-

CENTRES

Progammes & Centres

Location

[Unusually Quiet June 2015]

“On the gas front the most significant development was that of India trying to navigate the price storm that is sweeping global markets. On the international front India pressed Qatar for a reduction of LNG prices and on the domestic front it gave a pass to the proposal that sought to charge a premium for ‘difficult-gas’. On the coal front the most important news in June was that of BP declaring India as the fastest growth market for coal…”

Coal trading platform that includes private companies will improve efficiency in production!

Power tariff hike is not anti-people, it is anti-efficiency as it will offer a cushion for inefficiency!

[UGLY]

IEA’s caution against India’s coal-dominated growth strategy is not based on objective analysis just enlightened self-interest!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Unusually Quiet June 2015

· Ruling out funding for coal projects is unfair!

DATA INSIGHT………………

· Households Average Consumer Expenditure on Energy per Month- Delhi and Neighbouring States

[NATIONAL: OIL & GAS]

Upstream…………………………

· Carlyle Group commits up to $500 mn to India-focused Magna Energy

· India's crude oil output rises 0.8 percent in May

· India, Tanzania to fight terrorism, boost gas exploration

· ONGC supports Cairn plea for Rajasthan block’s term extension

· For overseas O&G assets, India may form joint venture with UAE, Kuwait

Downstream……………………………

· BPCL to go ahead with Bina expansion sans OCC

· RIL to outperform peers with refining margin of $9.5 in Q1: UBS

Transportation / Trade………………

· Odisha to apprise PM on progress of oil pipeline

Policy / Performance…………………

· West Bengal govt to take up petrol dealers’ issues

· Only 0.35 percent domestic LPG users gave up subsidy

· 'Shale gas policy needed in India'

· India cool to Kazakh offer on oil field, but keen on oil

· India stresses on petroleum pricing reforms at G20 Sherpa meet

[NATIONAL: POWER]

Generation………………

· BHEL commissions 250 MW unit of NTPC's Bongaigaon power plant

· NTPC puts 1.6 GW Gajmara project on back-burner

Transmission / Distribution / Trade……

· Torrent Power's agreement to distribute power in Kanpur cancelled

· Govt mulls common coal trading platform for CIL and private companies

· PSPCL to import 6 lakh tonnes of coal from South Africa

· GVK plant served ‘buy-out’ notice, asked to supply power to AP

Policy / Performance…………………

· Re-auctioned coalmines to restart production in 2 months: Coal Minister

· Power tariff hike is anti-people: Mayawati

· Govt transfers environment clearances of 19 coal blocks so far

· DERC to announce revised tariff despite AAP govt's objections

· UPSERC hikes power tariff by 5.47 percent across categories

· Odisha will get ` 450 bn from coal auction

· NTPC hopes to get Centre's nod on fuel linkage for Katwa

· India's research reactors not under nuclear insurance pool

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Rosneft and BP form JV to explore new opportunities in Siberia

· PetroVietnam, Gazprom seal agreement to develop 2 fields in Russia

· Qatar vast gas reserves ‘to last 138 yrs’

Downstream……………………

· Sonatrach terminates refinery modernisation contract

· Kuwait’s al-Zour oil refinery to be delayed beyond 2019

· Saudi Aramco may shut Jeddah refinery in several years

Transportation / Trade…………

· BP signs deal to supply liquefied natural gas to Egypt

· E.ON secures 4.4 bcm per year of gas from Rosneft

· Siberian oil deal sees BP bet on Russia’s pivot toward China

· NLNG eyes $1.5 bn debut ship yard in Nigeria

· Gazprom will double Nord Stream gas pipeline capacity to Germany

· Petrobras says pipeline leaked 600 liters of crude, some in ocean

· Gazprom and European partners to expand Nord Stream gas pipeline

· Engie lost 1.5 mn residential clients from 2010 to 2015 in the gas segment in France

Policy / Performance………………

· Dutch govt cuts Groningen gas field production

· Kuwait oil minister says oil price drop unlikely

· Tullow oil to settle Uganda tax dispute for $250 mn

· Russia, Saudi Arabia to discuss broad oil cooperation agreement

· DRC adopts new hydrocarbons code

· Kazakh minister says plans to supply energy resources to India

· World Bank lends US$700 mn for gas exploration in Ghana

[INTERNATIONAL: POWER]

Generation…………………

· Adaro plans to bid to operate 2 GW Java-5 power project in Indonesia

· RusHydro's Boguchanskaya hydropower plant at full capacity

· Suez Canal $78 mn power plant set for 2016 delivery

· Nigeria selects two sites for 2.4 GW nuclear projects

· PSEG Power acquires 755 MW power generation facility in Maryland

· Asif claims over 16 GW power generation in a day

Transmission / Distribution / Trade……

· Ethiopia signs US$120 mn contract for power interconnection to Kenya

· Schneider Electric secures contract for distribution management system in UK

· Veolia wins electricity grid management contract in Guinea

· Enel plans progressive divestment from Slovak power market

· Power grids in US, Canada are becoming more reliable

Policy / Performance………………

· Bulgarian govt rejects 20 percent power tariff hike for industry

· Pakistan to go ahead with construction of Karachi nuclear power plants

· Eranove agrees to construct €110 mn hydroelectric power plant in Mali

· Pakistan approves 1.4 GW coal-fired power project in Thar region

· South Korea's KHNP will close Kori-1 nuclear reactor in 2017

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· SunEdison announces completion of 1 MW canal top solar project for Karnataka govt

· SoftBank in tie-up for $20 bn investment in Indian solar projects

· DJB commissions 50 KW Solar PV Power Plant at Varunalaya Office Complex

· Ministry to focus on enforcement mechanisms for green laws: Javadekar

· MP govt provides solar power to 13 naxal-affected villages in a ` 125 mn investment

· IOC begins work on 4 MW solar power project in Nagapattinam

· IEA cautions against India's coal-dominated energy supply growth ahead of Paris climate summit

GLOBAL………………

· Japan is building huge floating solar power plants

· NRG Yield acquires 25 percent stake in 550 MW solar PV plant in the US

· Spain plans to raise biodiesel quota for 2016

· Carbon glut limits German options to meet emissions target

· Vatican says Jeb Bush should heed Pope on climate change

· UK to end onshore wind subsidies one year ahead of schedule

· EU on track to meet its 20 percent renewable target by 2020

[WEEK IN REVIEW]

COMMENTS………………

India monthly energy briefing

Unusually Quiet June 2015

Lydia Powell and Akhilesh Sati, Observer Research Foundation

|

I |

n general energy news in the month of June is dominated by statistics on thermal power plants having little or no coal stock and stories of long power outages even in privileged urban areas. These news stories are followed by numerous articles on the causes of these problems and how they must be sorted out. The words that one would often see in these articles included ‘privatise’, ‘govern’, etc. This June has been unusually quiet. There were almost no stories on coal shortages and there were only a few isolated stories of power outages in privileged urban areas. Instead we had many stories on numerous thermal power generating stations sitting with idle capacity and the availability of surplus power on India’s many power exchanges at throw away prices.

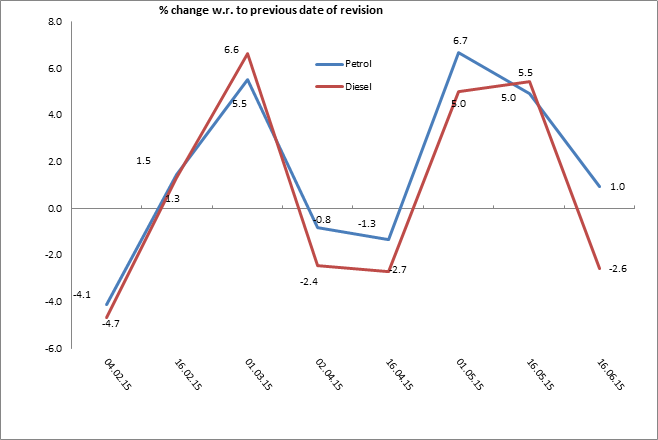

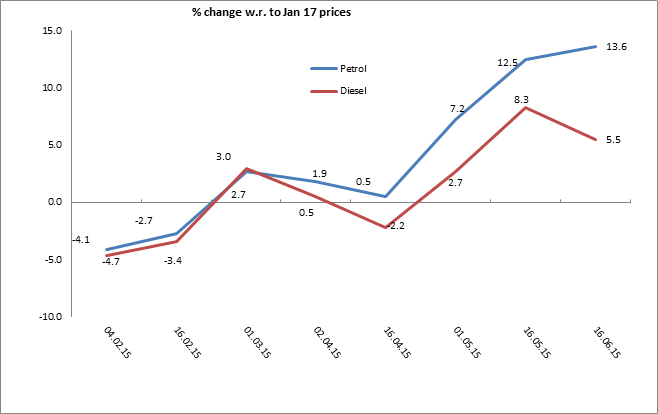

On the oil front, the price (at Delhi) of petrol was increased by ` 0.64 per litre and the price of diesel was decreased by ` 1.35 per litre on June 16, 2015. This was around 1% increase in petrol price and around 2.6% decrease in diesel price if we compare it with prices last revised on May 16, 2015. But if we compare the prices of June 16 prices with the prices during the beginning of the year (Jan 17, 2015) then both Petrol and Diesel prices show significant increase of around 14% and 6% respectively.

Chart 1: Change in Petrol & Diesel Prices (at Delhi)

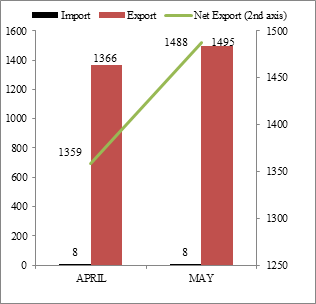

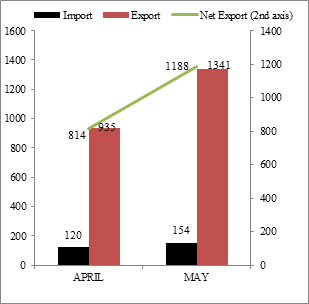

What was surprising was the explanation given for the change. Media reports said that ‘petrol prices were increased because international petrol prices had increased and that diesel prices were decreased because the international price of diesel had shown a downward trend’. This is probably the first time domestic price changes are being linked to product price changes in the international market rather than crude price changes. Given that India is not a net importer of petrol or diesel this line of reasoning is strange.

Chart 2: Foreign Trade in Diesel & Petrol (in ‘000 Tonnes)

Diesel

Petrol

The depreciation of the Indian rupee was also given as a reason but once again the depreciation of the rupee should have translated into an increase in the price of both rather than an increase in the case of petrol and a decrease in the case of diesel. A closer look at the data may reveal the rationale behind the changes but for now all we know is that there is more than what meets the eye when it comes to changes in product prices. It is a known fact that while the petrol is considered as the fuel of the rich, diesel is considered as a fuel for mass consumption. Thus decreasing the diesel prices and increasing petrol prices was good for political and economic mileage.

There was also news that only 0.35 per cent of domestic LPG users gave up subsidy voluntarily. Given that even the former Prime Minister’s wife was upset with subsidy reductions for domestic LPG this is not difficult to understand. On the international front, we saw efforts by India to leverage its position as the largest growth market for oil imports to ask OPEC to stop charging a premium from Asian importers. We also saw import of crude increasing from Iran as the probability of a nuclear deal between the USA and Iran increased.

On the gas front the most significant development was that of India trying to navigate the price storm that is sweeping global markets. On the international front India pressed Qatar for a reduction of LNG prices and on the domestic front it gave a pass to the proposal that sought to charge a premium for ‘difficult-gas’.

On the coal front the most important news in June was that of BP declaring India as the fastest growth market for coal. This is not news that agencies of the rich world such as the International Energy Agency (IEA) liked and so they promptly declared that India’s coal dominated strategy is a big risk in the context of negations on carbon emissions reduction in Paris towards the end of this year.

On the power front, we saw more signs of pain. Ultra mega power projects (UMPPs) that were projected, ten years ago as symbols of India coming of age in the power sector were being declared as unviable. A decade ago, these 4 GW coal based plants with tariffs lower than ` 2 per Kwh were said to indicate the absence of downside risk in the sector. Demand was seen to be so deep and so large that it was believed to be the ultimate insurance against any downside risk. With the benefit of hindsight few would now say the same thing. Ratings agencies declared that even the LNG based price pooling scheme was not capable of injecting momentum into the system. However electricity continued to charge politics as leaders from Mayawati to Kejriwal boldly declared that power tariff increase was anti-people. For its part the central government declared that it will not bail out debt ridden state utilities and also reiterated its commitment towards universal energy access.

As it has been the case since the new government took charge, news on foreign investors queuing up to invest in solar energy projects in India continued in June. One of the big announcements involved soft bank of Japan seeking to invest over USD 20 billion. Given that clean energy is the Prime Minister’s alibi among the international audience for what is described as his not so clean domestic ideologies, we can hope to see more and more news on the same lines in the future.

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

COMMENTS………………

Ruling out funding for coal projects is unfair!

Ashish Gupta, Observer Research Foundation

|

F |

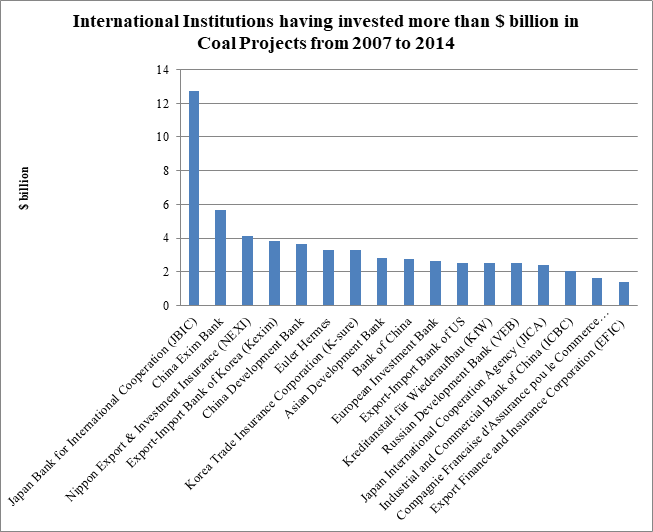

ossil fuel (especially coal) based growth which laid the foundation for almost all the richest economies is now being criticised by them in the wake of changing climate dynamics. Many institutions are advising investors not to invest in coal resources or in case they have already invested they must divest from the same. If these institutions are convinced of the same then they should first stop using coal in their own countries. Simply restricting funds for these projects in the poor countries is not a justifiable approach. The World Bank for instance in its Energy Direction Paper, 2013 has taken a firm stand not to finance any coal projects worldwide unless there is no alternative. Many other International Financing Institutions in United States, Denmark, Finland, France, Netherlands, Norway, Sweden, and Switzerland are also supporting the approach. Their support for the clean cause is good but it would be a mistake to definitively rule out coal in all circumstances. Any artificial restriction would defy its own principal of impartial support. Any restriction must be supported by a reasonable logic wherein due importance must be given to the country’s ability to absorb cost of clean technologies. This logic is simply missing in the approach as restricting funding for cheap coal projects would be bad for the sustainable and inclusive development.

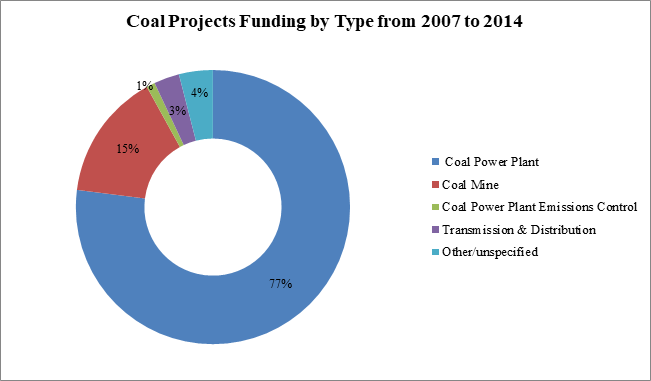

The International Institutions Funding in coal projects by type from 2007 to 2014 is given below:

Source: Natural Resources Defense Council, Oil Change International, World Wide Fund for Nature, 2015

It is clear from the chart that 77 percent of the funding is flowing towards the coal power plant construction and only 23 percent for coal associated activities. This indicates that there is enough space for efficiency. The improvement of efficiency in thermal power plants by 4-5 percent can cut down carbon emissions by 15 percent[1]. The 1972 Stockholm conference demonstrated why the effort to restrict energy sources is the real anti-environment movement because less modern energy is equal to more dependence on the environment. In poor countries where electricity supply is a constraint to growth and both hydro and geothermal resources are limited, coal based electricity is necessary for “firm capacity”. Why has this wisdom been forgotten?

The African Development Bank estimates the economic cost of the lack of energy, measured as the cost of running backup generation and the foregone production from power outages, at 1 to 4 percent of GDP in African countries[2]. As per the World Bank’s Enterprise Survey electricity is at the top of obstacles facing businesses in low income countries, with nearly one in four businesses identifying it as their biggest obstacle. Many countries who borrow from the World Bank Group on concessional rates are both poor and energy deprived. The clientele base of these poor nations is 82 and home to 1.8 billion of the world’s poorest people. As per the International Macroeconomic Data of Department of Agriculture Research, United States the developing world, for instance, has an average GDP/capita of just $3,000 (real 2005 $), compared to $40,000 in the developed nations, which is an indicator that they cannot absorb the higher cost of less reliable, naturally intermittent energy.

Underlying this view there is no country which has yet to demonstrate a growth strategy that does not rely on fossil fuels. Even Denmark, Portugal, Spain, Ireland and Guadeloupe which have committed to limit support for coal power plants have 80 percent of the electricity generation coming from a combination of fossil fuels. Therefore why only coal is targeted?

Source: Natural Resources Defense Council, Oil Change International, World Wide Fund for Nature, 2015

What happens if coal investments are ruled out by these institutions in poor countries? Is it fair to those countries? It is not the environment, but the poverty, that is a greatest threat developing nations face today. A lack of cheap energy is the silent killer that leads to poverty, hunger and easily preventable diseases.

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

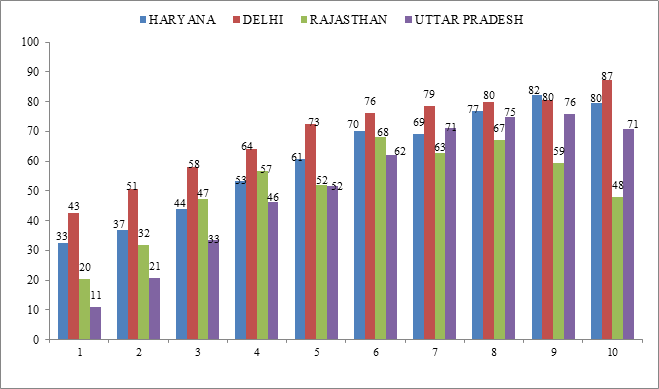

Households Average Consumer Expenditure on Energy per Month- Delhi and Neighbouring States

Akhilesh Sati, Observer Research Foundation

|

MPCE Class |

Average Expenditure (`) on Electricity by Households per Month (2011-12) |

|||

|

Delhi |

Haryana |

Rajasthan |

Uttar Pradesh |

|

|

mpce >=0 & mpce< 1000 |

294 |

212 |

135 |

60 |

|

mpce >=1000 & mpce<2000 |

429 |

294 |

249 |

132 |

|

mpce >=2000 & mpce<3000 |

512 |

397 |

400 |

223 |

|

mpce >=3000 & mpce<4000 |

533 |

441 |

523 |

360 |

|

mpce >=4000 & mpce<5000 |

830 |

487 |

400 |

515 |

|

mpce >=5000 & mpce<6000 |

1180 |

914 |

665 |

611 |

|

mpce >=6000 & mpce<7000 |

1300 |

690 |

693 |

1087 |

|

mpce >=7000 & mpce<8000 |

1265 |

1202 |

498 |

1227 |

|

mpce >=8000 & mpce<9000 |

1466 |

1863 |

269 |

1438 |

|

mpce >=9000 |

2037 |

1339 |

736 |

1075 |

|

Total Estimated Households (Million) |

3.19 |

5.30 |

12.57 |

34.41 |

Share (in %) of Electricity Expenditure in Total Household Expenditure on Fuel & Light (2011-12)

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|

mpce >=0 & mpce< 1000 |

mpce >=1000 & mpce<2000 |

mpce >=2000 & mpce<3000 |

mpce >=3000 & mpce<4000 |

mpce >=4000 & mpce<5000 |

mpce >=5000 & mpce<6000 |

mpce >=6000 & mpce<7000 |

mpce >=7000 & mpce<8000 |

mpce >=8000 & mpce<9000 |

mpce >=9000 |

MPCE: Monthly Per Capita Consumer Expenditure.

Source: Estimated from NSSO 68 Round on Consumer Expenditure.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

Carlyle Group commits up to $500 mn to India-focused Magna Energy

June 22, 2015. Carlyle Group has committed to invest up to $500 million in Magna Energy Ltd, an India-focused upstream oil and gas company, the global private equity firm said. Led by Mike Watts and Jann Brown who have a combined 60 years of oil industry experience, Magna Energy is seeking to become a full-cycle oil and gas company through acquisitions and securing local licences in the Indian sub-continent. It will have a primary focus on development and production. The buyout shop is making the investment through its unit Carlyle International Energy Partners, a fund that focuses on oil and gas exploration and production. (timesofindia.indiatimes.com)

India's crude oil output rises 0.8 percent in May

June 22, 2015. India's crude oil production rose marginally by 0.8 percent in May on the back of improved performance by Oil and Natural Gas Corp (ONGC). Crude oil production at 3.18 million tons in May was 0.8 percent more than 3.16 million tons in the same month a year ago. The increase was on account of 1.8 percent rise in ONGC's oil output at 1.9 million tons. Its western offshore fields produced 8.5 percent more crude oil at 1.3 million tons and helped tied over a 9 percent drop in onshore output at 0.48 million tons. However in April-May, the first two months of the current fiscal, the nation's crude oil production dipped 1 percent to 6.05 million tons. While ONGC produced 1.7 percent more crude oil at 3.71 million tons, fields operated by private firms saw a 6.3 percent dip at 1.92 million tons. Natural gas production declined 3.1 percent in May to 2.85 billion cubic meters (bcm) as ONGC saw dip in output. ONGC saw gas output dip by 1.8 percent to 1.9 bcm while eastern offshore production dropped 8.9 percent to 403.16 million cubic meters. In April-May, India's gas production decreased 3.3 percent to 6 bcm. ONGC's output was down 1.7 percent at 3.67 bcm. (www.business-standard.com)

India, Tanzania to fight terrorism, boost gas exploration

June 20, 2015. India and Tanzania will set up a joint working group to fight terrorism and increase gas exploration cooperation in the east African nation. This was agreed upon as Prime Minister Narendra Modi held talks with visiting Tanzanian President Jakaya Mrisho Kikwete. Modi said both countries have a common interest in maritime security in the Indian Ocean and a peaceful and prosperous Africa. (www.newkerala.com)

ONGC supports Cairn plea for Rajasthan block’s term extension

June 18, 2015. As a shot in the arm for Cairn India, its partner Oil and Natural Gas Corp (ONGC) has asked the government to extend the tenure of the prolific Rajasthan oil block by 10 years without any changes in terms and conditions. Cairn, which holds 30% interest in the Rajasthan block, wants to retain the Rajasthan block beyond the contractual deadline of 2020. And for such an extension the nod of the state-owned firm, which is a licence of the block holding 30% interest, was necessary. ONGC has agreed to the Cairn proposal and written to the oil ministry saying the licence term should be extended by 10 years on the existing terms and conditions. Unlike in 2011, when it had given conditional approval for Cairn being acquired by Vedanta Group to resolve the royalty dispute, ONGC has not put any pre-condition this time.

Cairn’s contractual term for exploring and producing oil and gas from the Rajasthan Block RJ-ON-90/2 expires in 2020 and the area is to return to the block licensee, ONGC. ONGC had previously told the ministry that the production sharing contract (PSC) can be extended beyond 2020 if all parties to the contract agree on mutually agreeable terms. The PSC states that the contractual term can be extended for 5 years if there remains oil to be produced and by 10 years if it is a gas bearing block. Cairn says it has a significant Raageshwari gas discovery in the block and so the term should be extended by 10 years, a contention that the state-owned ONGC has backed. The state-owned firm was to decide on terms on which it can agree on allowing Cairn to continue to operate the fields. ONGC as a licensee of the block, which produces about 160,000 barrels per day of oil, pays royalty to the government on not just its 30% stake but also on Cairn’s 70% interest. (www.livemint.com)

For overseas O&G assets, India may form joint venture with UAE, Kuwait

June 17, 2015. India is in talks with the oil rich United Arab Emirates and Kuwait to explore the possibility of setting up separate joint ventures that will acquire oil and gas assets in other countries, Oil and Natural Gas Corp (ONGC) chairman Dinesh K Sarraf said. A delegation led by oil minister Dharmendra Pradhan held separate discussions with the energy ministers of the two countries on the margins of a recent seminar of the Organisation of Petroleum Exporting Countries (OPEC) in Vienna. ONGC chairman Dinesh K Sarraf said while the UAE and Kuwait have plenty of oil to deal with at home, unlike India, "they also have plenty of cash to deploy". This explains the interest of the two countries in forming joint ventures with India to acquire assets in other countries, said Sarraf, who was part of the Indian delegation that also included government officials and top executives of other state-run oil firms. If discussions were to lead to a deal, Indian state-run firms might form separate joint ventures with state firms in the two countries. India's primary interest is in acquiring upstream assets while for Kuwait and the UAE the interests stretch to refineries, retailing and petrochemicals, Sarraf said.

The UAE and Kuwait have been India's significant trading partners and the proposed partnerships are an attempt at bringing together competence and capital in the critical energy sector while spreading the investment risks between countries. It's quite usual for oil companies to jointly own oil and gas projects, typically high-risk due to geological uncertainties, long-gestation and large capital requirements. India, which imports nearly 80% of the oil it consumes, mainly from West Asian countries, has been looking to increase its local output that has stagnated for years and aggressively bid for assets overseas. In the past two decades, it has acquired participating interests, mostly minority stakes through ONGC, in oil and gas fields across the globe in pursuit of its energy security. A sharp fall in crude oil and gas prices over the past year has curbed cash flow at major oil producers, shut or delayed many projects, but has also given rise to acquisition opportunities. Therefore, cash-rich countries aiming to secure energy for their citizens and industry are actively looking for energy assets. (economictimes.indiatimes.com)

Downstream………….

BPCL to go ahead with Bina expansion sans OCC

June 21, 2015. With Oman Oil Company (OCC) reluctant to put more money, Bharat Petroleum Corp Ltd (BPCL) has decided to fund the ` 18,000-20,000 crore expansion of the Bina refinery in Madhya Pradesh on its own. BPCL plans to raise Bina refinery capacity to 15 million tons in two phases - to 7.8 million tons a year from current 6 million tons at a cost of ` 3,500 crore by 2018 and then to 15 million tons at an additional investment of ` 18,000-20,000 crore in 5-6 years. OCC, which holds 26 percent stake in the Bharat Oman Refineries Ltd (BORL) - the firm that built the refinery, is willing to participate in the first phase expansion but not in the second phase. OCC in 2009 paid a 50 percent premium for a re-entry into the ` 11,397 crore Bina refinery project. The project was originally conceived through a joint venture company, BORL but the OCC did not contribute equity beyond the initial ` 75 crore.

BPCL operates a 12 million tons a year refinery at Mumbai and 9.5 million tons Kochi unit. It also has majority stakes in the 3 million tons Numaligarh refinery in Assam. BPCL is expanding and upgrading its Kochi refinery in Kerala to process high sulphur crudes by 2016. Kochi refinery capacity is being raised to 15.5 million tons from current 9.5 million tons. (profit.ndtv.com)

RIL to outperform peers with refining margin of $9.5 in Q1: UBS

June 19, 2015. Reliance Industries’ refinery at Jamnagar in Gujarat is likely to outperform peers to earn stronger margins of $9.5 in the current quarter, UBS Global Research has said. UBS said Singapore complex refining margins (GRMs) are holding firm at $8 per barrel in April-June quarter compared with $5.8 gross refining margin (GRM) a year ago. These are however lower than $8.5 a barrel of 4QFY15. GRM, or the margin earned on turning every barrel of crude oil into fuel, is driven by strong gasoline margins, better demand and tightened supply due to refinery maintenance shutdowns.

Jamnagar refinery’s superior complexity refinery with Nelson index of 12.7 and near 110 percent utilisation differentiates it from the US, EU and Asian refiners with complexity in range of 6-11 and operating at utilisation levels of 80-87 percent. RIL’s petcoke gasifier project is likely to be operational by early 2016 and will enhance its cost competitiveness by lowering energy cost and improve GRMs from $8.6 per barrel in FY15 to $9.3 a barrel in FY17. This will improve its average GRMs of $8.3 per barrel over FY10-15 to $8.9 over FY16-19. (www.financialexpress.com)

Transportation / Trade…………

Odisha to apprise PM on progress of oil pipeline

June 23, 2015. The Odisha government will apprise Prime Minister (PM) Narendra Modi about the progress made on construction of Paradip-Raipur-Ranchi oil pipeline through an interaction arranged under the multi-purpose and multi-modal platform, PRAGATI (Pro-Active Governance and Timely Implementation). The platform is aimed at addressing common man's grievances, and simultaneously monitoring and reviewing important programmes and projects of the Centre as well as projects flagged by state governments. The proposed pipeline will traverse the states of Odisha, Chhattisgarh and Jharkhand. The 1,067 km pipeline being built at a cost of ` 1,793 crore will transfer petroleum products from the proposed Indian Oil Corp (IOC) refinery in Paradip to Jatni, Jharsuguda, Ranchi, Raipur and Korba areas. The pipeline comprises main section of Paradip- Jatni-Sambalpur-Saraipalli-Raipur and branch lines of Sambalpur-Jharsuguda-Khunti and Saraipalli-Korba. (www.business-standard.com)

Policy / Performance………

West Bengal govt to take up petrol dealers’ issues

June 22, 2015. West Bengal consumer affairs minister Sadhan Pandey said he will write to the petroleum minister, urging him to implement a uniform commission system for eastern India, where petrol and diesel consumption is lower than in the rest of the country. The West Bengal Petroleum Dealers Association (WBPDA) recently announced an indefinite "no-purchase" agitation at three oil terminals to protest against the allegedly hostile and stressful conditions under which they operate. The agitation at the Mourigram, Budge Budge and Haldia oil terminals had rendered a sizeable part of West Bengal, including Kolkata, dry in terms of vehicle fuel. It was lifted after an assurance that the state government would look into the matter.

Dealers have also raised the issue of a mismatch in the volumes of fuel carried by the registered transporters of oil companies and the amount supplied to them. The oil companies must install meters to measure the fuel volumes being supplied, Pandey said at a convention of the Eastern India Petroleum Dealers' Association in Kolkata. Pandey has asked the WBPDA to submit a detailed report, following which he will hold a tripartite meeting with oil companies and the transporters and the local administration, if necessary. (economictimes.indiatimes.com)

Only 0.35 percent domestic LPG users gave up subsidy

June 21, 2015. Three months after Prime Minister Narendra Modi launched the 'Give It Up' campaign, only 0.35 percent of the domestic LPG consumers have so far given up using subsidised cooking gas. At a review meeting chaired by Oil minister Dharmendra Pradhan, it was informed that just over 5.5 lakh out of the 15.3 crore LPG consumers have so far voluntarily surrendered subsidised LPG and started buying the cooking fuel at the market price. Though Pradhan since January has been pushing for well off people to surrender their LPG subsidy, Prime Minister NarendraModi in March officially launched 'Give It Up' campaign so that the subsidy is better targeted for the needy. While an appeal has been made to all Members of Parliament (MPs) and MLAs, government officials and executives of public sector companies, the response has not been very enthusiastic. Pradhan is pushing hard to make the campaign launched by Prime Minister a success. He even made personal phone calls to VIPs, requesting them to give up buying subsidised LPG. Keen to ensure that the subsidised fuel reaches only those needing it, he surrendered his subsidised LPG connection soon after becoming a minister and has since then been buying gas at market rates. On his plea, finance minister Arun Jaitley and several other ministers as well chief ministers like Akhilesh Yadav of Uttar Pradesh have given up subsidised LPG but the campaign has not had the desired success, he said. Consumers are currently entitled to twelve 14.2 kg cylinders or thirty four 5 kg bottles in a year at subsidised rates. A subsidised 14.2 kg cylinder is currently available at ` 417 per bottle in Delhi while the 5 kg pack costs ` 155. Market priced LPG is available at ` 625.50 per 14.2 kg cylinder and ` 220 per 5 kg bottle. Giving up subsidised LPG will help cut government's subsidy bill which was at ` 36,580 crore on the fuel last fiscal year. In 2015-16 Budget estimates, petroleum subsidy has been halved to ` 30,000 crore from estimated ` 60,270 crore, in the current fiscal. Of ` 30,000 crore for next fiscal, ` 22,000 crore has been earmarked for LPG subsidy and the rest is for kerosene. Public sector oil marketing companies (OMCs) have given an option to existing LPG consumers to convert their existing domestic LPG connection into a non-subsidised domestic connection. This can be done by submitting a written request to the distributor or electronically via www.MyLPG.in. (timesofindia.indiatimes.com)

'Shale gas policy needed in India'

June 21, 2015. India needs a long term shale gas policy that is holistic and incorporates from the experiences of other countries on issues like gas pricing, environment and land acquisition, ICICI Securities said in a report. Shale gas refers to natural gas trapped within formations of sedimentary rocks. Describing how the shale gas revolution in the US in the new millennium is the result of technological breakthroughs of more than three decades, the report pointed out how individual landowners in that country can lease mineral rights to their property, a right which landowners do not have in other nations.

Oil and Natural Gas Corp (ONGC) has estimated the country's shale gas reserves at 187.5 trillion cubic feet, spread over the Cambay, Krishna-Godavari, Cauvery, Ganga and Assam and the Assam-Arakan basins. Extraction of shale gas is highly dependent on large scale harnessing of water, which water acquires additional pollutants, including radioactive elements, and much of the polluted water remains underground, the report said. (www.business-standard.com)

India cool to Kazakh offer on oil field, but keen on oil

June 17, 2015. ONGC Videsh Ltd (OVL) has cold-shouldered Kazakhstan's offer for stake in an oil field, even as oil minister Dharmendra Pradhan said India would study the possibility of importing oil and gas from the Central Asian country through pipeline or ships. OVL is reluctant to accept the Kazakh offer for taking 25% stake in Abai field on the ground that the projected reserve of 2.8 billion barrels of oil could be misplaced. The offer was made after the field was abandoned by Norway's Statoil. But the reality may be that OVL may be getting back at Astana for blocking in July 2013 its $5 billion deal to buy an 8.4% stake in the Kashagan oilfield, the world's largest oil find in five decades, from US energy giant ConocoPhillips. Kazakhstan exercised its pre-emption right to first buy the ConocoPhillips stake and then sell it to China National Petroleum Corporation. India was also dealt a raw deal by Kazakhstan when China was allowed to revise its bead to beat New Delhi's $4.18 billion deal for buying PetroKazakhstan in 2005.

After a meeting of the India-Kazakhstan inter-government commission, Pradhan said OVL and KazMunaiGas, Kazakhstan's state-run oil company, would begin exploratory drilling in Satpayev field where the Indian firm holds stake. He said the two countries have decided to establish a joint working group to look at transport and logistics linkages. Kazakhstan energy minister Vladimir Shkolnik said the central Asian nation plans to supply energy resources to a growing Indian economy. (timesofindia.indiatimes.com)

India stresses on petroleum pricing reforms at G20 Sherpa meet

June 17, 2015. India has pressed for petroleum pricing reforms globally to ensure stability in the energy sector at the G-20 meeting in Turkey. Railway Minister Suresh Prabhu, who has gone to Turkey as 'Sherpa' of Prime Minister Narendra Modi to attend the G-20 meeting, sought reforms in petroleum pricing and transparency in global gas markets to ensure price stability in the international market. 'Sherpa' is a senior official responsible for preparing the agenda for leaders to consider during the G-20 summit. Modi is expected to attend the summit in November. Focusing on the massive energy requirement in the future, Prabhu said global reforms in the sector will help the country in manufacturing activities. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

BHEL commissions 250 MW unit of NTPC's Bongaigaon power plant

June 23, 2015. Bharat Heavy Electricals Ltd (BHEL) said that it has commissioned a 250 MW unit of NTPC's Bongaigaon thermalpower plant in Kokrajhar district in Assam. Once the project is completed, it will become the highest rating coal-based power plant in Northeast India. The sets supplied by BHEL are considered as the workhorse and backbone of the Indian power sector. These sets have been performing much above the national average as well as international benchmarks. BHEL has so far contracted 251 sets of this rating class. In 2014-15, BHEL surpassed the capacity addition target set by the government for utility projects by 19 percent. The trend is continuing in the current year as well with eight sets having already been commissioned by the company in FY 2015-16, the company said. BHEL is the market leader in the Indian power sector with almost two out of three houses in the country being lit by power generated by BHEL sets. (www.business-standard.com)

NTPC puts 1.6 GW Gajmara project on back-burner

June 21, 2015. NTPC has put on back-burner its plan to set up a 1600 MW coal-based project at Gajmara in Odisha as it has enough projects in hand. According to the company, NTPC is yet to sign power purchase agreement with the state government. The company said that fuel linkage for the plant is not available. Present installed capacity of NTPC is 44,598 MW. With 17 coal based power stations, NTPC is the largest thermal power generating company in the country. The company has a coal-based installed capacity of 33,675 MW. (www.business-standard.com)

Transmission / Distribution / Trade…

Torrent Power's agreement to distribute power in Kanpur cancelled

June 23, 2015. Uttar Pradesh cancelled the agreement signed with Torrent Power in 2009 to distribute electricity in Kanpur. The state cabinet meeting chaired by chief minister Akhilesh Yadav gave its nod to the proposal of scrapping the agreement. The agreement with Torrent Power Ltd was signed by Kanpur Electricity Supply Company (KESCO) on May 18, 2009 during the previous Mayawati regime for the input based franchisee model. The model was propped up for distributing power in select urban centres of the state, including Bareilly, Moradabad, Gorakhpur, Varanasi, Allahabad, Aligarh and Meerut. After a bidding process, Torrent was selected to distribute power in both Agra and Kanpur, which were taken up in first phase since the transmission and distribution losses were the highest in these places at 42 percent and 47 percent respectively. Torrent was then supposed to buy power from UP at the rate of ` 1.96 per unit and ` 2.17 for Agra and Kanpur respectively for distribution to urban consumers and later realise revenue. The prevailing realisation by UP Power Corp Ltd (UPPCL) at Agra and Kanpur stood at ` 1.33 and ` 1.68 respectively. While, Torrent Power could take up power distribution in Agra, albeit after opposition from the state electricity department employees, the model could never take off in the industrial hub of Kanpur. However, five years passed since the agreement was signed in 2009 and the electricity distribution task could not be transferred to the Ahmedabad-based Torrent Power. Since, the financial basis of KESCO changed over the years, it was felt that pursuing the agreement would not be in the interests of the state energy department. In this context, a meeting was held between the representatives of the both the companies on December 27, 2015, which had agreed upon mutually to cancel the agreement. The cabinet put its seal of approval to this proposal. (www.business-standard.com)

Govt mulls common coal trading platform for CIL and private companies

June 22, 2015. The government is working on a common coal trading platform for Coal India Ltd (CIL) and private companies which are likely to be offered lucrative blocks with prior clearances for commercial mining. The electronic platform is likely to be an extension of the spot sale practice of Coal India called 'e-auction' where all the coal mined in the country, excluding from captive blocks, will be traded. Coal India sold around 11% of its output through e-auction at a market-driven price in January-March. The government has decided to auction the company's future coal supply to unregulated sectors such as steel, cement and captive power plants. The NDA government is working towards auctioning coal blocks for commercial use after enactment of Coal Mines Special Provisions Act that provides for opening the sector to Indian and foreign private firms, ending Coal India's monopoly. Prior to this, Indian companies with end-use plants were permitted to mine coal for captive purposes. (economictimes.indiatimes.com)

PSPCL to import 6 lakh tonnes of coal from South Africa

June 22, 2015. Punjab State Power Corp Ltd (PSPCL) said it has decided to import coal worth ` 550 crore from South Africa to meet growing energy demand. Facing lesser coal supplies, PSPCL will import 6 lakh tonnes of coal from South Africa. PSPCL said the imported coal would be sufficient to meet the rising demand for power in the wake of scorching heat and paddy sowing season. Earlier, the state-owned power utility had imported coal in 2006-07, PSPCL said. PSPCL is currently receiving 3.5 rakes of daily coal supplies against the demand for 9 rakes of coal. The supplies from Pachwara Coal block in Jharkhand to three plants of PSPCL have not yet started as mining developer has not been finalised yet. PSPCL's coal block was among other coal blocks in the country which were cancelled by the Supreme Court last year. (www.business-standard.com)

GVK plant served ‘buy-out’ notice, asked to supply power to AP

June 21, 2015. Two distribution companies of Andhra Pradesh (AP) have issued a “Buy-out” notice to the country’s first private independent power plant — the 217 MW Jegurupadu project of GVK Power & Infrastructure Limited. Both the AP Southern Power Distribution Company Limited and AP Eastern Power Distribution Company Limited have expressed their intent to buy-out its power purchase agreement (PPA) expiring on June 19, completing its 18-year tenure. There are three options for the project after the PPA expiry — buy-out, opt for refurbishment, and third, return of the plant to the owner. While GVK has estimated the cost of refurbishment at about ` 550-600 crore, AP Genco feels it could be lower as it has experience of running a gas-based power plant. Significantly, with the PPA expiring, the State has directed GVK to continue to generate power and supply to Andhra Pradesh. It is learnt that Telangana is also keen to buy out the project as it would find it equally attractive to take over such an asset created in unified AP. But AP contends that since it is in its jurisdiction it would acquire it. The plant is currently getting gas enough to run it at 30 percent plant load factor. With the Centre making an arrangement for pooled gas, AP expects it may be able to run at a higher capacity. (www.thehindubusinessline.com)

Policy / Performance………….

Re-auctioned coalmines to restart production in 2 months: Coal Minister

June 23, 2015. The coalmines that were auctioned under the new process by the Narendra Modi government and had been closed since the ownership right changed on March 31 would re-start production within two months. In Chhattisgarh, nine coalmines were operational that were re-auctioned after the apex court cancelled the allocation of coal blocks in September. The operating company was asked to wind up the work and handover the mine to the new owner on March 31. Of the nine mines, two were re-allotted to state-owned Rajasthan Vidyut Nigam Ltd in Parsa East and KeteBasen and hence the production continued even after March 31. However, with the change of guard in remaining seven coalmines, coal production came to a halt as required clearances could not be timely transferred besides other issues. In other states also, the new owners had been reportedly facing the same problem and the coalmines bagged by the private companies could not continue the production. In next two months, all the closed mines would re-start production, Minister of State with Independent Charge for Power, Coal and New & Renewable Energy Piyush Goyal said. The minister said a few coalmines that had been bagged by the state-owned companies including Coal India Ltd (CIL) would start production soon. The required clearances and consent to operate had been awarded, he said. Goyal said the coal production in the country had been constantly increasing. (www.business-standard.com)

Power tariff hike is anti-people: Mayawati

June 22, 2015. BSP supremo Mayawati criticised the power tariff hike in Uttar Pradesh and said it highlights the Samajwadi Party government's "insensitiveness" towards common people. Uttar Pradesh State Electricity Regulatory Commission (UPSERC) had increased power tariff for all categories of consumers by 5.47% on June 18. Mayawati said that while there was acute shortage of power in the state, more problem was being created for the consumers by effecting a hefty hike in power tariff. Crores of urban consumers were already facing serious problem of erratic power supply and damaged transformers due to which there were reports of dharna, demonstration and gherao of sub-stations and people have to face police lathis, she claimed. The BSP supremo said that giving a shock to consumers in such a situation highlights "insensitiveness of the SP government." In its election manifesto, the SP had promised 20 hours of power supply in rural areas and 22 hours supply in urban areas within two years. But even after three years, the SP government has not only failed on its promises, but it has not taken any concrete step to fulfill them, she said. Mayawati accused the SP government of trying to gain cheap publicity by completing works done by BSP regime on power front. Without strengthening the system, creating financial burden on the consumers was unjust, she said. (www.business-standard.com)

Govt transfers environment clearances of 19 coal blocks so far

June 22, 2015. The Centre has so far transferred the environment clearance (EC) of 19 coal blocks out of approved 29 mines from the earlier allottees to the new successful bidders including JSW Steel, GMR Chhattisgarh Energy, Jaypee Cement and Ambuja Cements among others. In a bid to expedite operations from the recently allocated coal mines, the Environment Ministry had amended EC norms after a request made by the Coal Ministry to facilitate transfer of ECs to successful coal bidders. The 19 coal blocks are located in Jharkhand, Chhattisgarh, West Bengal, Madhya Pradesh, Maharashtra and Odisha. These blocks have a combined coal production capacity of over 22 million tonnes per annum (mtpa). Of 19 coal blocks, the Environment Ministry had issued transferred letters for four coal blocks in April, nine blocks in May and six blocks in the current month, according to the data maintained by the Ministry. So far this month, the Ministry has transferred the ECs of six blocks from earlier allottees to JSW Steel, GMR Chhattisgarh, Jaypee Cement, Aumbuja Cement, Araanya Mines Pvt and Bharat Aluminium Company. As per earlier norms, the EC for any project was allowed to be transferred to another applicant with a written 'no objection' by the transferor, to and by the regulatory authority concerned. Now, the ministry has made amendments to the September 2006 EIA notification, allowing transfer of EC to new coal block allottees without taking 'no objection' nod from previous owners. The EC norms were eased as new coal block allottees feared that old allottees would create problems in transferring EC with no objection nod, thus delaying the commencement of mining operations. The Centre auctioned 29 blocks in two phases to companies like Monnet, GMR Chhattisgarh, Hindalco, Reliance Cement among others, garnering about ` 2 lakh crore. The auction followed the Supreme Court's cancellation of 204 coal blocks last year. (www.firstpost.com)

DERC to announce revised tariff despite AAP govt's objections

June 21, 2015. Delhi's power regulator DERC is all set to announce revised tariff for 2015-16 next month notwithstanding AAP government's directive not to go ahead with the new rates till the CAG has submitted its report on the financial condition of three private power distribution companies. Delhi Electricity Regulatory Commission (DERC) said the tariff determination process was going on and it will announce the new rates, which may see a marginal hike, even if the government had strong reservations about it. On June 12, the DERC had hiked tariff by upto six percent as it restored a surcharge to compensate the private distribution companies for rise in power purchase cost. The AAP government strongly criticised the DERC for the hike and said it was exploring legal option against the decision. The Delhi government had asked the DERC not to hike tariff till the CAG submits its report on finances of the discoms. Power tariff was a major issue for AAP during the Delhi polls. The Kejriwal government had in February announced a 50 percent subsidy on monthly power consumption of up to 400 units till the government receives the CAG report on financial condition of the discoms. In its first stint, the AAP government had ordered a CAG audit of all the three discoms, claiming that they have been misleading the government and the DERC about their financial position. The city has seen a series of hikes in power tariff in the past two years. (www.business-standard.com)

UPSERC hikes power tariff by 5.47 percent across categories

June 18, 2015. Uttar Pradesh State Electricity Regulatory Commission (UPSERC) increased power tariff for all categories of consumers in the state by 5.47 percent. A hike of 5.04 percent has been effected in residential connections from 3.74 per kilo watt hour (KWh) to ` 3.92 per KWh, while no hike has been made for rural domestic consumers, UPSERC said. It said that a hike of 5.04 percent has been made for industries from ` 7.07 to ` 7.42 per KWh. A hike of 11.97 percent from ` 6.69 to ` 7.49 per KWh has been effected for state tube-wells, medium and large pump canals. It has decided to abolish the One Time Settlement scheme. To encourage the consumers to get metered connection, the commission has directed the licensees that the cost of meter may be borne initially by them which shall be adjusted in the bill within six months time and this scheme would be applicable only for unmetered consumers who install meters by March 31, 2016. To incentivize consumers, a rebate of 0.25 percent has been approved by the commission for making the payments on or before due date. It has linked the number of hours of electricity supplied by the licensee with the tariff of the consumers. If a particular group of consumers gets additional supply hours then they may be charged certain incremental charges. (economictimes.indiatimes.com)

Odisha will get ` 450 bn from coal auction

June 18, 2015. Union coal secretary Anil Swarup said Odisha would get about ` 45,000 crore in next 25-30 years from the ongoing coal auction process. He said if all the mines are explored, the state would avail an estimated amount of about ` 45,000 crore during that period. Swarup's estimate came in contrast to Petroleum Minister Dharmendra Pradhan's claim earlier that Odisha would receive ` 2 lakh crore from the coal auction. The coal secretary denied rejecting any request of the Odisha government regarding allocation of coal blocks to Odisha Thermal Power Corporation (OTPCL). The Odisha government had demanded allocation of Chhendipada-I and Chhendipada-II coal blocks in favour of OTPCL, which has proposed to set up a 2,400 MW power plant at Kamakshya Nagar in Dhenkanal district. But the government claimed that the coal ministry has turned down the request. The government has also proposed to allocate coal blocks to the Odisha Mining Corporation. (www.business-standard.com)

NTPC hopes to get Centre's nod on fuel linkage for Katwa

June 18, 2015. NTPC said it was hopeful of getting the Centre's nod for receiving coal linkage from mines of the state government for its proposed Katwa plant. The proposal was scrapped by the Coal Minister Piyush Goyal. The minister said that NTPC was unable to float tender for the Katwa project without this coal linkage. He had said Chief Minister Mamata Banerjee had discussed the issue with Goyal during the inauguration of Coal India's new corporate office at Rajarhat recently. The chief minister on her part too assured the Centre of all help and cooperation in the setting up of the plant. Coal linkage and Environment Impact Assessment are the two pre-requisites for the project to get off the ground. (www.business-standard.com)

India's research reactors not under nuclear insurance pool

June 18, 2015. India's research reactors will not be covered under the newly set-up nuclear insurance pool as they are owned by the union government, the Bhabha Atomic Research Centre (BARC) director Sekhar Basu has said. Basu is also a member of the Atomic Energy Commission and a director in Nuclear Power Corp of India Ltd (NPCIL). BARC's two operational test reactors are the 100 MW and a very low-power Advanced Heavy Water Reactor (AHWR). Basu said what is applicable to BARC applies equally to the research reactors operated by the Indira Gandhi Centre for Atomic Research (IGCAR) at Kalpakkam. The IGCAR operates two small research reactors - fast breeder test reactor (FBTR) and Kamini. According to Basu, the upcoming 500 MW prototype fast breeder reactor (PFBR) expected to go on stream this year would come under the insurance cover once it starts the nuclear fission process. The government-owned Bharatiya Nabhikiya Vidyut Nigam Ltd (BHAVINI) is setting up the country's first indigenously designed 500 MW PFBR at Kalpakkam. The central government recently announced the setting up of the ` 1,500 crore India Nuclear Insurance Pool to be managed by national reinsurer GIC Re. The GIC Re, four government-owned general insurers and also some private general insurers have provided the capacity to insure the risks to the tune of around ` 1,000 crore and the balance ` 500 crore capacity has been obtained from the British Nuclear Insurance Pool. The losses or profits in the pool would be shared by the insurers in the ratio of their agreed risk capacity. Foreign nuclear plant suppliers were reluctant to sell their plants to India citing the provisions of Civil Liability for Nuclear Damage Act (CLND) 2010 that provides the right of recourse to NPCIL against the vendors under certain circumstances for compensation in case of an accident. The insurance pool was formed as a risk transfer mode for the suppliers and also NPCIL. All the 21 operating nuclear power plants in India owned and operated by NPCIL are expected to come under public liability insurance cover from next month onwards, New India Assurance Company Ltd said. The insurance cover would also extend to the 1,000 MW nuclear power plant at Kudankulam in Tamil Nadu built with Russian equipment. The final premium has not been arrived at but it will be between ` 100 crore and ` 150 crore. The proposed policy would cover the liability towards public as a consequence of any nuclear accident in the plants covered under the policy and also the right of recourse of NPCIL against the equipment suppliers. (zeenews.india.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Rosneft and BP form JV to explore new opportunities in Siberia

June 23, 2015. Rosneft has agreed to sell a 20% share in Taas-Yuryakh Neftegazodobycha (Taas) in eastern Siberia to BP for $750 mn, to form a joint venture (JV). The JV will further develop the Srednebotuobinskoye oil and gas condensate field in eastern Siberia, as well as explore new opportunities in the region. Rosneft and BP will also explore two additional areas of mutual interest in the West Siberian and Yenisey-Khatanga basins covering a combined area of about 260,000km2. The agreement signed by the two companies has a provision to create new joint ventures to obtain licences and perform exploration activities. All such JVs will be owned 51% by Rosneft and 49% by BP. (explorationanddevelopment.energy-business-review.com)

PetroVietnam, Gazprom seal agreement to develop 2 fields in Russia

June 23, 2015. Vietnam's state-owned energy company Vietnam National Oil and Gas Group (PetroVietnam) and Russian partner Gazprom sealed a deal for Gazpromviet -- their joint venture firm -- to explore and develop the Nagumanovskoye and Severo-Purovskoye fields in Russia. The agreement, signed June 18 during the 19th St. Petersburg International Economic Forum in Russia, sets out the conditions for both parties to develop the Nagumanovskoye oil, gas and condensate field in the Orenburg Region and the Purpovskoye gas and condensate oil field in the Yamal-Nenets Autonomous Area. PetroVietnam and Gazprom inked a framework agreement in 2014 for joint development of the two fields through Gazpromviet, which holds a subsurface use license for the fields. Gazprom has a 51 percent stake in Gazpromviet, with the remainder held by PetroVietnam. According to Gazprom, the Nagumanovskoye field holds 204.8 billion cubic feet or 5.8 billion cubic meters of proven in-place gas reserves, 15.17 million barrels (1.683 million tons) of recoverable condensate reserves and 7.58 million barrels (960,000 tons) of recoverable oil reserves, while the Severo-Purovskoye field contains an estimated 1.60 trillion cubic feet or 45.5 billion cubic meters of proven in-place gas reserves and 61.52 million barrels (6.826 million tons) of recoverable condensate reserves. (www.rigzone.com)

Qatar vast gas reserves ‘to last 138 yrs’

June 21, 2015. Qatar’s gas reserves are so vast it can maintain production at current rates for another 138 years. An “Economic Commentary” from the Qatar National Bank (QNB) said the vast reserves of the tiny Gulf country will ensure it maintains its prominent position in the hydrocarbon sector “for years to come“. Qatar is the third largest producer of natural gas in the world behind the United States and Russia. Globally, it accounts for just over five percent of the market. LNG is gas cooled to —160 degrees Celsius when it then turns into a liquid, allowing it to be more easily transported. The vast reserves of gas have helped fuel Qatar to becoming one of the richest countries on the planet. The QNB report was using figures contained in BP’s Statistical Review of World Energy, released. That review by the British multinational showed that UK imports of LNG in 2014 increased by 20.5 percent. (www.thehindubusinessline.com)

Downstream…………

Sonatrach terminates refinery modernisation contract

June 23, 2015. Algeria's national oil and gas company Sonatrach has terminated the contract signed in December 2010 with Technip for the modernisation, refurbishment and revamping of the Algiers refinery. The contract was terminated in early June 2015, prompting workers to stop modernisation works. (www.enerdata.net)

Kuwait’s al-Zour oil refinery to be delayed beyond 2019

June 22, 2015. The start-up date of Kuwait's al-Zour oil refinery is expected to be pushed beyond early 2019 as state refiner Kuwait National Petroleum Co (KNPC) is seeking additional funds to finance the giant plant, KNPC said. High construction costs forced KNPC to ask for additional funds from the government, the company said. The 615,000 barrel per day oil refinery, originally planned more than a decade ago, would be the biggest in the Middle East, but the project has been repeatedly delayed by bureaucratic and political issues, including tensions between Kuwait's parliament and the cabinet. Officials had previously said start-up would occur by late 2018 or early 2019. (www.reuters.com)

Saudi Aramco may shut Jeddah refinery in several years

June 22, 2015. State oil giant Saudi Aramco is considering whether to close its 90,000 barrel per day crude oil refinery in Jeddah after several years because of age and environmental concerns. The refinery, which started operating in 1967, serves much of the country's western region and its closure would increase demand at other Saudi facilities. It produces liquefied petroleum gas, gasoline, diesel, asphalt and jet fuel, and exports naphtha. Aramco was originally considering whether to close it in 2018 but now looks likely to postpone the closure to as late as 2022 because of growing domestic demand for oil products and since construction of a new refinery at Jizan, also on the Red Sea coast, has been delayed. Aramco has said it plans to bring the Jizan refinery online by 2018. However, industry sources said this was now expected to be delayed by at least two years for several reasons, including technical problems with building infrastructure in the sea. (www.reuters.com)

Transportation / Trade……….

BP signs deal to supply liquefied natural gas to Egypt

June 23, 2015. British oil major BP has signed an agreement to supply 16 cargoes of liquefied natural gas (LNG) through 2015 and 2016 to state-run Egyptian Gas. The agreement was initially intended to be part of the country's $2.2 bn tender awarded in January for 70 LNG cargoes. However, the deal with BP was put into doubts due to persistent delays as Egypt restructured its plan to meet energy requirements. As part of the tender, Trafigura, Vitol and Noble Group have secured rights to supply a combined 49 cargoes of LNG. BP was entailed to deliver the remaining 21 cargoes with the first shipments planned from April. The country reduced the number of BP's LNG cargoes shipments to 16 compared to previously planned 21 cargoes due to delays in signing the agreement. Separately, Algeria's state-run Sonatrach and Gazprom's trading arm have agreed to deliver six and 35 cargoes of LNG to Egypt, respectively. BP announced plans to invest over $12 bn in Egypt in the next five years, to double its gas supplies to the local market. (transportationandstorage.energy-business-review.com)

E.ON secures 4.4 bcm per year of gas from Rosneft

June 22, 2015. Russian oil and gas producer Rosneft has signed a 5-year gas supply agreement with E.ON for the delivery of 4.4 bcm/year, to be burnt at E.ON's Surgutskaya GRES-2 power plant. The contract is part of Rosneft's strategy to expand its presence in the gas market and to sign long-term supply contracts with major gas consumers. (www.enerdata.net)

Siberian oil deal sees BP bet on Russia’s pivot toward China

June 22, 2015. BP Plc’s $750 million purchase of a Siberian oilfield stake is as much a bet on China as it is on Russia. Taas-Yuriakh Neftegazodobycha LLC’s blocks near China’s northern border will supply the planned Tianjin refinery on the east coast, according to OAO Rosneft, which sold the 20 percent holding. BP Chief Executive Officer Bob Dudley predicts the unit’s natural gas reserves will prove strategic as Russia develops its Far East and builds ties with the world’s biggest energy consumer. BP’s Siberian acquisition comes at a time when Russia is turning to Asia for energy sales in response to sanctions imposed by the U.S. and European Union following its annexation of Crimea. China, which toppled the U.S. as the world’s biggest oil importer last year, has agreed to increase its Russian oil and gas purchases as it diversifies it sources of energy. The company agreed to buy the Taas-Yuriakh stake from Rosneft on June 19, a day after Royal Dutch Shell Plc, Europe’s biggest oil company, signed an agreement with OAO Gazprom to expand a gas export terminal in Sakhalin-2. Gazprom and China National Petroleum Corp. in May agreed on daily gas delivery volumes, gas quality and a pipeline entry point to China. Russia’s monopoly gas exporter also plans to exceed an earlier target of 30 billion cubic meters per year. Rosneft plans to ship 582,000 barrels a day to China this year, 27 percent more than in 2014. That’s 91 percent of its total planned exports to Asia in the year. (www.bloomberg.com)

NLNG eyes $1.5 bn debut ship yard in Nigeria

June 19, 2015. Nigeria Liquefied Natural Gas Company (NLNG) is sponsoring the construction of the first major ship yard in Africa's biggest economy at the cost of $1.5 billion, in its attempt to turn the country into a hub for maritime operations on the continent. Nigeria is the world's eighth biggest crude producer and Africa's top oil exporter but it does not have a drydock for maintaining and repairing large crude vessels, a major drawback for carriers sailing to the country, NLNG said. (www.reuters.com)

Gazprom will double Nord Stream gas pipeline capacity to Germany

June 19, 2015. Gazprom has reached an agreement with Shell, E.ON and OMV on the expansion of the Nord Stream gas pipeline, linking Vyborg in Russia to Lubmin in Germany. Two new lines (stages 3 and 4), with a combined capacity of 55 bcm/year, would double the capacity of the existing interconnection. Gazprom owns 51% in the North Stream and would also own 51% in the expansion; E.ON, Shell and OMV, along with other shareholders, could invest in the project. Earlier in June, Gazprom announced that it would stop exporting gas to Europe through Ukraine and that it would focus on the construction of the 63 bcm/year Turk Stream to Turkey, leaving European consumers the charge of developing new import routes. (www.enerdata.net)

Petrobras says pipeline leaked 600 liters of crude, some in ocean

June 19, 2015. An oil pipeline along Brazil's coast near Rio de Janeiro leaked 600 liters (3.77 barrels) of oil into nearby water courses with about 50 liters leaching into the Atlantic Ocean, state-run oil company Petroleo Brasileiro SA (Petrobras) said. Teams with vacuum equipment, floating oil barriers, absorbent materials, boats and trucks are on the scene trying to clean up the spill and prevent it from spreading, Petrobras said. (www.reuters.com)

Gazprom and European partners to expand Nord Stream gas pipeline

June 19, 2015. Gazprom has signed memorandums of intent with three European companies for the expansion of Nord Stream gas pipeline between Russia and Germany. The decision comes amid declining domestic gas production in Europe and increasing gas demand globally. The potential agreement with E.on, Shell and OMV entails the development of two additional gas pipelines, with an annual capacity of 55 billion cubic meters, from the Russian coast to the German coast through the Baltic Sea. Gazprom is seeking alternative routes for transportation of gas to European markets, by avoiding Ukraine. The four partners plan to establish a joint project company in future. The 1,220km-long Nord Stream offshore pipeline project already operates two pipelines with combined annual capacity of 55 billion cubic meters. (transportationandstorage.energy-business-review.com)

Engie lost 1.5 mn residential clients from 2010 to 2015 in the gas segment in France

June 17, 2015. According to the energy regulator, historical gas company Engie (ex-GDF SUEZ) has lost 1.5 million customers in five years in France: On 31 March 2015, the company supplied 82% of the 11 million households using gas, corresponding to a loss of 1.5 million customers on the residential segment since 2010. The company supplies 70% of commercial consumers, representing 42% of gas volumes sold to this segment from 75% in 2010. Engie is suffering from aggressive offers from alternative suppliers such as Eni or Direct Energie or from collective purchases. To offset client loss on the regulated segment, Engie is turning to the liberalised market: the group has taken part to grouped purchases and to public tenders. The group is also seeking to develop its electricity sales to offset its declining position on the gas market: Engie aims to double its customer base from the current 2.3 million to 4.6 million by 2018. (www.enerdata.net)

Policy / Performance…………

Dutch govt cuts Groningen gas field production

June 23, 2015. The Dutch government has ordered a further tightening of gas production at Groningen, Europe's largest gas field, in response to a spate of earthquakes that have caused extensive property damage in the Netherlands' northernmost province. Output at the field, the world's 10th largest, will be capped at 30 billion cubic metres (bcm) for the whole of 2015, Economy Minister Henk Kamp said. At the beginning of the year, production of 39.4 bcm was planned. British natural gas for October climbed 2.51 percent to 44.95 pence per therm, becoming the biggest gainer on the UK gas curve. In February, output was cut to 16.5 bcm for the first half of the year after the Dutch Safety Board said gas companies and state regulators had failed to take the threat of earthquakes seriously enough. In the second half of the year, output will be capped at 13.5 bcm, with stored gas tapped if necessary to make up for any shortfall. The government would use the second half of the year to assess how to meet supply needs from 2016 onwards. Kamp said Groningen production might range from 21 to 33 bcm, depending on temperatures. Excess demand from 2016 would be met using some combination of imported gas and conversion plants that turn imported high-calorific gas into the low-calorific gas upon which Dutch energy infrastructure is based. (www.reuters.com)

Kuwait oil minister says oil price drop unlikely

June 23, 2015. Kuwait's oil minister Ali Saleh al-Omair said he expected oil prices to continue rising, predicting gains in the final quarter of 2015 on the back of global growth. Omair said costs for the country's al-Zour refinery were expected to increase by around 1 billion Kuwaiti dinars ($3.31 billion) pushing up total cost to more than 5 billion dinars. Kuwait National Petroleum Company had said the start-up of the refinery would be delayed as the company was seeking more financing on the back of rising construction costs. The 615,000 barrel per day oil refinery, originally planned more than a decade ago, would be the biggest in the Middle East, but the project has been repeatedly delayed by bureaucratic and political issues, including tensions between Kuwait's parliament and cabinet. (www.reuters.com)

Tullow oil to settle Uganda tax dispute for $250 mn

June 22, 2015. Tullow Oil Plc settled a capital gains tax dispute with the government of Uganda after agreeing to pay $250 million related to a 2012 deal with Total SA and Cnooc Ltd. The company paid $142 million at the time and will pay the remaining $108 million in three equal installments, it said. The first $36 million portion has already been paid with remainder due in 2016 and 2017, it said. Significant output of oil in Uganda, first discovered there in 2006, has been restrained by delays including wrangling between the East African country and companies about how much crude to process locally or export through a pipeline. Uganda has an estimated 3.5 billion barrels of crude, according to the Energy Ministry, with Tullow, Total and Cnooc planning to tap the Lake Albert fields. (www.bloomberg.com)

Russia, Saudi Arabia to discuss broad oil cooperation agreement

June 18, 2015. The oil ministers of Russia and Saudi Arabia plan to discuss a broad cooperation agreement at an economic forum in St Petersburg. Saudi Arabia is the top producer in the Organization of the Petroleum Exporting Countries (OPEC) and the world's top oil exporter, while Russia, which is not an OPEC member, is the second biggest oil supplier to the global markets. The agreement to be discussed between Russian Energy Minister Alexander Novak and Saudi Oil Minister Ali al-Naimi would not be about joint oil production or export strategy. Russia has stepped up contacts with OPEC after oil prices plunged last year, but it has dismissed any suggestion it might cut output to prop up prices. OPEC has also refused to curb its output in order to defend market share. Saudi Arabia is pumping oil at a record high as it focuses on keeping market share, while Russian output hit a post-Soviet high of 10.71 million barrels per day in April. (www.reuters.com)

DRC adopts new hydrocarbons code

June 18, 2015. The parliament of the Democratic Republic of Congo (DRC) has adopted a new hydrocarbons code, which will replace the 1981 law regulating the oil sector. The new code is excepted to grant more revenues for the country. Previous drafts included a 40% capital gains tax on all contract and a provision requiring oil companies to cede a minimum 20% of shares in their operations to a "national society of commercial character"; the final bill was not immediately available. The DRC aims to boost its oil production, which averages 25,000 bbl/d (about 23,800 bbl/d in 2013) and accounts for just 11% of its export revenues. (www.enerdata.net)

Kazakh minister says plans to supply energy resources to India

June 17, 2015. Kazakhstan plans to supply energy resources to a growing Indian economy, its energy minister Vladimir Shkolnik said. India is the world's fourth-largest oil consumer and crude imports from Kazakhstan are almost negligible because of logistics and transportation issues. (af.reuters.com)

World Bank lends US$700 mn for gas exploration in Ghana

June 17, 2015. The World Bank has approved a US$700 mn loan for oil and gas exploration offshore Cape Three Points in the western region of Ghana. A consortium led by Eni in partnership with Vitol is in charge of exploration in the area. The US$7 bn project is expected to lead to the development of the Sankofa and Gye Nyame fields, which would provide gas to operate thermal power plants for 20 years. (www.enerdata.net)

[INTERNATIONAL: POWER]

Generation……………

Adaro plans to bid to operate 2 GW Java-5 power project in Indonesia

June 23, 2015. Indonesian coal mining group Adaro plans to participate in a tender to operate a 2,000 MW coal-fired power project, Java-5, in Banten. The group will soon establish a consortium to bid. Adaro aims to diversify its non-coal revenue sources and is already taking part to other coal-fired power projects in Indonesia, including a 200 MW project in South Kalimantan. The Java-5 project will include two 1,000 MW units, and will consume 8 to 10 Mt/year of coal. Commissioning is expected between 2019 and 2021. (www.enerdata.net)

RusHydro's Boguchanskaya hydropower plant at full capacity

June 22, 2015. RusHydro's Boguchanskaya hydropower plant has reached its full capacity of 2997 MW with the filing of the reservoir to its design level (208 m above sea level). The construction of the dam and the power plant consisting of nine units of 333 MW each started in 1980 and should have been completed in 12 years, but the end date was postponed several times. The first three 333 MW units were installed in November 2012 and the plant started to generate power and to sell on the wholesale market in December 2012. Three units were commissioned between January and December 2013. The units 7 and 8 were launched in September 2014 and the 9th unit in December 2014. With the reservoir filled, the plant may now produce 17.6 TWh/year and supply electricity to Rusal's Boguchansky aluminum smelter. (www.enerdata.net)

Suez Canal $78 mn power plant set for 2016 delivery

June 22, 2015. Egypt-based Arab Contractors will finalise works on a new $78.7 mn (EGP600mn) Suez power plant early next year, it was announced. The plant, due for operation in the beginning of 2016, is a part of the Egyptian government's five-year scheme. (www.constructionweekonline.com)

Nigeria selects two sites for 2.4 GW nuclear projects

June 19, 2015. The Federal Government of Nigeria, through the Nigeria Atomic Energy Commission (NAEC), has selected two sites for the potential construction of two 2,400 MW nuclear power plants. A plant could be built at Geregu in Kogi State, while the other would be built in Itu in Akwa Ibom State. In April 2015, the NAEC and Russian nuclear group Rosatom started talks to build four reactors with a combined capacity of 4,800 MW for a total cost of US$20 bn (about N3,900 bn). The reactors would be co-financed by Rosatom, which would then build, own, operate and transfer them to the government. (www.enerdata.net)

PSEG Power acquires 755 MW power generation facility in Maryland

June 18, 2015. PSEG Power has acquired the 755MW Keys Energy Center project from Genesis Power and an energy-focused private equity fund managed by Ares EIF Management. PSEG Power is planning to commence construction of the natural gas-fired, combined-cycle electric generating plant in 2015, with an investment of $825 mn to $875 mn and expected completion in 2018. (fossilfuel.energy-business-review.com)

Asif claims over 16 GW power generation in a day

June 18, 2015. Federal Minister for Water and Power Khawaja Asif claimed that over 16,000 MW electricity has been generated in the last 24 hours, a first in Pakistan’s history. Pakistan’s national power demand, excluding K-Electric, is about 20,000 MW and upon including K-Electric, the total demand swells to 22,700 MW. With the generation of 16,000MW, a deficit of around 4,000MW still persists, necessitating over six hours load shedding in urban and much more in rural areas. The hydel power plants contribute around 6,000 MW in the national grid while the contribution from Independent Power Producers is around 7,300 MW. The thermal units add about 2,450 MW to the national grid. (www.geo.tv)

Transmission / Distribution / Trade…

Ethiopia signs US$120 mn contract for power interconnection to Kenya