-

CENTRES

Progammes & Centres

Location

As of November last year, India had 36.9 GW of installed solar power generation capacity. Out of this, roughly 80 percent was grid connected. The rest consisted of off grid applications such as solar lamps, pumps and power packs. In 2019, the leading countries for cumulative solar PV capacity were China, the United States, Japan, Germany and India, and the leaders for capacity per inhabitant were Germany, Australia and Japan. These markets represented around 75 percent of solar PV installed capacity in 2019 and will remain crucial for the future development of solar PV.

India’s annual installations were down in 2019, following significant growth in 2018. Reasons for the decline included India’s economic slowdown, tariff caps and higher costs associated with tender participation, payment delays, renegotiation of PPAs in some States and challenges common to other energy projects such as land acquisition, lack of transmission infrastructure and of access to grid connections, liquidity issues and lack of financing. Curtailment also acted as a deterrent to new installations. Decline in demand for power due to the general slowdown in the economy accentuated by the pandemic also contributed to the slowdown in solar installations. However, generation from solar power for the year was up 27 percent relative to 2018. Around 35 GW of tenders was announced in India during 2019, down 8 percent relative to 2018, with more than 15.8 GW of projects auctioned. But several tenders were undersubscribed and, as in 2018, many auctions were cancelled retroactively. Nonetheless, by the end of 2019 nearly 24 GW of large-scale capacity was reportedly in the pipeline. Large-scale projects accounted for more than 85 percent of India’s newly installed capacity and represented the vast majority of total solar PV operating capacity.

Incentives for solar (and other renewable energy sources) include feed in tariff, accelerated depreciation, GBI (generation-based incentive), RPOs (renewable purchase obligations), waiver of interstate transmission charges and income tax breaks. Apart from these, the “must run” status under the Central Electricity Regulatory Commission (Indian Electricity Grid Code) Regulations 2010 (Grid Code) has been critical to the growth of PV in India. ‘Must run status’ implies that solar generation cannot be curtailed for factors other than grid safety or safety of equipment or personnel. Under the grid code, curtailment (reduction in power offtake) is allowed only on account of natural reasons such as, grid unavailability or failure or to ensure grid stability. This means that while scheduling generating stations in a region, system operators are required to aim towards utilization of available solar energy fully.

The inherent intermittent nature of solar impacts the grid stability and this entitles Discoms to curtail renewable power. Discoms also find it economical to absorb cheaper thermal power plants rather than solar power plants that benefit from high feed in tariff. The technical challenges in backing down base load thermal power plants and commercial disincentives in the form of continued liability to pay fixed charges of the two-part tariff for thermal plants encourage curtailment of renewable power.

As of 2019, the IEA estimates that the WACC for new projects stood at 2.6 – 5.0 percent in Europe and the United States, 4.4 – 5.4 percent in China and 8.8 – 10.0 percent in India (all in nominal terms after tax). Financiers have also been willing to lend higher shares of the project cost (70-80 percent in 2019). Strong policy support and improved technology maturity have helped mitigate perceived risks for investors and financiers. These factors helped reduce financing costs for solar PV WACC range Base rate projects underpinned by revenue support mechanisms by 15-30 percent between 2015 and 2019.

For new investment decisions, new utility-scale solar PV projects are in the range of $30-60/MWh in Europe and the United States, and $20-40/MWh in China and India. The required return on equity in India is around double that in advanced economies, given higher perceived risks stemming from the financial standing of distribution companies (the off-takers in most PPAs), the risk of curtailments of renewable generation (considered under volume risk in our analysis) and uncertainties over infrastructure enablers.

According to IRENA construction costs of solar PV in China and India are considerably lower than in Europe or the United States, leading to even lower LCOE for utility-scale projects. New solar PV FIDs (final investment decisions) in 2020 are estimated to have LCOE of $20-40/MWh under revenue support mechanisms, and these estimates are consistent with recent auction results in China and India. These costs are below the range of LCOE for new coal-fired power plants but LCOE comparisons do not take into account the cost of managing intermittency. On the value side, coal-fired power plants capture an additional $10-30/MWh of market value compared with solar PV, indicating a closer competition than one based on costs alone. Based on this analysis, revenue support mechanisms nevertheless make utility-scale solar PV competitive with coal-fired power generation in China and India for investment decisions taken today. For projects with low-cost financing that tap high quality resources, solar PV is now the cheapest source of electricity (not including balancing costs).

India has imposed new duties on product imports from several Asian countries and from Saudi Arabia as part of the push towards domestic manufacturing of solar cells. In addition to tariffs on imports, measures have been put in place to encourage local production or to penalise the use of imported products.

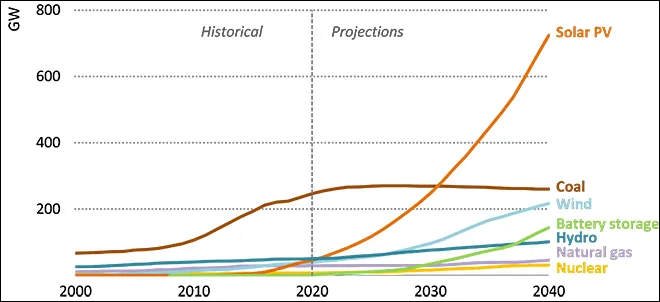

The emphasis on solar PV in India, with peak electricity demand most often in the evening, places a premium on storage. Storage will play an increasingly vital role in ensuring the flexible operation of India’s power systems. In fact, flexibility is rapidly becoming the cornerstone of electricity security in India with the growth in share of PV that has increased flexibility needs in the power system. Flexibility covers a variety of services spanning time scales measured in seconds to hours, days and across seasons. Hour-to-hour ramping requirements are an important aspect of flexibility, and they are set to more than double in India over the next decade, while also increasing by 50 percent in the United States and China. Coal-fired power plants are the main source of flexibility in many systems today, including China and India, while gas-fired power plants are the primary source in the United States. Hydropower provides the largest portion of flexibility in other systems, including Brazil, Canada and the European Union. Global utility-scale battery storage capacity is set for a 20-fold increase between 2019 and 2030, with 130 GW of installed batteries globally projected by 2030. The largest market for storage is expected to be India, where batteries absorb peak output from solar PV during the day, store it for several hours, and then discharge to help meet electricity demand peaks in the evening.

In India, a recent tender for 1 200 MW of renewables combined with storage led to the award of contracts involving battery storage at $57/MWh, signalling the rapidly improving competitiveness of battery technology. One of the key reasons for improved competitiveness is the falling costs of lithium-ion battery packs, down 90 percent from 2010 levels to about $150/kWh in 2019. To further boost prospects for batteries, initiatives such as India’s National Mission on Transformative Mobility and Battery Storage and the EU’s European Battery Alliance are supporting not only the development of domestic manufacturing capacities, but also markets for both EVs and battery storage

India’s coal-fired capacity is expected to plateau by around 2030 mainly due to ambitious targets for renewables, including the aim for renewables capacity to reach 175 GW by 2022 and for it to account for 60 percent of total capacity by 2030 (nearly double the share in 2019). Expanded deployment of solar PV, at both utility-scale and distributed form, is seen as the primary means of achieving these goals, complemented by onshore wind power. The expansion of renewable capacity will enable India’s power sector CO2 emissions to peak around 2035 as solar PV and other renewables come to play an increasingly central part in meeting rising electricity demand.

PV: photovoltaic, MW: megawatt GW: gigawatt, PPAs: power purchase agreements, IEA: International Energy Agency, WACC: weighted average cost of capital, MWh: megawatt hour, IRENA: International Renewable Energy Agency, LCOE: levelised cost of electricity, kWh: kilowatt hour, EU: European Union, EVs: electric vehicles, CO2: carbon dioxide

Power capacity in India by source in the Stated Policies Scenario of the IEA

India’s renewable power capacity is the fourth largest in the world and is growing at the fastest speed among all major countries. India’s annual renewable energy capacity addition exceeded that of coal-based thermal power since 2017. India is becoming a preferred destination for investment in renewables, with nearly ₹5k bn or over $64 bn investment made in the renewable energy sector in the past six years. India added a 763.47 MW renewable energy capacity in November this year, which took the total installed RE capacity to 90.39 GW as on 30 November 2020. Only solar and wind capacity addition changed in November. For solar it increased from 36.32 GW in October to 36.91 GW in November and for wind it increased from 38.26 GW in October to 38.43 GW capacity in November. India has set an ambitious target of 175 GW capacity by 2022, which would include 100 GW of solar energy, 60 GW of wind energy, 10 GW of small hydro power, and 5 GW of biomass-based power projects. India’s renewable energy capacity was currently at 136 GW, which was about 36 percent of the country’s total capacity. By 2022, the share of renewable capacity would increase to over 220 GW. During the last six years, over $64 bn investment has been made in renewable energy in India. The Coronavirus pandemic has left a big dent in India’s solar plan, although the industry is showing signs of recovery as new capacity jumped 114 percent to 438 MW in the third quarter from 205 MW installed in the second quarter as supply chains get restored. Third-quarter installations were 80 percent less than 2,177 MW added in the corresponding period of 2019. Similarly, total installations for the nine-month period were down 68 percent to 1.7 GW from 5.48 GW added in the same period of 2019. Large-scale installations showed improvement at 283 MW in the third quarter against 120 MW in the previous quarter, but the number was still down 85 percent compared to 1,932 MW installed in the year-ago period. Because of solar glass shortage and the anticipated demand rush in China in the fourth quarter to meet the year-end goals, developers are experiencing module shortages along with their prices firming up. The module scarcity and upward pressure on pricing could linger till the second quarter of 2021.

To save energy, reduce electricity bills and generate revenue from its own resources, South Delhi Municipal Corp plans to tie-up with NTPC Ltd for installing solar plants on over 200 buildings, including maternity centres, zonal offices, parking lots and school buildings. The proposal was approved at a standing committee meeting, which included signing a memorandum of understanding with NTPC for installing solar rooftop PV and solar ground-mounted plants. NTPC Vidyut Vyapar Nigam Ltd will be responsible for the project design, supply, erection, commissioning, operation and maintenance of the project for 25 years.

The newly built terminal building of Maharaja Bir Bikram Airport in Agartala, which is expected to be operational in the next three months, will be run on solar power. As part of green development initiative the Airports Authority of India is installing a 2 MW solar power plant for the energy requirement of the terminal building. The initial energy assessment of the new terminal is estimated to be a little more than 2 MW daily for illumination, cooling, water supply and other electrical device operations, which would be supplied from non-conventional sources. In the midst of stiff opposition against that Goa Tamnar Transmission Project Ltd project, and a debate on why solar power is not being generated in the state, the Goa Energy Development Agency has invited bidders to design, manufacture, supply, install, test and commission solar PV systems at various households in Goa. Earlier this year, in June, the state cabinet decided to implement the rural village electrification scheme for households to help 90 houses in Sanguem, Quepem, Sattari and Canacona get electricity through renewable energy. The scheme aims at bringing electricity, through renewable sources, to un-electrified remote villages, hamlets and wards where grid connectivity is either not feasible or not cost-effective.

Farmers would be able to sell power to Uttar Pradesh Power Corp Ltd after using a part of it to meet their requirements under the PM-KUSUM scheme. Out of 8,000 solar powered irrigation pumps, 2,882 have been allocated to east UP. The state government is working towards increasing non-conventional energy from the existing 6 percent to 20 percent of the total energy availability by 2021. The government issued guidelines for implementation of feeder-level solarisation under the PM-KUSUM scheme after consultation with state governments. In February 2019, the government had approved the launch of the PM-KUSUM scheme to provide financial and water security to farmers through harnessing solar energy capacities of 25.75 GW by 2022. PM-KUSUM scheme Component-C provides for solarisation of grid-connected agriculture pumps. After consultation with states, it was decided to also allow feeder-level solarisation where instead of putting solar panels at each individual agriculture pump, a single solar power plant of capacity adequate to supply power to an agriculture feeder or multiple feeders will be installed. Under Component-C of PM-KUSUM scheme, solarisation of 400,000 grid-connected pumps are targeted for sanction by 2020-21. Also, 50 percent of these are to be solarised through feeder level solarisation and balance through individual pump solarisation. The MNRE said it will be mandatory to use indigenously manufactured solar panels with indigenous solar cells and modules.

Indian authorities will invite competitive bids for close to 22.5 GW of new tenders for solar power projects by December end while about 43 GW of capacity is at different stages of commissioning by successful bidders. Currently, India’s solar power capacity stands at about 35 GW and the government is planning to increase it to 100 GW in the next couple of years to meet its ambitious targets under National Solar Mission. Also, India has 9.5 GW of wind power capacity under execution and new bids are expected in near future. Of the country’s 370 GW of total electricity generation capacity, renewable power accounts for close to 24 percent that is expected to grow year-on-year. The SECI is the nodal agency to facilitate the implementation of the Mission and managing 16.2 GW of tenders. SECI has invited 7.5 GW of the tender to commission solar projects in Jammu & Kashmir, 2.5 GW in Karnataka and 6.2 GW anywhere the developers want in India. CIL will set up 14 rooftop and ground-mounted solar power projects of 3,000 MW capacity by FY24 at an investment of about ₹56.5 bn. CIL has been mandated by the coal ministry to become a net-zero company and solar power initiative is a part of CIL’s diversification plans. The company has a JV with NLC India named Coal Lignite Urja Vikas Private Ltd which was floated on 10 November this year to develop 1,000 MW solar power projects. It also has a JV with NTPC and an MoU with the SECI for solar projects of 1,000 MW each, the progress of which is being worked out individually. CIL would gradually peak up to 1,340 MW in 2023-24, while for FY23 solar power capacity addition is targeted at 1,293 MW, with 220 MW capacity to come up in 2021-22. CIL’s subsidiaries have already identified 1,156 acres of land between them where they would set up 220 MW solar projects by end of FY22. Solar power generation by CIL and its subsidiaries stood at 4.6 mn units in FY20 and 4.25 mn units in FY19, which amounted to a reduction of over 3,000 tonnes of CO2 each year.

Rajasthan will meet the target of 30,000 MW solar energy and 7,500 MW wind and hybrid power generation by 2024-25. Currently, 10,000 MW solar and wind power projects have been installed and 27,000 MW capacity plants are being installed. The state has the capacity to produce 270,000 MW of solar and wind energy. The Rajasthan Investment Promotion Scheme 2019, Solar Energy Policy 2019, and Wind and Hybrid Energy Policy 2019 are expected to attract investment.

Madhya Pradesh has identified land for developing 5,000 MW solar parks in Sagar, Morena, Damoh and Ratlam districts. The land has been identified for developing 5,000 MW solar parks in Morena, Sagar, Damoh and Ratlam districts. Renewable energy accounts for 20 percent of the state’s total power generation and it will be expanded continuously. Mizoram earned a place on India’s solar power map with the commissioning of a two MW capacity solar power plant built at the cost of ₹140 mn, at Tlungvel in Aizawl district. With the commissioning of the 2 MW solar power plants, Mizoram has made its entry onto the solar map of the country. The state government-funded solar plant solar plant, construction of which was started in August 2018, is spread over five acres of land and has 5,340 solar modules. The plant is expected to generate 3 million kWh annually. Power Department said that a 20 MW solar power plant is currently under construction at Vankal in Khawzawl district in southern Mizoram.

The Greater Visakhapatnam Municipal Corp (GVMC) will install a smart solar flower at VMRDA Park (popularly known as Vuda Park) with around ₹4 mn as part of on-going renovation works. The smart solar flower, which works on a mechanism similar to a sunflower, is a ground-mounted solar system that follows the sun all day. The Maha Vikas Aghadi government has come out with a renewable energy policy that has set a target of adding 17,385 MW renewable energy capacity by 2025. An investment of ₹750 bn is expected in this sector in the coming five years. Other than this, a lot of solar energy will be generated in off-grid mode especially by installing 100,000 solar farm pumps every year. The current installed capacity is 9,305 MW and work on projects having 2,123 MW capacity is in progress. The policy also aims to meet Maharashtra Electricity Regulatory Commission’s targets for renewable energy, which MSEDCL has consistently failed to meet. The mammoth share of the total target belongs to solar — 12,930 MW. Other sources include: wind — 2,500 MW, bagasse and agricultural waste — 1,350 MW, small hydroelectric — 380 MW, municipal solid waste — 200 MW and new technologies — 25 MW. Increase in solar capacity through various routes has been stated in the policy. 10,000 MW solar capacity will be added by setting up plants with minimum 1 MW capacity. Private players will be selected through competitive bidding.

SunSource Energy, a Noida-based distributed solar energy firm, will be developing a 4 MW grid-connected floating solar photovoltaic power project, along with 2 MW battery storage system in Andaman and Nicobar Islands. Once commissioned, it would be one of India’s largest floating plus storage projects in Andaman and would offset about 8,112 tonnes of CO2 annually by reducing the region’s reliance on diesel for electricity. The project will be situated at the reservoir of Kalpong river, Kalpong Hydroelectric Project Dam, Diglipur in North Andaman. The company would sign a power purchase agreement for a 25-years period with the Electricity Department of the Andaman and Nicobar administration. Solar solution provider and park developer Rays Experts announced that it has commissioned solar projects of around 700 MW capacity across the country. These projects include a 440 MW solar plant inside the park, 210 MW solar plant outside the park, 49 MW rooftop installations for commercial/industrial sites, and 4 MW units across 8,400 homes. These projects include ground-mounted solar panels for 230 clients – including Delhi Metro, NDMC, airports, IITs and NITs, defence establishments, industries, and major hotel chains alongside others, the statement said. Rays Experts aims at venturing deeper into the commercial space and achieve a y-o-y growth of 20 percent by completing three more solar parks over the next financial year. Since India is estimated to have over 10 GW additional solar plants within the next two years, Rays Experts has its sights set on institutional projects and becoming a leader in residential rooftop installations by powering 330 mn homes across the country.

The MNRE has sought comments and feedback on its concept note for development of wind and wind-solar hybrid parks in the country. The concept note aims to address a key issue faced by renewable energy projects, in particular wind energy projects, in recent months. The solar power project is commissioned on contiguous land, while the wind power project requires scattered land on footprint basis which not only increases the transmission cost but also increases the possibility of land-related issues. If the site is found to be suitable, the park developer may consider developing a wind-solar hybrid park. The identified sites would be circulated to concerned state governments for their approval. The State government would designate park developer who would undertake the development of park including DPR preparation, land, transmission infrastructure, etc. Sites have been identified across seven states — Tamil Nadu, Andhra Pradesh, Karnataka, Telangana, Gujarat, Rajasthan and Madhya Pradesh — and the Concept Note has identified potential to install projects for a capacity of 53,495 MW (5 MW per square km). The capacity of each park should be 500 MW and more. However, parks of lower capacity may also be developed depending upon the availability of land and resource. In any case, the capacity of each park shall not be less than 50 MW. Park developers may also be allowed to pool small investor into the single park. MNRE will provide financial assistance of ₹2.5 mn per park to the developer for DPR preparation and ₹3 mn per MW or 30 percent of the park development cost to park developer, whichever is lower.

India’s largest hybrid renewable energy park having 30 GW capacity is to be set up at Vighakot village in the district of Kutch in Gujarat. According to the government the plant would provide employment to about 100,000 individuals and power produced from it would curb 50 mn tonne of CO2 emissions every year, which is equal to planting 9 mn trees. Setting up of wind turbines along the border region would strengthen and improve India’s border security as well. The park will have a hybrid park zone for wind and solar energy storage, as well as an exclusive zone for wind park activities.

India’s ambitious renewable energy targets will come with their own challenges such as solar waste, and will need a policy framework to guide the industry. Currently, India does not yet have any policy on how to discard solar waste such as PV modules. Industry estimates say that the average lifespan of a solar panel is roughly around 20 years.

Solar power tariff dropped to an all-time low of ₹2/kWh in an auction conducted by the SECI. Under the SECI auction concluded, Saudi Arabian firm Aljoemaih Energy and Water Co and Sembcorp Energy India arm Green Infra Wind Energy Ltd emerged as the lowest bidders by quoting a tariff of ₹2/kWh for 200MW and 400 MW capacities. NTPC Ltd quoted a price of ₹2.01/kWh for 600 MW capacity. In July this year, solar power tariffs had dropped to a low of ₹2.36/kWh in an auction of 2 GW capacities by SECI.

The Government’s plan to set up 5,000 compressed bio-gas plants by 2023-24 would give a boost to the country’s bamboo production and promote the industry as the commodity can be used to produce the gas, according to India Bamboo Forum. The process of generating CBG from biomass like bamboo and any agriculture waste is a two-step procedure wherein the waste is treated with a special bacterial solution, which generates a gas, which is then cleaned and compressed for use as fuel in vehicles.

JBM Renewables, a firm of JBM Group, said it has inked an MoU with the MoPNG for setting up 500 CBG projects across India. JBM Renewables has been shortlisted and is among the four companies that have been identified by the government for the biogas programme. It will work jointly with MoPNG on the SATAT programme. The ministry will offer its guidance, support, and facilitation in conceptualizing, establishing and functioning of the plants. The scheme envisages setting up 5,000 CBG plants by FY24 and the benefits from it will go to farmers, rural areas and tribals. JBM Renewables will get into multiple strategic partnerships to cater to the specific requirements of different regions where these projects shall be commissioned.

The government has received expressions of interest to set up manufacturing capacity of nearly 35,000 MW of solar equipment. If the bids materialise, they would result in the first large-scale plan to set up the manufacturing of ingots and wafers in the country. As per industry estimates, India currently has a manufacturing capacity of 3,000 MW for cells and 10,000 MW for modules.

Oil, gas and coal production must fall 6 percent a year in order to limit catastrophic global warming, the UN warned, even as high-polluting nations bank on fossil fuels to drive their Covid-19 recoveries. The UN’s annual Production Gap assessment measures the difference between the Paris Agreement climate goals and nations’ planned production of fossil fuels. But the report authors stressed that emissions need lowering immediately, and that the Covid-19 pandemic offered governments a golden opportunity to rebuild their economies without relying on polluting fuels.

China’s finance ministry has set the country’s renewable power subsidy for 2021 at 5.95 bn yuan ($905.7 mn), up 4.9 percent from this year, thanks to a big increase in the allocation to solar projects. The subsidy will go to wind farms, biomass power generators and distributed solar power operators, as well as solar power projects for poverty alleviation purposes, in 14 Chinese regions, according to the ministry’s Central Budget and Final Accounts Public Platform. China, the world’s biggest energy consumer, aims to peak carbon dioxide emissions by 2030 and achieve carbon-neutrality before 2060. It had slashed the subsidy in 2020 from the previous year by around 30 percent as it aimed to stop funding large producers of electricity from renewable sources to make them compete with coal-fired utilities and achieve grid-price parity. China has brought about 40 GW of new solar power into operation in 2020, taking its total installed solar capacity to 240 GW. China’s total solar capacity had increased more than fivefold since 2015 and could double in the next five years according to the China Photovoltaic Industry Association. Solar capacity growth has slipped back since hitting a record 53 GW in 2017, with the state grappling with a subsidy payment backlog in excess of 200 bn yuan ($30.55 bn) as well as grid access problems for many projects. Solar accounted for about 10 percent of China’s total generation capacity at the end of 2019. But it is now embarking on an accelerated clean energy transition as it bids to become “carbon-neutral” by 2060, and construction is expected to hit new highs in coming years.

China successfully powered up its “artificial sun” nuclear fusion reactor for the first time, marking a great advance in the country’s nuclear power research capabilities. The HL-2M Tokamak reactor is China’s largest and most advanced nuclear fusion experimental research device, and scientists hope that the device can potentially unlock a powerful clean energy source. Located in south-western Sichuan province and completed late last year, the reactor is often called an “artificial sun” on account of the enormous heat and power it produces. Chinese scientists have been working on developing smaller versions of the nuclear fusion reactor since 2006. They plan to use the device in collaboration with scientists working on the International Thermonuclear Experimental Reactor — the world’s largest nuclear fusion research project based in France, which is expected to be completed in 2025.

Japan plans to install as much as 45 GW of offshore wind power by 2040. The plans, if followed through on, would make Japan a global leader in offshore wind. They create targets for offshore wind capacity over the next two decades, which could spur more investment in the sector. The government passed legislation in 2018 designed to promote offshore wind development, but no major projects have been approved since then and some industry participants say that the rules for investment and regulations are too complicated. The government is now targeting 10 GW of offshore wind capacity by 2030 and between 35 GW and 45 GW by 2040. Japan, the world’s fifth-biggest greenhouse gas emitter, would aim for carbon-neutrality by 2050, in a major shift in position.

German utility Uniper is planning to develop 4 GW of solar and wind power projects beyond 2025. This includes the group’s business in Russia, where the company so far only operates fossil-fuel based power stations.

Pakistan has started loading fuel to its Chinese-assisted 1,100 MW nuclear power plant in Karachi for testing in run-up to its commercial operations in April 2021. The fuel loading for the newly built Karachi Nuclear Power Plant Unit-2 (K-2) began after obtaining fuel load permit from the Pakistan Nuclear Regulatory Authority. K-2 is a pressurised water reactor based on the Chinese HPR-1000 technology and a third-generation plant equipped with advanced safety features. K-2 is one of the two 1,100 MW nuclear power plants being constructed in Karachi. The other plant, K-3, is expected to become operational by the end of 2021. The completion of these nuclear power plants has remained largely on schedule despite the Covid-19 outbreak. The United Arab Emirates’ Barakah Nuclear Energy Plant has reached 100 percent of the reactor power capacity for Unit 1 of the facility during testing according to the Emirates Nuclear Energy Corp. The plant in the Al Dhafrah Region of Abu Dhabi, capital of the UAE, is the first nuclear power plant in the Arab world and part of the Gulf oil producer’s efforts to diversify its energy mix. Commercial operations are expected to begin in early 2021. When completed Barakah, which is being built by Korea Electric Power Corp, will have four reactors with 5,600 MW of total capacity. Construction of Unit 3 is 93 percent complete and Unit 4 is 87 percent complete. Unit 2 is complete and is awaiting licensing.

The ADB approved a $600 mn loan for Indonesian state utility Perusahaan Listrikk Negara (PLN) to expand electricity access and promote renewable energy. The loan is part of the second phase of an electricity grid development programme covering the outer regions of Kalimantan, Maluku, and Papua in the east of the country, which began in 2017. Indonesia’s government aims to have 23 percent of energy coming from renewable sources by 2025, up from around 9 percent in July, but progress on renewable projects has been slow. The country has over 400 GW potential capacity for sources like hydropower, solar and geothermal, but only around 2.5 percent had been utilised. It hopes to simplify pricing for electricity from renewables to encourage more investment in the sector.

President-elect Joe Biden’s promise to end US fossil fuel subsidies worth billions of dollars a year for drillers and miners could be hard to keep due to resistance from lawmakers in a narrowly divided Congress, including from within his own party. The challenge reflects just one of the obstacles that Biden will need to overcome as he seeks to usher in sweeping measures to combat climate change and transform the nation’s economy to net-zero emissions within three decades. Biden has said axing fossil fuel subsidies will generate money to help pay for his broader $2 tn climate plan. While Biden can take executive action to reverse President Donald Trump’s rollbacks of rules meant to reduce greenhouse gas emissions, reforming tax breaks that allow companies to produce oil, gas and coal more cheaply will require Congress to pass legislation. Obama also wanted to ditch tax breaks for fossil fuels to send a signal to the world that the US was serious about speeding a transition away from fossil fuels to tackle climate change.

US solar installations are expected to soar 43 percent this year, just shy of a pre-pandemic forecast, as the industry has recovered more quickly than expected from a virus-related slowdown. The improved outlook reflects robust demand from utilities seeking to meet carbon-reduction goals and a rebound in demand for home solar systems, thanks in part to declining costs for the technology. The sector is now expected to install more than 19 GW of solar this year, enough to power more than 3.6 mn homes. Last year it installed 13.3 GW of capacity. Solar energy also accounted for 43 percent of new US power capacity additions through the third quarter, compared with less than a third for wind and natural gas. The initial forecast for 2020 solar growth was of 47 percent, but that outlook slid to 33 percent as the coronavirus spread throughout the US in the spring. The solar industry has been growing rapidly in recent years thanks to declines in the cost of the technology that enable it to compete with power generated by coal and gas.

British power producer Drax plans to develop its biomass business using proceeds from the sale of its gas assets that could raise up to 193.3 mn pounds ($258 mn). Drax agreed to sell four combined cycle gas turbines — namely Damhead Creek (812 MW), Rye House (715 MW), Shoreham (420 MW) and Blackburn Mill (60 MW) — to VPI Holding for 164.3 mn pounds. Drax said it expected to use the proceeds to boost its production of biomass to use in generation to 5 MT a year by 2027 from a current target of 2 MT. It would cost 600 mn pounds to achieve the 5 mt target. The shift to more flexible and renewable generation aimed to cut the firm’s CO2 emissions so that by 2030 the firm was carbon negative, meaning it was capturing more than it produced. The British government will double the capacity of renewable energy projects eligible for support in its next round of subsidy auctions. Under the so-called Contracts-for-Difference (CfD) scheme, qualifying projects are guaranteed a minimum price at which they can sell electricity, and renewable power generators bid for CfD contracts in a round of auctions. The next allocation round for renewable energy technologies such as offshore wind will open late next year. It will increase the capacity of renewable energy from the 5.8 GW achieved in the last allocation round to up to 12 GW, which could be enough to power 20 mn electric cars on Britain’s roads in a year.

British utility SSE and Norwegian oil company Equinor have agreed to invest 6 bn pounds ($8.03 bn) to construct the first two phases of the Dogger Bank offshore wind power project. The project will become the world’s largest offshore wind farm, helping both companies to achieve their climate targets. The construction of 2.4 GW of capacity in the British part of the North Sea will be financed by a group of 29 banks and three credit export agencies. The first phase, of 1.2 GW, is expected to start operations in 2023, with the second following about a year later. Each phase will generate around 6 TWh of electricity annually. A third phase is planned for completion by 2026, by which time Dogger Bank would produce enough electricity to supply 5 percent of British demand, equivalent to powering 6 mn British homes each year. The British government, which plans to quadruple current offshore wind capacity to 40 GW by 2030, announced it would double the capacity of renewable energy projects eligible for support in its next round of subsidy auctions. Equinor said it aims to become a net zero emitter of greenhouse gases by 2050. It has invested in offshore wind in Europe and North America in recent years. Oil major BP has expanded a renewable energy supply deal with Amazon.com Inc to power the US e-commerce giant’s operations and Amazon Web Services in Europe. BP would supply Amazon with an additional 404 MW of wind power in Europe, starting in 2022, with more than half of that sourced from a new wind project in Sweden and the rest from two new wind projects in Scotland. The deal was a key part of its strategy to transform into an integrated energy company.

Germany’s government lifted a charge levied on power prices to support renewable energy for producers of so-called green hydrogen, part of a bid to encourage the nascent technology for low-carbon fuels. The Berlin cabinet decided to waive the renewable energy fee under the EEG feed-in tariff law for electricity derived from wind and solar sources following an economy ministry initiative. Green hydrogen, which is produced via electrolysis while conventional hydrogen is produced using fossil fuels, is meant to help decarbonise energy used in industry, transport and for heating buildings. The EEG surcharge was introduced to support the expansion of carbon-free green power from wind and solar plants. The government capped it to help household customers for whom it makes up a fifth of their power bills, and because renewable production costs have fallen steeply. Poland sees the total costs of building six nuclear reactors of 6-9 GW capacity over 20 years at around $30 bn. Poland generates most of its electricity from burning coal and sees nuclear energy as a way to help it reduce emissions as required by the European Union. The country wants to build 6-9 GW of nuclear energy capacity and plans to build its first nuclear power plant by 2033, but has not yet worked out a financing scheme. In October Warsaw and Washington struck a nuclear power agreement which says that over the next 18 months, the US and Poland will work on a report for the programme that seeks to build six reactors, as well as potential financing arrangements.

RE: renewable energy, PM-KUSUM: Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan, SECI: Solar Energy Corp of India, FY24: financial year 2023-24, MoU: Memorandum of Understanding, TWh: terawatt hour, CIL: Coal India Ltd, UP: Uttar Pradesh, mn: million, bn: billion, tn: trillion, MSEDCL: Maharashtra State Electricity Distribution Company Ltd, y-o-y: year-on-year, km: kilometre, MNRE: Ministry of New and Renewable Energy, CBG: compressed biogas, MoPNG: Ministry of Petroleum and Natural Gas, SATAT: Sustainable Alternative Towards Affordable Transportation, UN: United Nations, US: United States, UK: United Kingdom

22 December: India’s crude oil production fell by 5 percent in November primarily due to a sharp drop in output at Rajasthan oilfields operated by private sector Cairn Vedanta, government data showed. India is dependent on imports for 85 percent of its needs and the government is pushing domestic explorers to raise output to help cut down imports. Crude oil production in November at 2.48 million tonnes (mt) was lower than 2.61 mt produced in the same month a year back. Rajasthan fields produced 9.6 percent less crude oil at 476,990 tonnes as Mangala, Aishwarya and other fields in the Cairn block flowed less oil for a variety of reasons, according to data released by the Ministry of Petroleum and Natural Gas. Oil and Natural Gas Corp (ONGC) produced 1.5 percent less oil largely due to lesser than the anticipated output at newer fields. Oil India Ltd produced 6.6 percent less oil from Assam due to protests/agitation in the state following the Baghjan blowout. During April-November, India’s oil production was 6 percent lower at 20.42 million tonnes (mt). The output from Rajasthan during this period dropped 16 percent to 3.91 mt.

Source: The Economic Times

20 December: West Bengal found a place in the oil map of India as Union Oil Minister Dharmendra Pradhan dedicated an oil and gas producing field in North 24 Parganas district to the nation. He said production from the petroleum reserve, about 47 km from Kolkata, has started with the extracted oil being sent to Haldia refinery of Indian Oil Corp (IOC). PSU major ONGC (Oil and Natural Gas Corp) had spent ₹33.81 bn for discovery of the Ashoknagar oilfield, he said, adding that two more wells will be explored by the company under Open Acreage Licensing Policy (OLAP). The Minister said crude oil discovered at the Ashoknagar reserve is of high quality. He said commercial production from the oilfield will increase West Bengal’s revenue and create job opportunities in the state.

Source: The Economic Times

17 December: India’s petrol consumption spiked 9.5 percent in the first fortnight of December from a year ago but diesel demand still ran 5 percent short of the pre-pandemic days, indicating the economy is yet to come out of the woods. Data shows diesel sales of public sector retailers, who command about 90 percent of the market, rose 1.6 percent in the first fortnight of December from the same period of November. Diesel consumption, one of the barometers of economic activity, had fallen 7 percent from the year-ago period in November after shooting past the prepandemic level for the first time in eight months in October, clocking a 6 percent year-on-year growth. In contrast, petrol demand jumped more than 9.5 percent over the year-ago period on the back of a 4 percent increase in passenger car sales in November.

Source: The Economic Times

16 December: Rajasthan Chief Minister (CM) Ashok Gehlot said rising prices of domestic cooking gas cylinder will only add to the financial woes of people and that the increase in rate shows the government’s “insensitivity” towards them. Cooking gas or LPG (liquefied petroleum gas) price was increased by ₹50 per cylinder, the second hike in rate this month following firming of international prices. This is the second increase in rate this month. On 1 December, price was hiked by a similar ₹50 per cylinder.

Source: The Economic Times

22 December: A blast at a gas pipeline in Gujarat killed one person and injured two others early, authorities said. Local company Sabarmati Gas, partly-owned by Bharat Petroleum Corp Ltd (BPCL), said it was not involved. The massive explosion destroyed two houses in a residential area near ONGC (Oil and Natural Gas Corp)’s Kalol field in Gandhinagar district, trapping people under the debris.

Source: The Economic Times

20 December: Guwahati, Northeast India’s financial capital, is slated to get piped gas supply by next year. Rupam Goswami,Chairman of Duliajan Numaligarh pipeline Ltd (DNPL), said that the work to bring the gas line from Numaligarh in Upper Assam to Nagaon, is on. A consortium of three Public sector units, Assam Gas Company Ltd (AGCL), Oil India Ltd (OIL) and GAIL Gas Ltd, has incorporated a new company for implementation of the City Gas Distribution (CGD) Networks. AGCL is also willing to provide piped gas in seven other districts, and has participated in the expression of interest. The National Gas Grid Pipeline (Urja Ganga Project) which was originally planned for extension from Jagadishpur in Western Uttar Pradesh, to Haldia in West Bengal, was consented to be extended to Guwahati in Assam, by the Government of India through an intermediate spur line from Barauni in Bihar to Guwahati and the Gas Pipeline construction work is being carried out by GAIL (India) Ltd. Swargiyari said that the Barauni to Guwahati section of the Nation Gas Grid is likely to be completed by next year. Thereafter, eight states of the North East will be connected by Indradhanush Gas Grid Ltd. to the National Gas Grid.

Source: The Economic Times

18 December: Reliance Industries Ltd (RIL) and BP Plc have started production from the R-cluster, ultra-deep-water gas field in block KG D6 off the east coast of India. RIL and BP are developing three deepwater gas projects in block KG D6 – R-cluster, Satellites cluster and MJ – which together are expected to meet around 15 percent of India’s gas demand by 2023. The commissioning of the R-Cluster is the first of three deepwater projects. It is expected to reach plateau gas production of about 12.9 million standard cubic meters per day in 2021. These projects will use the existing hub infrastructure in KG D6 block. RIL is the operator of KG D6 with a 66.67 percent participating interest and BP holds a 33.33 percent participating interest.

Source: The Economic Times

22 December: Coal India Ltd (CIL) allocated 25.78 million tonnes (mt) of coal in the first eight months of this fiscal under spot e-auction scheme, registering a year-on-year increase of 59.4 percent. CIL had allocated 16.17 mt of coal in the April-November period of the previous fiscal, according to government data. Fuel allocation by CIL under the scheme also increased to 4.09 mt in November, from over 3.58 mt in the corresponding month of 2019. Coal distribution through e-auction was introduced to provide access to coal for such buyers who are not able to source the dry fuel through the available institutional mechanism, according to CIL. The purpose of e-auction is to provide equal opportunity to all intending buyers for purchasing coal through single window service. CIL accounts for over 80 percent of domestic coal output. CIL has revised its production target to 650-660 mt for the current fiscal in the wake of the disruptions caused by the Covid-19 pandemic.

Source: The Economic Times

18 December: Coal India Ltd (CIL) is aiming at substituting imported dry fuel of 80-85 million tonnes (mt) with more domestic supplies in the current fiscal. The miner has asked power plants in the coastal areas to submit proposals for a gradual increase of its supplies to these units to reduce foreign exchange outgo, CIL said. The government is likely to consider proposals to offer concessions on various counts such as quality and freight to make domestic coal attractive over the imported fuel. Duties, royalty and cess account for around 62 percent of domestic coal price, for which, imports get a comparative advantage.

Source: The Economic Times

17 December: Amid reports of poor progress in the development of coal blocks, allotted to various entities long ago, the Centre has engaged a consultant to assist them to overcome challenges and make the mines productive. The government intends to conduct the next round of coal block auctions in January. Mining companies often complain about delays in getting environmental and other regulatory clearances. The government is also taking strict actions against entities for the slow progress of coal block development. Coal will remain the main source of energy for the next 30-35 years.

Source: The Economic Times

21 December: The government has promulgated rules for rights of electricity consumers which provide for penalties upto ₹1 lakh on distribution companies for gratuitous load shedding and delay in grant of new connection or addressing a faulty meter. Power Minister R K Singh said that these rules shall empower the consumers of electricity. Distribution Companies across the country are monopolies – whether government or private – and the consumer has no alternative, Singh said. The key areas are covered in the Electricity (Rights of consumers) Rules are release of new connection and modification in existing connection, metering arrangement, billing and payment, disconnection and reconnection, reliability of supply and compensation mechanism.

Source: The Economic Times

20 December: India’s power consumption grew 4.8 percent to 50.36 bn units in the first half of December this year, showing consistency in economic activities, as per government data. Power consumption was recorded at 48.04 bn units during December 1-15 last year, according to the power ministry data. For the full month of December 2019, power consumption was 101.08 bn units. Therefore, the extrapolation of half-month data clearly indicates that power consumption is likely to record a year-on-year growth for the fourth month in a row, according to experts. After a gap of six months, power consumption recorded a year-on-year growth of 4.4 percent in September and 11.6 percent in October. In November, the power consumption growth slowed to 3.7 percent to 97.43 bn units compared to 93.94 bn units in the same month last year mainly due to early onset of winters. The growth in power consumption in the first half of this month shows that there is consistency in improvement in commercial and industrial demand due to easing of lockdown restrictions, experts said. The government had imposed a nationwide lockdown on March 25 to contain the spread of Covid-19. Power consumption started declining from March due to fewer economic activities in the country.

Source: The Economic Times

18 December: Direct tariff electricity subsidies from the state governments have increased 32 percent since FY16, amounting to ₹1,103.91 bn ($14.96 bn) in FY 2019, an independent report by the Council on Energy, Environment and Water (CEEW) and the International Institute for Sustainable Development (IISD) said. The report estimates that “cross-subsidies” — high tariffs for some consumers to cover below-cost tariffs for other consumers — were worth at least another ₹750.27 bn ($10.2 bn) in FY 2019, bringing the national total to at least ₹1,854.18 bn ($25.2 bn). According to the CEEW-IISD study, 25 out of 31 states and union territories (UTs) have failed to meet the requirements of the Ujjwal Discom Assurance Yojana (UDAY) scheme to reduce aggregate technical and commercial losses (AT&C) to 15 percent. Poor collection is typically the biggest contributor to these losses. The states that have met the UDAY targets on AT&C losses in FY19 include Delhi, Gujarat, Kerala, Maharashtra, Punjab, and Himachal Pradesh. Further, Jammu and Kashmir and Sikkim both stand out for a significant reduction in the power supply cost in FY2019.

Source: The Economic Times

16 December: The government approved ₹67 bn scheme for power system improvement in North East Region. The move aims at economic development of North Eastern Region through strengthening of intra – state transmission and distribution systems. The Cabinet Committee on Economic Affairs chaired by Prime Minister Narendra Modi has approved the revised cost estimate of the scheme. The scheme is being implemented through Power Grid Corp in association with six beneficiary North Eastern states namely, Assam, Manipur, Meghalaya, Mizoram, Nagaland, and Tripura and is targeted to be commissioned by December 2021. After commissioning, the project will be owned and maintained by the respective North Eastern state utilities. Implementation of this scheme will create reliable power grid and improve north eastern states’ connectivity to the upcoming load centers, and extend the benefits of the grid connected power to all categories of consumers beneficiaries in the region. The scheme was initially approved in December 2014 as a central sector plan scheme and is being funded with the assistance of World Bank fund and through the budget support of Ministry of Power on 50:50 basis.

Source: The Economic Times

22 December: Industry body CII has urged the Ministry of Finance in its memorandum submitted to impose the basic custom duty (BCD) on solar equipment as announced in the last general budget, stressing that the delay in implementation is impacting investments. Power Minister R K Singh had talked about imposing BCD on solar equipment. About the enforcement of must run status of renewable energy (RE) plants, it said that the issue of artificial curtailment has been a cause of concern for renewable energy generators especially in renewable energy rich states. The CII believes that this concept can open alternate mechanism to complement the existing secured fixed-term, fixed-tariff market and can further boost the trajectory for meeting the RE targets, it said.

Source: The Economic Times

22 December: The Udham Singh Nagar district administration is all set to implement the integrated solar-based micro irrigation scheme across the district. Introducing the scheme, the chief development officer of the district, Himanshu Khurana, said that in the first phase, 13 such units will be introduced and in the next financial year, when budget from the Government of India is released, the scheme will be further expanded. Khurana said that the administration will conduct drives to encourage farmers of the district for community irrigation, adding that the district administration would make available infrastructure in those areas which switch over to solar water pumps.

Source: The Economic Times

21 December: Indian Railways’ energy management arm is planning to rework its mega-tender for setting up 3 GW solar power project on vacant railway land following tepid response from developers. Railway Energy Management Company Ltd, a joint venture of Indian Railways and RITES, floated the tenders in three packages of 1,600 MW and 1,007 MW on BOO (build-own-operate) basis and a tranche of 400 MW on EPC (engineering, procurement construction) mode. Among major developers, the Tata group is reported to have bid for about 300 MW in the first package in addition to several others but the financial bid is yet to be opened. The other two tenders have seen multiple extensions and the bid submission remains pending.

Source: The Economic Times

20 December: NTPC Ltd proposes to forge a joint venture (JV) with government’s strategic investment fund NIIF to set up an infrastructure investment trust (InvIT). The proposed InvIT will help NTPC to monetise some of its operational renewable energy projects. Funds raised from such exercise would be used by the power producer to invest in additional renewable capacity. As per initial plan, NTPC would put the entire 1 GW of operational renewable assets and the 2 GW of RE projects in the pipeline under the trust. This will help to raise capital for expansion of renewable capacity. InvIT route would be ideal to unlock the value of existing assets for making future investments in green projects. With a total installed capacity of 62,110 MW, NTPC Group has 70 power stations comprising 24 coal-based units, seven combined cycle gas/liquid fuel stations, one hydro, 13 renewables, along with 25 subsidiary and joint venture entities.

Source: The Economic Times

19 December: Maharashtra will generate 17,385 MW from solar projects in the next five years at much cheaper rates, benefiting industries and agriculture in the state, State Energy Minister Nitin Raut said. He said that recently, the Maha Vikas Aghadi government had launched a new Renewable Energy Policy (REP), which would attract investment of ₹750 bn in the power sector and other affiliated industries. As per the estimates, Maharashtra has a capacity to produce 25,000 MW from solar projects, but the energy department has framed the REP to produce 17,385 MW in the next five years, he said. He informed that grid connectivity will be a right of the producers and will be allowed open access for ten years. He said that the new REP aimed at providing day time power to agriculture pumps and 5 lakh solar agriculture pumps would be installed in the state in the next five years. About 10,000 households in remote areas would be given solar power.

Source: The Economic Times

18 December: Continuous decline in solar power tariffs since the start of the current financial year (FY20-21) has been driven by a mix of structural and state-specific factors with the former likely to sustain over medium-term, India Ratings and Research (Ind-Ra) has said. The tariffs declined to ₹2.36 per kilowatt hour (kWh) in June and July, and ₹2 in November. In the latest bidding as well, while the winning bids are at ₹2 per kilowatt hour (kWh), the highest bid was at ₹2.43 per kilowatt hour (kWh) which is lower than the earlier tariffs. The decline in tariffs is being driven by a lower capital cost per megawatt of around ₹40 mn per megawatt because of advancement in panel designs, enabling a higher capacity utilisation factor (CUF). Additionally, few state-specific factors impacting the tariffs in the latest round include an exemption of ₹20 mn per MW of cess that the state government of Rajasthan levies on project development. Given that the plant will be set up in Rajasthan with proven solar potential, the average CUF is expected to be higher at over 25 percent. The bidders in the latest rounds are also banking on the exemption from paying inter-state transmission system charges for the projects commissioned before June 2023, Ind-Ra said.

Source: The Economic Times

18 December: The Punjab cabinet gave in-principle approval to Indian Oil Corporation Ltd (IOCL) for setting up a compressed biogas (CBG) plant at the site of closed cooperative sugar mills at Rakhra in Patiala. The plant, to be developed in collaboration with Sugarfed, will help reduce stubble burning through use of paddy straw for biogas generation, and will also nurture soil fertility through organic manure production, according to the government. The decision was taken at a virtual meeting of the cabinet chaired by Chief Minister Amarinder Singh. The upcoming CBG plant, which will create direct and indirect employment opportunities, will have capacity of 30 tonnes CBG (compressed bio gas) production, with daily feedstock capacity of approximately 300 tonnes of paddy straw per day. It would also generate organic manure to the tune of about 75,000 tonnes per annum. Moreover, CBG being an environment-friendly fuel with the potential to reduce greenhouse gas emissions by 98 percent, the plant would help in minimising dependency on fossil fuels, and thus become a major contributor to promoting circular economy. The CBG plant would also be instrumental in reducing stubble burning in fields, thereby containing air pollution in Punjab. Apart from these, it would also provide additional income or revenue to the state government through tax on sale of CBG produced from the proposed plant.

Source: The Economic Times

17 December: Cities having religious significance, including Ayodhya, Mathura, Varanasi, Prayagraj and Gorakhpur, will have clean and green energy by 2024. Uttar Pradesh Energy Minister Shrikant Sharma has said that these cities would get around 670 MW solar energy from solar panels to be installed on rooftops of the houses. To meet the target, the Central and the state governments will be providing subsidies of ₹8.59 bn s and ₹4.73 bn respectively to the consumers. He said the power demand has reduced by 682 MW in the peak hours while the carbon emission has reduced by 2.76 million tonnes (mt).

Source: The Economic Times

22 December: Norway’s supreme court upheld government plans for Arctic oil exploration, dismissing a lawsuit by campaigners who said they violated people’s right to a healthy environment. While most of Norway’s oil output flows from south of the Arctic, the government believes the greatest untapped potential lies in the Barents Sea off Europe’s northernmost coast. Norway is western Europe’s largest oil and gas producer, with a daily output of around 4 mn barrels of oil equivalent. The plaintiffs said pumping more oil would lead to increased climate-warming carbon dioxide emissions and ultimately violate Norway’s constitution as well as its commitments under the Paris climate agreement and the European Convention on Human Rights. The majority concluded, however, that parliament and the government had broad authority to award new oil acreage. The Ministry of Energy and Petroleum has announced plans for another round of Arctic licensing awards, setting an application deadline for early next year.

Source: Reuters

21 December: Petrol stations across Sudan will rely exclusively on imported fuel while the country’s main oil refinery begins routine maintenance, the energy ministry said. Sudan has operated a two-tier price system since October, in an attempt to decrease reliance on subsidies, whereby imported gasoline and diesel is sold at more than double the price of locally-produced fuel. However, with the 70-day maintenance of the Khartoum refinery, only imported gasoline and diesel will be available to consumers. Any fuel produced locally during this period will be directed towards the agriculture, electricity, public transportation, and security sectors. Fuel shortages and long queues at stations are common in Sudan as the government struggles to come up with foreign currency for imports, which were opened up to the private sector in April.

Source: Reuters

20 December: Russia and Saudi Arabia plan to continue working on balancing out the global oil market, Russian Deputy Prime Minister (PM) Alexander Novak said. Novak said that the two countries were committed to the OPEC+ agreement curbing global oil output.

Source: The Economic Times

17 December: Asian refining profits for gasoil have hit 4-1/2-month highs on recovering demand led by China and India, though analysts warn that rising shipments from those and other exporters may curb further gains. Refining margins, also known as cracks, for the benchmark 10 ppm gasoil grade in Singapore have surged 42 percent in the last month, but remain 54 percent weaker than their historical average for this time of year, Refinitiv data showed. Revived transportation and industrial activity in China and India since September have helped boost gasoil market sentiment, curbing Indian fuel exports and tightening regional stocks. Diesel refining margins in Europe have edged higher lately and have held largely flat in the United States on increased seasonal freight deliveries. However, refiners are expected to boost fuel output heading into 2021, potentially pressuring margins and prices in all key markets. Fresh lockdowns in several European countries, as well as tightening restrictions in parts of the United States, are slowing the fuel demand recovery in those regions, which will be key to the global diesel balance in 2021. Diesel cracks in Europe firmed to around $5.50 a barrel on a rise in trading volumes and a smaller-than-expected rise in US fuel inventories.

Source: The Economic Times

16 December: Saudi Arabia announced a 990 bn riyal ($263.91 bn) budget for 2021, around 7 percent less than estimated spending for this year, as the world’s biggest oil exporter seeks to tame a huge deficit caused by lower petroleum revenues and the coronavirus crisis. The kingdom expects to post a deficit of 298 bn riyals this year, or 12 percent of gross domestic product (GDP), as crude revenues are slated to drop by over 30 percent, and 141 bn riyals or 4.9 percent of GDP next year, according to budget. It plans to nearly balance its budget by 2023. Brent crude oil prices have rebounded since plunging to a more than 20-year low in April, but at around $50 per barrel they are significantly below the $67.9 per barrel that Saudi Arabia would need to balance its budget next year, according to the International Monetary Fund.

Source: Reuters

22 December: Gazprom has lost a third of its Finnish gas market share after a new pipeline made it possible to import liquefied natural gas (LNG) via the Baltic States, data from Gazprom and Estonian gas grid operator Elering showed. The pipeline, called Balticconnector, which opened early this year, links Finland and Estonia and can also send gas to the Baltics. In the first nine months of 2020, a total of 5.8 terawatt hour (TWh) of gas was exported to Finland via the pipeline, data provided by Elering showed. Meanwhile, direct gas exports from Russia to Finland over same period dropped by 35 percent to 11.4 TWh, from 17.6 TWh over January-September in 2019, Gazprom’s quarterly data, published on its website, showed. Natural gas prices between Finland and the Baltic states of Estonia, Latvia and Lithuania vary due to their access to the global LNG market, ability to store gas in Latvia and different Russian gas supply contracts. Most of the gas came from the only large-scale LNG import terminal in the Baltic states, in Lithuania, with capacity of 39 TWh per year. Built to transport about 25 TWh of gas per year, Balticconnector has been limited to about 11 TWh per year due to delays upgrading compressor stations. Gazprom is also facing competition in other parts of Europe from LNG imports, including from the United States. The Baltic and Finnish gas markets will get connected to mainland Europe at end-2021 by a new pipeline linking Lithuanian and Polish gas grids, potentially bringing in more competition.

Source: Reuters

21 December: PetroChina,Asia’s largest producer of oil and gas, has struck a large natural gas discovery in northwest China’s Xinjiang region with an initial estimated reserve exceeding 100 billion cubic meters. PetroChina tapped 610,000 cubic meters of daily gas flow and 106.3 cubic meters of crude oil at exploration well Hu-1, located in an exploration zone totalling 15,000 square kilometres at the southern rim of the Junggar basin. Xinjiang is among the top areas for PetroChina’s domestic exploration and production spending as the state energy giant has vowed to spend 150 bn yuan ($22.90 bn) between 2018 and 2020 to boost total oil and gas output at the region to 1 mn barrels per day oil equivalent.

Source: Reuters

21 December: Australia’s coal producers may have to start cutting output if China maintains limits on imports from them, the Australian government said, forecasting a sharp fall in coal export revenue this year. China is the second-biggest buyer of Australia’s thermal coal burned in power plants and metallurgical coal used to make steel. But Australia’s coal exports have been hit by delays at Chinese ports and prices have fallen amid a growing row between the two countries, after Australia called for an enquiry into the origins of the novel coronavirus pandemic. Metallurgical coal export revenue is expected to slump 35 percent to A$22 bn ($17 bn) in the year to June 2021 from a year earlier, the Department of Industry said in its report. The forecast is A$1 bn lower than the previous outlook in September, as prices for Australia’s metallurgical coal fell in the December quarter. Volumes are expected to fall around 5 percent.

Source: Reuters

18 December: Global demand for coal is set to jump 2.6 percent next year after a record pandemic-led drop this year, as recovering economic activity will lift use for electricity and industrial output, the International Energy Agency (IEA) said. Demand for thermal and metallurgical coal should rise to 7,432 million tonnes (mt) in 2021, from 7,243 mt this year, the Paris-based agency said in its Coal 2020 report. Global coal demand fell by 5 percent this year as the impact of the pandemic curbed usage, IEA said. Between 2018 and 2020, global coal demand will have fallen by an unprecedented 7 percent, or 500 mt, the agency said, due to the pandemic and as countries around the world seek to shift to cleaner sources of energy. While even the United States and Europe could see their first increases in coal consumption in nearly a decade next year, demand in 2021 would still trail 2019 levels and the IEA expected coal use to flatten out by 2025 at around 7.4 billion tonnes. The IEA said it would need to review its 2025 coal demand forecast, once the Chinese government releases its economic plans for 2021-2025, due in March.

Source: Reuters

18 December: The US (United States) Energy Secretary Dan Brouillette signed an order prohibiting electric utilities that supply critical defence facilities from importing certain power system items from China, in an effort to protect US security from cyber and other attacks. The Department of Energy said in a release the order prohibits utilities that supply the defence facilities at a service voltage of 69 kilovolt (kV) or above from acquiring, importing, transferring, or installing bulk power system electric equipment. Bulk power equipment consists of items used in substations, control rooms, or power plants, including nuclear reactors, capacitors, transformers, large generators and backup generators and other equipment.

Source: Reuters

17 December: Consumers in Sweden and Finland may be able to look forward to lower household bills after the Swedish power grid operator said it expects spot power prices to fall over the next five years. But in Norway, wholesale spot power prices, a key ingredient in end-user prices together with taxes and levies, could rise, grid operator Svenska Kraftnat predicted. Svenska Kraftnat predicts Finnish spot prices will fall by €5 to €34 per megawatt hour (MWh) over 2021-2025. This is due to a planned startup of the 1,600 MW Olkiluoto-3 nuclear reactor which will boost supply and reduce the need for imports from Sweden and other countries. Swedish power prices are also expected to fall by €2-3 to €29-34/MWh over the same period, pushed down by an increase in wind power supply, it said. Meanwhile, in Norway, power prices are expected to rise by €2 to €34 per MWh. This follows the start of exports via a new power cable to Germany, and plans for another link to Britain next year. In Denmark, the outlook for power prices is mixed, with western Denmark expected to see a rise by €3 to €37/MWh, while prices in eastern Denmark are seen falling by €1 to €34/MWh. Price volatility will increase, with prices of below €5/MWh and above €80/MWh occurring more often, the report said. This reflects a bigger share of intermittent power sources and a smaller share of output from producers that can plan production levels. Nordic countries are expected to remain net power exporters with annual supply rise of 40 terawatt hour (TWh) more than offsetting an expected demand increase by 32 TWh from 2021 to 446 TWh in 2025.

Source: Reuters

16 December: Poland plans to scrap the obligation for power groups to sell all the electricity they generate on a power exchange, arguing that this rule, in place since 2018, negatively affects the energy companies. Polish power groups, including the PGE, Enea, Energa and Tauron have been obliged to sell all their electricity via exchange since the end of 2018. The scheme was launched to prevent a surge in power prices and was seen as a key move for the development of Poland’s energy market.

Source: The Economic Times

18 December: The European Commission should simplify its proposed criteria for measuring the sustainability of hydropower projects to avoid harming the industry’s access to capital, the Norwegian government said. Hydropower is the backbone of the Norwegian energy system with an 87 percent share of domestic electricity consumption and although Norway is not a member of the European Union (EU), the bloc’s regulations impact its economy. In November, the Commission published a proposal for its financial taxonomy, a system of classifying activities that can be marketed as sustainable, and which acts as a powerful funding tool for achieving climate change objectives. Norway is worried that proposed screening criteria for hydropower, including detailed instructions on life-cycle CO2 (carbon dioxide) emissions as well as on the use of water and marine resources, could rob the industry of its green status, the finance ministry said. The criteria for hydropower were more comprehensive and detailed than for other renewable technologies such as wind and solar, the ministry said. The country’s flexible hydropower reserves also played an important role in balancing other renewable intermittent energy sources in European electricity markets, the ministry said. Norwegian industry lobby Energi Norge warned earlier in December that the current criteria could cut access to risk capital for future hydropower investments and risked higher costs of lending. Norway also requested clarification on criteria for hydrogen and carbon capture and storage, which it hopes will provide new business opportunities for its oil and gas industry.

Source: Reuters

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.