-

CENTRES

Progammes & Centres

Location

A day after the auction process of coal blocks for commercial mining was initiated with the aim of achieving self-sufficiency in energy and boosting industrial development, the Jharkhand government moved the SC challenging it on the ground that the pandemic situation would not fetch market price and tribals would be devastated by commercial exploitation of coalmines. The state government said the auction decision was illegal as there was no law to guide mining activities because of the legal vacuum created by lapse of the Mineral Laws (Amendment) Act, 2020, on 14 May. The suit is filed under Article 131 of the Constitution which provides for the state to move directly to the Supreme Court in matters of dispute with the Centre. The move came weeks after Jharkhand government had filed a separate petition in the apex court challenging the Centre’s action for virtual auction process of 41 coal blocks for commercial mining. Referring to the Fifth Schedule to the Constitution, which deals with administration and control of Scheduled Areas and Scheduled Tribes, it said that six of the nine coal blocks in Jharkhand – Chakla, Chitarpur, North Dhadu, Rajhara North, Seregarha and Urma Paharitola — which have been put up for auction fall within the Schedule Fifth areas. The Jharghand government moved a writ petition in the apex court, demanding a halt in the auctioning of coal blocks for commercial mining. Of the 41 blocks to go under the hammer, 20 are in Jharkhand. The coal ministry, however, went ahead with the auctioning process. Soon after, the state government knocked on SC’s door to challenge the decision. An SC bench gave the Centre four weeks to reply to the writ petition and an original suit filed by the Jharkhand government questioning the decision to auction coal blocks for commercial mining.

Workers of CIL started a three-day strike against the privatisation of the company. The workers raised slogans against the e-auction of coal blocks to private parties. Five labour unions are leading the strike and have halted mining and production activities across CIL’s subsidiaries in Jharkhand and seven other states. Protestors gathered outside the Central Coalfields Ltd headquarters and shouted slogans against commercial mining. The workers are making demands against the privatisation of CIL. CIL confirmed that there should be no cause of concern as there was no proposal to give away any coal block of the PSU giant for commercial mining. The Maharatna company has sufficient number of coal blocks with abundant resource capacity to continue as a commercially viable entity even in the competition era. CIL has 447 coal blocks, mostly explored, under its disposal. In addition to these, 16 more blocks were allocated to CIL — 10 under the Coal Mines (Special Provision) Act and six under Mines and Minerals (Development and Regulation) Act — making it the largest holder of coal resource in the country. Combined capacity of these 463 blocks is close to 170 bt. Most of the allocated16 blocks have a minimum 10 mtpa production capacity. Their combined peak rated capacity is 264 mt. Five trade unions in the coal sector have planned to mobilise people in mine areas to generate public opinion against the government’s decision to start commercial mining, after their three-day nationwide strike could not budge the Centre from its stand. The unions, including RSS-affiliated Bharatiya Mazdoor Sangh, of CIL have also decided to go for a day’s strike on 18 August, the last date for submitting bids for the auctioning of 41 blocks. The Centre has started the auction process for commercial mining, a move that opens the country’s coal sector for private players.

The trade unions at the MCL, a subsidiary of CIL called for a strike to protest against the miner’s decision to cut wages for workers who had participated in a three-day nationwide cease work. The four trade unions – AITUC, HMS, BMS and INTUC – have jointly served the notice of a day’s strike to the management of the Odisha-based subsidiary of the Maharatna PSU. MCL had issued wage-cut order for workers who took part in the three-day strike to protest against the Centre’s decision to start commercial coal mining. The miner had termed the three-day strike illegal. Most of 20,000 mineworkers did not report for work during the cease work. Key demands of the trade unions pertain to policy decisions beyond the purview of the company. No coal block allotted to MCL is going to be auctioned. CIL, including MCL, had been declared as Public Utility Services under the provisions of Industrial Dispute Act, 1947, and statutory restrictions have been prescribed against any strike in such organisations.

Expressing reservations about the central government allowing 100 percent FDI in the coal sector, West Bengal has written to the Centre requesting him to reconsider the decision. The state government described the move of the coal ministry to shift the desk offices of four of its subsidiary companies from the state as an “abrupt decision” and requested the Centre to intervene in the matter.

The Centre’s decision to start the process for auctioning 41 coal blocks for commercial mining is open for domestic as well as global firms under the 100 percent FDI route and is aimed at making India self-reliant in the energy sector. According to the government, auction of coal mines for commercial mining will make India self-reliant in the energy sector and create more than 280,000 jobs. Despite having the world’s fourth-largest coal reserves and being the second-largest producer, the country is the second-largest importer of coal. The rollout of commercial coal mining is part of the series of announcements made by the Centre under the Atmanirbhar Bharat Abhiyan.

The government reported interest from over 1,400 people in terms of investment in the country’s coal sector within the last 15 days in the auction of 41 coal blocks for commercial mining. Apart from no restrictions on the end-use of the production, the sector was also opened to 100 percent foreign direct investment. According to the coal ministry, the move is expected to bring in ₹330 bn of capital investment over seven years and generate ₹200 bn in annual revenue for state governments. The government expects to roll out the online single-window clearance system for coal block plans by the end of next month. The coal ministry has allocated around 80 mines in the last few years but only 32 of them have become operational and the remaining are still to begin operation. States have more responsibility of putting to production a coal block than the Centre.

The production of state-run CIL declined by 63 percent on the first day of three-day strike by its workers affiliated to five trade unions. The overburden removal, or clearing of top soil to make coal seams ready for mining, was 57.84 percent. CIL produced 481,000 tonnes of coal, which is 37 percent of the last 10 days average production (from 22 June to 1 July) of 1,296,900 tonnes. Protesting trade unions, however, had claimed that on the first day of the strike there was no production and dispatch. The coal ministry said that 37 percent of production could happen because of around 100,000 contract workers employed by CIL. The coal dispatch by CIL on the first day of the strike was 41.14 percent at 578,000 tonnes, when compared to 1,405,000 tonnes of average coal dispatched in the last 10 days (from 22 June to 1 July). The overburden removal was also 58 percent of the normal removal. CIL will engage MDOs to increase its coal output and reduce import dependency of the dry fuel in the coming years. The Maharatna coal mining behemoth in the process has identified a total of 15 greenfield projects to operate through MDO model of which 12 are open cast and 3 underground, Western Coalfields Ltd said. The contract period would be for 25 years or life of mine whichever is less. It informed reputed MDOs would be engaged to have multiple advantage of technology infusion, and operational efficiency in the system apart from increased production.

India’s private companies could start developing coalmines with an annual capacity of 15 mt a move that would end the near-monopoly of CIL. The annual production capacity is nearly one third of national total output. India’s consumption of coal fell 3.3 percent to 958 mt in the year ended March 2020, and is expected to fall further this fiscal year due to the coronavirus. Ratings agency Moody’s Indian unit ICRA said it expects domestic coal demand is estimated to grow at 2.9 percent between fiscal years 2021 and 2027, nearly half the rate seen in the preceding seven years.

MCL, an Odisha-based subsidiary of CIL said the company has set a target of producing 263 mt of coal by 2023-24 and employees must ensure normal mining operations to achieve the goal. In the current financial year, MCL has been assigned with a target of 173 mt of coal but the company is lagging behind in its production and overburden removal targets.

The 60-day extension granted by the Centre to GIDC to complete the formalities for the Dongri-Tal II coal block will come to an end in just over a month. GIDC is still waiting for clearance from the state government to appoint a transaction advisor who will help select a mine developer-cum-operator for the coal mine in Madhya Pradesh. With austerity measures in place and a fund crunch staring at the state, GIDC could lose out a second time on the coal block. GIDC had moved a file seeking approval from the state government for a request for proposal to select a transaction advisor to select the mine developer-cum-operator for the coal block as well as a separate consultant to assist in the auction of 500,000 square metres of land recovered from the Special Economic Zone promoters.

A senior Congress leader wrote to the Union Environment Minister on the coal blocks auction saying it is “triple disastrous” from an ecological viewpoint as several mines fall in dense forests. The mines on offer are largely fully explored ones meaning that they could be brought to production immediately. Moreover, more coalmines are on offer that could provide input to the steel sector. The mines are located in Chhattisgarh, Jharkhand, Madhya Pradesh, Maharashtra and Odisha. The Congress leader said that Prime Minister and Environment Minister have spoken eloquently in global forums on India’s commitment to fight global warming. He said that first the mining and transportation of coal will impose a very heavy environmental cost, second the loss of very dense forest cover will mean loss of a valuable carbon sink and third public health will be even more severely affected adding to the crisis we are already facing.

Greens and state ministers are pleased with the decision to scrap Bander coal blocks, near the buffer and eco-sensitive zone of TATR, from the auction list. Bander was among 41 blocks released for auction on 18 June. The decision was vehemently opposed not only by wildlife and environment activists but also Maharashtra Environment Minister. The proposed mines would destroy the tiger corridor to several protected areas in Central India. No process can be initiated for forest land diversion under the Forest Conservation Act, 1980. Maharashtra state government opposed the Centre’s proposal to conduct coal mining near TATR in Chandrapur district, as it would “destroy” the habitat of tigers. According to the forest department, the Bander coal block falls in Chimur tehsil under Bramhapuri forest division. It is located adjacent to the buffer zone boundary of the TATR.

The country’s coal imports registered a drop of 29.7 percent to 48.84 mt in the April-June period of the ongoing financial year. India had imported 69.54 mt of coal in the April-June period of 2019-20, according to provisional compilation by mjunction. The drop in imports assumes significance in the wake of government mandating CIL to replace at least 100 mt of imports with domestically-produced coal in 2020-21. The country’s coal imports also dropped 22.5 percent to 15.22 mt, against 19.64 mt of coal imported in June last fiscal. India is expected to save around ₹300 bn annually on import bill of thermal coal on account of commercial mining of blocks.

China aims to cap coal-fired power capacity at 1,100 GW and the number of coal mines at 5,000 by the end of 2020, the National Development and Reform Commission said. The world’s top consumer of coal had 1,040 GW of installed coal-fired power capacity and 5,268 coalmines nationwide by 2019. China, the world’s top consumer of coal, has approved two new coal mine projects in the northwestern regions of Xinjiang and Gansu with combined annual capacity of 3.6 mt at a total investment of 4 bn yuan ($566 mn). China, which produced 3.75 mt of the fossil fuel in 2019, has been shutting small and outdated mines to launch bigger ones in its coal-rich regions, such as Shanxi, Inner Mongolia, Shaanxi and Xinjiang. The National Energy Administration, which approved the projects, reaffirmed its commitment to building a clean, green and efficient coal industry and to cap the number of coal mines at 5,000 in 2020. To do this, it will hasten efforts to phase out mines with annual capacity below 300,000 tonnes. China’s coal imports in June dropped 6.7 percent from the same period last year, as stringent import restrictions at ports impeded purchases by traders and power plants, despite solid fuel demand. China, the world’s top coal importer, brought in 25.29 mt of the fuel. That compares with 27.1 mt in June last year but is still higher than 22.06 mn in May, driven by stockpiling demand ahead of the peak summer season. For the first half of 2020, China brought in a total of 173.99 mt of coal, up 12.7 percent over the corresponding period last year.

Poland’s biggest coal producer, state-run PGG, said that most of its infected miners have recovered from the novel coronavirus, as the company relies on government support to see it through the crisis. Polish coal mines have struggled with the rapid spread of the virus, with the mining region in southern Poland accounting for at least half of new daily cases throughout much of May and June. The government halted output at 10 PGG mines and at 2 mines owned by coking coal producer JSW to stop the spread of the virus. Poland’s JSW, the EU’s biggest coking coal producer, has launched a campaign to defend miners who it says have faced public abuse and unfair blame on social media over a rise in coronavirus infections. The government has reduced operations to minimum at a dozen coalmines temporarily to prevent the virus spreading further. The situation in Polish coal mines has stabilized after a rapid increase in new coronavirus cases in the past few weeks. But in the past few days new daily cases reported in the Silesia coal region have fallen to below 100 from above 200 earlier. The government has reduced operations to minimum at a dozen coal mines for three weeks to curb the virus. Coal trade unions have criticised the move saying it will lead to effectively closing the mines as the industry faces financial problems amid falling demand for coal and electricity, and rising costs.

Germany’s Bundestag, the lower house of parliament, passed a bill on the country’s exit from coal as a power source to meet climate targets. The bill involves over €50 bn ($56 bn) for mining and power plant operators, affected regions and employees to cushion the impact of the transformation from coal to renewables. Germany will abandon nuclear energy by 2022 and coal by 2038 at the latest, and will simultaneously aim for 55 percent cuts in greenhouses gas emissions by 2030 over 1990 levels. Costs of generating power from renewable sources have become increasingly competitive, and cheap gas is pushing coal out of the fuel mix in a trend that has been enhanced by the political will to drive up the cost of carbon emission allowances. Czech state-owned hard coal mining group OKD will shut all its mining operations for six weeks as it battles an outbreak of coronavirus infections. The mines, in the country’s industrial east, have been the Czech Republic’s main hot spot of new cases in the past weeks.

The Japanese government said it will tighten state-backed financing criteria for overseas coal-fired power plants after facing criticism over its support for the dirtiest fossil fuel. The move marks a partial shift away from Japan’s strong official backing for coal but includes exemptions, leaving some non-governmental organizations sceptical about how much impact the new approach will have. It has received criticism from many quarters over its support, usually through Japan’s export credit agency, for the construction of coal-fired plants in countries such as Indonesia and Vietnam, as well as new plants at home. UN urged countries to stop financing for coal and to make a commitment not to build new coal-fired power plants to enable a shift to clean energy. Japan’s latest move includes exemptions, however, such as when there are no alternatives to coal for the energy stability of a country seeking to build a coal-fired station provided it uses so-called clean coal technology from Japan. Japan’s private banks and companies have been tightening coal policies or cutting investments.

Australia’s Whitehaven Coal Ltd posted a 29 percent jump in fourth-quarter coal production, beating estimates, even as it warned that pricing pressure was likely to continue as the Covid-19 pandemic dents industrial activity. Whitehaven said that saleable coal output jumped to 6.2 mt for the quarter from 4.8 mt for the same period a year earlier, helped by higher production at its Narrabri mine. The miner said uncertainty surrounding future Chinese import quotas weighed on coal prices in the June quarter, despite high imports of Australian thermal and metallurgical coal to China in the second half of fiscal 2020. Prices for Whitehaven’s thermal coal, used in power generation, slid to $59/tonne from $84 a year earlier. Coal prices have slumped as coronavirus-fuelled curbs have disrupted industrial activity in most countries, including top importers Japan and India. The world’s largest mining company BHP Group has hired US investment bank JP Morgan to sell its Australian thermal coal mine, following pressure from investors concerned about global warming. BHP’s Mt Arthur open cut mine, in the Hunter Valley region of New South Wales, supplies thermal coal, used as fuel for power plants, to domestic and international customers and could fetch between $1.5 bn and $1.8 bn. Rival mining companies have also taken steps to go thermal coal free, with Rio Tinto selling its last coal mines in 2018, and Anglo American considering the spinoff or sale of its South African coal operations within the next two or three years.

| CIL: Coal India Ltd,: SC: Supreme Court, PSU: Public Sector Undertaking, mtpa: million tonnes per annum, mn: million, bn: billion, mt: million tonnes, bt: billion tonnes, MCL: Mahanadi Coalfields Ltd, FDI: foreign direct investment, MDOs: mine developer cum operators, GIDC: Goa Industrial Development Corp, TATR: Tadoba-Andhari Tiger Reserve, EU: European Union, US: United States |

21 July. The YS Jagan Mohan Reddy government, which has been claiming credit for implementing welfare schemes despite financial stress, has hiked the value added tax on petrol and diesel. The government said its own resources had dried up and hence, the hike in VAT (Value Added Tax) on fuel. As per a new order issued, amending the VAT Act, the state tax on petrol is increased by ₹1.24 and on diesel by 93 paise. The new tax on petrol is 31 per cent plus ₹4 and on diesel is 22.25 percent plus ₹4.

Source: The Economic Times

QuIck CommentHigh petroleum prices will reduce demand and impose costs on economic recovery! Bad! |

17 July. Indian state refiners’ petrol and diesel sales declined in the first half of July from the same period last month, according to preliminary data, as a renewed lockdown in parts of the country and rising retail prices hit demand. Fuel demand growth in India, the world’s third-biggest oil importer and consumer, plunged to historic lows in April when the federal government imposed a country-wide lockdown. State-refiners’ diesel sales, which account for two-fifth of overall refined fuel sales in India, fell by 18 percent to 2.2 million tonnes (mt) in the first half of July from the same period in June, and by about 21 percent from a year earlier, according to Indian Oil Corp (IOC) data. State companies – IOC, Hindustan Petroleum Corp Ltd (HPCL) and Bharat Petroleum Corp Ltd (HPCL) – own about 90 percent of India’s retail fuel outlets. Indian fuel demand had gathered pace from May when the lockdown was partly eased. But a spike in cases of coronavirus infection has led to authorities imposing fresh lockdowns and designating new containment zones in several states, including the largely rural Bihar in the east and the southern tech hub Bengaluru. State companies’ sales of petrol fell 6.7 percent to 880,000 tonnes in the first half of July from the same period in June, and by about 12 percent from a year earlier, the data showed. India’s diesel price has touched a record high of ₹81.35 ($1.09) a liter in New Delhi, slightly higher than that of petrol. India’s overall refined fuel demand includes consumption of fuel oil, bitumen and liquefied petroleum gas (LPG). State retailers sold 6.5 percent more LPG in the first half of July from a year ago, at about 1.075 mt.

Source: Reuters

17 July. Reliance Industries Ltd (RIL), operator of the world’s biggest refining complex in western Gujarat, will shut one of its crude refining units at its export-focused plant in the fourth week of July for 3-4 weeks of maintenance. Other Refinery units are expected to operate normally during this period, the company said. RIL has two equal-size crude distillation units at the 704,000 barrel per day (bpd) export-focused refinery. This refinery at the Jamnagar complex is adjacent to a 660,000 bpd plant that mostly meets local fuel demand.

Source: Reuters

17 July. Unexpected rise in diesel prices despite slower demand has extended the gain for the transport fuel over petrol in Delhi. With a 17 paise hike in diesel price in New Delhi while petrol prices remaining steady, the gap between the two auto fuels has further widened in the national capital. Diesel prices overtook that of petrol in the national capital, in an unprecedented development. Diesel was priced at ₹81.35 per litre in the capital, higher than the previous level of ₹81.18 a litre. Petrol prices, however, remain unchanged at ₹80.43 a litre, the same level as 29 June when it’s pump price rose marginally by 5 paisa over previous days price. With this, diesel is now almost a rupee higher than petrol overturning the advantage of running a vehicle on the fuel. With the price trends in diesel, it may soon catch up with petrol prices in other metros as well. Along with the Capital, diesel prices marginally increased in other metro cities as well but there the price of transportation fuel is still between ₹6-8 per litre lower than petrol.

Source: The Economic Times

15 July. State-run e-governance entity CSC e-Governance Services Ltd launched 2,000 cooking gas or LPG (liquefied petroleum gas) supply centres in rural India in collaboration with Bharat Petroleum Corp Ltd (BPCL). CSC has exclusively tied up with BPCL for this service where villagers will be able to book new LPG connections — government sponsored Ujjwala as well as general category, at common service centres. CSC’s objective is empowerment of poor people in rural India, and the launch of 2,000 centres will further benefit them.

Source: The Economic Times

17 July. GAIL (India) Ltd has issued a swap tender offering liquefied natural gas (LNG) cargoes for loading in the United States (US) and seeking cargoes for delivery into India, in 2022. It has offered to swap one cargo a month in 2022 in a tender that closes on 27 July. The cargoes it is offering will load from the Sabine Pass plant on a free-on-board (FOB) basis and the cargoes it is seeking will be delivered into India on a delivered ex-ship (DES) basis. The Indian importer has 20-year deals to buy 5.8 million tonnes (mt) a year of US LNG, split between Dominion Energy’s Cove Point plant and Cheniere Energy’s Sabine Pass site in Louisiana.

Source: Reuters

17 July. India and the US (United States) will hold the second ministerial meeting on strategic energy partnership in the backdrop of the global energy market trying to recover from the impact of a historic price crash and record slump in demand due to the Coronavirus pandemic. Oil Minister Dharmendra Pradhan will co-chair the virtual meeting with US energy secretary Dan Brouillette. The meeting, originally scheduled to be held in Washington in April this year but postponed due to the pandemic, is expected to focus on natural gas and India’s expanding market for the clean-burning fuel. Pradhan said that cooperation in natural gas sector has been identified as a priority area. He mentioned about several upcoming new opportunities in the field of LNG (liquefied natural gas) bunkering, LNG ISO container development, petrochemicals, bio-fuels, and compressed biogas in the Indian energy sector. He said India will see an investment of over $118 bn in oil and gas exploration as well as in setting up natural gas infrastructure, including the development of gas supply and distribution networks, in the next five years as the country gears up to meet the needs of a fast-growing economy.

Source: The Economic Times

21 July. Western Coalfields Ltd (WCL) has increased the production of coal to 57.6 million tonnes (mt) in fiscal year 2019-20 and provided it cheaply to government and private thermal power stations in Central, West and South India. The move has helped thermal power producers to reduce the rates of electricity supply to consumers, WCL said. According to WCL, in the last five years, it has opened 20 mines with a capacity of 45.64 mt. These mines produced 35.8 mt of coal in fiscal 2019-20. As a result, the company’s production increased to 57.6 mt and it was able to meet the coal demands of its customers. According to WCL, it supplied 17.60 mt of coal to MAHAGENCO (Maharashtra State Power Generation Company) during the fiscal year 2013-14. It increased its supply to 27 mt in the fiscal year 2019-20. In order to make more coal available to energy consumers, WCL has also identified 11 mines as “mine specific sources” dedicated to the power sector. WCL plans to increase production from the current 57.6 mt to 75 mt by the fiscal year 2023-24 and 100 mt in 2027-28.

Source: The Economic Times

18 July. Coal India Ltd (CIL), which is already reeling under the pandemic stress causing adverse impact on demand and supply of dry fuel, said the situation will remain uncertain in July-September as some states are resorting to fresh lockdowns. The miner produced 18.05 million tonnes (mt) of coal from 1 July to 16 July against 19.61 mt produced in the same period last year. The coal production in some of the major mines is still affected due to high coal stock and less offtake. Pithead stock of CIL as on 16 July is 72.88 mt as compared to 33.17 mt during the last year same period, it said. However, with concentrated efforts, a growth of 16.7 percent was registered in overburden (OB) removal during 1 July to 16 July as compared to the same period last year. Due to continuing lockdown and various guidelines issued by central and state governments, normalcy has not been restored yet, affecting coal production and despatch, CIL said. CIL produced 51.32 mt of coal from 15 March to 31 March. CIL had produced 121.01 mt of coal during 1 April- 30 June, compared to 136.94 mt during the same period last year.

Source: The Economic Times

QuIck CommentSpot e-auction of coal will increase supply and reduce imports! Good! |

17 July. Coal India Ltd (CIL) has introduced a special spot e-auction scheme for importers to boost sales and reduce India’s dependence on imports. Buyers including traders who imported coal after March 2018 are eligible for bidding under the scheme. CIL will soon notify the e-auction events for the period August 2020 to March 2021 under the scheme and coal companies will draw specific programmes for e-auctions. Bidders will need to quote prices in increments of ₹10 per tonne over the floor price to begin with. It will be increased to ₹20, ₹30 and ₹50 on a per tonne basis gradually as competition intensifies. The scheme will offer buyers the option of lifting the coal within, three, six or 12 months. According to CIL several non-power plants are importing coal from different countries for blending purposes or direct use. A need has arisen for consumption of domestic coal instead of imported coal to save foreign exchanges as sufficient domestic coal is available with CIL, the company said. At present CIL’s stocks are at an all-time high of 75 million tonnes (mt), while stocks at power plants have touched 44 mt.

Source: The Economic Times

16 July. Residents of three villages of Tandwa block in Chatra district do not want a portion of the road connecting National Thermal Power Corp (NTPC)’s Chatti Bariatu coal project in Hazaribag and Shivpur railway siding to pass through the villages and have submitted an alternate route to the company building the road. According to villagers, the under construction 7.5 kilometre (km) road from Sisai to Shivpur at an estimated budget of ₹230 mn is passing through three villages — Khailha, Brinda and Kabra — of Tandwa block.

Source: The Economic Times

15 July. The coal ministry plans to link the mining plan portal with PARIVESH website, a top official said. PARIVESH is a single-window hub for online submission, monitoring, and management of proposals submitted to the environment ministry by project proponents to seek various types of clearances. Coal Secretary Anil Kumar said that the government has taken steps for the ease of doing business in the coal sector. The system for seeking environment and forest clearances for coal mines has improved, he said.

Source: The Economic Times

21 July. NTPC Ltd, India’s largest power generation company, said it’s total installed capacity has increased to 62910 MW. The unit-2 of 800 MW of Lara Super Thermal Power Project has been added to installed Capacity of NTPC on successful completion of trial operation. With a total installed capacity of 62910 MW, NTPC Group has 70 Power stations comprising of 24 Coal, 7 combined cycle Gas/Liquid Fuel, 1 Hydro, 13 Renewables along with 25 Subsidiary & JV Power Stations, it said

Source: The Economic Times

20 July. Major reforms in the power sector and cooperation of engineering staff have for the first time resulted in record supply of over 23,400MW this week in the state, claimed energy minister Shrikant Sharma. This is about 7,000 MW more than the supply peak recorded by the previous Samajwadi Party (SP) government. Sharma said that the highest supply the Akhilesh government had recorded was about 16,000 MW, while the average supply during the SP regime was around 14,500 MW. Now, the state has managed to increase the supply peak by over 7,000 MW and this was not possible without the engineers’ cooperation and reforms introduced by the power ministry in the three-and-a-half-year of the Yogi government. Sharma said that on the basis of line losses he had classified feeders in three categories – red, orange and green.

Source: The Economic Times

20 July. The Gujarat government’s move to cancel its December 2018 Government Resolution (GR), which allowed higher tariffs to Adani Power, Tata Power and Essar Power, and issuance of new guidelines will reduce power tariff for supplemental power purchase agreement (PPA) currently under implementation, the state government claimed. Stating that the revocation of the GR was ‘in the interest of consumers’, the state government claimed the new guidelines issued last month post cancellation of the GR are expected to bring electricity tariff by around 30 paise per unit for supplemental PPA. Several modifications suggested by the Gujarat Electricity Regulatory Commission (GERC) while approving the supplemental power purchase agreement (PPA) with Essar Power Gujarat Ltd (EPGL) have also been incorporated into new guidelines.

Source: The Economic Times

20 July. Faced with a barrage of complaints on over-billing following hefty bills that consumers have received in June, CESC (Calcutta Electric Supply Corp) has decided to revise the bill and collect only the amount for the electricity consumed in June while keeping in abeyance the balance. The June 2020 bill had included the partial consumption of the past two months when meter could not be read due to the lockdown. This decision affects 26 lakhs domestic consumers. CESC had earlier announced a scheme to pay the June bill in three instalments following the outpouring of consumers’ anger on social media. The decision by CESC chairman Sanjeev Goenka followed a missive from the power department to explain how the June bill was computed. CESC managing director (distribution) Debasis Banerjee added that details in this regard are being worked out considering suitable regulatory guidelines. Meanwhile, the due date has been extended by 10 days. Though CESC has denied the allegation and issued advertisements to assuage consumers, the power minister was unhappy with the clarification as it did not explain how the slabs had been computed. Earlier in the day, an SMS was sent out to consumers with a link to view an interview with Banerjee where he clarified various aspects of billing. But the events that followed in the evening appear to have clearly overtaken such attempts to assuage consumers, leading to the dramatic decision to recall the June bill. With the 2020 bill comprising the difference between units recorded in the latest meter reading and the previous one in March minus the units charged in the provisional bills issued for April and May, it isn’t clear how the utility will determine how many units were consumed in June. Power Minister Sovondeb Chattopadhyay said CESC should have been more transparent in explaining the bill to consumers when there were allegations that the units were computed on higher slab rates.

Source: The Economic Times

20 July. Indian power regulator has proposed uniform price discovery through pooling of bids across power exchanges for optimal utilisation of transmission system besides stringent rules for electricity markets, including keeping a check on transaction fee of bourses. The industry, however, said stringent regulations and unnecessary interventions by regulatory commission will impede deepening of electricity market in the country, which has just begun to evolve. It said regulator’s interventions pose questions on free-trade concept. The Central Electricity Regulatory Commission (CERC) issued elaborate draft power market regulations 2020, which provide for a new concept called ‘Market Coupling’, meaning a process of collecting bids from all the power exchanges and matching them to discover a uniform market clearing price. The draft, supposedly lengthiest of all CERC regulations, has also proposed to allow long-term future contracts on power exchanges by doing away with the current 11 days restriction. The regulator has also sought to keep in check the quantum of transaction fee charged by power exchanges.

Source: The Economic Times

18 July. The Himachal Pradesh State Electricity Board Ltd (HPSEBL) has started serving disconnection notices to consumers who have not paid bills during the Covid-19 lockdown period. In its notices to consumers, the board is making an emotional appeal, saying it did not levy late payment charges but was reeling under severe financial crisis due to non-payment of bills by thousands of consumers.

Source: The Economic Times

18 July. Maharashtra has become the first State in the country to get the go-ahead to use drones for aerial surveillance and inspection of extra high voltage (EHV) power transmission lines and towers. The Union Ministry of Home Affairs and the Director General of Civil Aviation have permitted the Maharashtra State Electricity Transmission Company Ltd (MSETCL) to deploy drones to inspect faulty lines, reducing the risk posed to its staff. MSETCL said each of its zones will be given a drone, which will be equipped with ultra HD cameras to capture high-resolution close-up photographs and videos of EHV lines and towers. MSETCL said the drones will also help them slash maintenance costs and reduce losses from outages. State Energy Minister Nitin Raut asked the Maharashtra State Electricity Distribution Company Ltd (MSEDCL) to chalk out plans for the electrification of remote and inaccessible tribal areas in Melghat and Gadchiroli. Raut instructed MSEDCL officials to identify areas in the State which do not have electricity owing to geographical hurdles.

Source: The Hindu

18 July. The Aam Aadmi Party (AAP) organised a protest against hefty June power bills in various districts across Maharashtra and submitted its memorandum to various tehsildars and collectors. It has also collected 30,000 signatures offline and plans another one lakh signatures online through twitter and website campaign. AAP state secretary Dhananjay Shinde said that workers protested with slogans, placards and have demanded waiver of power bills during Lockdown months for upto 200 unit consumption. The political party has also received response from several power consumers on its newly launched website ‘hisaabdo.in’ from where it will route all complaints to the energy ministry.

Source: The Economic Times

16 July. India’s electricity generation during the first half of July fell at a slower pace than in June, provisional government data showed, as industries and commercial establishments opened up after further following gradual easing of lockdowns. Power generation fell 3.1 percent in the first 15 days of July compared with the same period last year, an analysis of daily load despatch data from federal grid operator POSOCO showed, compared with a 9.9 percent fall in June. In the second half of June, electricity generation declined 5.3 percent. While power use has picked up from previous months when India was under a strict lockdown, electricity demand – which is impacted by seasonal changes – is still lower when compared with the same periods from the previous year. Industries and offices account for over half of India’s annual power use. Prime Minister Narendra Modi has been citing electricity consumption to show there are “greenshoots” in the Indian economy. Major industrial states such as Maharashtra, Gujarat in the west and Tamil Nadu in the south continued to witness steep drops in electricity use amid higher incidence of coronavirus cases. However, many states with smaller yet significant industrial profiles saw growth in power demand for the first time since Modi announced a nationwide lockdown in March. The northern state of Uttar Pradesh – India’s most populous and home to the largest number of medium and small scale enterprises (MSMEs) in the country – witnessed a 10.1 percent growth in electricity use. Other states including Bihar, Rajasthan and Madhya Pradesh – all of which are known for MSMEs – saw an uptick in power demand.

Source: Reuters

15 July. Uttar Pradesh power distribution utility has sought ₹209.4 bn loan from REC Ltd and Power Finance Corp (PFC) under the Atmanirbhar Bharat liquidity infusion package in the power sector. This is the largest loan application made so far by any state distribution company under the scheme. Tamil Nadu has asked the Centre to relax borrowing cap and has shown intent to borrow about ₹206.22 bn. The power ministry has approached the Cabinet for the relaxations and the matter is likely to be taken up soon.

Source: The Economic Times

15 July. DMK president M K Stalin has convened a meeting of party’s district secretaries, MPs and MLAs to discuss the power tariff in Tamil Nadu. Party said that though there was no hike in power tariff as of now, the meeting would discuss the issue of people being asked to pay four months power bill at one go.

Source: The Economic Times

21 July. The first 2 MW solar power plant of the Indian Navy was inaugurated at the IN Karanja Station near Uran in Raigad district. Costing around ₹140 mn, it is fully indigenous and installed with the help of Indian companies. With this captive power plant, the Navy hopes to make significant savings of around ₹36.5 mn per annum in power bills as it will cater to nearly one third of the Karanja Station’s annual power needs. Besides the indigenous solar panels, tracking tables and inverters, the plant is also grid-interconnected by a state-of-art single-axis sun-tracking technology with computerised monitoring and control.

Source: The Economic Times

QuIck CommentZero fossil fuel import will not serve economic goals! Ugly! |

21 July. NHPC Ltd said it has inked a MoU (Memorandum of Understanding) with Green Energy Development Corp of Odisha Ltd (GEDCOL) to form a joint venture for developing floating solar energy projects in the state with initial capacity of 500 MW. The two entities may collaborate and cooperate to form a joint venture company (JVC) to plan and develop techno-commercially feasible floating solar power projects of 500 MW in Odisha under UMREPPs (Ultra Mega Renewable Energy Power Parks) scheme of Ministry of New and Renewable Energy), in a phased manner, preferably in packages of 50 MW each, it said.

Source: The Economic Times

18 July. The Punjab government will set up three solar parks in Anandpur Sahib parliamentary constituency, Congress MP Manish Tewari said. The state government has asked the deputy commissioners of Mohali and Rupnagar to identify the land for the purpose, the Anandpur Sahib MP said. Tewari said he had taken up the matter with Chief Minister Amarinder Singh. The MP said he had received a communication from the state government that the process will be taken up further after identifying the land. The Punjab Energy Development Agency (PEDA) will take up the matter with the Union Ministry of New and Renewable Energy (MNRE), the former Union minister further said. Tewari said he was told that for developing three solar parks with 200 MW capacity each, 1,000 acres of contiguous land was required. However, as per the MNRE guidelines, minimum capacity of 100 MW solar park can be set up at a single place which requires about 500 acre land, he said.

Source: The Economic Times

17 July. Zero dependence on fossil fuel is required for Aatmanirbhar Bharat, Power and Renewable Energy Minister R K Singh said. Singh said that once renewable energy and balancing power become cost-effective, thermal electricity and fossil fuel will be a thing of past in India’s energy mix. In order to bring down renewable tariff, storage has to be viable, pumped hydro to take off, in-house manufacturing to jumpstart and battery to become cheap, Singh opined. Expressing optimism for domestic manufacturing in the RE (Renewable Energy) sector, he also took cognizance of the existing issues that the government was rallying to solve payment security of the entire value chain, sanctity of contracts, land acquisition and regulatory issues.

Source: The Economic Times

17 July. Indian Oil Corp (IOC) has planned to set up more number of compressed biogas (CBG) units in the country. Executive director and state head of IOC P Jayadevan said IOC would be responsible for the compressed biogas and this can be consumed as a green renewable energy for automotive and industrial applications. Jayadevan said CBG is a cost-effective biofuel to the vehicle owner. The state currently has five compressed biogas units and it is being sold through the outlets at the cost of ₹59.42 per kilo.

Source: The Economic Times

16 July. Tata Power Green Energy Ltd (TPGEL) has received a letter of award from Tata Power Mumbai Distribution to develop a 225 MW hybrid renewable project. The project is required to be commissioned within 18 months from the date of execution of the power purchase agreement. Tata Power’s renewable capacity will increase to 3,782 MW of which 2,637 MW is operational and 1,145 MW is under implementation including 225 MW won under this letter of award.

Source: Livemint

16 July. Deputy Chief Minister Ajit Pawar and Energy Minister Nitin Raut have issued directives to Maharashtra State Power Generation Company Ltd (MAHAGENCO) for implementing 602 MW solar projects in the state in three stages. It will be implemented under Engineering Procuring Commissioning (EPC) contract on land owned by state power generation company. In the first stage, 187 MW solar projects, including those at Kaudgaon (50 MW), Latur (60 MW), thermal power station land at Bhusawal, Koradi, Parli and Nashik (52 MW) and Sakri (25 MW) will be developed, partly with bank loans. A proposal will be submitted immediately for cabinet approval.

Source: The Economic Times

16 July. The Indian Institute of Technology (IIT) Guwahati researchers have developed methods to produce biofuels from non-edible seeds. The team of innovators who have successfully executed the task is led by Dr Kaustubha Mohanty, Professor of the Department of Chemical Engineering at IIT Guwahati. Results of the team’s research have been published recently in high-impact journals such as Bioresource Technology, Fuel, Renewable Energy, Journal of Analytical and Applied Pyrolysis, Journal of the Energy Institute and Biomass Conversion and Biorefinery. Mohanty and his research team use a heat-chemical route to produce biofuels from these and other such seeds that they painstakingly collect from various parts of the country. To improve the properties of the biofuels derived from non-edible seed oils, the scientist used various catalysts such as calcium oxide, zeolite, etc., during the conversion of seed oil to biofuel. Both yield and quality improved, the biofuels produced were comparable in properties to regular diesel, except for viscosity.

Source: The Economic Times

16 July. The government is considering a proposal by the Ministry of New and Renewable Energy (MNRE) to impose 20 percent basic customs duty on solar modules to provide an edge to domestic manufacturers and discourage imports, particularly from China, Minister of State for Finance Anurag Thakur said. While the government has taken a number of steps to increase capacities in the renewable energy sector in the last few years, it is now time to cut down reliance on imports of solar equipment and components, especially from China, he said. Currently, Chinese firms supply about 80 percent of solar cells and modules in the Indian market. India imported solar power equipment worth $1.2 bn during April-December 2019, he said. The government has set up a green energy corridor with an estimated investment of $5.8 bn to ensure evacuation of renewable energy from generation points to the load centres by creating transmission infrastructure. Besides, he said, MNRE has announced a provision for bank loans up to a limit of $2.3 mn to borrowers to set up solar-based power generators, bio-mass based power generators, wind power systems and micro hydel plants.

Source: The Financial Express

21 July. Iraq’s crude oil exports have increased so far in July, according to shipping data and industry sources, suggesting OPEC (Organization of the Petroleum Exporting Countries)’s second-largest producer is still undershooting its pledge in an OPEC-led supply cut deal. Southern Iraqi exports in the first 20 days of July averaged 2.70 mn barrels per day (bpd), according to the average of figures from Refinitiv Eikon. The OPEC and allies, known as OPEC+, began a record supply cut in May to bolster oil prices hammered by the coronavirus crisis. Iraq is cutting output by 1.06 mn bpd under the deal. The July figures imply Iraq is still some way from fulfilling its pledges and is exporting far more than a July loading programme indicated. Iraq had told OPEC+ it would make up for over-production in May and June through larger cuts in later months. The south is the main outlet for Iraq’s crude, so a good part of its OPEC+ cut should show up in lower exports.

Source: Reuters

20 July. Chevron Corp said it would buy oil and gas producer Noble Energy Inc for about $5 bn in stock, the first big energy deal since the coronavirus crisis crushed global fuel demand and sent crude prices to historic lows. The oil price crash has decimated shares of many energy companies, making them attractive targets for those that have weathered the downturn and have the resources to buy. Chevron ended the first quarter with a cash pile of $8.5 bn after withdrawing a $33 bn bid for Anadarko last year and then being among the first big oil companies to slash spending during the downturn. The deal makes Chevron the first oil major to enter Israel.

Source: Reuters

21 July. Global gas flaring increased to 150 billion cubic meters (bcm) in 2019, the highest level in more than a decade, primarily due to increases in the United States (US), Venezuela and Russia, the World Bank said. Gas flaring, the burning of natural gas associated with oil extraction, in fragile or conflict-affected countries climbed from 2018 to 2019, in Syria by 35 percent and in Venezuela by 16 percent, the World Bank said. The top four gas flaring countries – Russia, Iraq, the US, and Iran – continue to account for 45 percent of all global gas flaring, for three years running (2017-2019), the World Bank said.

Source: Reuters

21 July. Romania’s gas grid operator Transgaz will likely finalise work on a European Union-backed pipeline this year, but with no progress on tapping offshore gas reserves it may have little to transport, energy regulator ANRE said. The pipeline to connect Bulgaria, Romania, Hungary and Austria and ease reliance on Russian gas will be able to carry 1.75 billion cubic meters (bcm) of gas in its first phase, which cost an estimated €479 mn (432.07 mn pounds) to build. Several gas producers have spent years and billions of dollars preparing to tap Romania’s Black Sea gas, but were blindsided by price caps, taxes and export restrictions pushed by a previous centre-left government.

Source: Reuters

19 July. The Israeli government approved an agreement with European countries for the construction of a subsea pipeline that would supply Europe with natural gas from the eastern Mediterranean. The Eastmed pipeline, which has been in planning for several years, is meant to transport gas from offshore Israel and Cyprus to Greece and on to Italy. A deal to build the project that was signed in January between Greek, Cypriot and Israeli ministers had still required final approval in Israel. The European Union and the pipeline’s owner IGI Poseidon, a joint venture between Greek gas firm DEPA and Italian energy group Edison, have each invested €35 mn in the planning. The pipeline is planned to initially carry 10 billion cubic meters of gas a year with the possibility of eventually doubling the capacity.

Source: Reuters

17 July. French oil major Total has signed a $14.9 bn senior debt financing agreement for its massive liquefied natural gas (LNG) project in Mozambique, the biggest project financing ever in Africa, it said. The project includes the development of the Golfinho and Atum natural gas fields in the Offshore Area 1 concession, and the construction of a two-train liquefaction plant with a capacity of 13.1 million tonnes per annum, Total said. Mozambique LNG is one of several projects being developed in the country’s northernmost province of Cabo Delgado after one of the biggest gas finds in a decade off its coast. Together, the projects are worth some $60 bn. Rival Exxon Mobil delayed the final investment decision on its nearby Rovuma LNG gas project due to the coronavirus pandemic, and Mozambique expects the decision next year. Mozambique LNG’s project financing includes direct and covered loans from eight export credit agencies (ECAs), 19 commercial bank facilities, and a loan from the African Development Bank, Total said.

Source: Reuters

17 July. Asian spot liquefied natural gas (LNG) prices edged higher this week ahead of anticipated warmer-than-usual temperatures in some parts though demand in the region remained sluggish. The average LNG price for September delivery into northeast Asia was estimated to be about $2.40 per million metric British thermal units (mmBtu), traders said. Prices for cargoes delivered in August were estimated to be about $2.30 per mmBtu, 10 cents higher than the previous week. Most areas in Japan, the world’s top LNG importer, are expected to experience warmer-than-normal weather between July and September, the Japan Meteorological Agency said in its three-month forecast on 1 July. Still, gas demand in the region remained sluggish amid fears of a second wave of coronavirus in some countries. Nearly 30 laden LNG tankers are idling in mostly Asian and European waters, as traders take advantage of cheap prompt prices and freight rates in a bet that high winter demand will eventually boost the market.

Source: Reuters

16 July. Indonesian fisherman Ramidin said he used to catch stingray by paddling just off the shore of his village, but as a giant coal power complex nearby has expanded over the last three decades, he has had to venture further and further out to sea. Korea Electric Power Corp (KEPCO) has confirmed it will partner Indonesia to add two more 1,000 MW units to the complex in Suralaya, which residents fear will further increase water and air pollution in the area. Greenpeace said the $3.5 bn expansion project could result in up to 1,500 premature deaths over the typical 30-year lifespan of a coal-fired power plant, as well as affect the air in the capital Jakarta, a city of 10 mn people that lies 120 km (75 miles) to the east. Many residents in Suralaya, on the western tip of Java, Indonesia’s most populous island, worry that the expanded coal complex will lock in decades of pollution that has plagued the once pristine village since the power complex began operating in 1984. The Indonesian government and KEPCO said the new coal units will use the latest technology to minimise pollution.

Source: Reuters

16 July. Germany’s imports of hard coal from the world market will likely decline by between 16 and 30 percent in 2020, importers group VDKi forecast. Germany’s position as Europe’s biggest economy and coal importer means it plays a significant role in global trade flows and price discovery at landing ports.

Source: Reuters

15 July. Vietnam has imported the first shipment of coal from the United States, coal miner Vinacomin said. The 21,700 tonnes of coal bought from IMI Fuels LLC arrived at a port in northern Vietnam, Vinacomin, formally known as Vietnam National Coal-Mineral Industries Corp, said. Vinacomin said the second batch was scheduled to arrive in September.

Source: Reuters

15 July. Mexico’s electrical power company announced it will buy 2 million metric tonnes of coal from Mexican producers to burn in power plants. The announcement came as many countries are moving to reduce their use of coal-fired power plants amid declines in electricity demand due to the coronavirus pandemic. Under announcement, the Federal Electricity Commission – known as the CFE – will buy the coal between July and December 2021, to help the economy of coal producers in the northern border state of Coahuila.

Source: The Economic Times

15 July. South Africa’s state utility Eskom cannot say how long a new round of power cuts that began will last. Eskom implemented planned power outages for the first time since March on 10 July, ending a period of unusually stable power supply thanks to reduced demand during a coronavirus lockdown. The company generates more than 90 percent of South Africa’s power but has battled to meet demand for years because of faults at its coal-fired power stations, which have interrupted power supplies, hampered economic growth and deterred investment.

Source: Reuters

21 July. Ukrainian parliament adopted a law significantly reducing tariffs for renewable energy, eliminating the problem of mass non-payments in the energy sector, criticised by investors and Western partners. Ukraine set up special tariffs for renewable energy companies several years ago to expand the green power production and pledged to buy all the energy produced.

Source: Reuters

21 July. A house with a white picket fence in the verdant suburbs has long been an American dream. It could also be a major hurdle for US (United States) chances of cutting climate-warming emissions, researchers at the University of Michigan said in a study. US households account for one-fifth of the country’s total greenhouse gas emissions, thanks partly to Americans’ general preference for bigger houses and spacious suburbs.

Source: Reuters

20 July. The Czech government approved a plan to give an interest-free loan to majority state-owned utility CEZ to push down the cost of building a new nuclear power station it wants to replace the country’s ageing coal and nuclear plants. The Czechs have been adamant about keeping nuclear power despite a shift to renewable energy in many European Union (EU) states, arguing nuclear is a carbon-free alternative.

Source: Reuters

20 July. EU (European Union) state aid regulators cleared an Irish scheme to produce electricity from renewable sources, saying it was in line with the bloc’s rules and its environmental objectives. Ireland’s Renewable Electricity Support Scheme aims to support electricity production from renewable sources, including solar photovoltaic and wind, to help the country shift away from fossil fuels. The project, budgeted between €7.2 bn and €12.5 bn ($14.3 bn), will run until 2025.

Source: Reuters

15 July. Brazil’s Ibitu Energia, owned by US (United States)-based asset manager Castlelake LP, plans to invest roughly 4.5 bn reais ($839.43 mn) in renewable energy assets in the coming five years. The commitment comes after Castlelake reached an agreement with Brazil’s engineering group Queiroz Galvao last year to acquire Ibitu’s existing assets, comprising a hydroelectric facility and wind power plants with a combined capacity of 832 MW. Ibitu is also considering new solar and wind projects totaling 1.2 GW.

Source: Reuters

15 July. The World Bank’s International Finance Corp (IFC), the European Bank for Reconstruction and Development (EBRD), and the European Union (EU) said they would finance development of the first utility-scale solar power plant in Armenia. IFC and EBRD each pledged to allocate $17.7 mn long-term loans for the project, while the EU would offer €3 mn investment grants. The project was developed by Fotowatio Renewable Ventures (FRV), part of Abdul Latif Jameel Energy, a global leader in utility-scale renewable energy projects. The plant is expected to generate more than 128 gigawatt hour (GWh) of electricity annually and will displace the release of 40,000 tonnes of carbon emissions annually. Around 70 percent of Armenia’s current electricity generation depends on imported fossil fuels.

Source: Reuters

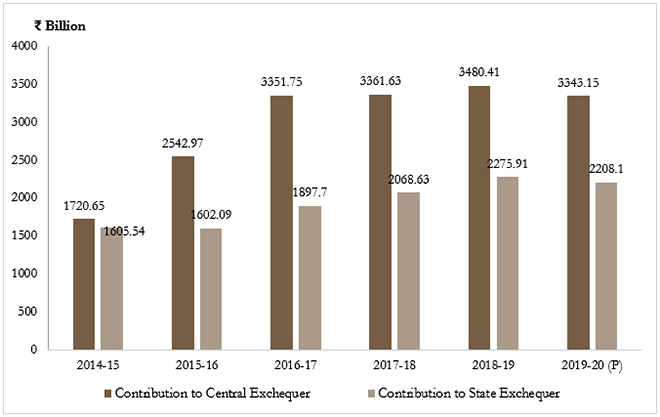

| Year(s) |

Petroleum Sector Contribution to Exchequer (All India) |

% change w.r.to previous year |

| 2014-15 | 3,326.2 | – |

| 2015-16 | 4,145.06 | 24.6% |

| 2016-17 | 5,249.45 | 26.6% |

| 2017-18 | 5,430.26 | 3.4% |

| 2018-19 | 5,756.32 | 6% |

| 2019-20 (P) | 5,551.25 | -3.6% |

Trends in Earning from Petroleum Sector by State and Centre

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.