-

CENTRES

Progammes & Centres

Location

Coal imports by India are set to reach 164 mt against the earlier forecast of 158 mt due to historic low levels of stocks at CIL and power plants amid surging industrial demand, Wood Mackenzie report said. India's spot market prices, for both coal and power, are expected to remain strong in the coming months as continuous industrial production growth is pushing demand, while supply remains tight, the report said. With a decade-low stockpile at CIL's mines and more than half of the plants with a supercritical level of less than seven days' stock, the reliance on imported coal for several power plants will increase the flow of imports into India. With the power sector increasingly relying on imports, an increase in imports is expected to continue till early next year.

Care Ratings said that it expects higher coal imports during the year on the back of improved capacity utilisation in various sectors, including power. Improved capacity utilisation in power, cement and steel sectors will be major drivers of coal import, it said. Coal imports grew by 13.9 percent at 95.2 mt during the April-August 2018 period. Share of coal from Australia, Indonesia and South Africa stood at 21.8 percent, 41.8 percent and 14.8 percent, respectively. India is the second largest producer and importer of coal behind China, it said. Total domestic coal production, it said, is likely to remain stagnant with 2.5-3.5 percent of growth in FY19 at 705-712 mt.

India's coal import increased substantially by 35 percent to 21.1 mt in September, as against 15.61 mt in the corresponding month previous fiscal. The rise in imports comes at a time when the captive power plants in the country are grappling with the issue of coal shortages. Overall, coal and coke imports during the first half of the current fiscal increased by 13.9 percent to 119.42 mt, compared to 104.81 mt in the April-September period of previous fiscal, according to mjunction services, a joint venture between Tata Steel and SAIL. Steam coal imports during the first six months of 2018-19 increased 17.5 percent to around 82.5 mt, compared to 70.21 mt in the same period previous year, mjunction said. With the power plants grappling with acute coal shortage, the government has recently directed CIL and its subsidiaries to give priority to power plants in fuel supply. MCL -- a CIL arm-- in a recent letter said in view of the acute shortage of coal at power plants, it was decided in the meeting that rakes will be loaded only for power plants. The government had earlier said that during 2017-18 coal imports increased to 208.27 mt due to increase in demand by consuming sectors. The country's coal import fell from 217.7 mt in 2014-15 to 190.9 mt in 2016-17.

CIL which is taking up "a series of steps" to increase the availability of domestic coal to power sector, has offered 5 mt of coal to NTPC Ltd on a credit basis and agreed to supply 794,000 tonnes of domestic coal per month to power utilities on condition of import cut. The miner, by prioritising coal supplies to the power stations of eastern states, ensured generation to meet the increased power demand during the just concluded Durga Puja festivals. However, the coal supplies to the power sector dipped to 1.169 mt per day during September 2018 due to rains. The miner has offered 5 mt of coal to NTPC to be lifted by road mode.

The government has asked CIL and its subsidiaries to prioritise coal supply to state power producers like NTPC Ltd, leaving private electricity plants in a lurch. The coal ministry has directed CIL to prioritise the coal supply to select central and state government-owned power houses under the pretext of building coal stocks at these plants. All subsidiaries of CIL like SECL have been directed to supply coal to state power generators such as NTPC. CIL has its subsidiaries like SECL to supply 25 rakes per day of coal to NTPC's Korba, Mouda and Bhilai power plants and such other state power plants. The government has directed CIL and its subsidiaries to give priority to power plants in fuel supply as plants are grappling with acute coal shortage. MCL in a letter said in view of the acute shortage of coal at power plants, it was decided in the meeting that rakes will be loaded only for power plants. CIL accounts for over 80 percent of the domestic coal output.

Power industry body ICPPA has requested the PMO to take steps to address the issue of coal availability and its supply. The ICPPA members include players from key sectors such as steel and aluminium. In the letter to PMO, ICPPA said aluminium is a highly power-intensive industry and around 14,500 kWh units are used for the production of 1 tonne of aluminium metal, which requires 11.7 tonne coal. Supply of coal is a long-standing issue for the captive power producers who unlike the IIPs don't produce it for commercial purpose. On prices, ICPPA had earlier said that the dry fuel must be supplied by CIL to CPPs at the same rate at which it is being given IPPs.

Captive power consumers, who primarily run their electricity generation units to cater to own industrial production demand, have expressed dissatisfaction over the government’s recent move of prioritising power production utilities and central government companies for loading railway rakes for coal transportation. Captive power plant producers, which traditionally bear the brunt of coal shortages in other sectors, have repeatedly been writing to the central government about the issue. While seeking resumption of regular coal supply in May, the industry had told the coal ministry and the PMO that curtailing fuel supply to captive units would compromise operations of about 28,000 MW of generation capacity, and in turn, jeopardising production in the aluminium, steel, fertiliser, cement and other sectors. The Aluminium Association of India had also written to the PMO in August about critical coal shortage. Supply by CIL to the non-power sector in the first five months of FY19 remained stagnant year-on-year at 50 mt. Simultaneously, coal allocated for this sector under the e-auction route, where price can rise as much as 70% over the notified amount, has been increased more than ten times to 3.47 mt. Though CIL has increased its dispatch to the power sector by 12% year-on-year to 197 mt in the first five months in FY19, 19 power plants had coal stock for less than seven days on 27 September. Analysts at India Ratings, while maintaining its negative outlook for the thermal power sector, recently said the coal supply issue arising from inadequate railway rakes to ferry the fuel remains one of the crucial challenges to the thermal power sector.

Captive power generation companies have offered an average 28% premium to CIL for booking nearly 16 mt of coal to be supplied yearly for five years at a recent auction. These supply contracts will now replace the current contracts that were signed earlier on a nomination basis. So far, CIL has offered 29.46 mt in three long-term e-auctions, of which 26.54 mt were booked. In the first auction, for sponge iron makers, it offered 7.3 mt, of which 6.4 mt was booked at an average premium of 38.9%. It was followed by an e-auction for cement sector where 4.26 mt of the 4.6 mt offered were booked at an average premium of 26.7%. The last concluded auction was for captive power plants where CIL offered the highest quantity at 17.2 mt. Around 16 mt was booked at an average premium of 29%. CIL subsidiary Central Coalfields plans to offer the highest quantity at 2.79 mt at the auction, followed by MCL at 1.41 mt. SECL plans to offer half a mt , followed by WCL and NCL at 864,000 tonne and 816,000 tonne, respectively. In all, non-power sectors would be allotted around 35 mt of coal including 5 mt of coking coal meant for the metallurgical sector, CIL said.

CIL is in talks with an Australian coal mining company to pick up a stake in the range of 20-30 percent. If the deal materialises, it will ensure a steady supply of coking coal to Indian steel and allied companies. The country’s coal giant plans to set up an office in Brisbane this year and the pact will mark its second foray into foreign shores, the first being in Mozambique way back in 2009. It can procure rights over coking coal, which can be supplied back to India at cheaper rates compared to global prices. During its first tranche of global expansion, after it narrowed down on this African country, the Mozambique government in August 2009 granted Coal India licenses to explore and mine coal which led it to floating Coal India Africana Limitada as a subsidiary in that country.

TANGEDCO sought to justify its decision to purchase imported coal from private players without going through the tender process. The distribution company said the calorific value of imported coal was much higher than what is supplied by CIL and hence the higher price is justifiable. The Indian coal cost is more than ₹ 2,000/t and as it has to be transported through rails, and then by sea, the total landing cost would be around ₹ 3,655/t. If imported, coal with similar GCV would be available at ₹ 3,150/t. It also said through a recent tender, TANGEDCO had decided to purchase 1.75 mt of imported coal and in the process saved ₹ 1.39 billion compared to the prevailing international prices.

Due to increase in coal supply, power generation by TANGEDCO units has increased. It touched 3500 MW. This has helped TANGEDCO meet a power demand of 13500 MW. As per Central Electricity Authority data, on 11 October, five units in Tuticorin had a total buffer stock of 164,000 tonnes of coal, including 96,000 tonnes which were imported directly by TANGEDCO. The buffer stock is enough for 13 days if all the units were to generate power to their full capacity. Generally, TANGEDCO used to have buffer stock for not less than 20 days. But in the last one month, the stock came down to even 1 day due to problem in getting rail rakes to evacuate coal from mines in Odisha.

THDCIL's proposed Khurja coal power plant in Uttar Pradesh would not only push up the cost of electricity at a time when renewable energy options are cheaper but will also be a threat to Delhi's air quality. THDCIL, formerly known as Tehri Hydro Development Corp Ltd, is a joint venture of the Central and Uttar Pradesh governments with a 75:25 equity sharing ratio. The electricity users -- the state and central governments -- and project's lenders should not be burdened with yet another expensive stranded asset at a time when local residents need cleaner energy options, US based the IEEFA said. Though IEEFA claims that renewable energy generation in India is now cheaper than Khurja's non-minemouth coal, to substantiate its argument, some experts said that renewable energy is cheaper only at the plant level (intermittent) and not at the system level (uninterrupted 24*7 supply).

A recent report by the UN's IPCC gives India a "huge" opportunity to develop differently and also stresses on the need to make smooth and viable transition from coal. According to the report, India could witness deadly heatwaves if the planet's temperature goes up by two degrees Celsius. India needs to make smooth and viable transition from coal, and simultaneously safeguard related jobs in the short term. The successful transformation of coal sector would need re-skilling the workforce along-side application of emerging technologies like Carbon Capture and Storage. The government has admonished CIL’s brass for poor project management, long delays in tendering, leniency with contractors and other issues that have starved thermal power plants of fuel and warned the company’s non-performers that it can take stern action. The central government wants CIL to liquidate 10 mt of pit head stocks from its existing 21 mt by end of October to take care of increased demand during festival season. The coal ministry is concerned that despite repeated instructions and reviews and even after the end of rainy season, coal production and supplies did not pick up to the extent necessary for achieving production and offtake target of 652.25 mt and 681.20 mt respectively. Progress of old stocks liquidation and over burden removal is also very slow and coal stocks at power plants are decreasing and number of critical and super critical plants are increasing.

The NCP claimed that rural areas in Maharashtra are facing extended power cuts every day because the coal supply meant for the state is being "diverted" to poll-bound Rajasthan, Madhya Pradesh and Chhattisgarh. Assembly elections are scheduled to be held in these three states over the next two months. Power load-shedding is likely to coincide with the upcoming festive season when the demand typically shoots up to 16,000 MW per day. The NCP leader claimed Maharashtra received only 30,000 tonnes of coal of the total requirement of 150,000 tonnes.

Talcher coalfields in Odisha's Angul district will contribute a record 100 mt of coal as against a target of 162.5 mt of MCL. MCL, the leading CIL subsidiary, has set a target of 162.5 mt of coal production during the financial year 2018-19. MCL said the Talcher coalfields will be growing at a rate of 50 mt every five years. Talcher coalfields had contributed over 81 mt to the total 143 mt of coal produced by the company during the previous financial year 2017-18.

China's leading role in financing a wave of new coal plants across Asia is drawing fresh scrutiny as the world’s top climate scientists weigh calling for much deeper cuts in emissions. China, India, Japan and the Philippines rank among the biggest investors in the 1,380 coal plants under construction or development worldwide, according to a study by the German pressure group Urgewald. For now, China’s thirst for energy supplies is so strong it pushed up the benchmark coal contract to $100/t the most in five years. Utilities by 2030 would have to consume just a third of the coal they burn now to hold global warming since the start of the industrial era to 1.5 degrees Celsius (2.7 Fahrenheit), according to a draft of a report by the UN’s IPCC.

Datong, a major coal-producing city in northern China’s Shanxi province, will establish “no-coal zones” in urban districts as part of its efforts to curb pollution, the provincial government said. The Shanxi government said the restrictions would cover 102 square kilometres (39 square miles) and would include bans on the storage, sale and direct combustion of all kinds of coal. Coal-fired power and central heating systems will still be permitted. It said 16,200 households in Datong would switch to cleaner gas heating this winter and that it had already demolished 3,812 coal-fired boilers. Datong was one of China’s major coal producing regions for decades, but many of its collieries are now depleted. Shanxi, which produces nearly a billion tonnes of coal a year, has been forced to relocate more than 650,000 people from unsafe former mining districts at risk of collapse. The province is one of China’s major pollution control zones over the 2018-2020 period and it is under pressure to keep coal consumption levels unchanged from 2015-2020. Neighbouring Hebei, which has been on the frontline of China’s war on pollution since 2014, established similar “no-coal zones” in several districts in the smog prone cities of Langfang and Baoding last year. Hebei was ordered by the central government to cut coal consumption by 40 mt over the 2013-2017 period as part of its commitments to boost air quality.

Authorities in eastern China’s Shandong province ordered 41 coal mines to halt production for security checks, after an accident at a mine in the province killed three people. The accident occurred at a coal mine operated by Shandong Energy, China’s second largest producer. Total capacity at the 41 mines ordered to halt output was not known, but the crackdown on safety comes ahead of winter, the most important coal consumption season. Shandong, one of the country’s top coal consuming regions, is working to reduce demand for coal by forcing heavy industry to get rid of coal-fired boilers and is also closing some coal-fired power plants. China’s thousands of coal mines are notorious for their poor safety record and the latest incident raises fresh questions about whether producers followed strict rules on exploration as they ramped up output. The accident was caused after a rock burst and destroyed part of a water drainage tunnel in the coal mine.

Australia’s Whitehaven Coal Ltd said equity coal sales fell 14 percent in the September quarter, as certain mechanical issues choked output from its Narrabri mine. Equity coal sales for the quarter came in at 4.1 mt compared to the 4.7 mt clocked in the corresponding period a year ago. The figure overtook a UBS forecast of 3.84 mt. This result follows a disappointing June quarter which saw equity coal sales decline 7.0 percent, again due to issues at Narrabri when the company had said longwall production at the mine is expected to recommence in September. Whitehaven said it sold thermal coal for an average of $113/tonne over the quarter, at a 4.0 percent discount to the Newcastle index price of $117.51/tonne. Newcastle coal is thermal coal exported from the port of Newcastle in New South Wales and is the price benchmark for seaborne thermal coal in the Asia-Pacific region. Australian spot thermal coal prices have traded around six-year highs in recent months, pushed up by a summer heatwave across the northern hemisphere as well as output cuts in China, the world’s biggest consumer of coal. Whitehaven’s stock, which debuted on the Australian exchange in 2007, has advanced over 24 percent so far this year on the back of intensifying demand for coal.

Australian miner South32 said first-quarter coking coal output more than tripled from the same year-ago period, helped by robust production at its Appin and Dendrobium collieries. Production of coking coal, also known as metallurgical coal, at the mines in Illawarra rose to 1.5 mt in the first quarter of the 2019 fiscal year from 494,000 tonnes a year earlier. That handily beat a UBS estimate of 1.2 mt. South32 had suspended operations at its Appin coal mine on the order of a government regulator last June due to concerns over high gas levels in the mine.

Coronado Global Resources, Australia’s biggest coal mining IPO since 2012, fell as much as 8.5 percent below its float price on the first day of trading, even after being priced at the bottom end of the offered range. Local fund managers shunned the offering on the view that Coronado’s private equity owner, The Energy & Minerals Group, was selling when coking coal prices were primed to fall on declining demand from China. Coronado mainly produces coking coal used in steel-making, with an annual output of 8.2 mt from three US mines and 8.5 mt from the Curragh mine in Australia, which it bought from Wesfarmers Ltd for A$700 million last December.

Environmental campaign group ClientEarth has launched a legal challenge seeking to revoke a permit for two coal-fired power plants in Greece, one of which has yet to be built, it said. ClientEarth said it launched the action with the Greek branches of Greenpeace and the World Wildlife Fund because Greece had failed to comply with Greek and EU laws when renewing the permit. Greece is heavily reliant on coal and has extended until 2028 the permit for the existing Meliti I plant and the adjacent Meliti II plant, which has yet to be built, ClientEarth said.

South African miner Exxaro Resources said it was looking to supply coal to state-owned power utility Eskom, which has been hit by supply shortages, posing a threat to the power supply in Africa’s most industrialised economy. Eskom, which has fewer than 20 days of coal supply at 10 of its power stations, supplies more than 90 percent of the nation’s power and is one of its most indebted state firms. Eskom said it was trying to secure new contracts with companies to ensure it had enough coal, after a major supplier cut supplies and sought insolvency protection. Eskom needs 3 mt of coal to close its deficit but was also looking to stockpile a further 10 mt.

Turkey has transferred the operating rights of seven high-potential coal fields to private companies. 19 mt of coal would be produced with the new agreements, which is expected to halve annual imported coal costs. Turkey produced 78.9 mt of raw coal in 2017, including 1.8 mt of hardcoal, and imported 36.6 mt of hardcoal, data from Turkey’s statistics institution shows.

Global miner Glencore and Japan’s Tohoku Electric Power agreed on a price of $109.77 per tonne for supplies of thermal coal from Australia for the year through September 2019. The agreed price, which serves as an industry benchmark for supplies of seaborne thermal coal in Asia, was 16 percent higher than the contract for the year through September this year. Glencore has two annual supply contracts with Japanese utilities but talks with Tohoku Electric on supplies for April 2018-March 2019 broke down earlier this year, forcing other utilities to set their own prices in the opaque market. Australian spot thermal coal prices have traded around six-year highs in recent months, pushed up by a summer heatwave across the northern hemisphere as well as output cuts in China, the world’s biggest consumer of coal. With annual imports of around 115 mt, Japan is one of the world’s biggest importers of thermal coal. Its utilities buy about 40 percent of all Australian exports of the commodity.

Half of Poland’s electricity generation will come from coal by 2040 though coal production should remain at current levels as energy demand is expected to increase. Poland and Germany are jointly responsible for over half of the EU’s carbon dioxide emissions from coal. Currently, around 80 percent of Poland’s power production is provided by coal-fired plant generation. It aims to cut that to half by 2040, with renewables and nuclear providing much of the rest and gas-fired generation providing back-up. Earlier this year, Poland said it planned to lower the share of coal in its energy production to 60 percent in 2030 and around 50 percent in 2050. Under a long-term plan to restructure the coal industry, some of the oldest and most polluting coal-fired power units could be decommissioned and replaced with bigger, cleaner and more efficient units. Poland is considering whether to open new fields of lignite - an intermediate between bituminous coal and peat - alongside new coal-fired power units which would take around 10 years or build a nuclear plant which would cost and take around the same.

CIL: Coal India Ltd, mt: million tonnes, FY: Financial Year, MCL: Mahanadi Coalfields Ltd, SECL: South Eastern Coalfields Ltd, WCL: Western Coalfields Ltd, NCL: Northern Coalfields Ltd, PMO: Prime Minister's Office, ICPPA: Indian Captive Power Producers Association, kWh: kilowatt hour, CPPs: captive power producers, IPPs: independent power producers, MW: megawatt, TANGEDCO: Tamil Nadu Generation and Distribution Corp, GCV: gross calorific value, IEEFA: Institute for Energy Economics and Financial Analysis, UN: United Nations, IPCC: Intergovernmental Panel on Climate Change, US: United States, calorific value, IEEFA: Institute for Energy Economics and Financial Analysis, UN: United Nations, US: United States, IPCC: Intergovernmental Panel on Climate Change, IPO: initial public offering, NCP: Nationalist Congress Party, EU: European Union

30 October. Bharat Petroleum Corp Ltd (BPCL) will shut a 120,000 barrels per day (bpd) crude unit and some secondary units at its Kochi refinery for about three weeks from early December for maintenance. BPCL last year raised the capacity of the Kochi refinery in southern India by about 63 percent to 310,000 bpd. As part of the expansion BPCL installed a new crude unit and secondary units including a delayed coker, fluid catalytic cracker, vacuum gasoil hydro-treater, diesel hydro-treater, sulfur Recovery Unit, and hydrogen generation unit.

Source: Reuters

30 October. The Narendra Modi government is contemplating to bring petrol and diesel under the ambit of Goods and Services Tax (GST), Union Minister Ramdas Athawale said. Athawale said the states should also cut the taxes on petrol and diesel to provide some relief to people. In the past, the opposition parties have demanded that petroleum products be brought under GST.

Source: Business Standard

29 October. Vedanta Ltd has won a 10-year extension of its contract for the prolific Rajasthan oil block, but on condition that it pays a higher share of profit to the government, the company said. The 25-year contract for exploration and production of oil and gas from Barmer block RJ-ON-90/1 of Vedanta, formerly Cairn India, is due for renewal on 14 May 2020. The tenure of the RJ Block PSC (Production Sharing Contract) has been extended for an additional period of 10 years with effect from 15 May 2020. The government had in last year approved a new policy for extension of PSCs that provided for an extension beyond the initial 25-year contract period only if companies operating the fields agree to increase the state's share of profit by 10 percent. Oil and Natural Gas Corp (ONGC), which as a government nominee picked up 30 percent stake in the Rajasthan block in 1995, also was of the opinion that PSC provides for an extension on same terms. ONGC had first in May 2015, then again on at least two occasions in 2016, concurred with Cairn's interpretation of the PSC for extension of the Rajasthan contract by 10 years on same terms. Vedanta had challenged the conditions for the extension of the contract in Delhi High Court. The Delhi High Court in July this year ordered extension be given on old terms and conditions. The Centre, however, has challenged the court order and the matter is sub judice currently.

Source: Business Standard

29 October. At least six global companies have shown preliminary interest in partnering India in the development of the second phase of its strategic petroleum reserves. The country imports over 82 percent of its crude oil supply and has fast-tracked efforts to build underground bunkers for oil storage to hedge against future supply disruptions. ISPRL (India Strategic Petroleum Reserves) is currently scouting for investors to participate in the construction of Phase-II of India’s strategic petroleum reserves and has held road-shows in New Delhi, Singapore and London. ISPRL Chief Executive Officer (CEO) H P S Ahuja said the second phase of the project is planned to be developed under Public Private Partnership (PPP) mode – a first of its kind initiative in the world – adding that companies like VITOL, OPAC, Glencore and Trafigura may show interest in a project of this nature. ISPRL is a Special Purpose Vehicle (SPV) created by the oil ministry with the mandate to construct strategic petroleum reserves across the country. Under Phase-I, it has already constructed strategic reserve capacity of 5.3 million tonnes (mt) across three locations at a cost of Rs 4,098 crore. This includes 1.3 mt at Vishakhapatnam in Andhra Pradesh; 1.5 mt at Mangaluru in Karnataka; and 2.5 mt at Padur in Odisha. The Union cabinet had in June this year approved setting up additional capacity as part of the second phase of the project in which India plans to constructing additional facilities at Chandikhol in Odisha and Padur in Karnataka for storage of around 6.5 mt of crude. The construction of these two SPRs is expected to cost around Rs 11,000 crore and add emergency reserves that can last for 12 days in addition to 10 days achieved in Phase I. During Prime Minister Narendra Modi’s visit to United Arab Emirates earlier this year, ISPRL and Abu Dhabi National Oil Company (ADNOC) had signed an agreement under which ADNOC agreed to store about 5.86 million barrels of crude oil in the Mangaluru facility at its own cost. As part of the agreement, India has already received two crude oil cargo shipments from ADNOC this year. The third shipment is expected to arrive in the first week of November, Ahuja said. ADNOC has so far filled two-thirds of the 5.86 million barrels of tank capacity at the Mangaluru facility. The agreement allows India to use the entire available crude oil stored by ADNOC at Mangaluru during emergency and also allows ADNOC to sell part of the crude oil to Indian refiners as and when required. Indian refiners maintain 65 days of crude storage. Taking that into account, the country’s crude storage capacity is likely to go up to 87 days post the commissioning of the second phase of the project. The International Energy Agency (IEA) mandates its member countries to maintain 90 days of crude storage to manage supply disruptions.

Source: The Economic Times

30 October. India has reached out to UK (United Kingdom)-based investors to attract international public-private-partnerships (PPP) in the country's oil and gas sector with a roadshow in London. The oil ministry, along with the Directorate General of Hydrocarbon (DGH), held an interactive session which attracted around 125 participants. The session was aimed at sharing the new policy and regulatory regime in India and details of investment opportunities in the field of oil and natural gas exploration and production (E&P). Earlier this year, Oil Minister Dharmendra Pradhan had launched Bid Round-II under Discovered Small Field Policy (DSF) and Open Acreage Licensing Policy (OALP) for competitive bidding. Based on the response of investors around the world, a suitable PPP model will be prepared for international competitive bidding by an individual organisation or through joint venture partners.

Source: Business Standard

28 October. Billionaire Mukesh Ambani has won oil regulator PNGRB (Petroleum and Natural Gas Regulatory Board)'s approval for selling his loss-making east-west natural gas pipeline to Canadian investor Brookfield. Ambani's Reliance Gas Transportation Infrastructure Ltd, which later changed the name to East West Pipeline Ltd (EWPL), a decade back built a 1,400-kilometer pipeline from Kakinada in Andhra Pradesh to Bharuch in Gujarat to transport natural gas discovered in a KG (Krishna-Godavari) basin block operated by his flagship firm Reliance Industries Ltd (RIL). However, the pipeline which had a capacity to transport 80 million standard cubic metres per day of natural gas is currently operating at less than 5 percent of its capacity as output from KG-D6 block of RIL fell sooner than expected. While the Competition Commission of India (CCI) had in September approved the transaction where Brookfield is sponsoring an Infrastructure Investment Trust (IIT) called India Infrastructure Trust as the acquisition vehicle, the PNGRB gave its nod a few weeks back. This will be Brookfield's first investment in the energy sector in India. However, the acquisition price has not been disclosed. According to 11 September approval of the CCI, the pipeline housed under EWPL will be transferred to an entity called Pipeline Infrastructure Pvt Ltd (PIPL), a wholly-owned subsidiary of Reliance Industries Holding Pvt Ltd (RIHPL).

Source: Business Standard

30 October. NTPC Ltd has entered into a Rs 10,000 crore contract with the Indian Railways for transportation of coal from mines to all its plants through fiscal 2020. The agreement entered into earlier this month has come as a boon for the cash-starved national transporter as NTPC has agreed to pay the entire amount in advance in three instalments. In return, railways is offering NTPC fixed prices for the rest of this fiscal year and the next and preferential allotment of rakes. This will effectively lower the transportation cost of coal for NTPC — the transportation time would reduce significantly and any upcoming revision in rail tariffs won’t be applicable to the country’s largest power producer.

Source: The Economic Times

29 October. Domestic coal supply remains significantly short of the domestic demand on the back of strong recovery in power demand and a healthy growth in production levels from non-regulated consuming sectors like cement, aluminium, and steel, rating agency ICRA said. Lower generation of hydropower in the current fiscal is also increasing the coal demand, it said. Coal India Ltd (CIL) has achieved a double-digit production growth of 10.6 percent during the first six months of the current fiscal. However, production ramp-ups are unable to keep pace with rising demand and the domestic coal supply remains significantly short of the domestic demand, it said. ICRA estimated that as on September 30, 22 non-pithead power plants had less than seven days of coal stock left. During the just concluded monsoon season, domestic coal production growth slowed down to 3.8 and 3.2 percent in September and August, respectively, against 10.6 percent in July and 13.2 percent in June, it said. This lead to coal stocks at power plants steadily deteriorating from a high of 21.1 million tonne (mt) in end-July to an estimated 15.8 mt in end-September, it said.

Source: Business Standard

26 October. The Supreme Court (SC) mandated body, Environment Pollution (Prevention and Control) Authority (EPCA), has asked Coal India Ltd (CIL) and other government bodies to curb the entry of coal into Delhi at the port level, which is the entry point for imported coal. A directorate general of foreign trade official present at the meeting was asked to take an undertaking from port authorities that the coal being imported is not meant for Delhi. Earlier, the usage of coal was banned by the Delhi Pollution Control Committee through a notification that was released. While the notification stated that industries in Delhi had 90 days to switch to approved fuels, it also mentioned that the usage of coal would only be allowed in thermal plants and if it had a sulphur content of 0.4% or less. In a meeting, EPCA said that it had recently been informed that high quantities of coal were entering Delhi, mainly imported from Indonesia and the United States.

Source: The Economic Times

26 October. The successful allottees of the 19 coal blocks the government is planning to auction this fiscal for sectors including iron and steel will be allowed to sell up to 25 percent of the actual production in open market at prices fixed by Coal India Ltd (CIL). The mines to be put to auction in the sixth round include - Brahmpuri coal mine in Madhya Pradesh, Bundu, Gondulpara and Chitarpur in Jharkhand, Gondkhari and Marki Mangli IV in Maharashtra, Jaganathpur A and Jaganathpur B in West Bengal, Bhaskarpara, Gare Palma IV -1 and Sondiha in Chhattisgarh, Jamkhani in Odisha. While in the seventh tranche the blocks are Brahmadiha, Choritand Tiliaya, Jogeshwar& Khas Jogeshwar, Rabodih OCP, Rohne in Jharkhand and Urtan North in Madhya Pradesh. Both rounds of auction are likely to be over by 15 January, next year.

Source: Business Standard

25 October. The government has identified eight new coal blocks with total reserves of around 1.3 billion tonnes (bt) that are likely to be allotted to Coal India Ltd (CIL). The allocation was recommended by a committee formed to identify additional coal and lignite blocks for allocation, headed by additional coal secretary. It had examined about 150 blocks with the help of CIL subsidiary Central Mine Planning and Design Institute (CMPDI). CMPDI said the eight blocks belonged to the dry fuel supplier some 20 years ago but were taken away from the company. The largest among these proposed blocks is Kuraloi (A) North in Odisha’s Ib Valley with a reserve of 686 million tonnes (mt). It is proposed to be allotted to CIL subsidiary Mahanadi Coalfields. In January this year, the government allotted 11 large coal blocks to three CIL subsidiaries so that the company could raise production by 225 mt a year by 2022 to help it meet its 1 bt production target. Of these, five blocks were de-allocated by the Supreme Court in 2014 and six were new blocks identified by the coal ministry for allocation.

Source: The Economic Times

25 October. India’s thermal coal imports rose at the fastest pace in three-and-a-half years in the September quarter, spurred by new demand and domestic infrastructure bottlenecks that are threatening government plans to cut foreign supplies. Imports jumped 35 percent to 42.7 million tonnes (mt) during the three months ended 30 September, according to data from American Fuels & Natural Resources, a Dubai-based trader of coal from the United States which tracks coal shipments around the region. It was the fourth straight quarterly rise in coal imports and puts the energy-hungry nation on track for a rise in annual imports after two straight years of decline. For the first nine months of 2018, imports of 124.6 mt are up 20 percent from the same period a year earlier. The American Fuels figures for the September quarter were in line with data from consultancy Wood Mackenzie, which estimated imports at 42 mt during the period. India last year put restrictions on the use of petroleum coke (petcoke), a highly polluting fuel derived from processing fuel oil into fuels at oil refineries. The increase in coal imports adds to the woes of Prime Minister Modi’s government, which has been facing criticism for the growing trade deficit and a weakening rupee. The value of India’s coal imports jumped 38 percent to Rs 1,385 billion ($18.9 billion) for the year ended March 2018, government data showed. Despite an abundance of local coal, traditional users of Indian coal such as coal-fired power plants are struggling with fuel shortages due to infrastructure issues hampering access to Indian supplies. Indonesia made up three-fifths of India’s thermal coal imports, while South Africa accounted for about a quarter and the United States 7 percent. Adani Enterprises, India’s largest coal trader, accounted for about 11 percent of all the imports during the period. The ports of Mundra, Krishnapatnam and Kandla handled about 43 percent of all of the imports, according to American Fuels.

Source: Reuters

30 October. The Supreme Court (SC) has allowed states that buy power from large projects of the Tata, Adani and Essar groups to approach the central electricity regulator for a tweak in contracts to allow the producers to bill these states for higher cost of imported coal. The decision is seen as a major relief for the ailing power plants, built at a cost of Rs 50,000 crore, and their investors. The plants depended on Indonesian mines for fuel, but a change in law in that country made coal too costly for these plants to be viable. The central electricity regulator and the appellate tribunal had approved higher tariffs to recover increased fuel costs. But the apex court ruled in April last year that the power producers cannot, as a matter of right, seek a tweak in compensatory tariff due to a change in law in another country. The Gujarat government had approached the apex court for directions based on the report of an expert panel — led by former Supreme Court Judge RK Agarwal — that suggested altering the power purchase agreements (PPAs). The petition said continuing the existing PPAs will push the projects into liquidation, which would be against the interests of consumers. The state government and Gujarat Urja Vikas Nigam Ltd (GUVNL) have advocated altering the PPAs contending that electricity from these projects would be cheaper than purchasing power from other sources even after a revision in tariffs. The Justice Agarwal-led panel had, in its report submitted early this month, recommended fuel cost pass-through and an option to producers to extend the power purchase contracts by 10 years. The panel, which consulted states and consumer groups, also recommended large haircuts for lenders and developers, and proposed a prospective tariff hike. Developers will also have to share profits from Indonesian mines. Tata Power has a 30% stake in an Indonesian coal mining firm while Adani Group holds equity in Bunyu mines in that country.

Source: The Economic Times

28 October. With power demand crossing 14,500 MW consistently for the past one week, state power utility TANGEDCO (Tamil Nadu Generation and Distribution Corp) has been heavily purchasing electricity from various sources including power exchanges. The demand is at least 1,000 MW more than what it used to be during the same period last year. Tangedco has been purchasing about 4,500 MW power from the electricity market at an average price of ₹ 4 per unit.

Source: The Economic Times

30 October. Odisha Chief Minister (CM) Naveen Patnaik launched the Soura Jalanidhi scheme that aims to increase use of solar energy for helping farmers in irrigating their land. 'Soura Jalanidhi', is a dug well-based solar pump irrigation system in convergence mode. Under the scheme, 5,000 solar pumps will be given to Odisha farmers at a subsidy of 90 percent to irrigate 2,500 acres of land. Patnaik launched the web portal of this scheme on the occasion. In the first phase, the facility will be available for farmers where electricity is not available for operating pump sets. The solar pumps will be given to the beneficiary farmers at a subsidy of 90 percent. A total of Rs 27 crore will be spent for the programme. Patnaik said the new scheme will lessen the cost burden of the farmers. Patnaik distributed four go-ahead orders for installation of solar pump to the farmers.

Source: The Economic Times

29 October. Nearly half of the solar power generation capacity worth Rs 28,000 crore currently under implementation in India is facing viability risk because of the continuous fall in the value of the Rupee. The currency depreciation has made imported solar modules costlier and has increased the cost of setting up solar power projects. The projects facing the risk have a combined capacity of 5,500 MW and were bid out in the past 9 months at a very low tariff of Rs 2.75 per unit of less. These projects are in the early phase of implementation and are unlikely to have bought solar modules, orders for which are typically placed 9-12 months after the bids are won. Modules account for 55-60 percent of the total cost of setting up a solar project, which is typically Rs 5 crore per MW. Project developers do not generally hedge the exchange rate before placing orders for modules. Developers had anticipated low module prices while bidding at low tariffs. The module prices have fallen by around 17 percent for these projects from $0.30 per watt at the time of their bidding to around $0.25 per watt at present -- a benefit of Rs 34 lakh per MW.

Source: The Economic Times

29 October. The Supreme Court (SC) prohibited the plying of 15-year-old petrol and 10-year-old diesel vehicles in the national capital region (NCR) and directed the transport departments concerned to announce that such vehicles would be impounded if found plying. Terming as “very critical” and “horrible” the prevailing pollution situation in Delhi-NCR region, the apex court directed that a list of 15-year-old petrol and 10-year-old diesel vehicles be published on the website of Central Pollution Control Board (CPCB) and transport department. The Bench directed the CPCB to immediately create a social media account on which citizens could lodge their complaint about pollution on which appropriate action could be taken by the authorities concerned. It permitted the court-mandated Environment Pollution Control Authority (EPCA) to take pre-emptive steps under the Graded Response Action Plan (GRAP) without strict adherence to pollution stages delineated in the plan. GRAP is aimed at tackling air pollution in Delhi-NCR and adjoining areas and it is designed to take urgent remedial action when air quality deteriorates. Earlier, the National Green Tribunal (NGT) also banned the plying of such vehicles in the NCR and the apex court had rejected a plea against the NGT’s order.

Source: Business Standard

29 October. As Delhi continues to battle alarming pollution levels, a new study has found that three of the world's largest nitrogen dioxide emission hotspots that contribute to formation of finer particulate matter causing air pollution are in India, with one in the Delhi-NCR. The study by Greenpeace comes as Delhi's pollution level climbed to alarming levels. Air quality continued to remain in the "very poor" category as a thick haze engulfed the city. NO2 is a dangerous pollutant in itself and also contributes to the formation of particulate matter (known as PM2.5) and ozone, two of the most dangerous air pollutants. Delhi-NCR, Sonbhadra in Uttar Pradesh and Singrauli in Madhya Pradesh and Talcher-Angul in Odisha are the identified hotspots in India. Sonbhadra and Singrauli are considered as part of a single hotspot. The list of the largest NO2 hotspots in the world from June 1 to August 31 this year includes well known coal-fired power plants in South Africa, Germany and India, and numerous coal-burning industrial clusters in China. The report also cited a World Health Organisation report which found that over 1 lakh children below the age of five died in India in 2016 due to exposure to toxic air.

Source: Business Standard

28 October. Delhi Power Minister Satyendar Jain launched the second phase of BSES Solar City Initiative Solarise Shakur Basti which seeks to provide installations at a single point for an entire apartment complex. BSES Rajdhani Power Ltd (BRPL) said the distribution company (discom) was targeting to realise around 5 megawatt peak (MWp) of rooftop net metering from the area by the financial year 2019-2020. According to the company, apart from JJ Clusters, the Shakur Basti area is home to several colonies like Paschim Vihar and apartment complexes like IFCI, Saakshara, Matriyi, Navbharat, Pragati, Priyadarshani and DDA Flats, and has a substantial rooftop solar potential of around 15 MWp. BRPL Chief Executive Officer (CEO) Amal Sinha said solar city initiative was promising to be a "game-changer". The first phase of the BSES Solar City Initiative, Solarise Dwarka, was an "extraordinary success" with around 100 societies showing interest and signing up for installing solar capacities of approximately 6 MWp. Of these, around 25 societies which have installed solar capacity of approximately 1.5 MWp, have already been energised or are about to be energised. The work at the remaining societies is underway.

Source: Business Standard

28 October. The UT (Union Territories) administration has written a letter to different department heads to provide details of spaces available for installation of solar power plants to meet solar energy target set by the Union government. The Union government had selected Chandigarh to be developed as model solar city with a target of generating 69 MW of solar energy by 2022 through net and gross metering. Chandigarh Renewal Energy, Science and Technology Promotion Society (CREST) has only managed to install solar power plant with a capacity of 22 MW in last six years. CREST will have to ensure generation of 47 MW within four years to meet the goal. The Central government in 2008 had selected Chandigarh to be developed as a ‘model solar city’. Solar rooftop plants have been installed in 260 government buildings and 255 private buildings. The existing solar rooftop plants are generating 28 million units per year. Of the 28 million units, bulk of power has been produced by plants on government buildings.

Source: The Economic Times

30 October. Chinese oil majors CNPC (China National Petroleum Corp) and CNOOC (China National Offshore Oil Corp) have expressed interest in bidding for onshore oil and gas (O&G) blocks in Greenland, the island’s Deputy Energy Minister Jorn Skov Nielsen said. Greenland will invite bids for onshore O&G blocks in the Disko Bay area and Nuussuaq Peninsula in 2021, the Minister said.

Source: Reuters

29 October. Private equity firm Carlyle Group said it signed an exclusive agreement with the Port of Corpus Christi, the top oil export hub in the United States (US), to develop an offshore crude export terminal to load the world’s largest tankers. The terminal, proposed for Harbor Island, would be the first onshore location in the US capable of providing export loadings of fully-laden Very Large Crude Carriers (VLCCs) capable of hauling up to 2 million barrels, the company said. Carlyle’s announcement comes as infrastructure in the US oil industry struggles to keep up with record levels of production, driven by the Permian shale patch in West Texas. Both international buyers and American producers are waiting for export capacity to increase. Corpus Christi has its own plan to expand operations to handle larger export tankers. Commodities trader Trafigura Ltd is developing its own port about 15 miles off Corpus Christi that would handle vessels able to fully load two million barrels of oil.

Source: Reuters

28 October. Iran began selling crude oil to private companies for export, part of a strategy to counter US (United States) sanctions which come into effect on 4 November and aim to stop the country’s key crude exports. Crude oil trade is state-controlled in Iran. Earlier, private refining companies could only buy crude oil for exports of oil products. Out of 1 million barrels offered on the energy bourse, 280,000 barrels were sold at $74.85 per barrel. Iran said in July it would start oil sales to private firms as part of its efforts to keep exporting oil and would take other measures to counter sanctions after the US told allies to cut all imports of Iranian oil from November.

Source: Reuters

28 October. Russian Energy Minister Alexander Novak said there was no reason for Russia to freeze or cut its oil production levels, noting that there were risks that global oil markets could be facing a deficit. He said that the OPEC (Organization of the Petroleum Exporting Countries) and non-OPEC oil-producing group of countries needs to wait to see the risks emerging in November before deciding on any further joint steps. OPEC and its allies hold their next policy meeting in December.

Source: Reuters

27 October. Russian state oil pipeline monopoly Transneft has resumed oil supplies to Rosneft Black Sea Tuapse refinery after floods affected the pipeline’s operations. Transneft said it was repairing the affected part of the Tikhoretsk-Tuapse-1 pipeline. The refinery said that it was operating despite the floods but it would adjust its October production plans in light of the pipeline suspension.

Source: Reuters

25 October. Exxon Mobil Corp has begun groundwork at a Texas refinery that would become the largest in the United States in advance of a final investment decision on the expansion. The company has begun hiring and training staff to operate what would be a third crude distillation unit at the site. The expansion would increase crude processing capacity at its Beaumont, Texas, refinery by at least 300,000 barrels per day (bpd) from the current 365,644 bpd. The proposed unit would convert crude oil from Texas shale fields into refined products, including diesel and gasoline. Exxon wants to triple daily crude production in the Permian Basin of West Texas and New Mexico to 600,000 barrels of oil equivalent by 2025.

Source: Reuters

25 October. Iran plans to supply more than 20 million barrels of crude oil to the Chinese port of Dalian in the October-November period, up sharply from the usual monthly volumes of up to 3 million barrels, Russian oil major Rosneft Chief Executive Officer (CEO) Igor Sechin said.

Source: Reuters

24 October. Vietnam’s crude oil output is expected to fall by 10 percent a year through to 2025 due to declining reserves at existing fields, Vietnam Oil and Gas Group, or PetroVietnam, said. The state-run firm said a lack of funds had kept it from boosting its exploration activities. In April, PetroVietnam said tensions in the South China Sea would hurt its offshore exploration and exploitation activities this year. Vietnam’s crude oil output in 2018 was expected to fall 14.7 percent to 11.3 million metric tonnes, or 227,130 barrels per day, the government said in March.

Source: Reuters

24 October. Oil prices rose modestly, rebounding after several days of weakness as a much bigger-than-expected drawdown in US (United States) gasoline and diesel inventories augured a seasonal increase in refining demand. However, traders remain concerned about worldwide demand, and that weakness in global equities would also reduce buying of assets like oil by investment managers. Looming US sanctions on oil exporter Iran have helped support prices. The US Energy Department said gasoline stocks fell 4.8 million barrels to 229.3 million barrels, the lowest since December 2017. Distillates, which include diesel, were down 2.3 million barrels, both more than forecast.

Source: Reuters

30 October. A Turkish ship will start drilling for oil and gas (O&G) in the Mediterranean, Energy Minister Fatih Donmez said. Attempts to tap gas and oil in the eastern Mediterranean, along with a dispute over Greece’s maritime borders, have recently caused friction between Athens and Ankara. Turkey and the internationally recognized Greek Cypriot government in Cyprus have overlapping claims of jurisdiction for offshore O&G research in the eastern Mediterranean, a region thought to be rich in natural gas.

Source: Reuters

29 October. The UAE (United Arab Emirates)'s RAK Gas has signed an oil and gas (O&G) production sharing agreement with Tanzania’s semi-autonomous region of Zanzibar. The agreement had been signed by RAK Gas’ Zanzibar subsidiary and the Zanzibar government.

Source: Reuters

29 October. Australia's LNG Ltd said it is delaying a final decision on whether to build its US (United States)-based Magnolia liquefied natural gas plant. The Australian-listed company is targeting final approval for Magnolia, located in Louisiana, in the first part of 2019. LNG Ltd had planned to make a final investment decision by the end of 2018 about Magnolia, which is designed to produce 8 million tonnes of LNG per year. LNG Ltd’s delay underscored how China, the world’s fastest-growing LNG market, has shifted its long-term LNG procurement strategies away from the US in the last few months due in part to the trade dispute.

Source: Reuters

27 October. The Ukrainian government plans to raise household gas prices from 1 January 2020 to match what state energy company Naftogaz charges the country’s industrial companies, the government said. Gas tariffs are heavily subsidized in Ukraine, which has committed to raise them gradually to qualify for more financial assistance from the International Monetary Fund (IMF). It had already announced on 1 November that they would go up by nearly a quarter. That announcement secured a new $3.9 billion standby aid deal from the IMF, helping the country maintain financial stability and the trust of investors as it heads into a national election next year.

Source: Reuters

26 October. Commodities trader Vitol said it will soon be importing its first liquefied natural gas (LNG) cargo from the United States (US) into the South Hook terminal in Britain. The vessel, Yari LNG, loaded a cargo at Sabine Pass LNG terminal and is expected to deliver the cargo into the South Hook LNG terminal at Milford Haven in Wales, Vitol said. South Hook Gas Company Ltd (South Hook Gas) will make available terminal capacity rights to regasify Vitol’s LNG cargo and deliver its gas into the UK natural gas grid, the company said.

Source: Reuters

26 October. Prime Minister (PM) Giuseppe Conte gave Italy’s final approval to the Trans Adriatic Pipeline (TAP), a gas transport project which had been strongly contested by the 5-Star Movement, one of the two parties in the ruling coalition. TAP, the last leg of the $40 billion Southern Gas Corridor that will bring Azeri gas to Italy, is due to start pumping gas in 2020 but local opposition to the project has raised concern that work at the Italian end may not be completed in time. The €4.5 billion ($5.13 billion) TAP is viewed as strategic by the European Union as it moves to wean itself off its dependency on Russian gas.

Source: Reuters

24 October. A small liquefied natural gas (LNG) project north of Vancouver is poised to move to construction in the first quarter of 2019, adding momentum to Canada’s efforts to become a significant exporter of the supercooled fuel. The C$1.6 billion ($1.2 billion) Woodfibre LNG project, backed by Indonesian billionaire Sukanto Tanoto’s RGE Group, would be Canada’s second LNG project to go ahead, following the approval of the massive LNG Canada project. Woodfibre LNG is a relatively small project at 2.1 million tonnes per annum (mtpa), but was long touted as the front runner to get Canadian natural gas to Asian markets, where demand for the fuel is booming. LNG Canada, which will produce some 14 mtpa further north in the town of Kitimat, British Columbia, has said it expects to be shipping fuel before 2025.

Source: Reuters

24 October. Australia’s government will not impose controls on exports of liquefied natural gas (LNG) next year because it does not see any shortages in the domestic gas market, Resources Minister Matt Canavan said. The country, which is vying to become the world’s biggest LNG exporter, enacted a law last year to control LNG exports in reaction to surging domestic natural gas prices. Not triggering the export controls will ease concerns among its buyers including Japan, the world’s biggest LNG importer. Rising natural gas prices became a political issues in Australia as households and manufacturers complained of the higher costs, especially in the country’s more populous east coast. Yet Australia has an abundance of gas and is a major LNG supplier to Japan, China and South Korea under long-term contracts. To deal with the crisis, Australia’s government passed a law to limit exports from any of the three LNG plants on the country’s east coast to beef up local supply.

Source: Reuters

29 October. The top US (United States) coal miners union has put a larger share of its campaign donations behind Democrats ahead of the 6 November elections than in 2016, as dimming hopes for a coal industry revival led by President Donald Trump reinforce fears about the safety of worker pensions. The United Mine Workers of America has donated nearly 84 percent of its money to Democratic candidates and committees in national races, according to a analysis of campaign finance data. That is a roughly 20-point jump from 2016, when Trump courted coal miners with promises of an industry comeback. A survey of utilities found that the administration’s replacement of Obama-era carbon regulations will not save US coal-fired power plants from shutdown. Ongoing closings of coal-fired plants have meanwhile pushed US coal consumption by utilities this year to the lowest since 1983, according to the Energy Information Administration.

Source: Reuters

26 October. China’s Hebei province has said it will ensure sufficient supplies of clean coal during the next three winters to avoid heating fuel shortages and reduce toxic air emissions. Several regions of China encountered fuel shortages last winter as Beijing pushed to switch millions of households to natural gas from coal as part of its anti-pollution campaign, leaving many thousands of households without heat. Hebei, which surrounds capital Beijing and major port Tianjin, is a key battlefield of the clean air effort. It will offer for purchase this winter 18.2 million tonnes (mt) of clean coal, including anthracite or blue coal, to 9.1 million households without access to clean-energy heating. In 2019, Hebei will offer 12.8 mt of clean coal and 7.4 mt in 2020. Hebei said it has signed contracts with major coal miners such as China Shenhua, Shanxi Jincheng Anthracite Mining Group, Shaanxi Coal and Chemical Industry Group to ensure the supply of clean coal. A total of 3.62 million households will be converted to natural gas or electrical heating from coal this year, including 1.74 million that are in Hebei.

Source: Reuters

30 October. Casino magnate Sheldon Adelson and investor Warren Buffett are set for a desert showdown over electricity next week as the two billionaires’ interests collide on election ballots in Nevada. At issue in the 6 November election is the cost and control of power from the neon lights shining on the Las Vegas Strip to the state’s gold mines. A measure supported by Republican donor Adelson, who is also Las Vegas Sands Corp’s chairman, would force state legislators to break up control over much of the state’s electricity effectively held by a unit of Buffett’s Berkshire Hathaway Inc, NV Energy. It would allow customers to choose their own power provider by 2023. Hotel-casinos like Sands’ Venetian, whose lights glitter in Las Vegas, are major power customers in the state. Caesars Entertainment Corp, Wynn Resorts Ltd and MGM Resorts International earlier opted to pay tens of millions in exit fees to drop their power provider. The Nevada measure puts more pressure on an industry shaken up by the growth of alternative energy sources, some of which have made it easier for consumers to generate their own electricity. US electric utilities have delivered investors a 1.3 percent return, including dividends, over the past year, nearly half the payout from utilities overall.

Source: Reuters

30 October. China’s newly added solar power capacity fell nearly 20 percent year on year for the January to September period. The National Energy Administration (NEA) said that newly installed solar generation capacity amounted to 34.54 GW in the first three quarters of this year, down from 43 GW a year earlier. After adding a record 53 GW in new photovoltaic capacity over all of last year, China capped total new capacity eligible for subsidies at 40 GW this year as it struggled to pay off a payment backlog of around 120 billion yuan ($17.2 billion). Renewable energy projects are entitled to a subsidy for each kilowatt-hour of power they sell to the grid, but China is trying to encourage developers to cut costs and achieve price parity with coal-fired power. NEA said that China constructed 17.4 GW of new solar power stations in the first three quarters of this year, down 37 percent compared to a year earlier. The decline in solar plant construction was partially offset by an increase in distributed solar projects built on rooftops or buildings, with added capacity in that subsector rising 12 percent to 17.14 GW over the nine months, NEA said. NEA said that additional renewable power capacity - including wind, hydro and biomass as well as solar - amounted to 55.96 GW in the first three quarters of the year, 69 percent of all power additions over the period. Total accumulated renewable power reached 706 GW by the end of September, up 12 percent from a year earlier. Total solar power hit 164.7 GW, up 37 percent on the year. China’s renewable power amounted to 40 percent of its total generating capacity and was more than the entire power capacity of Japan and India combined.

Source: Reuters

29 October. The first Franco-Chinese satellite was launched into orbit to study ocean surface winds and waves around the clock, better predict cyclones and improve scientists' understanding of climate change. A Long March 2C carrier rocket blasted off from the Jiuquan Satellite Launch Centre in northwest China's Gobi Desert to enter orbit 520 kilometres (323 miles) above the Earth, according to China's State Administration of Science, Technology and Industry for National Defence. The 650 kilogram (1,430 pound) machine is the first satellite jointly built by China and France and will allow climate scientists to better understand interactions between oceans and the atmosphere.

Source: The Economic Times

29 October. US (United States) electric power sector carbon dioxide (CO2) emissions have declined by 28 percent since 2005, the US Energy Information Administration (EIA) said. CO2 emissions from the electric power sector amounted to 1,744 million metric tons in 2017, the lowest level since 1987, the EIA said. The EIA said that US electricity demand has decreased in six of the past 10 years. The average declining rate was 0.1 percent per year, and the lower demand growth alone has reduced emissions by 654 tons. The switching among fossil fuels has also reduced emissions by 329 tons. The power sector has become less carbon intensive partly as natural gas-fired generation took over coal-fired and petroleum-fired generation. In the US, most of the changes in energy-related CO2 emissions have been in the power sector. Since 2005, as electric power sector carbon dioxide emissions fell by 28 percent, CO2 emissions from all other energy sectors fell by only 5 percent.

Source: Xinhua

29 October. Vattenfall is considering converting its German coal-fired power stations to use fuels including gas or biomass as utility companies in the country brace for a government deadline for phasing out coal altogether. The end of coal is the latest major challenge power firms face in Germany, whose energy transformation, or “Energiewende”, has already included a rushed exit from nuclear power and a costly expansion of solar and wind capacity. German rivals EnBW, RWE and Uniper, have also started to retrofit coal plants for biomass or gas, or are considering such steps to soften the hit to earnings a shutdown of the power stations would entail. In 2017, cheap nuclear power accounted for just 12 percent of Germany’s power production, down from 22 percent a decade ago. Meanwhile, the share of renewables in the energy mix more than doubled to a third last year. Germany aims to raise that to 65 percent by 2030 to help cut carbon dioxide emissions and achieve its climate commitments.

Source: Reuters

29 October. Iberdrola’s Scottish Power will use offshore wind power to replace the capacity of the gas and hydro power projects it is selling, with wind becoming its sole source of electricity production. Scottish Power, the British arm of the Spanish energy giant, earlier this month announced plans to sell a group of gas, hydro and pumped storage power plants for 702 million pounds ($900 million) to British power generator Drax. The sale makes Scottish Power the first of Britain’s big six energy suppliers to shift to 100 percent renewable electricity generation but it will more than halve its UK (United Kingdom) capacity. Scottish Power already owns around 2,000 MW of operational on and offshore wind projects in the UK and plans to more than double this, with new East Anglia wind projects off the east coast of England set to replace the lost generation. The 2.5 billion pound East Anglia One project will, at 714 MW of capacity, produce enough electricity to power around 600,000 homes in 2020. The company is also developing the East Anglia Three windfarm, which at 1,200 MW could power around 890,000 homes. At the East Anglia One site Iberdrola has installed 37 of 102 jacket foundations which will provide the base to house the near 200 meter high turbine towers for the project.

Source: Reuters

27 October. Bangladesh Prime Minister (PM) Sheikh Hasina inaugurated Payra Power Plant Rehabilitation Project at Kolapara in Patuakhali this afternoon and visited the power plant. The premier opened the scheme named Swapner Thikana at a function on the power plant premises. She said that the power plant will bring about a revolutionary change in the life and livelihood of the people of the southern region. Highlighting the government’s steps for generating electricity in the country, the PM said the government has been able to produce 20,000 MW electricity over the last 10 years.

Source: The Daily Star

26 October. The French government will decide on whether or not to build a new generation of EPR reactors between 2021 and 2025. France’s nuclear industry could be asked to draw an “industrial plan” by mid-2021 that would guarantee future EPR reactors are able to produce energy at a reasonable price, estimated between 60 and €70 per megawatt. The long-awaited plan (PPE) will outline how and by when France will reduce the share of nuclear energy in electricity generation, currently at about 75 percent, and is a crucial factor in the investment planning of state-owned utility EDF, which operates France’s 58 nuclear reactors.

Source: Reuters

25 October. South Korean state-utility Korea East-West Power Company (EWP) has completed a 3.5 MW floating solar project at a coal-fired power plant. Modules were deployed on a water body near a coal ash deposit site at the Dangjin power station. The solar facility will produce enough power for the equivalent of 1,600 households. EWP has 434 MW of renewable energy capacity and has targeted 25% of renewables in its energy mix by 2030.

Source: PV-Tech

24 October. Norway’s oil services firm Aker Solutions expects to win a lease off California to build a floating wind farm as part of a wider consortium, its Chief Executive Officer Luis Araujo said. In September, Redwood Coast Energy Authority and a consortium of private companies that includes Aker Solutions applied for a lease to build a 100-150 MW floating offshore wind farm off the coast of Humboldt County by 2024. The project is aimed to help the State of California to reach its ambition to become carbon neutral and use 100 percent clean electricity by 2045. The partners of the consortium bidding for the lease off California said their longer-term goal was to make Humboldt Bay a central hub for the United States west coast offshore wind industry.

Source: Reuters

24 October. New York’s attorney general sued Exxon Mobil Corp alleging that the world’s largest oil company for years misled investors about the risks of climate change regulations on its business. The suit, filed in New York Supreme Court, New York County, seeks undisclosed damages, a court order for a review of the company’s representations, and that the company corrects “numerous misrepresentations” to investors. It alleges Exxon assured investors it had properly evaluated the impact of climate regulations on its business using a “proxy cost” for the likely effects of future events on its business. However, these proxy figures frequently were not used in its internal planning or cost assumptions, the suit claims. The company failed to properly account for such costs in determining its volume of oil and gas reserves, or whether to write down the value of its assets, a metric important to investors, the suit claims. Exxon and other oil companies including BP Plc, Chevron Corp and Royal Dutch Shell face lawsuits by cities and counties across the United States seeking funds to pay for seawalls and other infrastructure to guard against rising sea levels brought on by climate change.

Source: Reuters

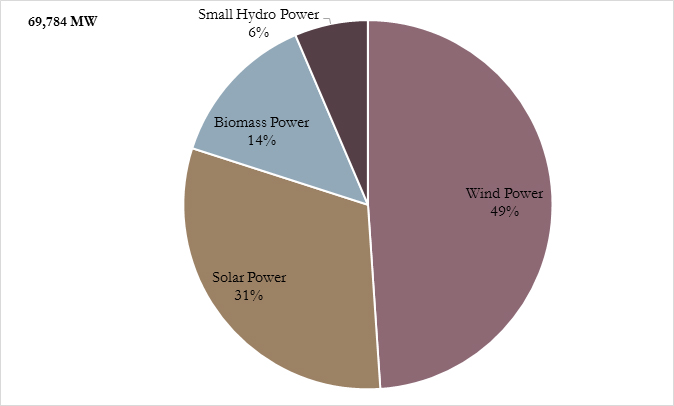

| Source | Capacity Target By 2022 (MW) | Capacity achieved as on 30.06.2018 (MW) |

| Wind Power | 60,000 | 34,293.48 |

| Solar Power | 1,00,000 | 23,022.83 |

| Biomass Power | 10,000 | 9,515.91 |

| Small Hydro Power | 5,000 | 4,493.20 |

| Total | 1,75,000 | 71,325.42 |

Installed Capacity of Renewable Power as on 31 March 2018

Source: Rajya Sabha Questions

Source: Rajya Sabha QuestionsPublisher: Baljit Kapoor

Editorial Advisor: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

| OBSERVER RESEARCH FOUNDATION 20, Rouse Avenue, New Delhi- 110 002 PHONE: (011) 3533 2000, FAX: (011) 3533 2005 E-Mail: [email protected] |

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.