[People’s Action Plan on Climate Change for Karnataka]

“These recommendations can go a long way in strengthening the National Action Plan and the State Action Plan on Climate Change, whose recommendations have not been known to the public. Since about 1,000 people from various walks of life have contributed to these recommendations, the state government should not hesitate to consider every one of them for early implementation…”

Energy News

[GOOD]

More power transmission lines through more states will balance power surplus and deficit across the country!

[BAD]

‘Me-too’ LNG projects have led to the warning of challenges that await these terminals!

[UGLY]

It is not the government’s business to get into the business of coal block acquisition!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· India’s Energy Sector: About to Take-off? (Part II)

ANALYSIS / ISSUES…………

· People’s Action Plan on Climate Change for Karnataka

DATA INSIGHT………………

· State-wise Wind Power Generation Capacity & Cost

[NATIONAL: OIL & GAS]

Upstream…………………………

· India's crude oil output down marginally

· RIL to relinquish two gas discoveries off east coast

Downstream……………………………

· IOC to invest ` 10 bn to raise stake in CPCL

· Royal Dutch/Shell reopens 77th petrol pump in India

· Essar to shut 400k bpd refinery for a month from mid-September

· IOC to restart crude unit at 300k bpd Paradip plant in August

Transportation / Trade………………

· Petrol pumps closed in Haryana after dealers indefinite strike

· Stiff challenges await LNG terminals: ICRA

· GAIL sells 2 mn tonnes US LNG abroad

· RIL sells diesel to Indian Railways

· Post N-deal, RIL may look at exporting petrol, diesel to Iran

Policy / Performance…………………

· Diesel price to go up by ` 2.80 a litre in Chandigarh

· Petrol, diesel to cost more as govt hikes VAT

· India to benefit from oil price fall post-Iran deal: Oil Minister

· Oil Minister stresses upon the need of new approach for energy security

[NATIONAL: POWER]

Generation………………

· Tata Power's Mundra power plant generates 6,296 MUs in Q1

· Damaracherla power plant works to begin soon

· Nabinagar unit likely to generate power by November

Transmission / Distribution / Trade……

· ABB bags ` 1.2 bn order to upgrade three substations

· About 1.2 mn power men to strike over Electricity Amendment Bill

· Tata Power commissions one of the largest radio frequency metering projects in India

· India will lay 7,800 km of power transmission lines through 7 states

· Power exchanges to begin extended market session

· Delhi power discoms seek yet another tariff hike

· Siemens wins ` 1.2 bn order from Bangladesh's Power Grid Company

· Private players queue up to bid for intra-state transmission projects

· Adani Power wins projects in Chhattisgarh

Policy / Performance…………………

· Odisha opposes changes in SBDs for UMPPs

· Maharashtra govt plans to retire high cost debt of ` 540 bn of three power companies

· West Bengal govt transfers hydro projects to NHPC

· Gujarat plans to relocate existing electricity infra

· CENVAT duty cannot be levied on sale of fly ash: Madras HC

· Centre yet to decide on Reliance’s Sasan coal blocks

· Delhi govt hopeful to get coal block by October

· Kudankulam-II to be commissioned in 6-8 months

· 'Arunachal received ` 14.9 bn as upfront money for hydel projects'

· Govt to offer 26 percent in DVC power plant to railways

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Total starts production from Dalia Phase 1A offshore Angola

· Eni found gas in Egypt

· Exxon’s Guyana oil discovery may be 12 times larger than economy

· Production begins at Ungani oil field in Australia

· Premier oil sees high potential in most-sought Mexico block

· Ithaca confirms 12k barrel per day target for 2015

· OVL fails to make cut in Mexico's historic oil block auction

· Iran no Qatar even with the world’s second-biggest gas reserves

Downstream……………………

· Pemex agrees to pay $295 mn to settle Mexican refinery upgrade disputes

· Idemitsu JV may double Vietnam refinery capacity

Transportation / Trade…………

· China's Iran oil imports hit two-month high in June

· Changfeng partners with Tangshan Caofeidian for natural gas business in China

· Tullow expects gas exports from Jubilee field to resume by mid-August

· Statoil to leave TAP gas pipeline project: SOCAR

· DUET to expand in gas with $1 bn Energy Developments buy

· Saudi Arabia crude exports fall to five-month low on China

· Caspian pipeline to halt oil exports Aug 17-20

· Contract signed for the sixth Iran-Iraq gas pipeline project

· Woodside sales slide 47 percent as gas trades near five-year low

· Nigeria's Seven Energy secures $495 mn to boost gas supply

Policy / Performance………………

· US banks prepare for oil and gas company loans to worsen

· Myanmar sees increased offshore exploration work in late 2015/early 2016

· Croatia will build 4-6 bcm LNG terminal by 2020

· Iranian crude oil output likely to increase in 2016: Fitch Ratings

· Kenya to sign $350 mn loan for refined products pipeline

· UK should monitor water, air, land if gas fracking to succeed

· Bangladesh considers building two new LNG terminal

· Argentina ended some incentives to develop shale O&G

[INTERNATIONAL: POWER]

Generation…………………

· Vietnam starts building 1.2 GW coal-fired power plant

· China to be world’s third largest nuclear-generating country

· Talen Energy to buy Mach Gen power plants for $1.1 bn

· France's Engie quits plans to build power plant

Transmission / Distribution / Trade……

· SGCC proposes to fund up to US$12 bn power grid project in Nigeria

· Japan confirms nuclear energy to supply a fifth of power by 2030

Policy / Performance………………

· UK says ‘very good prospect’ of EDF Hinkley deal this year

· Brasil energy efficiency program saved 2 percent of final power consumption

· Chile authorises O&G company Enap to enter the power market

· UK will close its last underground coal mine by end-2015

· Spanish residential electricity price will drop by 2.2 percent for 5 months

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Canals to harness 1 GW green energy in Punjab

· India's clean energy targets way ahead of others

· 'TN needs to improve infra for wind energy generation'

· TN BJP seeks detailed report on Adani deal on solar power

· MP to get cheapest solar power in country

· First power storage technology launched by ACME Cleantech

· Mahagenco invites bids to appoint consultants for solar projects

· Hero Future Energies bags solar power project from MP govt

GLOBAL………………

· German wind capacity addition increased threefold on first semester 2015

· Deal on climate change by year-end: French Minister

· UK signals more pain for renewables as Rudd protects consumers

· Climate scientists say 2015 on track to be warmest year on record

· EEX's to offer renewable power futures from Sep 14

· UK ends zero carbon homes policy

· Dubai Electricity & Water closes solar-park phase two financing

· Israel inks deal for $1 bn solar power plant

· Renewables outpace nuclear in economies making up 45 percent of world population

· EU bets on cap and trade in plan for deeper emission cuts

· AWS to build 208 MW wind farm in US

· Bio-bean to produce biofuel from coffee waste at UK stations

[WEEK IN REVIEW]

India’s Energy Sector: About to Take-off? (Part II)

Lydia Powell and Akhilesh Sati, Observer Research Foundation

Continued from Volume XII, Issue 4

ast week’s column observed that India’s energy take-off may be an ‘optical illusion’ caused by China’s slow-down. This casual remark must be tested against hard data on changes in India’s energy consumption patterns. We shall begin with the electricity sector.

Source: Central Electricity Authority 2015

Chart 5 shows sector-wise changes in consumption of electricity since 1947. In the last six decades, residential and commercial sectors have doubled their share of electricity consumption (from 10 to 24 percent and from 4 to 9 percent respectively) but the share of industrial consumption has declined from 70 percent to about 42 percent in 2014-15 after peaking at 74 percent in 1960. The share of electricity in traction has declined from about 7 percent in 1947 to about 2 percent in 2014-15 while the share of agriculture in electricity consumption has grown from about 3 percent to about 18 percent after peaking at 26 percent in 1997 (end of the 8th plan period).

Data on sector-wise ten year average compounded annual growth rate (CAGR)[1] is more informative (Chart 6).

Source: Central Electricity Authority 2015

Overall electricity consumption has grown by 7.24 percent in the period 2007-2015 compared to 5.65 percent in the period 1997-2007. The sector that has shown significant spurts in electricity consumption growth is agriculture. The ten year period between 1956 and 1966 recorded the highest ever growth rate of 19.6 percent. The reason is well known. When Pakistan was separated from India, it removed access to water for irrigation from the Indus canal system almost overnight. India with 82 percent of the population of undivided British India got only half the canal system carrying 400,000 cusecs of water and less than half of 24 million acres of land irrigated by state owned canals. Consequently the 3rd and 4th plans allocated almost a quarter of the budget for the power sector for electrification of pump sets for irrigation of agricultural land. The result was an unprecedented increase in agricultural consumption of electricity. Agricultural consumption continued to show double digit growth rates in the subsequent decades. The significant decline in growth rates of agricultural consumption was recorded during the 9th and 10th plan periods (1997-2007) when the average CAGR of agricultural consumption was only 1.6 percent. The period 2007-2015 has recorded a growth of 7.24 percent but this cannot be labelled a growth spurt. It is lower than the average growth of 11.34 percent and less than half the peak growth rate. Across all consuming sectors, growth-rates are below or close to historic average growth rates. This does not necessarily constitute a growth spurt.

The 18th power survey projects a demand of 3710 billion units corresponding to a peak load of 514 GW at bus bar in 2032. The survey assumes the following: 8-9 percent growth up to the end of the 12th plan and around 7-9 percent beyond that period; full electrification by 2017; high growth rate for electricity consumption in states with low per person electricity consumption but with policies in place for T&D loss reduction; restructuring and reduction in overall T&D loss levels to 15 percent barring the North East region and J & K. For a three-fold increase in power consumption (from 938 billion units in 2015 to 3710 in 2032) in the next 17 years, a CAGR of 8.4 percent in power consumption is required. This is roughly the average CAGR of power consumption since 1947.

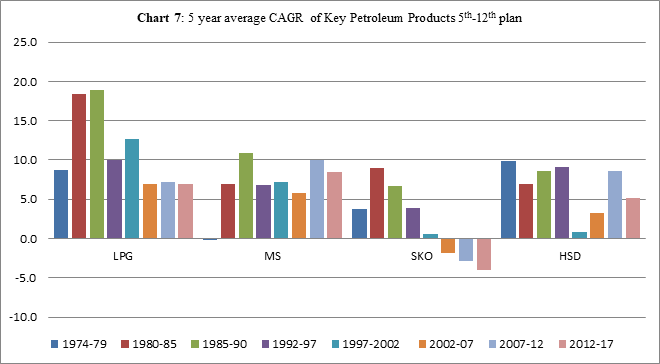

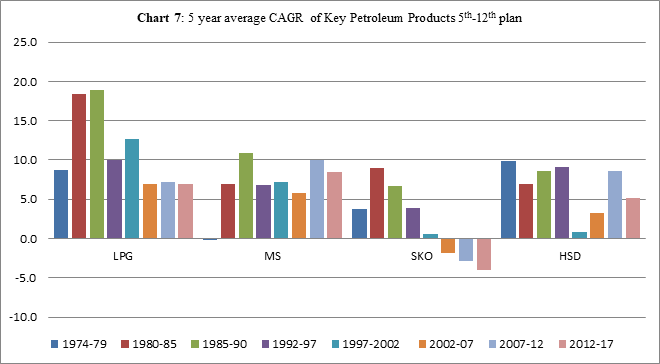

Source: Petroleum Planning & Analysis Cell

In petroleum products particularly that of petrol (MS), LPG, Kerosene (SKO) and diesel (HSD) that account for 69 percent of petroleum product consumption in India, there is no appreciable sign of a growth spurt, except in kerosene whose consumption is showing a consistent negative growth since 2002 (Chart 7). This may be attributed partly to increase in electrification rates because kerosene is a major source of lighting in un-electrified rural India. The absence of a corresponding increase in LPG consumption growth rates is surprising because kerosene is also a major source of cooking fuel in rural areas. The absence of a significant growth of LPG consumption may be attributed to the limits imposed on subsidised LPG consumption.

Among transportation fuels, the growth of petrol consumption (almost entirely consumed by the transportation segment) has exceeded the growth of diesel consumption (70 percent consumed by the transportation segment) during the 11th and 12th plan periods. About 61 percent of petrol is consumed by two-wheelers and about 34 percent by personal vehicles such as cars. The growth in petrol consumption may be interpreted as a sign of growth in personal vehicles which could in turn mean growth in consumption by middle class households.

Source: Society for Indian Automobile Manufacturers

The trend in sales of vehicles shows a significant growth for personal vehicles as opposed to commercial vehicles (Chart 8). Between 2009 and 2015 personal vehicle sales grew at 4.9 percent compared to a growth of 2.4 percent for commercial vehicles. While three wheeler sales grew at 3.2 percent, two wheeler sales grew at 9.3 percent. Long-term projections by the IEA do not show a significant departure from this trend where personal vehicle sales is dominated by sales of two wheelers.

On the whole data from the recent past does not indicate clear signs of a growth spurt in energy consumption. India’s growth rates in energy consumption may be higher than that of China in the next two decades but India’s growth is likely to be in line with past trends with no significant spurts. This is not necessarily good news. Even at economic growth rates of 8 percent or more a year in the next two decades India is unlikely to achieve per person energy consumption levels that represent decent quality of life. If we go by projections by the International Energy Agency, even by 2030, 20 percent of the Indian population will have no access to electricity and 46 percent of the population will remain dependent on traditional fuels for cooking. Perversely, this will limit the perceived threat posed by the scale of India’s energy transitions on global boundary conditions such as the global carbon budget.

Concluded

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

People’s Action Plan on Climate Change for Karnataka

Shankar Sharma, Power Policy Analyst

people’s action plan on Climate Change for the state was released on recent World Environment Day in Bangalore by the Chief Minister of Karnataka. This report, “Recommendations to State Action Plan on Climate Change” prepared for Karnataka State Pollution Control Board (KSPCB), and based on twenty one public consultation meetings held in different districts of the state, has been termed as a people’s action plan on Climate Change because it contains the views of the public on the developmental pathway for the state keeping the threats of Climate Change in proposer perspective.

A good reading of the report brings to the fore very many issues needing serious attention of the government and the public on problems confronting the state at present and in the future. The report indicates that the intent of the state govt. to have such public’s feedback on the issue of Climate Change, and the vast efforts of KSPCB in organizing such consultations were well appreciated by the public. It is perhaps for the first time that such public consultations were held in right kind of spirit in any state of the Union on this subject. For the same reason the recommendations, which have been made by people from various walks of life (such as teachers, college Professors, Doctors, engineers, NGOs, state govt. employees, college students, women, activists, industrialists, farmers and others), should be given due consideration they deserve.

The report has highlighted the geographic and climatic strengths and weakness of the state along with its traditional strengths in agriculture, forestry and horticulture. Looking from the perspective of Climate Change the state has many basic issues to be concerned about. Some of them are: about 77% of the land area is arid or semi-arid; about 54% of the land area prone for droughts; it is considered the second driest state in the Union; it has no reserve of fossil fuels; 5th most urbanized state; less than 20% forest and tree cover etc. The state also enjoys some good features: rich and diverse agricultural practices which contributes about 28.61% of Gross State Domestic Product; 64.6% of the total geographical area of the state under cultivation; farmers and agricultural laborers account to 56.5% of the total workforce; it is a leader in services sector such as IT and ITES, education; salubrious climate in most parts of the state; a beautiful coast line; one among the top industrial states etc.

The report puts up a forceful advocacy for a people centered and environmentally friendly developmental pathway for the state, which takes into account these constraints and which looks to harness its strengths on a sustainable basis, keeping in view the need to contain the demand for materials and energy within the manageable limits of the nature.

A large number of concerns /recommendations have been expressed in these meetings, and they have been grouped under 19 headings. Some of these headings are: pollution of land, water and air; forests and biodiversity; Western Ghats; coastal ecology; agriculture, horticulture and animal husbandry; food and human health; waste management; transportation; industries; energy; urbanisation and infrastructure; general awareness campaign; rural Karnataka and north Karnataka; women’s perspective; traditional Knowledge and life style issues.

Under each of these headings the recommendations have been grouped as tactical ones for early implementation and strategic ones for long term consideration. More than 600 recommendations, on the basis of public’s view points, have been compiled which are aimed to ‘mitigate’ and ‘adapt’ to the fast evolving Climate Change.

While some recommendations may appear to need further discussions for clarifications, there are a large number of credible, uncontestable and implementable recommendations which deserve urgent attention by our society and the govt. These recommendations include: the criticality of optimal use of our natural scarce resources such as water, minerals, energy and forests; minimise the pollution of land, water and air; move towards sustainable agriculture, horticulture and life style practices; massive educational and awareness campaigns targeting all sections of our state; much higher focus on rural development; minimise the impacts of the urbanisation; effectively involve women and all other sections of the society in planning and implementation; provide adequate focus to our traditional knowledge base.

The detailed report can be accessed from KSPCB website.

The report has recommended the state govt. should consider adopting the following policy statements:

Ø reduce the reliance on coal energy by certain percentage by 2025, 2040, 2050 etc. w.r.t the base year of, say, 2000; declare a peak coal year for the country, say 2022;

Ø reduce the consumption of petroleum products by certain percentage by 2025, 2040, 2050 etc. w.r.t the base year of, say, 2000; encourage the usage of bio-fuels so as to make it atleast 50% of our total vehicle fuel consumption by 2050;

Ø a minimum 75% of our total energy/electricity needs shall be met by new and renewable energy (RE) sources by 2050; of this about 70 to 80% should come from distributed type of RE sources such as roof top SPVs and community based bio-energy systems;

Ø make efficiency, conservation and demand side management as the fundamental doctrine of our energy policy;

Ø stop diverting the natural forests until the forest policy target of 33% of the land cover is reached again; take effective measures to increase the forest cover area by at least by 0.5% every year for the next 30 years;

Ø gradually reduce the inorganic chemicals used in agriculture so as to make our agriculture completely sustainable /organic by 2030; make sustainable agriculture, horticulture, dairying and other related sectors contribute a much higher share in national income and national employment;

Ø take all possible measures to reduce the urbanisation, and keep the overall urban population to less than, say, 30% by 2040;

Ø enact pollution control measures of highest standards across the country before 2025.

A coordinating agency, preferably a standing committee of responsible officers, credible NGOs and committed individuals, directly reporting to the Chief Minister should oversee the development and implementation of an effective state action plan on a continuous basis.

These recommendations can go a long way in strengthening the National Action Plan (NAPCC) and the State Action Plan on Climate Change (KSAPCC), whose recommendations have not been known to the public. Since about 1,000 people from various walks of life have contributed to these recommendations, the state government should not hesitate to consider every one of them for early implementation.

In the context that Pope Francis of Vatican City has issued a very powerful Encyclical on the issue of Climate Change on 18th June 2015, there is now even a moral obligation for our society to address the ‘ecological crises’. The pope’s 180-page Encyclical on the environment is at its core a highly convincing call for urgent action on phasing out the use of fossil fuels and usher in a just & equitable world based on sustainable harnessing of our natural resources.

The recent report produced by the Lancet/UCL commission on health and climate change, a collaboration of dozens of medical experts from around the world, and backed by Margaret Chan, head of the UN World Health Organisation needs a special emphasis in this context. It says that the Climate Change threatens to undermine half a century of progress in global health. The analysis also concludes that the benefits to health resulting from slashing fossil fuel use are so large that tackling global warming also presents the greatest global opportunity to improve people’s health in the 21st century.

Such people’s action plan developed for each state of the Union has become critical for the overall success of the nation’s efforts in addressing the threats of global warming. Concluded

Views are those of the author

Author can be contacted at [email protected]

State-wise Wind Power Generation Capacity & Cost

Akhilesh Sati, Observer Research Foundation

(As on Feb, 2015)

|

State

|

Installed Capacity (MW)

|

|

Andhra Pradesh

|

930

|

|

Gujarat

|

3,591

|

|

Karnataka

|

2,574

|

|

Kerala

|

35

|

|

Madhya Pradesh

|

606

|

|

Maharashtra

|

4,399

|

|

Rajasthan

|

3,095

|

|

Tamil Nadu

|

7,411

|

|

Others

|

4

|

|

Total

|

22,645

|

Cost (INR/KWh) of selling wind power to Utilities

* Cost range for Maharashtra is INR3.92 to 5.70 while for Rajasthan is INR5.64 to 5.93

Source: Rajya Sabha, Question No. 2000, Answered on 16.03.2015.

NEWS BRIEF

[NATIONAL: OIL & GAS]

India's crude oil output down marginally

July 21, 2015. India's crude oil production slipped marginally, less than 1 percent, to 3.1 million tonnes in June as good showing by ONGC's offshore fields offset fall in output from onland fields. India produced 3.101 million tonnes of crude oil in June as compared to 3.121 million tonnes a year ago. Oil and Natural Gas Corp (ONGC) produced at almost flat rate of 1.85 million tonnes after an over 3 percent rise in offshore production at 1.38 million tonnes was offset by 7.5 percent drop in production from onland fields. During the April-June quarter of the current fiscal, India's crude oil production was 0.86 percent down at 9.3 million tonnes. Natural gas output was down nearly 6 percent at 2.72 billion cubic meters (bcm). ONGC reported a 5.5 percent drop in production at 18 bcm and so did private firms like Reliance Industries Ltd (RIL) with output dropping 11 percent to 377.6 million cubic meters. This was offset by rise in coal-bed methane (CBM) output. (timesofindia.indiatimes.com)

RIL to relinquish two gas discoveries off east coast

July 19, 2015. Reliance Industries Ltd (RIL) has decided to relinquish two gas discoveries off the east coast and opted to carry out government prescribed confirmation tests to retain three other finds. Accepting a government offer to conduct Drill Stem Test (DST) under limited cost to retain gas discoveries that otherwise would have been taken away for not meeting timelines, RIL has opted to do confirmatory test on two of the three contentious gas finds in the KG-D6 block and one of the two discoveries in question in NEC-25 block. RIL and its partners -- BP plc of UK and Canada's Niko Resources -- will relinquish discoveries D-40 in NEC-25 block off the Odisha coast and D-31 in KG D6 block. The company will conduct DST on discoveries D-32 in NEC-25 block and D-29 and D-30 in KG D6 block. The budget for doing the DST within the government prescribed cost of $15 million each was approved at block oversight panel, called Management Committee, meeting. The Cabinet Committee on Economic Affairs (CCEA) had in April approved a policy to allow operators to develop a dozen contentious natural gas discoveries worth about ` 1 lakh crore at current prices. The new policy gives companies options to either develop the finds at their own risk or perform upstream regulator DGH-prescribed conformity tests before developing them and recoup the entire cost. The policy approved by CCEA settled long pending issue with regards to 12 discoveries in five blocks pertaining to Oil and Natural Gas Corp (ONGC) (six discoveries) and RIL (six discoveries). The 12 finds hold reserves of around 90 billion cubic meters (bcm) of gas. The CCEA allowed companies to either relinquish the blocks or develop the discoveries after conducting DST with 50 percent cost of DST being disallowed as penalty for not conducting the test on time. The cost recovery for carrying out DST capped at $ 15 million. (economictimes.indiatimes.com)

IOC to invest ` 10 bn to raise stake in CPCL

July 20, 2015. Indian Oil Corp (IOC) will invest ` 1,000 crore for raising stake in Chennai Petroleum Corporation Ltd (CPCL) by subscribing to preferential issue. IOC currently holds 51.89 percent in CPCL, while the other promoter, Iran's Naftiran Inter Trade Company Ltd, owns 15.40 percent. The preference allotment is being done only to IOC and not to the Iranian firm. CPCL did not say how much will IOC's shareholding in the company increase, upon it subscribing to the preference issue. They also approved raising borrowing limit to ` 8,000 crore for both domestic and foreign borrowings and to borrow ` 3,000 crore through a debenture issue on private placement basis to fund expansion plans. (profit.ndtv.com)

Royal Dutch/Shell reopens 77th petrol pump in India

July 20, 2015. Royal Dutch/Shell has reopened its 77th petrol pump across the country and is looking to expand the network in near future. Shell said it has reopened a petrol pump in the Rakhial area of Ahmedabad city, taking its total operational fuel stations in India to 77. Of these, 20 pumps are in Gujarat. The government had in October last year deregulated diesel pricing by stopping subsidies to state-owned fuel retailers. This puts PSU retailers, who operate over 94 percent of the 53,419 petrol pumps in the country, at par with private companies. Private retailers like Shell and Reliance Industries had few years back shut down their petrol pumps as they could not match the subsidised price offered by PSUs. Of the 53,419 petrol pumps in the country, 50,447 are with Indian Oil Corp (IOC), Bharat Petroleum Corp (BPCL) and Hindustan Petroleum Corp (BPCL). RIL has reopened 1,400 outlets while Essar Oil has 1,491 petrol pumps on ground. Shell V-Power, the premium performance petrol recently launched in the Indian market will also be available at the Rakhial outlet along with the main-grade petrol and diesel variants at market price. The outlet will also offer free engine oil service for bikers. Besides retail outlets, Shell operates a 5 million tonnes a year LNG import terminal at Hazira in Gujarat with Total. It had signed a memorandum of understanding (MoU) with state gas utility GAIL and other firms for setting up a floating LNG terminal off the east coast. Shell also has a downstream business marketing fuels, lubricants and speciality products. It recently announced creation of an in-house global IT centre in Bengaluru. (economictimes.indiatimes.com)

Essar to shut 400k bpd refinery for a month from mid-September

July 15, 2015. Essar Oil Ltd will shut its 400,000 barrels-per-day (bpd) Vadinar refinery from mid-September for a month, while Chennai Petroleum Corp Ltd (CPCL) will put a 1.85 million tonnes-per-year hydrocracker plant on maintenance. Essar Oil will shut the Vadinar refinery in Gujarat for planned maintenance. Trade sources had earlier said the shutdown could happen in July-August. CPCL will shut its hydrocracker plant for a month for routine maintenance at its Manali refinery that has a capacity of 10.5 million tonnes per year. (in.reuters.com)

IOC to restart crude unit at 300k bpd Paradip plant in August

July 15, 2015. Indian Oil Corp (IOC) shut the crude unit of its 300,000 barrels-per-day Paradip plant in May and will restart the same in August, its refineries head Sanjiv Singh said. There are 15 units (in total) that need to be commissioned in phases, Sanjiv Singh said. There is only one crude unit in Paradip, in the country's east. (in.reuters.com)

Transportation / Trade…………

Petrol pumps closed in Haryana after dealers indefinite strike

July 20, 2015. Over 2,300 fuel pumps in Haryana have stopped selling petrol and diesel to consumers as petroleum dealers went on their indefinite strike to press for various demands, including lower VAT on diesel. As many as 2,310 fuel pumps across the state went on strike, All Haryana Petroleum Dealers Association Senior Vice President Palwinder Singh Oberoi said. Petroleum dealers will not buy and sell fuel as per their protest, he said. However, some the fuel pumps, which are directly owned by oil companies like Indian Oil, BPCL and HPCL, are open. There is a complete shutdown of fuel outlets across the state, including Gurgaon, he claimed. Dealers have also refused to engage meeting with Haryana BJP Chief Subhash Barala for resolving the matter, saying they will talk only with Haryana Chief Minister Manohar Lal Khattar. The monthly sale of diesel in Haryana stands at 53 lakh kilo litres, dealers said. Petroleum dealers were agitated over the alleged failure of Haryana government in keeping the tax on diesel lower than that in neighbouring states for the "survival" of fuel pump owners. They were demanding tax on diesel should be lower by 1-2 percent than the rates prevailing in neighbouring states. They claimed that uniformity in tax rate on diesel in northern states will hit the sale of diesel in Haryana, saying that 70 percent of total sale of diesel is consumed by vehicles, including truck operators coming from other states. Dealers have been demanding removal of 5 percent surcharge on VAT and landing cost of crude oil at Panipat refinery from the state government. Punjab and Haryana had raised Value Added Tax (VAT) on diesel. While the SAD-BJP led government hiked VAT on diesel to 13.4 percent, the neighbouring BJP government in Haryana jacked up the tax to 16.4 percent on the commodity. After adding local levies like cess and surcharge, the effective rate of tax on diesel in Punjab and Haryana became 17.29 percent and 17.22 percent, respectively. UT Chandigarh had also increased VAT on diesel from 9.68 percent to 16.4 percent. (www.ndtv.com)

Stiff challenges await LNG terminals: ICRA

July 18, 2015. The new LNG import terminals will face major challenges due to price sensitive demand, the ratings agency ICRA said. The ratings agency believes that new entrants will face significant pressure on volumes and margins if the planned re-gasification terminals come on stream over the next 4-5 years, as they will have to compete with the existing players. Gas demand is expected to increase to 330 million standard cubic meters per day (mmscmd) by 2024-25, while domestic natural gas production will rise 60 percent to about 150 mmscmd. (www.newindianexpress.com)

GAIL sells 2 mn tonnes US LNG abroad

July 15, 2015. GAIL India Ltd has sold overseas two million tonnes of liquefied natural gas (LNG) it had contracted from the US, its Chairman BC Tripathi said. Out of the two million tonnes of LNG, one million tonne has been sold to Royal Dutch Shell. Tripathi refused to give details of other buyers. GAIL has signed a contract to buy 3.5 million tonnes of LNG per year for 20 years from the US—based Cheniere Energy and has also booked capacity for another 2.3 million tonnes per annum at Dominion Energy’s Cove Point liquefaction plant. The landed price of US LNG in India is not likely to be less than USD 10 per million British thermal unit, a rate that domestic industry may consider high after adding taxes, transportation charges and margins. (www.thehindubusinessline.com)

RIL sells diesel to Indian Railways

July 15, 2015. Reliance Industries Ltd (RIL) has started selling diesel to the state railways for the first time since 2005/06 after pricing of the fuel was freed, the company said. Indian Railways, the country's biggest diesel guzzler, consumes up to 2.5 million tonnes of the fuel each year. Until last year, it received supplies from state refiners who used to be compensated for selling fuel at below-market rates. The government freed diesel pricing last October, providing a level playing field to private companies like RIL and Essar Oil. RIL said the company has been selling a "small quantity" of diesel to the railways. It was not immediately clear how much it sold in 2005/06. (in.reuters.com)

Post N-deal, RIL may look at exporting petrol, diesel to Iran

July 15, 2015. Reliance Industries Ltd (RIL), which had abandoned fuel export to Iran six years back, is again looking at starting petrol and diesel export to the Persian Gulf nation following the landmark nuclear deal. The company said oil product from RIL's giant refining complex at Jamnagar in Gujarat are currently flowing more to eastern markets. Iran reaching deal with western powers to curb its nuclear programme in return of easing import and export restrictions, presents an "opportunity" to RIL. RIL expects fuel exports to the Middle East to diminish as local refineries start. Under mounting global pressure, especially from the US, RIL had in January 2009 stopped export of gasoline to Iran. (www.firstpost.com)

Diesel price to go up by ` 2.80 a litre in Chandigarh

July 17, 2015. A day after Punjab and Haryana hiked VAT on diesel, UT Chandigarh Administration also followed their footsteps and notified the increase in tax on the same, which will cause a hike of ` 2.80 per litre in diesel price. Chandigarh Administration raised the Value Added Tax (VAT) on diesel from 9.68 percent to 16.40 percent. The new tax rate will be effective from midnight tonight. With this hike, the retail rate of diesel will be ` 50.40 per litre as against current rate of ` 47.60 a litre, an increase of ` 2.80 per litre. Diesel in Punjab (Mohali) and Haryana (Panchkula) now stands at ` 50.41 a litre and ` 50.10 per litre respectively. Punjab and Haryana raised taxes on diesel to 17.29 percent and 17.22 percent respectively. The whole exercise of raising VAT is in the wake of decision taken by northern states -- New Delhi, Punjab, Haryana, Himachal Pradesh and UT Chandigarh -- to rationalise present tax regime by implementing a uniform tax structure (UTS) in these states view to eliminate evasion of taxes and curb smuggling of goods through state borders. The monthly sale of diesel in UT Chandigarh is pegged at 13,000 kilo litres per month. Meanwhile, Chandigarh Petroleum Dealers Association expressed disappointment with the hike in tax rates, saying it will have hit the common man. (www.business-standard.com)

Petrol, diesel to cost more as govt hikes VAT

July 16, 2015. The Delhi government increased the Value Added Tax (VAT) rates on petrol and diesel. The raise, effective from midnight, is the first hike in VAT introduced by the Aam Aadmi Party (AAP) government since it came to power. After the increase, petrol will cost ` 69.43 per litre (approx.), while diesel will be priced at ` 52.07 per litre (approx.). According to the government, the VAT rate was increased on the basis of a decision taken in the meeting of Finance Ministers of northern states for bringing uniformity in tax rates. However, the increase will have a cascading effect with basic commodities such as vegetables expected to cost more. The Delhi Petrol Dealers Association said this announcement was not welcome. However, AAP leaders said the move was taken to bring uniformity in process of petrol and diesel in the northern states. The move, meanwhile, has drawn criticism from the Opposition. BJP leader Vijender Gupta said the AAP government had not lived up to its promise of not increasing VAT and burdening the public. Even the Congress attacked the AAP and said that the government had increased VAT to meet its ` 526 crore budget for advertisements. (www.thehindu.com)

India to benefit from oil price fall post-Iran deal: Oil Minister

July 15, 2015. International oil prices will come down with the imminent lifting of sanctions against Iran and benefit India, Oil Minister Dharmendra Pradhan said. India is the world’s fourth largest oil consumer and also the second biggest buyer of Iranian oil after China, importing about 11 million tonnes of crude oil in 2014-15. However, Pradhan remained non-commital on whether India will increase imports from Iran after restricting it at 11 million tonnes in the past two fiscal. (www.thehindu.com)

Oil Minister stresses upon the need of new approach for energy security

July 15, 2015. Oil Minister Dharmendra Pradhan has stressed upon the need of new approach for energy security. Addressing the India Oil and Gas Summit 2015 in New Delhi, he said that lifting the sanctions on Iran is good news for India and both the countries will benefit from that. Pradhan mentioned, green and clean energy is the need of the hour. Therefore, energy basket should move towards clean energy. The Minister said that the sector has been steadily redefining production possibilities. Technological innovation has made it possible to extract fossil fuels that weren’t accessible just a decade or two ago. Pradhan said there’s no disputing the fundamental role innovation has played in the oil and gas industry. However more needs to be done in terms of Research and Development to bring in more innovation. (pib.nic.in)

[NATIONAL: POWER]

Tata Power's Mundra power plant generates 6,296 MUs in Q1

July 21, 2015. Tata Power said its 4,000 MW Mundra power plant generated 6,296 Million Units (MUs) in the June quarter. The Ultra Mega Power Plant (UMPP) located at Mundra in Kutch district has recently completed three years of operation and generated 62,945.77 MUs from 2012 to 2015. This power plant supplies electricity to eight discoms in five states, namely Gujarat, Rajasthan, Maharashtra, Haryana and Punjab. Gujarat is the largest procurer of power from Coastal Gujarat Power Limited (CGPL) at 47.5 percent, followed by Maharashtra at 20 percent, Punjab at 12.5 percent, and Haryana and Rajasthan at 10 percent each. (www.business-standard.com)

Damaracherla power plant works to begin soon

July 19, 2015. Works on the 4,400 MW super critical thermal power station being set up by the Telangana State Generation Corporation (TSGenco) at Damaracherla in Nalgonda district are likely to be grounded soon with the agency getting environmental clearance for the project recently. A major hurdle has been cleared for the project with the environmental clearance. However, the Union Ministry for Environment and Forests (MoEF) has given the clearance with a rider that the project management should develop green cover in the same extent that would be cleared of forest for the purpose of setting up the thermal power station. The MoEF has given its nod for utilisation of 1,892 hectares (4,730 acres) land against 4,000 ha sought by the State Government. However, such a large extent of land was not required because NTPC-CMD Arup Roy Chowdary had indicated during his recent visit to the city that they would set up the 2,400 MW plant at the complex where they were setting up a 1,600 MW plant at Ramagundam as part of the provision made in the Andhra Pradesh Reorganisation Act that the national power utility set up a 4,000 MW dedicated power plant for Telangana. (www.thehindu.com)

Nabinagar unit likely to generate power by November

July 15, 2015. The first unit (250x4 MW) of Bihar's coal-based thermal plant at Nabinagar is likely to start power by November this year. The joint venture project has been developed by Bharatiya Rail Bijlee Company Limited (BRBCL) with NTPC having 74% equity and the ministry of railways the remaining 26%. The joint venture company was proposed in 2002 with the signing of a memorandum of understanding (MoU). However, the Cabinet Committee on Economic Affairs approved the company in February, 2007. Bihar chief secretary Anjani Kumar Singh said the issues related to land acquisition in execution activities of 4x250 MW of BRBCL and 3x660 MW of Nabinagar Power Generating Company Limited (NPGCL) had almost been resolved. The BRBCL has almost been given possession of the 1,521.24 acre of land. As per the agreement, 75% of the power generated by the NPGCL would be supplied to Bihar and 7.5% will be kept unallocated at the disposal of the Centre. The remaining power will be allocated to other states of the eastern region. The power purchase agreement for total allocation has been signed by all the beneficiaries. (timesofindia.indiatimes.com)

Transmission / Distribution / Trade…

ABB bags ` 1.2 bn order to upgrade three substations

July 21, 2015. ABB India has bagged ` 125 crore order from the Power Grid Corporation of India Limited (PGCIL) for extension of three substations in Vadodara, Manesar and Malerkotla. This is part of a larger order, valued at ` 175 crore, which has been awarded to ABB Group. The order was booked in the second quarter of 2015. Gas-insulated switchgear (GIS) will be used to accommodate the expansion of all three existing substations. While in Vadodara and Manesar this involves the extension of the current 765/400 kilovolt (kV) GIS substations, in Malerkotla the substation will be upgraded from air-insulated switchgear (AIS) to GIS. Commissioning of these three substations is scheduled for end of 2016. ABB's solution will help the state utility augment their substations to meet growing demand in the states of Gujarat, Haryana and Punjab, which form the major part of the country's agricultural belt. ABB India will carry out the installation, testing and commissioning of the substations on site. (timesofindia.indiatimes.com)

About 1.2 mn power men to strike over Electricity Amendment Bill

July 21, 2015. To protest against the Electricity (Amendment) Bill, 2014, about 1.2 million employees of public sector power companies and engineers across India have threatened to go on strike for a day. Announcing its decision, the National Coordination Committee of Electricity Employees and Engineers has written to the Prime Minister, Union power and labour ministers and chief ministers. AIPEF said the proposed amendments were not based on ground realities but were meant only to service the interests of private players, who would ultimately make state power utilities go bankrupt. AIPEF said while 18 states had already opposed the Bill before the Parliament’s standing committee on energy, the Centre was hellbent on passing it for the benefit of corporate houses. (www.business-standard.com)

Tata Power commissions one of the largest radio frequency metering projects in India

July 20, 2015. Tata Power, India’s largest integrated power company has been committed to provide value added services to its consumers. Keeping this philosophy, Tata Power commissioned one of the largest radio frequency (RF) metering projects in India taking a step towards providing error free bills and eliminating the entry process of a utility person in premises for meter reading. The company has benefitted by lowering the carbon footprint involved in a typical meter reading exercise along with saving man-hours and cost of manual meter reading and data punching. The project includes installation of meters with RF communication, data concentrator units (DCU), head end software and meter data acquisition system (MDAS). Meter data is collected every hour through RF mesh network communication and transmitted to a central server using GPRS network. Data received is used for automated generation of bills ruling out any human intervention. The company has been able to achieve a success rate of more than 98 percent for monthly billing using these meters. The company has successfully implemented this low power RF based remote meter reading solution for more than 5,000 retail consumers in residential and commercial complexes in Mumbai. The commissioning of the project from Tata Power is supported by Larsen & Toubro, Cyan Technology (UK) and Neosilica Technologies (Hyderabad). This is the largest end to end project based on RF communication in the country and will surely help in building a strong and sustainable relationship with the consumers. (www.tata.com)

India will lay 7,800 km of power transmission lines through 7 states

July 20, 2015. The government of India approved a 7,800 km-long intra-state power transmission project to connect renewable power projects in seven northern states, including Rajasthan, Gujarat, Andhra Pradesh, Karnataka, Himachal Pradesh, Madhya Pradesh and Maharashtra. The US$1.35 bn (` 8,550 crore) power corridor will be funded by the National Clean Energy Fund (NCEF) (40%), the German bank KfW (40%) and by the States (20%). (www.enerdata.net)

Power exchanges to begin extended market session

July 20, 2015. In a major order, the Central Electricity Regulatory Commission (CERC) has allowed Indian Energy Exchange Ltd (IEXL) and Power Exchange India Ltd (PXIL) to operationalise the extended market session. Currently, at IEXL, the intra-day market session is open from 1,000 hours to 1,700 hours, which will be changed to 0030-2000 hours. In case of PXIL, the intra-day market session at present is open from 0800 hours to 2000 hours, which will now be revised to 0000-2400 hours. Both exchanges currently trade day ahead, term ahead products and renewable energy certificates (RECs). They believe that due to the extension of time, the market players will be able to mitigate their contingency requirements. Both the exchanges have submitted amendments to their respective bylaws and business rules to operationalise the extended market session. IEXL clocks a daily turnover of about 85 million units (MUs) compared to PXIL’s 10 MUs. CERC in its order said the existing products for day ahead contingency and intraday markets would continue to be operated by the exchanges. However, as a principle, the timeline for these products is being extended so that trading window is open for same day delivery (up to 2400 hours) and next day deliver (0000-2400 hours). In case of same day delivery, the trading window will now be opened round the clock for delivery of power on the same day (minimum delivery period - 3 hours after contract execution subject to corridor availability). For next day delivery, the trading window will be opened after declaration of day ahead results and will remain open till end of day. PXIL in its submission to CERC said it has proposed to increase the pre-bid margin from 100% to 105% to cover the statutory charges including transmission charges, operating charges in view of banking hour restrictions. (www.business-standard.com)

Delhi power discoms seek yet another tariff hike

July 19, 2015. Delhi's three private power distribution companies have pitched for early announcement of annual tariff revision. The companies, which have sought up to 20 percent hike in tariff, have communicated to Delhi Electricity Regulatory Commission (DERC) about the resource crunch being faced by them owing to steep rise in power purchase cost. BSES discoms has petitioned the DERC for upto 19 percent hike, while Tata Power Delhi Distribution Ltd (TPDDL) has demanded an increase of 20 percent. The DERC is in the process of finalising the tariff for 2015-16 and is likely to announce the new rates by the end of August after taking views of various stakeholders including the consumers. Making a case for hiking tariff, the discoms have argued that their combined revenue gap due to absence of a cost-reflective tariff has gone upto ` 28,000 crore and the financial position would worsen further if there was no increase in rates. The total under recoveries of BSES Rajdhani Power Ltd and BSES Yamuna Power Ltd have risen to ` 20,000 crore while for TPDDL, it has been estimated at ` 8,000 crore, as per the discoms. The DERC had hiked tariff by upto six percent to compensate the discoms for rise in power purchase cost. The AAP government had strongly criticised the DERC for the hike. DERC said the discoms have been buying 95-98 percent of power as per provisions of the long-term power purchase pacts signed between erstwhile Delhi Vidyut Board (DVB) and state-run power utilities like NTPC. Power experts said Delhi discoms have to incur 60 percent more cost on buying power compared to other states because of the long-term power purchase. (www.ndtv.com)

Siemens wins ` 1.2 bn order from Bangladesh's Power Grid Company

July 16, 2015. Siemens said it has bagged a ` 123 crore order from Power Grid Company of Bangladesh at two sites located in Dhaka. The scope of work for the project involves design, procurement, supply, installation, testing, commissioning of 230/132kV GIS Substation at Shyampur and 132/33kV GIS Substation at Dhamrai- both sites located in Dhaka, it said. (www.business-standard.com)

Private players queue up to bid for intra-state transmission projects

July 15, 2015. Private players, including Alstom T&D, KEC, Kalpataru and Sterlite, are aggressively participating in intra-state transmission projects. Tamil Nadu, Andhra Pradesh, Maharashtra, Rajasthan, Gujarat, Karnataka, Madhya Pradesh and West Bengal have firmed up plans to invest ` 20,000 crore a year to augment their transmission networks. Kalpataru, KEC and Alstom recently bagged contracts in these states. Sterlite has secured the ` 400 crore Maheshwaram transmission project. L&T secured a transmission and distribution work order on engineering, procurement, construction basis from Odisha Power Transmission Corporation. Besides, private players will participate in the ` 1 lakh crore transmission projects to be auctioned by the Centre, as announced by Union Power Minister Piyush Goyal. (www.business-standard.com)

Adani Power wins projects in Chhattisgarh

July 15, 2015. Adani Power has won all three transmission projects in Chhattisgarh worth over ₹ 3,500 crore that were up for auction by the Power Finance Corporation. The company beat Vedanta Group’s Sterlite Grid to win the ₹ 825 crore Chhattisgarh A transmission project. The project only saw two bidders in the financial bid stage because it was a challenging project crossing 70 existing transmission lines in the region. The qualified bidders for the project were Power Grid Corporation, L&T, Essel Infrastructure, Sterlite Grid, Jindal Power, Adani Power, Isolux and Kalpataru Power Transmission Ltd. However, only Sterlite Grid and Adani Power participated in the financial bid stage. While there was more competition for the ₹ 2,000 crore Chhattisgarh B project, Adani Power saw competition from PowerGrid, Sterlite Grid, Essel Infrastructure and Kalpataru Power Transmission Ltd (KPTL). For the ₹ 863 crore Sipat project, Adani Power was the lowest bidder amongst Jindal Power, Sterlite Grid, KPTL and PowerGrid. Sterlite Grid was the ‘L2’ bidder in all the three projects. The company won the Maheshwaram Transmission project worth ₹ 400 crore floated by the Rural Electrification Corporation. All the projects are part of the Government’s plan to auction ₹ 1 lakh crore worth of transmission projects to strengthen the power evacuation infrastructure in the country. (www.thehindubusinessline.com)

Policy / Performance………….

Odisha opposes changes in SBDs for UMPPs

July 21, 2015. Odisha has voiced its opposition to some changes proposed in the standard bidding documents (SBDs) for ultra mega power plants (UMPPs). In the revised SBDs, the Centre was mulling to fix responsibility on the host state for timely completion of critical milestones like land acquisition and rehabilitation & resettlement (R&R). In case of delay in achieving these milestones, the host state would be held accountable and also be liable for penalty provisions. State energy minister Pranab Prakash Das recently wrote to the Union power ministry, flagging off Odisha's concerns and reservations over the changes proposed to SBDs for UMPPs. Non-finalisation of bidding terms by the central power ministry has pushed the Odisha UMPP to the brink of delay. The 4000 MW UMPP is being set up near Bhedabahal village in Sundargarh district. In December last year, the Union power ministry decided to cancel the bidding process for Odisha and Tamil Nadu UMPPs. The bidding process had initiated in 2012. The ministry instead, decided to have a re-look at the SBDs and constituted a committee for the purpose. The power ministry's decision to revise the SBDs stemmed from the pull out of the private players from the bidding process. (www.business-standard.com)

Maharashtra govt plans to retire high cost debt of ` 540 bn of three power companies

July 21, 2015. The Maharashtra government is exploring the option of retiring the high-cost debt of ` 54,000 crore of its three unbundled power firms by raising loans at lower interest rate. The government has held talks with Life Insurance Corporation of India (LIC), National Bank for Agriculture and Rural Development and SBI Caps to raise loans at 9-10 percent. The three companies - the Maharashtra State Electricity Distribution Company (MahaVitaran), Maharashtra State Power Generation Company (MahaGenco), and the Maharashtra State Electricity Transmission Company (MahaTransco) —had taken loans at 11-13 percent following the unbundling of the erstwhile Maharashtra State Electricity Board in 2005. The government is also planning to raise ` 5,000 crore at lower interest rate for the working capital of MahaVitaran with a consumer base of 22.5 million. Further, the government has roped in rating agency CARE to fix the ratings of the three power companies. Simultaneously, the government will complete the financial restructuring plan of MahaVitaran, MahaGenco and MahaTransco, which will further establish their strengths and weaknesses. (www.business-standard.com)

West Bengal govt transfers hydro projects to NHPC

July 20, 2015. West Bengal government has given a fillip to Centre's mega merger plan of all state-owned hydro electric units with National Hydroelectric Power Corporation (NHPC), by handing over state's four hydro power projects with a combined capacity of about 293 MW to the central PSU. These four projects -- Teesta Low Dam-V, Teesta low dam I & II combined, Teesta Intermediate Stage and Rammam Stage-I, all located in District Darjeeling of West Bengal – were so far under West Bengal government-run power agency West Bengal State Electricity Distribution Company Limited (WBSEDCL). Following a state cabinet decision in this effect, West Bengal government has signed an MoU with NHPC, to execute the transfer. According to the agreement all these projects shall be developed on build, own, operate and maintain (BOOM) basis by NHPC. The development comes at a time, when Narendra-Modi government has taken up a plan to merge all central hydro power companies with NHPC and create a mega entity. For this a an initiative has already been taken up for merger of central hydro power utilities — the National Hydroelectric Power Corporation (NHPC), Tehri Hydro Development Corporation, Satluj Jal Vidyut Nigam and North Eastern Electric Power Corporation — into a single entity, which will see NHPC taking the lead role. According to a report prepared by SBI Caps at the behest of NHPC, the plan is to turn NHPC into a mega hydro power entity with a market value of over ` 51,000 crore and a government stake of up to 81 percent. Beside, NTPC, India’s single-largest thermal power company generation capacity of over 43,000 MW, is also asked to focus on its core area, and NTPC too may consider transferring its hydro projects to NHPC if the government takes such an initiative. NTPC is currently constructing 1,500 MW hydro capacity, which are in the various stages of implementation. (www.business-standard.com)

Gujarat plans to relocate existing electricity infra

July 20, 2015. The Gujarat government has decided to undertake a project to relocate existing electricity infrastructure, such as poles and transformers, at a cost of ` 100 crore. The decision has been taken by State Energy and Petrochemicals department recently, state Energy Minister Saurabh Patel said. Apart from relocating existing infrastructure to expedite construction of roads and streets in cities and towns, one of the main objectives of the project is to remove electricity lines hanging dangerously in residential areas. Patel said that it is multi-purpose scheme where up-gradation of electricity infrastructure would also takes place. (timesofindia.indiatimes.com)

CENVAT duty cannot be levied on sale of fly ash: Madras HC

July 18, 2015. The Central Board of Excise and Customs cannot levy Central Value Added Tax (CENVAT) duty on sale of fly ash generated during burning of pulverised coal in thermal power plants, the Madras High Court (HC) has held. In a judgement reserved in the Principal Seat of the High Court in Chennai and delivered in its Bench, Justice S. Vaidyanathan ruled that fly ash would not fall under the purview of excisable goods since it was not a manufactured product. Partly allowing a writ petition filed by Mettur Thermal Power Station (MTPS), a unit of Tamil Nadu Generation and Distribution Corporation (Tangedco), the judge said that excise duty was an incidence of manufacture and therefore it could be levied only on manufactured goods. Taking a cue from a 2003-Supreme Court judgement which had exempted cinders, small pieces of partly-burnt coal, from the purview of excise duty for similar reasons, the judge said that the ratio laid down in that decision would squarely apply in the case of fly ash too. The power station had approached the court challenging a notice issued by the Central Board on March 21, 2014, demanding ` 1.4 crore, along with interest, towards excise duty for sale of fly ash and ` 1.85 lakh for the sale of fly ash bricks. (www.thehindu.com)

Centre yet to decide on Reliance’s Sasan coal blocks

July 17, 2015. The Coal Ministry is yet to take a decision on Reliance Power’s request to allow it to keep mining 20 million tonne per annum from Sasan ultra mega power project’s (UMPP) two coal mines — Moher and Moher Amlohri Extn. In June, the Ministry of Coal had asked the company to restrict mining to 16 million tonne per annum and submit a new mining plan for the same. This was after the Ministry had de-allocated the Chhatrasal block which was given to the Sasan UMPP, as coal from the block was being diverted to its Chitrangi power plant according to a directive from the previous UPA government. The tussle over the coal blocks began after Reliance Power announced its decision to seek termination of the Tilaiya UMPP in Jharkhand. The directive from the previous UPA Government allowed Reliance Power to sell the excess coal to its Chitrangi power plant in Madhya Pradesh. (www.thehindubusinessline.com)

Delhi govt hopeful to get coal block by October

July 17, 2015. The Delhi government is hopeful that the Centre will allocate it a coal block by October this year. Power minister Satyendar Jain said he had a series of meetings with the Centre over the issue and has been assured that the coal block will be allocated at the earliest, following which the government would set up a pithead plant and transmit the power to Delhi. The power minister further said that a number of gas plants have been set up, but with no gas available, they were pointless. The government said that the power they would produce from their thermal plant would be around ` 2-3/unit and will enhance the city's internal power generation. The government had informed the Centre that they wanted to surrender power purchase agreements (PPAs) of about 2,255 MW electricity rationed from eleven central government power plants for Delhi to reduce costs. (timesofindia.indiatimes.com)

Kudankulam-II to be commissioned in 6-8 months

July 16, 2015. The second unit of the Kudankulam Nuclear Power Plant in Tamil Nadu will be commissioned in the next 6-8 months amid efforts to expedite the setting up of 12 atomic plants proposed to be built by Russia in India in two decades. Indian Ambassador to Russia P S Raghavan said discussions are underway on the units III, IV, V and VI to be built at Kudankulam. Process is also underway to identify a site in Karnataka and Andhra Pradesh for a plant which was proposed to be set up in Haripur in West Bengal but could not materialise due to various factors, including protests by locals. Asked about the progress on unit-II of Kudankulam Nuclear Power Plant (KNPP) which is behind schedule, he said work is underway on the unit which will have the capacity to generate 1,000 MW of electricity. (www.ibnlive.com)

'Arunachal received ` 14.9 bn as upfront money for hydel projects'

July 16, 2015. Arunachal Pradesh received ` 1,495.62 crore as upfront money and processing fees in last ten years from various power developers for hydropower projects in the state, Chief Minister NabamTuki informed the Assembly. Taki wanted to know details of the projects and their progress so far. Tuki further informed that MoUs and MoAs were signed with 159 companies, including central PSUs and private companies, to execute power projects in the state with installed capacities of 46,938.02 MW. The Chief Minister said 11 projects have been withdrawn for non-compliance of the MoU and MoA of which four projects have been re-issued after clearing all issues. Tuki informed that an amount of ` 51 crore was spent for restoration of mini and micro hydel projects in the state and works were in progress. Stating that restoration works in 10 hydel projects have been completed, the Chief Minister informed that a few projects which were commissioned several decades back need regular maintenance. Replying to another supplementary raised by BJP Opposition Leader TamiyoTaga on restoration of 2 MW Midpunghydel project which remained defunct, the Chief Minister said work would be completed soon. (www.outlookindia.com)

Govt to offer 26 percent in DVC power plant to railways

July 15, 2015. The government plans to offer a 26% stake in generation-to-irrigation utility Damodar Valley Corporation (DVC)'s coal-fired power plant at Raghunathpur in West Bengal, which is expected to be acquired by central generation utility NTPC, to the Indian Railways. Power minister Piyush Goyal is likely to make the offer to railway minister Suresh Prabhu soon. He is of the view that buying into the project in Purulia district of the state would provide a captive source to the railways and reduce its daily power consumption costs. Goyal said NTPC's takeover of the project will benefit all stakeholders, including the two states — West Bengal and Jharkhand. He has already spoken to the chief ministers Mamata Banerjee and Raghuvar Das, who are believed to have agreed to the plan. DVC has not been able to complete the project because of lack of funds. It has a debt of ` 30,000 crore and ` 8,000 crore arrears — much of it from Jharkhand. The company may not be keen on selling the project to NTPC but the proceeds could reduce its financial burden. Goyal said the government is also working to ensure that DVC gets its outstanding from the Jharkhand government soon. (timesofindia.indiatimes.com)

[INTERNATIONAL: OIL & GAS]

Total starts production from Dalia Phase 1A offshore Angola

July 21, 2015. Total announced that it has started production from Dalia Phase 1A, a new development on the offshore operated Block 17, located 83 miles off the coast of Angola. The Dalia Phase 1A project involves the drilling of seven infill wells tied back to the Dalia Floating Production Storage and Offloading (FPSO) unit. The project will develop additional reserves of 51 million barrels and will contribute 30,000 barrels per day to Block 17’s production, according to Total. Total operates Block 17 with a 40 percent interest alongside Statoil, which holds a 23.33 percent interest, Esso Exploration Angola Block 17 Ltd, which holds a 20 percent interest, and BP Exploration Angola Ltd, which holds a 16.67 percent interest. Through Blocks 17, 0 and 14, Total’s equity production reached 200,000 barrels of oil equivalent per day in 2014. The company’s operated production exceeded 700,000 barrels of oil equivalent per day in 2015, making it Angola’s leading oil operator. (www.rigzone.com)

July 21, 2015. Eni has made an important gas discovery in the Nooros exploration prospect, located in the Abu Madi West license in the Nile Delta, 120 km north-east of Alexandria, Egypt. Preliminary estimates of the discovery account for a potential of 15 billion cubic meters (bcm) of gas in place with upside, plus associated condensates. The new discovery will be put into production in two months’ time through a tie-in to the existing Abu Madi gas treatment plant. At end-2014, Egypt had proved natural gas reserves of 2,167 bcm. (www.enerdata.net)

Exxon’s Guyana oil discovery may be 12 times larger than economy

July 21, 2015. An Exxon Mobil Corp. discovery in the Atlantic Ocean off Guyana may hold oil and natural gas riches 12 times more valuable than the nation’s entire economic output. The Liza-1 well, which probably holds the equivalent of more than 700 million barrels of oil, may begin producing crude by the end of the decade, Raphael Trotman, the South American country’s minister of governance, said. The prospect would be on par with a recent Exxon find at the Hadrian formation in the Gulf of Mexico, and would be worth about $40 billion at international crude price. Guyana produces no oil and its gross domestic product of $3.23 billion in 2014 ranked between Burundi and Swaziland, according to the World Bank. Exxon said it found a 295-foot (90-meter) column of oil- and gas-soaked rock in a subsea region known as Stabroek Block. The well is 120 miles (193 kilometers) offshore and 5,710 feet beneath the sea surface. The discovery may foretell a revival for the Irving, Texas-based company, which has been stung by three consecutive years of declining production and slowing reserves growth. Exxon’s exploration failure rate worsened to 39 percent last year from 33 percent in 2013, according to the U.S. Securities and Exchange Commission. The Guyana discovery would be on par with the combined size of a cluster of three reservoirs Exxon found in the Gulf of Mexico between 2009 and 2011. (www.bloomberg.com)

Production begins at Ungani oil field in Australia

July 20, 2015. Mitsubishi and Buru Energy joint venture (JV) has commenced production at the Ungani oil field in the Canning Basin, located in the Kimberley region of Western Australia. Equally owned by Buru Energy and Mitsubishi, the Ungani field is estimated to have an initial production capacity of 1,250 barrels of oil per day (bopd) and would be increased up to 3,000 bopd later this year. The produced oil will be transported to the port of Wyndham with logistical support from trucking firm Fuel Trans. In an effort to further expand hydrocarbon reserves to more than 100 million bbl, the joint venture is also considering exploring prospects near the Ungani field. The JV partners have recently spudded Praslin 1, as part of the 2015 conventional oil exploration program. Lying 15km from the Ungani, the field is the second being developed under the program. (drillingandproduction.energy-business-review.com)

Premier oil sees high potential in most-sought Mexico block

July 20, 2015. Premier Oil Plc, the London-based producer that won rights to explore for Mexico crude, sees a “very good indication of oil and gas” in the most coveted of the blocks auctioned. Premier, which jointly bid with Talos Energy LLC and Sierra Oil & Gas, observed a spot in its seismic studies of block 7 that is “likely to be oil,” Robin Allan, the company’s Director of North Sea and Exploration, said. Of the 14 blocks auctioned by Mexico for exploration, block 7 received the most interest from producers, including bids from Statoil ASA, Hunt Oil Co. and a group led by Eni SpA. Premier’s group was the only winner, claiming rights to explore for crude in shallow waters off the coasts of the Veracruz and Tabasco states. The group also won rights to explore block 2, which could contain as much as 1 million barrels of oil, Allan said. (www.bloomberg.com)

Ithaca confirms 12k barrel per day target for 2015

July 16, 2015. North Sea-focused independent producer Ithaca Energy has reiterated its target of 12,000 barrels of oil equivalent per day (boepd) for 2015 after producing 12,667 boepd during the second quarter. The firm said that the target figure takes into account planned maintenance shutdown activities during the second half of the year. Ithaca said that progress continues on execution of the "FPF-1" floating production facility modifications programme and sail-away of the vessel to the field remains scheduled for late in the first quarter of 2016, resulting in first hydrocarbons in the second quarter of that year. (www.rigzone.com)

OVL fails to make cut in Mexico's historic oil block auction

July 16, 2015. ONGC Videsh Ltd (OVL), the overseas acquisition arm of Oil and Natural Gas Corporation (ONGC), failed to make the cut in Mexico's first sale of exploration blocks in 88 years, even as global majors stayed away. OVL had on its own bid for two blocks but the offers fell short of the Mexican government's floor for share of profit that ranged from 25% to 40%. The cut-off marks for the blocks for which OVL had bid was not known. Mexico's hydrocarbons commission had pre-qualified OVL, along with global giants such as Chevron and ExxonMobil, to bid for 14 shallow water blocks in the Gulf of Mexico. (timesofindia.indiatimes.com)

Iran no Qatar even with the world’s second-biggest gas reserves

July 15, 2015. Natural gas made Qatar’s citizens the richest in the world within a generation. Even with bigger fuel reserves, Iran will struggle to follow its neighbour’s path. Iran’s own production is consumed by a population of 78 million and an oil industry that injects gas into fields to boost productivity. Qatar, with a population of 2.3 million, now ranks second only to Russia in gas exports, generating about $86 billion last year. While Iran and world powers reached a nuclear deal after almost two years of talks that would ease sanctions and allow more investment, the government in Tehran is contending with domestic gas demand that is doubling every decade. Iran holds 18 percent of the world’s gas and yet accounts for less than 1 percent of trade. Iran has consistently been a net importer of gas for a decade and the development of South Pars, part of the world’s biggest gas field, will probably take longer than expected, according to Moses Rahnama, an analyst at Energy Aspects in London. A “noticeable” increase in output will take at least three years, he said. Gas accounted for less than 4 percent of Iranian export earnings in 2010, compared with 78 percent for crude and condensates, according to data from the Energy Information Administration. Wood Mackenzie Ltd. says domestic gas consumption will reach 190 billion cubic meters (6.7 trillion cubic feet) in 2025, from 150 billion in 2015. Iran doesn’t produce liquefied natural gas and the terminal it is building is only 50 percent complete. The nation had planned to produce its first LNG in 2010. While the project is likely to resume after sanctions are lifted, it probably won’t start before 2018, Rahnama said. While Iran may boost spending in petrochemical and LNG projects, an impact to markets is probably a few years away, Barclays Plc analysts said. Iran needs $100 billion to rebuild its gas industry, and seeks to boost daily production to 1.2 billion cubic meters in five years, from 800 million now, National Iranian Gas Co said. (www.bloomberg.com)

Pemex agrees to pay $295 mn to settle Mexican refinery upgrade disputes

July 21, 2015. Mexican state oil and gas company Petróleos Mexicanos (Pemex) has reached a settlement with Conproca, a joint venture between Siemens and South Korea's SK Engineering & Construction, to pay $295 mn to resolve a long-standing legal issue. The deal was signed originally in March, closing the 14-year-long dispute, but did not disclose final settlement details. Siemens sued Pemex for $690 mn for additional expenses incurred earlier. The issue began with Pemex filing a lawsuit against Conproca in 2012 in the US alleging corruption and cost overruns related to the Cadereyta refinery reconfiguration project (CRRP). It has contended that the joint venture has paid bribes to Pemex officials. Conproca was launched by the two partners to bid for the CRRP located on the outskirts of Monterrey, Mexico's northern state of Nuevo Leon. The refinery reconfiguration project involved construction of ten new plants, expansion of four plants and building a 1,317 km crude oil pipeline. The US courts have dismissed the suit observing that the claims made by Pemex are insufficient to run a case in the US courts. (refiningandpetrochemicals.energy-business-review.com)

Idemitsu JV may double Vietnam refinery capacity

July 16, 2015. A joint venture (JV) including Japanese oil refiner Idemitsu Kosan Co is considering doubling the capacity of a 200,000 barrels-per-day refinery in Vietnam, which is scheduled to start operations in July 2017, to meet rising domestic demand. Idemitsu, Kuwait Petroleum International, Petrovietnam and Mitsui Chemicals Inc are working together to build the Nghi Son refinery in the summer of 2017. The company was not considering such expansion for now, though Vietnam's oil demand is projected to rise strongly in the future. (af.reuters.com)

Transportation / Trade……….

China's Iran oil imports hit two-month high in June

July 21, 2015. China's crude oil imports from Iran rose in June to a two-month high, customs data showed, just as the Islamic nation begins to look ahead to ramping up its exports in the wake of nuclear deal. Iran's largest oil client imported 2.76 million tonnes last month, or 671,800 barrels per day (bpd), up 29.6 percent from May and 26.5 percent from a year ago. Iran's oil minister, Bijan Zanganeh, has said the country is aiming to add 500,000 bpd to output within two months of sanctions being eased, and as much as 1 million bpd in six to seven months. Most analysts do not expect Iran to make a major return to the market until next year because of time needed to implement the nuclear agreement and to revamp the OPEC producer's oil infrastructure. Over the last 2-1/2 years, sanctions put in place by the United States and the European Union cut Iran's crude exports roughly in half to around 1 million bpd. China's shipments from Iran rose in June at about the same rate as its overall crude imports, which were up 27 percent from a year ago. At the same time, China's crude imports from Saudi Arabia jumped 35.8 percent in June to 1.29 million bpd, the highest level since January 2013. That gave the top OPEC producer the No.1 supplier spot again after it dropped to third behind Russia and Angola in May. Still, Russian imports were also up on year, surging 57.2 percent to 920,000 bpd. Imports from Iran in the first half of 2015 were at 589,400 bpd, down 6.1 percent compared to the same period last year. Over all of 2014, China imported roughly 555,000 bpd of Iranian crude. This year, Chinese companies have contracted to lift slightly more than 600,000 bpd of Iranian oil, including a deal with an independent petrochemical maker to supply condensate, a very light oil normally used as a petrochemical feedstock. (www.reuters.com)

Changfeng partners with Tangshan Caofeidian for natural gas business in China

July 21, 2015. Changfeng Energy subsidiary Sanya Changfeng Offshore Natural Gas Distribution and Tangshan Caofeidian Development Investment Group (CFD Group) have signed a joint venture agreement to pursue natural gas trading, distribution, transportation, and related infrastructure construction in China. The 50-50 joint venture, Caofeidian Evergrowth Energy, will have a registered capital of the CNY200mn ($32.6 mn), which will be funded equally by Changfeng and CFD Group. Under the joint venture agreement, both parties will work with a third party in order to establish and operate an energy resource exchange in northern China. Changfeng expects to fund its CNY20mn ($3.2 mn) portion for the registered capital from its internal cash flows. Changfeng Energy is a natural gas service provider for industrial, commercial and residential customers. Till date, the company has developed a natural gas pipeline network as well as urban gas delivery networks, stations, substations and gas pressure regulating stations in Sanya City and Haitang Bay. (transportationandstorage.energy-business-review.com)

Tullow expects gas exports from Jubilee field to resume by mid-August