-

CENTRES

Progammes & Centres

Location

[Are large projections for renewable only cosmetic?]

“Interestingly, as China reduces its consumption, India will be increasing its production level by 3 percent from 2012 level. So whatever space is vacated by China will be taken over by the India. Apart from this Australia and Indonesia will also be increasing their coal production by 2 percent and 3 percent respectively from 2012 levels. Therefore major consumers as well as major coal exporting countries will be increasing their production…”

Energy News

[GOOD]

Falling coal imports is good news for India even if it is coming at a time of falling demand!

If the past is any guide rescue packages for discoms are not necessarily an incentive for reform!

[UGLY]

No single country can make an important contribution to climate change unless all other countries make important contributions!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· INDCs will only make a marginal impact on emission reduction

· Are large projections for renewable only cosmetic?

UPCOMING EVENT...........

DATA INSIGHT………………

· World Coal Markets: Prices and Variations

[NATIONAL: OIL & GAS]

Upstream…………………………

· ONGC profit dips 11 percent on sharp fall in oil prices

Downstream……………………………

· Gujarat okays IOC's proposal to acquire land for expansion

Transportation / Trade………………

· Russia, India discuss possible pipeline project: Russian Energy Ministry

· India’s October Iran oil imports lowest since March

Policy / Performance…………………

· Cairn wants India to appoint arbitrator by November 11

· Time has come for stopping LPG subsidy to well-off: Oil Minister

· Govt hikes excise duty on petrol, diesel

· Govt plans to bring kerosene under DBT

· India, Qatar working to tweak LNG deal

[NATIONAL: POWER]

Generation………………

· DAE may set up nuclear power plant if Odisha proposes

· NTPC expects to start 1st 800 unit of Kudgi plant in FY16

· India in talks to set up JV in South Africa for coal blocks

· WCL to produce 100 mt by 2020

Transmission / Distribution / Trade……

· Coal imports drop 5 percent to 14.52 mt in October

· PM Modi says would ensure 24X7 power supply by 2020

· UAE’s TAQA starts selling power from India hydro project

· TANGEDCO in reforms overdrive to improve supply, up revenue

Policy / Performance…………………

· Gas-insulated substation in Ghaziabad by March

· 'Hope discoms restructure package will be adopted pan-India'

· Cabinet to decide on UCG policy soon

· Rajasthan govt to sell Giral power plant

· Govt plans to ease coal usage rules in bid to improve supply

· Delhi govt extends power amnesty scheme till December

· India unveils rescue package for power sector

· Govt to unveil power reforms in next couple of days: Finance Minister

· PM Modi reviews progress of Kishanganga Hydro Electric Project

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· US lowers 2016 crude output forecast as drillers idle rigs

· Iraq oil partners seek contract changes to boost output

· Apache said to get takeover approach for $18 bn company

· Oil investment cuts at $200 bn as Saudi prince sees rally

· BP signs deal to accelerate development of Atoll gas field in Egypt

· Eni partners with Sonangol to provide natural gas to Angola

Downstream……………………

· SOCAR says looks at stakes in Egypt oil refineries

· South African deputy president to visit Iran over planned refinery

· CNPC in talks to build 10 mn tonne per year Pakistan oil refinery

· Asia expected to see robust oil refining margins next year

Transportation / Trade…………

· Africa oil sees joint pipeline as only option for Uganda, Kenya

· France and Belgium connect 8 bcm per year gas pipeline project

· Dubai airports get more jet fuel with new ENOC pipeline

· LNG tanker steams toward US Sabine Pass for inaugural loading

· Obama rejects Keystone XL pipeline in win for greens

· China's CNOOC tenders to sell third Australian LNG cargo

· TransCanada to build only one Energy East oil export terminal

Policy / Performance………………

· Israel eyes more offshore gas exploration within 6 months

· China, Mideast to overtake Europe as biggest gas users: IEA

· Oil price to rise only gradually to $80 by 2020: IEA

· Pakistan says finalises 15 year, $16 bn LNG deal with Qatar

· OPEC ready to make needed investments to respond to future needs: Secretary General

· Iran's oil return to boost SUMED volumes: Egypt Oil Minister

· US shale producers get ready for budget cuts in 2016

· China gets its own crude contract

[INTERNATIONAL: POWER]

Generation…………………

· Egbin Power plans to build 1.3 GW power plant by 2019

· UK's National Grid requests extra power generation to cover shortage

Transmission / Distribution / Trade……

· ABB to strengthen power transmission grid in New Jersey

· EDF reviews its power transmission grid strategy

· Entergy Louisiana to signs power supply agreement for Lake Charles LNG project in US

Policy / Performance………………

· Pakistan govt, frustrated by power crisis, changes tack

· Global coal consumption heads for biggest decline in history

· NERC issues 126 licences to power plants

· Brazil’s power-plant auction delayed by politics

· South Africa poised to make decision on nuclear energy providers

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· India makes strong pitch for climate finance ahead of Paris climate summit

· US hopes India would make important contribution on climate change

· Adani's Australia coal mine project faces fresh legal challenge

· Tata Power to enhance focus on Renewables by aggregating and carving out renewable assets

· CIL mulls big investment on solar power generation units

· India aims to achieve colossal renewable energy targets 2 yrs in advance

· 175 GW of green energy is big challenge: Railway Minister

· Solar energy to become main pillar in India’s renewables target

· SunEdison to develop 500 MW of solar power plants in India

GLOBAL………………

· German company to build solar power plants in Iran

· Vestas to supply turbines for 200 MW of wind projects in China

· Lekela Power will build a 250 MW wind project in Egypt

· Peabody Energy resolves New York probe into climate disclosures

· Shell sees carbon price of $60 to $80 needed to justify CCS

· Construction begins on 1GW Miraah solar plant in Oman

· Solar energy is cheapest source of power in Chile, Deutsche says

· Everbright International to develop waste-to-energy project in Henan Province, China

· Kazakh sovereign wealth fund seeks $106 mn solar expansion

· Canada's Trudeau pledges new climate focus ahead of Paris summit

· Apple, Google, Microsoft among best companies protecting climate

· Hitachi Zosen completes 6 MW wood chip biomass power plant

· Rich countries must pay up for climate technology: French President

[WEEK IN REVIEW]

COMMENTS………………

INDCs will only make a marginal impact on emission reduction

|

A |

s of 1 October 2015, 119 INDCs had been received, covering 147 Parties to the Convention, including one regional economic integration organization, and representing 75 percent of Parties and 86 percent of global emissions in 2010. Given that some sectors and gases are not covered by the communicated INDCs, 80 percent of the global emissions are covered by the communicated INDCs.

All Parties included information on their mitigation contributions. A total of 100 Parties, accounting for 84 percent of the INDCs, also included an adaptation component in their INDC. Most of the INDCs are national in scope; they address all major national GHG emissions or at least the most significant sources. Many contain quantified emission reduction targets, which take a variety of forms.

· Some of the INDCs include economy-wide mitigation targets, with absolute emission reduction targets expressed as an emission reduction below the level in a specified base year and ranging from 9.8 to 90.0 percent.

· A few of the INDCs contained absolute targets that are not linked to a base year but establish an overall maximum absolute limit one missions (e.g. carbon neutrality by a future date); Half of the INDCs include relative targets for reducing emissions below the ‘business as usual’ (BAU) level, either for the whole economy or for specific sectors, ranging from 1.5 to 89.0 percent;

· A few of the INDCs contain intensity targets, with reductions in GHG emissions per unit of gross domestic product (GDP) or per capita ranging from 13 to 65 percent relative to the level in a base year (e.g. 2005 or 2010) or to the absolute level of per capita emissions by 2025 or 2030;

· A few of the INDCs specify the year or timeframe in which the respective Party’s emissions are expected to peak (e.g. by 2030 or earlier)

· Some of the INDCs contain strategies, plans and actions for low GHG emission development reflecting the respective Parties’ special circumstances, in accordance with decision 1/CP.20, paragraph 11.

Aggregate effect of the intended nationally determined contributions until 2030

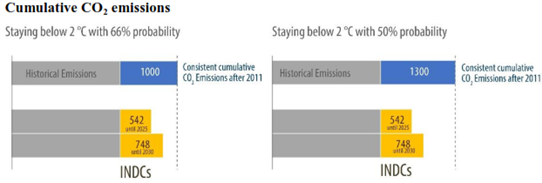

· The implementation of the communicated INDCs is estimated to result in aggregate global emission levels of 55.2 (52.0 to 56.9) Gt CO2eq in 2025 and 56.7 (53.1 to 58.6) Gt CO2eq in 2030. The global levels of emissions in 2025 and 2030 were calculated by adding the estimated aggregate emission levels resulting from the implementation of the communicated INDCs (41.7 (36.7 to 47.0) Gt CO2eq in 2025 and 42.9 (37.4 to 48.7) Gt CO2eq in 2030) to the levels of emissions not covered by the INDCs. Aside from various uncertainties in the aggregation of the INDCs, these ranges capture both unconditional and conditional targets. Global cumulative CO2 emissions after 2011are expected to reach 541.7 (523.6–555.8) Gt CO2 in 2025 and 748.2 (722.8–771.7) Gt CO2 in 2030

· Compared with global emissions in 1990, 2000 and 2010, global aggregate emission levels resulting from the INDCs are expected to be higher by 34–46 percent in 2025 and 37–52 percent in 2030 in relation to the global emission level in 1990; 29–40 percent in 2025 and 32–45 percent in 2030 in relation to the global emission level in 2000; and 8–18 percent in 2025 and 11–22 percent in 2030 in relation to the global emission level in 2010. While these figures show that global emissions considering INDCs are expected to continue to grow until 2025 and 2030, the growth is expected to slow down substantially, to 11–23 percent in the2010–2030 period compared with 24 percent in the 1990–2010 period. The relative rate of growth in emissions in the 2010–2030 period is expected to be 10–57 per cent lower than that over the period 1990–2010, reflecting the impact of the INDCs.

· Global average per capita emissions considering INDCs are expected to decline by 8 and 4 percent by 2025 and by 9 and 5 percent by 2030 compared with the levels in 1990 and 2010, respectively. This is based on estimated global average per capita emissions, considering INDCs, of6.8 (6.5–7.1) t CO2 eq/capita in 2025 and 6.7 (6.4–7.2) t CO2 eq/capita in 2030. Emissions in 2000 were approximately equal to expected per capita emission levels in 2030 (range: –5 to +6 percent) and 1 percent above expected 2025 levels (range: –3 to +5 percent).

· Implementation of the INDCs would lead to lower aggregate global emission levels than in pre-INDC trajectories. The level of global GHG emissions associated with the INDCs is expected to be lower than the emission level in pre-INDC trajectories, by 2.8(0.2–5.5) Gt CO2 eq in 2025 and 3.6(0.0–7.5) Gt CO2 eq in 2030. Taking into account the conditional components of the INDCs would make the upper level of this range 1.0 and 1.9 Gt CO2 eq lower than with unconditional components only. These figures provide an estimate of the aggregate effect of the INDCs stemming from the action to reduce emissions and enhance sinks compared with emission scenarios that are consistent with action communicated by Parties for the pre-2020 period.

· Compared with the emission levels consistent with the least-cost 2°C scenarios, aggregate GHG emission levels resulting from the INDCs are expected to be higher by 8.7 (4.7–13.0) Gt CO2 eq (19 percent, range 10–29 percent) in 2025 and by 15.1 (11.1–21.7) Gt CO2 eq (35 percent, range 26–59 percent) in 2030.

· Figure (below) compares cumulative CO2 emissions expected under the INDCs (medians) and cumulative CO2 emissions in line with keeping the global average temperature rise relative to pre-industrial levels below certain levels. Shown are comparisons for keeping temperatures below 2°C with 66 percent (middle panel) or 50 percent likelihood (right panel). Historical (grey, 1,890 Gt CO2) and consistent future cumulative CO2 emissions (blue) are taken from the contribution of Working Group I to the AR5. Numbers shown relate to Gt CO2 emissions after 2011.

Courtesy: Synthesis report on the aggregate effect of the intended nationally determined contributions (Advance Version), UNFCCC

COMMENTS………………

Are large projections for renewable only cosmetic?

Ashish Gupta, Observer Research Foundation

|

T |

here are many optimistic projections from various quarters regarding the future of coal. Many agencies are predicting that coal usage in power generation will come down dramatically by 2040. Some even expect that those who invest in coal will be doomed and the coal sector will die a premature death.

According to the BP Energy Outlook 2014, coal and oil consumption is expected to slow down whereas gas consumption expected to grow at 1.9 percent compared to overall energy demand growth of 1.7 percent. Renewable sector is expected to grow substantially at 39 percent during the period 2014-2035. This indicates huge renewable capacity will be added in the future posing a very important question whether there will be any role for coal?

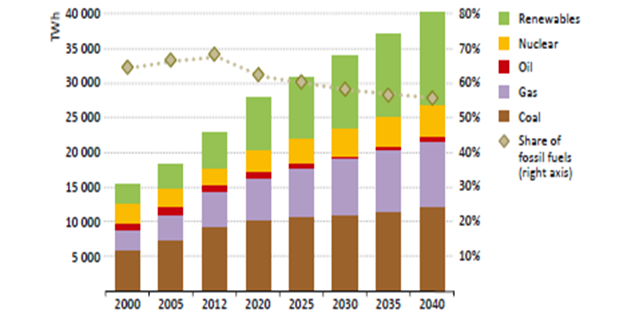

Projected Share of Renewables in Power Generation

Source: IEA World Energy Outlook 2014

TWh= Terawatt hour

From the graph (IEA New Policy Scenario), it is clear that the role of fossil fuels will be reduced substantially whereas renewable will continue to grow massively. The share of fossil fuels in the power generation which was at around 69 percent in 2012 will be reduced to 52-23 percent by 2040. The electricity generated from coal (app. 12,000 TWh) and renewable (app. 12,000 TWh) will be almost equal in 2040. But these large estimates for renewables must be qualified as it also includes hydro. This means that the increment will come have to come from the hydro sector and not specifically from the new renewable sources like solar, wind etc. If hydro is excluded then the share of renewable will come down by 50 percent because 6,000 TWh is expected to be generated by hydro in 2040. Therefore are these large estimates for renewables are only cosmetic? This is an issue that must be clarified. Let us have a look on world coal production planned during the same period.

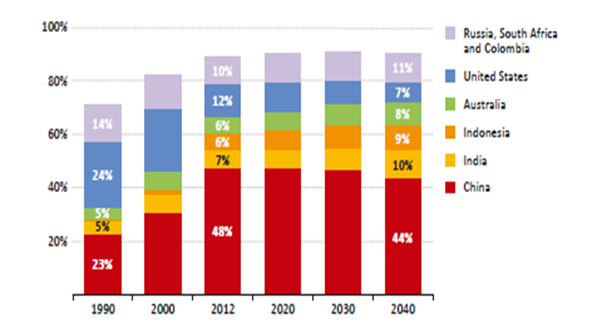

World Coal Production

Source: IEA World Energy Outlook 2014

It is evident from the above graph that some countries will curb their coal production whereas some countries will increase their production. This means that the production level will remain the same while countries change their preferences for fuel primarily for economic reasons. For example China’s coal production is expected to be reduced by 4 percent from the 2012 levels. But this is not enough to make us believe that this reduction is the result of renewable proliferation. It is possible that efficiency gains might be the reason behind such reduction. Effectively China will use less coal to produce more electricity or steel.

Interestingly, as China reduces its consumption, India will be increasing its production level by 3 percent from 2012 level. So whatever space is vacated by China will be taken over by the India. Apart from this Australia and Indonesia will also be increasing their coal production by 2 percent and 3 percent respectively from 2012 levels. Therefore major consumers as well as major coal exporting countries will be increasing their production. They all see opportunity in coal. So it is clear that both consumers as well as exporters expect coal to stay as a key fuel for power generation for the foreseeable future.

Views are those of the author

Author can be contacted at [email protected]

UPCOMING EVENT

“Can Coal Block Auctions Be The Path To Modernize Coal Mining?”

to be held on 23 November 2015, 10:30 AM To 2:00 PM, at ORF, New Delhi

to confirm participation please contact

World Coal Markets: Prices and Variations

Akhilesh Sati, Observer Research Foundation

$/Million Tonnes

|

Years |

Australian Coal |

Colombian Coal |

South African Coal |

|

2001 |

32.31 |

36.43 |

33.86 |

|

2002 |

25.31 |

28.52 |

26.02 |

|

2003 |

26.09 |

33.80 |

30.24 |

|

2004 |

52.95 |

60.93 |

54.68 |

|

2005 |

47.62 |

51.09 |

46.20 |

|

2006 |

49.09 |

52.20 |

50.69 |

|

2007 |

65.73 |

63.76 |

62.65 |

|

2008 |

127.10 |

122.38 |

120.60 |

|

2009 |

71.84 |

59.41 |

64.68 |

|

2010 |

98.97 |

77.97 |

91.62 |

|

2011 |

121.45 |

111.50 |

116.30 |

|

2012 |

96.36 |

83.99 |

92.92 |

|

2013 |

84.56 |

71.88 |

80.24 |

|

2014 |

70.13 |

65.93 |

72.34 |

|

2015 Jan |

62.10 |

56.65 |

62.18 |

|

2015 Feb |

61.40 |

57.75 |

63.28 |

|

2015 Mar |

60.12 |

57.64 |

60.82 |

|

2015 Apr |

57.81 |

55.31 |

59.34 |

|

2015 May |

60.40 |

54.34 |

61.88 |

|

2015 Jun |

58.84 |

53.25 |

60.96 |

|

2015 Jul |

59.13 |

52.34 |

57.05 |

|

2015 Aug |

58.57 |

49.65 |

54.36 |

|

2015 Sept |

54.75 |

49.13 |

51.44 |

|

2015 Oct |

52.16 |

48.28 |

49.81 |

Source: The World Bank

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

ONGC profit dips 11 percent on sharp fall in oil prices

November 6, 2015. Oil and Natural Gas Corp (ONGC) reported a 11 percent drop in its September quarter net profit as slumping global crude prices hurt its revenues. Net profit in the July-September quarter at ` 4,842.02 crore was 11 percent lower than ` 5,444.89 crore clocked in the same period of last fiscal, it said. While the net price for crude oil produced from nomination fields, on which the company has to pay a fuel subsidy discount, was up 18 percent at $48.83 per barrel, the rates realised for oil produced from market-lined joint venture fields slumped 40 percent to about $50 per barrel. ONGC said gross realisation from nomination fields was $51.24 per barrel and it allowed a $2.41 a barrel discount to PSU refiners to help them sell kerosene at the government controlled rate. Its net realisation of $48.83 per barrel compared with $41.45 per barrel of Q2 of last fiscal. Its subsidy payout of ` 596 crore in Q2 compared with ` 13,641 crore payout in the same period last fiscal. The impact of the subsidy discount on profit was ` 329 crore in July-September quarter of current fiscal, a small percentage of ` 7,645 crore impact ONGC had to bear on account of subsidy discounts a year earlier. ONGC said revenue was up 1.1 percent at ` 20,732 crore on account of higher production. Crude oil production from its fields was up nearly 3 percent at 5.36 million tonnes (mt) while output from joint venture fields soared 5.1 percent to 0.91 mt. Similarly, natural gas production from its own field was up 0.5 percent to 5.356 billion cubic meters (bcm) but joint venture output was down nearly a percentage at 0.346 bcm. The company has approved Field Development Plan of 140 square KM Madanam Field in north of Karaikal district of Tamil Nadu. ONGC said during the quarter it made three oil and gas discoveries in Mumbai offshore, shallow waters of Krishna Godavari basin off the east coast and in Tripura. (timesofindia.indiatimes.com)

Downstream………….

Gujarat okays IOC's proposal to acquire land for expansion

November 4, 2015. The Gujarat government has approved a proposal of Indian Oil Corporation (IOC) Gujarat Refinery seeking acquisition of 75 acre land for its expansion projects, the company said. The expansion plans are for raising its crude refining process to 18 million metric tonnes (mmt) per year from the existing 13.7 mmt per year, IOC Gujarat Refinery said. The refinery located at Koyali village on the outskirts of Vadodara city needs a total of 130 acre land for its expansion projects, of which 55 acre have been acquired. The proposal was lying before the state government for over past two years and was cleared recently. The refinery authorities had sought clearance for purchasing the land needed for the expansion project vital for meeting the norms of government's Auto Fuel Vision Policy- 2025. Spread over 1,950 acre, the Gujarat refinery facility includes Asoj and Dumal terminal operations and five primary Atmospheric Distillations Units. (timesofindia.indiatimes.com)

Transportation / Trade…………

Russia, India discuss possible pipeline project: Russian Energy Ministry

November 6, 2015. Russia and India discussed the possibility of building a pipeline system for hydrocarbons between the two countries, the Russian energy ministry said. (in.reuters.com)

India’s October Iran oil imports lowest since March

November 5, 2015. India’s oil imports from Iran fell 41.5% in October from a year ago to the lowest in seven months, according to tanker arrival data, as state-run refiner Mangalore Refinery and Petrochemicals Ltd (MRPL) cut imports due to a maintenance shutdown. India, Iran’s top customer after China, took 181,200 barrels per day (bpd) oil from Tehran in October, down 22.3% from September, according to the data. MRPL, which operates a 300,000 barrels per day (bpd) coastal refinery in southern India, is a key Indian oil client of Iran. The refiner had shut nearly 46% of its crude processing capacity for about a month from 18 September for planned maintenance. MRPL planned fewer purchases of Iran oil for last month as its biggest crude distillation unit (CDU) was shut, the company said. While MRPL received about 45,000 bpd Iranian oil in October, private refiner Essar Oil took about 136,300 bpd, the data showed. India, the world’s fourth-biggest oil consumer, bought 21.8% less Iranian crude for the January-October period at about 212,600 bpd, the data showed. India’s imports from Iran for the year-to-date have been dragged down by deep cuts in shipments by New Delhi in the first quarter of 2015, under pressure from the United States to keep its imports within the limits of sanctions targeting Tehran’s disputed nuclear programme. In the first seven months of India’s fiscal year, running from April through October, its oil imports from Iran jumped 5.6% to 249,100 bpd as refiners raised purchases after the July deal that may mean the removal of sanctions next year. (www.livemint.com)

Policy / Performance………

Cairn wants India to appoint arbitrator by November 11

November 8, 2015. Cairn Energy of UK is willing to suspend its appeal to International Court of Justice seeking appointment of an arbitrator on behalf of Government of India to resolve the ` 10,247 crore tax dispute, provided an arbitral panel is put in place by November 11. The British oil explorer wrote to Finance Minister Arun Jaitley reminding him of government’s promise to appoint an arbitrator “soon” to resolve the issue. Cairn told Jaitley that he and the government on two separate occasions in September promised to appoint an arbitrator but no tangible progress has been made even after more than six weeks. The IT Department says Cairn Energy allegedly made a capital gain of ` 24,503.50 crore in 2006 while transferring all its India assets to a new company, Cairn India. (www.thehindu.com)

Time has come for stopping LPG subsidy to well-off: Oil Minister

November 7, 2015. Oil Minister Dharmendra Pradhan hinted of stopping supply of subsidised cooking gas (LPG) to the well-off as only 42.5 lakh out of nearly 15 crore cooking gas consumers have so far voluntarily give up subsidy. So far more than 42.5 lakh domestic LPG consumers have volunteered to give up their LPG subsidy. The subsidy surrendered is used to connect poor households with LPG connections and relieve them from cooking with firewood or biomass which leads to not only increased carbon emissions but adversely impacts on their health. (www.khabarindia.in)

Govt hikes excise duty on petrol, diesel

November 7, 2015. The government tonight hiked excise duty on petrol by ` 1.60 per litre and the same on diesel by 40 paisa a litre to mop up additional revenue to meet budgetary targets. The basic excise duty on unbranded or normal petrol was increased from ` 5.46 per litre to ` 7.06 a litre, according to a Central Board of Excise and Customs (CBEC) notification. After including additional and special excise duty, the total levy on petrol will be ` 19.06 per litre as against present levy of ` 17.46. Similarly on unbranded or normal diesel, excise duty has been increased from ` 4.26 per litre to ` 4.66 a litre. After including special excise duty, total incidence of excise duty on diesel will be ` 10.66 per litre as against present ` 10.26. The excise duty on branded petrol has been hiked from ` 6.64 to ` 8.24 per lire. Special and additional excise duty of ` 12 per litre will continue as before. (www.thestatesman.com)

Govt plans to bring kerosene under DBT

November 7, 2015. The government is working on a plan to bring kerosene under direct benefit transfer (DBT), Oil Minister Dharmendra Pradhan said. Highlighting the success of DBT for cooking gas, Pradhan said 14.6 crore people receive cooking gas subsidy directly under the Pahal scheme. The minister made a pitch for targeted subsidies. (www.livemint.com)

India, Qatar working to tweak LNG deal

November 6, 2015. India is in talks with Qatar’s RasGas Company to tweak a decade-old liquefied natural gas (LNG) procurement deal. Indian firm Petronet LNG has been forced to cut down gas volumes from Qatar after the fuel bought through this long-term contract became nearly twice as expensive than spot purchases. India’s petroleum minister Dharmendra Pradhan is scheduled to visit Doha to attend the 6th Asian Ministerial Energy Roundtable. Pradhan would discuss the Petronet-RasGas deal with Mohammed Saleh Al Sada, the minister of energy and industry of Qatar. On December 26, 2014, India received the 1,000th cargo under its long-term contract with RasGas at Dahej LNG terminal in Gujarat. Nearly 16 years back, Doha-based RasGas and New Delhi-based Petronet LNG had signed the first sales and purchase agreement (SPA) to import 7.5 million metric tonne per annum (mtpa) liquefied natural gas (LNG) on take-or-pay basis and price linked to a 60-month average of crude oil. At present, the LNG through this route costs around $12.67 per million British thermal unit (mmBtu) at India’s west coast, excluding other charges such as re-gasificiation, transportation, marketing margin and state levies. On the other hand, spot cargoes are available at nearly half the price at $6-6.5 per mmBtu. Since gas procured from Qatar is expensive, GAIL is not finding buyers for it and forced to utilise it at its petrochemical plant further hurting its revenues. (www.financialexpress.com)

[NATIONAL: POWER]

Generation……………

DAE may set up nuclear power plant if Odisha proposes

November 8, 2015. The Department of Atomic Energy (DAE) will consider establishing a nuclear power plant in Odisha if the State government evinces interest and provides adequate land, DAE secretary Sekhar Basu said. He said that Indian government is giving thrust on nuclear energy as it is clean energy. Fossil fuel cannot be used for all times to come, he said. At present, there are 21 nuclear reactors operating in different States and there are plans to establish 10 more reactors. Basu said signing nuclear treaties with different countries will enable India to avail more uranium for its nuclear power plant. (www.thehindu.com)

NTPC expects to start 1st 800 unit of Kudgi plant in FY16

November 7, 2015. Country's largest power producer NTPC expects to commission the first 800 MW unit of its 4,000 MW Kudgi super thermal power project in Karnataka in the current fiscal. NTPC CMD A K Jha said that productivity and efficiency would help NTPC overcome the challenge of mounting fuel bills and bring down cost of power. Appreciating the contribution of every member of NTPC family on the occasion of 40th Raising day of the company, Jha said that performance of each player matters for success of any team. He expressed faith that NTPC will soon be a leader in the solar sector like thermal for which we all need to work harder and faster to achieve its goals to be the best power producer in the world. Jha said that the company's financial results have been good with improved generation. The process of reallocation of coal blocks is also complete and mine developer and operator (MDO) has been appointed for PakhriBarwadih coal mine. He lauded the Vindhaychal team for commencement of timely commercial operations of 500 MW of Unit 13. (www.business-standard.com)

India in talks to set up JV in South Africa for coal blocks

November 5, 2015. India is in talks to set up a joint venture (JV) for mining and owning coal blocks in South Africa, which, meanwhile, has looked at the Indian experience to evolve its own template for allocating coal blocks. The governments of the two countries are in discussions to set up the JV, which may also own the coal blocks, Coal Secretary Anil Swarup said, who oversaw the coal field auctions earlier this year and put in place a template for the allocation of natural resources in the country. State-owned firms of the two countries will form the JV. India will be represented by Coal India Ltd (CIL). The talks with South Africa, one of the world’s biggest coal miners, come against the backdrop of India’s growing quest for energy. Coal fuels power plants that produce 169,118 MW of power, making up 61% of India’s total power generation capacity. (www.livemint.com)

WCL to produce 100 mt by 2020

November 5, 2015. Amid Coal India Ltd (CIL) eyeing production target of one billion tonnes by FY20, its arm Western Coalfields Ltd (WCL)is planning an output of 100 million tonnes (mt) in another five years. Lauding WCL for resetting its goal from 60 mt to 100 mt of coal production by 2020, the Minister said that enhancing coal production will help in providing electricity to the deprived parts of the country. The enhanced production will not only fulfill coal demand of Maharashtra but will also provide relief to the southern areas of the country, Power and Coal Minister Piyush Goyal said. Goyal hoped that through the pace with which coal mines are opening, the dream of providing 24x7 affordable power for all will become reality. By opening one project mine every month, WCL has already opened 10 projects in last 10 months. It has geared up to take a challenge of opening 36 projects in 36 months. (www.business-standard.com)

Transmission / Distribution / Trade…

Coal imports drop 5 percent to 14.52 mt in October

November 9, 2015. Government said coal imports have declined by 5 percent to 14.52 million tonnes (mt) in October over the year-ago period. In October 2015, it is down by 5.10 percent over October 2014, Coal Secretary Anil Swarup said. Coal imports had dropped by 27.16 percent to 12.6 mt in September on rise in domestic production. Coal imports down from 17.3 mt in September 2014 to 12.6 mt in September 2015, Swarup said. India had imported 212.103 mt of coal worth over ` 1 lakh crore last fiscal, according to provisional coal statistics of 2014-15 released by the Coal Ministry. (www.thehindu.com)

PM Modi says would ensure 24X7 power supply by 2020

November 8, 2015. Prime Minister (PM) Narendra Modi said he has set a target of providing 24x7 power around the year across the country by the time India celebrates its 75 years of independence. Modi referred to technology that can be used to save electricity as well as money while asking people to use LED bulbs to save power. He said 18,000 villages continue to be deprived of electricity across the country and said his dream was to provide them uninterrupted power supply in next 1,000 days. (timesofindia.indiatimes.com)

UAE’s TAQA starts selling power from India hydro project

November 7, 2015. Abu Dhabi National Energy Company (TAQA) has begun selling electricity from its hydro power project in Himachal Pradesh, which will provide another revenue stream for the company which has been hit by low oil prices. The state-controlled oil exploration and power supply group swung to a net loss of 421 million dirhams ($114.7 million) in the second quarter as revenues from oil and gas nearly halved partly on the impact of the lower prices. The 100 MW Sorang hydro power project started selling power to northern India from Oct. 31, TAQA said. The facility can supply emissions-free electricity to 500,000 homes at full capacity, it said. TAQA said it began commercial operations at the expanded T2 power plant in Ghana. In April, TAQA announced full commercial operations at its Bergermeer gas storage facility in the Netherlands. TAQA’s India operations also include a 250 MW lignite power station in the Neyveli region of south India. (in.reuters.com)

TANGEDCO in reforms overdrive to improve supply, up revenue

November 4, 2015. Tamil Nadu Generation and Distribution Corporation (TANGEDCO) has lined up a slew of reforms in its bid to improve distribution of power and augment revenue. This includes repair of transformers and monitoring solar and wind power production through a separate distribution centre and channel. As a first step, the TANGEDCO has started installing mini-transformers statewide to benefit consumers and save a lot of money on repairs of transformers. These mini-transformers have a life span 10 years more than the current lot, the corporation said. The corporation said that from now on, every 200 connections would have a transformer as against one for about 1,000-1,500 at present. The advantage is supply to a vast area would not be affected if anything goes wrong with the transformer and repairs have to be done. (www.business-standard.com)

Policy / Performance………….

Gas-insulated substation in Ghaziabad by March

November 9, 2015. The city is likely to get its first gas-insulated substation (GIS) by March 2016. The 400-kV substation is being built by UP Power Transmission Corporation Limited (UPPTCL) at Kala Patthar near Indirapuram. The power corporation said a gas-insulated substation occupies only a fourth of the space required for building a conventional substation. The 400 kV substation project was involved in a case at the National Green Tribunal, as it is being built on a green belt adjacent to NH-24. Residents of a housing society adjacent to the project site had also opposed the substation out of concerns for health and environmental degradation of the green belt. However, the green tribunal cleared the project in August 2013 with certain riders, including the need for necessary permissions from the national highway authority of India and of re-location costs to be borne by the project proponent, in case a need arises for widening of the highway in future. The tribunal had imposed a stay on the project in July 2012, following the petition filed by local residents. (timesofindia.indiatimes.com)

'Hope discoms restructure package will be adopted pan-India'

November 9, 2015. Power Minister Piyush Goyal expressed hope that the recent cabinet approved financial restructuring package for state electricity distribution companies (discoms) will find a "pan India" acceptance. Noting that discoms were trapped in a vicious cycle with operational losses being funded by debt, he said they were not charging fair tariff for the electricity consumed and, as a result, are unable to supply adequate power at affordable rates. With the losses of electricity distribution companies inIndia touching a staggering ` 3.8 trillion ($58 billion), the cabinet approved a major restructuring and revival package for the sector, with both checks and incentives, to remove what is considered the weakest link in the government's ambitious plan of power for all by 2022. Announcing the cabinet decision to reporters, the minister said the Ujjwal Discom Assurance Yojana (Uday) package includes steps to reduce the interest burden of discoms by as much as 600 basis points, by converting 75 percent of their debt into state governments bonds. These bonds, he added, will bear the same interest as that for government securities, plus 50 basis points. Goyal told power ministers of states and union territories at a meeting in Kochi last week that the cabinet-approved Uday would help wipe out the accumulated losses of state electricity distribution companies (discoms) by 2019. He also assured the state ministers that their apprehensions regarding the proposed amendments to the Electricity Act would be addressed. (www.business-standard.com)

Cabinet to decide on UCG policy soon

November 8, 2015. The Coal Ministry will soon seek the Cabinet's approval for a proposed policy on underground coal gasification (UCG). UCG is a method of converting coal still in the ground to a combustible gas that can be used for various uses, including power generation. On the proposed policy, Coal and Power Minister Piyush Goyal had recently said that it was progressing very well. Goyal had said that a draft policy is under formulation for development of underground coal gasification from unexplored coal and lignite bearing areas in the country. The government had said that India should explore using coal gasification as feedstock to produce chemicals and petrochemicals in order to increase domestic output of these energy products. (www.asianage.com)

Rajasthan govt to sell Giral power plant

November 6, 2015. The state government has started the ground work to sell the crisis-ridden and loss-making 250 MW Giral Thermal Power project situated at Thumbali in Barmer district. The ` 1,600 crore power project has already run into losses of more than ` 700 crore. Out of the two units of 125 MW each, the plant at Thumbali is lying closed permanently and requires at least ` 50 crore to start it afresh. Since the government has refused to infuse any capital to revive the plant, selling off the unit remains the only possibility. Operational Energy Group India Pvt Ltd, which had the contract to operate the plant till October this year, has already issued notice to its 350 employees to terminate their services. (timesofindia.indiatimes.com)

Govt plans to ease coal usage rules in bid to improve supply

November 6, 2015. In a bid to improve fuel supply to coal-based power plants across India, the government is planning to come out with a policy to allow inter-state and inter-company swapping of coal. To start with, the mechanism would first be allowed for state-owned NTPC, which has an installed capacity of 45,048 MW. The government estimates the policy could result in savings of around ` 20,000 crore. The policy would allow NTPC to use coal lying unused at one plant at other nearby locations. Coal and Power Minister Piyush Goyal said a note will soon go to the cabinet on coal linkages and, in the days ahead, the power and fertilizer sector will have a different linkage policy. Coal-fuelled plants, which produce 169,118 MW of power, account for 61% of India’s generation capacity. The country plans to mine 1.5 billion tonnes of coal by 2020. Of this, 1 billion tonnes is from Coal India Ltd (CIL) and 500 million tonnes from other sources, in line with the government’s push to raise the production of natural resources to boost economic growth. The fuel will play an important part, given that around 280 million Indians do not have access to electricity. (www.livemint.com)

Delhi govt extends power amnesty scheme till December

November 5, 2015. Delhi government extended its power amnesty scheme till December and also brought under its ambit the victims of the 1984 anti-Sikh riots making it possible for them to settle disputes related to power theft, non-payment of bills among others. In case of outstanding bills, the families of riot victims will be charged ` 250 per month from the date of last payment till July 2015 and those who lines have been disconnected will be charged on similar basis till the date of disconnection. The late payment surcharge will be fully waived off in all such cases and the consumers will be given the option of paying the dues in instalments over a period of six months. (www.financialexpress.com)

India unveils rescue package for power sector

November 5, 2015. India approved a rescue package for its loss-making power utilities, unveiled as a major reform that Prime Minister Narendra Modi hopes will end electricity blackouts and spur economic growth. Power Minister Piyush Goyal said states would over the next two years be allowed to take on 75 percent of the debts of their utility companies, which have grown to ` 4.3 trillion ($65.3 billion) after years of undercharging customers for electricity. By clearing past debts and putting them on a better financial footing, Goyal said the utilities would be returned to profitability before 2019. Modi has urged the power ministry and states to find a way to overhaul the power distribution sector, whose weak finances have limited bank lending and undermined the push to provide reliable electricity in Asia's third-largest economy. (in.reuters.com)

Govt to unveil power reforms in next couple of days: Finance Minister

November 4, 2015. The government in the next couple of days will announce a major policy for the stressed power sector, which has been reeling under high debt, Finance Minister Arun Jaitley said. While Jaitley did not elaborate, it is believed that the Cabinet at its next meeting may consider recasting ` 4.3 lakh crore of loans of nine power distribution companies subject to states agreeing to raise electricity tariff over a period of time. Jaitley said India is generating more power than it needs. While an electricity transmission grid can take the electricity to every part of the country, discoms have now become extremely vulnerable because some of the states are not charging people adequately for user charges. Power sector is one area of infrastructure which has remained unaddressed for so many years. (www.businesstoday.in)

PM Modi reviews progress of Kishanganga Hydro Electric Project

November 4, 2015. Prime Minister (PM) Narendra Modi reviewed the progress of the 330 MW Kishanganga Hydro Electric Project, especially the Resettlement and Rehabilitation Plan prepared by the state government for the project affected families. The Prime Minister held his monthly review meeting via video-conference under his Pro-active Governance and Timely Implementation (PRAGATI) initiative, with Union Secretaries of various Ministries and Chief Secretaries of states. He said Jammu and Kashmir Chief Secretary B R Sharma participated in the meeting. The Prime Minister in respect of the state reviewed further progress on the 330 MW Kishanganga Hydro Electric Project and the Resettlement and Rehabilitation Plan prepared by the state government for the project affected families. He said the chief secretary briefed the Prime Minister about the overall progress of the project and the status of the R&R Plan. (www.dnaindia.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

US lowers 2016 crude output forecast as drillers idle rigs

November 10, 2015. The Energy Information Administration cut its U.S. crude production outlook for next year as declining prices are prompting shale drillers to put rigs aside. Cheaper gasoline is expected to stoke demand for the motor fuel. The agency decreased its 2016 forecast by 1 percent to 8.77 million barrels a day. It boosted its estimate for this year to 9.29 million barrels a day from the 9.25 million predicted last month. America’s oil drillers have sidelined more than half the country’s rigs since October as prices have tumbled. The number of active oil rigs in the U.S. has fallen by 103 in the past 11 weeks to 572, the least in five years, according to data. (www.bloomberg.com)

Iraq oil partners seek contract changes to boost output

November 10, 2015. International oil companies could boost production in Iraq beyond current targets if production contracts were changed to give more incentives for investment, according to BP Plc and Royal Dutch Shell Plc. Companies working in the country have proposed that the government change contracts from the current service-fee model to be closer to production sharing agreements, Michael Townshend, BP’s regional president for the Middle East, said. The suggestions were made earlier this year amid talks about development budgets needed to operate Iraq’s oil fields next year, he said. BP operates Rumaila, Iraq’s largest deposit. Production from the southern field will average 1.3 million to 1.35 million barrels a day this year. Output next year depends on spending approved by the government, which has asked foreign companies to decrease their 2016 budgets due to the drop in crude prices, Townshend said. Total capital expenditure on the field will be about $2.5 billion this year, with BP responsible for about half of that, he said. The government sees an opportunity to reach an agreement to decrease the 2016 budgets of foreign oil companies, Oil Minister Adel Abdul Mahdi said. Iraq, the second-largest producer in the Organization of Petroleum Exporting Countries after Saudi Arabia, pumped 4.3 million barrels a day in October, according to data. The country produced about 2.4 million barrels a day at the end of 2010 and plans to boost capacity to 6 million in 2018. (www.bloomberg.com)

Apache said to get takeover approach for $18 bn company

November 9, 2015. Apache Corp., the oil and natural gas company worth more than $18 billion, has received an unsolicited takeover approach. Apache reported a smaller-than-expected adjusted loss and boosted its 2015 production forecast. It’s one of the biggest leaseholders in the Permian Basin in western Texas, the largest U.S. shale play and the only one where oil output has continued to grow even as drillers slash spending and idle rigs. It also explores in Egypt, the Gulf of Mexico, Canada and the Eagle Ford and Woodford shale basins in the U.S. A deal for Apache would be the largest for an independent oil and gas producer in the U.S. this year. Noble Energy Inc. bought Texas shale driller Rosetta Resources Inc. for $3.9 billion, including assumed debt, in an all-stock transaction in July. (www.bloomberg.com)

Oil investment cuts at $200 bn as Saudi prince sees rally

November 9, 2015. The oil and gas industry has cut $200 billion from investments this year as low prices discourage new projects, leading to cuts in crude supplies equal to half the daily output of Saudi Arabia, according to the kingdom’s Prince Abdul Aziz bin Salman. Nearly 5 million barrels a day of projects have been deferred or cancelled, Bin Salman, who is also vice oil minister for Saudi Arabia, said in prepared remarks set to be delivered to energy ministers meeting in Doha. Saudi Arabia pumped 10.38 million barrels a day in October, according to data. Oil prices have dropped 42 percent in the past year as Saudi Arabia led the Organization of Petroleum Exporting Countries in maintaining production in the face of a global glut rather than make way for booming U.S. output. Supply from outside the 12-member group will start to decline next year, after oil prices near $150 a barrel in 2008 proved unsustainable, Bin Salman said. Energy companies will probably reduce investments another 3 to 8 percent next year, making it the first time since the mid-1980s that the industry cut spending for two consecutive years, he said. (www.bloomberg.com)

BP signs deal to accelerate development of Atoll gas field in Egypt

November 6, 2015. UK-based oil and gas major BP has signed a heads of agreement (HoA) with the Egyptian Minister of Petroleum to advance the development of the Atoll gas field in the country. The deal enables the company to accelerate the development of the Atoll field, which is estimated to hold 1.5 trillion cubic feet of gas resources and 31 million barrels of condensates, and commence initial production in 2018. The field is planned to be developed in two phases by Pharaonic Petroleum, joint venture formed by BP with EGAS and Eni. The first phase involves two development wells, which will be tied back to existing infrastructure. Further investment and wells will be included upon successful completion of initial phase. Upon completion of the first phase, additional investment and further wells will be included to increase production from the field. Besides providing additional production to the Egyptian domestic market, the new agreement is expected to help to meet Egypt's energy demands. The deal follows an agreement signed by BP in March for the West Nile Delta project to develop five trillion cubic feet of gas resources and 55 million barrels of condensates. By the end of the decade, BP plans to maintain its current oil production capacity and double gas production capacity to reach 2.5 billion cubic feet per day, with partners in Egypt. This increased production represents more than 50% of current gas production in the country. (drillingandproduction.energy-business-review.com)

Eni partners with Sonangol to provide natural gas to Angola

November 5, 2015. Italian energy company Eni has signed an agreement with Angola's national oil company Sonangol for providing natural gas to the domestic market in Angola. Under the terms of the deal, the gas extracted by Eni in Angola will be supplied to Angola domestic market and to support the local economy. The partners plan to assess the development of gas fields in the Angolan basin of the Lower Congo. In 2014, Eni and Sonangol agreed to cooperate in activities and joint projects in the oil and gas sector to develop in the country. As per the deal, a joint venture will be launched by the firms to study the potential of the non-associated gas present in the Lower Congo Basin, which is considered to be a highly promising area in terms of hydrocarbon production located offshore Angola. Production of Eni in Angola currently amounts to 105,000 barrels of oil equivalent per day. (explorationanddevelopment.energy-business-review.com)

Downstream…………

SOCAR says looks at stakes in Egypt oil refineries

November 10, 2015. Azeri state energy firm SOCAR is interested in buying stakes in refineries in Egypt and in participation in the African country's oil refining sector, SOCAR's president Rovnag Abdullayev said. Abdullayev made his comments a day after his return from Egypt, where he was discussing cooperation in energy sector. Azerbaijan is exporting about one million tonnes of oil and refined products per year to Egypt. (af.reuters.com)

South African deputy president to visit Iran over planned refinery

November 5, 2015. South Africa's deputy president Cyril Ramaphosa will visit Iran to explore opportunities for co-operation in the energy sector with a view to attracting investment into a refinery Pretoria is planning to build. South Africa is considering building an oil refinery that will process Iranian crude to bolster its petrol supply and reduce its dependence on foreign companies. Plans for the new refinery are at an early stage, and estimated cost or time frame for construction have not yet been made public. South Africa has been diversifying its crude sources after the European Union and the United States imposed sanctions on Iran, its former top supplier. The country's Strategic Fuel Fund has said it is seeking to import 24 million barrels of oil a year from Iraq to boost its reserves in what would be South Africa's first crude imports from Baghdad for more than a decade. (www.reuters.com)

CNPC in talks to build 10 mn tonne per year Pakistan oil refinery

November 4, 2015. Pakistan is negotiating with China National Petroleum Corp (CNPC) on building a 10 million tonne per year refinery that would slash its oil products import bill by up to two-thirds, the minister for petroleum Shahid Abbasi said. He hoped the final details of the deal, expected to cost between $3 billion and $5 billion, would be hammered out early next year. The refinery might be built in modular stages, he said, with the first phase capable of refining 3 million tonnes per year (60,000 barrels per day). Pakistan is spending - at current low oil prices - about $9 billion per year importing 15 million tonnes a year of gasoline, diesel and fuel oil, he said, and another $3 billion to $4 billion on importing crude oil. Around 80 percent of the country's gasoline is imported, he said. Pakistan State Oil (PSO) currently holds 22.5 percent of the refinery and is finalising details of a deal to take another 26 percent within this fiscal year. Abbasi said Pakistan was also seeking to save money by changing the grade of fuel they import from nonstandard RON 87 - which is produced by Pakistan's ageing refineries - to standard RON 92 plus within the next few months, he said. Although the fuel would be slightly more expensive, it was more efficient and moving to a standard fuel would allow more bidders to offer supplies to Pakistan, he said. (af.reuters.com)

Asia expected to see robust oil refining margins next year

November 4, 2015. Asian oil refining margins will be robust in 2016, but are unlikely to return to the heights they climbed earlier this year as crude prices have started to pick up, industry executives and analysts said. Margins are likely to be buoyed as gasoline remains a bright spot in otherwise oversupplied markets for oil products, with double-digit growth in demand for the fuel from Asia's largest consumers, China and India, analysts said. Asian refining margins DUB-SIN-REF, the difference in value between crude and the products churned out by refineries, enjoyed a stellar run this year on weak oil prices. They hit their highest in more than two years above $11 per barrel in September, but have since eased to about $7 as crude prices began to inch up. Low crude oil prices have boosted petroleum demand-growth to 1.7 million barrels per day (bpd) globally, far outpacing this year's expansion in refining capacity of 800,000 bpd, according to analysts. Gasoline demand-growth will continue to drive refining margins as it feeds off low oil prices, they said. In Asia, India's gasoline demand has grown by 14 percent and China's by 12 percent so far this year. China is delivering a quarter of global gasoline demand-growth this year, with Asian refiners unlikely to keep up with such hefty appetite, they said. The main drag on Asian refining margins is likely to come from slowing demand for diesel combined with rising supply of the industrial fuel from mammoth refineries in the Middle East, industry executives said. New refineries are typically configured so middle distillates, comprising diesel and jet fuel, account for about 30 to 50 percent of their output, leading to a glut of these products. (www.reuters.com)

Transportation / Trade……….

Africa oil sees joint pipeline as only option for Uganda, Kenya

November 10, 2015. East Africa’s race to export its first oil will eventually be a tie between neighbours Kenya and Uganda because both need to share a pipeline rather than compete for different routes, a producer in the region said. The company sold stakes in some East Africa assets to Maersk Oil & Gas A/S. A pipeline to the Indian Ocean would allow Africa Oil, together with larger partner Tullow Oil Plc, to start exports from joint ventures. Tullow has found oil in both countries, with Uganda estimating finds at 6.5 billion barrels and Kenya at 600 million barrels. Maersk Oil said it will acquire half of Africa Oil’s shares in three onshore exploration licenses in Kenya and two in Ethiopia for as much as $845 million. The deal shows companies are willing to invest in East African discoveries even before a pipeline route is decided. It drove Tullow shares up 4.5 percent. (www.bloomberg.com)

France and Belgium connect 8 bcm per year gas pipeline project

November 10, 2015. French gas transmission network operator GRTgaz and its Belgian counterpart Fluxys have commissioned the new Hondschoote - Alveringem interconnection point. The project aims at delivering up to 8 billion cubic meters (bcm) per year from France to Belgium through the "Artère des Flandres" gas pipeline in France to the Hondschoote metering station at the border. In Belgium the project involved Fluxys Belgium building the Alveringem regulating station, a new interconnection station at Maldegem and a 75-km long pipeline between these two sites. The project will enable to export gas as of 2016 from the Dunkirk LNG terminal to the Belgian grid. (www.enerdata.net)

Dubai airports get more jet fuel with new ENOC pipeline

November 9, 2015. Emirates National Oil Co (ENOC) announced the completion of a new jet fuel pipeline from its storage terminals to Dubai International Airport to cope with an expected increase in demand. The $250 million project will be able to pump 850 cubic meters of jet fuel per hour to the airport, which is 55 percent of its total demand, the Dubai government-owned company said. (www.reuters.com)

LNG tanker steams toward US Sabine Pass for inaugural loading

November 9, 2015. Cheniere Energy's landmark Sabine Pass liquefied natural gas export plant in Louisiana will receive its first tanker for loading on Jan. 12, according to ship tracking data. The Energy Atlantic LNG tanker is the first in a string of test cargoes that will be loaded before commercial operations begin later in the year. The expected arrival of the tanker to Sabine Pass was confirmed by a source and by IHS Waterborne consultants that track LNG shipments globally. It marks a milestone for the long-awaited project, the first of its kind to be built in the United States in nearly 50 years, and for the U.S. gas market that has been swamped with new supply in recent years due to a domestic drilling boom. It is unclear when the Energy Atlantic will actually leave Sabine or where it will go. The test phase could take four to six months before the first shipments under a long term contract between Cheniere and LNG shipper BG Group begin. The first export shipment represents a turnaround for Cheniere, which in 2008 built an import terminal at the same site in Sabine Pass which was quickly rendered obsolete by the rise in U.S. production. Now, however, other headwinds exist for exports, including a global glut of supply that has pushed prices way below year-ago levels. (www.reuters.com)

Obama rejects Keystone XL pipeline in win for greens

November 6, 2015. U.S. President Barack Obama rejected the proposed Keystone XL oil pipeline from Canada in a victory for environmentalists who campaigned against the project for more than seven years. The denial of TransCanada Corp's more than 800,000 barrels per day project will make it more difficult for producers to develop the province of Alberta's oil sands. It could also put the United States in a stronger position at global climate talks that start in Paris on Nov. 30 in which countries will aim to reach a deal to slow global warming. Keystone XL would have linked existing pipeline networks in Canada and the United States to bring crude from Alberta and North Dakota to refineries in Illinois and, eventually, the Gulf of Mexico coast. TransCanada first sought the required presidential permit for the cross-border section in 2008 but the proposal provoked a wave of environmental activism that turned Keystone XL into a rallying cry to fight climate change. Blocking Keystone became a litmus test of the green movement's ability to hinder fossil fuel extraction in Canada's oil sands. TransCanada and other oil companies said the pipeline would have strengthened North American energy security, created thousands of construction jobs and helped relieve a glut of oil. But since 2008 the United States has experienced a domestic drilling boom which has boosted oil production 80 percent and contributed to a slump in U.S. oil prices from above $100 a barrel to about $44. (www.reuters.com)

China's CNOOC tenders to sell third Australian LNG cargo

November 6, 2015. China National Offshore Oil Corporation (CNOOC) has tendered to sell a liquefied natural gas (LNG) cargo of Australian origin. The tender suggests a loading date in late December from the BG Group-operated Queensland Curtis LNG export plant. CNOOC owns a stake in the plant. In September, CNOOC launched its first tender to sell two LNG cargoes from the facility. The decision to offload supply onto the spot market follows an acceleration in LNG oversupply as import demand from China and other Asian countries has fallen far short of forecasts. (af.reuters.com)

TransCanada to build only one Energy East oil export terminal

November 5, 2015. TransCanada Corp said it has scrapped plans to build a port in Quebec and will have only one crude oil export terminal for its proposed Energy East pipeline, a possible setback for the controversial project. The move comes days after TransCanada asked the U.S. State Department to pause its review of the company's long-delayed Keystone XL pipeline, a request that Washington turned down amid speculation President Barack Obama will ultimately reject the pipeline. Like Keystone, Energy East is opposed by environmentalists who want to stop expansion of the oil sands industry. The 1.1 million-barrel-per-day project is intended to carry crude from Alberta across Canada to New Brunswick, where it could be shipped abroad. (www.reuters.com)

Policy / Performance…………

Israel eyes more offshore gas exploration within 6 months

November 10, 2015. Israeli Energy Minister Yuval Steinitz said he expects offshore natural gas exploration to accelerate in the next few months, with investment from some of the world's largest oil and gas companies. Steinitz said he recently met officials from ENI and 20-30 other energy firms, such as Shell, Hess, Exxon Mobile and EOG, in a bid to entice them to invest in Israeli fields off its Mediterranean coast. Under a framework agreement approved in August by lawmakers, a group led by Houston-based Noble Energy and Israeli conglomerate Delek Group will be allowed to keep control of the yet to be developed Leviathan field. Delek will have to sell its stake in another field, Tamar, and Noble will be required to cut its stake in the field to 25 percent from 36 percent. They will also have to sell their holdings in two smaller sites, Tanin and Karish. Steinitz said experts estimate there are between 10,000 and 15,000 billion cubic meters (bcm) of gas in the East Mediterranean basin that includes Israel, Egypt and Cyprus -- enough to supply domestic needs as well as Europe. Italy's ENI this year discovered the large Zohr field off Egypt's coast. Only 25-30 percent of Israel's economic waters have been properly investigated, Steinitz said. Leviathan's development remains a top priority, Steinitz said. With estimated reserves of 622 bcm, it is set to begin production in 2018 or 2019 and is expected to supply billions of dollars' worth of gas to Egypt and Jordan in addition to Israel. (af.reuters.com)

China, Mideast to overtake Europe as biggest gas users: IEA

November 10, 2015. China and the Middle East, spurred by lower prices and ample supply, will drive global natural gas demand growth in the next 25 years as consumption in Europe fails to recover to peak levels seen in 2010, according to the International Energy Agency (IEA). Both regions will become larger consumers of gas than the European Union, the IEA said. Global demand for gas, a cleaner-burning fuel for power generation than coal, will rise almost 50 percent in the period to 2040, making it the fastest-growing fossil fuel. Emerging economies are increasing gas use to reduce the share of dirtier coal in power generation, which the IEA sees dropping to 30 percent from 41 percent. Gas is also being used to spare use of oil and to back up renewable energy generation. U.S. gas futures, used to price contracts for the first liquefied natural gas exports originating from the shale boom, declined 46 percent over the past year. Exports from the Sabine Pass terminal are scheduled to start early next year, adding to expanding output of the super-chilled fuel from Australia. Brent oil declined 43 percent in the past year, dragging down oil-linked gas contracts. (www.bloomberg.com)

Oil price to rise only gradually to $80 by 2020: IEA

November 10, 2015. Oil is unlikely to return to $80 a barrel before the end of the next decade, despite unprecedented declines in investment, as yearly demand growth struggles to top 1 million barrels per day, the International Energy Agency (IEA) said. The IEA said it anticipates demand growth under its central scenario will rise annually by some 900,000 barrels per day to 2020, gradually reaching demand of 103.5 million bpd by 2040. The drop in oil to around $50 a barrel this year LCOc1 has triggered steep cutbacks in production of U.S. shale oil, one of the major contributors to the oversupply that has stripped 50 percent off the price in the last 12 months. Oil companies have grappled with the downturn and a "lower for longer" price outlook by slashing spending, cutting thousands of jobs and delaying around $200 billion in mega-projects around the world. The IEA estimates investment has already fallen by 20 percent this year. Higher-cost producers in Canada and Brazil, as well as the United States are likely to fall victim to low oil prices faster than most exporters, but these declines could be offset by supply growth in Iraq and Iran. (in.reuters.com)

Pakistan says finalises 15 year, $16 bn LNG deal with Qatar

November 9, 2015. Pakistan has finalised a 15 year, $16 billion liquefied natural gas (LNG) deal with supplier Qatar and shipments are expected to begin next month, Pakistani energy minister Shahid Khaqan Abbasi said. The amount is 1.5 million tonnes per year, the minister said. The two sides have agreed a price, he said. (www.reuters.com)

OPEC ready to make needed investments to respond to future needs: Secretary General

November 8, 2015. OPEC Secretary General Abdullah al-Badri said that despite uncertainties, OPEC members were ready to make the necessary investments to respond to the world's future energy needs. The secretary general said he saw Asia oil demand rising to almost 46 million barrels per day by 2040, an increase of nearly 16 million barrels per day from 2015. Oil-related investment requirements between now and 2040 are estimated at about $10 trillion, he said. (www.reuters.com)

Iran's oil return to boost SUMED volumes: Egypt Oil Minister

November 6, 2015. Egypt anticipates a ramp-up in oil volumes through the SUMED pipeline once Iran re-enters the world market - a move that is welcomed by Cairo, the country's Oil Minister Tarek El Molla said. SUMED, which owns and operates Egypt's Mediterranean port of Sidi Kerir, is half owned by state-run oil company Egyptian General Petroleum Corp. A group of four other Gulf Arab countries - Iran's arch rival Saudi Arabia, as well as Kuwait, the United Arab Emirates and Qatar - owns the other half. The 200-mile (320-km) SUMED pipeline runs from the Red Sea to the port west of Alexandria. Western sanctions imposed on Iran's oil sector have brought shipments through Ain Sukhna and Sidi Kerir to a virtual halt since 2012, compounded by a freeze on insurance provision. Once an energy exporter, Egypt has turned into a net importer because of declining oil and gas production and increasing consumption. It is trying to speed up production at recent discoveries to fill its energy gap as soon as possible. El Molla said exploration in the Western Desert had enabled Egypt to maintain steady oil production as new finds have offset declines from mature fields. He said oil production would stay steady at around 700,000 barrels per day for the next two years, but may increase after that because of new wells. (in.reuters.com)

US shale producers get ready for budget cuts in 2016

November 6, 2015. US shale oil producers have reduced the fat from their 2015 budgets after a 50% drop in crude prices. Shale companies including Devon Energy Corp, Continental Resources and Marathon Oil released their preliminary 2016 plans for spending. The cuts come after between 30% and 40% reductions earlier this year. Lower costs and improved productivity would allow them to hold shale oil production largely flat. While he did not provide a specific figure, Doug Lawler, the Chief Executive Officer of Chesapeake Energy Corp, said 2016 spending would be “cut in a meaningful way” at the Oklahoma-based company. Devon said it expects to spend $2 billion to $2.5 billion on exploration and production next year, down from about $4 billion this year. Marathon Oil is cutting about $1 billion from its projections. Oasis Petroleum Inc, which produces oil in North Dakota, said it expects to spend $350 million in 2016 on drilling and completion of new wells, roughly $200 million below what it plans to spend for those services this year. (www.energyvoice.com)

China gets its own crude contract

November 5, 2015. Crude oil is flowing eastward as rising demand in Asia outstrips the West’s stagnant appetite. Next year, China wants traders—including oil speculators, refiners, and big state-owned companies that buy and sell futures contracts—to follow a similar path. By the end of 2015, China, the world’s No. 1 oil importer as of April, may start its own crude futures contract. As it becomes more exposed to price swings on global markets, China wants its pricing influence to match its purchasing power. State oil giant China National Petroleum predicts that this year, for the first time, China will import more than 60 percent of the oil it consumes. Over time, the new contract will give China more control over the price of oil it imports, because the value will reflect the supply-and-demand dynamics of China rather than those of the U.S. Midwest or Europe’s North Sea, where stored crude is represented by trading in New York and London. Before China can exert greater pricing power, traders will have to use its contract. Like any commodity derivative, this one will be backed by physical supplies. The Shanghai exchange is planning to use more than 14 million barrels of storage capacity along China’s coast. (www.bloomberg.com)

[INTERNATIONAL: POWER]

Generation……………

Egbin Power plans to build 1.3 GW power plant by 2019

November 9, 2015. Nigerian power generation company Egbin Power plans to double the capacity of its 1,320 MW thermal power plant by 2019. The company aims to build an additional 1,350 MW on the site of its oil- and gas-fired power plant, to supply power to small, medium and large scale enterprises and ultimately make Egbin town a hub of industrial activities. The 1,320 MW Egbin power plant was commissioned in 1986 and has been rehabilitated after the privatisation of Egbin Power in 2013. (www.enerdata.net)

UK's National Grid requests extra power generation to cover shortage

November 4, 2015. Britain's energy system operator National Grid requested the energy industry to bring 500 MW of extra power generation capacity online between 1630 and 1830 GMT to cover shortages caused by plant breakdowns, it said. The National Grid said it wanted to have a bigger buffer for power held in reserve. (af.reuters.com)

Transmission / Distribution / Trade…

ABB to strengthen power transmission grid in New Jersey

November 10, 2015. The substations are part of PSE&G’s program to protect and strengthen utility substations against increasingly frequent severe weather occurrences and enable reliable and resilient energy delivery. ABB, the leading power and automation technology group, has won an order worth around $40 million in the United States, from Public Service Electric & Gas, New Jersey’s largest utility, to supply Gas Insulated Switchgear to two substations and help strengthen reliability. The order was booked in the third quarter of 2015. (www.pennenergy.com)

EDF reviews its power transmission grid strategy

November 6, 2015. Energy group EDF is reviewing the strategy of its power transmission grid activities, carried out by subsidiary RTE. EDF owns 100% of the share capital of RTE but does not control the company, which was spun off as an independent transmission system operator in 2005. The sale of a stake in the company has long been considered and could enable RTE to finance investments and new projects thanks to new investors. A sale could also help EDF finance the acquisition of Areva's reactor business, its nuclear new-build programme in France and in the United Kingdom and its €55 bn upgrade programme for its ageing nuclear power plants in France. (www.enerdata.net)

Entergy Louisiana to signs power supply agreement for Lake Charles LNG project in US

November 5, 2015. Entergy Louisiana has signed an agreement to supply power to the proposed Lake Charles LNG project in southwest Louisiana. Under the contract, Entergy Louisiana could supply up to 255 MW of power to the LNG project that is being developed by BG Group with Energy Transfer Equity, L.P. and Energy Transfer Partners, L.P., which owns the existing LNG regasification facility in Lake Charles. (transportationandstorage.energy-business-review.com)

Policy / Performance…………

Pakistan govt, frustrated by power crisis, changes tack

November 10, 2015. Pakistan's government, struggling to fulfil election promises to end daily power cuts, is shifting from big generation projects to less splashy reforms including new transmission systems, privatisation and better management. Since Prime Minister Nawaz Sharif came to office in 2013, his government announced a string of big-ticket power plants that have failed to live up to their fanfare billing. A 6,000 MW coal powered park has been quietly put on the back burner. A planned 1,000 MW solar park only has an installed capacity of 100 MW so far, and the Nandipur plant of 425 MW closed days after the prime minister inaugurated it over management and pricing disputes. It recently reopened. Pakistan produces about 16,000 MW and faces a shortfall of around 6,000 MW, although supply and demand fluctuate, the planning ministry said. (in.reuters.com)

Global coal consumption heads for biggest decline in history

November 9, 2015. Coal consumption is poised for its biggest decline in history, driven by China’s battle against pollution, economic reforms and its efforts to promote renewable energy. Global use of the most polluting fuel fell 2.3 percent to 4.6 percent in the first nine months of 2015 from the same period last year, according to a report released by the environmental group Greenpeace. That’s a decline of as much as 180 million tons of standard coal, 40 million tons more than Japan used in the same period. The report confirms that worldwide efforts to fight global warming are having a significant impact on the coal industry, the biggest source of carbon emissions. It comes a day before the International Energy Agency is scheduled to release its annual forecast detailing the ways the planet generates and uses electricity.

In China, responsible for about half of global coal demand, use in the power sector fell more than 4 percent in the first three quarters and imports declined 31 percent, according to the report. Since the end of 2013, the country’s electricity consumption growth has largely been covered by new renewable energy plants. The share of coal used to generate electricity in the U.S. will fall to 36 percent this year from 50 percent a decade ago. More than 200 coal-fired power plants, with total capacity of 83 GW, have been scheduled for retirement, including 13 GW expected to retire this year. Coal consumption in the 28-nation European Union was flat in the first nine months, after declining a record 6.5 percent in 2014, according to Greenpeace. In India, domestic coal production has been on the rise, with sales by Coal India increasing 7 percent in the first nine months, and consumption increasing about 5 percent. India’s efforts to promote renewable energy is also eating into demand for coal, and stockpiles in the country have increased sharply. (www.bloomberg.com)

NERC issues 126 licences to power plants

November 5, 2015. Dr Steven Andzenge, the Commissioner in charge of Legal, Licensing and Enforcement, Nigerian Electricity Regulatory Commission (NERC), said the organisation issued 126 licences since it was established. Andzenge said this in Abuja at the formal presentation of the licence to Ibom Power Limited to generate 685 MW of electricity in Akwa Ibom. The commissioner said the total capacity of on-grid was 35,314 MW; Off-grid 428,12 MW and embedded 298 MW. Other licences issued include those for Diverse Energy Mix 4; Hydro 1968 MW; Coal 6 with 1,815 MW; Wind 2 with 110 MW and Solar 189 MW. Adzenge said that NERC had also issued licences for undertakings in all the six geo-political zones of the country. (nannewsnigeria.com)

Brazil’s power-plant auction delayed by politics