-

CENTRES

Progammes & Centres

Location

In 2011, the International Energy Agency (IEA) brought out a special report titled “Are we entering a golden age of natural gas?” The IEA’s expectation of a golden age of natural gas, though cautious as captured by a question mark, was based on assumptions of (i) an increase in gas use in China, (ii) greater use of natural gas in transportation, (iii) slower growth in nuclear power capacity, and most importantly (iv) an optimistic outlook for gas supply from unconventional gas resources at relatively low cost. That year, natural gas production from the United States at 617.4 billion cubic meters (BCM) exceeded natural gas production from the Russian Federation (616.8 BCM), until then the world’s largest gas producer. Increasing the share of natural gas in the global energy basket was expected to reduce carbon emissions as well as local pollution, diversify energy supply (from secure sources such as the US), and thus, increase energy security, act as back-up capacity for intermittent renewable based power generation and increase overall energy supply to meet the growing needs of China and India that were rapidly urbanising.

Though environmentalists have not necessarily welcomed the idea of a golden age for natural gas, gas has done well compared to most other fuels barring renewables in the period 2011-2019 (2020 was an unusual year for energy consumption). If renewables are treated as outliers as they receive financial and policy support that other fuels do not, natural gas comes out as the best performing fuel with a growth of over 20 percent in 2011-2019. In this period, primary energy consumption grew by about 12 percent, hydropower consumption by over 15 percent, oil consumption by over 10 percent while coal consumption declined by 0.54 percent. The IEA report projected that the share of natural gas in the global primary energy basket would increase from about 22 percent to over 25 percent by 2035. In 2021, the share of natural gas in the global primary energy basket was close at 24.7 percent.

Most of the growth in natural gas consumption in 2011-19 occurred in countries that were net exporters of gas such as the US (28.9 percent), Iran (46.1 percent), and Canada (16.48 percent) but China, a net importer of natural gas was an exception with gas consumption growing by over 138 percent. In the US the share of natural gas in its primary energy basket increased from 25 percent to over 32 percent in 2011-2019 and in China it increased from about 4.8 percent to 7.8 percent. China’s growth was driven by strict mandates to substitute coal with natural gas and also by the investment in infrastructure such as pipelines.

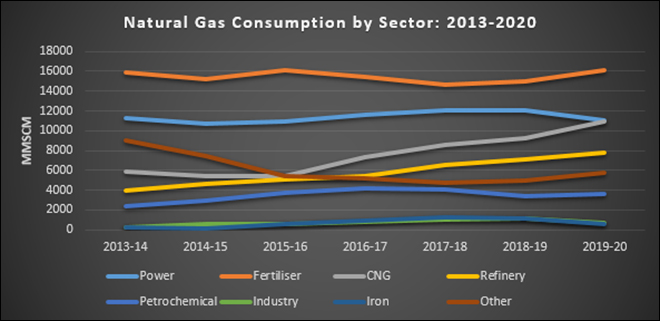

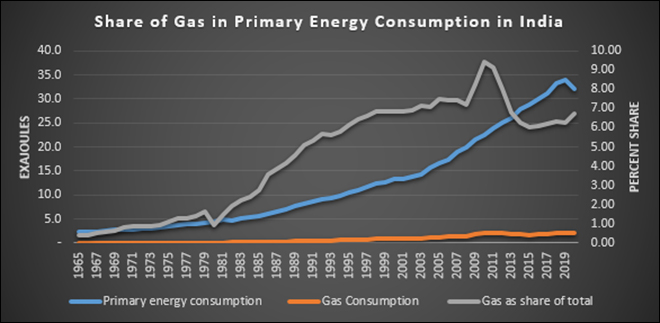

The idea of making India ‘a gas-based economy’ was initiated in 2016, when the dream of a golden age of gas was fresh and promising. The quantitative task under this narrative was to increase the share of gas in India’s primary energy basket from about 6 percent in 2016 to 15 percent by 2030. The IEA report pinned its hope for a golden age for gas on consumption growth in India along with China. But India did not live up to the expectations. Natural gas consumption fell by about 1 percent in 2011-2019 and the share of gas in India’s primary energy basket fell from its peak of 9.4 percent in 2010 to 6.29 percent in 2019 (share without biomass in total primary energy consumption). Between 2013-14 and 2019-20, consumption of natural gas in power generation fell marginally by over 2 percent and consumption from the fertiliser segment increased only slightly by just over 1 percent. These two segments that accounted for over 42 percent of consumption in 2019-20 are showing flat or negative growth which explains the slow growth of gas consumption. However other segments have shown phenomenal growth in the same period. CNG (compressed natural gas) consumption (including transportation) grew by over 1,700 percent, industries by over 160 percent, refining by over 96 percent, petrochemicals by over 40 percent and sponge iron by over 310 percent. Unlike other countries in which gas consumption was driven by power generation, India leans heavily on growth in household and transportation segments served by CNG. Unlike the power and fertiliser segments consumers (vehicles and households) are dispersed which increases transaction costs. This slows down overall gas consumption growth.

The share of natural gas in India’s energy basket increased marginally to 6.7 percent in 2020, despite the overall decrease in energy consumption primarily because of the fall in global liquefied natural gas (LNG) prices. It is unlikely that this trend will be sustained in 2021 given the phenomenal increase in international gas prices in the second half of the year. In the early 2000s, consumption of natural gas, led by the power and natural gas segments, increased mainly because of the availability of affordable domestic gas from the east coast of India. When production of domestic gas fell from this region, consumption declined with it. This points to two key challenges that inhibit gas consumption growth in India: High price and high transaction costs in growth segments like CNG. Substitution of gas for biomass used as fuel for cooking reduces emission of black carbon (soot) and carbon monoxide. In transportation, substitution of gas for liquid petroleum fuels reduces exhaust emissions—that is the primary cause of fog in Northern India—and in power when gas is substituted for coal, it reduces carbon emissions by half. As many industry experts have pointed out, to improve the pace of India’s dash for gas, at least a fraction of the policy and financial support that renewable energy receives needs to be extended to natural gas which reduces carbon emissions in all segments of end use. In addition, natural gas does not pose the problem of intermittency in power generation from renewables that requires expensive stand by power.

According to a report released by the finance ministry, volatility in the prices of crude oil, edible oils, and metal products pose concerns for India’s economy, though inflation is expected to ease in coming months. The Reserve Bank of India’s monetary policy committee left policy interest rates unchanged, lowering its retail inflation projections to 5.3 percent from 5.7 percent for the current fiscal year ending in March 2022, while warning about the risk of higher fuel prices.

According to government data, India’s fuel and electricity consumption grew at a slower pace in September compared with August, despite a recovery in factory activity. Sale of gasoil, which accounts for about two-fifths of India’s refined fuel demand, by state retailers rose 0.79 percent in September, preliminary government data showed. Gasoil sales rose 16 percent in August compared with last year. Electricity consumption rose 0.8 percent in September, compared with 17.1 percent growth in August, data from federal grid regulator POSOCO showed. India’s factory activity improved last month as a recovery in the economy from the pandemic-induced slump boosted demand and output, a private survey showed. It was not immediately clear why there was a slump in the pace of energy demand growth. Gasoline sales rose 6.57 percent in September, compared with a 13.6 percent rise in August. Indian Oil Corp (IOC), Hindustan Petroleum Corp Ltd (HPCL) and Bharat Petroleum Corp Ltd (BPCL) own about 90 percent of the country’s retail fuel outlets.

In the coming days, the Centre could allow fair price shops (FPS) to retail small liquefied petroleum gas (LPG) cylinders, as well as offer financial services, in a bid to ensure the financial viability of such outlets. The proposal in this regard was taken up during a virtual interaction between the Union ministry of food and consumer affairs and state governments. The Oil Marketing Companies (OMCs) “appreciated” the Union government’s proposal to retail LPG cylinders at FPS shops, also known as ration shops, while also assuring that the necessary support would be provided in this regard in coordination with the interested state and Union territory (UT) governments. The state governments, on their part, said that collaborating with common service centres (CSC), will increase the viability of the ration outlets.

For the first time, Kolkata Port has successfully handled ship-to-ship (STS) lighterage operation of liquid petroleum gas (LPG) of BPCL at Sandheads. Syama Prasad Mookerjee Port said the first-ever STS operation of LPG in the Indian Coast was undertaken by BPCL on October 15 and a quantity of 23,051 million tonnes (MT) of cargo was transferred to the daughter vessel in 17 hours. The mother vessel, MT Yushan, with a parcel load of 44,551 MT cargo carried out the STS operation with daughter vessel, MT Hampshire, at Sandheads. For BPCL, this ship-to-ship lighterage operation under Haldia Dock System will save time by 7-9 days and US $3,50,000 (INR26 million) per voyage. Import of LPG from the port had more than doubled in the last five years.

Cooking gas or LPG price was hiked by INR15/cylinder in line with a surge in international fuel prices. Rates of both subsidised and non-subsidised LPG prices were hiked. Cooking gas now costs INR 899.50/cylinder in Delhi. Simultaneously, petrol price was increased by 30 paise/litre and diesel by 35 paise a litre. Petrol now costs INR 102.94/litre in Delhi and diesel is priced at INR 91.42/litre.

The government’s collection from levy of excise duty on petroleum products has risen 33 percent in the first six months of the current fiscal when compared with last year and is 79 percent more than pre-COVID levels, as per data from the Controller General of Accounts (CGA) in the Union Ministry of Finance. Finance Ministry and Oil Ministry had blamed the oil bonds for limiting fiscal space to give relief to people from fuel prices trading at all-time high levels. The bulk of the excise collections come from petrol and diesel on which the Modi government had levied record taxes last year. Excise duty on petrol was hiked from INR 19.98/litre to INR32.9 last year, to recoup gain arising from international oil prices plunging to multi-year low as pandemic gulped demand. On diesel, the duty is hiked to INR 31.80. The government had raised excise duty on petrol and diesel to mop up gains that would have otherwise accrued to consumers from international oil prices crashing to as low as US $19/barrel.

According to petrol pump owners, fuel business in border districts of Madhya Pradesh (MP) is severely hit, as most vehicles prefer to refuel in Maharashtra or Chhattisgarh, where petrol and diesel are cheaper. Hike in petrol and diesel prices have been exacerbated in the border districts of MP due to transportation cost and cheaper rates in neighbouring states. In the Anuppur district of the state, petrol prices crossed INR120/litre. Similarly, the cost of petrol in Balaghat, which falls on the state’s border with Chhattisgarh and Maharashtra, reached INR119.23/litre.

A litre of diesel is only INR 2 shy of a century in Kolkata at present as fuel prices in the city rose again, with diesel reaching INR98.03/litre and petrol selling at INR106.78/litre in yet another all-time high. Fuel prices in the country have been hovering at record levels since April this year. While diesel used to sell at INR77.41 at the start of the year and had a INR6 rise in the first four months, it has shot up by close to INR 15/litre in six months and is set to climb further according to fuel station operators in the city. State-run oil refiners such as IOC, BPCL and HPCL revise the fuel rates on a daily basis based on crude oil prices in international markets and the rupee-dollar exchange rates. Any changes in petrol and diesel prices are implemented with effect from 6am every day. Fearing the soaring fuel prices will lead to hike in prices of essential and non-essential goods across several categories, petrol pump owners’ association demanded the Centre and the state to reduce taxes—which constitute to more than 50 percent of the total price.

Karnataka Chief Minister (CM) hinted at reducing cess and sales tax on petrol and diesel in the state to ease the fuel prices, which have touched an all-time high. CM had earlier outrightly rejected any tax cuts on fuel in the state. The petrol price has reached INR 109.16/litre and diesel price has touched INR100 in Karnataka. Opposition Congress has demanded a reduction in taxes on fuel on the lines of the Tamil Nadu government, which had reduced the taxes on petrol by INR 3/litre.

Recent hikes in fuel prices resulted in petrol and diesel touching all-time highs in several states as international crude oil prices soared to a seven-year high of US $83.59/barrel. A litre of petrol now costs more than INR100 in almost all state capitals. It crossed the INR 100-a-litre mark in Delhi, Rajasthan, Madhya Pradesh, West Bengal, Maharashtra, Andhra Pradesh, Telangana, Karnataka, Jammu and Kashmir, Odisha, Tamil Nadu, Ladakh, Punjab and Bihar. Petrol in Mumbai is the costliest at INR 110.41/litre, while diesel stands at INR101.03/litre. According to BPCL, one litre of oil costs around INR 41. Now, add INR 3.79 as commission to the petrol pump dealer, which raises the cost to INR 44/litre. The rest is all tax. The Centre charges INR 32.9/litre as taxes on petrol while the state taxes vary around INR 20/litre.

According to Union Ministry of Petroleum and Natural Gas, India’s private oil refiners are willing to work with state-run peers to bargain collectively for better oil import deals, as the nation looks to cut its import bill. India is forming a group bringing together state and private refiners to seek better crude import deals. As per the ministry, the private companies are “enthused” by the plan. India is the world’s third-largest oil importer and consumer, reliant on imports for about 85 percent of its crude and buying most of that from Middle East producers. Private companies including Reliance Industries (RIL), operator of the world’s biggest refining complex, and Nayara Energy, partly owned by Russian oil major Rosneft, control about 40 percent of India’s 5 million barrel per day (bpd) refining capacity. With local gasoline and gasoil prices rising to record highs in India’s worst power crisis for years, the nation wants to redouble efforts to buy wisely. India’s trade deficit last month surged to a record US $22.6 billion (bn), its highest in at least 14 years, driven by expensive imports. India has repeatedly asked the Organization of the Petroleum Exporting Countries (OPEC) and its allies, together known as OPEC+, to boost output to bring down global oil prices.

Refineries of (IOC) are running at nearly 90 percent capacity according to company. As per the company, the refineries will soon be operating at 100 percent capacity as demand for most fuels cross or reach pre-pandemic levels. It noted that under a business-as-usual scenario, around 30 percent of IOC’s ATF (Aviation Turbine Fuel) sales are to these international flights. IOC is the country’s largest fuel refiner and retailer, commanding close to a third of India’s 5 million bpd crude oil refining capacity.

IOC has deferred a maintenance shutdown at the 160,000 bpd Haldia refinery by at least 15 days to mid-November to meet higher local fuel demand during the festival season. The country’s top refiner had planned to shut an about 80,000 bpd crude unit and some secondary units at its eastern India plant from 1 November. The refiner plans to shut a crude unit and a vacuum distillation unit for 40 days, a fluidised catalytic cracker for 50 days and a diesel hydro desulphuriser for 25 days. Haldia refinery has two crude and vacuum distillation units.

Mangaluru-based Mangalore Refinery and Petrochemicals Limited (MRPL) has entered into an agreement with PEP Fuels, a start-up company promoted by ONGC, for door-to-door delivery (DDD) of diesel. PEP Fuels is a start-up company registered with the department of promotion for industry and internal trade (DPIIT), ministry of Commerce and Industry. As per the agreement, PEP Fuels will source HSD from MRPL and deliver it at the customer’s doorstep through mobile dispensers easing the product sourcing and reducing inventory carrying costs for customers. The PEP Fuels online platform enables the customer to place and process orders through mobile/web, with minimum manual intervention. Based on the success of this model, MRPL intends to expand DDD services to other cities and towns shortly.

India, the world’s third-largest energy consumer, has told Saudi Arabia and other OPEC (Organisation of Petroleum Exporting Countries) nations that high oil prices will hurt the nascent economic recovery the world is witnessing after the devastating pandemic and that they have to price oil at reasonable levels. Petrol and diesel prices have shot up to record highs across the country after relentless price increases since early May. India, which imports almost two-thirds of its oil needs from West Asia, has told crude oil producers, including the OPEC, that high oil prices will hasten the transition to alternate fuels and such rates will be counter-productive for the producers. Oil Ministry has flagged the issue of high oil prices to Saudi Arabia, the UAE, Kuwait, Qatar, the US, Russia and Bahrain. Ministry, in its meetings with OPEC and its counterparts in Saudi Arabia and other nations, conveyed India’s serious concerns over crude oil price volatility. It conveyed India’s strong preference for responsible and reasonable pricing which is mutually beneficial for consumers and producers. India is again likely to raise the issue of high oil prices when global leaders meet for the India Energy Forum by CERAWeek. India is 85 percent dependent on imports to meet its oil needs and relies on overseas shipments to meet 55 percent of its gas requirement. Not just price, India also wants better commercial terms like optional volumes in yearly supply contracts and larger time to pay for oil bought.

According to the World Bank, the stunning recent run-up in global oil prices could threaten economic growth, and is unlikely to retreat until 2023. Average crude prices are expected to end the year at US $70 a barrel, 70 percent higher than in 2020, according to the latest Commodity Markets Outlook. Oil prices in recent weeks have surged above US $80 a barrel, the highest point in years, as economies reopen following the pandemic shutdowns and amidst shipping bottlenecks. As per the World Bank, the 2022 average is projected to rise to US $74 before falling to US $65 in 2023.

Oil prices fell with Brent down after Chinese data showed slowing economic growth and US (United States) factory output dropped in September, raising fresh concerns about demand amidst a patchy recovery from the coronavirus pandemic. US oil fell 33 cents, or 0.4 percent, to US $82.11 a barrel, having risen 0.2 percent in the previous session and nearly 10 percent. Factory output in the US dropped the most in seven months last month as a global shortage of semiconductors slowed auto production, further evidence that supply constraints are a strain on economic growth. In China, the world’s second-biggest economy, bottlenecks also contributed to a decline in the growth rate to a one-year low as energy shortages and sporadic outbreaks of coronavirus hit the country. China’s daily crude oil processing rate fell again last month to the lowest level since May last year. But with temperatures falling as the northern hemisphere winter approaches, prices of oil, coal, and gas are likely to remain elevated.

Credit rating agency Moody’s has increased its medium-term oil price range to US $50-$70/barrel—the range it had before the coronavirus pandemic—to reflect the expectation that the full average cost of production of a marginal barrel of oil will keep increasing in step with a continued recovery in demand. The US Energy Information Administration (EIA) recently raised its estimates of growth in global demand, and now expects that oil demand will marginally exceed the pre-pandemic level of 101 million bpd by the end of 2022, after a strong recovery to 97 million bpd in 2021. Updated expectations from the International Energy Agency (IEA) and OPEC also anticipate that oil demand will almost fully recover to its pre-pandemic level in 2022. As per the rating agency, the price range reflects its view of the level of oil prices necessary for producers to reinvest profitably. Since oil producers deplete their existing reserves as they generate earnings, oil prices must support reinvestment over the medium term for the industry to maintain its ever-depleting resources and support existing levels of production, as well as growth. Moody’s had in May 2020 reduced its medium-term oil price expectations by US $5/barrel amidst a sharp drop in production and development costs based on a rapid decline in demand. It had then expected that the oil industry would need to postpone its development of higher-cost reserves until demand had fully recovered. But an accelerated recovery in global oil demand in the third quarter of 2021 propelled oil prices into the US $70-$80/barrel range. Oil producers achieved significant cost savings in 2020-21, but production costs started to rise in step with oil demand and a broader economic recovery.

Saudi Arabia’s oil company Aramco reached a US $2 trillion valuation as it hit near record levels during trading hours. Its market cap value puts Aramco just behind Microsoft and Apple as the world’s most valuable company. It comes as crude oil prices climb to over US $82 a barrel, the highest in seven years. Demand for energy is picking up, despite the ongoing coronavirus pandemic’s continued toll on travel and other key gas-guzzling sectors. Demand for oil is forecast to hit 99 million bpd by the end of the year, and a little over 100 million bpd next year. Aramco raked in a net income of around US $47 bn in the first half of 2021, double what it earned over the same period last year when the coronavirus grounded travel and pummelled global demand for oil.

OPEC and its key allies will meet to decide whether to ramp up oil production in a bid to calm overheated global energy prices. The market landscape has changed little since the previous 1 September meeting of the OPEC+, with demand continuing to weigh on global crude supply. Oil prices jumped above US$80 for the first time in almost three years, handing the club, led by Saudi Arabia and Russia, both a boost and a dilemma. OPEC has been sticking to an increase in production of 400,000 bpd, agreed in July, but could nonetheless be tempted to open the taps further. US urged such an approach in August, when National Security Advisor said the cartel was not doing “enough” to boost oil production.

Canadian heavy crude’s price collapsed at the US trading hub of Cushing as refiners shun heavy and higher-sulphur crude for lighter grades that are less expensive to process in refineries. Western Canadian Select’s discount for December to West Texas Intermediate widened to US $9 a barrel at Cushing, the steepest in about two years, according to NE2 Group data. The discount is about US $7 a barrel smaller than the price at the Canadian oil hub at Hardisty, Alberta. The price has weakened at Cushing after a newly built oil export pipeline called Line 3 increased shipments of Canadian oil to the US.

Crude inventories are swelling on the US Gulf Coast, but the pile-up won’t last for very long. Supplies have surged by nearly 20 million barrels so far in October, the most for this month in at least a decade, on the reversal of Capline pipeline and as more barrels are pulled to the region for export due to demand from Asia. But refiners are beginning to ramp up operations after maintenance and that should lead to stockpile declines. In contrast to the supply situation along the Gulf Coast, stockpiles at Cushing, Oklahoma, the delivery point for West Texas Intermediate crude futures, have slumped to the lowest since October 2018. The difference in the two regions highlights how the US crude benchmark does not fully reflect supply and demand in the Gulf Coast.

US oil prices rose for a fifth day to their highest since 2014 amidst global concerns about energy supply on signs of tightness in crude, natural gas and coal markets. Brent crude prices also climbed for a fourth day on the supply anxiety, particularly after the OPEC+, decided to say with their planned output increase rather than boosting it further. OPEC+ agreed to adhere to its July pact to boost output by 400,000 bpd each month until at least April 2022, phasing out 5.8 million bpd of existing production cuts. Oil prices have surged more than 50 percent this year, adding to inflationary pressures that crude-consuming nations such as the US and India are concerned will derail recovery from the COVID-19 pandemic. The American Petroleum Institute reported US oil inventories rose by 951,000 barrels in the week to 1 October.

Brazil’s oil auction ended in disappointment, with the government selling offshore drilling rights in only five out of 92 blocks on offer. The dismal results reflected the weakened state of the oil industry during the COVID-19 pandemic as well as environmental concerns, according to experts. The auction brought in just 37.14 million reais (US 6.7 million) compared to the US $2 bn raised at the previous auction held in October 2019, before the pandemic started.

Lanka IOC (LIOC), the subsidiary of Indian Oil Corporation in Sri Lanka, has hiked the retail prices of both petrol and diesel by INR5 per litre in the wake of the rising global oil prices. Accordingly, a litre of petrol now costs INR162 and diesel INR116. The hike came days after the LIOC urged the government to allow them to increase the prices, although it has no obligation to ask the government in determining their retail prices. As per the LIOC, though the retail price determination is at the company’s discretion, it is consulting the Sri Lankan government due to the prevailing condition in the country. The Lankan government, which is facing a severe foreign exchange crisis, has put on hold the expected retail price hike of fuel despite increasing the prices of cooking gas and other essentials. LIOC’s competitor, the state-run fuel distributor Ceylon Petroleum Corporation (CPC), is yet to take any decision on increasing the fuel prices, however, it has also urged the government to approve price hikes. As per the LIOC, the company was expecting an increase in petrol price by INR 20/litre and diesel by INR 30/litre. It said that the crude oil price in the international market now fluctuates between US $83-94/barrel from being around US $65 four months ago. As a result, the LIOC has suffered huge losses. Meanwhile, with the LIOC raising the fuel prices, people queued at the CPC-run petrol stations, however, most of them had put up ‘no petrol’ signboards, which motorists claim was caused by the anticipated government’s decision to raise oil prices. However, Energy Ministry has ruled out increasing retail fuel prices. LIOC has been in operation in Lanka since 2002, and maintains over 200 retail fuel stations catering to about 12 percent of the country’s fuel market. CPC has sought a US $500 million credit line from India to pay for its crude oil purchases amidst a severe foreign exchange crisis in the island nation. Energy ministry had earlier warned that the current availability of fuel in the country can be guaranteed only till next January.

PetroChina will be spending billions of dollars to accelerate drilling of rare shale formations in northeast China that could be pivotal to sustaining oil output in the world’s largest consumer. The state-run oil and gas producer aims to kick off production at its unconventional oil project in 2025 and double its capacity by the end of this decade. If the pilot is successful, the technologies could be replicated elsewhere to unlock China’s vast untapped shale reserves. Gulong, situated at the sprawling Songliao basin, lies within the area of PetroChina’s flagship Daqing field, China’s biggest oilfield which has been pumping for over six decades but where output is diminishing. The oil major’s plans would sustain Daqing’s role as the top producing field as well as help arrest China’s declining oil production. China produces only 35,000 bpd of shale oil mostly in the northern Ordos basin and northwestern Jungar basin, less than 1 percent of total output. But Gulong is touted as a more prospective project, with lower cost and higher and better-quality output. The success of Gulong could hold the key to sustaining China’s oil production at 4 million bpd, nearly 30 percent of its consumption, the minimum supply to power manufacturing activities and military services.

4 November: With the Centre slashing excise duty on petrol and diesel, the Haryana government announced a reduction in VAT (Value Added Tax) on the fuels, making them cheaper in the BJP-JJP-ruled state by INR12 per litre on Diwali. Some other BJP-ruled states have lowered their VAT rates as well. The Narendra Modi government announced a cut in the excise duty on petrol and diesel by INR5 and INR10 respectively, bringing down their retail rates from record highs. Reducing the excise duty, the Union government urged states to commensurately reduce VAT on petrol and diesel to give relief to consumers.

9 November: Reliance Industries Ltd (RIL) has exited all its business in the upstream oil and gas shale play that was based out of the United States (US). Reliance Eagleford Upstream Holding (REULP), a wholly-owned step-down subsidiary of RIL, announced the signing of agreements with Ensign Operating III, a Delaware limited liability company, to divest its interest in certain upstream assets in the Eagleford shale play of Texas, US. RIL had divested all of its interest in certain upstream assets in the Marcellus shale play of southwestern Pennsylvania. Those assets were sold to Northern Oil and Gas, (NOG), a Delaware corporation. In April 2020, the falling demand for crude oil in the US will adversely impact investments made by Indian companies in the shale business there. For RIL, its investment in US shale has been providing it negative returns on equity. When crude oil prices drop, production of alternative fuels like shale oil and gas becomes unviable.

7 November: Coal dispatch to the power sector has increased by 27.13 percent to 59.73 million tonnes (mt) in October, owing to a spurt in power demand amidst unprecedented rise in import prices. The country’s several thermal power plants were facing a crisis in the wake of low coal stock positions at their end. Coal supply to the power sector was 46.98 mt in October last year, according to government data. However, the supply of coal to the sponge iron sector last month declined by 29.2 percent to 0.46 mt, over 0.65 mt in the corresponding month a year ago. The fuel dispatch to the cement sector dropped to 0.47 mt in October, over 0.68 mt in the year-ago period. Recently, Union Minister for coal Pralhad Joshi had asked Coal India Ltd (CIL) and its subsidiaries to make ‘all out efforts’ to ensure that at least 18 days of coal stock with thermal power plants by the end of November. Coal India Ltd (CIL) accounts for over 80 percent of domestic coal output. CIL has been prioritising the supply of coal temporarily to power producers to refill the reducing stocks of coal with them.

5 November: Weeks after several states faced an energy crisis due to depleting coal stocks, the Congress-led Rajasthan government has asked Chhattisgarh to fast-track the development of its two coal blocks in the state to help aid electricity production and ward off any blackouts. Rajasthan Chief Minister Ashok Gehlot wrote to his Chhattisgarh counterpart Bhupesh Baghel, who is also from the Congress party, urging him to clear roadblocks in the development of the two coal blocks that were allocated to his state in 2015. Parts of Rajasthan had witnessed several hours of power cuts in September and October after coal stock depleted at power plants that supply electricity to the state. In 2015, the central government had allocated three coal blocks in Chhattisgarh to Rajasthan Rajya Vidyut Utpadan Nigam Ltd (RVUNL) but only one of them has been able to commence production. The other two blocks are stuck in procedural delays. RVUNL produces 15 million tonnes (mt) of coal from Parsa East and Kanta Basan block and the opening of other Parsa and Kente Extension blocks will double the production. Gehlot said Parsa coal block has the potential to produce 5 mt per annum of coal. Similarly, Kente Extension can give an additional 9 mt per annum.

8 November: The Union power ministry said that peak power demand deficit in the country was almost wiped out in 2020-21 period. Providing statistics, the ministry said the deficit stood at 0.4 percent in 2020-21 compared to 16.6 percent in 2007-08 and 10.6 percent in 2011-12. In the current year (2021-22) till October, the peak power demand has been (-)1.2 percent and the marginal spike was attributable to the annual post monsoon pressure on power output. According to the ministry, India had a massive power deficit of 16.6 percent in 2007-08 and in 2011-12, it was 10.6 percent. In the last nearly seven years, the augmentation of the installed power capacity in the country has been 1,55,377 MW.

9 November: Praj Industries Limited (Praj) and Indian Oil Corporation (IOC) have inked a Memorandum of Understanding (MoU) to explore opportunities in the production of alcohol to jet (ATJ) fuels, 1G & 2G ethanol, compressed bio-gas (CBG) and related opportunities in the biofuels industry. Exploring these green energy horizons will be crucial for India to achieve carbon neutrality by 2070. The MoU will boost ATJ fuel production capacity and its use in India which will in turn help curb emissions emanating from the airplanes as per The International Air Transport Association (IATA)’s mandate. As per the MoU, Indian Oil and Praj will also collaborate to set up biofuel production facilities, including CBG, biodiesel and ethanol.

8 November: In a bid to achieve the target of installing 500 GW (gigawatt) renewable energy capacity by 2030, India needs to tap its hydro resources, Union Minister R K Singh has said. The Minister has directed NHPC Ltd to exploit hydro resources in the country to become one of the largest hydro power companies in the world. He asked NHPC to set up as many hydro capacities as possible and bring in NHPC in the list of top hydro power companies in the world. NHPC presently has an installation base of 7071.2 MW from 24 power stations including 2 projects in JV mode. Besides, the company is also making progress in the solar and wind energy sectors. It has commissioned 103.13 MW of solar, rooftop solar and wind energy projects at various locations in India. NHPC said NHPC is presently working on projects totaling 6,000 megawatts (MW) and another 9,000-10,000 MW is in the pipeline. He said the company will meet its 50,000 MW energy capacity which includes solar, within time. He said the company will meet its 50,000 MW energy capacity which includes solar, within time.

8 November: Inox Wind has bagged an order for a 150 MW wind power project from NTPC Renewable Energy Limited. As part of the order, the company will supply and install DF 113/92 – 2.0 MW capacity Wind Turbine Generators with 113 meters rotor diameter and 92 meters hub height. Inox Wind will provide comprehensive operation and maintenance (O&M) for the lifetime of the project.

5 November: Prime Minister (PM) Narendra Modi has placed India in a position where it can guide the world in dealing with the crisis of climate change, Union Environment Minister Bhupender Yadav said. Yadav said he was privileged to represent India in the negotiations and also overwhelmed to see the impact the Prime Minister’s initiatives and ideas have created on world leaders. The project aims to reduce reliance on non-renewable energy such as coal by enabling and popularising the use of affordable solar power from other countries.

4 November: The state cabinet approved the government’s proposal to establish solar power plants at Kajra in Lakhisarai and Pirpainty in Bhagalpur district on the land earlier acquired for the thermal power plants, state cabinet secretariat department additional chief secretary Sanjay Kumar said. The cabinet allowed to amend the energy department’s resolution of 12 December 2010 under which chunks of land had been acquired for the establishment and opening of thermal power plants.

8 November: Oil prices rose after Saudi Arabia’s State-owned oil producer Aramco raised the official selling price for its crude, suggesting demand remains strong at a time of tighter supplies. Aramco late raised its December official selling price to Asia for its Arab light crude to US $2.70 a barrel versus Oman/Dubai crude, up US $1.4 from this month. The move by Aramco suggests “demand remains strong” as the OPEC producer and other major oil exporters keep the reins on supply, ANZ Research said in a note. The Organization of the Petroleum Exporting Countries (OPEC) and allies such as Russia, together known as OPEC+, agreed stick to their plan to raise oil output by 400,000 barrels per day from December. US President Joe Biden had called on OPEC+ to produce more barrels to dampen rising prices and said his administration has “other tools” to deal with the higher price of oil. Elsewhere, China’s oil imports slumped in October to the lowest in three years, as State-owned refiners withheld purchases due to higher prices, while independent refiners were restrained by limited quotas for bringing in crude.

6 November: US (United States) President Joe Biden said that his administration has ways to deal with high oil prices after OPEC (Organization of the Petroleum Exporting Countries) and its allies rebuffed US pleas for the producers to pump more crude. OPEC+, a group of producers including Saudi Arabia, Russia and other countries, snubbed US pleas to go beyond a previous plan to raise oil output by 400,000 barrels per day from December. Oil prices have hit over US $80 a barrel, raising fuel prices for consumers. US Energy Secretary Jennifer Granholm has said that the Energy Information Administration forecasts gasoline prices slipping to US $3.05 a gallon in December, which is probably not a level, she said, that the strategic reserve would come into play. But the forecasts could change, she said.

4 November: The discovery of significant geological shale oil reserves at Shengli Oilfield will further boost oil output in the country while ensuring national energy security, experts said. China Petroleum and Chemical Corp, also known as Sinopec and the world’s largest refiner by volume, said that the company has discovered an initial 458 million tonnes (mt) of geological shale oil reserves at Shandong province’s Shengli Oilfield, one of the country’s largest conventional oil and gas fields. Total shale oil resources amount to more than 4 billion tonnes, according to preliminary calculations. The oilfield has vowed to realize production capacity for shale oil of up to 1 million tonnes during the 14th Five-Year-Plan period (2021-25). The National Bureau of Statistics said China’s domestic oil production has been gradually increasing from 189.11 mt in 2018 to 191.01 mt in 2019 and 194.92 mt in 2020.

7 November: Pakistan accepted an LNG (liquefied natural gas) cargo at the highest-ever price of US $30.6 per million metric British thermal units (mmBtu) from Qatar Petroleum on the grounds of averting a possible gas crisis in the upcoming peak winter month. The Pakistan LNG Limited (PLL) had floated emergency bids for two cargoes to be supplied in November, as the firms involved, Gunvor and ENI, had defaulted on their commitments. The PLL has short- and long-term agreements with Gunvor and the ENI for one LNG cargo every month, but both suppliers refused to honour their part of the agreements. As a result, the state-owned firm had to call a tender on emergency basis for two LNG cargoes for the months of December and January. The PLL has been facing criticism for lacking proper strategies and ensuring LNG supplies when its prices were low in the international market. At the same time the state-owned entities had restricted the private sector from importing LNG as it could challenge the monopoly enjoyed by the public sector.

8 November: Global miner BHP Group Ltd signed a deal to sell its stake in BHP Mitsui Coal (BMC), a metallurgical coal joint venture (JV) in Queensland, to Stanmore Resources Ltd for up to US $1.35 billion, the companies said. Stanmore, which is majority-owned by Singapore-listed Golden Energy and Resources Ltd, agreed to acquire BHP’s 80 percent stake in BHP Mitsui Coal, which owns and operates two open-cut metallurgical coal mines in the Bowen Basin. Golden Energy runs a thermal coal mine in Indonesia and a gold mine in Queensland. It will guarantee Stanmore’s obligations and any break fee to up to US $600 million.

8 November: Australia said it will sell coal for “decades into the future” after spurning a pact to phase out the polluting fossil fuel to halt catastrophic climate change. Australia, along with some other major coal users such as China and the United States, did not sign up. Defending Australia’s decision, Pitt said Australia had some of the world’s highest quality coal. Demand for coal is expected to rise until 2030. Australia is one of the world’s largest producers of coal and natural gas, but has also suffered under increasingly extreme climate-fuelled droughts, floods and bushfires in recent years. Pitt said some 300,000 Australians’ jobs were reliant on the coal sector. The Minerals Council of Australia itself says the coal industry directly employs 50,000 workers while supporting another 120,000 jobs.

3 November: China flagged it is targeting a 1.8 percent reduction in average coal use for electricity generation at power plants over the next five years, in a bid to lower greenhouse gas emissions. The target, announced by China’s economic planner, the National Development and Reform Commission (NDRC), comes as the world’s top climate negotiators have gathered in Scotland for the COP26 climate talks. Average coal use for electricity generation in China fell by about 17.4 percent in the 15 years till 2020. By 2025, coal-fired power plants in China must adjust their consumption rate to an average of 300 grams of standard coal per kilowatt-hour (kWh), NDRC said.

9 November: More than 20 countries agreed to phase out coal power at the UN (United Nations) climate talks in Glasgow, but not Japan – a “leap backwards” for a country that once led the way on the Kyoto Protocol to reduce greenhouse gas emissions. The pact was amongst a raft of pledges made at the COP26 summit. Japan, the world’s third-biggest importer of the dirtiest fossil fuel, declined to sign because it needed to preserve all its options for power generation. Critics called that short-sighted, even as new the Prime Minister, Fumio Kishida, has agreed to step up other environmental measures. The criticism highlights the shift in Japan’s circumstances. It led climate change efforts during the 1990s Kyoto Protocol era, but has been burning more coal and other fossil fuels after the Fukushima disaster 10 years ago left many nuclear plants idle. Japan has pledged billions of dollars for vulnerable countries and to support building infrastructure in Asia for renewables and cleaner-burning fuels. It has also cut targets for coal use and raised those for renewables.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.