-

CENTRES

Progammes & Centres

Location

[Politics of Hope: The Myth of Smart Cities]

“But cities were once the solution to the problem of prosperity for many. By diminishing distance and increasing density it created the perfect environment for prosperity through specialisation, exchange and trade. We may not achieve much by making it the problem…”

CONTENTS INSIGHT……

[WEEK IN REVIEW]

Energy…………………

· Politics of Hope: The Myth of Smart Cities

Coal………….

· Illegality of Coal allocations: Whose interests will it serve?

DATA INSIGHT………………

· Wind Power: India & Other Countries

[NATIONAL: OIL & GAS]

Upstream…………………………

· Oil Ministry proposes to extend exploration phase for deep-sea blocks by three yrs

· Cairn gets environment clearance to hike output from Rajasthan block

Downstream……………………………

· Govt plans to stop RIL from selling crude to Jamnagar refinery

Transportation / Trade………………

· GAIL plans ` 100 bn pipeline to bring CNG to Varanasi

· Proposed strike of petrol dealers called off: Maharashtra

· GAIL's subsidiary BCPL seeks over ` 120 bn subsidy

· RIL to import 1.5 million tonnes of ethane a year from US

Policy / Performance…………………

· RIL, ONGC, BP, Cairn demand immediate hike in natural gas price

· India, Vietnam to deepen cooperation in defence, oil sectors

· 70 per cent Mumbaikars to have piped gas connection by 2022: Petroleum Minister

· Govt sets up panel to decide on natural gas pricing

· Oil Ministry to seek Cabinet nod on diesel deregulation: Reports

· Oil Ministry to digitise files and important data

· PM dedicates IOC's Jasidih terminal to nation at Jharkhand

· Govt scraps off gas pricing under APM to curb fuel shortage in power plants

· Diesel prices will soon be market linked: Economic Affairs Secretary

· Cut gas from non-priority areas for retail needs: Govt to GAIL

· Under-recoveries on petro products set for drastic dip: Oil Secretary

[NATIONAL: POWER]

Generation………………

· Adani Group plans to build ` 125 bn power plant in Odisha

· Reliance Power opts out of gas-fired power plant in Dadri, to return land

· Reliance Power commissions 5th unit of its Sasan UMPP

· DVC's Purulia 600 MW unit generation hinges on land acquisition in Purulia, West Bengal

· 28 GW power capacity may be affected due to SC judgement: Deloitte

· Centre to provide financial support to J&K in generating power

· JSW Bengal says Salboni project hinges on govt support

· NTPC seeks to tie up with Coal India, BHEL

Transmission / Distribution / Trade……

· Power demand touches new high in Haryana

· Alstom bags ` 32.5 bn contract from Power Grid Corp

· DVC to suspend power supply to Madhya Pradesh

· R-Infra: Stay migration of customers to Tata Power

· NTPC cuts power supply in Chhattisgarh

· Modi to dedicate 765kv transmission line in Jharkhand to nation

Policy / Performance…………………

· Billionaires lose as India mine permits ruled illegal

· SC order on coal blocks: Mining operators face bleak future

· PowerMin moves Cabinet note to ensure coal supply for plants

· SC stays compensatory tariff for Adani, Tata

· PM meets Jaitley, Goyal; discusses bottlenecks in power sector

· Govt begins work on four new UMPPs

· Andhra seeks ` 157.1 bn central aid for 24X7 power

· PSPCL to examine financial implications of 2.74 per cent tariff hike

· 'Goa's open-cast mines can generate hydel power'

· Policy on swapping of coal linkages on cards

· India court orders Uranium Corp to probe deformities near mines

· Civil nuclear deal: India expects turbine from Japan, uranium from Australia

· Govt plans to merge all state-run hydropower firms

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Norway to cut oil-production forecasts as costs delay projects

· Hayward vies with Abramovich for profit from gas-to-liquids

· Islamic state now resembles the Taliban with oil fields

· First oil flows at CNOOC's Wenchang 13-6 field in South China Sea

· YPF makes O&G discovery in Patagonia

· Pemex tax burden bloated by water content in oil barrels

Downstream……………………

· Chile Aconcagua refinery expected to run normally soon

· BP to spend $9 bn on Australia fuel stations, exploration

· Toyo to support Petronas’ Malaysian refinery and petrochemicals project

Transportation / Trade…………

· Kurds get seizure order thrown out for Texas oil tanker

· Statoil signs agreement to supply LNG to Lithuania

· Israel nears gas sales to Egypt as Mideast unrest flares

· Iran to build mini-LNG facilities to stabilize gas supply network

· Plains to build Cushing-to-Memphis pipeline for Valero

· Russia's Gazprom Neft begins Seaborne oil shipments from Arctic Field

· Iraqi Kurds, Turkey to double oil export pipeline capacity

Policy / Performance………………

· Iran delays oil contracts conference until after nuclear talks

· Kuwait to boost oil exports to China to 500k bpd

· Russia said near oil tax plan that may cost state $6.6 bn

· European gas reverses biggest drop since 2009 on Ukraine

· Mozambique sees $30 bn investment for 2018 LNG exports startup

· Woodside sees better-priced M&A as global energy giants sell

· Ghana expects Hess offshore oil field to join project lineup

[INTERNATIONAL: POWER]

Generation…………………

· L&T inks contract with BPDB to set up 225 MW power plant in Bangladesh

· Fujian's Fuqing nuclear power plant connects to grid

· Calpine to buy Boston-area power plant for $530 mn

· PSALM reviewing bid for Malaya power plant

· Mussels force EON to close German Wilhelmshaven hard coal plant

· Dynegy to spend $6.2 bn on power plant acquisitions

Transmission / Distribution / Trade……

· Angola finances construction of power transmission line in Sao Tome and Principe

· China coal port seen as economic barometer set for record supply

Policy / Performance………………

· Nepal and GMR Consortium of India likely to sign PDA soon

· Saudi Electricity says Riyadh capacity to be online by 2017

· ADB supports 290 MW hydropower project in Lao PDR

· Japan to mull price-support system for nuclear power generation

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· India vows to buy local as solar dumping deadline passes

· Tata Power Solar & British Gas partner to solarise Toyota Manufacturing UK

· Haryana approves comprehensive Solar Power policy

· Green energy to be used to run 2,200 mobile towers

· Suzlon seeks Japanese partner to tap offshore wind market

· Tata Solar to supply 1 lakh solar panels for JNNSM project in Rajasthan

· Aries Agro commissions 100 KW solar power plant

GLOBAL………………

· US coal exports to South Korea would reduce CO2: Study

· Coal gas boom in China holds climate change risks

· China to let foreign investors trade in Shenzhen carbon market

· MSU researchers develop new transparent solar generator

· Epic drought in West is literally moving mountains

· Atlantis gets $83 mn for world’s largest tidal-stream farm

· Climate change puts Europe at dengue risk

· Africa to add more renewables in 2014 than past 14 yrs

· Climate change threatens south Asia’s escape from poverty

· Australia review Chills $20 bn clean-energy industry

[WEEK IN REVIEW]

ENERGY………………

Politics of Hope: The Myth of Smart Cities

Lydia Powell, Observer Research Foundation

|

T |

he mediation of social conflict (invariably connected to distribution of resources, wealth and power) has been a human preoccupation for thousands of years. ‘Big God’ was the first political invention of mankind to mediate social conflict. Thousands of years later it replaced ‘Big God’ with ‘Big Government’ and then quickly replaced ‘Big Government’ with ‘Big Market’. Now it is the turn of ‘Big Technology’ and its twin ‘Big Data’ to mediate social conflicts. Technology, like God or the Market, is seen as smart and powerful as opposed to Man who is ignorant and powerless.

With technology in control everything will become ‘smart’, or so we are told. For those who have the responsibility of thinking about complex social problems, this is a very attractive concept. It could both absolve them from the responsibility of solving the problem and also take on the blame if things do not work out according to plan. For a politician this is nirvana. ‘Smart’ is both vague and positive sounding which make it the most politically desirable adjective. Every politician (and also businessmen and opinion makers who choose to act as weathervanes to political power) can effortlessly convert problems into solutions by attaching the adjective ‘smart’ to the problem. The result is that we have smart growth in place of growth, smart phones instead of phones and smart cities instead of cities. We may even hear of smart politicians soon but whether he will be human is something we cannot be sure of at this point.

As an eager appropriator of the concept, the Government is leading us to believe that we can move out of our stupid old cities that are filthy, unorganised, polluted, chaotic and starved of power & water and go into gleaming smart new cities that would not have any of these problems. Technology will give us smart energy solutions that would be clean, abundant, efficient and cheap. Data will ensure that not a drop of these scare resources is wasted and so on.

The politics of hope that underpins this narrative is understandable. However those of us in the business of playing spoilsport must justify our existence by questioning the idea.

First let us ask if ‘smart cities’ is really a new idea? Unfortunately it is not. Engineers, economists and planners have studied the scientific management of cities for over a century. Major wars gave rise to the idea that military planning experience could be incorporated into city planning. Thus a range of data, information and analytical models have been used to rid the city of its stupidity. However, few of these supposedly scientific and smart plans succeeded in creating ‘cities without problems’. When one problem was solved another new one was created. This is a well documented fact. The lesson here is that we cannot plan our way out of urban social problems. Planning attempts to depoliticise what is essentially a political problem: who gets to live where, how and at whose expense?

The second question we may ask is if it is a good idea to create new smart cities? For an answer we may look at some of the smart new cities that have already been created. Once again the answer does not seem to be positive. Green-field smart cities such as Masdar in United Arab Emirates, Songdo in South Korea and the Living PlanIT in Portugal and Lavasa in India are yet to produce social or economic outcomes of any significance. They are either empty or expensive if not both. The ‘build it and they will come’ approach that underpins these smart cities is apparently not the right one, not just in the Indian context but also in the context of affluent countries like UAE and South Korea.

The third question we may ask is for whom and by whom is the smart city created? To answer this we can take a look at the small scale prototypes of supposedly smart cities that already exist within and outside India in the form of gated communities. The logic that underpins gated smart communities is the exclusion of the sources of problem not the solving of the problem. The poor (other than those serving as drivers, cooks and maids of smart people), the chaos and the noise are shut out by high walls, motion sensors, smart cameras with the back-up of armed guards, just in case smart technology fails. The resource problem is solved by privatising resource extraction and production (ground water extraction and captive/back-up power generation). How many such selfish cities can we build? Even if we do whose interests will it serve and at whose expense? What would we do with the rest who do not fit in even as butlers, maids and drivers?

The fourth question is over the desirability and justification of the mass invasion of privacy that most of the smart cities demand. For example at Masdar, a smart city designed by master architect Norman Foster, surveillance systems are designed to monitor user details such as electrical energy consumption, travel patterns, waste disposal habits etc and pass on the data to the a central control. The central control in-turn is expected to prepare a menu of options that are passed on to the smart city dweller through a hand-held device. Even if it is in the name of resource efficiency, how many of us would want our travel plans and garbage disposal habits to be monitored by a machine and passed on to others?

The final question is over corporate interests that often create problems to suit solutions that they have created. When corporate interests create anti-aging solutions, they tell us that aging is a major problem and not a human condition. So it is in the case of smart cities. Many of the devices that infiltrate smart cities are said to be products and services of technology companies that probably draw their motivation from their earlier role as defence sector suppliers. These are essentially products and services that are data driven surveillance and control solutions looking for opportunities of their application in the civil world. For the companies that make these products, the smart city is an ideal prop for their marketing campaign.

The thoughtless embrace of smartness is probably the product of what Evgeny Morosov has labelled ‘solutionism’ in his excellent book on the same topic. Under ‘solutionalism’ every human inadequacy (inefficiency and stupidity) can and must be corrected by the careful application of data driven technology. Since solutions are the product of smart data driven technologies, no solution can be left behind. Each solution must find a problem.

But cities were once the solution to the problem of prosperity for many. By diminishing distance and increasing density it created the perfect environment for prosperity through specialisation, exchange and trade. We may not achieve much by making it the problem.

Views are those of the author

Author can be contacted at [email protected]

COAL……………

Illegality of Coal allocations: Whose interests will it serve?

Ashish Gupta, Observer Research Foundation

|

T |

he recent ruling of the Supreme Court on the allocation of the coal blocks from 1993 onwards as illegal has come as a hard blow to private captive coal blocks owners. Irregularities were part of the process of the award of coal blocks to the private companies and they need to be punished. But the mainstream media is more worried about companies rather than the impact it will have on the economy. India is already facing coal shortages and the move will add to the shortage and contribute to the slowdown of the economy. The biggest losers in the current environment are our financial institutions.

Coal Mines Nationalisation Act, 1973 was amended in 1993 to allow private participation in coal mining for captive use only as notified by the government. At that time few companies had knowledge of the coal sector. Many power companies were new and were not willing to come forward to bid for coal blocks. They were also genuinely satisfied with the services of Coal India Limited. At that time even the officials of the Screening Committee were not very clear on how to select a particular company. Those were the years when coal blocks were chasing companies and not the other way around. Since there were no takers, coal blocks were awarded arbitrarily. One cannot find fault with this. The idea of the then government was to enhance the coal production rather than earn revenue for the exchequer. If the companies that were awarded coal blocks in the initial years are penalised then it must be on the basis of whether the benefit of cheaper coal was passed on to the consumers or not. If yes, they must pay a price and if not they should be heavily fined!

From the beginning, Captive Coal Policy was flawed as there was no clear direction on how to move forward. In every forum the issue of the strict qualification was raised but the important question that needs to be answered by policy makers is how they came to the conclusion that the companies engaged in power or cement production are the best qualified to mine coal. The classic example is National Thermal power Corporation which is considered as a miner but in reality one of the best power generators. Therefore the clause of the strict qualification does not make sense. The result was arbitrary allocations which were subject to manipulation by vested interests. If companies must be punished so must those who gave away coal blocks to these companies.

Coming to the question of coal auctions, auctions could not justified until the buyer interest exceeded that of the seller. That did not happen for a long time. Auctions became meaningful only when interest in coal mines multiplied. In this context cancellation of early coal allocations cannot be justified.

Despite the irregularities, some good mining companies emerged from the process of allocation. These companies have brought some coal blocks into operation. Once again the rationality of penalising serious companies that only responded to policy is not clear.

On the other hand, penalty must be imposed on coal block owners with power plants that are selling power at unjustifiably high rates given that they obtained coal blocks for free. Full electrification was the objective behind coal allocation rather than earning revenue. The answer must be sought from all the private coal block owners who have failed to contribute to affordable power to all. Interestingly, after the Supreme Court ruling the media has started saying that there is extreme coal shortage. Of course scrapping of coal blocks will create shortage but exaggerated stories of shortage at this juncture are misleading! This is probably designed to influence the Supreme Court before the second hearing on 1st September, 2014. Those who sinned must be punished but that does not mean eliminating captive miners!

The decision of the honourable court contradicts the recent call by the Government for involvement of overseas companies in the coal sector. Needless to say in such an environment no overseas company would like touch the Indian coal sector. The same holds true for the Indian companies. Beating everyone with the same stick is unlikely to serve the objective of increasing coal production! To generalise would be a mistake. To be case specific would be intelligent. This is the only way forward!

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

Wind Power: India & Other Countries

Akhilesh Sati, Observer Research Foundation

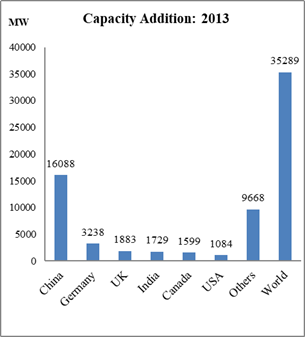

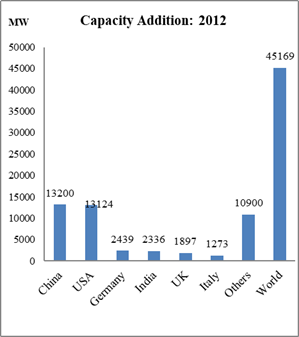

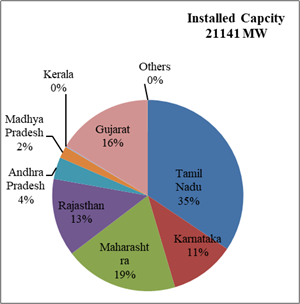

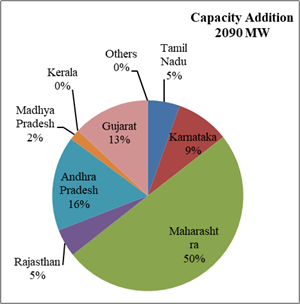

India’s Position at Global Level: 2012 & 2013 (Dec End)

Wind Power: State-wise Distribution for 2013-14

Source: 1) Global World Energy Council

2) Indian Wind Energy Association

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

Oil Ministry proposes to extend exploration phase for deep-sea blocks by three yrs

August 23, 2014. The oil ministry proposes to extend exploration phase for companies operating in deepsea blocks by three years, accepting the demand of energy firms that said the seven years allowed by the government may be adequate for onland blocks but challenging areas in deep waters required more time. In the proposed new regime for blocks, which will be auctioned in future, it has also specified that the government would have the right to impose financial penalties on contractors for "minor" errors, such as deviations from approved field development plan, delays in executing projects or small technical errors.

The ministry proposes to terminate the contract in the case of a "major default" such as knowingly submitting false statements to the government and selling of stakes in the block without prior approval of the government, the oil ministry said. The penal provision for minor defaults is a new feature of the proposed revenue sharing model to avoid litigation, the oil ministry said. The ministry has invited stakeholder comments on proposed changes in oil and gas contracts.

The government plans to introduce simpler revenue-sharing in the next auction of oil and gas blocks, so it does not need to micromanage oilfield affairs and companies have no incentive to inflate costs. After getting comments from industry and other stakeholders, the ministry will seek Cabinet approval to change the contractual regime and then it will launch the tenth round of the New Exploration Licensing Policy (NELP-X). (economictimes.indiatimes.com)

Cairn gets environment clearance to hike output from Rajasthan block

August 21, 2014. The Ministry of Environment and Forests has given environment clearance to Cairn India to raise crude oil production from its prolific Rajasthan block by 50 per cent to 300,000 barrels per day. The Ministry gave environment clearance to Cairn to produce up to 165 million standard cubic feet per day of natural gas from the Barmer basin block.

The Ministry noted that the hydrocarbon resource potential of the Rajasthan block is estimated at 7.3 billion barrels of oil equivalent and the estimated cost of project is ` 16,000 crore. According to the proposal, Cairn will develop 205 well pads for additional production/injection/EOR wells and evacuation infrastructure.

Rajasthan block produced 181,894 barrels per day of crude oil in April-June and 8 million standard cubic feet per day of gas. Cairn, which is investing $3 billion in raising oil production from the Rajasthan block, plans to invest another $200 million in developing a gas find in the predominantly oil-rich block. Gas production is planned to reach 22 mmscfd by end of the fiscal and the new investment in the field development would take it to 90 mmscfd by end of FY16. Oil and Natural Gas Corp (ONGC) holds 30 per cent interest in the Rajasthan block where Cairn is the operator with 70 per cent stake. (economictimes.indiatimes.com)

Downstream………….

Govt plans to stop RIL from selling crude to Jamnagar refinery

August 20, 2014. The Oil Ministry is considering ordering Reliance Industries Ltd (RIL) to stop selling KG-D6 crude oil to its Jamnagar refinery and instead sell it to Chennai Petroleum Corp Ltd (CPCL) at lower rates. The Production Sharing Contract (PSC) mandates producers to sell crude oil at the best available market rate so as to ensure highest profit petroleum and royalty to the government. RIL, which sold crude oil from the MA oil field in the predominantly gas-rich KG-D6 block to CPCL during first five years of production on negotiated terms, floated a tender for sale of 2.5 million barrels of oil in 2014-15. Jamnagar refinery of RIL won the tender as CPCL offered a pricing formula that was about USD 4-5 per barrel less than the formula quoted by the private sector refiner. (economictimes.indiatimes.com)

Transportation / Trade…………

GAIL plans ` 100 bn pipeline to bring CNG to Varanasi

August 25, 2014. After a cleaner Ganga, residents of PM Narendra Modi's constituency Varanasi and 16 other eastern cities can also look forward to breathing cleaner air. The Narendra Modi government has pulled out from the cold storage a ` 10,000 crore pipeline project that would make it possible to provide CNG and PNG services in these cities and revive sick fertilizer plants in the region. The project envisages laying a 2,050-km pipeline connecting Jagdishpur in UP to Haldia in West Bengal within two years. GAIL already has its main pipeline running from Hazira in Gujarat to Jagdishpur in UP via Bijaipur in Madhya Pradesh. The new pipeline will extend its reach, completing a truly West-East energy lifeline - described by the PM as 'Urja Ganga'. This would mark the first stage of creating a national gas grid, close to the Modi government's heart. Besides Varanasi, the new pipeline would also bring cleaner and cheaper fuel to Allahabad in UP; Patna, Gaya, Chapra, Siwan, Gopalganj, Muzaffarpur, Bettiah and Bhagalpur in Bihar; Bokaro, Dhanbad, Ranchi and Jamshedpur in Jharkhand; and Asansol, Durgapur and Kolkata in West Bengal. The new pipeline would help the government revive defunct fertilizer plants at Gorakhpur in UP, Barauni in Bihar, Sindri in Jharkhand and Durgapur in West Bengal by supplying gas, considered a cheaper feedstock than naphtha. In addition, the pipeline will also supply natural gas to refineries at Barauni and Haldia, steel industries, power plants and other large manufacturing units in the region. The blueprint of the pipeline was drawn and approved years ago during the UPA regime. But GAIL was reluctant to start work as it did not find the project economically feasible in the absence of anchor consumers -- essentially big and medium industries. But with the Modi government making a commitment in Parliament to develop the eastern region, GAIL sees prospects improving for major consumers. The oil ministry under Dharmendra Pradhan had recently tweaked the domestic gas allotment policy to speed up CNG and PNG services in the country to reduce vehicular pollution and subsidy on diesel and kitchen fuels. Under the changed policy, CNG and PNG services would get domestic gas for all of their demand. Domestic gas costs three times less than imported liquid gas, providing cheaper fuels for consumers. (economictimes.indiatimes.com)

Proposed strike of petrol dealers called off: Maharashtra

August 25, 2014. The proposed indefinite strike called by petrol dealers in Maharashtra has been called off after mediation by Vinod Tawade, BJP leader and leader of opposition in the state legislative council. The decision was taken after Tawade assured leaders of Federation of All Maharashtra Petrol Dealers' Association, including its president Uday Lodha, that Shiv Sena-BJP alliance would positively consider scrapping local body tax and reducing VAT if voted to power in the October assembly election. According to Lodha, Maharashtra government did not hold any talks with the Association to avert the strike. (economictimes.indiatimes.com)

GAIL's subsidiary BCPL seeks over ` 120 bn subsidy

August 24, 2014. GAIL-promoted BCPL, which is setting up a petrochemical project 'Assam Gas Cracker Project', has sought subsidy of more than ` 12,000 crore on account of feedstock and revenue for a period of more than 10 years after it starts operating. GAIL is the main promoter having 70 per cent of equity participation in the Brahmaputra Cracker and Polymer Ltd (BCPL) and the rest 30 per cent is equally shared by Oil India Ltd (OIL), Numaligarh Refinery Ltd (NRL) and Government of Assam. The Assam Gas Cracker Project will be the first ever project in the entire North-East at Lepetkata near Dibrugarh in Assam. The feedstock for the project will be natural gas and naphtha. OIL and ONGC will supply gas and naphtha shall be supplied by NRL. The Department of Petrochemicals has asked BCPL to rework on its proposal for subsidy on feedstock as gas price considered for calculating the subsidy is more than the prevailing market price. BCPL has also approved to submit a proposal for enhancement of the capital cost to ` 9,586.25 crore and this will be second time the cost of project will be enhanced. (economictimes.indiatimes.com)

RIL to import 1.5 million tonnes of ethane a year from US

August 21, 2014. Reliance Industries Ltd (RIL) is implementing a project to import 1.5 million tonnes of ethane to feed its crackers in India, taking advantage of the US shale gas revolution. Ethane is the second-largest component of natural gas after methane and it has become the dominant feedstock for crackers replacing liquids in last five years. RIL has executed storage and capacity agreements for liquefaction and export of ethane with a North American terminal, which is expected to commence operations in the second half of 2016. RIL has also ordered six state-of-the-art very large ethane carriers (VLECs) which will be the largest vessels ever built in the world. Reliance is also building facilities in India for liquefied ethane and pipeline to deliver ethane to its crackers. (economictimes.indiatimes.com)

Policy / Performance………

RIL, ONGC, BP, Cairn demand immediate hike in natural gas price

August 25, 2014. Reliance Industries Ltd (RIL), ONGC, BP and Cairn India unanimously demanded an immediate hike in natural gas prices, saying current sub-market price of $ 4.2 was impeding development of over a dozen discoveries. As the government began consultations with stakeholders on raising gas prices, gas producers and consumers met a committee of secretaries (CoS) separately with their pleas on the issue. (economictimes.indiatimes.com)

India, Vietnam to deepen cooperation in defence, oil sectors

August 25, 2014. India and Vietnam agreed to deepen cooperation in defence and oil sectors among others as External Affairs Minister Sushma Swaraj reviewed the entire gamut of bilateral ties with the strategically-important country. Putting into play the "Act East Policy" of the Narendra Modi government, Swaraj held meetings with her Vietnamese counterpart Pham Binh Minh and Prime Minister Nguyen Tan Dung during which a number of key bilateral and regional issues were discussed. Vietnam, which is involved in a tussle with China over the South China Sea, also gave a presentation to her on their point of view over this issue. The two sides also discussed Indian investments in Vietnam's oil sector.

Both sides also discussed "briefly" the five oil blocks which Vietnam had offered to India during the visit of Secretary General of Vietnamese Communist party Nguyen Phu Trong, last November. The visit to Vietnam comes just days after Hanoi renewed India's lease of two oil blocks in South China Sea for another year, a move that could rile China. China and Vietnam have an acrimonious relationship due to their standoff over the South China Sea, a huge source of hydrocarbons. (economictimes.indiatimes.com)

70 per cent Mumbaikars to have piped gas connection by 2022: Petroleum Minister

August 24, 2014. Government of India said it is preparing a concrete plan for providing piped gas connections to at least 70 per cent of households in Mumbai by 2022. Currently, there are 15 crore LPG connections in the country, while the number of piped natural gas (PNG) connections stands at around 20-22 lakh, of which Mumbai alone accounts for 7.30 lakh customers, Petroleum Minister Dharmendra Pradhan said. Modi government is committed to extend the piped gas networks in the country to 30,000 kms in the next 15 years as against the 15,000 kms network, the Minister said. Besides, the government also has plans to provide PNG connectivity to all crematoriums in the city as people often complain of power and fire wood shortage at these places, he said. (economictimes.indiatimes.com)

Govt sets up panel to decide on natural gas pricing

August 23, 2014. The government has constituted a committee of secretaries to take a decision on the contentious issue of natural gas pricing, which energy firms say is a crucial issue that can impact billions of dollars in investment in the sector and pave the way for the launch of the muchdelayed exploration licensing round. The panel will begin its deliberations with both producers and consumers of gas. It has already invited oil and gas companies, which are pitching for higher prices and argue that several new fields will not be viable unless prices are raised. The panel will also consult key consumers, who want moderate rates, because their plants will not be viable at the rates sought by gas producers. The panel will examine a wide range of issues related to gas pricing, including the Rangarajan formula, which was approved by the UPA government, but could not be implemented after the Election Commission barred it from announcing the price. The formula would almost double the gas price to $8.4 per unit from April 1.

The government said the committee would also examine gaps in the approved formula such as why it is silent on heat value, which is important for gas pricing; and why it used the weighted average of imported gas rates instead of the simple average. It will also examine whether a uniform pricing of gas is justified in the country where risks are negligible in producing gas from coal bed methane compared to deepwater fields. The committee is expected to consult all stakeholders before recommending its suggestions to the government. A final call will be taken by the Cabinet. The Cabinet Committee on Economic Affairs decided to "comprehensively review" the issues related with gas pricing in public interest. (economictimes.indiatimes.com)

Oil Ministry to seek Cabinet nod on diesel deregulation: Reports

August 22, 2014. The Oil Ministry will approach Cabinet regarding the possible deregulation of domestic diesel pricing as local prices could soon reach parity with global levels. The country regulates diesel prices to protect the poor and curb inflation and deregulation could bring the return of private firms such as Reliance Industries and Essar Oil to retail sales. Such companies do not receive federal support for selling diesel at discounted rates and currently sell via state refiners despite having their own sales infrastructure. Any decision to deregulate retail prices would require a mandate from the Cabinet. A rising subsidy bill and strained public finances in a sluggish economy forced the Cabinet in January 2013 to allow state retailers to raise retail diesel prices marginally each month. Fuel retailers have been hiking pump prices by 40-50 paise or less than a cent per litre each month since. (economictimes.indiatimes.com)

Oil Ministry to digitise files and important data

August 22, 2014. The oil ministry has decided to digitise files and important data, taking its first step towards the Narendra Modi government's e-governance plan that the Cabinet approved. The oil ministry controls many companies that deal with millions of buyers of automotive and kitchen fuel. The ministry plans to integrate such services with the Digital India programme, which aims to provide government services to citizens electronically. Oil firms have already launched a portal where customers can book cooking gas cylinders, track their deliveries, monitor subsidy transferred to bank accounts and voluntarily opt out of subsidy. (economictimes.indiatimes.com)

PM dedicates IOC's Jasidih terminal to nation at Jharkhand

August 21, 2014. Prime Minister (PM) Narendra Modi dedicated to the nation a newly built oil storage depot of Indian Oil Corp (IOC) at Jasidih in Deoghar district of Jharkhand. Spread on 26 acres, the Jasidih terminal, which was built at a cost of ` 109 crore, is the first pipeline fed terminal of Jharkhand, IOC said. The state-of-the-art terminal would handle petrol, diesel and kerosene supplies to the markets of Bokaro, Shanbad, Giridih, Deoghar, Jamtara, Godda, Dumka, Pakur and Sahibganj. The supplies to these areas are currently being met from Dhanbad and Ranchi depots. The Jasidih terminal has been equipped with product storage facilities aggregating to 31,600 kilolitres (kl). Of this, petrol would be 10694 kl, diesel 15814 kl, kerosene 4882 kl and ethanol 210 kl. The entire operations of the terminal would be controlled from a centralised Control Room, with minimum manual intervention. The terminal would be loading about 160-180 tank-trucks per day in single shift. (economictimes.indiatimes.com)

Govt scraps off gas pricing under APM to curb fuel shortage in power plants

August 21, 2014. Government has approved several relief measures such as exclusion of projects receiving gas under the Administered Pricing Mechanism (APM) from pooling and a financial package to benefit plants worth ` 1.2 trillion stranded due to shortage of fuel. In a meeting to discuss gas price pooling for the power sector, it was decided that the Ministry of Power will evaluate its impact and possible ways to meet the revenue gap arising out of that. The government will exclude those gas-based plants, which are currently receiving APM gas from pooling. The price of gas under the APM is set by the government. (economictimes.indiatimes.com)

Diesel prices will soon be market linked: Economic Affairs Secretary

August 21, 2014. The Finance Ministry expressed hope that domestic diesel prices will soon become market linked in the backdrop of softening global crude oil rates. Economic Affairs Secretary Arvind Mayaram said that with the softening of crude prices in the international market, it would be possible for the government to move to market-driven prices of diesel, sooner than later. Brent crude oil prices declined to 14-month low of $102 a barrel. Mayaram said there is an emphasis on the Direct Benefit Transfer (DBT), and hoped that in the next 2-3 years, the subsidy burden on the government will come down significantly. Currently, the retail selling price of diesel is below international market price. Government compensates retailers for the losses some three to six months later. (economictimes.indiatimes.com)

Cut gas from non-priority areas for retail needs: Govt to GAIL

August 20, 2014. The government has ordered state gas utility GAIL India Ltd to cut natural gas supplies of non- priority sectors like steel and petrochemicals so as to meet full requirement of CNG retailers like Indraprastha Gas Ltd. The Petroleum Ministry in an order said it has revised guidelines for allocation/supply of domestic natural gas to city gas distribution (CGD) entities for CNG and piped cooking gas sector. The gas would be supplied at uniform base price to each CGD entity. GAIL will undertake allocation exercise after end of every six months and supply of domestically produced gas to CGD entities based on their average consumption. Any increased requirement of the gas would be met by cutting supplies of non-priority sectors, the order said. (economictimes.indiatimes.com)

Under-recoveries on petro products set for drastic dip: Oil Secretary

August 20, 2014. The government expects under- recoveries of oil companies to come down substantially in the current fiscal on account of better pricing and stable global crude prices. The under-recoveries are expected to come below ` 1 trillion this fiscal as against ` 1.40 trillion last fiscal," Oil Secretary Saurabh Chandra said. The expected substantial contraction in the under- recoveries will come on the back of reducing gap in the pricing of petroleum products. Already, diesel under-recovery has come down to just ` 1.78 per litre as of August 15 as global crude prices have slipped to a 14-month low. On the vexed issue of new gas pricing regime, which was to come into effect from April, but deferred to September by the Modi Government, Chandra said a decision is likely to be taken within the three months deadline. He said the government is considering the Rangarajan formula on gas pricing, which had recommended doubling of rates to USD 8.4 Bmtu. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

Adani Group plans to build ` 125 bn power plant in Odisha

August 26, 2014. Adani Group is planning to invest ` 12,500 crore for setting up a thermal power project in Odisha, days after it announced the ` 6,000 crore deal to buy Lanco Infratech's plant in Karnataka. Adani Power will set up a 2,500 MW thermal power plant in Odisha from "coal reject", or residues after washing the fuel, from its two mines in the state. This plant is also part of Adani Group's plan to have a power generation capacity of 20,000 MW by 2020 and will be funded through a debt equity ratio of 70:30. The proposed ` 12,500 crore plant will be set up by a subsidiary of Adani Power. An expenditure of approximately ` 5 crore is incurred for generating 1 MW of power. (economictimes.indiatimes.com)

Reliance Power opts out of gas-fired power plant in Dadri, to return land

August 26, 2014. Reliance Power told the Supreme Court that it wasn't interested in setting up its ambitious gas-fired power plant in Dadri, Uttar Pradesh, any more and would return about 956 acres of land acquired for the company to the state government. The land has been mired in legal wrangles, with the Allahabad High Court on December 5, 2009, quashing a state move to acquire the land through an emergency clause. This allows the state to waive a clause in the law that mandates the seeking of objections from farmers before acquiring their land. The judgement made it mandatory for the state government to go back and get a no-objection certificate (NOC) from each seller or get them to return the compensation received to the government. Reliance Power and the state government had both contested the high court ruling. After all arguments in the case were completed and the top court reserved its verdict just a fortnight ago, Reliance Power submitted its affidavit, saying it would have set up the project had there been no legal issues with the land acquired for the project. The company also claimed that in the 10 years since the project was envisaged, it has become more difficult to get a regular supply of natural gas. (economictimes.indiatimes.com)

Reliance Power commissions 5th unit of its Sasan UMPP

August 26, 2014. Reliance Power’s Sasan based Ultra Mega Power Project (UMPP) started power generation from the fifth unit of 660 MW. This takes the cumulative operational capacity of the plant to 3,300 MW out of the planned 3,960 MW. Sasan UMPP is the largest integrated power plant and coal mining project in the world. Coal production has already commenced from the 20 million tonnes Moher and Moher-Amlohri coal mines associated with the power project. The sixth and last unit of the power plant is expected to commission in few months. Reliance Power said the company is hopeful to achieve a capacity of 6,000 Mw by end of 2014. With the commencement of this unit, the Reliance Power’s generation capacity has increased to 5,185 MW which includes 5,100 MW of thermal capacity and 85 MW of renewable energy based capacity. Sasan UMPP has signed power purchase agreement with utilities of seven states vis a vis Madhya Pradesh, Punjab, Uttar Pradesh, Delhi, Haryana, Rajasthan and Uttarakhand to sell power at 70 paisa per unit. (www.business-standard.com)

DVC's Purulia 600 MW unit generation hinges on land acquisition in Purulia, West Bengal

August 25, 2014. The first 600-MW unit of Damodar Valley Corporation's (DVC) Raghunathpur thermal power plant in Purulia is currently under trial run, having achieved its full load. But for commercial generation to start, sufficient land is required for constructing a water corridor. DVC said that the unit would be tested for 14 days as part of the full-load trial. However, as the state government remained supportive and if DVC did not face any further problem completing the water corridor, commercial generation could be a reality by early 2015. The second unit with the same installed capacity of 600 MW could also be synchronised over the next six months. The company has a second phase plan of 1320 MW (600 MWx2). DVC has a power purchase agreement with West Bengal and a few other states in south India. (economictimes.indiatimes.com)

28 GW power capacity may be affected due to SC judgement: Deloitte

August 25, 2014. As much as 28,000 MW of power generation capacity may be affected if the Supreme Court (SC) were to cancel coal mines that it has declared illegally allocated between 1993-2010, according to Deloitte. The 28,000 MW capacity includes output from both state-run and private sector projects. Power and Coal Minister Piyush Goyal hailed the decision of the apex court and said that the government is ready to act quickly once the court delivers its final view on the coal mines allocation. (www.business-standard.com)

Centre to provide financial support to J&K in generating power

August 23, 2014. Union Power Minister Piyush Goyal said the Centre will provide necessary financial support to Jammu and Kashmir (J&K) for realising the potential of generating 20,000 MW electricity in the state. He said the Central government will provide all financial support to Jammu and Kashmir to realise this goal. Goyal said the government, led by Narendra Modi, has focused on Jammu and Kashmir specially and the development of power sector will receive special place. He said the issues between the state and the Union Power Ministry can be easily resolved through the process of meetings and interactions. Goyal said the Union Power Ministry will provide full cooperation to the state in moving ahead confidently on road to achieve new goals in power development sector. The Minister said the huge potential of 20,000 MW of hydro energy available in the state if harnessed will not only give significant boost to the state's economy but also benefit the country. He asked the officers of Union and state governments to draft detailed project reports for all identified hydel projects so that no delay is caused at the time of the launch of each project. (economictimes.indiatimes.com)

JSW Bengal says Salboni project hinges on govt support

August 22, 2014. JSW Bengal has said it is ready to start construction activities at Salboni project as soon as the state effects changes in the agreement that allows the captive power plant executed as independent power project. JSW had signed an agreement with West Bengal for ` 35,000 crore investment for 10 million tonnes of steel and captive power plant at Salboni. (www.business-standard.com)

NTPC seeks to tie up with Coal India, BHEL

August 20, 2014. NTPC is keen to join hands with Coal India Ltd (CIL) and Bharat Heavy Electricals Ltd (BHEL) to augment its generation capacity and capability, which have been hit by coal shortage. In 2013-14, the thermal power producer’s dependency on imported coal increased to 10.39 million tonnes (mt) from 9.09 mt in 2012-13. For this financial year, the figure is expected to rise to 17 mt. The company’s fuel costs rose to ` 12,765 crore in the June 2014 quarter, 35 per cent more than in the corresponding period last year, while revenue from operations rose 16 per cent during the same period. NTPC said the robust business models of private entities in the sector offered substantial competition. The company said to improve efficiency in fuel optimisation and power generation, they were considering an active partnership with CIL and BHEL. Despite the fact that the private sector’s capacity is 1.3 times NTPC’s, its generation is lower than the public sector entity’s. Currently, NTPC has 22,414 MW of projects under construction, while private entities account for 54,286 MW. While NTPC generates 251 billion units of power, the cumulative power generation by private companies was 216 billion units. NTPC is set to commission its first hydro project of 1,499 MW by the end of this financial year. (www.business-standard.com)

Transmission / Distribution / Trade…

Power demand touches new high in Haryana

August 26, 2014. The power transmission and distribution system in Haryana supplied a record 9,152 MW after a surge in electricity demand due to rise in mercury and almost no rains in the state. The state had seen a peak load of 6,787 MW of electricity on the corresponding day last year. The Haryana Discoms (Dakshin Haryana Bijli Vitran Nigam and Uttar Haryana Bijli Vitran Nigam) supplied 1,924.71 lakh units of power against 1,428.82 lakh units supplied on the corresponding day of the last year. Duration of supply has been more than the schedule fixed by the discoms. Industries were given supply for 23.34 hours, urban consumers for 23.37 hours, rural domestic consumers for 14 hours and agriculture tube wells for over eight hours. (www.business-standard.com)

Alstom bags ` 32.5 bn contract from Power Grid Corp

August 25, 2014. Alstom has been awarded euro 400 million (` 3,250 crore) from Power Grid Corporation for building a transmission link between Haryana and Chhattisgarh. It will execute the ` 3,250 crore Ultra-High Voltage Direct Current link between Champa (Chhattisgarh) and Kurukshetra (Haryana), the French power equipment maker said. This new 3,000 MW transmission link will run parallel to the first UHVDC transmission link awarded to Alstom in 2012, increasing the total transmission capacity of the system to 6,000 MW. The link will transfer clean, bulk power efficiently from the Chhattisgarh region to the load centre in the northern region of the country, Alstom said. (www.business-standard.com)

DVC to suspend power supply to Madhya Pradesh

August 21, 2014. Damodar Valley Corp (DVC), a central government-controlled power generation firm, has decided to suspend power supplies to Madhya Pradesh due to repeated defaults, a move that may force power cuts on most of the state. As on July 31, state utility Madhya Pradesh Power Management Co (MPPMC), which has been defaulting on payments since November 2013, owed ` 595 crore to Damodar Valley Corp (DVC) even after 60 days from the date of billing, DVC told the state utility in a notice. DVC supplies 500 MW of power to Madhya Pradesh. It plans to suspend power supplies to the state from midnight of August 24. Madhya Pradesh with installed generation capacity of 4,600 MW has demand of close to 5,500-6,500 MW and DVC is one of its key suppliers. The development comes at a time when Prime Minister Narendra Modi is on an inauguration spree of power generation and transmission projects. (economictimes.indiatimes.com)

R-Infra: Stay migration of customers to Tata Power

August 21, 2014. Reliance Infrastructure (R Infra) has filed an appeal in the Appellate Tribunal for Electricity (APTEL) seeking a stay on the Maharashtra Electricity Regulatory Commission (MERC)’s recent order on change-over and switch-over of R-infra’s consumers to Tata Power in the Mumbai distribution area. R Infra has said that a stay be granted until MERC approves Tata Power’s network rollout plan in its distribution area in Mumbai and up to northern suburb Dahisar. R Infra clarified that it has not prayed for a stay on MERC's order delivered last week granting distribution licence to Tata Power in Mumbai up to August 2039. In the same order, MERC had directed Tata Power to submit network rollout in six weeks. (www.business-standard.com)

NTPC cuts power supply in Chhattisgarh

August 20, 2014. National Thermal Power Corporation (NTPC) has curtailed the power it had been supplying to Chhattisgarh plunging the state to face electricity crises. NTPC has two major power projects in Chhattisgarh. While the Korba power station had an installed capacity of 2600-MW, the Sipat Power Project in Bilaspur district had been generating 2980-MW power. The state had been getting about 1100-MW of power from the NTPC. Chhattisgarh requires about 2500-MW of power to meet the demand. The supply could be restricted to 2200-MW that had resulted in power crises in the otherwise power surplus state. The power distribution company had started power cut in the rural areas. The Naxal -infested pockets had however been exempted from the load-shedding. In the rural areas, the load-shedding had been effective for two hours daily. The urban areas had been exempted from load-shedding as of now and the decision would be taken if the crises deepened. (www.business-standard.com)

Modi to dedicate 765kv transmission line in Jharkhand to nation

August 20, 2014. Prime Minister Narendra Modi will dedicate to the nation the Ranchi-Dharamjaygarh-Sipat 765kv inter-regional power transmission line in Jharkhand. This line is the first inter-regional link between eastern region and western region. The Prime Minister will also inaugurate commencement of work at state-run NTPC's thermal power plant (3x660 MW) at North Karanpura at Chatra in Jharkhand. Central transmission utility Power Grid Corporation has implemented the Ranchi-Dharamjaygarh-Sipat inter-regional transmission line at a total cost of ` 1,600 crore. Two new sub-stations have been built at Ranchi in Jharkhand and Dharamjaygarh in Chhattisgarh. (economictimes.indiatimes.com)

Policy / Performance………….

Billionaires lose as India mine permits ruled illegal

August 26, 2014. Billionaires Anil Ambani, Kumar Mangalam Birla and Savitri Jindal lost a combined $1 billion of their net worth after India’s highest court ruled that the allocation of coal mines since 1993 was illegal. The verdict spurred concern mining permits may be cancelled and drove down the shares of their companies in Mumbai. The policy of allocating 218 mines for captive use to companies without auctioning them didn’t conform to transparency. The court on Sept. 1 will hear arguments regarding termination of the mining licenses. Annulment of mining rights may lead to fuel scarcity at several factories, including power plants and steel mills, undermining Prime Minister Narendra Modi’s aim to curb blackouts in Asia’s third-biggest economy. Inadequate coal output has prompted companies to seek supplies overseas, as state producer Coal India Ltd battles slow land acquisition and government approvals. The Coal Ministry allocated the blocks between 1993 and 2011, of which it canceled 80 permits for failure to meet production milestones, according to the ministry. Criticism about the discretionary process of allocation forced the government in 2010 to amend the mining laws and adopt a policy of auction. The nation has yet to auction its first coal mine. (www.bloomberg.com)

SC order on coal blocks: Mining operators face bleak future

August 26, 2014. The Supreme Court (SC) order, holding mining rights given out by state governments to private companies as illegal, has put the fate of companies functioning as mining developer and operator (MDO) under a cloud. Companies like Monnet Ispat, Reliance Power and Adani have chalked out plans to operate as MDOs. In April 2013, Adani announced the launch of its integrated MDO operations, with start of coal production from the Parsa East-Kente Basan mine in Chhattisgarh. The coal mine has reserves in excess of 450 million tonnes. The Union government has allotted coal blocks to 29 state government public sector undertakings through the screening committee route and another 72 blocks to PSUs under the government dispensation route. Under this, only state or central government entities were given mines. The state governments appointed MDOs for commercially mining coal in some cases. (www.business-standard.com)

PowerMin moves Cabinet note to ensure coal supply for plants

August 26, 2014. The Power Ministry has moved a draft Cabinet note to ensure coal linkages for power projects which are already commissioned or are likely to be commissioned by March. It follows Finance Minister Arun Jaitley's announcement in the Budget 2014-15 speech that adequate quantity of coal will be provided to power plants that are already commissioned or would be commissioned by March 2015, to unlock dead investments. The Power Ministry has sought suggestions of various ministries like coal, finance, law and environment on its draft note that seeks to ensure coal supplies for the thermal power plants.n (www.business-standard.com)

SC stays compensatory tariff for Adani, Tata

August 26, 2014. In major relief to Gujarat, Haryana, Rajasthan, Punjab and Maharashtra, the Supreme Court (SC) stayed an order allowing Tata Power and the Adani group to charge higher electricity tariffs on account of a rise in the cost of coal. Responding to a petition by the power distribution utilities of Haryana, the apex court stayed the interim order of the Appellate Tribunal of Electricity (APTEL) on compensatory tariff, and asked the tribunal to finalise the matter expeditiously. The levelised tariff originally offered by Tata Power’s 4,000 MW ultra-mega power project (UMPP) was ` 2.26 a unit, but after adding the compensatory tariff of 52 paise, it would have been ` 2.8 a unit. Power from Adani’s Mundra 1,980-MW power plant would have cost Haryana ` 2.39 after the compensatory tariff component and Gujarat ` 2.09. Higher tariff after March 2014 would have fetched Tata’s Mundra UMPP ` 25,000 crore and Adani’s project an additional ` 18,500 crore over its remaining life. (www.business-standard.com)

PM meets Jaitley, Goyal; discusses bottlenecks in power sector

August 25, 2014. Prime Minister (PM) Narendra Modi met Power and Coal Minister Piyush Goyal to discuss bottlenecks in the power sector and also deliberated on the fallout of the apex court's view on coal block allocation. The Supreme Court held that all coal block allocations made since 1993 till 2010 before pre-auction era during previous NDA and UPA regimes have been done in an illegal manner by an ad-hoc and casual approach without application of mind. Goyal met the Prime Minister along with Finance Minister Arun Jaitley. (www.business-standard.com)

Govt begins work on four new UMPPs

August 24, 2014. Government has started the process for setting up four new ultra mega power projects (UMPPs) in Bihar, Jharkhand and Odisha, which will together add 16,000 MW capacity to the country's power generation. UMPP is a thermal power project of at least 4,000 MW capacity, with an approximate investment of ` 25,000 crore. Power Finance Corporation, the nodal agency for UMPPs, in consultation with the state government has commenced work on these projects. Two UMPPs have been proposed in Odisha, one in Bihar and Jharkhand each. (www.business-standard.com)

Andhra seeks ` 157.1 bn central aid for 24X7 power

August 24, 2014. The Andhra Pradesh government has urged the Centre to provide financial assistance to the tune of ` 15,718 crore to support its round-the-clock Power For All (PFA) Programme. The PFA initiative requires a total expenditure of ` 54,332 crore during the next five years up to 2018-19. The state government is contemplating meeting the balance amount by taking financial assistance from PFC, Rural Electrification Corporation and various banks. It may be noted the Centre had selected Andhra Pradesh as one of the three states for the implementation of the PFA programme. (www.business-standard.com)

PSPCL to examine financial implications of 2.74 per cent tariff hike

August 23, 2014. Punjab State Electricity Regulator Commission (PSERC) announcing 2.74 per cent hike in power tariff, power utility Punjab State Power Corp Ltd (PSPCL) said it is examining the financial implications of "minimal" revised energy charges. PSPCL said the revised tariff charges will not boost PSPCL's revenue in considerable manner. PSPCL said since the Fuel Cost Adjustment (FCA) of 12 paise per unit was discontinued by PSERC, there will be virtually "negligible" impact of power tariff hike on consumers. Sparing the domestic supply consumers who consume 0-100 units from any hike in tariff hike, the commission raised the power tariff in the range of 11-13 paise per kWh for all categories except the farm sector. The announcement of consumer-friendly measures announced by PSERC would also have implications on overall revenue collection of PSPCL.

In new tariff order, PSERC has announced rebate of ` 1 per unit to consumers for consuming "more" power, 5 paise per kWh more rebate for consumers which are catered at higher voltages, raising of rebate in 'Time of Day' tariff from ` 1 per unit to ` 1.50 per unit to large supply consumers and ` 1 per unit rebate to medium supply consumers. (economictimes.indiatimes.com)

'Goa's open-cast mines can generate hydel power'

August 22, 2014. Goa's 90 odd open-cast iron ore mines, currently closed for nearly two years following a mining ban, could be tapped for generating hydel power, National Wildlife Board said. The National Wildlife Board said that mining is necessary but not at such a scale that it "consumes us". Until the time mining was banned by the Supreme Court in September 2012, Goa's 90 odd operational iron ore mines produced 45 million tonnes of iron ore annually.

The ban was lifted in April this year, but mining could not be resumed because of formalities and policies which the apex court has asked the state government to put in place. Open-cast mines are shaped like volcanic craters and in these millions of cubic feet of water is collected during the monsoon. This water is normally pumped out and is literally wasted, before mining operations begin. (www.business-standard.com)

Policy on swapping of coal linkages on cards

August 22, 2014. The Coal Ministry has said it is planning to formulate a policy for swapping of coal linkage between State utilities and Central power utilities, a move that may help in augmenting the fuel availability and reduce transportation charges. The development comes at a time when the demand-supply gap of coal is widening in the country. This follows the request being received from the Power Ministry in the recent past for swapping the linkages between two entities. At present, coal linkages given to companies are exclusive to a particular project. These linkages are non-transferable even between group companies.

The matter had also come up for discussion at the meeting of the Standing Linkage Committee held recently. It was discussed during the meeting that in the event of the policy being framed, each proposal of swapping shall be decided on case to case basis, depending upon merits and there shall be no automatic route for swapping between two entities. (www.business-standard.com)

India court orders Uranium Corp to probe deformities near mines

August 21, 2014. India’s sole uranium mining company is being ordered by a regional court to disclose radiation levels and the presence of any heavy metals in soil and water in a cluster of villages with reports of unusual numbers of deformed and sick children.

The order by the Jharkhand High Court also mandates that Uranium Corp of India Ltd explain how it ensures the safety of nearby civilian populations who may be exposed to its 193-acre radioactive waste dump near the village of Jadugora in eastern India. (www.bloomberg.com)

Civil nuclear deal: India expects turbine from Japan, uranium from Australia

August 20, 2014. Japan and Australia might soon join a clutch of countries that co-operate with India in the civil nuclear sector. Japan is the leading producer of turbine required for 1,000 MW capacity. The proposed civil nuclear deal will be mutually helpful to both India and Japan. While Japan can tap huge business potential in India's nuclear sector, India will be able to get India will certainly benefit to get the equipment which is not available generally, the Department of Atomic Energy (DAE) said.

On India’s civil nuclear deal with Australia, the DAE said the latter with its huge uranium reserves will be able to meet India’s future supplies. Australia holds a third of the world’s recoverable uranium resources and it exports nearly 7,000 tonnes a year. Since 2005 onwards, India has entered into civil nuclear agreements with the US, Mangolia, Australia, Namibia, Argentina, the UK, Canada, Kazakhstan and South Korea.

The DAE said India will also get uranium supply from Canada, France, Russia, Mangolia, Namibia and Kazakhstan. During 2011-12 and 2013-14, India imported 2,100 tonnes of uranium. Canada, one of the largest producers of pressurised heavy water reactors, can export those reactors to India. South Korea, which manufactures 1,000 MW reactors, can supply them to India in its ongoing capacity programme.

At present, reactors with a total capacity of 3,300 MW are under various stages of development. In addition to this, start of work on 19 new nuclear power reactors with a total capacity of 17,400 MW is planned in the XII Five Year Plan. These reactors are expected to be completed progressively in the XIII Plan/ XIV Five Year Plan. More reactors are also planned in future, based on indigenous technologies as well as with foreign technical cooperation. (www.business-standard.com)

Govt plans to merge all state-run hydropower firms

August 20, 2014. The government plans to create public sector energy giants with a massive restructuring exercise that will amalgamate all state-run hydropower firms and transfer their thermal projects to NTPC to create strong companies that can take on the rapidly growing private conglomerates. The exercise aims to merge all four central hydropower companies.

According to the proposal, NHPC, SJVN, THDC and NEEPCO may be merged into one organisation that will control 10,000 MW of existing and 32,500 MW of proposed capacity. It would also transfer 4,600 MW of thermal plants controlled by hydro firms to NTPC, which in turn would shed 1,400 MW of its hydropower plants if the proposal goes through. (economictimes.indiatimes.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Norway to cut oil-production forecasts as costs delay projects

August 26, 2014. Norway, western Europe’s biggest oil producer, will probably cut its long-term forecast for crude production as companies reduce spending to counter rising costs and improve shareholder returns. As investments in Norway’s oil industry fall after a peak this year, production beyond 2015 will be lower than expected, according to the Norwegian Petroleum Directorate (NPD). The estimate cuts are expected to be reflected in the NPD’s annual prognosis scheduled to be published in January. Norway is struggling to sustain oil production that’s more than halved since a peak in 2000 as producers including Statoil ASA scale back spending plans. The NPD in its latest prognosis in January predicted oil production would rise this year and remain stable through 2018. Still, the forecasts were lower than those made at the beginning of 2013. Oil companies operating in Norway could reduce investments by more than 20 percent next year as they fight costs that have cut margins amid stagnating oil prices, Statistics Norway said. Statoil said it will cut planned investments during the next three years by 8 percent at the same time as abandoning earlier goals for production growth. (www.bloomberg.com)

Hayward vies with Abramovich for profit from gas-to-liquids

August 26, 2014. Tony Hayward, the ex-head of BP Plc, and Roman Abramovich, the billionaire owner of London’s Chelsea Football Club, are vying to prove small-scale plants that turn natural gas into liquid fuel can make a profit. The technology is attractive for two reasons. First, the shale boom in North America has flooded the market with gas, making it cheap relative to oil. Second, in many countries drillers are no longer allowed to burn off gas that’s a byproduct of oil drilling. The market to stop gas flaring at oil fields alone could be worth $375 billion, according to Oswald Clint, a Sanford C. Bernstein & Co. analyst in London. While a $19 billion Royal Dutch Shell Plc project in Qatar has proved gas-to-liquids works in very large plants, the challenge is making it economic on a smaller scale. Hayward and his partner Ian Hannam, an ex-JPMorgan Chase & Co. banker, together stepped in to restructure the unprofitable business in February. Abramovich, who made billions in the Russian oil industry, has been building its stake in Velocys Plc, a $400 million company that’s working on technology to make fuel from shale gas in the U.S. Velocys and CompactGTL, both based in the U.K., are working on gas-to-liquids plants with a maximum capacity of 15,000 barrels a day, which is about a 10th the size of Shell’s Pearl venture in Qatar, the world’s largest. Chevron Corp. this year started work on a 33,000 barrel-a-day Escravos plant in Nigeria, expected to cost $8.4 billion. Even on a smaller scale, gas to liquids is expensive. The plants cost about $100,000 for each barrel of capacity to produce liquid fuels. Both companies say that they can make the business profitable. (www.bloomberg.com)

Islamic state now resembles the Taliban with oil fields

August 26, 2014. With its reign of terror over a large population and ability to self-finance on a staggering scale, the extremist group that beheaded American journalist James Foley resembles the Taliban with oil wells. The Islamic State, which now controls an area of Iraq and Syria larger than the U.K., may be raising more than $2 million a day in revenue from oil sales, extortion, taxes and smuggling, according to U.S. intelligence officials and anti-terrorism finance experts. The revenue streams available to the Islamic State through its control of a vast oil-rich territory and access to local taxes dwarfs the income of other groups. With its control of seven oil fields and two refineries in northern Iraq, and six out of 10 oil fields in eastern Syria, the terror group is selling crude at between $25 and $60 a barrel, Luay al-Khatteeb, a visiting fellow at the Brookings Institution’s Doha Center in Qatar, said. That reflects a discount from world market prices due to the risk faced by middlemen smuggling and brokering the oil. By comparison, Brent crude for October settlement fell 1 cent to $102.28 a barrel on the London-based ICE Futures Europe exchange. (www.bloomberg.com)

First oil flows at CNOOC's Wenchang 13-6 field in South China Sea

August 26, 2014. China's largest offshore crude oil and natural gas producer CNOOC Ltd announced that it has commenced production at the company-operated Wenchang 13-6 oil field in the Western South China Sea, offshore China. The Wenchang 13-6 oilfield, located in average water depths of approximately 393 feet on the west of Pearl River Mouth Basin, is part of the Wenchang oil fields and shares the existing adjacent facilities for the offshore development. The main production facilities comprise one wellhead platform and 12 producing wells, including 5 wells that are currently producing approximately 1,300 barrels per day. First production from Wenchang 13-6 oil field, in which CNOOC has a 100 percent interest, has been brought into operation as indicated in a company presentation in January. CNOOC commenced production at Panyu 10-2/5/8 oil development in the Pearl River Mouth Basin in the South China Sea, while first gas flowed at the Lingshui 36-1 field offshore Zhejiang province, China in late July. (www.rigzone.com)

YPF makes O&G discovery in Patagonia

August 25, 2014. Argentine state-controlled oil company YPF said that it had struck oil and gas at a well drilled in Patagonia. The find has potential production of 200,000 cubic meters of gas and 370 barrels of oil per day, the company said. The well was drilled to a depth of 2,770 meters. Located in the province of Santa Cruz, where President Cristina Fernandez first rose to power, the discovery is a rare piece of good news for the president, who is struggling with an economy in recession and recent debt default. Argentina needs more oil and gas production to halt a drain on central bank dollar reserves caused by expensive energy imports. (www.rigzone.com)

Pemex tax burden bloated by water content in oil barrels

August 23, 2014. Petroleos Mexicanos, the crude producer that accounts for about a third of state revenue in Mexico, said it pays taxes on oil production volume that’s inflated by water and other measurement inaccuracies. Under existing law, the company known as Pemex pays some taxes based on reported volume at the wellhead, it said. Pemex cut its year-to-date production to 2.34 million barrels a day from a previously reported 2.47 million. (www.bloomberg.com)

Downstream…………

Chile Aconcagua refinery expected to run normally soon

August 25, 2014. Chile's Aconcagua oil refinery has made progress in returning to normal operations since it was partially halted following an earthquake and is expected to be running normally in the next few days, the state-run oil firm ENAP said. ENAP stopped some operations as a security measure following a 6.4 magnitude quake in central Chile. Chile has two major oil refineries, Aconcagua and Bio-Bio, both run by ENAP. (www.downstreamtoday.com)

BP to spend $9 bn on Australia fuel stations, exploration

August 22, 2014. BP Plc, the operator of the biggest oil refinery in Australia, plans to spend A$10 billion ($9.3 billion) expanding its filling station network and developing oil and gas projects such as the Browse venture. The company will open a dozen new filling stations during the next 12 months while seeking to increase the fleet through acquisitions. The London-based group will spend about A$2.3 billion over the next five years on its downstream unit that also includes the Kwinana refinery in Perth. BP is seeking to expand its retail business even as it scales back refining in Australia while companies including Trafigura Beheer BV, the world’s third-largest independent oil trader, and Vitol Group gain a foothold in the industry. The company will also spend more than A$1 billion on a deep-water drilling campaign off the southern coast. The company owns about 330 of the 1,300 BP-branded filling stations in Australia. It will halt operations at its Bulwer Island refinery in Queensland by mid-2015 and may convert the facility into a fuel-import terminal amid competition from Asia. (www.bloomberg.com)

Toyo to support Petronas’ Malaysian refinery and petrochemicals project

August 22, 2014. Toyo Engineering has received steam cracker complex (SCC) project services contract from PRPC Refinery and Cracker, a subsidiary under the Petroliam Nasional Berhad (PETRONAS) group, Malaysia’s national oil and gas company. Under the JPY240bn ($2.32 bn) contract, Toyo Engineering will provide services for a SCC at Pengerang in Johor, Malaysia. A consortium comprising Toyo-Japan and Toyo-Malaysia will manage the contract. The steam cracker complex, slated for construction at Petronas' refinery and petrochemicals integrated development (RAPID) project in Pengerang, Johor, Malaysia, will be completed in the middle of 2019. RAPID is considered to be the largest liquid-based green-field downstream in Malaysia, and is a part of Petronas's Pengerang Integrated Complex (PIC) development, which is valued at $27 bn. The project will feature a refinery with a capacity of 300,000 barrels per day, and a petrochemical complex. (refiningandpetrochemicals.energy-business-review.com)

Transportation / Trade……….

Kurds get seizure order thrown out for Texas oil tanker

August 26, 2014. The Kurdistan Regional Government can bring $100 million of crude ashore in Texas after a U.S. judge threw out a court order that would have required federal agents to seize and hold the cargo for the Iraqi Oil Ministry until a court there decided which government owns it. U.S. District Judge Gray Miller in Houston said he lacked authority under federal laws governing property stolen at sea to decide the dispute. Both Iraq’s central government and the regional government claim control of 1 million barrels of Kurdish crude waiting in a tanker moored in international waters off the Texas coast for almost a month. Miller ruled that Iraq’s national oil ministry lost control of the crude when the Kurdish government pumped it without authorization from oilfields in the northern part of the country. Iraq failed to convince Miller that the oil was misappropriated when it was loaded into a tanker in the Mediterranean Sea after being pumped across Turkey in an Iraq-owned pipeline. (www.bloomberg.com)

Statoil signs agreement to supply LNG to Lithuania

August 25, 2014. Norway's Statoil has signed an agreement to supply liquefied natural gas (LNG) to Lithuania, in an effort to cut the nation’s dependence on Russia. Under the $1 bn contract, Statoil will supply 0.54 billion cubic metres (bcm) of gas from 2015, which is enough to meet about one-fifth of Lithonia's total needs.

According to Lithuanian importer Litgas, about 900-1,000 litas ($346-$384) per 1,000 cubic meters will be paid by Lithuania for the Norwegian gas based on NBP prices for the last four months. (transportationandstorage.energy-business-review.com)

Israel nears gas sales to Egypt as Mideast unrest flares

August 21, 2014. In the midst of some of the worst Middle East tensions in a decade, one-time enemies Egypt and Israel are negotiating deals that may mean the sale of $60 billion in Israeli natural gas to liquefaction plants in Egypt. The talks come as Israel resumes air strikes on Gaza after Hamas, which the U.S. and the European Union classify as a terrorist group, fired rockets following a breakdown in Egypt’s efforts to broker a cease-fire. The move is all the more improbable because Egypt -- little more than a year ago -- was under the sway of the Muslim Brotherhood, which had begun to steer the country away from viewing Israel as a trading partner. Noble Energy Inc. and units of Israel’s Delek Group Ltd. plan to deliver as much as 6.25 trillion cubic feet of gas from the Tamar and Leviathan offshore fields to LNG facilities in Egypt’s Damietta port and the coastal town of Idku. (www.bloomberg.com)

Iran to build mini-LNG facilities to stabilize gas supply network

August 21, 2014. Iran is planning to construct mini-LNG plants in order to balance the gas network pressure and the supply of natural gas to remote areas, the National Iranian Gas Company (NIGC) said. The mini-LNG plants, each with a storage capacity of 90 million cubic meters (mcm) of natural gas, will be built in four border regions that have low temperature. Mini-LNG facilities will enable supply of gas to villages and will be more cost-effective than pipe networks. The plants, which will be constructed with an investment of $100 mn, can stabilize the gas supply network of the country. (transportationandstorage.energy-business-review.com)

Plains to build Cushing-to-Memphis pipeline for Valero

August 21, 2014. Plains All American will build a crude oil pipeline from its terminal at the U.S. futures hub in Cushing, Oklahoma, to Valero Energy Corp's Tennessee refinery, helping the largest U.S. refiner cut transportation costs to tap cheap inland U.S. oil. Plains said it will build the 440-mile (708 km), 200,000 barrels-per-day (bpd) Diamond Pipeline to the 180,000 bpd refinery, which is configured to process light crudes. The $900 million project is targeted to start up in late 2016, Plains said. (www.downstreamtoday.com)

Russia's Gazprom Neft begins Seaborne oil shipments from Arctic Field