,788 MW generation at Talwandi Sabo, and 497 MW at GVK power plant. The total hydro generation is around 445 MW.

Government will make efforts to meet 230 GW peak demand in April 2023: Power Secretary

11 December: The

government will take all possible measures to meet the 230 gigawatt (GW) single-day peak demand expected in April 2023, according to Power Secretary Alok Kumar. Power Minister R K Singh presided over a meeting to review the preparation to meet the high electricity demand expected in April next year. On the outcome of the meeting, the secretary said there are two parameters on which the government will work. Firstly, it will ensure there should be enough power generation capacity, and for that companies have been directed to carry out maintenance work of their plants so there is no issue at that time, he said. According to Kumar, the demand in April next year could be as high as 230 GW. As per official figures, the maximum all-India power demand met at 2:51 pm on 26 April 2022 was 201.066 GW. Earlier this year, the power minister had asked state power generation companies (GENCOS) to import 10 percent of coal requirement for blending purposes and lift the entire quantity of coal offered under rail-cum-road (RCR) mode expeditiously to build coal stock to avoid shortage during monsoon.

National: Non-Fossil Fuels/ Climate Change Trends

NTPC crosses 1 GW annual capacity mark in RE segment in FY23

13 December: NTPC Ltd has crossed the milestone of 1 GW annual capacity in renewable energy (RE) segment by adding 1074.59 MW RE capacity in FY23. With this, standalone installed and commercial capacity of NTPC has reached 57,801.27 MW, while group installed and commercial capacity stands at 70,416.27 MW, the company said. As per the NTPC, the 150 MW and 90MW Devikot Solar PV project is being developed in under the CPSU Scheme Phase-II Tranche-I of Ministry of New & Renewable Energy, Government of India (MNRE). At present, the NTPC has a commissioned renewable energy capacity of 2,332 MW. Overall, the installed power generation capacity, including fossil-fuel based, of the NTPC Group (including joint ventures and subsidiaries) stands at 70,254 MW. The government has set the target of having 500 GW of power generation capacity from clean sources like solar, wind, and hydro plants by 2030.

India to attract US$10 bn in green energy investment in 2023: Bank of America

13 December: India could attract close to US$10 billion in renewable energy investment in 2023, a bright spot as public markets remain largely shut to big-ticket capital raising, according to Bank of America Corporation. Deals and investments will continue to flow into areas such as electric vehicles and green hydrogen, Kaku Nakhate, the lender’s president and India country head, said. Sectors such as renewable energy and retail are set to benefit as India pulls ahead of emerging market rivals in attracting overseas investors. Even as deal making globally has been hit by rising interest rates and market volatility, the South Asian nation’s geopolitical stability helps position it for greater inflows. Investors and companies attending the bank’s recent North American roadshow were impressed by the Indian government’s clear targets to achieve net zero carbon, Nakhate said. The bank will continue to build out its distressed debt financing business in the renewable energy sector, which has generated double-digit returns, Nakhate said.

Centre extends rooftop solar programme till march 2026

9 December: Central Government announced that it has

extended the Rooftop Solar Programme till 31 March 2026. The subsidy under the programme will be available until the target under the Programme is achieved. The government has advised all residential consumers to not pay any additional charges to any vendor on account of fee for application on the National Portal or any additional charges for net-metering/testing which are not prescribed by the respective distribution company. On the National Portal, any consumer willing to install rooftop solar from any part of the country can apply and track complete process starting from registration to release of subsidy directly into his bank account. The subsidy under National Portal has been fixed at INR14,588 per kW (for capacity upto 3 kW) for the entire country and residential consumers have to install rooftop solar plant from any one of the vendors registered by the respective distribution company of their locality.

Thiruvarur to get first district-level solar park in Tamil Nadu

8 December: Tamil Nadu Generation and Distribution Corp Ltd

(TANGEDCO) will float tenders to set up a solar park in Thiruvarur district, marking the beginning of the state's plan to set up 20,000 MW solar energy generation capacity, covering all districts in 10 years. Thiruvarur will get TANGEDCO’s first district-level solar park. Initially, the plan is to set up solar energy power generation capacity of 4,000 MW and 2,000 MW of battery energy storage systems across the state. Chief Minister (CM) M K Stalin is scheduled to launch the Tamil Nadu climate change mission. The district administrators have identified 6,333 acres for setting up solar parks as part of the state-wide exercise. The identified locations are in Salem (5,820 acres), Thiruvarur (143 acres), Karur (54 acres), Chengalpet (142 acres) and Kancheepuram (139 acres). As per the notification issued by the Union ministry of new and renewable energy in July, the revised renewable purchase obligation trajectory for 2029-30 has been fixed at 43.3 percent. Tamil Nadu has the highest installed wind energy generation capacity of 8,685 MW in the country, which is 25 percent of the nation’s wind power generation capacity. It stands fourth in the country in terms of installed solar capacity (5,694 MW).

ONGC inks MoU with Shell for carbon capture, utilization, storage

8 December: Oil and Natural Gas Corporation Limited (ONGC) signed a Memorandum of Understanding (MoU) with global petroleum giant Shell on 7 December 2022, for cooperation in Carbon Capture, Utilization and Storage (CCUS) studies. The

MoU is aimed at developing Carbon capture, utilisation and storage, or CCUS/carbon capture and storage (CCS) as an emissions mitigation tool for combating climate change and injecting carbon dioxide (CO

2) for geological storage as well as enhanced oil production from mature fields of ONGC.

India plans to build more nuclear power plants

7 December: India plans to build more nuclear power plants to increase the production of clean energy, the government said. The government has approved five new sites for nuclear power plants and given the financial go-ahead to build 10 700 MW pressurized heavy water reactors.

International: Oil

OPEC sees robust global oil demand growth in 2023 after 2022 Chinese contraction

13 December: Organization of the Petroleum Exporting Countries

(OPEC) said it expected to see robust global oil demand growth in 2023 with potential economic upside coming from a relaxation of China’s zero-COVID policies, which this year have pushed the country's oil use into contraction for the first time in years. World oil demand in 2023 will rise by 2.25 million barrels per day (bpd), or about 2.3 percent, OPEC said. Chinese demand, hit by COVID containment measures, will average 14.79 million bpd in 2022, down 180,000 bpd from 2021, OPEC said. An annual contraction in Chinese demand for gasoline, diesel and jet fuel would be the first since 2002, according to Energy Aspects which earlier forecast one. Oil prices, which came close to the all-time high of US$147 a barrel in March after Russia invaded Ukraine, have unwound most of their 2022 gains. Crude was trading around US$80.

Russia could cut oil production over 'stupid' price cap: President

9 December: Russia, the world’s biggest exporter of energy, could cut oil production and will refuse to sell oil to any country that imposes the West's "stupid" price cap on Russian oil, President Vladimir Putin said. The Group of Seven major powers, the European Union and Australia last week agreed to a US$60 per barrel price cap on Russian seaborne crude oil after EU members overcame resistance from Poland. Putin said Russia had a production agreement with other members of the OPEC+ oil producers' club, so such a drastic step was still only a possibility. Putin dismissed the West’s attempt to squeeze Russian finances, saying the US$60 price cap corresponded to the price at which Russia was selling oil.

Russia’s Gazprom Neft eyes steady oil refining volumes in 2023

8 December: Gazprom Neft, the oil arm of Russian gas giant Gazprom,

plans to keep its oil refining steady next year, at around 41 million tonnes, as the firm goes ahead with a modernisation of its ageing refineries. The stable output at Gazprom Neft, which controls Russia’s largest oil refinery in the western Siberian city of Omsk, shows the resilience of the Russian oil industry despite the harshest Western sanctions in recent history. Russian oil refineries, many of which were built by the Soviet Union, have been undergoing a massive modernisation in a drive to improve fuel quality to meet ecological and technological requirements. The 400,000 barrel per day (bpd) Omsk plant, 1,600 km east of Moscow, started operations in 1955 and is Russia’s largest oil refinery.

International: Gas

Portuguese PM wants to extend Iberian gas price cap beyond May

13 December: Portugal and Spain should start negotiations with the European Union (EU) to allow them to extend beyond May a cap on the benchmark price of gas used by power plants to generate electricity, Portuguese Prime Minister (PM) Antonio Costa said. Recognising the Iberian Peninsula has weak energy links to the rest of Europe, the European Commission in May allowed the two countries to initially cap gas prices at €40 per megawatt-hour, with the price limit projected to average out at €50 (US$53.14) over 12 months. Costa said the Iberian cap had already allowed Portuguese electricity consumers to save around €360 million. European Union energy ministers are meeting in Brussels to try

to agree an EU-wide cap on gas prices after months of deadlock over whether the measure can ease the energy crisis. The contract price would also need to be €35 higher than a reference price based on existing liquefied natural gas price assessments.

Gas producers warn Australian supply at risk under price cap plan

13 December: Australia’s biggest natural gas producers warned that the government was putting supply at risk, escalating an outcry after the government landed a surprise proposal to control prices beyond a one-year cap. In the first move that could hit supply, global major Shell paused accepting bids for gas under a plan to boost supply for Australia's populous east coast in 2023 and 2024 while it assesses the government’s proposal. The government announced a 12-month cap on gas and coal prices to keep a lid on bills for households and businesses hit by soaring global energy prices following Russia’s invasion of Ukraine. But producers are more concerned about the government’s proposed long-term "reasonable pricing" regime that would

set gas prices at the cost of production plus an agreed profit margin after the one-year price cap expires.

China shipyards feast on record LNG tanker orders as South Korea builders are full up

12 December: China is making fast inroads in the market for new build LNG (liquefied natural gas) tankers as local and foreign ship-owners turn to its shipbuilders for the specialty vessels because long dominant yards in South Korea are fully booked. Three Chinese shipyards - only one of them having experience building large LNG tankers - won nearly 30 percent of this year’s record orders for 163 new gas carriers, claiming ground in a sector where South Korea usually captures most of the business. LNG tanker order books for Chinese yards tripled as China’s gas traders and fleet operators sought to secure shipping after freight rates soared to records following the upending of global energy supply flows by Russia’s invasion of Ukraine. With South Korean shipbuilders swamped by orders to service Qatar’s massive North Field expansion, Chinese yards also attracted more foreign bookings, including first overseas orders for some ship makers only recently certified to build membrane-type LNG carriers. Chinese shipyards this year won 45 LNG tanker orders worth an estimated US$9.8 billion, about five times their 2021 order values, according to shipping data provider Clarksons Research. By late November, Chinese yards had grown their LNG order books to 66 from 21, giving them 21 percent of global orders worth around US$60 billion.

US, Britain launch energy partnership to boost supplies

7 December: The United States

(US) and Britain announced an energy partnership aimed at sustaining a higher level of LNG (liquefied natural gas) exports to Britain and collaborating on ways to increase energy efficiency. Britain and other European countries have turned to the United States as they try to reduce their reliance on Russian energy supplies following Moscow’s invasion of Ukraine begun in February. The US became the world’s largest LNG exporter in the first half of 2022, US Energy Information Administration data showed as the country rapidly increased its export capacity and high prices, particularly in Europe led to higher exports. Britain said the US would aim to export 9-10 billion cubic metres of LNG over the next year under the agreement, maintaining the increase in exports seen this year. Refinitiv Eikon data showed Britain has imported around 11 billion cubic meters (bcm) of gas from the United States so far in the first 11 months of 2022, up from 4 bcm in 2021.

International: Coal

UK approves first new coal mine in decades, sparking anger

8 December: Britain’s Conservative government

approved the UK (United Kingdom)’s first new coal mine in three decades, a decision condemned by environmentalists as a leap backwards in the fight against climate change. It said coal from the mine would be used to make steel — replacing imported coal — rather than for power generation. The invasion of Ukraine has made countries across Europe reconsider plans to cut their use of fossil fuels. Britain has also approved more North Sea oil and gas drilling, while the Czech Republic reversed a plan to stop coal mining in a key region.

South Africa’s Thungela expects coal prices to double annual profit

8 December: South Africa’s thermal coal exporter Thungela Resources expects its full-year profit to double, it said, as demand and higher prices for the fossil fuel offset the negative impact of poor rail performance on its export shipments. The company said

coal prices had been driven by demand, especially from Europe, whose energy supplies have been disrupted following major fuel exporter Russia's invasion of Ukraine. Benchmark coal prices averaged US$276.57 per tonne for the year to date, compared to US$124.11 per tonne last year, Thungela said.

Glencore ditches plans for US$1.3 bn Australian coal mine

8 December: Glencore has shelved development of a A$2 billion

(US$1.3 billion) coal mine in Australia's Queensland state given global uncertainties and a hike in state royalties that damaged investor confidence, it said. The miner had been in a permitting process for the Valeria mine in the Bowen Basin, which would have produced up to 20 million tonnes of thermal and metallurgical coal a year, and was part of a package it bought from Rio Tinto Ltd for US$1.7 billion in 2018. Its decision comes against a backdrop of uncertainty over the speed of global decarbonisation and as project finance has become harder to find for greenfield coal mines - those that are not expansions of existing projects.

International: Power

Australia’s volatile power market killing competition

8 December: Australia’s competition watchdog warned that power bills are going up because smaller energy retailers, unable to cope with soaring and volatile wholesale markets, are shutting down, reducing competition. The report landed just as the government is hunting for ways to cap wholesale gas and coal prices, which have rocketed due to the Ukraine crisis, aiming to finalise a plan before Christmas. Power competition has dwindled as six retailers have folded since May, while other retailers have encouraged customers to switch providers or refused to take on new customers, the Australian Competition and Consumer Commission said in a report.

International: Non-Fossil Fuels/ Climate Change Trends

Germany’s 2022 renewable power production rises but still behind 2030 target

12 December: Germany’s power production from renewable energy rose in 2022, but it is still below the threshold needed to reach the target of generating 80 percent of electricity from renewables by 2030, the Environment Agency said. Renewable energy is expected to account for around 46 percent of German power consumption this year, up from 41 percent a year earlier, the agency said. Some 256 terrawatt hours (TWh) were generated last year, mainly from wind and solar power, up 9% year-on-year, but still below the target of 269 TWh for the year in order to achieve the goal of around 600 TWh by 2030, the agency said. With the goal of becoming carbon neutral by 2045, Berlin raised its renewable energy targets this year and passed several bills to ease restrictions and accelerate the rollout of wind and solar power, declaring the expansion to be of "outstanding public interest". The need for renewables became ever more urgent with the decline of Russian fossil fuel imports to Europe’s biggest economy following Moscow’s invasion of Ukraine. Only around 0.8 percent of land in Germany is currently designated for onshore wind power. Berlin earlier this year drafted a bill setting out a minimum percentage of land in each of the 16 federal states that must be available for wind farms.

Australian government to underwrite renewable energy capacity

8 December: The

Australian government has agreed to underwrite new wind and solar farms backed by energy storage, in hopes of unleashing investment at least A$10 billion (US$6.7 billion) to stabilise the grid as coal-fired plants retire. Energy Minister Chris Bowen said the government would hold tenders for the capacity and agree floor and ceiling revenue for the projects. If revenue is below the floor, the government will pay the difference, and if the ceiling is exceeded, it will share in the profits.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2022 is the nineteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

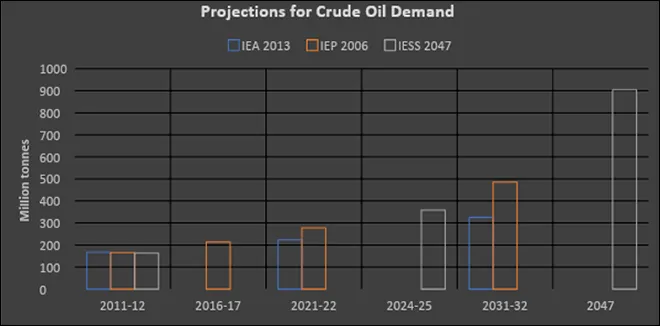

Source: Reports as indicated; IEA: International Energy Agency; IEP: Integrated Energy Policy; IESS: India Energy Security Scenarios, Planning Commission

Source: Reports as indicated; IEA: International Energy Agency; IEP: Integrated Energy Policy; IESS: India Energy Security Scenarios, Planning Commission Source: Reports as indicated; PNGRB: Petroleum & Natural Gas Regulatory Board; IEA: International Energy Agency; IEP: Integrated Energy Policy; IESS: India Energy Security Scenarios, Planning Commission; IHV: India Hydrocarbon Vision

Source: Reports as indicated; PNGRB: Petroleum & Natural Gas Regulatory Board; IEA: International Energy Agency; IEP: Integrated Energy Policy; IESS: India Energy Security Scenarios, Planning Commission; IHV: India Hydrocarbon Vision  Source: Reports as indicated; IEA: International Energy Agency; IEP: Integrated Energy Policy; IESS: India Energy Security Scenarios, Planning Commission; IHV: India Hydrocarbon Vision

Source: Reports as indicated; IEA: International Energy Agency; IEP: Integrated Energy Policy; IESS: India Energy Security Scenarios, Planning Commission; IHV: India Hydrocarbon Vision