RYOGENIC TRUCKS GO WHERE PIPELINES DO NOT

Gas News Commentary: September - October 2018

India

H-Energy, the oil and gas arm of Mumbai-based Hiranandani Group, is planning to commission its first LNG retail outlet in Panvel, Maharashtra in a year. The outlet, part of a larger expansion plan, will help the company sell gas from its Jaigarh LNG terminal located in Ratnagiri district in the state. The company is setting up the Jaigarh terminal in two phases. The first phase of the project – consisting of a jetty-based Floating Storage & Regasification Unit of 4 mtpa capacity -- is already operational. In the second phase, a land-based terminal of 8 mtpa capacity is being planned. H-Energy has started work on laying a tie-in pipeline from Jaigarh to Dabhol which will carry regasified LNG from the terminal to the natural gas grid of GAIL (India) Ltd. The 60 km tie-in pipeline will carry re-gasified LNG to natural gas grid of GAIL in Dabhol. H-Energy said the 60 km tie-in pipeline is expected to be complete in two months, effectively kicking off operations by next year, and helping the company extend gas supply to natural gas consumers located in key demand regions. Also, the company is working on laying a 635 km pipeline from Jaigarh to Mangalore, to connect to natural gas consumers in the east part of the country. Work on the second LNG terminal being planned to be set up by the company at Digha in West Bengal is likely to start in December. That project will be based on a mixed model with both floating and on-land facility for LNG regasification. The company’s investment plan of around Rs 45 crore for setting up the LNG terminals and the pipelines is on track. PLL, the country’s largest importer of natural gas, is planning to launch around 20 LNG fuelling stations on a 4,000 km route between Delhi and Thiruvananthapuram as part of a larger plan being worked upon with oil marketing companies and state road transport authorities of Rajasthan, Gujarat and Kerala. PLL expects around 200,000 trucks to run on LNG every year in the near future. LNG, a cleaner option than conventional fuels, is seen to provide 30-40 percent lower running costs.

French energy giant Total SA is in talks to buy up to half of Adani Group's stake in LNG projects in Gujarat and Odisha, an under-construction LPG import facility and in its city gas projects. The French firm is keen on investing in fast growing gas market in India and finds Adani a suitable vehicle as it owns the crucial downstream infrastructure. Adani holds 25 percent stake in just-completed 5 mtpa LNG import terminal at Mundra. It is also building a similar capacity LNG import terminal at Dhamra in Odisha at a cost of Rs 51 billion. Total is in talks to buy half of Adani's stake in the two terminals. India is looking at more than doubling the share of natural gas in its energy basket to 15 percent in next few years and is giving major push to city gas distribution projects. It imports half of its gas needs, which are projected to rise exponentially as it shifts from polluting liquid fuels to environment friendly natural gas. Adani Gas, a subsidiary of Adani Enterprises Ltd, is developing CGD networks to supply the PNG to the industrial, commercial, domestic units and CNG to the transport sector. It already has set up city gas distribution networks in Ahmedabad and Vadodara in Gujarat, Faridabad in Haryana and Khurja in Uttar Pradesh. Total is looking at buying half of Adani's stake all the CGD networks. Total has signed an agreement to sell 0.5 mtpa to Shell over five years, on a delivery basis to supply the Indian and neighbouring markets. The deliveries will be sourced from Total's global LNG portfolio and are expected to begin in 2019.The MNGL has firmed up its plans to invest Rs 16 crore in Nashik to create infrastructure for supply of green fuel. The state-owned PSU has won the bids to supply CNG for vehicles and PNG for domestic purpose in Nashik, Dhule and Sindhdurg districts. The PNGRB has decided the bids have set a schedule that MNGL has to follow in the supply of green fuel in the three districts. The firm will lay over 108 kilometre underground steel pipeline from Jawhar to Nashik via Trimbakeshwar to draw liquefied natural gas from the terminal at Dabhol. The MNGL has set a target of setting up 156 CNG stations in Nashik in eight years.

India will start operating a new LNG import facility in western Gujarat state by end-October, as part of the nation's steps to build infrastructure for a gradual rise in gas use. The 5 mtpa LNG terminal is 75 percent owned by the state while billionaire Gautam Adani-controlled Adani group holds the remainder. The gas pipeline linking Vendanta Ltd's Barmer block in the desert state of Rajasthan to the national gas grid will come on-stream shortly. Against the estimated gas demand of 494 mmscmd in the fiscal year to March 2018, India consumed about 144.75 mmscmd gas with about half of that met through imported LNG, according to the government data.

IGL, India's biggest city gas retailer, plans to add a record 60 CNG dispensing stations and give piped cooking gas connections to at least 200,000 households this fiscal as it steps up efforts to achieve the government's target of a gas-based economy. The company, which retails CNG to automobiles and piped cooking gas to household kitchens in Delhi and its suburbs, has adopted a dealer-franchise model in the push for rapidly expanding the network. The company, with 452 CNG stations in Delhi, Noida, Greater Noida, Ghaziabad and Rewari, has started to give the franchise to dealers who own lands. The company opened 30 CNG stations last year and in the current financial year running from April 2018 to March 2019 it has a target to open 50. The government is aggressively pushing for use of CNG as a transportation fuel to cut on use of polluting liquid fuels like diesel. IGL is committed to achieving the targets in the push towards a gas-based economy.

Essar Group has started supply of gas produced from coal seams to GAIL. EOGEPL had in August signed a 15-year contract to supply the block's entire gas production to GAIL. Peak CBM production from Raniganj East block is envisaged at 2.3 mmscmd. Essar had in February this year sold its entire CBM production from the West Bengal block to GAIL using the same formula that Reliance Industries used for pricing of its CBM. The price comes to around $8/mmBtu at the current oil price. At the time of the signing of Gas Sale and Purchase Agreement in August, EOGEPL had said it would be focussing on ramping up production from its existing 348 CBM wells and the 150 wells it intends to drill in the future in the block. EOGEPL has already invested more than Rs 40 crore in the Raniganj East CBM block in drilling wells, setting up supply infrastructure, and laying customer pipelines to Durgapur and nearby industrial areas. The block has 348 completed CBM wells alongside robust gas and water handling capacity.

IOC said it will invest Rs 54.63 crore in setting up city gas distribution network for retailing CNG to automobiles and piped cooking gas to households in seven districts. IOC had, in the recently concluded 9th bid round for city gas licences, won permits for seven cities on its own and another nine in a joint venture with Adani Gas. The company said its board in a meeting approved investments in seven cities it has won on its own. IOC said its board approved a Rs 5.2 crore investment for production of ethanol using LanzaTech gas fermentation technology at Panipat refinery in Haryana. The proposed ethanol plant is designed to produce 33.5 kilotonnes per annum of anhydrous ethanol for use in automotive fuel. The board approved a Rs 13.32 crore investment in laying a pipeline from Paradip in Odisha to Haldia in West Bengal.

Indian energy firms are eyeing stake in oilfields in Russia's Pechora and Okhotsk Seas as well as developing the LNG project in the former communist nation. The two sides are also looking at the possibility of building a gas pipeline from Russia to India to supply energy. The two sides supported continuing dialogue between PJSC NOVATEK and the energy companies of India for cooperation in the field of LNG.

ONGC said it has awarded a Rs 117.40 crore contract for development of its mega KG-D5 oil and gas fields to a consortium of Baker Hughes, McDermott International and L&T Hydrocarbon Engineering. ONGC is developing a cluster of oil and gas discoveries in Krishna Godavari basin block KG-DWN-98/2 (KG-D5) at a cost of over $5 billion. The first gas is targeted for end 2019 and oil in March 2021. Total peak gas production rate from Cluster-2 is envisaged to be about 16 mmscmd and peak oil production rate of 80,000 bpd. The project is one of the first major deep-water developments in India and a milestone for realizing country's domestic energy potential. Delivery is scheduled for 2020 for the gas system and 2021 for the oil system, it said.

ONGC is betting high on the second and third round of auctions under the OALP for petroleum blocks. It has given a formal EoI for seven areas in the second round and is in the process of doing so for discoveries in the Bay of Bengal region for the third round. Also, it would be participating in the second round of Discovered Small Fields auction (DSF-II) that has already been launched. OALP is designed to allow companies to carve out their own exploration areas, improving on gaps found in the earlier model. In the EoI stage, companies may carve out their area based on the National Data Repository. The second stage involves bidding and others can come in. ONGC contributes 71 percent of the country's total oil production and 75 percent of gas production, at 35.7 mt and 32.65 bcm respectively.

India has raised the price of its locally produced gas by nearly 10 percent to $3.36/mmBtu for the October-March period, compared with the previous six months, a government website showed. India has also set the ceiling price for gas to be produced from difficult fields at $7.67/mmBtu October-March, compared with $6.78/mmBtu in the previous six months, the website of the Petroleum Planning and Analysis Cell of the oil ministry showed. The prices will be applicable on gross heat value basis. Higher gas prices will lead to higher earnings for ONGC and Oil India Ltd.

Rest of the World

Azerbaijan will deliver one-third of Bulgaria’s gas demand. The gas pipeline will be fully operational by the end of next year – early 2020 and will be able to supply 1 bcm of gas to Bulgaria. Azerbaijan’s state oil company SOCAR has expressed interest in participating in gasification of Bulgaria. IGB is a gas pipeline, which will allow Bulgaria to receive Azerbaijani gas, in particular, the gas produced from Azerbaijan's Shah Deniz 2 gas and condensate field. IGB is expected to be connected to TAP via which gas from the Shah Deniz field will be delivered to the European markets. The initial capacity of IGB will be 3 bcm of gas.

Ukraine’s Naftogaz is in talks in London with a number of big oil and gas firms to help it develop the country’s existing and yet-to-be-tapped gas fields. Ukraine used to produce around 70 bcm of gas a year when it was part of the Soviet Union but now draws out only around 20 bcm. The potential to recover some of the production lost over the last 50 years is sizable if it can revive existing gas fields and tap new shale and offshore areas. Ukraine imported almost 30 percent of its gas during last year’s icy winter but the cost has risen in recent years due to the hryvnia’s devaluation in international currency markets. The International Monetary Fund is also demanding Kiev hike what households are charged for gas to match what it costs the country to buy it.

French energy market regulator CRE fines Vitol €5 million for gas market manipulation. CRE said fines for engaging in market manipulation on the French southern virtual gas trading point “PEG Sud” between 1 June 2013 and 31 March 2014. It said Vitol would issue multiple sell orders, generally at the beginning of the trading day, when liquidity was low. Vitol would then issue sell orders at gradually decreasing prices. Once prices had decreased, Vitol would engage in important purchases. CRE said after having proceeded with those purchases, Vitol would cancel its sell orders to finish the day as a net buyer.

China’s Changqing oil and gas field, operated by state energy giant PetroChina, is expected to produce record amount of natural gas this year exceeding 38 bcm as more wells were brought online, its parent company CNPC said. Changqing, in northern China, the largest gas producer in the country, has nearly 11,000 wells in production by late September, after over 100 new wells started pumping, CNPC said. At 38 bcm, the output at Changqing makes up about a quarter of China’s total gas production. State oil and gas firms have been stepping up domestic production as well as imports to be prepared for another winter of strong demand growth of the cleaner burning fuel

Egypt will begin importing natural gas from Israel under a $15 billion deal as early as March if an undersea pipeline connecting the Mediterranean neighbours is found to be in good condition, moving the country closer to its goal of becoming an energy-exporting hub. East Gas Company, a major Egyptian partner in the pipeline, said supplies would begin at 2.8 mcm/d in the first quarter of 2019 and gradually rise to a maximum of 19.8 mcm/d. The partners expect to begin testing the pipeline soon before modifying facilities to reverse the flow. The procedures were expected to take three to four months. Once the gas has been flowing for 30 days, the deal will close. Egypt halted supplies to Israel in 2012 due to a domestic gas shortage and repeated attacks by Islamist militants on a connecting overland stretch of pipeline in the Sinai. Egypt announced it had once more become self-sufficient in gas due to a six-fold increase in production at its own giant Zohr gas field. Egypt has idle liquefaction plants that allow it to export any of its own surplus gas or re-export gas piped in from Israel or elsewhere in the region. For Israel, using existing infrastructure to export via Egypt saves it the cost of building its own facilities. Texas-based Noble Energy sold its 43.5 percent stake in Israel’s Tamar Petroleum after announcing that it would help finance a gas export deal with Egypt. Noble, Israel’s Delek Drilling and the Egyptian East Gas Company said they would buy a 39 percent stake in the EMG pipeline to enable a landmark $15 billion deal to export natural gas from Israel to Egypt to begin next year. The $518 million purchase will enable the supply of 64 bcm of gas over 10 years from Israel’s offshore Tamar and Leviathan fields.

Norway expects its gas export price to fall by more than a quarter by 2021 as increasing global LNG supplies outstrip growth in European demand. Norway’s 2019 fiscal budget showed it expects the average price for Norwegian gas to fall to 2.05 crowns/m3 and reach a low of 1.70 crowns/sm3 by 2021, then rebounding in 2022. The projections are higher than what Norway, Europe’s second largest gas supplier after Russia, was expecting in its revised budget in May, when 2018’s price was seen at 1.8 crowns/m3 and 2019 just below 1.5 crowns. The average price for Norway’s gas was about 2.20 Norwegian crowns ($0.2655)/sm3 in 2018. LNG supply to Europe will fall in the period 2022-2025, which will push Norway’s gas export prices up again.

CNOOC plans to expand its LNG project in eastern Jiangsu province to meet rising demand from more regions. CNOOC will lift the storage tank facility of each of the four tanks linked to the Jiangsu Binhai LNG receiving terminal to 220,000 cubic meters, up from 160,000 cubic meters. The terminal and its storage tanks will be able to serve a broader region including the provinces of Jiangsu, Anhui, Henan and Shandong, where the government is switching winter heating fuel to gas from coal. The first phase of the project, with a supply capacity of 3 mt will be completed in September 2021, Chen Jiong, a project manager for the Binhai project, said.

Seventy percent of funds needed to finance the Nord Stream 2 underwater gas pipeline from Russia to Germany have been raised. Nord Stream 2, which will double the capacity from the existing Nord Stream 1 pipeline from a current 55 bcm/year, is owned by Gazprom, which is taking on half of the planned costs of €9.5 billion ($11 billion). The rest is divided between five European energy companies - Germany’s Uniper and Wintershall, Anglo- Dutch group Royal Dutch Shell, France’s Engie and Austria’s OMV.

Europe may need 100 bcm of new gas supply each year by 2030 due to falling production, Gazprom, said. Russian gas supplies to Europe may hit a record high this year. The world needs access to Russian gas, which is among the cheapest on the planet, Saudi Energy Minister said. Russian LNG could help Saudi Arabia to reduce the amount of oil liquids burnt in the kingdom. Saudi Aramco was in active talks with Russia’s independent gas producer Novatek about participating in the next phase of the Russian Yamal LNG project.

Japanese trading house Mitsubishi Corp said it will join in developing the LNG Canada project in British Columbia led by Royal Dutch Shell, which has taken a final investment decision to go ahead with the development. The C$40 billion ($31 billion) project, on the west coast of Canada, will consist of two LNG production facilities, known as trains, that are expected to export about 14 mtpa of the fuel. LNG Canada is a joint venture between Shell, Malaysia’s Petronas, PetroChina Co Ltd, Mitsubishi and Korea Gas Corp. Mitsubishi said it share of the project is 15 percent and it will take delivery of 2.1 mt of LNG annually, based on its share.

The launch of a massive LNG export project in Canada could fire the starting gun on a wave of other approvals around the world, potentially curbing a supply crunch expected after 2020. Royal Dutch Shell said it would export LNG from the west of Canada by 2025 after approving a C$40 billion ($31.2 billion) project capable of initially producing 14 mtpa. The Canada and Qatar developments will significantly boost the around 300 mt of LNG traded per year, helping ease a supply shortage expected in the next decade amid surging appetite for cleaner fuels from places such as China and wider Asia.

Singapore’s port authority has so far invested S$26 million ($19 million) into developing cleaner-burning LNG as a marine fuel at the city-state, the world’s largest marine refueling hub, Alan Lim, deputy director at the Maritime and Port Authority of Singapore, said. The bulk of the investments, totaling about S$18 million, were directed at co-funding the construction of LNG-powered vessels including tug boats, Lim said. The remainder was directed at developing the use of LNG in the marine refueling, also known as bunkering, sector. These included S$6 million for the construction of two barges capable of supplying ships with LNG bunkers through ship-to-ship transfers, as well as S$2 million for the development LNG-bunker trucking facilities at the Singapore LNG Terminal.

Morocco is preparing to invite bids for an LNG project in Jorf Lasfar worth $4.5 billion. Moroccan state-owned power utility ONEE said it had picked HSBC Middle East Ltd as financial adviser for its plan to boost imports of LNG. The project includes the import of up to 7 bcm of gas by 2025, and the construction of a jetty, terminal, pipelines and gas-fired power plants.

US oil and gas producer ConocoPhillips said it signed a deal to sell its 30 percent stake in the Greater Sunrise gas field to East Timor for $350 million. East Timor wants the gas to come to its shores as it is eager to develop oil and gas-based industries, such as petrochemicals manufacturing, to diversify its economy, one of the world’s poorest. The need is urgent as the government’s main source of revenue, the Bayu Undan gas field run by ConocoPhillips, is set to run dry by 2022. The Sunrise and Troubadour gas fields, together known as Greater Sunrise, were discovered in 1974 and hold around 5.1 trillion cubic feet of gas, according to the project’s operator, Australia’s Woodside Petroleum.

Iraq has begun producing gas from the Nasiriya oilfield in the south of the country at a rate of 50 million cubic feet a day. The development plans announced at the time included using 50 million cubic feet of gas produced as a by-product of oil production to supply power stations in the province. Iraq has continued to flare some of the gas extracted alongside crude oil at its fields because it lacks the facilities to process it into fuel. Iraq has said it hopes to end gas flaring by 2021, which costs the government nearly $2.5 billion in lost revenue each year, according to the World Bank.

Qatar announced plans to boost its LNG production capacity, which will put the tiny state on a par with top energy exporters in an apparent show of strength amid a protracted political row with Gulf neighbours. Qatar Petroleum, the world’s top supplier of LNG, said it was adding a fourth LNG production line to raise its output capacity from the North Field, to 110 mtpa. Russia, a major oil and gas producer, pumps around 11 million bpd while Saudi Arabia, the world’s top oil exporter, produces about 10.5 million bpd of crude. Additional gas volumes available for exports will mean more revenue for the state budget and more cash for Qatar Investment Authority, the country’s sovereign wealth fund, to invest abroad. For Qatar, which is locked in a dispute with four Arab states, broadening its investments outside the Middle East would cement its position as the world’s largest LNG supplier and help it to weather the boycott with its neighbours.

French oil and energy group Total said it had made a major gas discovery on the Glendronach prospect, located off the coast of the Shetland islands in the North Sea. Total said preliminary tests on the new gas discovery confirmed good reservoir quality, permeability and well production deliverability, with recoverable resources estimated at about one trillion cubic feet. It said Glendronach, located near its Edradour field, will be tied back to the existing infrastructure and developed quickly and at low cost. Total said the discovery will extend the life of the West of Shetland infrastructure and production hub which includes the Laggan, Tormore, Edradour & Glenlivet fields, as well as the Shetland Gas plant, all of which contribute to about 7 percent of the UK gas consumption. It is the largest conventional discovery in the UK in the recent past. Woodside Energy Trading Singapore said it signed a HOA with Germany’s Uniper Global Commodities for the supply of up to 0.6 mt of LNG per annum. The agreement is for a period of four years starting from 2019, the company said. The LNG will be supplied from Woodside’s portfolio sources to markets in Europe and Asia, Chief Executive Peter Coleman said. Woodside said the HOA is conditional on the execution of a fully termed LNG sales and purchase agreement.

Shipments of LNG from the USA to China remain cheaper than other sources despite a 10 percent tariff that was imposed on the cargoes this week in the trade war between the two nations. But political risks may still deter Chinese buyers from US cargoes even if they are a lower price. China said it would tax US products worth $60 billion effective 24 September in retaliation for tariffs imposed by US President Donald Trump. This includes a 10 percent tariff on LNG shipments from the US, although this was less than the 25 percent it had threatened to impose. Shipments of LNG from the US to China work out at least 9 percent cheaper than the delivered price into China compared with those loading from other key suppliers.

LNG: liquefied natural gas, mtpa: million tonnes per annum, km: kilometre, PLL: Petronet LNG Ltd, LPG: liquefied petroleum gas, CGD: city gas distribution, PNG: piped natural gas, CNG: compressed natural gas, MNGL: Maharashtra Natural Gas Ltd, PSU: Public Sector Undertaking, PNGRB: Petroleum and Natural Gas Regulatory Board, mmscmd: million metric standard cubic meter per day, IGL: Indraprastha Gas Ltd, EOGEPL: Essar Oil and Gas Exploration and Production Ltd, CBM: coal-bed methane, IOC: Indian Oil Corp, KG: Krishna-Godavari, ONGC: Oil and Natural Gas Corp, OALP: Open Acreage Licensing Policy, EoI: Expressions of Interest, mt: million tonnes, bcm: billion cubic meters, mmBtu: million metric British thermal units, CNPC: China National Petroleum Corp, mcm/d: million cubic meters per day, CNOOC: China National Offshore Oil Corp, US: United States, bpd: barrels per day, HOA: heads of agreement, UK: United Kingdom

NATIONAL: OIL

For first time, diesel costlier than petrol, Odisha dealers fear 50 percent loss

23 October. With Odisha becoming the first state in the country where diesel is costlier than petrol, dealers say they will lose 50 percent of their highway business to their counterparts in the neighbouring states. The per litre retail price of diesel in Bhubaneswar ranged between Rs 80.45 and Rs 80.69 while petrol was being sold at anywhere between Rs 80.32 and Rs 80.57 per litre. Conventionally, the retail price of diesel is lower than petrol’s because of lower taxes, dealer commissions and base price. But the base price of diesel, which is the price charged from dealers by oil companies without tax, and the dealer’s commission has increased due to the growing demand for fuel. The base price of diesel has touched Rs 50.51 compared to that of Rs 46.49 for petrol.

Source: Business Standard

Government may ease norms for setting up pumps to get more private fuel retailers

23 October. The government is mulling relaxing norms for setting up petrol pumps as it is keen on getting more private players into fuel retailing so as to increase competition. The oil ministry has set up an expert committee to recommend easing of fuel retailing licensing rules, the ministry order said. At present, to obtain a fuel retailing licence in India, a company needs to invest Rs 20 billion in either hydrocarbon exploration and production, refining, pipelines or liquefied natural gas (LNG) terminals. It has been asked to furnish its report within 60 days after due consultations with stakeholders. State-owned oil marketing companies - Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL), currently own most of 63,498 petrol pumps in the country. Reliance Industries Ltd (RIL), Nayara Energy - formerly Essar Oil and Royal Dutch Shell are the private players in the market but with limited presence. RIL, which operates the world's largest oil refining complex, has less than 1,400 outlets. Nayara has 4,833 while Shell has just 114 pumps. BP plc of UK (United Kingdom) had a couple of years back secured a licence to set up 3,500 pumps but hasn't yet started doing so. French energy giant Total in a joint venture with Adani Group announced plans to set up 1,500 petrol pumps in the next 10 years. IOC is the market leader with 27,325 petrol pumps in the country, followed by HPCL with 15,255 outlets and BPCL at 14,565 fuel stations. Currently, the three oil marketing companies are following the same methodology for fixing retail prices, which on almost all occasions are in sync with one another and prices vary by just a few paise.

Source: Business Standard

India’s crude oil import bill to peak at record $125 bn in current fiscal: Oil ministry

22 October. The ongoing historic surge in the global benchmark crude oil rates, coupled with a depreciating Rupee against the Dollar and increased reliance on imports, is likely to push India’s crude oil import bill higher by a whopping 42 percent to $125 billion or Rs 881,282 crore in the current financial year ending March 2019. The highest peak of annual crude oil imports for India was witnessed in 2013-14 when the Indian basket of crude oil averaged $105.52 per barrel. The country had imported 189.23 million tonnes (mt) of crude oil then, valuing around Rs 864,875 crore. India meets over 82 percent of its crude requirement through imports and has been facing the onslaught of rising crude rates and Rupee depreciation which have been adding pressure on the Current Account Deficit (CAD), fiscal deficit and inflation. The retail prices of petrol and diesel in India are linked to international fuel prices which are impacted by the supply-demand dynamics of the respective fuels but closely trail global crude oil prices. Moody's Investors Service had said higher oil prices and robust non-oil import demand might widen the CAD to 2.5 percent of the Gross Domestic Product in the current fiscal from 1.5 percent in 2017-18. The Union budget for 2018-19 had allocated Rs 24,933 crore as petroleum subsidy for the current fiscal, a mere 2 percent increase over the Revised Estimate of Rs 24,460 crore for 2017-18. Moody’s had earlier said that the surge in international oil prices would result in the country’s petroleum subsidy ballooning to Rs 53,000 crore.

Source: The Economic Times

Odisha urges Centre for free LPG cylinders in 3 cyclone-hit

22 October. Noting that Cyclone 'Titli' and resultant floods have "shattered" the poor in Gajapati, Ganjam and Rayagada districts, Odisha government urged the Centre for supply of free LPG (liquefied petroleum gas) cylinders to beneficiaries of the Pradhan Mantri Ujjawala Yojana (PMUY). Odisha Food Supplies and Consumer Welfare Minister S N Patro, in a letter to Oil Minister Dharmendra Pradhan, said people in these districts are the "worst sufferers" and unable to pay the subsidised rate for the cylinders. The Centre provides subsidised LPG cylinders to poorer sections of the society under the PMUY in the three districts. While 50,990 subsidised gas connections under the PMUY are provided in Gajapati district, the figure is 2,39,683 in Ganjam and 81,979 in Rayagada, Patro said.

Source: Business Standard

RIL halts Iranian oil imports

17 October. India’s Reliance Industries Ltd (RIL), owner of the world’s biggest refining complex, has halted imports of Iranian crude ahead of US (United States) sanctions against Tehran’s oil sector. RIL has boosted purchases from other Middle Eastern suppliers and the US to make up for the loss of Iranian barrels and reduced intake of Venezuelan oil. The company’s decision to stop buying Iranian oil from October-November came after an advisory from its insurers. RIL imported 2 million barrels of Iranian oil in September, ship tracking data showed. Its two advanced plants at Jamnagar in western Gujarat state can together process 1.4 million barrels per day (bpd) of oil and have the capability to turn cheaper, dirtier crudes into high-value refined products. RIL had also declared force majeure on gasoline exports from its Jamnagar site in August due to a technical glitch at a fluid catalytic cracker. The company’s exports of refined products during the September quarter totalled 10.1 million tonnes compared to 11.2 million tonnes a year earlier. The company has 1,325 fuel stations. The price of gasoil and gasoline sold through that network is on a par with that of state fuel retailers.

Source: Business Standard

India presses OPEC for responsible pricing of oil

17 October. India, the world's third-biggest oil consumer, pressed OPEC (Organisation of Petroleum Exporting Countries) to move to responsible pricing of oil and gas saying the recent spike in rates are far detached from market fundamentals and are hurting importing nations. A combination of crude oil climbing to four-year high and rupee dipping to its lowest level against US dollar has sent retail petrol, diesel and cooking gas or liquefied petroleum gas (LPG) rates to record high. The relentless price rise has wiped away tax cuts done by the government to give relief to consumers. India imports over 83 percent of its crude oil needs. Of the crude oil imported, about 85 percent of comes from OPEC nations. Also, 80 percent of gas imports come from those countries. India believes OPEC has a major role in shaping oil prices and availability and the current high oil prices dent the economic development of many countries and threaten already fragile world economic growth. Oil Minister Dharmendra Pradhan said he also expressed concerns on global trade practices limiting the affordability of energy.

Source: Business Standard

India seeks investors for building 2nd phase of strategic oil storage

17 October. The government began roadshows to attract investors for building its second phase of strategic oil storage at a cost of over Rs 11,000 crore that would more than double the emergency cover against any supply disruption to 22 days. India, which is over 83 percent dependent on imports to meet its oil needs, built the first phase of 5.33 million tonnes (mt) of emergency storage in underground rock caverns in Mangalore and Padur in Karnataka and Visakhapatnam in Andhra Pradesh. It now plans to build another 6.5 mt of storage at Padur and Chandikhol in Odisha. Oil Minister Dharmendra Pradhan said the second stage of strategic oil storages will be built on a public-private partnership where the investor would take the responsibility of constructing, filling up and operating the cavern. Roadshow in the national capital, which will be followed up with similar meets in Singapore and London, would drum support from oil traders and producers would use the storage to stock their oil and sell it to refineries in the region on commercial terms. India will have the right of first refusal to buy the crude oil stored the facilities in case of an emergency, he said. India is adding 330,000-380,000 barrels per day to global oil demand -- around 20 percent of the incremental global demand. To further improve strategic reserve, the union cabinet granted approval for establishing an additional 6.5 mt of strategic petroleum reserve which will be able to provide an extra 12 days of supply, he said.

Source: Business Standard

NATIONAL: GAS

'ONGC bought GSPC gas field stake for half the asking price of Rs 200 bn'

21 October. Oil and Natural Gas Corp (ONGC) bought Gujarat State Petroleum Corp (GSPC)'s (GSPC) stake in a KG (Krishna-Godavari) basin gas block for $1.2 billion (Rs 8,000 crore) when the replacement value of brand new assets built by the company is at least $1.5 billion and the asking price was Rs 20,000 crore, its Former Chairman D K Sarraf said. While in Deen Dayal field, ONGC got assets it can use to monetise its own gas discoveries in the neighbouring block, HPCL (Hindustan Petroleum Corp Ltd) made it an integrated company, helping it hedge price risks that a pure exploration and production (E&P) company faces, he said. Deen Dayal block had not produced any gas before the December 2016 deal with ONGC. Sarraf said ONGC, under him, found the GSPC block attractive as it could use the infrastructure in Block KG-OSN-2001/3 to bring to production Cluster-1 discoveries in its neighbouring KG-DWN-98/2 or KG-D5 block. Also, the KG-OSN-2001/3 block infrastructure gave a back-up option for Cluster-II discoveries in KG-D5 in case of disruptions, he said. Deen Dayal is an HPHT field and ONGC has similar assets which it could bring to production using experience of GSPC field, he said.

Source: The Economic Times

NATIONAL: COAL

Power companies offer CIL 28 percent premium for coal

23 October. Captive power generation companies have offered an average 28% premium to Coal India Ltd (CIL) for booking nearly 16 million tonnes (mt) of coal to be supplied yearly for five years at a recent auction. These supply contracts will now replace the current contracts that were signed earlier on a nomination basis. So far, CIL has offered 29.46 mt in three long-term eauctions, of which 26.54 mt were booked. In the first auction, for sponge iron makers, it offered 7.3 mt, of which 6.4 mt was booked at an average premium of 38.9%. It was followed by an eauction for cement sector where 4.26 mt of the 4.6 mt offered were booked at an average premium of 26.7%. The last concluded auction was for captive power plants where CIL offered the highest quantity at 17.2 mt. Around 16 mt was booked at an average premium of 29%. CIL subsidiary Central Coalfields plans to offer the highest quantity at 2.79 mt at the auction, followed by Mahanadi Coalfields at 1.41 mt. South Eastern Coalfields plans to offer half a mt , followed by Western Coalfields and Northern Coalfields at 8.64 lakh tonne and 8.16 lakh tonne, respectively. In all, non-power sectors would be allotted around 35 mt of coal including 5 mt of coking coal meant for the metallurgical sector, CIL said.

Source: The Economic Times

Proposed Khurja coal power plant overpriced, threat to Delhi's air quality: IEEFA

23 October. THDCIL's proposed Khurja coal power plant in Uttar Pradesh would not only push up the cost of electricity at a time when renewable energy options are cheaper but will also be a threat to Delhi's air quality. THDCIL, formerly known as Tehri Hydro Development Corp Ltd, is a joint venture of the Central and Uttar Pradesh governments with a 75:25 equity sharing ratio. The electricity users -- the state and central governments -- and project's lenders should not be burdened with yet another expensive stranded asset at a time when local residents need cleaner energy options, US (United States)-based the Institute for Energy Economics and Financial Analysis (IEEFA) Director of Energy Finance Studies Tim Buckley said. According to Buckley, renewable energy generation in India is now cheaper than Khurja's non-minemouth coal, with ongoing price declines prompting states, including Uttar Pradesh, to seek solar and wind options to meet incremental demand growth.

Source: Business Standard

Coal for Adani arrives at Sandheads

22 October. MV Samjohn Solidarity, carrying 1,64,928 tonnes of coal for Adani Enterprises Ltd, is anchored at Sandheads. The vessel, after discharging 1,00,000 tonnes at Sandheads – off the Haldia Dock Complex — will proceed to Paradip to unload the remaining cargo. According to the Kolkata Port Trust (KoPT), the vessel was anchored at Sandheads on 17 October. Two floating cranes are used for loading cargo into barges. The cargo will be brought to the floating jetty at Haldia for final discharge, KoPT said.

Source: The Hindu Business L ine

CIL offers domestic coal to power sector to curtail imports

22 October. Coal India Ltd (CIL), which is taking up "a series of steps" to increase the availability of domestic coal to power sector, has offered five million tonnes of coal to NTPC Ltd on a credit basis and agreed to supply 7.94 lakh tonnes of domestic coal per month to power utilities on condition of import cut. The miner, by prioritising coal supplies to the power stations of eastern states, ensured generation to meet the increased power demand during the just concluded Durga Puja festivals. However, the coal supplies to the power sector dipped to 1.169 million tonnes (mt) per day during September 2018 due to rains. The miner has offered 5 mt of coal to NTPC to be lifted by road mode.

Source: Business Standard

TANGEDCO breathes easy as imported coal arrives at port

17 October. Due to increase in coal supply, power generation by TANGEDCO (Tamil Nadu Generation and Distribution Corp) units has increased. It touched 3500 MW. This has helped TANGEDCO meet a power demand of 13500 MW. As per Central Electricity Authority (CEA) data, on 11 October, five units in Tuticorin had a total buffer stock of 1.64 lakh tonnes of coal, including 96,000 tonnes which were imported directly by TANGDEDCO. The buffer stock is enough for 13 days if all the units were to generate power to their full capacity. Generally, TANGEDCO used to have buffer stock for not less than 20 days. But in the last one month, the stock came down to even 1 day due to problem in getting rail rakes to evacuate coal from mines in Odisha.

Source: The Economic Times

NATIONAL: POWER

PTC India to sign pacts with 7 firms, 5 states for 1.9 GW power by October-end

19 October. Power trading solutions provider PTC India will sign medium-term power purchase agreements (PPA) for 1,900 MW coal-based power capacities with seven companies and five states by month-end under a pilot scheme, the power ministry said. After this tender, the company plans another round of 3,000 MW of medium term PPAs to give some relief to stressed power projects as PPAs are required for getting fuel supplies, the ministry said. Five states which would buy power from these plants are Telangana (550 MW), Tamil Nadu (550 MW), Haryana (400 MW), Bihar (200 MW) and West Bengal (200 MW). IL&FS Energy will supply 550 MW to Tamil Nadu while RKM Powergen will supply 550 MW to Telangana. Jhabua Power Ltd and JP Nilgiri Project would supply 100 MW each to West Bengal. MB Power (Madhya Pradesh) Ltd will supply will supply 175 MW to Haryana while the SKS Power will supply 300 MW to Haryana as well as Bihar. Jindal India Thermal Power will supply 175 MW to Bihar. The government had launched a pilot scheme to procure 2,500 MW electricity for three years under medium-term arrangement from commissioned power plants without power purchase agreements earlier this year in April.

Source: Business Standard

NTPC may bid for 8-9 stressed private power companies

18 October. NTPC Ltd is gearing up to bid for 8,000-10,000 MW of stressed private power projects when they are moved to the bankruptcy court. The company has identified eight-nine power plants and has negotiated with banks for funding. The company will look at commissioned projects with easy spare parts availability and coal transportation facilities. NTPC had in November last year invited bids from developers and lenders of stressed power plants, and had received interest from four private power projects.

Source: The Economic Times

Andhra Pradesh conserving power worth Rs 10 bn annually by energy efficiency

17 October. The Andhra Pradesh government is conserving 2,000 million units (mu) of power and saving about Rs 1,000 crore annually by promoting energy efficiency initiatives for the last three years. Under the energy efficiency programme, the state government has so far completed installation of 18 lakh street lights in both rural and urban areas. The state government has distributed over 2 crore LED (light emitting diode) bulbs to one crore families so far at a cheaper rate of Rs 10 per piece. While the state's total power requirement is 60,000 mu annually, the Andhra Pradesh government aims to conserve 15,000 mu of power in the next five years, The state, which has an installed power capacity of 18,000 MW, generates energy from thermal, hydro and renewables.

Source: Business Standard

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

'Green' Dwarka is Delhi's new pollution hotspot

23 October. As winter approaches, Anand Vihar makes news each year as Delhi's pollution hotspot, recording the worst air quality. Not far behind are industrial locations such as Narela, Bawana, Jahangirpuri and Mundka. This year, however, a new pollution hub has emerged in a fairly 'green' area of the capital - Dwarka, which has often recorded higher levels of pollution than Anand Vihar. Dwarka's poor air quality has prompted the Environment Pollution (Prevention and Control) Authority (EPCA) - responsible for enforcing the Graded Response Action Plan in NCR - to plan an inspection in the locality after receiving multiple complaints of open waste burning in the area. The EPCA in a meeting held last month had also highlighted how Dwarka had emerged as a pollution hotspot with 'red dots' being seen on satellite images in Dwarka, indicating fires on the ground.

Source: The Economic Times

NTPC to use biomass to co-fire coal-based power plants, cut emissions

21 October. NTPC Ltd, India's largest power producer, plans to start biomass co-firing across all its coal-based thermal power stations in a bid to reduce greenhouse gas emissions and cut pollution. NTPC plans to burn biomass like scrap lumber, forest debris, crop residues, manure and some types of waste residues along with coal to generate electricity. Biomass can typically provide between 3-15 percent of the input energy into the power plant. NTPC will start procurement of biomass pellets and torrefied biomass pellets/briquettes for co-firing across all its coal fired power plants and will soon float a tender. As per 'Biomass Resource Atlas of India' prepared by IISc Bangalore in collaboration with the Ministry of New and Renewable Energy (MNRE), India had about 145 million tonnes (mt) per year of surplus agro residue (based on survey data of year 2002-04). This surplus agro residue can generate 18,728 MW of electricity. With coal based generation of 1,96,098 MW, about 100 mt of agro residue can be absorbed in coal-based power plants with 10 percent co-firing with non-torrefied pellets while reducing their carbon emission. The Central Electricity Authority (CEA) had last November issued an advisory to all public and private generating utilities to endeavour to use 5-10 percent biomass pellets primarily made of agro residue along with coal.

Source: Business Standard

Rosatom ships equipment for KKNPP unit 4 to India

21 October. Russia's state atomic energy corporation Rosatom has manufactured and shipped out a set of equipment for Unit 4 of the Kudankulam Nuclear Power Plant (KKNPP) in Tamil Nadu. The equipment includes moisture separator reheaters (MSR-1000-1). The weight of the separator is 47 tonnes, height is around six metres and diameter is four metres. The life of the product is 30 years. The KKNPP is jointly constructed by Rosatom and Nuclear Power Corp of India Ltd (NPCIL). Each unit of the plant has a capacity of 1,000 MW. The KKNPP Unit 1 was synchronised with the southern power grid in October 2013. The KKNPP Unit 2 was connected with the grid in August 2016. The agreement for establishment of units 3 and 4 was signed in April 2014. The work on units 5 and 6 has also begun at the site.

Source: Business Standard

Solar park project in Trichy gets approvals under smart cities mission

20 October. Trichy Corp has managed to obtain both administrative and technical approvals for establishing a 2.5 MW solar park under smart cities mission to generate electricity from sunlight. In a list of more than 18 proposals made by Trichy Corp, the civic body had also envisaged a plan to establish a solar power park. Identifying Panchapur as apt location, the civic body earlier submitted a proposal with a high power committee comprising senior bureaucrats from the state government. The proposal estimated at Rs 13 crore will establish 2.5 MW solar powerplant sprawling for 15 acres in Panchapur on Trichy-Madurai NH. The civic body has planned to join hands with Tamil Nadu Generation and Distribution Corp (TANGEDCO) for supplying the electricity generated through the solar park to a public grid. In return, Trichy Corp will be equally compensated while paying their electricity bill charged by electricity board for operation and maintenance works.

Source: The Economic Times

As climate threats drive migration, Indian women find opportunities

18 October. In the last inhabited villages deep in the dense mangrove forests of India’s Sundarbans region, rice harvests have fallen by half in the last decade. Rising seas and stronger storms, linked to climate change, are driving crop-killing seawater further inland - and driving farmers out. In India’s Sundarbans region, one in five households now has at least one family member who has migrated, and in Gosaba sub-district, according to a 2018 study by the Deltas, Vulnerability and Climate Change: Migration and Adaptation (DECCMA) project, backed by the British and Canadian governments. India’s Sundarbans has 3,500 kilometers (2,200 miles) of embankments, many of which are 150 years old, according to West Bengal’s Department of Sundarban Affairs.

Source: Reuters

India can save 11 mn life years by replacing coal plants with clean energy

18 October. India could save an estimated 11 million life years annually by replacing coal-fired power plants with clean, renewable energy, according to a Harvard study. The 2.7 billion people who live in India and China -- more than a third of the world's population -- regularly breath some of the dirtiest air on the planet, researchers from the Harvard University in the United States said. Air pollution is one of the largest contributors to death in both countries, ranked 4th in China and 5th in India, and harmful emissions from coal-fired power plants are a major contributing factor, they said. In the study, researchers wanted to know how replacing coal-fired power plants in China and India with clean, renewable energy could benefit human health and save lives in the future. They found that eliminating harmful emissions from power plants could save an estimated annual 15 million years of life in China and 11 million years of life in India. Previous research has explored mortality from exposure to fine particulate matter (known as PM2.5) in India and China but few studies have quantified the impact of specific sources and regions of pollution and identified efficient mitigation strategies, researchers said. The researchers were able to narrow down the areas of highest priority, recommending upgrades to the existing power generating technologies in Shandong, Henan, and Sichuan provinces in China, and Uttar Pradesh in India due to their dominant contributions to the current health risks.

Source: Business Standard

INTERNATIONAL: OIL

Russia has no plan to boost oil output to 12 mn bpd by end of 2018

23 October. Russia does not plan to boost oil output to 12 million barrels per day (bpd) by the end of 2018, Energy Minister Alexander Novak said. Russia’s oil output reached a post-Soviet record high of 11.36 million bpd last September, surpassing the previous peak of 11.247 million bpd hit in October 2016.

Source: Reuters

Saudi, Russian oil output unable to compensate for Iranian crude: Iranian Oil Minister

22 October. Iranian oil output cannot be replaced by other oil producing countries if Tehran is hit by sanctions by the United States (US) in November, Iranian Oil Minister Bijan Zanganeh said. Washington is pushing allies to cut imports of Iranian oil to zero and will impose a new round of sanctions on Iranian oil sales in November. But Iran, OPEC (Organization of the Petroleum Exporting Countries)’s third-largest producer, has repeatedly said that its oil exports cannot be reduced to zero because of high demand levels in the market and has blamed US President Donald Trump for an oil price rally caused by the sanctions on Tehran.

Source: Reuters

New Iraqi National Oil Company aims to produce 7 million bpd: Oil Minister

21 October. Iraq is seeking to produce 7 million barrels of oil per day (bpd) through its newly established National Oil Company and to export 4 million bpd in 2019, Oil Minister Jabar al-Luaibi said. Luaibi said Iraq hoped to export 1 million bpd through Jordan’s Akaba port, without specifying a timeline. The burning of gas produced as a byproduct of oil extraction would stop by 2021, Luaibi said. The northern refinery of Baiji was brought back online and is producing 70,000 bpd, Luaibi said.

Source: Reuters

INTERNATIONAL: GAS

Asia's slowing LNG demand growth to curb spot market buying

23 October. Asia's demand growth for short-term, or spot, cargoes of liquefied natural gas (LNG) could dip as the region's thirst for LNG will increase less than last year on forecasts for a warmer winter and as nuclear power plants erode the need for gas. The lower demand for spot cargoes this winter could help to cap prices which have climbed after China's gasification push last year sparked higher imports, lifting the country to become the world's second-largest LNG user after Japan. Consultants Wood Mackenzie and FGE forecast slowing overall LNG demand growth in Asia for the winter months, from November this year to February 2019. During the period, FGE predicts LNG demand in Asia to rise by 0.8 percent to about 84 million tonnes (mt) while Wood Mackenzie sees slightly more positive growth of 9.8 percent to about 90 mt. Falling LNG demand in Japan, the largest LNG importer globally, will contribute to the slower Asian growth as gas is replaced by nuclear energy.

Source: The Business Times

Saudi Aramco in talks with Russia's Novatek on large LNG project

23 October. Saudi Aramco Chief Executive Officer (CEO) Amin Nasser is negotiating with Russia’s Novatek to invest in a large liquefied natural gas (LNG) project. Saudi Arabia signed deals worth more than $50 billion in oil, gas, infrastructure and other sectors at an investment conference in Riyadh.

Source: Reuters

First LNG cargo exported from Ichthys: France's Total

23 October. French oil and gas major Total said that the first cargo of liquefied natural gas (LNG) cargo from Australia’s Ichthys LNG project has been exported following the production start-up at the end of July. Ichthys LNG, with reserves of more than 3 billion barrels of oil equivalent offshore Western Australia, including around 500 million barrels of condensate, is operated by Japan’s Inpex Corp with a 62.2 percent stake. Total is a major partner in the project with a 30 percent stake.

Source: Reuters

CNPC starts shale gas transit station in Sichuan

23 October. China National Petroleum Corp (CNPC) started its largest transit station for shale gas in the southwestern province of Sichuan, as the state energy major boosts production of the unconventional gas ahead of the peak winter season. The transit station in Weiyuan is able to supply annual 9 billion cubic metres (bcm) of gas and connects the Weiyuan shale gas block with the existing pipeline grid. CNPC making up some 70 percent of the country’s total. It has set a target to raise shale gas output to 12 bcm in 2020, in which the Weiyuan block will contribute 5 bcm, CNPC said. China’s state oil firms have been stepping up drilling at domestic fields to boost production, and raising imports of liquefied natural gas by nearly 50 percent so far this year versus a year ago to feed robust demand for the fuel.

Source: Reuters

'Japan has spent $4 bn to back global LNG infrastructure push'

22 October. The Japanese government along with private companies have spent $4 billion in the past year on liquefied natural gas (LNG) projects, mainly in Asia and across the supply chain, to help spur demand for the fuel, the country’s Trade Minister Hiroshige Seko said. Seko said Japan offered training to 200 people from 15 countries to develop a workforce to work in the LNG supply chain. Seko announced a year ago that Japan would offer $10 billion to support projects jointly sponsored by private enterprise and the government to supply LNG or build LNG infrastructure in Asia and develop a workforce of 500 people for projects in gas producing and consuming countries. The financing will go towards upstream, midstream and downstream LNG projects in developing countries in Asia and other countries to spur LNG demand. The initiative came after Seko and US (United States) Energy Secretary Rick Perry agreed in June 2017 that the two countries would work together to expand the LNG market in Asia. The expansion of Asian LNG markets would create demand for rising US LNG exports.

Source: Reuters

Ethiopia signs peace deal with rebels from gas-rich region

22 October. Ethiopia signed a peace deal with Ogaden National Liberation Front (ONLF) rebels from its Somali Region, whom it had previously outlawed as a “terrorist group”. The ONLF launched its bid for secession of the Somali Region, also known as Ogaden, in eastern Ethiopia in 1984. In 2007, Ethiopian forces launched a large-scale offensive against the group after the rebels killed 74 people in an attack on a Chinese-run oil facility. Earlier this year, parliament removed the ONLF from a list of banned movements as part of a reform drive being led by Prime Minister Abiy Ahmed, who has extended an olive branch to opponents. The Ogaden region contains four trillion cubic feet of gas and oil deposits, the government said. China’s POLY-GCL Petroleum has been developing two gas fields there since 2013.

Source: Reuters

Ukraine secures new $3.9 bn IMF deal after gas price hike

19 October. Ukraine secured a new $3.9 billion stand-by aid agreement with the International Monetary Fund (IMF), helping the country maintain financial stability and the trust of investors as it heads into a choppy election period next year. The IMF announced the deal hours after the government decided to raise household gas prices by nearly a quarter, an outstanding IMF requirement. Ukraine’s Prime Minister Volodymyr Groysman had warned the country was headed for default without an IMF deal, but the gas price hike triggered fierce criticism from opposition politicians, giving a taste of the backlash that is likely to follow. The government initially had agreed to raise gas prices but later backtracked, knowing the potential for voter anger during presidential and parliamentary elections. Groysman said household gas prices would be raised by 23.5 percent from 1 November.

Source: Reuters

New Pakistani government seeks to renegotiate LNG terminal deals: Petroleum Minister

18 October. Pakistan’s new government will renegotiate agreements for two liquefied natural gas (LNG) import terminals, Petroleum Minister Ghulam Sarwar Khan said. Khan said the government of ousted premier Nawaz Sharif agreed to pay too much to Pakistan’s Engro Corp Ltd for at least one of the terminals. The rapid adoption of LNG infrastructure made Pakistan one of the industry’s fastest-growing markets in Asia, sparking interest from the world’s major energy producers and traders. Engro, Pakistan’s largest listed conglomerate, built the country’s first LNG terminal in 2015 and has said it will begin building another one starting in early 2019. Khan made no direct claim of corruption in the LNG deals but said the contracts gave a maximum return on equity of up to 44 percent, which he said was far above the industry standard.

Source: Reuters

Exxon Mobil signs framework agreement to supply LNG to Zhejiang Energy for 20 years

18 October. Exxon Mobil Corp said it signed a framework agreement for a liquefied natural gas (LNG) supply deal with Zhejiang Provincial Energy Group, the Chinese company’s first long-term supply deal. Peter Clarke, the president of Exxon Mobil gas and power marketing, inked the 20-year supply deal in a signing ceremony during the International Petroleum and Natural Gas Enterprise conference at Zhoushan, in Zhejiang province, the company said in a statement. The Chinese company will receive 1 million tonnes of LNG per year from Exxon Mobil under the agreement, Zhejiang Energy President Tong Yahui said. Exxon Mobil said it will deliver the LNG starting in the early 2020s. Exxon Mobil is stepping up its efforts to meet soaring LNG demand, coupling multi-billion dollar production projects around the world with its first mainland storage and distribution outlet. LNG supplies to China would come from a combination of Exxon Mobil’s global portfolio - not necessarily from the United States - as the company boosts output from Papua New Guinea and Mozambique, Clarke said. Zhejiang Energy is a coal producer and utilities operator, and formed a joint venture earlier this year with commodities trader Glencore to trade energy products including LNG. Zhejiang Energy is teaming up with state-owned Sinopec Corp to build a LNG receiving terminal near the city of Wenzhou in Zhejiang with a capacity of 3 million tonnes per year. The plant is planned for start up by the end of 2021.

Source: Reuters

Poland's PGNiG to buy stake in Norwegian gas field from Equinor

18 October. Polish gas firm PGNiG has agreed to buy Equinor’s 42.38 percent stake in the Tommeliten Alpha gas and condensate field in Norway for $220 million, as part of its plan to diversify supplies, PGNiG said. Poland uses around 17 billion cubic metres (bcm) of gas a year and imports more than half of that from Russia’s Gazprom. In order to reduce that reliance, Poland has increased liquefied natural gas (LNG) deliveries via a Baltic Sea terminal and also plans to build a gas pipeline to Norway via the Baltic Sea and Denmark by 2022 when the deal with Gazprom expires. PGNiG said the stake would entitle it to recoverable reserves at the Tommeliten Alpha field of around 52 million barrels of oil equivalent. PGNiG said the deal would help it increase gas output in Norway by 0.5 bcm a year for the first six years of field production, which is expected to start in 2024. The company plans to increase its gas output in Norway to 2.5 bcm by 2022 from 0.55 bcm in 2017. The Baltic Pipe’s capacity will be 10 bcm a year.

Source: Reuters

Global LNG demand to outperform

17 October. Demand for LNG (liquefied natural gas) will post strong growth to 2027, outperforming the wider energy complex, according to oil and gas analysts at Fitch Solutions Macro Research. Fitch Solutions Macro Research said China will see its share progressively diluted, in part due to a slowdown in its own LNG import growth. Outside of Asia the outlook for emerging market demand is more clouded, according to Fitch Solutions Macro Research.

Source: Rigzone

INTERNATIONAL: COAL'

Coronado coal float flops on Australian market debut

23 October. Coronado Global Resources, Australia’s biggest coal mining IPO since 2012, fell as much as 8.5 percent below its float price on the first day of trading, even after being priced at the bottom end of the offered range. Local fund managers shunned the offering on the view that Coronado’s private equity owner, The Energy & Minerals Group (EMG), was selling when coking coal prices were primed to fall on declining demand from China. Coronado mainly produces coking coal used in steel-making, with an annual output of 8.2 million tonnes from three US (United States) mines and 8.5 million tonnes from the Curragh mine in Australia, which it bought from Wesfarmers Ltd for A$700 million last December.

Source: Reuters

China's Shandong halts 41 coal mines after accident

22 October. Authorities in eastern China’s Shandong province ordered 41 coal mines to halt production for security checks, after an accident at a mine in the province killed three people. The accident occurred at a coal mine operated by Shandong Energy, China’s second largest producer. Total capacity at the 41 mines ordered to halt output was not known, but the crackdown on safety comes ahead of winter, the most important coal consumption season. Shandong, one of the country’s top coal consuming regions, is working to reduce demand for coal by forcing heavy industry to get rid of coal-fired boilers and is also closing some coal-fired power plants. China’s thousands of coal mines are notorious for their poor safety record and the latest incident raises fresh questions about whether producers followed strict rules on exploration as they ramped up output. The accident was caused after a rock burst and destroyed part of a water drainage tunnel in the coal mine.

Source: Reuters

Australia's South32 first-quarter coking coal production triples

18 October. Australian miner South32 said first-quarter coking coal output more than tripled from the same year-ago period, helped by robust production at its Appin and Dendrobium collieries. Production of coking coal, also known as metallurgical coal, at the mines in Illawarra rose to 1.5 million tonnes in the first quarter of the 2019 fiscal year from 494,000 tonnes a year earlier. That handily beat a UBS estimate of 1.2 million tonnes. South32 had suspended operations at its Appin coal mine on the order of a government regulator last June due to concerns over high gas levels in the mine.

Source: Reuters

INTERNATIONAL: POWER

EGENCO up for power generation increase in Malawi

22 October. The Electricity Generation Company (EGENCO) has said it plans to increase electricity generation capacity from 384 MW to 2,300 in 2034. EGENCO has lined up short and long-term programmes which are aimed at eliminating challenges of electricity supply. 10 MW would be added by December 2018, another 10 MW in May 2019 and 19.5 MW by December 2020. Currently, only 14 percent of the country’s population has access to electricity and population experts estimate that the country’s population would be around 30 million in the next 10 years.

Source: The Maravi Post

Iran’s power generation capacity nears 80 GW

21 October. Iran’s nominal capacity to produce electricity has reached nearly 80,000 MW following the connection of a number of power plants to the country’s national grid over the past weeks. Since the beginning of the current Iranian year (21 March), Iran’s overall nominal capacity to generate electricity has increased by 1,005 MW. With the coming into service of several new power plants, the capacity reached 79,665 MW in the month of Mehr (23 September – 22 October). Iranian Energy Minister Reza Ardekanian highlighted the country’s self-sufficiency in the area of power generation and said the Islamic Republic is the top producer of electricity in the Middle East. He said that Iran’s capabilities in the area of power generation have developed over the past four decades so much that the country has become the top producer of electricity in the region.

Source: Tasnim News Agency

Bosnian government to help keep Aluminij smelter on power grid

19 October. A Bosnian regional government will help to keep aluminium smelter Aluminij Mostar running, after heavy debt brought it to the brink of closure. Management at Bosnia’s sole aluminium smelter had called for the Bosniak-Croat Federation to intervene after the business was hit by rising alumina and electricity prices. The company sounded the alarm when the country’s power regulator threatened to cut it off the grid because of unpaid bills. The Federation ministries of industry and finance will consider providing guarantees for bank loans that Aluminij could take to purchase the electricity and raw materials necessary for production, Industry Minister Nermin Dzindic said. The government will also work on renegotiating the electricity debts once Aluminij has started a financial review and operations audit, Dzindic said.

Source: Reuters

Siemens may have to share big Iraq power contract with GE

17 October. Siemens may have to share a multi-billion dollar deal with US (United States) rival General Electric (GE) to improve Iraq’s energy supply system following an intervention by President Donald Trump’s administration. The US government intervened in favour of GE and put pressure on the Baghdad government. Although no decision has been made, Siemens had been the favourite to win the contract to supply 11 GW of power generation equipment to Iraq in a deal reported to be worth around $15 billion. GE, which has been battling a severe downturn in its power division, is now expected to take a substantial part of the sale, which could be included in its figures when it reports its third-quarter earnings on 30 October.

Source: Reuters

Swiss government proposes broad electricity market deregulation

17 October. The Swiss government proposed complete liberalisation of the electricity market as it moves to decentralise production and promote renewable energy. Opening a period of public comment that runs through January, the cabinet said that while five-sixths of power purchases took place on open markets, more than 99 percent of retail and business consumers remain bound to regulated suppliers. These consumers should in future be allowed to choose where to buy their electricity, the government said. Retail consumers should also be able to draw power exclusively from Swiss producers, of they so choose, of which part would have to be from renewable sources. Switzerland has 20 GW of installed power capacity, which ensures demand is covered even after nuclear power plants go offline, reducing capacity to 16.5 GW, it said.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

SkanGas expands liquefied biogas customer base to Finland

23 October. SkanGas, a Norwegian-based unit of Finland’s state-owned Gasum, has delivered liquefied biogas (LBG) to two Finnish customers for the first time, it said. LBG, a renewable version of liquefied natural gas (LNG), is produced from organic waste and can reduce the carbon footprint of companies using it, SkanGas said. While LBG is still considered an immature market and thus costlier than many alternatives, it is also part of a growing trend of bioenergy consumption. STEP, an acronym for Finnish Industrial Energy Services, offers sustainable energy solutions for industrial customers and is a joint venture owned by Pori Energia and Veolia.

Source: Reuters

Australia backs hydrogen project to store renewable energy

22 October. The Australian government said it would provide half the funding for the country’s biggest trial to produce hydrogen using solar and wind energy, which could then be used as a back-up for gas supplies. The A$15 million ($11 million) project is being run by gas pipeline company Jemena, which plans to build a 500 kilowatt electrolyser in western Sydney that will use solar and wind power to split water into hydrogen and oxygen. Most of the hydrogen will then be injected into the local gas network, aiming to show that renewable hydrogen could be used for energy storage in Australia’s gas networks, the Australian Renewable Energy Agency said.

Source: Reuters

European Commission clears €200 mn in French renewable energy state aid

22 October. The European Union’s competition watchdog approved €200 million worth of state aid to support electricity production from renewable sources for self-consumption in France until 2020. The European Commission said the French government’s support program would contribute to add 490 MW of new capacity and was available for small installations. The selected installations would receive a premium on top of the market price over 10 years, it said.

Source: Reuters

Hungary's Paks nuclear plant powers down reactor for repairs

21 October. Hungary’s Paks nuclear power plant powered down one of its four reactors for repairs to a malfunctioning mechanical unit, the plant operator said. It said the repairs would cut capacity at Hungary’s only nuclear power generator by 504 MW. The plant began powering down reactor 2. It is due to return to full capacity on 31 October.

Source: Reuters

Group led by EDP Renewables to invest in floating wind farm

19 October. A consortium led by Portugal’s EDP Renewables (EDPR) will invest €125 million ($144 million) over three years in a 25 MW floating offshore wind farm, EDPR’s principal shareholder Energias de Portugal said. The project, Europe’s second floating wind farm, involves anchoring three turbines on semi-submersible platforms at water depths of up to 100 metres. The wind farm will be in the Atlantic about 20 km (13 miles) off the coast of Viana de Castelo in northern Portugal. The farm’s total capacity of 25 MW will be enough to power 60,000 homes for a year. The turbines, each with 8.4 MW capacity, will be the most powerful turbines installed on a floating base at sea, the company said.

Source: Reuters

Russia and Uzbekistan start work on nuclear power plant

19 October. Russia and Uzbekistan started preliminary work on the Central Asian nation’s first nuclear power plant project which Moscow estimates will cost $11 billion. Russian President Vladimir Putin and Uzbek President Shavkat Mirziyoyev symbolically marked the commencement of the project at a meeting in Uzbekistan.

Source: Reuters

China's State Power considering bids for Brazilian hydro and thermal plants

18 October. China’s State Power Investment Corporation is in talks to acquire two additional hydroelectric dams and thermal plants in Brazil. One of the hydroelectric dams is Usina Três Irmãos, 800 MW dam in Sao Paulo state, controlled by Brazil’s infrastructure group TPI- Triunfo Participações e Investimentos SA. The Chinese power company is also expected to present a binding offer by the end of the month for the control of the Santo Antonio hydropower dam, in the northern state of Rondonia. Talks to acquire the dam have been ongoing for almost two years. State Power is also considering a bid for two coal thermal plants that France’s Engie SA owns in the southern Brazilian states of Santa Catarina and Rio Grande do Sul. Engie put the plants for sale six months ago.

Source: Reuters

Energy firms, green groups call for strong UK carbon price to keep coal at bay

18 October. Energy companies and green groups have written separate letters to Britain’s Finance Minister Philip Hammond asking for the country’s strong carbon price to be maintained to prevent a rise in coal-fired power generation and greenhouse gas emissions. The letters come ahead of Britain’s 29 October budget and after the government said it was considering four carbon pricing options for Britain when it leaves the European Union (EU) next year. Britain’s carbon price is currently made up of two levies, a domestic carbon tax set at 18 pounds ($24) per ton, paid on top of obligations under the European Emissions Trading System, which forces companies to surrender one carbon permit for every ton of CO2 (carbon dioxide) they emit. EU carbon prices have more than doubled this year to around €19 ($22) a ton, meaning the total carbon price for British companies is around 35 pounds a ton.

Source: Reuters

French groups Engie and Casino set up solar power joint venture

17 October. French utility Engie and supermarket retailer Casino launched a new solar power joint venture, with France looking to expand its capacity in the fast-growing area of renewable energy. Engie and Casino said they would invest about €100 million ($115.60 million) per year in the new solar joint venture. France wants to develop more wind, solar and other low-carbon energy sources to cut its dependence on nuclear energy power, which currently counts for over 75 percent of its needs. Government data showed that French Ecology Minister Francois de Rugy had approved 392 rooftop solar power projects with a total capacity of 230 MW under a plan launched in 2016 to develop 1,450 MW of solar capacity within three years.

Source: Reuters

US greenhouse emissions fell in 2017 as coal plants shut

17 October. Greenhouse gases emissions from the largest US (United States) industrial plants fell 2.7 percent in 2017, the Trump administration said, as coal plants shut and as that industry competes with cheap natural gas and solar and wind power that emit less pollution. The drop was steeper than in 2016 when emissions fell 2 percent, the Environmental Protection Agency (EPA) said. EPA acting administrator Andrew Wheeler said the data proves that federal regulations are not necessary to drive carbon dioxide reductions. While Wheeler gave the administration credit for the reductions, which mainly came from the power sector, the numbers also underscore that the administration has not been able to stop the rapid pace of coal plant shutdowns. Voters in states that produce and burn coal form a large part of President Donald Trump’s base, but the administration has not been able to forge a path for subsidizing aging coal and nuclear plants, despite industrial players urging the administration to act. Trump has said that the climate is changing but he does not know the extent to which humans are causing it, and last year he announced his intention to pull the country out of the 2015 Paris climate agreement.

Source: Reuters

DATA INSIGHT

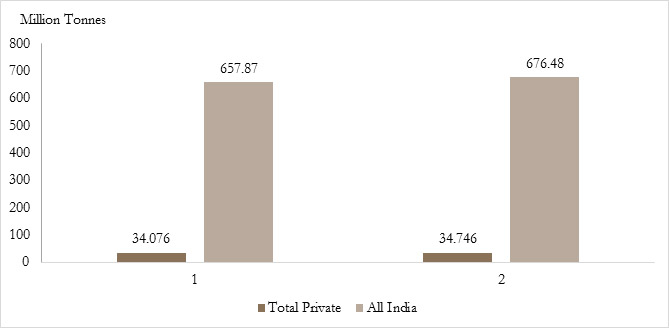

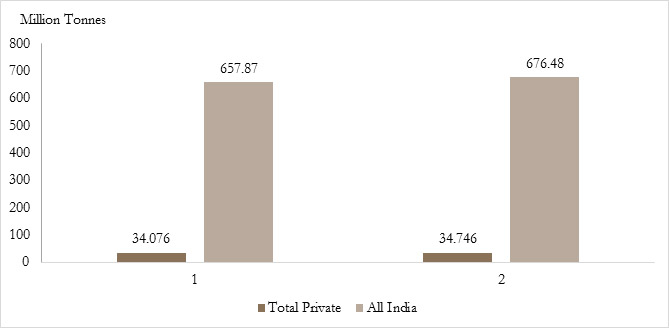

Production of Coal by Private Sector in India

Million Tonnes

| Company |

2016-17 |

2017-18 (P) |

% change |

| TISCO |

6.316 |

6.256 |

-0.9 |

| Meghalaya |

3.712 |

2.308 |

-37.8 |

| HIL Total |

2 |

2.499 |

25.0 |

| JPVL |

2.8 |

2.8 |

0.0 |

| SIL |

0.153 |

0.27 |

76.5 |

| BALCO |

0.18 |

0 |

-100.0 |

| SPL |

16.997 |

18.003 |

5.9 |

| CESC |

1.742 |

1.832 |

5.2 |

| GMR |

0.151 |

0.27 |

78.8 |

| RCCPL |

0.025 |

0.063 |

152.0 |

| TUML |

0 |

0.445 |

- |

| Total Private |

34.076 |

34.746 |

2.0 |

P: Provisional

P: Provisional

Source: Press Information Bureau

Publisher: Baljit Kapoor

Editorial Advisor: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

|

OBSERVER RESEARCH FOUNDATION

20, Rouse Avenue, New Delhi- 110 002

PHONE: (011) 3533 2000, FAX: (011) 3533 2005

E-Mail: [email protected] |

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

P: Provisional

P: Provisional PREV

PREV