-

CENTRES

Progammes & Centres

Location

WEEK IN REVIEW

Ø ENERGY: India’s Energy Strategy: Does it Pay to be Strategic?

Ø COAL: Clean Coal: Not even for big daddy!

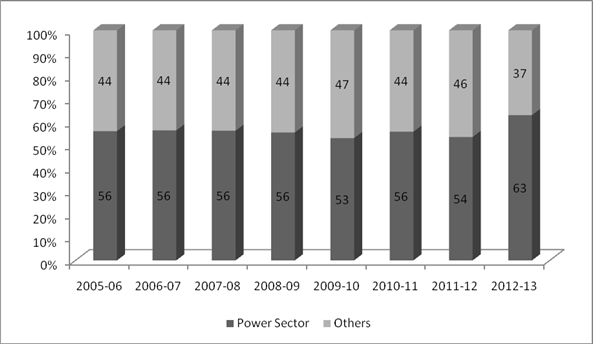

DATA INSIGHT

Ø Contribution to the Power Sector by the Coal Sector

NEWS HEADLINES AT A GLANCE

INDUSTRY DEVELOPMENTS

· ONGC to raise gas output to 100 mmscmd by 2017-18

· Essar uses Brazil’s Peregrino crude

· Oil firms' record ethanol purchase to boost blending goal

· CCEA defers approval to IOC stake purchase in gas assets

· NTPC to lay foundation stone of 1.6 GW project in MP

· ADB passes $350 mn loan for MP power transmission

· Pemex in JV talks to boost crude production: CEO

· Global oil companies to cut exploration spending

· Indian firm signs contracts to explore for oil, gas off Bangladesh

· Shell to drill for oil in Namibian waters

· ExxonMobil commences gas production from Damar field in Malaysia

· Eni flows oil, gas in third discovery offshore Congo

· Poland's PGNiG finds new gas deposit in southern Poland

· PetroChina to start new refinery’s commercial operations in April 2014

· Japan's TonenGeneral considers cutting Chiba refinery capacity

· Hyundai Merchant to divest LNG transport business in South Korea

· Alberta First Nation to build 1 GW gas-fired power plant

· ABB wins order to strengthen Canadian power grid

POLICY & PRICE

· Adani Gas reduces CNG, PNG prices in Ahmedabad, Vadodara

· No stopping gas price hike: Moily

· ONGC biggest gainer from govt’s decision to increase gas prices

· Power Engineers oppose natural gas price hike proposal

· Committee to decide stake offer to Shell in Kakinada gas project

· Demystifying India's gas pricing policy

· Interim Budget 2014: Excise duty cut to fuel power gear orders

· Coal ministry imposes bank guarantee on NTPC Power tariffs set to go up in Bihar

· Norway to offer 61 blocks in new licensing round

· Egypt signs oil, gas exploration deals Dana, Edison, Petroceltic

· Is Bangladesh gas price an unfair benchmark?

· Pakistan’s Keyal Khwar hydro project receives €100mn EIB loan

· China Three Gorges says govt finds favoritism in bidding

· Tata, Welspun, Essel Power keen on Mahagenco's 50 MW solar plant

· India budget plans 2 GW of solar farms next year

· Suzlon writes down Illinois wind project

· Hindustan Cleanenergy to set up 150 MW solar farm in Punjab

· UP solar power sector might see ` 8.8 bn inflow

· India to double renewable power capacity by 2017: Planning Commission

· Shaw joins KKR buying cleaner energy rivals won’t touch

· EU leaders said to delay decision on 2030 carbon target

· EU factories facing first carbon shortfall since 2008

· China sets 2014 installation limits for solar power subsidies

· Germany needs to end renewables aid earlier, Pfeiffer says

· Vestas wins 21 MW wind power contract in Costa Rica

· NRDC and US utilities urge grid payments for solar

WEEK IN REVIEW

ENERGY

India’s Energy Strategy: Does it Pay to be Strategic?

Lydia Powell, Observer Research Foundation

|

T |

his was the question Memduh Karakulluku, a brilliant young thinker from Turkey seemed to be asking (not in those exact words!) when he presented highlights of Task Force report on Turkey’s energy strategy in a global context at the Observer Research Foundation last week. He began by pointing out a few similarities and differences between India and Turkey in the context of energy and went on to use those similarities and differences to unravel a perspective on energy security that was refreshing and enlightening.

The common elements between Turkey and India in the context of energy is that both are dependent on fossil fuels, both import most of the fossil fuels and both are obsessed with the idea of ‘self-reliance’. Key differences between India and Turkey in the context of energy include the difference in the scale of their respective energy needs and the respective socio-economic contexts. Both India and Turkey diverge from the global optimum energy profile but problem for Turkey is different from that of India on account of the difference in scale. India can essentially alter the global boundary conditions by its mere presence or absence. When India accesses global energy supplies, such as coal, it has an impact on total global supply available and consequently the price of the resource. When India emits carbon it pushes global limits. The second significant difference is the number of people without access to modern energy resources in India on account of their inability to pay. This is a question of redistribution which necessarily means an important role for the State in the energy sector. The unavoidable presence of the State has a consequence as it limits India’s ability to use the market as a means of mitigating risks.

All this has an impact on the nations’ strategic position but the word ‘strategic’ needs some clarification at this point as it means very little to those outside the ‘strategic’ community. ‘Strategic’ essentially means gaining an advantage over others militarily, economically or otherwise even if it is at the cost of others. It is an abrasive adjective for those who believe in the greater common good but part of the essential vocabulary for those who are in the business of promoting national interest. The adjective essentially captures a realist response to an anarchic world in which there is no authority to enforce rules. But the energy world is no longer anarchic. The market has a pervading presence in most fuel segments and it has rules that every market participant is obliged to follow. In this light, we can ask the question again: does it pay to be strategic?

The dependence on fossil fuels has traditionally been seen as a source of strategic weakness because there are no viable alternatives to fossil fuels, especially oil. Dependence on import of these fossil fuels is seen as a related but more acute strategic weakness as it drives a wedge between nations that have and nations that do not have oil. Both weaknesses relate to the question of access to fossil fuels which could be limited by physical risks such as threats to supply lines or economic risks such as inadequate currency reserves to secure the resources. The conventional remedy to mitigate the physical risk is to diversify the fuel basket to the extent possible and compliment it with diversification of geographic sources from where those fuels are sourced; these strategies are inadequate and possibly inappropriate in the current global context as pointed out by the Turkish expert.

The most reliable insurance policy against the risk of access to fossil fuels is to integrate with global markets. The fragmentation of global markets through formation of regional markets or bilateral relationships can weaken rather than strengthen access to fossil fuels. In this context the idea that the United States is well on its way towards ‘energy independence’ (equivalent to the idea of self-reliance) on account of the dramatic increase in shale gas and tight oil production and that all other nations would do well to replicate its success needs to be questioned. Energy independence of the United States or any other country/region will contribute to fragmentation and regionalisation of the global energy (oil) market. The oil market today is one of the most liquid, secure and flexible markets in the world and isolation from it will reduce rather than increase security. In fact, the fragmentation of the oil market will have implications far beyond the energy market. What is pragmatic for the world to do is to press for reduction in barriers to trade of oil and gas in the United States so that all increase in supply is accessible through the market to all market participants. Being a part of the fragmented regional markets or bilateral trade deals (generally seen as giving a strategic advantage) generates interdependencies that can actually become a burden on both the economic and security calculations. In addition the supplier will gain a disproportionate advantage in both a fragmented regional market and a bilateral deal. In the longer term, both can undermine broader global cooperation. The ‘market’ is not the only instrument that can reduce the risk of access to fossil fuels. Technologies such as liquefying natural gas for transport could also reduce risks of access by integrating regional gas markets. In the longer term technology could also increase substitutability between oil & gas and consequently increase access to supplies. Redundancies and flexibilities in terms of fuels, sources, technology and infrastructure are the key sources of security today as they will help India adapt rapidly to changes in the energy market be it in terms of supply, price, infrastructure or technology.

The second key insight was on the longer term shift towards low carbon energy sources. The shift will be engineered by technologies and India could either choose to be a consumer or supplier of new low carbon technologies. The former would be a part of its energy policy but the latter part of India’s industrial policy. In this regard there seems to be some confusion as far as the Jawaharlal Nehru National Solar Mission (JNNSM) is concerned. On the one hand JNNSM seems to be a part of energy policy as its target is primarily an energy target (20GW by 2020). On the other hand the condition of domestic content requirement in solar projects seems to be implying industrial policy. Perhaps India wants to portray itself both a supplier and consumer of new technologies and there is nothing wrong in it. But these objectives must be qualified with the necessary capabilities to develop new technologies and capacity to absorb new technologies. As pointed out by Karakulluku the energy competition of the future will involve intangibles such as property rights and carbon rights (to emit and to clean it up). The response would be to arm oneself with the right ‘rights’.

With regard to nuclear energy, which has both a fuel component and a technology component, exposure to risk is part of the bargain as the expert put it. The upside risk (that of obtaining clean reliable energy) is controlled by the national actor but not the downside risk (that of natural or manmade accident) which creates a different dynamics. This means that a country’s nuclear calculations cannot be made in isolation from global safety or security calculations. If every participant in the nuclear energy landscape is expected to invest in the global intellectual and institutional resources to control the global downside risk it would control the global supply risk. This is an interesting point that new entrants and old participants in the nuclear domain must take note of. In the light of observations made thus far, it probably is not strategic to be strategic any more, at least as far as the energy sector is concerned!

Views are those of the author

Author can be contacted at [email protected]

COAL

Clean Coal: Not even for big daddy!

Ashish Gupta, Observer Research Foundation

|

T |

here is no denying that there are negative impacts of using coal as a source of power generation. But coal is also a lifeline source for many countries including the countries who are exporting coal. Interestingly export of coal to energy hungry countries like India makes a huge contribution to the country’s GDP. India too has prospered on all fronts by using coal! When coal is labelled as “killer” for a green country like ours it must also be acknowledged that it is the source of luxury to many. This is a duality which we need to live with.

In the midst of the argument over whether coal is a lifeline for energy or a climate disaster, the new concept of “clean coal” has emerged. It is still an alien concept to a country like India but India has begun to work on the issue. The concept has been initiated surprisingly from the most polluting countries in the West. They are seen to be green as they as they have became the custodian of the world climate. Coal is required to meet energy needs of most developing countries but coal is beginning to be sidelined by rich countries and in this light making coal clean becomes important. Though intentions on cleaning coal are good but implementation is lacking in substance. Interestingly “clean coal” is now seen as an acceptable panacea to climate problems after the evidence that CO2 emissions significantly affect temperature has suffered a setback.

The big question is whether coal is dominant choice for the developing countries only? Do developed countries not gain advantages of using coal? Coal was the dominant choice in developed countries three four years back. The reality is that even today two fifths of world electricity comes from coal fired power plants in developed countries. Interestingly, Europe which wants to be seen as world leader in climate protection is consuming more and more coal. Coal consumption in Europe is growing as it is still a low cost fuel. What this highlights is that the switch to alternate sources will be guided by economics irrespective of whether you are a rich or a poor country. It should not be a problem to understand that India faces the same choice.

In 2012, the states in USA which were generating electricity through coal paid an average of 8.8 cents/kwh in USA while the states that curbed coal electricity generation paid 12.44 cents/ kwh. The low coal states actually ended up paying 26% more than the average national price of electricity. Apart from this coal was responsible for providing 760,000 jobs. Ever since CO2 mitigation became a concern, many coal companies started working on the ‘green coal’ concept. It was not by choice but by force. Things started moving when Congress in 2009 pursued the Climate legislation and the American Coalition for Clean Coal Electricity initiated a “Fact finding tour” that included the series of videos with expert’s suggestions detailing how the coal industry can capture the carbon dioxide from coal fired plants. But the result is dismal!

The green coal concept which started with so much enthusiasm is now losing the momentum and now the coal industry has realized that clean (green) coal technologies is not a safe bet. Hundreds of millions of dollars investment went into green coal projects just to arrive at the conclusion that clean coal technology is not viable. But now since the US has discovered shale gas they can reduce carbon emissions. It also makes sense to mine indigenous gas resources rather than go for costly clean coal technologies. So what will the U.S coal industry do? It will tap opportunities coming from China and India. But coal is unlikely to lose ground in USA as low cost energy is quintessential necessity for American business. It is key in the production of steel, cement, plastics, activated carbon, carbon fibres and so maintaining access to affordable energy will be the key for the America economy. Or else the American products will lose the competitiveness in the global market.

Coming to the Indian coal sector which has many other challenges, it has also been advised by many to pursue clean coal strategy. Interestingly if big and rich countries are unable to cope with clean coal strategies how is it feasible for a country like ours to absorb the same? The reality is that the clean coal technology is still in the demonstration stage and its commercial viability is yet to be proven. The implication for India is to learn lessons from the USA. First, go for the abundant indigenous coal reserves rather than unviable alternate sources. Second, deploy clean coal technologies only when it becomes viable for Indian coal. Third, make energy choices depending on specific advantages for development irrespective of whether it can be provided through hydro, renewable or nuclear etc. The only thing that needs to be kept in mind that it should be affordable on paper and in practice!

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT

Contribution to the Power Sector by the Coal Sector

Akhilesh Sati, Observer Research Foundation

|

Financial Year |

Availability (Million Tonnes) |

Consumption by Power Sector (Utilities) (Million Tonnes) |

Plant Load Factor of Coal & Lignite based Power Plants (in %) |

||

|

Coal |

Lignite |

Total |

|||

|

2005-06 |

433.27 |

66.84 |

500.11 |

281.00 |

73.71 |

|

2006-07 |

462.35 |

72.34 |

534.69 |

302.00 |

76.8 |

|

2007-08 |

502.82 |

82.82 |

585.64 |

330.00 |

78.6 |

|

2008-09 |

549.57 |

89.19 |

638.76 |

355.00 |

77.19 |

|

2009-10 |

585.3 |

105.21 |

690.51 |

367.00 |

77.48 |

|

2010-11 |

589.87 |

102.2 |

692.07 |

387.00 |

75.07 |

|

2011-12 |

638.84 |

139.44 |

778.28 |

417.56 |

73.32 |

|

2012-13 |

720.07 |

454.60 |

69.93 |

||

Source: Ministry of Coal, Ministry of Statistics and Central Electricity Authority

NEWS BRIEF

NATIONAL

OIL & GAS

Upstream

ONGC to raise gas output to 100 mmscmd by 2017-18

February 17, 2014. Oil and Natural Gas Corp (ONGC) plans to raise its natural gas output by over 53 per cent to 100 million standard cubic metres a day by 2017-18 as new fields start off the west and east coasts. The newer gas finds will help turn the tide for ONGC, which has seen oil and gas output stagnating in recent times. Natural gas production will rise from about 65 mmscmd currently to over 100 mmscmd in 2017-18, ONGC said. The incremental output will come from fields off both east and west coast. ONGC's western offshore C-Series gas fields of C-24 and C-26 as well as Daman will produce 10 mmscmd. Another 7 mmscmd will come from GK-28/42 fields. ONGC said another 30 mmsmcd from eastern offshore KG-DWN-98/2 fields and the neighbouring G-4-6. The C-Series gas field has proved to be more prolific than previously predicted, ONGC said. The reserves of 30 billion cubic meters (bcm) have been upgraded to 130 bcm because drilling in some of the eight structures in the C-Series field has yielded more gas. The fields, which currently produce 3 mmscmd, will double output this year and another 7 mmscmd would be added when the Daman structure in the field starts output in 2016. ONGC's showpiece KG-DWN-98/2 block off the east coast, which sits next to the KG-D6 gas discovery area of Reliance Industries, would start production by 2017-18, ONGC said. ONGC plans to use RIL's KG-D6 infrastructure to bring the discovery in the Krishna Godavari basin to production. Economic and technical feasibility of laying a pipeline to carry gas from the field to RIL's offshore gas gathering station and then to its landfall facilities at Gadimoga near Kakinada is being studied. ONGC had signed a memorandum of understanding with RIL to explore the possibility of sharing the east coast infrastructural facility. If successful, the same concept will be considered for the nine gas discoveries in ONGC's KG block KG-DWN-98/2, which sit next to Reliance's flagging KG-DWN-98/3 or KG-D6 block. Instead of setting up separate gas processing and transportation facilities, ONGC is looking to hire RIL's under-utilised gas gathering station at KG-D6 along with pipelines to take the fuel to land as also its processing plant at Kakinada in Andhra Pradesh. Reliance's pipelines and other facilities are capable of handling gas output of 80 mmscmd. Output at KG-D6 has dipped to below 14 mmscmd from 69 mmscmd in March 2010 and the company has indicated it may never touch 80 mmscmd due to unexpected geological complexities. (economictimes.indiatimes.com)

ONGC makes four discoveries in India in 3Q of FY2014

February 17, 2014. Oil and Natural Gas Corporation Limited (ONGC) reported that it has made four new discoveries, comprising three onshore and one offshore, in the third quarter of fiscal year 2013-2014 ending December, according to financial results released by the company. The sole offshore discovery is at the MBOS51NAA#1 (NELP Block MB-OSN-2005/1) in India's western offshore basin. The exploratory well, drilled to a depth of 11,105 feet (3,385 meters), is the second discovery in this block after MBOS51NBA#1. These discoveries, which are near to the C-37/ C-39, B-9 areas, will enhance the overall gas potential of the area. The first onshore discovery was made at Mandapetta South # 1 exploratory well in Godavari Onland PML of KG Onshore basin in Andhra Pradesh state. The well was drilled to a depth of 9,842 feet (3,000 meters). The second onshore discovery, made at exploratory well SB#300 (SBCG) in Geratpur PML, Western onshore basin in Gujarat state, was drilled to a depth of 6,578 feet (2,005 meters). The final onshore discovery Gedanapalli#3 (GLAC), located in Godavari onland PML, Krishna Godavari onshore basin in Andhra Pradesh state, was drilled to a depth of 9,835 feet (2,998 meters). (www.rigzone.com)

Essar uses Brazil’s Peregrino crude

February 13, 2014. Essar Oil Ltd., India’s second-biggest oil refiner, processed crude from Brazil’s Peregrino field for the first time as it seeks to boost margins by using grades that are heavier and cheaper. Peregrino, a heavy, high-sulfur oil, is among the crudes Essar refined in the quarter ended Dec. 31, according to the company said. A record 98 percent of the grades it processed over those three months at its 400,000 barrel-a-day Vadinar refinery in western Gujarat state were heavy or ultra-heavy, the company said. Heavier crudes are cheaper than lighter grades because they are denser and harder to process into higher-value products. Oil is considered heavy if it has an API measurement of 22 degrees or below, according to the U.S. Energy Information Administration. Peregrino has a gravity of 13.7 degrees, according to Statoil SA, which produces it. Brent crude, produced in the North Sea and used as a price benchmark for more than half the world’s oil, is 38 degrees, EIA data show. Saudi Arabia, the world’s biggest exporter, is selling its 27-degree Arab Heavy to European buyers for March at a $6.60 a barrel discount to Brent. While Essar processed a record volume of heavier crudes, 84 percent of its product output was higher-value middle and light distillate fuels, the company said. The refiner processed 4.86 million metric tons of crude during 85 days of the quarter, or about 419,000 barrels a day. Operating rates fell 5.5 percent from a year ago because of a seven-day shutdown for maintenance during November. (www.bloomberg.com)

Transportation / Trade

Oil firms' record ethanol purchase to boost blending goal

February 18, 2014. Oil marketing companies (OMCs) have bought a record 720 million litres of ethanol from the country's cash-strapped sugar mills for blending, in an attempt to curb fossil fuel imports. The purchases would help the OMCs hit a government-mandated goal of 5 per cent blending of ethanol in gasoline for the first time in 2013/14 since its introduction seven years ago and lift earnings at indebted mills in the world's No.2 sugar producer. With the 5 per cent blending, New Delhi could save around $1 billion on annual imports of crude, the Indian Sugar Mills Association estimates. Disagreements between sugar mills and oil companies over pricing stymied progress after India launched its ambitious ethanol blending programme in 2006, trying to emulate the success of Brazil's booming biofuel industry. New Delhi is scrambling for ways to cut nearly $20 billion off its oil costs as it battles a high current account deficit. Three state-run oil marketing companies - Indian Oil Corp Ltd, Hindustan Petroleum Corp and Bharat Petroleum Corp - have lifted 230 million litres ethanol out of the contracted 720 million litres. (economictimes.indiatimes.com)

CCEA defers approval to IOC stake purchase in gas assets

February 12, 2014. The Cabinet Committee on Economic Affairs (CCEA) deferred nod to Indian Oil Corp's (IOC) proposal to acquire Malaysian firm Petronas' 10 per cent stake in a shale-gas assets and a liquefied-natural-gas (LNG) project in British Columbia for USD 900 million. The CCEA deferred approval to IOC to buy the stake in Progress Energy Resources Corp for 1 billion Canadian dollars (USD 900 million). The acquisition, when approved, will mark IOC's maiden entry into North America. IOC's 10 per cent will come with an offtake agreement for the Indian energy company. IOC is looking to expand its portfolio of exploration and producing assets while Petronas wants to share some of its costs. IOC, which had previously ventured into overseas oil and gas exploration and production with OIL India Ltd, is currently talking to Petronas alone. There has been no decision so far on taking OIL on board for the acquisition. (economictimes.indiatimes.com)

Policy / Performance

Adani Gas reduces CNG, PNG prices in Ahmedabad, Vadodara

February 18, 2014. Adani Gas Ltd reduced prices of Compressed Natural Gas (CNG) by ` 12 per kg and Piped Natural Gas (PNG) by ` 5 per standard cubic meter (scm) for its consumers in Ahmedabad and Vadodara. The private firm, a major supplier of gas in the two of the biggest Gujarat cities, slashed the prices under the new guidelines issued by the Centre. The revised prices comes as a major relief for over 1.5 lakh CNG vehicle users and 1.9 lakh households using PNG in these cities. Adani Gas had reduced the prices of CNG by ` 10 kg and PNG by ` 8 per scm after the Gujarat High Court asked the Centre to provide gas to City Gas Distribution (CGD) entities under Administered Price Mechanism (APM) in line with Delhi and Mumbai. At that time, the price of CNG stood at ` 68.80 per kg and that of PNG around ` 37 per scm. (economictimes.indiatimes.com)

Pricing of CNG, PNG is policy matter, can't be decided by Delhi HC

February 18, 2014. The Delhi High Court (HC) steered clear of the pricing issue of CNG and PNG (piped natural gas) saying such decisions pertained to policy matters and courts cannot look into it. The average consumption of natural gas in CNG and PNG segment in the first half of 2013-14 was 8.32 mmscmd and hence there would be no shortfall in their supply. Taking the guidelines into the records, the court disposed of the plea of Delhi Contract Bus Association which alleged the reduced supply of CNG to Delhi would adversely impact the cheap transport sector. (economictimes.indiatimes.com)

No stopping gas price hike: Moily

February 15, 2014. Petroleum and natural gas minister M Veerappa Moily said that the government will not go back on its decision to raise gas prices from April 1. Moily also called "unconstitutional" a Delhi government move to file police complaint against present and past functionaries of the Centre. He said the government followed rules and regulations while revising gas prices. The decision was taken after the Cabinet twice considered each contentious matter carefully before approving the new pricing formula, which was proposed by the Rangarajan Committee, he said.

In December, the Cabinet had accepted the Rangarajan Committee's formula that will almost double the price of natural gas from $4.20 per unit. Prime Minister Manmohan Singh, on the request of Moily's predecessor Reddy, had constituted the committee on May 31, 2012. ONGC and other companies will be entitled for new prices from April 1 without any conditions, the oil ministry said. (economictimes.indiatimes.com)

Centre's nod on gas issue allowed 'future windfall' to RIL: FIR

February 14, 2014. The approval by Centre to Reliance Industries Ltd (RIL) allowing expenditure of 8.8 billion dollar to increase production of gas from KG basin paved the way for "future windfall" revenue of ` 1.2 lakh crore (USD 20 billion) to the RIL, the Anti-Corruption Branch (ACB) alleged in its FIR. The Delhi government's ACB has annexed documents in its five-page FIR to drive home its point that though in 2006, the Centre had not acceded to give such approval in the wake of objections raised by Parliamentarians, the same was ignored later. The FIR on Reliance gas pricing issue, in which Petroleum Minister M Veerappa Moily, Ambani and others have been made accused, also annexed documents, including a complaint sent to Chief Minister Arvind Kejriwal on the basis of which the case was lodged. According to the complaint, in 2004 RIL had submitted an integrated development plan (IDP) saying they would produce 40 mm standard cubic meters per day for an investment of 2.39 billion dollar. It also alleged that within two years, RIL had submitted another plan saying they would produce 80 mmscmd for an increased investment of 8.8 billion dollar.

Besides Moily and RIL chairperson Ambani, former Petroleum Minister Murli Deora, ex-Director General of Hydrocarbons V K Sibal and other unknown persons have been named as accused in the case. The FIR was lodged under sections 420 (cheating), 120-B (criminal conspiracy) of the IPC and under provisions of the Prevention of Corruption Act. (economictimes.indiatimes.com)

ONGC biggest gainer from govt’s decision to increase gas prices

February 14, 2014. Oil and Natural Gas Corp (ONGC) is having the last laugh after being the biggest gainer from the controversial move to raise natural gas prices, which has prompted Delhi Chief Minister Arvind Kejriwal to start an anti-corruption probe against Oil Minister Veerappa Moily and RIL Chairman Mukesh Ambani. State-run firms led by ONGC produce more than 65% of India's natural gas, according to the oil ministry. Reliance produces barely 10% of the gas, while other private firms or joint ventures account for the rest. This makes state firms the biggest beneficiaries from the new gas price, government said. Oil ministry said that RIL was not alone in demanding higher rates. Gas prices will double to about $8 per unit from April, when the Rangarajan formula is implemented. (economictimes.indiatimes.com)

Power Engineers oppose natural gas price hike proposal

February 13, 2014. All India Power Engineers Federation (AIPEF) opposed the proposed doubling of natural gas prices from April 1, 2014 as announced by the central government. Federation secretary general Shailendra Dubey warned that power tariffs would move north following the decision, while it would also be detrimental for the domestic fertiliser companies. He has urged the Centre to reverse the natural gas price hike proposal and even called upon the opposition leaders viz. Sushma Swaraj and Arun Jaitley to raise the vital issue in Parliament. Last year in June and September also, the federation had raised this issue, when the cabinet committee on economic affairs had recommended the price hike proposal. He claimed that the decision would result in over ` 15,000 crore additional profits to Reliance Industries, which extracts gas from KG Basin. Dubey said the cost of production would rise by 25 paise per unit in gas-based power plants with the proposed natural gas price hike from April, which he also termed as illegal. (www.business-standard.com)

Demystifying India's gas pricing policy

February 12, 2014. Before 1987, ONGC and Oil India Ltd fixed gas prices. But from January-end 1987 the government began regulating prices on a cost-plus basis. The last revision under this so-called administered price mechanism was effective July 2005. When the government began bidding out oil and gas blocks under the New Exploration and Licensing Policy (NELP), it opted for marketdetermined rates for gas.

The producer enjoyed marketing freedom but needed to get the pricing formula approved through 'arm's length pricing'. (This is a transaction where buyers and sellers act independently. They have no relationship with each other. This ensures that both parties are acting in their own selfinterest and are not subject to any pressure or duress from the other party). In 2006 the first controversy began when Reliance Industries invited bids from users and arrived at a price of $4.32 per million metric British thermal units. The matter was referred to an empowered group of ministers headed by Pranab Mukherjee which agreed on a price of $4.20 a unit after suggesting a few changes to RIL's formula, including elements to do away with volatility.

The Cabinet Committee on Economic Affairs approved a new formula based on recommendations of a committee headed by C Rangarajan, chairman of the Economic Advisory Council to the PM. The new policy was based on the price of Indian liquefied natural gas (LNG) imports. Then, the weighted average price at major trading hubs in the UK, the US and Japan was also calculated. Finally, a simple average of the prices of imported LNG and the average international price was calculated. Based on this formula, the current price of domestically-produced gas works out to $6.7 a unit, which will go up to $8.4 a unit from April when the new five-year pricing policy kicks in.

The change was undertaken because the current pricing policy expires at the end of March 2014. The Rangarajan Committee had suggested the new formula arguing that no market-determined arm's length price was available in India and is unlikely to happen for several more years.

Apart from the impact on consumers, many, including some MPs, have alleged corporate influence in policy formulation. Some cabinet ministers questioned the rationale for price revision although officially, the government has maintained that the guidelines will help incentivize investment and check cartelization. (economictimes.indiatimes.com)

Committee to decide stake offer to Shell in Kakinada gas project

February 12, 2014. The Andhra Pradesh government has appointed a committee of senior officials to explore the possibility of offering a 30 per cent stake to Europe's largest oil company - Royal Dutch Shell - in a gas project at Kakinada. Any decision on the sale would be contingent on the company abandoning the proposal to set up similar venture on the east coast.

The state government has already obtained legal opinion from Solicitor General of India Mohan Parasaran, who favoured the idea with some riders. Infrastructure and Investment Secretary M T Krishna Babu said a high level committee headed by Chief Secretary P K Mohanty recently met and appointed a panel of senior officials to give a report with various options to the State Industrial Promotion Board (SIPB), which will take a final call.

In 2013, Shell had announced plans to build a floating LNG of up to 5 million tonnes per annum capacity off Kakinada coast in a joint venture with Reliance Power, which exited the project last year. Similarly, the AP government-owned APGIC and GAIL floated AP Gas Distribution Company (APGDC) to set up a 3.5 million tonnes capacity (expandable up to 10 million tonnes) Floating LNG Storage Regasification Unit (FSRU) in the East Coast at Kakinada Deepwater Port. APGDC also tied up with the GDF Suez LNG UK Ltd by offering 26 per cent stake in the project. Perturbed with Shell's proposed venture, the state government wrote a letter to the Ministry of Environment and Forests that it has not cleared the project keeping in view the technical and commercial aspects. Deputy High Commissioner of the UK, along with senior officials of Shell recently met Chief Minister N Kiran Kumar Reddy and expressed their intention to join the FSRU project being taken by the APGDC, which tied up with the GDF Suez LNG. The state government was earlier willing to offer stake up to 24 per cent to others so as to keep 50 per cent with APGDC. According to the new proposed formula that was worked out, the APGDC will have 41 per cent, Shell 30 per cent, GDF Suez 26 per cent and Kakinada Seaports 3 per cent stake in the yet-to-be-formed SPV, Krishna Babu said. (economictimes.indiatimes.com)

POWER

Generation

Power generation capacity doubles to 234 GW: Chidambaram

February 17, 2014. The government said the country's installed power generation capacity has more than doubled to 2,34,600 MW in the past 10 years. India's power generation capacity 10 years ago (2004) was 1,12,700 MW, it has now risen to 2,34,600 MW, Finance Minister P Chidambaram said in the interim budget (2014-15) speech in Parliament. He said over 29,000 MW of power generation capacity has been added in the current financial year alone.

Power Secretary Pradeep Kumar Sinha said that the government is confident of adding 1,18,000 MW capacity by 2017. The target includes the shortfall in addition from the previous Plan period, the Planning Commission's current target of over 88,000 MW and nuclear and renewable power capacities. (www.business-standard.com)

NTPC to lay foundation stone of 1.6 GW project in MP

February 16, 2014. NTPC will lay the foundation stone of its 1,600 MW Gadarwara plant, that entails an investment of nearly ` 11,000 crore, in Madhya Pradesh (MP). The project, located in Narsingpur district, would have two super critical units, each with 800 MW capacity.

NTPC said foundation stone for the plant is scheduled to be laid on February 19. Coal for the project would be sourced from the Talaipalli block in Mand-Raigarh coalfields. Half of the electricity generated from the plant would be supplied to Madhya Pradesh while the rest would be provided to other states in the Western region.

Already, NTPC has a few projects in Madhya Pradesh including the 4,260 MW Vindhyachal thermal power station. One more unit of 500 MW is under construction at Vindhyachal.

The company is also working on 50 MW solar plant at Rajgarh in the state. Currently, NTPC has an installed generation capacity of 42,464 MW. (www.business-standard.com)

NTPC evaluating private power projects for acquisition in 2014

February 13, 2014. NTPC aims to go on an expansion drive by buying out some stranded private generation plants for which it is in talks with the concerned companies.

The company will also advertise for the same, asking companies to come forward with their stranded projects, evaluate them one by one and then take a call. The company is also hopeful of finalising these proposals.

It is looking at the quality of equipment of these projects, the level of clearances they have achieved, coal availability and sourcing the fuel in case of non-availability before buying these thermal power stations.

NTPC is reportedly in talks with private power companies like L&T and Shapoorji Pallonji Group for taking over their stranded plants. The state-owned generation firm aims to add 14,000 MW capacity by 2017.

The company, which issued notices to Delhi discoms -- BSES Rajdhani and BSES Yamuna -- for clearing their outstanding dues, said it will make its presentation in this regard to the Supreme Court soon. Supreme Court had directed NTPC not to suspend electricity supplies to the two BSES firms till March 26, 2014. (economictimes.indiatimes.com)

Transmission / Distribution / Trade

ADB passes $350 mn loan for MP power transmission

February 18, 2014. The government signed a $350 million loan from the Asian Development Bank (ADB) for improving the power transmission and distribution system in Madhya Pradesh (MP), the finance ministry said. The project would fund about 1,800 circuit kilometres of transmission lines and over 3,100 circuit kilometres of distribution lines, as well as building or upgrading transmission and distribution substations.

Its estimated completion date is December 2018. The mismatch between supply and demand in the state has caused regular load shedding in the past, and currently only about two-thirds of all households are connected to the system, the ministry said.

With its economy is growing quicker than the national average, electricity demand in Madhya Pradesh is expected to rise by about 11 percent a year between 2013 and 2017, resulting in a potential transmission and distribution capacity gap of 20 percent, the finance ministry said. (www.business-standard.com)

CBI registers cases on imported coal supply to NTPC, NSPCL

February 18, 2014. CBI has registered cases related to supply of low quality imported coal to NTPC and NSPCL (NTPC-SAIL Power Company Ltd), Parliament was informed. In January, CBI teams have conducted search operations in the offices and residential premises of some officials at NTPC Unchahar and at NSPCL Bhilai project, Minister of State for Coal Pratik Prakashbapu Patil said. Both the cases are being dealt by CBI Gandhi Nagar Branch, he said. (economictimes.indiatimes.com)

Tata Power Delhi threatens tariff hike amidst surging gas price

February 18, 2014. With a hike in gas price looming over their heads, Delhi's power distribution companies are a worried lot. While the BSES companies are yet to chalk out a plan on how to control their costs, Tata Power Delhi has asked Delhi government and Centre to consider re-allocation of power from gas-based power stations for them. The discom said that if re-allocation of power from gas-based power stations was not done, it would lead to an increase in cost of power purchase and, consequently, tariff. Delhi gets power from three central sector power stations—Dadri gas, Auraiya and Anta—and three plants owned by the Delhi government—Pragati power station, Bawana and gas turbine power station. The city gets approximately 1,255 MW power from gas-based power stations.

According to Tata Power Delhi, it has made adequate arrangements for meeting the 2014 summer demand at much lower rates. It's also assured of meeting any contingencies at a price which, it says, would be much lower than the estimated price from gas station produced plants. Tata Power Delhi gets 237 MW from gas-based power stations. The BSES discoms, Rajdhani and Yamuna, are trying to work out a formula on how to bring down costs but have not sent any official communication to the government yet. (economictimes.indiatimes.com)

Interim Budget 2014: Excise duty cut to fuel power gear orders

February 18, 2014. The ailing capital goods industry will witness a short but sharp boost as finance minister P Chidambaram proposed to slash the excise duty by 2% on capital goods to 10% — applicable till June 30, 2014. The power firms, which planned to order equipment during the later part of 2014 will now place orders before June 30, 2014 to benefit from duty reduction, leading to increase in order books of capital goods firms in the coming quarter. The finance minister slashed excise duty to 10% on all goods falling under chapter 84 and 85 of the schedule to the Central Excise Tariff Act for the period up to June 30, 2014. These include nuclear reactors, boilers, electrical machinery and mechanical appliances. (economictimes.indiatimes.com)

J&K govt not to give any power project to NHPC: Omar

February 17, 2014. Jammu and Kashmir (J&K), Chief Minister Omar Abdullah said that no new power project in the state will be allotted to NHPC in the future as it had not returned the earlier projects despite several demands. Omar said it was a bold decision and added that the Dulhasti-II and Uri-II power projects allotted to NHPC earlier have been got back and will now be joint-venture projects between the J&K government and NHPC. The Chief Minister said his government had pressed the Centre for the return of the older power projects from NHPC, but in vain.

Omar said no new power project will be given to NHPC. The Chief Minister said that as against the indigenous power projects of 750 MW established in the state since 1947, his government had allotted power projects of 1,500 MW in just five years since 2009. (www.business-standard.com)

West Bengal CM promises lower power tariffs

February 17, 2014. West Bengal Chief Minister (CM) Mamata Banerjee said power tariffs will be reduced in near future, in the state. A step, she said, that will benefit industry and poorer sections in society. Mamata said that electricity tariffs are likely to come down. (www.business-standard.com)

India records peak power deficit of 4 pc: CEA

February 17, 2014. Country's peak power deficit -- shortfall in electricity supply when the demand is at the maximum point -- was 5,378 MW or 4 per cent last month. The deficit was much lower than recorded in January 2013. According to the latest data by the Central Electricity Authority (CEA), the total peak power demand in the country last month was 1,33,506 MW, of which 1,28,128 MW was met - leaving a shortage of 5,378 MW. Peak power deficit in January 2013 was 11.4 per cent. The power demand then was 1,32,948 MW against a supply of 1,17,790 MW, according to the CEA data.

The north-eastern region was the worst effected, registering a deficit of 8.2 per cent or 171 MW. The total demand for electricity in the seven sister states -- Assam, Meghalaya, Manipur, Arunachal Pradesh, Nagaland, Tripura and Mizoram -- was 2,096 MW as compared to a supply of 1,925 MW.

North Indian states/UTs -- Chandigarh, Delhi, Haryana, Himachal Pradesh, Punjab, Rajasthan, Uttar Pradesh and Uttarakhand reported a peak power shortage of 5.1 per cent. The total electricity demand in the region last month was 40,300 MW, of which 38,227 MW was met, as per the CEA data. The peak power deficit in the southern region of the country -- Andhra Pradesh, Karnataka, Kerala, Tamil Nadu, Puducherry, Lakshadweep -- was 4.4 per cent at 1,573 MW.

The electricity requirement of the region was 35,736 MW, of which the supply was 34,163 MW. The western region, which includes Chhattisgarh, Gujarat, Madhya Pradesh, Maharashtra and Goa, reported a power shortage of 3.4 per cent. The demand was 41,109 MW against a supply of 39,731 MW. The electricity requirement in eastern states including West Bengal, Odisha, Bihar and Jharkhand in December was 14,265 MW while the supply was 14,082 MW, leaving the region with a shortage of 183 MW or 1.3 per cent deficit. (economictimes.indiatimes.com)

Work on NTPC’s ` 80 bn Katwa power plant to begin soon

February 13, 2014. The West Bengal government has allocated 96 acres for NTPC's proposed 1,320 MW thermal power plant at Katwa, while local residents have agreed to add 150 acre to the land pool, raising hopes that the long-delayed project will get off the block. NTPC's proposed ` 8,000-crore project has been stuck for almost three years due to problems with land acquisition. So far, the power producer has got only about 70% of the 800 acre it needs to set up the plant.

The 96 acre is a mix of vested land (38 acres), agriculture land of about 31 acres and the rest belonging to the panchayat and irrigation department, West Bengal power minister Manish Gupta said. Almost all of the 96 acre belongs to the state and hence will not necessitate fresh land acquisition. This includes 20 acre of uninhabited land on the flats of Ajay River, in Bardhaman, where the pump house will be set up, some 50 acre of embankment through which the water will be transported, and roadsides. A 25-acre strip near the plant site, which will be used for setting up a township, belongs to the agriculture department. The development means that work on the project could begin within six months. The state has also decided to divert excess coal from West Bengal Power Development Corporation to the project till such time that production begins at the recently allotted Deocha Achine block in Birbhum. NTPC will acquire the 150 acre directly from the landowners at an agreed price without government's help. (economictimes.indiatimes.com)

Coal ministry imposes bank guarantee on NTPC

February 13, 2014. The coal ministry has imposed bank guarantee of ` 138 crore on power generator NTPC Ltd for failure to develop its captive coal block Pakri Barwadih in Jharkhand on time The block, with reserves of 1.4 billion tonne, is the largest among six such acreages held by NTPC. The company is sitting on a tenth of the total 49 billion tonne captive reserves allocated by the government to companies since 1993. NTPC was expected to commission the block within four years of its allocation in 2004. An Inter-Ministerial Group (IMG) had found in May 2013 that no significant progress had been made for its development and recommended imposing bank guarantee. Coal from the block is to be supplied to two power plants – 3,200 MW Darlipalli in Odisha and 4,000 MW Lara in Chattisgarh. Both the plants are to be commissioned in 2016-17. The captive block is a ` 3,193 crore project. NTPC had by June last year invested ` 1,093 crore in the mine. In addition, ` 1,139 crore has been invested in the Lara project and ` 380 crore in the Darlipalli power plant.

The ministry had issued a show-cause notice to NTPC in June last year threatening cancellation of allocation. The company had argued that approval for a part of the land acquisition for the block was pending with the Jharkhand government which is causing the delay. The ministry’s review comes at the backdrop of severe domestic coal shortage that is fuelling coal imports worth ` 86,000 crore annually. The delay is attributed to captive miners who failed to commission their blocks on time. The ministry is also reviewing allocations as part of a Supreme Court-monitored probe in the alleged ` 1.86 lakh crore coal scam. (www.business-standard.com)

Confident of adding 118 GW by March 2017: Power Ministry

February 13, 2014. The government said it would be able to meet the target of adding 1,18,000 MW capacity by March 2017. The government, which was unable to achieve the previous plan period (2007-12) target of 78,577 MW due to fuel scarcity issues, aims to add 118,000 MW power generation capacity by March 2017. The target includes the spill-over of the previous Plan's shortfall, Planning Commission's current target of over 88,000 MW and nuclear as well as renewable power capacities. About 18,200 MW, including 2,000 MW of solar power, is to be added during the current financial year, ending March 31. As for the domestic supplies, Coal India plans to increase its production to 615 million tonnes by 2016-17. In 2012-13, India added over 20,000 MW capacity. The government was unable to achieve the revised target of 62,000 MW in the 11th plan period (2007-12), mainly due to scarcity of coal and gas. The original target for the plan period was 78,577 MW. The total capacity added during the period was close to 55,000 MW. India's installed generation capacity is 2,28,722 MW. (www.business-standard.com)

Power tariffs set to go up in Bihar

February 13, 2014. The state government's power distribution companies (DISCOM) are pushing for a major hike in the electricity tariffs on account of the rising operational costs. According to state government, these companies are already under heavy losses. Hence, it's imperative for these companies to pass some of their cost to the customers.

The state government has already submitted its proposal to the Bihar Electricity Regulatory Commission (BERC), the authority responsible for fixing electricity prices in the state, for the tariff hike. The BERC would more likely to decide on this matter early next month. The state government, in its proposal, has asked the commission for a 20-25 percent increase in the power tariffs. However, going by the past records, the commission may grant a hike of up to 10 percent. (www.business-standard.com)

Discount for defaulters: 50 pc subsidy for those who backed AAP for not paying electricity bills

February 12, 2014. The Aam Aadmi Party (AAP) government announced sops for supporters who backed Arvind Kejriwal's protest against power bills in the national capital. AAP announced that people who backed Kejriwal's call to not pay electricity bills will get 50% cut in their bill. People who did not pay their electricity bills between October 2012 and April 2013 heading to a call given by Arvind Kejriwal will now have to pay only 50 per cent of the dues. They will also not have to pay any penalty. The move is likely to cost the exchequer ` 6 crore. The Aam Aadmi Party had promised to reduce power tariff in Delhi if voted to power. AAP is engaged in a battle with discoms, but Chief Minister Arvind Kejriwal has assured Delhiites that they would not have to live without electricity. Kejriwal has however, asked people to be ready for "some difficulties" in case power distribution companies continued with their "blackmailing" tactics.

Alleging that there was "active collusion" between the companies and the previous Congress government, Kejrial has said that the power tariff would be decided on the basis of the CAG scrutiny of the three private discoms.

Delhi's power regulator DERC asked AAP government to examine ramifications of possible cancellation of licenses of BSES discoms, particularly about their huge financial liabilities. In a letter, the Delhi Electricity Regulatory Commission conveyed to the government that it examine various issues carefully including appointment of administrators in the discoms in the event of suspension of their licensees. The DERC said it has increased the power tariff by nearly 70 per cent in the last four years to help the discoms financially. (economictimes.indiatimes.com)

INTERNATIONAL

OIL & GAS

Upstream

Pemex in JV talks to boost crude production: CEO

February 18, 2014. Petroleos Mexicanos, the world’s fifth-largest oil producer, will begin its first production joint ventures (JV) as early as the end of this year, its chief executive officer (CEO) said. Mature fields are the “low hanging fruits” where Pemex, as the state-owned oil company is known, can increase production in the short term, CEO Emilio Lozoya said. Through new technology and investment, Pemex expects to increase output in mature fields with proven reserves that currently only yield minimal crude, he said. Pemex, the third-largest oil exporter to the U.S., has seen production decline for nine consecutive years, as output fell to 2.52 million barrels per day in 2013 from 3.3 million barrels per day in 2004. Given a new law enacted by President Enrique Pena Nieto, the company intends to partner with foreign companies for the first time in 76 years to boost production to as much as 4 million barrels per day by 2025.

Pemex reported a find of 150 million to 200 million barrels of oil in a deep-water well in the Perdido area east of the Texas-Mexico border. Lozoya said it will be able to partner with private companies to co-develop deep-water fields in the Gulf of Mexico. (www.bloomberg.com)

Global oil companies to cut exploration spending

February 18, 2014. Global oil firms, hit by one of the worst years for discovery in two decades, are about to cut exploration spending, pulling back from frontier areas and jeopardising their future reserves, industry insiders say. Notable exploration failures in high-profile places such as Africa's west coast, from Angola all the way up to Sierra Leone, have pushed down valuations for exploration-focused firms and are now forcing oil majors to change tack. It is becoming increasingly difficult to find new oil and gas, and in particular new oil, says Tim Dodson, the exploration chief of Statoil, the world's top conventional explorer last year.

The discoveries tend to be somewhat smaller, more complex, more remote, so it is very difficult to see a reversal of that trend, Dodson said. The industry at large will probably struggle going forward with reserve replacement. Although final numbers are not yet available, Dodson said 2013 may have been the industry's worst year for oil exploration since 1995. (economictimes.indiatimes.com)

Indian firm signs contracts to explore for oil, gas off Bangladesh

February 17, 2014. Indian state-run oil and gas company ONGC Videsh signed two production sharing contracts (PSC) to explore oil and gas in Bangladeshi waters. State-run Bangladesh Oil, Gas and Mineral Corporation, known as Petrobangla, awarded shallow water blocks SS-04 and SS-09 in the Bay of Bengal to the Indian company.

Finance Minister Abul Maal Abdul Muhith said that Bangladesh needed to be more prudent in its use of natural gas because of falling production and rising consumption. Bangladesh currently faces a daily shortfall in gas supplies of 500 million cubic feet (mmcf) on demand of 2,700 mmcf per day, he said, and demand is rising 8 to 10 percent each year. Under the PSC, ONGC Videsh will spend $103.2 million during the initial exploration of the two blocks. It will also conduct an in-depth seismological survey of the blocks during a five-year initial exploration period which will be followed by a three-year exploration period. The contractors will be allowed to operate and sell oil and gas for 20 years from an oil field and 25 years from a gas field.

The firm must offer to sell gas to Petrobangla and if Petrobangla does not accept within six months the contractor can sell it in Bangladesh. Bangladesh's offshore gas output has been zero since Oct. 1 when the Sangu offshore field was shut permanently because it was not commercially viable. Sangu was only producing 2.5 million cubic feet gas a day compared to the up to 180 million cubic feet of gas a day it produced at its peak. (in.reuters.com)

Shell to drill for oil in Namibian waters

February 17, 2014. Royal Dutch Shell is to drill offshore Namibia, a growing area of interest for oil and gas explorers, the southern African country's mines and energy minister said. Shell has taken over exploration blocks 2913A and 2914B in the Orange Basin from Signet Petroleum, with the Anglo-Dutch group acquiring a 90 percent stake in the two blocks and Namibian national oil company Namcor keeping its 10 percent carried interest.

Best known for its uranium reserves, Namibia is attracting interest from oil and gas companies keen to explore its offshore potential, which has been likened to Brazil's Santos basin. Shell was involved in exploration work around the Kudu gas field in the Orange Basin, the only economically feasible fossil fuel find made so far in Namibian waters, but dropped out in 2002. Spanish company Repsol said it would drill its first well in Namibian waters as early as February or March, the Welwitschia-1 well in the Walvis Basin, in partnership with London-based Tower Resources. (www.rigzone.com)

Libya's oil output falls to 390k bpd due to protests in west: NOC

February 16, 2014. Libya's oil production has fallen to 390,000 barrels per day, some 70,000 bpd less than, as protests have partly blocked flows from the El Sharara oilfield, the state National Oil Corp (NOC) said. Armed groups, former rebels and tribes often shut down pipelines or occupy oilfields to make demands on the state as Libya tries to overcome instability nearly three years after a NATO-backed revolt toppled leader Muammar Gaddafi.

National production is around 390,000 bpd, NOC said. The El Sharara oilfield was below its capacity of 340,000 bpd because protesters partially shut down a pipeline near the western town of Zintan leading from the field to the port of Zawiya. Output at the El Sharara field had been at 301,000 bpd. The El Wafa oilfield was again working normally after protesters had shut gas and oil pipelines from the field, which produces around 30,000 bpd of very light oil condensate. (www.reuters.com)

ExxonMobil commences gas production from Damar field in Malaysia

February 14, 2014. US-based ExxonMobil has commenced gas production at the Damar field off the east coast of Peninsular Malaysia. ExxonMobil, along with its joint-venture partner Petronas Carigali, has planned a total of 16 development wells for the platform. ExxonMobil Exploration and Production Malaysia, a subsidiary of ExxonMobil, holds a 50% stake in the project, while the Petronas Carigali holds the remaining 50% stake. ExxonMobil Development said that Damar will help meet increasing natural gas demand in Malaysia. Damar field, which has been developed under a gas production sharing contract between ExxonMobil, Petronas Carigali and Petronas, has a projected capacity of 200 million cubic ft of gas per day. (drillingandproduction.energy-business-review.com)

Colombia looking to sweeten terms for deepwater contracts

February 14, 2014. Colombia is working to sweeten contract terms for oil and gas companies looking to exploit its harder-to-reach deepwater reserves at an auction this year. Royal Dutch Shell Plc, Exxon Mobil Corp. and ConocoPhillips are among foreign producers interested in bidding at the July auction of 97 offshore and onshore blocks, Javier Betancourt, head of the Hydrocarbons Agency, said. Terms for conventional and unconventional contracts will remain the same as a 2012 bidding round. The 2014 auction will include about 10 offshore blocks in the Caribbean and three in the Pacific, as well as 19 unconventional blocks, located primarily in Colombia’s La Luna shale formation, Betancourt said.

The hydrocarbons agency also plans to auction six to eight coal-bed methane blocks after the main July round, seeking to follow in the footsteps of the U.S. and Australia where the energy source is being exploited. Mexico’s imminent energy industry opening means the country will become an important player, with the additional supply contributing to a “buyers’ market” for energy companies looking for new contracts, Betancourt said. (www.bloomberg.com)

Eni flows oil, gas in third discovery offshore Congo

February 13, 2014. Eni S.p.A. has discovered wet gas and a light oil accumulation in a pre-salt area in the Marine XII block, about 11 miles offshore Congo. The exploratory well, Nene Marine 3, is an extension of the discovery well Nene Marine 1 and the appraisal well Nene Marine 2. Both wells are located at a distance of 1 mile and 2 miles, respectively.

Eni now estimates that the discovery of the Nene Marine filed contains 1.2 billion barrels of oil and 30 billion cubic meters of gas in place. Overall, the potential of the field and the nearby Litchjendilj Marine field is estimated to hold 2.5 billion barrels of oil equivalent in place.

The company plans to continue to focus on exploration, it said in its 2014-2017 strategic plan, with its key areas being Mozambique and Kenya in East Africa, Congo, Angola and Gabon in West Africa, the Pacific basin, the Barents Sea and Cyprus. Eni also stated in a separate statement that the company’s growth will be driven by 26 projects, which will contribute about 500,000 barrels of oil equivalent per day by 2017. (www.rigzone.com)

Poland's PGNiG finds new gas deposit in southern Poland

February 12, 2014. Polish gas monopoly PGNiG found a new gas deposit in the south-eastern part of the country with resources estimated initially at several billion cubic metres, the company said.

PGNiG plans to start production from the new deposit in the second half of 2015 with daily production seen at 100,000 cubic metres. (www.rigzone.com)

Downstream

PetroChina to start new refinery’s commercial operations in April 2014

February 17, 2014. PetroChina plans to start commercial operations at its new $6 bn greenfield and petrochemical complex in southwest China, in April 2014. The 200,000 bpd refinery, which is situated in Pengzhou of Sichuan province, has started its test operations in January 2014. The plant has been designed to process PetroChina's own crude from northwest Xinjiang region, as well as oil from Kazakhstan and Russia.

Through a trunk pipeline started in 2006, the crude will be piped to the refinery from Kazakhstan. The refinery is integrated with a petrochemical complex comprising 800,000 tonne-per-year ethylene unit that makes feedstock for plastics and textiles. (refiningandpetrochemicals.energy-business-review.com)

S.Korea's KNOC selling land for refining or petchem investment

February 17, 2014. Korea National Oil Corp (KNOC) is seeking a refiner or a petrochemical maker willing to buy land to build a 5 trillion won ($4.70 billion) refining or petrochemical plant, the state-run oil company has said. South Korean refiner S-Oil Corp is likely to bid to acquire the land for a refinery or petrochemical plant it has been planning.

S-Oil, with 669,000 barrel-per-day of refining capacity, is looking to expand its paraxylene plant by buying the land from KNOC. Paraxylene, used to make clothing and plastic bottles, is produced by processing naphtha, a refined product of crude oil or condensates.

KNOC has said that potential bidders must submit approvals from their boards of directors for a refinery or petrochemical plant investment plan as one of the qualifications for participating in the tender for the land. (www.downstreamtoday.com)

Greece's Hellenic Petroleum to temporarily shut down flexicoker in March

February 14, 2014. Greece's biggest refiner Hellenic Petroleum said it will shut down its Elefsina flexicoker unit for about a month in March for maintenance and repairs. Elefsina units other than the flexicoker will also be temporarily affected, it said. Hellenic said previously it was preparing for a shutdown after it discovered small fractures and a distortion on the hull of the flexicoker's gasifier. (www.downstreamtoday.com)

Japan's TonenGeneral considers cutting Chiba refinery capacity

February 14, 2014. Japanese oil refiner TonenGeneral Sekiyu KK is considering cutting capacity at its Chiba refinery by 13 percent, or 23,000 barrels per day (bpd), to meet government norms on improving efficiency. The Japanese government imposed a law in 2010 requiring decades-old refineries to either scrap inefficient crude distillation units (CDUs) or invest in heavy residue cracking units by the end of March 2014 to better compete with Asian rivals. TonenGeneral said it is examining cutting capacity of the sole 175,000 bpd CDU at Chiba. Japan's second-biggest refiner by capacity also said its previously flagged plans to scrap the 67,000 bpd No. 1 CDU at its Kawasaki refinery and the 38,000 bpd No. 2 CDU at its Wakayama refinery will come in March. TonenGeneral also plans to raise the capacity of its sole residue refining unit that processes low-priced heavy oil into lighter products such as gasoline, called a residue hydrocracking unit, to 34,500 bpd from 31,000 bpd in March. That unit is at the Kawasaki refinery. The refining law comes as a falling population and a shift to less polluting vehicles has cut demand in Japan for everything from gasoline to petrochemicals used to make nappies, leading to surplus capacity at refiners, estimated at around 20 percent, or more than 1 million barrels per day (bpd), in 2010. (www.downstreamtoday.com)

Transportation / Trade

BP to partly shut Indonesia LNG facility in July for maintenance

February 18, 2014. One liquefied natural gas (LNG) train at BP's Tangguh facility in Indonesia will shutdown for 30 days for planned maintenance in July-August. Indonesia's oil regulator SKKMigas forecast LNG production from Tangguh in Papua to reach 116 cargoes this year, up from 107 cargoes targeted in 2013. (www.downstreamtoday.com)

Hyundai Merchant to divest LNG transport business in South Korea

February 13, 2014. South Korea-based logistics company Hyundai Merchant Marine is planning to sell its liquefied natural gas (LNG) transport business to a local investment firm, for around $1.03 bn. IMM Investment has been selected as preferred bidder to take over LNG transport business, while the deal is expected to complete in the first half of 2014. The LNG unit, which includes ten vessels, transports around 20% of the country's annual LNG imports under long-term contracts with state-run Korea Gas. The divestment of LNG transport business is part of parent Hyundai Group's plan to raise support funds of around $3.10 bn. (transportationandstorage.energy-business-review.com)

Pakistan terror strike hits Tapi pipeline project

February 13, 2014. India, which hopes to receive natural gas from a $9-billion gas pipeline from Turkmenistan via terror-hit regions of Afghanistan and Pakistan, is concerned about the series of blasts in pipelines in Pakistan that disrupted supplies in the neighbouring country.

Pakistan had to suspend gas supply in most parts of Punjab after terrorists blasted three pipelines near Yousaf Abad. Pakistani authorities reportedly said the gas supply would be restored. The delay was mainly because people could not go near the blast sites due to the heat. India had raised the issue of its security, but recent serial blasts in the gas pipeline in Pakistan would not affect the Turkmenistan-Afghanistan-Pakistan-India (TAPI) pipeline project. Turkmenistan has conveyed to India that the consortium leader for the TAPI project would be finalised in the first quarter of 2014.

The proposed pipeline crosses through volatile regions of Afghanistan and Pakistan, which was initially a major concern for India. But India agreed to join the project after other countries agreed to take up the full responsibility of the safe passage of gas from their territories. According to the plan, the pipeline starts from the Dauletabad gas field in southeast Turkmenistan and after crossing a 145-km stretch in the country enters Afghanistan. It covers about 735 km in Afghanistan and about 800 km in Pakistan before entering the Indian boarder in Punjab. (economictimes.indiatimes.com)

Policy / Performance

Norway to offer 61 blocks in new licensing round

February 14, 2014. Norway plans to offer oil firms a total of 61 blocks for oil and gas exploration in the 23rd licensing round on its continental shelf, the country's oil and energy ministry said. Thirty-four blocks are in the south east part of the Arctic Barents Sea, 20 are in other parts of the Barents Sea, while the remaining seven are in the Norwegian Sea, it said.

The ministry said oil firms had nominated a total of 160 blocks for the 23rd round. It is common for the ministry to offer fewer blocks than requested by the oil firms. (www.rigzone.com)

Egypt signs oil, gas exploration deals Dana, Edison, Petroceltic

February 13, 2014. Egypt has signed gas and oil exploration deals with the United Arab Emirate's Dana Gas, Ireland's Petroceltic International and Italy's Edison, the oil ministry said. The deals will bring in investment of at least $265 million for eight new wells in Northern Sinai in Mediterranean Sea and Nile Delta. Exploration companies have been hesitant to develop untapped gas finds in Egyptian waters partly because the amount the government pays them barely covers their investment costs.

Egypt has been struggling with soaring energy bills caused by high subsidies it provides on fuel for its population of 85 million. The subsidies have turned the country from a net energy exporter into a net importer over the last few years. Egypt has started repaying some of its debt to foreign oil companies, which had reached more than $6 billion this year. (www.rigzone.com)

Iraq considers more actions against Exxon for Kurd oil venture

February 12, 2014. Iraq is considering additional measures against Exxon Mobil Corp. over deals the company signed with the semi-autonomous Kurdish region, Deputy Prime Minister for Energy Affairs Hussain al-Shahristani said. The Oil Ministry is “studying other measures” against Exxon after requiring the company to reduce its involvement in the West Qurna-1 field. Authorities in Baghdad have received a reply from the Kurdistan Regional Government, or KRG, on proposals for ending an impasse over oil exports from the region, al-Shahristani said.

Iraq’s Kurds have halted crude flows via the national export pipeline to Turkey amid a dispute with authorities in Baghdad on the legality of deals the Kurds signed with international companies, such as Exxon and Total SA. The KRG has announced plans to sell crude it has pumped through its own new pipeline to Turkey.

National oil production is also being constrained by insufficient storage space in the south, Shahristani said. Iraq will be unable to maintain production levels at full capacity of 3.5 million barrels a day unless it increases handling capacity at the southern port of al-Faw, Shahristani said. Iraq pumped as much as 3.524 million barrels on one day in January, he said. (www.bloomberg.com)

Is Bangladesh gas price an unfair benchmark?

February 12, 2014. Delhi chief minister Arvind Kejriwal's example of Canadian explorer Niko Resources, which holds 10% in Reliance Industries Ltd's KG-D6 block, selling gas in Bangladesh at half the price in India is akin to comparing apples with oranges.

Niko sells gas to Bangladesh's state-run BAPEX at $2.4 -2.6 per million cubic feet (1,000 cubic feet) from Block 9. This is an on-land block west of Dhaka producing 100 million cubic feet of gas and 300 barrels per day of condensate. It includes the Bangora-I gas-producing facility and the Lalmai discovery. The price in Bangladesh is in million cubic feet. Under the Indian system of measuring gas volumes by mmBtu (per million metric British thermal unit), the price works out to $2.04 and $0.8 per cubic metre.

This may stack up well even against present gas price of $4.2 per mmBtu in India. But the favourable comparison ends there. Block 9 is an on-land field that was given to Niko years ago without bidding. On-land fields require less time and investment to explore and develop than deepwater blocks such as KG-D6, off the Andhra coast. The market dynamics in Bangladesh is different from India. There's not enough gas demand in Bangladesh to consume its entire indigenous production. But with domestic production not keeping pace with rise in demand, India meets 40% of its gas needs through imports priced up to $18 mmBtu. Bangladesh's state-run explorers have lost the financial capacity to invest, explore or expand due to years of sub-optimal pricing. Investors too have exited, one example being Tullow recently selling out 30% in the very Block 9 to Kris Energy of Singapore. (economictimes.indiatimes.com)

POWER

Alberta First Nation to build 1 GW gas-fired power plant

February 17, 2014. Focus Equities Inc. and the Paul First Nation have announced that they have formally advised the Alberta Electric System Operator (AESO) of their intent to proceed with, and connect the proposed 1,000 MW Great Spirit Power Project to the Alberta grid. The new combined cycle, gas-fired power plant is proposed for the Paul First Nation’s industrial park, with construction of the facility to be completed in 2017. (www.pennenergy.com)

EIB signs loan agreement for El Shabab power plant project

February 14, 2014. The European Investment Bank (EIB) has signed a loan agreement for an amount of €205mn to finance El Shabab power plant project. The project consists of the conversion of an open-cycle power plant to combined-cycle gas technology. It will significantly improve the generating efficiency of the power plant, resulting in an increase in capacity to 1500 MWe representing a 50% increase in electricity output, in order to meet the growing electricity demand at a competitive cost and with a low environmental impact. (fossilfuel.energy-business-review.com)

Siemens signs Baiji power plant service agreement

February 13, 2014. Siemens Energy has secured a contract to perform service and maintenance at the 600 MW Baiji gas power plant, located in the Salah al-Din governorate in Iraq. Awarded by Iraq's Ministry of Electricity, the contract requires the company to supply and deliver spare parts for the power plant's four SGT5-2000E gas turbines, and perform significant upgrades, remote monitoring and diagnostic services, and field service for an initial period of four years. (fossilfuel.energy-business-review.com)

Transmission / Distribution / Trade

ABB wins order to strengthen Canadian power grid

February 18, 2014. Swiss power and automation technology group ABB has secured a $60 mn order from Canadian Hydro-Québec to replace major components of the ultra-high voltage transmission system that supplies clean electricity from North to South Quebec. As per the order, ABB will be responsible for upgrading two Static Var Compensators (SVC) at the Albanel substation, located about 500km north of Montreal. The substation is said to provide fast-acting reactive power compensation for the 735kV power transmission network. The upgrades will be completed by 2016. (utilitiesnetwork.energy-business-review.com)

Pakistan’s Keyal Khwar hydro project receives €100mn EIB loan

February 18, 2014. The Government of Pakistan has been awarded a €100mn long-term loan by the European Investment Bank (EIB) for the construction of the Keyal Khwar hydropower project. To be constructed by the Water and Power Development Authority (WAPDA), the project calls for the construction of a 128 MW run-of-river hydropower plant with a small 1.5ha reservoir for daily regulation to provide a clean and reliable supply of energy. (hydro.energy-business-review.com)

China Three Gorges says govt finds favoritism in bidding

February 18, 2014. China Three Gorges Corp., the state-owned operator of one of the world’s biggest hydro-power projects, said a government investigation found favoritism in awarding construction contracts. Managers allowed friends and family members to be involved in projects, the company said. Others violated rules around extravagant spending, owning several apartments and purchasing higher-standard cars than allowed. Construction of the Three Gorges Dam on the Yangtze River began in 1994. Now one of the world’s largest power stations, it has attracted controversy for its environmental impact and the displacement of the local population. (www.bloomberg.com)

RENEWABLE ENERGY / CLIMATE CHANGE TRENDS

National

Tata, Welspun, Essel Power keen on Mahagenco's 50 MW solar plant

February 18, 2014. The Maharashtra power generation company or Mahagenco has received expressions of interest from Tata Power, Welspun Energy and Essel Power to set up a 50 MW solar plant on PPP model at Shirsuphal in Baramati district. Mahagenco has planned to set up a 50 MW solar project in Baramati on a public-private partnership basis, in which the power producer will have to build, operate and maintain the plant for 25 years and even share revenue with the state power generation company.