-

CENTRES

Progammes & Centres

Location

[November 2015: Shades of Paris]

“Today climate evangelists are telling India to reduce carbon emissions to save the World. If we oblige and make absolute reductions in carbon emissions to save the world we may get into a similar problem in the future. The guarantee from experts that expensive energy will not compromise on India’s development is not encashable. The only comfort is that in an evolving environment with a complex interplay of economics and demographics, the Paris treaty may stand only until parties of interest negotiate a new instrument for a new context in the future…”

Energy News

[GOOD]

Seeking a better LNG deal from Qatar is a step in the right direction!

It is not a good sign if fuel demand growth is higher than economic growth!

[UGLY]

Seeking an agreement to phase out fossil fuels by 2100 is irrational!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· November 2015: Shades of Paris

· Coal Sector Needs an Institutional Makeover

DATA INSIGHT………………

· Petroleum Products Consumption and Growth in India

[NATIONAL: OIL & GAS]

Upstream…………………………

· ONGC sees 20-30 percent lower capex next fiscal on crude price slump

· About 11.12 bcm gas of ONGC shifted to RIL's KG-D6

· Govt likely to extend Cairn's PSC by 10 yrs

Downstream……………………………

· IOC sends first consignment from Paradip oil refinery

· Swan Energy to invest ` 56 bn for FSRU terminal

· Automation of fuel pumps to ensure transparency: IOC

Transportation / Trade………………

· PNG supply, CNG stations for Smart Cities suggested

· India's Petronet near to winning better gas terms from Qatar

· LPG distribution brought under ESMA

Policy / Performance…………………

· Pradhan favours crude cess reduction, says talking to Finance Ministry

· India, not China, powering growth in fuel demand

· Natural gas prices to fall next fiscal: Goldman Sachs

[NATIONAL: POWER]

Generation………………

· LNG power plant to come up at Brahmapuram

· GMR Energy arm starts 768 MW power plant operation in AP

· Kudankulam nuclear unit to restart from December 25

Transmission / Distribution / Trade……

· PFC transfers 3 transmission projects to Adani Power

· Tripura to supply power to Bangladesh from December 16

· DVC to waive 60 percent of arrears on Jharkhand

· CCEA approves 10 percent stake sale in CIL

Policy / Performance…………………

· Govt plans cheap gas import for long term: Power Minister

· CEA agrees to give 250 MW power to Telangana

· AP Power sector to get ` 40 bn assistance from World Bank

· List of third party samplers to test coal to be ready in a month

· Creditors of companies which did not win coal mines may be paid: Delhi HC

· Haryana to come out with new power policy

· Series of foreign pacts to give fillip to India's nuclear industry

· CCI asks CIL to examine spot e-auction scheme afresh

· Atomic Energy Act to be amended to boost nuclear power sector

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Norway oil companies to deepen spending cuts amid sub-$50 crude

· Poland's PGNiG to launch gas production in Pakistan

· Lukoil predicts its Russian output will be unchanged next year

· Shale drilling boosted US oil and gas reserves in 2014: EIA

· Colombia's Ecopetrol to explore in four Gulf of Mexico blocks

· Malaysia's Sarawak has more O&G fields not monetized yet

· Shell confirms Kaikias development potential

· Noble and Delek start sale process for small gas fields off Israel

Downstream……………………

· European oil refiners set for strong 2016

Transportation / Trade…………

· Gazprom may sell UK-Belgium gas pipeline stake after 20 yrs

· Kinder Morgan files application for $5 bn natural gas pipeline project in US

· Saudi Arabia edges out Russia in China oil sales as OPEC digs in

· Glencore seals Libyan oil deal in scramble for profits

· Oil traders prepare for next big price drop in March 2016

· Iraqi oil selling at $30 as OPEC readies for new battles

· In Shell-BG review, China wants concessions on huge gas deals

Policy / Performance………………

· China's NDRC approves development of the Sanjiao CBM project in Ordos Basin

· Iran seeks more cooperation with Russia in energy sector

· KrisEnergy secures govt approval for Rossukon Production Area off Thailand

· Venezuelan Oil Minister says OPEC cannot allow a price war

· Oil platform operator to pay more than $41 mn in penalties: US Justice Dept

· Poland's PM flags possible second LNG terminal

· Dutch court to rule on gas output from Europe’s biggest field

· Oil, gas industry welcomes UK govt's pro-gas energy policy

[INTERNATIONAL: POWER]

Generation…………………

· Siemens secures first funding for Egypt power plant project

· E.ON stops last unit at Ironbridge coal-fired power plant

· MHPS wins order for 1 GW coal-fired power project in South Korea

· Egypt and Russia sign agreement on nuclear power project in Egypt

· EIB lends €50 mn to rehabilitate 243 MW Warsak hydro plant

Transmission / Distribution / Trade……

· 1MDB to divest energy business to China General Nuclear Power for $2.3 bn

· City Power will upgrade Johannesburg power grid

· China and India drive recent changes in world coal trade: EIA

Policy / Performance………………

· Japan's NRA approves full reactor licenses for three nuclear units

· ADB lends $1.4 bn to help Pakistan resolve power crisis

· OECD countries to limit overseas financing for coal plants

· UK's coal plants to be phased out within 10 yrs

· Ghana approves 140 MW gas-fired power project in Beyin

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· India opposes deal to phase out fossil fuels by 2100 at climate summit

· SunEdison to sell 425 MW of solar projects in India to 'yieldco'

· India surpassed by Chile in green ranking as Modi seeks funds

· Govt seeks political consensus over key climate issues ahead of Paris summit

· Suzlon wins 31.5 MW wind power project order

· LM Wind Power plans new blade factory in India

· Lanco Solar inks pact with Chhattisgarh Govt for 100 MW plant

· Reliance Group to develop 6 GW Solar Park in Rajasthan

· IOC betting big on green energy

· India’s rooftop solar capacity to touch 6.5 GW by 2020

· Hi-tech coal plants cheaper than solar to fight India's climate battle: WCA

GLOBAL………………

· Japan says advanced coal technology can help global CO2 cut

· TransAlta Renewables to invest $404 mn in three Canadian power projects

· World Bank sets $16 bn plan for African climate action

· Turkey announces new renewable energy subsidies

· Morocco plans to add 6.8 GW of renewables from 2015 to 2025

· Japan looks at wind power generation for Tonga

· US Govt agencies to slash greenhouse gas emissions 41.8 percent

· UK Bioenergy Group adds 25 MW waste-to-power plant in Hull

· Indonesia to make green financing compulsory for banks by 2018

· Alberta to limit oil-sands emissions in climate policy revamp

· BCEP acquires California based Bottle Rock Power geothermal plant

· World's top miners risk $10 bn of earnings on carbon cost

· China again tops for clean energy investment

· AWS selects EDP Renewables to build 100 MW wind farm in US

· Japan’s Ministry of Environment eyes scrutiny of small coal power

· Rampal plant won't affect Sundarbans: Bangladesh's Environment and Forest Minister

· US Senate shoots down rules on power plant emissions

· Lower-cost wind and solar will drive energy storage technology

· UK plans to prioritise nuclear, gas over renewables to cut CO2

[WEEK IN REVIEW]

COMMENTS………………

India monthly energy briefing

November 2015: Shades of Paris

Lydia Powell and Akhilesh Sati, Observer Research Foundation

Climate Change

|

E |

nergy sector news in November was dominated by news on development of renewable energy projects and rhetoric geared towards climate negotiations in Paris. This year (2015) was declared as the hottest year ever by World Meteorological Organisation (WMO) continuing with the tradition of declaring a year as the hottest ever just before a climate summit. It is probably the ‘hottest’ year for a climate treaty as well. Indian leaders were busy calling for climate justice, energy justice and financial justice from every available platform in the hope of retaining at least a semblance of equity in any agreement that may be agreed upon in Paris. Companies were making commitments to pour money into renewable energy on every media channel. Ironically companies such as Coal India Limited (CIL) and National Thermal Power Corporation (NTPC) whose cash flows critically depend on fossil fuels were among the many companies making huge promises on renewable energy. SunEdison, the American company supposedly spearheading the solar revolution in India promised that it will set up 500 MW of solar plants in India. Surprisingly the news that the share prices of SunEdison have fallen by over 87 percent in the last one year did not make it to the front pages of the Indian business press. What is behind the fall in share prices continues to be debated but one cannot rule out the possibility that SunEdison has the potential to become the Enron of the solar sector.

The Hon’ble Minister for Environment, Forests and Climate Change launched justclimateaction.org a new website on India’s climate action in November. ‘We are not part of the problem but we are willing to be part of the solution’ is a notable quote from the Hon’ble Minister featured on the website. China was reported to be in favour of a binding treaty giving rise to optimism over a legally enforceable / binding treaty in Paris. Whether India will foreclose and narrow her liberty of choice by declarations made to other powers is not clear at this point but if it does India may be voluntarily walking into a low income trap. China offers a lesson. Population evangelists told China that the number of Chinese babies must be reduced to save the world. China obliged and reduced the number of its babies. Today China is looking for ways to increase the number of its babies. It may not succeed as it is now too expensive to bring up babies in China. Today climate evangelists are telling India to reduce carbon emissions to save the World. If we oblige and make absolute reductions in carbon emissions to save the world we may get into a similar problem in the future. The guarantee from experts that expensive energy will not compromise on India’s development is not encashable. The only comfort is that in an evolving environment with a complex interplay of economics and demographics, the Paris treaty may stand only until parties of interest negotiate a new instrument for a new context in the future.

Conventional Fuels

This is not the best of times for fossil fuels. The problem of plenty is keeping prices down for coal, oil and gas. There were reports of profits of state owned oil and gas producers dropping. There was also news of the government increasing taxes on petroleum products to maintain its revenue stream amidst falling prices. The government continued to urge affluent consumers to give up their subsidised LPG connections. The threat of withdrawing subsidised LPG connections for those with an annual income above a million Indian rupees was also issued but no concrete policy action was announced. But the low price environment also facilitated an end to the stalemate in a policy on pricing natural gas. Signals of freeing up gas prices started emerging in November which is a positive sign. The downward pressure on gas prices was also affecting prospects for imported LNG. NTPC was reported to be refusing to buy high priced gas from GAIL (India) Ltd and India and Qatar were reported to be adjusting their LNG import agreement to new realities. Talks on trans-border pipelines such as TAPI continued as they tend to do even when the economic case for their viability decreases exponentially.

India’s growth in demand for petroleum fuels was widely reported. India fuel demand is said to have grown by 17.5 percent from the same month last year according to data from PPAC. India’s total fuel consumption for 2014-15 could be about 3.6 million barrels per day (bpd) accounting for a growth of 8.7 percent in 2015-16 (Please refer to Data Insight at page no. 7). Overall India’s fuel demand grew by 440,000 bpd since 2013-14. This must warm the hearts of OPEC countries but send shivers down the spines of climate alarmists.

On the coal front, news of coal imports declining continued to flow. There are also signs of easing coal use rules which could pave the way for introducing a ‘market’ for coal. Washing of coal appears to be seeing a revival. The restructuring package for distribution companies was announced in November but it is not clear if this will go the way of earlier restructuring plans – vanish without a trace of improvement in efficiency or economic viability.

The winter of discontent over fossil fuels continues but it can bounce back and shock as it has done so in the past!

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

COMMENTS………………

Coal Sector Needs an Institutional Makeover

Ashish Gupta, Observer Research Foundation

|

I |

ndia is currently the third largest consumer of electricity and this position will continue over the coming years on account of sustained economic development, urbanisation, improved electricity access and an expanding manufacturing base. Recently, the Ministry of Coal, Power & Renewable Energy stated that universal and affordable energy access 24/7 is the mission of the present government under Prime Minister. This mission cannot be fuelled without coal and therefore it requires special attention. This is important because Coal occupies an important place in India’s energy basket due to its affordability. Unfortunately, the coal sector is unable to garner the requisite momentum because of its entrenchment with the political class. There have been discussions happening for a very long period to reform this crucial sector by adopting international best practices. But the reforms initiated are either not sufficient to bring desired change in the coal sector or reforms are implemented in a hasty manner. Some of the key reforms that are required to keep the sector attractive are given below:

Mine Development Operator (MDO)

MDOs usually work on contract basis for mining coal. They are not the owners of the coal block and are generally averse to take on risk. Currently 68 percent of coal production comes from work outsourced to MDOs. Some MDOs are of international repute but the compensation for the contracted work is so low that there is no incentive to use specialised mining equipments. Apart from this when CIL outsources, it is only for a limited time and at fixed cost of production. This only allows use of shovels that last for 9 years and dumper last for about 5 years. Commercial mining practices cannot be used in this environment and because of this large quantity of coal is left unmined at the coal blocks.

Division of coal blocks

Many coal blocks with large coal reserves are divided into smaller coal blocks and awarded to different companies. This block-wise division of the coal is not really economic because the coal block divisions are not necessarily congruent with the natural geological boundaries. This can lead to unnecessary wastage between the blocks.

Skilled Manpower

Currently CIL has 0.3 million manpower in which 0.06 million comprised of technical personnel including clerical staff. Coal India also faces superannuation of about 750 middle and senior management personnel every year, which leads to draining of years of knowledge base. While the bottom managerial level is being replenished, there is a vacuum in the middle management preventing adequate supply of talent to top management.

Most of the engineers are either opting for more lucrative disciplines and many who are trained to perform the task want to work as planning engineers rather than to work on field. The pay structure is still not at par with software engineers though it is a highly technical field with high risk attached to it. This is a very critical issue hindering the growth of the coal sector.

Reluctance to change

Starting from the establishment of the CIL in 1975, more thrust was given to acquire engineers only. Now engineers are not required to play a role of activist, environmentalist, human resource person, finance manager and so on like it used to be in the past. All these disciplines are now distinct from one another and require special skill set. Absence of specialised skill leads to engineering solutions that do not take into account the social and economic element.

CIL’s dilemma

CIL’s productivity is criticised routinely. But the question is, is it CILs fault? The government is looking to disinvest 10% share of its shareholding in CIL. The move will certainly generate much needed revenue for the government and will also improve efficiency in the working of CIL. But a memorandum of the trade unions submitted to the Joint Bipartite Committee for Coal Industry has highlighted deep concerns of workers over disinvestment of CIL.

Needless to say, the governments in the past have failed to unite unions. What is not clear is if this is inevitable or intentional. CIL cannot be faulted for opposing moves towards efficiency because unions which are affiliated to political parties that actually oppose efficiency. The government needs to take a rational stand and engage in dialogue with trade unions for increasing efficiency, productivity and wages.

Given the changing dynamics in the market CIL needs to adopt best management culture and techniques. CIL is an energy company, for energy companies nothing is more critical than efficiency.

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

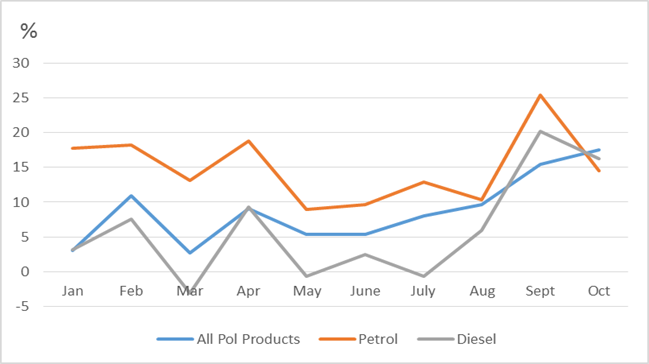

Petroleum Products Consumption and Growth in India

Akhilesh Sati, Observer Research Foundation

(‘000 tonnes)

|

Month |

All Products |

Petrol |

Diesel |

||||||

|

2014 |

2015 |

% growth |

2014 |

2015 |

% growth |

2014 |

2015 |

% growth |

|

|

Jan |

13523 |

13939 |

3.1 |

1384 |

1629 |

17.7 |

5639 |

5820 |

3.2 |

|

Feb |

12838 |

14246 |

11.0 |

1379 |

1630 |

18.2 |

5380 |

5784 |

7.5 |

|

Mar |

14291 |

14678 |

2.7 |

1489 |

1684 |

13.1 |

6083 |

5893 |

-3.1 |

|

Apr |

13486 |

14715 |

9.1 |

1502 |

1784 |

18.8 |

5933 |

6487 |

9.3 |

|

May |

14740 |

15528 |

5.3 |

1683 |

1834 |

8.9 |

6477 |

6435 |

-0.6 |

|

June |

13980 |

14733 |

5.4 |

1611 |

1767 |

9.7 |

6139 |

6291 |

2.5 |

|

July |

13292 |

14357 |

8.0 |

1481 |

1672 |

12.9 |

5741 |

5705 |

-0.6 |

|

Aug |

12904 |

14152 |

9.7 |

1599 |

1764 |

10.3 |

5121 |

5426 |

6.0 |

|

Sept |

12771 |

14740 |

15.4 |

1499 |

1879 |

25.4 |

4899 |

5887 |

20.2 |

|

Oct |

12956 |

15220 |

17.5 |

1616 |

1850 |

14.5 |

5455 |

6343 |

16.3 |

Growth of Petroleum Products Consumption for same months (2014 & 2015)

Source: Petroleum Planning & Analysis Cell

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

ONGC sees 20-30 percent lower capex next fiscal on crude price slump

November 24, 2015. ONGC will maintain its capex plan for this year at the same level as last year at about ` 30,000 crore, its chairman Dinesh K Saraf has said. However, the company sees reduction in the same next fiscal year, to the tune of 20-30 percent. Saraf also called for higher gas price to make KG block Cluster-2 viable. He said that the company is trying to reduce the development cost of the KG block cluster-2 by deploying better technologies. When asked about the projected output from these KG blocks he said it is seen at 75,000 barrels per day (bpd) oil, 17 million standard cubic meters per day (mmscmd) of gas. Whether the company has abandoned the cluster 1 at the KG Blocks, he did not offer a direct answer but said further development depends on the resolutions of issues with Reliance Industries Ltd (RIL). (indiatoday.intoday.in)

About 11.12 bcm gas of ONGC shifted to RIL's KG-D6

November 22, 2015. About 11.12 billion cubic metres (bcm)of natural gas worth ` 11,055 crore have flowed from idling Bay of Bengal blocks of the Oil and Natural Gas Corporation (ONGC) to neighbouring KG-D6 fields of Reliance Industries Ltd (RIL), US-based consultant DeGolyer and MacNaughton (D&M) has said. D&M, in its report, established that reservoirs in ONGC's Krishna Godavari basin KG-DWN-98/2 (KG-D5) and the Godavari Producing Mining Lease (PML) are connected with Dhirubhai-1 and 3 (D1 & D3) field located in the KG-DWN-98/3 (KG-D6) Block of RIL. D&M is of the opinion that there exists one big gas resource several metres below sea bed which extends from Godavari PML and KG-D5 to KG-D6. Of the 58.68 bcm of gas produced from KG-D6 block since April 1, 2009, 49.69 bcm belongs to RIL and 8.981 bcm could have come from ONGC's side, D&M said in its 553-page report. At gas price of $4.2 per million British thermal unit, the volume of gas belonging to ONGC which RIL has produced comes to $1.7 billion (` 11,055 crore). ONGC had in 2013 claimed that RIL had deliberately drilled wells close to the common boundary of the blocks and that some gas it pumped out was from its adjoining block. D&M estimated that ONGC's Godavari-PML had 14.209 bcm of gross in-place reserves and KG-D5 another 11.856 bcm. RIL's D&D3 fields held 80.697 bcm gross in-place reserves. Of these, 12.80 bcm of Godavari-PML, 8.01 bcm of KG-D5 and 75.33 bcm of KG-D6 are connected, it said. It estimated that 11.89 bcm of gas from ONGC blocks would have migrated to KG-D6 by January 1, 2017. This volume would rise to 12.713 bcm by May 1, 2019. The volume of gas remaining after this would not be economically viable for ONGC to develop. D&M was jointly appointed by ONGC and RIL to find if the neighbouring fields are connected. ONGC believes the KT-1/D-1 gas find in its Krishna Godavari block KG-DWN-98/2 (KG-D5) and G-4 Pliocene gas find in Godavari Block extend outside the block boundaries into KG-D6. According to ONGC, RIL's D6-A5, D6-A9 and D6-A13 wells drilled close to the block boundary may be draining gas from the G-4 field while the D6-B8 well may be sucking out gas from DWN-D-1 field of KG-DWN-98/2 block. While RIL started production in April 2009, ONGC is yet to finalise an investment plan for its fields. (zeenews.india.com)

Govt likely to extend Cairn's PSC by 10 yrs

November 21, 2015. The government is likely to extend Vedanta group firm Cairn India's licence to explore and produce oil from the Barmer block in Rajasthan by ten years, provided the firm agrees to pay more profit share to the exchequer. Cairn has a Production Sharing Contract (PSC) which expires in 2020. The Government of India has offered an extension of the PSC to Cairn for 10 years on condition that they increase their share of revenue to the Government of India. At present, the government's profit petroleum ranges from 25% to 60%. In case of Cairn's Rajasthan block, it is 50%. Once that happens, the PSC will be extended by 10 years till 2030. (www.dnaindia.com)

Downstream………….

IOC sends first consignment from Paradip oil refinery

November 24, 2015. Indian Oil Corporation (IOC) said it has started commercial production of fuel from its ` 34,555 crore Paradip oil refinery in Odisha, sending out first consignment of diesel and LPG. IOC began processing crude oil at the 15 million ton a year Paradip refinery in April-end and has since then commissioned various units of the mammoth refinery one by one. The first consignment of products from IOC's Paradip refinery comprising of High Speed Diesel, Superior Kerosene and Liquefied Petroleum Gas (LPG) was dispatched, the company said. While crude oil processing began seven months back, some of the products require further processing in secondary units, which IOC commissioned in stages. IOC said the whole refinery complex will become fully operational in an integrated manner in the near future. The refinery is designed to process broad basket of crude, including cheaper high sulphur heavy crudes, and has an overall Nelson complexity factor of 12.2. It is capable of producing Euro-IV/Euro-V quality transportation fuel. Once fully operational, the refinery will produce 700,000 tonnes of LPG, 200,000 tonnes of propylene a year, 3.8 million tonnes of petrol, 380,000 tonnes of ATF and 6.9 million tonnes of diesel. The distillate yield from the refinery is expected to be best in class, with 81.1 percent with no black oil production. Paradip will be IOC's eighth refinery in the country and is expected to help the company scale up its refining capacity to 69.2 million tonnes from the current 54.2 million tonnes per annum. Paradip, which was initially planned to begin operations in 2012 but a flurry of problems including environmental issues and natural calamities delayed the commissioning, will reach 80 percent of the installed capacity before end of 2016-17 fiscal. The Paradip refinery is the most sophisticated of IOC's 11 units. HPCL-Mittal Energy Ltd's 9 million ton Bathinda refinery in Punjab was the last refinery commissioned in India three years ago. (economictimes.indiatimes.com)

Swan Energy to invest ` 56 bn for FSRU terminal

November 24, 2015. Swan Energy Limited will invest around ` 5,600 crore towards setting up of Jafrabad LNG Port project in Gujarat with one jetty-moored Floating, Storage and Regasification Unit (FSRU). The project will be jointly developed and operated by Swan Energy along with its JV partners, Belgian firm Exmar Marine N V and Gujarat-government's Gujarat State Petroleum Corporation (GSPC). Swan Energy holds 51 percent stake in the JV company, Swan LNG Pvt Ltd, while Exmar Marine and GSPC hold 38 percent and 11 percent respectively. The FSRU receiving terminal will have an initial capacity of 5-million tonnes per annum (mtpa), making it arguably India's first FSRU facility. The capacity will be expanded to 10 mtpa with an additional investment of $300 million (` 2,000 crore) in due course of time. While 20 percent of the funding will be made through equity, the company will raise the remaining 80 percent funds through a mix of qualified institutional placements (QIPs) and Foreign Currency Convertible Bonds (FCCBs) to meet the funding requirement. Exmar will provide experience in floating LNG solutions into the integrated project management team and will participate as equity partner in the LNG receiving terminal. As a State government's terminal policy, 30 percent of the operational capacity will be booked by the state PSU. As a result, GSPC has tied up for 1.5 mtpa capacity, while three other PSUs including ONGC, Indian Oil Corporation and Bharat Petroleum Corporation (1 mtpa each) have tied up for a period of 20 years. The unit is expected to be commissioned by January 2019. Exmar had pioneered the floating regasification solutions in the world by introducing the first FSRU in 2005. The FSRU design has been finalised with Korea-based Daewoo Shipbuilding & Marine Engineering (DSME) Shipyard. The delivery of the first FSRU is expected by December 2018. (www.thehindubusinessline.com)

Automation of fuel pumps to ensure transparency: IOC

November 21, 2015. Indian Oil Corporation (IOC) said it has made rapid strides in introducing hundred percent automation at its petrol pumps to ensure complete transparency in refueling operations and provide highest standards in quality and quantity. IOC said consumers will enormously be benefited with the introduction of hundred percent automation at its petrol pumps. IOC said with the complete automation, the base headquarter of particular state will keep eye on the working and operation of all the Indian Oil fuel outlets as similar metering will be present at the headquarter. The fuel filled in the vehicle of customer and remaining stock in the fuel tank of Petrol pump could be checked at headquarter, IOC said. In case of doubt or any suspicion with regard to quantity of fuel, customer can directly call at headquarter where measurements can be checked through newly automation system instantly, IOC said. About the retail automation, IOC said automation entails automated billing which reassures the customer and enhances customer satisfaction due to its transparent process. It provides for online price change and quicker services. It also ensures quick and effective customer grievance redressal due to availability of records for each transaction, IOC said. The features in automation help serve customers better and also provide inputs to its channel partners by way of alarms, interlocks, facility planning, inventory management & resources allocation for better retail outlet efficiency, IOC said. (timesofindia.indiatimes.com)

Transportation / Trade…………

PNG supply, CNG stations for Smart Cities suggested

November 21, 2015. Union urban development ministry asked the states and urban local bodies (ULBs) to provide for piped natural gas (PNG) supply and CNG stations in the cities selected for development as Smart Cities. They were also asked to ensure convergence of various schemes of the Central government aimed at enhancing energy supply and related infrastructure in the Smart City Plans under preparation. Additional Secretary in the urban development ministry Sameer Sharma informed the States and ULBs that Prime Minister Narendra Modi at a recent meeting of the NITI Ayog desired PNG supply and convergence of energy related and Digital India related schemes in Smart Cities being developed. Sharma made it clear to States and Urban Local Bodies that all claims regarding initiatives so far taken and proposed to be taken for smart city development should be substantiated by necessary evidence and the deadline for submission of Smart City Plans by December 15 will not be extended. Petroleum and Natural Gas Joint Secretary Ashutosh Jindal said that supply of gas is not a constraint for enabling PNG supply in Smart Cities and urged the urban local bodies to ensure speedy approvals for laying City Gas Distribution (CGD) Pipelines in smart cities. Jindal informed that currently, 30 lakh PNG connections have been provided in 67 cities including 35 smart cities and the remaining Smart Cities need to be covered by piped gas supply. (timesofindia.indiatimes.com)

India's Petronet near to winning better gas terms from Qatar

November 20, 2015. India's biggest gas importer Petronet LNG is close to renegotiating a major deal with its Qatari supplier Rasgas, lowering the cost of gas shipments and avoiding a $1.5 billion penalty fee for lifting less gas than agreed. The renegotiation is another sign of how falling oil prices and a global gas glut are bringing producing giants such as Qatar to the negotiating table. Petronet, which has a 25-year contract with Rasgas to annually buy 7.5 million tonnes of liquefied natural gas (LNG) has reduced purchases by about a third this year due to high prices -- even though it is only allowed to take 10 percent less, making it liable for a $1.5 billion penalty. Oil Minister Dharmendra Pradhan reinforced the need to renegotiate prices and quantity under the long term deal with Qatar during his visit to Doha this month. The two firms are exploring the possibility of altering the contract's pricing formula, in which the LNG is valued based on a 60-month average of a basket of Japanese crude oil prices. Instead, a 3-month average of Brent crude is being considered, which would be a major coup for Petronet by lowering its LNG costs in line with sharply lower crude oil prices. Petronet currently pays about $12-$13 per million British thermal units (mmBtu) for Qatari LNG under a deal that began in 2004, compared with around $7-$8 per mmBtu for LNG in the spot market. Petronet has been increasingly substituting costly Qatari LNG with spot shipments. But the proposed revision should allow it to step up Qatari imports as prices fall. Under the new deal, Rasgas will also grant relief to Petronet from paying a $1.5 billion penalty on the condition that the Indian firm lifts full volumes in subsequent years. (in.reuters.com)

LPG distribution brought under ESMA

November 18, 2015. The State government brought the distribution of subsidised cooking gas cylinders under the provisions of the Essential Services Maintenance Act (ESMA). Food and Civil Supplies Minister Anoop Jacob said that the move would prevent truckers and labour unions from holding consumers to ransom by organising impromptu strikes and protracted go-slow agitations. His Ministry had mooted the declaration to empower District Collectors to tackle recurrent strikes in the LPG distribution sector. Simmering labour problems in the bottling plants of public sector oil companies had of late often disrupted LPG distribution in the State, upending the daily life of large sections of the population. Households in urban areas were invariably those most hard hit by LPG scarcity. Lakhs of households found it difficult to get their cylinders refilled on time, and backlog at gas agencies often mounted hugely.

Oil companies contracted loading and unloading of LPG cylinders to a labour supplier through a process of competitive bidding. Often, the contractors employed labourers cheaply, forcing them to go on unannounced strikes. Labour unrests in bottling plants and supply networks often caused hoarding and black market sales of subsidised cooking gas cylinders. The High Court had in an order deemed that all loading and unloading and distribution activities stood covered by the ESMA. It has also empowered the government to invoke the provisions of the law whenever the public was put to difficulty by such service providers. (www.thehindu.com)

Policy / Performance………

Pradhan favours crude cess reduction, says talking to Finance Ministry

November 24, 2015. The Oil Ministry is talking to the Finance Ministry on reducing the cess that the industry has been seeking since the steep fall in crude prices beginning June 2014, Oil Minister Dharmendra Pradhan said. Currently, the oil exploration companies are charged 30 percent cess or ` 4,500 per tonne on crude. Since 2006, the government has linked crude prices and oil cess, which means as prices have always rising, the government has been regularly increasing the cess as well. Carin India said that it is not fair for the government to continue to levy crude cess at 30 percent when prices have fallen by around 60 percent since June 2014. ONGC said the company favours an ad valorem based cess, but did not elaborate. It can be noted that the two state-owned oil producers ONGC and Oil India, as well as private sector Cairn India have been asking the government to cut the cess on crude oil in the view of slump in prices. The producers want the government to levy ad-valorem rate of cess which will result in higher payouts when prices are high and lower payout when rates fall. Currently, ONGC and Oil India pay a cess of ` 4,500 per ton on crude oil they produce from fields given to them on nomination basis. Cairn has to pay the same cess for oil from the Rajasthan block. (www.business-standard.com)

India, not China, powering growth in fuel demand

November 20, 2015. China's fuel usage tends to gather headlines as an indicator of the strength of global crude oil demand, and while this has been justified, the real growth action is happening over the Himalayas in India. India's total demand for oil products is about one one-third of that in China, but the South Asian nation is powering up as China's growth moderates. This isn't entirely unexpected given that the slowdown in China's economic growth is well known, as is the rotation toward a more service- and consumer-oriented economy from one reliant on heavy industry. India's rapid gains in fuel consumption have seen it overtake Japan to become Asia's second-largest crude oil importer behind China, and this growth trend appears likely to continue. India's fuel demand in October grew at its fastest pace in almost 12 years, rising 17.5 percent from the same month a year earlier, according to data from the Petroleum Planning and Analysis Cell, a unit of the oil ministry. Total consumption of refined oil products was 15.2 million tonnes, which equates roughly to 3.6 million barrels per day (bpd). This is using a conservative conversion rate, the crude oil factor of 7.3 barrels per tonne, while the factors for the main products India consumes, diesel and gasoline, are 7.5 and 8.5, respectively. If the pace of fuel demand growth for the first seven months of India's April to March fiscal year is maintained, it puts the nation on track for consumption of at least 3.6 million bpd for the 2015-16 year. If this is achieved, it will mean that India's fuel demand growth was 8.7 percent higher in 2015-16 over the prior year, equivalent to a gain of about 290,000 bpd. In contrast, India's fuel demand has grown strongly, with likely 2015-16 consumption of 3.6 million bpd about 8.7 percent higher than that in 2014-15, and some 14 percent above what it was in the 2013-14 fiscal year. Put another way, India's fuel demand has grown by 440,000 bpd since the 2013-14 fiscal year, while China's has expanded by about 810,000 bpd from 2013 to the current calendar year. While India's growth in volumes since 2013 is just over half China's, in percentage terms it's almost double the pace. With India's government pushing for more rapid urbanization and industrialization, in contrast to China's move to a consumer-driven economy, this trend of faster fuel demand growth is likely to continue, and possibly accelerate. It's too early to say China has had its day in the sun as far as oil demand goes, but it's increasingly clear that India has well and truly stepped out of the shade. (www.reuters.com)

Natural gas prices to fall next fiscal: Goldman Sachs

November 18, 2015. Natural gas prices for existing fields such as KG-D6 of Reliance Industries will dip to $3.6 per unit in next fiscal from $3.82 currently, Goldman Sachs said. This has resulted in Indian producers potentially losing $2 billion annually in value added assuming they can replace imports entirely, it said. The Oil Ministry floated a consultation paper for freeing prices of natural gas produced from fields auctioned in future. The rates for existing and old fields will remain to be priced at the current formula which uses average price prevailing in gas-surplus economies. The nomination blocks of ONGC and Oil India with cost ranging from $3.2 to $3.6 per million British thermal unit (mmBtu) would fail to make economic returns at the new rates. The BJP-led government had in October last year approved a new pricing formula for all domestically produced natural gas. (www.thehindu.com)

[NATIONAL: POWER]

Generation……………

LNG power plant to come up at Brahmapuram

November 24, 2015. The first Liquefied Natural Gas (LNG) powered power plant of Kerala State Electricity Board (KSEB) is likely to come up at Brahmapuran near Kakkanad. The ` 110 crore LNG powered 40 MW power plant will be built by Wartsila India. The power plant is likely to be completed by early 2017. Gas Authority of India Limited (GAIL) will be supplying LNG for the new power plant from the Petronet LNG Terminal at Puthuvype. It is learnt that KSEB has also applied for domestic natural gas supply for the power plant. The Brahmapuram plant has a total of five machines with a capacity to generate 20 MW power each. However, only three machines at the plant are in working condition. The new power plant requires 20 lakh cubic feet of LNG per day. KSEB points out that when natural gas is used, the cost of power will be less than ` 5 per unit considering the low cost of LNG now. If diesel is used as fuel, the power generation cost will be ` 6.50 per unit. The board has also plans to construct a 400 MW liquefied natural gas (LNG)-based combined cycle power project on the premises of the existing power plant at Brahmapuram. Hyderabad-based agency BhagavathyAnalabs is preparing an Environmental Impact Assessment study on the project. State government had allotted ` 59 crore in the last budget for all the natural gas based power plants in the state. Altogether, the state dreams to generate power to the tune of around 5,300 MW using natural gas, no time period has been set for the same. The proposed mega power plants in the state using natural gas as fuel, are expansion of the Kayamkulam NTPC (1,950 MW), Puthuvype (1,200 MW) Cheemeni project (1,200 MW), Brahmapuram Combined Cycle Plant (400 MW), conversion of Kayamkulam NTPC (360 MW), Brahmapuram Diesel Power Plant (40 MW) and the BSES Naphtha Power Plant at Eloor (157 MW). The estimated investment for these projects is around ` 30,000 crore. (www.newindianexpress.com)

GMR Energy arm starts 768 MW power plant operation in AP

November 20, 2015. GMR Energy Ltd said its subsidiary GMR Rajahmundry Energy Ltd (GREL) has commenced commercial operation of gas-based 768 MW power plant in Rajahmundry, Andhra Pradesh (AP). Power generated from this plant would be supplied to AP power distribution companies. With e-bid RLNG Scheme, the 768 MW power plant can operate at 50 percent Plant Load Factor (PLF), thereby generating 384 MW and supplying power to AP discoms continuously, it said.

GMR Energy said current operations will continue up to March 2016, depending on gas availability and thereafter the Centre will call for a fresh round of bidding. The GREL power plant was awarded allocation of gas along with GMR Vemagiri Power Generation Ltd (GVPGL), which got operational recently. Both plants are located adjacent to each other. As per the scheme, the government will subsidise the power distribution companies to the extent of ` 1.44 per unit from the Power Sector Development Fund. (economictimes.indiatimes.com)

Kudankulam nuclear unit to restart from December 25

November 20, 2015. Nuclear Power Corporation of India Ltd (NPCIL) has breached its target of restarting a unit at Kudankulam on November 19 and has now fixed revised target as December 25, 2015. The commissioning of the second unit is expected to happen at the end of 2016. The start up process for second unit's approach to criticality is expected to happen during the first quarter of 2016-2017, the NPCIL said. According to Power System Operation Corporation Ltd (POSCO), the first 1,000 MW nuclear power unit at Kudankulam was expected to restart in December 2015. The unit has breached several restart deadlines after it was shut down for annual maintenance in June 2015 for 60 days.

Anti-nuclear power activists said NPCIL loses around ` 8 crore per day due to shut down of Kudankulam unit. The NPCIL at an outlay of ` 17,000 crore is setting up two 1,000 MW Russian reactors at Kudankulam in Tirunelveli district. The first unit attained criticality, which is the beginning of the fission process, in July 2013. Subsequently it was connected to the southern grid in October 2013. However, commercial power generation in the unit began on December 31, 2014. Operating at full capacity the unit supplies power to Tamil Nadu (562.50 MW), Puducherry (33.50 MW), Kerala (133 MW), Karnataka (221 MW) and Andhra Pradesh (50 MW). (www.ndtv.com)

Transmission / Distribution / Trade…

PFC transfers 3 transmission projects to Adani Power

November 24, 2015. Power Finance Corporation (PFC) said its arm PFC Consulting Ltd has transferred three wholly owned subsidiaries to Adani Power Ltd. These three firms are Sipat Transmission Limited, Chhattisgarh-WR Transmission Limited and Raipur-Rajnandgaon-Warora Transmission Limited. Adani Power won these three transmission projects through tariff-based competitive bidding process. (economictimes.indiatimes.com)

Tripura to supply power to Bangladesh from December 16

November 23, 2015. Tripura will start supplying power to Bangladesh from December 16, Tripura State Electricity Corporation Limited (TSECL) said. Tripura had promised to export 100 MW power to Bangladesh from its share of 196 MW power in the 726 MW Palatana project. This is an expression of gratitude as Bangladesh allowed Tripura to bring its heavy equipment for the project. The project could not be taken up earlier because several weak bridges on the Assam-Agartala highway made transportation of heavy equipment impossible. Work on the 18-km transmission line from Tripura's Surajmani Nagar to Bangladesh's Comilla is being done by the Power Grid Corporation of India Ltd (PGCIL). On the Bangladesh side, another 47 km of transmission line is being constructed by Power Grid Company of Bangladesh Limited (PGCB). PGCB said that the project started one year ago will be done up soon. (www.thefinancialexpress-bd.com)

DVC to waive 60 percent of arrears on Jharkhand

November 22, 2015. The Damodar Valley Corporation (DVC) will waive 60 percent of arrears on Jharkhand, which will benefit the state approximately ` 1,200 crore. During the previous government, the DVC had on October 14 last year said it would not stop power supply to the state till March this year as the state government paid ` 200 crore against its dues owed to the public sector. In May last year, the DVC had threatened to reduce power supply to the Jharkhand Electricity Board due to non-payment of dues. (www.business-standard.com)

CCEA approves 10 percent stake sale in CIL

November 18, 2015. The Cabinet Committee on Economic Affairs (CCEA) approved a 10 percent disinvestment in Coal India Ltd (CIL), the third government stake sale in the company's history. The government is expected to get around ` 20,000 crore from the disinvestment. At the company’s current market capitalisation, a 10 percent stake sale will fetch the government around ` 21,100 crore. While announcing the Cabinet’s decision, Coal and Power Minister Piyush Goyal said that the government was looking to mop up ` 20,000 crore from the disinvestment in CIL. If the government attains its target amount from the CIL stake sale, this will go a long way in meeting the disinvestment target of ` 69,500 crore for this financial year. So far, the government has been able to pare its stake in only four companies — Power Finance Corporation, Rural Electrification Corporation, Dredging Corporation and Indian Oil Corporation — and has earned only ` 12,600 crore. The Department of Disinvestment has reportedly asked for the disinvestment target to be brought down to ` 30,000 crore. If this happens, then a successful Coal India stake sale could see the government overshooting its target. The date and price of the stake sale is yet to be decided, Goyal said. (www.thehindu.com)

Policy / Performance………….

Govt plans cheap gas import for long term: Power Minister

November 24, 2015. The government will approach global markets for long-term gas supply pacts in view of low prices of the fuel, Power Minister Piyush Goyal said. The government is already running a Power System Development Fund (PSDF) scheme to ensure supply to stranded gas-based power projects and plants running at sub-optimal levels due to lower supplies. Under the scheme, RLNG (re-gasified liquefied natural gas) is imported to run these power projects. The projects are required to bid for lower gas subsidy to get the supplies under the scheme. The minister informed that the gas pooling mechanism is till 2017 and the system can continue the supplies even after that. Regarding the upcoming auction of the ultra mega power projects (UMPPs) of 4000 MW each, the minister clearly indicated that as many as four projects will be put on the block in the next three months. The projects include Cheyyur UMPP in Tamil Nadu, Bedabahal UMPP in Odisha and Banka UMPP in Bihar. Besides, there will be another UMPP for offer in Jharkhand. The minister said 5-6 states are already working on the MoU (Memorandum of Understanding) under the UDAY scheme and going forward it is expected that every state in the country will sign up. (profit.ndtv.com)

CEA agrees to give 250 MW power to Telangana

November 24, 2015. The Telangana government scored over Andhra Pradesh in the ongoing power- sharing tussle, with the Central Electricity Authority (CEA) agreed to give 250 MW power to the state. The CEA which held a meeting to resolve the power-sharing row between AP and Telangana in Delhi, agreed with the argument of Telangana officials to increase the share of the state in Central Generating Stations (CGS) from the original 52.17 percent to 53.88 percent. (www.newindianexpress.com)

AP Power sector to get ` 40 bn assistance from World Bank

November 23, 2015. The World Bank has given an in-principle approval for providing nearly ` 4,000 crore financial assistance to Andhra Pradesh (AP) for power sector. The Centre is also extending support for infrastructure development in power sector for both rural and urban areas to the tune of nearly ` 3,200 crore, the State Energy Conservation Mission said. Steps have been taken by AP discoms to clear all 1,932 low tension and high tension pending applications with 500 MW load on war footing. (www.thehindubusinessline.com)

List of third party samplers to test coal to be ready in a month

November 23, 2015. To minimise disputes between the buyer and Coal India, the government notified that third party coal samplers will be appointed and accredited by the Central Institute for Mining and Fuel Research (CIMFR). The move was prompted by frequent disputes between Central Government public sector units NTPC and Coal India over fuel quality. The Coal Ministry has been focussing on methods to minimise such disputes and allowed third party sampling of coal last year. However, disputes then arose over the process followed by such samplers. Accreditation of such third party samplers will remove such disputes, Coal Secretary, Anil Swarup said. Under the new guidelines, four samples will be collected. One will be used for analysis by the third party, one each will be given to the buyer and the seller and one will be kept as a referee sample.

Swarup said the testing will be at the loading end since Coal India sells its coal on a FOR or Free on Railway basis under which the responsibility of the fuel in transit lies with the buyer. Further, a committee has been constituted under the co-chairmanship of Director (Operation) NTPC and Director (Marketing) Coal India Ltd for looking into further modification of the guidelines, if required. The committee will also have members from the Central Electricity Authority, Railways and other state-owned power utilities. To ensure that disputes with regard to the grade of coal are minimised, the Coal Controller Office will be able to outsource the sampling analysis of grade of coal. In another significant decision, the Coal Ministry has decided to provide tapering linkages to power plants of Central or State Government public sector units that have been allotted coal blocks under the Government dispensation route. The move is for those plants that have been allotted coal blocks where development may take some time. The Ministry has already granted a tapering linkage to NTPC’s 4,000 MW Ramagundam plant in Telangana. (www.thehindubusinessline.com)

Creditors of companies which did not win coal mines may be paid: Delhi HC

November 20, 2015. Delhi High Court (HC) set aside its restraint on the government paying the secured creditors of companies, which had failed to win the coal blocks earlier allocated to them and were deallocated on the orders of the Supreme Court. It passed the order on the applications moved by various iron, steel and power companies, like GVK Power, Jayaswal Neco, Sarda Energy and others, which had sought that the money collected by the government from successful bidders may be released to the secured creditors. While the government has computed the compensation amount as ` 68 crore, the companies claimed it was ten times more. (www.thehindubusinessline.com)

Haryana to come out with new power policy

November 20, 2015. Haryana Chief Minister Manohar Lal Khattar announced that the state government was preparing a policy for power sector in the state. He said besides the use of solar power, provisions will be made for Micro, Small and Medium Enterprises (MSMEs) in the new power policy. He said a scheme had been prepared to provide 24X7 power supply to consumers in Gurgaon. He said industries should flourish and such arrangements were being made that shortage of electricity did not pose any hindrance in the way of their progress. He said the government was working on the ways to reduce the losses of power utility companies and at the same time, provide reliable power supply to the consumers. (www.tribuneindia.com)

Series of foreign pacts to give fillip to India's nuclear industry

November 19, 2015. India's domestic nuclear industry is expected to get a fillip with series of foreign civil nuclear collaboration beginning with much awaited signing of nuclear pact with UK during PM's trip and announcement of conclusion of processes to implement Indo-Australian civilian nuclear deal. The Indo-UK nuclear pact, sealed five years after declaration, is a significant as it would enable industrial collaboration between two countries including sharing of views as US Nuclear major Westinghouse is building nuclear power plants in both Britain and Gujarat. Besides Indo-UK cooperation would entail joint research in nuclear science and technical level cooperation. While UK does not possess any uranium mines, it has a slightly bigger nuclear industry than India. The country, however, possesses plutonium from which India can benefit, indicated people familiar with nuclear industry. With the conclusion of pact with UK, India now has civil nuclear cooperation with four out of five permanent members of UN Security Council (UNSC). The partnership also marks significant stepping up of civil nuclear cooperation with Europe. India has growing nuclear energy partnership with France and contemplating an arrangement with Spain. However, French nuclear major Areva which is building nuclear power plant in Jaitapur (Maharashtra) is undertaking internal changes and this has slowed commercial negotiations with Nuclear Power Corporation of India Limited. It is understood that the process is expected to pick up next year. The nuclear deal with Japan will also give momentum to implementation of Indo-US nuclear deal and Westinghouse's proposed plant in Gujarat. Japan's industry major Toshiba has major stakes in Westinghouse. (economictimes.indiatimes.com)

CCI asks CIL to examine spot e-auction scheme afresh

November 18, 2015. The Competition Commission of India (CCI) has asked Coal India Ltd (CIL) to examine afresh its spot e-auction scheme to obviate possible violation of competition norms even as the watchdog rejected a complaint of unfair business practices against the state-owned miner. Earlier also, CIL had come under the scanner of the Competition Commission of India (CCI). In December 2013, the regulator had imposed a fine of ` 1,773 crore on the miner which has challenged it. In the latest instance, it was alleged by DB Power that CIL and its subsidiary Northern Coalfields Ltd abused their dominant positions with respect to spot e-auction of coal. CCI considered 'sale of non-coking coal to the bidders under spot e-auction scheme in India' as the relevant market in the present matter. While CIL and its subsidiaries were found to be dominant in the relevant market in earlier cases, the Commission said no case of abuse of dominance by opposite parties is there. However, CCI said it was constrained to note that the e-auction scheme has come up in challenge in various cases where buyers have alleged lack of reciprocity and mutuality of obligations in the terms and conditions thereof. (www.newindianexpress.com)

Atomic Energy Act to be amended to boost nuclear power sector

November 18, 2015. Seeking to fast-track nuclear power projects in the country, the Union Cabinet decided to amend the Atomic Energy Act to enable Nuclear Power Corporation of India Ltd (NPCIL) to enter into joint ventures with other public sector undertakings (PSUs). The amendment has been brought in to facilitate the fast expansion of the nuclear power, utility and establishment, and this is living up to India’s commitment of using nuclear energy for peaceful purpose, Jitendra Singh, Union Minister of State for the Prime Minister’s Office, which looks after the Department of Atomic Energy (DAE), said. Singh said the move will help in getting funds for big ticket projects. (news.niticentral.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Norway oil companies to deepen spending cuts amid sub-$50 crude

November 24, 2015. Oil and gas companies operating in western Europe’s biggest crude producing country deepened estimated cuts in investments next year after predicting offshore spending will fall by 10 percent this year. Investments in offshore Norway will fall to 192.8 billion kroner ($22.3 billion) in 2015 and to 171 billion kroner next year, according to Statistics Norway’s quarterly survey. Falling investments due to a drop in Brent crude are threatening to throw the economy of western Europe’s largest oil producer into a recession. Crude producers and service companies such as state-controlled Statoil ASA have announced more than 25,000 job cuts, sending ripples through an economy where one in nine jobs depend on oil. (www.bloomberg.com)

Poland's PGNiG to launch gas production in Pakistan

November 24, 2015. Polish gas company PGNiG will launch gas production in December at its concession in Pakistan, it said. Earlier this year the state-run group discovered a "tight" gas deposit in Pakistan with total reserves estimated at 4.5 billion cubic metres. PGNiG has been present in Pakistan since 2005 and plans further exploration works there. (af.reuters.com)

Lukoil predicts its Russian output will be unchanged next year

November 24, 2015. Oil producer Lukoil aims to maintain output in Russia at this year's level of 86-87 million tonnes and to increase it by 1.5-2 million tonnes in 2017, its chief executive, Vagit Alekperov, said. Russia intends to provide further discounts on its Urals crude blend in order to defend its market share in Europe as other grades have been increasingly flowing into the region, the government said. (af.reuters.com)

Shale drilling boosted US oil and gas reserves in 2014: EIA

November 23, 2015. Reserves of oil and natural gas in the United States shot higher last year, according to government data released, setting records that reveal the extent to which a decade-long drilling boom has transformed the energy landscape. Proved reserves of natural gas rose by 34.8 trillion cubic feet (Tcf), or 10 percent, to a record high of 388.8 Tcf in 2014, while oil reserves rose 3.4 billion barrels, or nine percent, to 39.9 billion barrels, the highest since 1972, the Energy Information Administration (EIA) said. The EIA describes proved reserves as oil and gas that can be extracted using current technology and under economic conditions. The Marcellus shale in Pennsylvania, which currently produces about 20 percent of the country's natural gas, contributed most to the increase in gas reserves, adding 10 Tcf of proved reserves. The Texas portions of the Eagle Ford and the Permian Basin saw the largest increase in oil reserves, adding 2.05 billion barrels. North Dakota saw the second largest increase, a gain of 362 million barrels, driven by the Bakken shale. Production of oil and natural gas increased in 2014, the EIA said. Production of crude oil and lease condensate increased about 17 percent, from 7.4 to 8.7 million barrels per day. Gas output increased 6 percent, from 73 to 77 billion cubic feet per day. (www.reuters.com)

Colombia's Ecopetrol to explore in four Gulf of Mexico blocks

November 23, 2015. The U.S. affiliate of Colombian state-run oil company Ecopetrol will explore for oil in four blocks in the Gulf of Mexico, the company said, partially in partnership with Anadarko U.S. Offshore Corp. Three of the blocks, located offshore of Texas, will be explored in concert with Anadarko U.S. Offshore, a unit of Anadarko Petroleum Corp. The two companies offered $2.4 million for exploration rights, Ecopetrol said. Ecopetrol has complete rights to exploration in the fourth block, for which it bid $2.8 million in August. The U.S. government's Bureau of Ocean Energy Management has approved the bids. Ecopetrol first explored in the Gulf in 2008. (www.reuters.com)

Malaysia's Sarawak has more O&G fields not monetized yet

November 23, 2015. Malaysia has more than 200 discovered oil and gas (O&G) fields off the eastern state of Sarawak that have not been monetized, state-owned firm Petroliam Nasional Bhd (PETRONAS) said. PETRONAS has pumped in over $70 billion (MYR 300 billion) in cumulative investment in Sarawak in upstream, midstream and downstream projects and activities. Sarawak has 60 oil and gas producing fields, 26 oil and 34 gas, producing an average of 0.85 million barrels of oil equivalent per day. (www.rigzone.com)

Shell confirms Kaikias development potential

November 19, 2015. Royal Dutch Shell plc now estimates that the development potential of its Kaikias discovery in the deepwater Gulf of Mexico could exceed over 100 million barrels of oil equivalent. Discovered in 2014, Shell completed the appraisal of its wholly-owned Kaikias discovery in August of this year. Appraisal drilling revealed over 300 feet of net oil pay, Shell said. Full evaluation of the well results continues. Shell used Noble Drilling’s Noble Globetrotter I (UDW drillship) for exploration and development drilling. Located approximately 60 miles offshore Louisiana in 4,575 feet of water, Kaikias is situated near Shell’s existing deepwater Gulf infrastructure, and builds upon the company’s exploration and leadership position in the Mars-Ursa Basin, the company said. Shell was able to complete Kaikias’ drilling and appraisal ahead of schedule and under budget, allowing Shell to achieve cost savings of over 20 percent. (www.rigzone.com)

Noble and Delek start sale process for small gas fields off Israel

November 18, 2015. US energy group Noble Energy and Delek Group are taking the first steps in the sale of two small gas fields in the eastern Mediterranean Sea. Noble Energy will sell its 47% stake in the undeveloped Karish and Tanin fields, which are estimated to hold 85 billion cubic meters (bcm) of gas reserves, to Delek for US$67 mn. Delek will then sell the fields to a new buyer with 14 months, as part of the agreement reached with the Israeli government on the development of the giant Leviathan offshore gas field in August 2015. In August 2015, the Leviathan consortium (39.66% Noble Energy, 22.67% Delek) committed to invest US$1.5 bn in the Leviathan project over the next two years and to sell its minor gas fields to open the Israeli gas sector to competition. The Leviathan offshore gas field was discovered in 2010 and is estimated to hold 620 bcm of gas reserves. The US$6.5 bn field was initially expected to start production in 2018 but could be delayed. (www.enerdata.net)

Downstream…………

European oil refiners set for strong 2016

November 18, 2015. European oil refiners are set for another good year in 2016, helped by strong demand and a battle among crude producers for market share, the Finnish refiner Neste said. The state-controlled company, which has two traditional refineries in Finland as well as renewable refineries in Singapore and Rotterdam, reported a 47-percent rise in quarterly core profit helped by high European refining margins and favorable foreign exchange rates. (www.reuters.com)

Transportation / Trade……….

Gazprom may sell UK-Belgium gas pipeline stake after 20 yrs

November 23, 2015. Gazprom PJSC, the supplier of about 30 percent of Europe’s natural gas, may sell its stake in one of the two pipelines connecting the U.K. to mainland Europe after more than two decades. The company will consider disposing of its 10 percent stake in the U.K.-Belgium gas link operator, Interconnector UK Ltd., at a meeting on Nov. 30, the Moscow-based producer said. Gazprom purchased its stake in the 235 kilometer pipeline that can switch the direction of gas flows between terminals at Bacton in the U.K. and Zeebrugge in Belgium in December 1994. Russia’s state-run exporter has been using the pipe to sell gas in the U.K. through its trading unit Gazprom Marketing & Trading Ltd. Gazprom rents about 6 billion cubic meters (200 billion cubic feet) a year of the pipeline’s capacity to the U.K. and 2 billion cubic meters in the opposite direction. The link has an annual capacity to Britain of 25.5 billion cubic meters and to Belgium of 20 billion. Britain used 66.7 billion cubic meters of gas last year and Belgium 14.7 billion, BP Plc data show. In October 2014, Gazprom Chief Executive Officer Alexey Miller said his company was reviewing its strategy of targeting end-customers in Europe because it wasn’t “a buyer’s market” and as Russia’s energy ties with Europe soured over the conflict in Ukraine. Miller said the company is again targeting European end-users as it agreed on doubling the capacity of a pipeline under the Baltic Sea from Russia to Germany. (www.bloomberg.com)

Kinder Morgan files application for $5 bn natural gas pipeline project in US

November 23, 2015. US based energy company Kinder Morgan’s subsidiary Tennessee Gas Pipeline has filed an application with the Federal Energy Regulatory Commission to build a 419.66 mile natural-gas pipeline. The company plans to build the pipeline called Northeast Energy Direct Project to carry natural gas from the Marcellus region of Pennsylvania to markets in the Northeast. The project has two components which include 'Supply Path' component and 'Market Path' component with a maximum design capacity of 1.2 billion cubic feet per day. The 133-mile supply path pipeline will span from Tennessee Gas Pipeline's existing 300 Line system in northern Pennsylvania to an interconnection with TGP's 200 Line system and Iroquois Gas Transmission System at Wright, New York. The company plans to start certain construction activities in January 2017 following receipt of approval and bring the project on stream in November 2018. (utilitiesnetwork.energy-business-review.com)

Saudi Arabia edges out Russia in China oil sales as OPEC digs in

November 23, 2015. Saudi Arabia reclaimed its position from Russia as the largest crude supplier to China as OPEC members extended their global fight for market share. The world’s biggest oil exporter sold 3.99 million metric tons to China in October, 0.8 percent more than in September, the Beijing-based General Administration of Customs data showed. Angola, another member of the Organization of Petroleum Exporting Countries (OPEC), also surpassed Russia in shipping crude to the Asian nation. China has become a battleground for oil producers who are seeking to defend sales amid a worldwide oversupply. Prices have slumped 40 percent since OPEC embarked on a strategy last November to keep pumping and drive out higher-cost competitors such as U.S. shale companies. Saudi Arabia this year twice ceded the top spot to Russia in crude sales to China, in May and September. The kingdom accounted for about 15 percent of China’s imports in the first 10 months of this year, compared with 12 percent for Russia, according to the customs data. Russia supplied 3.41 million tons to its neighbour in October, a 16 percent drop from a record in September. Angola’s shipments climbed 27 percent from the previous month to 3.64 million tons, the data showed. (www.bloomberg.com)

Glencore seals Libyan oil deal in scramble for profits

November 20, 2015. Trading house Glencore has secured a deal to buy as much as half of the oil Libya is currently exporting, as it looks to boost trading to help offset flagging profits from mining. For war-torn, cash-strapped Libya it offers steady sales to international buyers and shifts to Glencore the risks associated with loading oil and chartering vessels at ports where operations have become more unpredictable due to the conflict in the north African nation. Under the arrangement with Libya's state-run National Oil Corp. (NOC), which began in September, Glencore loads and finds buyers for all the Sarir and Messla crude oil exported from the Marsa el-Hariga port near the country's eastern border with Egypt. While Libyan oil exports peaked at 1.6 million barrels per day (bpd), battles between rival factions seeking to control the country, as well as strikes and blockades by local tribes, have kept production under 0.5 million bpd for most of the past year. Hariga, with exports of up to 140,000 bpd, has become Libya's largest exporting terminal, as the two biggest - Es Sider and Ras Lanuf - remain closed. Libya is still exporting oil from other locations, such as offshore platforms Bouri and Al-Jurf, without a Glencore go-between, and is working to reopen its larger fields of El Feel and Sharara. Some oil companies and refineries had grown reluctant to send vessels to load Libyan oil for fear of lengthy and costly loading delays and force majeure declarations. The NOC earlier this year denied reports of an exchange of crude for oil products with Glencore, and said any arrangement that did not route payments via its central bank would be illegal. (www.reuters.com)

Oil traders prepare for next big price drop in March 2016

November 19, 2015. Oil traders are preparing for another downward turn in prices by March 2016, market data suggests, as what is expected to be an unusually warm winter dents demand just as Iran's resurgent crude exports hit global markets after sanctions are ended. Crude futures have already lost around 60 percent of their value since mid-2014 as supply exceeds demand by roughly 0.7 million to 2.5 million barrels per day to create a glut that analysts say will last well into 2016. Goldman Sachs said that there was a substantial risk of a "sharp leg lower" in oil prices. Goldman and other analysts say persistently high U.S. shale oil output that producers aren't allowed to export could overwhelm the country's storage tanks, which are already filled with near-record inventories. The market may also have to accommodate a rapid rise in Iranian oil exports if sanctions are lifted, which many analysts say could happen in the first half of 2016. (www.reuters.com)

Iraqi oil selling at $30 as OPEC readies for new battles

November 19, 2015. Iraq may increase oil output further in 2016, although less dramatically than this year, intensifying a battle for market share between OPEC members and non-OPEC rivals that has forced Baghdad to sell some crude grades for as little as $30 a barrel. Iraq's output in 2015 has jumped almost 500,000 barrels per day (bpd), or 13 percent, according to the International Energy Agency (IEA). That has made Iraq the world's fastest source of supply growth and a key driver of surging OPEC production. Iraq plans to export 3.0-3.2 million bpd from the south in 2016. The scale of Iraq's growth this year surprised many observers. Moreover, the extent of any slowdown in 2016 and Iran's growth are on the minds of OPEC delegates heading into the group's Dec. 4 meeting on output policy. (www.reuters.com)

In Shell-BG review, China wants concessions on huge gas deals

November 19, 2015. Chinese regulators vetting Royal Dutch Shell's proposed merger with BG Group are pressing the Anglo-Dutch company to sweeten long-term gas supply contracts in a move that could cast new doubt over the near-term benefits of the $70 billion tie-up. For China, the opportunity to re-negotiate existing liquefied natural gas (LNG) supply contracts with Shell, which combined with BG would supply around 30 percent of its imports by 2017, comes at an ideal time because the world's top energy consumer faces a large surfeit over the next five years. For Shell, any revision of the contracts with China could dilute the near-term financial benefits of a merger that has already raised concern among some investors and analysts because of stubbornly low oil prices. Shell declared it wanted to become the world's top trader of LNG when it agreed a takeover of BG in April. It expects global demand for LNG to grow by nearly 5 percent per year by 2030. Power plants, industries and vehicles are shifting to the less polluting gas, which once extracted from the ground is cooled and liquified, loaded onto ships before being turned back into gas at its destination. The proposed Shell-BG tie-up has already won mandatory approvals from Brazil and the European Union. It secured clearance from one of two Australian regulators but still requires the green light from China. (uk.reuters.com)

Policy / Performance…………

China's NDRC approves development of the Sanjiao CBM project in Ordos Basin

November 24, 2015. Sino Oil and Gas Holdings Limited announced that the National Development and Reform Commission (NDRC) has approved the overall development plan (ODP) of its Shanxi Sanjiao Coal Bed Methane (CBM) Project in China's Ordos Basin -- the first Sino-foreign CBM development involving China National Petroleum Corporation (PetroChina) to have gained the NDRC's approval. The firm indicated that it had entered into a production sharing contract (PSC) with PetroChina -- its partner in China to explore, utilize and produce from the CBM field in the Sanjiao block in Shanxi and Shaanxi provinces. The Approval signifies that the Sanjiao CBM project will soon, in accordance with the ODP, commence the sizable development and production with an annual capacity of 17.66 billion cubic feet (500 million cubic meters), Sino Oil and Gas said. (www.rigzone.com)

Iran seeks more cooperation with Russia in energy sector

November 23, 2015. Iran's president Hassan Rouhani said after talks in Tehran with his Russian counterpart Vladimir Putin that Tehran was seeking greater cooperation with Moscow in the energy, banking and transportation sectors. He said several memorandums of understanding had been signed, showing "the ties between Iran and Russia are growing day by day." (www.reuters.com)

KrisEnergy secures govt approval for Rossukon Production Area off Thailand

November 23, 2015. KrisEnergy Ltd., a Singaproe-based independent upstream oil and gas company, reported that it has secured government approval for the Rossukon Production Area in the Gulf of Thailand. The Department of Mineral Fuels Thailand's upstream regulator, approved the Production Area Application for the area -- covering 33.88 square miles -- containing the offshore Rossukon oil discovery in Block G6/48 over the Karawake Basin in the Gulf of Thailand. KrisEnergy drilled two exploration wells and two intentional sidetrack wells in the Rossukon area, with each well encountering oil and gas, adding to volumes from the original Rossukon discovery made in 2009. (www.rigzone.com)

Venezuelan Oil Minister says OPEC cannot allow a price war

November 22, 2015. OPEC cannot allow an oil price war and must take action to stabilize the crude market soon, Venezuelan Oil Minister Eulogio del Pino said. Venezuela had made a proposal in Vienna on Oct. 21 about an equilibrium price that could stabilize the market, del Pino said, repeating that the equilibrium price where future investments can continue to replace a natural decline in production is at the level of $88. He said low oil prices will affect future oil investments which could mean not meeting future demand growth for oil and that could lead to a spike in prices later. (www.reuters.com)

Oil platform operator to pay more than $41 mn in penalties: US Justice Dept

November 19, 2015. The offshore oil platform operator ATP Oil & Gas Corp. has agreed to pay more than $41 million in penalties to settle claims it made unauthorized discharges of oil and chemicals from a production platform in the Gulf of Mexico, the U.S. Justice Department said. ATP is going through bankruptcy and is no longer operating. The U.S. Bankruptcy Court for the Southern District of Texas approved an agreement allowing an unsecured claim of $38 million for a judicial civil penalty judgment, according to the Justice Department. ATP will also pay administrative penalty of $3.85 million for related violations, it said. (www.reuters.com)

Poland's PM flags possible second LNG terminal

November 18, 2015. Poland may consider building a second liquefied natural gas (LNG) terminal on the Baltic Sea to increase its energy security, Prime Minister (PM) Beata Szydlo said. Poland's first LNG terminal should be ready for commercial use next May, its operator has said. The terminal, being built in the Baltic city of Swinoujscie, is Poland's flagship project to diversify gas supplies and reduce its dependence on Russia. It was originally scheduled to open in 2014 but has been delayed several times. (af.reuters.com)

Dutch court to rule on gas output from Europe’s biggest field