-

CENTRES

Progammes & Centres

Location

RE Policy and Market Trends

India has asked state lenders to provide over $1 bn to government power distribution companies to clear longstanding debts to green energy firms that could hinder further investment. The companies owe solar and wind power generators including Goldman Sachs-backed ReNew Power and Softbank-backed SB Energy over ₹97 bn ($1.35 bn), according to the CEA. Adding to the problems of the power generators, a new government in Andhra Pradesh state – which owes renewable energy firms more than any other state – wants to renegotiate its contracts, saying the prices it pays are inflated. Foreign investment is central to India’s green energy ambitions, and a slowdown in overseas funding could hurt India’s commitment to increase adoption of renewable energy. India is looking to install 175 GW in renewable energy capacity by 2022, solar and wind power. Japan’s SoftBank Group Corp has plans to invest up to $100 bn in solar power generation in India. Andhra Pradesh, which accounts for about a 10th of India’s renewable energy capacity, owes green energy generators ₹25.1 bn ($353 mn), over a fourth of all dues. Increasing its pressure further on renewable energy developers, the Andhra Pradesh government has amended its solar and wind power policies, effectively taking more control over setting tariffs from such power generation units. According to industry sources, the move would create further confusion in the investment environment in the renewable energy sector in the state. Deleting older provisions, the new order mandates that the transmission and distribution charges for wheeling power would be determined by the state power regulator. In its latest order, Andhra Pradesh energy department states that tariff from renewable energy-based electricity will not be more than the “difference between pooled variable cost and balancing cost”. Balancing cost refers to the expenses that power distribution companies incur in order to accommodate renewable energy in the system. Variable cost mainly includes the expenses on fuel and its transportation for power generation by conventional sources. Andhra Pradesh is among the largest adopters of renewable energy and ReNew Power, about 49 percent owned by Goldman Sachs, is India’s largest renewable energy company. But the state has been curtailing power procurement from renewable energy companies, citing high prices, and pushed to renegotiate its supply contracts with them. ReNew has an installed capacity of over 5 GW and plans to add another 3 GW by mid-2021. The government will not remove the wind and solar ‘tariff caps’ or the fixed highest ask price in the wind and solar capacity auctions of the Government of India, MNRE. SECI conducts capacity auctions on behalf of the government. The tariff caps for the latest auctions of wind and solar were ₹2.93 and ₹2.85 respectively. The existence of the tariff caps has been a sore point with the industry, which it finds unfair and unviable. In India, solar capacity auctions were always held on the basis of tariffs. The solar energy company (or, ‘developer’) who offered to sell at the least tariffs would get to sign a power purchase agreement for a specified capacity. Utilities used to procure wind power at fixed tariffs determined by the respective state electricity regulatory commission. However, the SECI options became a template for state governments to follow; they gave up fixed tariffs and began buying wind and solar power through auctions. In Gujarat’s auction of December 2017, tariffs fell to ₹2.43, the lowest ever. Ever since, renewable energy developers – wind companies in particular – have been clamouring for removal of caps, but the government has been unrelenting.

The MNRE has issued guidelines for setting up of 10 lakh grid-connected solar power pumps under the ambitious PM-KUSUM scheme. Under “Component C” of the scheme 10 lakh agriculture pumps of 7.5 HP capacity each are planned to be solarised by 2022. As per provisions of the scheme, initially one lakh grid-connected pumps are targeted to be solarised on pilot basis and further scale-up will be carried out after the evaluation of the pilot phase. The scheme aims at ensuring reliable day time power supply for irrigation, reducing subsidy burden on discoms and providing additional sources of income to the farmers. The scheme provides for support for individual farmers with grid-connected agriculture pumps. It will support setting up solar photovoltaic capacity up to two times the pump capacity in kW so that farmers can use the power to meet their irrigation needs and generate additional income by selling surplus solar power to discoms. The guidelines for the implementation of PM KUSUM Scheme were issued in July this year stating that central public sector undertakings and state implementation agencies will carry out the tendering process. The centre has already said it will provide CFA up to 30 percent of the cost of solarisation of the pump for solar PV components including solar modules, controllers or inverters, balance of system, installation & commissioning on the basis of benchmark cost or cost discovered through tender. The CFA will be provided for solarisation of pumps up to 7.5 HP and depending upon the tariff model adopted, discoms will purchase solar power from farmers at a rate decided by the respective state entities.

The MNRE is planning to review a programme that aims to set-up 5,000 MW of solar power generation capacity under the JNNSM. MNRE has invited bids from consultants for evaluation of the scheme under batch-IV of the phase-II of JNNSM. According to the document of the proposed study, proposals have been invited from the eligible parties within three weeks from the date of notification inviting bids i.e. by 20 November. The government has been implementing this scheme since February 2016 with the objective of implementation of at least 5,000 MW grid-connected solar projects with viability gap funding. The solar power procured from the projects is being sold to discoms and state utilities at a pre-defined tariff or tariff discovered through competitive e-bidding, with a trading margin of 7 paisa per kilowatt hour assigned by the SECI. The ministry said that the detailed study report on the evaluation of the scheme would be prepared by the bidder to determine the extent to which it has been implemented during the period between 2015-2016 and 2018-2019 by random sample selections of the solar projects out of the total projects commissioned under the scheme. The evaluation must be done by the bidders on the need for continuation of the scheme along with the period of further continuation. The CFA provided under the scheme for the solar projects also need to be reviewed and recommendations should be suggested in the same. According to the ministry, other areas of evaluation would include assessment of tariffs for solar projects under the scheme, constraints and roadblocks under the current model, especially, if it has to be extended to the northeast regions of the country, and ways to increase the involvement of state governments in the implementation of the scheme.

New solar installations in the country are coming down, as India added only 3.2 GW of solar power across the country in the first half of this year, down 35 percent year-on-year. As against this, about 5 GW of solar capacity was installed across the country including both large-scale and rooftop solar in the first half of 2018. Cumulative solar installations at the end of September 2019 reached 33.8 GW, representing 9.2 percent of the total power generation capacity in India, which comes around 366 GW. India’s target is to reach 100 GW capacity of solar installations by 2022. Of late, investor concerns on policies, falling tariffs, land issues and funding have resulted in no takers for new biddings for solar projects. Rooftop solar installations accounted for 17 percent of total solar installations in the first half, a decline of 45 percent compared to first half of the 2018. Cumulative rooftop installations totalled nearly 3,816 MW as of June. Although new solar installations were down, India was still third largest solar market in the world behind China and the United States, data from Mercom India Research, part of global clean energy communications and consulting firm Mercom Capital Group, said. The Mercom report said Adani is the largest project developer in terms of cumulative solar installations as of June 2019. Five companies, led by ACME Solar, had a cumulative project development pipeline of over 1.5 GW apiece at the end of June 2019. Installations in the Indian solar market rose by 36 percent y-o-y during Q3 of calendar year 2019, reaching 2,170 MW from 1,592 MW a year ago. Compared to the second quarter of 2019, installations are up by 44 percent. However, solar installations in the first nine months of 2019 reached 5.4 GW, down 19 percent from 6.7 GW of capacity added in the first nine months of 2018, according to Mercom India Research. Total power capacity addition during nine months of 2019 was 13 GW from all power generation sources. Of this, renewable energy sources accounted for nearly 56 percent of installations, with solar representing 41.4 percent of new capacity and wind with 13.6 percent. Tamil Nadu was the top state for large-scale solar installations in Q3 2019, followed by Rajasthan and Karnataka. Large-scale solar installations were mostly concentrated in five states, which made up 96 percent of installed capacity in the quarter. Gujarat government has set a target of 30,000 MW of renewable energy generation by 2022 from the current 9,670 MW. At present, the state has a total of 9,670 MW production of renewable energy which includes 6,880 MW wind energy and 2,654 MW solar energy. Gujarat has overtaken Maharashtra as its contribution in the country in industrial production increases 16.81 percent compared to 14.21 percent of latter.

Solar Projects

CIL has invited bids from developers for setting up a 100 MW solar power plant in Solar Power Developer and Operator mode in Chhattisgarh. It will cater to the green energy requirement of CIL subsidiary of South Eastern Coalfields which consumes around 850 million units of power annually. CIL’s total annual Power requirement for coal production is around 4.5 billion units which would require setting up 3000 MW of solar power projects. In order to achieve its goal, the company has formed a joint venture with NLC India, formerly Neyveli Lignite Corp, to jointly set up 5000 MW of power generation capacity of which 3000 MW would be solar powered while the rest 2000 MW would be coal-fuelled. The tender of the first solar power plant to be set up in the Gurugram has been released. With the initial capacity of 30 MW, HPGCL plans to generate a total of 90 MW of solar power in near future. The first plant will come up in Sainik Colony of Sector 49 here with an installed capacity of 30 MW and the construction work is expected to start within the designated period after the opening of the bid on 28 November. Notably, the HPGCL had to close a 210 MW coal power station located at Bata Chowk several years ago as it had completed its life and had been a cause of air pollution. Haryana has now set a target of 3,200 MW of solar power to be generated by 2021-22. The current installed and commissioned solar capacity in the state is 73.27 MW. Under the Mukhyamantri Solar Power Yojana, Delhi government’s flagship scheme launched in 2018, 146 MW solar capacity has been achieved in 2,900-odd installations that has helped reduce 500 tonnes CO2-eq emissions daily. Last year, 25 percent of the societies in Dwarka availed the scheme. It also explained that if any society wanted to install solar panels, Delhi government provided subsidy worth 30 percent of the cost of the plant. BRPL, one of the power discoms of Delhi, will launch a blockchain-based platform on a trial basis for consumer-to-consumer (or peer-to-peer) solar power trading. The method can be used by consumers with rooftop solar power infrastructure to further monetise their investment. Consumers with this infrastructure can sell their excess solar energy to their neighbours even if they do not have rooftop solar power, BSES said. BRPL has partnered with Australia’s Power Ledger, a global player in the blockchain technology, to launch the consumer-to-consumer solar power trading on a trial basis. The UP government has introduced the blockchain technology to the rooftop solar power segment, allowing consumers to trade their surplus solar energy. Two state power utilities —UPPCL and UPNEDA — have launched the ambitious project as a pilot in select government buildings in Lucknow with installed rooftop solar power plants. According to state energy watchdog UP Electricity Regulatory Commission, Phase-I of the pilot project is expected to be completed in six months. The pilot project drafted by UPPCL and UPNEDA will demonstrate the technical feasibility of peer-to-peer energy trade between rooftop solar PV ‘prosumers’ using the modern blockchain technology. Power consumers who also produce electricity through rooftop solar PV system are referred to as ‘prosumers’.

The government is planning to set up 14 MW solar power projects in Leh and Kargil. The government has set an installation target of 175 GW of grid-connected renewable power capacity by 2020. Of this, 100 GW. Even five years after the signing an MoU with the Union Government on generating 7,500 MW solar power energy, J & K has failed to achieve the target in this regard. In March 2014, an MoU with the MNRE for the implementation of solar power projects of the capacity of 7,500 MW was signed. Under the MoU, solar projects of the capacity of 5,000 MW in Ladakh and 2,500 MW in Kargil, possessing tremendous potential for new and renewable energy, was to be taken up for implementation. Similarly, it was also part of the MoU to set up solar panels in all technical institutes across J&K. The erstwhile state of J&K, comprising Ladakh, had solar power potential of 111.05 GW and it was the second highest in the country after Rajasthan, which has the solar energy potential of 142 GW. The solar power capacity of the country recently crossed the milestone of 5,000 MW, with Rajasthan topping the list with the total commissioned capacity of 1264.35 MW, followed by Gujarat with 1024.15 MW. J&K does not figure in the list where the states have grid-connected solar power projects as it has failed to generate energy through solar power plants.

As many as 42,500 buildings will sport solar panels on its rooftops, as KSEB is set to tap solar energy from January onwards. It has selected the buildings among 278,257 registered for the Soura programme. The buildings include houses, shops, institutions. Thrissur tops the list with 7549 buildings ready for solar makeover. The first phase of project would be completed by June. The project aims at generating 200 MW of power. Nearly 150 MW of projects would be developed under the tariff-based RESCO mode and 50 MW will be developed under engineering, procurement, and construction mode. KSEB had started online registration of the program in July 2018 and closed it on 31 January 2019. The second phase of the project is aimed at generating 300 MW. It is expected to complete by May 2021. Clay roof tiles, colloquially referred to as Mangalorean tiles that typically adorn roofs of traditional Goan homes, may soon make way for more modern and solar energy-generating tiles. Goa will implement the RESCO model of solar power generation, in which roof space is utilised for outfitting of solar panels that help generate cheaper power. Private empanelled vendors will be roped in for installation of solar tiles, which would reduce consumption of conventional energy up to 30-40 percent inside the dwellings. Twenty percent of the cost of the electricity saved will be paid to the vendors for installation of the solar panels. The Goa government plans to generate at least 13 MW of power through solar installations in the state by March next year, and the solar power would be connected to the state power grid. The state consumes 650 MW of power on a daily basis. The Legislative Assembly Secretariat in Puducherry inaugurated its rooftop solar power project. The 20 kW solar plant will generate 100 units of power per day. The solar panels costing ₹1.32 mn are mounted on to three buildings in the Legislative Assembly complex. They are expected to generate around 30,000 units of electricity every year and will reduce electricity bills by₹168,000 per year. Under the Solar City Project, the Renewable Energy Agency of Puducherry has entered into an agreement with an agency for installing rooftop panels on 22 government buildings. The project aims to generate 950 kWp of power per day from the panels. This will reduce power bills by ₹1.5 mn per year. BHEL is all set to commence construction of the 25 MW floating solar power plant at NTPC Simhadri Super Thermal Power Station in Deepanjalinagar, 40 km from the city. Once completed, the floating solar power plant would be the largest in Andhra Pradesh. This also marks the second largest initiative taken by NTPC towards adopting renewable energy, after the 100 MW floating solar photovoltaic power plant at Ramagundam in Telangana. BHEL has the largest portfolio in the green initiative segment for generation of renewable energy by offering engineering solutions for off-grid and grid-interactive solar photovoltaic power plants, rooftop, floating solar and canal-top solar projects. IIT-Kharagpur said 44,000 micro solar domes will be provided to poor households in rural areas of ten states under a project to provide clean energy at an affordable price. Poor families are often unable to afford the grid- connected electricity while others may find disruption of power supply due to natural disasters. The project intends to provide 44,000 micro solar domes in households of marginalised (SC and ST) communities in rural areas in West Bengal, Chhattisgarh, Madhya Pradesh, Kerala, Assam, Odisha, Tripura, Manipur, Rajasthan, and Bihar.

Wind Projects

Wind energy solutions provider Inox Wind said it has been granted extension by SECI for the scheduled commissioning of 550 MW inter-state transmission system connected wind power projects in Gujarat. The time extension has been granted by SECI due to delay in operationalisation of long-term access by the central transmission utility, Inox Wind said. Inox Wind is a player in the wind energy market with three manufacturing plants in Gujarat, Himachal Pradesh and Madhya Pradesh. The company’s manufacturing capacity stands at 1,600 MW per annum. Leading wind energy solutions provider Inox Wind said it has bagged an order for a 38 MW wind power project to be developed at Anjar town in Kutch district of Gujarat. The project from ReNew Power Ltd is under the SECI second regime. It is scheduled to be commissioned by January 2020. The order comprises of supplying 19 units of Inox Wind’s 2 MW 113 metre rotor diameter turbine combined with 92 metre hub height. ReNew Power is already an existing customer of Inox Wind with an installed capacity of 236 MW supplied by Inox Wind spread across multiple wind-rich states. India has set an ambitious target of having 175 GW of clean energy capacity by 2022, including 100 GW solar and 60 GW of wind energy.

Biomass Projects

In a bid to make the city’s Gaushalas self-dependant, Lucknow Municipal Corp has proposed a project that will generate biogas and CNG from cow dung. With air quality over north India deteriorating once again, UP has appealed to farmers to not burn crop residue but instead use it to increase soil productivity. The government was exploring the opportunity to convert crop residue into fuel and at some point in future, could even purchase it from farmers. Farm fires in rice producing states of UP, Haryana and Punjab have been identified as a major cause of air pollution. Several cities in UP where air pollution is being monitored have shown extremely high levels of harmful particulate matter. Burning stubble decreases the productivity of soil and adversely impacts environment. The government is promoting sugarcane production and opening more sugar mills in UP. Sugarcane leaves would be generated as “waste” but instead of being burnt, they could be used for maintaining moisture in the soil for the next sugarcane crop. As part of its efforts to promote waste-to-energy, the government has set up a total capacity of 56.34 MW for power generation from waste in last three years. So far 199 waste-to-energy projects for generation of biogas/bio-CNG/ power based on urban, industrial, agriculture waste and municipal solid waste have been successfully established in the country as on 31 October 2019. The MNRE is implementing a scheme ‘Programme on Energy from Urban, Industrial and Agricultural Wastes/Residues’ for promoting setting up waste-to-energy to recover energy in the form of biogas or bio-CNG from urban industrial and agricultural wastes. Crop stubble in Punjab and Haryana, blamed for making the already foul air of northern India more toxic on being burnt, will feed four large ethanol and bio-CNG plants being set up in the two states. Farming in the two states produces 30 mt of paddy stubble every kharif season. Most farmers burn this crop residue as there is no cheaper way of clearing the fields. But this practice, and the criticism that it is leading to health emergencies, could soon ebb as work on the planned ethanol and bio-CNG plants has picked up pace. Praj Industries is the main technology provider for second-generation ethanol to Indian companies including IOC, BPCL, HPCL and MRPL. It is working on the four-integrated commercial-scale smart biorefineries based on in-house 2nd-generation technology to convert biomass to ethanol. IOC and HPCL are setting up bio-refineries in Haryana and Punjab, respectively.

Hydro Projects

BBMB signs MoU for 40 MW hydropower project Shimla: After 40 years of completion of Beas Satluj Link project, 40 MW hydel project would come up at Pandoh-Baggi tunnel. BBMB has entered into an MoU with the Himachal Pradesh government for setting up of 40 MW Baggi power house in Mandi district during the ‘Global Investors Meet’ at Dharamshala. This power project includes two units of 20 MW each and is located at the tail of Pandoh-Baggi tunnel. The project has been assigned BBMB by the Union power ministry on 22 October, after concurrence of all the partner states. The project would cost ₹3.5 bn. SJVNL signed a pact with Himachal Pradesh for commissioning the 430 MW Reoli Dugli Hydro Electric Project on the Chenab river basin. Earlier, the SJVNL had signed seven pacts with the state. The eight projects required an investment of ₹240 bn and they are expected to generate employment for 11,950 people. The eight projects will generate 2,388 MW of electricity. The company is currently generating 2015.2 MW of power.

Nuclear Projects

A total of 440 MW of Nuclear Power generation is expected to begin in Tamil Nadu and Karnataka between 27 November and 1 December this year, as per Power System Operation Corp Ltd. The two units of 220 MW each belongs to India’s nuclear power operator NPCIL. The NPCIL has two units of 220 MW each at Madras Atomic Power Station and four units of 220 MW each at Kaiga Generating Station.

International Cooperation

The Union Cabinet gave ex-post facto approval to a pact signed between India and Guinea in the field of renewable energy. The objective of the MoU is to establish the basis for a cooperative institutional relationship and to encourage and promote bilateral technical cooperation in renewable energy on the basis of mutual benefit, equality and reciprocity between the parties. The areas of cooperation include solar energy, wind energy, bio-energy, and waste to energy, small hydro storage and capacity build. German Chancellor Anjela Merkel visited the Dwarka Sector 21 metro station, which is fitted with solar panels funded by the KfW, a state-owned development bank of her country. Merkel visited the terrace of the metro station where she was briefed by officials of the Delhi Metro Rail Corp about the solar project. The Frankfurt-based bank has also offered soft loans for other projects in India, including the Clean Ganga Mission. The visit to the metro station, the first-solar fitted one in the mammoth Delhi Metro network, was the last leg of Merkel’s trip to India

Global Trends

The world’s major fossil fuel producers are set to bust global environmental goals with excessive coal, oil and gas extraction in the next decade, the UN and research groups said in the latest warning over climate crisis. The report reviewed specific plans from 10 countries, including superpowers China and the US as well as trends for the rest of the world and estimated that global fossil fuel production by 2030 would be at levels between 50-120 percent over Paris Agreement targets. Under that 2015 global pact, nations committed to a long-term goal of limiting the average temperature increase to within 1.5-2 degrees Celsius above pre-industrial levels. The International Finance Corp has led the financing of a first-of-its-kind programme to build six wind power projects in Pakistan, named the Super Six, with a total investment of $450 mn. The programme aims to help deliver cleaner, cheaper power to meet the country’s critical demand for energy and reduce reliance on expensive imported fossil fuels. The Super Six plants, with a combined capacity of 310 MW, will deliver among the lowest-cost power generation in the country to date. The programme is also expected to lead to emission reductions of about 650,000 tonnes of CO2 per year. Spent fuel storage at South Africa’s Koeberg nuclear plant will reach full capacity by April as state power utility Eskom awaits regulatory approval for new dry storage casks, the company said. Storage of high-level radioactive waste is a major environmental concern in the region, as South Africa looks to extend Koeberg’s life for another two decades and mulls extra nuclear power plants. Koeberg, Africa’s only nuclear facility, is situated about 35 km from Cape Town and was connected to the grid in the 1980s under apartheid. Anti-nuclear lobby group Earthlife Africa said South Africa could not afford the social, environmental and economic costs associated with nuclear waste. The EIB said it would stop funding fossil fuel projects at the end of 2021, a landmark decision that potentially deals a blow to billions of dollars of gas projects in the pipeline. The bank’s new energy lending policy, which it said was approved with “overwhelming” support, will bar most fossil fuel projects, including traditional use of natural gas. Under the new policy, energy projects applying for EIB funding will need to show they can produce one kilowatt hour of energy while emitting less than 250 grams of carbon dioxide, a move which bans traditional gas-burning power plants. The policy raises new risks for the gas industry, which has more than $200 bn in LNG projects lining up to go ahead worldwide over the next five years, aiming to provide a cleaner alternative to coal and oil. Under the new policy, gas projects would have to be based on what the bank called “new technologies,” such as carbon capture and storage, combining heat and power generation or mixing in renewable gases with the fossil natural gas. Environmental organisations celebrated the EIB decision, but expressed disappointment that its introduction will be delayed by a year after lobbying by European Union member states.

China

China will cut its renewable power subsidy to 5.67 bn yuan ($806.50 mn) in 2020 from 8.1 bn yuan in 2019, the finance ministry said, as the country will soon stop funding large solar power stations. The subsidy for 2020 will be allocated to wind farms, biomass power generators and distributed solar power operators, as well as solar power projects for poverty alleviation purposes, in 11 regions across the country, according to the finance ministry. Total subsidies for solar projects are set at 2.63 bn yuan, while wind farms will receive 2.97 bn yuan and biomass generators will get 73.39 mn yuan. The amount of new installed solar capacity was 16 GW in the first three quarters of this year, the National Environmental Administration has reported. China plans to end subsidies for new onshore wind power projects at the start of 2021. Surging renewable power capacity in the recent years has left the finance ministry with a subsidy payment backlog of at least 120 bn yuan and endangered the cash flow of renewable power operators. China plans to make power purchasers take fair returns into account when buying electricity from renewable power generators, according to a draft rule issued by the NEA aimed at improving their revenues. The draft rule will apply to non-hydropower resources, including wind, solar, biomass, geothermal and ocean power. China said it will cut its renewable power subsidy by 30 percent to $800 mn in 2020, and plans to stop funding large solar power stations and onshore wind farms in the coming two years, partly due to a payment backlog. China, the world’s largest energy consumer, has been boosting consumption of clean energy by forcing grid firms to prioritise renewable power resources and to maximise purchases from local renewable power providers. In future, local energy administrations would also need to take into account “fair returns” for renewable power producers, the NEA said. A preliminary text agreed by EU member states calls on the European Investment Bank to stop funding fossil fuel projects, in what would be a breakthrough in the bloc’s climate policy and a blow to the coal, gas and oil industries. The text for the first time calls on the EIB, a multilateral development bank and the bloc’s top lender, to bring to an end its multi-billion-euro funding of fossil fuel projects in a bid to reduce carbon emissions. EIB figures show the bank funded almost €2 bn ($2.2 bn) of fossil fuel projects last year and €13.4 bn worth since 2013. The EIB board, which is composed of the same EU finance ministers who will have to endorse the document, failed to find an agreement to end fossil fuel funding last October, as countries remained divided. China will ban the construction of small hydropower plants in regions that already have an electricity surplus and encourage new dams in poor and remote locations with little grid access, its energy regulator said. China’s National Energy Administration said the draft rules aim to promote the orderly development of the hydropower sector after decades of rampant and poorly planned capacity growth. The regulator said small hydro plants would be banned in forest parks, scenic spots, habitats for rare fish and other “ecologically fragile” zones. China’s hydropower sector is a major source of clean energy, with a capacity of about 350 GW or around 18 percent of the country’s total.

Rest of Asia

ADB has signed a $60 mn financing package with Nepal Water and Energy Development Company to help build and operate a 216 MW run-of-the-river hydropower plant on the Trishuli River near the capital Kathmandu. The project is one of the largest private sector investments in Nepal to date. It will enhance the country’s energy security by helping to utilise its renewable hydro resources and reduce imports of electricity. Once operational, the plant is expected to provide over 1,200 GWh of clean electricity annually to the national grid. The project is aligned with ADB’s operational priorities outlined in Strategy 2030, notably to eradicate remaining poverty, reduce inequalities, tackle climate change, build climate and disaster resilience, and enhance environmental sustainability.

Middle East and Africa

Saudi Arabia’s Al Jouf region will launch its first renewable power project before the end of the year. The 300 MW Sakaka solar photovoltaic IPP project is estimated to generate enough clean energy to power 45,000 households in the Al Jouf region while offsetting over 500,000 tonnes of CO2 a year. The project is said to be the first renewable energy project being built under King Salman’s renewable energy initiative. Iran started pouring concrete at its second nuclear power plant, a key step in building the facility with Russian help in the southern port of Bushehr. The United States plans to allow Russian, Chinese and European companies to continue work at Iranian nuclear facilities to make it harder for Iran to develop a nuclear weapon.

Europe and UK

Norway is working on a new licensing system to speed up the construction of onshore wind farms after a public backlash forced it to abandon a previous plan to develop the sector. The government shelved a wind power framework proposed by the Norwegian Water Resources and Energy Directorate (NVE), casting uncertainty on applications for new wind farms amid an existing moratorium on licenses. The NVE stopped approving new wind power projects in April after a raft of protests to give the government time to work on a new framework for developments. Polish energy group PGE is close to signing a deal to sell 50 percent stakes in two planned offshore wind projects in the Baltic Sea to Denmark’s Orsted, the companies said. The projects, which have a total capacity of up to 2.5 GW, are key to developing the offshore wind sector in otherwise coal-reliant Poland. For coal-reliant Poland, offshore wind, together with other renewables, is seen as an opportunity to put the energy industry on a greener path. The Polish government has set a target of generating at least 10 GW of offshore wind power by 2040 compared to zero, and is finalizing the legal framework to support this. Italian defense and aerospace group Leonardo has invested in a company developing solar-powered drones potentially capable of unlimited flight with no refueling, it said. The drone, which is expected to begin autonomous flights next year and go into production in 2021, can operate from existing airbases around the world and remain airborne for much longer than current aircraft. Leonardo said the system would comply with European export laws and would not be subject to international arms trafficking restrictions. However, development has been hampered by issues such as installing solar panels that generate enough power for flight without adding too much weight to the aircraft. French utility EDF said had temporarily stopped operating reactors 2, 3 and 4 of its Cruas nuclear plant in the Ardeche region, to carry out additional checks after the area was hit by an earthquake earlier in the day. Reactor 1 of the Cruas plant had already been shut down for scheduled maintenance. EDF said that reactors would be restarted after the checks have been completed and approved by French nuclear safety authority ASN. Halting the reactors removed around 2,700 MW of French power generation capacity. The Cruas reactors have a capacity of around 900 MW each. Reactor number 1 has been offline since 7 September for planned maintenance and it is expected to restart on 1 December. French electricity consumption is expected to jump by around 9.2 GW. France wants to construct a wind farm off the coast of Normandy as the nuclear-dependent nation moves to expand power generation from renewable sources, the energy ministry said. The planned 1 GW wind farm could have up to 80 wind turbines of around 12 MW each, in an area where wind conditions and the seabed are very favorable for offshore wind power at a competitive price, the ministry said. France is racing to boost the share of renewable generation capacity in its energy mix and reduce its dependence on nuclear energy. It plans to shut down old nuclear plants and will phase out coal-fired generation to curb greenhouse gas emissions. The ministry said it plans to boost the share of renewables in the French energy mix to around 40 percent by 2030. Nuclear power from its 58 reactors currently covers around 75 percent of French electricity needs. Although France has one of Europe’s biggest coastlines with good wind speeds for viable wind farm projects, it is lagging its European peers in developing offshore wind projects. The government announced in June that it will double its target for developing offshore wind projects to 1 GW per year from 500 MW. It currently has no offshore wind farm in operation. The Normandy offshore project is likely to attract bids from major energy companies such as state-controlled utility EDF, energy major Total and Engie as the firms vie to expand the footprint in the renewables sector. EDF edged out rivals Total and Engie for a contract to build a 600 MW offshore wind project near Dunkirk in western France in June. Spanish power firm Iberdrola SA said it plans to make its first foray into the Asia-Pacific, building a A$500 mn ($343 mn) wind and solar farm in Australia. Iberdrola, which up to now has focused on Europe, the United States, Mexico and Brazil, has picked a site in South Australia, Australia’s most wind power-reliant state, to build a 320 MW hybrid project. The company aims to have the projects up and running by 2021.

North & South America

Solar companies expect a run of California wildfires that triggered power outages across vast swathes of the state will fuel demand for panels and battery storage systems from homeowners seeking to avoid blackouts. The fires, driven by howling seasonal winds, have forced California power utility PG&E to cut electricity to millions of people to prevent its transmission lines from touching off new blazes. Solaria, a California-based solar panel manufacturer, has also introduced a discount of 2 percent to 5 percent for California installers who put up its product. Demand for battery storage has grown around 30 percent to 40 percent in areas affected by the outages. The outages have affected affluent parts of California that can afford solar and battery systems to keep their electric vehicles charged and wine cellars cold.

Australia

Australian power generation company Genex Power said it received credit approval to fund two of its solar projects in the country. The A$175 mn ($118.97 mn) debt facility will be used to fund the construction of its 50 MW Jemalong Solar Project in the state of New South Wales and to refinance the existing debt facility for the 50 MW Kidston Solar One Project in Queensland state, the company said.

| SECI: Solar Energy Corp of India, CEA: Central Electricity Authority, mn: million, bn: billion, MW: megawatt, GW: gigawatt, MNRE: Ministry of New and Renewable Energy, PM-KUSUM: Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan, HP: horsepower, discoms: distribution companies, CFA: Central Financial Assistance, PV: photovoltaic, JNNSM: Jawaharlal Nehru National Solar Mission, y-o-y: year-on-year, Q3: third quarter, CIL: Coal India Ltd, HPGCL: Haryana Power Generation Corp Ltd, CO2: carbon dioxide, BRPL: BSES Rajdhani Power Ltd, UP: Uttar Pradesh, UPPCL: UP Power Corp Ltd, UPNEDA: UP New and Renewable Energy Development Agency, MoU: Memorandum of Understanding, J&K: Jammu and Kashmir, KSEB: Kerala State Electricity Board, RESCO: renewable energy service company, kW: kilowatt, BHEL: Bharat Heavy Electricals Ltd, kWp: kilowatt peak, km: kilometre, CNG: compressed natural gas, BBMB: Bhakra Beas Management Board, SJVNL: Satluj Jal Vidyut Nigam Ltd, NPCIL: Nuclear Power Corp of India Ltd, UN: United Nations, EIB: European Investment Bank, LNG: liquefied natural gas, NEA: National Energy Administration, EU: European Union, ADB: Asian Development Bank, GWh: gigawatt hour, UK: United Kingdom |

| To read article ‘Universal Access to Electricity in India: Is this an Evolutionary or Revolutionary Outcome? Part II (1975-2005)’ please refer to India Energy Analysis |

2 December. The government said there is no proposal to reduce taxes on petrol and diesel. Finance Minister Nirmala Sitharaman said that no where in the world do the prices of petrol and diesel remain steady for a particular period of time. To a query on whether petrol and diesel would be brought under the Goods and Services Tax (GST) regime, Sitharaman said that in a way, they are already under the zero rate category of the GST. The rates have to be decided by the GST Council. Sitharaman said that at present, no new tax on petrol and diesel is being considered. The central government imposes various central excise and custom duties on petrol and diesel.

Source: Business Standard

29 November. The Delhi High Court (HC) sought the Centre and Oil Marketing Companies (OMCs) response on a plea alleging non-implementation of Legal Metrology rules mandating verification of the standards of fuel dispensation units as they “were liable to be easily tampered with”. A bench of Chief Justice D N Patel and Justice C Hari Shanker issued notice to the Consumer Affairs and Petroleum ministries, the OMCs — Indian Oil Corp (IOC), Hindustan Petroleum Corp Ltd (HPCL), Bharat Petroleum Corp Ltd (BPCL) — and manufacturers of the units, seeking their stand on the petition by a petroleum dealers group. The Empowered Petroleum Dealers Foundation has accused the government of not implementing the Legal Metrology rules regarding verification of the units at the place of manufacture and instead allowing the companies to do away with the requirement. It said the verification was now taking place at the time of installation at the pump when the unit has been transferred to the ownership of OMCs. The foundation, in its petition, has also said it carried out a sting, with the knowledge of the authorities and OMCs, this year which revealed the fuel dispensing units “were liable to be easily tampered with”. It has sought directions to the government to ensure the law and the rules are strictly implemented.

Source: Business Standard

28 November. Thousands of employees across India protested an upcoming stake sale at state owned refiner Bharat Petroleum Corp Ltd (BPCL), fearing loss of jobs and benefits. In what is seen as the biggest privatisation push in India in decades, Prime Minister Narendra Modi’s government approved the sale of BPCL and four other state-run companies. Unions of other state-run companies such as Hindustan Petroleum Corp Ltd (HPCL) and Mangalore Refinery and Petrochemicals Ltd (MRPL) joined forces with BPCL workers to protest against the privatisation plans. Employees at BPCL’s Kochi refinery – the company’s largest with a capacity of 15.5 mn metric tonnes per year – fear that privatisation will strip them of various benefits and result in job cuts. BPCL employees also marched in the financial capital of Mumbai, where the company runs another refinery, a union member at BPCL said. Oil Minister Dharmendra Pradhan indicated that international energy firms would be invited to participate in privatisation of state-owned oil companies.

Source: Reuters

28 November. Saudi Arabia and the United Arab Emirates (UAE) discussed a planned refinery in the western Indian state of Maharashtra that will cost at least $70 bn, a figure that exceeds the initial $44 bn estimate previously announced. The two sides discussed the initiative, first announced in 2018, to develop the refinery and petrochemicals complex, which would secure the supply of 600,000 barrels per day of Saudi and Emirati crude oil for India’s market.

Source: Business Standard

30 November. GAIL Gas Ltd will supply PNG to three lakh households in Dehradun district under the city gas distribution (CGD) project. GAIL Gas Ltd managing director (marketing) V Gautam said work on laying pipelines for the project will begin in a month. In five to six months, the firm will start supplying piped natural gas to 5,000 households in Chakrata, Dehradun, Doiwala, Kalsi, Rishikesh, Tyuni and Vikasnagar areas of Dehradun district, he said. The target is to cover three lakh households spread over an area of 3,088 square kilometre in the district at a cost of Rs15 bn in the next eight years. Registration of PNG (piped natural gas) consumers under the project will soon get under way, he said. As laying pipelines from Haridwar to Dehradun is likely to take some time, PNG will be supplied in the district for the time being through de-compressed units (DCUs) of which 4-5 will be set up in Dehradun, he said.

Source: Business Standard

27 November. India’s largest electricity trading platform plans to unveil the nation’s first natural gas exchange by March as it seeks to tap increasing demand for the cleanest fossil fuel. Indian Energy Exchange started putting together the infrastructure and a team of about 20 officials to run the bourse, Rajesh Mediratta, strategies director at the company, said. The world’s second most populous nation has been mulling a gas exchange for several years but the move has been reinvigorated by increasing use of the fuel as a global glut damps prices. The country seeks to increase the share of natural gas in its energy mix to 15 percent by 2030 from the current 6 percent, drawing interest from global majors including Total SA and Exxon Mobil Corp. The exchange will help bring down the price of natural gas through competitive trade, boosting usage in a country that relies heavily on cheaper coal for its energy needs, Mediratta said. India’s gas market needs uniform trading rules and freedom for consumers to buy the fuel wherever they want. A plan to allocate a certain volume of domestic gas for trading at exchanges is also waiting for government approval.

Source: The Economic Times

3 December. The Union power ministry has formulated a methodology for conducting coal auctions for power plants without sufficient power purchase agreements (PPAs). The methodology paves the way for such units to apply for coal linkages, provided electricity produced from this coal is sold through spot power exchanges or through the government’s ‘DEEP’ portal, where bidding is conducted for bilateral short-term supply. This move is part of the Scheme for Harnessing and Allocating Koyala (Coal) Transparently in India (Shakti scheme), which was amended in March after the Cabinet Committee on Economic Affairs had approved certain recommendations of a high-level empowered committee (HLEC) constituted to address issues of stressed thermal power projects. The original version of the Shakti scheme allowed coal supply only to power generation capacities with long-term and mid-term PPAs. According to the latest guideline, Coal India Ltd (CIL) and Singareni Collieries Company will have to earmark mines for such auctions within the next 45 days. The quantity of coal supplied through this route should help the plant run for three months, the government said. Winning bidders will have to intimate their lenders every month that the net surplus generated after meeting operating expenses are being used to service debts. If it is found that a power plant has diverted this coal for other use, it will be barred from receiving coal through this policy for three years.

Source: The Financial Express

2 December. Coal production and offtake were higher in the month of November 2019 sequentially over the previous month by 27 percent and 17 percent respectively, as the Coal India Ltd (CIL) has been gradually recovering from the impacts of the monsoon. CIL production for November was at 50.02 million tonnes (mt), an absolute increase of 10.67 mt compared to that in the previous month of October registering a growth of 27.1 percent. But, the monthly production under review was down nearly 4 percent over the corresponding month of the previous year. While coal off-take for November 2019 grew by almost 17 percent month-on-month comparison supplying 47.37 mt of coal.

Source: Business Standard

1 December. Despite 20 percent of the total coal production in the country, various thermal power plants and industries in Chhattisgarh are starving for a sufficient supply of fuel. Over 7000 MW capacity industries have been shut down due to lack of coal available to them. Chhattisgarh has nearly 18 percent of the nation’s coal reserves. South Eastern Coalfields Ltd (SECL), a subsidiary of Coal India Ltd (CIL), operates with a production target of 165 million tonnes (mt) annually, though the state requires just 19 percent of it, which is around 32 mt for coal-fired power stations and industries. However, merely 50 percent of the state’s small requirement of coal are cited to be met. Owing to huge coal reserves in Chhattisgarh over 200 units have set up their operations expecting convenient access to coal supply from the mines.

Source: The New Indian Express

30 November. Illegal coal mining and its transportation have been going on in Assam and the state government is taking action to prevent such activities. State Parliamentary Affairs Minister Chandra Mohan Patowary said that there is no “coal syndicate” operating at present. Currently, the cases of illegal coal mining and its transportation are being investigated by CID wing of the Assam Police, he said. From January 2016 to October 2019, a total of 254 cases of illegal coal transportation have been registered and 422 persons were arrested, while 665 coal-laden vehicles were seized in this period, Patowary said. The Office of the Transport Commissioner has intercepted a total of 10,793 trucks transporting coal for overloading across the state.

Source: Business Standard

3 December. The ensuing real-time market mechanism, where power can be traded on a real-time basis, is expected to provide a fillip to the electricity exchanges with a likely spurt in trading volume. Currently, the most popular form of spot power transaction is the day ahead market (DAM) mechanism where distribution companies (discoms) bid for power supply for the next day. The real-time mechanism is seen to significantly reduce the time of delivery to just over an hour. Existing models for intra-day power trading include DSM (deviation settlement mechanism), ancillary services and contingency, which are not adequate to address emerging needs of time and have thrown up challenges that call for changes in market design. In September, only 3.3 percent of the total electricity generated was transacted through the DAM on power exchanges and 1.9 percent through the DSM. Nearly 70 mn units of electricity are traded through DSM every day. Power Exchange India Ltd (PXIL) chief executive officer Prabhajit Sarkar, believes that a significant chunk of this volume would be up for trade in the exchanges after the implementation of the real-time market mechanism.

Source: The Financial Express

3 December. Delhi’s peak power demand this winter season can go up to 4,700 MW, BSES said. Last year, the peak demand in Delhi reached 4,472 MW. The peak winter power demand in BSES discoms (distribution companies) BRPL and BYPL areas was recorded 1,926 MW and 1,091 MW respectively. This year, it is expected to reach 2,020 MW and 1,165 MW for BRPL and BYPL, he said. Accurate “load forecasting” helps BSES to optimise power purchase costs. Also, its discoms use advanced statistical forecasting solutions, including artificial intelligence and machine learning for it.

Source: Business Standard

29 November. ABB India said that the Bengaluru Bench of the National Company Law Tribunal (NCLT) has approved the demerger of its power grids business to ABB Power Products and Systems India Ltd (APPSIL). The scheme will be effective upon filing the certified copy of order of NCLT (National Company Law Tribunal) with Registrar of Companies.

Source: The Economic Times

28 November. India and Asian Development Bank (ADB) signed a $451 mn loan to strengthen power connectivity between southern and northern parts of Chennai-Kanyakumari Industrial Corridor (CKIC). The state government has identified quality infrastructure including a reliable power supply as a key prerequisite for its further economic development. The project will help establish extra-high-voltage transmission link between Virudhunagar and Coimbatore to transfer the additional generation capacity of 9,000 MW, including 6,000 MW from renewables, by 2025 to meet the increased power demand in CKIC.

Source: Business Standard

27 November. To ensure uninterrupted power supply and bring down pilferage, the Jammu and Kashmir (J&K) administration has decided to make certain that all consumers have metered connection and strictly enforce provisions of the Central Electricity Act for stringent punishment to violators. According to an order issued by the administration of the Union territory, all power distribution corporations of J&K have been directed to ensure that electric metres are installed at all industrial and commercial establishments within two months. It further said massive enforcement drives will be launched, physical audit of each household carried out, and load agreement revised in all such cases based on average power consumption, so as to realize flat rate revenue based on actual units consumed by households, till such households are fully metered.

Source: Business Standard

27 November. While concurring with Waste Management Minister Michael Lobo that electricity woes in North Goa’s coastal belt have been neglected for several years, Chief Minister (CM) Pramod Sawant assured that the issue would be sorted out soon. Power Minister Nilesh Cabral has been working hard to clear the backlog and that the problem would be resolved by next year.

Source: The Economic Times

QuIck CommentLower tariffs will add to discom woes! Ugly! |

27 November. Power and Renewable Energy Minister R K Singh said the ministry has asked states to lower tariffs in view of the implementation of pre-payment arrangement for procuring power by distribution companies (discoms). Earlier this year, the government has taken steps such as mandatory issuance of letter of credit to generating companies by discoms and single-day payment. Under single-day payment, discoms have to make payments a day in advance to procure power supply, which will be carrying cost.

Source: Business Standard

3 December. Siemens Ltd said it will provide digital solutions to Lalitpur Power Generation Company Ltd for improving operational efficiency and reducing emissions. Siemens will provide a complete thermal twin for the Bajaj Group-owned coal-fired power plant in Uttar Pradesh (UP), enabling improvements in the plant’s performance, Siemens said.

Source: Business Standard

QuIck CommentSubsidised solar pumps may subsidise ground water depletion! Bad! |

2 December. Former Energy Minister Chandrashekhar Bawankule had given a target to MSEDCL (Maharashtra State Electricity Distribution Company Ltd) of installing one lakh solar farm pumps by March 2020 under Mukhyamantri Saur Krishi Yojana (MSKY). So far, it has been able to install only 12,500 pumps. In view of the target for the financial year, the MSEDCL should have installed over 8,334 pumps a month and in the eight months that have passed, over 66,000 pumps should have been installed. Going by this rate, MSEDCL will need 64 months or over five years to complete the target. MSEDCL’s performance in Vidarbha is as bad as other regions. It had received 49,956 applications for solar pumps of which 15,108 were rejected due to various reasons. Quotations were issued to the remaining 32,469, of which 15,718 applicants paid the required charges to the MSEDCL.

Source: The Economic Times

2 December. Possibilities for setting up mega hydel power projects in the state are grim, Kerala’s Power Minister M M Mani said while talking about the importance of tapping solar energy. Two MoUs (Memorandum of Understandings) were signed in the meet for exploring solar and wind energy potential of the state. An agreement for setting up a 13.5 MW solar power project by installing solar power generating units in KWA (Kerala Water Authority)-owned land parcels across Kerala was signed by water authority Managing Director A Kaushik and ANERT (Agency for Non-Conventional Energy and Rural Technology) director Amit Meena. Another MoU was signed between National Institute of Wind Energy and ANERT for drawing a wind energy map of Kerala to analyse wind energy potential of the state.

Source: The Economic Times

1 December. Although Gujarat has agreed to provide land to winners of auctions conducted by central agencies, developers feel it is too little too late. Considered one of the best wind producing states, Gujarat had been reluctant to lease land to winners of auctions conducted by central agencies such as the Solar Energy Corp of India (SECI), the nodal agency of the renewable energy ministry through which it conducts wind and solar auctions. Out of the 7,000 MW of wind projects auctioned by SECI last year, government land was expected to be provided by the Gujarat government for 3,500 MW. But because of fast approaching commissioning deadlines, winners of those auctions ended up buying expensive private land in the state and elsewhere.

Source: The Economic Times

QuIck CommentCompromise on green contracts will reduce uncertainty in sector! Good! |

29 November. The Centre and Andhra Pradesh have reached a compromise to end the impasse over the Y S Jagan Mohan Reddy-led government’s controversial decision to reopen renewable energy contracts inked by the previous state government. The Andhra Pradesh government’s move had sent the wrong signal to international investors as it would have serious implications on India’s ability to attract overseas investments and perception about the sanctity of legal contracts. The move also drew criticism from the central government, as well as the governments of France, Canada and Japan. Andhra Pradesh has around 7,700 MW of solar and wind projects. It is home to India’s second-largest installed capacity of clean energy, accounting for around 10 percent of the country’s green energy capacity, with investments of around ₹600 bn. The state has 4,092 MW of installed wind power projects awarded through feed-in tariffs. Also, the resource-rich state has 3,230 MW of solar power projects awarded through competitive bidding. Investors claimed that the decision of the Andhra Pradesh government could have put at risk 5.2 GW of solar and wind energy projects, with an estimated debt exposure of more than ₹210 bn.

Source: Livemint

28 November. The government said a total 31,696 MW of grid connected solar power generation capacity has been set up in the country till October 2019. The government’s target is to installing 1,00,000 MW grid connected solar power capacity by December 2022, Power and Renewable Energy Minister R K Singh said. Tenders for another 36,278 MW capacity projects have been issued and with new tenders of around 15,000 MW planned in remaining period of 2019-20 and 2020-21, and the country is on course for achieving the target, he said. Most of the solar power projects in the country have been/are being set up with private investment, Singh said.

Source: Business Standard

28 November. The cabinet approved a proposal for extending the power purchase agreement executed with M/s NTPC Vidyut Vypar Nigam Ltd (NVVNL) for purchase of solar power by three years. Power Minister Nilesh Cabral said that a lower rate of Rs5.5 per unit has been negotiated as against the earlier Rs7.99 per unit. According to the directives of the Joint Electricity Regulatory Commission (JERC), it is mandatory for the electricity department to purchase a defined percentage of its power from renewable sources, including solar and non-solar. The earlier five-year contract ended on 22 August. The cost to the government for the renewed contract period is Rs206 mn. The decision to extend the contract with NVVNL was taken since there was no response to its tender floated in March to meet the target of solar renewable purchase obligation (RPO) for 2019-20 of 187 mn units even after the last date to receive bids was extended. The market study showed there was no short-term power available due to high RPO target fixed by respective state regulatory commissions. In the face of the target for the current financial year, and no adequate solar power available with the electricity department, the proposal was made to the government to extend the power purchase agreement with NVVNL for the balance financial year.

Source: The Economic Times

3 December. Australia’s Woodside Petroleum said the final field development plan for the Sangomar oil field was submitted to Senegal government, a joint project owner, paving the way for partners to proceed with final investment decisions. The first phase will develop 230 mn barrels, with first oil targeted for early 2023, Woodside said. FAR Ltd, which owns a 15 percent interest in the field, said the plan outlined the full multi-phase development of oil and gas at the field, previously known as SNE, with plans for 645 mn barrels of oil equivalent (boe) to be developed.

Source: Reuters

3 December. Saudi Arabia raised its light crude prices for sales to Asia in January to the highest in six years, tracking gains in the Middle East crude benchmark and higher margins for light distillates. In line with the gains, Saudi Aramco raised the January official selling price (OSP) for its Arab Light crude oil for Asian customers by 30 cents a barrel versus December to a premium of $3.70 per barrel to the Oman/Dubai average, the highest since January 2014. The January OSP for Arab Extra Light sold to Asia was also raised to a six-year high after Aramco increased it by 70 cents to a premium of $5.80 a barrel. Aramco cut the January OSPs for Arab Medium and Arab Heavy crude after high-sulphur fuel oil (HSFO) margins plunged to record lows ahead of cleaner ship fuel rules set to start in January.

Source: Reuters

30 November. Vietnam’s Binh Son Refining and Petrochemical Co (BSR) has inked an agreement with Azeri state energy company SOCAR to buy 5 mn barrels of crude in 2020, BSR said. SOCAR Trading will provide 5 mn barrels of Azeri Light crude to BSR’s Dung Quat refinery during the first half of 2020, BSR said. The company said Azeri crude would also become one of its strategic crude oil products from 2020, following Vietnam’s abolishment of an import tax on crude oil which took effect from November. BSR said it would import 8 mn to 10 mn barrels of West Texas Intermediate and Bonny Light crude oil in 2020 for its Dung Quat refinery. Vietnam has been relying more on imported crude due to a slowdown in domestic output as reserves at its existing fields decline, and as China’s increasingly assertive stance in the region hampers offshore exploration.

Source: Reuters

2 December. Russian President Vladimir Putin and his Chinese counterpart Xi Jinping oversaw the launch of a landmark pipeline that will transport natural gas from Siberia to northeast China, an economic and political boost to ties between Moscow and Beijing. The start of gas flows via the Power of Siberia pipeline reflects Moscow’s attempts to pivot to the East to try to mitigate pain from Western financial sanctions imposed over its 2014 annexation of Ukraine’s Crimea. The move cements China’s spot as Russia’s top export market and gives Russia a potentially enormous new market outside Europe. It also comes as Moscow is hoping to launch two other major energy projects — the Nord Steam 2 undersea Baltic gas pipeline to Germany and the TurkStream pipeline to Turkey and southern Europe. The 3,000 kilometre long (1,865 mile) Power of Siberia pipeline will transport gas from the Chayandinskoye and Kovytka fields in eastern Siberia, a project expected to last for three decades and to generate $400 bn for Russian state coffers. Flows via the pipeline are expected to gradually rise to 38 billion cubic meters (bcm) per year in 2025, possibly making China Russia’s second-largest gas customer after Germany, which bought 58.50 bcm of gas from Russia last year. Moscow began supplying natural gas to western and central Europe in the 1950s and Europe has long been Russia’s major consumer of gas, supplied by Kremlin-controlled energy giant Gazprom, with total annual supplies of around 200 bcm.

Source: Reuters

28 November. Five companies have technically qualified for Pakistan LNG (liquefied natural gas)’s buy tender to import liquefied natural gas (LNG) cargoes for delivery in January, the firm said. The company had sought five cargoes for delivery over 6-7 January, 11-12 January, 16-17 January, 23-24 January and 28-29 January in a tender that closed on 26 November. Trading firms DXT Commodities, Gunvor Singapore, PetroChina International, SOCAR Trading and Trafigura have “technically qualified” to supply LNG to Pakistan LNG for the period, according to the notice. A total of 19 bids were received for the tender, Pakistan LNG said. Pakistan LNG typically opens the commercial offer only for companies whose technical information is complete and fully compliant with the requirements of the tender.

Source: The Economic Times

27 November. A final investment decision on a $3.15 bn liquefied natural gas (LNG) project near Mozambique’s capital will be taken around the middle of 2020, France’s Total and its partners in the project said. The project will see a floating storage and regasification unit moored in the harbor of Matola, a suburb of the capital Maputo, and it will be connected to a new gas-fired power plant nearby and to South Africa’s gas network. Total will supply the gas. Total and its partners, including Gigajoule, a gas company focused on southern Africa, and Mozambique’s Matola Gas Company (MCG), which operates a 100 kilometre (km) gas pipeline network in Maputo province, signed an agreement to develop the project. Mozambique is on the cusp of a gas boom as blockbuster projects by the likes of oil majors including Total and Exxon Mobil get underway in its gas-rich north. Total, Gigajoule and MGC signed a memorandum of understanding related to the project in 2017. Concessions for the development and construction of the gas infrastructure and for the design, construction and operation for the power station were awarded in July.

Source: Reuters

2 December. Indonesia is reviewing rules that require coal miners to sell a portion of their coal to local buyers, as suppliers struggle to meet the regulation. Coal miners are currently required to sell 25 percent of their output to the local market, mainly state-owned electric company PT Perusahaan Listrik Negara (PLN), a policy known as the domestic market obligation (DMO). However, since PLN’s demand is limited while output is climbing, the miners are unable to maintain the ratio of exports to domestic sales. The Indonesian Coal Mining Association said that domestic coal consumption remains unchanged at 120 million tonnes (mt) a year while output is climbing to 600 mt. Some miners have also complained that they cannot sell to domestic buyers because they require low-calorie coal while the miners mostly produce high-calorie coal. Indonesia’s Energy and Mineral Resources Minister Arifin Tasrif said the government plans to keep the price cap at $70 for 2020. The government will also draft new regulations to support its agenda of building a downstream industry for coal. Indonesian President Joko Widodo wants the country to expand the downstream uses for coal at home, including processing coal into dimethyl ether to substitute for imported liquefied petroleum gas (LPG).

Source: Reuters

28 November. China is carrying out a new round of safety inspections on coal mines across the country from 27 November until 27 February, the National Coal Mine Safety Administration said. China, the world’s largest coal miner and consumer, has reported six coal mine accidents since October and aims to address the poor safety record. Coal mines typically rush to ramp up output between November and February to meet annual production targets. China produced 3.06 billion tonnes (bt) of coal over the first 10 months this year, up 4.5 percent from the same period in 2018.

Source: Reuters

28 November. South Korea will idle up to a quarter of its coal-fired power plants between December and February to help limit air pollution while its remaining plants are expected to supply sufficient power, the energy ministry said. The shutdown will be applied to 8 to 15 plants including two older 500 MW plants which have higher emission levels than others, the ministry said. The ministry said that the remaining coal power plants will operate at no more than 80 percent capacity from December to February. South Korea, Asia’s fourth-largest economy, has about 60 coal-fired power plants, generating 40 percent of the country’s electricity. But it aims to reduce its use of coal power over the long term to reflect growing public calls for cleaner air. In early November, the government said it would close the country’s 6 older coal-fired power plants by 2021, a year earlier than planned.

Source: Reuters

27 November. France’s AXA said it was strengthening its climate strategy by committing to exit coal more quickly across a greater number of countries, as policymakers seek a faster transition to a low-carbon economy. AXA said that as an investor it would exit completely from the coal industry across countries in the Organisation for Economic Cooperation and Development (OECD) and the European Union by 2030, and the rest of the world by 2040. AXA said that as an insurer, it would restrict coal underwriting policy and stop selling insurance contracts, apart from employee benefits offers, to clients developing new coal projects that exceed 300 MW in capacity. Italian bank UniCredit pledged to halt all lending for thermal coal projects by 2023.

Source: Reuters

2 December. Indonesia’s state electricity company PT Perusahaan Listrik Negara (PLN) will spend a bulk of the government’s capital injection for 2020 on transmission infrastructure, acting Chief Executive Sripeni Inten Cahyani said. About 3.7 tn rupiah ($262.78 mn) of the approved 5 tn rupiah for next year will be spend on electricity transmission infrastructure for Sumatra, Kalimantan, Sulawesi islands and part of Java island, Cahyani said. About 1 tn rupiah of the capital injection will be used to build power plants for Sumatra, eastern area of Java and for Bali and Nusa Tenggara regions, Cahyani said.

Source: Reuters

30 November. The African Development Bank (AfDB) has approved a $210 mn loan to help Nigeria upgrade its dilapidated electricity transmission and distribution network. The loan to Transmission Company of Nigeria (TCN) will support construction of 330 kilovolt (kV) double circuit quad transmission lines and sub-stations across the country, AfDB said. The AfDB funded project will run across seven states and will improve the capacity of power grid where it is most constrained. Nigeria privatised most of its power sector in 2013 but retained control of its monopoly grid, operated by TCN. Most of the country’s power generation is from thermal power stations that use gas. The creaking power grid has often been blamed for hobbling growth in west Africa’s largest economy. The country’s power output stands at around 4,000 MW, the Nigeria Electricity System Operator has said. Total power generation capacity is about 7,000 MW but the transmission network cannot cope if plants operate at full tilt. Nigeria’s privatized power sector typically does not use meters to provide invoices, bill collections are low and energy tariffs have remained fixed for three years.

Source: Reuters

27 November. The Ministry of Energy and Mines of Brazil has signed the operation license of the second phase of the 800 kilovolt (kV) power transmission line connecting the 11.2 GW Belo Monte hydropower plant in Vitória do Xingu, in the state of Pará, to the Brazilian grid. The 2,539 kilometre (km) long UHVDC line was built by the State Grid Corp of China, which started works in September 2017, and stretches across 5 states until Rio de Janeiro.

Source: Enerdata

27 November. Workers at Greece’s Public Power Corp (PPC) launched a two-day strike to protest a draft law aimed at reforming the troubled utility, its largest labour union GENOP/DEH said. The strike came as Greek lawmakers debated a bill that would introduce flexible wage contracts for new hirings, cut discounts on employees’ and pensioners’ electricity bills in place since 1990, and set conditions for voluntary exits. The walkout is not expected to affect the utility’s operations materially, as power demand has been weak due to hot weather, a PPC unionist said. The new conservative government which took power in July is keen to reform the utility, which is saddled with €2.8 bn of bills left unpaid by Greek consumers during the country’s financial crisis.

Source: Reuters

3 December. Italy’s biggest regional utility A2A has signed a deal with China’s Talesun to acquire a pipeline of solar power projects with an overall capacity of around 1,000 MW. A2A said the deal would make it one of the leading solar power players in Italy. A2A currently has a solar capacity of around 100 MW.

Source: Reuters

2 December. Spain’s Repsol pledged to reduce net carbon emissions from its operations and most of its products to zero by 2050 and absorb a €4.8 bn ($5.3 bn) hit to the value of its oil and gas assets in the process. Repsol said it wanted to lead a wider transition to renewable energy, in line with the goals of the 2015 Paris Agreement to avert catastrophic climate change. Repsol announced its target as delegates opened a United Nations climate summit in Madrid aimed at injecting fresh impetus into the accord, which enters a crucial implementation phase next year. Repsol said the new target covers 95 percent of the emissions released by the use of products it sells, which are complex to account for and have become a key issue for shareholders. Companies aiming to achieve “net-zero” usually balance emissions from their operations by investing in technology that can store carbon, or in natural sinks such as forests. Repsol said it could reach at least 70 percent of its goal using technology that was already developed or nearly mature, and then would implement carbon capture, use and storage to raise that figure, and turn to natural sinks if necessary. It will also increase its targets for low-carbon generation capacity to a total 7.5 GW in Spain and beyond by 2025, double its production of biofuels from vegetable oils, and start producing green hydrogen in its refining business.

Source: Reuters

29 November. French alternative power suppliers have requested 147 terawatt hours (TWh) of utility EDF’s nuclear power generation for 2020 through the ARENH auction window, the energy market regulator CRE said. Under the so-called ARENH mechanism, EDF’s rivals have the right to buy up to 100 TWh, or about a quarter of its annual nuclear output, at a fixed price of €42 ($46.29) per megawatt hour (MWh). The scheme is aimed at giving them fair access to cheap nuclear energy.

Source: Reuters

29 November. The European Union (EU) executive will propose by March 2020 a new climate law to turn the bloc neutral in terms of carbon dioxide emissions by 2050 and help lead the planet’s struggle against global warming. The European Commission document said it would by next October present a plan to halve the bloc’s greenhouse gas emissions by 2030. Anxiety is growing around the world that governments are not doing enough to reach the Paris Agreement’s target of curbing emissions sufficiently to keep temperature rises to within 1.5-2 degrees Celsius of pre-industrial levels. Some EU countries dependent on coal for energy like Poland, the Czech Republic and Hungary, oppose the 2050 carbon neutral target, arguing they need help transforming energy production.

Source: Reuters

28 November. Greece hopes to generate investment worth about €44 bn ($49 bn) over the next decade on projects to reduce its dependence on fossil fuels, authorities said. A game plan approved by the cabinet showed Greece will try to reduce its carbon footprint by more than 55 percent by 2030 compared with 2005, and would close down all its coal-fired power plants in the next eight years. Wind, solar and hydroelectric power should account for at least 35 percent of energy consumption by then, up from about 15 percent in 2016, with investments worth about €9 bn. Other investments include natural gas networks and in recycling projects. The country will invest about €2 bn in the next 10 years to help tackle natural disasters from climate change like floods and forest fires.

Source: Reuters

28 November. Implementation of Indonesia’s plan for biodiesel to contain 30 percent palm-based fuel is expected to reduce fossil diesel fuel consumption by 165,000 barrels per day (bpd), the energy ministry said. Indonesia, the world’s top palm oil producer, aims to start its “B30” programme in January, expanding it from the current mandatory use of 20 percent bio-content in biodiesel.

Source: Reuters

27 November. Pope Francis, who met victims of the Fukushima nuclear disaster while in Japan, said that nuclear energy should not be used until there are ironclad guarantees that it is safe for people and the environment. The pope comforted victims of the 2011 Fukushima disaster in Tokyo and noted a call by Japan’s Catholic bishops to abolish nuclear power outright. Francis said assertions that nuclear accidents were rare were insufficient because effects of radiation are felt for decades on people and the environment, such as in the area around the Chernobyl reactor in Ukraine which was crippled by a meltdown in 1986. Francis, who wrote a major encyclical in 2015 on protection of the environment and the effects of global warming, said humanity had gone beyond the limit in violating nature.

Source: Reuters

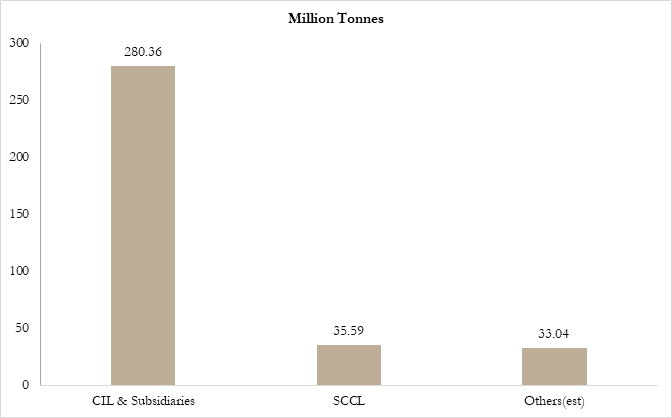

Million Tonnes

| Particulars | 2017-18 (P) | 2018-19 (P) | % Change with respect to 2017-18 |

| Production | 675.4 | 730.35 | 8.1% |

| Availability | 883.67 | 965.59 | 9.3% |

Coal Production 2019-20 (April to October) (P)

P: Provisional

est: Estimated production from Captive & others till August 2019.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar