-

CENTRES

Progammes & Centres

Location

India will gradually end central controls on gas pricing as it seeks to attract foreign investment and technology to lift local output. India, which is a large emitter of greenhouse gases and has multiple gas pricing regimes, aims to raise the share of gas in its energy mix to 15 percent by 2030, from 6.2 percent. To boost gas usage, India is expanding infrastructure including building new LNG import plants and connecting households with an expanding gas pipe network. No authorisation was needed to set up LNG dispensing facilities for vehicles. India’s top gas importer Petronet LNG said it wants to partner with fuel and gas retailers on LNG stations along highways for long-haul trucks and buses. Petronet wants to set up 5 LNG stations in the fiscal year ending March 2021, and 300 by 2023. It eventually aims to have 1,000 LNG stations across India. Meanwhile, IOC the country’s top refiner and fuel retailer wants to start LNG retailing through its fuel pumps. GAIL (India) Ltd is looking for partners to set up LNG dispensing facilities. India’s gas demand is expected to rise by 3-4 percent between October 2020 and March 2021, after witnessing a huge fall in April-May due to a coronavirus lockdown. Imported LNG accounted for about half of India’s 60.8 bcm of gas consumption in the fiscal year to March 2019.

India is simplifying its gas pipeline tariff structure to make the fuel more affordable and to attract investment for building gas infrastructure in the country. India has set a target to raise the share of gas in India’s energy mix to 15 percent from the current level of about 6.3 percent to cut its carbon footprint. Use of gas is also set to rise as India wants to push local manufacturing to cut costly imports and lift its battered economy. The new tariff structure would help to create a single gas market in the country by attracting investment to complete the gas grid and make it more easily accessible. India’s current “zonal” tariff rates for gas pipelines resulted in higher transportation charges and had hindered development of gas markets and demand centres in remote areas. India, the world’s fourth biggest importer of LNG, is spending $60 bn to strengthen its gas infrastructure that includes expanding the pipeline network and building gas import terminals. New rationalised tariff would help to promote faster development of city gas project to connect households, industries and transport sectors with gas network.

India launched its first gas trading exchange, IGX, enabling local and foreign players such as Shell, Vitol and Trafigura to sell directly to domestic customers. India, a large emitter of greenhouse gases, is expanding its gas infrastructure, including connecting households with expanding gas pipe network. The nation’s current daily consumption of gas – which is less polluting than other fossil fuels such as coal and oil – is about 165 mcm of which 47 percent is met through imported LNG. IGX is initially expected to facilitate trading in LNG, mainly cheaper spot volumes, as locally produced gas is sold at state-fixed prices to designated customers. The bulk of growth in India’s gas consumption would be met through imports. The IGX offers spot and forward contracts at Dahej and Hazira in Western Gujarat state and Kakinada in southern Andhra Pradesh. Currently, global traders sell LNG to Indian clients through companies like Peronet LNG, IOC, GAIL, BPCL & GSPC. Shell is the only foreign company that sells directly to customers through its LNG terminal at Hazira.

At a time when the price of domestic natural gas is as low as $2.39/mmBtu, IGX, the country’s first natural gas exchange, has got a market-discovered price of $4.07/mmBtu within the first two days of operation. The platform has so far traded 100 mmBtu gas. Giving major boost to IGX, big LNG players like GAIL and Petronet LNG have joined the exchange as members. Private sector majors like Adani Gas, too, have joined IGX as its member partner. Other members of the platform include Manikaran Power, GMR Energy Trading, Zak Venture, Kreate Energy, Gita Power and Infrastructure, Abja Power, Arunachal Pradesh Power Corporation, Andhra Pradesh Gas Power Corporation, and Instinct Infra and Power. Trade members facilitate trade on the exchange on behalf of their clients. They act as the link between the exchange and the clients registered on the exchange. The market-discovered price for first two days was ₹309/mmBtu or $4.07/mmBtu. The exchange is LNG-driven, while the price of domestically produced natural gas is notified by the government. At present, the domestic natural gas price is at $2.39/mmBtu, which most producers, including ONGC have cited as unviable. The government has endorsed a market-driven pricing mechanism and hinted at the introduction of a new tariff policy on gas. IGX is expected to help in finding market-driven pricing in India. Though in the international market, the spot price of LNG is low at around $2/mmBtu, the price at the consumer end in India will come to around $5-7/mmBtu, including transmission cost, marketing margins, local taxes, and levies. The country’s LNG capacity is also expected to increase from 37.5 mtpa to 62.5 mtpa by 2021-22. IGX will offer spot and forward contracts at Dahej, Hazira, and Kakinada. Spot contract for the day-ahead market means gas will be delivered the following day.

According to the IEA after a temporary slowdown in 2020, India is set to emerge as one of the primary drivers of growth in gas demand in Asia. Based on the IEA forecast, India is set to see an estimated 28 bcm per year increase in total consumption during 2019-25, owing to a combination of supportive government policies and improved LNG and pipeline infrastructure. The report indicates that India’s natural gas production is also expected to increase 12 bcm a year in 2019-25, with most of the net increase coming from a handful of ongoing deepwater development projects. The report highlighted that the Asia Pacific region may increase its share of total LNG imports, from 69 percent in 2019 to 77 percent by 2025. Out of this, India will lead to LNG growth accounting for about 20 percent of incremental trade, and its imports too may increase by 50 percent between 2019 and 2025 to support strong growth in demand. Natural gas consumption in India rose by an estimated 10 percent year-on-year during the first quarter of 2020. On the LNG front, India’s imports may increase by 16 bcm annually and reach 48 bcm by the end of the forecast period. With the recent addition of the Ennore and Mundra terminals and the expansion of the Dahej facility, effective regasification capacity stands at 53 bcm, the report said. India has come out with a roadmap to increase the share of natural gas in its energy basket from 6 percent to 15 percent.

According to Morgan Stanley the Covid-19 outbreak has accelerated the transition in India’s energy sector with profound implications for the economy, including addition of $140 bn of new direct investments in gas over eight years, rise in the employment growth rate by up to 300 basis points and a lower current account deficit by an average $4-4.7 bn annually. The investment banking firm expects gas to account for around 10 percent of India’s primary energy supply in 2025, up from 6 percent currently, with renewables at 6 percent from the current 3.6 percent. As global oversupply has accelerated, prices for Asian gas consumers have deflated to the greatest extent. India is the biggest beneficiary as consumer prices have fallen 25 percent and remain structurally low at a time when gas infrastructure is doubling and the advent of renewables is making gas even more prominent in the fuel mix. The bank expects personal use of gas for cooking and travel to rise as last mile infrastructure more than doubles by 2025.

ONGC has temporarily suspended operations at two drilling rigs in the Arabian Sea after 54 employees tested positive for coronavirus and one died but the oil and gas production has not been impacted. Operations at two rigs operating in the firm’s prime Mumbai High and Bassein fields off the west coast were temporarily suspended after the company’s testing rigour detected coronavirus positive cases. The suspension of operations at the drilling rig has not impacted production and the company continues to produce 170,000 bpd of oil and 12 mmscmd of gas from Mumbai High and 60,000 bpd oil and 32 mmscmd gas from Bassein. Mumbai High and Bassein are India’s top oil and gas producing fields, accounting for almost a two-third of the country’s production.

RIL has pushed back the start of production from the second wave of discoveries in its eastern offshore KG-D6 block to September-October after the Covid-19 lockdown imposed unprecedented constraints in execution of the deep-water project. The company, along with its partner BP Plc of the UK was initially targeting the start of production from the R-Series field in the Krishna Godavari block in May but pushed it back to June-end due to the lockdown. The lockdown has further pushed the start of production to mid of 2020-21 fiscal. The key focus for 2019-20 for RIL was to monetise the about 3 tcf of discovered resources in KG-D6 deepwater. Combined production from these three fields is expected to be 30 mmscmd by FY24. The output is equal to a third of India’s current natural gas production. The company’s D1 and D3 fields in the KG-D6 block ceased to produce in February this year after being in production for a decade. R-Cluster will have a peak output of 12.9 mmscmd while Satellites, which are supposed to begin output from mid-2021, would produce a maximum of 7 mmscmd. MJ field will start production in the second half of 2022 and will have a peak output of 12 mmscmd. The peak production from the three fields is expected to reach about 15 percent of India’s projected demand that year, it said. The D1-D3 field was India’s first deepwater gas field to be put on production in April 2009. The KG-D6 Block has so far produced an overall 3 tcf of gas, oil and condensate.

Experts including those from Singapore have submitted a detailed draft plan to control the fire in a gas well in Assam’s Tinsukia district. The plan submitted to the ministry was drawn up to cap the well by a team of experts from M/s Alert, Singapore, along with those of ONGC and Oil India Ltd, while the first load of equipment mobilized from ONGC-Sibsagar has reached Duliajan and will be sent to the site after inspection by the experts. The blaze at Oil India’s Baghjan gas well, which began on 9 June following a major blowout on 27 May, was still raging but the extent of it has been contained to the well with fire tenders kept ready at the site to arrest any incidents of flash fire. Production and operations in gas wells and oil wells of Oil India were affected by blockades put up people at several areas of the district.

In a first, India’s biggest LNG importer Petronet said it is close to signing a long-term LNG deal benchmarked to daily or spot prices, which generally are lower than standard rates of such contracts. India bought LNG under long-term contracts from Qatar and Australia at an average of $3.5-4.5/mmBtu in the current quarter. Spot or current prices of LNG are in the range of $2/mmBtu. Petronet had in February sought bids from suppliers for 1 mt of LNG per year for 10 years, starting 2024. The company wanted 1 mtpa of LNG on a delivered ex-ship basis. Currently, Petronet buys close to 10 mtpa of LNG through contracts with ExxonMobil and Qatar Petroleum. These contracts are priced at an average of benchmark crude oil rates of a particular period. GAIL has contracted 5.8 mt of LNG from the US benchmarked to prevailing rates on Henry Hub plus a fixed portion.

According to the IEA the coronavirus crisis and a very mild winter in the northern hemisphere have put global natural gas demand on course for the biggest annual fall on record. Global gas demand is expected to fall by 4 percent, or 150 bcm to 3,850 bcm this year – twice the size of the drop following the 2008 global financial crisis. Major global gas markets have experienced price falls to record lows as lockdowns and reduced industrial output due to the Covid-19 pandemic have stunted demand.

Asian spot LNG prices were stable this week, with demand still sluggish in an oversupplied market. The average LNG price for August delivery into northeast Asia LNG-AS was estimated at around $2.20/mmBtu. Some Chinese buyers were on the market and there could be gas demand for air conditioning in Japan due to hot weather, but overall, buying was subdued. Indian buyers were quiet as there is not much capacity in Indian ports to take more cargoes, in particular during the monsoon season. In Europe, June LNG deliveries dropped by 32 percent from volumes in May and by 5.6 percent from June 2019, Refinitiv data showed, as gas stocks in Europe move close to full capacity. Gas storage sites in Europe are on average just over 80 percent full, according to Gas Infrastrucure Europe data.

China aims to produce 1 percent more crude oil this year than in 2019 and to boost natural gas output by 4.3 percent, as the country seeks to safeguard energy security even after a coronavirus-driven collapse in oil prices. The world’s biggest energy consumer has set a goal of producing 193 mt of crude, or 3.85 mn bpd in 2020, and 181 bcm of gas, according to the NEA. The NEA said it would focus on expanding its four key energy production bases to achieve the goals – one offshore in Bohai Bay in northern China, as well as onshore in Sichuan province in the southwest, in the Erdos Basin and in the far western Xinjiang region. According to China Gas Holdings Ltd, one of China’s largest independent piped gas distributors gas sales in its latest financial year rose just 2.9 percent, a sharp fall from the previous year as the coronavirus pandemic hit fuel demand. China Gas sold 25.4 bcm of gas in the year ended 31 March, equivalent to roughly 8 percent of China’s total gas demand, but the rate of growth collapsed from a 32 percent surge in the year earlier period. The company said it had completed construction of a gas transmission pipeline network with a total length of 402,381 km. The firm expected its distribution network in northeast China to generate 500 mcm of gas sales this year, due to its proximity to the Russia-China Power of Siberia project that started pumping gas to China in late 2019.

Japan’s banks and public agencies have funnelled nearly $25 bn into LNG projects since 2017 but the investments may sour as prices plummet from the Covid-19 pandemic and as climate change risks rise. Spurred on by the government to boost energy security since the 2011 Fukushima disaster shut down the country’s reactors, Japan’s investment in LNG rivals that for coal, the dirtiest fossil fuel, while more evidence is emerging of the high climate impacts from LNG and gas. Japan is the world’s biggest importer of LNG, with burning gas from LNG producing about 40 percent of the country’s electricity, though purchases are in long-term decline. Japanese banks, public agencies and other entities have provided $23.4 bn of loans and support in 10 countries for more than 20 LNG terminals, tankers and pipelines.

Berkshire Hathaway Inc said its energy unit will buy Dominion Energy Inc’s natural gas transmission and storage network for $4 bn, while letting Dominion focus on utilities operations. The transaction announced includes more than 12,390 km of natural gas transmission lines and 900 bcf of gas storage. Berkshire Hathaway Energy is buying Dominion Energy Transmission, Questar Pipeline, Carolina Gas Transmission, 50 percent of the Iroquois Gas Transmission System, and 25 percent of the Cove Point liquefied natural gas facility in Maryland.

Exxon Mobil Corp has reduced crude output at its nascent project off Guyana’s coast due to problems with gas reinjection equipment, a move meant to avoid excessive gas flaring. Output at the Liza field, which Exxon operates in a consortium with Hess Corp and CNOOC Ltd, has fallen to between 25,000-30,000 bpd after an issue with gas reinjection equipment. Without the compressor fully functioning in order to reinject gas produced alongside the crude into the reservoir, Exxon had to reduce crude output to avoid exceeding a 15 mcf/day limit agreed to with authorities for gas flaring. Oil companies worldwide are seeking to reduce gas flaring from their operations in order to reduce greenhouse gas emissions. But that is complicated in places like Guyana, which lack gas pipeline infrastructure. Plans to build a gas pipeline from Guyana’s offshore Stabroek block to the coast have not yet gotten off the ground.

Texas as early as this fall could tighten some rules for the controversial practice of natural gas flaring. Texas regulators would also improve the data available on flaring, tracking for the first time how the gas is disposed, under the recommendations.

The Australian state of New South Wales said a controversial coal seam gas project planned by Santos Ltd should be approved as it would be crucial to plugging an expected shortfall in supply from 2024. The project could meet up to half of the state’s gas needs, helping to replace the rapidly depleting Bass Strait gas source that has supplied Australia’s southeastern states for 50 years. The state’s review found that in addition to providing essential gas supplies, the project would keep a lid on gas prices, support the development of gas-fired power stations to back up wind and solar power and create jobs. The state recommended imposing strict conditions to ensure the project does not deplete or contaminate water supplies and protects the Pilliga State Forest and the health and safety of the local community. Santos accepted the conditions and was in a position to ramp up appraisal well drilling as soon as the commission makes a decision.

French oil giant Total will proceed with its $23 bn gas project in northern Mozambique despite uncertainties caused by the coronavirus pandemic and militant attacks on nearby villages. Northern Mozambique has been hit by a jihadist insurgency since 2017 that has killed more than 1,000 people and complicated the country’s plans to develop its offshore gas reserves. Nearly 100 workers at Total’s LNG site have been infected by the new coronavirus, forcing the partial shutdown of activities for two months as 5,000 workers went into quarantine. Mozambican development depends heavily on the exploration and export of natural gas deposits concentrated in northern Cabo Delgado province near the border with Tanzania.

| FY: Financial Year, LNG: liquefied natural gas, IOC: Indian Oil Corp, mn: million, bn: billion, bcm: billion cubic meters, IGX: India Gas Exchange, mcm: million cubic meters, BPCL: Bharat Petroleum Corp Ltd, GSPC: Gujarat State Petroleum Corp, mmBtu: million metric British thermal units, ONGC: Oil and Natural Gas Corp, IEA: International Energy Agency, bpd: barrels per day, mmscmd: million metric standard cubic meter per day, RIL: Reliance Industries Ltd, UK: United Kingdom, tcf: trillion cubic feet, KG-D6: Krishna Godavari Dhirubhai 6, US: United States, mtpa: million tonnes per annum, mt: million tonnes, NEA: National Energy Administration, km: kilometre, bcf: billion cubic feet, CNOOC: China National Offshore Oil Corp |

14 July. LPG (liquefied petroleum gas) dealers expect a major disruption in the supply of cylinders to the micro-containment zones in the city during the 10-day total lockdown. The All India LPG Distributors Federation and local agencies said a shortage of staff, a sudden spurt in panic booking of cylinders and barricades are the main hurdles in serving the 109 sealed areas. All India LPG Distributors Federation’s Maharashtra president Usha Poonawalla said there was a 10-15 percent increase in the number of bookings in the past two days.

Source: The Economic Times

13 July. Diesel price in the national capital inched towards the ₹81 per litre-mark following a rate hike after a four-day hiatus. Diesel price was increased by 16 paise per litre, according to a price notification of state-owned oil marketing companies. This took the retail selling price to ₹80.94 per litre in the national capital — the highest ever. There was no change in petrol price for almost two weeks, and it continues to be priced at ₹80.43 per litre. Rates vary from state to state depending on the incidence of local sales tax or VAT (Value Added Tax). While diesel price was last revised on 7 July, petrol rates were last changed on 29 June. In the last five weeks, diesel price has increased on 24 occasions while petrol rates have risen 21 times. The cumulative increase since the oil companies started the cycle on 7 June totals to ₹9.17 for petrol and ₹11.55 for diesel. In Mumbai, petrol is priced at ₹87.19 — unchanged since June 29, while diesel rate was hiked to ₹79.17 litre from ₹79.05.

Source: The Economic Times

10 July. India’s Reliance Industries Ltd (RIL) will load its first cargo of Venezuelan crude in three months in exchange for diesel under a swap deal the parties say is permitted under the US (United States) sanctions regime on the Latin American country, according to RIL and a shipping document from state oil firm PDVSA. RIL gave the US State Department and the Office of Foreign Assets Control (OFAC) notice of the diesel swap and received word back that the policies that allowed the transaction were still in place. RIL has previously said that its supplies of fuel to PDVSA in exchange for crude were permitted under sanctions. An oil tanker named Commodore would load the cargo of crude in Venezuela and ship it to India, the tanker’s manager NGM Energy said. The Commodore is loading a 1.9 mn barrel cargo of crude for RIL at Venezuela’s main oil port of Jose, according to an internal PDVSA cargo schedule. RIL has a swap deal to provide diesel to Venezuela in exchange for fuel, but has not received a cargo of crude since April. Indian refiners said they planned to wind down their purchases of Venezuelan oil to avoid any problems with supply due to sanctions.

Source: Reuters

QuIck CommentFree LPG refills will benefit households suffering loss of income! Good! |

9 July. The Union Cabinet approved extension of Employees’ Provident Fund (EPF) support for small businesses and workers earning up to ₹15k till August. The decision has been taken to facilitate a higher take-home salary for employees and help employers make the statutory contribution, the government said. Union Minister Prakash Javadekar said that extension of the benefit will provide relief to nearly 3.7 lakh establishments and 72.2 lakh employees. The Centre has estimated total expenditure of ₹48.60 bn for this. It will pay both the 12 percent employees’ share and the 12 percent employers’ share under EPF. The Centre allowed 74 mn poor women to avail of three free LPG (liquefied petroleum gas) cylinders till September. Earlier, it had allowed them to get this quota between April and June.

Source: The Economic Times

9 July. Cairn Oil & Gas has trimmed its workforce by about 300, nearly a fifth of its employees, primarily by laying off people as low oil prices hit India’s largest private oil producer. Cairn, a unit of mining baron Anil Agarwal’s Vedanta, laid off hundreds of employees in the last week of June, mostly from non-critical functions, according to people with knowledge of the matter. This has brought down Cairn’s employees count to 1,400 from 1,700 previously, they said. Cairn, which contributes about a quarter of India’s oil output, is facing a double whammy of declining production and a slump in oil prices. Its oil and gas production fell 14 percent year-on-year in the fourth quarter as it struggles with ageing fields. Oil and gas revenue fell 24 percent year-on-year during the quarter. A dramatic fall in oil prices that began in March has hurt Cairn and other oil producers. Prices had fallen to under $20 a barrel in late April but have now recovered to $40 but are still way below $66 at the beginning of the year.

Source: The Economic Times

14 July. No shareholder can have more than 15 percent stake in a natural gas exchange, as per the draft regulations by the Petroleum and Natural Gas Regulatory Board (PNGRB). The draft, hosted on the PNGRB’s website, is the maiden attempt by India to build a regulatory framework for a gas exchange that would trade physical contracts. Anybody wanting to set up an exchange would require an approval from the PNGRB, which would have the power to regulate an exchange, call for information, order investigation and cancel authorisation if needed. At least 51 percent equity capital of an authorised clearing corporation shall always be held by one or more gas exchanges. But no clearing corporation can hold any stake or interest of any nature in the gas exchange, as per the draft.

Source: The Economic Times

9 July. Oil Minister Dharmendra Pradhan reviewed the progress of capping activities of inferno at gas producing well of Oil India Ltd (OIL) in Baghjan in Tinsukia district. OIL stated that air quality monitoring was conducted in Baghjan and Guijan side and noise monitoring was conducted in Guijan Side. Due to stoppage/blockades, there was production loss of 304 million tonnes (mt) of Crude Oil and 0.94 million metric standard cubic meter (mmscm) of Natural Gas. Operations were disrupted in 11 Oil wells & 05 gas wells. Cumulative production loss since 27 May 2020 due to bandhs and blockades: 9504 mt Crude oil, 12.91 mmscm of natural gas. Effort is on to kill the gas producing well which blew out on 27 May and on 9 June it exploded into a massive inferno.

Source: The Economic Times

14 July. The Supreme Court (SC) issued notice to the Centre on Jharkhand government’s pleas challenging its decision to auction coal blocks for commercial mining. A bench of Chief Justice S A Bobde and Justices R Subhash Reddy and A S Bopanna gave the Centre four weeks to reply to the writ petition and an original suit filed by the Jharkhand government questioning the decision to auction coal blocks for commercial mining. The state government has alleged that the announcement was made by the Centre “unilaterally” without consulting it.

Source: The Economic Times

QuIck CommentPower deficit amidst low demand is perverse! Ugly! |

13 July. The trade unions at the Mahanadi Coalfields Ltd (MCL), a subsidiary of Coal India Ltd (CIL), have called for a strike on 24 July to protest against the miner’s decision to cut wages for workers who had participated in a three-day nationwide cease work. The four trade unions – AITUC, HMS, BMS and INTUC – have jointly served the notice of a day’s strike to the management of the Odisha-based subsidiary of the Maharatna PSU, they said. MCL had issued wage-cut order for workers who took part in the three-day strike from 2 July to protest against the Centre’s decision to start commercial coal mining. The miner had termed the three-day strike illegal. Most of 20,000 mine workers did not report for work during the cease work.

Source: The Economic Times

11 July. The government has seen interest from over 1,400 people in terms of investment in the country’s coal sector within the last 15 days, according to Minister of State for Finance Anurag Singh Thakur. On 18 June, Prime Minister Narendra Modi launched the auction of 41 coal blocks for commercial mining. Apart from no restrictions on the end-use of the production, the sector was also opened to 100 percent foreign direct investment. According to the coal ministry, the move is expected to bring in ₹330 bn of capital investment over seven years and generate ₹200 bn in annual revenue for state governments.

Source: The Economic Times

14 July. The Covid-19 pandemic and slowdown in demand across sectors has not eased the country’s power supply deficit situation which widened to 0.5 percent in April-June quarter of 2020, up from 0.4 percent in the same period last year. According to power supply data released by Central Electricity Authority (CEA), about 291.8 bn units of power was supplied in the first quarter of current financial year against a demand of 293.29 bn units. This represents a deficit of 1,484 mn units or 0.5 percent. Though power deficit has been shrinking over the last few years, the unmet supply is encountered during different times of the year. With power demand falling drastically during Covid-19 outbreak and lockdown, there was expectation that the deficit may not arise. While India’s power supply deficit has widened, the peak deficit has narrowed, an indicator that we are managing peak load a tad better this year. India’s power supply deficit stood at 0.5 percent at the end of March for the financial year 2019-20, and the peak power deficit stood at 0.7 percent, according to the CEA’s data.

Source: The Economic Times

14 July. The Bombay High Court (HC) directed the Maharashtra State Electricity Distribution Company Ltd (MSEDCL) to give prompt hearing to complaints of high power bills and act on them at the earliest. A bench of Justices P B Varale and Milind Jadhav was hearing two public interest litigations filed by Mumbai businessman Ravindra Desai and Sangli resident M D Shaikh over high electricity bills they had received. Desai, through his lawyer Vishal Saxena, had approached the high court on June 29, claiming that his electricity charges for the previous month were “10 times more than his usual bill”. The petitioner had sought relief from having to pay the bill till the court decided the matter finally. Advocate Saxena told the court that high electricity bills during the Covid-19 lockdown would add to the suffering of citizens. Owing to the lockdown and as per the Maharashtra Electricity Regulatory Commission (MERC) guidelines, meter reading had been suspended in March-end and for December, January and February, consumers were billed as per average usage. According to Desai’s lawyer, the court had pointed out the petitioner had approached the MSEDCL with a complaint on 25 June and in four days, he had filed his plea in the court without waiting for a response from the power company.

Source: The Economic Times

13 July. West Bengal Power Development Corp Ltd (WBPDCL) has started preliminary works for setting up its ₹44 bn Sagardighi super- critical plant from this month and expects to complete the construction of the unit over the next three-and-half years. The company has decided to consider 1 July as the “zero date” for the implementation of the 660 MW thermal power plant project in Murshidabad district. Usually, the project completion period is counted from the zero date. The WBPDCL has four units of 1600 MW in Sagardighi and the fifth one will increase the plant’s capacity to 2,260 MW. The power producer has four more plants in Bandel, Bakreswar, Kolaghat and Santaldihi and an overall generation capacity of 3,150 MW.

Source: The Economic Times

11 July. In a significant development aimed at executing key projects, Maharashtra Energy Minister Nitin Raut ordered the Maharashtra State Electricity Distribution Compan Ltd (MSEDCL) to delegate powers to all its regional offices. Accordingly, the MSEDCL’s four regional offices in Nagpur, Aurangabad, Pune and Kalyan shall be vested with all powers pertaining to quantity freezing and time limit extensions under all projects, with the joint managing directors and regional directors monitoring them for timely completion, Raut said. The move comes almost five years after the four regional offices were carved out from the MSEDCL in 2016 for the very purposes of on-time execution of all projects and providing high quality services to the electricity consumers.

Source: The Economic Times

10 July. UP (Uttar Pradesh) Power Minister Srikant Sharma appealed to the MLAs and MPs to adopt 10 electricity feeders and help the state government in bringing down the line losses for better power supply. In a letter addressed to all MPs, MLAs and gram pradhans, Sharma underlined the need of bringing down line losses upto 15 percent in what would allow the state government to provide round the clock power supply to the respective areas. Sharma said that he expected the people representatives to respond to his call in the next 90 days. He urged them to exhort people to pay their bills timely and help in bringing down line losses. He said that bringing down line losses would help the UP Power Corp Ltd (UPPCL) getting higher revenues which would eventually be pooled to install better power infrastructure including replacement of dilapidated electricity wires and installations of transformers of higher capacity. The Minister highlighted the state government initiatives of coming up with schemes like Easy Installment Scheme and Kisan Asaan Kisht Yojana envisaging payment of electricity arrears up to the month of June in 12 to 24 installments with a waiver in surcharge.

Source: The Economic Times

10 July. All India Power Engineers Federation (AIPEF) claimed that as many as 11 states and 1 UT (Union Territory) have opposed many provisions of the Electricity Amendment Bill 2020. According to AIPEF, the Electricity (Amendment) Bill 2020 to usher “so-called reforms” in the power sector threaten to violate long-cherished principles of federalism. The states (opposing the provisions of the bill) are Kerala, Telangana, Tamil Nadu, Andhra Pradesh, West Bengal, Jharkhand, Bihar, Maharashtra, Chhattisgarh, Rajasthan and Punjab. The UT, which opposed the bill, is Puducherry. Punjab has objected to the proposal of doing away with free power to farmers and replacing it with the direct benefit scheme.

Source: The Economic Times

10 July. Adani Electricity Mumbai Ltd (AEML) said it has waived interest on EMIs for consumers who have opted for the facility to make payment of their electricity bills. The company had offered EMI facility for three months to consumers to make payment of their bills for the month of June, as the amount was significantly higher. The company had said that it is allowing EMI facility at a rate of 9.9 percent interest as per the guidelines of the Maharashtra Electricity Regulatory Commission (MERC). However, the company said it will offer three interest free installments. The company had said that it was able to recover overdues from 3.3 lakh consumers out of 7.5 lakh consumers as of 30 June. AEML, which distributes power to around 30 lakh consumers from Bandra to Bhayandar and Kurla to Mankhurd, had received nearly 48,000 complaints of inflated electricity bills, of which it claimed to have resolved nearly 96 percent.

Source: The Economic Times

9 July. Tamil Nadu Chief Minister (CM) Edappadi K Palaniswami urged the Centre not to privatise power distribution. The CM expressed his opposition to the direct benefit transfer of subsidy to farmers. He wanted the Centre to release ₹200 bn sought by TANGEDCO (Tamil Nadu Generation and Distribution Corp Ltd) under the PM-Kusum scheme. The CM said it would be very costly to have a separate feeder for agriculture and instead suggested solarising individual grid-connected pump sets. The CM wanted the Centre to declare the Raigarh–Pugalur-Trissur HVDC transmission corridor as strategic and of national importance.

Source: The Economic Times

9 July. Power distribution company (discom) BSES said that it was geared up to ensure incident-free power supply to its over 44 lakh consumers in the national capital and issued an advisory to the public on adopting simple safety precautions during the rainy season, including maintaining “social distancing” from electricity infrastructure. The discom said that the BSES Rajdhani Power Ltd (BRPL) and BSES Yamuna Power Ltd (BYPL) have undertaken extensive preventive maintenance works to minimise the accumulation of moisture in grids and panels. It advised customers to caution their children from playing near electricity installations, even if they are barricaded, and not play in parks that are water logged. The discom said that customers should get the entire wiring in their premises thoroughly checked by a licensed electrical contractor. Emphasising that power theft by hooking on to an electricity system poses a serious safety hazard, BSES urged customers to report incidents of power theft and convince people not to illegally draw electricity by hooking on to mainlines or roadside electrical equipment. The discom urged customers to alert BSES in case somebody comes across any fallen cable, pole, exposed wiring or digging work on the roadsides.

Source: The Economic Times

14 July. The Raigarh-Pugalur 800 kV (kilovolt) ultra-high-voltage direct current (UHVDC) transmission line will now take renewable power from Tamil Nadu instead of bringing thermal power into the state. As per the original policy, nearly 4,000 MW (total capacity of line is 6,000 MW) of power from pit thermal units in Raigarh was to be brought through this line to Pugalur and from there 1,000 MW was to be transferred to Kerala. But recently the Centre decided to use the line to transmit 3,000 MW of wind and solar power from Tamil Nadu to the western states to help them fulfil their renewable power obligations.

Source: The Economic Times

13 July. French government-owned power utility Électricité de France SA (EDF) and consulting firms McKinsey & Co., Boston Consulting Group (BCG), Kearney, Deloitte and PricewaterhouseCoopers (PwC) are among entities that have shown interest in creating the roadmap for a global solar grid planned by India. These companies plan to participate in a request for proposal called by India’s Ministry of New and Renewable Energy (MNRE) for consultants, the two people said on condition of anonymity. The chosen consultant will help develop a long-term roadmap, including a technical and financial proposal, for the ‘One Sun One World One Grid’ (OSOWOG) to transfer solar power across borders. The World Bank is providing technical assistance for the ambitious task. India’s global grid plans have gained traction against the backdrop of China’s attempt to co-opt countries into its ‘One Belt One Road’ initiative that seeks to invest billions of dollars in infrastructure projects across Asia, Africa and Europe.

Source: Livemint

QuIck CommentCustoms duty exemption will sustain solar projects at the expense of forex flows! Bad! |

11 July. India will lose nearly ₹500 bn in foreign exchange if solar developers are given exemption from basic customs duty on Chinese imports, the All India Solar Industries Association (AISIA) has said. On 1 July, Power and Renewable Energy Minister R K Singh had said that Chinese imports for public solar projects will be exempted from duty if power purchase agreements are signed before implementation of duty, which is proposed from 1 August this year. With safeguard duty scheduled to end on 31 July, the government has proposed to impose a 20-25 percent basic customs duty on solar modules and around 15 percent on cells, that will gradually go up to 40 percent for both.

Source: The Economic Times

11 July. Global wind turbine major Siemens Gamesa Renewable Energy will start making the 3.4 MW wind turbine at its Indian plant in Tamil Nadu. The new machine will be the highest capacity wind turbine in India will be manufactured at its Indian plant in Tamil Nadu early 2021. The company is targeting the auction market with its new machine. The new model has been upgraded with the 145-metre rotor of the Siemens Gamesa 4 MW platform due to its modularity.

Source: The Economic Times

10 July. As the world designs and implements Covid-19 recovery plans, it has a choice of either going back to where it was, or investing in a better, more sustainable future, UN Secretary General Antonio Guterres said. Citing the case of India, he said at the International Energy Agency’s Clean Energy Transition Summit that solar auctions have seen popularity amidst the height of the pandemic. New research on G20 recovery packages released shows that twice as much recovery money — taxpayers’ money – has been spent on fossil fuels as clean energy.

Source: The Economic Times

10 July. Prime Minister (PM) Narendra Modi inaugurated Asia’s largest 750 MW solar power project at Rewa in Madhya Pradesh. Notably, this mega solar power project is comprised of three solar generating units of 250 MW each located on a 500-hectare plot of land situated inside a solar park. Central financial assistance of ₹1.38 bn has been provided to Rewa Ultra Mega Solar Ltd for development of the solar park.

Source: The Economic Times

9 July. BHEL (Bharat Heavy Electricals Ltd) said it has successfully commissioned a 1.7 MW solar photovoltaic (PV) plant at Bina in Madhya Pradesh for the Indian Railways. The plant will directly feed power to traction systems of Indian Railways. The concept to design and engineering was carried out in less than one and a half month and the project has been installed and commissioned by the BHEL in just 4 and a half month, BHEL said. This development marks a major step of merging the advantages of renewable energy in the railway sector in an unprecedented way, BHEL said.

Source: The Economic Times

9 July. The deadly border conflict between India and China in the Ladakh region is setting the ground for a first set of restrictions that India proposes to impose on imports from the Asian giant. Efforts were on at the official level to explore ways of denying Chinese firms from participating in the bids for the upcoming 7,500 MW solar power project in Ladakh. Power and Renewable Energy Minister R K Singh, who has recently been vocal about use of domestically manufactured equipment in the power sector and restricting all imports where domestic capabilities exist, is believed to have sounded public sector enterprise conducting solar auctions to see imports were kept at minimum and a ward projects keeping in mind the strategic nature of terrain. The 7,500 MW solar development contract also involves setting up strategic power transmission link that will take power from the Union Territory and connect it to a grid for nationwide circulation. The deadline for the bid submission tender is 31 July.

Source: The Economic Times

9 July. Gujarat Chief Minister (CM) Vijaybhai Rupani has decided to extend the time frame of ‘Gujarat Solar Power Policy – 2015’ up to 31 December 2020, State Energy Minister Saurabhbhai Patel said. The Minister said that Gujarat is the frontal state in solar power generation in the country. Besides this, against the installed capacity of renewable energy of 10,711 MW, we have attained capacity of 3057 MW. He said that in line with the approach adopted by Prime Minister Narendra Modi to promote the production and expansion of clean-green energy in the country. The extension of time frame in policy would give boost to the Gujarat’s target to achieve 8,000 MW solar energy production in the state by 2022.

Source: The Economic Times

8 July. Enel Green Power has reached a deal with Norwegian Investment Fund Norfund to bankroll, build and operate new renewable projects in India, Enel said. Italy’s biggest utility said its Green Power unit would take the lead in developing and building each project that would be jointly financed and governed by Enel and Norfund.

Source: Reuters

14 July. Global oil demand will soar by a record 7 mn barrels per day (bpd) in 2021 as the global economy recovers from the coronavirus crisis but will remain below 2019 levels, OPEC (Organization of the Petroleum Exporting Countries) said in its monthly report. It was the first report in which OPEC assessed oil markets next year. It said the forecast assumed no further downside risks materialised in 2021 such as US (United States)-China trade tensions, high debt levels or a second wave of coronavirus infections. Oil prices collapsed this year after global demand fell by a third when governments imposed lockdowns to stop the spread of the virus. OPEC said in 2020 oil demand would drop by 8.95 mn bpd, slightly less than in last month’s report. OPEC expects to cover the lion’s share of the massive projected demand spike in 2021 with demand for its crude rising by 6 mn bpd to reach 29.8 mn bpd. From May 2020, OPEC and allies led by Russia have been cutting output by nearly 10 mn bpd, or a 10th of global demand, to help prop up oil prices. Output in countries such as the US, Norway and Canada has also fallen, although they are not part of the OPEC+ agreement on output cuts. OPEC said it expected non-OPEC oil supply in 2020 to fall by 3.26 mn bpd and rise by just 0.92 mn bpd in 2021.

Source: Reuters

14 July. BP delivered 3 mn barrels of Iraqi oil to the Shanghai International Energy Exchange (INE), becoming the first major global trader to make a physical delivery since China launched the futures market in 2018. BP delivered 3 mn barrels of Iraqi oil Basra Light into an INE storage facility in east China’s Shandong province. BP is set to deliver another 1 mn barrels of Abu Dhabi Upper Zakum crude under an August contract. Mercuria is set to send 1 mn barrels of Upper Zakum crude for August and another 1 mn barrels for September. The INE crude contract is one of a handful Chinese futures products open for direct foreign participation, as the world’s top commodities consumer seeks greater influence over pricing. China’s June crude oil imports jumped by a third from a year earlier, setting a second straight monthly record, as cheap cargoes bought during April’s oil price crash arrived at Chinese ports. Crude delivered into INE storage are also counted as imports.

Source: Reuters

14 July. Russian President Vladimir Putin signed legislation requiring companies involved in oil production or handling other hydrocarbons to have adequate resources for a contingency plan in the case of a spill. In late May, a fuel tank at a power station in the Arctic city of Norilsk leaked 21,000 tonnes of diesel into rivers and subsoil, an incident that the environmental campaign Greenpeace compared to the 1989 Exxon Valdez oil spill. The Kremlin has said the new legislation is aimed at preventing similar spills.

Source: Reuters

13 July. US (United States) crude oil output from seven major shale formations is expected to decline by about 56,000 barrels per day (bpd) in August to about 7.49 mn bpd, the lowest in the two years, the US Energy Information Administration (EIA) said. The EIA projected the biggest decline would be in the Eagle Ford in Texas where output will slide about 23,000 bpd to 1.1 mn bpd, the lowest since August 2017. Output from the Bakken in North Dakota and Montana is the only region forecast to see increases. Production there plunged by more than many other parts of the country earlier this year as oil prices collapsed after the coronavirus pandemic eroded global fuel demand.

Source: Reuters

13 July. Russia’s Gazprom Neft, the oil arm of gas giant Gazprom, has shipped its first cargo with Arctic oil to China via the Northern Sea Route (NSR), it said. Russia is betting on the NSR, an Arctic route requiring icebreakers and special ice-class tankers, to deliver cargoes both to Europe and Asia. Gazprom Neft said it took 47 days to deliver a cargo with 144,000 tonnes of light Novy Port oil grade to the Chinese port of Yantai on the Bohai Sea from Russia’s north-western city of Murmansk. Before the landmark delivery of Novy Port oil, extracted on the Yamal peninsula in Russia’s Arctic, Gazprom Neft, the country’s third biggest oil company by output, was already using the NSR for exports to Europe. Combined with its second Arctic oil field, Prirazlomnoye in the Pechora Sea, Gazprom Neft has shipped over 40 million tonnes (mt) of Arctic oil to Europe since 2013, it said.

Source: Reuters

11 July. Iran is determined to develop its oil industry in spite of US (United States) sanctions imposed on the country, Iranian Oil Minister Bijan Zanganeh said. The Minister was speaking before the signing of a $294 mn contract between the National Iranian Oil Company and Persia Oil & Gas, an Iranian firm, to develop the Yaran oilfield that is shared with neighbouring Iraq’s Majnoon field. The agreement aims to produce 39.5 mn barrels of oil from the Yaran oilfield in Khuzestan province in southwestern Iran, the ministry said. Hit by reimposed US sanctions since Washington exited Iran’s 2015 nuclear deal in 2018, Iran’s oil exports are estimated at 100,000 to 200,000 barrels per day (bpd), down from more than 2.5 mn bpd that Iran shipped in April 2018. The Islamic Republic’s crude production has halved to around 2 mn bpd.

Source: Reuters

10 July. The Paris-based International Energy Agency (IEA) bumped up its 2020 oil demand forecast but warned that the spread of Covid-19 posed a risk to the outlook. The IEA raised its forecast to 92.1 mn barrels per day (bpd), up 400,000 bpd from its outlook last month. The easing of lockdown measures in many countries caused a strong rebound to fuel deliveries in May, June and likely also July, the IEA said. But oil refining activity in 2020 is set to fall by more than the IEA anticipated and to grow less in 2021, it said. Demand in 2021 will likely be 2.6 mn bpd below 2019 levels, with kerosene and jet fuel due to a drop in air travel accounting for three-quarters of the shortfall.

Source: Reuters

8 July. OPEC (Organization of the Petroleum Exporting Countries) member Algeria, facing financial pressure after a fall in energy revenue, will launch a new economic plan to reduce reliance on oil and gas and give the private sector a greater role, the government said. President Abdelmadjid Tebboune, who was elected in December, has repeatedly vowed to reform the oil-reliant economy by developing the non-energy sector and seeking new funding sources. A further drop in oil and gas earnings during the coronavirus pandemic forced the government to cut public spending and delay planned investment projects in sectors including energy.

Source: Reuters

8 July. Mexico’s state oil company Pemex and a private consortium led by US (United States)-based Talos Energy Inc have been instructed to come to an agreement detailing how they will jointly develop a large offshore oil find, the energy ministry said. The formal instruction from the energy ministry, dated 7 July but announced, follows a determination that the Zama discovery made in the Talos-operated block in the Gulf of Mexico extends into Pemex’s neighbouring block. Discovered in 2017, Zama is believed to contain nearly 700 mn barrels of oil, making it the biggest new find in Mexico notched by a private company in decades. Prior to a landmark 2013 overhaul of Mexico’s oil sector, which ended Pemex’s longstanding monopoly, only the state-run firm was legally allowed to explore for and develop oil and gas projects in the country. The energy ministry said that Pemex and Talos Energy have 120 working days to present a unification agreement to jointly develop the Zama reservoir in a way that would maximize its value.

Source: Reuters

9 July. European gas trading volumes this year may beat the record 63,038 terawatt hour (TWh) seen in 2019, as trading hubs expand due to more commercial and financial demand for gas price hedging, research firm Prospex said. There are industry-specific reasons why the traded gas market – worth €925 bn ($1.05 tn) in 2019 – is an exception in the economic gloom brought by Covid-19, the report showed. Trading strategies are driven by the need to bring more gas into the region as domestic production in the Netherlands is falling. Prospex said that in 2019, Dutch gas exchange Title Transfer Facility (TTF) traded 45 percent more volume than in 2018 while Britain’s National Balancing Point (NBP) lost 18 percent. The TTF has become Europe’s main venue for spot and forward delivery gas, for price risk management by traders of physical volumes and for financial hedges by institutional investors.

Source: Reuters

14 July. China’s coal imports in June dropped 6.7 percent from the same period last year, as stringent import restrictions at ports impeded purchases by traders and power plants, despite solid fuel demand. China, the world’s top coal importer, brought in 25.29 million tonnes (mt) of the fuel, the General Administration of Customs data showed. That compares with 27.1 mt in June last year but is still higher than 22.06 mn in May, driven by stockpiling demand ahead of the peak summer season. For the first half of 2020, China brought in a total of 173.99 mt of coal, up 12.7 percent over the corresponding period last year.

Source: Reuters

14 July. Australia’s Whitehaven Coal Ltd posted a 29 percent jump in fourth-quarter coal production, beating estimates, even as it warned that pricing pressure was likely to continue as the Covid-19 pandemic dents industrial activity. Whitehaven said that saleable coal output jumped to 6.2 million tonnes (mt) for the quarter from 4.8 mt for the same period a year earlier, helped by higher production at its Narrabri mine. The miner said uncertainty surrounding future Chinese import quotas weighed on coal prices in the June quarter, despite high imports of Australian thermal and metallurgical coal to China in the second half of fiscal 2020. Prices for Whitehaven’s thermal coal, used in power generation, slid to $59 a tonne from $84 a year earlier. Coal prices have slumped as coronavirus-fuelled curbs have disrupted industrial activity in most countries, including top importers Japan and India.

Source: Reuters

9 July. The Japanese government said it will tighten state-backed financing criteria for overseas coal-fired power plants after facing criticism over its support for the dirtiest fossil fuel. The move marks a partial shift away from Japan’s strong official backing for coal but includes exemptions, leaving some non-governmental organizations sceptical about how much impact the new approach will have. It has received criticism from many quarters over its support, usually through Japan’s export credit agency, for the construction of coal-fired plants in countries such as Indonesia and Vietnam, as well as new plants at home. UN (United Nations) Secretary-General Antonio Guterres urged countries to stop financing for coal and to make a commitment not to build new coal-fired power plants to enable a shift to clean energy. Japan’s latest move includes exemptions, however, such as when there are no alternatives to coal for the energy stability of a country seeking to build a coal-fired station provided it uses so-called clean coal technology from Japan. Japan’s private banks and companies have been tightening coal policies or cutting investments.

Source: Reuters

13 July. Britain’s National Grid said it had started construction on Viking Link, an electricity interconnector between Britain and Denmark. Viking Link is a joint venture between National Grid Ventures, part of National Grid, and the Danish electricity system owner and operator, Energinet. The 1.4 GW high voltage electricity interconnector will be the longest in the world when completed, stretching 765 km between Lincolnshire in eastern England and South Jutland in Denmark, National Grid said. Siemens Energy will construct the British and Danish converter stations on both ends of the interconnector link.

Source: Reuters

8 July. Lithuania, Latvia and Estonia are considering slapping a fee on power imports from Russia and Belarus, as they move towards a full decoupling from the countries’ Soviet-era common power system by 2025. The fee for using transmission infrastructure could be as much as €8 per MWh, Estonia’s power grid operator Elering said. Russia and Belarus produced about 20 percent of power consumed in the Baltic States in 2017-2019, Latvian transmission system operator Augstspriegumu Tikls (AST) said. Talks between the three countries on the future of their common power system have reached a stalemate over Vilnius’ refusal to accept electricity imports from the plant.

Source: Reuters

8 July. US (United States) electricity consumption will collapse by a record 4.3 percent in 2020 due to business closures for coronavirus-linked lockdowns, the US Energy Information Administration (EIA) said. EIA projected total US power demand will drop to 3,730 bn kilowatt hour (kWh) in 2020 from 3,896 bn kWh in 2019 before rising to 3,785 bn kWh in 2021. That compares with an all-time high of 4,003 bn kWh in 2018, according to federal data going back to 1949. If power consumption falls as expected in 2020, it would be the first time since 2012 that total demand declines for two consecutive years. EIA projected power sales to commercial and industrial consumers will drop by 7.0 percent and 5.6 percent, respectively, in 2020 from 2019 as offices close and factories run at reduced capacity for the coronavirus. Electricity sales to the residential sector will hold steady in 2019 and 2020 as mild weather reduces heating and air conditioning use even though government lockdowns are causing many people to stay home. While both the residential and commercial sectors consumed record amounts of electricity in 2018 at 1,469 bn kWh and 1,382 bn kWh, respectively, the industrial sector set its all-time high of 1,064 bn kWh in 2000.

Source: Reuters

14 July. The Kuwaiti cabinet cancelled plans to construct the Al-Dabdaba solar plant, which would have provided 15 percent of the oil sector’s needs of electrical energy, due to the coronavirus pandemic. The project, which was to be carried out by Kuwait National Petroleum Company, was supposed to start operating in February 2021. But the proposal was extremely delayed due to bureaucratic procedures. Kuwait has plans to generate 15 percent of its energy via renewable sources by 2030.

Source: Reuters

14 July. A European Commission proposal for the European Union (EU)’s long-term budget and recovery fund risks leaving a huge shortfall in the “green” investment needed to meet Europe’s climate goals, researchers said. With the coronavirus pandemic plunging the EU into a deep recession, leaders from its 27 countries will meet in Brussels to attempt to agree the bloc’s budget for 2021-27 and an economic stimulus fund. The EU Commission has proposed a €1.85 tn ($2.10 tn) package, which it says will drive a recovery in Europe’s virus-hit economies based on “green” industries and technologies that help to reduce emissions of the greenhouse gases fuelling climate change.

Source: Reuters

10 July. The French government will be fined €10 mn ($11.3 mn) every six months if it does not reduce air pollution in line with the law, the Council of State, the country’s highest administrative court, said. Following complaints by environmental organisations, the council ordered the government in July 2017 to take measures to reduce carbon dioxide and particulate matter pollution in several regions to bring them in line with a 21 May 2008 European Union directive that was transposed into French law.

Source: Reuters

9 July. China will build six to eight nuclear reactors a year between 2020 and 2025 and raise total capacity to 70 GW, up 43.5 percent compared to the end of May. The China Nuclear Energy Association said the country’s total installed nuclear capacity is expected to stand at 52 GW by the end of 2020, falling short of a 58 GW target. But it would soon get back on track and could bring total capacity either in operation or under construction to around 200 GW by 2035, the association said.

Source: Reuters

9 July. Japan will craft new rules and support infrastructure in a drive that aims to build offshore wind farms at 30 sites during the next decade. The new policy aims for three or four projects each year with total generation capacity of 1 GW, from the financial year starting in April 2021 until fiscal 2030/2031, for an accumulated total of 10 GW. The Ministry of Economy, Trade and Industry (METI) plans to revise power grid rules to scrap restrictions on greener power suppliers.

Source: Reuters

8 July. Denmark’s Orsted said that Taiwan Semiconductor Manufacturing Company (TSMC) has agreed to buy the entire power production from its third offshore wind farm in the Asian country. Under what Orsted called “the largest-ever contract of its kind within renewable energy”, TSMC will for 20 years buy 920 MW of power from the Greater Changhua 2b & 4, when the offshore wind farm project is scheduled to be finalised by 2025 or 2026.

Source: Reuters

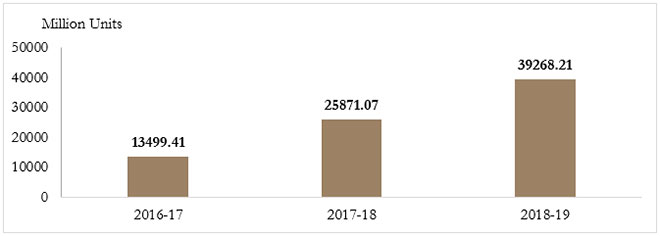

Million Units

| State/UT | Solar Electricity Generation | State/UT | Solar Electricity Generation |

| Chandigarh | 13.51 | Tamil Nadu | 3,554.5 |

| Delhi | 10.84 | Lakshadweep | 1.12 |

| Haryana | 65.95 | Puducherry | 2.58 |

| HP | 0 | Andaman & Nicobar | 8.04 |

| J&K | 0 | Bihar | 179.89 |

| Punjab | 1,492.9 | Jharkhand | 19.14 |

| Rajasthan | 4,633.95 | Odisha | 249.13 |

| Uttar Pradesh | 1,192.85 | Sikkim | 0 |

| Uttarakhand | 318.29 | West Bengal | 40.61 |

| Chhattisgarh | 335.14 | DVC | 0.06 |

| Gujarat | 2,410.32 | Arunachal Pradesh | 1.21 |

| Madhya Pradesh | 2,503.41 | Assam | 6.66 |

| Maharashtra | 2,206.62 | Manipur | 1.88 |

| Dadra and Nagar Haveli | 5.76 | Meghalaya | 0 |

| Daman & Diu | 18.94 | Mizoram | 0.12 |

| Goa | Nagaland | 0 | |

| Andhra Pradesh | 4,545.8 | Tripura | 0 |

| Telangana | 6,297.53 | Others (CPSUs/PSUs) | 1,464.79 |

| Karnataka | 7,575.83 | Total | 39,268.21 |

| Kerala | 110.84 |

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.