-

CENTRES

Progammes & Centres

Location

Soaring mercury levels during the second week of June in many parts of the country has resulted in narrowing of power demand slump to 10.5 percent, compared with a fall of 19.7 percent during the previous week. However, the slump in power demand in June so far has been slightly higher than 8.8 percent recorded in the previous month. In the second week of June, the power demand has improved due to intensifying heat wave from 8 June when peak power demand touched 153.13 GW and further shot up to 163.30 GW, as per data from the power ministry. The peak power demand of 163.30 GW is 10.5 percent less than 182.45 recorded in June last year. With the start of paddy transplantation, demand for power rose by over 1,200 MW from the previous day to 9,296 MW. Power supply in the state was 207 mn kWh.

According to the data from Power System Operation Corp, consumption rose by 11.6 percent to 3,297 mn kWh/day between 11 May and 17 May compared to the last seven days of the previous month. Northern and southern states showed visible improvements in business activity. Nearly two-thirds of the manufacturing companies in the BSE-200 index have restarted production at utilisation rates of 25-40 percent of their capacities. The plant utilisation of some of the consumer companies has improved to 80-85 percent compared with below 40 percent in the last week of March. The gap between regular and peak power consumption during 11-17 May narrowed to 12-15 percent year on year after companies restarted factories. The maximum demand for power rose by 14.7 percent to 146.657 GW during the period. Maximum power demand in the northern states of Punjab, Rajasthan, Delhi and UP increased by 11-22 percent over the past seven days. The share of these four states to the total maximum demand rose to 25 percent compared with 20 percent in the pre-lockdown period.

The spurt in power demand due to intensifying heat wave and spur in commercial and industrial activities across the country after easing of the lockdown in second half of May had raised hopes that power consumption would further inch towards normal levels (of last year) in June. According to power ministry data, the peak power demand met ranged between 138.28 GW (on 4 June) to 146.53 GW (on 6 June) in the first week of June. Thus, the peak power demand for this week was 146.53 GW, which is 19.7 percent less than the 182.45 GW recorded in June last year. The peak power demand met is the highest energy supply during the day across the country. The peak power demand met in May stood at 166.42 GW (recorded on 26 May), which was 8.82 percent less than 182.55 GW in the same month a year earlier. Similarly, the peak power demand met in April stood at 132.77 GW, 25 percent less than 176.81 GW in the same month a year earlier. Therefore, the power demand slump had narrowed down to 8.8 percent in May from 25 percent in April this year. Power consumption had improved after government started giving relaxations for economic activities and mercury soared beyond 45 degree intensifying heat wave in the country in May. The total electricity consumption was 103.02 bn units in May this year compared to 120.02 bn units in same month a year ago.

Power consumption by industries and other users has touched 78.7 percent of the normal power consumption in Gujarat, signalling the resumption of economic activity on a large scale in the state even as Lockdown 4.0 is being enforced. Going by the trend, in two or three days, the state government expects an increase in power consumption across the state as compared to the same period last year. With permission granted to industries in Ahmedabad and other cities which are out of containment zones to function, power consumption will further increase. On May 19 last year, Gujarat’s total power consumption was 16,176 MW, while on 19 May 2020, the total power consumption stood at 14,242 MW, which is 1,934 MW lesser.

The daily peak power demand across Maharashtra has increased to over 20,000 MW from 15,000 MW with industry and commercial users resuming operations in green and orange zones. The peak power demand was 21,288 MW and the daytime demand was around 20,356 MW, according to Maharashtra State Power Generation Company data. During lockdown, daily power consumption was around 15,000 MW. Maharashtra State Electricity Distribution Company Ltd may face problems in cross-subsidy to low-end power users, live farmers, as revenue collection from industry and commercial users has dipped in last three months.

With the mercury rising and many establishments being allowed to operate in Lockdown 4.0, Delhi discoms are expecting the peak power demand to surpass last year’s record high in the coming months. While the demand may reach 7,380 MW in June, it is expected to cross 7,500 MW in July. In the past two decades, Delhi’s peak power demand has increased by over 250 percent — from 2,879 MW in 2002 to an all-time high of 7,409 MW on 2 July 2019. In the first half of the lockdown, the capital saw up to 49 percent slump in the peak demand. The commercial demand has already started to increase with the easing of restrictions and the increase in temperature is resulting in night peaks. The first 19 days of May has also seen more demand — over 24 percent — than the same period this April. While the highest peak power demand was 3,362 on 1 April, the same was 4,195 MW on 19 May. According to the city discoms, arrangements have been made to source adequate electricity to meet the demand.

PSPCL is all set to maintain 8-hour power supply for tubewells. On the first day of paddy transplantation last year, power demand rose by more than 1,900 MW to touch 11,141 MW. Last year, PSPCL successfully catered to a record maximum demand of 13,606 MW and supplied the highest ever 299.9 mn kWh of electricity in a single day on 3 July last year. Due to the Covid-19 pandemic, power demand is likely to remain subdued this year.

The rebate that state-owned power generators and transmission companies have offered to state discoms is only a one-time contribution to support business continuity in an unprecedented situation and prevent litigations, the power ministry has said. The rebate was on fixed charges for power drawn by discoms during the 40 days of complete nationwide lockdown period. Almost all states have been drawing lesser electricity than normal during the lockdown period. Now, if the contracted capacity of a discom is 500 MW and it normally drew 400 MW but because of the lockdown it drew only 300 MW, then the discom will get a rebate of about 20 percent on the 300 MW for 40 days from concerned central public sector enterprises. But it will have to pay fixed charges for the remaining 200 MW. For the 100 MW that it usually drew but did not draw during the lockdown period, the discom can pay the fixed charges in three monthly instalments. The ministry had issued a revised advisory to central undertakings such as NTPC Ltd, NHPC Ltd, Power Grid Corp of India, and Damodar Valley Corp to forego up to a fourth of fixed charges they collect from state discoms for the lockdown period.

The Congress demanded that the Telangana government stop extortion of money in the name of non-telescopic tariff plans and immediately withdraw this method of billing, which has become a burden for the consumers. The party also called for waiver of electricity bills for the lockdown period for the poor. It demanded that the government waive off electricity bill payments of March, April and May to those consuming less than 200 kWh per month. HERC has decided to not increase the power tariff for any category of consumers in the state in view of the coronavirus pandemic. The move comes as a relief to nearly 6.8 mn power consumers in the state. Also, for agro-industries, the HERC has created a new tariff category of such industries up to 20 kWh load. Such units will be charged a concessional tariff of ₹ 4.75/kWh. Earlier they were being charged a tariff of ₹7.05/kWh. The total benefit that will accrue during 2020-21 is estimated to be ₹425 mn, as per the HERC tariff order which is effective from 1 June. In its order on aggregate revenue requirement of the power discoms HERC provided relief to the agro industry with over ₹2/kWh reduction in power tariff. Domestic consumers having consumption up to 150 kWh per month will continue to enjoy concessional tariff with the lowest tariff being ₹2/kWh for consumers for power consumption up to 50 kWh.

In what may bring relief to over 30 mn electricity consumers in the state, UP energy department is mulling not to increase power tariff this year in view of economic slowdown triggered by coronavirus-induced lockdown. The UPPCL said the utility has decided to keep tariff unchanged while filing the annual revenue requirement with the UPERC, which would eventually take a final call. Tariff hike of around 12 percent was effected in September last year. The focus was on rural areas where line losses had to be brought down to less than 15 percent to ensure round-the-clock power supply. Significantly, average line losses have been between 25 percent and 30 percent in most of the districts. Only Noida accounts for less than 15 percent line losses and is qualified to get uninterrupted power supply. According to UPPCL, the utility is reeling under financial arrears of more than ₹800 bn which needs to be recovered by controlling line losses and bringing in transparency in power distribution system. The state government said earlier that it would not impose any fresh tax on consumers. The UPPCL has submitted a fresh business plan to UPERC for the next five years.

The Maharashtra unit of Aam Aadmi Party has demanded that the state government waive off electricity bills of up to 200 units for people who have suffered economically due to the Covid-19 lockdown. The party said that the pandemic and the subsequent lockdown has hit people financially and it was imperative that they receive adequate support at all levels from the state government. The Maha Vikas Aghadi government should waive off electricity bills for up to 200 units for the last four months.

Categorically rejecting allegations about withdrawal of free power to Punjab’s farmers the state government said it is ready to forego the portion of fiscal deficit enhancement offered by the Centre, but would not compromise with the farmers’ interest at any cost. The free power facility for farmers would continue to exist till the current government is in power and the government will take loans to bridge the fiscal deficit, and the government of India cannot dictate the terms of a sovereign loan being taken by a state government.

The Goa electricity department has defended its proposed power tariff hike in the agriculture category, stating that the tariffs in neighbouring states are much higher. Both fixed as well as energy charges have been hiked for low and high-tension consumers in the agricultural category. While fixed monthly charges have seen an increase of between ₹3 to ₹10, the energy charges have gone up by 5 to 10 paise. Earlier, the department had defended its proposal for a hike in power tariffs for all consumers saying that there was no hike last year and that the entire burden had been borne by the state government. Meanwhile, the Joint Electricity Regulatory Commission has stated that the power tariff should progressively reflect the cost of supply. The commission, which has recommended a 5.31 percent increase in power tariff, which is higher than the 3.84 percent hike proposed by the electricity department, added that while determining the tariff for the financial year 2020-21, it had considered the prudent cost of the department and accordingly determined the tariff for each consumer category.

Uttarakhand announced an exemption of three months in interest and surcharge on electricity to dharamshalas. Various categories of electricity consumers were earlier given exemption in interest and surcharge during the lockdown period. The announcement to waive the fixed charges of electricity has brought a huge relief to the Dharamshalas as the burden will be borne by the state government.

A section of industrial power consumers has taken a legal recourse against the utilities in West Bengal after their plea for relief on the fixed charges among other demands in the lockdown was rejected. The West Bengal Electricity Regulatory Commission had also paid no heed to their demands, when they approached the regulator, the high-tension power consumers claimed. The state governments such as Maharashtra, Punjab, Gujarat and UP have offered some benefits to their industrial consumers and announced rebates on load-factor in electricity bills. The fixed charges are an amount that consumers pay monthly to stay connected to grid, while the variable charges are calculated on the basis of units consumed. The iron and steel sector was the worst-hit as they are required to pay huge amount on account of the electricity bills, though the mills remained shut for 4-5 weeks during the lockdown. The distribution companies cannot provide relief on fixed charges as it is a part of the current contracts and have similar agreements with the power producers. The Centre is expected to issue guidance to the central power companies including NTPC, NHPC and PGCIL advising them to defer fixed charges on electricity not drawn by distribution companies and offer rebates.

According to the Tamil Nadu government the scheme of free power supply for farmers will not be scrapped at any cost. The State government had introduced a tatkal scheme to obtain agriculture power connections and the metres were fixed for only tatkal connections.

Millions of power sector employees and engineers are protesting against the Electricity Amendment Bill 2020 and the government’s move to privatise power distribution companies in union territories, according to AIPEF. The power ministry circulated a draft Electricity Amendment Bill 2020 on 17 April 2020. According to AIPEF, power sector employees and engineers exercised their democratic right by wearing black badges and holding gate meetings in all the states and Union Territories, including Punjab, Haryana, UP, Maharashtra, Gujarat, Assam, Telangana, Tamil Nadu, Andhra Pradesh, Kerala, West Bengal, Karnataka, Chhattisgarh, Jammu & Kashmir, Ladakh, among others. After the Bill is passed, farmers will have to pay a monthly power tariff of ₹5,000-6,000, while subsidized domestic consumers will have to pay at least ₹8-10/kWh consumption of up to 300 kWh per month. The Bill has been notified by the power ministry at a time when all forms of meetings, interactions, discussions and protests are choked. Access to affordable electricity is a right and not a luxury and burdening farmers and BPL consumers with high rates is a retrograde step.

The Andhra Pradesh government has opposed the proposed amendments to the Electricity Act, 2003, saying they were not only “against the spirit of the Constitution of India” but also were likely to undermine consumer interest and affect industrial growth. The proposed Electricity Amendment Act was apparently aimed at usurping the powers of the states, the state government felt. It appears to offer more protection to generators than required, and is likely to increase power purchase costs which constitute 75 percent of power sector cost and thereby cost of service.

Terming the Electricity Amendment Bill 2020 as “harmful” for the poor and farmers, Chhattisgarh government has urged the Centre to put the proposed bill on hold for the time being, considering the current situation in the country. It said that the Electricity Amendment Bill 2020 proposed by the Central Government is harmful to the lower strata of the society as the provision of cross-subsidy in the proposed bill is “impractical” and not in the interest of farmers and poor. Farmers will face crisis regarding irrigation of crops if the subsidy on electricity given to farmers is not continued and this will affect the production of food grains and the country will face a crisis. It demanded that labourers and farmers, who have made the country self-reliant in food with their hard work, should be respected. The Direct Benefit Transfer System, which is currently in force, is correct. By changing this, the poor section of the society and small and marginal farmers will be deprived of benefits.

According to India Ratings and Research, the ₹900 bn package would provide only a temporary relief to power distribution companies but not long-term stability. Discoms owe ₹940 bn to power generation companies. As a result, despite the transfer of a major portion of debt from the books of discoms to state governments, the finances of several discoms have remained in reds and weak, even prior to Covid-19 related lockdown. The lockdown has only aggravated the stress of discoms.

India proposes to end tariff differentiation between electricity consumers by charging them as per their consumption rather than on the basis of the end use of power. The Centre expects the proposal, along with other proposed National Tariff Policy amendments, will be the biggest consumer-centric reforms. Domestic power tariffs are low in India, while the industrial tariffs are among the highest in the world due to cross subsidisation. The Tariff Policy proposes six categories of consumers on voltage basis against the present 50-60 categories and sub-categories. The other proposals of the tariff policy include laying service standards for power discoms including 24×7 power supply, penalising gratuitous load shedding and ban on passing on more than 15 percent of commercial losses to consumer tariffs.

The Union power ministry has reverted to its earlier rules, set in 2018, on public charging stations for EVs. The latest revision has capped the ‘per unit cost’ of electricity to be used for charging an EV at a public station — for domestic charging, the existing rate of that particular state would be applicable. The power ministry in its new amendment has specified that the tariff for public charging station should not be more than 15 percent of the state’s ACS. ACS is the average of the rates at which a state supplies electricity to all sets of consumers — domestic, commercial, industrial, and agriculture. All India ACS stands at ₹5.48/kWh (as last recorded in 2017-18). Power tariff for consumers in a state is decided by its State Electricity Regulatory Commission. However, the guiding principles are set by the Union ministry of power under the NTP, issued periodically. The NTP was last issued in 2018. For 2019-20, the Delhi Electricity Regulatory Commission had fixed the unit and tariff for EVs at ₹4.5/kWh and ₹4/kWh, respectively. This is lower than the ACS of Delhi which is more than ₹6.5/kWh. UP in FY20 had set the public charging rates for EVs in range of ₹7.3-7.7/kWh higher than its ACS of ₹5.2/kWh. In states, such as Karnataka, Gujarat, and Maharashtra, the public charging rates of EV are close to or less than the ACS (of 2017-18).

According to the state electricity regulator people will be entitled for compensation if they face prolonged power cuts in Chhattisgarh. The CSERC had enacted new rules in a bid to ensure interruption-free power supply to consumers and for the first time included the provision of giving compensation against extended outages. Chhattisgarh has become the first State to implement a compensation-for-power-cut policy. Under the Electricity Act, 2003, a target was set for ensuring supply of quality and uninterrupted power to consumers. As per the parameters, in a city having a population of 10 lakh or more, if power supply remains disrupted for a total 10 hours or more during a month from April to June, the distribution company will have to pay compensation to consumers. For other urban and rural areas, the time-limit has been set at 20 hours or more per month during this period. Similarly, from July till March, if power outage exceeds 6 hours or more in a month, in a city having a population of 10 lakh or more, 15 hours for other urban areas and 20 hours for rural areas, then consumers will be entitled for compensation from the distribution company. For restoring power supply, maximum time limit of four hours has been set for urban areas, while the same is 24 hours in rural areas after power cut each time. The power distribution company will have to pay compensation at the rate of ₹5 per hour in case it fails to comply with the parameters. The CSERC observed that with the implementation of this regulation, it would not only bring reforms in the working of power distribution companies but will establish a sense of responsibility towards consumers. Chhattisgarh has become the first State in the country to enact and implement this rule with an intention to ensure quality and uninterrupted power supply for consumers.

The APTEL, New Delhi, has directed the TANGEDCO to pay 50 percent of the late payment surcharge of ₹1.68 bn as on 20 May to DB Power Ltd in two equal parts — first part to be paid (order passed on 8 June) and the second part to be paid within the week following that. APTEL also pulled up TANGEDCO for dragging the issue without appearing before it for the trial and insisted the TANGEDCO submit a report outlining the reasons for not appearing to fix accountability on the additional burden on TANGEDCO due to the delay.

The UP government is making new arrangements to facilitate providing power connection to industries. If an entrepreneur applies for power connection on “Nivesh Mitra” portal, the department itself will rectify shortcomings in the application and an executive officer will be deployed for every application. This initiative has been taken to promote investment as power connection is essential for every new unit and the move will help them in getting it.

The Government of India has begun the process of privatising power distribution in J&K, a move aimed at reducing the government’s spending but which will make electricity twice as costly for the consumer. J&K power department said that the tariff is undoubtedly going to be at least twice the current rate after privatisation. By the current electricity tariff, a household on average pays between ₹2 – ₹3/kWh while commercial and industrial consumers pay slightly more than ₹3/kWh. The actual cost of a unit is more than ₹5/kWh. The gap is balanced by the government’s subsidy, which runs into hundreds of crores. At present, the government in J&K spends about ₹30 bn each year on purchase, transmission, and distribution of power to households. Out of the total cost of ₹50 bn incurred on these heads, the government recovers about ₹20 bn from consumers. People in J&K have been resisting for more than a decade now the power department’s attempts to install meters in households. The government will face tough opposition from the power department employees who fear that they may lose their perks, including pension.

According to the Kolkata Municipal Corp the West Bengal government or the civic body cannot be held responsible for the continued disruption in power supply in several parts of the city after Cyclone Amphan. Private power utility CESC Ltd itself clarified that they did not have the required staff to carry on restoration work.

With hand held billing suspended during the lockdown, the energy department pitched for trust billing, that is, self-generation of electricity bill. UPPCL has been receiving complaints that consumers are not getting bills because of the lockdown. The only solution would be trust billing wherein a consumer could generate electricity bill by logging on to UP energy department website www.upenergy.in. Under the process, a consumer has to create an ID and generate bill. The facility will be applicable for consumer having a load up to 9 kW. The department was also receiving complaints of consumers not being given electricity connections under Saubhagya scheme. Also, many applications under Jhatpat connection and Nivesh Mitr portal are pending.

India is set to start real time trading on power exchanges, enabling electricity purchase to be as quick as placing an online meal. State discoms and industrial consumers will be able to meet emergency short-term power needs through the new RTM. Power can now be bought an hour before its requirement in real time market, unlike the popular day-ahead market by discoms on spot exchanges where trade happens a day in advance. In the same manner, power generating stations with excess power capacity or discoms with more than required contracted capacities can sell at a short notice in the real time market. According to the CERC Electricity RTM launch has not been deferred amid the nationwide lockdown and will start operations as per the schedule on 1 June. The auctions in RTM will be held every half-hour. The bidding criteria will be similar to that of day-ahead where market clearing price is determined through demand and supply. Currently, there are intra-day markets on power bourses where electricity delivery can take place after 2.5 hours of the auctions but they are less popular since their bidding criteria requires the traders to match winning bids. CERC has disabled last minute changes in power schedule by discoms to let power generators sell excess in RTM. Power plants with long-term power tie-ups will be required to share half of their gains with the discoms. The real time market is an endeavour by the regulator, CERC, to make the power market dynamic by enabling trade in electricity through half-hourly auctions. There will be 48 auction sessions during the day with delivery of power within one hour of closure of the bid session. The market will greatly aid the distribution utilities to manage power demand-supply variation and meet 24×7 power supply aspirations in the most flexible, efficient, and dynamic way.

In what may be a reversal of private participation in distribution, India’s largest electricity generator NTPC said it was interested in buying a majority stake in Reliance Group’s power distribution assets in Delhi. Reliance Infrastructure owns a majority stake in BSES Yamuna and BSES Rajdhani, which are joint ventures with the government of Delhi. The Reliance Group has been looking to cut debt by selling stakes in some of its companies. It sold its Mumbai electricity distribution business to Adani Transmission in 2018.

Tata Power has taken over the management of CESU after receiving the letter of intent from OERC for distribution and retail supply of electricity in Odisha’s five circles. These five circles are Bhubaneshwar, Cuttack, Puri, Paradeep and Dhenekal. As per the order issued by the OERC on 28 May, Tata Power will hold 51 percent equity with management control and the GRIDCO will have remaining 49 percent stake. Tata Power has committed to improve and modernise the distribution system in the five circles. The priority of the company is to improve reliability, reduce aggregate technical and commercial losses and offer good customer service. As per the agreement, the company will retain all the existing employees of CESU and will govern them by their existing policy structure. Tata Power said it will provide better opportunities and facilities to the employees to update their knowledge and skills along with exposure to best practices and cutting edge technologies as a part of change management in CESU. Tata Power has received a license for 25 years. With CESU, Tata Power aims to expand its consumer base to 50 lakh consumers from the present base of 2.5 million across Mumbai, Delhi and Ajmer. The average demand of CESU is around 1,300 MW with the annual input energy of 8,400 mn units (FY18).

Italy’s biggest utility Enel Group is competing with homegrown private power producer-distributors Greenko and Torrent Power to acquire Reliance Infrastructure’s Delhi electricity distribution business. The Anil Ambani-led Reliance Group is looking to sell assets to pay off lenders. The unit is India’s largest in terms of consumers. Reliance Infrastructure had hired KPMG to find buyers for the 51 percent stake each it holds in BRPL and BYPL. The Delhi government owns the remaining 49 percent in both. The three submitted bids to comply with the deadline. Ambani sold the Mumbai city power distribution business to Adani Transmission Ltd for ₹188 bn in August 2018. Reliance Group and Tata Power supply power to about 93 percent of Delhi. The two BSES companies cater to 4.4 mn customers in the national capital, handling peak power demand of 4.8 GW. Last July, New Delhi touched an all-time high electricity demand of 7.4 GW.

China under the multi-billion-dollar CPEC will set up a 1,124 MW power project in Pakistan-occupied Kashmir despite India’s objection to it. The project will be built on the Jhelum River and aims at annually providing more than five billion units of clean and low-cost electricity for consumers in Pakistan. The CPEC passes through PoK, over which India has conveyed its protests to China.

Mexico’s energy regulator has approved new rates that electricity providers must pay the national power utility for transmission, it said, as a dispute rumbles on between the private sector and government over industry rule changes. The regulator, known by its Spanish initials CRE, said the new rates will apply to firms that signed contracts with the utility, the CFE, before a constitutional reform of the energy sector in 2013-14. In the reform, renewable firms awarded the right to generate power in auctions under the last government delivered power directly to the CFE without paying transmission costs. The new transmission rates were approved following a request made by the CFE in March 2019. Mexico is seeking to strengthen the role of the state in the energy sector and rework contracts with the CFE, arguing that past governments had handed too much control of it to private interests.

The Mexican government’s fight with private power firms over access to the grid owned by CFE threatens further legal conflict over new plants as well as the country’s transition to a greener future. The push for a stronger state role in the energy sector also could strike another blow to the government’s already shaky reputation with foreign investors. Canada and the EU have weighed into the fight in support of their investors, which include Spain’s Iberdrola and France’s Engie, that have invested in the Mexican power sector. Mexico’s energy ministry issued a decree to give the state more say over who can generate electricity and how much, again citing the pandemic as a rationale.

Mexico was ready to negotiate over changes to the electricity market that angered firms and foreign allies, opening the door to a potential compromise that could ease tensions over energy policy. The government has pledged to revive state oil firm Petroleos Mexicanos and national power company the CFE. The electricity dispute follows a spat last year over several natural gas pipeline contracts the government said were costing Mexico too much. After weeks of talks, the dispute was resolved under revised terms the government said would benefit taxpayers.

Zambia’s CEC will stop supplying power to Vedanta’s local unit KCM, it said after talks on an extension to their supply agreement broke down over debt owed to CEC. KCM would now receive its power directly from utility ZESCO, which has previously sold electricity to CEC for onward supply to KCM. Energy Minister Matthew Nkhuwa said the bulk electricity supply agreement between ZESCO and CEC, which expired on 31 March, would not be renewed.

Wild weather downed trees and left tens of thousands of people without power in Western Australia, as emergency services began cleaning up in Perth after some of the worst weather in a decade. Around 50,000 customers were without power due to storm-related outages, utility Western Power said, as the remnants of Cyclone Mangga hit a cold front and brought squalling rain and emergency level storm warnings to the south of the state.

Lebanon has turned to global power plant manufacturers including General Electric to arrange financing to build badly needed electricity capacity, hoping favourable terms can be agreed with help from their governments. Lebanon had modified its approach to the process since it defaulted on its sovereign debt in March, meaning it was unable to offer the kind of sovereign guarantee sought by investors. Fixing the loss-making power sector is seen as critical for the country which is mired in a financial crisis seen as the biggest threat to its stability since the 1975-90 civil war. The country has failed to provide 24-hour power since the war, leaving households reliant on expensive private generators.

| FY: Financial Year, kWh: kilowatt hour, MW: megawatt, GW: gigawatt, mn: million, bn: billion, discoms: distribution companies, PSPCL: Punjab State Power Corp Ltd, HERC: Haryana Electricity Regulatory Commission, UP: Uttar Pradesh, UPPCL: UP Power Corp Ltd, UPERC: UP Electricity Regulatory Commission, PGCIL: Power Grid Corp of India Ltd, AIPEF: All India Power Engineers Federation, BPL: Below Poverty Line, EV: electric vehicle, ACS: average cost of supply, NTP: National Tariff Policy, CSERC: Chhattisgarh State Electricity Regulatory Commission, APTEL: Appellate Tribunal for Electricity, TANGEDCO: Tamil Nadu Generation and Distribution Corp Ltd, J&K: Jammu and Kashmir, RTM: real time market, CERC: Central Electricity Regulatory Commission, CESU: Central Electricity Supply Utility, OERC: Odisha Electricity Regulatory Commission, CFE: Comision Federal de Electricidad, CEC: Copperbelt Energy Corp, KCM: Konkola Copper Mines, EU: European Union, ZESCO: Zambia Electricity Supply Corp |

QuIck CommentFuel price hike is a burden on the people when public transport is constrained! Bad! |

22 June. The Communist Party of India (CPI) members protested the petrol and diesel price hike. The fuel price was hiked nine times so far this year, the party representatives said that was when crude oil prices were falling. The central government has not passed on the benefits (of falling crude oil prices) to the people. M Arumugam, a district representative of the party, said the crude oil price was lower than that of the pre-Covid period, but the Centre was not passing the benefits onto the people.

Source: The Economic Times

21 June. State-run oil companies are rushing additional fuel supplies to Ladakh and have tanked up storage depots in the northern region to meet increased demand from the defence forces, deployed in large numbers as the deadly border stand-off with China continues in the Galwan valley and Pangong Tso (lake in Ladakhi) areas of the newly-created federal territory. The oil companies have also deployed aviation bowsers in several locations, essentially for easy refuelling of helicopters being used extensively by the forces. Jet fuel stocks have also been beefed up as the air force has moved fighter aircraft to forward locations. Transporters said more than 100 tankers are leaving daily from IndianOil’s Jammu, Jalandhar and Sangrur storage terminals carrying diesel, jet fuel, kerosene and petrol to Kargil, Leh and other forward areas. Tankers are also being sent from Hindustan Petroleum’s refinery in Punjab’s Bhatinda. The oil companies had a target of moving a total of 150,000 kilolitres of liquid fuels and 3,300 tonne of LPG (liquefied petroleum gas) this year for both civilian consumption and defence forces.

Source: The Economic Times

20 June. India’s crude oil imports in May fell 22.6 percent from a year earlier, it’s biggest drop since at least 2005, as fuel demand and refinery production was hurt by a country-wide lockdown to curb the spread of coronavirus. Crude oil imports fell to 14.61 million tonnes (mt), it’s lowest since 2015, Petroleum Planning and Analysis Cell data showed. Oil products imports eased 0.8 percent to 3.57 mt year-on-year, while exports rose by 5.9 percent to 5.75 mt, gaining for a ninth straight month in May as slowing demand at home prompted companies to ship more oil overseas. The country has relaxed coronavirus-led restrictions in lower risk areas, which is expected to improve demand and scale up crude processing. Diesel exports, which continued to account for a major share of exports, increased by nearly 33 percent to 2.79 mt. India revised down its crude oil imports figure for April to 16.55 mt- a decline of 16 percent year-on-year, from 17.28 mt reported earlier, the data showed.

Source: Livemint

20 June. Oil India Ltd has lost production of over 7,627 million tonnes (mt) of crude oil from 33 wells and around 10 mmscmd (million metric standard cubic meter per day) of natural gas from five gas wells due to blockades by protesters in two districts of Assam. Oil India said that as experts from the USA and Canada associated with Singapore-based M/S ALERT, firefighters, NDRF and engineers intensified efforts to douse the oil well fire in eastern Assam’s Tinsukia district, local people and various students organisations had forced Oil India to stop its operations at many drilling locations and nine work-over locations in Tinsukia and Dibrugarh districts. In the meantime, the Army has started to build a 150-metre bridge over a water body to facilitate technical works to control gas leak and oil well fire, following request from Tinsukia Deputy Commissioner Bhaskar Pegu.

Source: The New Indian Express

17 June. The rates of fuel have been increased again in the national capital causing more troubles for the commuters. With the hike in fuel prices, the petrol prices stand at ₹77.28/litre (increase by ₹0.55), and the diesel prices stand at ₹75.79/litre (increase by ₹0.69) in Delhi, according to a price notification of state oil marketing companies. The daily commuters, who were spotted filling the tanks of their vehicles at petrol pumps.

Source: The Economic Times

23 June. ONGC (Oil and Natural Gas Corp) has temporarily suspended operations at two drilling rigs in the Arabian Sea after 54 employees tested positive for coronavirus and one died but the oil and gas production has not been impacted. Operations at two rigs operating in the firm’s prime Mumbai High and Bassein fields off the west coast were temporarily suspended after the company’s testing rigour detected coronavirus positive cases. The suspension of operations at the drilling rig has not impacted production and the company continues to produce 1,70,000 barrels per day (bpd) of oil and 12 million metric standard cubic meter per day (mmscmd) of gas from Mumbai High and 60,000 bpd oil and 32 mmscmd gas from Bassein. Mumbai High and Bassein are India’s top oil and gas producing fields, accounting for almost a two-third of the country’s production.

Source: The Economic Times

18 June. At a time when the price of domestic natural gas is as low as $2.39 per million metric British thermal unit (mmBtu), the Indian Gas Exchange (IGX) — the country’s first natural gas exchange — has got a market-discovered price of $4.07 per unit within the first two days of operation. Launched, the platform — set up by the Indian Energy Exchange — has so far traded 100 mmBtu gas. Giving major boost to IGX, big liquefied natural gas (LNG) players like GAIL (India) Ltd and Petronet LNG have joined the exchange as members. Private sector majors like Adani Gas, too, have joined IGX as its member partner. Other members of the platform include Manikaran Power, GMR Energy Trading, Zak Venture, Kreate Energy, Gita Power and Infrastructure, Abja Power, Arunachal Pradesh Power Corporation, Andhra Pradesh Gas Power Corporation, and Instinct Infra and Power. Trade members facilitate trade on the exchange on behalf of their clients. They act as the link between the exchange and the clients registered on the exchange. The market-discovered price for first two days was ₹309 per mmBtu or $4.07 per mmBtu. The exchange is LNG-driven, while the price of domestically produced natural gas is notified by the government. At present, the domestic natural gas price is at $2.39 per mmBtu, which most producers, including Oil and Natural Gas Corporation, have cited as unviable. Launching the IGX, Oil Minister Dharmendra Pradhan had endorsed a market-driven pricing mechanism and hinted at the introduction of a new tariff policy on gas. He said the IGX would help in finding market-driven pricing in India. Though in the international market, the spot price of LNG is low at around $2 per mmBtu, the price at the consumer end in India will come to around $5-7 mmBtu, including transmission cost, marketing margins, local taxes, and levies. The country’s LNG capacity is also expected to increase from 37.5 million tonnes per annum (mtpa) to 62.5 mtpa by 2021-22. IGX will offer spot and forward contracts at Dahej, Hazira, and Kakinada. Spot contract for the day-ahead market means gas will be delivered the following day.

Source: Business Standard

23 June. BJP (Bharatiya Janata Party) said the Hemant Soren government is posing “unnecessary” hurdles in the Centre’s move to initiate commercial coal mining by challenging the matter in the Supreme Court (SC). The Soren government moved a writ petition in the apex court, demanding a halt in the auctioning of coal blocks for commercial mining. Of the 41 blocks to go under the hammer, 20 are in Jharkhand. The coal ministry, however, went ahead with the auctioning process. Soon after, the state government knocked on SC’s door to challenge the decision.

Source: The Economic Times

QuIck CommentCoal Mine Development Operators take more of return and less of risk! Ugly! |

22 June. Coal India Ltd (CIL) will engage mine developer cum operators (MDOs) to increase its coal output and reduce import dependency of the dry fuel in the coming years. The Maharatna coal mining behemoth in the process has identified a total of 15 greenfield projects to operate through MDO model of which 12 are open cast and 3 underground, Western Coalfields Ltd (WCL) said. The contract period would be for 25 years or life of mine whichever is less. It informed reputed MDOs would be engaged to have multiple advantage of technology infusion, and operational efficiency in the system apart from increased production.

Source: The Economic Times

20 June. Senior Congress leader Jairam Ramesh wrote to Union Environment Minister Prakash Javadekar on the coal blocks auction saying it is “triple disastrous” from an ecological viewpoint as several mines fall in dense forests. The mines on offer are largely fully explored ones meaning that they could be brought to production immediately. Moreover, more coal mines are on offer that could provide input to the steel sector. The mines are located in Chhattisgarh, Jharkhand, Madhya Pradesh, Maharashtra and Odisha. The Congress leader said that Prime Minister Narendra Modi and Javadekar have spoken eloquently in global forums on India’s commitment to fight global warming. Ramesh said that first the mining and transportation of coal will impose a very heavy environmental cost, second the loss of very dense forest cover will mean loss of a valuable carbon sink and third public health will be even more severely affected adding to the crisis we are already facing.

Source: The Economic Times

20 June. A day after Prime Minister Narendra Modi kicked off the auction process of coal blocks for commercial mining with the aim of achieving self-sufficiency in energy and boosting industrial development, the Jharkhand government moved the Supreme Court (SC) challenging it on the ground that the pandemic situation would not fetch market price and tribals would be devastated by commercial exploitation of coal mines. The state government said the auction decision was illegal as there was no law to guide mining activities because of the legal vacuum created by lapse of the Mineral Laws (Amendment) Act, 2020, on 14 May. The Centre’s decision to start the process for auctioning 41 coal blocks for commercial mining is open for domestic as well as global firms under the 100 percent FDI route and is aimed at making India self-reliant in the energy sector.

Source: The Economic Times

19 June. Union Home Minister Amit Shah said that Prime Minister Narendra Modi’s decision to auction 41 coal mines for commercial mining will make India self-reliant in the energy sector and create more than 2.8 lakh jobs. Earlier, Prime Minister Modi launched the auction of 41 coal mines for commercial mining and reiterated his call for India to become self-reliant in energy by reducing imports. Despite having the world’s fourth-largest coal

QuIck CommentNarrowing of power demand slump is a sign of economic recovery! Good! |

reserves and being the second-largest producer, the country is the second-largest importer of coal. The rollout of commercial coal mining is part of the series of announcements made by the Centre under the Atmanirbhar Bharat Abhiyan.

Source: The Economic Times

23 June. Madhya Pradesh Chief Minister (CM) Shivraj Singh Chouhan announced that people having electricity bills between ₹100 to ₹400 have to pay ₹100 only and those having electricity bills over ₹400 have to pay half of the entire bill. Chouhan said that consumers who have been assigned fixed charges can pay in 6 equal instalments from October 2020 to March 2021, they will get a benefit of 1.83 bn.

Source: The Economic Times

22 June. The Manohar Lal Khattar-led BJP (Bharatiya Janata Party) government in Haryana has cancelled contracts with Chinese companies for installing pollution control equipment worth ₹7.8 bn at two of its thermal power facilities, in the wake of heightened tension between the two neighbours. The contracts had been awarded by the Haryana Power Generation Corp Ltd (HPGCL) through global tendering for the installation of the equipment in the plants in Yamunanagar and Hisar towns. Against the tender for the power station in Yamunanagar, five bids were received, in which three were from Chinese bidders and the others from Indian bidders. In the tender for the plant in Hisar, three firms participated, with two being Chinese and the third one domestic company with a foreign collaborator.

Source: The Economic Times

21 June. Intense heat wave during the third week of June has helped further narrowing of power demand slump to 9.76 percent from 10.5 percent in the previous week, showing commercial and industrial activities are yet to reach optimum levels. The slump in power demand in the first week of the June was recorded at 19.7 percent. However, the decline so far is still higher than 8.8 percent recorded in May. In the third week of June, the power demand has improved due to intensifying heat wave, and it hovered around 162 GW from 15 June onwards, and further shot up to 164.64 GW, as per the power ministry data. The peak power demand met stood at 163.30 GW on 11 June and remained slightly lower at 158.02GW on 12 June, 157.79 GW on 13th and 156.88 GW on 14th. The peak power demand met slump narrowed from 19.7 percent in the first week of June to 10.5 percent in the second week of this month. The peak power demand met is the highest energy supply during the day across the country. An industry expert said power demand can rise closer to normal levels of the previous year with further increase in commercial and industrial activities. The government started easing the lockdown imposed on 25 March for economic activities from 20 April. However, the demand from the commercial and industrial sector is still to achieve its optimum levels as there is still a power demand slump of 9.76 percent despite intense heat waves in the country, an industry expert said.

Source: The Economic Times

21 June. TPDDL (Tata Power Delhi Distribution Ltd) prevented over 1.5 lakh manual meter-reading visits of its staff during the lockdown, safeguarding them and the consumers from possible coronavirus exposure, through around two lakh smart meters installed within its distribution area. The smart meters helped raise over 3.5 lakh electricity bills based on actual readings, instead of provisional ones, during the lockdown months of April-May and prevented over 1.5 lakh visits to consumer premises, the company said. The company has installed around two lakh smart meters across its consumer segments — domestic, industrial and commercial — under its Advanced Metering Infrastructure (AMI) project. TPDDL supplies electricity to a population of around 70 lakh in north and northwest Delhi. It has a registered customer base of 17 lakh. With the introduction of smart meters, the consumers are now monitoring their maximum demand indicator (MDI) and power factor through the TPDDL Connect mobile application on an almost real-time basis (at a gap of four hours) and maintaining them in an efficient way while saving on the fixed and energy charges, the company said. A close monitoring of the MDI is also helping them save about 30 percent on load-violation charges beyond their sanctioned load, the company said. TPDDL said with the shift to smart meters, the company aims to engage and empower the consumers by providing them full control on their electricity consumption.

Source: India Today

19 June. India’s electricity generation during the first half of June fell at a slightly faster rate than in May, provisional government data showed, driven by lower consumption in western states hit hardest by the coronavirus outbreak. Power generation fell 14.5 percent in the first 15 days of June, federal grid operator POSOCO data showed, compared with a 14.3 percent fall in May. Electricity use by the industrial western states of Maharashtra and Gujarat – the top electricity consuming states in the country – fell over 24 percent each, compared with declines of 13.8 percent and 18.9 percent in May. Consumption in Delhi fell nearly 30 percent, a steeper fall than the 26.8 percent decline in May. Electricity use in the state is slated to fall in the coming days as it has imposed a strict lockdown in and around its capital city of Chennai until the end of June.

Source: Reuters

19 June. Smart Power India (SPI) said that it has launched a customer voucher scheme (CVS) for mini-grid customers. The scheme is expected to have a significant positive impact on over 125,000 lives in 200 mini-grid villages, SMI said. Mini-grid customers will be able to redeem the vouchers against their monthly electricity bill issued by Mini-Grid Operators (MGO) for a period of three months. Amidst the lockdown, electricity demand has dropped by up to 70 percent, especially from commercial and enterprise customers, it said. As per the recent surveys conducted by SPI across mini-grid villages, rural households are prioritizing their spending on food, shelter, and safety over electricity consumption. The scheme, therefore, is expected to play a significant role in retaining the mini-grid customers during the lockdown and ensure continued on-time payment behaviour once cash flow improves, it added. Over the next three months, the scheme will maintain the electricity demand and restore MGO’s cash flow back to pre-lockdown levels, it said.

Source: The Economic Times

18 June. The Aam Aadmi Party (AAP) launched a protest demanding waiver of electricity bills of the last three months because of the lockdown. The protest march ‘Chowk se Chorahe Tak’ started from Gandhi Bhavan where AAP members gathered and shouted slogans against the state government. During the rally, the members covered Chuddi Bazaar, Naya Bazaar and Kachari road asking the shopkeepers to support the protest. AAP division president Kirti Pathak said because of the lockdown, the common man was unable to pay electricity bills.

Source: The Economic Times

18 June. June has been humid and power cuts that have returned with annoying frequency in Noida and Ghaziabad have made working from home an even bigger challenge because of frequent disruptions in the AC and the Wi-Fi. For the past 10 days, in Ghaziabad, certain pockets of trans-Hindon areas have witnessed two hours of power cuts on an average. On 1 June and 5 June, Indirapuram witnessed 6 hours and 5 hours of power cuts, respectively. The electricity department said the blackouts are caused by local snags, and work on infrastructure upgrade was hampered due to the lockdown. But overall, it said, power supply has improved in trans-Hindon. Noida has been facing outages more frequently, and for longer, since May.

Source: The Economic Times

18 June. KSEB (Kerala State Electricity Board) has informed the Kerala high court (HC) that higher consumption during the lockdown resulted in higher bills being issued to consumers. The system of bimonthly billing has been followed by KSEB for more than 30 years and it is an accepted formula by domestic consumers. KSEB said that bimonthly billing is beneficial to consumers by stating that they can avail the benefit of telescopic billing by consuming less within a period spread over 60 days. KSEB submitted that 97 percent of domestic consumers have consumption of less than 250 units and are eligible for telescopic tariff. Changing to monthly billing system would result in additional employee cost of around ₹480 mn annually, the court was told.

Source: The Economic Times

18 June. The government initiated separation of electricity transmission system planning business from Power Grid Corp of India Ltd (PGCIL)– a long pending demand of the industry for fair bidding of transmission lines. The move will help PGCIL diversify to other businesses and comes just in time when the government has kicked off a power distribution programme starting with the Union Territories. PGCIL may explore bidding for some of the upcoming distribution licences on block. The government has directed PGCIL to immediately set up Central Transmission utility (CTU) as a 100 percent subsidiary with separate accounting and board structure which would identify and plan transmission network in the country. The CTU subsidiary would be separated into a wholly owned government entity in six months, sources said. PGCIL has been asked to prepare the rules and guidelines for the process. Private power transmission companies have time and again alleged that PGCIL purposefully mismanages transmission planning so that the lines get delayed and are given to the state –run firm on nomination basis.

Source: The Economic Times

17 June. Union Power Minster R K Singh said the power ministry may consider extending beyond 2022 the waiver of Inter-state Transmission System (ISTS) charges for renewable energy projects. Last year in November, the ministry had extended the ISTS charges waiver to wind and solar energy projects by nine months till December 2022. Under the waiver, all these projects commissioned by December 2022 are eligible for availing exemption of ISTS charges and losses on transmission of electricity for 25 years. Initially, the waiver was for the projects commissioned till 31 March 2022.

Source: The Economic Times

23 June. In what will make solar cells, modules and inverters imported from China expensive, India is set to impose a basic customs duty as soon as the safeguard duty, currently in place, expires on 29 July. To impose this 20 percent tariff barrier on imports of green energy equipment, the ministry of new and renewable energy will soon write to the ministry of commerce and industry. The National Democratic Alliance (NDA) government had imposed the safeguard duty on solar cells and modules imported from China and Malaysia on 30 July 2018. India currently has a domestic manufacturing capacity of 3 GW for solar cells and recently awarded a manufacturing-linked solar contract that will help in establishing additional solar cell and module manufacturing capacity.

Source: Livemint

22 June. Chandigarh Renewal Energy, Science and Technology Promotion Society (CREST) will now install solar plants under Renewable Energy Service Company Model (RESCO) model that UT (Union Territory) administrator V P Singh Badnore has approved. CREST director Debendra Dalai, said they will soon float a tender and rope in companies under the model, where they will install solar plants on private properties. In return, the building owner will be charged a much lesser tariff (₹3.44 per unit) for the solar-produced electricity in the bills as compared to normal electricity tariffs (₹2.75 to ₹5.20 per unit). The plant will be installed for 15 years (the details of exact years will be finalised after tender process), and after that the house owner will be given the power plant, he said. The building owner and private company will sign an agreement. The plant will be installed under net metering mode, whereby a solar power system is connected to the electrical connection of a building owner and solar energy exported to the grid is adjusted in terms of units imported from the electricity department during a billing cycle. Dalai said the building owner will have to pay ₹3.44 per unit fixed tariff for 15 years, whereas in the current scenario there is a power tariff hike every year. Besides, a solar plant has a life of around 25 years, which means, after 15 years for the next 10 years, the building owner will not pay even a single penny for power consumption, he said.

Source: The Economic Times

22 June. India’s solar power generation plunged about a third during the solar eclipse. Power grid operators, however, handled the sharp drop and surge in generation during the celestial event, underscoring the country’s ability to manage its growing green energy generation and the impact on the national grid. The drop in solar power generation was expected to be around 11,943 MW on 21 June. Eclipses occur every year, but annular solar eclipses are not common. India has experienced three solar eclipses in the past 10 years—on 22 July 2009, 15 January 2010, and 26 December 2019. The eclipse this year also comes against the backdrop of the lockdown to contain the spread of coronavirus, which has led to a drastic fall in pollution and has improved solar radiation. India has 34.6 GW of solar power, and aims to have 100 GW of solar capacity by 2022.

Source: Livemint

19 June. Tata Power will develop a 100 MW solar project in Maharashtra, the company announced just days after it secured a solar project development in Gujarat. Currently, India has about 35,000 MW of total installed capacity of solar power, which is less than 10 percent of India’s total power generation at 3,70,348 MW, inclusive of wind energy, coal energy etc.

Source: The Financial Express

20 June. Global oil demand may have peaked in 2019 as Covid-19 has heightened the risk that behavioural changes such as working and shopping from home may be long-term trends, while renewable energy and electric cars are rapidly reducing the use of fossil fuels, Moody’s said in a research report. Recovery would take even more time for some oil-intensive activities like aviation. Transportation, including daily commuting, air travel and cruises, which account for more than half of global oil demand, will take a long time to recover as business and leisure travel will take a long time to revive, while companies adjust to a new normal where commuting is reduced. Oil demand would fall further after 2025 as emission targets in China, Europe and California require more electrification and greater internal combustion engine efficiency, it said.

Source: The Economic Times

19 June. Energy companies can apply to explore for oil and gas in 36 new exploration blocks off Norway, the country’s oil and energy ministry said. Companies can apply for so-called awards in pre-defined areas, with results due in the first quarter of 2021, the ministry said.

Source: Reuters

19 June. The recovery in Asia’s demand for oil remains fragile despite the reopening of economies across the region, as a second wave of coronavirus outbreaks could hit consumption again, Malaysia’s Petronas CEO (Chief Executive Officer) Wan Zulkiflee Wan Ariffin said. Petronas cut crude and LNG exports in second quarter. In the long run, oil and gas will remain the dominant contributors to its energy mix, although Petronas is stepping up renewables and specialty chemicals investments.

Source: Reuters

18 June. Japan’s weaker oil demand amid the coronavirus pandemic is currently balanced by reduced supply from OPEC+ nations, the Petroleum Association of Japan (PAJ) said. The world’s largest oil exporter, Saudi Aramco, has reduced the volume of July-loading crude that it will supply to at least five buyers in Asia. That followed a deal struck by the Organization of the Petroleum Exporting Countries (OPEC) and its allies to keep production cuts of 9.7 mn barrels per day (bpd) in place until the end of July.

Source: Reuters

17 June. US (United States) shale producers are expected to restore roughly half a mn barrels per day (bpd) of crude output by the end of June, according to crude buyers and analysts, amounting to a quarter of what they shut since the coronavirus pandemic cut fuel demand and hammered oil prices. Such a swift rise in US production would complicate efforts by top producers Saudi Arabia and Russia to encourage global allies to fulfill their pledges to make record production cuts. US producers cut supply by roughly 2 mn bpd. But the recovery in benchmark oil prices to around $40 a barrel makes some shale output profitable again, even though that level is unlikely to spur additional new drilling activity. Larger producers are re-opening the taps in low-cost plays in Texas, but also in expensive shale basins in North Dakota and Oklahoma.

Source: Reuters

17 June. Brazil’s state-controlled oil company Petroleo Brasileiro SA (Petrobras) is resuming plans to unload its remaining stake in the country’s top gas station operator, Petrobras Distribuidora SA. Both sales are part of a wider push by Petrobras to sell up to $30 bn in assets by 2024 to reduce its hefty debt load. Those plans have been slowed of late by coronavirus-related market turbulence, leading the company to scrap its debt reduction target for the year. In January, Petrobras had hired the investment banking units of Morgan Stanley, JPMorgan Chase & Co, Goldman Sachs Group Inc, Itau Unibanco Holding SA, XP Inc, Bank of America Corp and Citigroup Inc to manage the offering.

Source: Reuters

22 June. China aims to produce 1 percent more crude oil this year than in 2019 and to boost natural gas output by 4.3 percent, as the country seeks to safeguard energy security even after a coronavirus-driven collapse in oil prices. The world’s biggest energy consumer has set a goal of producing 193 million tonnes (mt) of crude, or 3.85 mn barrels per day (bpd), in 2020, and 181 billion cubic meters (bcm) of gas, according to the National Energy Administration (NEA). The NEA said it would focus on expanding its four key energy production bases to achieve the goals – one offshore in Bohai Bay in northern China, as well as onshore in Sichuan province in the southwest, in the Erdos Basin and in the far western Xinjiang region.

Source: Reuters

20 June. French oil giant Total will proceed with its $23 bn gas project in northern Mozambique despite uncertainties caused by the coronavirus pandemic and militant attacks on nearby villages. Northern Mozambique has been hit by a jihadist insurgency since 2017 that has killed more than 1,000 people and complicated the country’s plans to develop its offshore gas reserves. Nearly 100 workers at Total’s LNG site have been infected by the new coronavirus, forcing the partial shutdown of activities for two months as 5,000 workers went into quarantine. Mozambican development depends heavily on the exploration and export of natural gas deposits concentrated in northern Cabo Delgado province near the border with Tanzania.

Source: The Economic Times

17 June. Texas as early as this fall could tighten some rules for the controversial practice of natural gas flaring, the head of the state’s regulatory commission said. Texas regulators would also improve the data available on flaring, tracking for the first time how the gas is disposed, under the recommendations.

Source: Reuters

23 June. The world’s largest mining company BHP Group has hired US (United States) investment bank JP Morgan to sell its Australian thermal coal mine, following pressure from investors concerned about global warming. BHP’s Mt Arthur open cut mine, in the Hunter Valley region of New South Wales, supplies thermal coal, used as fuel for power plants, to domestic and international customers and could fetch between $1.5 bn and $1.8 bn. Rival mining companies have also taken steps to go thermal coal free, with Rio Tinto selling its last coal mines in 2018, and Anglo American considering the spinoff or sale of its South African coal operations within the next two or three years.

Source: Reuters

19 June. The situation in Polish coal mines has stabilized after a rapid increase in new coronavirus cases in the past few weeks, Deputy Prime Minister Jacek Sasin said. But in the past few days new daily cases reported in the Silesia coal region have fallen to below 100 from above 200 earlier, Sasin said. The government has reduced operations to minimum at a dozen coal mines for three weeks to curb the virus. Coal trade unions have criticised the move saying it will lead to effectively closing the mines as the industry faces financial problems amid falling demand for coal and electricity, and rising costs.

Source: Reuters

18 June. China aims to cap coal-fired power capacity at 1,100 GW and the number of coal mines at 5,000 by the end of 2020, the National Development and Reform Commission (NDRC) said. The world’s top consumer of coal had 1,040 GW of installed coal-fired power capacity and 5,268 coal mines nationwide by 2019.

Source: Reuters

18 June. Poland’s JSW, the European Union (EU)’s biggest coking coal producer, has launched a campaign to defend miners who it says have faced public abuse and unfair blame on social media over a rise in coronavirus infections. The government has reduced operations to minimum at a dozen coal mines temporarily to prevent the virus spreading further.

Source: Reuters

19 June. Burkina Faso’s national energy supplier, SONABEL, has worked with MAN Energy Solutions to increase generation capacity by 55 MW with the expansion of one of its power plants. The plant in Kossodo is owned by SONABEL, and work was done by local company Tecmon BF as the main contractor.

Source: ESI Africa

18 June. Tokyo Electric Power Company (TEPCO) has partnered with Itochu Corporation, a Japanese major trading company, to build a blockchain-based system for trading surplus electricity. Households in Japan will be able to use the new system within three years. If successful, it will be the first instance of surplus electricity trading between households in Japan. The energy trading system appears to be similar to TEPCO and Itochu’s. Blockchain technology tracks energy consumption while AI enables users to sell surpluses to other residents.

Source: Asia Times

23 June. Nevada’s Governor Steve Sisolak said his state plans to adopt California’s zero emission vehicle (ZEV) mandate and tailpipe emissions rules even as the Trump administration has moved to strip states of the right to implement such requirements. Nevada will be the latest state to adopt California’s low-and zero-emission vehicle rules following similar announcements by Washington in March and Minnesota and New Mexico in September. California’s vehicle emissions rules, which are more stringent than rules advocated by the Environmental Protection Agency (EPA) under President Donald Trump, are currently followed by states accounting for more than 40 percent of US (United States) vehicle sales.

Source: Reuters

23 June. Royal Dutch Shell will announce a major restructuring by the end of the year as the energy company prepares to accelerate its shift towards low-carbon, CEO (Chief Executive Officer) Ben van Beurden told employees. CEO said that the restructuring would involve job cuts as part of broad cost reductions, although no figures have been decided yet. The new structure will not take effect before 2021. The review, which could result in the first major change to Shell’s structure in over a decade, comes after the Anglo-Dutch company set out ambitious plans to reduce greenhouse gas emissions to net zero by 2050 and announced a cut in its dividend for the first time since the 1940s.

Source: Reuters

23 June. Spain’s cabinet approved a decree aimed at smoothing the rollout of renewable energy generation, with measures to combat speculation in the market, cut red tape and overhaul an outdated auction system to reassure investors and lower prices. Spain wants to make use of rich natural resources including prodigious sunlight both to reduce pollution and create jobs, in response to the devastation the coronavirus has wrought on an economy that relies heavily on tourism and cars. It follows plans being developed by the European Union (EU) to use low-carbon investments to battle the downturn. Spain is working on joining a handful of wealthy nations embedding targeted emissions reductions into law.

Source: Reuters

22 June. More investors are publicly backing a resolution to curb coal project lending that shareholders of Mizuho Financial Group are expected to consider, the first time such a step is to figure at the annual meeting of a Japanese listed company. As a new front of stakeholder activism opens up in Japan, advisory groups such as the Institutional Shareholder Services group and Glass Lewis, which advise funds worth more than $35 tn, back the proposal in recommendations seen by Reuters. If resolution is passed, it could push Japanese banks, one of the last remaining major holdouts on financing coal, to live up to recent commitments to end lending for the dirtiest fossil fuel as climate concerns grow.

Source: Reuters

19 June. Eastern European Union (EU) countries have rejected using carbon emissions trading to boost the bloc’s budget, as leaders convened to wrangle over how to pay for recovery from the coronavirus pandemic. The 27 national EU leaders are discussing by video link an unprecedented stimulus package based on a proposal by the bloc’s executive to raise €750 bn for a recovery fund that would top up the next EU budget worth €1.1 tn. If approved, the plan would need to lay out how to repay the debt, with the European Commission proposing raising new EU funds to achieve that, including using the EU emissions trading system (ETS) to garner €10 bn. That proposal has faced opposition from east European states that want to keep hold of their carbon revenue.

Source: Reuters

19 June. Norway announced plans to tighten rules for onshore wind power developments to better protect nature, a move that is likely to slow surging growth in the sector. The country has seen a boom in wind power development in the past few years, but has also seen public protests with environmental campaigners accusing some developers of building larger turbines than originally approved, obscuring landscapes and endangering birds. Last year Norway put on hold the approval of any new wind power projects after police had to intervene to stop protesters from vandalising some construction sites, although the development of existing licenses continued. The country produces almost all its electricity from renewable sources, mainly hydropower.

Source: Reuters

18 June. Denmark will reduce greenhouse gas emissions by 44 percent by 2030 compared with 1990 levels if no new initiatives are introduced, the Danish Energy Agency (DEA) projected. This means Denmark, broadly seen as a leader in efforts to tackle climate change, has to find ways to cut emissions by 26 percentage points more – or 20 million tonnes (mt) of carbon dioxide equivalents – to reach its 70 percent target by the start of the next decade. Denmark had achieved a 29 percent reduction in greenhouse gas emissions as of 2018 by building up its renewable power and by making energy efficiency improvements, the DEA said. It expected coal to be completely phased out by 2030 and power consumption to be 100 percent based on renewable energy by 2027.

Source: Reuters

18 June. The Vatican urged Catholics to disinvest from the armaments and fossil fuel industries and to closely monitor companies in sectors such as mining to check if they are damaging the environment. The Vatican bank has said it does not invest in fossil fuels and many Catholic dioceses and educational institutions around the world have taken similar positions.

Source: Reuters

18 June. Polish President Andrzej Duda said that he would discuss cooperation with the United States (US) on nuclear energy in talks with President Donald Trump in Washington. Poland generates most of its electricity from coal, but aims to replace it with gas and nuclear energy in response to European Union (EU) calls to cut emissions.

Source: Reuters

18 June. The US (United States) Environmental Protection Agency (EPA) has received 52 new petitions for retroactive biofuel blending waivers that, if granted, would help bring oil refiners into compliance with a court ruling this year, EPA data showed. The new pending applications for blending exemptions are for compliance years 2011 through 2018. The waivers exempt oil refiners from US laws that require they blend billions of gallons of biofuels into their fuel pool. Under the US Renewable Fuel Standard (RFS), oil refiners must blend billions of gallons of biofuels into their fuel, or buy credits from those that do. Small refiners that prove the rules would financially harm them can apply for exemptions.

Source: Reuters

| Production of Petroleum Products – May 2020 | ‘000 Tonnes | % share in Total Production |

| LPG | 964 | 5.6 |

| Petrol | 2367 | 13.7 |

| Diesel | 7383 | 42.7 |

| SKO | 183 | 1.1 |

| Others | 6385 | 36.9 |

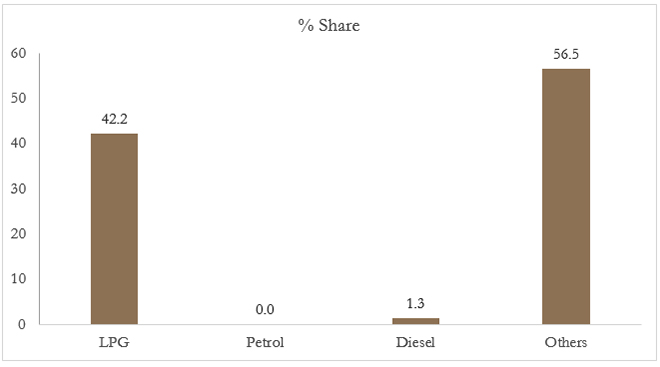

Share of Petroleum Products Imports in Total Petroleum Products Imports for May 2020

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.