-

CENTRES

Progammes & Centres

Location

[Energy Security: Multiple interpretations of an undefined idea!]

“The important priority for India is to provide electricity to all, infuse efficiency and expedite indigenous resource production. India must acquire stakes in energy blocks overseas. India’s energy security program lacks vision because of the weak political structure. India’s energy security is related to affordability. It cannot be experimenting with energy resources on the advice of developed nations.…”

CONTENTS INSIGHT……

[WEEK IN REVIEW]

Energy/power…………………

· The Personalisation of Power Generation in India

Energy…………………

· Energy Security: Multiple interpretations of an undefined idea!

Energy…………………

· Natural Gas in India: An Analysis

DATA INSIGHT………………

· Small Hydro Power Scenario in India

[NATIONAL: OIL & GAS]

Upstream…………………………

· Cairn says Rajasthan block holds 1-3 Tcf of gas reserves

· GSPC’s KG gas to sell at $4.2 per unit till Oct

· OMEL gives up oil block in Nigeria

· ONGC net misses estimate after dry well write-offs double

Downstream……………………………

· IOC to hike processing of cheaper crude to 30 per cent by 2017-18

· MRPL buys 2nd Argentinian crude cargo this year

Transportation / Trade………………

· IOC to invest ` 12 bn on LPG pipeline projects

· India in advanced talks for gas export to Pakistan

· Petroleum Ministry says negligence caused fire at GAIL pipeline in Andhra Pradesh

· GAIL issues tenders for LNG vessels from the US

Policy / Performance…………………

· Indian refiners' credit metrics to improve in 12 months: Moody's

· Oil ministry plans to relaunch NELP X to bring simpler sharing of revenues

· Diesel can be market-priced by Sep as crude falls to $100

· RIL, Essar may resume fuel retailing by Diwali

· Modi govt limits investigative agency's powers in gas pricing case

· Petroleum Ministry says presentation ‘forged’, no new gas price formula

· Top officials of power, oil ministries to meet PMO on gas price pooling

· New natural gas pricing formula by Sep 30: Govt

[NATIONAL: POWER]

Generation………………

· BHEL develops new boiler for power generation

· JSW Energy eyes JP Power's Bina, Nigrie power plants

· Lanco Infratech puts plants with 3 GW capacity on sale to reduce debt

· Power capacity addition nearly doubles in April-July 2014

· NLC to add 2.5 GW in 3 yrs

· Tata Power aims to double generation capacity to 18 GW by 2022

Transmission / Distribution / Trade……

· APEPDCL starts recovery of pending dues worth ` 9 bn

· PGCIL comes under vigilance lens over gear tender process

· Jaya seeks Modi's help for long-term access to TN's power suppliers

· Modi to dedicate Raichur-Solapur transmission line

Policy / Performance…………………

· Madras HC dismisses PIL against Cheyyur UMPP

· Govt proposes to ensure coal supply to each

· Meghalaya tribals oppose Jaypee getting power project

· DAE team to visit US to explore funding options for projects

· Modi eyes 24x7 power supply, bats for saving electricity

· Tata Power gets Mumbai power distribution licence for 25 yrs

· Power tariff increase in Kerala from Aug 16

· ` 1 bn unpaid power charges due from Assam govt depts

· West Bengal is going to get two more power plants

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Apache Australia oil find boosts potential sale value

· PetroChina said to plan energy asset sale in restive Xinjiang

· Carnarvon Petroleum announces Phoenix South-1 oil discovery

· UK's Elgin gas field to restart production: Total

· Rosneft, Statoil start exploration for oil, gas in Norway

· Mexico oil output bloated by water barrels

· Exxon ends oil search with Total in South Sudan as war rages

· Expats flee Iraq’s oil boomtown as Islamic state attacks

Downstream……………………

· Thai Oil eyes refinery upgrade in Indonesia, Myanmar

Transportation / Trade…………

· Capacity set to double on Iraqi Kurdistan's oil pipeline

· South Stream venture in Bulgaria raises capital despite ban

· Qatargas delivers first LNG cargo to China's Hainan terminal

· PetroChina Reviews Push to Produce LNG Used in Transport

· Libyan gas flows to Italy climb as Russian supplies threatened

· US Energy Dept finalizes overhaul of natural gas export reviews

Policy / Performance………………

· PetroChina said to plan energy asset sale in restive Xinjiang

· Hedge Funds least bullish on Brent crude in two yrs

· Thailand aims to liberalise gas pipeline business by mid-2015

· World awash in oil shields markets from 2008 price shock

· Ukrainian parliament backs bill to open gas pipelines to EU, US firms

· Pemex granted all probable reserves sought in oil opening

· Norway sees no krone volatility exit as oil crowds economy

· Norway oil services see Russia sanctions risking arctic push

· US cuts 2014 oil price forecast as production surges

[INTERNATIONAL: POWER]

Generation…………………

· Russia to build Jordan's first nuclear power plant

· Panda Power starts construction on 829 MW Patriot power plant in US

· Coal’s reign ebbing in UK may delay new plants

Transmission / Distribution / Trade……

· GDF Australia assets said to draw interest from PTT, Keppel

· Emerson taps Goldman for $1 bn-plus power unit sale

Policy / Performance………………

· Mexico to award $4.9 bn of power plants and pipes

· China plan to cut wholesale power price may help coal producers

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Goyal announces 2 GW solar project for Punjab

· People's Climate March in Delhi Sep 20 to seek action

· India ranked 5th amongst top 10 wind power producers: Report

· Import levy could push solar projects into litigation: MNRE

· AP to announce new solar power policy soon

· Welspun to invest ` 150 bn in solar, wind energy segments

· Solargise buys majority stake in Grapp Energies for $200 mn

· Tata Power Solar commissions plant in AP

GLOBAL………………

· Solar boom driving first global panel shortage since 2006

· Uruguay agrees to buy 9.8 MW of solar power for 30 yrs

· Mexico approves 220 MW of solar projects

· SunPower starts solar leasing program for homes in Australia

· UK wind generated record 22 per cent of electricity

· HSH Nordbank provides $150 mn in solar farm loans in France

· Obama’s green dilemma: Punish China, imperil US solar

· China seeks to close loophole on solar polysilicon import duties

· Trina Solar acquires 49.9 MW solar power plant in UK

· Antarctic melt may lift sea level faster in threat to megacities

· Groups sue EPA for failing to make polluters pay

[WEEK IN REVIEW]

ENERGY/POWER……………

The Personalisation of Power Generation in India

Lydia Powell, Observer Research Foundation

|

T |

he news that may have shocked keen observers of the Indian energy sector last week is that India has about 90 GW generating capacity in captive industrial and commercial back-up diesel generators above 100 kVA. This is roughly 36% of current installed capacity. If small back-up generators of household/small business are included this capacity may increase to perhaps 50% of total installed capacity. One could very easily use this figure to present the picture of an acute shortage of supply and huge unmet demand for electricity. There is another piece of information which says the exact opposite. Against an installed capacity of 243 GW, peak demand is only 130 GW which when interpreted in a narrow technical sense means that there is a huge surplus in power generation. If we generalise these two pieces of information we would arrive at diagonally opposite but inaccurate conclusions. In order to understand why such extreme contradictions co-exist in the country we need to unpack the issue carefully and look at the granular details and also go beyond mere technical perspectives.

From a technical perspective, the contradictions can be understood by taking into account the discontinuities in the spatial and temporal dimension of power supply and demand. According to the minutes of the meeting of the central advisory committee of the CERC, all States except Bihar and Punjab have contracted capacities that exceed peak demand. However, only a handful of States meet their peak demand from contracted capacities. Many of the States including Delhi have large off peak surpluses. Part of the reason is that the physical link between the two, i.e, the transmission capacity, is either inadequate or non-existent. Either the new generating stations that have been commissioned lack evacuation capacity or those with transmission capacity lack generating capacity. This spatial inconsistency is one of the major reasons why surplus and scarcity co-exist in the country. The extent of curtailed volume due to transmission congestion is said to have increased from 2000 million units (MU) in 2011-12 to over 6000 MU in 2013-14. The other is temporal inconsistency, which means that off peak surplus in many States (such as during winter in Delhi) does not exactly coincide with peak demand in other parts of the country. When they do, the flow of electricity from surplus to deficit is stopped by the lack of physical infrastructure.

There is yet another dimension to the problem. The sub-optimal electricity network system that is unable to connect supply with demand has to operate on the back of a sub-optimal and distorted market. This means that electricity cannot flow from a region of surplus to a region of scarcity even when physical networks exist to facilitate such a transfer. States with surpluses do not find buyers even at times of intense load shedding because illiquid SEBs of deficit states prefer load shedding to buying power at market rates. On the other hand some States are reluctant to sell power in the short term market as cost of surplus generation and procurement is more than the average short term rate. For example in Delhi, where the average power generation tariff is ` 3.92/Kwh with top 10% of the most expensive electricity available at ` 5.78/kwh, it does not make sense to sell electricity at the short term market at ` 2.89/kwh. Delhi discoms would sell surplus power only if the prospect of recovering part or all of the fixed cost of generation in addition to the energy charge arises. Moreover revenue gaps in some States lead to under-contracting and consequent peak deficit. In some States the regulator imposes a price cap on the purchase of short term power.

Coal and gas shortage have received much media attention as the reason for power shortages probably because it is easy to establish the causality: There is no power because there is no gas/coal. However the stranded capacity of coal and gas based generation which are held up as examples of coal and gas shortages are the result of inadequate assessment of electricity demand, reckless speculation and risk taking on supply.

In this sub-optimal environment, it is quite natural that the consumers, be it industrial, commercial or household prefer to invest in robust and reliable diesel generators at substantially higher cost than wait for two inadequate networks (electricity and market) to be sorted out by the State. The large scale decentralisation and privatisation of electricity generation (even though it may be limited to most affluent 20% of electricity consumers who account for 70% of power consumption) guarantees uninterrupted supply of power at a price. Those unwilling to pay that price have no choice but to live without electricity.

The privatisation of supply is not a phenomenon unique to electricity. In the case of water, most industrial, agricultural and household users of water have resorted to what the water expert Tushar Shah calls ‘water scavenging’ to access ground water over which the State exerted little control or regulation until very recently.

While privatised power generation meets the demand for uninterrupted supply for those who can afford to pay for it, it takes a heavy toll on the economic prosperity of the nation. As it excludes those who cannot be part of such arrangements, it also takes a toll on the quality of life of millions of people.

The most important question that must be raised here is why consumers in India opt to privately acquire goods that are publicly provided in most other nations? The minutes of the meeting of the advisory body referred to above observes that large consumers of electricity prefer captive diesel generation to paying a smaller premium for uninterrupted supply from utilities. This could partly be due to lack of trust but partly due the nature of civil society in India that does not want to look beyond its own interests. Why does the middle class not demand for the provision of these resources and hold the State to ransom when such services are denied? In the last few decades exit of the middle class from publicly provided services such as education and health care resulted in the exit of the State from such services or the substantial decline in the quality of the publicly provided good. It created a huge demand for the private provision of these services and increased cost of these services to such an extent that it excluded the majority. If the provision of electricity goes the same way we can expect more privatisation and also more exclusion.

Views are those of the author

Author can be contacted at [email protected]

ENERGY……………

Energy Security: Multiple interpretations of an undefined idea!

Ashish Gupta, Observer Research Foundation

|

M |

ost of the developing countries including some developed nations are fixated on the concept of energy security. Though the concept is not new the meaning of energy security differs from country to country and it is reflects their approach for achieving the same.

United Kingdom: This is a developed nation fully electrified having per electricity consumption of 5,516 kwh. The country does not have to bother about further electrification program and that is why their energy security definition is not commensurate with India’s notion of energy security. Since the UK is very much dependent on energy imports it aims to become self sufficient by deploying renewable sources. Indeed this may work for them as they have financial resources to invest in new technologies. However their approach of self sufficiency is not limited to their own borders and they are promoting the idea that developing nations must follow the same path as they consider themselves the global guardians of the climate. Their financial institutions have stopped financing coal based power plants in many developing nations. Some say it was a good move but some say it was not. But somehow it looks like they along with the rest of the industrialised world are looking to control the energy sector in the name of climate negotiations. No one knows where the truth lies but we can be certain that energy security is primarily about national interest.

United States: The notion energy security started way back in 1973 after the Arab oil embargo which had a profound and lasting impact on all oil importing nations. Since then most of US leaders have been advocating the idea of energy security. Their energy security is related to reducing their oil import dependency. USA is fully electrified having 13,246 kwh per capita electricity consumption. Now with the advent of the shale gas revolution the US is looking to become net exporter of gas in the coming decade. They are also among leaders in renewable technology which they want to export to poor countries. Their energy security is related to claiming supremacy on the technology front as well as acquiring stakes in energy resource rich countries. Their approach is anchored in securing reliable energy resources and at the same time maintains commercial interest.

China: The vision of energy security started way back during 1980s when they initiated power for all program. By and large they are fully electrified with per capita electricity consumption of 3,298 kwh. Their renewable manufacturing sector is quite efficient and subsidised and therefore it offers stiff competition to the developed nations. But their problem now is how to sustain the same kind of growth in the manufacturing sector through affordable and reliable energy supplies. Their energy security vision is to secure their future energy needs by acquiring energy resource assets overseas aggressively. They are also well aware that their import dependency on energy resources cannot be mitigated in the foreseeable future. They also know that they cannot remain dependent indigenous energy resource through self sufficiency given the rising energy demand for energy from the manufacturing sector. On the whole China’s energy security vision is economically driven.

India: India does not fall into any of the categories described above as a large chunk of the population lacks access to the electricity with per capita electricity consumption at 684 kwh which falls in the bottom of the list. India’s energy security vision is somewhat unique because it is not commercially driven but rather fixated on poverty alleviation. India started its electrification program in the 1980s but it is yet to achieve full electrification.

Having said that, there has been improvement on all fronts even in energy access but still there is a long way to go. India is also trying to acquire overseas energy resources like China but due to capital constraints India’s approach is not aggressive. India lags in prioritising its activities when it comes to energy security. India is still trying to implement models of different countries for achieving energy security but the reality is that there is no model for India to follow. India has to strategise its own model taking into account its financial capacity. India is not UK or US or China. The important priority for India is to provide electricity to all, infuse efficiency and expedite indigenous resource production. India must acquire stakes in energy blocks overseas. India’s energy security program lacks vision because of the weak political structure. India’s energy security is related to affordability. It cannot be experimenting with energy resources on the advice of developed nations. India must prioritise its needs so that it can achieve energy security vision.

Views are those of the author

Author can be contacted at [email protected]

ENERGY………………

Natural Gas in India: An Analysis

Achitha Jacob*

|

T |

he biggest challenge in the energy sector for the Indian government is to promote economic efficiency brought about by free market forces while not compromising on affordable access to energy for the poorest sections of society. To add to this dilemma, resources spent on subsidies are not only inefficient but also unsustainable, emphasizing the need to bring about better-designed subsidy schemes. In this scenario, natural gas, which is cheaper than alternate fuels in many sectors and competes with subsidized fuels in others, while being more environment friendly, is set to become an increasingly important fuel in the energy mix.

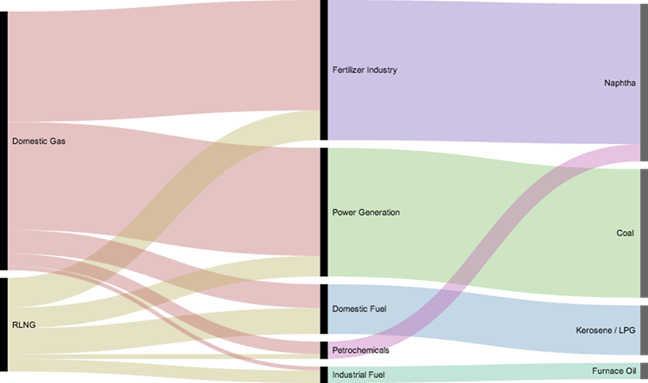

Natural gas currently accounts for around 8.5% of India’s energy consumption, and, according to the twelfth year plan, is projected to rise to 13% by 2021-22. Vision 2030, published by PNGRB, projects a share of 20% in the year 2030. In 2012-13, domestic gas accounted for around 2/3rd of the total gas supply while the rest was imported in the form of r-LNG. The power generation sector was the largest consumer at 33% of the total natural gas consumption, closely followed by the fertilizer industry at 28%. Other major sectors of consumption were domestic fuel at 5%, industrial fuel at 3% and petrochemicals at 1%. While the growth rate of consumption of natural gas is not impressive for most sectors, the compound annual growth rate (CAGR) of the domestic fuel sector has been 50%- at least 10 times better than any other sector over the same period.

Figure 1: Natural Gas Supply, Sectors of Demand and Important Substitutes to Natural Gas in these Sectors [Values for January 2013]

Source: Vision 2030, Petroleum and Natural Gas Regulatory Board (PNGRB), Author’s Analysis

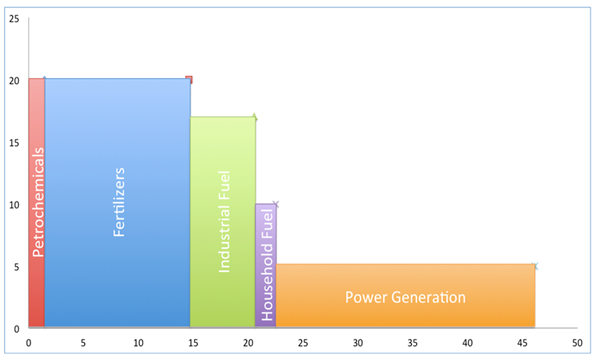

Across different sectors, natural gas is a substitute for a wide variety of fuels (Figure 1) from the rather cheap coal in the power generation industry to significantly more expensive naphtha in the fertilizer industry. As such, it is understandable that at a higher price, natural gas may be a viable substitute to naphtha, but not coal, which possibly accounts for the decline in consumption of natural gas by the power generation industry when the price rose from 1.8 $/mmbtu to 4.2 $/mmbtu in 2010-11. This price rise did not result in any significant decline in consumption of natural gas in other sectors as may be explained by the fact that natural gas continued to remain cheaper than other substitutes even at the higher price.The price of the cheapest substitutes to natural gas in various sectors is analyzed to design a theoretical current demand curve (Figure 2). The price given in each sector is the maximum cost that a particular sector would be willing to pay for natural gas, given the current cost of alternate fuels. The amount demanded is a conservative estimate equal to the maximum consumption in each sector over the last 8 years.

Figure 2: Theoretical Current Demand Curve for Natural Gas for 5 Sectors in bcm/annum and $/mmbtu

Source: Author’s Analysis, Indian Petroleum and Natural Gas Statistics 2012-13

Note: The demand curve is oversimplified for clarity; it only accounts for the demand in the 5 specified sectors which are presumed to be homogenous.

The sector that is most sensitive to a change in the price of natural gas is the power sector due to the availability of cheap coal; indeed, for base power generation natural gas is likely to be viable only if it is cheaper than 5 $/mmbtu (Figure 2). Given that the cost of natural gas is expected to increase from 4.2 $/mmbtu to around 8 $/mmbtu based on the recommendations of the government appointed committee under the chairmanship of Dr. C Rangarajan, at least for some pockets of domestic supply, growth of natural gas consumption in the power sector seems restricted, at the very least. There is significant possibility for the growth of natural gas in the industrial fuel sector and domestic fuel sector (which includes PNG for CGD and CNG for vehicles), as the price of competing fuels are estimated at 17 $/mmbtu and 10 $/mmbtu respectively (Figure 2). However, consumption is likely to be constrained by restrictive supply, as the fertilizer industry and power generation industry is likely to be prioritized over these sectors and provided subsidized natural gas to achieve goals of social welfare.

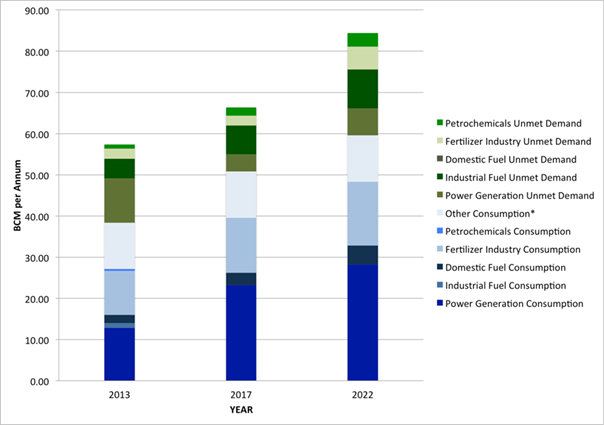

Figure 3: Current and Future Natural Gas Consumption and Unmet Demand in India FY 2013, 2017, 2022

Source: Author’s Analysis, Indian Petroleum and Natural Gas Statistics 2012-13

The biggest inhibitor to the growth of natural gas infrastructure and investment in upstream activities is the unpredictable and constrained supply of natural gas to sectors. In fact, given current trends of consumption over the last 8 years, and using the demand estimated in Figure 2 and current growth rates of the respective sectors, the current unmet demand is likely to continue to persist until the end of the thirteenth five year plan (Figure 3). This intensifies the importance of allocating natural gas across different sectors. The current prioritization of allocation of gas is:

i. Fertilizer plants producing subsidized fertilizers

ii. LPG plants

iii. Power plants

iv. City Gas Distribution (CGD) for CNG and PNG

v. Steel, petrochemicals, refinery, captive power plants, and CGD for industrial and commercial customers

There is a clear prioritization of social welfare, with subsidized LPG and fertilizers at the top of the list. In 2012-2013, the fertilizer industry claimed 28% of the natural gas supply at a subsidized rate of 4.2 $/mmbtu. Considering the market price of natural gas to be 8 $/mmbtu, it translated into effective subsidies worth 1.6 billion $. On the other hand, pursuing an aggressive policy that would triple the current PNG consumption in cities and replace 60% subsidized LPG in urban areas with natural gas at 8 $/mmbtuwould result in savings of 2.27 billion $ for the government. Government savings on LPG subsidy could then be used to subsidize the fertilizer industry, preferably through direct cash transfers to farmers. A shift in focus from providing subsidized access of natural gas to the fertilizer industry towards allocating natural gas in an economically efficient manner and creating a non-subsidized market for natural gas would promote investment in upstream activities, ultimately resulting in more accessible natural gas across all sectors. Perhaps, sometimes, achieving economic efficiency and promoting social welfare are not necessarily contradictory goals.

Sources:

• Vision 2030, Petroleum and Natural Gas Regulatory Board (PNGRB)

• Indian Petroleum and Natural Gas Statistics 2012-13

• http://www.gailonline.com/gailnewsite/businesses/customerinformation.html

• http://www.rrecl.com/PDF/Energy%20Basics.pdf

• https://www.coalindia.in/DesktopModules/DocumentList/documents/1_Price_Notification_2783_18122013(1).pdf

• http://businessworld.in/news/business/energy-and-power/why-falling-imported-coal-prices-are-failing-to-save-power-cos/1158915/page-1.html

• http://www.bharatpetroleum.co.in/YourCorner/PetroPrice.aspx?id=5

• http://www.ficci.com/sector/88/Project_docs/sector-profile-FICCI-petrochemical.pdf

• http://planningcommission.gov.in/aboutus/committee/wrkgrp12/wg_fert0203.pdf

• http://mospi.nic.in/Mospi_New/upload/SYB2014/CH-14-INDUSTRY/INDUSTRY-WRITEUP.pdf

• http://articles.economictimes.indiatimes.com/2013-02-27/news/37331102_1_capacity-addition-power-sector-power-projects

* The article is based on a study by the author over the course of a short internship with the Observer Research Foundation. The views are those of the author. The author may be contacted at [email protected]

DATA INSIGHT……………

Small Hydro Power Scenario in India

Akhilesh Sati, Observer Research Foundation

|

State |

Installed Capacity (MW) |

State |

Installed Capacity (MW) |

|

Andhra Pradesh |

221.03 |

Meghalaya |

31.03 |

|

Arunanchal Pradesh |

103.91 |

Mizoram |

36.47 |

|

Assam |

34.11 |

Nagaland |

29.67 |

|

Bihar |

70.70 |

Orissa |

64.63 |

|

Chhattisgarh |

52.00 |

Punjab |

156.20 |

|

Goa |

0.05 |

Rajasthan |

23.85 |

|

Gujarat |

15.60 |

Sikkim |

52.11 |

|

Haryana |

70.10 |

Tamil Nadu |

123.05 |

|

Himachal Pradesh |

638.91 |

Tripura |

16.01 |

|

Jammu & Kashmir |

147.53 |

Uttar Pradesh |

25.10 |

|

Jharkhand |

4.05 |

Uttrakhand |

174.82 |

|

Karnataka |

1031.66 |

West Bengal |

98.40 |

|

Kerala |

158.42 |

Andaman & Nicobar |

5.25 |

|

Madhya Pradesh |

86.16 |

Others |

0.00 |

|

Maharashtra |

327.43 |

Total 3803.68 (As of Mar 2014) |

|

|

Manipur |

5.45 |

||

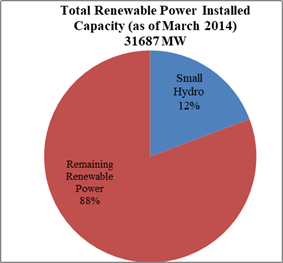

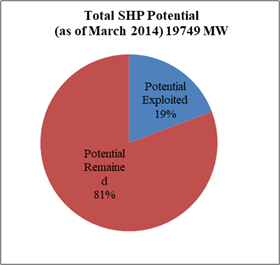

Small Hydro Share in Total Renewable Power SHP Potential Remained for Exploitation

Source: Compiled from Lok Sabha Question Nos. 1189, 1029, 5225.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

Cairn says Rajasthan block holds 1-3 Tcf of gas reserves

August 18, 2014. After oil, Cairn India's prolific Rajasthan block holds significant natural gas reserves, estimated at 1-3 Trillion cubic feet (Tcf), over half of which can be produced. Cairn has so far made 36 discoveries in the Rajasthan block, including the biggest onland oil field of Mangala. It made a significant gas discovery in Raageshwari find. Recent exploration drilling and the proximity of the Raageshwari deep gas field indicates the presence of a larger multi-Tcf gas resource base, comprises Raag Deep, Guda Deep and Guda South structures. Cairn currently sells 8-9 million standard cubic feet per day (mmcfd) of gas from the Raageshwari Deep gas field, which it plans to more than double to 22 mmcfd by the end of the current fiscal and take it to 90 mmscfd by FY16. The company is currently testing an important offset well to the Raageshwari field and have an additional six well programme of exploration appraisals to drilling and testing over the remainder of the financial year. Cairn said it plans to invest $ 200 million in the Raageshwari Deep Gas to upgrade facilities and laying of the pipeline to help produce more. The company estimated an in-place resource potential of about 10 billion barrels of oil and oil equivalent gas in the Rajasthan block. (economictimes.indiatimes.com)

GSPC’s KG gas to sell at $4.2 per unit till Oct

August 18, 2014. Gujarat State Petroleum Corporation (GSPC) is ready to sell gas from its Krishna-Godavari (KG) basin block at $8.5 per unit, much lower than $13 proposed earlier, but the oil ministry will not allow it to charge more than $4.2 until the end of next month. GSPC is keen to quickly start production but it may also consider waiting up to September 30 to get better rates. It has developed the Dayal West (DDW) block in the KG basin. It won the block in the third New Exploration Licensing Policy (NELP) auction round about 14 years ago. GSPC is operator of the block with 80 per cent interests. Jubilant group holds 10 per cent stake while the balance is held by GeoGlobal Resources. GSPC claims to have invested about ` 15,000 crore on the block located near Reliance Industries-operated D6 block in the KG basin. (economictimes.indiatimes.com)

OMEL gives up oil block in Nigeria

August 17, 2014. ONGC-Mittal Energy Ltd (OMEL) has relinquished an oil block in Nigeria after the African nation refused to relieve it of a $ 6 billion downstream investment commitment. OMEL - a joint venture of ONGC Videsh and Mittal Investment Sarl - had in 2005 won right to explore for oil and gas in offshore OPL-279 and OPL-285 blocks after committing to invest $ 6 billion in an 180,000 barrels per day greenfield refinery, a 2,000 MW power plant or a railway line from east to West of Nigeria. It paid a signature bonus of $ 50 million for OPL-285 and $ 75 million for OPL-279. The company had in 2012 relinquished deepsea block OPL-279 after prospective hydrocarbon zones did not offer any viable commercial development. It offered to continue with the other block OPL-285 provided Nigeria relieved it of the $ 6 billion commitment. As the waiver was not agreed by Nigeria, OMEL transferred its 64.33 per cent stake in the block to partners Total of France and EMO, a local Nigerian company. After this relinquishment, OMEL is left with just the Al-Furat project in Syria with China National Petroleum Company International. However the oil and gas field has been shut since late 2011 after the European Union imposed oil trade sanctions on Syria due to geo-political developments. OMEL had in February 2007 singed production sharing contract (PSC) for OPL-279 and OPL-285. As per the MoU for the blocks, the Nigerian government was to offer OMEL 120,000 barrels a day (6 million tons a year) crude oil lifting rights on a commercial basis, two deep water exploration blocks that would attract a signature bonus structured to reflect an appropriate carried participation in a proposed 180,000 bpd refinery and assurances of LNG off take. (economictimes.indiatimes.com)

ONGC net misses estimate after dry well write-offs double

August 14, 2014. Oil & Natural Gas Corp’s (ONGC) first-quarter profit missed analyst estimates after India’s biggest explorer more than doubled writedowns for digging unsuccessful wells and sold crude at a steeper discount. Net income rose 19 percent to 47.8 billion rupees ($782 million) in the three months ended June 30 from a year earlier, ONGC said. That missed the ` 58.5 billion median estimate of 29 analysts surveyed. It wrote down ` 38.3 billion for exploration costs, compared with ` 15.68 billion a year earlier. The company also gave higher discounts on crude oil it sells to state-owned refiners that market fuels below cost to keep retail prices in check. The discount, on the behest of the Indian government, takes almost half of ONGC’s profit every quarter. Even so, Finance Minister Arun Jaitley is preparing to sell shares in the company to help narrow the nation’s budget deficit to the lowest in eight years. The explorer gave ` 132 billion in discounts to refiners including Indian Oil Corp (IOC) in the quarter, compared with ` 126.2 billion a year earlier, according to the statement. Sales rose 13 percent to ` 218.1 billion. The company hasn’t been able to increase oil and gas production from its Indian fields, some as much as 40 years old, leaving its profits more dependent on crude prices and fluctuations in the rupee. The net selling price for a barrel of oil, after discounts, increased to $47.15 from $40.33, the company said. The price of Brent crude, a benchmark for more than half the world’s oil, averaged 6.2 percent more in the quarter, compared with a year earlier. (www.bloomberg.com)

Downstream………….

IOC to hike processing of cheaper crude to 30 per cent by 2017-18

August 18, 2014. Indian Oil Corp (IOC) plans to raise processing of cheaper crude oil varieties to 30 per cent by 2017-18 as part of its efforts to improve margins. In 2013-14, IOC, which owns 30 per cent of the nation's oil refining capacity, turned 54.65 million tons of crude oil into fuel. Of the crude oil processed, 16.1 per cent was heavy and high TAN (total acid number) crude. In pursuit of this plan, IOC has been enhancing capabilities of its refineries to process cheaper crude varieties as well as initiated action to provide optimum crude mix to refineries. To leverage the capability of processing tougher crudes, high sulphur crude has also increased from 44.3 per cent in 2009-10 to 53.7 per cent (including Mangla crude from Cairn's Rajasthan fields) in the year 2013-14. With its 15 million tons a year Paradip refinery being commissioned this fiscal, the same will increase to 67 per cent. IOC said improving gross refining margins (GRM) as a means to improve profitability has been one of the biggest challenges for the company. In April-June quarter of current fiscal, IOC earned USD 2.25 on turning every barrel of crude oil into fuel. This is compared to Essar Oil's Vadinar refinery reporting a GRM of USD 9.04 and Reliance Industries earning USD 8.70 per barrel GRM. IOC and its subsidiary company, Chennai Petroleum Corp Ltd, together own and operate 10 of India's 22 refineries with a total refining capacity of 65.7 million tons per annum accounting for 30.54 per cent of country's refining capacity. The firm said Paradip refinery is inching closer towards commissioning. (economictimes.indiatimes.com)

MRPL buys 2nd Argentinian crude cargo this year

August 13, 2014. Mangalore Refinery and Petrochemicals Ltd (MRPL) has bought its second Argentinian crude cargo this year. MRPL has bought the 1-million-barrel cargo from trading firm Glencore at a discount of about $2.70 to dated Brent on a free-on-board basis for lifting in the second half of September through a tender. MRPL is the only Indian company that has purchased the grade so far. MRPL, which operates a 300,000 barrels per day refinery in Southern India, aims to buy as much as 40,000 bpd of Latin American grades in the current fiscal year that began on April 1. Rising US shale oil output is re-routing the flow of Algerian, Latin American, Canadian and West African crudes, which used to flow regularly to the United States. India's state-run refiners are snapping up Latin American oil after upgrading their plants, reaping the benefit of cheap prices for crudes that have lost their market in the United States to shale oil. (economictimes.indiatimes.com)

Transportation / Trade…………

IOC to invest ` 12 bn on LPG pipeline projects

August 18, 2014. Indian Oil Corp (IOC) has proposed to invest about ` 1,200 crore during the current financial year for expanding its Liquefied Petroleum Gas (LPG) pipeline projects. Recently, IOC has renewed focus on LPG pipelines so as to leverage the economics and safety aspects of LPG transport via pipelines. With increased LPG imports and significant evacuation through tankers, LPG pipelines are in the next growth avenue, IOC said. (economictimes.indiatimes.com)

India in advanced talks for gas export to Pakistan

August 17, 2014. State-run gas utilities from India and Pakistan are in advanced talks for export of gas via a pipeline running from Jalandhar in India to the Attari border and to Lahore in Pakistan. Negotiations between the sides on commercial aspects of the gas export are at an advanced stage, the petroleum ministry said. While Pakistan has been asking India to re-consider the proposed gas price, India has sought sovereign payment guarantees before entering into any contract. Petroleum Minister Dharmendra Pradhan informed that negotiations are underway between GAIL India and the Inter State Gas Systems (ISGS) of Pakistan for supply of five million metric standard cubic metres a day (mmscmd) of lean gas to Pakistan for a period of five years. Under this proposal, GAIL would lay 110 km pipeline from Jalandhar to the Amritsar-Attari border. The technical feasibility of laying the gas line up to Lahore has already been ironed out after five rounds of negotiations between both sides.

Liquefied natural gas, or LNG, will be imported through terminals in Maharashtra or Gujarat and then moved through GAIL's existing pipeline network up to Jalandhar. LNG would be gasified by the Indian side as Pakistan does not have an LNG import facility. LNG imports into India are currently in the range of $13-14 per million British thermal units (mbtu) and after including customs or import duty, pipeline transportation charges and local taxes, the delivered price will be close to $21 per mbtu. (economictimes.indiatimes.com)

Petroleum Ministry says negligence caused fire at GAIL pipeline in Andhra Pradesh

August 17, 2014. The Petroleum Ministry has blamed negligence for causing the devastating fire at state-owned gas transporter GAIL India Ltd's gas pipeline in Andhra Pradesh that killed 22 people. An inquiry committee in a report submitted concluded that negligence caused the fire at the Tatipaka-Kondapalli pipeline on June 27. The committee found that the pipeline had corroded due to condensate and water that came along with the natural gas from an Oil and Natural Gas Corp (ONGC) field.

GAIL has decided to put separators at gas sources in the Krishna Godavari, Cauvery and Cambay basin. GAIL has reduced pressure at pipelines in Andhra Pradesh, Tamil Nadu and Gujarat and is carrying out thorough checks. Any pipeline which is found to have been corroded or is more than 15 years old is being replaced. Under a 2006 agreement between ONGC and GAIL, the latter is responsible for removing condensate and water, which corrode the pipeline because of high presence of sulphur. The 18-inch pipeline carried gas from ONGC's gas field in the East Godavari district. (economictimes.indiatimes.com)

GAIL issues tenders for LNG vessels from the US

August 15, 2014. GAIL India Ltd has issued a tender to hire nine ships to transport liquefied natural gas (LNG) from the US. GAIL wants to hire newly built ships to transport up to 5.8 million tonnes per annum of LNG it had contracted in the US, beginning 2007. Bids are due by October 30, according to the tender document. The bidders will be required to quote for lots of three vessels, with a provision that under each lot, one of the ships shall be built in Indian shipyard. The bidder can quote either for one, two or all three lots.

The remaining two vessels from Indian shipyards will be delivered within six years of award of contract. The two ships from overseas shipyards in the third lot will be delivered between February 1, 2018 and September 30, 2018. The third vessel from the Indian shipyard would be delivered within six years of award. (economictimes.indiatimes.com)

Policy / Performance………

Indian refiners' credit metrics to improve in 12 months: Moody's

August 19, 2014. Moody's Investors Service said it expects Indian refiners' credit metrics to improve over the next 12 months on decline in borrowings. Indian Oil Corp (IOC) and Bharat Petroleum Corp Ltd (BPLC) reported stronger normalised earnings and margins for the April-June 2014 compared to a year ago. IOC benefited from higher non-core income, while BPCL benefited from higher sales volumes. However, although the refiners are nearly fully compensated for under-recoveries, the six-month delay between the realization of the under-recoveries and the government's reimbursement means that IOC and BPCL rely heavily on short-term borrowings to fund the under-recoveries in the interim. Furthermore, the government does not reimburse the interest incurred on these loans. Moody's anticipated a full deregulation of diesel prices over the next few months as it expects the newly elected government will continue to support the 40-50 paisa per litre price hike that has been in place since early 2013.

As of August 1, the under-recovery on diesel is at its all-time low of ` 1.33 per litre. In the upstream oil and gas segment, Moody's said Oil and Natural Gas Corp (ONGC) and Oil India Ltd (OIL) reported stronger operating results for April-June on the back of the higher crude oil price environment. (economictimes.indiatimes.com)

Oil ministry plans to relaunch NELP X to bring simpler sharing of revenues

August 19, 2014. The oil ministry plans to introduce simpler revenue-sharing in the next auction of oil and gas blocks, so it does not need to micromanage oilfield affairs and companies have no incentive to inflate costs, official sources said. The ministry will shortly seek Cabinet approval after inviting public comments. It plans to launch the 10th round of the New Exploration Licensing Policy (NELP-X) by December.

The revenue-sharing system was suggested by a panel headed by C Rangarajan, who proposed ending the controversial system in which oil companies recover costs before sharing profit. The ministry has several disputes with exploration firms on issues linked to cost of development, which has an impact on the government's share. CAG has criticised the government's handling of contracts.

The Vijay Kelkar panel said the proposed model would discourage companies, though some officials, including the former director general of hydrocarbons, disagree. The panel's final report is expected by September. The Rangarajan panel had a specific mandate including review of production sharing contracts, including in respect of profit-sharing mechanism with pre-tax investment multiple as base parameter, say government sources. In the next NELP auction, 46 explorations blocks in 13 sedimentary basins may be offered though the number could change. (economictimes.indiatimes.com)

Diesel can be market-priced by Sep as crude falls to $100

August 19, 2014. With the losses of state-run oil marketers on diesel sales below cost falling to under a rupee per litre, brokerage firm Goldman Sachs estimated the monthly price hikes would end after September assuming oil prices remain around the current $100 level. In January 2013, the government allowed oil marketing companies (OMCs) to monthly raise diesel rates in small doses of 40-50 paise a litre towards wiping out losses. Since then, rates have cumulatively risen by ` 11.24 per litre in 18 instalments. OMCs, effective Aug 16, are incurring combined daily under-recovery of about ` 230 crore on the sale of diesel, PDS kerosene and domestic LPG. (economictimes.indiatimes.com)

RIL, Essar may resume fuel retailing by Diwali

August 19, 2014. Reliance Industries Ltd (RIL) and Essar Oil are all set to restart their petro-retail operations as diesel prices are likely to be de-regulated by Diwali. The price differential between the market price and sale price of diesel has narrowed down to ` 1.33 paisa per litre since the start of August on the back of falling crude oil prices, an appreciating Indian rupee against the dollar and the 50-paisa monthly increase in diesel prices since January 2013.

RIL — after having cornered about 14% of diesel sales within a couple of years of getting into petro-retailing — had to close down its pumps in 2008 due to the differential with the diesel prices of state-owned oil marketing companies (OMCs) and private retailers. Essar Oil plans to more than double its 1,400 retail outlets to 3,000 in the next three years to capitalize on the de-regulation of the diesel sales.

Shell India has close to 100 retail outlets and is keeping a watch on the de-regulation process to start scaling up its fuel retail operations. India has over 45,000 petrol pumps, a third of which is owned by Indian Oil Corp. Meanwhile, fearing an onslaught by the private players post diesel's de-regulation, the OMCs have chalked out aggressive plans to roll out 16,000 retail outlets in the next few years. (economictimes.indiatimes.com)

Modi govt limits investigative agency's powers in gas pricing case

August 19, 2014. The Delhi government's Anti Corruption Branch (ACB) does not have authority to probe graft allegations against former UPA ministers and others in relation to alleged irregularities in raising price of gas from RIL's KG-D6 basin. Appearing for the Delhi government and the ACB told the court that such powers have been taken away from the ACB by a recent notification of the Central government. The recent central government notification has amended the November 8, 1993 notification of the Lieutenant Governor, saying it shall be applicable to the officers and employees of that (Delhi) government only.

The ACB, which has now sought time to file its fresh reply as well as to place the notification on record, had recently asserted that it was well within its right to lodge the First Information Report (FIR) against Reliance Industries Ltd (RIL) and others, including then Oil Minister M Veerappa Moily, for alleged irregularities in raising gas prices. (www.business-standard.com)

Petroleum Ministry says presentation ‘forged’, no new gas price formula

August 18, 2014. The proposed revision in the price of natural gas has run into a fresh controversy, with the Petroleum Ministry denying having made the presentation before the Prime Minister’s Office (PMO) that recommended a new pricing regime of $6-6.5 per million British thermal units (mBtu) for domestic producers. Planning Commission’s former principal advisor Surya P Sethi had emailed a copy to the PMO and other ministers of the ‘Presentation on Gas Price Issues’, saying it had “inaccuracies and misrepresentations” and any decision based on its “selective, misleading and erroneous claims” would be highly detrimental to public interest. The ministry plans to write to the PMO that it was a forged presentation and would be asking Sethi to divulge his source of information since “gas pricing is a sensitive issue and such rumours disturb the policy environment of the country”. As per reports, in the “presentation”, the ministry had modified the Rangarajan Committee formula to arrive at a wellhead price of $6-6.5 per mBtu for all domestic producers except Reliance Industries, which would have to sell KG-D6 gas at existing rate of $4.2 till it made up for shortfall in supplies of the past four years.

There were varying reports regarding whom the “presentation” was made to — one version said it was made to Petroleum Minister Dharmendra Pradhan and then sent to the PMO for reference, another claimed that Pradhan made the presentation before the PMO. The former UPA government had in January this year notified the Rangarajan formula for implementation from April 1 but general elections were declared before a new rate could be announced. The price revision was deferred by three months on the advice of the Election Commission. On June 25, the new government put this off by another three months pending a comprehensive review as both the Parliamentary Standing Committee on Finance and the Standing Committee on Petroleum had made adverse comments on the formula and sought a relook at production costs before deciding the new rates. The Rangarajan panel had proposed that all domestic gas be priced at an average of liquid gas (LNG) imports into India and the rate prevalent in the US and UK trading hubs as well as LNG imports into Japan. This would have led to the doubling of domestic gas price to $8.4 in April and to $8.8 for the current quarter. (indianexpress.com)

Top officials of power, oil ministries to meet PMO on gas price pooling

August 14, 2014. Top bureaucrats of the power and oil ministries will meet the Prime Minister's Office (PMO) to decide a mechanism to pool prices of domestic gas with imported gas to help 26,000 MW of stranded power plants. The meeting is likely to decide the contours of the mechanism that will be placed before the Union Cabinet for approval.

The power ministry has proposed to pool prices of imported and domestic gas and supply the fuel to about 10,000 MW APM (administered price mechanism) gas-based projects at a higher cost. The ministry seeks to subsidise the state distribution companies to keep electricity tariff at ` 5 a unit from such gasbased plants in the current financial year and ` 5.5 a unit in FY16. The estimated subsidy to be borne by the government would be about ` 3,621 crore in FY15 and ` 2,056 crore in FY16 to support APM gas-based plants. The total subsidy during 2014-16 works out to be ` 5,677 crore. (economictimes.indiatimes.com)

New natural gas pricing formula by Sep 30: Govt

August 13, 2014. The government said it will come out with a new natural gas pricing formula by September 30 keeping in mind the interest of investors and public. Oil Minister Dharmendra Pradhan said the NDA government decided to review the pricing formula keeping in mind public interest and recommendations of the Parliamentary Standing Committee.

The previous UPA government had in December last year decided to price all domestic gas from April 1, 2014 according to a formula suggested by the Rangarajan Committee. The formula was notified on January 10 but before a new rate could be announced, General Elections were declared and the issue was left for the new government to decide. The new government on June 25 decided to defer the implementation till September-end to hold wider consultations. The existing gas pricing under New Exploration Licensing Policy (NELP) was approved in 2007 and was to remain valid up to March 2014.

For reviewing the formula, the government constituted a committee under C Rangarajan in May 2012 and based on the panel's recommendation, Domestic Natural Gas Pricing Guidelines, 2014 was notified in January this year. The Rangarajan formula would lead to doubling of natural gas prices to $8.4 per million British thermal unit, an increase that would jack up urea production cost, electricity tariff and CNG rates. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

BHEL develops new boiler for power generation

August 18, 2014. Bharat Heavy Electricals Ltd (BHEL) has developed a new kind of boiler. This is one of the key equipment in power generation. Known as ‘Fuel Flexible Supercritical Boilers', this new equipment can help in producing electricity with 100 per cent domestic coal or 100 per cent imported coal. Currently, the companies are required to mix both categories of coal in a fixed ratio and also have to consider few characteristics before blending. Now, with the help of this new boiler, there would not be any such requirements. According to a company, the new equipment is meant for coal-based power plant also known as thermal power plant. Latest data for power generation states that 3,55,499 billion units of power were generated during April-July of the current year, out of which 2,94,833 billion units were by the thermal power plant. This is 82 per cent of the overall power generation. (www.thehindubusinessline.com)

JSW Energy eyes JP Power's Bina, Nigrie power plants

August 18, 2014. JSW Energy, after being pipped in the last two power deals by Reliance Power and Adani Power is now moving fast to be ahead in the race to buy the rest of the assets on the block. JSW Energy is in talks to buy JP Power's Bina and Nigrie thermal power units. Bina Thermal Power Plant has a capacity of 500 MW may have an Enterprise Value of ` 3,500 crore. Nigrie power project could command a valuation of over ` 9,000 crore provided the coal JV with the state of Madhya Pradesh is part of the deal. JSW Energy is in talks to replace Jaiprakash Associates from the 49:51 joint venture with Madhya Pradesh State Mining Corp Ltd for the coal requirements of the Nigrie power plants. Nigrie Thermal Power Project in Madhya Pradesh has commissioned its first unit last month and will have a capacity of 1320 MW in the next six months. (economictimes.indiatimes.com)

Lanco Infratech puts plants with 3 GW capacity on sale to reduce debt

August 18, 2014. Lanco Infratech is aiming to raise ` 20,000 crore by selling power plants with capacity of 3,000 MW, stepping up efforts to liquidate assets just days after selling an electricity generating station in Karnataka for ` 6,000 crore. For Lanco, shedding electricity assets will help it reduce debt, which was at around ` 38,000 crore before it sealed a deal to sell its coalfired 1,200 MW Udupi Power Corporation to the Gujaratbased Adani Power. For the Indian power sector, it will mark an intensification of consolidation after the election of a new government in May. Jaypee agreed to sell three hydel power plants to Reliance Power for ` 12,000 crore. Macquarie, SBI Capital Markets, Edelweiss, ICICI Securities and E&Y are among the bankers appointed by Lanco Infratech for the sale of assets from its power generation portfolio of 17,200 MW. Apart from domestic strategic investors like the Adani group, JSW, Tata group and Reliance Power, global strategic investors including Power Tech and multinational private equity firms have initiated due diligence. After Udupi, Lanco is left with 3,600 MW of operating assets, 4,600 MW of assets under construction and close to 9,000 MW of assets under development where some are attached to coal mines. (economictimes.indiatimes.com)

Power capacity addition nearly doubles in April-July 2014

August 17, 2014. Power generation capacity addition almost doubled to 4,998 MW during April and July this year compared to year-ago period. During the first four months of the last financial year (April-July 2013) 2,512 MW of power was added, which rose to 98.98 per cent in the same period this year at 4,998.44 MW, latest by the Central Electricity Authority (CEA) said. CEA provides assistance to the Ministry of Power in all technical and economic matters. In July alone this year close to 770 MW capacity was commissioned. One thermal power project of 700 MW capacity was commissioned at Rajpura in Punjab and the 68.67 MW unit of the Rampur hydro-electric power plant of SJVNL in Himachal Pradesh also commenced operations during the month. During April-June 2014 4,731.1 MW of thermal and 267.34 MW of hydro power was added, as against 2,380 MW and 132 MW in the same period, last year, respectively. The total installed capacity of the country stood at 2,50,256.99 MW, as on July 31 2014. Meanwhile, the peak power deficit or shortfall in supply of electricity when demand is maximum, was down to 5.1 per cent between April and July this year as against 6.3 per cent in the same period, last year. The total electricity demand during the first nine months of the current financial year (2014-15) was 1,48,166 MW of which 1,40,633 MW leaving a gap of 7,533 MW. (economictimes.indiatimes.com)

NLC to add 2.5 GW in 3 yrs

August 15, 2014. Navaratna company Neyveli Lignite Corporation (NLC) is planning to add 2,500 MW capacity over the next three years. The company said that the 2X250 MW TS II Expansion is yet to be ready for commissioning. Though the rectification work in the first Unit was completed and synchronised in February 2014, the unit has not been able to attain stabilised operations yet, due to recurring technical problems in the Super Heater Coil in Fluidized Bed Heat Exchangers (FBHE). The company expects Unit-I to be commissioned and Unit-II in October 2014, as committed by BHEL during the high-level review meeting. Another 2X500 MW, joint venture NTPL project at Tuicorin, lighting up of Unit I Boiler was completed in March 2014 and it is expected that Unit-I to be commissioned this month and Unit-II in October 2014. (www.business-standard.com)

Tata Power aims to double generation capacity to 18 GW by 2022

August 13, 2014. Tata Power aims to double its generation capacity to 18,000 MW from all sources of energy by 2022. The company generates power from different fuel sources -- thermal (coal, gas and oil), hydroelectric power, renewable energy (wind and solar Photo-Voltaic). Its current generation capacity is 8,613 MW. Tata Power generated 11,866 million units from its thermal stations during the quarter ended June 30, 2014. Its two projects -- Coastal Gujarat Power Ltd (CGPL) and Maithon Power Ltd (MPL) -- were the top contributors to increased generation. Tata Power has presence in the clean energy sector with a gross installed capacity of 1,202 MW. Its total operating capacity includes 460.6 MW from wind farms and 54 MW from solar generation. The company has 447 of hydro and 240 MW from waste gas based generation. (www.business-standard.com)

Transmission / Distribution / Trade…

APEPDCL starts recovery of pending dues worth ` 9 bn

August 19, 2014. The Andhra Pradesh Eastern Power Distribution Company Ltd (APEPDCL) has initiated the process to recover pending dues worth ` 900 crore from government and private sector. Of the total amount, pending bills from the government sector was ` 300 crores, while the remaining from private sector, APEPDCL said. APEPDCL said that measures like issuing notices, filing police complaint, have been undertaken to recover the outstanding bills, adding, cases which are pending in various courts is hampering the collection process. From June this year, the company has so far replied to 3,232 complaints of distribution transforms failure, while 11,063 messages were sent to customers from April this year, till now, regarding payment and billing. (www.business-standard.com)

PGCIL comes under vigilance lens over gear tender process

August 15, 2014. The vigilance commission is looking into allegations that Power Grid Corporation of India (PGCIL) has deviated from its guidelines for tender process, which has benefited Chinese power equipment makers at the expense of local companies. Indian power gear makers are up in arms against the operator of transmission network for what they allege altering tender conditions to source equipment and introducing reverse auction after opening bids. According to the Indian Electrical and Electronics Manufacturers' Association, after the Indian equipment makers have emerged as the lowest bidders, they were compelled to participate in Power Grid's "abruptly introduced" reverse auction that is held electronically. According to the association's estimates, imported electrical equipment have now captured over a third of the market. It claimed that the built-up capacity of domestic industry stands underutilised at 70% across several products due to sluggish domestic demand and the surge in imports of electrical equipment in recent years. Power Grid is one of the largest procurers in the sector and accounts for a significant chunk of orders for Indian gear makers. (economictimes.indiatimes.com)

Jaya seeks Modi's help for long-term access to TN's power suppliers

August 14, 2014. Tamil Nadu Chief Minister J Jayalalithaa asked Prime Minister Narendra Modi to direct the Ministry of Power and the Power Grid Corporation of India (PGCIL) to consider the Long Term Access application of the state's power suppliers, without taking into account the temporary allocation of surrendered power. She also asked the Ministry of Power and PGCIL to review the transmission reliability margin so that Tamil Nadu can get its rightful share of long-term access. In a letter to the Prime Minister, Jayalalithaa asked for his "urgent" intervention in the matter of allocation of transmission capacity under Long Term Access by PGCIL to enable transmission of power from the western and eastern regions to Tamil Nadu. Tamil Nadu Generation and Distribution Corporation Limited (TANGEDCO) has signed 15-year Power Purchase Agreement (PPAs) with Private Power Producers to facilitate this transmission. Present demand of power in the state is around 13,000-13,500 MW and this is expected to go upto 14,500 MW by the end of 2014-15. The installed capacity of conventional energy sources of TANGEDCO is 11,884.44 MW as on March 31, 2014. Under medium term power purchase, 500 MW of power is being procured from June 2013. Power purchase agreements have been signed to procure 3,330 MW of power under long term for 15 years from 2014-15. Out of this, 224 MW of power is already being availed. 1,500 MW of power would be flowing from August 2014. The balance will be available from 2015-16. (www.business-standard.com)

Modi to dedicate Raichur-Solapur transmission line

August 14, 2014. Prime Minister Narendra Modi will dedicate to the nation the Raichur-Solapur transmission line in Maharashtra, which will augment inter-regional capacity through synchronisation with the southern grid. The second 765kV Raichur-Solapur transmission line implemented through private sector participation has been completed on June 30, 2014, with guidance from Power Grid. The transmission line connects Raichur in Karnataka with Solapur in Maharashtra. With both the transmission lines now in operation, the interconnection has helped in achieving a pan-India synchronous grid of 2,49,000 MW, one of the largest synchronous operating grids in the world. (economictimes.indiatimes.com)

Policy / Performance………….

Madras HC dismisses PIL against Cheyyur UMPP

August 19, 2014. The Madras High Court (HC) has dismissed a public interest litigation (PIL) challenging the land acquisition process for the proposed 4,000 MW Ultra Mega Power Project (UMPP) in Cheyyur, stating that the plea of the petitioner to stay the process as the environmental issues related to the project are pending before the National Green Tribunal, is not permissible. The ` 24,200 crore Cheyyur UMPP in Tamil Nadu is reportedly India's first coastal power plant to be bid out with an attached captive port. The dispute related to the environmental issues of project is pending with the National Green Tribunal. (www.business-standard.com)

Govt proposes to ensure coal supply to each

August 18, 2014. The government is considering a proposal to ensure the supply of fuel to every coalfired power plant, as it aims to revitalise an industry that is key to the economy but is now grappling with fuel shortages. The power ministry proposal is in line with finance minister Arun Jaitley's assurance in the Union budget, and covers existing and upcoming plants that would be commissioned before April 2017. It covers projects with or without fuel tie-ups, as well as those with captive coal mines that have been cancelled or delayed. Coal India can meet the additional requirement of the dry fuel through. It can realise the additional cost on imports by pooling in imported coal with domestic fuel and supplying it to new power plants without firm fuel contracts. As per the ministry's assessment, existing and upcoming power plants of 12,000 MW without coal tie-ups will lead to an annual revenue loss of ` 32,000 crore. The proposal, if implemented, will immediately benefit idled coalbased generation capacity of 7,230 MW and another 10,930 MW that is likely to be commissioned before April 2015. It seeks to offer 50% coal supply without any premium to projects with captive mines that have been delayed or cancelled due to reasons that are beyond the control of the developers. Currently, Coal India charges up to 40% premium for supply to such plants. The power ministry has proposed to provide coal to projects with letters of assurance from Coal India at 60% of the requirement. It has also sought fuel supply pacts for plants which don't have such assurance letters at 50% of the needed quantity, but without any penalty clause for non-supply or not lifting the accepted quantity. (economictimes.indiatimes.com)

Meghalaya tribals oppose Jaypee getting power project

August 18, 2014. Tribals in Meghalaya opposed the handing over the proposed construction 240 MW Umngot hydro electric project to Jaypee Group, saying that it has flouted the international norms. Initially, the Meghalaya government had approved the Meghalaya Energy Corp Ltd (MeECL) to execute the Umngot hydro electric project, estimated at a cost of ` 1,853 crore in an area of 390 hectares straddling on both Jaintia Hills and East Khasi Hills districts. However, Power Minister Clement K. Marak said the decision to handover the proposed construction of the hydro project to Jaypee was taken after an empowered committee felt that the MeECL may not be able to execute the project due to various reasons. (www.newkerala.com)

DAE team to visit US to explore funding options for projects

August 17, 2014. Ahead of Prime Minister Narendra Modi's visit next month, a team of officials from the Department of Atomic Energy (DAE) will travel to the US to explore funding options from Exim Bank for a nuclear power plant in Mithi Virdhi in Gujarat, which is to be built by American firm Westinghouse. Westinghouse is to build 6 reactors of 1000 MW each in Chhaya Mithi Virdhi. It is one of the two projects to come up in India after the signing of the Indo-US Civil Nuclear Deal--the other one being at Kovvada in Andhra Pradesh of equal size to be built by another US company General Electrical. The visit also assumes significance as it will send a signal to the US that India is serious about the project. The Americans are not happy with the progress of the project. Issues like certain clauses of the Civil Liability Nuclear Damage Act 2010 has been objected to by many foreign players. The Modi government has ratified the Additional Protocol of the International Atomic Energy Agency (IAEA), mandatory under the Indo-US civil nuclear cooperation which will put the civilian nuclear facilities under international inspection and scrutiny. This was also a signal that his government was committed to the promises made under the deal by the previous UPA government. However, the cost of the project still remains unclear as financial negotiations are still in the preliminary stages. The initial price quoted by Westinghouse was around ` 14 per unit, something which India finds very expensive and wants that the rate be brought down drastically. (economictimes.indiatimes.com)

Modi eyes 24x7 power supply, bats for saving electricity

August 16, 2014. Prime Minister Narendra Modi declared that his government was aiming to provide 24-hour power supply across every nook and corner of the country. While outlining his vision for infrastructure development with a nationwide network of roads, power transmission lines and power and water grids, Modi also equated saving of electricity with service to the nation. The Prime Minister also laid the foundation stone for four-laning of Solapur-Maharashtra/Karnataka Border Section of NH-9. He asked the students and youth to check their monthly electricity bills and discuss with family members about how to bring down the consumption. Modi also shared the concern of Maharashtra Chief Minister Prithviraj Chavan over power plants in the state remaining idle due to shortage of coal and gas. Referring to his government's decision to grant permission to raise the height of the Narmada Dam, Modi said once completed Maharashtra would get electricity worth ` 400 crore from the project every year for free. (indiatoday.intoday.in)

Tata Power gets Mumbai power distribution licence for 25 yrs

August 16, 2014. Maharashtra Electricity Regulatory Commission (MERC) has granted distribution licence to Tata Power for Mumbai area for 25 years, from August 16, 2014, to August 15, 2039. Tata Power's licence was valid up to August 15, 2014. The new licence was granted under sub Section (8) of Section 15 of the Electricity Act, 2003. Tata Power has 500,000 consumers in its area of operation of 475 sq km in Mumbai. The company is creating capacity to serve 1.4 million consumers by FY18-19. Of the 1.4 million, 800,000 would be around slum areas. In a recent order, MERC directed Tata Power to file a network roll-out plan in six weeks. Tata Power has launched an investment plan of ` 1,879 crore for a network spread across its entire licence area between 2014-15 and 2018-19. MERC had invited expressions of interest (EoIs) in February for the distribution licence in the area serviced by Tata Power in Mumbai. MERC had got EoIs from Tata Power, Maharashtra State Electricity Distribution Company (MahaViataran) and Kolkata-based India Power Corporation. Adani Power,Torrent Power, Reliance Infrastructure, GMR, GVK and Calcutta Electric Supply did not send EoIs. MERC rejected EoI filed by MahaVitaran and India Power Corporation while granting licence to Tata Power after fulfillment of required norms. (www.business-standard.com)

Power tariff increase in Kerala from Aug 16

August 14, 2014. A hefty increase of about 24 per cent in power tariff has been slapped on domestic consumers of electricity in Kerala with effect from August 16. The orders issued by Kerala State Electricity Regulatory Commission said there would be an average increase of 8.5 per cent tariff for power consumption for all categories of consumers to mobilise an additional revenue of ` 1,027 crore for the Kerala Electricity Board. For domestic consumers only, the hike is, however, about 24 per cent.

There was no change in the power tariff of ` 1.50 for consumption of power upto 40 units but this has been limited to BPL category families. Other domestic consumers would have to pay ` 2.80 up to 50 units and the present slab system would continue with minor changes upto consumption of 250 units per month. Domestic consumers who consume more than 250 units would have to pay ` 5 per unit for each unit. (www.business-standard.com)

` 1 bn unpaid power charges due from Assam govt depts

August 14, 2014. Various Assam government departments have not paid electricity bills running into ` 108 crore even as the average tariff for common people is proposed to be hiked by 17% to ` 7.45 per unit in 2014-15. According to the document, different government departments have a total arrear of ` 108 crore for electricity consumption till March 31, 2014. Of this, the highest amount is due from the Industry Department at ` 24.34 crore.

The document said bill amounts from government functionaries are collected as per rules framed by the Assam Electricity Regulatory Commission (AERC). It said that during power cuts in the state, the power distribution utility normally tried to maintain uninterrupted electricity connection at residences of ministers, MLAs and IAS officers on account of 'security' reasons.

The non-recovery of this huge amount has put the Power Department in a quandary as the state has a peak hour electricity shortage of 225 MW against the demand of 1,400 MW, while it is 113 MW against 1,062 MW during off-peak hours. To meet the shortage, the Assam Power Distribution Company Ltd buys power on daily basis from Indian Energy Exchange through short-term open bidding. (www.business-standard.com)

West Bengal is going to get two more power plants

August 13, 2014. The state government is coming up with two new pumping storage power projects in Purulia. One with the capacity of 1000 MW coming up at Bagmundi will not only generate power during the lean period but it will be linked with a 250 MW solar power plant that will be established in the same area.

Pumping storage power plant is a concept where the water of the river is stored in a particular reservoir during the day time and during night period this stored waters is used for generation of power. (timesofindia.indiatimes.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Apache Australia oil find boosts potential sale value

August 19, 2014. Apache Corp, the U.S. oil producer weighing plans to sell international assets after investor pressure, announced the largest discovery in 20 years off the coast of Western Australia. The Canning Basin may hold as many as 300 million barrels of oil, according to six samples from a well about 110 miles north of Port Hedland, the Houston, Texas-based company said.

Apache announced it will sell its stake in two natural gas export projects, including one in Australia, and consider a sale or separation of international assets. Oil production in Australia is forecast to rise to an average of 385,000 barrels a day in the year through June 2015, according to the country’s Bureau of Resources and Energy Economics. Total global output may be 95.1 million barrels a day over the same period, it said. (www.bloomberg.com)

PetroChina said to plan energy asset sale in restive Xinjiang

August 19, 2014. The parent of PetroChina Co. plans to sell oil and gas field stakes to local investors in the northwest province of Xinjiang as part of government efforts to bring growth and jobs to the restive region. China National Petroleum Corp (CNPC) is looking for partners with around 10 billion yuan ($1.6 billion) to invest in exploration and production ventures. Beijing-based PetroChina owns most of its parent’s oil and gas fields in Xinjiang and will handle the offer of stakes in at least two large untapped oil and gas fields this year. (www.bloomberg.com)

Carnarvon Petroleum announces Phoenix South-1 oil discovery

August 18, 2014. Carnarvon Petroleum Ltd announced a significant oil discovery in the Phoenix South-1 well in the North West Shelf in Western Australia. The discovery represents one of the most significant developments in Australian oil and gas in recent times.

At this preliminary stage it is too early to quantify the recoverable volumes of oil. Further technical evaluation of log and core data will enable Carnarvon and its partners to be in a position to make that information public by the end of 2014. (drillingandproduction.energy-business-review.com)

UK's Elgin gas field to restart production: Total

August 18, 2014. Britain's Elgin condensate gas field in the North Sea will restart production, after a period of maintenance went on longer than planned, Total Exploration & Production said. Gas from the field is exported via the Shearwater Elgin Area Line pipeline to Shell's Bacton terminal where it is sent to Britain's National Grid or to continental Europe. (www.rigzone.com)

Rosneft, Statoil start exploration for oil, gas in Norway

August 18, 2014. Russia's Rosneft and Norway's Statoil have embarked on joint exploration for oil and gas on the Norwegian continental shelf in the Barents Sea, Rosneft said. The companies expect to analyse the drilling results up until the end of this year. A subsidiary of sanctions-hit Rosneft was granted the award of a 20 percent participating interest in the four fields within the Norwegian continental shelf in the Barents Sea during a licensing round last year. (www.rigzone.com)

Mexico oil output bloated by water barrels

August 14, 2014. Petroleos Mexicanos, facing a 10th straight year of production declines, is including water in its oil output and may revise previously reported data, according to the company. A record gap this year between reported output and what the company processes is partly explained by measuring systems at older fields that are unable to differentiate water-heavy oil from actual crude, asking not to be named as Pemex debates reducing figures for the past three years or more. The company cut its 2014 output forecast to 2.44 million barrels a day. (www.bloomberg.com)

Exxon ends oil search with Total in South Sudan as war rages

August 14, 2014. Exxon Mobil Corp, the U.S.’s largest oil company, ended exploration plans with Total SA in South Sudan, Total and the government said, a sign of faltering investor confidence in the African nation as a civil war enters its eighth month. Exxon in April didn’t renew an agreement with Total to negotiate for joint-exploration over parts of a 46,300 square-mile concession in Jonglei state, Total said. Total is still bidding to explore in partnership with Kuwait Foreign Exploration Petroleum Co. Crude oil output, South Sudan’s almost sole source of revenue, has fallen by at least a third to about 160,000 barrels-per-day since conflict erupted in December and the army battled rebels in two oil-producing states. (www.bloomberg.com)

Expats flee Iraq’s oil boomtown as Islamic state attacks

August 13, 2014. Marc Kolber, a native of Long Island, has spent more than three years overseeing the construction of offices for foreign oil companies in Iraqi Kurdistan. Now he’s joining an exodus of expatriates from the capital, Erbil. The Kurdistan region of Iraq has attracted hundreds of foreigners in the past five years, enticed by a mixture of oil, security and growing prosperity. The autonomous region, largely free from the violence that’s plagued the rest of the country, has some of largest untapped oil fields in the world. Islamic State fighters are battling Kurdish troops just 50 miles from Erbil, threatening the energy boom that’s brought a thriving international airport and modern office blocks to one of the world’s most ancient cities. Oil companies including Chevron Corp and Afren Plc have evacuated expatriate staff and halted drilling operations. (www.bloomberg.com)

Downstream…………

Thai Oil eyes refinery upgrade in Indonesia, Myanmar