-

CENTRES

Progammes & Centres

Location

[The ‘Hottest’ Year Ever]

“For those who firmly believe that mandates rather than markets are the best way to control choices of human beings, particularly energy choices, this is the ‘hottest’ year ever. Not only has the World Meteorological Organization announced that 2015 is the hottest year ever on record, influential leaders including the Pope and the Presidents of the World Bank and the United Nations have signalled their determination to make it the hottest year ever for striking a global climate deal…”

Energy News

[GOOD]

The old idea of transporting coal by waterways must be revived to improve transportation efficiency of the sector!

Given the quality of power supplied, power consumers must go on a strike not power sector employees!

[UGLY]

Delhi is trapped in smog because millions are trapped in poverty!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· The ‘Hottest’ Year Ever

ANALYSIS / ISSUES…………

· India’s energy import dependence: Growing anxiety and concerns

DATA INSIGHT………………

· Solar Power Projects in India

[NATIONAL: OIL & GAS]

Upstream…………………………

· D&M submits final report on ONGC-RIL gas dispute

· India’s crude oil output to continue to fall despite govt’s efforts: IEA

· RIL faces cut in gas marketing margin

· Hardy Oil & Gas talks to buy RIL's 90 percent stake in GS01 block

Downstream……………………………

· Stage-1 of Assam Gas Cracker project commissioned

Transportation / Trade………………

· GAIL starts satellite monitoring of its gas pipeline network

· Hyundai looking for new partner to bid for building LNG ships for GAIL

· India's oil import bill likely to dip 35 percent in FY'16

· TAPI gas pipeline project to start from December 13

Policy / Performance…………………

· Govt mulling policy to push O&G investments in Northeast

· Non-subsidised LPG dearer by ` 61.50, jet fuel cheaper

· Data bank for oil exploration biz by fiscal-end: Oil Ministry

· Oil firms to benefit from low rates, price deregulation: Fitch

· Petroleum sector got only ` 3 bn FDI during April-September 2015

· Petrol price cut by 58 paise per litre, diesel by 25 paise per litre

· Time good for India to firm up long-term LNG contracts: IEA

· FAME-India scheme to save ` 600 bn on oil import bill: Govt

· Free gas pricing policy won't help 15-17 Tcf gas discoveries but future finds

[NATIONAL: POWER]

Generation………………

· Coal India misses November production target by 4.42 percent

· Dabhol power plant restarts generation

· MCL targets 250 mt coal production by 2020

Transmission / Distribution / Trade……

· Power sector employees to hold strike on December 8

· Transporting coal via waterways can save ` 100 bn per year: Gadkari

· Railways gets cheaper power from Dabhol plant

· L&T Construction wins power T&D orders valued ` 10.3 bn

Policy / Performance…………………

· India plans to construct 6 more Fast Breeder Reactors

· Govt plans to douse century-old fire to extract coal worth ` 600 bn

· New restructuring package for state discoms a positive: Fitch

· Power deficit dips further, hits fresh record low of 2.4 percent

· "Working on policy to provide electricity in hamlets"

· Govt to give all households in West Bengal 4 energy efficient LED bulbs

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Production begins from Edvard Grieg field offshore Norwegian North Sea

· US lower 48 natural gas output up to record high in September: EIA

· More Russian oil drilling shows its resolve to OPEC

· Dana Gas Group awarded $1.9 bn in Iraq Kurds dispute

· Mexico's Sierra O&G sees first exploratory drill in early 2017

Downstream……………………

· Lukoil's Bulgarian refinery sees crude processing at 6 mt in 2015

· Sinopec offers refineries bonus to export surplus diesel

· Saudi Aramco to invest more in Indonesia's oil and gas sector

· Petrobras says to buy 461k barrels of gasoline from Braskem

· BG Group's Australian LNG plant fully operational

Transportation / Trade…………

· US oil reserve sale reduced in transportation bill deal

· Lithuania expects LNG cargo from Norway on December 15-16

· Mozambique-South Africa gas pipeline to be expanded by 2017

· UAE's Dragon Oil in talks with Turkmenistan on $10 bn TAPI pipeline

· Gazprom says signs 8 year deal to buy all LNG from Cameroon export plant

· Leviathan gas field developers sign LOI to export gas to Egypt

· Gazprom halts gas supply to Ukraine

· PetroChina to sell stake in Trans-Asia Gas Pipeline to China reform for $2.4 bn

· Canadian crude-by-rail exports rebound 38 percent in third quarter

Policy / Performance………………

· Iraqi Kurdistan minister says no link between oil sales and Islamic State

· Scotiabank's soured O&G loans jump 72 percent in fourth quarter

· Crude oil prices remain weak ahead of OPEC meeting

· Mexico reveals bid minimums for December's onshore oil auction

· Iran offers 50 oil projects to foreign investors

· UK uses new powers to rule on Cuadrilla shale gas permits

· Iran plans to start 40 mt per year of LNG projects within three years

[INTERNATIONAL: POWER]

Generation…………………

· FPL argues for new $1.2 billion power plant in Okeechobee County

· Sinohydro starts construction of 750 MW hydroelectric project in Zambia

· Dangote to build 500 MW power plant for Kano

· IFC and OPIC will finance 53 MW power plant in Senegal

Transmission / Distribution / Trade……

· ADB lends $80 mn to upgrade Yangon power grid

Policy / Performance………………

· Dutch parliament votes to phase out coal-fired power plants

· China presents new measures to reform its power sector

· World Nuclear Association urges world leaders to add 1000 GW nuclear energy by 2050

· Australia approves Rio Tinto's Warkworth coal mine expansion

· ADB to provide $800 mn loan to boost power efficiency in Pakistan

· Brazil awards operation licenses for 29 hydropower plants

· Iran's nuclear past may remain unclear even as atomic probe ends

· America to decide whether a nuke can outlive a human

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Delhi trapped in smog as world urged to act on climate change

· Norway's Statkraft forms solar power partnership with India's BLP

· India to give $30 mn to boost global solar energy generation

· Rich nations behind global warming: PM Modi

· India defends emissions targets as Modi heads to Paris for talks

· Environment Ministry asks Haryana, UP & Delhi Governments to set up emergency response mechanism to curb burning of urban waste

· 'India will fulfil responsibilities on climate'

· World must turn to Sun to power its future: PM Modi

· India pavilion will show our commitment to control climate change: Javadekar

· Govt bats for revising RPO target to 10 percent by 2022

· Delhi needs Euro VI urgently to check ever increasing air pollution: IIT Kanpur

· Govt planning $1 bn fund for renewable energy sector: Goyal

· FICCI unveils CEOs pledge on climate responsibility ahead of Paris climate summit

GLOBAL………………

· EU approves UK state aid for RWE biomass-fired power plant

· African Union Introduces $20 bn Renewable Energy Plan

· White House announces 73 new companies to join climate pledge

· Vietnam approves Renewable Energy Development Strategy to 2030

· Dubai plans $27 bn investment in Green Fund to boost renewables

· Germany, Norway, Sweden and Switzerland create $500 mn climate fund

· World headed toward 'suicide' if no climate agreement: pope

· China plans to launch carbon-tracking satellites into space

· US ethanol use set to rise as EPA unveils biofuels targets

· Shiroro to build 300 MW solar power plant

· Finland drafts new energy and climate strategy

· Honour pledge to give $100 bn to developing nations: Ban to West

· Bill Gates to announce multibillion dollar clean-energy fund

· US govt agencies plan 42 percent cut in GHG emissions over 2008-2025

· Japan's CO2 emissions fall 3 percent to 3 year low in FY2014

· Malaysia introduces NEM mechanism for solar PV

· Kazakhstan plans to commission 3 GW of renewable projects by 2020

[WEEK IN REVIEW]

COMMENTS………………

Briefing: International Energy November 2015

The ‘Hottest’ Year Ever

Lydia Powell and Ashish Gupta, Observer Research Foundation

Carbon Constraints

|

F |

or those who firmly believe that mandates rather than markets are the best way to control choices of human beings, particularly energy choices, this is the ‘hottest’ year ever. Not only has the World Meteorological Organization (WMO) announced that 2015 is the hottest year ever on record, influential leaders including the Pope and the Presidents of the World Bank and the United Nations have signalled their determination to make it the hottest year ever for striking a global climate deal.

Signing of a global deal is the story that the world has latched on to as it finds it appealing and is likely to stick to it even if evidence of its ability to change the course of the world is lacking. In the oversimplified media narrative China, India and the United States are in the cage reserved for the defendant and the most of the rest of the world on the benches reserved for the plaintiff in the court room in Paris. India and to a lesser extent China are in the cage primarily on account of their physical size or people numbers. The United States is there because of the size of energy the people of the United States consume. There is a big difference but media generalisations do not worry about such nuances. If there is no-deal, one or all of those in the cage will be assigned blame. India may be singled out for blame as it is too vocal in defending its position. Once an enemy (fossil fuels/coal/India/china or a combination of these) is found and punished in Paris the world is likely to move on with its life of production and consumption not realising that it is this life of production and consumption that causes emissions.

Hydrocarbon Markets

The rejection of Keystone XL by the Obama government came as a shock to Canada in early November. But there was comfort for TransCanada as it received a contract to build a natural gas pipeline to Mexico. This is the year of a Paris Climate Deal and one could not have expected a different decision from Obama. A report by US regulators found that aggressive acquisition and exploration strategies from 2010 to 2014 had led to an increase in leverage making many borrowers susceptible to protracted decline in commodity prices. The trouble for Petrobras of Brazil increased with strikes over pay which reduced oil production by over 200,000 barrels per day (bpd). Low oil prices are reported to be impacting Arab Gulf projects. Saudi Aramco is said to be considering delay of expansion plans for a key oil field and also planning postponement of development of an LNG terminal. The international energy agency (IEA) released its world energy outlook for 2015 (WEO 2015) in November. Some of the key trends that the report predicts are a phase out of fossil fuel subsidies in many parts of the world, decoupling between economic growth and carbon emissions, china’s shift to a less energy intensive growth path, India taking over from China as the driver of growth and the return of Iran to the energy markets. The IEA is cautious in its predictions for oil prices. It expects a rebalancing of the oil market at $ 80/bbl in 2020 but hedges its bet with a high probability for prices staying around $50/bbl in the next decade and moving towards $85/bbl only in 2040. IEA does not see a future for coal with its share in the energy basket falling to 10% by 2040 from about 45% now.

Global oil production exceeded demand by roughly 1 million/bpd destroying hopes of a price rebound. Meanwhile oil production from US shale basins was reported to be declining with the largest declines coming from Eagle Ford. There was speculation over OPEC decisions but most thought that status quo will prevail. A less noticed development was the slashing of natural gas prices by China which could assist in increasing the demand for natural gas.

Coal Markets

November was a bad month for coal as it was painted as the enemy to be killed in Paris but it was also portrayed as a cause of development. The UK announced its ambition to phase out the burning of coal by 2025. Coal fired electricity generation is expected to be replaced by natural gas and renewable as long as coal-burning plants cannot find an effective way to capture carbon emissions.

Coal may now emerge as the fuel for the poor in poor regions. Interestingly it is already reported to be happening in United States where wealthy states like California are moving most aggressively to stop using coal, while poor states like Kentucky and West Virginia cannot do away with coal.

Rich nations are working aggressively to reduce funding for coal projects. The Organisation of Economic Cooperation and Development (OECD) struck a deal to restrict subsidies used to export technology for coal-fired power plants.

On the other hand Japan stated that Japanese exports of advanced technology for coal-fired power plants will help fight global warming. Japanese Prime Minister Shinzo Abe in 2013 pledged to triple the country's export of infrastructure that includes power stations to about 30 trillion yen ($244.88 billion) by 2020.

The similar views proposed by World Coal Association in its report “India’s Energy Trilemma” released last month. The analysis shows that replacing sub-critical coal plants by super-critical or ultra-critical technology saves CO2 at a cost of around $10/ tonne in 2035. By comparison, abating a tonne of CO2 through deployment of large scale renewable can cost up to $40/ tonne even accounting for the cost declines expected through 2035.

Though the report is India specific it applies to all developing countries that cannot absorb high cost of cleaner sources. This is important for developing countries because coal is commodity which needs infrastructure to be erected before coal is mined and where it is used. Huge investment (often financed through debt) along with hard work goes into for developing such infrastructure. One cannot turn them into Non-performing Assets under pressure in a single stroke. The fortunes for coal may turn once a Paris deal is signed and the world finds something else to worry about.

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

ANALYSIS / ISSUES……………

India’s energy import dependence: Growing anxiety and concerns

Kapil Narula*

|

T |

he recently released World Energy Outlook (WEO) 2015 hints that India is moving to the center stage of global energy system. Considering that the IEA has devoted an entire section of the WEO 2015 to India which carries a detailed assessment on India’s current energy scenario, the outlook for its future demand and supply and a discussion on the implications for India’s energy development, India’s growing importance on the world energy scene is apparent.

Energy demand forecast

The New Policies Scenario[1], presented in WEO 2015 forecasts that the energy demand in the world will grow by nearly one-third between 2013 and 2040. While the growth in Chinese energy demand is slowing and the demand from OECD countries reduces by 3%, the net growth comes from developing countries, led by India.

It is forecasted that India’s total primary energy demand will grow by more than 1000 million tones oil equivalent (mtoe) from 2014 to 2040 to reach 1900 mtoe, which will be larger than the growth in any of the regions including China, Africa, South East Asia, Middle East and Latin America. Although renewable energy is forecasted to add to more than 25% of the electricity generation, a large part of the growth in energy demand is likely to be met by oil, coal, and gas. India’s demand for oil will grow by 6 million barrels per day (mbpd) surpassing China’s growth in demand of oil (4.9 mbpd) to reach around 9.8 mb/d in 2040 during the period. India is also forecasted to become the second largest oil importer around 2035 overtaking U.S. which ceded the top spot to China early this year. A similar story unfolds for coal and India’s coal consumption is likely to reach 1,300 mtoe in 2040, with the largest growth in demand (around 750 mtoe) in the world. Although China will lead the demand in growth for natural gas, India’s demand is likely to increase by 100 mtoe during the period. Solar PV is estimated to add to 250 TWh of energy during the period which is marginally lower than the figures estimated for China.

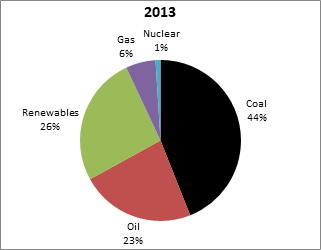

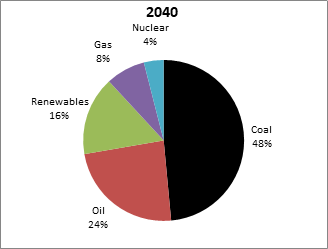

The share of primary energy for India for 2013 and that projected for 2040 is shown in figure 1 (a) and (b). The share of fossil fuels in India’s energy mix is forecasted to increase from 73% in 2013 to approximately 80% by 2040. While the share of oil, gas, coal and nuclear increases marginally, the share of renewable energy actually reduces due to replacement of traditional forms of biomass with commercial energy.

Figure 1 (a) & (b). Share of primary energy for 2013 and estimated for 2040

This reverse transition from renewable (domestic) to fossil fuel based energy sources (imported) despite ambitious targets of electricity generation from solar energy and modern renewables is a regressive step and a cause of concern for India.

Increasing demand-supply gap

The drastic increase in energy demand coupled with weak trends in the growth rate of domestic energy production will lead to an increase in India’s import dependency. India Energy Security Scenarios-2047(IESS-2047)[2], forecasts an increase in India’s import dependence for coal, oil and gas. The forecasted range of import dependency for fossil fuels using four[3] inbuilt scenarios (pre-calculated by the model) for 2027 and 2047 are shown in Table 1.

Table 1. Import dependency for fossil fuels

|

|

2012 |

2027 |

2047 |

|

Coal |

16% |

26- 58% |

44-87% |

|

Oil |

77% |

81-91% |

74-96% |

|

Gas |

26% |

56-65% |

59-75% |

|

Overall |

31% |

44-62% |

48-85% |

The report by CPR which compares results from different modeling studies (albeit to a closer time horizon of 2032) also concludes that there will be a similar rise in fossil fuel import dependence for India. Therefore it is evident that energy imports will become increasingly important in the coming years and unless steps are taken now, it could jeopardize India’s energy supply security and consequently pose a risk to its economic growth and development.

A window of opportunity

Ensuring physical availability of energy and unfettered energy flow is paramount for India’s economic growth. In the light of the recent push to the manufacturing sector and the focus on ‘Make in India’, India needs to ensure adequate availability of energy. Growing import dependency requires that there should be sufficient infrastructure in place for energy imports and domestic distribution of energy. This includes ramping up of port capacity and rail infrastructure for transportation of coal; domestic pipelines for delivery of natural gas, crude oil and oil products; cross country pipelines for sourcing natural gas from gas fields, LNG terminals for regassification of natural gas and storage capacity for crude and LNG.

The second aspect is the cost of energy imports. As commodity prices adjust downward to accommodate the slowdown in world economic growth, the World Economic Outlook released in October 2015 by the IMF predicts that this period of low commodity prices is likely to continue. Thus countries such as India which are net importers of energy and are in the midst of a growth cycle are uniquely placed to benefit from the relatively lower energy prices.

The price of crude oil has dropped close to US $ 40 and based on the futures prices, the average petroleum spot price is expected to stay between US $ 50-55 a barrel till 2017. Though the uncertainty is higher for the longer term, IMF predicts that the price is expected to be close to US $ 60 a barrel in 2019 (moves within the range of US $40-80 per barrel with 68% confidence interval in the period 2015-2019). This drop in prices is attributed to slowdown in energy demand from China, availability of shale gas in the U.S., overproduction from OPEC members and in anticipation of easing of sanctions on Iran. Similarly the price of high grade Australian coal fell by almost 40% between September 2012 and September 2015 and the price of natural gas has also plummeted to one of its lowest historical value to nearly US $ 2/mmBtu.

This gives a window of opportunity for India to further cut down its subsidies on kerosene and LPG (fossil fuel subsidies on prices of diesel and petrol have been already eliminated) and to build up its strategic reserves. It is also important that large scale investments are made in building electricity distribution infrastructure to provide access to electricity and clean energy for cooking for achieving the goal of ‘Sustainable Energy for All’ by 2030.

The last aspect is to lower the demand of energy by giving a push to energy efficiency and energy conservation. As per final energy balances for India, approximately 40% of energy is lost in conversion from primary to final energy and in the energy distribution chain. Although India’s overall energy intensity is expected to reduce from 0.11 tonnes of oil equivalent (toe) per $1,000 of gross domestic product (GDP) in 2013 to 0.05 toe per $1,000 of GDP in 2040, it would be attributable to structural changes in the Indian economy. Hence it is important that efforts are focused to improve the physical energy intensity in various sectors by changes in processes and technology. Restructuring the state electricity boards for increasing the productivity and to increase conversion efficiency in electricity generation plants and distribution of electricity also needs to be undertaken. This would yield long term benefits in terms of resource efficiency and cost savings.

Conclusion

Energy security is a component of national security. It was, is and will continue to remain a prime concern of countries. It is forecasted that based on current trends India will become a global energy player and will drive the world energy demand in the next couple of decades. The increase in the supply-demand gap is inevitable and will lead to an increase in import dependency for fossil fuels for India and strengthening of energy import infrastructure is essential to ensure availability of energy. The fall in commodity prices presents a unique window of opportunity to India to shore up its energy security. While some steps have already been taken in this direction, it is important that India increases the intensity of its efforts so as to meet time bound targets which would reap significant benefits in the long run.

*Commander Kapil Narula is serving officer in the Indian Navy and is currently a Research Fellow at National Maritime Foundation, New Delhi. He is an inter-disciplinary researcher and is awaiting the defence of his PhD titled ‘Sustainable Energy Security for India’ in the field of development economics.

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

Solar Power Projects in India

Akhilesh Sati, Observer Research Foundation

|

Year |

Rooftop |

Ground Mounted Solar Power Projects |

Total (in MW) |

|

2015-16 |

200 |

1,800 |

2,000 |

|

2016-17 |

4,800 |

7,200 |

12,000 |

|

2017-18 |

5,000 |

10,000 |

15,000 |

|

2018-19 |

6,000 |

10,000 |

16,000 |

|

2019-20 |

7,000 |

10,000 |

17000 |

|

2020-21 |

8,000 |

9,500 |

17,500 |

|

2021-22 |

9,000 |

8,500 |

17,500 |

|

Total |

40,000 |

57,000 |

97,000 |

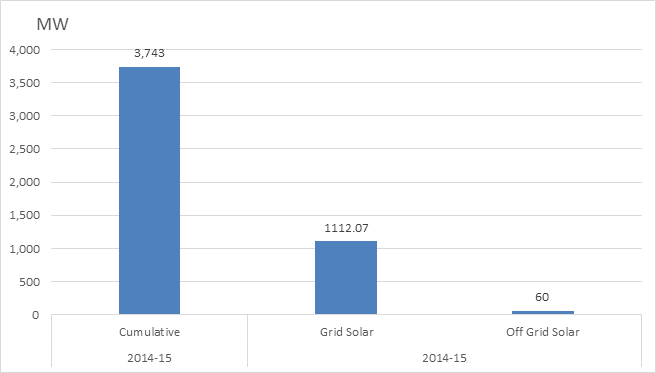

Solar Capacity Achievement till 2014-15

Source: Press Information Bureau, Government of India

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

D&M submits final report on ONGC-RIL gas dispute

December 1, 2015. US-based consultant DeGolyer and MacNaughton (D&M) has submitted its final report on the gas dispute between Oil and Natural Gas Corporation (ONGC) and Reliance Industries Ltd (RIL), establishing that natural gas worth over ` 11,000 crore has migrated from idling KG fields of the state-owned firm to the adjoining KG-D6 block. D&M has submitted its final report to the Directorate General of Hydrocarbons (DGH). The government will examine the report and decide on how and to what extend should ONGC be compensated for its gas being produced by RIL. D&M, in its report, established that reservoirs in ONGC's Krishna Godavari basin KG-DWN-98/2 (KG-D5) and the Godavari Producing Mining Lease (PML) are connected with Dhirubhai-1 and 3 (D1 & D3) field located in the KG-DWN-98/3 (KG-D6) Block of RIL. It states that as much as 11.122 billion cubic meters of ONGC gas has migrated from Godavari-PML and KG-DWN-98/2 to KG-D6. At gas price of $4.2 per million British thermal unit, the volume of gas belonging to ONGC which RIL has produced comes to $1.7 billion (` 11,055 crore). ONGC had in 2013 claimed that RIL had deliberately drilled wells close to the common boundary of the blocks and that some gas it pumped out was from its adjoining block. D&M was jointly appointed by ONGC and RIL to find if the neighbouring fields are connected. (www.firstpost.com)

India’s crude oil output to continue to fall despite govt’s efforts: IEA

November 30, 2015. India's crude oil production will continue to fall in the next quarter century despite the government's ambitious targets, declining to less than half the current output as new reserves fail to compensate for the decay in existing fields, the International Energy Agency (IEA) has said. The Narendra Modi government has set a target of cutting oil import dependence by 10% in the next seven years as it hopes to reverse the decline in domestic oil output through a slew of policy measures, fresh investments and technological interventions. But the Paris-based agency has poured cold water over the government's plan, underlining in its 'India Energy Outlook' report that low-quality reserves and insufficient policy responses will make the country more dependent on imports. By 2040, India's imports will rise to 90% of the overall oil demand, from 70% at present, according to the IEA. India's crude oil production fell marginally in 2014-15 and was about the same in the seven months of the current fiscal as that a year-ago period. Crude oil production will fall 3.5% annually to 0.3 million barrels a day (mbd) in 2040 from 0.7 mbd in 2013, as per the IEA, turning India into the second-largest oil importer, behind China. During this period, oil demand in India will grow 4.6% annually, as per the projection. The oil block in Rajasthan, operated by Cairn India, contributes about a quarter to the country's crude oil output. Most other contributions come mainly from the fields operated by ONGC, and Oil India. Proven reserves of 5.7 billion barrels against an annual crude demand of 1.4 billion barrels, and increasing every year, underline the "stark" mismatch between domestic resources and needs of the country, the agency said. India's record in attracting big investments to the upstream sector has been dismal. Of the 254 blocks awarded under the New Exploration and Licensing Policy in about 15 years, only 128 discoveries have been made and just 11 fields developed. BP is perhaps the only global oil company currently invested in the upstream sector. The government has just announced new financial terms to attract developers for 69 marginal fields set to be auctioned next year, and plans to replicate these terms in its policy being finalised for major blocks. But low oil prices can dampen investor interest. According to the IEA, natural gas output will increase to 89 billion cubic meters (bcm) in 2040 from 35 bcm in 2013, with a 3.6% growth a year. About 80 bcm of natural gas will have to be imported to meet local demand in 2040. Most gas produced in the country is priced according to a formula set by the government last year, according to which the local prices have dropped a quarter since March, tracking global decline. The gas price will climb from about $4 per unit now to $7 in 2025 and $9 in 2040, according to the agency. India needs to develop some 2,000 bcm of new gas resources until 2040 but some of the gas needed as early as 2020s will require a higher price than that implied by the existing formula, or a premium attached to it, the IEA said. (energy.economictimes.indiatimes.com)

RIL faces cut in gas marketing margin

November 29, 2015. Reliance Industries Ltd (RIL) is facing a 40 percent cut in the marketing margin that it charges on selling KG-D6 gas to fertiliser and LPG plants after the government notified a ceiling of ` 200 per thousand standard cubic metres (scm). RIL was charging $0.135 per million British thermal unit (mBtu) as margin to hedge marketing risks on the sale of its eastern offshore KG-D6 gas. This is over and above the gas price of $4.24 per mBtu. The marketing margin being fixed at net calorific value (NCV) basis on 10,000 kilocalorie (kcal) will at current foreign exchange rate translate into a levy of $0.79-0.8 per mBtu, the Oil Ministry said. Had the government fixed the margin at 8,300 kcal, the margin would have come to $0.85 per mBtu. The marketing margin charged on gas produced from Oil and Natural Gas Corporation's fields is ` 200 per thousand scm and will not be changed following the notification. However, for RIL, there will be a 40 percent cut as all of its 11-1 million standard cubic meters per day of KG-D6 gas is sold to fertiliser plants. The oil ministry had in December 2013, gave freedom to gas retailers, including RIL and GAIL (India) Ltd, to fix the marketing margin they want to charge on the sale of natural gas to consumers other than urea manufacturing units and LPG plants. It had decided that the government needed to regulate the marketing margin for supply of domestic gas to urea and LPG producers, as the same had implications on the Centre's subsidy outgo. Both urea and LPG are subsidised. GAIL markets gas produced from ONGC fields. The Petroleum and Natural Gas Regulatory Board (PNGRB) was asked to suggest the marketing margin for the same. The PNGRB recommended the range of ` 150-200 per thousand scm. (ww.telegraphindia.com)

Hardy Oil & Gas talks to buy RIL's 90 percent stake in GS01 block

November 26, 2015. UK's Hardy Oil & Gas plc said it is in talks to acquire Reliance Industries' entire 90 percent stake in a gas discovery block off the Gujarat coast. RIL wants to exit GujaratSaurashtra offshore basin block (GS01) as it feels that reserves discovered so far are not economically significant. It said the completion of this process was pending the resolution of a longstanding liability associated with unfinished minimum work programme that is under consideration with the Government of India since 2009. HardyReliance have told the government the matter of possible liquidated damages associated with the two firms not completing their committed drilling programme, which is under consideration of the government since 2009, needs to be closed out prior to the conclusion of the acquisition process. Hardy currently owns 10 percent interest in the block where a gas discovery, named Dhirubhai33, was made in 2007. The well that discovered the reserves flowed 18.6 million standard cubic feet per day of gas and 415 barrels of condensate during tests. The GS01 licence is located in the GujaratSaurashtra offshore basin off the west coast, northwest of the prolific Bombay High oil field, with water depths varying between 80 meters and 150 meters. The retained discovery area covers 600 square kilometers. (economictimes.indiatimes.com)

Downstream………….

Stage-1 of Assam Gas Cracker project commissioned

November 29, 2015. The first phase of long-delayed ` 9,285 crore Assam Gas Cracker project, the first petrochemical project in the North East, has been commissioned. The plant has started producing ethylene, which will form feedstock for manufacturing polymers that are basic building blocks of plastics, GAIL (India) Ltd said. LLDPE/HDPE unit will be made operational after receipt of ethylene from the cracker plant. GAIL holds 70 percent interest in Brahmaputra Crackers and Polymers Ltd (BCPL) while the remaining 10 percent is equally split between Oil India Ltd (OIL), Numaligarh Refineries Ltd (NRL) and the Assam government. The Centre has approved a capital subsidy of ` 2,136 crore and a feedstock subsidy of ` 908.91 crore for a 15 year period for the project with an exemption of excise and income tax for 10 years. GAIL and BCPL have already signed a deal for marketing petrochemical products sold at the plant. The feedstock for the project will be natural gas and naphtha. OIL and ONGC will supply natural gas and naphtha shall be supplied by NRL. (indiatoday.intoday.in)

Transportation / Trade…………

GAIL starts satellite monitoring of its gas pipeline network

November 26, 2015. GAIL (India) Ltd said it has launched satellite surveillance portal to monitor its 13,000 km of gas pipeline network with a view to address security concerns. The move follows an unnoticed corrosion in its pipeline in Andhra Pradesh causing gas leakage and a massive fire in East Godavari district in June 2014, killing at least 18 persons. The company believes space technology can be efficiently used for monitoring the pipeline Right of Use (RoU). It has over 13,000 km of pipeline network wherein monthly monitoring of pipeline ROU at present is being carried out through helicopter surveys. The portal is operated with manual as well as auto-change analysis options to monitor the changes along natural gas pipeline Right of Use (RoU). The change analysis can be made with the help of this technology within the ROU and also outside the ROU up to 1 km risk zone. GAIL developed an application from which the pictures taken locally from any mobile describing the actual scenario can be uploaded instantly to the portal. To establish the technical feasibility of utilising space technology for its pipeline applications, GAIL started the study with Imageries from Indian Satellites and later shifted to very high resolution foreign satellites. Pipeline securities is a major issue across the world and with recent progress in satellite sensing technology, availability of new high resolution satellites and object oriented image analysis, there is a possibility to introduce space technology for pipeline monitoring applications. (indiatoday.intoday.in)

Hyundai looking for new partner to bid for building LNG ships for GAIL

November 26, 2015. Korean shipbuilder Hyundai Heavy Industries is scouting for a new local partner to replace L&T so that it can bid for building liquefied natural gas (LNG) ships for domestic GAIL India, a key MakeinIndia push in the oil sector. Hyundai has reached out to both private and staterun shipyards, without confirming whether any tieup has been firmed up. If Hyundai is unable to form a consortium with a local shipyard soon, the orders for all nine or more ships might be just split between the two likely contenders, Samsung and Daewoo. This can potentially raise the delivery risk for GAIL, which is already running late in acquiring ships. L&T's shipbuilding arm has broken ties with Hyundai for building LNG ships primarily due to a strategic shift towards the defence sector where prospects have brightened with the government's increased resolve to raise local production. About six months ago, L&T, which operates two shipyards at Kattupalli in Tamil Nadu and Hazira in Gujarat, had signed an initial agreement with Hyundai for technology transfer and joint building of LNG carriers in India. This was a result of the diplomatic push by India, which convinced the Korean government and the companies to agree to transfer complex technology for building LNG ships in India, advancing Prime Minister Narendra Modi's MakeinIndia initiative for increased manufacturing in the local economy. Kochi Shipyard also tied up with Samsung Shipyard and Reliance's Pipavav Shipyard with Daewoo Shipbuilding hoping to bid for GAIL's LNG ships. GAIL needs to charter at least nine LNG vessels, of which at least a third need to be built in India, to carry home up to 5.8 million tonne annually from the US from December 2017. The ship liners have to bid for GAIL's order and also simultaneously tieup with shipbuilders such as Hyundai or Samsung that will build at least a third of the vessels in India in partnership with local yards such as Kochi or Pipavav. GAIL's previous bid to charter LNG ships earlier this year failed to attract foreign bidders reluctant to transfer technology and build ships in India, triggering Indian diplomatic efforts. Another assurance GAIL has recently given to possible bidders is not to impose penalty on ships for delays in loading and unloading due to congestions at the US or Indian terminals. According to the GAIL tender document, the vessels from foreign shipyards have to be delivered between JanuaryMay 2019 and from Indian shipyards between July 2022 and June 2023. An LNG vessel costs about $200 million on average. The LNG ships proposed to be built at home will have up to 49 percent Indian shareholding and a longer construction time compared to overseas carriers, aimed at boosting the confidence of foreign shipyards hoping to manufacture in India. (economictimes.indiatimes.com)

India's oil import bill likely to dip 35 percent in FY'16

November 25, 2015. India's crude oil import bill is likely to dip by 35 percent to $73 billion this fiscal as global energy prices slumped on weak demand. India had imported 189.43 million tons of crude oil in 2014-15 for $1,12,744 billion or ` 6.87 lakh crore. This fiscal the imports are projected at 188.23 million tons, almost the same level as last year. According to data available from Petroleum Planning & Analysis Cell (PPAC) of the Ministry of Petroleum & Natural Gas, the country imported 114.9 million tons of crude during April- October for $43.6 billion. Going by the trend, PPAC projected an import of 188.23 million tons for $73.28 billion or ` 4.73 lakh crore. While the April-October 2015 imports are based on actuals and for November 2015 to March 2016, the imports are estimated at $55 per barrel of oil and an exchange rate of ` 65 to a US dollar. An $1 per barrel change in crude price impacts the net import bill by ` 3,513 crore (` 35.13 billion) or $0.54 billion. Similarly, ` 1 variation in exchange rate impacts the import bill by ` 2,972 crores ($0.46 billion). The basket of crude oil that India buys averaged $55.79 per barrel during the first half of current fiscal as against $84.16 a barrel average in full 2014-15 fiscal. The Indian basket had averaged $105.52 per barrel in 2013-14. Besides crude oil, India also imported 16.5 million tons of petroleum products for $6.5 billion in April-October, according to the PPAC data. This compared to 12 million tons of import for $8 billion in the same period last fiscal. Petroleum product exports too declined to 33.6 million tons in April-October from 37.1 million tons a year ago. India earned $17.3 billion this fiscal from exports as compared to $32.2 billion last year. The growth in consumption was led by 7 percent to 42.6 million tons. LPG demand rose to 10.9 million tons from 10 million tons in 2014 while petrol demand was up 14.5 percent to 12.6 million tons. Fuel consumption registered a robust growth of 17.5 percent in October to 15.2 million tons. Except for kerosene, all other products recorded a positive growth. (www.rediff.com)

TAPI gas pipeline project to start from December 13

November 25, 2015. The ground-breaking ceremony of the proposed multibillion dollar 1,735 kilometre gas pipeline connecting Turkmenistan, Afghanistan, Pakistan and India will start from December 13, Turkmenistan Ambassador to Pakistan Atadjan Movlamov has said. The trans-national gas pipeline project known as TAPI, is intended to carry 33 billion cubic meters of gas annually through the Afghan cities of Herat and Kandahar and terminate in Fazilka, a border town in India's Punjab state. Turkmenistan is said to have the world's fourth-largest gas reserves, but currently exports almost all of it to China. TAPI is vital for economic growth of regional countries, Pakistan's Inter-Provincial Coordination Minister Riaz Hussain Pirzada said. He said TAPI project is vital for Pakistan's energy needs and would strengthen relations between Islamabad and Ashgabat. (timesofindia.indiatimes.com)

Policy / Performance………

Govt mulling policy to push O&G investments in Northeast

December 1, 2015. Government is considering a special policy dispensation to promote oil and gas (O&G) investments in the Northeast region, the Oil Ministry said. The oil and gas sector in Northeast region is confronted with several challenges ranging from demand-side issues to infrastructure to availability of advance technology to arrest the natural decline in oil production, the Oil Ministry said. At present, North East region supply 10 percent of the gas and 12 percent of the oil requirements of the country. Oil production has come down from 4.84 million tonnes to 4.54 million tonnes between 2011 to 2015 and refineries in the region are now being fed from imported crude oil. (news.niticentral.com)

Non-subsidised LPG dearer by ` 61.50, jet fuel cheaper

December 1, 2015. The price of non-subsidised cooking gas cylinder a consumer buys on exhausting the subsidy quota, was hiked by ` 61.50 per cylinder while aviation turbine fuel (ATF) rates were marginally reduced by 1.2 percent. Allowing for local levies, the market price of non-subsidised LPG (liquefied petroleum gas) cylinder of 14.4 kg is now ` 606.50 in Delhi, ` 636.50 in Kolkata, ` 618.50 in Mumbai and ` 621 in Chennai. This is the second straight increase in non-subsidised cooking gas rates. Prices were hiked by ` 27.5 on November 1. The three state-run oil marketing companies (OMCs) have reduced petrol and diesel prices in the national capital by 58 paise per litre and 25 paise per litre respectively. OMCs said that the hike in LPG cylinder rates was owing to a hardening of global rates that has also led to the subsidy being paid on cooking gas going up from ` 127.18 to ` 188.68 per cylinder. The government subsidy on cooking gas is paid directly into consumers' bank accounts. The aviation turbine fuel (ATF) price in Delhi, however, was cut by ` 526.2 per kilolitre (kl), or 1.2 percent, to ` 44,320.32 from ` 44,846.82 per kl. This is the third straight monthly reduction for jet fuel since October. OMCs revise jet fuel and non-subsidised LPG rates once a month. (www.business-standard.com)

Data bank for oil exploration biz by fiscal-end: Oil Ministry

December 1, 2015. A National Data Repository with information related to oil and gas exploration in India will be ready by the end of this fiscal. The National Data Repository is being set up and it should be ready by March 2016, the Oil Ministry said. Work on the project has been going for a long time. According to information on the National Data Repository on the Directorate General of Hydrocarbons (DGH) website, the data bank will provide reliable exploration and production data for India with provisions for seamless access and on-line data management. The data bank will have geo-scientific data, facilitate data reporting and exchange as well as support an open acreage system for an improved exploration and production business environment in India. (www.thehindubusinessline.com)

Oil firms to benefit from low rates, price deregulation: Fitch

December 1, 2015. Fitch Ratings said low oil rates and price deregulation in India's oil and gas sector will have a positive impact on the rated companies in the sector, especially the oil refining and marketing firms. Upstream companies like Oil and Natural Gas Corporation (ONGC) will benefit from having to offer lower discount on crude oil they sell to refiners following greater clarity on the fuel subsidy-sharing formula. Fitch expects refining margins to narrow from January-June levels this year, although margins will remain "relatively robust in 2016". The sector outlook for Indian oil and gas entities is negative in 2016. Fitch said low crude-oil prices and diesel price deregulation would be positive for marketing firms Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) as that would trim their under-recoveries on subsidised fuels, working capital and related debt requirements. It said benchmark Brent oil price may stay at $55 per barrel for one more year. The government has, however, proposed in October 2015 to relax natural gas price controls for new fields to incentivise exploration and production activities. (profit.ndtv.com)

Petroleum sector got only ` 3 bn FDI during April-September 2015

November 30, 2015. Oil Minister Dharmendra Pradhan said that the Government is encouraging Foreign Direct Investment (FDI) in order to supplement domestic investment and technological capabilities in the petroleum sector. According to the FDI data provided by the government, the FDI inflow in the petroleum sector is a meagre ` 302.62 crore in the April-September 2015, compared to ` 6495.67 crore in 2014-15. The figures for 2013-14 were ` 678.39 crore and ` 1192.57 crore for 2012-13. (energy.economictimes.indiatimes.com)

Petrol price cut by 58 paise per litre, diesel by 25 paise per litre

November 30, 2015. The price of petrol was cut by 58 paise per litre and that of diesel by 25 paise, reversing the trend of increasing rates, on global cues. Petrol will cost ` 60.48 per litre from mid-night tonight in Delhi as against ` 60.70 a litre currently. A litre of diesel will cost ` 46.55 compared with the ` 46.80 now, Indian Oil Corporation (IOC) said. The price cut more than reverses the hike of 36 paise a litre in petrol rates effected on November 16, the first increase in five months. Similarly, in the case of diesel, it reverses the three rounds of hikes since October — the last being 87 paise a litre on November 16. Prior to the November 16 hike, petrol price had been slashed on four occasions — by ` 2.43 on August 1, ` 1.27 on August 16, ` 2 on September 1 and 50 paise on November 1. Diesel rates were not changed on November 1, but hiked by 95 paise on October 16 and 50 paise on October 1. Rates of diesel were last cut by 50 paise on September 1. State-owned fuel retailers — IOC, BPCL and HPCL — revise petrol and diesel prices on 1st and 16th of every month based on average imported cost and rupee-dollar exchange rate in the previous fortnight. (www.financialexpress.com)

Time good for India to firm up long-term LNG contracts: IEA

November 28, 2015. India must tie up long-term LPG contracts now as global prices are low and there could be an additional downward pressure on prices in the future as new players enter the market, Executive Director of the International Energy Agency (IEA), Fatih Birol said. Birol commented on the future of oil prices, a move unusual for the normally reticent IEA. Oil Minister Dharmendra Pradhan said that India’s rising energy stature globally was well-deserved. The India Energy Outlook report predicts that India will contribute more than any other country to the rise in global energy demand by 2040. However, it adds that on a per capita basis, India’s energy demand will still be 40 percent below the world average at that time. Natural gas consumption is expected to triple by that time, to 175 billion cubic metres. However, at eight percent, it is still expected to contribute a very small proportion of the energy mix in the country. (www.thehindu.com)

FAME-India scheme to save ` 600 bn on oil import bill: Govt

November 26, 2015. The FAME-India scheme offering incentives on hybrid and electric vehicles will help save ` 60,000 crore annually on the country's oil import bill by 2020, the government said. India's crude oil import bill is likely to drop by 35 percent to $73 billion this fiscal on lower global energy prices and weak demand. India had imported 189.43 million tonnes of crude oil in 2014-15 for ` 6.87 lakh crore. This fiscal, the imports are projected at 188.23 million tonnes, almost the same level as last year. FAME-India is short for Faster Adoption and Manufacturing of Hybrid and Electric vehicles in India and part of the National Electric Mobility Mission Plan. The scheme, which was launched in April, envisages ` 795 crore support in the first two fiscals starting with the current year. The Heavy Industries Ministry has estimated a total requirement of about ` 14,000 crore for the scheme. The ministry said the government intends to gradually convert two-, three-, four-wheelers as well as commercial vehicles and buses to hybrid and electric vehicles. The ministry said he has called a meeting on December 9 to ask for cooperation from all state governments for the scheme. The government had issued a notice to German car major Volkswagen after testing agency ARAI found "significant variations" in on-road emission levels in the auto maker's diesel models of Jetta, Octavia, Audi A4 and Audi A6 in India. (www.business-standard.com)

Free gas pricing policy won't help 15-17 Tcf gas discoveries but future finds

November 25, 2015. Government move to free natural gas pricing will not resolve the issue of economically developing already discovered 15-17 trillion cubic feet (Tcf) of gas reserves as the policy will only apply to future finds. The oil ministry's proposal to make natural gas prices market driven for blocks or areas awarded in future exploration licensing rounds/auctions is a forward looking policy framework. Pricing and marketing freedom will help develop and manage a vibrant oil and gas market. However, it does not resolve the issue of economically developing the already discovered 15-17 Tcf of natural gas, which can yield an additional 100 million standard cubic meters per day by 2022 to help reduce import dependency. The existing capped natural gas price of $4.24 per million British thermal unit is not enough to support multi-billion dollar investment for developing the gas finds, most of which are in deep sea and difficult areas. (www.firstpost.com)

[NATIONAL: POWER]

Generation……………

Coal India misses November production target by 4.42 percent

December 1, 2015. Coal India's production stood at 47.47 million tonnes in November, down by 4.42 percent from the targeted output level for the month. Coal India Ltd (CIL) said the actual coal production was 47.47 million tonnes in November this year, while the offtake was 45.33 million tonnes in the same month. During the April-November period of this fiscal, total coal production was 321.38 million tonnes, it said. The government has set one billion tonne production goal for the company by 2020. The corresponding figure for the current fiscal is 550 million tonnes. Coal India missed the production target for 2014-15 by 3 percent, recording an output of 494.23 million tonne. The company accounts for more than 80 percent of the domestic coal production. (www.business-standard.com)

Dabhol power plant restarts generation

November 26, 2015. The Dabhol power plant in Maharashtra recommenced electricity generation after remaining shut for nearly two years. The Dabhol power plant, owned by Ratnagiri Gas and Power Private Ltd (RGPPL), restarted electricity generation after having been shut for nearly two years due to shortage of domestic gas, the power ministry said. The plant is initially producing 290 MW power which will be sold to the Indian Railways, it said. RGPPL, promoted by NTPC and GAIL, was set up to takeover and revive the assets of Dabhol Power Company project. The company has 1,967 MW capacity power plant located at village Anjanwel, in Ratnagiri district in Maharashtra, nearly 330 km away from Mumbai. (www.newkerala.com)

MCL targets 250 mt coal production by 2020

November 26, 2015. Mahanadi Coalfields Ltd (MCL), a wholly owned subsidiary of Coal India Ltd, has set 250 million tonne (mt) of coal production target by 2020 along with diversification into power generation and transmission sectors. The company is setting-up a 2 x 800 MW super critical thermal power plant at its Basundhara area in Sundergarh district besides a joint venture with transmission utility Neelachal Power Transmission Company Pvt Ltd. The company has entered into joint venture with Odisha government and the railways to form a company-Mahanadi Coal Railway Ltd- to boost the rail development project and strengthen transport communication network in the state. Coal production from MCL is likely to get a fillip as Indian Railways is expected to complete the 52-kms Barpali-Jharsuguda line by June 2016, solving the major evacuation problem in the coal-rich Basundhara fields in Sundergarh district of Odisha. The completion of single-line at the estimated cost of ` 1,007 crore, is projected to increase off-take from MCL by 35 million tonne. (www.business-standard.com)

Transmission / Distribution / Trade…

Power sector employees to hold strike on December 8

December 1, 2015. A power sector employees’ and engineers’ union said a day-long strike on December 8 to protest against Electricity (Amendment) Bill, 2014, is unavoidable as negotiations remained deadlocked. About 1.2 million employees and engineers from the sector are likely to participate in the strike. According to the All India Power Engineers Federation (AIPEF), National Coordination Committee of Electricity Employees and Engineers (NCCOEEE) has already served the strike/work boycott notice to Power Minister Piyush Goyal. AIPEF said that besides opposition of power employees and engineers, central government has placed Electricity (Amendment) Bill 2014 on agenda of Lok Sabha for Winter Session. (www.business-standard.com)

Transporting coal via waterways can save ` 100 bn per year: Gadkari

November 28, 2015. Inland waterways can not only boost the movement of goods and passengers across the country, but will also help in saving about ` 10,000 crore annually in transporting coal, Shipping Minister Nitin Gadkari said. The minister said that he is hopeful of Parliament's nod on the bill to convert 111 rivers across India into National Waterways in the current Winter Session. The waterways is a cheaper and environment friendly medium for transporting of goods, he said. The minister said that port sector in India has turned around under the present government and those managing ports have been directed to improve the performance. Necessary permissions and approvals for undertaking such assignments have been completed, he said. (www.newindianexpress.com)

Railways gets cheaper power from Dabhol plant

November 26, 2015. The Railways has started receiving cheaper, reliable power from Dabhol power plant in Ratnagiri since morning. It will result in saving approximately ` 1,000 crore every year. The Railways had decided to buy electricity from the Dabhol plant, offering a lifeline to the 1,967 MW power project now owned by Ratnagiri Gas and Power Pvt Ltd. The national transporter will, in turn, benefit from lower tariffs. The proposal to source 500 MW from the Maharashtra-based project at ` 4.70 per unit is part of the railways' plan to slash its electricity purchase cost to less than ` 5 per unit from the present average of around Rs 7-8 per unit. (timesofindia.indiatimes.com)

L&T Construction wins power T&D orders valued ` 10.3 bn

November 26, 2015. The Power Transmission & Distribution (T&D) Business of L&T Construction has won orders worth ` 1038 crores in the international and domestic markets in November 2015. Larsen Toubro Saudi Arabia LLC, a fully owned subsidiary of LT, has bagged an order valued at SAR 405.75 Million (USD 108.2 Million) for the construction of five 132 kV Substations at Hail area from the National Grid, Saudi Arabia, a subsidiary of Saudi Electricity Company. The scope involves detailed designing, engineering, testing and commissioning of the 132 kV gas insulated switchgear, 132/13.8 kV, 50/67 MVA power transformers, 132/33 kV, 80/100 MVA power transformers, 13.8 kV switchgears, 33 kV switchgear, control protection system, substation automation system, HVAC, Novec firefighting system with associated auxiliary systems and civil works. These projects are in the central province of Saudi Arabia and are scheduled to be completed in 24 months. In the domestic market, the business has bagged an order from the Odisha Power Transmission Corporation Limited (OPTCL). Forming a part of the power system improvement project in the state capital, the order is for engineering, supply, erection and commissioning of several KMs of underground EHV HV cable networks, compact substations and other distribution elements in the city of Bhubaneswar, Odisha. (www.newkerala.com)

Policy / Performance………….

India plans to construct 6 more Fast Breeder Reactors

December 1, 2015. India is planning to construct six new Fast Breeder Reactors over the next 15 years, Chairman and Managing Director of Bharatiya Nabhikiya Vidyut Nigam Ltd (BHAVINI), P Chellapandi. BHAVINI, the implementing arm of the Department of Atomic Energy, has plans to construct the reactors in next decade and a half. Country's first 500-MWe Prototype Fast Breeder Reactor (PFBR) at Kalpakkam, around 70 km from Chennai, being set up by BHAVINI, is expected to become critical in March or April 2016, P Chellapandi, said. On the first 500-MWe PFBR being set up, he said the PFBR construction is over and they are seeking clearance from the Atomic Energy Regulatory Board (AERB) in phases for sodium charging, fuel loading, reactor criticality and power rising (generation). (www.ndtv.com)

Govt plans to douse century-old fire to extract coal worth ` 600 bn

December 1, 2015. The government is looking to douse a century-old fire that has blocked the extraction of high-quality coal worth an estimated ` 60,000 crore from the underground mine, with plans to relocate people settled in the area. The plan is to convert the mine at Dhanbad in Jharkand into an opencast one to extract reserves of 195 billion tonnes by extinguishing the fire that has been burning at least since 1916, when it was detected. Power and Coal Minister Piyush Goyal has sought land from DVC and Jharkhand to relocate more than 1 lakh families living in an area of about 500 sq km. The field is owned by Coal India Ltd (CIL) subsidiary Bharat Coking Coal Ltd, which is primarily engaged in the mining of coking coal. It meets more than half the coking coal requirement of India's steel sector. India imports most of its coking coal requirement of around $4 billion. Putting out the fire would mean saving on some of this amount. The government has an ambitious production target of 1 billion tonnes of coal by 2019-20. According to coal secretary Anil Swarup, the government has already identified mines with assets of more than 908 million tonnes. In 1975, a Russian team had tried and failed to put out the fire. Later, the World Bank suggested turning it into an opencast mine. However, previous governments haven't been able to do this following disputes with residents, small businessmen and the local mafia who have been mining small quantities of coking coal. (energy.economictimes.indiatimes.com)

New restructuring package for state discoms a positive: Fitch

November 30, 2015. Terming the new restructuring package offered to state discoms as a positive, Fitch said states opting for the package and delivering on loss reductions over the medium-term is essential for the success of the programme. The agency sees the new restructuring package offered to the state discoms in November 2015 as a positive, the rating agency said. Successfully addressing the weak financial positions of state distribution companies (discoms) is key to improving the health of India's power sector, it said. The weak fiscal position of these entities has led to sustained delays in payment to market participants and weak offtake from power generators, in addition to increasing the risks associated with much-needed investment in the sector, it said. Fitch said it forecasts substantial capex to continue in 2016 for the rated utilities in India, weighing on their financial profiles. However, it maintains a stable outlook on the utilities sector and ratings of Indian discoms in 2016, it said. In a bid to rescue almost bankrupt state electricity retailers, the Cabinet had approved a scheme for rejig of ` 4.3 lakh crore debt of the utilities besides measures to cut power thefts and align consumer tariff with cost of generating electricity. (www.businesstoday.in)

Power deficit dips further, hits fresh record low of 2.4 percent

November 30, 2015. Government has said the power deficit in the country has fallen further and has hit a fresh lowest-ever level of 2.4 percent due to additional 29,168 MW power generation capacity in the last one and a half year. The government said the country witnessed the highest-ever generation capacity addition of 29,168 MW during this period. More than three crore energy-efficient LED bulbs have been also been distributed till now, it said. Earlier in May, the government had said that 22,566 MW of power generation capacity was added since the Prime Minister Narendra Modi-led government came into power. Moreover, Power and Coal Minister Piyush Goyal had then said the deficit dipped to an all-time low of 3.6 percent. (timesofindia.indiatimes.com)

"Working on policy to provide electricity in hamlets"

November 28, 2015. The Central government is focusing on electrifying every household and is preparing a policy for issuing connection to hamlets in the country, Power & Coal Minister Piyush Goyal said. He said the government would include Jhunjhunu in a pilot project related to electricity. He said the government has asked the states to hold monthly meetings chaired by MPs to review power related issues so that the problems can be addressed. Goyal was in the city to attend a programme organised by a private foundation in which Noble Prize winner Kailash Satyarthi was also present. (www.ptinews.com)

Govt to give all households in West Bengal 4 energy efficient LED bulbs

November 27, 2015. All households in West Bengal will soon receive four energy efficient light emitting diode (LED) bulbs from power utilities as part of state government's initiate to cut down on energy consumption, state commerce and industry minister Amit Mitra said. Mitra said consumers would be able to get these bulbs on easy instalment and government will provide assistance to the poor so that they can replace incandescent bulbs and tube lights at home. The proposal has already been cleared by the board of West Bengal State Electricity Distribution Company Ltd. Mitra was talking at the inaugural session of an international lighting industry event organized by the Indian Society of Lighting Engineers. He said the state government has also started LED street lighting initiative in several areas such as RajpurSonarpur municipality, Behala, Falta, Kasba, Calcutta Leather Complex, New Haldia and North Bengal. The state has also finalized the energy conservation building code and the draft is with the department of power for issuing the gazette notification, Mitra said. The minister also used the platform to pitch to the lighting industry for investment in West Bengal. He said the government has ready plugandplay infrastructure available and invited all the big companies to invest in the lighting equipment or LED bulb and luminaire manufacturing. The market for LED bulbs and light in India has been growing at over 50% for the last six years and projected to continue this pace of growth for next few years. (economictimes.indiatimes.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Production begins from Edvard Grieg field offshore Norwegian North Sea

December 1, 2015. Lundin Petroleum and partners have commenced production from the Edvard Grieg field located in production license (PL) 338, in the Utsira High area of the Norwegian North Sea. Discovered in 2007, the Edvard Grieg field is estimated to hold gross 2P reserves of 187 million barrels of oil equivalents and has been developed with a steel jacket platform resting on the seabed. The oil produced from the field will be transported to the Sture terminal on the west coast of Norway through the Grane pipeline while the produced gas will be transported to St. Fergus in Scotland via a separate pipeline system. The partners plan to use the Rowan Viking jack-up rig for development drilling at the field which is scheduled to commence soon and expected to continue through 2018. A total of ten production wells and four water injection wells will be drilled by the partners at the field. Plateau production is expected during the second half of 2016. Additionally, the Edvard Grieg will receive oil and gas from the neighbouring Ivar Aasen field for further processing. (drillingandproduction.energy-business-review.com)

US lower 48 natural gas output up to record high in September: EIA

November 30, 2015. U.S. natural gas output in the lower 48 states climbed to an all-time high of 83.9 billion cubic feet per day (bcfd) in September from a revised 83.5 bcfd in August, the U.S. Energy Information Administration (EIA) said in its monthly 914 production report. That would be a fourth monthly increase in a row for the lower 48 states. Before the revision, EIA said output in the lower 48 in August was 84.3 bcfd. Gas production in September was up 7 percent from year-earlier levels of 78.7 bcfd, the EIA said. Output in the biggest producing states was mixed, with Texas up 0.2 percent to 25.0 bcfd in September from August, Pennsylvania up 0.4 percent to 13.2 bcfd and Oklahoma down 0.2 percent to 7.0 bcfd. That was the most gas production per month for both Texas and Pennsylvania, at least according to federal data going back to 2005. In the federal Gulf of Mexico, meanwhile, output increased by 1.4 percent to 4.0 bcfd in September from August. (www.reuters.com)

More Russian oil drilling shows its resolve to OPEC

November 30, 2015. Russian oil firms are drilling more, showing the world's top crude producer is ready for a longer fight for market share with Organization of the Petroleum Exporting Countries (OPEC), as its industry can carry on even if oil prices reach $35 per barrel. As OPEC prepares to meet in Vienna, Russia is sending a low key delegation for talks which are very unlikely to result in any output deal. OPEC oil ministers have repeatedly said they would only cut production in tandem with non-OPEC. According to Eurasia Drilling Company (EDC), the largest provider of land drilling services in Russia and offshore in the Caspian Sea, Russian drilling measured in meters rose 10 percent in the first six months of this year from a year ago, despite a decline in oil prices to less than $50 per barrel from their peaks of $115 in June 2014. Moscow has surprised the OPEC by ramping up output to new record highs this year despite low oil prices, which OPEC had hoped would depress production from higher cost producers. Moscow responded by steeply devaluing the rouble, giving an edge to its exporters. In many OPEC Gulf producers currencies are firmly pegged to the dollar. According to EDC, the Russian drilling market is based on long-term contracting, which results in lower pricing and less margins volatility, as compared to other countries more subject to the spot market. Total drilling has more than doubled over the past decade to more than 22 million meters per year.

Russian oil production, which together with sales of natural gas account for half of state budget revenues, has been steadily rising since 1998, apart from a marginal decline in 2008. According to data, the number of producing wells in Russia has increased in 2014 to 146,279 from 143,875 in 2013. The number of horizontal wells - a more efficient method of extracting oil - has increased by more than six times since 2005. The number of wells in the Middle East, including in Saudi Arabia, has also risen over the past year, according to data from OPEC - in steep contrast to fast declines in many other producing areas as a result of low oil prices. In the United States, the number of oil rigs has fallen by 1,173 over the past year to 744 as the shale oil boom cools due to lower oil prices, according to oil services company Baker Hughes. Merrill Lynch said that most Russian oil companies break even at an oil price as low as $35 per barrel comparing to $40-$50 for Latin America's producers. (www.reuters.com)

Dana Gas Group awarded $1.9 bn in Iraq Kurds dispute

November 29, 2015. Dana Gas PJSC said a court has ordered the Kurdistan Regional Government (KRG) to pay it and two other energy companies $1.98 billion in a dispute over development rights for two oil and natural gas fields in Iraq’s self-governing Kurdish region. The London Court of International Arbitration ordered the KRG to pay Dana, Crescent Petroleum and Pearl Petroleum Co. within 28 days for condensate and liquefied petroleum gas produced up until June 30, the United Arab Emirates-based energy producer said. Dana Gas said the tribunal in July confirmed the group’s exclusive rights to develop and produce gas and petroleum from the Khor Mor and Chemchemal fields in northern Iraq for not less than 25 years, an arrangement the KRG had disputed since May 2009. The group’s further claims for substantial damage from “wrongfully delayed” development of the fields will be heard in 2016, as will the KRG’s remaining counterclaims, Dana Gas said. Dana Gas, which operates mostly in Egypt and Iraq, and its partners have invested over $1.2 billion and produced the equivalent of more than 150 million barrels of gas and petroleum liquids in the Kurdish region. (www.bloomberg.com)

Mexico's Sierra O&G sees first exploratory drill in early 2017

November 25, 2015. A consortium that includes Mexico's Sierra Oil & Gas plans in early 2017 to make its first exploratory drill in one of the fields it was awarded as part of a landmark energy reform, Sierra's chief executive officer said. In a July tender, a consortium comprised of Sierra, U.S company Talos Energy and British company Premier Oil won two blocks that were among 14 production-sharing contracts offered at the outset of Mexico's sweeping energy sector opening. A second exploratory drill would depend on the results of the first one, he said, which would last for between 40 and 70 days. The two blocks are located in the shallow waters of the Gulf of Mexico, and each one will require an average investment of $1.3 billion over the course of five years, according to Mexico's energy regulator. Mexico's government hopes the landmark energy opening, which was finalized in 2014 and ends decades of state-run control over the country's hydrocarbons, will fuel more robust growth in Latin America's second biggest economy. As part of the overhaul, from 2017 private companies will be able to import and distribute gasoline in Mexico. From 2018, they will be able to refine crude oil and sell gasoline at market prices, putting them in direct competition with state-run Pemex. (www.reuters.com)

Downstream…………

Lukoil's Bulgarian refinery sees crude processing at 6 mt in 2015

November 27, 2015. The Bulgarian refinery of Russian oil producer Lukoil expects to process about 6 million tonnes (mt) of crude oil this year due to improved consumption, Valentin Zlatev, member of the supervisory board of the refinery said. The refinery at the Black Sea port of Burgas still works below its capacity of 7.5 million tonnes a year as the Bulgarian economy slowly recovers following the global financial and economic crisis in 2008-09, Zlatev said. Lukoil Burgas Neftochim, Bulgaria's only oil refinery, processed 5.9 million tonnes of crude in 2014. It exports 60 percent of its output, mainly to the neighbouring Balkan countries and Turkey. (af.reuters.com)

Sinopec offers refineries bonus to export surplus diesel

November 27, 2015. China's Sinopec Corp is offering its subsidiary refineries big incentives to export their diesel fuel, in a rare move that reflects the top Asian refiner's deepening concerns about a growing domestic glut. The internal bonus scheme marks the latest step by the state-owned refiner to battle local oversupply of the industrial fuel as slowing economic growth curbs diesel use in mining, construction and transportation. The company has maintained relatively high production in order to feed growing domestic demand for kerosene and gasoline, thus exacerbating the diesel surplus. Sinopec's crude runs were up 1.4 percent in the first three quarters of 2015 compared with a year ago. About a half-dozen of Sinopec's refineries are being offered around 240 yuan ($37.60) for each tonne of diesel exported, under a scheme that started in September and has been extended to December. The payments are a tiny portion of the company's $4.25-billion net profit in the first three quarters of the year, and with refining profits up 34.3 percent, the company has plenty of room for the export incentive, analysts said. (www.reuters.com)

Saudi Aramco to invest more in Indonesia's oil and gas sector

November 26, 2015. Saudi Aramco is looking for further investment opportunities in Indonesia's downstream refining and petrochemicals industry, the company's CEO Amin H Al-Nasser said, after initiating a $5.5 billion project to upgrade the country's largest refinery. The Saudi Aramco CEO's comments are positive for Indonesian President Joko Widodo's efforts to attract investment after a clean-up of the country's oil and gas sector that followed a series of scandals. Indonesia will rejoin OPEC as its 13th member nation next month. The project is expected to increase the refinery's crude processing capacity to 370,000 barrels per day (bpd) from 348,000 bpd at present, and is also likely to include an agreement to import crude from Saudi Arabia, the world's top crude exporter. (www.reuters.com)

Petrobras says to buy 461k barrels of gasoline from Braskem

November 25, 2015. Brazil's state-controlled oil company Petroleo Brasileiro SA (Petrobras) said that it agreed to buy 73,300 cubic meters (461,000 barrels) of gasoline in December from Brazilian petrochemical company Braskem SA. The fuel will be purchased from Braskem plants in São Paulo and the far-southern state of Rio Grande do Sul, Petrobras, as the oil company is known, said. Petrobras, which owns 36 percent of Braskem and supplies it with naphtha, agreed to buy 82,000 cubic meters (515,764 barrels) of gasoline from the petrochemical company in November. (af.reuters.com)

BG Group's Australian LNG plant fully operational

November 25, 2015. BG Group has started commercial operations at the second train at its Queensland Curtis LNG (QCLNG) plant and has taken full control of both trains and associated facilities at the Australian site, the company said. BG Group said that its Australian subsidiary has assumed control of Train 2 from Bechtel Australia, which built the plant. The project is expected to produce enough LNG to load about 10 vessels a month by mid-2016, equivalent to exporting around eight million tonnes of LNG a year, the company said. BG Group is one of Australia's leading natural gas explorers and producers, supplying gas to the domestic market and LNG internationally. The company is also building an LNG plant on Curtis Island, off Gladstone in central Queensland. (af.reuters.com)

Transportation / Trade……….

US oil reserve sale reduced in transportation bill deal

December 1, 2015. The U.S. transportation bill will be partially funded by selling off some of the U.S. emergency oil reserve, but less will be sold than originally planned after negotiators in the Senate and House of Representatives reached a deal. About 66 million barrels of crude from the Strategic Petroleum Reserve will be sold from 2023 to 2025 under the deal, instead of about 100 million barrels, the amount in the original bill passed by the Senate in July. The legislation, which has bipartisan support, is expected to reach the floor of each chamber, when a short-term funding measure runs out. Once passed, it would then go to President Barack Obama's desk to be signed. The world's largest supply of government-owned emergency oil, held in a series of salt caverns in Texas and Louisiana, currently holds 695 million barrels, well over the minimum required by international agreements. The deal could also allow the secretary of energy to direct the sale of some oil during fiscal years 2016 to 2017. (www.reuters.com)

Lithuania expects LNG cargo from Norway on December 15-16

November 30, 2015. Lithuania expects to receive liquefied natural gas (LNG) tanker Arctic Aurora with a cargo from Norway on December 15-16, later than previously planned, the country's LNG importer Litgas said. It had previously planned to receive about 140,000 cubic metres of gas from Norway under a contract with Statoil on Nov. 29, data showed. Litgas signed a five-year deal with Statoil in 2014 to buy around 540 million cubic metres of gas annually via the Klaipeda LNG import terminal, operated by Klaipedos Nafta. The government has asked the Lithuanian importer, part of state-owned power group Lietuvos Energija, to renegotiate its contract with Statoil to get more flexibility. Lithuania has received five commercial LNG cargoes from Norway since December 2014, meeting about 18 percent of gas demand, with the rest supplied by Russia's Gazprom via pipelines. (uk.reuters.com)

Mozambique-South Africa gas pipeline to be expanded by 2017