-

CENTRES

Progammes & Centres

Location

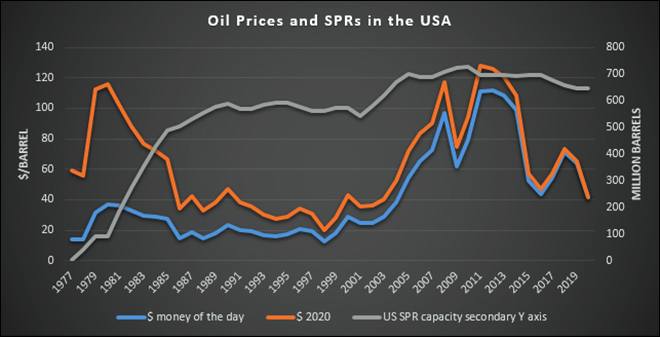

On 23 November 2021, the US administration authorised the release of 50 million barrels of crude oil from the strategic petroleum reserve (SPR) operated by the US Department of Energy (DOE). 50 million barrels of oil is about half the global oil consumption per day and about three days of US oil consumption. Oil prices had touched levels not seen in seven years driving the US decision to release SPR oil crude oil. In the words of the Secretary DOE, the release of oil from the SPR underscored the US President’s commitment to use the tools available to bring down costs for working families (by reducing the retail price of gasoline in the US) and continue economic recovery. The decision to release SPR oil by the US was coordinated with parallel decisions in China, India, Japan, South Korea, and the United Kingdom. India’s share in the coordinated release of oil stored in SPRs was 5 million barrels, a tenth of US SPR release, not sufficient to influence oil prices given that the world consumes 100 million barrels a day (b/d).

The goal of SPR oil release was not achieved as oil prices increased marginally by US $1/barrel (b), after the announcement of SPR release. But when news of a new COVID-19 variant in South Africa broke on 26 November 2021, it did what the release of the SPR by the Biden administration could not, that is reduce oil prices and that too by a significant 10 percent. This implies that expectations of oil demand growth influenced by factors like the pandemic are more important in moving oil prices than expectations of supply corrections such as the oil release by the SPR. The apparent impotence of the SPR release raises questions over the costs and benefits of maintaining SPRs.

India’s SPR is managed by the State-controlled Indian Strategic Petroleum Reserves Limited (ISPRL), which was set up in 2004 as a wholly owned subsidiary of Indian Oil and then handed over to Oil Industry Development Board (OIDB) in 2006. Under Phase I, ISPRL established petroleum storage facilities with total capacity of 5.33 million tonnes (MT) at 3 locations: (i) Vishakhapatnam (1.33 MT), (ii) Mangaluru (1.5 MT) and (iii) Padur (2.5 MT), all of which have been filled with crude oil. This will be sufficient to meet nine and a half days of India’s crude requirement. In July 2021, the government approved establishment of two additional commercial-cum strategic facilities with total storage capacity of 6.5 MT underground storages at Chandikhol (4 MT) and Padur (2.5 MT) under public private partnership (PPP) mode under phase II of the SPR programme. When phase II is completed, it will meet an additional 12 days of India’s crude requirement.

The capital cost for constructing the SPR facilities (phase I) was originally estimated to be INR 23.97 billion at September 2005 prices. The revised cost estimate for the three locations stands at INR 40.98 billion. Most of the capital cost was met with funds available with OIDB while Hindustan Petroleum Corporation Limited (HPCL) met the cost of 0.3 MT compartment at Visakhapatnam. Operation and maintenance cost of the strategic reserves is met by the Government of India. In the year 2019-20, ISPRL recorded a net loss of over INR 1 billion.

The dramatic increase in the price of oil in the late 1970s redefined the energy policies of industrialised nations from one that managed abundance to one that managed scarcity. Countries in Western Europe, barring France, and the United States reached an agreement to create the International Energy Agency (IEA) in 1974 to counter actions of the OPEC (Oil Producing and Exporting Countries). France and the US joined the IEA later. Though Henry Kissinger who coordinated the international response to the oil crisis had ambitious plans for the IEA, it eventually became a modest mechanism for managing scarcity through an oil sharing arrangement between member countries that required maintenance of strategic oil stocks to mitigate supply risk. All oil importing member countries of the IEA have an obligation to hold emergency oil stocks equivalent to at least 90 days of net oil imports. Industrialised countries represented by the IEA pushed for China and India to build and maintain strategic stocks of oil to address short term volume and price risk. Crude oil price increases generally result from actual or anticipated increase in demand or decrease in supply or both. The logic is that the release of SPR oil would potentially provide temporary relief from rising prices but more importantly make up for temporary supply losses that are behind the price rises.

Though strategic stockpiling of oil was promoted by policymakers as the best way of insuring against supply shocks, questions remain as to whether the high cost of maintaining these stocks justified the benefits, especially for developing economies. Theoretically, release of SPR oil by rich industrialised nations to influence crude oil prices provides a global public good of lower oil prices. No country can be excluded from lower prices that is expected follow the release of SPR oil, and therefore, it is possible for poor countries to ‘free ride’ on the SPRs held by industrialised countries. But industrialised countries have put pressure on India and China, now large importers of oil to share the burden of holding SPR reserves. Most studies estimate that the opportunity cost of holding crude oil is more than the cost of crude oil. To reduce this cost, auctioning or trading oil in SPRs is suggested.

India initiated selling crude from its SPR five months ago in July 2021, following news of China’s decision to auction crude from its SPR. India’s goal was to commercialise SPR crude reserves to generate revenue using oil stocks for trading and from licensing capacity. The logic behind this is to purchase crude at lower levels and supply in the domestic market when prices rise meaningfully. For example, China’s SPR crude that was bought in April-May 2020 when oil prices were about US$40/b was auctioned on 24 September 2021 at US$65-$70/b which helped improve refining margins for buyers of crude and also improved state finances. ISPRL has leased capacity to United Arab Emirates’ ADNOC (Abu Dhabi National Oil Company) to hold 750,000 MT of crude under a government-to-government deal. ISPRL plans to lease out an additional 30 percent capacity to international investors with the option of exporting crude.

Overall, the SPR is like an insurance policy against future oil supply or price shocks. The premium is the cost of maintaining the SPR. The issue is whether the premium is justified. The strategic importance of oil has reduced substantially partly because of abundant availability of oil resources and partly because of the negative perception of oil and other fossil fuels as sources of carbon emissions. Oil supply shocks have not only become rarer but also short lived. The benefit of SPR release in influencing price is probably overstated as the most recent SPR release illustrated. Maintenance of SPR is perhaps justified under current circumstances as oil continues to underpin almost all other energy sources including renewables (in manufacture and transport of renewable energy equipment). But in the future the value of the insurance premium on oil storage may have to be re-evaluated.

A global study has found that India is the most cost-effective country for generating rooftop solar energy at US $66 per megawatt-hour, while the cost in China is marginally higher at US $68 per megawatt-hour. Due to the lower cost, rooftop solar photovoltaics (RTSPV) technology, such as roof-mounted solar panels used in homes, and commercial and industrial buildings, is currently the fastest deployable energy generation technology. This, according to this global study, is projected to fulfil up to 49 percent of the global electricity demand by 2050. With an additional capacity installation of 41 GW, RTSPV currently accounts for 40 percent of the global cumulative installed capacity of the solar energy and nearly one-fourth of the total renewable capacity additions since 2018, which is more than the combined new installed capacities of both coal and nuclear. According to the study, India has a significant solar rooftop potential of 1.7 petawatt-hour per year. This is against the country’s current electricity demand of 1.3 petawatt-hour per annum, it said. The Rooftop solar photovoltaics technology as a subset of the solar photovoltaic electricity generation portfolio can be deployed as a decentralised system either by individual homeowners or by large industrial and commercial complexes, the study said.

Jharkhand Chief Minister (CM) called on common people to generate solar power in their backyards and promised subsidy for setting up the plants for which a new scheme will be launched. He promised that the surplus power will be bought by the state government which will also help people generate additional income. Eighty-two projects worth INR2.75 billion (bn) (US$36.92 mn) were inaugurated, and the foundation stone for 18 schemes worth INR917.9 million (US$12.32 mn) was laid. Amongst the inaugurated projects, a grid substation at Itkhori and 108-km-long Chatra-Latehar transmission line will provide an uninterrupted power supply to large parts of Chatra district. Asserting that his government is promoting solar power generation, CM urged people to set up plants on barren lands and rooftops. As per the CM the government is preparing special plans for the development of backward districts such as Chatra, Garhwa, and Latehar.

United States (US) Special Presidential Envoy for Climate John Kerry said India’s goal of reaching 450 GW of renewable energy (RE) by 2030 is doable as it has already crossed the 100 GW (Gigawatt) RE mark. The Intergovernmental Panel on Climate Change’s (IPCC) Sixth Assessment Report asserts that the contribution of greenhouse gas emissions from various activities is the scientific basis for global warming and climate change.

India’s solar energy output growth slowed in September, an analysis of government data showed, at a time when coal-fired utilities are facing a shortage of a fuel that accounts for more than 70 percent of the country’s power generation. Growth in solar energy is critical this year as half of India’s 135 coal-fired power plants have fuel stocks of less than three days. India expects the coal shortage to last for up to six months. Solar energy generation growth slowed to 24.7 percent year-on-year in September from 41 percent in August, an analysis of federal grid regulator POSOCO’s daily load dispatch data showed. However, CRISIL, a unit of ratings agency S&P, forecast 15–16 percent growth in solar output during the six months ending March 2022 and a slowdown in overall power demand growth would ease constraints on India’s coal-fired power plants.

The state government has decided to set up a floating solar power plant on four dams in the state and has invited expression of interest (EoI) for selection of solar power developer for setting up of a grid connected floating solar power plant at these sites. The solar power plants will be set up on Selaulim, Amthanem, Anjunem and Chapoli dams on a design, built, finance and operate model for a period of 25 years. The objectives of the EoI includes solar power generation, conservation of water due to less evaporation, creation of employment to the rural community and higher solar generation due to maintained temperature of solar panels. Since the solar power project will be installed on the water surface, the other land surfaces for the same capacity of the project can be utilised for other purposes and land cost is not applicable. The salient feature of the EoI is that the department of new and renewable energy (DNRE) will assist in providing the required area at all the four sites from the water resources department (WRD) for installation of floating solar power plant projects.

SJVN Chairman and Managing Director (CMD) met Uttarakhand Chief Minister (CM) at Dehradun and expressed keen interest to invest in more hydropower projects in the state. As per SJVN, it was on an exponential growth drive in the field of developing energy and at present; it is working in the field of hydro, wind, solar, and thermal sector. Besides, SJVN was developing projects across the country and also operating in the neighbouring countries of Nepal and Bhutan. The company informed that the 60 MW (Megawatt) Naitwar Mori Hydroelectric project, which was under construction in Uttarkashi, district of Uttarakhand, was in advanced stages and was likely to be completed by June 2022. SJVN has requisite expertise in construction and operation of hydro projects in Himalayan terrain and requested to allot more projects in Tons and Yamuna Valley to SJVN.

A Delhi-based entrepreneur’s agricultural waste recycling project was named amongst the winners of Prince William’s inaugural Earthshot Prize, dubbed the “Eco Oscars”, at a gala ceremony in London. Vidyut Mohan-led Takachar was named the winner of the GBP 1 mn (US$1.35 mn) prize for its cheap technology innovation to convert crop residues into sellable bio-products in the “clean our air” category. It was amongst five worldwide winners of the prize, created by Prince William, the Duke of Cambridge, to reward people trying to save the planet. Takachar was named a winner for its technology which reduces smoke emissions by up to 98 percent, aimed at helping improve the air quality that currently reduces the affected population’s life expectancy by up to five years. If scaled, it could cut a billion tonnes of carbon dioxide a year, described as “a win for India’s farmers will be a win in the fight against climate change”. The final five winners were connected to the eco-friendly awards ceremony by global broadcast, and no celebrities flew to London for the ceremony, no plastic was used to build the stage. Each year for the next decade, the prize is awarding GBP 1 mn each to five projects that are working to find solutions to the planet’s environmental problems.

Union Minister Nitin Gadkari stressed the need to enhance the production of biofuel in the country by using the stubble of certain crops to reduce the dependence on the import of crude oil and fuel gases. Gadkari’s suggestion came at a time when the retail prices of petrol and diesel have skyrocketed in the country following the rise in the rates of crude oil in the international market.

Chhattisgarh Chief Minister (CM) launched an electricity generation project that uses cow dung as fuel at a farmers’ event to mark Gandhi Jayanti. According to the CM, it will be environment-friendly and also benefit women’s self-help groups engaged in dung procurement and gauthan committees. On the occasion, the CM launched such cow dung powered units set up at Sikola gauthan in Durg, Bancharoda gauthan in Raipur and Rakhi gauthan in Bemetara.

According to an official plan published by state media, China is targeting an ambitious clean energy goal of reducing fossil fuel use to under 20 percent by 2060. The document follows a pledge by President Xi Jinping to wean the world’s biggest polluter off coal, with a target of peaking carbon emissions by 2030 and achieving carbon neutrality 30 years later. But the country has been criticised for pushing ahead with opening dozens of new coal power plants. The guidelines also reiterated an earlier aim for carbon emissions per unit of GDP to fall 18 percent in 2025, from 2020 standards.

According to the Abu Dhabi government, Abu Dhabi National Oil Co (ADNOC) has signed a deal with a local utility to supply up to 100 percent of its power grid with nuclear and solar energy sources. The supply deal follows the oil producing United Arab Emirates (UAE) announcing plans to achieve net zero emissions by 2050.

Power company Energias de Portugal (EDP) plans to invest 12.86 billion pounds (US $17.65 billion) in wind and solar projects in Britain by 2030 as the country strives to lower its emissions to net zero by mid-century. EDP plans to invest via its subsidiary EDP Renovaveis (EDPR), the world’s fourth largest renewable energy producer, which has 1 GW of offshore wind capacity under construction and 0.9 GW under development in Britain. EDP’s joint venture, Ocean Winds, submitted bids in the tender and is targeting a minimum of 3.9 GW between a floating and fixed offshore wind project. Britain has the largest offshore wind market in the world, with around a third of all installed offshore wind capacity at the end of 2020. It plans to generate a third of its electricity from offshore wind farms by 2030 as part of its own efforts to reach net zero carbon emissions by 2050. The UK government announced the biggest auction round of its renewable energy support scheme, which will open in December, and will include onshore wind and solar for the first time.

Greenpeace and other environmental groups called for a Europe-wide ban on adverts and sponsorships by oil and gas companies, comparing them to harmful tobacco promotions. The groups said they would launch protests and collect a million signatures from EU (European Union) citizens to put a law banning ads for fossil fuels before the EU Commission.

2 November: India is unlikely to see demand for oil peaking before 2040 and other forms of energy will slowly and gradually find a place in the country’s energy mix, the head of the nation’s third-largest state fuel retailer said. Hindustan Petroleum Corp Ltd (HPCL) chairman and managing director (CMD) M K Surana said oil companies had been consciously making investments in alternate and cleaner energy sources such as setting up EV charging stations, biofuels and hydrogen plants. These investments are in the direction of achieving the net-zero target, he said. But the world’s third-largest oil-importing and consuming nation will continue to rely on oil for the next two decades. The country’s reliance on oil for meeting its energy needs will stay as almost all of its road, rail, air and sea transport happens on fuel produced from oil. Surana said oil companies are switching to using green energy such as one generated from solar, for meeting electricity needs at refineries and other installations. Surana said crude oil prices may hover around US$80-85 per barrel in the October-December quarter.

1 November: India’s gasoil consumption in October rose above pre-COVID levels for the first time in a year, as increased industrial activity ahead of the festival season spurred demand for the fuel. The country’s factory activity expanded in October at its quickest pace in eight months on strong demand and increased output, according to the Manufacturing Purchasing Managers’ Index, compiled by IHS Markit. Gasoil sales totalled 5.86 million tonnes last month, equivalent to 189,200 tonnes per day, up 1.27 percent from October 2019, but a decline of 5.08 percent from the same month last year, preliminary sales data of state fuel retailers showed. Gasoline sales at 2.48 million tonnes (mt) rose by 3.93 percent from a year earlier, the data showed. India’s gasoil consumption, which accounts for about two-fifths of the country’s fuel demand, typically rises during a month-long festival season that ends with the celebration of Diwali as diesel-guzzling trucks hit the road and industrial activity gathers pace. Easing of COVID-led restrictions also aided to a recovery in diesel sales. Improved overseas fuel margins and rising diesel sales in the world’s third-biggest oil consumer and importer are helping refiners to raise crude processing. State retailers—Indian Oil Corp, Bharat Petroleum Corp and Hindustan Petroleum Corp—control about 90 percent of the fuel stations in the country.

1 November: Oil India Ltd (OIL) has set its eyes on becoming a 4 million tonnes per annum (mtpa) oil producer by 2023-24. CMD (chairman and managing director) Sushil Chandra Mishra said OIL would be increasing its annual capital expenditure to around INR45 bn to achieve this goal. The company aims to pay off all the long-term debt it had raised for acquiring controlling stake in Numaligarh Refinery Ltd (NRL) if the current crude oil price rally sustains.

1 November: The petroleum ministry has told ONGC (Oil and Natural Gas Corporation) to give away 60 percent stake plus operating control in India’s largest oil and gas producing fields of Mumbai High and Bassein to foreign companies, according to the state-owned company letter. According to the letter, the redevelopment projects will raise recovery of the mature and continuously declining Mumbai High field from 28 percent to 32 percent, “which is quite low”. Mumbai High, which was discovered in 1974, and B&S, which was put into production in 1988, are ONGC’s mainstay assets, contributing two-thirds of its current oil and gas production. Without these assets, the company will be left with only smaller fields. It wanted ONGC to bring in global players in gas-rich block KG-DWN-98/2 where output is slated to rise sharply by next year, and the recently brought into production Ashokenagar block in West Bengal. Also identified for the purpose is the Deendayal block in the KG basin which the firm had bought from Gujarat government firm GSPC a couple of years back.

31 October: The government’s collection from levy of excise duty on petroleum products has risen 33 percent in the first six months of the current fiscal when compared with last year and is 79 percent more than pre-COVID levels, Data available from the Controller General of Accounts (CGA) in the Union Ministry of Finance showed. First, Finance Minister Nirmala Sitharaman and then Oil Minister Hardeep Singh Puri had blamed the oil bonds for limiting fiscal space to give relief to people from fuel prices trading at all-time high levels. The bulk of the excise collections come from petrol and diesel on which the Modi government had levied record taxes last year. Excise duty on petrol was hiked from INR19.98 per litre to INR32.9 last year, to recoup gain arising from international oil prices plunging to multi-year low as pandemic gulped demand. On diesel, the duty is hiked to INR31.80. The government had raised excise duty on petrol and diesel to mop up gains that would have otherwise accrued to consumers from international oil prices crashing to as low as US$19 per barrel.

27 October: According to petrol pump owners, fuel business in border districts of Madhya Pradesh (MP) is severely hit, as most vehicles prefer to refuel in Maharashtra or Chhattisgarh, where petrol and diesel are cheaper. Hike in petrol and diesel prices have been exacerbated in the border districts of Madhya Pradesh due to transportation cost and cheaper rates in neighbouring states. In the Anuppur district of the state, petrol prices crossed INR120 per litre, while diesel prices hovered around ₹INR10 per litre. Similarly, the cost of petrol in Balaghat, which falls on the state’s border with Chhattisgarh and Maharashtra, reached INR119.23 per litre. Petrol pump owners in the region said that the fuel business in border districts of Madhya Pradesh is severely hit, as most vehicles prefer to refuel in Maharashtra or Chhattisgarh, where petrol and diesel are cheaper.

27 October: In the coming days, the Centre could allow fair price shops (FPS) to retail small liquefied petroleum gas (LPG) cylinders, as well as offer financial services, in a bid to ensure the financial viability of such outlets. The proposal in this regard was taken up during a virtual interaction between the Union ministry of food and consumer affairs and state governments, with food secretary Sudhanshu Pandey chairing the talks. The OMCs (Oil Marketing Companies) “appreciated” the Union government’s proposal to retail LPG cylinders at FPS shops, also known as ration shops, while also assuring that the necessary support would be provided in this regard in coordination with the interested state and Union territory (UT) governments, the release noted further. The state governments, on their part, said that collaborating with common service centres (CSC), will increase the viability of the ration outlets, it said.

29 October: India’s southern Tamil Nadu state is considering restarting a shelved 1.6 gigawatts (GW) coal-fired power project in Uppur, as its debt-ridden utility seeks to expand its coal fleet to address rising power demand. After the order, the Tamil Nadu Generation and Distribution Corp Ltd (TANGEDCO) had decided to shift the project to Udangudi, about 200 kilometres away from Uppur, where a 1.3 GW coal-fired plant is already being built.

28 October: Indian utilities’ coal imports fell more than 73 percent in September to their lowest in more than seven years due to high prices, government data showed, despite a call by the federal government to boost shipments to arrest a crippling coal shortage. Imports by Indian utilities fell to 1.08 million tonnes (mt) in September, compared with 4.03 mt in the same period in 2020 and 5.23 million tonnes in September 2019. Import data for periods preceding April 2014 were unavailable. India had urged utilities to import coal in late August as coal-fired electricity generation surged after coronavirus-related curbs were eased, with several power plants being pushed to the verge of running out of fuel. However, data from the Central Electricity Authority showed state government-run coastal power plants, which are dependent on imported coal, had cut supplies as global prices surged, increasing pressure on state-run Coal India Ltd to produce more. Nearly three-fifths of India’s coal-fired capacities currently have coal inventories that would last three days or less, federal power ministry data shows. Coal imports by power plants fell 55 percent during the quarter, making it the biggest fall in at least six and a half years.

27 October: The Aluminium Association of India has urged the Central government to immediately restart supply of coal and rakes to the aluminium industry to normalise the “precarious situation” due to fuel shortage. The statement comes at a time when Coal India Ltd (CIL), which accounts for over 80 percent of the domestic coal output, has temporarily prioritised fuel supply to power producers. Since 21 August, the industry is getting just 50 percent coal supplies, which has been drastically reduced to 10 percent currently. The industry is struggling to sustain operations with alarmingly depleted coal stocks of only 1.5 to 3 days and is on the verge of stock out, it said. Union Minister Pralhad Joshi reviewed the coal production and stressed on continuing the momentum to dispatch maximum supply of the dry fuel to thermal power plants.

1 November: India’s power consumption grew 4.8 percent in October to 114.37 bn units, indicating a good recovery amidst coal shortages at electricity generation plants, according to power ministry data. Last year in October, power consumption stood at 109.17 bn units and in the same period in 2019, it was at 97.84 bn units. During October, the peak power demand met or the highest supply in a day stood at 174.60 GW, higher than 169.89 GW in the same month last year. The data clearly shows that there is recovery in power consumption as well as demand in the country. Experts said the recovery in power demand as well as consumption would increase further due to the government’s efforts to ramp up coal supplies at plants and improvement in economic activities following the lifting of lockdown restrictions by states. Experts said the recovery in power demand and consumption in September 2021 remained subdued mainly because of delayed Monsoon.

30 October: Punjab Chief Minister (CM) Charanjit Singh Channi approved a proposal of power utility Punjab State Power Corporation Limited (PSPCL) for terminating the power purchase agreement (PPA) with private sector electricity generator GVK due to high cost. The PSPCL has issued a termination notice to the company, according to an official statement. Channi said this step has been taken to safeguard the interests of consumers by way of “reducing the burden of costly power”. As per the PPA, the company was required to arrange a captive coal mine but it failed to do so even after the lapse of more than five years of synchronisation with the grid, he said. The capacity charges are being decided by the Punjab State Electricity Regulatory Commission (PSERC) based on capital cost of around INR30.58 bn, which is equivalent to about INR1.61 per unit of fixed cost. He said GVK went against this decision and moved Appellate Tribunal for Electricity (APTEL) for claiming higher fixed cost to the tune of INR2.50 per unit based on claims of capital cost of about INR44 bn, which is pending adjudication.

31 October: India and the UK (United Kingdom) will launch a project that aims to create a solar grid connecting countries in different parts of the world at the upcoming UN (United Nations) climate talks in Glasgow, Scotland. The project, known as the “Green Grids Initiative,” is being initiated by the International Solar Alliance, which was launched by India and France at the 2015 Paris climate conference to promote solar energy. The UK and India agreed to join forces in the initiative in May this year. Although solar energy is becoming cheaper than dirtier alternatives, countries cannot rely on it at night and must fall back on fossil fuels that produce earth-warming greenhouse gases. This is especially the case in countries like India, where demand for power is soaring. The new project is based on the idea that the sun is always shining in some part of the world, and the project aims to create a global grid that will transfer the sun’s power from one place to another, Ajay Mathur, the director general of the International Solar Alliance, said. Mathur said estimates showed that in the next three years, solar power will become as cheap as power from fossil fuels, which will make it easier to build new solar power plants and storage facilities. But even then it will require countries with different priorities to reach complex agreements.

30 October: India has proposed new rules to lower emissions and fight climate change, including setting a minimum share of renewable energy to be used by its industries, the federal power ministry said. The proposals, aimed at promoting green Hydrogen as an alternative to the fossil fuels currently used by industries, will be made effective through amendments to India’s 2001 Energy Conservation Act. The proposed amendments would facilitate the development of a carbon market in India and prescribe minimum consumption of renewable energy either as direct consumption or indirect use through grid, the power ministry said. The announcement comes just days after India rejected calls to announce a net zero carbon emissions target and said it was more important for the world to lay out a pathway to reduce such emissions and avert a dangerous rise in global temperatures. India, the world’s third-biggest emitter of greenhouse gases after China and the United States, is under pressure to announce plans to become carbon neutral by mid-century or thereabouts at next week’s climate conference in Glasgow.

29 October: Tata Steel is investing in enabling long term sustainable solutions in logistics and supply chain and has pioneered the electric vehicles for transportation of finished steel in the country. Tata Power said it has collaborated with Tata Steel to set up 41 megawatt (MW) grid-connected solar projects in Jharkhand and Odisha. Tata Power and Tata Steel, the two flagship companies of the Tata Group, have come together to develop grid-connected solar plants in Jharkhand and Odisha, Tata Power said.

27 October: Projects with the capacity of generating 14,963 MW of electricity from non-conventional sources are currently operational in Gujarat, the state government said. The government said the state accounts for 15 percent of the country’s installed capacity for power generation from non-conventional energy sources. Gujarat stands first in the country with 1,444 MW installed capacity in relation to solar rooftop projects. These include residential, commercial, and industrial solar rooftop projects. The government said that in terms of setting up solar rooftop systems on private residential properties, Gujarat is the first in the country. Solar rooftop systems have been installed on 2.84 lakh houses and 1,081MW electricity is being generated. Gujarat stands third in the country in terms of solar power generation. The installed capacity of wind power projects in the state is 8,860 MW, the government said.

27 October: Shiromani Gurdwara Parbandhal Committee (SGPC) president Bibi Jagir Kaur inaugurated a solar power plant at the Golden Temple. She said the solar energy would not only be environment-friendly, but would bring financial benefit too. A total of 3 MW solar power plant is being installed by the SGPC, for which the United Sikh Mission, USA, offered its services. At present, 525 kW plants could be installed on the rooftop of the headquarter and Dharam Parchar Committee office. She said the work of installing solar plants at Gurdwara Bir Baba Buddha Sahib, Thatha and Gurdwara Shaheed Ganj Baba Deep Singh, Sri Amritsar, is also underway.

1 November: Oil prices rose as expectations of strong demand and a belief that a key producer group will not turn on the spigots too fast helped reverse initial losses caused by the release of fuel reserves by China, the world’s biggest energy consumer. US (United States) West Texas Intermediate (WTI) crude futures gained 40 cents, or 0.5 percent, to US$83.97, having fallen to US$82.74 earlier. Oil rallied to multi-year highs, helped by a post-pandemic demand rebound and the Organisation of the Petroleum Exporting Countries (OPEC) and allies led by Russia, or OPEC+, sticking to gradual, monthly production increases of 400,000 barrels per day (bpd), despite calls for more oil from major consumers.

31 October: Canadian heavy crude’s price collapsed at the US (United States) trading hub of Cushing as refiners shun heavy and higher-sulfur crude for lighter grades that are less expensive to process in refineries. Western Canadian Select’s discount for December to West Texas Intermediate widened to US$9 a barrel at Cushing, the steepest in about two years, according to NE2 Group data. The discount is about US$7 a barrel smaller than the price at the Canadian oil hub at Hardisty, Alberta. The price has weakened at Cushing after a newly-built oil export pipeline called Line 3 increased shipments of Canadian oil to the US.

28 October: Crude inventories are swelling on the US (United States) Gulf Coast, but the pile-up won’t last for very long. Supplies have surged by nearly 20 million barrels so far in October, the most for this month in at least a decade, on the reversal of Capline pipeline and as more barrels are pulled to the region for export due to demand from Asia. But refiners are beginning to ramp up operations after maintenance and that should lead to stockpile declines. In contrast to the supply situation along the Gulf Coast, stockpiles at Cushing, Oklahoma, the delivery point for West Texas Intermediate crude futures, have slumped to the lowest since October 2018. The difference in the two regions highlights how the US (United States) crude benchmark does not fully reflect supply and demand in the Gulf Coast.

29 October: Algeria has decided to abandon the 11.5 bcm (billion cubic meters) per year GME (Gaz Maghreb Europe) gas pipeline crossing Morocco to supply Spain and Portugal, due to tensions with Morocco. The country will now deliver natural gas to Spain exclusively through the 8 bcm per year Medgaz pipeline, which already operates at full capacity. Algeria is considering raising LNG (liquefied natural gas) exports to ensure gas supply to Spain and increasing the capacity of the Medgaz gas pipeline. In 2020, Algeria exported 8.7 bcm of natural gas via pipelines to Spain, accounting for about a quarter of the country’s total gas imports, and 1.3 bcm to Portugal.

27 October: Equinor ASA is boosting natural gas exports to ease Europe’s supply crunch, sacrificing some oil production in the process. The Norwegian giant has halted the re-injection of gas that had been used to boost oil output at the Gina Krog field, and will export the fuel instead, Equinor Chief Executive Officer (CEO) Anders Opedal said. The company is ramping up production at other gas fields, including the giant Troll. The change at Gina Krog will provide an extra 8 million cubic meters a day of gas, Equinor said. While this is a relatively small addition to Norway’s total supply, which exceeds 320 million cubic meters a day, every molecule of fuel will count in Europe this winter. The continent’s gas inventories are at their lowest seasonal level in at least a decade. Flows from its biggest supplier, Russia, are capped and competition with Asia for liquefied natural gas cargoes is intense. Both gas and oil prices will stay high this winter, assuming average weather conditions, Opedal said.

1 November: China’s coal supply situation has seen significant improvement with joint efforts from coal producers, logistics and downstream users, while coal prices have also stabilised, the National Development and Reform Commission (NDRC) said. The government has since July approved capacity expansions at hundreds of coal mines across the country amidst a widespread power shortage partly due to insufficient supply, and has rolled out a raft of measures to tame runaway coal prices which soared nearly 190 percent this year. China’s new coal output rate puts it on pace to produce more of the fuel this year than ever before if the increase is sustained. Meanwhile, daily coal supply to the key coal-fired power plants has topped to 8.32 million tonnes, the highest ever level in history. That helps drive up total coal inventory at Chinese power plants to 106 million tonnes, up more than 28 million tonnes from end-September, and these could support 19 days of consumption, the NDRC said. The NDRC estimated coal stocks at power plants to exceed 110 million tonnes within three days. China has repeatedly urged coal companies to strictly perform their contractual obligations at an aim to steady coal prices.

1 November: Electricity prices in Japan rose to their highest in nearly 10 months, amidst elevated global prices for liquefied natural gas (LNG) and coal—the main fuels to supply country’s US$150 billion power market. Prices for delivery of electricity early on Tuesday morning reached 55 yen (US$0.48) per kilowatt hour (kWh) the highest since late-January. Traders said higher LNG (liquefied natural gas) prices were starting to filter through to the local power market. Elevated electricity prices in recent weeks are reviving memories of last winter when prices hit record highs and Japan’s grid nearly failed in the worst energy crisis for the country since the Fukushima disaster.

29 October: Britain will launch a 160 million pound (US$220 million) fund to help developers of floating offshore wind technology as part of efforts to ramp up renewable power and meet climate targets, the government said. Britain has a target to generate 40 gigawatts (GW) of electricity from offshore wind by 2030—up from around 10 GW currently—which it says would be enough to power every home. Floating wind farms are expected to account for 1 GW of that. Scotland’s Crown Estate this year launched a tender for seabed licences around the coast for up to 10 GW, attracting bids from renewables companies and oil majors, with many of the sites likely to require floating wind technology. The Crown Estate for England, Wales and Northern Ireland has also launched a leasing round just for floating wind projects in the Celtic Sea for 0.3 GW of projects.

29 October: Qatar has unveiled a new climate change action plan, which aims at achieving a 25 percent reduction in greenhouse gas (GHG) emissions by 2030, compared to the business-as-usual scenario, and to reduce the carbon intensity of its liquefied natural gas (LNG) plants by 25 percent by 2030. The plan proposes to intensify efforts at carbon capture and storage at its LNG facilities.

29 October: China has updated its Nationally Determined Contribution (NDC). The country aims to have CO2 (carbon dioxide) emissions peak before 2030 and to achieve carbon neutrality before 2060, to lower its CO2 intensity (CO2 emissions per unit of GDP) by over 65 percent from the 2005 level, to increase the share of non-fossil fuels in primary energy consumption to around 25 percent, to increase the forest stock volume by 6 bcm (billion cubic meters) from the 2005 level, and to bring its total installed capacity of wind and solar power to over 1,200 GW by 2030.

29 October: Total Eren has signed a Memorandum of Understanding (MoU) with the Ministry of Energy of Kazakhstan, the national wealth fund Samruk-Kazyna, and the state-owned oil and gas company KazMunaiGas to work on the development, financing, construction, and operation of hybrid power plants in central Kazakhstan. The project will consist of about 200 wind turbines totalling 1 GW of installed capacity, coupled with a very large battery storage system (500 MW-1 GWh) provided by Saft. The country targets 15 percent of renewables in its power mix by 2030; in 2020, it had already reached 11.6 percent. Kazakhstan has a total capacity of 26 GW (end-2020), including 12 GW of coal, 7.1 GW of gas, 2.8 GW of hydro, 2.5 GW of oil and 1.7 GW of solar. In December 2020, the country pledged to reach carbon neutrality by 2060.

28 October: The United Kindgom (UK) government has unveiled a new funding model for nuclear power plants. Under the new RAB (Regulated Asset Base) model, consumers will contribute to the cost of new nuclear power projects during the construction phase. Under the existing mechanism to support new nuclear projects – the Contracts for Difference (CfD) scheme – developers have to finance the construction of a nuclear project and only begin receiving revenue when the station starts generating electricity. This led to the cancellation of recent potential projects, such as Hitachi’s project at Wylfa Newydd in Wales and Toshiba’s at Moorside in Cumbria.

28 October: The Netherlands will likely miss climate targets set for 2030 unless more is done to curb greenhouse gas emissions quickly, the Dutch government’s climate policy adviser (PBL) said. Emissions of Carbon Dioxide (CO2) in the euro zone’s fifth-largest economy will be 38 percent to 48 percent lower than in 1990 by 2030, the PBL said, based on current policies and measures announced for the years to come. The Netherlands introduced up to €7 billion (US$8.1 billion) in new subsidies for sustainable energy projects and other measures to fight climate change last month.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.