-

CENTRES

Progammes & Centres

Location

[The Baptist and the Bootlegger Unite]

“This is not the best of times for the fossil fuel industry. It is under attack from both ends. At one end we have peak profit rather than peak oil or peak coal haunting the sector. At the other we have an evangelical mob waging war against carbon. What can it do other than cannibalise its weaker constituents just to stay alive!…”

Energy News

[GOOD]

CIL‘s stellar performance must be congratulated even if it is coming at a time when it is least needed!

High growth in carbon emissions in India at a time of low economic growth is unwarranted!

[UGLY]

Subsidies for rooftop solar will reduce private costs but increase social costs!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· The Baptist and the Bootlegger Unite

· India's Coal Sector: Unable to capitalise on falling prices

UPCOMING EVENT...........

DATA INSIGHT………………

· World Energy Markets: Prices and Variations

[NATIONAL: OIL & GAS]

Upstream…………………………

· IOC says eyeing stake in Russia's Vankor Field

· IOC wins oil block in Africa

· ONGC to intensify exploration activities, secures more rigs

Downstream……………………………

· IOC to spend ` 18 bn for BS-IV norms implementation at Gujarat refinery

· BPCL says in talks to sell 24 percent stake in Bina refinery

· IOC's Paradip refinery may start commercial operations in March

Transportation / Trade………………

· Iraq unseats Saudi Arabia as top crude supplier to India for third month

Policy / Performance…………………

· Oil Minister pushes for better hydrocarbon ties with Africa

· ATF price cut marginally; non-subsidised LPG rate hiked

· Oil Minister confirms BS-VI fuel rollout target of 2020

· Make excise rates on LPG uniform: Oil Ministry to Finance Ministry

· Crude cess: Finance Ministry unlikely to lower rates

· RIL regains top slot in Platts global ranking, elbows out ONGC

[NATIONAL: POWER]

Generation………………

· KNPP director admits to delay in maintenance work in Unit 1

· Adani announces setting up of ` 37 bn power plant in Punjab

· NTPC's Vindyachal plant to be country's largest power generating station

· CIL forays into power generation

Transmission / Distribution / Trade……

· Fuel supply contracts of steel and cement companies with CIL to continue

· India to give 100 MW more electricity to Bangladesh

Policy / Performance…………………

· DERC seeks more funds from govt to hire extra staff

· Small suppliers of nuclear energy sector won't have obligation in case of liability: DAE

· Celebrations to mark CIL’s 41 yrs

· Reliance Power’s Sasan UMPP doesn’t require Chhatrasal coal block: Govt

· CIL will surpass 550 mt target: Goyal

· Power sector revival a priority: Finance Minister

· CAG finalises draft report on e-auctions of coal blocks

· SC to hear Bagrodia's plea on November 30

· Goyal asks BBMB, NHPC to raise capacity to 'highest level'

· Fourth round of coal mines auction likely in 15 days: Coal Secretary

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Chevron begins O&G production from $2 bn Lianzi field offshore Central Africa

· Noble to make investment decision on Israel's gas fields in 1 yr

· Russian oil output in October hits post-Soviet high 10.78 mn bpd

· Sonangol, Total deepwater project to add 30k bpd to Angola oil output

· Almost a billion cubic feet of US gas shut down by low prices

· Oil companies have cut back everything except crude production

· CNOOC to ease spending cuts next year to save oil output target

· Statoil delays production at Mariner oil field

· BP will start producing gas at North Alexandria in early 2017

Downstream……………………

· US oil refiners look abroad for crude supplies as North Dakota boom fades

· Oil traders scouting further afield for NY diesel storage

· ExxonMobil will expand its Rotterdam refinery

· TonenGeneral imports Japan's second cargo of US condensate

· Marathon Petroleum scraps oil upgrader plans for Louisiana refinery

· Vietnam's Nghi Son refinery 60 percent complete

· US diesel demand flat as freight growth slows

Transportation / Trade…………

· Shell completes the sale of its Butagaz LPG business in France

· Rosneft to supply Egypt with six fuel oil shipments by end 2015

· Petrobras oil workers begin strike, seek to block asset sales

· South African trade gap narrows as lower oil curbs imports

· OPEC October oil output falls led by Saudi, Iraq

· Iran seen jolting oil market with 90 day supply after sanctions

Policy / Performance………………

· Yergin sees oil price near bottom as US output set to fall

· Egypt's giant Zohr gas field aims to start output in 2017: Oil Minister

· BP sees technology nearly doubling world energy resources by 2050

· Israel's long-stalled gas plan extricated from impasse

· Ukraine looks to shed dependence on Russian LPG

· Magufuli wins Tanzania presidency with gas to tax reform vow

· Equatorial Guinea to launch new bidding round for offshore blocks in 2016

· PetroChina profit plunges to record low on oil price rout

· Hess slashes 2016 drilling budget 27 percent on oil swoon

· Singapore plans to set up a domestic gas trading market

[INTERNATIONAL: POWER]

Generation…………………

· Entergy to close FitzPatrick Nuclear Power Plant in New York

· Exelon defers decision on Clinton nuclear power plant for one year

Transmission / Distribution / Trade……

· PPL plans 345 kV power line to connect PJM and NYISO systems

· Wolverine to purchase power from Exelon’s 153 MW Michigan Wind 3 project in US

· EVN commissions 500 kV Son La - Lai Chau transmission line

Policy / Performance………………

· Indonesia's coal exports may fall by 17 percent in 2017 due to low prices

· EBRD grants €200 mn loan to help improve power sector in Serbia

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· ACME wins 50 MW solar project in Uttarakhand

· Swedish companies to become partner in Punjab's renewable energy sector

· Bharat Light ties up with Europe’s largest renewable energy generator

· Gamesa bags 200 MW wind power order from Ostro Energy

· Propose to have cities buy power generated from waste: Goyal

· India’s energy emission growth at 8.2 percent, highest globally: PwC

· Katra solar project to save ` 10 mn energy bill for Railways

· SCB to begin solar power generation

· Govt may turn to FIs to restart stalled biomass projects

· VPT to generate 10 MW solar power

· India to introduce Euro-VI emission compliant fuel by 2020

· India likely to propose special session on solar energy in Paris

· Rays Power bags ` 3 bn order from NHPC

· Rooftop solar panels policy to be before Cabinet soon: Goyal

GLOBAL………………

· Nigeria targets 2 GW of renewable power capacity by 2020

· Goldman Sachs targets $150 bn in clean-energy deals by 2025

· Statoil secures Scottish govt consent for floating offshore wind farm

· SEC signs $667 mn deal to build green power plant

· Hanwha Q Cells to build solar power plant in Texas

· France’s Fabius says UN report shows climate goal attainable

· China said to mull wind, solar power tariff cuts through 2020

· World set to exhaust 75 percent of `carbon budget' by 2030, UN says

· Morocco builds world's largest solar power plant

· New York City pension approves hiring adviser to weigh climate change risk

[WEEK IN REVIEW]

COMMENTS………………

Briefing: International Energy

The Baptist and the Bootlegger Unite

Lydia Powell and Akhilesh Sati, Observer Research Foundation

Carbon Constraints

|

T |

he announcement by ten large oil companies (BP, BG, Eni, Repsol, Saudi Aramco, Shell, Statoil, Petroleos Mexicanos, Reliance Industries and Total) who together account for almost 20 percent of the world’s oil and gas output that they will back policies consistent with the goal of keeping the increase in average global temperatures to within 2 degrees Celsius was embraced by climate Baptists as the ultimate endorsement of their agenda. The approach of the ten company group labelled oil & gas climate initiative (OGCI) to co-opt the enemy is not new. The Bootleggers colluded with the Baptists in the United States to ask for prohibition on alcohol as it helped the cause of the Baptists and the business of the bootleggers. In think tank language this ploy is celebrated as a move that makes ‘strategic sense’. The statement by OGCI follows a letter in June by European gas companies BP, Eni SpA, Royal Dutch Shell Plc, Total SA, Statoil and BG urging governments to agree to carbon pricing at the United Nations’ COP21 climate change summit starting in Paris in December. These gas companies appear to be looking at a market opportunity for gas if an agreement in Paris calls for a reduction in carbon emissions. Once a global declaration against carbon is made, coal fired power plants are likely to be the first targets for attack which will clear the way for gas.

Exxon Mobil that is not part of the collation against coalis in the middle of a controversy over allegations that it hid conclusions of its own research on climate change as it had ramifications for its business. Judicial activism against perceived corporate evil is not new in the United States but what the activist judges may not have realised is that fossil fuel is nottobacco. All are implicated when it comes to fossil fuel use unlike tobacco. When judges punish fossil fuel companies they will also punish themselves – either by imposing higher burden on their wallets (more tax or more money for energy use) or by having to live with complicated energy.

Meanwhile Toyota announced that it will transform its product line with hybrid vehicles that run on fuel cells. The result according to Toyota will be a 90 percent reduction in emissions compared to emission from its automobiles in 2010. This surprise move away from battery driven vehicles appears to be driven by concern over recharging time for batteries that Toyota thinks is detrimental to adoption of electric vehicles world-wide.

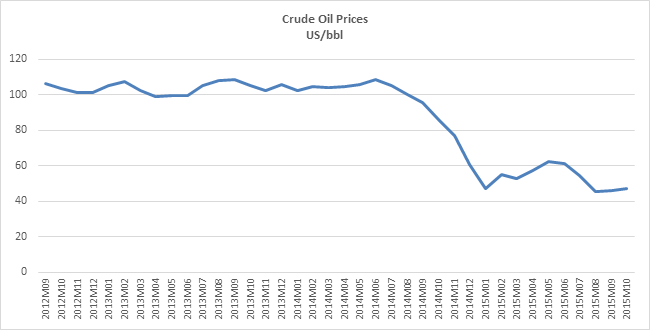

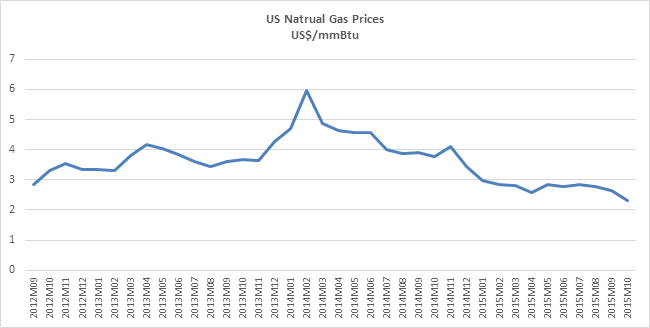

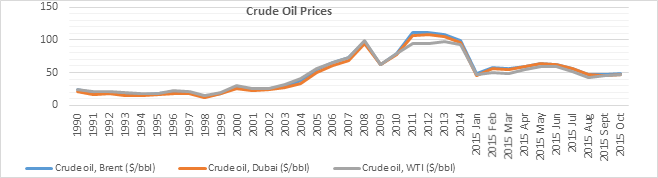

Hydrocarbon Markets

Last month continued to be depressing for oil prices but there were some positive signs. Early in October the dollar weakened which pushed up the price of crude. US production continued to contract even as its oil demand continued to increase. Escalating conflict in the Middle East made a small contribution to pushing oil prices up but Goldman Sachs held on to its prediction that the market was oversupplied and that prices will remain lower for a longer period. The repeal of the ban on oil exports from the United States did not make progress.

As it is often the case in the United States, unrelated commitments such as funding renewable energy and land conservation projects were supposedly being considered as sweeteners by the export lobby. The US department of interior cancelled two lease sales in the Arctic effectively ruling out drilling in the near future. A notable setback in the shale region was reported in October as Occidental Petroleum decided to pull out of Bakken.

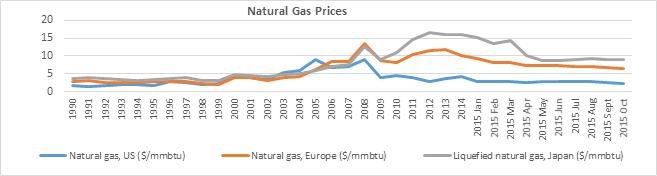

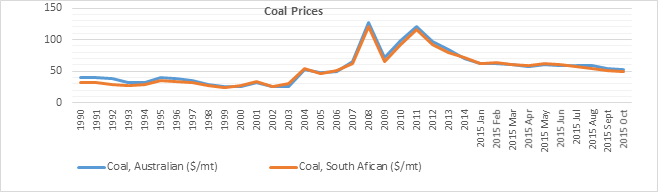

Source: The World Bank

Saudi Arabia reduced prices for November oil sale to Asia and the USA to keep its supply competitive with rival supplies. Speculation on Russia’s position in stabilising the oil market continued. There was even talk of Russia joining the OPEC but it appears to be far-fetched. Russia continued to increase supplies driving down prices. The war for market share is said to be raging between Saudi Arabia and Russia with China as the primary battleground. Meanwhile Iran is fine tuning its oil E&P contract terms to make it more attractive for potential investors. The country is said to be targeting an investment of $100 billion for developing the oil and gas industry. Iran is also said to have lined up buyers for 500,000 barrels of new oil. BP and CNPC announced a partnership agreement during the Chinese President’s visit to London this month. The two companies already have a successful partnership in developing the Rumalia field in Iraq and they now seek to put it to use in developing the shale resources in China.

The future of these investments hinges on things brightening up in a bleak market. The International Energy Agency (IEA) said in its monthly report that oil markets will be oversupplied in 2016 as it expected demand growth to slow down. The regulator at the Bank of England asked British Banks to disclose their exposure to commodity assets as concerns over the financial system’s exposure to collapse in commodity prices grew. The energy information administration (EIA) reported that US crude oil storage levels were close to 80 year highs at 476 million barrels. According to IMF estimates, if oil prices stay low, Middle Eastern oil producers stand to lose $1 trillion budget hole.

Notwithstanding IHS Global’s observation that only one in twenty LNG projects around the world will be developed by 2025, Malaysia’s Petronas reaffirmed its commitment to the LNG project in Canada’s pacific coast. The French company ENGIE (formerly GDF Suez) announced a deal to import LNG from Cheniere Energy of USA from its Sabine Pass and Corpus Christi export terminals. The deal could facilitate EU diversifying away from Russian gas. However prospects for LNG do not look bright as growth in demand in China is lower than expected. Japan’s return to nuclear power is unlikely to help.

This is not the best of times for the fossil fuel industry. It is under attack from both ends. At one end we have peak profit rather than peak oil or peak coal haunting the sector. At the other we have an evangelical mob waging war against carbon. What can it do other than cannibalise its weaker constituents just to stay alive!

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

COMMENTS………………

India's Coal Sector: Unable to capitalise on falling prices

Ashish Gupta, Observer Research Foundation

|

T |

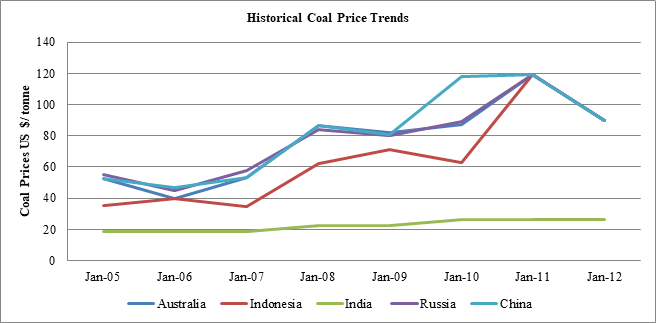

he coal sector has witnessed a lot of turmoil in the recent past. In 2010-11 the price of coal reached an all time high but now it is crawling at low level. The single most important reason for the rise and fall of coal prices is China.

Source: Various coal prices index

As one can see from the graph above until 2009, the price differentials did not favoure imported coal use in China. But after that the situation changed dramatically. China which was self reliant in coal became a net importer of coal in 2010-11. China emerged as an importer not because of coal availability deficit but because it wanted to take advantage of the arbitrage opportunity. The reason was that transporting domestic coal to south east China was expensive on account of insufficient rail and road network. Coal had to be first transported to the east on rail lines (Da-Qin & Shuo-Huang) and then to eastern ports (Quinhuangdao, Hunaghua and Rizao) and then loaded onto boats and finally shipped south via sea routes. The length of the voyage and the price were the key disadvantages. The landed price in the southern markets was comparable to the price of imported coal in the same ports. The arbitrage opportunity allowed Chinese coal buyers to take the advantage of price differentials between domestic Chinese coal and international coal prices. This role reversal strategy helped China to gain on both the fronts financially as well as strategically but India is at the receiving end as prices continue to fall.

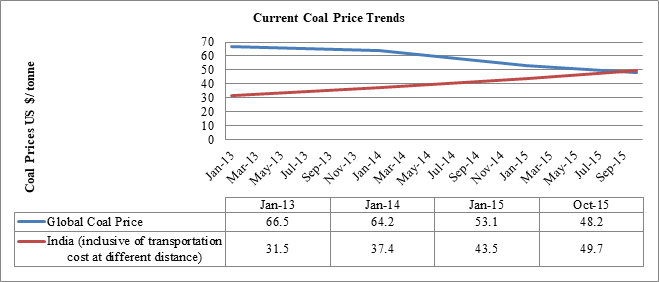

When global coal prices were too high as compared to Indian coal prices, it made no commercial sense for the power sector to go for higher imports. But the recent collapse of global coal prices has changed the whole cost dynamics.

China had always played an important role in shaping global trade flows and increasing price fluctuations in world coal markets. When China’s import demand increased it created over-capacity in coal exporting countries which turned into oversupply when prices collapsed in the global market. This behaviour does not imply that that Chinese demand for coal has come down but the same demand is now satisfied with domestic coal. A shoft towards efficient power plants also means that China can generate the same quantity of power from less coal. China can therefore move on to the next level of efficiency and save a lot on the coal consumption front signifying its continued progress in the sector.

Source: https://www.quandl.com/data/DOE/COAL-US-Coal-Prices-by-Region?utm_medium=graph&utm_source=quandl & https://www.fois.indianrail.gov.in/FoisWebsite/html/Freight_Rates.htm

From the above graph, it is evident that the price of coal from Coal India (CIL) are now on par with global coal prices level (prices calculated for distance at 1000 km, 1300 km, 1600 km & 1900 km) specially the low quality coal that is supplied to power plants. But the question remains whether the decline in global coal price will bring any advantage for India? Unfortunately, the answer is .no’. Though imported coal is of high quality the appetite of Indian power plants are full. The extra-ordinary performance of CIL has created an oversupply of coal in the country in an environment of low demand from the power sector. Most of the power plants have more than adequate coal stocks.

However there may be some benefit for power projects running on imported coal as coal prices slide. With imported coal prices plummeting, returns of such projects are expected to improve. But the number of such projects are small and therefore it will not have a country-wide impact There will also be some saving on foreign exchange reserves which will benefit the economy. Apart from this coking coal importers may also reap some benefits. power projects based on domestic coal may also benefit, as they can increase blending of imported coal and boost utilisation rates. Overall India is not in a position to take advantage of a favourable situation in the coal market.

Views are those of the author

Author can be contacted at [email protected]

UPCOMING EVENT

“Can Coal Block Auctions Be The Path To Modernize Coal Mining?”

to be held on 23 November 2015, 10:30 AM To 2:00 PM, at ORF, New Delhi

to confirm participation please contact

DATA INSIGHT……………

World Energy Markets: Prices and Variations

Akhilesh Sati, Observer Research Foundation

|

Year |

Crude Oil in $/bbl |

Coal (Australian) in $/mt |

LNG (Japan)- $/mmBtu |

|

1990 |

22.88 |

39.67 |

3.64 |

|

1995 |

17.18 |

39.37 |

3.45 |

|

2000 |

28.23 |

26.25 |

4.71 |

|

2005 |

53.39 |

47.62 |

5.99 |

|

2010 |

79.04 |

98.97 |

10.85 |

|

2014 |

96.24 |

70.13 |

16.04 |

|

2015 Jan |

47.11 |

62.10 |

15.12 |

|

2015 Feb |

54.79 |

61.40 |

13.37 |

|

2015 Mar |

52.83 |

60.12 |

14.28 |

|

2015 Apr |

57.54 |

57.81 |

10.22 |

|

2015 May |

62.51 |

60.40 |

8.72 |

|

2015 Jun |

61.31 |

58.84 |

8.59 |

|

2015 Jul |

54.34 |

59.13 |

8.87 |

|

2015 Aug |

45.69 |

58.57 |

9.18 |

|

2015 Sept |

46.28 |

54.75 |

9.00 |

|

2015 Oct |

46.96 |

52.16 |

9.00 |

Source: The World Bank

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

IOC says eyeing stake in Russia's Vankor Field

November 3, 2015. Indian Oil Corporation (IOC) wants to buy a stake in Rosneft's Vankor field in Russia, as the country's top refiner aims to source at least 160,000 barrels per day (bpd) oil through its own assets by 2020. India imports about 80 percent of its crude needs and has mandated its oil firms to acquire oil and gas assets overseas in a bid to cut an oil import bill running in billions of dollars. ONGC Videsh Ltd (OVL) in September bought a 15 percent stake in Vankor in Siberia to secure access to about 66,000 bpd of oil production. IOC has not decided on the size of any stake. IOC recently submitted a bid to buy 100,000 bpd of sweet oil in the latest annual tender issued by Nigerian state oil firm NNPC. (af.reuters.com)

IOC wins oil block in Africa

October 29, 2015. Indian Oil Corporation (IOC) has partnered Delonex Energy, a new Africa-focused oil and gas explorer led by former Cairn India chief Rahul Dhir, to win its maiden oil block in Mozambique. IOC and Delonex were awarded onshore Block P5-A in southern Mozambique. Russia's Rosneft and ExxonMobil have won rights for three offshore blocks. Other companies that have been awarded areas as operators include Italy's Eni and South Africa's Sasol. Delonex would operate the 9,988 square km Area P5-1 in the Palmeira basin, while IOC will hold 20 percent interest. Mozambique's national oil company ENH will hold the remaining 10 percent. The partners have committed $20 million in first phase of exploration, which will last three years. Dhir has got private equity firm Warburg Pincus to commit up to $600 million for the oil and gas explorer he had floated. (www.telegraphindia.com)

ONGC to intensify exploration activities, secures more rigs

October 28, 2015. Oil and Natural Gas Corporation (ONGC) is expected to increase its upstream capital expenditure by 10 percent next year and intensify its exploration activities, taking advantage of the current depressed global energy market. Rig rates are down by 30-40 percent on the year and other exploration services rates are down by 40-50 percent, ONGC said. Industry sources at the gala event said more and more rigs were being laid off while services companies seeking new contracts at discounted rates. According to ONGC is increasing its 2016 capital expenditure to about ` 36,000 crores, up by about 10 percent from the current ` 33,000 crore. ONGC said that value of any exploration and production company increases through exploration activities. (profit.ndtv.com)

Downstream………….

IOC to spend ` 18 bn for BS-IV norms implementation at Gujarat refinery

November 3, 2015. Indian Oil Corporation (IOC) will be spending an estimated ` 1800 crore for a 100 percent BS-IV fuel norms implementation by 2017 at its Gujarat Refinery in Vadodara district. The move is part of the central government's Auto Fuel Vision & Policy-2025 which has called for supply of BS-IV fuels across India from April 2017 onwards. As part of the upgradation project for implementation of BS-IV fuel norms, Gujarat Refinery is revamping its diesel treating units including diesel hydrotreating unit (DHDT), diesel hydrodesulphurisation unit (DHDS) and vacuum gas oil hydrotreating unit (VGO-HDT) in a short time. Also, in order to be total BS-V compliant by the year 2020 new units including DHDT, gasoline sulphur treatment unit and hydrogen generation unit along with allied facilities will be set up. The quality upgradation project will enable Gujarat Refinery to supply 100 percent BS-IV diesel and petrol. (www.business-standard.com)

BPCL says in talks to sell 24 percent stake in Bina refinery

October 29, 2015. Bharat Petroleum Corp Ltd (BPCL) is in talks with foreign companies to sell a 24 percent stake in its 120,000 barrels per day Bina refinery in India's Madhya Pradesh state. The refinery is a joint venture with Oman's state oil firm. The company wants to boost the capacity of the refinery by about 30 percent. (in.reuters.com)

IOC's Paradip refinery may start commercial operations in March

October 28, 2015. Indian Oil Corporation (IOC) is expected to start commercial operation at its new 300,000 barrels per day (bpd) Paradip refinery around March 2016. When the refinery reaches full capacity, it could temporarily cut the refiner's dependence on gasoline imports, Mathew C. George, Chief Manager of Petrochemicals-Exports, said. When the Paradip refinery hits full capacity, IOC would cut its gasoline imports but that would last a year or a year-and-a-half, after which it would have to rely on imports again as demand would outgrew its supplies, George said. India has surplus refining capacity, mainly because of Reliance Industries and Essar Oil, but IOC on its own is lacking in gasoline supplies for now and importing the fuel is more economical. IOC was not a regular gasoline importer until February this year. It has sought over 900,000 tonnes of gasoline for March to December delivery to various ports including Kochi and Paradip. IOC operates a naphtha cracker in Panipat which has a capacity of more than 800,000 tonnes of ethylene a year. It is currently running at full capacity, George said. The unit consumes over 2 million tonnes of naphtha produced at IOC's Gujarat, Mathura and Panipat plants. (in.reuters.com)

Transportation / Trade…………

Iraq unseats Saudi Arabia as top crude supplier to India for third month

October 28, 2015. Iraq overtook Saudi Arabia as the top crude exporter to India in September for the third time in 2015, according to tanker data, as the two biggest OPEC producers battle for market share in leading Asian buyers. Saudi Arabia also lost its top spot in China last month, with Russia overtaking the world's biggest crude exporter as the main supplier for the second time this year. Traders attributed the shift to a hike in Saudi's official selling price (OSP) of crude. India imported 640,300 barrels per day (bpd) of oil from Saudi Arabia last month, about 30 percent lower than in August and the weakest in a year, the data showed. The figure was still up 12.8 percent from a year ago. While Saudi's market share in India is shrinking, Iraq is expanding its hold over one of the world's fastest-growing markets by offering attractive pricing. India shipped in about a fifth of its imports from Iraq in September, while Saudi Arabia's share dropped to 17 percent from about 22 percent in August. In the first half of India's fiscal year running from April to September, Saudi Arabia supplied nearly 19 percent more oil to India at about 776,000 bpd, while volumes from Iraq surged 36 percent to about 676,000 bpd. India is stepping up purchases from Africa, where more crude is available after China raised shipments from Russia and the United States began processing its own shale oil. India imported nearly 27 percent more African crude in April-September, mainly from Angola and Nigeria. India, which is Iran's second-biggest customer behind China, bought about 17 percent more oil from Tehran in the April-September period, the data showed. Overall oil imports by India slipped 7.4 percent last month from August as Essar Oil, which rarely buys Saudi oil, shut its 400,000 bpd refinery for a month from mid-September for maintenance. (in.reuters.com)

Policy / Performance………

Oil Minister pushes for better hydrocarbon ties with Africa

November 2, 2015. India, which imports nearly 18% of its crude oil requirement from African producers, is working towards further expanding ties with the energy-rich nations from Africa. Oil Minister Dharmendra Pradhan stressed upon intensifying hydrocarbon cooperation with the African countries on upstream, midstream and downstream areas. At present, India imports about 33 million tonne crude oil from Africa. Indian PSU oil and gas companies have invested about $8 billion in oil and gas assets in Mozambique, Sudan and South Sudan. Pradhan, along with top officials from his ministry and heads of PSUs — IOC, OIL, EIL and OVL, conveyed to the leadership of the African countries that India is keen to graduate to a stronger energy partnership with the African nations. (www.financialexpress.com)

ATF price cut marginally; non-subsidised LPG rate hiked

November 2, 2015. Aviation Turbine Fuel (ATF) or jet fuel price has been cut marginally while rate of non-subsidised cooking gas LPG has been hiked by ` 27.50 a cylinder in line with global trends. ATF price in Delhi has been cut by ` 142.56 per kilolitre, or 0.3 percent, to ` 43,041.61 per kilolitre, oil companies announced. The reduction comes on the back of 5.5 percent or ` 2,245.92 per kilolitre increase in ATF price on 1 October. Rates vary from airport to airport depending on the local sales tax or value-added tax (VAT). Jet fuel constitutes over 40 percent of an airline's operating costs and the price cut will bring marginal relief to the cash-strapped carriers. Simultaneously, the oil firms have also raised prices of non-subsidised LPG, which consumers buy after exhausting their quota of subsidised cooking fuel, by ` 27.5 per 14.2-kg bottle. Non-subsidised cooking gas (LPG) costs ` 545 in Delhi. The hike in rate comes on back of four straight monthly reduction. Non-subsidised LPG price was last cut on October 1 by ` 42 to ` 517.50 in Delhi. Prior to that, rates were cut by ` 25.50 on 1 September, ` 23.50 on 1 August and by ` 18 per cylinder to ` 608.50 on 1 July. Non-subsidised or market-priced LPG is one that consumers buy after exhausting their quota of 12 bottles of 14.2-kg each at subsidised rates in a year. Subsidised LPG costs ` 417.82 per 14.2-kg cylinder in Delhi. The three fuel retailers - Indian Oil Corp, Hindustan Petroleum and Bharat Petroleum - revise jet fuel prices and non-subsidised LPG rates once a month. (www.firstpost.com)

Oil Minister confirms BS-VI fuel rollout target of 2020

October 30, 2015. Oil Minister Dharmendra Pradhan confirmed that his Ministry still aimed to implement introduction of the cleaner Bharat Stage-VI fuel in the country by 2020, notwithstanding the substantial resistance to the proposal from automakers. While the earlier plan was to implement BS-V by 2020 and BS-VI by 2024, the Petroleum Ministry sought to skip BS-V and directly implement BS-VI standards by 2020. This has met huge resistance from the automobile industry. The Society of Indian Automobile Manufacturers (SIAM) had written to the government explaining that the technology in BS-VI engines was substantially different from that in BS-V engines making it unviable to skip the BS-V stage entirely. Each stage of new technology had to be validated over 6-7 lakh kilometres, and could not be developed simultaneously, SIAM said. (www.thehindu.com)

Make excise rates on LPG uniform: Oil Ministry to Finance Ministry

October 29, 2015. Oil Ministry has asked the Finance Ministry to make excise rates uniform for different categories of domestic cooking gas (LPG), Oil Minister Dharmendra Pradhan said. There is no excise duty on a 14.2-kg of subsidised LPG cylinder, but a similar sized non-domestic bottle attracts 8 percent levy. Besides, while a subsidised domestic cylinder is exempt from customs duty, a 5 percent import duty is levied on non-domestic LPG cylinder. LPG or domestic cooking gas, is sold in different pack sizes - 5 kg, 14.2 kg and 19 kg. A household customer is allowed 12 cylinders of 14.2-kg each or 34 cylinders of 5 kg each during a year at subsidised rates. Any requirement beyond this has to be bought at market rate. The subsidised LPG cylinders are exempt from excise as well as customs duty but not the other categories including 19 kg commercial cylinders. This anomaly has led to diversion or black-marketing of subsidised cylinders for other uses. Government plans to increase LPG cover to 75 percent of the households in the country in next four years from the current coverage of 60 percent. Pradhan said India is seeking to increase import of crude oil as well as raise its level of energy engagement with Africa. India is looking at acquiring oil and gas fields as well as taking up refinery, pipeline and gas distribution projects in Africa. (indiatoday.intoday.in)

Crude cess: Finance Ministry unlikely to lower rates

October 29, 2015. The Finance Ministry has decided to turn a deaf ear for the time being to the demand made by the Ministry for Petroleum & Natural Gas to calculate cess on domestic crude oil at the cost of production. Currently, the cess is levied at a fixed rate – ₹ 4,500 a tonne. The cess rate constitutes about 20 percent of the Brent. But, if it is made ad-valorem (or at cost) it will become market linked. While the cess amount has increased with the rise in crude oil prices, it has not reduced accordingly. The cess is not a pass through and therefore has to be borne by the producers. The Finance Ministry said that this demand is always made by the domestic oil producers whenever the crude oil prices are low. The Finance Ministry’s decision on cess is also influenced by the fact that at present the government’s maximum earnings are coming from the savings on account of fuel subsidy and earnings from the increased duties – both customs and excise – on crude oil and petroleum products. The country’s oil subsidy bill has come down by at least ₹ 20,000 crore due to lower crude oil prices, and excise duty almost doubled to ₹ 80,208 crore by August end. Led by Cairn India, the domestic oil producers have been seeking reduction in cess amount to ₹ 2,500 a tonne from the current ₹ 4,500 a tonne. The government levies cess on domestic crude oil production as a duty of excise. The current level of cess was imposed in the Budget of 2012-13, when the crude price was over $ 100 a barrel. The crude price has since dropped significantly. When the government had doubled the cess amount, Cairn had approached the then Prime Minister’s office seeking review as it was only the Rajasthan block production sharing contract which was materially affected by this increase. While the Petroleum Ministry had then agreed that it would adversely affect Cairn, it had left the private sector explorer to fight its own battle. NELP (New Exploration Licensing Policy) PSCs are exempted from cess. For most other blocks offered before the licensing rounds and producing crude oil like Ravva and Panna-Mukta-Tapti joint venture fields, cess is fixed at ₹ 900 a tonne. (www.thehindubusinessline.com)

RIL regains top slot in Platts global ranking, elbows out ONGC

October 28, 2015. Reliance Industries Ltd (RIL) has regained the top slot among Indian energy companies on the Platts global list by surpassing Oil and Natural Gas Corporation (ONGC) in the rankings for this year. In all, 14 Indian energy companies made it to the 2015 Platts Top 250 Global Energy Company Rankings, a financial performance roster of publicly traded companies with assets greater than USD 5 billion. The company improved its overall ranking to 14 from 22 in 2014. ONGC too improved its position to 17 from 21 previously. Rankings are based on assets, revenues, profits and return on invested capital for the prior fiscal year. Global giants Exxon Mobil Corp, Chevron Corp and Royal Dutch Shell plc occupied the top three slots while Chinese firm CNOOC Ltd for the first time broke into top five at No.4. PetroChina was a close fifth. India, the second largest Asian demand power house, saw its energy consumption hit an all-time high. With the fastest growth in energy consumption for the last five years, more coal, LNG and oil were required. (www.financialexpress.com)

[NATIONAL: POWER]

Generation……………

KNPP director admits to delay in maintenance work in Unit 1

October 31, 2015. Admitting to a delay in undertaking maintenance work in Unit-I of Kudankulam Nuclear Power Plant (KNPP) its director R S Sundar said it would be over by November this year and power generation would begin by that month end or December. Sundar said maintenance of turbines was over and work on the reactors was being done now. Sundar said power generation in Unit II was also being delayed due to the maintenance work and expressed confidence that Unit II would start generating power by February 2016. He said preliminary work on Units 3 and 4 were going on in full swing. Referring to the fifth and sixth units, he said talks were going on. The first unit of the Indo-Russian Joint Venture has been operational commercially since December 2014. It had attained criticality in July 2013 after much delay, largely due to protests against the project by anti-nuclear activists, spearheaded by People’s Movement Against Nuclear Energy, in areas around the complex. (www.freepressjournal.in)

Adani announces setting up of ` 37 bn power plant in Punjab

October 28, 2015. Adani Enterprises chairman Gautam Adani announced setting up of a ` 3700 crore power plant in Punjab during the ongoing Progressive Punjab Summit in SAS Nagar. The government has fulfilled five promises made during the first edition of the summit, which included providing ease of doing business, 24x7 supply of power, connectivity, establishment of industrial parks, and urban development. (www.hindustantimes.com)

NTPC's Vindyachal plant to be country's largest power generating station

October 28, 2015. NTPC's Vindhyachal Super Thermal Power Station (VSTPS) will become country's largest power generating plant with the commissioning of another 500 MW unit. Overall, the total commercial capacity of VSTPS, NTPC and the NTPC Group will become 4,760 MW, 38,442 MW and 44,443 MW respectively. VSTPS will also become the largest operating power station in the India, the company said. The power plant is located in district Singrauli of Madhya Pradesh. The beneficiary states of the project are Madhya Pradesh, Chattisgarh, Maharashtra, Gujarat, Goa, Daman & Diu and Dadar Nagar Haveli. (www.business-standard.com)

CIL forays into power generation

October 28, 2015. Coal India Ltd (CIL) will soon make foray into thermal power generation with its first plant to be set up by subsidiary Mahanadi Coalfields Ltd (MCL) in Sundargarh district of Odisha, MCL's chairman-cum-managing director-designate Anil Kumar Jha said. Besides its plans to set up the 1,600 MW (2x800) power plant, MCL is gearing up to meet a target of producing 150 million tonnes of coal production during the current fiscal, according to Jha. CIL has set for itself a target of 550 million tonnes (mt) during 2015-16 up from last year's 494 mt. Mahanadi is to ramp up its production from current 121 mt to 150 mt making up for more than 25% of the CIL production. At the same time most of the 28 washeries that CIL is setting up will come under MCL area for providing better quality coal with lesser ash content. According to Jha the best coking coal is available in Jharia area of Dhanbad coal belt. But the area is thickly populated and only a complete rehabilitation of population can help in increasing output there. A draft rehabilitation plan is ready. Once it is implemented so much coking coal can be taken out there will be no necessity for imports. Jharia has vast reserves of high quality coking coal. India last year imported coal worth ` 93,000 crore, much of it coking coal used in steel industry. He lauded Union shipping and transport minister Nitin Gadkari's proposal for using waterways to transport coal. If coal is transported through sea and river routes it would go a long way in overcoming congestion of rail traffic, non-availability of dedicated freight corridor and rakes to transport coal. (timesofindia.indiatimes.com)

Transmission / Distribution / Trade…

Fuel supply contracts of steel and cement companies with CIL to continue

November 3, 2015. The fuel supply contracts of steel and cement companies with Coal India Ltd (CIL) will not be discontinued for auction. This comes as a big relief to the companies as the government had earlier announced that all the coal supply agreements between CIL and non-power firms will end on June next year. The government said the fuel supply agreements of companies in non-power sectors like steel and cement are not proposed to be ended prematurely. The government will wait for the contracts to end and then auction them. This is a change from the government’s earlier stance to discontinue the agreements and auction them afresh next year. Most fuel supply contracts of CIL are set to lapse in 2017. The government is expected to auction about 28 million tonne of coal supply pacts to unregulated sectors next year. The coal ministry has finalised the policy for auction of CIL contracts to unregulated sectors like steel and cement that will be tabled before the Union Cabinet for approval within a month. The private steel and cement firms will have to indicate their coal requirement and their enduse projects to the coal ministry before bidding for supply from CIL. The coal ministry has committed to reserve coal for auction to the unregulated sectors like steel and cement out of CIL’s incremental production every year. This has been done to avoid desperate bidding by private firms in the upcoming round of bidding for coal supply from CIL. As per the proposed mechanism, CIL will invite bids from companies for supplying a fixed quantity of coal at a floor price. Once bids are received, the state-run miner will increase the floor price till the demand and supply reach the same level. (www.diligentia.net.in)

India to give 100 MW more electricity to Bangladesh

October 31, 2015. India will start transmission of fresh 100 MW electricity from Tripura to Bangladesh by January and the government-owned company is working round-the-clock to erect the transmission line by December. The Indian government-owned Power Grid Corporation of India (PGCIL) is working round-the-clock to erect the 47-km transmission line from western Tripura to southern Comilla (in eastern Bangladesh) by December this year. Electricity-starved Bangladesh will begin receiving 100 MW of power from Tripura to meet the energy crisis in the eastern part of the country. The 100 MW power will be in addition to the 500 MW Bangladesh already receives from the West Bengal and a like amount that is on the cards from the State, as the two neighbours enter a new phase of bilateral cooperation for regional benefit. Prime Minister Narendra Modi discussed the power supply from Tripura with his Bangladeshi counterpart Sheikh Hasina during Dhaka-visit last June. He had declared that India would enhance the supply of power to Bangladesh from the existing 500 MW to 1,100 MW. Tripura Chief Minister Manik Sarkar had earlier said that after completion of a new 101 MW gas-based power projects at Monarchak (10 km from the Bangladesh border) in western Tripura, at least 200 MW of power would be surplus in Tripura. The Central government-owned Oil and Natural Gas Corporation (ONGC) has commissioned its biggest ever 726 MW commercial power project at Palatana, 60 km from Agartala, while the state-run North East Electric Power Corporation is setting up a 101 MW project at Monarchak in western Tripura, 70 km from Agartala. The gas based Palatana project, which supplies power in seven of the eight northeastern states, is a hallmark of the cooperation between India and Bangladesh, which ensured the smooth passage of heavy project equipment and turbines to Palatana through its territory by road and waterways from Haldia port in West Bengal. India had begun supplying 500 MW of power to Bangladesh in 2013 after the government-run Bangladesh Power Development Board and India's NTPC Vidyut Vyapar Nigam Ltd (NVVN), a subsidiary of NTPC, signed a deal Feb 28, 2012, following an agreement signed during Hasina's visit to New Delhi in January 2010. (www.assamtribune.com)

Policy / Performance………….

DERC seeks more funds from govt to hire extra staff

November 3, 2015. Delhi Electricity Regulatory Commission (DERC) is looking at much busier days ahead after being designated as the sole authority to audit the capital's power distribution companies by Delhi high court. The commission is shifting focus on strengthening the organisation following the court's directives to investigate the three discoms. Working on an annual budget of approximately ` 10 crore, DERC is learnt to have sought additional funds from the government in the current fiscal to aid its working and bringing in additional manpower. The electricity regulator has said they are fully equipped to audit the power utilities and supported the CAG scrutiny specifically for public interest. It is learnt that DERC has sought ` 13 crore this fiscal to bring in more manpower and hire consultants for prudence checks. The government is yet to get back to the regulator as the matter is being examined by the finance department. Apart from the annual tariff exercise, DERC has started verification of physical assets of the discoms. The commission said that CAG audit would have been a second check of the discoms, in addition to the analysis already being carried out. (timesofindia.indiatimes.com)

Small suppliers of nuclear energy sector won't have obligation in case of liability: DAE

November 3, 2015. In a major relief to component suppliers in the nuclear energy sector, government said they will not have any "obligation" if there is any liability. However, the major suppliers, for instance companies building the reactors, will not be absolved if there is such an eventuality. India is also looking at approaching foreign market as the Domestic banks are not equipped to give the massive amount of loan required to build an atomic reactor. Sekhar Basu, Secretary, Department of Atomic Energy (DAE), was speaking at the 7th Nuclear Energy Conclave organised by the India Energy Forum. Basu said that companies building the reactor will not be absolved under this. The decision comes as a major relief to small suppliers, mostly Indian companies, which had been complaining about the stringent provisions of the Civil Liability Nuclear Damage(CLND) Act 2010, which held suppliers responsible in case of any accident. Basu said the DAE is also looking for cheaper loan option outside. (zeenews.india.com)

Celebrations to mark CIL’s 41 yrs

November 2, 2015. The subsidiaries of Coal India Limited (CIL) subsidiaries operating in Jharkhand celebrated the 41st foundation day of the parent company. On the eve of (CIL) 41st foundation day, the CCL, a subsidiary of CIL, said the company has registered a growth in coal production, over burden removal and dispatch till the second quarter of the ongoing financial year in comparison to the 2014-15 FY. CCL said that the company has so far performed well in terms of liquidation of coal stocks, with as much as 4.3 million ton (mt) of the 9.7 mt stocks being liquidated already till April 1. The CIL subsidiary has been upbeat after it recorded 55.64 mt production in the 2014-15 fiscal, a growth rate over 11% from the 2013-14 fiscal. This year, the company has set a production target of 61 mt target in the ongoing fiscal. (timesofindia.indiatimes.com)

Reliance Power’s Sasan UMPP doesn’t require Chhatrasal coal block: Govt

November 2, 2015. The government justified cancellation of one of three coal blocks allocated to Reliance Power Ltd’s Sasan Ultra Mega Power Project (UMPP), saying the unit’s coal requirement could be met by the other two. Defending its decision, the coal ministry told Delhi high court that Reliance Power had on several occasions represented that its Sasan unit required only 16 million tonnes per annum (mtpa) of coal which could be easily met by the Moher and Moher-Amlohri extension coal blocks in Madhya Pradesh. The ministry has said that since the two blocks could meet the requirements of the project, the third block - Chhatrasal - was deal located. It said the company also did not fulfill the allocation condition of developing the Chhatrasal block, in Madhya Pradesh, and commencing coal production from there. It said that after Reliance Power emerged as the successful bidder, it wanted to use the surplus coal from Chhatrasal for its other projects, which could not be allowed as the Supreme Court had directed that coal blocks allocated for UMPPs would be used for UMPPs only and no diversion of coal for commercial exploitation would be permitted. RPower had argued before the high court that the apex court had “specifically excluded” UMPPs while deal locating 214 coal blocks by its orders of August and September last year. (www.livemint.com)

CIL will surpass 550 mt target: Goyal

November 1, 2015. Asserting India will not have to depend upon imports, Coal and Power Minister Piyush Goyal exuded confidence of Coal India Ltd (CIL) surpassing its production target of 550 million tonne (mt) for the current fiscal. He said the CIL was on track towards achieving its production target of one billion tonne of coal by 2019-20. Goyal said there was no shortage of power in any part of the country and credited CIL for ensuring that all power plants in the country had adequate supply of coal. Urging employees to consider themselves more as trustees of the nation's asset, Goyal exhorted them to make the CIL the world's most valuable company. (www.business-standard.com)

Power sector revival a priority: Finance Minister

October 31, 2015. Finance Minister Arun Jaitley said the government will look into the issues being faced by the power sector, after having taken steps to pull the highways and steel sectors out of distress. The minister said the main challenge in the power sector is at the last mile as many discoms are in distress. Jaitley said very soon the government will revive stalled projects, without elaborating further. (www.business-standard.com)

CAG finalises draft report on e-auctions of coal blocks

October 30, 2015. The Comptroller and Auditor General (CAG) has finalised its draft report on the e-auctions of coal blocks allocated by the NDA government and is likely to table the report in the forthcoming winter session of Parliament. This would be the first report by the federal auditor on the Modi government's allocation of natural resources, a performance review of its policies like the appraisal report prepared by the auditor for UPA's 2G spectrum allocation and Coalgate. The auditor has looked into allegations of cartelisation in award of coal blocks through e-auctions. After allegations of cartelisation surfaced, the NDA government had cancelled coal blocks allocated to Naveen Jindal group on the grounds of alleged riggings. The auditor has reviewed all bidding documents and whether fair practices were adopted in allocation of mines through the new process. (timesofindia.indiatimes.com)

SC to hear Bagrodia's plea on November 30

November 2, 2015. The Supreme Court (SC) said it will hear on November 30 the plea of former Union Minister Santosh Bagrodia seeking parity with former Prime Minister Manmohan Singh for stay of criminal proceedings against him in a coal block allocation case. Earlier, CBI had opposed the stand of Bagrodia seeking parity with the former Prime Minister saying that the legal provisions challenged by both of them were different. Special Public Prosecutor for coal scam cases R S Cheema had said while in Singh's case, constitutional validity of section 13(1)(d)(iii) of Prevention of Corruption Act has been challenged, Bagrodia's case pertained to section 13(1)(d). Bagrodia, former Minister of State for Coal in Singh's cabinet, has been summoned as accused by special CBI court in a case concerning allocation of Maharashtra's Bander coal block to AMR Iron and Steel Pvt Ltd. (www.ptinews.com)

Goyal asks BBMB, NHPC to raise capacity to 'highest level'

October 31, 2015. Taking stock of operations of Bhakra Beas Management Board (BBMB) and NHPC, Coal and Power Minister Piyush Goyal called upon their managements to increase their efficiency and raise capacity to the highest level. Goyal said that a joint meeting of Chief Ministers of all these four states will be held here shortly to sort out the long pending issues. He directed BBMB Chairman to submit an action plan to him within a month for strengthening the public warning system to avoid accidents by immediate release of water from the dams. Goyal directed BBMB to make an inventory of all its assets, including unused vacant land within six months. (www.newindianexpress.com)

Fourth round of coal mines auction likely in 15 days: Coal Secretary

October 30, 2015. The government is planning to auction up to 11 coal blocks in the fourth round of bidding which is likely to start in a fortnight. In another 15 days (the fourth phase of coal mines auction may start), Coal Secretary Anil Swarup said. Coal and Power minister Piyush Goyal had earlier said the process and formalities of the fourth round of auctions are at the last stage. The government is planning to auction blocks to the unregulated non-power sectors, including cement, steel and aluminium, as per sources. The first three rounds as well as allotment of mines had fetched states over ` 3 lakh crore. In the third phase of auction held in August, the government had to be content with proceeds of just ` 4,364 crore as legal and other issues forced it to put only three out of the proposed 10 mines on the block. The Supreme Court in September last year had cancelled allocation of 204 coalmines to companies without auction. (dc.asianage.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Chevron begins O&G production from $2 bn Lianzi field offshore Central Africa

November 3, 2015. Chevron subsidiary Chevron Overseas (Congo) has started oil and gas (O&G) production from the $2 bn Lianzi development field located in a unitized offshore zone between the Republic of Congo and the Republic of Angola. Located 65 miles (105 km) offshore in approximately 3,000 feet (900 meters) of water, the cross-border project is estimated have an average production capacity of 40,000 barrels of crude oil per day. Estimated to hold proven reserves of 70 million barrels of oil, the field represents the company's first operated asset in Congo and the first cross-border oil development project offshore Central Africa. Oil produced from the field is transported to the existing Benguela Belize Lobito Tomboco host platform located in Angola Block 14. (explorationanddevelopment.energy-business-review.com)

Noble to make investment decision on Israel's gas fields in 1 yr

November 2, 2015. U.S. oil and gas producer Noble Energy Inc said it would make a final investment decision on two large gas fields in Israel in about a year's time, a day after the country's prime minister promised to fast-track the projects. Prime Minister Benjamin Netanyahu said he would take control of the economy ministry - after a minister who had been holding up the plan stepped down - and give final approval to a framework deal with Noble and Israel's Delek Group. The framework deal reached in August gives control of Israel's largest gas field, Leviathan, to a consortium led by Noble and Delek. Leviathan, a massive field with reserves of 22 trillion cubic feet, was initially slated to begin production in 2018 with most of the gas earmarked for exports. Noble also owns a large stake in Tamar, another field offshore Israel's Mediterranean coast that started production in 2013 and has reserves of 10 trillion cubic feet. The company, which also operates in U.S. shale fields and offshore Gulf of Mexico and West Africa, said it now plans to spend less than $3 billion in 2015. Noble, which acquired Rosetta Resources in a $2 billion deal earlier this year, raised its fourth-quarter sales volume forecast to 385,000-405,000 barrels of oil equivalent per day (boepd) from 375,000-400,000 boepd. (www.reuters.com)

Russian oil output in October hits post-Soviet high 10.78 mn bpd

November 2, 2015. Russian oil production, the world's largest, hit a post-Soviet high in October, rising 0.4 percent month on month to 10.78 million barrels per day (bpd), Energy Ministry data showed. Output reached 45.572 million tonnes versus 43.961 million in September, or 10.74 million bpd, which was at that time a post-Soviet high. The data showed that Russian oil output under production-sharing agreements, designed in the 1990s to encourage investment by foreign oil firms, jumped 6.7 percent in October from September to 1.367 million tonnes (323,000 bpd). (www.reuters.com)

Sonangol, Total deepwater project to add 30k bpd to Angola oil output

November 2, 2015. Sonangol and a unit of France's Total will break ground on a new deepwater oil pumping project that will add over 30,000 barrels a day to Angola's oil production, the state oil company said. The project, part of the offshore Rosa oil production field north of the capital Luanda, involves four multi-phase high-pressure pumps installed close to the bottom of sea and will link up with an existing subsea network for pumping crude, the company said. The project involves Total's Angola unit which operates Angola Block 17, Sonangol said. The additional pumping capacity will be a boost for the southern African nation whose coffers have suffered as a result of a sharp slide in oil prices since mid-2014. Oil output represents 40 percent of Angola's gross domestic product and over 95 percent of its export revenue. (af.reuters.com)

Almost a billion cubic feet of US gas shut down by low prices

October 30, 2015. Natural gas drillers in the U.S. Northeast have curbed production by about 900 million cubic feet a day as prices for the fuel hover near three-year lows, based on Williams Cos. estimates of curtailments on its system. Output from the Marcellus shale formation in Pennsylvania will fall 1.3 percent in November to 15.89 billion cubic feet a day, the fifth consecutive monthly decline and the biggest drop since July 2014, according to the Energy Information Administration. Spot gas prices in Pennsylvania fell to a record low in July. Curtailments of 300 million cubic feet a day from Ohio’s Utica shale region during the quarter have ended and a record 1 billion cubic feet a day was seen at the company’s hub there over the past weekend. (www.bloomberg.com)

Oil companies have cut back everything except crude production

October 30, 2015. A year after the bear market in crude began, oil companies have cut workers, are using fewer rigs and have less money to spend. But they’re still pumping more oil. BP Plc, Royal Dutch Shell Corp. and Hess Corp. are among the companies producing more crude than a year ago. In the U.S., shale explorers have focused on the most productive parts of their land, drilled faster and better wells there and negotiated lower prices from oilfield service companies. It’s helped keep total U.S. output about 1.6 percent higher than at this time last year, even as drilling rigs have fallen by 63 percent. High production all year has pushed U.S. inventories to the highest October level since 1930, helping keep prices deflated. The good news for oil bulls is that production gains may be ending soon. Hess and Whiting Petroleum Corp. are among companies that produced less in the third quarter than in the second. U.S. onshore production is expected to fall to 7.7 million barrels a day in the fourth quarter, according to Rystad Energy AS, about 100,000 less than the same period last year. Some companies have maintained production because they used financial hedges, so are still getting paid pre-crash prices for their crude. (www.bloomberg.com)

CNOOC to ease spending cuts next year to save oil output target

October 29, 2015. CNOOC Ltd. will ease spending cuts in 2016 after China’s biggest offshore oil and gas producer targeted a 30 percent reduction this year amid a plunge in energy prices. The global energy industry has had to slash more than $100 billion in spending and 200,000 jobs to keep pace with crude prices that have tumbled by more than half since June 2014. Oil companies are suffering from a slump in prices as producers compete for market share amid an oversupply. The company is on target to lower spending to as much as 70 billion yuan ($11 billion) this year. Revenue from oil and natural gas output was 36.3 billion yuan in the three months ended Sept. 30. The drop in revenue was narrower than the 50 percent slump in oil prices during the period while production is on track to reach the high-end of its annual target. CNOOC planned to cut this year’s spending to between 70 billion yuan and 80 billion yuan. The Beijing-based company expects to produce 475 million to 495 million barrels of oil equivalent this year, an increase of as much as 15 percent from 2014. CNOOC is targeting 509 million barrels in 2016, which would be a 3 percent increase from the high end of this year’s target. (www.bloomberg.com)

Statoil delays production at Mariner oil field

October 28, 2015. North Sea oil firm Statoil has announced it is delaying the start-up of the massive Mariner oil field. The Norwegian company has postponed production by a year, to the second half of 2018. The Mariner field lies about 93 miles (150km) east of Shetland. According to Statoil, Mariner is the largest field development on the UK Continental Shelf (UKCS) in more than a decade, and will be in production for at least 30 years. Statoil said the delay in starting production would not impact on jobs - although some recruitment for the £4.6bn ($7 bn) project will now be staggered. The firm insisted it was still "fully committed" to the North Sea. Aberdeen-based EnQuest said it had produced its first oil from the Alma/Galia development in the central North Sea. Alma, which was formerly known as Argyll, was the first commercially-produced oil field in the UK Continental Shelf. (www.bbc.com)

BP will start producing gas at North Alexandria in early 2017

October 28, 2015. British oil major BP plans to start producing gas from its North Alexandria concession in early 2017, i.e. a few months earlier than initially planned. The offshore gas concession is excepted to produce around 450 mcf/d in 2017; gas production will be ramped up to 1.2 bcf/d by the end of 2019. BP has recently been awarded three new offshore exploration blocks in Egypt. The company plans to invest US$229 mn in their development. These new resources are expected to improve domestic supply in Egypt, once an energy exporter, which is facing falling oil and gas production and rising demand and has to divert supplies to its domestic market. (www.enerdata.net)

Downstream…………

US oil refiners look abroad for crude supplies as North Dakota boom fades

November 3, 2015. PBF Energy Inc, one of the largest independent oil refiners in the United States (US), spent heavily in recent years to build the rail terminals at its Delaware City complex that it needed to take delivery of large loads of crude coming from North Dakota's Bakken oil fields. The sudden lack of interest in Bakken crude by PBF, which is run by Thomas O'Malley, one of the biggest names in the U.S. oil refining industry, reflects a dramatic recent change in the way East Coast refineries are sourcing the crude that they turn into everything from gasoline to heating oil and jet fuel. PBF disclosed that it is only budgeting to take 25,000 barrels a day of Bakken oil delivered by rail at its East Coast refineries in 2016. PBF's Delaware City refinery imported about twice as much crude in July as in January, bringing in cargoes from Colombia and Peru, according to data from the U.S. Energy Information Administration. The company's Paulsboro, New Jersey, refinery increased its imports by 50 percent in the same period. The refiners had previously found that relying on crude from the likes of Colombia, Mexico and Saudi Arabia was unprofitable. But now it may be different provided Bakken crude remains relatively expensive and the U.S. economy doesn't head into a downturn. (www.reuters.com)

Oil traders scouting further afield for NY diesel storage

November 2, 2015. Oil traders are scouring the East Coast for places to store surplus diesel supplies, including on tankers just outside New York (NY) Harbor, as prompt prices trade at their deepest discounts since the financial crisis. Kinder Morgan, which operates roughly 165 storage terminals from Los Angeles to New York, has received interest from traders looking to lease storage space beyond New York Harbor. The winter contango in the benchmark New York Harbor diesel fuel market is the deepest since 2009, when the oil market was still emerging from the financial crisis. The Chinese-flagged Hua Lin Wan is currently being used as floating diesel storage. The ship came into the Harbor empty before filling up and idling in the New York anchorage, according to shipping data. (www.reuters.com)

ExxonMobil will expand its Rotterdam refinery

October 30, 2015. US energy group ExxonMobil has decided to expand the hydrocracker unit at its 191,000 bbl/d Rotterdam refinery (Netherlands) to upgrade heavier by-products into higher-value finished products, including EHC Group II base stocks and ultra-low sulfur diesel, to meet growing global market demand. The project’s environmental impact assessment has been approved and the site-permitting process is being finalised. Permits are expected in early 2016. Pending receipt of permits, construction is scheduled to begin in 2016 and unit startup is targeted for 2018. (www.enerdata.net)

TonenGeneral imports Japan's second cargo of US condensate

October 30, 2015. Japan's second-biggest oil refiner by capacity, TonenGeneral Sekiyu, imported the country's second cargo of U.S. condensate derived from booming shale production. Trade ministry data showed 318,773 barrels (50,681 kilolitres) of processed condensate was imported to Japan in September. The Ministry of Finance data showed the same volume of crude condensate passed through Kawasaki customs near Tokyo last month. TonenGeneral Sekiyu, which operates a 258,000 barrels per day refinery in Kawasaki, declined to comment. (af.reuters.com)

Marathon Petroleum scraps oil upgrader plans for Louisiana refinery

October 29, 2015. U.S. refiner Marathon Petroleum Corp said it would cancel a planned expansion project at its 522,000-barrel-per-day Garyville, Louisiana refinery. The company had said that it would defer the final investment decision on the project to convert residual fuel to diesel using hydrogen. The decision to scrap the residual oil upgrader is expected to cost Marathon Petroleum up to $2.5 billion and comes amid a slump in global crude oil prices. (www.reuters.com)

Vietnam's Nghi Son refinery 60 percent complete

October 28, 2015. Construction at Vietnam's second oil refinery, the $7.5-billion Nghi Son plant, is more than 60 percent complete and is on track to be finished in mid-2017. The refinery will supply mainly to the domestic market and will take in crude from Kuwait. The facility is owned by Japan's Idemitsu Kosan, Mitsui Chemicals, state oil and gas group PetroVietnam and Kuwait Petroleum International. The 200,000 barrels per day (bpd) Nghi Son facility will increase the country's oil processing capacity to 330,500 bpd by 2017, but it and a smaller older plant will only be able to meet half of the nation's fuel demand at that time, PetroVietnam has said. (af.reuters.com)

US diesel demand flat as freight growth slows

October 28, 2015. U.S. diesel consumption has been flat this year after growing strongly in 2013 and 2014, mirroring a slowdown in inland freight movements and the worldwide slowdown in the raw materials sector. Diesel consumption measured by the Energy Information Administration's data on distillate supplied is closely correlated with freight movements measured by the Bureau of Transportation Statistics' transportation services index. Diesel demand has been more cyclical than gasoline, plunging during the recession of 2008/09, then rebounding more quickly in 2010/11 and 2013/14. Diesel consumption surged more than 200,000 barrels per day (bpd), almost 5.5 percent, in 2014, according to the Energy Information Administration (EIA). By contrast, gasoline consumption rose by just 78,000 bpd, less than 1 percent. But in 2015 the situation has reversed, with strong growth in gasoline demand and little or no increase in diesel consumption. In the first seven months of the year, diesel was essentially flat compared with the same period in 2014, while gasoline demand rose by more than 250,000 bpd, almost 3 percent. The slowdown in diesel appears directly linked to the slowdown in freight movements since the start of 2015 which is in turn linked at least in part to the ending of the energy boom. (www.reuters.com)

Transportation / Trade……….

Shell completes the sale of its Butagaz LPG business in France

November 3, 2015. Shell has completed the sale of its Butagaz LPG business in France to DCC Energy for €464 mn. Shell had received a binding offer from DCC in May 2015. Other activities in France will remain owned and operated by Shell. The sale is part of Shell's strategy to concentrate its downstream footprint on assets and markets where it can be most competitive, and to divest its LPG businesses worldwide. (www.enerdata.net)

Rosneft to supply Egypt with six fuel oil shipments by end 2015

November 2, 2015. The Egyptian General Petroleum Corporation has agreed to import six shipments of fuel oil from Rosneft, Russia's largest oil producer, by the end of 2015, Oil Minister Tarek El Molla said. Egypt's Oil Ministry said it had signed initial deals with Rosneft to supply benzine and bitumen, as well as 24 LNG cargoes for state gas company EGAS over two years starting from the fourth quarter of 2015. Egypt has become a big importer of gas because it needs to plug severe energy shortages that have crippled its industrial production. (af.reuters.com)

Petrobras oil workers begin strike, seek to block asset sales

November 2, 2015. Brazil’s main oil union began a nationwide strike to halt asset sales by state-controlled Petroleo Brasileiro SA (Petrobras) at a time the company is slashing investments to reduce the biggest debt load in the oil industry. The Oil Workers Federation, known as FUP, said the nationwide strike started on Nov. 1. Some of the FUP’s regional member unions began work stoppages. FUP wants Petrobras to resume investments in the refining network and maintain Buy in Brazil policies to protect jobs, it said. Petrobras said that a work stoppage from some units won’t affect its production or deliveries to the market. The strike is the latest in a series of setbacks for the Brazilian producer, which had its debt downgraded to non-investment grade in September as it tries to deal with a collapse in commodity prices and a widening graft scandal that has resulted in some of its suppliers seeking bankruptcy protection. Petrobras plans to continue holding talks with the union and it has offered an 8.1 percent wage adjustment, the company said. The union has been negotiating with Petrobras for more than 100 days, it said. Petrobras plans to sell $15.1 billion in assets this year and in 2016 to raise cash for investments and debt reduction. Petrobras approved the sale of a 49 percent stake in its gas pipeline unit Gaspetro to Mitsui & Co Ltd. for 1.9 billion reais ($490 million). (www.bloomberg.com)

South African trade gap narrows as lower oil curbs imports

October 30, 2015. South Africa’s trade deficit narrowed to 0.9 billion rand ($65 million) in September as lower oil prices curbed imports. The trade gap eased from a revised 10.1 billion rand in August, the Pretoria-based South African Revenue Service said. The median estimate of 14 economists surveyed was for a shortfall of 4.9 billion rand. South Africa’s trade outlook has improved this year as falling oil prices and weaker domestic demand curbs imports. The deficit for the first nine months of the year was 37.35 billion rand, almost half its value in the same period of 2014. That’s easing pressure on the current-account deficit and may underpin the rand after it fell 16 percent against the dollar this year. (www.bloomberg.com)

OPEC October oil output falls led by Saudi, Iraq

October 30, 2015. OPEC oil output has fallen in October from the previous month, a survey found, as declines in top producers Saudi Arabia and Iraq outweighed higher supply from African members. The drops are not indicative of deliberate supply cuts to prop up prices, the survey said, and the Organization of the Petroleum Exporting Countries (OPEC) is still pumping close to a record high as major producers focus on defending market share. OPEC supply has fallen in October to 31.64 million barrels per day (bpd) from a revised 31.76 million in September, according to the survey, based on shipping data and information from sources at oil companies, OPEC and consultants. With one day left in October, the final figures could be revised. The OPEC increase has added to ample supplies, which have helped cut prices by more than half from June 2014 to below $50 a barrel. Still, with reductions in capital spending by oil companies expected to curb future supply, analysts see signs that OPEC's strategy will deliver. The biggest supply drop in October has come from Saudi Arabia, which trimmed output due to reduced use of crude in domestic power plants and refineries, sources in the survey said, despite higher exports. Saudi output, at 10.10 million bpd, remains not far below the record high of 10.56 million bpd it pumped in June. Exports from Iraq's main outlet, its southern terminals, were higher for much of October - reaching a record 3.1 million bpd in the first 27 days of the month - but have slowed since as poor weather delayed cargoes, shipping data showed. Shipments from Iraq's north by the Kurdistan Regional Government via Ceyhan in Turkey have edged lower, while those by Iraq's State Oil Marketing Organisation have fallen to zero from about 20,000 bpd in September, the survey found. Smaller increases have come from OPEC's two west African producers, Nigeria and Angola, and from Libya. Output in Iran, OPEC's second-largest producer until sanctions forced a cut in exports in 2012, continues to edge up, the survey found. A lifting of sanctions on Iran has the potential to boost OPEC output further in 2016. (www.reuters.com)

Iran seen jolting oil market with 90 day supply after sanctions

October 30, 2015. Iran may roil global oil markets with plans to sell about 45 million barrels of fuel stored in tankers in the Persian Gulf within three months of the removal of sanctions on its economy, according to analysts. Most of the stored oil is condensate that contains a sulfur compound, which complicates sales because many refineries can’t process it, Victor Shum of IHS Inc. and Robin Mills at Dubai-based Manaar Energy Consulting said. To market this large amount of oil within three months -- the equivalent of about half a million barrels a day -- Iran will have to resort to offering deep discounts, they said. The country is seeking to claw back the market share it lost under sanctions by boosting oil exports after a July deal with world powers to return to energy and financial markets. The condensate in tankers moored off its southern coast will add to a worldwide oil glut, putting more pressure on crude prices that have dropped more than 40 percent in the last year. Sanctions curbed Iran’s sales of crude and condensate to 1.4 million barrels a day in 2014 from 2.6 million in 2011, the U.S. Energy Information Administration said. Iran pumped 2.8 million barrels of crude a day in September, making it the fifth-largest producer in the Organization of Petroleum Exporting Countries (OPEC), according to data. It plans to boost crude production and exports by 500,000 barrels a day within a week after sanctions are lifted, National Iranian Oil Co. said. (www.bloomberg.com)

Policy / Performance…………

Yergin sees oil price near bottom as US output set to fall

November 3, 2015. Oil is near a bottom and global supplies look poised to close their gap with demand as investments in new production decline and consumption grows, according to Pulitzer Prize-winning author Daniel Yergin. U.S. crude output, which surged to the most in more than three decades this year and triggered a price collapse, will retreat by about 10 percent in the 12-months ending April, according to Yergin, vice chairman at IHS Inc. Global oil supply and demand will begin to move into balance by late 2016 or 2017 and prices may rise to $70 to $80 a barrel by the end of the decade. Yergin joins analysts including Gary Ross of PIRA Energy Group who predict an increase in demand next year will help offset the global oversupply. PIRA forecasts demand for oil will grow 1.7 million barrels a day in 2016, while Yergin said it may increase as much as 1.3 million barrels a day. The last annual U.S. oil production decline was in 2008, according to the Energy Information Administration. Lower prices will lead to consolidation in the U.S. shale businesses as weaker companies get bought or are forced to sell assets, according to Yergin. (www.bloomberg.com)

Egypt's giant Zohr gas field aims to start output in 2017: Oil Minister

November 2, 2015. Egypt aims to start natural gas production from its massive offshore Zohr field in 2017, a year ahead of schedule, Oil Minister Tarek El Molla said. The Zohr gas field, discovered by Italy's Eni, is the biggest in the Mediterranean, and with an estimated 30 trillion cubic feet of gas it is expected to plug Egypt's acute energy shortages and save it billions of dollars in precious hard currency that would otherwise be spent on imports. Eni has said it expects to invest between $6 billion and $10 billion to develop the Zohr field. Previously, officials had said production was expected to start in 2018. Once an energy exporter, Egypt has turned into a net importer because of declining oil and gas production and increasing consumption. It is trying to speed up production at recent discoveries to fill its energy gap as soon as possible. In October British oil major BP said it would begin gas production at its north Alexandria concession in early 2017 rather than mid-2017. That should add up to 1.2 billion cubic feet of gas per day by late 2019. In July the oil ministry raised the price paid for gas from Eni to a maximum $5.88 for every million British thermal units and a minimum of $4, based on amounts produced, from $2.65. It then cut a similar deal with British Gas. The total value of Egypt's natural gas projects, excluding Zohr, is now $13.8 billion, and El Molla said the Zohr discovery had made additional investment much more likely. Current projects underway will add 2.4 billion cubic feet to the country's daily gas production by 2019, said El Molla. Current production is roughly 4.5 billion cubic feet. On the back of this, the stock of foreign oil and gas investment in Egypt is expected to increase to $8.5 billion during the current fiscal year ending next June, from $7.5 billion last year, El Molla said. (uk.reuters.com)

BP sees technology nearly doubling world energy resources by 2050