-

CENTRES

Progammes & Centres

Location

[July 2015: Moving Closer to Electricity for All?]

“In the power sector, the most important news in July was the repackaging and re-launching of the Rajiv Gandhi Vidyudikaran Yojana as Deen Dayal Upadhyaya Gram Jyoti Yojana with an outlay of ` 76,000 crore. The ever moving target date for providing electricity for all and the ever changing names of schemes that are supposed to provide electricity for all does not inspire hope…”

Energy News

[GOOD]

Peak power deficit falling to 3 percent is a positive milestone!

50 GW capacity is unviable because we focussed on development of supply not on development of demand!

[UGLY]

Solar power is cheaper than thermal power only when thermal network on which they are imposed are ignored!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· July 2015: Moving Closer to Electricity for All?

· No Clean Energy Resource is Cheap

DATA INSIGHT………………

· Electricity & Agriculture Sector in India

[NATIONAL: OIL & GAS]

Upstream…………………………

· ONGC to invest $8.8 bn in KG O&G finds

Downstream……………………………

· IOC, HPCL & BPCL have cancelled 160 retail outlet licences in the last three years

Transportation / Trade………………

· New Delhi to seek revival of Iran-Pak-India gas pipeline

· India defers taking delivery of LNG from Qatar

· Oil imports from Saudi Arabia down 8 percent in FY15

Policy / Performance…………………

· Petrol and diesel prices may come down from August 1

· How safe is your old LPG cylinder: First testing of LPG cylinder takes place only after 10 yrs

· Cash insurance: Petrol pumps to install ATM-like machines to secure cash and men

· GAIL must pay ` 20 lakh in penalty for pipeline explosion: Regulator

[NATIONAL: POWER]

Generation………………

· 46 GW of power projects facing viability issues: CRISIL

· Bakreswar power plant of Kolkata operates without clearances

· Tata Power to raise generation capacity to 18 GW by 2022

· India ranks 12th in world in nuclear power generation

· NTPC power plant idling away

· Adani halts work on Australia coal project after approval delay

Transmission / Distribution / Trade……

· PGCIL approves ` 3 bn investment for transmission Project

· Coal imports could slide 3 percent in 2015/16: Govt

· Daily spark missing from India's international power trade

Policy / Performance…………………

· Notify de-allocation of costly power from NTPC: Odisha tells Centre

· Penalties may result in no power tariff hike in Delhi

· Peak power deficit drops to 3 percent in June as against 5.1 percent a year ago: CEA

· PM launches new scheme for power reforms in rural areas

· Coal contracts to be linked with power tariff

· ‘CERC has played parenting role in regulatory set up of the country': Goyal

· Rajasthan to begin campaign to boost power infrastructure

· 7 coal blocks auctioned recently have begun operations: Goyal

· Now register 'no power supply' complaints using mobile app

· Goyal urges lighting industry to correct LED pricing

· Power projects on the blink despite clearances by govt

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Deep-sea oil projects make up most of $200 bn deferrals: Wood Mackenzie

· SABIC plans to invest in US shale gas projects

· China says has every right to drill in East China Sea

· Statoil and Total E&P make North Sea gas, condensate discovery

· Victoria O&G almost triples its daily gas production

Downstream……………………

· PES seeks to buy Bakken logistics assets

· Pemex to send crude to JX Nippon's refinery in Japan

· Kuwait raises Al Zour refinery project costs to US$16 bn

Transportation / Trade…………

· Attack halts flow in natural gas pipeline from Iran to Turkey

· Nord Stream says to halt Russian gas flows to Germany on Aug 11-20

· Oil hits four-month low on China rout, supply glut

· APA signs gas transportation agreement to support Victoria-New South Wales Interconnect

· Iraq's southern oil exports head for another record in July

· Italy's Saras says in contact with Iran over oil imports

· LNG seen overtaking iron ore as Australia’s main export driver

· Russia's Rosneft seeks end to Gazprom gas export monopoly

Policy / Performance………………

· UAE raises gasoline prices as OPEC member halts subsidies

· Russia's Gazprom gas output seen at all-time low in 2015

· UK awards new licenses for O&G exploration in North Sea

· Total likely to get rights to explore for oil, gas offshore Sri Lanka

· Nigeria considers splitting national oil firm NNPC into two companies

· Iran eyes $185 bn oil and gas projects after sanctions

[INTERNATIONAL: POWER]

Generation…………………

· Endesa Chile to develop 6.3 GW of power projects in Latin America

· CGNPC starts building 1 GW Hongyanhe-6 nuclear reactor

· Lahmeyer to provide engineering services to 140 MW hydropower plant in Nepal

· KHNP commissions Shin Wolsong-2 nuclear power project

· Iran starts building $2.5 bn power plant in Iraq

· Amec Foster to support 220 MW combined heat and power plant in Poland

· Philippines' Ayala building $1 bn coal-fired power plant

· China to construct two nuclear power plants in Iran

Transmission / Distribution / Trade……

· Azerbaijan, Iran to sign new agreement on electric power transmission

· Indonesian coal exports to China fell by 38 percent in the first half of 2015

· ABB wins power distribution automation technology contract in China

· China grants loan to Mozambique for power transmission line

Policy / Performance………………

· Angola's Parliament adopts Electricity General Law

· Belgium will raise VAT on electricity from 6 percent to 21 percent in Sep 2015

· Armenia extends lifetime of Metsamor nuclear power plant to 2026

· BPA will raise wholesale power, transmission rates

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Rajasthan clears solar power projects worth ` 1.56 lakh crore

· ACME Solar commissions 150 MW plants in Odisha, Rajasthan

· Infosys to set up 7 MW solar plant at Hyderabad campus

· Plan afoot to make AIIMS a green hospital

· Guwahati and five other cities to be developed as 'solar cities' in northeast

· Metro's Phase III project to bring green benefits to Delhi

· GMR Energy’s Gujarat solar plant gets quality certification

· SunEdison inks pact with Tata to supply solar power in Delhi

· India ranks third among top 10 countries for LEED green buildings with 1,883 certified projects

· Vestas gets 46 MW order in India

· Solar power may become cheaper than thermal in 2-3 yrs: India Ratings

GLOBAL………………

· Jordan approves 5 wind projects

· Enel commissions integrated geothermal and biomass power plant in Italy

· SkyPower inks $2 bn deal to build solar power plants in Kenya

· Hillary Clinton sets renewable energy goals to spur more wind, solar power

· Aviva targets $3.9 bn of renewable energy investments

· France passes new energy law quadruples carbon price

· US proposes voluntary O&G company cuts in methane emissions

· Colombia commits to 20 percent CO2 emission cut by 2030

· UK plans to cut renewable energy subsidies on solar and biomass plants

· China starts building its largest solar plant

· Obama hopes to persuade India, China on climate change

[WEEK IN REVIEW]

COMMENTS………………

India monthly energy briefing

July 2015: Moving Closer to Electricity for All?

Lydia Powell and Akhilesh Sati, Observer Research Foundation

|

T |

he nuclear deal between Iran and the United States was the most significant development in July 2015 not just in the context of global geo-politics but also in the context of global energy markets. Iran has the potential to contribute to the supply of oil and gas to an extent that will affect the price of these key energy commodities. This may not be good news at this point in time. The likelihood of Iran adding 500,000 barrels per day (bpd) of oil supplies in the near term is not exactly what the oversupplied market needs. The prospects of an increase in gas production have also improved but this is yet to affect the market as it is expected to some time to materialise.

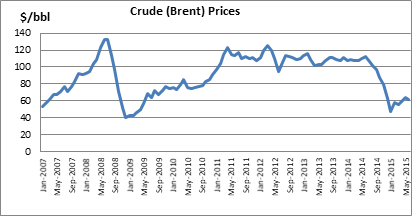

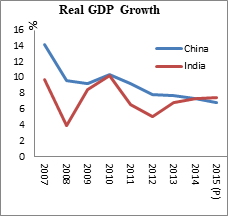

Comments from India on the Iran nuclear deal have focused on how the lifting of sanctions imposed on Iran would mean more oil imports from Iran and also on the possibility of the revival of the Iran-Pakistan-India pipeline. Increase in Iranian oil production will definitely depress global crude prices and this will benefit India by way of lower oil import bills. Lower import bills have been projected by policy makers and political leaders as an achievement of their effort but what they have failed to realise is that lower oil prices are a sign, not just an oversupplied market but also a slowing global economy. Savings on energy import bills may not automatically translate into spending and investment that would boost economic growth. The line of causation between energy, particularly oil consumption (and prices) and economic growth runs both ways. Crude oil prices are high when economic growth rates in India (and other large energy consumers like China) are high and consequently their contribution to oil demand growth is high. Crude oil prices are low when economic growth rates in India (and China) are low and their contribution to oil demand growth is low. What this means is that oil prices are low when our economy has the lowest capacity to make use of it. But overall the persistence of lower petroleum prices is a positive development as it will contribute to price stability.

Chart 1

P: Projection

Source: Energy Information Administration & IMF

Among other news that made it to the headlines in July was the Prime Minister’s visit to Central Asia. Most official visits to net energy exporting countries generate news on how the visit would contribute to energy security. The PM’s visit to Central Asia was no exception. The idea that a visit to a net energy exporting country followed by a Memorandum of Understanding (MoU) or two will automatically lead to energy security is accepted without any questions. But when even the much celebrated nuclear agreement with the United States has not translated into greater energy security, what can one expect from simple MoUs from relatively small countries?

In July the news on gas was confusing. On the one hand we saw news that ONGC was cutting gas production as well as news on private companies relinquishing their interest in potential prospects. On the other hand we also saw news on India getting LNG from Canada. If both are true, there is something wrong with policy making in India. How can poor country like India discourage domestic gas production (that could increase energy supplies, reduce carbon emissions and also generate employment and taxes domestically) and encourage the same in a country that is far richer than India? Why is a poor country desperate to subsidise a rich country? To add to the confusion we also saw news on credit rating agencies warning about the financial viability of LNG re-gasification projects.

Chart 2

Source: Ministry of Petroleum & Natural Gas

In the power sector, the most important news in July was the repackaging and re-launching of the Rajiv Gandhi Vidyudikaran Yojana as Deen Dayal Upadhyaya Gram Jyoti Yojana with an outlay of ` 76,000 crore. The ever moving target date for providing electricity for all and the ever changing names of schemes that are supposed to provide electricity for all does not inspire hope.

As for solar energy there was little that was new in July except for the fact that the last energy project that the much loved departed leader Dr Abdul Kalam inaugurated was a solar energy project. Dr Kalam dreamed of a developed India. It is probably good that he did not live to see that his dream is likely to remain a dream!

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

COMMENTS………………

No Clean Energy Resource is Cheap

Ashish Gupta, Observer Research Foundation

|

I |

n Indian context, the discourse on climate change is dominated by the war on fossil fuel used and calls are made to impose an embargo on fossil fuel use. All sorts of renewable and low carbon technologies are promoted as sources that would replace fossil fuels and mitigate carbon emissions. The big question is this: Is coal the dominant choice only for developing countries? Do developed countries not gain from using coal? Coal was the dominant choice for electricity generation in developed countries three four years back. Even today two fifths of world electricity comes from coal fired power plants in developed countries. Interestingly, Europe which wants to be seen as world leader in climate protection is consuming more and more coal. Coal consumption in Europe is growing as it is still a low cost fuel. What this highlights is that the switch to alternate sources will be guided by economics irrespective of whether you are a rich or a poor country. It should not be a problem to understand that India faces the same choice.

Interestingly, hydro (a renewable source) is not counted as a renewable source though small hydro (less than 25 MW) is counted as renewable. There is no consensus whether to count big hydro projects as renewable. Only run of the river project are considered as renewable projects and not the storage ones. The trade-off between environment and development are never acknowledged in these discourses. .

Renewable energy is promoted as the best option for mitigating carbon emissions and energy security but the ground reality is quite different. On the cost front, the capex cost of solar projects has came down drastically to about ` 60 million/ per MW but when all costs including all the incentives and subsidies are taken into account, the cost is nearly about ` 300 million/ per MW[1]. The same is true for the wind projects as well. Despite the high capex it is promoted as a source with low tariffs. This argument can be discredited using a hypothetical example.

Let us assume that a company has got a project quoting a low tariff of ` 6/unit. Consumers may assume that they will have to pay the same tariff but in reality they have to pay more. The consumers have to pay a fixed charge for conventional backup which is around ` 2/unit or 2.5/ unit[2]. The actual tariff for the consumer will be ` 6 + ` 2 = ` 8/ unit.

The idea of enforcing renewable obligation on the industry is also promoted. This obligation may make roof-top solar projects viable. The idea sounds promising but what is missing is industrial cost dynamics. In India, the Industry is already cross-subsidising domestic consumers by paying high tariffs. If they start consuming their energy through renewable sources then they will have to pay renewable source tariffs plus the cross-subsidy amount. Can Industry remain competitive under this heavy burden?

The idea of introducing Carbon, Capture and Storage (CCS) technology is premature. Given the negative impacts of burning coal, the concept of CCS is good but the technology is not commercially viable and it is still in the demonstration stage.

In 2012, the states in USA which were generating electricity through coal paid an average of 8.8 cents/kwh in USA while the states that curbed coal electricity generation paid 12.44 cents/ kwh. The low coal states actually ended up paying 26% more than the average national price of electricity. Apart from this coal was responsible for providing 760,000 jobs. Ever since CO2 mitigation became a concern, many coal companies started working on the ‘green coal’ concept. It was not by choice but by force. Things started moving when Congress in 2009 pursued the Climate legislation. The American Coalition for Clean Coal Electricity initiated a ‘fact finding tour’ that included the series of videos with expert suggestions detailing how the coal industry can capture the carbon dioxide from coal fired plants. But the result is dismal!

If the technology employed in haste it will be a disastrous for power plants. Needless to say, all the power plants will become Non-Performing Assets. Interestingly if big and rich countries are unable to cope with clean coal strategies how can a country like ours to absorb this expensive technology. The implication for India is to learn lessons from the USA. Go for the abundant indigenous coal reserves rather than unviable alternate sources.

Why CCS is not viable today:

There is another futuristic technology which sounds promising but is yet to prove commercial viability. The technology is based on separating carbon through gas membrane process rather than capturing in which waste carbon is not dumped. In this carbon is converted into a commercially viable product. This technology is still at the developmental stage and is highly energy intensive. Apart from that there is no study conducted on the cost of deploying this technology at the power plant and its impact on power tariffs.

All this is indicates that no technology is perfect and no clean source is cheap till now. In India where sustainability is interlinked with affordability, these technology and energy sources must be deployed in a slow and phased manner. Most importantly we must focus on the energy efficiency component where it is proved that even one percent efficiency improvement at the power plant can save five million tonnes of carbon emissions. Given the nation’s interest, bias towards renewable should be avoided and effort must be devoted on making coal sector more eco-friendly. It is imperative for India to make energy choices depending on specific advantages for development irrespective of whether it can be provided through coal, gas, hydro, renewable or nuclear etc. The only thing that needs to be kept in mind that it should be affordable on paper and in practice!

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

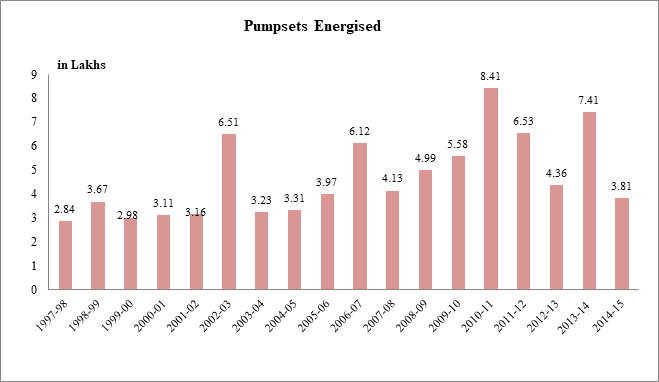

Electricity & Agriculture Sector in India

Akhilesh Sati, Observer Research Foundation

|

Years |

% Share of Agriculture to total GDP (at 2004-05 prices) |

|

1997-98 |

24.47 |

|

1998-99 |

24.39 |

|

1999-00 |

23.27 |

|

2000-01 |

22.31 |

|

2001-02 |

22.42 |

|

2002-03 |

20.13 |

|

2003-04 |

20.32 |

|

2004-05 |

19.03 |

|

2005-06 |

18.27 |

|

2006-07 |

17.37 |

|

2007-08 |

16.81 |

|

2008-09 |

15.77 |

|

2009-10 |

14.64 |

|

2010-11 |

14.59 |

|

2011-12 |

14.37 |

|

2012-13 |

13.95 |

|

2013-14 |

13.94 |

|

Year |

% Growth of Electricity Consumption in Agriculture Sector |

|

1950-60 |

66.96 |

|

1960-70 |

71.06 |

|

1970-80 |

13.55 |

|

1980-90 |

12.6 |

|

1990-2000 |

7.52 |

|

2000-10 |

2.05 |

|

2010-15 |

7.41 |

Source(s): 1. Central Electricity Authority

2. Planning Commission (Niti Aayog)

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

ONGC to invest $8.8 bn in KG O&G finds

July 26, 2015. Oil and Natural Gas (ONGC) plans to invest over $8.8 billion in bringing to production its much-touted KG-basin oil and gas (O&G) discoveries by 2018-19. ONGC has divided 12 oil and gas finds in the block KG-DWN-98/2 or KG-D5 and gas discovery in an adjacent G-4 block the Bay of Bengal into three clusters to quickly bring them to production, the company said. The 7,294.6 sq km deep-sea KG-D5 block has been broadly categorised into Northern Discovery Area (NDA - 3,800.6 sq km) and Southern Discovery Area (SDA - 3,494 sq km). The company plans to develop the 11 oil and gas finds in the NDA together with one gas find in G-4 block at an investment of $ 8.843 billion, the company said. ONGC plans to develop the discoveries in the block in three clusters - 14.5 million standard cubic meters per day (mmscmd) of gas for 15 years from Cluster-1 comprising of D&E finds of NDA in KG-D5 block and G-4 find in the a neighbouring area. Cluster-2A mainly comprises of oil finds of A2, P1, M3, M1 and G-2-2 in NDA which can produce 75,000 barrels per day (3.75 million tonnes per annum). Cluster 2B, which is made up of four gas finds - R1, U3, U1, and A1 in NDA - envisages a peak output of 14 mmscmd of gas, with cumulative production of 32.5 bcm of gas in 14 years. Cluster-3 is the UD-1 gas discovery in SDA. Gas produced from Cluster-1 is proposed to be taken to a Fixed Platform in shallow water depths through an 18-inch, 16.1 km pipeline and treated and subsequently evacuated to Odalarevu onshore terminal in Andhra Pradesh through 20-inch, 35.5 km pipeline for sales. Oil produced from Cluster-2 is proposed to be taken on to an FPSO (Floating Production Storage and Offloading) anchored in high-sea through an 18-inch, 21.5 km pipeline. While oil will then be transferred to tankers for transportation to refineries, gas produced alongside will be evacuated on to Fixed platform through an 18-inch, 21.4 km pipeline. (businesstoday.intoday.in)

Downstream………….

IOC, HPCL & BPCL have cancelled 160 retail outlet licences in the last three years

July 27, 2015. Oil Marketing Companies (OMCs) Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) have detected malpractices including under-measurement and adulteration at their retail outlets in the country. OMCs have terminated 160 such retail outlets for such irregularities during the last three years and current year (April - June, 2015), Oil Minister Dharmendra Pradhan said. In case of proven cases of under-measurement and adulteration, there is a provision to cancel the license under Marketing Discipline Guidelines (MDG)/Dealership Agreement. Public Sector Oil Marketing Companies (OMCs) have a system in place for regularly checking the quality and quantity of petrol and diesel being supplied by them to their retail outlets (ROs) in the country, the minister said. (energy.economictimes.indiatimes.com)

Transportation / Trade…………

New Delhi to seek revival of Iran-Pak-India gas pipeline

July 28, 2015. India is set to push for the proposed $7-billion gas pipeline from Iran via Pakistan, seeking to grab the opportunity presented by the nuclear deal between the gulf country and major powers of the world this month that has lifted the fog of restrictions. Oil Ministry will lead a delegation of oil industry executives shortly to Iran to press for India's interest in revival of the pipeline project that was put on the back burner for years as well as developing the Farzad-B block. India wants to resurrect Iranian oil and gas projects that were stalled for years under pressure from the United States, which had accused Iran of pursuing nuclear weapon development programme and imposed sanctions. A consortium of state-run companies - ONGC Videsh Ltd (OVL), Oil India Ltd (OIL) and Indian Oil Corp (IOC) - had discovered gas in the Farzad-B block in Iran in 2008 and subsequently prepared a field development plan to recover about 12.8 trillion cubic feet of gas. The plan had to be abandoned following the US sanctions, but India is now hoping to get the block back for development since it has already spent $90 million on exploration. Following meetings between the delegations of the two countries about three months ago, Iran had asked India to present a new plan for the development of the field. India is readying the plan. Much like the Farzad block, the plan to lay Iran-Pakistan-India pipeline was also abandoned by India under pressure from the US, which pushed the country into working towards an alternative gas transport line from Turkmenistan via Afghanistan and Pakistan. Construction is yet to begin on the pipeline from Turkmenistan despite years of negotiations as the countries have failed to appoint a consortium leader that will build and maintain the line. For India, the cross-border energy pipelines have scarcely progressed beyond announcements. Besides Iran and Turkmenistan, the government has been considering pipelines from Kazakhstan, Russia and Myanmar too. India imports nearly 80 percent of its crude oil requirement and about a third of its gas requirements. High prices and capacity constraints have, however, held back gas imports into the country. The sharp fall in prices of crude oil over the past year and the convenience that pipelines bring have the potential to push up India's consumption of gas, which is considered cleaner than other fuels. Several power plants, especially in South India, have been lying idle for want of cheap gas which dried up due to falling local supplies. (energy.economictimes.indiatimes.com)

India defers taking delivery of LNG from Qatar

July 28, 2015. As global gas prices slumped, India has deferred taking deliveries of at least 20 shiploads of expensive liquefied natural gas (LNG) from its main supplier Qatar and wants a rate cut matching the 60 percent fall in international rates. India buys 7.5 million tonnes a year of LNG on a long-term from RasGas of Qatar on a 25-year contract, indexed to a moving average of crude oil price. The price of LNG from Qatar comes close to $13 per million British thermal unit (mmBtu) as compared to the $6-7 rate at which it is available in the spot or current market. In a full year, 7.5 million tonne of LNG translates into 120 cargoes or shiploads. LNG from Qatar, on the long-term, was once considered the cheapest. The fuel cost $2.53 per mmBtu for the first five years, from 2004 to 2009. For the next five years, the price was linked to moving average of crude oil price of last 5 years and thereafter direct indexation with crude oil. Qatar has so far not responded to India's request. (www.mydigitalfc.com)

Oil imports from Saudi Arabia down 8 percent in FY15

July 27, 2015. India has cut crude oil imports from its top supplier Saudi Arabia by over 8 percent in 2014-15 as it raised purchases from Africa and Latin America in an apparent bid to cut reliance on volatile Middle-East. Crude oil import from Saudia Arabia was cut to 34.99 million tonnes (MT) in the year to March 31, 2015 from 38.18 MT in 2013-14, Oil Minister Dharmendra Pradhan said. While imports from sanction-hit Iran were almost flat at 10.95 MT, shipments from Kuwait fell to 17.85 MT from 20.35 MT.

Imports from Iraq were almost flat at 24.51 MT but the same from UAE rose 15 percent to 16.11 MT. Overall, imports from Middle East fell by over 5 percent to 109.88 MT, he said. Crude oil imports from Africa and South America rose 10 percent each as Indian refiners bought more heavier but cheaper grade oil, he said. Indian refineries have consistently reduced imports from traditional markets like Saudi Arabia and stepped up purchases from newer geographies like Mexico and Venezuela as imports have become viable due to availability of cheaper variants and softening of shipping cost. India imported 189.44 MT of crude oil in 2014-15, almost unchanged from the previous fiscal, to meet over 80 percent of its oil needs. Saudi Arabia was the top supplier with 34.99 MT with Iraq being number two. Venezuela was a very close third with 24.40 MT of oil supplies, 13 percent higher than 2013-14. With 17.82 MT of crude oil supplies, Nigeria was tied with Kuwait for the fourth spot. Pradhan said imports from Africa rose to 33.05 million tonnes in 2014-15 from 30.39 MT in the previous year. (www.moneycontrol.com)

Policy / Performance………

Petrol and diesel prices may come down from August 1

July 28, 2015. Consumers can expect a reduction in petrol and diesel prices on August 1 when oil marketing companies review rates, thanks to falling global prices. Oil marketing companies, led by Indian Oil Corp (IOC), reduced the retail prices of petrol and diesel each by ` 2 per litre. India imports nearly 80% of its energy needs, on which it gives a subsidy. While budgeting its subsidy outgo, the government had factored in a global price of $70 a barrel and an exchange rate of ` 63 to a US dollar. While the Indian import crude basket is currently hovering around $54 a barrel, the rupee-dollar rate is at ` 64.17.

In Budget 2015, finance minister Arun Jaitley had earmarked ` 30,000 crore for subsidies towards petroleum products. According to data by the Controller General of Accounts, till May 31, just over ` 8 crore out of the budgeted subsidy for 2015-16 has actually been disbursed. (www.hindustantimes.com)

How safe is your old LPG cylinder: First testing of LPG cylinder takes place only after 10 yrs

July 27, 2015. The first testing that any LPG cylinder undergoes is only after 10 years, all new LPG cylinders are required to be put for first statutory Testing & Painting (ST&P) after 10 years of manufacturing date of the cylinder, Oil Minister Dharmendra Pradhan said. Oil Marketing Companies (OMCs) have reported that no specific complaint relating to expired/old/obsolete LPG cylinders in circulation have been received. LPG cylinders are manufactured as per BIS 3196 through manufacturers approved by Chief Controller of Explosives, Nagpur (CCOE) and having BIS License. Thereafter, the LPG cylinders are checked at the LPG Bottling Plants and only the cylinders which are found to meet BIS standards are filled, checked for quality after filling and are sent to the distributors for distribution to the customers, informed the minister in the statement. Subsequently, the LPG cylinders are put to ST&P after every 5 years. Such testing of LPG cylinders are done through repairers approved by Petroleum and Explosives Safety Organisation (PESO). (energy.economictimes.indiatimes.com)

Cash insurance: Petrol pumps to install ATM-like machines to secure cash and men

July 25, 2015. Cash worth well over ` 1,000 crore changes hands at petrol pumps in India every day. This is what makes the filling stations and their staff easy targets for criminals. But now, by beginning to use the services of cash logistics firms, petrol pumps have started securing their cash and men. On average, one petrol pump is targeted by criminals every six hours in India, said Ajay Bansal, chief of the All India Petroleum Dealers' Association, highlighting the point that handling cash by dealers is a big challenge. This has driven Bansal to buy the services of AGS Transact Technologies, a cash logistics firm that manages bank ATMs as well as provides technological solutions to fuel stations. Bansal's filling station at Mayur Vihar in New Delhi now has an ATM-type machine that accepts cash obtained from customers, rejects fake or spoilt currency notes, and can throw up transaction slips whenever sought. The machine is linked to AGS' network and can tell the service provider as well as the dealer the cash balance at any point in time. Just in case criminals take away the machine, as they have done with ATMs at times in the past, both parties would know the amount of cash lost and AGS will have to compensate the dealer the entire amount within 10 days, Bansal said. For this, AGS has a contract with insurance providers at the backend. Its armed men show up at least twice a day to transfer cash from filling stations. AGS charges ` 30,000 a month for the service, Bansal said. The fee is too high for many petrol pumps with low sales. India has about 53,000 petrol pumps, with 95% of them controlled by Indian Oil Corp, Bharat Petroleum and Hindustan Petroleum, and the balance shared by Reliance Industries, Essar Oil and Shell. A proliferation of petrol pumps in a decade has left many pumps, especially the new ones, with lower income. The average volume of petrol and diesel sold from a retail outlet has fallen to 160 kilolitres a month from 200 KL. More than 80% of transactions are done in cash. At present, only about a dozen petrol pumps have signed up with AGS. A few more in Mumbai will join in a month. Bansal said the association is negotiating with cash logistics firms to bring the rates down. The service will get more sophisticated in the second phase, Bansal said, when the machine installed at the retail outlets will get linked to the dealers' bank account. Then the cash accepted by the machine will immediately reflect in the dealer's account. In the third phase, he said, the plan is to get banks to install ATMs at fuel outlets so that the cash collected there is immediately absorbed by the banks, obviating the need for a risk-fraught transfer of cash from stations to bank branches. (economictimes.indiatimes.com)

GAIL must pay ` 20 lakh in penalty for pipeline explosion: Regulator

July 23, 2015. The Petroleum and Natural Gas Regulatory Board, the downstream regulator, has ordered GAIL Ltd pay ` 20 lakh in fine for the lapses by the gas company that caused a pipeline explosion in June last year in Andhra Pradesh, which had killed 21 people and injured 18 others. Following the pipeline explosion and the subsequent fire that gutted many houses and trees, a probe ordered by the government found GAIL responsible for many lapses. Based on the findings of the government probe, the regulator issued a show-cause notice to the pipeline operator and after hearing its arguments ordered the penalty. GAIL has admitted to many lapses highlighted in the probe findings, including transporting wet gas through a pipeline meant only for dry gas, not providing gas dehydration unit despite promising to do so, and not complying with norms needed to keep the pipeline fit for transportation, the regulator said in its order. The probe panel findings and the penalty has highlighted lax safety standards at India's largest pipeline operator. GAIL was also recently blamed by a government probe panel for another incident involving its LPG pipeline in April this year that left at least two people dead. Following the incidents, GAIL, which operates 11,000-kms of natural gas pipeline network, has embarked on an exercise to strengthen its safety standards. The company is in the process of replacing 300 kilometres of older pipelines in Andhra Pradesh, Gujarat and Tamil Nadu. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

46 GW of power projects facing viability issues: CRISIL

July 28, 2015. Power projects with a collective capacity of 46,000 MW are facing viability issues due to lack of long term energy buyers, inadequate fuel supply, and aggressive bidding to win projects and coal blocks. Of this, 36,000 MW are coal-based within which tariff under-recovery has affected 20,000 MW in capacity. The rest are reeling because of inadequate feedstock and poor electricity offtake by distribution companies (discoms). Further, 10,000 MW of gas-based projects have become unviable due to dwindling fuel supplies from the Krishna Godavari basin. In a report titled "Current Worries" released, CRISIL Ratings said loans of ` 75,000 crore are at risk if these problems are not resolved soon. Another ` 1.9 lakh crore debt is owed by weak discoms for which moratorium on principal repayment based on a financial restructuring package announced in 2012 and new in the current and next fiscal. Till date, government support has prevented these discoms from turning weak. The assurance of continuing financial support is necessary, else this debt too can be at risk. (www.business-standard.com)

Bakreswar power plant of Kolkata operates without clearances

July 28, 2015. The National Green Tribunal (NGT) Eastern Zone Bench wanted to know from the West Bengal Pollution Control Board (WBPCB) why no closure notice was served on Bakreswar Thermal Power Project (BkTPP) even after its 'Consent to Operate' expired on December 31, 2014. The bench has also wanted to know from the West Bengal Power Development Corporation Ltd (WBPDCL) why the power plant should not be shut down for pollution the Bakreswar and Chandrabhaga river systems in Birbhum. The bench was hearing a petition by environment activist Subhas Datta against fly-ash pouring out from a pond where it was supposed to be deposited into the rivers. BkTPP started operations in 2000 and got three units by 2001. It then had a single fly-ash pond. In 2008, two more units were added but no more fly-ash ponds were dug. NGT had wanted to know from WBPDCL whether it felt that a single pond to collect fly-ash is sufficient. In reply to this, WBPDCL stated that appropriate steps are being taken. (energy.economictimes.indiatimes.com)

Tata Power to raise generation capacity to 18 GW by 2022

July 23, 2015. Tata Power said it plans to scale up generation capacity to 18,000 MW, with 20-25 percent coming from clean and green sources, by 2022. In financial year 2015-16, Tata Power's 126 MW Dagachhu Hydro Power Corporation (DHPC) achieved full commissioning. The clean power generated by this plant will be sold to India, thereby helping reduce carbon emission, it said. Besides, the 187 MW Adjaristsqali hydro project in Georgia, which recently achieved financial closure, will help Georgia achieve energy self-sufficiency. The three lenders are providing a total of USD 250 million of long-term financing for the project. As the first hydropower project in Georgia, it is expected to produce about 450 GW hours of power annually and reduce greenhouse gas emissions by more than 200,000 tonnes per year. Tata Power is developing over 200 MW of wind power projects in India. Two wind projects of 154 MW are under construction in Gujarat and Rajasthan, of which 18 MW is already commissioned. The company has acquired land in the states of Gujarat and Rajasthan for future solar-based projects and is in the process of acquiring land parcels in the state of Telangana. The 202.5 MW Kalinganagar project is being executed through Industrial Energy Ltd, a joint venture (JV) of the company with Tata Steel for its steel plant in Kalinganagar, Odisha. The project is in advanced stages of execution. The company is also developing projects abroad to use clean and green sources. The company's JV in South Africa, Cennergi Ltd, achieved financial closure of 134.4 MW Amakhala Emoyeni Wind Farm and 95.17 MW Tsitsikamma Community Wind Farm in May, 2013 and June, 2013 respectively. The construction of both projects is progressing on schedule. (www.newindianexpress.com)

India ranks 12th in world in nuclear power generation

July 23, 2015. India ranks 12th in the world in terms of power generation from nuclear sources, according to data published in May 2015 by the Power Reactor Information System (PRIS) of the International Atomic Energy Agency (IAEA). Minister of State for Atomic Energy and Space Jitendra Singh said that there are 31 countries, including India, in the world which generates electricity from nuclear sources. In terms of number of reactors in operation, India, with 21 reactors, stood in the sixth position globally, he said. The current installed nuclear power capacity is 5780 MW, which is expected to increase to 10080 MW on progressive completion of projects under commissioning and construction by 2019. The Government has accorded financial sanction and administrative approval for Gorakhpur Haryana Anu Vidyut Pariyojana (GHAVP) Units – 1&2 (2X700 MW) and Kudankulam Units- 3&4 (2X1000 MW) with a total capacity of 3400 MW. These projects are being prepared for launch in the current year. Singh said India had signed nuclear cooperation agreements with the United States, France, Russia, Namibia, Mongolia, South Korea, Argentina, United Kingdom, Kazakhstan, Canada, Sri Lanka and Australia. India is open to negotiation with other friendly countries who seem to have potential to make contribution to India’s nuclear energy programme, he said. (netindian.in)

NTPC power plant idling away

July 22, 2015. The NTPC’s Kayamkulam power plant has remained idle since January as the State has not placed any order for power since then. There is uncertainty over the resumption of power generation at the 350 MW plant as monsoon rainwater collected in reservoirs in the State is being utilised for power generation to the established capacity. Though the plant is not producing power for the State, Kerala would have to continue to shell out about ` 18 crore a month as returns on investment as per the original agreement between the State government and the Union government enterprise, according to NTPC. The NTPC has been planning expansion to add 1050 MW in the first phase and an additional 1050 MW in the second phase. Both the Union and State governments could be faulted for the present state of affairs at the NTPC, which had been projected earlier as the harbinger of Kerala’s progress on the commercial and industrial fronts. (www.thehindu.com)

Adani halts work on Australia coal project after approval delay

July 22, 2015. Adani Mining announced that the latest suspension of work on its A$10 billion ($7.4 billion) Carmichael coal mine in Australia was due to delays in government approvals for the project, which environmentalists say could damage the Great Barrier Reef. Output from the mine, one of a handful under development in the Galilee Basin of Queensland state, will be mostly exported to India, where it will be central to plans by Prime Minister Narendra Modi to bring electricity to hundreds of millions of people living off the grid. Environmentalists are campaigning to have the mines stopped, saying they will put parts of the Great Barrier Reef under threat and help accelerate global warming. Supporters say that at 247,000 square kilometres, the Galilee Basin has the potential to become Australia's largest coal-producing region, providing thousands of jobs. Parsons Brinckerhoff and Korea's POSCO Engineering & Construction (E&C) Co Ltd, which is also touted as an investor in the final project, were told to stop work on the Carmichael mine. POSCO E and C said Adani had asked it to halt its design work as of July 16, with tentative plans to resume work in early October. Greenpeace called on the Australian Federal Environment Minister Greg Hunt to revoke the project's mining licence. Adani has signed up buyers for about 70% of the 40 million tonnes Carmichael is due to produce in its first phase. The project mainly hinges on environmental approval to deepen a port on the fringe of the Great Barrier Reef in order to ship the coal. The Australian federal government must approve the actual channel dredging, and Queensland state needs to clear Adani's solution for storing the spoil. (www.hindustantimes.com)

Transmission / Distribution / Trade…

PGCIL approves ` 3 bn investment for transmission Project

July 27, 2015. Power Grid Corp of India Ltd (PGCIL) has approved an investment of ` 307.18 crore for setting up transmission system for Rajasthan Atomic Power Project. The transmission system would commission in 28 months from the date of investment approval, the company said. Under the RAPP 7 & 8, two Pressurised Heavy Water Reactor will be set to generate a total of 1,400 MWe of electricity at Rawatbhata in Rajasthan. (www.business-standard.com)

Coal imports could slide 3 percent in 2015/16: Govt

July 23, 2015. India could import 3 percent less coal in the year to next April despite a jump in demand, the Coal Minister Piyush Goyal said, as local output rises at a record pace in Prime Minister Narendra Modi's push for power to all. The world's third-largest coal importer wants to end its dependence on foreign supplies this decade, mainly for the variety used in power generation, and has set ambitious targets for Coal India. It is also working on opening the nationalised sector to private companies. If India manages to become self-sufficient in thermal coal, it would be a double blow for exporters Indonesia and Australia, already grappling with depressed demand from top buyer China. India, however, is expected to keep consuming increasing amounts of coal as Modi tries to step up economic growth and provide continuous power, even to the third of India's 1.25 billion people who still use oil lamps or other traditional means to light their homes. Coal requirements will jump 10 percent to 910 million tonnes this fiscal year, Goyal said. Domestic supplies are estimated to be 700 million, 15 percent more than last year, and imports could drop to 210 million tonnes. Coal India's April-June output rose 12 percent to 121.3 million tonnes as it opened new mines and received environmental approvals to expand existing ones. The government wants to double the company's output to 1 billion tonnes by 2019/20. (in.reuters.com)

Daily spark missing from India's international power trade

July 23, 2015. India has emerged as a hub of south Asian transmission network but daily spark of day-ahead trading is missing in its cross-border power trade due to regulatory hurdles. Indian power exchanges have petitioned the Central Electricity Regulatory Commission to open the doors to spot buyers from neighbouring countries as millions of units go waste at home due to busy transmission lines or poor appetite of financially stressed state utilities. Tata Power has petitioned the regulator for permission to import power from its 126 MW Dagachhuhydel project in Bhutan through the Indian exchanges for sale in India till bilateral contracts are signed. Industry sources say there are consumers in Nepal and Bangladesh, countries with large unmet demand, willing to buy power from the Indian spot market. But for the regulator, it is a grey area as the existing policy does not reflect the changing reality of expanding interlinks with neighbouring countries and power projects coming up in Bhutan and Bangladesh with Indian private investments. The government is examining the new reality and at least Tata Power's case is awaiting the foreign ministry's approval. The Indian grid is connected with Bhutan, Bangladesh and Nepal. Plans for establishing interlinks with Pakistan and Sri Lanka have remained enmeshed in the complexities of bilateral politics. Trade through the existing interlinks is guided by bilateral arrangements between governments. There is no third-party transit through the Indian network. India imports power from hydel projects it has set up in Bhutan and supplies electricity from a central pool to Nepal and Bangladesh. The Dagachhuhydel project is the first of several private power projects being built on foreign soil for supplying to local market, India or a third country. Reliance Power and Adani group recently inked deal for large power plants in Bangladesh. The petitions by power exchanges point out that the ground is ready for cross-border trading because of financial and regulatory similarities in electricity markets of the interlinked countries. Initially, the volumes are expected to be small due to limited interlink capacity. But with plans for their expansion, a full-on regional power market is just round the corner, much in line with the scenario in Europe. India, with a rapidly expanding generation capacity - estimated at 2.72 GW at last count - and surrounded by deficit countries, can be in the driver's seat only if it moves fast. (timesofindia.indiatimes.com)

Policy / Performance………….

Notify de-allocation of costly power from NTPC: Odisha tells Centre

July 28, 2015. The state government has urged the Ministry of Power (MoP) to notify de-allocation of costly power allocated to the state from plants owned by NTPC outside Odisha. The state has to fork out ` 7.22 per unit for power procured from NTPC stations located outside the state against the procurement cost of ` 3.15 for power bought from an NTPC plant located within the state. The MoP, in July 2012, had allocated 418 MW power to Odisha from Barh Stage-I (3x660 MW) and 166 MW power from Barh Stage-II (2x660) of NTPC situated in Bihar. As per NTPC bill, the total procurement of power from these stations comes to ` 7.22 per unit including capacity charge of ` 2.80 per unit and energy charge of ` 4.42 per unit. Odisha has also sought allocation of funds from the National Clean Energy Fund (NCEF) for promotion of renewable energy projects in the state. State owned Odisha Hydro Power Corporation (OHPC) is planning to establish 600 MW pump storage hydro power plant at Upper Indravati hydro electric project at a cost of ` 1600 crore to address the peak power requirement of the state. It has sought financial support from the Centre from NCEF to fund this project. (www.business-standard.com)

Penalties may result in no power tariff hike in Delhi

July 28, 2015. Power discoms BSES Yamuna and Rajdhani may face the heat of Delhi Electricity Regulatory Commission (DERC) over a list of violations, proceedings for which will be held shortly. Some of the violations could result in penalties when tariffs are announced by the regulatory watchdog. However, this will depend on the outcome of the proceedings as the power companies will strongly resist imposing of penalties or action against them. DERC announced the dates for public hearing on tariff announcement for 2015-16. The final revenue gaps, as per the commission's findings, for all three power companies could amount to a zero tariff hike due to penalties being considering to be imposed on the discoms. At least 12 violations have been noted by DERC against the BSES discoms. (energy.economictimes.indiatimes.com)

Peak power deficit drops to 3 percent in June as against 5.1 percent a year ago: CEA

July 27, 2015. All India peak deficit of power dropped to three percent in June as against 5.1 percent in the corresponding period a year ago mainly on the back of sizeable generation capacity addition which more than doubled during the month, data by the Central Electricity Authority (CEA) showed. The peak demand of power in the country in June was 144,732 MW of which 140,441 MW was met, the data showed. Generating capacity addition for June was 2315 MW while the same last year was 978.67 MW. However, the northern and north-eastern regions of the county faced high peak deficit at 5.4 percent and seven percent respectively. The northern region comprising of Chandigarh, Delhi, Haryana, Himachal Pradesh, Jammu & Kashmir, Punjab, Rajasthan, Uttar Pradesh and Uttarakhand had peak demand of 50,883 MW in June of which 48,138 MW was met leaving a deficit of 5.4 percent. Jammu & Kashmir recorded the highest deficit at 18.8 percent in the northern region followed by Uttar Pradesh at 12.1 percent and Uttarakhand at two percent. The north-eastern part of the country including Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland and Tripura witnessed 2,356 MW peak demand while the power supplied to the region was 2,190 MW causing 7 percent peak deficit. Assam recorded the highest deficit in June among the seven sisters at 5.1 percent followed by Nagaland at 2.4 percent and Meghalaya at 2.3 percent. (indianpowersector.com)

PM launches new scheme for power reforms in rural areas

July 25, 2015. Prime Minister (PM) Narendra Modi launched the ‘Deen Dayal Upadhyaya Gram Jyoti Yojana’ for power sector reforms in rural areas with a view to ensuring round the clock electricity supply to farmers and rural households. Modi said that development is the panacea for all problems related to poverty and unemployment. The new power scheme focuses on feeder separation (rural households and agricultural) and strengthening of sub-transmission and distribution infrastructure, including metering at all levels in rural areas. The scheme is one of the flagship programmes of the Power Ministry and will facilitate 24x7 supply of electricity. The earlier scheme for rural electrification, Rajiv Gandhi Grameen Vidyutikaran Yojana (RGGVY), which was launched by previous UPA government, has been subsumed in the new scheme as its rural electrification component. The major components of the new scheme are feeder separation; strengthening of sub-transmission and distribution network; Metering at all levels (input points, feeders and distribution transformers); Micro grid and off grid distribution network & Rural electrification - already sanctioned projects under RGGVY to be completed. The scheme has an outlay of ` 76,000 crore for implementation of the projects under which the Centre shall provide grant of ` 63,000 crore. A total of ` 14,680 crore worth projects have already been approved out of which projects amounting to ` 5,827 crore have been approved for Bihar state. (www.thehindubusinessline.com)

Coal contracts to be linked with power tariff

July 24, 2015. Power companies that undertake to supply electricity at lowest rates to distributors stand to win coal supply contracts from Coal India as the mining major plans a tariff-based bidding mechanism to award all contracts in the future. Coal India is likely to allot fuel supply contracts to state distribution companies that in turn will call tariff-based competitive bids from companies on the lines of ultra-mega power projects, the government said. The government clarified that the present contracts of the state-run miner with power companies will not be terminated. A policy to auction Coal India supplies to the companies is underway. The government has already decided to provide coal to power plants affected due to cancellation of captive mining licences by the Supreme Court till May 2016. Power projects that had temporary coal arrangements with Coal India till their captive coal blocks started operations too will continue to get coal till May next year. Coal India will also earmark 10 million tonnes of coal through spot auction for power plants stressed due to lack of coal. Separate e-auctions of five million tonnes of coal each will be conducted for power plants with long and medium term power purchase agreements and projects with no contracts or short term power contracts. (economictimes.indiatimes.com)

‘CERC has played parenting role in regulatory set up of the country': Goyal

July 24, 2015. Minister of State for Power, Coal and New and Renewable Energy Piyush Goyal said that the Central Electricity Regulatory Commission (CERC) has played a parenting role in the regulatory set up in the country. Goyal said that CERC has acted as benchmark regulator in the country. He said that the regulator has to act as a bridge between developers and the consumers and the regulator simultaneously balancing the interest of both parties. He expressed his satisfaction that the regulators in India have contributed immensely in this regard. Goyal narrated five principles of proportionality, consistency, accountability, transparency and targeting for better productivity. Goyal underlined the need for fast decision making and also to keep power affordable. (www.canindia.com)

Rajasthan to begin campaign to boost power infrastructure

July 24, 2015. In order to ensure better electricity supply, speedy disposals of public grievances and check on transmission and distribution losses, Rajasthan government will run a special campaign next month and also aim to strengthen the power infrastructure. The decision was made during a presentation, attended by Chief Minister Vasundhara Raje, by the state Energy department. Raje has asked the departmental officers and district collectors to play active role in bringing the T & D losses down. She also slammed the previous government saying they did not make efforts to strengthen power infrastructure in the state which has made the present situation challenging. (thefirstmail.in)

7 coal blocks auctioned recently have begun operations: Goyal

July 23, 2015. Seven out of 67 coal mines auctioned and alloted recently have begun operations while the remaining blocks are at various stages of development, the government said. Coal Minister Piyush Goyal said at this stage it may not be possible to estimate the yield from all the 204 coal mines which were earlier deallocated. He said the government has taken proactive measures to ensure that statutory clearances, including environment and forest, are transferred to the successful bidders and allottees expeditiously. He said that the Centre has taken up the matter of expediting various clearances with the concerned coal-bearing state governments and has been regularly pursuing with the authorities concerned for bringing the auctioned/alloted mines into production as soon as possible. (economictimes.indiatimes.com)

Now register 'no power supply' complaints using mobile app

July 22, 2015. Consumers of BSES Rajdhani Power Ltd (BRPL) and BSES Yamuna Power Limited (BYPL) can now register 'no supply' complaints through a newly-launched app, and need not call the discoms call centre for the purpose. Using the 'BSES App', the consumers can easily register complaints related to no supply, street-lights and those related to emergency (fire and shock). To begin with, this application is only for Android phones. It will also be launched for other mobile platforms in some time. Consumers can download this App from the BSES website www.bsesdelhi.com, under the Customer Support section and from Google Play. (www.ndtv.com)

Goyal urges lighting industry to correct LED pricing

July 22, 2015. Minister of State for Power, Coal and New and Renewable Energy Piyush Goyal, has called for a correction in the pricing of LED (light-emitting diode). Goyal said that it cannot be that the government procures LED bulbs at ₹ 72/unit while the market price is very high. Goyal said that the lessons on price discovery could be learned from the recently concluded coal mine auctions. He said government procurement could be done through an online bidding mechanism that is transparent. The aim of the government is to completely replace all incandescent bulbs in the country with LED lights in the next three years, the Minister said, adding that this will provide a huge business opportunity to the lighting industry. The minister said that there is scope for more innovation in the products related to LED and that the Government is willing to support research and development to bring innovation into this industry. (www.thehindubusinessline.com)

Power projects on the blink despite clearances by govt

July 22, 2015. In a major hurdle to the National Democratic Alliance government's poll promise of 24x7 power for all, over 80 major projects - both generation and transmission - are facing delays. These projects have a stuck capital of ` 3.75 lakh crore. While land and fuel availability has been the prime reason for delay, issues relating to 20 generation projects have been resolved. According to Project Management Group (PMG) data, the projects facing fuel issues have either got coal blocks or supply through the linkage system. The Centre and state-level clearances have also been achieved in land allocation. But the delay in clearances has led to cost overruns, which could trigger another set of problems. National Thermal Power Corporation's (NTPC) ` 15,000 crore north Karanapura project remained a non-starter for want of coal and land for almost a decade until last year when linkage was facilitated to it. The company was quick to award ` 7,900 crore engineering, procurement and construction (EPC) contract for the project to Bharat Heavy Electricals Litd (BHEL). NTPC said work was on full swing at the project site, but the delay has impaired their plans. As many as 737 cases are pending at the Central Electricity Regulatory Commission (CERC); 80 percent are for revision of tariff due to delays. Lanco Babandh Power Project in Odisha is a case in point. The project cost is being revised as it got delayed due to land allocation. The company is selling off its assets to battle mounting debt. (www.business-standard.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Deep-sea oil projects make up most of $200 bn deferrals: Wood Mackenzie

July 27, 2015. Oil and gas projects in deep basins account for most of deferred investments worth more than $200 billion made due to the oil price crash, analysts at consultancy Wood Mackenzie said in a report. Oil and gas majors have slashed capital expenditure budgets between 10-15 percent this year in response to oil prices halving over the past year. A large chunk of these cost savings have been made by deferring investment decisions in expensive projects, shelving more than $200 billion worth of investments, the analysts said. Estimates by rival consultancies have varied between $150-$200 billion. As much as 10.6 billion barrels of oil equivalent in resources located in deep or ultra-deep oil and gas projects are affected by the delays, showing projects in frontier areas are worst hit. Canada's oil sands projects make the country most vulnerable to project deferrals, with 5.6 billion barrels of liquid reserves at risk in the country, Wood Mackenzie said. (www.reuters.com)

SABIC plans to invest in US shale gas projects

July 27, 2015. Saudi Basic Industries Corp (SABIC) plans to invest in shale gas projects in the US through joint ventures. An agreement was signed recently with Texas-based Enterprise Products Partners to purchase shale gas. SABIC said that the feedstock will be used by the company in the US or would be exported to other countries including the UK. In the UK, shale gas will be used as feedstock to produce olefins and their derivatives at competitive costs. In April, SABIC announced its plan to boost operations in the US and China due to growth constraints in Saudi Arabia amid gas shortage. The petrochemicals major does not have plans to involve directly in shale production in Saudi Arabia, but the potential shale gas discovery would provide the company with indirect investments opportunities, SABIC said. (refiningandpetrochemicals.energy-business-review.com)

China says has every right to drill in East China Sea

July 24, 2015. China said it had every right to drill in the East China Sea close to waters disputed with Japan. It did not recognise a "unilateral" Japanese median line setting out a boundary between the two in the waters. Japan called on China to halt construction of oil-and-gas exploration platforms in the East China Sea close to waters claimed by both nations, concerned that Chinese drills could tap reservoirs that extend into Japanese territory. Patrol ships and aircraft from both countries have been shadowing each other in the area over the past couple of years, raising fears of a confrontation and clash. China resumed exploration in the East China Sea two years ago, Japan said. In 2012, Japan's government angered China by buying a disputed island chain there from private owners. Before then, China had curtailed activities under an agreement with Japan to jointly develop undersea resources in disputed areas. China's Foreign Ministry said its drilling activities in waters which are not disputed and under Chinese administration are "completely appropriate and legal". (in.reuters.com)

Statoil and Total E&P make North Sea gas, condensate discovery

July 23, 2015. Statoil announced that it has made a gas and condensate discovery in the North Sea’s Julius prospect, with the help of its PL146/PL333 partner Total E&P Norge. Statoil estimates the volumes in Julius to be between 15 and 75 million barrels of recoverable oil equivalent. Well 2/4-23S also aimed to appraise the King Lear gas and condensate discovery made by the PL146/PL333 partnership in 2012. The well provided important information on reservoir distribution and reservoir communication in the King Lear discovery, according to Statoil, and the acquired data will now be further analysed. Following the appraisal, Statoil said that “King Lear volumes will stay within the previously communicated range of 70-200 million barrels of recoverable oil equivalent”. (www.rigzone.com)

Victoria O&G almost triples its daily gas production

July 23, 2015. Victoria Oil & Gas (VOG) revealed that it almost tripled its daily gas production in 2Q 2015, compared to the first quarter of the year. The company said that average gas production for the three month period ended June 30, 2015 was 12.6 million cubic feet per day, which represented a significant increase from the daily gas production rate in 1Q 2015 of 4.5 million cubic feet. VOG’s 2Q average daily gas production was also higher than 4Q 2014, which was 4.1 million cubic feet, 3Q 2014, which was 4 million cubic feet, and 2Q 2014, which was 2.6 million cubic feet. (www.rigzone.com)

Downstream…………

PES seeks to buy Bakken logistics assets

July 27, 2015. Philadelphia Energy Solutions (PES) is pursuing a joint venture that would give the U.S. East Coast refiner greater control over its supply chain out of North Dakota's Bakken oil fields, the company has said. PES, a joint venture partly owned by Carlyle Group LP, said that in early June, it entered into a preliminary agreement with Globe Resources Group, parent company of BOE Midstream. The deal would give PES controlling interest in a 210,000 barrel-per-day crude rail loading facility, nearly 1 million barrels of crude oil storage and a 39-mile pipeline in North Dakota. The Bakken rail terminal will serve the 335,000 bpd PES refinery complex in Philadelphia, the largest consumer of Bakken oil in the country. The company has built a 280,000 bpd crude rail offloading facility in Philadelphia, and the company has credited its recent success to access to cheaper, domestic Bakken crude. (www.reuters.com)

Pemex to send crude to JX Nippon's refinery in Japan

July 27, 2015. Mexican state oil and gas company Petróleos Mexicanos (Pemex) has signed an agreement with JX Nippon Oil & Energy to ship six million barrels of light crude to the latter's refinery in Japan. Pemex will deliver Isthmus crude which is mainly produced in the Campeche zone, Mexico. The crude will be transported in six cargoes from Pemex's Salina Cruz terminal on the southern Pacific coast between this August and January 2016. Separately, Pemex is planning to submit requests for tie-ups with private companies for five deepwater fields in the Gulf of Mexico. The five fields include Trion, Exploratus, Maximino, Kunah and Piklis. The company has previously submitted sale requests for 11 of 16 fields, to the Mexican energy ministry. The Mexican Government is considering privatization of oil and gas fields following ending of monopoly of 75-year-old Pemex in 2013. (refiningandpetrochemicals.energy-business-review.com)

Kuwait raises Al Zour refinery project costs to US$16 bn

July 23, 2015. The Ministry of Oil of Kuwait has raised the budget for the development of the 165,000 bbl/d Al-Zour refinery project by KWD 871mn (US$2.88 bn) to KWD 4.871bn (US$16 bn). Al-Zour has been planned for more than a decade but has been repeatedly delayed by political and bureaucratic issues. The project is now expected to be completed in 2019. (www.enerdata.net)

Transportation / Trade……….

Attack halts flow in natural gas pipeline from Iran to Turkey

July 28, 2015. Saboteurs attacked a pipeline carrying natural gas from Iran to Turkey in Turkey's eastern province of Agri, halting the flow, Turkish Energy Minister Taner Yildiz and state gas company Botas said. The pipeline, which carries around 10 billion cubic meters of Iranian gas to Turkey annually, frequently came under attack by Kurdish militants during the 1990s and up until 2013, when a ceasefire was established. Turkey buys around a quarter of its 40 billion cubic meters of piped natural gas imports from Iran, making its eastern neighbour its second-biggest supplier after Russia. Natural gas is used for almost half of its electricity generation. (www.reuters.com)

Nord Stream says to halt Russian gas flows to Germany on Aug 11-20

July 27, 2015. The Nord Stream gas pipeline, which carries Russian gas to Germany under the bed of the Baltic Sea, will undergo planned maintenance from August 11-20 which will stop gas flows, the pipeline operator said. It said the routine maintenance would require a temporary shutdown of both lines at once. These works are an essential part of Nord Stream's long-term pipeline integrity management strategy to ensure that the pipelines will be able to continue transporting up to 55 billion cubic metres of gas per year safely and efficiently for at least 50 years, Nord Stream said. (af.reuters.com)

Oil hits four-month low on China rout, supply glut

July 27, 2015. Oil hit four-month lows after a steep drop in Chinese stock markets and on more evidence of a global supply glut that has halved prices over the past year. Chinese stocks tumbled more than 8 percent, the biggest one-day drop in eight years, showing an unprecedented government rescue effort to prop up valuations has run out of steam. China is the world's biggest energy consumer and a huge oil importer. Investors worry that a stock market crash could destabilize the Chinese economy and cut fuel demand. Global oil supplies are ample with major oil producers in the Middle East Gulf competing for market share and pumping 2-3 percent more oil than needed, analysts say. Weekly U.S. drilling rig data showed that 21 oil rigs had been added, the highest gain since April 2014, pointing to a further increase in U.S. oil output. In Iraq, exports from its southern oilfields are on course for a monthly record, having topped 3 million barrels per day so far this month. Investors were also looking to the U.S. Federal Reserve for direction. The central bank starts a two-day policy meeting that could result in a September interest rate hike that would strengthen the greenback. A weaker dollar makes dollar-denominated commodities, including oil, cheaper for consumers using other currencies. (www.reuters.com)

APA signs gas transportation agreement to support Victoria-New South Wales Interconnect

July 27, 2015. APA Group has signed a new multi-service gas transportation agreement to support further capacity expansion of the Victoria – New South Wales Interconnect. The new agreement provides for the delivery of gas sourced from Victoria to the gas market in eastern Australian and is for a term of seven years. The expansion project will require looping on both the Moomba Sydney Pipeline and the Victorian Transmission System. The total cost of the expansion is expected to be approximately $85 million and will increase the daily capacity of the Victoria - New South Wales Interconnect by 30 TJ. Project works have commenced and construction is expected to be completed by the middle of calendar year 2016. (transportationandstorage.energy-business-review.com)

Iraq's southern oil exports head for another record in July

July 24, 2015. Iraq's southern oil exports have risen above 3.0 million barrels per day (bpd) so far in July, according to loading data and an industry source, setting shipments from OPEC's second-largest producer on course for a monthly record. The Iraqi boost is an indication of continued high output from the Organization of the Petroleum Exporting Countries (OPEC), which is focusing on keeping market share rather than curbing supply to support prices. Exports from Iraq's southern terminals averaged 3.06 million bpd in the first 23 days of this month, up from a record 3.02 million bpd in all of June. Shipments jumped in June after Iraq's decision to split the crude stream into two grades, Basra Heavy and Basra Light, to resolve quality issues. This has allowed some companies working at Iraqi oilfields to increase production. The southern fields produce most of Iraq's oil. Located far from the parts of the country controlled by Islamic State militants, they have kept pumping despite the conflict. Shipments from Iraq's north via Ceyhan in Turkey have remained steady despite tensions between Baghdad and the Kurdistan Regional Government (KRG) over budget payments. The KRG, which says it has not received its share of revenues from Baghdad, has boosted independent sales and cut allocations to Iraq's State Oil Marketing Organisation (SOMO). Independent KRG exports averaged 520,000 bpd in the first 23 days of July, according to loading data, while SOMO has exported one tanker and one pipeline shipment during the month, or an average of 33,000 bpd. Taken together, this means total northern shipments are close to June's rate, even though exports under the SOMO banner have slowed to a trickle. Iraq's growth follows investment by Western oil companies in the southern oilfields and an easing of export bottlenecks. Risks include bad weather, technical problems and unrest. (www.reuters.com)

Italy's Saras says in contact with Iran over oil imports

July 23, 2015. Italian refiner Saras said it was in contact with Iran and would be ready to restart importing its crude oil once sanctions are lifted. Iran used to account for a significant part of Saras crude feedstock before the U.S-led embargo was imposed on the country. Iran had used its time out of the oil market very wisely and was in a position to bring 1 million barrels of crude per day onto the market overnight when sanctions were lifted. Iran outlined plans to rebuild its main industries and trade relationships following a nuclear agreement with world powers, saying it was targeting oil and gas projects worth $185 billion by 2020. (uk.reuters.com)

LNG seen overtaking iron ore as Australia’s main export driver

July 23, 2015. Liquefied natural gas (LNG) will overtake iron ore as the main driver of Australia’s exports with annual shipments surging to more than A$50 billion ($37 billion) by 2020, according to Australia & New Zealand Banking Group Ltd. The contribution of LNG to Australia’s economic growth will surpass iron ore next year and peak at 0.75 percentage points in 2017, the bank said. Iron ore will still dominate export revenues at about A$60 billion by 2020, according to the bank. Australia, expected to challenge Qatar as the world’s biggest supplier of the super-cooled natural gas by 2018, is getting a boost from LNG even as falling energy prices threaten to erode the industry’s returns. Chevron Corp. and Royal Dutch Shell Plc are among companies developing Australian projects to tap Asian demand. (www.bloomberg.com)

Russia's Rosneft seeks end to Gazprom gas export monopoly

July 22, 2015. Russia's largest oil producer Rosneft has asked the government to end Gazprom's decade-long exclusive right to export pipeline gas, the RIA news agency reported. RIA said Rosneft had also proposed splitting Gazprom into producing and transportation companies -- an idea long resisted by Gazprom. Rosneft and Gazprom, Russia's top energy companies, have been at loggerheads over number of issues, including gas exporting rights and access to Gazprom's network of pipelines. The latest Rosneft proposal may signal growing discomfort over its own business situation, which is being hampered by international sanctions over Moscow's role in the Ukraine crisis. Rosneft is aiming for a 20 percent increase in its hydrocarbon production by 2020. Rosneft, Gazprom and the energy ministry declined to comment on the RIA report. However, Rosneft said a discussion of the "gas market model" was underway. According to RIA, Rosneft wants to start tests for companies other than Gazprom to export pipeline gas from 2016. The government has already granted approval for Rosneft and Russia's No.2 gas producer Novatek to export liquefied natural gas in future. RIA also said Rosneft had proposed spinning-off Gazprom's pipeline business from its upstream division in 2025. (uk.reuters.com)

Policy / Performance…………

UAE raises gasoline prices as OPEC member halts subsidies

July 28, 2015. The United Arab Emirates (UAE) OPEC’s third-biggest producer, will raise unleaded gasoline prices by 24 percent next month when it becomes the first country in the oil-rich Persian Gulf to remove subsidies on transport fuel. Motorists will pay 2.14 dirhams per liter (58 cents) for 95-octane unleaded gasoline starting Aug. 1 as the country deregulates fuel prices. The gasoline grade currently sells for 1.72 dirhams per liter, according to the Ministry of Energy. Gasoline is now subsidized in the UAE, the second-biggest Arab economy and home to about 6 percent of global oil reserves. Gulf members of the Organization of Petroleum Exporting Countries (OPEC) provide some of the largest per capita energy subsidies in the world, according to the International Monetary Fund. The payments have cost UAE state energy companies about $1 billion a year over the last decade, Energy Minister Suhail Al Mazrouei said. The energy ministry set prices for 98-octane unleaded gasoline at 2.25 dirhams per liter and 91-octane grade at 2.07 dirhams per liter, WAM reported. Prices for diesel will drop 29 percent to 2.05 dirhams per liter. Cheaper diesel will reduce costs for industry, shipping and cargo, the ministry’s Price Review Committee said. The committee will review fuel prices on a daily basis and announce them on the 28th day of each month. The current U.S. price for premium unleaded gasoline is $3.15 a gallon, or 83 cents a liter, according to AAA, the biggest U.S. auto group. That compares with 26 cents in Qatar and 21 cents in Kuwait, both of them OPEC members, and 15 cents in Saudi Arabia, the group’s largest producer, according to data compiled by GlobalPetrolPrices.com. The worldwide average price for gasoline is $1.10 a liter, the data show. The UAE, which doesn’t levy income or value-added taxes, comprises seven sheikhdoms including Abu Dhabi and Dubai, the Gulf business hub. Expatriates number about 80 percent of the country’s residents. Removal of fuel subsidies is part of the government’s plan to make the economy more competitive and diversify sources of income, Al Mazrouei said. (www.bloomberg.com)

Russia's Gazprom gas output seen at all-time low in 2015