-

CENTRES

Progammes & Centres

Location

The budget wish list from the energy industry was monopolised by the renewable energy (RE) sector. The electric vehicle (EV) industry wanted full customs duty exemption for import of hybrid storage products. This wish for lower import duties for batteries was reiterated by project developers in the solar industry. Solar companies participating in the production linked incentive (PLI) programme of the government wanted high import duties on finished equipment but lower duties on components implying assembly of modules rather than full integrated manufacture. The solar and wind industries wanted the 30 percent limit on interest deduction to be increased so that the companies can help India fulfil its COP26 commitments but also improve India’s ease of doing business rankings. Reduction in the tax rate under goods and services tax (GST) for batteries and tax relief for hybrid RE projects was another item reiterated by many RE companies. Increase in budgetary allocation for transmission and financial incentives for research and development (R&D) in solar module and battery manufacture was another common wish from RE industry leaders. Tax rebate, accelerated depreciation, interest intervention, subsidies to promote uptake of RE were amongst terms that appeared in almost all RE industry wish lists. The India hydrogen alliance the newest industry body amongst RE sectors wanted extension of tax benefits applicable to the infrastructure sector to green hydrogen-related activities including 100 percent accelerated depreciation benefits on new investments in green hydrogen technologies and tax deductions of income and profits of green hydrogen production entities. The alliance also wanted lowest possible duties and taxes on import of components required to manufacture electrolysers and offtake guarantees for hydrogen components such as electrolysers and low-interest loans for the setting up of green hydrogen system demonstration and production facilities.

To a large extent, the specific items in the wish list of the RE industry were not addressed in the Budget speech, described as the shortest in history. However, the budget did substantially increase financial incentives to the RE industry along with broad policy support. The additional funding of INR195 billion (over US$ 2.6 billion) to the PLI programme could potentially facilitate domestic manufacture of high efficiency solar modules towards meeting the ambitious goal of 230 GWp (gigawatt peak) installed capacity for solar by 2030. Green bonds to be issued as part of the overall market borrowings of the government in 2022-23 will mobilise resources for green infrastructure. Studies have found that investors are willing to accept weaker returns from green bonds and that it provides issuers (the Indian government in this case) to raise green ambitions. To improve the eco-system for EVs, the government stated that it will encourage the private sector to develop a sustainable and innovative business model for battery swapping given the constraints of space in urban areas for charging stations. Experience on battery swapping is mixed. Tesla’s battery swap trial in North America in the early 2010s was not well received and eventually abandoned, but battery swapping remains quite successful in China. India could replicate China’s success. The government’s goal of promoting public transport in urban areas along with special mobility and zero-fossil fuel zones will complement EVs in reducing carbon dioxide (CO2) emissions. To address the problem of stubble burning, the budget proposed co-firing 5-7 percent biomass in thermal power plants that is expected to reduce CO2 emissions by 38 MT (million tonnes) or about 1.6 percent of India’s annual emissions in 2020. The budget also proposed four pilot projects for coal gasification and conversion of coal into chemicals required for the industry. This may not be appreciated by the climate activists fundamentally opposed to fossil fuels but deploying coal-bioenergy gasification systems with carbon capture and storage (CBECCS) will provide the opportunity to simultaneously address India’s carbon reduction and urban clean air quality problems and also enhance India’s energy security through increase in the use of domestic fuels. The promise of more efficient trains will contribute overall energy efficiency. The absence of any concession for the nascent hydrogen industry in the budget is surprising given the presence of large players in the sector and more importantly their effort in promoting their wish list prior to the budget.

Many commentators have hailed the budget as one that had energy transition at its heart. This is probably because the terms associated with the energy transition such as clean energy, storage, batteries and clean mobility are used throughout the Budget speech rather than be confined to a section on climate change or sustainability. But the budget does not do justice to the label of an energy transition budget. Though the budget offers several incentives to the RE industry, it does not reflect an unambiguous focus on the energy transition of the country. As articulated in the budget speech, the ‘parallel track’ on which the budget aims to put India on are: (i) Improving prospects for the marginalised and unemployed and (ii) pushing for investment in modern infrastructure (Gatishakti) to ready India for its 100th anniversary as an independent country. The latter, creating a shining India for the future, receives far greater attention than the former, creating a better life for millions in the present. Energy transition is one of the many means to achieve that goal of a shining India in 2047. As a cog in the wheel of Gatishakti and a facilitator of Atmanirbhar Bharat Abhiyaan or self-reliant India, the energy transition may achieve less than what it is projected to. The RE industry, dominated by the private sector is understandably leveraging these dominant narratives to seek protection at the supply end with high import duties for cheaper imports and protection at the demand end through a guaranteed market such as the PIL programme. The RE industry will prosper but whether this will contribute to a climate resilient India is uncertain. The embrace of self-reliance could potentially increase the cost of the energy transition and as economists have pointed out may also condemn Indian economy to mediocrity. Decarbonisation of the economy through an energy transition is one of the many objectives for India and mediocre growth is definitely not one of them even if that means lower carbon emissions as the year 2020 has shown.

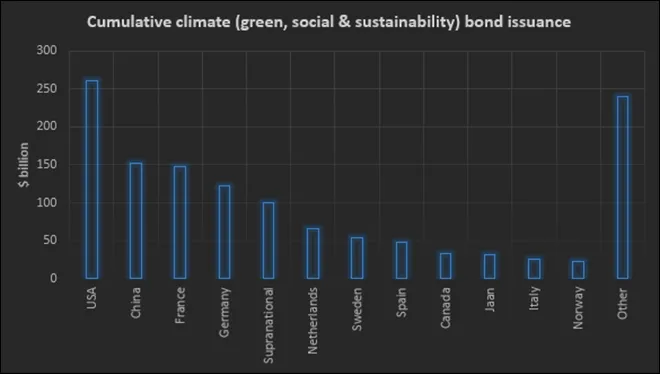

Source: Climate Bonds Initiative

Source: Climate Bonds InitiativeUnion Power Ministry has approved 23 new inter-state transmission system projects worth INR158.93 bn. The new inter-state transmission system (ISTS) projects comprise 13 projects with an estimated cost of INR147.66 (US$1.98) bn to be developed under Tariff Based Competitive Bidding (TBCB) and 10 projects with an estimated cost of INR11.27 bn (US$151.35 mn) to be developed under Regulated Tariff Mechanism (RTM). As per the ministry, these projects were approved after examining the recommendations of the National Committee on Transmission and in accordance with the National Tariff Policy 2016, notified by the central government, which provides that ISTS project is developed through TBCB, except for certain category projects, which are strategic, technical-upgradation or time-bound in nature. The above transmission network expansion would augment seamless transfer of power from power surplus regions to power deficit regions and thus optimising the use of generation resources as well as meeting the demands of end consumers without any transmission constraints.

Adani Transmission Limited (ATL) has completed the construction of one of the India’s longest intra-state transmission lines of 897 circuit km. The transmission line, set up by ATL subsidiary Ghatampur Transmission Ltd (GTL) will connect Ghatampur thermal power station in Kanpur district to Hapur substation in western Uttar Pradesh. The transmission line comprises four 765KV (Kilovolt) and 400KV bay extensions at Agra, Greater Noida and Hapur. This project has been developed under PPP mode on a build, own, operate and maintain (BOOM) basis. As per the company, this will provide transmission services to long-term transmission customers (LTTC) with 35 years of runway ahead. The project will evacuate power from 3x660 MW (megawatt) Ghatampur TPS owned by the Neyveli Uttar Pradesh Power Limited—a joint venture between Neyveli Lignite Corporation and Uttar Pradesh Rajya Vidyut Utpadan Nigam—and will also strengthen UP's transmission network. The transmission line passes through severe right of way (ROW) challenged urban areas and also through highly undulated ravine topography. One of the biggest challenges surpassed by GTL was the uncertainty caused by the COVID pandemic which made deployment of the workforce difficult.

Electricity trade volume at Indian Energy Exchange (IEX) rose nearly 54 percent year-on-year (yoy) in November this year to 9,477 million units (MU). The Day-Ahead Market achieved 4,719 MU volume in November seeing a 3 percent yoy decline. The average monthly price at INR 3.1 per unit saw a significant 62 percent month-on-month price reduction mainly due to increased liquidity on the supply-side with the sell-bids at 1.8X of the cleared volume. This ensured ample availability of power and competitive price of power thereby providing optimisation opportunities to the distribution utilities. The Term-Ahead Market comprising intra-day, contingency, daily and weekly contracts traded 302.7 MU during the month and recorded 23.4 percent yoy growth.

India will supply 20 percent more power to Bangladesh as the two countries renewed the contract for another five years. Tripura State Electricity Corporation Limited (TSECL) will supply 192 MW power to Bangladesh, an increase from the earlier 160 MW it supplied, as per the renewed agreement. India and Bangladesh inked an agreement on 11 January 2010 for power trading at a mutually agreed price. The agreement had expired on 16 March 2021. The new agreement came into effect from 17 March 2021 and would be in force till 16 March 2026.

Meghalaya and Assam have become front-runners in terms of firming up their proposals under the Revamped Distribution Sector Scheme (RDSS), meant for the revival of distribution companies (discoms). Accordingly, their state-level Distribution Reforms Committee (DRC) and State Cabinet have approved the proposals, including Action Plan and DPR, for consideration under the scheme. These proposals would now be put forward to the Monitoring Committee set up by the Ministry of Power for approval. It is noteworthy that RDSS has an outlay of INR3037.58 (US$40.79) billion (bn) with an estimated budgetary support from central government of INR976.31 (US$13.11) bn, which would be available till FY2025-26. Key interventions envisioned under this program include providing support to discoms to undertake activities for ensuring 100 percent system metering, implementing prepaid smart metering, energy accounting, and implementing infrastructure works for loss reduction, as well as for modernization and system augmentation aimed at improving the quality and reliability of power supply.

Employees of the Department of Electricity in Puducherry who formed Joint Action committee to protest the Centre’s move to privatise distribution of power staged a demonstration. The protesters carrying banners took out a procession through main thoroughfares and held the demonstration at the Head Post office in the heart of the town. The central government was making the move to open up distribution of electricity in the Union Territories including Puducherry. The panel had planned to submit a petition to the Lt Governor at the end of the procession but the participants were stopped at the post office by the police. Puducherry does not have an Electricity Board and the distribution of power is being done here through the Department of Electricity. Several political parties have expressed strong protest against the Centre's decision to privatise power distribution. The Puducherry government purchases power from central power generating undertakings to meet the local requirements. A Power Corporation was started in Karaikal to generate power to meet the local needs.

A record 15692 MW of power was successfully supplied by the Madhya Pradesh government owned electricity distribution companies (discoms). The state’s power demand shot up to 15692 MW, which was met by the three discoms and this was the highest ever power supply in the state’s history. The surge in electricity demand was due to the agriculture load as the Rabi season is underway.

According to Union Ministry of Power, India’s power consumption grew by 1.3 percent in the first ten days of this month from December 1 to 10 to 34.23 billion units (BU) over the same period a year ago. In 2020, power consumption was 33.78 BU during December 1 to 10. In the entire month of December 2020, consumption was 105.62 BU, up from 101.08 BU in December 2019. Experts are of the view that power consumption as well as demand would grow at a steady pace in December with improvement in economic activities across the country. During the first 10 days of December this year, the peak power demand met or the highest supply in a day, touched 169.12 Gigawatt (GW) compared to 165.42 GW in the same period in 2020. The peak power demand met in December 2020 was 182.78 GW up from 170.49 GW in December 2019. Many states had imposed lockdown restrictions after the second wave of the pandemic hit the nation in April this year and affected the recovery in commercial and industrial power demand as states started imposing restrictions in the latter part of the month. Curbs were gradually lifted as the number of COVID cases fell.

At 3,831 MW, the capital’s peak power demand this November was the highest ever recorded for the month. While last year's November peak was 3,769 MW, the figure stood at 3,631 MW for the month the previous year. Similarly, the city’s peak power demand this October, at 5,388 MW, was higher than the previous two years - it was 4,769 MW in October 2020 and 4,553 in 2019. The power distribution companies have already warned that Delhi’s peak power demand this winter season could surpass that of 2019 (5,021 MW) and 2020 (5,343 MW) and go up to 5,400 MW. BSES has made long-term agreements with including hydro- and gas-based power generating stations. It is also receiving more than 440 MW of solar power from Solar Energy Corporation of India (SECI), 250 MW of wind power from a plant and 25 MW from another waste-to-energy set-up.

The Union power ministry was working on resource adequacy plan guidelines to ensure 24x7 power supply to the consumers. The ministry was also discussing some bigger reforms to make discoms viable and was working on steps like de-regulating the sector or making regulation adaptability more industry friendly. Resource adequacy is the ability of a utilities' reliable capacity resources (supply) to meet the customers' energy or system loads (demands) at all hours. The factor that affects supply is the availability of sufficient dispatchable capacity resources in order to meet the demand. A focus on 24x7 power can be ensured if discoms properly have resource adequacy in place. There are a few private players who are working in this direction. The ministry was working on resource adequacy plan guidelines so that discoms can be integrated at the state level and then more at national level. The advantage of this will be lesser resource requirement.

ABB India has partnered with Indore Smart City Development Ltd (ISCDL) to deploy next-generation digital technology that enables continuous supply of electricity to homes and businesses. According to ABB India, in the first phase of the collaboration, this technology enabled more than 2,300 connections to achieve 24/7 electricity supply with an efficient automatic response system (ARS) in case of power outages or disruption. Indore, the largest city in Madhya Pradesh and home to over three million people and several key industries in the state, is also part of the central government’s mission to develop 100 smart cities across the country. One of the key parameters of a smart city is 24/7 supply of electricity to enable digital transformation and the supply of key services to citizens.

Arunachal Pradesh has successfully implemented the Centre’s rural electrification schemes like Saubhagya and Deendayal Upadhyay Grameen Ujwala Yojana. All projects under the rural electrification schemes would be completed within the current financial year. The RDSS involves a compulsory smart metering ecosystem across the distribution sector, starting from electricity feeders to the consumer level. The state power department had already installed 24,874 pre-paid energy meters at the premises of consumers in Itanagar and Naharlagun towns in the state capital complex and the revenue collection through the pre-paid energy meters are very encouraging.

Electricity supply from the 300 MW Lake Turkana wind power plant in Kenya has been cut off indefinitely after a section of the 220kV Loiyangalani-Suswa electricity line clashed. This has raised fears of a power shortage and rationing in the country in the coming days following the incident where four towers collapsed in the Longonot area of Mai Mahiu. Already, Kenya Power company has warned of a pending power shortfall as its engineers moved in to access the damage. Already, engineers from the power company and the Kenya Electricity Transmission Company (KETRACO) have embarked on repairing the damaged sections. Following the incident, Kenya Power issued a statement to assure electricity consumers that normalcy would be restored in the coming days. The company noted that the incident had led to the switching off of the Turkana power plant that is connected to the Suswa substation resulting in a generation shortfall.

According to the organization responsible for North American electric reliability, several parts of the United States (US) could face energy shortfalls during the next decade due to insufficient power generation resources. Specifically, the North American Electric Reliability Corp (NERC) said in a study that there is a high probability of insufficient resources and energy to serve electricity demand as early as summer 2022 in many parts of the Western Interconnection, which includes California and other states in the US West. As per NERC, extreme weather conditions and performance issues associated with some inverter-based resources, such as solar, wind and new battery or hybrid generation, may also have a potential negative impact on reliability.

30 December: The Jharkhand government announced a subsidy of INR25 per litre on petrol and diesel prices for people living BPL (below poverty line) in the state. The decision was taken on the occasion of a programme organised to mark two years of the Hemant Soren-led coalition government in the state. The benefits would be extended on the purchase of petrol or diesel up to 10 litres every month.

30 December. Chhattisgarh Chief Minister (CM) Bhupesh Baghel asked the Centre to reduce the cess levied by it on petrol and diesel instead of slashing central excise duty. Addressing a pre-budget meeting convened by Union Finance Minister Nirmala Sitharaman, he contended that slashing of central excise duty on petrol and diesel will lead to a reduction in the state’s share of taxes and also result in lower value added tax (VAT) collection. Baghel argued that instead of excise duty, the cess should be reduced. Cess is charged by the central government over and above the existing taxes. The Centre does not share cess with the government as it is utilised for the purpose it has been collected for.

4 January: Maharashtra has sought the coal ministry’s intervention in getting forest clearance for the Chhattisgarh government coal block allotted to its power stations in the Vidarbha region, becoming the second state to knock on the Centre’s doors over mining hurdles in a state that has the country’s third-largest coal deposits.

1 January: Coal India Ltd (CIL) reported a 3.3 percent rise in coal production to 60.2 million tonnes (MT) in December. Coal India Ltd (CIL) had produced 58.3 MT of coal in the corresponding month of the previous fiscal. The company’s coal output increased to 413.6 MT during the April-December period from 392.8 MT in the corresponding period of the previous fiscal. Coal India accounts for over 80 percent of domestic coal output. The country’s coal production is expected to record a "sizeable leap" in 2022 with increased output mainly from CIL and captive mines, providing an adequate firewall against any possible dry fuel shortages like the one witnessed in the latter half of this year. Coal Secretary Anil Kumar Jain had said the increase in coal output would be on account of more production from CIL, captive coal blocks auctioned between 2015-2020 and commercial mines put on sale last year. In the last financial year, CIL dug out about 596 MT of coal, he had said. In the ongoing fiscal, the output is likely to be upped to 640 MT.

31 December: An industry body has sought the intervention of Odisha Chief Minister (CM) Naveen Patnaik in resolving the acute coal shortage faced by captive power plants in the state. The Utkal Chamber of Commerce and Industry Ltd (UCCI) said the paucity due to curtailment of coal supplies since August was a threat to the survival of the local industry, leading to loss of lakhs of jobs. Industries that rely on captive power plants (CPP) in Odisha are facing alarmingly depleted coal stocks of only two-three days as compared to the prescribed level of 15 days, UCCI president Brahma Mishra said. Over 65 percent of the coal in Odisha is being supplied by the Mahanadi Coalfields Ltd (MCL) to power plants in other states, resulting in local industries facing coal deficit, he said. The acute coal shortage due to the diversion of the supply has brought down the CPP-based industries, and micro, small and medium enterprises (MSMEs) to a grinding halt, resulting in increased prices of finished products, he said.

2 January: Delhi’s peak power demand surged to 7,323 MW in 2021, only a shade lower than the all-time high of 7,409 MW in 2019 but considerably higher than the corresponding demand of 6,341 MW in 2020, official statistics on power demand in the national capital reveal. Power distribution companies officials attribute this demand for power in the capital to a devastating second wave of COVID-19 and adverse weather conditions for a prolonged period. On a day-to-day basis, Delhi saw a rise in power demand on 227 days of 2021 compared to similar days of 2020, implying that on 61 percent days of 2021, Delhi needed higher power than what was needed in 2020. Delhi’s peak power demand during 2021 was 7,323 MW, 6,431 MW in 2020 and an all-time high of 7,409 MW in 2019.

31 December: Kalpataru Power Transmission Ltd (KPTL) said that it has bagged new orders worth INR15.6 bn. The orders include those from India, Africa, CIS and South America in the power transmission business. Besides, KPTL’s international subsidiary has secured new power transmission projects in Europe.

31 December: PTC India announced that it will supply 270 MW of power to the Kerala State Electricity Board (KSEB) under Pilot Scheme-II of the Ministry of Power, from 1 January. The power will be supplied by the Jindal India Thermal Power Project in Odisha under a medium-term PPA (power purchase agreement) for three years. PTC India was selected as an aggregator to facilitate the purchase and sale of power. PTC has also tied up power under the scheme with TANGEDCO and JKPCL. Supply is expected to start soon. The power trading solutions firm is one of the leading companies in power trading and has been mandated by the Centre to trade electricity with Bhutan, Nepal and Bangladesh.

3 January: ITC has commissioned its first offsite solar plant in Dindigul, Tamil Nadu. The 14.9 MW solar plant, built at an investment of INR760 mn, will help reduce CO2 (carbon dioxide) emissions over the course of its lifetime. The plant has already helped ITC to achieve the rare feat of meeting 90 percent of its electricity requirement from renewable sources in Tamil Nadu. This new project is in line with ITC chairman Sanjiv Puri’s ‘Sustainability 2.0’ Vision, a comprehensive goal-based agenda which raises the bar for sustainability performance. It calls for inclusive strategies that can support even more livelihoods, pursue newer pathways to fight climate change, support circular economy and enable transition to a net zero ecosystem. As a part of this Vision, ITC plans to meet 100 percent of the entire grid electricity requirements from renewable sources by 2030 and contribute meaningfully to combat the threat of climate change. ITC’s renewable portfolio comprises 138 MW of wind power plants and 14 MW of solar plants with 53 MW of additional solar capacity under execution. Currently, projects are also underway in other sources of renewable energy like biomass boilers. The Company has made investments of over INR10 bn in renewable energy assets to date.

3 January: Pondicherry University saves more than INR10 mn per annum on electricity bills after the commissioning of solar power plants with a total capacity of 2.4MW at a cost of INR130 mn. Renewable Energy Service Company (Resco), an energy service company which provides energy to consumers from renewable energy sources, has developed, installed and financed the plant. The company operates and owns the rooftop solar power project and supplies power generated from the project to the university. Resco has installed rooftop solar plants in 15 buildings and car porches in two areas in various locations on the campus. The university roughly spends INR75 lakh per month on electricity.

29 December: State-owned power producer SJVN said it will invest INR600 bn to harness 5,097 megawatts (MW) of hydropower in Arunachal Pradesh. SJVN has set an ambitious target to achieve an installed capacity of 5,000 MW by 2023, 12,000 MW by 2030 and 25,000 MW by 2040. The firm had urged the Uttar Pradesh government to allot the company more renewable power projects in the state.

31 December: Sri Lanka will sign a deal with Lanka Indian Oil Corporation (LIOC) to restore 75 oil tanks as the country moves to secure a US$500 million fuel credit line from India, its energy ministry said. The island nation is facing dwindling foreign exchange reserves and has nearly US$4.5 billion worth of debt repayments in 2022, prompting it to look at innovative ways to bring in foreign exchange. The facility, with 99 storage tanks, is located next to a harbour off Sri Lanka’s east coast and though India and Sri Lanka agreed to jointly develop it in 1987, negotiations dragged on for decades. The cost of restoration is pegged at about US$1 million per tank. The latest round of negotiations between the Sri Lankan government, its Indian counterpart and LIOC began in August 2020.

30 December: China has issued its first refined fuel import quotas for 2022, with gasoline and diesel volumes sharply up from a year ago, and naphtha, a petrochemicals feedstock, largely steady. Under the issue, naphtha totalled 10.09 million tonnes (MT), including 5.75 MT issued to state-run companies and another 4.34 MT allotted to independent petrochemical producers, the document from the Ministry of Commerce showed. That compared to a total of 9.94 MT issued under the first lot of 2021. Import quotas for gasoline rose to 700,000 tonnes versus 200,000 tonnes a year earlier, and diesel was set at 750,000 tonnes, versus 200,000 tonnes under the first allotment a year ago. The quotas for gasoline and diesel were exclusively handed to state-run companies. The government is expected to release the first batch of refined fuel export quotas in January, after cutting the whole of 2021 issues by about a third versus 2020. China overall has a surplus of refined fuel products - mainly gasoline, diesel and aviation fuel - after a rapid growth in the private sector in recent years created refining overcapacity.

30 December: The United States (US) Department of Energy said it had approved a release of 2 million barrels of crude oil to Exxon Mobil Corp from its Strategic Petroleum Reserve (SPR) as part of a previously announced plan to try to reduce gasoline prices. The Energy Department said it has now provided a total of over seven million barrels of crude oil from its reserve to boost the nation’s fuel supply.

29 December: Oil prices rose, after government data showed US (United States) crude and fuel inventories fell, offsetting concerns that rising coronavirus cases might reduce demand. Brent crude rose 29 cents to settle at US$79.23 a barrel. US West Texas Intermediate (WTI) crude rose 58 cents to settle at US$76.56 a barrel. In the US, the average number of daily confirmed coronavirus cases hit a record high of 258,312 over the last seven days. Both oil futures contracts earlier traded at their highest in a month after US government data showed lower oil inventories. US gasoline stocks fell by 1.5 million barrels over the same period to 222.66 million barrels, compared with analysts' expectations in a Reuters poll for a 0.5 million-barrel rise. Distillate stockpiles fell by 1.7 million barrels to 122.43 million barrels, versus expectations for a 0.2 million-barrel rise, the EIA (Energy Information Administration) data showed. Oil prices have been underpinned by Ecuador, Libya and Nigeria declaring forces majeures on part of their oil production because of maintenance issues and oilfield shutdowns. Russian Deputy Prime Minister Alexander Novak said that the OPEC+ group of producers has resisted calls from Washington to boost output because it wants to provide the market with clear guidance and not deviate from policy on gradual increases to productions.

1 January: Bulgaria’s energy regulator said it has approved a 30.4 percent increase of the wholesale natural gas price for this month, following a request by Bulgargaz, the Balkan country’s main gas provider and public supplier. Natural gas prices have soared in Europe in the past year, adding to inflationary pressure and threatening to dent consumer confidence. The regulator set the January gas price at 133.4 levs (US$77.60) per MWh before costs for transport and taxes from 102.3 levs in December. Bulgargaz said the price for Bulgarian consumers would still be some 35 percent less than prices at European gas hubs, as the company secures its gas mix under a long-term hybrid contract with Russia's Gazprom and an oil-indexed contract with Azerbaijan’s SOCAR. The energy regulator said the increase is likely to put heating utilities that rely on natural gas under pressure, after parliament froze the prices for electricity and heating until the end of March. It urged the new centrist government to launch its state aid scheme to help the heating utilities cope with the higher gas prices. Bulgaria imports about 3 billion cubic meters (bcm) of gas per year, mainly from Russia’s Gazprom. Smaller amounts of gas are also imported from Azerbaijan. Bulgargaz said it has enough natural gas in storage to meet increased demand until the end of March.

30 December: Asian liquefied natural gas (LNG) prices fell on muted Asian demand and a drop in European gas prices in thin holiday trading, though a bullish outlook remained on concerns over tight European supply. The average LNG price for February delivery into Northeast Asia fell to 33.8 per metric million British thermal units (mmBtu), down US$14.5, or around 30 percent from the previous week. Demand in Asia stalled as buyers resisted high spot market prices that recently reached around US$45/mmBtu and favoured alternative fuels, but demand could recover in January, Rystad Energy said in a report. European gas prices declined from all-time highs seen despite concerns over Russian supply with the Yamal pipeline that brings Russian gas to heat homes and power electricity generation in Germany remained in reverse direction, sending fuel back to Poland for a 10th day. The arrival of several LNG gas tankers sent prices down and helped offset low exports from Russia. Pacific LNG freight spot rates fell 28 percent week-on-week to US$85,500 per day, according to data intelligence firm Spark Commodities.

1 January: Indonesia has banned coal exports in January due to concerns over low supplies for domestic power plants. The Southeast Asian country is the world's biggest exporter of thermal coal, exporting around 400 million tonnes in 2020. Its biggest customers are China, India, Japan and South Korea. Indonesia has a so-called Domestic Market Obligation (DMO) policy whereby coal miners must supply 25 percent of annual production to state utility Perusahaan Listrik Negara (PLN), at a maximum price of US$70 per tonne, well below current market prices. The ministry instructed that all coal at harbours should be stored to supply power plants and independent power producers (IPP). In August 2021, Indonesia suspended coal exports from 34 coal mining companies it said failed to meet domestic market obligations between January and July last year. Indonesia is amongst the top 10 global greenhouse gas emitters and coal makes up around 60 percent of its energy sources.

30 December: Egypt and Saudi Arabia are investing US$1.8 billion in an electricity interconnector with a capacity of 3,000 MW, which is one and a half times more than the production of the River Nile’s High Dam. The project enables Egypt to export electricity as it is working to connect with Saudi Arabia and take advantage of the different peak times of energy consumption. The exchange of power is further enabled using storage installations. The project is also considered the starting point for Egypt to transform into a main hub for the Arab electricity market.

3 January: The German government has said that it considers nuclear energy dangerous and objects to European Union (EU) proposals that would let the technology remain part of the bloc’s plans for a climate-friendly future. Germany is on course to switch off its remaining three nuclear power plants at the end of this year and phase out coal by 2030, whereas its neighbour France aims to modernise existing reactors and build new ones to meet its future energy needs. Environmentalists have criticised Germany’s emphasis on natural gas, which is less polluting than coal but still produces carbon dioxide – the main greenhouse gas – when it is burned.

30 December: Chinese centrally owned state firms must cut their energy consumption per 10,000 yuan (US$1,570) of output value by 2025 to 15 percent below their 2020 levels, the state-asset regulator said. State-owned enterprises also have to reduce carbon dioxide emissions per 10,000 yuan of output value by 18 percent from 2020 levels, also by 2025, the State Assets Supervision and Administration Commission (SASAC) said. The regulator also said firms' installed proportion of renewable energy power generation should be raised to more than 50 percent, as part of China's target of having carbon emissions peak before 2030.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.