-

CENTRES

Progammes & Centres

Location

[The Negotiating Text for Paris: An Appeal]

“This time the United States has shaped the agenda for a ‘bottom-up’ regime again with no multilaterally determined emission reduction commitments and is pushing for review of “mitigation” actions of developing countries. India and China are stressing review of modification of longer term trends or lifestyles, to focus on the causes of the problem. India’s INDC is subtitled ‘working towards climate justice’ stressing international cooperation to enable the transformation required by Article 2…”

Energy News

[GOOD]

Domestic coal boom halting import growth is among the biggest achievements of the sector!

When SEBs are reluctant to buy power hydropower how can they be forced to buy solar power?

[UGLY]

Coal auctions have replaced allocation with court action!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

ANALYSIS / ISSUES…………

· The Negotiating Text for Paris: An Appeal

COMMENTS…………………

· Notes: Development / Discussions in the run up to Paris COP 21

DATA INSIGHT………………

· India and South Asia: Petroleum Trade

[NATIONAL: OIL & GAS]

Upstream…………………………

· ONGC targets $10-$12 bn foreign O&G investments

· ONGC to buy into Adani-Welspun’s oil block off Mumbai coast

· Tapti gas field seen ceasing production by year end: RIL

· ONGC has no claims in KG gas row: RIL

· Gas leak continues from OIL well in Jaisalmer

· Deep Industries wins order worth ` 903 mn from ONGC

Downstream……………………………

· IOC sells rare Kandla cargo at small premium

· RIL's refinery margins will continue to improve: Moody's

· Essar Oil restarts Vadinar refinery

Transportation / Trade………………

· GAIL will deploy drones to guard gas pipelines to raise safety standards

· External Affairs Minister holds talks with Turkmen counterpart on TAPI

· IOC opposes move to declare its pipeline as common carrier

Policy / Performance…………………

· OMCs increase diesel prices by 95 paise per litre

· GAIL inks a GCA with Jharkhand govt

· Transparent LPG cylinders soon to keep a tab on gas quantity

[NATIONAL: POWER]

Generation………………

· Odisha to firm up 300 MW through power banking

· BHEL starts building 800 MW coal-fired unit at Wanakbori

· Construction of two RAPS units on: NPCIL

· NTPC incorporates arm to run and expand Patratu power plant

Transmission / Distribution / Trade……

· RECTPL to announce lowest financial bids for 2 projects

· India's domestic coal boom halts import growth

· India's September coal imports slump 27 percent to 12.6 mt

· 'Lower dependence on imported coal credit positive for IPPs': Moody's

· SEBs reluctant to buy power from NHPC projects

· Indian Railways to procure 50 MW electricity from Adani Power

· Alstom T&D wins orders worth ` 1.4 bn from OPTCL

Policy / Performance…………………

· 'Scope to cut power tariff'

· Odisha hopes to bag Baitarani West coal block soon

· Rajasthan signs MoUs with PSUs, companies worth ` 505 bn

· Coal Ministry asks States to expedite clearances for auctioned mines

· Assocham urges govt to resolve issues of auctioned coal mines

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· AGOCO to drill 93 wells in Libya within 10 yrs

· US cancels remaining Arctic oil lease sales under Obama

· Niger aims to triple oil output by 2018

· US crude oil stocks jump by 7.6 mn barrels: EIA

· DEA to acquire E.ON's North Sea O&G assets for $1.6 bn

· Azerbaijan expects to keep oil output at ACG fields at 31.5 mt in 2015

· Lukoil discovers deepwater gas field in Romania

· SKK Migas approves EMP's plan to develop Seng, Segat gas fields in Sumatra

Downstream……………………

· Sinopec completes $1 bn refinery expansion

· SOCAR gets US$1.8 bn loan to upgrade Baku refinery

· China reduces oil processing as refineries shut for work

· Moroccan oil refiner Samir gets backing for $1 bn capital increase

· Total European refining margin hits new record in Q3

· Ecopetrol Cartagena refinery to resume operation: Finance Minister

· Gazprom begins construction of Amur GPP in Russia

Transportation / Trade…………

· ConocoPhillips, Dong said to sell stakes in Norway gas pipelines

· Saudi crude oil exports fall in August to 6.998 mn bpd: JODI

· Russia's Rostec to build $2.5 bn gas pipeline in Pakistan

· EnBW to become Germany's third-largest gas player in $1.6 bn deal

· Occidental's North Dakota deal mixed omen for pending oilfield deals

· Jordan picks Shell to supply first two years of LNG supply in tender

· Greece wants to speed up IGB gas pipeline deal fraught with delays

· Sinopec gets approval for $20 bn coal-to-gas pipeline

Policy / Performance………………

· Beijing firm highest bidder in Xinjiang oil tender: Govt

· Iran to pay oil companies larger fees in 20 yr contracts

· Venezuela's President says oil industry needs $88 price

· World Bank revises down forecast of crude oil prices

· Iran sees no OPEC output change as country seeks $70-$80 oil

· Nigeria defers plan to slash gas supply to Ghana

· Angolan govt cuts spending by 50 percent as oil revenue plunges

· Lithuania govt proposes to allow LNG re-exports

· South African regulator raids five LPG suppliers

· China said to plan gas price cuts up to 30 percent in fuel push

[INTERNATIONAL: POWER]

Generation…………………

· Construction starts at 445 MW Salalah-2 CCGT power project

· Wärtsilä wins 378 MW Flexicycle power plant contract in El Salvador

· PSEG to spend $3.5 bn over 5 yrs to expand US power plant fleet

Transmission / Distribution / Trade……

· China 2016 coal imports could fall a further 25 mt

· Ayala bullish on power business

· ABB receives $300 mn contracts to support power transmission projects in China

Policy / Performance………………

· South Africa plans to raise power capacity by 28 percent by 2025

· China targets 110 nuclear reactors on operation by 2030

· Armenia will not abandon plans to build new nuclear power plant

· Australia's Federal govt re-approves Carmichael coal project

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Visakhapatnam to get its first 'smart streetlight' soon

· Odisha needs ` 300 bn to implement climate plan for 2015-20

· Vardhan stresses on need for alternate sources of energy

· World’s largest solar power plant to come up in MP

· RIL, 9 global oil majors commit to cut green house gases

· Chinese firm Sany Group to invest $3 bn in renewable energy sector in India

· World's poor must have fair access to global resources: India

· India, Sweden agree to cooperate in urban sector initiatives

GLOBAL………………

· Vestas to sell stake in 310 MW Kenyan wind project to Google

· China solar installations double despite delay in sales to grid

· Nuclear climate solution is cheaper than coal: IAEA

· Vietnam commits to reduce GHG emissions by 8 percent by 2030

· Two companies will develop 175 MW of solar projects in Nigeria

· Merkel joins Bachelet in push for a price on global pollution

· US said to propose fallback for international carbon trade

· EGP and F2i create solar PV JV in Italy

· China’s wind power capacity to hit 120 GW

· Clean Power Plan to shutter 4 GW of Texas coal output

· Big oil companies back agreement to prevent climate change

· Norway fund chief says Carney raises important climate questions

· Germany sees new carbon market bolstering feeble climate pledges

[WEEK IN REVIEW]

ANALYSIS / ISSUES……………

The Negotiating Text for Paris: An Appeal

Mukul Sanwal*

|

T |

here are two opposing visions of the new climate regime and the unresolved issue is whether the multilateral consensus at Paris will be around climate justice, reflecting the concerns of the majority of the human population, or environmental integrity, which reflects the approach adopted in the negotiation text, released on 5 October 2015.

The essential question that negotiators need to ask is how the Articles of the text, and the draft decisions, will achieve the ‘Purpose’ enumerated in Article 2 of the Agreement. This is: “…strengthen and support the global response and international cooperation to collectively meet the urgent threat of climate change by further addressing its causes and by further increasing resilience and the ability to adapt to its adverse impacts, with a view to promoting the global transformation to low-carbon [emission] and climate-resilient societies and economies to keep within the global carbon budget. It reflects equity and common but differentiated responsibilities and respective capabilities, in light of different national circumstances and levels of development”.

According to the negotiation text, the focus of international cooperation should be on environmental integrity, or risk-management. The information required to be communicated under Article 3 to the multilateral level is limited to mitigation. Its review to determine future national actions under Article 9.2 and 10 is based solely on emissions reduction. Consequently, adaption, finance, technology development and transfer (and this term occurs only in a title) are considered national level actions, and multilateral assessment and review of these elements to strengthen international cooperation is not considered. The review is considered a technical exercise with the secretariat given an active role with respect to actions to be taken by Parties and stocktaking is sought to be opened up to non-Parties. This framework is presented as the new framework for achieving “global low-carbon transformation”.

For the others, and this view has been articulated most clearly by India and also by China, the universal regime for the “global low-carbon transformation” cannot be achieved without giving equal weightage to climate justice and environmental integrity. As provision of information is the only ‘commitment’ in the climate regime Article 2 must include all elements to achieve the transformation – what the text calls mitigation, adaptation, finance and technology development and transfer. Emissions reduction deals with the symptoms of climate change while the ‘Purpose’ of the Agreement, in Article 2, calls for a focus on the causes - lifestyles.

The change from the Convention negotiated in 1992 is that the world is now faced with ecological limits and the limited carbon space, in the absence of equitable allocation criteria, requires strengthening the global response to enable all to achieve middle class levels of wellbeing. The recent report of the IPCC has re-framed the global concern in terms of sharing the global climate budget, and that consideration of ethics and justice will lead to a stronger climate agreement. International cooperation, as Article 2 points out, is the purpose of the Agreement.

The negotiating text rightly focuses on ‘transparency’ (linking it with review) but the meaning of ‘understanding’ includes comprehension and awareness of others feelings, and the latter would be appropriate only in the context of climate justice. The ‘Purpose’ in Article 2 does not use the terms ‘mitigation’ and ‘adaptation’; mitigation refers to reducing the severity of pollution and adaptation refers to anticipating adverse effects; the stress is on promoting the global transformation, and that has not been considered in the text with its focus on emissions.

The only ‘commitment’ is to provide information. Review of the information and the elements of the information to be provided will be the most contentious articles to be negotiated, just as it was in 1992, because the Parties continue to have different notions of fairness. The compromise arrived at then was that the United States drafted Article 4.2(a) and ensured there were no emission reduction commitments, only an “aim”. India with the support of China drafted Article 10 and ensured there would be only assessment of aggregate effects of the measures taken by developing countries. This time the United States has shaped the agenda for a ‘bottom-up’ regime again with no multilaterally determined emission reduction commitments and is pushing for review of “mitigation” actions of developing countries. India and China are stressing review of modification of longer term trends or lifestyles, to focus on the causes of the problem. India’s INDC is subtitled ‘working towards climate justice’ stressing international cooperation to enable the transformation required by Article 2 of the Agreement, with technology development and transfer as a key element. The unresolved issue is how the ‘Purpose’ of the new regime in Article 2 will be reconciled with the information requirements, multilateral review and future collective actions of all Parties, that is, the nature and scope of international cooperation.

Other unresolved, yet significant, issues include

1. The objective of transparency (Art. 9) of the review should be ‘fairness’, or, confidence in meeting the Purpose of the Agreement and not just one component. Defining transparency related capacity should specify data, research and analytical capacity, including exchange of experiences, as this is a critical element (DD Paragraph 58).

2. Reviews should be Party driven not by experts, and the pre-2020 review is being conducted by the SBI while the post-2020 reviews are by expert groups! Peer review should be available for countries that opt for such arrangement (Article 6, DD paragraph 69). The text also has a common review arrangement (Art. 6) and does not make the critical distinction between countries whose emissions have peaked and those who have yet to do so, which is essential for a fair review process; the former also requires more frequent reporting.

3. Justification is needed for withdrawal from a regime whose purpose is to strengthen international cooperation (Art.25)

4. Role of non-Parties in decision-making is questionable (Article 8, Draft Decision paragraphs 77 to 87), and their efforts should not be recognised along with efforts of Parties (Draft Decision paragraph 82) and kept separate for transparency.

5. Global stocktaking, another critical element, should not be limited to only consider reports of the IPCC (DD Paragraphs 60 and 61) and analytical reports submitted by Parties should also be considered for better clarity and understanding.

6. The pre-2020 review by the SBI (draft Decision paragraph 14) should be with reference to achieving the purpose of this Agreement in Article 2, and not with reference to Article 2 of the Convention.

7. The role of the secretariat should be to support the peer-review, technical expert groups and the SBI, as at present, and not extended to preparing technical papers and coordination with other intergovernmental bodies (Draft Decision paragraph 70).

8. The nominated high level champions (Draft decision paragraph 83) will dilute the role of the Bureau and the Party driven process, because they are to coordinate the involvement of non-Party stakeholders and experts with a specific budget provision making it an on-going and substantive activity, its value-added is questionable. Such activities, if agreed, should be conducted by the Bureau or the SBI.

9. The selection of experts needs to be re-visited in a universal climate regime so as not to repeat the experience of the IPCC where the Lead Authors and other experts in decision-making roles continue to be from developed countries or developing country experts who have moved to developed countries. The majority should now be from developing countries based on nominations of qualified persons by the Regional Groups.

10. Facilitation is a term that has not been defined in over 20 years of the implementation of the Convention, and is best avoided in the new regime.

In 1992, the best the developing countries could achieve was to get their key concerns into the Preamble. This negotiating text also puts the key current concern of developing countries –“recognizing the intrinsic relationship between climate change, poverty eradication and sustainable development” – into the Preamble and does not link it to any of the operative articles, and will be contested in a more equal world.

The International Science Council (ICSU) and the International Social Science Council (ISSC) in February 2015 advised the negotiators of the Global Sustainable Goals to have a greater understanding of the interplay between the social, economic and environmental dimension as the goals apply to all countries of the world, climate and development should not considered in isolation from one another and goal should guide implementation. The scientists recommended that this meta-goal be “a prosperous, high quality of life that is equitably shared and sustained.” The most recent interdisciplinary science provides an integrating vision for the new climate regime.

The differences around what constitutes a ‘balanced’ agreement should not be seen as competing visions because climate justice includes environmental integrity; both should be the basis for the provision of information, its peer- review and international cooperation to enable the agreed transformation. Let not coming generations say that they were served only moderately well by the very capable women and men negotiating the new climate regime.

*Former United Nations diplomat. Views are those of the author

Courtesy: India Environment Portal (http://www.indiaenvironmentportal.org.in/content/419937/the-negotiating-textfor-paris-an-appeal/)

COMMENTS………………

Notes: Development / Discussions in the run up to Paris COP 21

Lydia Powell, Observer Research Foundation

· The US performed an impressive back-flip and endorsed both Loss and Damage as a stand-alone section and committed an annual 0.7% of GDP to financing it.

· Negotiators from Saudi Arabia came to a newfound appreciation of human rights and are now supporting their comprehensive integration throughout the document.

· Australia has convinced the Umbrella Group to accept major compromises on both mitigation and the long-term goal.

· The latest EU numbers show that greenhouse gas emission fell 4% between 2013 and 2014. This brings the EU’s domestic emissions down to 23% below 1990 levels, and will most likely lead to below 30% by 2020. EU’s current 2020 reduction commitment is 20% below 1990.

· The Oil and Gas Climate Initiative released a report calling for a price on carbon and investment in carbon capture and sequestration.

· Shell and BHP announced a commission to advise governments on climate policy.

· Among all of the financial mechanisms under the Convention, the Adaptation Fund (AF) has made unique progress. The AF plays an important role in the climate finance landscape by providing funding for small-scale adaptation projects. It now has a portfolio of 50 such projects, enabled especially through its direct access modality. Furthermore, the AF has successfully accredited 20 national implementing entities (NIEs) and helped build local capacity

· The new version contains a good proposal featuring the AF as a key instrument of the Financial Mechanism. The AF can help recipient countries to implement their NAPs and their INDCs. Despite the scarcity of the resources, the Fund’s board received an unprecedented 15 proposals (including the first regional programmes) at its last meeting.

· This burgeoning interest may be understood as a call for more pledges to help the Fund reach the fundraising target of US$100 million by COP21.

· As the AF is a fund where all developing countries are eligible for financing in principle, it is a powerful tool for advancing the adaptation debate across the globe. Within a few years, the AF has pioneered a robust direct access and operationalised a streamlined and rapid project cycle that enables developing countries to maintain full ownership throughout project implementation and ensure monitoring and transparency at each stage.

· A new report, Fair Shares: A Civil Society Equity Review of INDCs shows that there is still a big gap between what it will take to avoid catastrophic climate change, and what countries have put forward so far.

· The report says all high emitting countries will have to do more to close this emissions gap, and this can be done in a fair way. Richer emitters must reduce their emissions substantially and they must contribute to more emissions and adaptation action by poorer countries by providing additional finance and technology access.

· The report recommends that the Paris Agreement provides a framework where governments set targets in line with fairness and what the science says is needed.

o To avoid a 3 degree world, governments must agree targets to reduce emissions in 2025, 2030, 2040 and 2050, with a view of near-zero emissions by the middle of the century;

o The Paris agreement should include a mechanism to ratchet up current targets before they come into effect in 2020, and every five years thereafter

o It should include a step-change in international climate finance;

o It should create a clear and fair plan to address the emissions gap through new cooperative action fuelled by scaled-up support from the developed countries that are most responsible.

Views are those of the author

Author can be contacted at [email protected]

Sources: Compiled from various credible sources

DATA INSIGHT……………

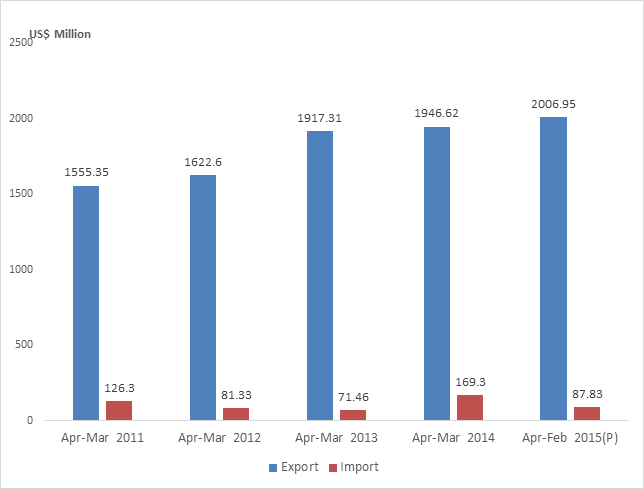

India and South Asia: Petroleum Trade

Akhilesh Sati, Observer Research Foundation

|

Trade of Commodities (in US$ Million) |

Apr-Feb 2014 |

Apr-Feb 2015 (P) |

|

Import |

||

|

Petroleum (Crude & Products) |

167.22 |

87.83 |

|

All Commodity Imports from South Asia |

2287.7 |

2610.83 |

|

Exports |

||

|

Petroleum (Crude & Products) |

1729.95 |

2006.95 |

|

All Commodity Exports to South Asia |

15643.43 |

18558.58 |

Source: Lok Sabha Unstarred Question No. 3943, 7003.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

ONGC targets $10-$12 bn foreign O&G investments

October 20, 2015. The foreign investment arm of India's top oil explorer ONGC is targeting $10-$12 billion of oil and gas asset purchases over the next three years, including more corporate acquisitions. ONGC Videsh Ltd (OVL) hopes to capitalise on cheaper assets after a slump in oil prices and Prime Minister Narendra Modi's diplomatic efforts to boost the global presence of Indian firms. OVL, which produces about 175,000-180,000 barrels per day (bpd) from its overseas assets, wants to double output by 2018 and increase it six-fold by 2030. The firm has stakes in 33 oil and gas projects from Venezuela to South Sudan but its first corporate investment in 2008, buying Russia's Imperial Energy for $2.6 billion, did not turn out as planned with output slumping to 8,000 bpd from an estimated 60,000 bpd. OVL concluded a deal to buy a 15 percent stake in Rosneft's Vankor field to secure access to about 66,000 bpd of oil production at the Siberian field. But OVL said Africa and Latin America were likely to be the hotspots for new investment with some companies financially stressed due to high capital expenditure and low oil prices. OVL is also better placed than some of its global peers to invest due to the financial strength of its parent, Oil and Natural Gas Corp (ONGC). ONGC and its Indian partners have submitted a $5-billion revised plan to Iran seeking development rights of Farzad B gas field, OVL said. The revised contract offered more flexibility and included a mix of production sharing and service contracts, OVL said. Investment could double if infrastructure is built to supply gas to New Delhi. (uk.reuters.com)

ONGC to buy into Adani-Welspun’s oil block off Mumbai coast

October 20, 2015. Oil and Natural Gas Corporation Ltd (ONGC) is in talks with Adani-Welspun Exploration Ltd (Adani-Welspun) to buy a stake in the latter’s oil block in the western offshore region off the coast of Mumbai. ONGC is in advanced talks to either partner with or completely buyout block MB-OSN-2005/2 held by Adani-Welspun since 2005. A deal could be signed before the end of the current fiscal. A pact between the two firms will help ONGC establish continuity among three of its other blocks located in the same region and develop these blocks using common infrastructure. It will also help Adani-Welspun monetize reserves in the block, which they have held for almost a decade now. ONGC has three blocks in proximity of the block held by Adani-Welspun—MB-OSN-2005/1, MB-OSN-2005/5 and MB-OSN-2005/6 which the company won in the eighth round of NELP (New Exploration Licensing Policy). While ONGC has established presence of crude oil in the block, its development for production is yet to start. Talks are at an advanced stage and Adani-Welspun is keen to monetize the block at the earliest. Adani-Welspun has two on-land exploration blocks—Cambay Basin in Gujarat and Assam-Arakan Basin in Assam—apart from the block in the Mumbai offshore. Adani-Welspun prefers to offload a partial stake than sell off the block. The move to buy into the Adani-Welspun block is a part of ONGC’s long-term plan to make western offshore its production hub. ONGC currently has three major mid-sea assets off the west coast: Mumbai High, India’s largest oil field; Bassein and satellite fields, which produce gas; and Neelam and Heera fields, which produce both. The Mumbai High asset is India’s biggest oil field producing 210,000 barrels of oil per day (bopd), while Bassein and satellites is India’s biggest natural gas producing field producing 24 million metric standard cubic meters per day (mmscmd) of gas. In November 2014, ONGC approved a total investment of ` 10,600 crore in western offshore over the next five years. In 2014-15, ONGC’s domestic crude oil production registered a marginal increase in production, mainly due to a 4.3% increase in production from its Western offshore assets. This helped reverse a 10-year trend of falling production reported by ONGC till last year, according to the company. (www.livemint.com)

Tapti gas field seen ceasing production by year end: RIL

October 18, 2015. The depleted Tapti gas field of the Panna/Mukta and Tapti (PMT) cluster in Arabian Sea is likely to cease production by the end of this year, Reliance Industries Ltd (RIL) has said. Tapti gas field, off the West Coast, produced 0.6 billion cubic feet (bcf) of gas in the July-September quarter, down from 3.9 bcf in same period a year ago, RIL said. The output was lower than 1.9 bcf in April-June this year. BG Group of UK and RIL hold a 30 percent stake each in the PMT fields while Oil and Natural Gas Corporation (ONGC) has the remaining 40 percent. Once production ceases, the consortium would move into the decommissioning phase and handover of certain Tapti facilities to ONGC, in accordance with the production-sharing contract. While Panna/Mukta are primarily oilfields, Tapti is a gas field. The production sharing contract for PMT fields was signed in 1994. Panna/Mukta fields began production in December 1994 and Tapti field began out in 1997-98. The field produced a peak of 17 million standard cubic meters per day till 2007-08 after which the natural decline set in. ONGC has agreed to take over a part of the abandoned assets of the Tapti field to produce from its fields in the western offshore. ONGC will use the Tapti field assets, which include sub-sea pipelines and gas gathering stations as well as process platform, to advance production of gas from its neighbouring Daman field. The assets include Tapti gas processing platform, which received gas from sub-sea wells, removes water and other impurities before transmitting it to onshore. ONGC will lay a small length of pipeline from the Daman field to the process platform, which is connected by a 70-km pipeline to its facility at Hazira. The BG-RIL-ONGC venture will continue to operate the Panna-Mukta field, which primarily is an oil bearing field located 90-km north-west of Mumbai in the Arabian Sea. It produced 7.2 million barrels of oil and 70.7 bcf of gas. RIL said Panna/Mukta field produced 1.88 million barrels of oil in the second quarter, up from 1.76 million barrels in the period a year ago. The fields also produced 17.2 billion cubic feet of gas. (profit.ndtv.com)

ONGC has no claims in KG gas row: RIL

October 16, 2015. Oil and Natural Gas Corporation Ltd (ONGC) will have no claims to make for natural gas migrating from its block to neighbouring contiguous fields of Reliance Industries Ltd (RIL) in Bay of Bengal after all expenses are accounted for, the private firm said. The assertion comes after US-based consultant DeGolyer and MacNaughton (D&M) in a draft report stated that about 9 billion cubic meters (bcm) of natural gas worth around ` 9,000 crore may have migrated from ONGC's idling Bay of Bengal fields to adjoining KG-D6 fields. It said that the hydrocarbon resources belong to the nation and the main objective of the PSC is for the contractor to expeditiously develop and produce such resources for the benefit of the nation. RIL believes if all the expenses it had incurred in putting up infrastructure as well as royalties and profit petroleum paid to the government on the share of gas produced is accounted for, ONGC will get nothing. D&M submitted to the two firms as well as the Directorate General of Hydrocarbons (DGH) a draft report stating that ONGC's Godavari Block (known as G-4) as well as KG-DWN-98/2 blocks are contiguous to RIL-operated Block KG-DWN-98/3 (KG-D6). According to D&M, RIL had drawn 58.67 bcm of gas from four wells near the boundary wall with ONGC block up to 31 March 2015, out of which at least 9 bcm may belong to ONGC. (www.firstpost.com)

Gas leak continues from OIL well in Jaisalmer

October 14, 2015. Gas leakage continues almost 10 days after it was first detected from an Oil India Limited (OIL) well at Dandewala area in Jaisalmer, which is near the India-Pakistan border. Though experts from OIL and Oil and Natural Gas Corporation Limited (ONGC) have been working to stop the leakage, it would take few more days for the situation to be brought under control. According to the Oil India, one effort was made to control the gas leak and it resulted in partial success. The Border Security Force (BSF) in the area and the Jaisalmer district administration has been informed of the leak. (www.thehindu.com)

Deep Industries wins order worth ` 903 mn from ONGC

October 14, 2015. Deep Industries won an order worth ` 90.3 crore from Oil and Natural Gas Corporation (ONGC). The company said that the order is for 1000 Horse Power (HP) drilling rig for ONGC’s Tripura project. The company had received a 1000 HP drilling rig project for ONGC’s Ahmadabad project. The current order book of the company stands at ` 700 crore. The company expects earnings before interest, tax, depreciation and amortization (EBITDA) growth of 50-55 percent year-on-year. The company expects more order inflows in the gas dehydration segment for which it has received some orders in April already. (www.moneycontrol.com)

Downstream………….

IOC sells rare Kandla cargo at small premium

October 20, 2015. Indian Oil Corporation (IOC) has sold 18,000-20,000 tonnes of naphtha for Oct. 29 to Nov. 3 loading from Kandla after cancelling a previous tender for the same cargo due to low bids, traders said. The state-owned refiner sold the cargo to Thai firm PTT at a premium of about $1 a tonne to IOC's own price formula on a free-on-board (FOB) basis. This was the first time this year that IOC has sold a cargo out of Kandla, data showed. Traders said domestic demand had curbed exports from Kandla but IOC continues to export naphtha regularly out of Chennai, Dahej and Haldia. IOC had earlier offered the Kandla cargo for Oct. 20-25 loading but bids were mostly at discount levels to IOC's formula on a FOB basis. Smaller parcels, below 30,000 to 35,000 tonnes, usually fetch a lower price as they do not help buyers maximise on freight rates. (af.reuters.com)

RIL's refinery margins will continue to improve: Moody's

October 20, 2015. Reliance Industries' refinery margins will continue to improve as it completes margin-enhancing projects, Moody's Investors Service said. Reliance Industries Ltd (RIL) reported a growth of 2 percent in its pre-tax profit during July-September compared to the preceding quarter. It has reported highest ever quarterly net profit of ` 6,720 crore for the July-September period. The company earned $10.6 on turning every barrel of crude oil into fuel during the second quarter of the current fiscal, the highest in the last seven years. During the second quarter, fuel oil cracks declined significantly while gasoline cracks largely remained stable as compared to the first quarter, resulting in RIL's gross refining margin (GRM) outperforming the benchmark refining margin by $4.3 per barrel - the highest in the last six years. Pre-tax profit for the petrochemical segment improved by 8 percent quarter-on-quarter despite softening product spreads as RIL's production increased by 7 percent. Moody's said earnings of the upstream oil and gas segment continued to deteriorate with a 70 percent decline as production levels and oil prices remain weak. (www.business-standard.com)

Essar Oil restarts Vadinar refinery

October 19, 2015. Essar Oil said it has restarted its 20 million tonnes a year Vadinar refinery in Gujarat after a month-long maintenance shutdown. The company had taken a 30-day shutdown from September 18 to October 17 at the refinery. The company, in this period, undertook major maintenance and inspection jobs of all its refinery units. The previous such major planned shutdown was taken in September/October, 2011. There was no production during this period. Being a continuous process industry, refinery shutdown is a meticulously planned operation which refineries need to undertake once every 3-4 years in order to maintain their operational reliability since all major units typically operate under high temperature and pressure and are subject to wear and tear as well as corrosion. During this period, all the units are thoroughly inspected and wherever required, repairs/replacements are carried out. This opportunity is also used for undertaking debottlenecking activities and improvement in facilities. Essar Oil last undertook its turnaround shutdown in September-October 2011, when it connected the base refinery with expanded units, which were then bought on-stream in phases in 2012. (profit.ndtv.com)

Transportation / Trade…………

GAIL will deploy drones to guard gas pipelines to raise safety standards

October 20, 2015. GAIL, India's largest natural gas pipeline operator, will deploy drones to guard its pipelines, as part of a host of initiatives to raise safety standards that includes replacing old pipelines and integrating advanced technologies. The move follows one of the worst accidents involving the firm in June last year when its pipeline carrying natural gas exploded in Andhra Pradesh. A government probe into the accident had highlighted safety lapses at the firm and prompted the regulator, Petroleum and Natural Gas Regulatory Board (PNGRB), to slap a penalty. The accident, along with a struggling natural gas business due to a global commodity crash, has hammered the company's public standing since. GAIL plans to conduct a pilot in 2-3 months, wherein a drone will fly over a 200-km stretch of pipeline, collecting all relevant data using smart technology. It will soon issue a tender seeking the drone services. At present, GAIL mostly deploys foot patrolling to spot encroachments and seeks local administration's help in getting those cleared. It also partly uses helicopters for the job and has spent about ` 15-20 crore on this in the past two years. The company is looking to induce a new culture of safety in the organisation. Since the accident last year, GAIL has increased patrolling and follow-up actions. The company is replacing older pipelines of about 500 km at a cost of ` 3,000 crore in three years. The advanced technological systems are being deployed to detect any safety breach and quickly respond to it. It is installing online analysers to identify moisture and corrosive substance in the supply, a key reason leading to last year mishap, and increasing frequency of integrity measures. GAIL has set up a group of specialists to monitor all pipeline parameters. About 6,500 km of the 11,000 km of natural gas pipeline the company operates have already been examined for their health and the process is underway for the rest. (economictimes.indiatimes.com)

External Affairs Minister holds talks with Turkmen counterpart on TAPI

October 19, 2015. External Affairs Minister Sushma Swaraj held talks with her Turkmen counterpart Rashid Meredov on key issues, including TAPI gas pipeline and Ashgabat Agreement on trade and transit. Swaraj met Meredov who said that they will be sending the Ashgabat Agreement copy to India for further discussion. The discussions came after Prime Minister Narendra Modi during his visit to Turkmenistan in July expressed gratitude for Turkmenistan's support to India in joining the Ashgabat Agreement on trade and transit. The Ashgabat Agreement is a transit agreement established in year 2011 between the countries of Uzbekistan, Iran, Turkmenistan and Oman. Kazakhstan has also joined the bloc. The USD 10 billion TAPI -- Turkmenistan-Afghanistan- Pakistan-India -- project is expected to bring Turkmen natural gas from its giant Dauletabad and Galkynysh gas fields to Pakistan and India. The project is likely to take off in December. (www.business-standard.com)

IOC opposes move to declare its pipeline as common carrier

October 18, 2015. Indian Oil Corporation (IOC) has opposed the move by the Petroleum and Natural Gas Regulatory Board (PNGRB) to declare 20 of its petroleum product pipelines as common carrier to allow third-party access for transportation of fuel, saying the move will hamper refinery industry and may lead to supply issues. PNGRB issued a notice to the declared 20 pipelines of IOC, accounting for close of half of the company's pipeline capacity of 80 million tons, as common carrier by reserving some portion of lines for use by third parties. The move would allow private firms like Essar Oil and Reliance Industries Ltd (RIL) to get rights to move products on the 5,900-km network. The 20 pipelines have a combined capacity to move 38.59 million tonnes of products annually.

Strongly opposing the move, IOC in its comments on the proposal said all of the 20 pipelines are for captive use. The pipelines, it said, originate from IOC's refineries and terminate at the company's depots. IOC said petroleum product pipelines are not natural monopolies as alternative modes of transport (rail/road) are available. IOC said its pipelines are not 'common carrier' under provision of the PNGRB Act of 2006 and the regulator's authority, in respect of those pipelines which are not covered within the definition of common carrier, is limited. Among the pipelines PNGRB had sought to be declared as common carrier include Barauni-Kanpur, Koyali-Ahmedabad, Mathura-Delhi, Panipat-Ambala-Jalandhar, Chennai-Bangalore, Haldia-Barauni and Guwahati-Siliguri. (profit.ndtv.com)

Policy / Performance………

OMCs increase diesel prices by 95 paise per litre

October 16, 2015. Oil marketing companies (OMCs) announced a rise of 95 paise in diesel rates, but kept the petrol prices unchanged to align the domestic prices with global product prices. Now, diesel will cost ` 45.9, including local taxes, in Delhi. The current level of international prices and rupee-dollar exchange rate warrant a price increase, which is being passed on to consumers with this price revision, Indian Oil Corporation (IOC) said. It said that the movement of prices in the international oil market and the exchange rate would continue to be monitored and developing trends of the market will be reflected in future price changes. This is the second rise in diesel prices this month. Rates were increased by 50 paise on October 1. During the last revision on September 1, petrol was cut by ` 2 per litre. Petrol currently costs ` 61.20 per litre in Delhi. It would also meet regularly to monitor the facilitation process and issue directions to the authorities concerned. (www.business-standard.com)

GAIL inks a GCA with Jharkhand govt

October 16, 2015. GAIL (India) and the Government of Jharkhand have signed a Gas Cooperation Agreement (GCA) for creation of Natural Gas and City Gas Distribution infrastructure, which will facilitate construction of ‘Urja Ganga’ Jagdishpur - Haldia Pipeline project in the state. The Jagdishpur – Haldia Pipeline (JHPL) is slated to pass through six districts of Jharkhand, i.e., Bokaro, Giridih, Hazaribagh, Singhbhum, Ranchi and Dhanbad. It will have a total of 340 kms in the state, of which 174 kms will be mainline and 166 kms spurlines. As part of the GCA, GAIL and the Jharkhand Government will evaluate ways for cooperation in development of use of eco-friendly fuel Natural Gas and related infrastructure, promotion of Joint Venture for CGD projects and study various options to evaluate the energy demand (including for Natural Gas, LPG and other liquid hydrocarbons) in the state. The Department of Industries of the Jharkhand Government shall coordinate grant of all necessary permissions and clearances required for development of Natural Gas, CGD, distribution infrastructure and associated facilities. The GCA will also facilitate establishment of pipeline connectivity from the seven Coal Bed Methane (CBM) blocks awarded in the state to various consumption centres. The 2,000 km-long JHPL, the ‘Energy Highway’ of Eastern India being constructed by GAIL, will carry eco-friendly Natural Gas to eastern Uttar Pradesh, Bihar, Jharkhand and West Bengal. (money.livemint.com)

Transparent LPG cylinders soon to keep a tab on gas quantity

October 14, 2015. The government is planning to introduce transparent cooking gas cylinders that will make it almost impossible for vendors to deliver lower-than-promised quantity and address one of the biggest complaints of liquefied natural gas (LPG) consumers. This will be a big step to raise the quality of service following the direct cash transfer and subsidy surrender campaigns that aimed mainly at plugging leakage and improving the government's finances. Oil Minister Dharmendra Pradhan favours an early rollout of the scheme. The oil ministry discussed the plan with executives of state-run fuel retailing corporations Indian Oil, Hindustan Petroleum and Bharat Petroleum. A transparent cylinder is likely to cost ` 2,500-3,000, almost double the regular steel cylinder, for which LPG distributors charge ` 1,400 as security deposit. Nearly 35 lakh households have given up their share of subsidy following appeals by Prime Minister Narendra Modi and actor Amitabh Bachchan in a high-voltage campaign for months. India has a little over 18 crore LPG consumers, of which nearly 15 crore households have already agreed to get their share of gas subsidy directly in their bank accounts, helping the government in its effort to block diversion of subsidised cylinders for commercial use. Consumers are routinely frustrated at vendors delivering much less than the promised amount of gas in cylinders. The companies expect all vendors to carry a weighing machine with them. But often the spring balance is rigged. The roll-out could begin as early as March 2015, with initial stock of transparent cylinders likely to be imported. The steel cylinders displaced by the new ones will be put to use in the rural areas where residents are fairly underserved. About two-thirds of Indians live in villages but the number of cooking gas consumers in rural areas are 40 percent less than that in urban areas. (timesofindia.indiatimes.com)

[NATIONAL: POWER]

Generation……………

Odisha to firm up 300 MW through power banking

October 20, 2015. Faced with a peak power deficit of 300-350 MW, Odisha is making all out efforts to plug the demand-supply gap. The state government is increasingly turning to power banking option to cater to its rising power demand. Odisha has already tied up 100 MW power deals with Delhi and West Bengal, on the power banking mode. Both West Bengal and Tata Power Delhi Distribution Ltd are supplying 50 MW each to the state grid. Tata Power is expected to scale up its supply to 100 MW from November and continue supplies till June next year. Gridco would return 105 percent of the procured power to the company from July next year. Meanwhile, Gridco, has sought the nod of power regulator Odisha Electricity Regulatory Commission (OERC) to buy power from captive generating plants (CGPs). Gridco wants to buy power from CGPs at a price of ` 2.75 per unit. However, CGPs are insisting on supplying power at a rate of ` 3.20 per unit or higher, a factor that could burden Gridco's finances by around ` 400 crore. Peak power deficit in the state was hovering around 500 MW but of late, it has narrowed to 300 MW after two NTPC units at Kaniha and Talcher Thermal have restarted operations. One unit of NTPC Kaniha (500 MW) and the third unit of the maharatna PSU's Talcher Thermal plant were under annual maintenance and have resumed power generation. Odisha gets 150 MW (as state share) from the Kaniha unit and 60 MW from the Talcher Thermal plant. Peak power demand in the state touched 3,900 MW but availability from various sources was 3,600 MW, leaving a shortfall of 300 MW. Average power demand stood at 3,600 MW. The state's hydro power generation suffered due to deficient monsoons. Water levels at Rengali and Upper Indravati, the two key reservoirs, were below 60 percent, hindering higher generation to plug power deficit. The state is banking on independent power producers like Ind-Barath Energy Utkal Ltd (IBEUL) and Monnet Power whose coal based power projects are likely to be commissioned soon. IBEUL has synchronised the first 350 MW unit of its proposed 700 MW coal-fired thermal power plant at Sahajbahal near Jharsuguda. Monnet Power is expected to put on stream two 525 MW units (1,050 MW) near Angul. (www.business-standard.com)

BHEL starts building 800 MW coal-fired unit at Wanakbori

October 19, 2015. Bharat Heavy Electrical Ltd (BHEL) has laid the foundation stone for the eight unit of the Wanakbori coal-fired power plant in Gujarat, consisting of seven 210 MW units (1,470 MW). The new unit will be rated 800 MW and will use supercritical technology. The project is expected to be completed within three years (by late 2018). (www.enerdata.net)

Construction of two RAPS units on: NPCIL

October 19, 2015. Construction of two 700 MW nuclear power units at the Rajasthan Atomic Power Station (RAPS) is progressing fast and preparatory work to install the coolant channels was on, Nuclear Power Corporation of India Ltd (NPCIL) said. NPCIL said the 7th unit was expected to go on stream sometime in 2017-18 and almost 57 percent of the physical work had been completed. NPCIL is building the two 700 MW pressurised heavy water reactors at RAPS with an outlay of around ` 12,300 crore. The NPCIL already has six units at RAPS, with a total capacity of 1,180 MW (4x220 MW and one each of 100 MW and 200 MW). As for the 8th unit, the overall physical progress was around 40 percent. (www.business-standard.com)

NTPC incorporates arm to run and expand Patratu power plant

October 16, 2015. NTPC said it has incorporated Patratu Vidyut Utpadan Nigam Ltd in a joint venture with Jharkhand BijliVitran Nigam Ltd for operating the Patratu thermal power plant in the state. The subsidiary has been incorporated to acquire, establish, operate, maintain, revive, refurbish, renovate and modernise the performing existing units and further capacity expansion of Patratu Thermal Power Station in Ramgarh district of Jharkhand, the company said. Patratu Vidyut Utpadan Nigam Limited has an initial authorised and paid up capital of ` 10,00,000. NTPC shall hold 74 percent of the equity share capital in Patratu Vidyut Utpadan Nigam Limited and balance 26 percent shall be held by Jharkhand BijliVitran Nigam Limited (JBVNL), the company said. (indiatoday.intoday.in)

Transmission / Distribution / Trade…

RECTPL to announce lowest financial bids for 2 projects

October 20, 2015. REC Transmission Projects Ltd (RECTPL) will announce the names of the lowest bidders on the basis of financial bids for Vemagiri II and Alipurduar power transmission projects worth around ` 8,100 crore. PowerGrid, Sterlite, Essel and Adani had submitted the bids for these two projects. Besides, Kalpataru Power Transmission has bid for the Alipurduar project. The Vemagiri II project will strengthen the transmission system beyond Vemagiri and will be called Vemagiri II Transmission Ltd. It will traverse through Andhra Pradesh and Karnataka. Similarly, the Alipurduar project will strengthen transmission system in India for transfer of power from new hydroelectric projects in Bhutan. It will traverse through Bihar and West Bengal. The government has planned to put transmission projects worth ` 1 lakh crore on the block for auction during the current fiscal. Various government panels and authorities have been backing the move to rope in private developers. Power sector regulator CERC has stated that tariffs discovered through competitive bidding are 30-45 percent lower than the cost-plus route. (economictimes.indiatimes.com)

India's domestic coal boom halts import growth

October 20, 2015. The thermal coal industry's hopes of Indian demand growth helping absorb global oversupply are being dashed by a jump in domestic production from the world's second largest importer. India is looking to more than double its total coal output to 1.5 billion tonnes by the end of this decade, with 500 million coming from the private sector. Coal India's output grew 32 million tonnes to 494.2 million tonnes in the fiscal year 2014/15, the biggest volume rise in its four-decade history. Coal fuels 60 percent of India's power production and the turnaround in India's coal industry has been a highlight of Prime Minister Narendra Modi's tenure in office since May last year, as he aims to connect to the grid millions of Indians who still make do with kerosene lamps. (in.reuters.com)

India's September coal imports slump 27 percent to 12.6 mt

October 19, 2015. India's coal imports fell 27 percent to 12.6 million tonnes (mt) in September from a year earlier as local output jumped, Coal Secretary Anil Swarup said. India is opening a mine a month as it races to double coal output by 2020. (in.reuters.com)

'Lower dependence on imported coal credit positive for IPPs': Moody's

October 19, 2015. Decline in power producers' consumption of costly imported coal in India is a key credit positive for them as well as the entire sector, Moody's Investors Service said. Some independent power producers (IPPs) are also locked into power purchase agreements (PPAs) that have become in viable because they do not allow rising fuel costs to be passed through, Moody's said. Coal India, which accounts for 80 percent of domestic coal output, raised its production by 7 percent in the financial year ending March 31 2015, and by a further 9.4 percent in the first five months of the current financial year. Output rose after the government initiated a process of auctions and allotments for coal mines. With the power sector's other challenges, Moody's is of view that the financial weakness of the state-owned distribution utilities has constrained their ability to enter into long-term PPAs with the generators. This scarcity of long-term PPAs has in turn undermined the IPPs' ability to secure binding fuel supply agreements for cheap domestic coal, as generators backed by long-term PPAs are given preferential access to such supply arrangements. Moody's said that improving the financial profile will require consistent tariff revisions and reductions in distribution leakages. (www.newindianexpress.com)

SEBs reluctant to buy power from NHPC projects

October 19, 2015. In what may impact India’s hydropower generation plans, states are averse to buying electricity from NHPC Ltd’s projects because of high tariffs. State electricity boards (SEBs) are not signing the power purchase agreements (PPAs) for the full life cycle of a project, further exacerbating the situation for the state-owned utility. The primary reason behind high tariff is time and cost overrun because of issues such as disputes between states, geological issues and resistance from the local population. In the case of the 330 MW Kishanganga project in Jammu and Kashmir, Rajasthan, Uttar Pradesh and Himachal Pradesh are unwilling to buy electricity from the same. In the case of some commissioned projects, PPAs have been signed for five years as compared to a desired 35-year period. Many SEBs are unwilling to extend even those PPAs which have been signed for five years and have lapsed. PPAs totalling 1,337 MW, enough to supply electricity to a state such as Jammu and Kashmir from projects such as Uri-II (240 MW), Parbati-III (520 MW), Teesta Low Dam-III (66 MW), Sewa-II (120 MW), Chamera-III (231 MW) and Teesta Low Dam-IV (160 MW) have only been signed for five years. Even in the case of those PPAs which have signed for five years and have lapsed, the electricity distribution companies are unwillingly to extend them due to high cost; BSES Rajdhani Power Ltd (BRPL) and BSES Yamuna Power Ltd (BYPL) refused to do so in the case of the Sewa-II project. (www.livemint.com)

Indian Railways to procure 50 MW electricity from Adani Power

October 16, 2015. As part of its budget announcement of procuring power through bidding, Indian Railways signed a contract with Adani Power for supply 50 MW for three years. Adani will provide electricity at a landed tariff of ` 3.69 per unit for the period, said a railways ministry statement, adding this would result in an annual saving of about ` 150 crore as compared to the earlier tariff of NTPC. Railway Minister Suresh Prabhu said the railway is committed to go in a big way in reducing its energy bill through an appropriate energy mix, procuring energy through bidding and using alternative sources of energy. In the railway budget this year, it was proposed to buy electricity through the bidding process at economical tariff from generating companies, power exchanges and bilateral arrangements which would result in substantial savings of at least ` 3,000 crore in next few years. (www.thestatesman.com)

Alstom T&D wins orders worth ` 1.4 bn from OPTCL

October 14, 2015. Alstom T&D India has bagged orders worth € 20 million (` 140.3 crore) from Odisha Power Transmission Corporation Ltd (OPTCL) for supply of air insulated and gas insulated substations. These substations form part of the major drive initiated by OPTCL to improve the transmission network of the state. Alstom will also deliver a GIS consisting of five 220 kV bays, nine 132 kV bays, substation automation and control system as well as associated civil works. (www.businesstoday.in)

Policy / Performance………….

'Scope to cut power tariff'

October 18, 2015. Weeks after announcing the new power tariff, which have remained constant, Delhi Electricity Regulatory Commission has said there is scope for reducing them in future orders. The commission said this could be due to a physical verification of assets and billing audit of the three discoms BRPL, BYPL and Tata Power Delhi, which is going on. The regulator has asked consumers to help identify physical infrastructure of power companies, which are either non-existent or incomplete. The commission has come out with a list of all physical assets of BYPL, BRPL and Tata Power Delhi. The commission's findings on the accuracy of the claims made by the discoms on their assets could also be a component of future tariff orders. The regulator has already completed verification of assets from 2006-11 and found minor discrepancies. Consumers have long been demanding regular inspections of infrastructure, the poor upkeep of which has led to localised outages in many areas. DERC has asked consumers to send their comments on the issue after coming out with a detailed list of all physical assets. A number of consumers and activists have openly doubted the claims made by the power companies in terms of assets and infrastructure investment. DERC is in the process of finalising the prudence check for the capital works completed during fiscal years 2006-07 to 2010-11 of the three private discoms. (timesofindia.indiatimes.com)

Odisha hopes to bag Baitarani West coal block soon

October 17, 2015. The state government hopes to bag the Baitarani West coal block soon for its PSU, Odisha Thermal Power Corporation (OTPCL), a 50:50 joint venture between Odisha Mining Corporation (OMC) and Odisha Hydro Power Corporation (OHPC). Initially, the state government had demanded allotment of Chhendipada and Chhendipada II coal blocks to OTPCL. But since these coal blocks have already been earmarked for auctions, the Coal Ministry asked the state government to seek an alternative coal block. OTPCL had earlier bagged the Tentuloi coal block. But being an underground block, it is tough to mine and would not cater to OTPCL's requirement. Most of the reserve is below 900 metre depth. Even with the use of best technologies, only two million tonne of coal can be extracted from this mine annually while OTPCL's requirement for the power project is 16 million tonne per annum (mtpa). This prompted the state government to seek an alternative coal block. The state government justified the allocation demand stating that OTPCL was a 100 percent government owned company being a 50:50 joint venture between OMC and OHPC. (www.business-standard.com)

Rajasthan signs MoUs with PSUs, companies worth ` 505 bn

October 16, 2015. The Rajasthan government signed 13 Memorandum of Understanding (MOUs) with various public sector undertakings and private companies involving investments of ` 50,527 crore. Twelve MOUs include those signed with Steel Authority of India (` 6,500 crore), RashtriyaIspat Nigam Ltd. (` 2,500 crore), Hindustan Copper (` 900 crore), Reliance Cement (` 3,400 crore), Hindustan Zinc (` 8,357 crore) and UltraTech Cement Limited (` 5,100 crore). The state government signed an MoU for ` 10,000 crore with Power Grid Corporation of India for planning and development of an inter-state transmission system for solar energy generated at solar power parks in Jodhpur and Jaisalmer districts. (www.business-standard.com)

Coal Ministry asks States to expedite clearances for auctioned mines

October 15, 2015. The Ministry for Coal has clarified to the State governments that for the purpose of transfer and mutation no fresh valuation is required for the land of coal mines that were auctioned earlier this year. The Ministry has written to the Chief Secretaries of Maharashtra, Chhattisgarh, Madhya Pradesh, Odisha, West Bengal and Jharkhand that all the land owned by the previous mine owner, whether acquired by the Government or the private party, has been directly vested to the winning bidder in the auctions held under the Coal Mines (Special Provisions) Act. The letter further clarified that the value of the coal mine land has been determined by the Coal Ministry only for the purpose of compensation to the prior allottee. The State governments had also sought clarification on whether stamp duty and registration/mutation charges are payable by the successful bidders. The Ministry of Coal clarified that stamp duty is applicable and that the successful bidders have already been informed about the same. Till date, 31 mines have been auctioned under the Coal Mines (Special Provisions) Act while 27 mines have been allotted to public sector enterprises. However, delays in getting all approvals meant only seven have started production. Coal and Power Minister Piyush Goyal had flagged the issue of confusion on stamp duty when asked about the delay in the start of production in the auctioned mines. (www.thehindubusinessline.com)

Assocham urges govt to resolve issues of auctioned coal mines

October 14, 2015. Stating that production from auctioned coal blocks have not started even after six months of mines auction in the absence of clearances by both Centre and states, industry body Assocham said it has asked the government to urgently resolve all issues. Even after six months of mines auction, output of coal has not started as clearances have not been accorded by the central and state governments, thereby hampering the cash flow in sectors, including steel and power, Assocham said in a communication to Coal and Power Minister Piyush Goyal. Assocham has requested the Power Ministry to hold the second and third installment of upfront payment till the mining lease is signed, the industry body said. The government had auctioned 29 coal blocks in first two tranches of mines auction early this year. The government had put on block barely three out of the proposed 10 mines during the third round in August. (www.business-standard.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

AGOCO to drill 93 wells in Libya within 10 yrs

October 19, 2015. The Arabian Gulf Oil Company (AGOCO) is planning to drill 93 wells in its Libyan concession areas within the next decade, according to the company. AGOCO, a National Oil Company Libya subsidiary, has interests in eight fields in the country, with the main producers being Sarir, Messla, Nafoora, Beda and Hammada. The new wells have a target potential in excess of 2.3 billion barrels of oil/condensate and 3.1 trillion cubic feet of natural gas, according to the company. The company said that Sarir, Libya’s biggest oilfield, is currently producing 130,000 barrels of oil per day, however, based on the forecast from studies “done by experts”, the field has the potential to produce 250,000 barrels per day. (www.rigzone.com)

US cancels remaining Arctic oil lease sales under Obama

October 17, 2015. The U.S. Interior Department effectively halted drilling off Alaska’s coast for the remainder of President Barack Obama’s term by canceling two sales of Arctic oil and gas leases. The decision comes less than a month after Royal Dutch Shell Plc said it would indefinitely cease exploration in the region as the company didn’t find sufficient quantities of oil or gas in a Chukchi Sea drilling zone. The cancellations highlight the changing environment for the oil industry after international prices fell more than 50 percent from their 2014 peak as supply overwhelms demand. Drilling in treacherous Arctic waters is also expensive, and Shell cited the high costs in shuttering its $7 billion search for oil and gas in the region. Alaska projects oil to account for about 75 percent of the revenue generated in the state for fiscal 2015 -- down from 88 percent the previous year -- and state politicians immediately criticized the decision to cancel the lease sales. The canceled sales were part of the Interior Department’s 2012-2017 offshore leasing program. The Obama administration in January proposed its offshore plan for 2017-2022, potentially curbing exploration in the Beaufort and Chukchi seas while opening part of the Atlantic region to drilling. The plan hasn’t been finalized. Separately, the Interior Department said its Bureau of Safety and Environmental Enforcement has denied requests from Shell and Norway’s Statoil ASA to retain their existing Arctic leases after they expire within the next five years. The companies didn’t show a “reasonable schedule of work” to explore for oil and gas under the leases, the Interior Department said. The American Petroleum Institute, a Washington-based industry group for oil and natural gas companies, said investment in the Arctic has dwindled due to uncertainty about federal regulations. (www.bloomberg.com)

Niger aims to triple oil output by 2018

October 15, 2015. Niger aims to more than triple its oil production by 2018. Output from the West African country stands at 20,000 barrels of oil per day. The government hopes to raise this to 70,000 barrels per day in the coming three years, Deputy Budget Minister Mohamed Boucha said. Production is expected to grow as the China National Petroleum Corporation (CNPC) brings a pipeline on stream in 2016 and increases its output. The pipeline will inaugurate Nigerien crude exports, carrying oil from the Agadem field to a coastal terminal in Cameroon. A deal was reached in mid-2014 between Niger and Chad for the pipeline, a 193-kilometre link to an existing Chad-Cameroon line. Niger began producing oil in 2011 following a $5 billion exploration deal struck with the CNPC. (www.theoilandgasyear.com)

US crude oil stocks jump by 7.6 mn barrels: EIA

October 15, 2015. U.S. crude stocks surged by 7.6 million barrels, the largest build since April, while gasoline and distillate inventories fell, data from the Energy Information Administration (EIA) showed. Crude inventories rose by 7.6 million barrels to 468.56 million barrels, compared with analysts' expectations for an increase of 2.8 million barrels. The rise posted by the EIA was not as large as the 9.4 million-barrel jump reported by industry group American Petroleum Institute (API). The API pegged total U.S. crude stockpiles at 465.96 million barrels. Crude stocks at the Cushing, Oklahoma, delivery hub rose by 1.125 million barrels, EIA said. U.S. crude imports rose by 247,000 barrels per day (bpd), EIA data showed. Crude stocks in the Gulf Coast region gained 3.032 million barrels to 242.971 million, their second highest level since EIA started tracking it in 1990. Only the East Coast posted a drop in crude inventories, slipping 297,000 barrels to 15.193 million. (www.reuters.com)

DEA to acquire E.ON's North Sea O&G assets for $1.6 bn

October 15, 2015. DEA Deutsche Erdoel (DEA), the German-based oil and gas (O&G) firm has signed an agreement to acquire Norwegian North Sea oil and gas assets from German utility E.ON for $1.6 bn. Under the terms of the deal, E.ON will divest 100% stake in E.ON E&P Norge, which holds the Norwegian portfolio of its oil and gas North Sea upstream business. As per the deal, DEA will also purchase stakes in additional developments and discoveries, including Snilehorn, Snadd and Fogelberg, as well as portfolio of exploration licenses on the Norwegian Continental Shelf. DEA said that the acquisition is expected to more than double its Norwegian portfolio from its current production to 75,000 barrels of oil equivalent per day. (drillingandproduction.energy-business-review.com)

Azerbaijan expects to keep oil output at ACG fields at 31.5 mt in 2015

October 14, 2015. Azerbaijan expects to keep oil production at its main Azeri, Chirag and Guneshli (ACG) fields at 31.5 million tonnes (mt) in 2015, the same level as in 2014, the Azeri state energy company SOCAR said. The company said oil production at the BP -operated ACG fields in 2014 was 31.5 million tonnes. (www.rigzone.com)

Lukoil discovers deepwater gas field in Romania

October 14, 2015. PJSC Lukoil announced that its wholly owned subsidiary Lukoil Overseas Atash BV has, along with its joint venture partners PanAtlantic Petroleum Ltd and Societatea Nationale de Gaze Naturale Romgaz SA, discovered a deepwater gas field within the Trident block (EX-30) offshore Romania. According to seismic data the field’s reserves could potentially exceed 1.05 trillion cubic feet of gas. The size of the discovery, and a precise assessment of the potential hydrocarbon reserves available at the site, will be confirmed in 2016, according to Lukoil. (www.rigzone.com)

SKK Migas approves EMP's plan to develop Seng, Segat gas fields in Sumatra

October 14, 2015. Indonesian oil and gas exploration firm PT Energi Mega Persada Tbk (EMP) reported that it has received official approval to proceed with the development of the Seng and Segat gas fields in the Bentu block in Riau, Sumatra, Indonesia. The development, approved by Indonesia's upstream regulator SKK Migas, will increase the block’s output by over 50 million cubic feet per day (mmcf/d) of gas from 2017, with the gas to be sold to Pertamina Dumai at a price ranging between $7.5 and $8 per million British thermal unit (mmBtu). Gas production from the Bentu block stood at an average of 48.1 mmcf/d as of June 30, with the existing gas production sold to PLN Pekanbaru at $5.5 mmBtu, Riau Andalan Pulp & Paper at $5.2 per mmBtu and Perusda Pelalawan at $4.7 per mmBtu. EMP -- which operates 12 oil, gas, and coal bed methane projects in Indonesia and in Mozambique -- produced 11,454 barrels of oil per day and 218 mmcf/d of gas in the first half of 2015. (www.rigzone.com)

Downstream…………

Sinopec completes $1 bn refinery expansion

October 20, 2015. Sinopec Corporation said it has completed expansion works at a refinery in eastern China by adding a 100,000 barrels per day (bpd) crude unit, and plans to raise throughput in the fourth quarter. The Sinopec Jiujiang refinery, located in Jiangxi province, is expected to process 20 percent more crude oil in the fourth quarter, it said in a report. The report did not say if the 20 percent increase was a comparison with the third quarter or with the same period a year earlier. The expansion was largely on schedule as Sinopec had earlier flagged that it would be completed in September. In addition to the 100,000 bpd crude distillation unit, new facilities at the plant included a 1.7 million tonne-per-year residue fuel hydrotreating unit and a 2.4 million tpy hydrocracking unit, designed to produce higher grade fuels. Sinopec spent 930 million yuan on environmental facilities, or 13.8 percent of total spent, said the report, which would make the total investment around 6.7 billion yuan ($1.05 billion). Sinopec plans to spend another 440 million yuan to make national five grade diesel, a quality standard similar to Euro V, by end of August next year, the report said. (www.reuters.com)

SOCAR gets US$1.8 bn loan to upgrade Baku refinery

October 19, 2015. The International Bank of Azerbaijan has approved a Manat 1.86 bn (US$1.8 bn) loan to the State Oil Company of Azerbaijan (SOCAR), which will be directed to the reconstruction of the Heydar Aliyev Baku refinery (Manat 1.26 bn, i.e. US$1.2 bn) and to gas field drilling (wells in Bulla Deniz and Azeri-Chirag-Deepwater Guneshli (ACG) fields, Manat 600 bn, i.e. US$575 mn). SOCAR aims to reconstruct and modernise its Baku refinery and to raise its capacity from 6 million tonnes (mt) per year to 8 mt per year; the gasoline production capacity will be raised to 3 mt per year. (www.enerdata.net)

China reduces oil processing as refineries shut for work

October 19, 2015. China’s crude oil processing in September fell from the previous month as refiners shut for seasonal maintenance amid an economic slowdown. Refineries processed 42.43 million metric tons of crude last month, or about 10.37 million barrels a day, according to data released by the Beijing-based National Bureau of Statistics. That’s down 1 percent from August and the lowest since July on a daily basis. The shutdowns come amid slowing economic expansion in the world’s second-biggest oil user. Gross domestic product in the three months through September grew 6.9 percent from a year earlier, the slowest quarterly pace since the first three months of 2009, based on previously announced data. China’s apparent oil demand last month fell 1.8 percent to 10.16 million barrels a day, the second-lowest in 11 months, according to data. Net oil product exports climbed to the highest in 11 months in September while crude imports rose 8.6 percent from the previous month to 6.83 million barrels a day, customs data showed. China Petroleum & Chemical Corp., the nation’s largest refiner, shut its 5 million ton-a-year Qingdao refinery in mid-September for two months and PetroChina Co.’s similarly sized Hohhot refinery in northwestern China has been undergoing work since August, according to Oilchem.net. (www.bloomberg.com)

Moroccan oil refiner Samir gets backing for $1 bn capital increase

October 19, 2015. Moroccan oil refiner Samir said it has won the backing of its extraordinary general assembly for a capital increase of 10 billion Moroccan dirhams ($1.04 billion) in an effort to end the company's financial difficulties. The country's only refinery, controlled by Saudi's Corral Petroleum Holdings, suspended production at its 200,000 barrel-per-day (bpd) Mohammedia plant since August. It said it was working on a plan to resume production, without giving details. As Morocco's only refinery, its closure would make the country entirely reliant on imports. At just under 300,000 barrels per day, Morocco's petroleum consumption is Africa's fifth largest, according to data from the U.S. Energy Information Administration. (af.reuters.com)

Total European refining margin hits new record in Q3

October 15, 2015. French oil and gas company Total said that refining margins in Europe had risen to a new record high in the third quarter (Q3) of the year. Total, Europe's biggest refiner, said its European refining margins indicator rose to $54.8 per tonne in the third quarter of 2015 from $54.1 in the previous quarter. That was the highest level since records started in 2003. The indicator had hit a four-year low in the first three months of last year. (af.reuters.com)

Ecopetrol Cartagena refinery to resume operation: Finance Minister

October 15, 2015. Colombian state-run oil producer Ecopetrol will restart operation of its Cartagena refinery on Nov. 10, Finance Minister Mauricio Cardenas said. The reopening will make Colombia self-sufficient in refined oil products it has had to import in increasing quantities during the facility's refurbishment, which will more than double its capacity to 165,000 barrels per day. The first cargo will be of 80,000 barrels and by Jan. 15 it will move as much as 140,000 barrels, Cardenas said. The expansion, estimated to cost more than $7 billion, will enable the export-focused facility to vastly increase fuel production for the domestic market, supplementing output from the inland Barrancabermeja refinery, Colombia's biggest. It will ease at least some of the financial strain Colombia's biggest company has faced since a plunge in crude oil prices from June last year, which cut net profit in the second quarter by 38.5 percent to $583 million. (www.reuters.com)

Gazprom begins construction of Amur GPP in Russia

October 15, 2015. Gazprom has started construction of the Amur gas processing plant (GPP) in the Svobodnensky District of the Amur Region, Russia. The Amur GPP will have a processing capacity of up to 49 billion cubic meters of gas a year. Planned to be developed using Linde technologies, the project involves construction of a helium production block, which have up to 60 million m3 of annual production capacity. The construction follows a deal signed by Gazprom in September 2015 with the Russian Far East, for constructing the Amur gas processing plant. (refiningandpetrochemicals.energy-business-review.com)

Transportation / Trade……….

ConocoPhillips, Dong said to sell stakes in Norway gas pipelines

October 19, 2015. ConocoPhillips and Dong Energy A/S agreed to sell their stakes in Gassled, Norway’s offshore gas-pipeline network, to CapeOmega AS, an oil company backed by Norwegian private-equity firm HitecVision AS. Conoco owns a 1.68 percent stake in Gassled and Dong holds 0.98 percent, according to network operator Gassco AS. The two companies agreed to sell this summer and both deals still need approval from authorities before they can be closed. Four other owners representing 44 percent of the shares in Gassled sued the Norwegian government over a cut in gas-transportation tariffs that they said would reduce their income by 15 billion kroner ($1.9 billion). Conoco and Dong, who were not part of the lawsuit, signed their deals with CapeOmega before an Oslo court ruled in favor of the Norwegian government in September. Conoco and Dong’s deals come at a time when oil companies are reducing spending and selling assets to counter a collapse in crude prices. Total, Europe’s second-biggest oil company by market capitalization, agreed in August to sell gas pipelines and a terminal in the U.K. North Sea for 585 million pounds ($906 million). (www.bloomberg.com)

Saudi crude oil exports fall in August to 6.998 mn bpd: JODI

October 19, 2015. Saudi Arabia's crude oil exports fell by 278,000 barrels per day (bpd) in August, despite historically high wellhead production, while volumes of shipped refined oil products rose to a record high, the Joint Organisations Data Initiative (JODI) showed. The Organization of the Petroleum Exporting Countries (OPEC) heavyweight shipped 6.998 million bpd in August, down from 7.276 million bpd in July, figures published by the JODI showed. The world's biggest crude exporter trimmed its production by around 100,000 bpd in August pumping 10.265 million bpd, but still maintained high output levels in line with a strategy of defending market share. Monthly export figures are provided by Riyadh and other members of the OPEC to JODI, which published them on its website. (www.reuters.com)

Russia's Rostec to build $2.5 bn gas pipeline in Pakistan

October 16, 2015. A unit of Russian state company Rostec will build a new gas pipeline in Pakistan which will connect Karachi with the provincial capital of Lahore, Rostec said. Rostec said that its unit, RT Global Resources, will build the pipeline with capacity of up to 12.4 billion cubic metres of gas per year, which should connect LNG-receiving facilities in Karachi with Lahore. It said that the construction is expected to take 42 months, with the pipeline reaching its full capacity by the second quarter of 2020 and expected costs of around $2.5 billion. (af.reuters.com)

EnBW to become Germany's third-largest gas player in $1.6 bn deal