ROBUST DEMAND GROWTH UNDERWRITES REFINERY EXPANSION

Monthly Oil News Commentary: January 2019

India

India is expected to become the second-largest oil demand growth centre globally in 2019, behind US but ahead of China, research and consultancy group Wood Mackenzie said. India’s overall fuel demand grew 4.47 percent to 210 mt in calendar year 2018, as compared to 201 mt consumed in calendar year 2017. The group said that LPG demand growth would remain robust in 2019 at 5 percent to 40,000 bpd, lower than the 56,000 bpd growth achieved in 2018.

India’s total refining capacity is set to grow at an average annual growth rate of 5.3 percent until 2023, according to a new report from the data and analytics firm GlobalData. According to the report, India’s total refining capacity will hit 6.525 mn bpd in 2023. By comparison, the figure for 2018 was 5.01 mn bpd, the firm said. India’s share of Asia’s crude oil refining capacity through the period should remain steady at 15 percent – second in the region to China, the firm said. In 2023, three of India’s 23 refineries will account for more than one-quarter of India’s 6.525 mn bpd refining capacity. They include the Jamnagar II (704,000 bpd), Jamnagar I (660,000 bpd) and Vadinar (405,000 bpd) facilities, the firm said.

The government approved a capacity expansion plan for Numaligarh Refinery in Assam from the existing 3 mtpa to 9 mtpa at an estimated cost of ₹ 225.94 bn. The project is to be completed within a period of 48 months after the approval and receipt of statutory clearances. The expansion project involves setting up crude oil pipeline from Paradip to Numaligarh and product pipeline from Numaligarh to Siliguri at a cost of ₹ 225.94 bn.

India's three OMCs have invited applications for setting up fuel retail outlets at 23,946 locations in Rajashtan, Madhya Pradesh, Telangana, Chhattisgarh and Mizoram. Invitation for applications in these states had missed an earlier expansion round due to state elections. The last date for submission of applications is 12 January. The companies have offered 9,647 retail outlet dealerships in Rajasthan, 7,318 dealerships in Madhya Pradesh, 3,507 in Telangana, 3,347 in Chhattisgarh and 127 in Mizoram. According to OMCs, HPCL received applications for 95 percent of the locations offered in November, BPCL received applications for 97 percent of the locations and IOC received applications for 92 percent of the locations. Cumulatively, under the current expansion drive, the three state-owned refiners have offered more than 78,500 retail outlet dealerships across 35 states and Union Territories. India currently has 63,674 petrol and diesel retail outlets. The three government-owned OMCs account for 90 percent of these. Among private players, Nayara Energy tops the list with 4,895 pumps followed by Reliance Industries Ltd (1,400) and Royal Dutch Shell with 116 retail outlets. Most of the existing petrol and diesel retail outlets are in Uttar Pradesh (7,473), Maharashtra (5,970), Tamil Nadu (5,388), Rajasthan (4,476), Karnataka (4,214), Gujarat (4,025), Madhya Pradesh (3,711), Punjab (3,427), Haryana (2,862), Telangana (2,626), Bihar (2,695), West Bengal (2,333) and Kerala (2,100). India has added about 17,481 petrol and diesel outlets in the past six years across the country, growing at an average annual rate of 5.61 percent. Overall, the three OMCs have offered setting up maximum number of fuel retail outlets in Rajasthan (9,647), Uttar Pradesh (9,027) and Madhya Pradesh (7,318) followed by Maharashtra (6,647), Karnataka (4,974), Gujarat (4,413), and Chhattisgarh (3,347), according to information provided by the OMCs on the Petrol Pump Dealer Chayan website.

Indian state-owned fuel retailers have stopped absorbing a government-mandated cut of ₹ 1 (0.014 US cents)/liter in their marketing margins on the sale of petrol and diesel due to a steep fall in global oil prices. In October, India’s finance ministry had cut its production tax on the two fuels by ₹ 1.50/liter and had asked state-owned fuel retailers to reduce their marketing margins by ₹ 1/liter to insulate consumers from a surge in global oil prices at the time. But oil prices have slumped in recent weeks allowing the marketing margin to be restored to its former levels. In October, companies were told to gradually recover the reduction in the margins if crude prices fell, the finance ministry said. It means that India’s state-owned oil refiners, who are also its main fuel retailers, will not be passing on all the benefits of the drop in crude prices to consumers as they seek to recoup the margin hit they have been taking. This is reflected, at least in part, by the relative difference in the recent declines of Indian fuel prices and global benchmarks. The price of Brent crude, Singapore gasoline and Arab Gulf Diesel have declined between 37-40 percent since 1 October while Indian petrol and diesel prices have been reduced by about 17-18 percent. That loss of margin should be full reversed by the March end of the current fiscal year. The state-owned retailers - IOC, HPCL and BPCL - control most of the fuel retail business in India. Petrol and diesel prices in India are linked to Singapore gasoline prices and Arab Gulf diesel prices, which mostly track movements in crude oil prices.

HPCL may build its second LPG cavern in Mangalore, Karnataka. HPCL is planning to build an underground LPG storage facility and had been in talks with France’s national oil company, Total SA, to partner it. Total SA is also HPCL’s partner in the first LPG cavern in Visakhapatnam, Andhra Pradesh. The cavern will be the second such facility in India and will cost ₹ 10 bn. HPCL already has an LPG import facility in Mangalore. HPCL said that looking at the growing demand for LPG, a new cavern is a commercially viable option. The facility at Mangalore will be exclusively used by HPCL and may have a capacity of over 60,000 tonne. HPCL and Total SA, through their joint venture South Asia LPG, operate a 60,000 tonne underground LPG storage facility in Visakhapatnam, which was commissioned in 2007 at an investment of ₹ 3.33 bn. HPCL said that its cavern at Visakhapatnam has been dug in rock to store LPG. The storage facility is made up of two caverns of 19 metres in height, 20 metres base width and 160 metres in length with inter-connections. HPCL may commence the project this calendar year and complete it within the next four years. HPCL is the second largest LPG marketer in India. Last fiscal year, the company had clocked LPG sales growth of 8.5%. It also maintained market leadership in the non-domestic bulk LPG segment with over 48% market share.

BPCL will import 1 mn barrels of Iranian oil in February after a gap of three months, with the nation’s overall purchases from Tehran remaining at 9 mn barrels. The US in early November granted India a six-month waiver from sanctions on Iran’s oil exports. Under the agreement, New Delhi must restrict its Iranian oil purchases to 1.25 mt or 9 mn barrels. BPCL and HPCL will lift 1 mn barrels each of Iranian crude oil in February. HPCL resumed purchases of Iranian oil after a gap of six months. IOC the country’s top refiner, will lift 5 mn barrels of Iranian oil in February, the same as this month. Mangalore Petrochemicals Ltd will buy 2 mn barrels compared with 3 mn barrels. India recently exempted rupee payments to the NIOC for crude oil imports from a steep withholding tax, paving way for pending dues to be cleared.

IOC said that Iran may still invest in a refinery expansion project at one of its subsidiaries. IOC said that Iran has not ruled out participating in the expansion at Chennai Petroleum Corp Ltd, a south India-based 20,000 bpd refinery. Iran’s participation has been questioned after India cut back its Iranian crude oil imports following US sanctions. India has exempted rupee payments to the NIOC for crude oil imports from a withholding tax. The exemption will allow Indian refiners to settle about $1.5 bn of outstanding payments to NIOC through direct rupee payments. It has been expected that these payments could help Iran invest in Indian projects, particularly the Chennai Petroleum expansion. Chennai Petroleum plans to invest up to ₹ 356.98 bn ($5.1 bn) to replace the 20,000 bpd Nagapattinam refinery in Southern Tamil Nadu state with a 180,000 bpd plant. Naftiran Intertrade, the Swiss subsidiary of NIOC, holds a 15.4 percent stake in Chennai Petroleum, while IOC has about a 52 percent share.

ONGC’s latest tender, drawn out on the QCBS scheme, has attracted old jack-up rigs averaging 41 years. The earlier tender from the country’s largest oil and gas explorer did not have the QCBS scheme and the age of jack-up rigs averaged 36 years. Indicating ONGC’s skew for lower-cost rigs over the better-quality and newer generation of jack-ups. ONGC introduced the QCBS criterion which gives 25 percent weightage to technical and 75 percent to commercial aspects. But, in effect, the technical weightage given is only 7.5 percent and this translates into a cost difference of just about $1,000-$1,500 a day between a new generation and a 39-year-old rig. ONGC is the largest client for most of the domestic oil drilling industry. Nearly 95 percent of the drilling industry revenue comes from it.

Vedanta reduced crude oil supplies to IOC for about three months until October even as the two negotiated oil rates for the year, and restored it to the officially-allocated level only after the government intervened. The government allocates all locally-produced crude to refineries based on their location, processing capability and transport logistics. All state-run and private oil producers and refiners must stick to these allocated quantities for the year. But producers and refiners are free to decide oil price formula between them, which is usually for 12 months and agreed to at the beginning of the financial year. But this year, the price negotiations between IOC and Vedanta stretched on for far too long, concluding only after the middle of the financial year. While price negotiations were underway, Vedanta cut supplies to IOC, in a bid to mount pressure for a higher price. Vedanta supplies to private refiners, which usually offer higher oil rates compared to state refiners, leaving the private producer with an incentive to serve private refiners better. IOC takes about 1.6 mt of crude a year from Vedanta, which operates the prolific Barmer block that accounts for nearly a fourth of the country’s oil output. Vedanta’s oil is processed at three refineries of IOC, including the ones at Panipat and Koyali. After Vedanta cut supplies, IOC raised the matter with the government.

The government is planning to incentivise ONGC and OIL to raise output from fields given without auction to state-run firms in previous years. The government is auctioning 14 blocks in this round for which bids will be accepted until 12 March. In the past four years, the government has ushered in several policy reforms aimed at attracting investment in the exploration and production sector, and boosting domestic oil production which has been declining for years. A new exploration licensing policy that offers marketing and pricing freedom for gas producers, and a higher gas price for output from difficult fields have been the key policy changes made to ignite interest in the country’s upstream sector. Nearly 70% of India’s oil production is generated by fields that were nominated to ONGC and OIL before the country started auctioning blocks in the 1990s. State-run firms have in the past demanded incentives for some of their gas fields that are unviable at current domestic prices. Eight of the 14 blocks are located on land, five in shallow water and one in ultra-deep water.

India expects to launch a third round of auctions for the exploration of oil blocks under its open acreage licensing programme within next few weeks, according to the government. Exploration blocks to offered in the third round to be spread over 32,000 square kilometre, the government said. India launched the second round of auctions under which 14 exploration blocks spread over 30,000 square kilometre were offered. India hopes to launch fourth and fifth rounds of auctions later this year. Bids for the second round of auctions to close on 12 March, the government said. The bid rounds could generate $500-$600 mn.

Rest of the World

Global oil and gas prices are likely to remain volatile but range bound in 2019 on the back of multiple factors, ratings agency Moody’s said in a report. The medium-term price band for WTI crude, the main North American benchmark, will be $50-$70 per barrel, it said. Market expectations for continued strong oil demand growth of 1.4 mn bpd have remained in place, despite concerns of slowing demand growth tied to weaker global economic growth, the impact of tariffs and a strong US dollar, especially in the emerging markets. Very high Saudi and Russian production, mixed signals on Iran sanctions, and US presidential pressure on Saudi Arabia to maintain high production levels have all heightened supply volatility. According to Moody’s the Exploration and Production companies in 2019 will continue to exercise spending discipline and focus on capital efficiency.

Oil prices dipped as US crude production quickly approached an unprecedented 12 mn bpd just as worries about weakening demand emerge. US WTI crude futures were at $52 per barrel, down 31 cents, or 0.6 percent, from their last settlement. International Brent crude oil futures were down 34 cents, or 0.6 percent, at $60.98 per barrel. American crude oil production reached a record 11.9 mn bpd in the week ending 11 January, the EIA said, up from 11.7 mn bpd, which was already the highest national output in the world. US output has soared by 2.4 mn bpd since January 2018, stoking fears of a supply glut. The EIA said gasoline stockpiles climbed 7.5 mn barrels, far exceeding analyst expectations in a poll for a 2.8 mn barrel gain. At 255.6 mn barrels, gasoline stocks were at their highest weekly level since February 2017. Distillate stockpiles, which include diesel and heating oil, rose by 3.0 mn barrels, versus expectations for a 1.6 mn barrel increase, the EIA data showed. Along with the surge in US crude output, exports from the US are rising, hitting a record 3.2 mn bpd by the end of last year. To stem a lurking petroleum glut, the Middle East-dominated OPEC and non-OPEC producer Russia are leading efforts to cut supply.

Oil prices ended with full-year losses for the first time since 2015, after a desultory fourth quarter that saw buyers flee the market over growing worries about a supply glut and mixed signals related to renewed US sanctions on Iran. For the year, US WTI crude futures slumped nearly 25 percent, while Brent tumbled more than 19.5 percent. The market had been on track for solid gains for the year until October, when the US granted larger-than-expected waivers to importers of Iran's oil, and as demand in emerging economies started to sag. That combination dragged down both benchmarks from four-year highs above $76 a barrel and $86 a barrel, respectively, and even a late-year decision by the OPEC and its allies including Russia, known collectively as OPEC+, to ratchet down output was not enough to restore bullish sentiment. Oil prices fell more than a third this quarter, the steepest quarterly decline since the fourth quarter of 2014. Analysts have turned bearish on 2019, according to a poll. A survey of 32 economists and analysts forecast an average Brent price of $69.13 next year, more than $5 below analyst projections a month ago, and compared with an average real price of $71.76 in 2018. Brent, the global benchmark, rose by almost a third between January and October, to a high of $86.74. That was the highest level since late 2014, the start of a deep market slump amid bulging global oversupply. OPEC+ opened its taps in autumn as demand reduced global inventories, then reversed course as priced tumbled. US drillers added about 138 oil rigs in 2018, the second year in a row of boosting the rig count. But North American producers will likely begin to reduce spending on drilling in 2019 as prices fall below break-even levels for new wells in the Permian Basin and the Eagle Ford shale field in Texas, analysts said. Still, prices could stagnate for weeks until OPEC’s cuts begin to affect global supplies in mid-January and early February.

OPEC crude cargoes leaving for the US in December dropped to the lowest level in at least five years, data from Refinitiv Eikon and market intelligence firm Kpler show. Oil cargoes departing from OPEC nations to the US fell to 1.63 mn bpd last month, down from 1.80 mbpd in November and 1.78 mbpd in October, the data show. Saudi Arabia, the biggest producer in the OPEC, and several others curbed supplies in the face of rising US production and inventories, analysts said. OPEC and allies including Russia agreed last month to cut crude production beginning this month by 1.2 mn bpd, following a strategy to support prices when supplies overwhelm demand. OPEC pumped 32.68 mn bpd last month, according to a survey, down 460,000 bpd from November, suggesting some members moved to reduce supplies ahead of the recent accord. Vessels carried about 534,000 bpd from Saudi Arabia to the, down from 632,000 bpd in November. Algeria sent 10,000 bpd, down 94,000 bpd, and Nigeria shipped 103,000 bpd, down by 48,000 bpd, according to Kpler.

Norway’s oil output in 2019 will be smaller than previously forecast and its lowest level in three decades, although it should rebound in the following years, the country’s oil industry regulator said. Investment in Western Europe’s largest oil producer and Europe’s second-largest gas producer, behind Russia, is surging after a decline due to the slump in oil prices in 2014 to 2016. Despite that, oil output in 2018 of 86.2 mcm, or 542 mn barrels, missed a 90.2 mcm forecast made a year ago, the NPD said. The regulator said output in 2019 was expected to be 82.2 mcm, against a previous forecast of 87.2 mcm, but will rise to over 100 mcm next year after Equinor starts its giant North Sea Johan Sverdrup field. Norway’s combined oil and gas production is expected to come close to its 2004 record level by 2023, when production peaks at Sverdrup, which is expected to account for about 40 percent of Norwegian oil output after 2022. Still, while output in the early years of this century was dominated by oil, the majority of production is now made up of gas, NPD data shows. NPD expects oil firms to drill about the same number of exploration wells in 2019 as in 2018 as cost-cutting and higher oil prices raise profitability of new developments. Costs of development wells fell by more than 40 percent from 2014 to 2018, but operating costs are flattening and exploration costs, which included both drilling and seismic surveys, were expected to rise by about 10 percent in 2019 from 2018, NPD said.

Oil and gas investment in Norway is expected to grow for a second year in a row in 2019 but will fall back between 2020 and 2023. Western Europe’s largest oil producer has seen a recovery in oil industry activity thanks to higher crude prices, after a slump in 2014-2016. Investment in Norway’s oil industry is estimated to rise by 16 percent year-on-year to 184.5 bn crowns ($21.5 bn), the Norwegian Oil and Gas Association said. It previously expected 2019 investment of 153 bn crowns.

Global oil refining capacity is set to increase at its fastest pace on record this year, possibly boosting stocks of products such as diesel, gasoline and marine fuel, the IEA said. Oil refining capacity will rise by 2.6 mn bpd and demand for refined products by around 1.1 mn bpd, the IEA said in a monthly report. It was not clear yet what that meant for margins, which slumped as the price of crude rose last year, said the Paris-based IEA, which coordinates the energy policies of industrialised countries. An increase in stocks of refined products could be “useful”, the IEA said, ahead of the implementation next year of regulations by the International Maritime Organization to reduce sulphur content in shipping fuel.

Japanese refiners have loaded Iranian oil onto a tanker, resuming imports after halting purchases because of sanctions by the US. Japan is the last of the four biggest Iranian oil buyers in Asia to resume imports after receiving a waiver from US sanctions on crude imports that started in November. China and India maintained their imports after November while South Korea halted imports for four months, resuming them over the weekend. Iran is the fourth-largest oil producer among the members of the OPEC. Still, the Iranian exports to Japan, the world’s fourth-biggest oil import, may be short-lived as two buyers based in Japan said they may not be able to continue after annual tanker insurance backed by the Japanese government expires in March. Japan stopped oil imports from Iran in November when the sanctions came into effect. Iranian oil accounted for 5.3 percent of Japan’s total crude imports in 2017. However, waivers were granted to Iran’s biggest oil clients - Japan, China, India, South Korea, Taiwan, Italy, Greece and Turkey - which allow them to import some oil for another 180 days. South Korea received its first Iranian oil cargo in four months. South Korea received its first Iranian oil cargo in four months, data on Refinitiv Eikon showed. The cargo marks the first Iranian oil import by South Korea in four months after the world’s fifth-largest oil buyer halted imports before the US re-imposed sanctions on Iran in November

Exxon Mobil Corp unit Exxon Mobil Cepu Ltd is expected to produce 216,000 bpd of crude oil in 2019, making it Indonesia’s biggest oil producer, the country’s upstream oil and gas regulator (SKKMigas) said. In second place Chevron Corp unit Chevron Pacific Indonesia is expected to produce 190,000 bpd of crude oil in 2019, the regulator said. State-owned Pertamina unit Pertamina EP is expected to produce 85,000 bpd of oil in 2019. Crude oil output from the US is expected to rise to a new record of more than 12 mn bpd this year and to climb to nearly 13 mbpd next year, the US EIA said in its first 2020 forecast. US crude production is forecast to climb 1.14 mn bpd to 12.07 mn bpd in 2019 and an additional 790,000 bpd in 2020 to 12.86 mn bpd. The US has become the world’s largest crude producer, boosted by output from shale formations, with production of nearly 11 mn bpd in 2018, which broke the country’s annual record set in 1970. The forecast indicates that the US will become a net crude exporter in late 2020. US demand for diesel and other distillate fuels is expected to rise 20,000 bpd to 4.15 mn bpd in 2019 and to rise to 4.19 mbpd in 2020, the EIA said. US gasoline demand in 2018 was seen at 9.29 mbpd, down from 9.31 mn bpd previously. Gasoline demand is expected to rise to 9.35 mn bpd in 2019 and to hold that level in 2020, the EIA said.

CME Group said it plans to launch an electronic auction platform with US energy firm Enterprise Products Partners LP in March to sell US spot crude oil export cargoes. The US became the world’s largest oil producer last year as shale production hit new highs, encouraging exchanges and pricing agencies to launch new mechanisms to allow companies to price and hedge US oil exports. Enterprise transports crude oil from the Permian Basin to Houston via the Midland-to-ECHO pipeline system, which has a capacity of 575,000 bpd. The ECHO terminal in Houston can store 7.4 mn barrels of crude oil.

Saudi Arabia plans to set up a $10 bn oil refinery in Pakistan’s deepwater port of Gwadar. Pakistan wants to attract investment and other financial support to tackle a soaring current account deficit caused partly by rising oil prices. Last year, Saudi Arabia offered Pakistan a $6 bn package that included help to finance crude imports.

Mexico completed its 2019 oil hedge, the world’s largest sovereign derivatives trade, at an average of $55 per barrel, placing the equivalent of $1.23 bn in put options, the finance ministry said. Mexico hedges its crude every year and deals are closely watched by the market since the trades are big enough to affect prices. The program is a longstanding part of Mexico’s strategy for safeguarding oil revenues from market volatility. For more than a decade, Mexico’s government has paid for a hedge in a bid to guarantee its revenues from oil exports by state company Pemex.

BP said it has discovered two new oilfields in the Gulf of Mexico and has identified an additional bn barrels of oil at an existing field thanks to new seismic technology. The British company, which has only recently turned a corner following the deadly 2010 Deepwater Horizon spill, also announced plans to expand production at its Atlantis oilfield in the Gulf of Mexico, consolidating its status as the largest oil producer in that region. The company has put a heavy emphasis on technology and data processing capabilities in recent years in order to unlock new resources and cut costs. The $1.3 bn Atlantis Phase 3 development will include drilling eight wells and a new subsea production system that will boost BP’s production by 38,000 boepd. It is scheduled to start production in 2020. Together with the new discoveries, BP aims to grow its Gulf of Mexico production from over 300,000 boepd at present to 400,000 boepd by the mid-2020s. BP said that new seismic technology helped it identify an additional 1 bn barrels of oil at its Thunder Horse field within weeks, whereas previously it would have taken a year to analyse. BP announced oil discoveries in the Manuel and Nearly Headless Nick prospect in the Gulf. The Manuel prospect, half owned by Royal Dutch Shell, will be linked to the Na Kika platform.

Crude oil output at CNPC’s Daqing oil field, China’s largest, fell to 32 mt in 2018, down more than 6 percent from a year earlier. The fall came despite mounting efforts from the producer to increase domestic output, with Daqing accounting for nearly one third of CNPC’s crude production inside China. China’s national oil and gas producers have pledged to expand domestic oil and gas exploration and production to help boost national energy security. CNPC is having to use more non-traditional drilling techniques at the ageing oilfield, with crude output in 2018 down about 20 percent from the field’s peak annual output of 40 mt in 2008.

Libya’s closed Sharara oilfield is expected to lose 8,500 bpd to looting, state oil company NOC said. NOC declared force majeure at Sharara, its biggest oilfield, after it was taken over by tribesmen, armed protesters and state guards demanding salary payments and development funds. The internationally recognized government and NOC agreed on a security plan last week to protect the Sharara field. OPEC member Libya had previously boosted output to up to 1.3 mbpd. NOC runs the field with Spain’s Repsol, France’s Total, Austria’s OMV and Norway’s Equinor, formerly known as Statoil

Iraq’s oil exports averaged 3.726 mn bpd in December, a significant increase from the previous month, the oil ministry said. Exports from Iraq’s southern Basra ports rose to a record high of 3.63 mn bpd, up from 3.363 mn bpd in November, the ministry said. Shipments from Iraq’s northern Kirkuk oilfields to the Turkish port of Ceyhan increased to 99,000 bpd from 8,716 bpd in November, the ministry said. Iraq exported 3.372 mn bpd of crude oil in November. The average sale price in December was $52.8 per barrel, generating around $6.1 bn in revenue, the ministry said. Iraq is producing below its maximum capacity of nearly 5 mn bpd in line with an agreement among members of the OPEC and other exporters, such as Russia, to curtail global supply in order to support prices.

China issued its first batch of crude oil import quotas for 2019 at a lower volume than for the same batch a year ago though expectations are for the volumes to climb later this year. The commerce ministry granted quotas totalling 89.84 mt to 58 companies in its first allowances for 2019. This is down from the 121.32 mt issued in the first batch of allowances for 2018, although Beijing may increase the overall volume for 2019 in a second batch of quotas later this year. Lower import quotas may signal slowing crude demand growth for the first half of 2019 in China, the world’s largest oil importer and second-largest oil consumer.

mt: million tonnes, LPG: liquefied petroleum gas, bpd: barrels per day, mtpa: million tonnes per annum, mn: million, bn: billion, US: United States, OMCs: Oil Marketing Companies, HPCL: Hindustan Petroleum Corp Ltd, BPCL: Bharat Petroleum Corp Ltd, IOC: Indian Oil Corp, NIOC: National Iranian Oil Company, QCBS: Quality and Cost Based Selection, ONGC: Oil and Natural Gas Corp, OIL: Oil India Ltd, WTI: West Texas Intermediate, EIA: Energy Information Administration, OPEC: Organization of the Petroleum Exporting Countries, mcm: million cubic meters, NPD: Norwegian Petroleum Directorate, IEA: International Energy Agency, boepd: barrels of oil equivalent per day, NOC: National Oil Corp, CNPC: China National Petroleum Corp

NATIONAL: OIL

PIL against opening of new petrol pumps in Madhya Pradesh

29 January. A PIL (public interest litigation) has been filed before Indore bench of high court challenging advertisement by various petroleum companies for opening new retail outlets across Madhya Pradesh. The PIL filed by Manthan Parmarthik Sansthan of Ujjain through advocate Lokendra Bhatnagar has raised an environmental concern through it. The petition states that on one hand the country had been taking steps to reduce fuel usage, on the other hand petroleum companies had been opening thousands of new outlets. The petitioner has submitted figures of number of existing petrol pumps in the state and the proposed increase in number of petrol retail outlets. Madhya Pradesh has 3711 petrol pumps, while government has planned to increase the number to 7397- around twice the existing number of petrol pumps. The petitioner has referred to an order by the Rajasthan high court in a similar petition, which the court has granted a stay on allotting new retail outlets in the state. The petitioner has submitted that there is a need for encouraging use of vehicles running on other forms of energy instead of petrol vehicles. The petitioner has referred to three advertisements for new petrol pumps in Ujjain at a spot where a pump was already operational and three other companies had defined the same area with different landmarks and were planning to set up total four petrol pumps in the patch.

Source: The Economic Times

Government to video chat with 60 mn Ujjwala families

29 January. Setting its sights on the 60 mn beneficiaries of the Ujjwala LPG (liquefied petroleum gas) scheme, the poll-bound government has started a programme, Ujjwala Swabhiman Utsav, where Oil Minister Dharmendra Pradhan and other ministers will interact with the families through video conferencing. The first such programme took place on 24 January, when Pradhan and women and Child Welfare Minister Maneka Gandhi interacted with around 50,000 beneficiaries of the Ujjwala scheme in 30 districts of Odisha through video conferencing from Delhi. The beneficiary women had acknowledged how the scheme helped them and the changes it brought to their lives. The government is planning to take it to other parts of the country. First, Odisha will be covered and then it is likely to reach Uttar Pradesh.

Source: The Economic Times

HPCL’s Barmer refinery achieves financial closure

28 January. Hindustan Petroleum Corp Ltd (HPCL)’s ₹ 431.29 bn refinery project in Barmer district of Rajasthan has achieved financial closure with tying up of a ₹ 287.53 bn loan from a consortium of lenders, the company said. HPCL, a subsidiary of Oil and Natural Gas Corp (ONGC), signed a debt syndication agreement with the consortium of nine lenders led by State Bank of India, the company said. It comprises a 9 million tonnes (mt) a year oil refinery and a 2 mt per annum petrochemicals unit. Prime Minister Narendra Modi on 16 January 2018, started work on the project that will be completed by 2022-23. Originally, then Congress president Sonia Gandhi had laid foundation stone of the refinery on 22 September 2013.

Source: Business Standard

PM Narendra Modi dedicates BPCL’s refinery expansion complex in Kochi

27 January. Prime Minister (PM) Narendra Modi dedicated to the nation an integrated refinery expansion complex of the public sector Bharat Petroleum Corp Ltd (BPCL) at the Kochi Refinery. He laid the foundation stone for a petrochemical complex at the refinery and a skill development institute at Ettumanoor besides inaugurating a mounded storage vessel at the LPG (liquefied petroleum gas) bottling plant of the Indian Oil Corp (IOC). The integrated refinery is a modern expansion complex and would transform the Kochi Refinery as the largest PSU (Public Sector Undertaking) refinery in the country with world class standards. It is equipped for production of cleaner fuels. It will double the production of LPG and diesel and commence production of feedstock for petrochemical projects in the plant. Mounded Storage Vessel, IOC LPG Bottling Plant, inaugurated by Modi has a total storage capacity of 4350 million tonnes. Storage capacity at the plant was enhanced to meet the LPG requirement of nearly six days bottling capacity of the plant. It is considered the safest storage vessel ensuring highest level of safety for plant and adjacent areas. LPG receipt through pipeline will bring down movement of LPG tankers on roads. Petrochemical complex, BPCL Kochi refinery is a Make in India initiative aimed at reducing dependence on imports.

Source: Hindustan Times

Nepal-India oil pipeline moving ahead with forest clearance okayed

27 January. The stalled Nepal-India petroleum pipeline has been expedited with the Nepal government okaying forest clearance for the project, which is now expected to be completed by April-end, Nepal Oil Corp (NOC) said. NOC received the Cabinet's go-ahead to cut trees that lie along the 9 kilometre (km) Pathlaiya-Amlekhgunj section of the project. The 69 km long pipeline stretches from Amlekhgunj in Nepal to Motihari in India. Pipe laying works on a nine-km stretch in Nepal had stalled due to the forest clearance issue. The pipeline project started on 9 March last year. The ground-breaking of the pipeline project took place more than two decades after the first discussion on the project was held between Nepal and India. Indian Oil Corp (IOC) had proposed construction of a cross-border pipeline in 1995 and signed a memorandum of understanding with NOC at the junior executive level a year later. In 2004, the two sides upgraded the agreement to the chief executive level. However, due to a number of legal hurdles, the project failed to take off. Around 200,000-litre diesel can be imported in an hour upon completion of the project. The fuel pumping facilities will be located in Motihari, India. NOC plans to conduct a trial of the project by supplying diesel in the first phase.

Source: Business Standard

ONGC mulling on a vision document 'Strategic Roadmap 2040': CMD

26 January. Oil and Natural Gas Corp (ONGC) is mulling on a vision document for 2040 that will lay the strategic roadmap for the nation's largest oil and gas producer for the next two decades. ONGC Chairman and Managing Director (CMD) Shashi Shanker said the vision document 'Strategic Roadmap 2040' would craft the strategy for the firm as an integrated energy major with a long-term perspective. The Perspective Plan 2030 was ONGC's earlier vision document that outlined strategic goals for the growth of the organisation and for the energy security of the nation, the company said. Shanker expressed satisfaction with the performance of the company's subsidiaries. Overseas production recorded another strong year of growth. Oil plus oil equivalent gas output increased to over 14 million tonnes (mt) in FY18 against 12.80 mt a year back.

Source: Business Standard

DGH nod must for going beyond oilfield area

23 January. The government has forbidden oil and gas production from fields that extend beyond the contract area unless the operator takes prior approval—a significant change in rules to prevent bitter disputes like the one between Reliance Industries Ltd (RIL) and Oil and Natural Gas Corp (ONGC) over output from a reservoir that straddled both companies’ areas. The government has amended the Model Revenue Sharing Contract (MRSC) of Discovered Small Fields Bid Round-II to insert two key points on reservoirs extending beyond contract areas. The failure to inform DGH can lead to termination of contract. If the contractor gets to know about extension of reservoir beyond its field after submitting the field development plan, it would have to inform the DGH within 15 days of receiving such information, as per amended rules.

Source: The Economic Times

NATIONAL: GAS

Adani Group may get controlling stake in Mundra LNG terminal

25 January. Gujarat may offer an additional 50% stake in Gujarat State Petroleum Corp (GSPC) LNG Ltd to Adani Group, which already holds a 25% stake in the company, after Indian Oil Corp (IOC) decided to opt out of the race. The Gujarat government, which owns 50% in GSPC LNG, had been looking to induct a third partner for the remaining 25% stake. It may allow the Adani Group to pick up the 25%, and offload up to 25% of its own stake in the company. The Gujarat government had set up GSPC LNG as a special purpose vehicle for implementing the project with a proposed capacity to re-gasify 5 million tonnes per annum (mtpa). The cost of the project was estimated at ₹ 45-50 bn. The terminal’s capacity can be expanded to 10 mtpa and is designed to have a berth for receiving LNG (liquefied natural gas) tankers and storage tank facilities for re-gasification and gas evacuation. The terminal was inaugurated in September by Prime Minister Narendra Modi. Four months on, however, it is yet to be commissioned as the land lease and sub-concession agreements are yet to be signed between the promoters and the Gujarat government. A commissioning cargo from the US (United States) had arrived at the Mundra LNG terminal in November last year but it had to be diverted to Hazira port as it was not allowed to discharge at Mundra. The LNG terminal project was originally conceived way back in 2008 by the Gujarat government. Back then, it was planned to come up at Hazira and GSPC was to hold a 50% stake in the project with management control, while Adani and Essar Power Ltd were to hold 25% each. Essar later backed out of the project and the site of the terminal was shifted to Mundra.

Source: Livemint

GAIL’s tariff proposal for KG basin natural gas pipeline faces resistance from stakeholders

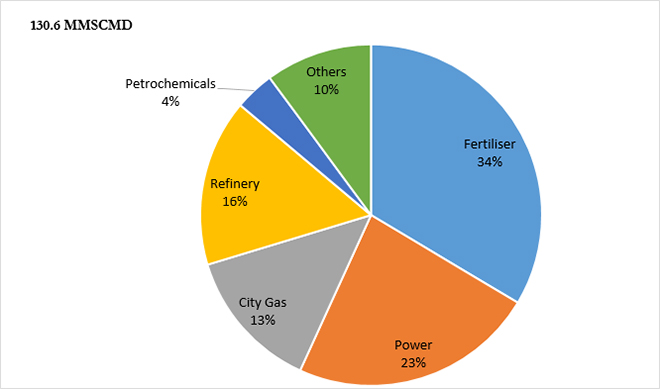

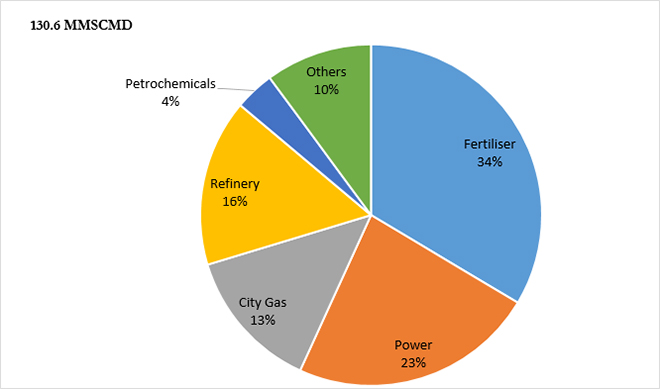

24 January. A proposal by GAIL (India) Ltd for transportation tariff for a major KG (Krishna-Godavari) basin natural gas pipeline has faced opposition from stakeholders including GMR group, H-Energy, and Gujarat State Petronet Ltd (GSPL). PNGRB (Petroleum and Natural Gas Regulatory Board) is going to hold an open house to discuss the comments of all the stakeholders. PNGRB has said the then tariff order issued was without considering any extension in the life of the pipeline beyond February 2017 and the extension of economic life beyond February 2017 is still under consideration of the board. The KG-basin natural gas pipeline is a 877.86 kilometre (km) pipeline network with a provisional capacity to transport 15.99 million metric standard cubic meter per day (mmscmd) of gas, including common carrier capacity of 4 mmscmd. The regulator had determined a transportation tariff of ₹ 5.56 per million metric British thermal units (mmBtu) for the gas pipeline on Gross Calorific Value (GCV) basis for the period between 2008-09 and 2014-15; ₹ 5.56 per mmBtu for 2015-2016 and ₹ 45.32 per mmBtu for financial year 2016-2017. Subsequently, in a letter dated 25 September 2018, PNGRB asked GAIL to make an updated tariff filing with actual data up to 2017-2018. GAIL has proposed a transportation tariff of ₹ 45.32 per mmBtu for period between 2016-17 to 2018-19 and a tariff of ₹ 47.20 per mmBtu for the period between 2019-20 up to 11 February 2027. GAIL said that the pipeline is used for transportation of gas to various customers and more than 80 percent of supplies cater to the needs of fertilizer plants, power plants, refineries, LPG (liquefied petroleum) gas plants, petrochemical plants and other Industrial units. GAIL said that in order to take care of the requirements of the downstream sector at least 20 days of planned maintenance may be considered while determining the tariff for natural gas pipelines and, accordingly, the number of working days in a year may be considered as 345.

Source: The Economic Times

NATIONAL: COAL

RPF to harvest modern technology to reduce coal pilferage

28 January. The Railway Protection Force (RPF) said it has decided to harvest modern technology and increase coordination with Government Railway Police (GRP) to reduce pilferage of coal in transit. While a loss of 0.8 percent of total movement of coal through railways is permissible during transit due to various technical reasons, the actual amount lost during transportation is as high as 1.2 percent, RPF Director General Arun Kumar said. He said that the 1.2 percent loss during transit includes pilferage, apart from various technical reasons. He said that closer coordination between RPF and GRP of different states at divisional security commissioner level will be encouraged to ensure prompter action in stopping pilferage of coal. Stating that security requires to be increased at coal sidings which are loading or unloading points, Kumar said that the main problems lie at places of loading coal on railway wagons. Kumar said that RPF can provide them with its personnel for ensuring a better security system to prevent theft.

Source: Business Standard

Coal shipments at India’s 12 major ports up 16 pc to 121 mt in April-December

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Increase in domestic coal supply will contain imports!

< style="color: #ffffff">Good! |

27 January. Coal shipments handled by India's 12 major ports saw a 16.28 percent jump in the nine months ending December 2018 to 121.13 million tonnes (mt), according to ports' body IPA (Indian Ports Association). Coal shipments, comprising thermal/steam and coking coal, were up 17 percent and 15 percent respectively in the April-December period of the ongoing fiscal. These ports had handled 104.17 mt coal in April-December 2017. IPA said these state-run ports handled 78.24 mt of thermal/steam coal during the nine months against 66.87 mt in the year-ago period. IPA said the major ports handled shipments of 42.89 mt of coking coal during the nine months as against 37.30 mt in the year-ago period. Thermal coal is the mainstay of India's energy programme as 70 percent of power generation is dependent on the dry fuel, while coking coal is used mainly for steel-making. Paradip Port Trust in Odisha handled the highest thermal and steam coal shipments during the period at 24.39 mt, followed by Kamarajar Port (erstwhile Ennore) in Tamil Nadu at 18.17 mt and Deendayal Port Trust in Gujarat at 11.41 mt. As regards coking coal, Kolkata port handled 14.12 mt during the period, followed by Paradip (9.45 mt) and Visakhapatnam (5.03 mt). India is the third-largest producer of coal after China and the US (United States) and has 299 billion tonnes (bt) of resources and 123 bt of proven reserves, which may last for over 100 years. Overall, the 12 major ports recorded 3.77 percent growth in cargo traffic during April-December 2018 at 518.64 mt. The growth was on account of higher handling of shipments such as coal, containers and finished fertilisers.

Source: Business Standard

Power producers seek resolution of issues to augment coal output from Korba mines

27 January. Flagging lower coal production in Chhattisgarh’s Korba Coalfield that contributes around 25 GW to the country's power generation capacity, the Association of Power Producers (APP) has urged ministries of coal and power to resolve issues to augment production, especially contractual. APP said the entire upto 100 mm sized coal production by surface miners should be dispatched through direct rail mode from South Eastern Coalfields Ltd (SECL)’s own sidings and merry-go-round train, or conveyor belt. The industry body pleaded that less than 250 mm sized coal should not be supplied through direct rail mode at the SECL sidings and should be allocated through washery or road mode, which are having the facilities to handle such run of mine coal.

Source: Business Standard

CIL’s supplies to power sector rise 8 percent to 390 mt

24 January. The government said Coal India Ltd (CIL) supplied 389.63 million tonnes (mt) of coal to the power sector in the current financial year till up to 22 January, registering a rise of 8 percent over the previous year. CIL’s railway rake loading, including loadings from washery and good-shed siding, has increased 8 percent during the current financial year as compared to the corresponding period last year. Karnataka Chief Minister H D Kumaraswamy met Coal Minister Piyush Goyal and demanded the Centre to ensure immediate supply of coal to Raichur Thermal Power Station.

Source: Business Standard

52 coal mines opened in 5 yrs to fuel power drive

23 January. The Narendra Modi government has opened 52 new coal mines since coming to power in May 2014 to fuel its flagship village and household electrification programmes without tripping the system. These 52 mines represent 86% growth over the number of mines added in the five-year period between 2009 and 2014, when most projects were stuck in red tape, especially pertaining to environment and forest clearances, before the NDA government took over. Structural reforms in the government's functioning since 2014 made it possible to quickly open such a large number of coal mines, a cumbersome process involving approvals and permissions from various statutory authorities. The new mines have added 164 million tonnes (mt) to India's annual coal production capacity, marking 113% increase over capacity added during the 2009-2014 period. Since 57% of power is generated in India by burning coal, these mines allowed the government to rapidly move towards universal electricity access without creating shortages. Coal and Railway Minister Piyush Goyal said that all-India coal production stood at 433.9 mt during the April-November period of 2018-19 financial year, indicating a growth rate of 9.8%. During the same period, Coal India Ltd (CIL)’s production stood at more than 358 mt, marking a growth rate of 8.8% over the previous corresponding period.

Source: The Economic Times

NATIONAL: POWER

Delhi discoms losing ₹ 1.5 bn annually to power theft for charging e-rickshaws

27 January. Organised theft of power in Delhi for charging of e-rickshaws has assumed serious proportions with discom (distribution company) sources putting the annual losses due to it at nearly ₹ 1.5 bn. There are three power distribution companies (discoms) -- BYPL and BRPL of BSES and Tata Power Delhi Dsitribution Ltd (TPDDL) -- that supply electricity to the national capital. As per estimates there are over one lakh e-rickshaws plying on the city roads and only one-fourth of them are registered, despite a subsidy scheme of the government. Power experts and discom sources claim lack of proper charging facilities has led to organised rackets of power theft in prominent parts of the city, especially in areas close to metro stations. On an average, an e-rickshaw consumes around 7-10 units per day. This comes to about 2,500-3,600 units per e-rickshaw per annum. Power theft is at its peak at night due to bulk charging at facilities set up by the rackets, discom said. Sangam Vihar, Kalkaji, Tughlakabad, Sarai Kale khan, Dakshin Puri, Raghubir Nagar, Tagore Garden, Madipur, Seelampur, Yamuna Vihar, Shastri Park, Karawal Nagar, Mustafabad, Nand Nagri, Karol Bagh, Keekarwala Keshampuram, Civil Lines are some areas where power theft for e-rickshaw charging is "rampant", discom said. In the latest tariff order, the Delhi Electricity Regulatory Commission has fixed the rate of ₹ 5.50 per unit for e-rickshaw charging. Discom said a typical e-rickshaw owner pays between ₹ 100 to ₹ 150 to an illegal charging station. This comes down to ₹ 50 per e-rickshaw if charged through a legal connection. The company is employing technology to track power theft in its area of distribution and has installed AMR (Automated Meter Reading) based energy systems at distribution transformers.

Source: Business Standard

NLC India to set-up mines, power projects in Tamil Nadu

26 January. NLC India plans to invest about ₹ 238 billion ($3.4 billion) in Tamil Nadu to set up mines and power projects, the company said. The company signed an agreement with Tamil Nadu’s government to set up mines to produce 15.5 million tonnes per year of lignite, a lignite-fired power plant with 2,640 MW capacity and a 1,000 MW solar project, it said.

Source: Reuters

Now, get new electricity connection at doorstep in Jaipur

25 January. Now, the residents won’t need to go to the Jaipur Vidyut Vitran Nigam Ltd (JVVNL) office to get a new electricity connection, as the discom (distribution company) has launched a new scheme to bring the registration for electricity connections, to their doorstep. A new feature will be added to the ‘Bijli Mitra App’ — named as ‘Door Step’, from where a person can get registered after filling in the details. For this feature, IT and Customer Care Centre (CCC) are working together. So when a customer registers he will receive an OTP, have to fill the form, an alert will be sent to the CCC. They will further send it to the official concerned in that area who will get in touch with the customer and will go to his house on the time suitable to the customer. There, the documents will be collected, scanned and after the completion of all the requirements, the connection will be allotted.

Source: The Economic Times

10 lakh households benefit from electricity subsidy plan in Madurai

25 January. Nearly 10 lakh households in both city and rural limits have benefited from the Tamil Nadu government’s 100-unit free electricity plan, which was announced by late Chief Minister J Jayalalithaa in May 2016. A statement from the district collectorate claimed that uninterrupted power supply is one of the most important things for the growth. On 23 May 2016 the Jayalalithaa government announced the 100 units free electricity scheme, under Vision 2023. Ever since, the state government has ensured uninterrupted power supply to all homes, which are benefiting by not having to pay the electricity charges if their usage is less than 100 units. In the rural pockets of the district, the number of electricity connections given by the Tamil Nadu Generation and Distribution Corp (TANGEDCO) is 4.71 lakh. The villages have 2.15 consumers who use less than 100 units, and the subsidy obtained by them is ₹ 366.7 mn. The number of consumers using less than 200 units is 1.46 lakh and just 5,874 utilize more than 500 units in the bimonthly cycle.

Source: The Economic Times

Nepal, India to set up Energy Banking to utilise surplus electricity

25 January. Nepal and India have agreed to set up an 'Energy Banking' mechanism that would help the Himalayan country export its surplus electricity to neighbour India during the monsoon season and import power during its lean season in winter. The agreement on the 'Energy Banking' mechanism was arrived at during a meeting between the Nepali and Indian Energy Secretaries in Pokhara, following recommendations by the electricity authorities of both the neighbours. Nepal’s demand for electricity reaches its peak during the summer months, but production slumps to one-third of demand. Likewise, in India demand reaches its peak during the monsoon season and slumps during winter. Following the agreement, Nepal will export its surplus electricity to India during the monsoon season. The Nepal Electricity Authority (NEA) stated that in a couple of years, about 4,750 MW surplus electricity that would otherwise have remained unused will now be utilised. With the losses mounting over time, the NEA had stopped signing power purchase agreements (PPA) with the private sector producing electricity. According to a PPA signed by the NEA, almost 2,250 MW run-of-the-river electricity goes waste during the monsoon season. The Energy Banking agreement would be initiated from newly- constructed Dhalkebar-Mujaraffpur 400 KVA transmission line. As per the agreement, India has also agreed to provide up to 80 MW electricity to Nepal, through setting up a temporary 50 MVA (megavolt-ampere) capacity temporary transformer at Tanakpur. India has agreed to set up a new transformer within two months. At present, Nepal is able to import only 30 to 35 MW electricity from Tanakpur. Aiming to make Nepal's electricity mechanism strong and stable, the Indian side has agreed to extend the capacity of the Raksaul-Parwanipur and Kataiya-Kusaha 132 kV (kilovolt) transmission line. An

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Delay in resolving the issue of stressed power assets will increase cost of future resolution!

< style="color: #ffffff">Bad! |

equilibrium of 50-50 MW electricity is being imported through these two transmission lines. With the reformation of the transmission lines, it would be easy for India to import electricity from Nepal based on the Energy Banking mechanism. Besides the two transmission lines, another circuit is vacant and Nepal has proposed adding another one, to which India has agreed India has also given the green signal to Nepal to extend its transmission lines into Indian territory as well as do the repairing. After the transmission line is extended into India it would help the Bhairahawa Industrial Estate manage the load through 132 kV transmission line. Likewise, India also has given its nod to construct the Kohalpur-Nanpara 132 kilometre (km) transmission line as requested by Nepal and would start the feasibility study of the site -- covering a distance of 50 km (25 km in Nepal and 25 km in India).

Source: Business Standard

MSEDCL to appoint 23k 'power managers' in Maharashtra villages

23 January. Maharashtra State Electricity Distribution Company Ltd (MSEDCL) will appoint 'power managers' in 23,000 villages to attend to the complaints related to electricity and its theft. MSEDCL will appoint 23,000 'village electrical managers' one at the gram panchayat level. They will attend to the power-related complaints and electricity thefts. Energy Minister Chandrashekar Bawankule said the course will open employment opportunities for the youth in rural areas, as the 'village electrical manager' will work for the MSEDCL at the gram panchayat level.

Source: Business Standard

Cabinet to decide soon on stressed power assets: Singh

23 January. The recommendations of a high-level empowered committee (HLEC) on stressed power assets will be placed before the Cabinet soon for approval, Power Minister R K Singh said. A group of ministers (GoM) headed by Finance Minister Arun Jaitley is deliberating on the HLEC recommendations and deciding on their viability, Singh said. The proposals in the upcoming tariff policy have a provision where the regulator would assess if discoms (distribution companies) have sufficient long-term and mid-term PPAs (power purchase agreements) to meet their respective annual average demand, warranting new PPAs to be offered. Additionally, the provision of penalty for gratuitous loadsheddings in the tariff policy would also push discoms to have adequate PPAs tied up.

Source: The Financial Express

UT power department aims to earn ₹ 400 mn from regulatory surcharge

23 January. The UT (Union Territory) power department is aiming to earn ₹ 400 mn from regulatory surcharge in the next financial year. The UT power department would be imposing regulatory surcharge following the directions issued by Joint Electricity Regulatory Commission (JERC). The JERC had recently directed the department not to slap 5% regulatory surcharge on fuel and power purchase cost adjustment (FPPCA) charges. Instead, the panel directed the department to charge 5% regulatory surcharge on the total bill. The FPPCA charges are the difference between per unit actual cost of power purchase and per unit approved cost of power purchase. The charge is added on per-unit basis to each electricity bill over and above the regular tariff. The UT power department generates bills bi-monthly for domestic customers and monthly for commercial and industrial consumers. The charges are revised after every quarter. In its tariff order issued on 29 March last year, the JERC had imposed a cap on FPPCA charges to be levied by the department from April onwards. The commission had limited FPPCA charge to 10% of the approved cost for a quarter. The commission had also directed the department to charge 5% regulatory surcharge on the total bill. However, the department sought clarification from the commission on slapping 5% regulatory surcharge on FPPCA as well, which was denied by the commission. The power department caters to 2.28 lakh consumers, who are divided into nine categories. As per official figures, 1.99 lakh consumers are domestic users, accounting for more than 87% of the overall figure. The remaining 13% consumers are divided into commercial, small power, medium supply, large supply, bulk supply, public lighting, agriculture power and temporary supply categories. Chandigarh does not have its own power plant and buys power from Central power generating stations like Nuclear Power Corp of India, National Thermal Power Corp, Bhakra Beas Management Board, National Hydroelectric Power Corp (NHPC) and Satluj Jal Vidyut Nigam (SJVN). Power allocation from each station is fixed for a year, while the deficit is met through an unallocated quota and short-term power purchase.

Source: The Economic Times

Kannauj man charged ₹ 230 mn for electricity

23 January. In a peculiar turn of events, a man has received an electricity bill of ₹ 230 mn after consuming a mere 178 units of electricity. Worried about the huge amount charged for his electricity consumption, Abdul Basit, a resident of Uttar Pradesh’s Kannauj, ran pillar to post to mitigate the problem. The exact amount charged was ₹ 23,67,71,524. Executive engineer Shadab Ahmed said payment will be sought only after the bill is rectified.

Source: Business Standard

Now, get duplicate BSES bill on WhatsApp

23 January. Delhi electricity distribution company (discom) BSES announced it has launched a WhatsApp service to help customers get duplicate bills, making it the first discom in the capital to provide such a service. The discom said consumers can already retrieve a duplicate bill thorough the BSES website and mobile app and Whatsapp is an addition to its digitisation initiative. This service is first being rolled out for the consumers in south and west Delhi and will be extended subsequently for consumers of east and central Delhi, it said. The discom had earlier introduced the facilities of registering "no supply" complaints and reporting power thefts on WhatsApp.

Source: Business Standard

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

NTPC’s Darlipali Super Thermal Power Project to start generating power by March

29 January. NTPC Ltd said the first unit of its 1600 MW Darlipali Super Thermal Power Project (DSTPP) in Sundargarh district of Odisha is likely to generate power by the end of March. Stating that the turbine of the Darlipalli power plant is ready, NTPC’s Regional Executive Director (East-II), M P Sinha Sinha said the boiler is likely to be completely fit for operations early next month. While the total cost of the ambitious project is to the tune of ₹ 120 bn, an amount of ₹ 85 bn has already been spent so far, he said. Odisha will get 50 percent of the total power produced by the plant. The second 800 MW unit of the plant is under construction and start generating power around six months after the first unit kicks off generation, Sinha said. The power plant is expected to become fully operational by September, this year. The Maharatna company has already concluded power purchase agreements (PPA) with states for the DSTPP. Considered the country's largest power producing company, the NTPC at present generates 3,470 MW of power from Talcher Super Thermal Power Station, Talcher Thermal Power Station and solar power station at Kaniha in Angul district. Its total power generation in Odisha will reach 4270 MW with the start of generation from Unit-1 of Darlipalli project, the company said.

Source: Business Standard

India urges caution on 'actions' to tackle climate change from security perspective

28 January. India urged caution as the United Nations (UN) Security Council deliberated on the impacts of climate related disasters on international peace and security. Participating in the open debate in the UN Security Council, India pointed out the pitfalls arising from viewing actions to tackle climate change from a security perspective. Climate change presents an “unprecedented challenge” to global civilisation therefore must be a priority area for international cooperation. India cautioned against the fallout of that a takeover by a “structurally unrepresentative institution with an exclusionary approach” such as the UN Security Council would have on the inclusive process under the United Nations Framework Convention on Climate Change. Addressing the open debate in the UN Security Council, India’s Permanent Representative to the UN Syed Akbaruddin said that global institutions should be responsive to felt human needs including disaster preparedness as well as resilience and response in the face of disasters. India cautioned consideration of the implications of the Security Council taking lead on addressing climate change, questioning whether the institution was equipped to provide leadership on such a complex and challenging issue.

Source: The Economic Times

Solar ‘prosumers’ to get 50 percent subsidy in Goa

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Subsidy to solar prosumers should not mean higher bills for poor power consumers!

< style="color: #ffffff">Ugly! |

28 January. To incentivise production of solar power in the state, the cabinet has approved amendments to the Goa State Solar Policy 2017 where small and large prosumers (consumers and producers of solar power) will receive 50% subsidy instead of the earlier proposed interest-free loan that was be recovered in instalments. The subsidy will be of two parts — a 30% central share and 20% state share. The central share will be credited to the prosumer as per the guidelines of the Ministry of New and Renewable Energy (MNRE) while the state subsidy will be released upon completing of six months of the solar power being injected into the grid. The subsidy will be 50% of the capital cost or the benchmark cost provided by MNRE or cost arrived at through tendering process by the Goa Energy Development Agency (GEDA), whichever is lower. As per the Solar Policy 2017, prosumers were to be provided grant of 50% of the capital cost as an interest-free loan, which was to be recovered by way of instalments after six months from the time the power flows into the grid. The state government through the electricity department has entered into agreement with the Solar Energy Corp of India Ltd for 25 years to purchase 25 MW solar power and with the NTPC Vidyut Vyapar Nigam Ltd for purchase of 6 MW solar power to meet the partial Solar Renewable Purchase Obligation.

Source: The Economic Times

Hydropower in India is growing at the slowest pace, renewables surging

27 January. In the late 2000s, hydroelectric power was billed as a sustainable, renewable alternative to coal and gas based electricity for India. The government drew up ambitious plans for setting up hydel plants and the private sector was keen to get in on the action. In 2008, growth in India’s installed hydel capacity outpaced the rise in India’s total power capacity. But it has been a different story since. Hydropower has slowly faded from the discourse on the future of India’s energy security, as solar and wind projects garner much of the attention. India’s installed hydro capacity at the end of 2018 was around 45,400 MW, an annual growth of just 1%, the lowest since 2009. What’s more, between 2008 and 2018, hydel power’s share of India’s total installed electricity capacity has halved from 25% to 13%. Beset by land acquisition troubles, uncertainty over final costs as well as estimated time for completion, and low tariffs, the hydel sector is unlikely to have a turnaround in the near future. While hydropower is renewable, its social and environmental impact — from displacement of thousands of people and adverse effects on biodiversity as a result of dams, to methane emissions from the rotting vegetation in their reservoirs — means that big hydel projects are no longer hyphenated with solar, wind and biomass energy. In 2015, the Indian government stopped categorising hydel projects larger than 25 MW as renewable. India has 4,500 MW of hydel projects with a capacity of less than 25 MW each. The govt has estimated the country’s hydropower potential (more than 25 MW) at over 1,45,000 MW.

Source: The Economic Times

Working on hydropower to make Himachal self-reliant: CM

26 January. Tourism and hydropower can play a big role in making Himachal a self-reliant state, Chief Minister (CM) Jai Ram Thakur said. He said the government had been taking effective steps to attract investors in both these sectors and developing infrastructure facilities. He said the government was committed to double the farm income by the year 2022 and the natural farming was being encouraged in a big way. A new scheme ‘Prakritik Kheti, Khushhal Kisan’ had been launched with a budget provision of ₹ 250 mn and farmers are being encouraged to adopt natural farming in the state in a big way, Thakur said.

Source: The Economic Times

Gujarat finds solar tariffs high, cancels auction

25 January. The Gujarat government has cancelled the solar auction for 700 MW it held in December on the grounds that the winning tariffs reached were too high. The decision was conveyed to the winning developers at a meeting, attended by Gujarat’s additional chief secretary in the energy department, Raj Gopal, and officials of the Gujarat Urja Vikas Nigam Ltd (GUVNL), the agency which conducted the auction. Foreign players had won the entire 700 MW, with Softbank-backed SB Energy getting 250 MW at ₹ 2.84 per unit, and Finland’s Fortum as well as France’s Engie getting 250 MW and 200 MW respectively at the same price of ₹ 2.89 per unit. The previous auction for 500 MW held by GUVNL in September 2018 had seen the lowest tariff at ₹ 2.44 per unit, and officials were unhappy over the sharp rise in just three months. Developers attributed the rise mainly to the high charges levied at the Raghanesda Solar Park in the state, where the projects have to be located, unlike the ones won in September, which could be put up anywhere in the state. They had welcomed the rise in tariff, claiming tariffs were finally becoming realistic after their sharp fall in the past three years. The Gujarat government was likely to reduce the charges at the solar park, after which GUVNL would hold a fresh auction. It has already announced another auction for 500 MW to be held in end-January. This is the second auction GUVNL has cancelled due to perceived high tariffs. Earlier, it also cancelled a 500 MW auction held in March last year, at which the lowest price reached was ₹ 2.98 per unit.

Source: The Economic Times

HAL taps wind to power its Bengaluru facilities

25 January. Hindustan Aeronautics Ltd (HAL) said it has opened a wind energy plant in Karnataka's northwestern Bagalkot district to power its facilities in Bengaluru. The 8.4 MW wind energy power plant was opened by HAL’s Chairman and Managing Director R Madhavan near Ilkal town in Bagalkot district, about 480 kilometre (km) northwest of Bengaluru. The ₹ 590 mn plant comprises four wind turbines, set up along with Pune-based wind turbine supplier Suzlon Energy Ltd. The plant has the potential to generate about 260 lakh units of energy per annum with an estimated annual savings of ₹ 180 mn to the company in its power consumption, HAL said. The company aims to increase its share of renewable energy in total energy consumption, he said.

Source: Business Standard

Three technology missions on solar, water treatment to be launched at IIT Madras

24 January. Harsh Vardhan, Union Minister for Science and Technology, Earth Sciences and Environment, Forests and Climate Change will launch three technology mission centres at IIT (Indian Institute of Technology) Madras to address various issues around solar energy and water treatment. The first, it said, is the DST-IIT Madras Solar Energy Harnessing Centre. Scientists from IIT Madras, IIT Guwahati, Anna University, ICT-Mumbai, Bharat Heavy Electricals Ltd (BHEL) and KGDS Renewable Energy Private Ltd will be engaged in the activities of the centre. Second in line is the DST-IIT Madras Water Innovation Centre for sustainable treatment, reuse and management which has been established with the aim to undertake synchronized research and training programmes on various issues related to wastewater management, water treatment, sensor development, stormwater management and distribution and collection systems. The third one would be the test bed on solar thermal desalination solutions which are being established by IIT Madras and KGDS as solution providers in Naripaaiyur, Ramanathapuram district, Tamil Nadu with the aim to deliver customized technological solutions to address prevalent water challenges in the arid coastal villages located on the shores of the Bay of Bengal.

Source: Business Standard

Delhi government proposes to augment green cover, expand CNG bus fleet to combat climate change

24 January. In a bid to combat climate change, the Delhi government has proposed to increase the capital’s green cover from 20 to 33 percent by planting over 10 lakh trees. The AAP (Aam Aadmi Party) government, in its State Action Plan on Climate Change (SAPCC), which was submitted recently to the Ministry of Environment, Forests and Climate Change in pursuance to the National Green Tribunal’s order, proposed to increase the fleet of CNG (compressed natural gas) buses in the Delhi Transport Corp (DTC) within one year. Presently there are 4,352 DTC buses which the city government plans to augment to 6,900, the SAPCC said. Besides DTC buses, 1,758 cluster buses, 238 metro feeder buses, 802 mini private stage carriage buses and 6,146 Gramin Sewa are currently being operated in the city, it said. Besides expanding the green cover and increasing CNG bus fleet, the SAPCC has laid down four initiatives by the city government, including improving solar energy capacity from 88 MW to 150 MW by the end of March. The SAPCC comes nine years after the government asked all the states to submit it under the National Action Plan for Climate Change (NAPCC). All other states have already submitted the plan to the government which have been approved. Lastly, the city government has initiated a strategic knowledge mission which aims to identify challenges of climate change by ensuring focused research and creating awareness in collaboration with Mahatma Gandhi Institute for Combating Climate Change (MGICCC).

Source: Business Standard

India calls for diaspora role in developing renewable energy sector

23 January. India called upon its diaspora to play a role in boosting the renewable energy sector, with Minister of State for External Affairs V K Singh calling for suggestions from the participants at the Pravasi Bharatiya Divas (PBD) -- the Indian diaspora conclave -- on how to develop solar energy. Singh outlined the achievement of the government in attaining nearly 25 GW of the 100 GW target set for solar energy till 2022 at a plenary session on the role of Indian diaspora in capacity building for affordable solar power. He invited the audience to contribute with positive suggestions for successful implementation of the government's policies. India initiated the International Solar Alliance (ISA) at the Paris climate summit in 2015. Launched by Prime Minister Narendra Modi and then French President Francois Hollande at the Paris climate summit in 2015, the ISA was conceived as a coalition of solar resource-rich countries to address their special energy needs and provide a platform to collaborate on dealing with the identified gaps through a common, agreed approach.

Source: Business Standard

Government to re-issue 5 GW of solar manufacturing tender

23 January. The government is planning to re-launch 5 GW of manufacturing-linked solar tender out of the initial 10 GW that had received a single bid. With this, the earlier sole bid received from Azure Power will be cancelled and fresh bidding will start. With an aim to boost local manufacturing of solar equipment, the manufacturing-linked tender was first floated by Solar Energy Corp of India (SECI) in May last year. However, due to low interest from the industry the bid submission was postponed six times. Azure Power has bid for 2,000 MW power capacity linked with 600 MW solar equipment manufacturing capacity while most of the other large industry players stayed away from the tender.

Source: The Economic Times

Budget 2019: Industry expectations in the solar power sector

23 January. The Indian solar energy sector has mixed expectations from the upcoming union budget. While a majority of industry stakeholders anticipate tax reduction, better rate of interest, subsidies for developers in the Union Budget 2019-20, others do not expect mega announcements with general elections around the corner. Industry captains in the sector are hoping this year’s budget paves the way for achieving the ambitious solar targets agreed upon in the Paris agreement and the government should provide level-playing-field to solar developers. The government could lower the interest rates and provide attractive long-term financing options to encourage more people to own and adopt renewable generation in view of the 100 GW solar capacity target and the larger aim to provide electricity for all, Ramnath Vaidyanathan, Chief Executive Officer (CEO) of solar developer WiSH Energy, a subsidiary of Bengaluru-based Enzen, believes. Other industry leaders think that this year's budget may have provisions for promoting the domestic solar panels manufacturing capacity in order to cut down the current heavy reliance on cheaper Chinese imports. The 2017-18 budget had announced doubling the targeted solar park installation capacity to 40 GW.

Source: The Economic Times

INTERNATIONAL: OIL

Economic growth in Kuwait to strengthen on the back of oil prices: IMF

29 January. The International Monetary Fund (IMF) said Kuwait’s non-oil growth is projected to increase to about 3.5 percent in 2020, from 2.5 percent last year, as higher oil prices will boost capital spending. The IMF said the recent OPEC (Organization of the Petroleum Exporting Countries) decision to cut production is expected to hold oil output to 2 percent growth in 2019, which could rebound to 2.5 percent in 2020 given spare capacity. It said higher oil revenues and investment income helped improve the overall fiscal balance in 2017/18 to an estimated surplus of 8 percent of GDP (Gross Domestic Product), which will reach almost 12 percent of GDP in fiscal year 2018/19.

Source: Reuters

Iraq close to deal with Jordan on trade in oil and other goods

29 January. Iraq is close to reaching a deal to cut the price of oil it sells Jordan in return for receiving preferential tariffs on goods Jordan ships to Iraq via the port of Aqaba, Iraqi Prime Minister Adel Abdul Mahdi said. Aqaba port at the north end of the Red Sea has long been a major transit route for Iraqi imports and exports, and Amman has long relied on Iraqi crude to fuel its economy.

Source: Reuters

Saudi Arabia’s Energy Minister sees no impact on oil markets from Venezuela turmoil

28 January. Political turmoil in Venezuela has so far had zero impact on global oil markets, Saudi Arabia’s Energy Minister Khalid al-Falih said. He saw no need to take additional measures on the oil market because of the situation in Venezuela. He hoped a global oil output deal would be “more than a hundred percent” carried out and that the situation would need to be reassessed in March-April.

Source: Reuters

Crude oil production from Mexico’s Pemex up slightly in December

25 January. Crude production from oil company Pemex averaged 1.71 million barrels per day (bpd) in December, up 0.8 percent compared to output the previous month, according to company data. Despite the monthly uptick, December production levels are among the lowest on record dating back several decades for the struggling Mexican oil giant. The firm’s crude output has steadily declined since hitting 3.4 million bpd in 2004 as its top-producing fields located in the shallow waters of the southern Gulf of Mexico have aged, and new ones to replace them have not been developed. Mexican President Andres Manuel Lopez Obrador has pledged to boost Pemex’s budget and raise output to between 2.4-2.6 million bpd by the end of his six-year term in 2024.

Source: Reuters

OPEC focused on averting new oil glut before April meeting: Barkindo

24 January. OPEC and its allies do not rule out taking further action at their next meeting in April should oil inventories build up in the first quarter, OPEC (Organization of the Petroleum Exporting Countries) Secretary General Mohammad Barkindo said. Worried by a drop in oil prices and rising supplies, the OPEC and non-OPEC countries such as Russia agreed in December to return to production cuts in 2019. The producers meet on 17-18 April to review the pact. Barkindo said producers were making significant oil production cuts to avoid a build-up during the first quarter, and the oil market had reacted well.

Source: Reuters

Japan’s Iran oil loading likely to continue through March: PAJ president