SANCTIONS AND SUBSIDIES CAST SHADOW OVER OIL MARKET

Oil News Commentary: April - May 2019

India

The next government at the Centre would have around ₹133 bn left in its petroleum subsidy provisioning for the current financial year — 2019-20, or FY20 — as 2018-19 closed with a ₹370 bn requirement. The kerosene subsidy provision for 2019-20 has been subsumed entirely by the requirement last year. In fact, the government would have to provide ₹13.11 bn more for last year when a full Budget is presented in June. The subsidy bill on LPG for FY19 saw a 49.4 percent increase, to ₹312 bn compared to ₹208.80 bn in FY18. The kerosene subsidy bill last year saw a 21 percent increase, from ₹47.85 bn in FY18 to ₹58 bn. The rise in subsidy burden on LPG was because of an increase in consumption and a rise in international prices during the period. The subsidy estimate for LPG for FY20 is expected to be ₹358.80 bn, and ₹27.30 bn for kerosene. The government had provisioned ₹329.89 bn for LPG and ₹44.89 bn for kerosene in the 1 February interim Budget to meet the requirement of both the years. The three oil marketing companies, IOC, BPCL & HPCL, have together added 45.5 mn customers by the end of 31 March. Of this, 36.3 mn come under the subsidy scheme, through which cooking gas connections are allotted to poor families. In contrast, kerosene subsidy had remained under control because those getting LPG connections and power were no more entitled to kerosene given through the public distribution system. Based on the latest data available with the PPAC, the LPG consumption recorded a growth of 10.2 percent during March 2019 and a cumulative growth of 6.8 percent during FY19. Under the flagship Ujjwala Yojana, the government has added 71.9 mn connections since the launch of the scheme on 1 May 2016. During March 2019, of the five regions, north had the highest share in LPG consumption of 33.3 percent followed by south at 26.8 percent, west at 22 percent, east at 15.4 percent and northeast at 2.6 percent. In 2017-18, India became the second largest consumer of LPG in the world by taking 22.5 mt. According to the government estimates, this is likely to increase to around 30.3 mt by 2025 and 40.6 mt by 2040.

A late surge in oil prices is expected to increase India’s oil import bill to its five-year high. As per estimates, India could close 2018-19 with crude import bill shooting to $115 bn, a growth of 30 percent over 2017-18’s $88 bn. The latest estimates are based on increase in global crude oil prices from the second half of March, when prices reached a new high in 2019. Crude is hovering around $70 a barrel on the back of extended production cuts from the OPEC and Russia, and expectation of demand pick-up. However, contradicting apprehensions, the oil ministry’s PPAC in its latest assessment has made a conservative estimate of import bill growing by 27 percent from $88 bn in 2017-18 to $112 bn in 2018-19. Interestingly, PPAC’s estimates are based on the Indian basket of crude oil price at $57.77 a barrel and exchange rate at ₹70.73 against the dollar. This estimate has long been breached with price of Indian basket of crude hovering at $70 a barrel. On the rupee front, however, there is some relief as the currency gained a bit in March after running over ₹70-71 to a dollar for most of January and February. The oil import bill at over $115 bn will take it closer to FY13 and FY14 levels, when international oil prices had skyrocketed and hovered around $100 a barrel for most of the year. This will push the FY19 crude import bill to the highest in five years and very close to the level when the prices had breached all records to touch $140 a barrel. The Centre has maintained that though rising oil prices are a concern, they are manageable and may not upset the macro-economic fundamentals of the economy. In fact, Finance Ministry sources confirmed the government had met the 3.4 percent fiscal deficit target, which meant that the latest changes in oil prices had been accounted for. The deficit numbers have been achieved largely through expenditure cuts. If crude price rises $1 per barrel, the net import bill will increase by ₹30.29 bn. And if exchange rate rises by ₹1 to a dollar, the net import bill will increase by ₹24.73 bn. The PPAC estimate is for January-March 2019.While the recent oil price spike has alarmed the government, the fall in crude rates led to big savings in FY16 and FY17. India's bill nearly halved to $64 bn in FY16 for 202.1 mt crude oil shipment, against import of 189.4 mt for $112.7 bn in the FY15.

For 2019-20, the PPAC has estimated the country's import bill to be around $112.72 bn, as against $111.95 bn during FY19. This is despite imports from Iran coming to "zero" in May, after the United States lifted waivers to India on Tehran sanctions. The imports were estimated at the average price of Indian basket crude oil at $66 a barrel and average exchange rate for ₹71 per dollar. In terms of quantity, the crude oil imports for FY20 is expected to go up 233 mt compared to 226.6 mt in FY19.

The hallmark of the past four years for the Indian economy was the drop in global crude oil prices that made it easy to manage not just inflation but also the current account deficit. With crude oil showing signs of climbing back, the focus on boosting exports is back on the table. As exports get fixed, the benefit from lower crude oil prices could end soon for the current account balance. The country’s import bill shrank mainly because of the fall in crude oil prices in FY19. However, crude oil has gained 32 percent since January this year. Surging global oil prices will pose a first big challenge to India’s new government especially as domestic prices have been allowed to lag, meaning consumers are in for a painful surge as they catch up. For oil-import dependent India, higher global prices could lead to a weaker rupee, higher inflation, the ruling out of interest rate cuts and could further weigh on twin current account and budget deficits, economists warned. But compounding future pain, state-run fuel suppliers and retailers have held off passing on to consumers the higher prices during a staggered general election, which began on 11 April and ends on 23 May. That delay is expected to be unwound once the election is over. And there could be additional price increases to make up for losses or profits missed during the period of delayed increases. In some major Asian countries, such as Japan and South Korea, pump prices are adjusted periodically so they move largely in tandem with international crude prices. That was what was supposed to happen in India but the election means there have been many days when pump prices have been unchanged. In New Delhi, for example, while crude oil prices have gone up by nearly $9 a barrel, or about 12 percent, in the past six weeks, gasoline prices have only risen by 0.47 rupees a litre, or 0.6 percent. State-controlled fuel suppliers and retailers declined to say why they had delayed price increases. Prices were similarly held down for 19 days in the southern state of Karnataka last year, when it held state assembly elections. India had switched to a daily price revision in June 2017 from a revision every two weeks, as the government allowed retailers to set prices.

India has put in place a robust plan for adequate supply of crude oil to refineries. Indian refiners are increasing their planned purchases from the nations of the OPEC Mexico and the US to hedge against loss of Iranian oil. Refiners in India, the world’s third-biggest oil importer and Iran’s top oil client after China, had almost halved their Iranian oil purchases since November when petroleum sanctions went into effect. At the time, the US granted waivers from sanctions, known as significant reduction exceptions, for six months to countries that purchased some amounts of Iranian crude, including India.

India and China, two most sought-after customers of the OPEC have put in place a mechanism to figure out ways to fight crude oil volatility and teamed up for other energy issues in global markets. The two countries have set up a joint working group that would identify subjects of cooperation in the energy sector, including ways to rein in global oil prices. China and India, second- and third-largest oil consumers, respectively, have been meaning to form a joint front for more than a decade to assert their weight in the oil market, dominated by a producers’ cartel, OPEC. The idea was originally proposed in in 2005 but it didn’t make much headway. The countries, however, partnered in some upstream projects in the last decade after engaging in fierce competition for oil and gas blocks in Africa and Asia. A big cooperation opportunity exists in swapping oil and LNG, making it commercially advantageous to both. India can potentially swap its share of oil and gas from Russia with China that has easy access to Russian energy pipeline. Bringing Russian oil to Indian refineries is expensive due to long distance.

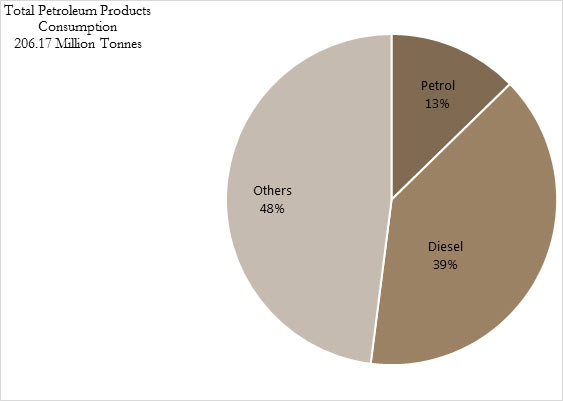

The decision to reduce India’s oil import dependence by 10 percent has not materialised as the country’s reliance on foreign oil for meeting its energy needs has jumped to a multi-year high of nearly 84 percent, government data showed. India planned to bring down its oil import dependence from 77 percent in 2013-14 to 67 percent by 2022 when India will celebrate its 75th year of independence. Further, the dependence was to be can be cut to half by 2030. But with consumption growing at a brisk pace and domestic output remaining stagnant, India’s oil import dependence has risen from 82.9 percent in 2017-18 to 83.7 percent in 2018-19, according to PPAC. Import dependence in 2015-16 was 80.6 percent, which rose to 81.7 percent in the following year, PPAC said. The country’s oil consumption grew from 184.7 mt in 2015-16 to 194.6 mt in the following year and 206.2 mt in the year thereafter. In 2018-19, demand grew by 2.6 percent to 211.6 mt. According to PPAC, India spent $111.9 bn on oil imports in 2018-19, up from $87.8 bn in the previous fiscal year. The import bill was $64 bn in 2015-16. For the current fiscal, it projected crude oil imports to rise to 233 mt and foreign exchange spending on it to marginally increase to $112.7 bn. ONGC’s output fell to 19.6 mt in 2018-19 from 20.8 mt in the previous year. ONGC's oil production was 20.9 mt in 2016-17 and 21.1 mt in 2015-16. Output from fields operated by private firms has dropped from 11.2 mt in 2015-16 to 9.6 mt in 2018-19.

Annual crude oil production by ONGC has fallen to its lowest level in 16 years, according to fresh data sourced from the oil ministry’s website. Oil output recorded by the company declined 5.42 percent to 21.042 mt last financial year as compared to 22.249 mt produced in the previous fiscal. The worrisome trend is mainly attributed to drop in output from nearly all the offshore and onshore blocks in ageing fields. Crude oil production from onshore blocks increased by a marginal 1 percent to 6,074 tmt in 2018-19. Cumulative crude oil production from onshore blocks reached a five-year in 2018-2019. Oil production from offshore blocks last fiscal year declined 8 percent to 14.969 mt – lowest in 16 years. The government has shelved a proposal to farm out or privatise ONGC fields twice in the past 5 years. The proposal was a result of the continued drop in production. Later, the upstream regulator DGH had asked ONGC to submit detailed data on its top 47 fields to monitor production, projects and to raise output.

ONGC has arrested a declining crude oil production trend in its onshore fields and registered a 1.25 percent rise in output in the fiscal year ended March 2019. ONGC produced 6.141 mt of crude oil from its onshore fields despite majority of them being more than 50 years old and facing a natural decline. India’s largest oil and gas producer has in recent times faced immense pressure from the government, which has blamed it for the continuing decline in the country’s output. ONGC has already reversed years of decline in natural gas output, posting a record 6.5 percent jump in production to 25.9 bn cubic metres in 2018-19. However, oil production from offshore fields continues to be on a decline and will only reverse next year when Krishna Godavari basin field KG-DWN-98/2 comes onstream. ONGC has monetised five out of the total 13 discoveries during 2018-19 on a fast-track mode which helped contribute to the growth in production from onshore fields. In order to sustain production and achieve higher onshore growth, ONGC drilled 303 wells during the last fiscal, which is the highest since 2014-15. The company has also engaged reputed international oil and gas consulting firm Gaffney Cline & Associates for high level review of two major fields of largest onshore producing asset, Mehsana in Gujarat and a few other onshore fields for enhancement of production.

India is becoming increasingly uncomfortable with the idea of buying more American shale oil, which the US has been pushing to counterbalance the impact of sanctions on Iranian oil exports. India’s main problem with US shale is that it will be more expensive for Indian refineries to process it, effectively increasing the price of the output. Once the US sanctions on Iranian oil kicked in, India’s future purchases from alternative energy suppliers will be finalised keeping in mind the country’s energy and commercial security. The US sanctions will disrupt supplies from Iran, which accounted for 10 percent of India’s energy imports in 2018-19. Only a handful of new refineries, IOC’s Paradip Refinery, can process shale oil as its composition and properties are different from crude oil. India imported oil and gas worth close to $4 bn from the US last year and it is committed to buying American oil and gas worth $5 bn per annum. IOC executives confirmed the company imported 3.8 mt of shale oil from the US during 2018-19 for Paradip Refinery.

IOC aims to achieve 100 percent capacity utilisation of its 15 mtpa Paradip refinery in 2019-20 even if US ends the waiver of oil import from Iran. IOC’s 15 mtpa coastal refinery at Paradip is spread over 3,345 acres, built with an estimated cost of ₹345.55 bn. The refinery can process 100 percent high-sulphur and heavy crude oil to produce various petroleum products, including petrol and diesel of BS-IV quality, kerosene, aviation turbine fuel, propylene, sulphur, and petroleum coke. It is also designed to produce Euro-V premium quality motor spirit and other green auto fuel variants for export. IOC has pledged to invest ₹520 bn more on ramping up refinery capacity and commissioning some additional units of its planned petrochemicals complex.

IOC has set up a trading desk at its office to buy crude oil from international market on a real-time basis, helping it cut import price by locking in best price and quality. IOC, which buys 30 percent (15 mt) of its oil requirement from spot or current market, had set up a trading office in Singapore in 2017 but has now developed in-house software and trading team to buy crude oil on a real-time basis. It made the first purchase through the desk on 25 March when it bought 1 mn barrel of Nigeria’s Agbami crude. While private sector firms like RIL have had a local trading desk for buying of crude and exporting fuel it produces, IOC would be the first state-owned refiner to set up such a desk. The Singapore desk was used to buy crude oil on a short-tender basis where the purchase was decided in two-hour time after receipt of offers from an international seller. But with a trading desk at its office in the national capital, IOC is deciding on purchases on a real-time basis. IOC plans to transfer the trading desk once it stabilises in Singapore to do the real-time purchase of quantities of crude oil it buys from the spot market. Also, it could trade on fuel its refineries would export. Currently, one cargo of 1 mn barrels are bought through trading desks at Singapore or at New Delhi. The trading desk is part of progression IOC has seen in crude procurement policy since 2016 when the government gave flexibility to state refiners to devise their own crude import policies. Prior to that, IOC used to take 26 hours to decide on a tender for import of crude oil from spot or current market. In April 2016, after the Cabinet gave state-owned oil refiners freedom to devise their own crude import policies, the time has been shrunk to 12 hours.

Saudi Arabia’s Aramco made headlines for reportedly being in discussions to pick a stake in Reliance Industries' core business. The deal, if successful, may take overall foreign interest in Indian’s oil and related assets to $44.46 bn. This includes the Rosneft investment made in 2017, a foreign participation share of proposed investment in the West Coast refinery and the speculated deal value for a stake in RIL’s refining and petchem business. The invested and committed capital, in turn bring India higher geopolitical currency. Saudi Aramco is already committed to partner India’s oil marketing companies, along with ADNOC for an equal participation in a $44 bn west coast refinery. ADNOC also has its interests in the Indian oil market, through India’s strategic oil storage facilities. The Abu Dhabi oil company has a pact to lease part of India’s its underground strategic oil storage in Karnataka for storing crude oil. RIL’s current refinery complex in Jamnagar has a cumulative capacity to process 68.2 mtpa of crude oil. After expansion, RIL’s total crude oil processing capability would increase to 74 mtpa, overtaking Indian Oil Corp’s cumulative capability of 69.2 mtpa.

Eleven years after RIL began shuttering its fuel retail outlets, it has regained market share in petrol and diesel sales to pre-2006 levels. While petrol and diesel sales nationwide grew 9 percent and 3 percent, respectively, in 2018-19 from a year ago, RIL outperformed the industry with figures of 21 percent and 16 percent, respectively, the company said. Till 2006, when RIL’s fuel sales were at its peak, it had a market share of 14.3 percent in diesel and 7.2 percent in petrol. RIL, which enjoyed an overall 12 percent market share in fuel retailing till 2006, saw it slip to less than 0.5 percent in 2014, by when it had shut most of its fuel retail outlets due to spiralling crude oil prices. RIL spent ₹50 bn in setting up 1,470 retail outlets in 2004 and 2006. In 2008, however, it started shutting outlets, and later reopened some. In 2018-19, it reopened or added 59 stations, reaching 1,372 fuel retail outlets now. Under regulations issued in October 2016 by the International Maritime Organization, ships must shift to fuel oil with sulphur content below 0.5 percent January 2020, against the present 3.5 percent. With this impending shift, demand for low-sulphur fuel oil is expected to rise. According to analysts, RIL’s gross refining margin stands to gain from expansion in middle distillate cracks, including LPG, diesel, fuel oil, kerosene and marine bunker fuel. RIL has also outperformed the industry in sales of aviation turbine fuel and bulk diesel, and is preparing to on-board Air India for diversifying its portfolio and reinforce its industry position.

RIL and Royal Dutch Shell plan to exit the Panna-Mukta oilfields when their contracts with the government expire this year. This would likely leave the task of managing these depleting fields with ONGC. RIL and Shell each own a 30 percent participating interest in the PMT fields, located close to the Bombay High offshore facility of ONGC, which holds the balance 40 percent. The two companies have conveyed to the government that they don’t want their production-sharing contract for PMT extended beyond December 2019 when the 25-year term ends. Panna and Mukta produced 1.08 mn barrels of crude oil and 13.5 bn cubic feet of natural gas in the October-December quarter, as per RIL’s earnings report. Tapti stopped producing three years ago. Some of its facilities have been handed over to ONGC. Last year, the oil ministry ordered RIL, Shell and ONGC to together pay $3.8 bn as the increased share of the government’s earnings from the PMT fields, following an arbitration award in the government’s favour. India’s crude oil production has been falling for seven straight years, making it hard to abandon declining fields.

Rest of the World

Global oil markets are adequately supplied and spare production capacity remained at comfortable levels, the IEA said, while highlighting the need to avoid higher oil prices amid fragile global economic growth. Iranian shipments of crude and condensates are running around 1.1 mn bpd 300,000 bpd lower than March, and 1.7 mn bpd lower than May 2018. OECD oil inventories at the end-February were at 2.871 bn barrels, above the five-year average, IEA said. Total oil supplies from the United States are expected to increase by 1.6 mn bpd this year.

Global oil supply dropped in March as US sanctions and power outages pushed Venezuela’s crude output to a long-term low of 870,000 bpd the IEA said, even lower than OPEC reported the day before. The IEA, which coordinates the energy policies of industrialized nations, said the output decline of 270,000 bpd was Venezuela’s second largest month-on-month drop and put the country’s production at 600,000 bpd less than a year earlier. Venezuela told the OPEC that the nation pumped 960,000 bpd last month, a drop of almost 500,000 bpd from February, OPEC said. The IEA said the voluntary curbs of that deal and reduced output by Venezuela had caused OPEC production to fall 550,000 bpd in March. The IEA maintained its forecast of growth in global oil demand for 2019 at 1.4 mn bpd.

Gazprom Neft, the oil arm of Russian gas giant Gazprom, expects the global oil deal between OPEC and its allies to end in the first half of the year. The OPEC and other large oil producers led by Russia agreed to cut their combined oil output by 1.2 mn bpd from 1 January for six months in order to support oil prices and balance the market. The deal’s participants will meet in June in Vienna to decide on the future of the deal. Gazprom Neft is currently taking long-term investment decisions assuming an oil price of $50 per barrel.

Iran’s crude oil exports have dropped in April to their lowest daily level this year, tanker data showed, suggesting buyers are curbing purchases before Washington clamps down further on Iranian shipments as expected next month. The US re-imposed sanctions on Iran in November after pulling out of a 2015 nuclear accord between Tehran and six world powers. Those sanctions have already more than halved Iranian oil exports, the country’s main source of revenue. Shipments are averaging below 1 mbpd so far this month. That’s lower than at least 1.1 mbpd as estimated for March. The latest drop deepens supply losses resulting from an OPEC led global agreement to cut oil production and US sanctions on another OPEC member, Venezuela. Supported by those moves, oil prices have risen 30 percent this year to $71 a barrel. The US, seeking to avoid an increase in oil prices, granted sanctions waivers to China, India, Greece, Italy, Taiwan, Japan, Turkey and South Korea that allowed them to keep buying some Iranian crude.

Iran will not allow any country replace its oil sales in the global market, the foreign ministry said, after the US told importers to halt Iranian purchases from May. Washington has decided not to renew its exemptions from US sanctions against Iran that it granted last year to buyers of Iranian oil. US President Donald Trump was confident Saudi Arabia and the United Arab Emirates would fill any gap left in the oil market. China, Iran’s largest crude oil customer, formally complained the US over its decision to end waivers on sanctions on Iranian oil imports. Saudi Energy Minister Khalid al-Falih said that China had “not yet” asked for more oil after the US decided to end its waivers that had allowed Beijing to keep buying from Tehran. After the US re-imposed sanctions on Iran’s oil exports in November, it initially allowed the eight biggest buyers of Iranian oil to keep purchasing limited imports for six months until April.

Saudi Arabia’s oil exports will be below 7 mn bpd until the end of May. Its oil production would be much lower than 10 mn bpd until the end of next month. Saudi Arabia’s crude oil exports fell by 277,000 bpd in February from the month before, according to data from the Joint Organizations Data Initiative. The world’s top oil exporter shipped 6.977 mn bpd in February, down from 7.254 mn bpd in January, according to the data. It pumped 10.136 mn bpd in February, down from 10.243 mn bpd in January. Saudi crude inventories rose to 204.567 mn barrels in February from 200.834 mn in January, according to the data. Saudi oil stocks peaked in October 2015 at a record 329.430 mn barrels. Saudi’s local refineries processed 2.767 mn bpd in February, up from 2.758 mn bpd in January, according to the data. Exports of refined oil products in February fell to 1.461 mn bpd, from 1.616 mn bpd the month before, according to the data. The OPEC heavyweight used 259,000 bpd of crude oil to generate power in February, down from 377,000 bpd the month before, while Saudi demand for oil products in February was 2.157 mn bpd, up slightly from 2.073 mn bpd in January, according to the data.

Saudi Arabia is willing to compensate for any potential loss of crude supply if the US ends waivers granted to buyers of Iranian oil, but the kingdom will assess the impact on the market before raising its output. The US is expected to announce that buyers of Iranian oil need to end imports soon or face sanctions, triggering a 3 percent jump in crude prices to their highest so far this year. Any action by the top oil exporter depends on the certainty of scrapping the waivers and its effect on the oil market.

China’s privately owned Hengli Petrochemical has increased its Saudi Arabian crude imports for April and May as it prepares to bring a new refinery in north-eastern China to full capacity. The purchases have kept Saudi crude exports to China elevated so far in the second quarter despite lower global demand during peak refinery maintenance season. Saudi oil exports to China averaged at 1.37 mn bpd in the first four months this year, up from 1.01 mn bpd in the same period of 2018, Refinitiv trade flow data showed. Hengli is expected to lift 6 mn to 8 mn barrels of Saudi crude in May (194,000 bpd to 258,000 bpd), after loading about 8 mn barrels in April, the highest monthly intake since it started trial runs at its 400,000 bpd refinery in December. From June onwards, Hengli’s Saudi oil intake will average around 4 mn to 6 mn barrels per month, while the remaining supplies will be made up of Iraq’s Basra Light crude and Brazil’s Marlim grade, the company said. Hengli has signed on to buy 130,000 bpd of crude from Saudi Aramco, a deal that started in the second-half of 2018.

The Russian energy ministry said that clean Russian crude oil meeting all quality requirements had arrived at the Mozyr refinery in Belarus, after contaminated crude led it to halt flows in the pipeline. Belarus state oil company Belneftekhim said it had started receiving new supplies of Russian oil at its pipeline service station and was planning to start refining it on 6 May. Russia halted oil flows along the Druzhba pipeline to Eastern Europe and Germany after some crude was contaminated. The news lifted global oil prices to a six-month high and left refiners in Europe scrambling for supplies. The Russia energy ministry said the quality of oil at the Baltic Sea port of Ust-Luga was expected to return to normal on 7 May.

The European diesel market is finding unexpected support from disruption in the refining sector after the shutdown of Russia’s Druzhba pipeline due to contaminated oil. Diesel refining margins, a measure of the profitability of making diesel from crude, hit a six-week high of nearly $15 a barrel and were trading close to this level. Oil in the 1 mn bpd Druzhba pipeline running from Russia to eastern Europe via Belarus was contaminated by chemical compounds which made it unusable by several European refineries that rely on its supply. Poland, Hungary and the Czech Republic are making available to their domestic refiners around 8 mn barrels of crude from strategic stocks to tackle the Russian Druzhba pipeline shutdown. Traders said that Total’s 240,000 bpd Leuna refinery in Germany had slashed runs because of the contamination by around 30 percent but exact details could not be immediately confirmed. German industry Group MWV said that Leuna and PCK’s 240,000 bpd Schwedt refinery were arranging to receive crude from tankers coming to the Baltic Sea. It was not immediately clear how the crude would then be transported to the refineries. Traders said the rally in the diesel market follows a bearish April where European demand eased and stock levels fell less than expected. Traders said imports of diesel from the United States were expected at around 900,000-950,000 tonnes in May, compared with 850,000 tonnes in April. Imports of diesel from the east were expected to top 2 mt in May, traders said.

From algorithms to track “dark” ships smuggling stolen crude oil to an online licensing system to undercut corruption, one Nigerian government agency hopes it can use new technology to tackle theft which has cost the country billions. But the initiative by the DPR may be too late to stem the migration of energy majors to the relative safety of drilling at sea, driven offshore by an illegal trade that Nigeria’s sprawling bureaucracy has for decades proved unable or unwilling to tackle. Africa’s top oil exporter has turned to French data firm Kpler, just six years old and staffed by a hundred mostly young employees, to help it ferret out the smugglers from the thousands of ships plying Nigerian waters. The United Nations Security Council estimates that Nigeria lost $2.8 bn of revenue to oil theft in 2017, although Kpler says the minimum 100,000 bpd — $3 bn to $8 bn a year — identified in a 2013 Chatham House report better approximates current losses. The DPR is also rolling out other plans to record oil and gas flows into a real-time central database. But the projects come many years past the point at which oil majors lost patience and began diversifying offshore — for safety and in pursuit of tantalizing new gas resources. Shell alone recorded 128 oil spills resulting from sabotage in 2018, more than double the previous year and the highest since 2014.

Indonesia’s state-owned energy company Pertamina has bought its first-ever cargo of US crude oil, which is set to arrive at one of its refineries in June. Indonesia is the latest Asian country to import US crude as shale production growth enabled the US to ship out more competitively-priced light oil to a growing number of buyers in Asia and Europe. Pertamina purchased the cargo in a tender as the offer for the US oil was more competitive than offers for African crude grades.

Brazil’s government laid out some additional terms regarding a massive oil auction scheduled for later this year, in which it will sell off an oil-producing zone known as the transfer-of-rights area. The Ministry of Mines and Energy detailed rules on how winning bidders will compensate oil firm Petrobras for exploratory and infrastructure work it has performed in the zone. The compensation would be made assuming an oil price of $72 per barrel, taking into account differences in quality between oil extracted from the transfer-of-rights area and Brent crude. The TOR area was demarcated in a 2010 deal between the government and Petrobras, when the company raised some $70 bn in the world´s largest-ever share offering at the time. In order to maintain control of the company, the government granted Petrobras the rights to extract 5 bn barrels of oil in the TOR area, in return for new shares worth 74.8 bn reais, or about $42.5 bn. The TOR arrangement provided for Petrobras and the government to revise some terms in the contract when fields were declared commercially viable, taking into account shifts in oil prices, production costs and other variables. In effect, that led to a years-long dispute between the two sides, and kept billions of barrels of excess oil in the TOR area locked under the sea floor. Earlier in April, the government agreed to pay Petrobras $9.058 bn to settle the dispute and allow for an auction of excess oil in the area in October. Under the terms of the accord, Petrobras will be compensated by auction winners for work it has already done.

| FY: Financial Year, mn: million, bn: billion, LPG: liquefied petroleum gas, IOC: Indian Oil Corp, BPCL: Bharat Petroleum Corp Ltd, HPCL: Hindustan Petroleum Corp Ltd, PPAC: Petroleum Planning and Analysis Cell, OPEC: Organization of the Petroleum Exporting Countries, US: United States, LNG: liquefied natural gas, ONGC: Oil and Natural Gas Corp, tmt: thousand metric tonne, DGH: Directorate General of Hydrocarbons, mt: million tonnes, KG: Krishna-Godavari, IOC: Indian Oil Corp, mtpa: million tonnes per annum, RIL: Reliance Industries Ltd, ADNOC: Abu Dhabi National Oil Company, PMT: Panna, Mukta and Tapti, IEA: International Energy Agency, bpd: barrels per day, OECD: Organization for Economic Cooperation and Development, DPR: Department of Petroleum Resources, Petrobras: Petroleo Brasileiro SA, TOR: transfer-of-rights |

NATIONAL: OIL

Moody’s signals tough times ahead for Indian oil companies

13 May. India’s oil and gas consumption will support its investments in refining capacity and upstream production but crude imports will keep growing amid stagnant production, and government pressure for shareholder returns will temper the credit quality of national oil companies, Moody’s Investors Service said. The Indian government demands high shareholder returns from the state-owned companies in the form of dividends and share buybacks. In addition, because of the high rate of growth in consumption, the oil companies also need to continue to invest in expanding capacity, Moody’s said. All petroleum products in India are now sold at prices linked to international or regional market prices, which has opened up the petroleum product retail market, but the refining and marketing NOCs (National Oil Companies) -- Indian Oil Corp (IOC), Hindustan Petroleum Corp Ltd (HPCL) and Bharat Petroleum Corp Ltd (BPCL) -- continue to enjoy over 90 percent market share in petroleum product distribution. Also, the two upstream NOCs Oil and Natural Gas Corp (ONGC) and Oil India Ltd (OIL) produce about 70 percent of India’s oil and 80 percent of its natural gas. The government continues to set the selling price of natural gas in the country. Moody’s said that the carbon transition risk for Indian oil companies is manageable.

Source: The Economic Times

Only 1 Indian client of Iran takes up extra Saudi oil for June

13 May. Only one Indian buyer of Iranian oil has taken up Saudi Arabia’s offer of additional oil to make up for the loss of supplies from Tehran due to US (United States) sanctions, taking an extra 2 mn barrels from the Kingdom for June shipment. Saudi Arabia approached Indian buyers offering them additional supplies to compensate for loss of Iranian oil after the US threatened to sanction entities buying oil from Tehran. The US had imposed new sanctions on Iran in November last year, but gave a six-month waiver to eight countries, including India, which allowed them to import some Iranian oil. India was able to buy about 300,000 bpd of Iranian oil under the waiver. But last month, Washington ended the waivers and said buyers should stop Iranian oil purchases or face sanctions. Only state refiners - Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL), Mangalore Refinery and Petrochemicals Ltd (MRPL) and Hindustan Petroleum Corp Ltd (HPCL) - accounting for about 60 percent of India’s 5 mn bpd refining capacity had purchased oil from Iran since November. In January-April 2019 India received about 304,500 bpd Iranian oil. In June, Saudi Arabia will supply an additional 250,000 tonnes (2 mn barrels) of oil to MRPL on top of its normal requirement of about 320,000 barrels (about 2.5 mn barrels). MRPL might not lift the additional Saudi oil as the refiner had declared force majeure and shut half of its plant due to water shortages. IOC, BPCL and HPCL have not placed a request for extra Saudi oil for June after the Kingdom raised official selling price for Asia. Indian refiners have raised optional volumes under annual contracts with key producers as well as testing new grades and origins to make up for loss of Iranian oil.

Source: Reuters

Oil Minister promises supply of 1k kilolitre kerosene to cyclone-hit Odisha

13 May. Oil Minister Dharmendra Pradhan has promised to supply 1,000 kilolitre of subsided kerosene to Odisha, as per a request made by state chief minister Naveen Patnaik in the aftermath of cyclone Fani. The Minister said that an oil PSU (Public Sector Undertaking) under the oil ministry will contribute Rs32 mn from its CSR fund to the Chief Minister Relief Fund. The Minister affirmed that the oil ministry and its PSUs will continue to provide assistance to the Odisha government in the aftermath of the cyclonic storm.

Source: Business Standard

Petrol pump owner duped of Rs7 lakh in Pune

13 May. The Hadapsar police registered an offence against unidentified suspect(s) for duping a petrol pump owner of Rs7 lakh by fraudulent transactions, misusing a point of sale machine between 11 February and 13 February, this year. Ajinjkya Tekawade, owner of the petrol pump, has lodged an FIR with the Hadapsar police. Assistant inspector S D Chavan said, a probe revealed that while receiving the payment through debit or credit cards from the customers, the suspect(s), who are employees of the petrol pump, used to swipe it on the POS machine. Though the transaction was cancelled, the bill amount was debited from the customer’s account, but never transferred to the petrol pump’s account. The fraud came to light when the Rs7 lakh difference was traced during the audit. The amount was transferred to an account in a public sector bank.

Source: The Economic Times

Elections boost India’s petrol use to highest-ever

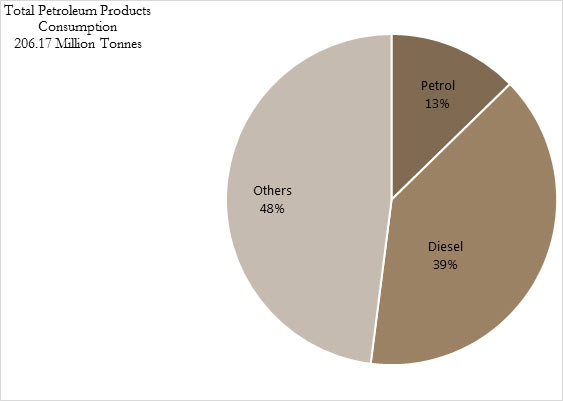

9 May. March 2019 recorded the highest level of monthly petrol consumption in India, thanks to the campaigning for the ongoing general elections, improved economic activity and the reduced price differential between petrol and diesel cars that boosted consumers’ preference for petrol vehicles, according to the oil ministry. The country consumed 2,577 thousand tonne of petrol in March, a growth of 7.2 percent over 2,404 thousand tonne in the same month last year. However, data for the full financial year 2018-19, released recently, shows petrol consumption growth during the year dropped to 8.06 percent, a 6-year low rate of growth, according to Petroleum Planning and Planning Cell (PPAC), the statistical arm of the Ministry of Petroleum and Natural Gas. Overall, India’s petroleum product consumption in 2018-2019 rose 2.65 percent to 2,116,40 thousand tonne, as compared to 2,06,166 thousand tonne recorded in the previous fiscal. The growth of 2.65 percent was the lowest recorded in past five years. ICRA Senior Vice President K Ravichandran said that India’s petroleum products consumption is projected to grow 3-4 percent in the present financial year ending March 2020. India’s diesel consumption in March 2019 rose by a marginal 1.38 percent to 7,451 thousand tonne, as compared to 7,349 thousand tonne recorded in the corresponding month a year ago. According to PPAC, the slight increase in diesel use in the month was attributed to increased infrastructure works across the country in anticipation of general elections and the opening of new mines in Nagaland and Jharkhand. Cumulatively, diesel consumption during the full financial year 2018-2019 increased 3 percent to 835,20 thousand tonne, as compared to 810,73 thousand tonne recorded in the previous fiscal. Cumulative demand for LPG (liquefied petroleum gas) in 2018-2019 increased 6.8 percent to 249,18 thousand tonne, as compared to 233,42 thousand tonne recorded in the previous financial year. Also, ATF (aviation turbine fuel) consumption last financial year grew 9.1 percent to 8,325 thousand tonne, aided by an over 13 percent increase in domestic passenger traffic.

Source: The Economic Times

India monitoring costs of importing non-Iranian oil

8 May. The finance ministry is closely watching the economic costs of oil imports from other alternative markets like Iraq and Saudi Arabia, following the United States' withdrawal of the waiver granted last year to some countries by the US on its Iran sanctions. Following the withdrawal of the US waiver, India has stopped contracting oil shipments from Iran. Oil Minister Dharmenra Pradhan had said that government has put in place a robust plan for the adequate supply of crude oil to Indian refineries. With 80 percent of India’s requirements being met through imports, higher-priced oil from non-Iranian sources can make a big dent in the country's current account deficit and forex reserves. Oil imports from Iran in the past fiscal ended March amounted to about $9 bn, as per industry figures. Iran used to offer India a longer credit period of 60 days compared to other crude suppliers, while the cargo insurance was free. Iran’s eight biggest oil buyers - China, India, Japan, South Korea, Italy, Greece, Turkey and Taiwan - had received the US waivers last November, which had allowed them to continue importing limited volumes of Iranian crude. Though India has not yet officially made known its position on future Iranian crude imports, imports from Iran were down 57 percent in April on a year-on-year basis. The decline was 31.5 percent on the previous month’s imports. India is scheduled to receive two crude carriers carrying 4 mn barrels of Iranian oil this month. The two deliveries were loaded in April, prior to the end of the waiver that came into effect on 2 May. India has been Iran’s second largest customer of oil, after China.

Source: Business Standard

NATIONAL: GAS

Amritsar gets first PNG connection for domestic cooking

14 May. In a major revolution in cooking fuel, Amritsar’s first PNG (piped natural gas) connection was commissioned in village Fateghpur Rajputan which will be followed by another one hundred PNG connections in the village in near future. The development of similar kind of pipeline network was already in progress at Circular road, Majitha road, Ranjit Avenue and Cantonment Board of Amritsar where PNG connections would be provided in near future. However, sources informed that the PNG connections in the Beas city, Mehta village, Nava Pind and Baba Bakala would reach in one year.

Source: The Economic Times

Iran may offer the Farzad-B gas block to India on easier terms

14 May. Iran is expected to offer the Farzad-B gas bloc to India on easier terms during talks between External Affairs Minister Sushma Swaraj and her Iranian counterpart Javed Zarif. But, with the US (United States) refusing to allow India an extension to a waiver allowing New Delhi to source crude oil from Iran, Zarif may push India to take a tougher stance and shelve its plans of cutting down Iranian. In November last year, India — the third largest oil importer — had managed to squeeze out a six-month waiver from the US with regards to sourcing oil from Iran. But with the Trump administration remaining firm, New Delhi has been unable to buy more crude oil after the quota of 9 mn barrels was shipped. Senior officials from ONGC Videsh Ltd (OVL) — the overseas investment arm of ONGC — have said it may reduce its investment outlay, and agreed to Iran taking delivery of all gas already produced in the field. Farzad-B’s gas reserve is estimated at 21.6 trillion cubic feet.

Source: Business Standard

GAIL awards contracts worth Rs105 bn for key pipeline projects

10 May. GAIL (India) Ltd announced awarding of major contracts worth Rs105 bn for the ongoing Jagdishpur-Haldia and Bokaro-Dharma natural gas pipeline projects and Barauni–Guwahati pipeline project. The pipelines are part of the Pradhan Mantri Urja Ganga project. GAIL chairman B C Tripathi said the company has exceeded its capex target of Rs64 bn for financial year 2018-19. The pipeline has already reached Barauni and GAIL is ready for supplying gas to refinery and upcoming fertilizer plants in the region. The work for balance portion is scheduled to be completed by December 2021 in a phased manner. The company said it is currently executing around 5,500 kilometre (km) of pipeline related projects for Rs250 bn to provide gas supply largely to Eastern and Southern parts of the country. Another 1,400 km pipeline involving capital expenditure of Rs70 bn is under evaluation which is targeted to be completed by 2023. These pipeline projects by GAIL will be part of the National Gas Grid, connecting the mainland with the eastern part of the country.

Source: The Economic Times

NATIONAL: COAL

Supreme Court grants 15 days for coal transport from Meghalaya

11 May. The Supreme Court allowed transportation of 75,050 metric tonnes of coal from Meghalaya for 15 days beginning 17 May but asked the state government to ensure that no other coal should be transported or mined. The court, however, imposed some criteria for transportation of the specified coal. It asked the state government to take “necessary precaution” that no other kind or category of coal is permitted to be transported or mined under the guise of the permission. It said only those who have transport challans, after the order of the court dated 4 December 2018, should be permitted to transport the 75,050 mt coal. The actual transportation, after due verification and issuing of a verification certificate by an officer not below the rank of deputy commissioner, will be permitted from 17 May till 31 May, after which no transportation will be allowed.

Source: Telegraph India

CIL’s coal allocation under spot e-auction drops 38 percent in FY19

8 May. CIL (Coal India Ltd)’s coal allocation under spot e-auction scheme declined by 37.7 percent to 34.34 million tonnes (mt) in the last fiscal (2018-19). The country’s top dry-fuel miner had allocated 55.17 mt of coal in FY 2018, according to government data. However, the coal allocated by the PSU (Public Sector Undertaking) under the scheme in March increased by 10.2 percent to 4.18 mt, compared to 3.79 mt in the corresponding month of FY 2018, it said. Coal distribution through e-auction was introduced with a view to provide access to coal for such buyers who are not able to source the dry fuel through the available institutional mechanism, as per the information available on CIL website. The purpose of e-auction is to provide equal opportunity to purchase coal online through single window service to all intending buyers. CIL accounts for over 80 percent of domestic coal output. The company reported a growth of 7 percent in coal production to 606.9 mt in 2018-19, a shade below the MoU (Memorandum of Understanding) target of 610 mt with the coal ministry. The coal production stood at 567.4 mt in FY 2018.

Source: Business Standard

Chotia coal block output to reach 1 mtpa in near term: Vedanta

8 May. Mining giant Vedanta Ltd has said that coal output from the mine located in Chhattisgarh will be increased to 1 million tonnes per annum (mtpa) as it looks to secure 90 percent of its requirement from linkage and captive block. Bharat Aluminium Company Ltd (BALCO), part of Vedanta, had bagged Chotia block during the first phase of coal mine auctions held in 2015. The output from the captive mine stood at 0.45 mt in the fourth quarter of last fiscal, it said. The mine has a capacity of 1 mtpa. Known for its high quality coal reserves, BALCO had bid a price of Rs3,025 per tonne during the auctions.

Source: Business Standard

SC seeks Centre’s reply on Essar Power's plea to surrender coal block

8 May. The Supreme Court (SC) sought the Centre’s response on a plea of Essar Power MP Ltd seeking to surrender the coal mines won by it in the 2015 auctions and refund of money paid to the government. A bench comprising Chief Justice Ranjan Gogoi and Justice Deepak Gupta issued notice to the Centre on the appeal of Essar Power which has challenged the Delhi High Court’s decision disallowing its plea. Essar had won Tokisud North coal mine in Jharkhand in the auctions carried out by the Centre in 2015-16. The company had submitted that it wanted to surrender the coal block and hence, its deposit be returned.

Source: Business Standard

NATIONAL: POWER

Powergrid helps restore power supply in cyclone-hit Odisha

14 May. Power Grid Corp of India Ltd (Powergrid) said it has helped state utilities restore electricity supply in cyclone-hit Odisha. Cyclone Fani on 3 May caused massive damage to power supply infrastructure in coastal Odisha, uprooting lakhs of electric poles, transformers and collapse of towers, Powergrid said. Powergrid has also created 24x7 control rooms at various locations for coordination between various state agencies in providing timely assistance and feedback to its teams and state entities at ground zero.

Source: Business Standard

Chennai to get its first unmanned substation

13 May. TANGEDCO (Tamil Nadu Generation and Distribution Corp) has identified a substation to be upgraded into an unmanned substation — the first of its kind in the city. The 33 kilovolt (kV)/11 kV substation, located right at the heart of the central business district of Anna Salai, near the Express Mall on Woods Road, has been chosen for the upgrade. It was constructed only a year ago. The unmanned substation concept is similar to the successful working model of the Power Grid Corp India Ltd.

Source: The Hindu

Average spot power price to be less than Rs3.5 per unit in May

12 May. Average spot power price is unlikely to breach the Rs3.50 per unit level in May on account of sufficient coal stock for thermal plants and enhanced supplies from clean energy sources, according to experts. According to the Central Electricity Authority (CEA), out of 127 thermal power plants monitored by it, two power stations had super critical coal situation as on 9 May 2019. These two plants had coal stock of less than four days and there was only one plant which had critical coal situation with stock of less than a week. So, dry fuel shortage is not affecting power generation. Indian Energy Exchange (IEX) Director Rajesh K Mediratta said that average spot power price at IEX was Rs 3.3 per unit till May 10, 2019, which was far lower than Rs4.67 per unit in May 2018. The peak demand of power this month was 178 GW due to summer season, Mediratta said. High peak demand of 178 GW was recorded in September 2018.

Source: Business Standard

Maharashtra to distribute 77 mn LED lamps by end 2019

11 May. Maharasthra government plans to distribute 77 mn LED (light emitting diode) lamps in the state by the end of the current year as part of a larger plan in the works with Energy Efficiency Services Ltd (EESL) to save electricity. The centre had launched the ambitious Unnat Jyoti by Affordable LEDs for All (UJALA) scheme in 2015 as the world’s largest domestic lighting programme. Under the scheme, EESL procures the appliances and provides them to consumers at a rate of Rs70 per LED bulb and Rs220 per LED tube light, much below the market price.

Source: The Economic Times

79-year old woman from Pune lived her whole life without electricity

8 May. With summer at its zenith, can you imagine living without electricity for a few weeks or even a few days? The answer will obviously be no. However, Dr Hema Sane, a 79-year old former professor has been living in a house without electricity in Budhwar Peth, Pune all her life. And the reason behind not using electricity is her love for nature and the environment. Shane is a PhD holder in Botany from Savitribai Phule Pune University and she was even a professor at Garware College Pune for several years.

Source: Business Standard

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

8 firms awarded wind power projects in Gujarat

14 May. As many as eight renewable energy companies bagged contracts to develop wind power projects in Gujarat, aggregating 745 MW. Anisha Power Projects Pvt Ltd bid the lowest tariff of Rs2.80 per unit for 40 MW. Gujarat Urja Vikas Nigam Ltd (GUVNL) had in March invited bids for supply of 1,000 MW from wind power projects to be set up in Gujarat. The state-run power utility received bids for 931.4 MW, against the tendered capacity of 1,000 MW. According to the tender rules, GUVNL conducted a reverse auction for 745 MW. Among the other successful bidders, Powerica Ltd bagged 50.60MW at a tariff of Rs2.81 per unit. Vena Energy Shivalik Wind Power Private Ltd and Virdi Clean Alternatives Ltd won contracts for 100 MW each at Rs2.81 and Rs2.95 per unit, respectively. Sarjan Realities Ltd quoted Rs2.87 per unit for 100.80 MW. Renew Wind Energy Pvt Ltd quoted Rs2.95 per unit for the highest capacity of 200 MW and Inox Wind Ltd received a contract for 40 MW at the same tariff. Although Adani Renewable Energy Park (Gujarat) Ltd bid for 300 MW, it bagged only 113.6 MW. Some 459.65 MW of wind power capacity was installed in Gujarat in 2018-19. With 6,073.07 MW, the state ranks second in terms of wind power capacity after Tamil Nadu (installed capacity 8,968.91 MW). Gujarat Industries Power Company Ltd and Tata Power Renewable Energy Ltd quoted Rs2.75 per unit for 50 MW and 250 MW solar power projects at the Dholera solar park. GUVNL had invited bids for 1,000 MW but the tender remained undersubscribed as it received bids only for 300 MW.

Source: The Economic Times

NTPC picks greener technology for 660 MW unit in Madhya Pradesh

14 May. With the aim of reducing emissions, power behemoth NTPC Ltd will for the first time commission a 660 MW unit based on ultra-supercritical technology by June. The ultra-supercritical technology burns coal at a much higher efficiency. Across the country, most of the power plants are based on sub-critical technology, which has a 38 percent thermal efficiency. It means that 38 percent of thermal energy gets converted into electrical energy. In the ultra-supercritical plant, this efficiency is 44 percent. The power unit is a part of the Khargone Power Plant in Madhya Pradesh, which is still under-construction. The second unit of the plant is also with the same technology. The total plant capacity would be 1,320 MW, which will require an investment of about ₹99 bn.

Source: The Hindu Business L ine

SECI again extends deadline till 31 May for 3 GW manufacturing-linked solar bids

14 May. Solar Energy Corp of India (SECI) again extended bids submission deadline for manufacturing-linked 3 GW solar power tender till 31 May. On 22 April, SECI had extended the last date of bid submission for tender till 14 May. According to the notice, the last date of bid submission is extended till 31 May 2019 (till 1600 hours). The techno-commercial bid opening shall be carried out from 1700 hours on the same day. SECI had floated the fresh tender for the 3 GW manufacturing-linked solar power tender in January this year. Initially, the bidders were to submit their bids by 18 March. SECI had extended deadline for bid submission to 4 April, from 18 March. Again, the deadline was extended from till 22 April.

Source: Business Standard

India likely to add 80 GW of renewable energy capacity in next 5 yrs

13 May. India is expected to add about 80 GW of renewable energy capacity in the next five years, according to a survey by consultancy Bridge To India. About 47 GW will be from utility scale solar, 21 GW from wind, 8 from rooftop solar and 3 GW from floating solar projects, the survey said. About 73 percent of the respondents are optimistic about the growth prospects of the Indian renewable industry, it said. Around 78 percent the respondents feel that the government has propelled industry growth by increasing the renewable target to 175 GW. The government aims to achieve the renewable energy target of 175 GW by 2022 of which 100 GW would be solar energy and 60 GW through wind energy.

Source: Business Standard

Government buildings dampen Bengaluru’s solar power hopes

12 May. Major urban centres around the world are embracing renewable energy sources to power homes and businesses, but Bengaluru is unlikely to feature in that hallowed list anytime soon. Since 2014, only 1,750 solar panels have been installed atop complexes in the city, with the least number of units coming up at government buildings. The dismal record is reflected in the data compiled by Bangalore Electricity Supply Company (BESCOM), and it has complicated the utility’s target of generating 1,200 MW of electricity through solar panels till 2020. To date, it has achieved only 106 MW. The tender for installation of more solar panels at government buildings was issued earlier this year and the contract will be awarded within six months.

Source: The Economic Times

PMPML to build solar panels on rooftops of 11 depots

10 May. After the successful pilot project undertaken by Pune Mahanagar Parivahan Mahamandal Ltd (PMPML) where a solar power plant was installed on the rooftop of Swargate bus depot, the city transport provider has decided to install similar plants at 11 depots in the city. The electricity consumption at the Swargate bus depot has reduced by 80 percent since the solar power plant was installed on its rooftop in October 2018. According to PMPML, the hybrid solar power plant at Swargate depot is first of its kind in the city. A wind and solar hybrid non-conventional energy project at Swargate depot consists of the systems of a capacity generation of 20 kilowatt (kW) wind and 15 kW solar energy. The entire system can generate average 80 kilowatt hour (kWh) energy daily during the trial phase which can be increased to average 110 kWh daily. A wind and solar hybrid non-conventional energy project at Swargate depot consists of the systems of a capacity generation of 20 kW wind and 15 kW solar energy. The entire system can generate average 80 kWh energy daily during the trial phase which can be increased to average 110 kWh daily.

Source: Hindustan Times

Renewable energy projects hit due to poor cash flow of Andhra, Telangana discoms

9 May. Poor cash flow and credit profiles of power distribution companies (discoms) of Telangana and Andhra Pradesh have adversely affected the financial health of many renewable energy projects, India Ratings and Research (Ind-Ra) has said. In its first report on the renewables sector, Ind-Ra said the soaring receivables from the discoms of the Telugu states have weakened the internal liquidity of many projects in the fledgling renewable market and kept them hostage to state utilities.

Source: The Economic Times

Solar power generation in India increased by 34 percent yoy in Q1 2019

9 May. Solar power generation in India has increased substantially over the past few years. According to the data released by the Central Electricity Authority (CEA), solar power accounted for over 11.4 bn units of electricity produced in Q1 2019. This marks a growth of 34 percent year-over-year (yoy) from the 8.5 bn units generated in the Q1 2018. During FY 2018-19, India produced approximately 39.2 bn units of solar power, an increase of nearly 52 percent compared to the preceding FY 2017-18. Of the total electricity generation in FY 2018-19, over 90 percent came from non-renewable sources followed by renewables which stood at just 9 percent. According to Mercom’s India Solar Project Tracker, solar installed capacity in the country at the end of FY 2018-19 reached 30 GW, a 32 percent increase compared to 22.7 GW installed as of FY 2017-18. Even with impressive yoy growth, solar accounted for just 2.85 percent of the total power generated in the country and still has a long way to go. India’s transition towards renewable energy presents an incredible opportunity but also challenges.

Source: Mercom India

Indore airport eyes solar power, energy efficiency to cut CO2 emission

9 May. Indore airport, also known as Devi Ahilyabai Holkar Airport, may soon be recognized for its significant progress in managing carbon emissions by a global airport body. Airport authorities plans to apply for carbon management certification programme – ‘Airport Carbon Accreditation’, which is run by Airports Council International (ACI). It was launched in 2009 and is the only voluntary global carbon management standard for airports. Four Indian airports already have this rating. This accreditation recognizes efforts of an airport in managing and reducing carbon dioxide (CO2) emissions through independent assessment and verification. The accreditation aims at reducing carbon footprints by implementing cost-effective carbon mitigation action and instituting an environment policy. Authorities had earlier planned for obtaining Indian Green Building Council (IGBC)’s Green Existing Building rating for airport building. However, it was dropped, and they have now decided to apply for ACI’s airport carbon accreditation.

Source: The Economic Times

India to exceed climate compliance under Paris Agreement: Moody’s

9 May. India will exceed the compliance of its commitment made to address climate change through green energy installations under the landmark Paris agreement, according to global credit rating agency Moody’s Investors Service. The share of generation capacity from non-fossil-based fuel sources in the country will likely increase to 45 percent by 2022 as India plans to increase its renewable energy capacity, excluding hydro, to 175 GW and both wind and solar have already achieved grid parity, according to Moody’s analysis. In India, the generation volume from coal power is expected to continue to increase through 2030 in the International Energy Agency’s New Policies Scenario and remain the largest contributor to the country’s power supply. But the share of coal in the country’s power mix in the NPS decreases to 57 percent in 2030 from around 74 percent in 2017. The rating agency said that the risk of stranded asset for coal power is growing, and it varies by geography. Companies in most Asian geographies are unlikely to reduce coal plant utilization sharply or retire operational coal plants earlier than planned through 2030.

Source: The Economic Times

HERC rejects petition to retain exit clause of a 36 MW hydropower project

9 May. In a review petition, the Haryana Power Purchase Center (HPPC), had asked the Haryana Electricity Regulatory Commission (HERC) to review its order passed on 8 March 2019, in which it allowed the deletion of an exit clause in the power purchase agreement. The petition was for a 36 MW hydropower project which HPPC purchased power from. The project is owned by IA Hydro Energy Pvt Ltd. Recently, Maharashtra Electricity Regulatory Commission passed an order reprimanding the Maharashtra State Electricity Distribution Company Ltd for not paying the interest accumulated on its principle dues to a small hydro project developer in the state.

Source: Mercom India

Piramal Group in talks with PTC India to buy 290 MW wind assets

8 May. The $10 bn glass-to-financial services major Piramal Enterprises is in talks with PTC India to acquire its subsidiary PTC Energy’s 290 MW wind assets as part of their strategy to expand investments in renewable sector – wind and solar. Piramal Group is planning to acquire the entire wind portfolio of PTC India across Madhya Pradesh, Karnataka and Andhra Pradesh, which is likely to cost the company around Rs22 bn. Piramal signed a Memorandum of Understanding (MoU) with Canadian Pension Plan and Investment Board to co-sponsor an infrastructure investment trust to invest in renewable assets with a corpus of $600 mn (Rs42 bn). Piramal Group chairman Ajay Piramal said the renewable energy sector is at an inflection point and is witnessing significant consolidation, the pace of which is likely to increase in the near future.

Source: The Financial Express

INTERNATIONAL: OIL

OPEC sees more 2019 demand for its oil as it keeps cutting output

14 May. OPEC (Organization of the Petroleum Exporting Countries) said that world demand for its oil would be higher than expected this year as supply growth from rivals including US (United States) shale producers slows, pointing to a tighter market if the exporter group refrains from raising output. But the OPEC, in a monthly report, said its output fell in April. Top exporter Saudi Arabia cut output despite oil prices hitting a 2019 high above $75 a barrel and US President Donald Trump urging action to lower prices. Supply losses in OPEC members Iran and Venezuela, both under US sanctions, have deepened the impact of an OPEC-led production-limiting deal. The so-called OPEC+ group of producers meets next month to review whether to maintain the pact beyond June. OPEC+ returned to output cuts this year due to concern that an economic slowdown would produce a supply glut. But demand has weakened no further for now, as OPEC kept its estimate of global growth in oil use in 2019 steady at 1.21 mn barrels per day.

Source: Reuters

Oil prices rise over 1 percent on drone attack on Saudi Aramco facilities

14 May. Oil prices rose over 1 percent after top exporter Saudi Arabia said explosive-laden drones launched by a Yemeni-armed movement aligned to Iran had attacked facilities belonging to state oil company Aramco. That move higher comes as the market waits for a report from the American Petroleum Institute (API), an industry group, which is expected to show US crude stockpiles fell by 800,000 barrels, their second decline in a row, according to analysts in a poll. Saudi Arabia said armed drones had struck two oil pumping stations in the kingdom in what it called a “cowardly” act of terrorism two days after Saudi oil tankers were sabotaged off the coast of the United Arab Emirates. Tehran has been embroiled in an escalating war of words with the US over stricter US sanctions, which have cut its oil exports and tightened global supply. A fifth of global oil consumption passes through the Strait of Hormuz from Middle East crude producers to global markets.

Source: Reuters

Iran sent oil shipment to Syria, easing fuel crisis

10 May. Syria received its first foreign oil supplies for six months, with the arrival of two shipments including one from Iran, easing the war-torn country’s fuel crisis. The oil was delivered in two tankers, one sent by Iran, the other by an unnamed businessman. Syria has suffered an acute fuel shortage this winter, with the government introducing rationing for gasoline and cooking gas and long queues building at petrol stations. President Bashar al-Assad said the crisis was part of a siege imposed by governments that oppose him, including the United States, which has imposed sanctions that broadly prohibit trade with Damascus.

Source: Reuters

Japan refiners tap more oil from Middle East to replace Iran supply

9 May. Japanese refiners are tapping more oil from the Middle East after the United States (US) ended all waivers from sanctions on Iran starting from this month. Fuji Oil Company bought 1.5 mn barrels of Oman crude, Banoco Arab Medium from Bahrain, and Upper Zakum, an Abu Dhabi grade, to load in June in a spot tender held last month. Alternative imports are not expected to come from the US - now the world’s largest producer - as the US crude is lighter than Iranian crude, Takayuki Uematsu, senior executive officer at Cosmo Energy Holdings Co Ltd, said. Iranian oil accounted for about five percent of Cosmo’s total procurement, and Japan’s third-largest refiner feels confident it will be able to secure enough supply from other sources, he said. Fuji Oil President Atsuo Shibota said he also does not see any problems in securing oil supplies from sources other than Iran but he expects it may raise costs by as much as 100 mn yen ($911,000) a month for the company. Fuji Oil said Iranian oil accounted for about 20 percent of the company’s supplies in the financial year through March, down from around 30 percent the previous year.

Source: Reuters

Russia’s Rosneft to boost oil exports from Pacific amid problems in Europe

9 May. Russia’s Rosneft will load an extra crude oil cargo from the Pacific port of Kozmino on 30-31 May in addition to the initial loading plan, amid Russian oil export problems in Europe, traders said. Overall exports from Kozmino will jump in May to an all-time high of 2.94 million tonnes (mt). The move comes after Russian oil exports to Europe have been curtailed for more than two weeks due to quality issues. Kozmino’s ESPO crude oil blend is traded more than a month upfront which means May cargoes had been already sold to buyers more than a month ago. The way the crude is sold makes late additions to the loading programmes from Kozmino very rare, traders said.

Source: Reuters

Nigerian court dismisses oil export claims against Eni, Petrobras

8 May. A Nigerian court dismissed government claims that subsidiaries of Eni and Petrobras illegally exported crude oil to the United States (US), but a lawyer representing authorities in the West African country said an appeal would be launched. Crude oil sales are the mainstay of Africa’s biggest economy, making up two-thirds of the country’s revenue and around 90 percent of foreign-exchange earnings. In a lawsuit filed in 2016, Nigeria alleged that a number of companies exported a total of 57 mn barrels of crude oil to the US between 2011 and 2014.

Source: Reuters

INTERNATIONAL: GAS

US LNG shipments to China face mounting tariffs

13 May. China said it would raise tariffs on liquefied natural gas (LNG) imports from the United States (US) amid a series of additional levies, a move that could further reduce US LNG shipments to the world’s fastest growing importer of the fuel. So far this year, only two LNG vessels have gone from the US to China, versus 14 during the first four months of 2018 before the start of the 10-month trade war. China said it would boost the tariff on US LNG to 25 percent starting 1 June versus the current rate of 10 percent. The US, meanwhile, is the fastest-growing LNG exporter in the world, and is expected to rank third in exports in 2019 behind Qatar and Australia. China is the second biggest LNG importer in the world behind Japan. The US and China started imposing tariffs on each other’s goods in July 2018. As the dispute heated up, China added LNG to its list of proposed tariffs in August and imposed a 10 percent tariff on LNG in September. US LNG sales had already been affected by a 60 percent collapse in Japan Korea Marker (JKM) LNG prices seen since September.

Source: Reuters

Iraq awards gas recovery contract to CPECC

9 May. A Chinese energy company was awarded a contract to recover natural gas from Iraq’s Halfaya oil field, to fuel power stations in the country’s underserved Maysan province. The China Petroleum Engineering and Construction Corp (CPECC) said its gas processing plant would be able to recover and refine 300 mn standard cubic feet of gas daily. For decades, Iraqi oilfields have burned off the hydrocarbon byproducts of crude oil drilling instead of capturing them for energy production. The push into gas recovery comes amid diplomatic pressure by the United States (US) to have Iraq halt its gas and electricity imports from Iran. The US applied sanctions against Iran's energy and financial sectors last year. CPECC said its gas plant will be operational in 30 months. Representatives from CPECC, PetroChina, and the oil ministry signed an agreement in Baghdad. Iraq produces approximately 1 bn cubic feet of gas daily, according to the US Energy Information Administration. The country is planning, or has already initiated, projects to recover another 1.85 bn cubic feet of gas daily, Oil Minister Thamer Ghadhban said.

Source: The Economic Times

INTERNATIONAL: COAL

Australia’s Pembroke wins government approval for $700 mn coking coal mine

14 May. Privately held Pembroke Resources won approval from Australia’s Queensland state to develop a $700 mn coking coal mine, as it pushes to tap strong demand for the steelmaking ingredient in Asia. Construction is due to start next year, with the company looking to begin negotiating contracts soon for supplies of coal from the mine, CEO (Chief Executive Officer) Barry Tudor said. Pembroke has been talking to potential customers in Japan, South Korea and India, and is also open to selling a stake in the mine that will eventually produce 15 million tonnes (mt) of nigh-quality coking coal a year out of the state’s developed Bowen Basin.

Source: Reuters

Poland to hold high-level talks on Prairie Mining coal projects dispute

13 May. Poland’s Prime Minister and other government officials will meet to discuss a threat by Australia’s Prairie Mining to sue Warsaw over difficulties it faced in developing coal projects. Prairie Mining, which has been developing two mines in Poland, said in February that it had notified the Polish government about an investment dispute and that it had the right to take the case to international arbitration if it could not be resolved amicably. The mines contain coking coal as well as thermal coal. Thermal coal, used for power, is struggling to attract investment because of concerns about the environment, but coking coal, used in steelmaking, is still viewed as a strategic mineral. The two projects are near mines belonging to state-run Polish mining companies Bogdanka and JSW respectively. JSW, the European Union’s biggest coking coal producer, plans to bid for a controlling stake in Prairie in an attempt to boost future output. That plan, however, is opposed by the energy minister, who is reluctant to let foreign investors have any access to coal deposits considered strategic assets for Poland’s energy security.

Source: Reuters

Britain has first coal-free week in over a century

8 May. Britain, the birth place of coal power, has gone seven days without electricity from coal-fired stations for the first time since its 19th century industrial revolution, the country’s power grid operator said. Britain was home to the world’s first coal-fuelled power plant in the 1880s, and coal was its dominant electric source and a major economic driver for the next century. However, coal plants emit almost double the amount of carbon dioxide (CO2) - a heat-trapping gas blamed for global warming - as gas-fired power plants, and were moved out of Britain’s cities from the late 1950’s to reduce air pollution. As part of efforts to meet its climate target to cut greenhouse gas emissions by 80 percent compared with 1990 levels in the next three decades, Britain plans to wean itself completely off coal-fired power generation by 2025. Low power prices and levies on CO2 emissions have also made it increasingly unprofitable to run coal plants, especially when wind and solar power production are high. The National Grid, Britain’s power transmission network, said coal-free runs like the one would become a regular occurrence as more renewable energy entered the system. Britain’s last deep-cast coal mine closed in North Yorkshire in 2015, marking the end of an era for an industry once employing 1.2 mn people in nearly 3,000 collieries.

Source: Reuters

China April coal imports up 13.6 percent on-year due to stockpiling

8 May. China’s April coal imports rose from the same month last year, customs data showed, as power plants stockpiled supplies ahead of peak demand for electricity over the summer. China imported 25.3 million tonnes (mt) of coal in April, the data from the General Administration of Customs showed. That was up 13.6 percent from 22.28 mt a year earlier. For the first four months of 2019, imports were 99.93 mt, up 1.7 percent from a year ago, according to the data.

Source: Reuters

INTERNATIONAL: POWER

Zimbabwe faces worst power cuts in 3 yrs, mines hit

13 May. Zimbabwe’s state power utility imposed the worst rolling blackouts in three years, with households and industries including mines set to be without electricity for up to eight hours daily. The power cuts could stoke mounting public anger against President Emmerson Mnangagwa’s government as Zimbabweans grapple with an economic crisis that has seen shortages of US (United States) dollars used as the official currency, fuel, food and medicines as well as soaring inflation that is eroding earnings and savings. The Zimbabwe Electricity Transmission and Distribution Company (ZETDC), citing reduced output at its largest hydro plant and ageing coal-fired generators, said power cuts started and would last up to eight hours during morning and evening peak periods. The southern African country last experienced such serious blackouts in 2016 following a devastating drought. Mining accounted for more than two-thirds of Zimbabwe’s $4.8 bn in total export earnings last year and any power cuts in the sector will affect production and exports. In the past, some of the big mines, including platinum and gold producers, have resorted to directly importing electricity from neighbouring countries like Mozambique and South Africa. The power utility’s holding company ZESA said it had applied to the national energy regulator to raise its tariff by 30 percent for maintenance of its grid and after the price of inputs like diesel went up. Zimbabwe, now producing 969 MW of electricity daily against peak demand of 2,100 MW, is entering its peak winter power demand season, which will only increase power consumption.

Source: Reuters

Thailand’s Global Power Synergy to buy power project from Thai Oil for $757 mn

10 May. Thailand’s Global Power Synergy Pcl plans to buy a 250 MW power project from Thai Oil Pcl for $757 mn, the companies said. The move by PTT Pcl’s energy unit Global Power Synergy (GPSC) is the latest in a string of deals to buy power-generating assets. The power project will support both companies’ core businesses as well as increase efficiencies in power generating and oil refinery operations of PTT Group, PTT Chief Executive Officer Chansin Treenuchagron said. The power plant, still under construction, is expected to come online in 2023 and will sell power to Thai Oil, the country’s second largest refiner with a capacity of 275,000 barrels per day.

Source: Reuters

Firms flock to power auction for troubled Brazil state near Venezuela