-

CENTRES

Progammes & Centres

Location

WEEK IN REVIEW

Ø ENERGY: India Energy Competitiveness Outlook 2035

Ø POWER: Regulators – Helpless, Politics – Hopeless, Utilities – Clueless and Consumers – Cashless!

DATA INSIGHT

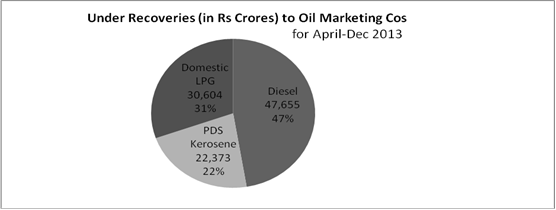

Ø Domestic LPG: Subsidy versus Direct Benefit Transfer

NEWS HEADLINES AT A GLANCE

INDUSTRY DEVELOPMENTS

· Cairn India turns its focus to gas in Rajasthan

· Jammu-Pak border might have oil & gas, says ONGC

· Essar Oil plans expansion in Tier II Indian cities

· HPCL's Vizag refinery resumes full operations

· ONGC to sell additional gas to SEIL

· BP seeks licence to sell jet fuel in India

· IOC may buy minority stake in Canada shale gas & LNG project for $1 bn

· Tata Power commissions 10 kW micro hydro project in Maharashtra

· Patel Engineering consortium lowest bidder for 1 GW hydel project

· Baytex Energy to acquire Aurora Oil to add shale production

· Norway’s biggest oil find in decades may yield 70 pc recovery rate

· French oil refiners blame US, Asia, Mid East for near $1 bn loss

· Italy companies to build LNG terminal to lower energy costs

· Rosneft to export extra 9 million tonnes of oil to China this year

· Spectra Energy to expand pipeline systems in New England

· Tidal Lagoon seeks to build $1.2 bn UK marine power plant

· Petrovietnam to import coal from 2017 for power plants

· Power shortage is pulling Indo-Nepal trade scenario against Nepal

POLICY & PRICE

· ONGC, Oil India seek to buy Indian Oil stake at lower price

· Price fixing of petro products done as per expert advice: Moily

· Govt orders RIL to stop LPG retailing

· CNG price slashed by ` 14.90 per kg, cooking gas by ` 5 per unit

· CAG asks oil ministry to explain delay in KG-D6 audit

· Fossil fuel subsidies must go: Mayaram

· Govt keen on investment despite South Sudan unrest: Khurshid

· Planning Commission prepares Cabinet note on coal for captive power plants

· West Bengal govt clears hurdle for NTPC project

· SC orders NTPC not to cut power supply to BSES till March 26

· Govt cannot directly regulate power tariff: Scindia

· Delhi govt reaching out to power companies for replacing discoms

· Kuwait approves $12 bn bids for clean fuels project

· Iran plans to offer better oil exploration terms than Iraq

· Pakistan hopes to sign cut-price gas deal with Qatar

· Russia offers stake in 10 exploration blocks to ONGC

· Indonesia to limit coal production this year to support prices

· UP to draw ` 8.8 bn investment into solar power projects

· Tamil Nadu to buy solar power after consumers freed of mandate

· AAP's free water policy may end up in lot of wastage: Pachauri

· India to build world's largest solar power plant

· Restore accelerated depreciation scheme for wind sector: Suzlon

· Tata Power to invest ` 15 bn in renewables

· Hindustan Cleanenergy signs 30 MW & 20 MW PPAs for solar projects in Punjab, UP

· China extends electric-car subsidies to fight air pollution

· Global-warming slowdown due to Pacific winds, study shows

· India, China & SA should agree to emission cuts: Annan

· Brazil presidential candidate proposes clean energy incentives

WEEK IN REVIEW

ENERGY

India Energy Competitiveness Outlook 2035

Lydia Powell, Observer Research Foundation

|

O |

ne of the significant observations in World Energy Outlook 2013 (WEO 2013) is that energy price competitiveness is likely to redraw the world industrial map. What would the world industrial map look like and what would that mean to India? The answer depends critically on the availability and affordability of energy in India relative to the regions that it is in competition with for export markets and trade.

One of the key developments predicted is that high gas and industrial electricity prices in the European Union (EU) and Japan are likely to lead to a strong decline in their share of global exports of energy intensive goods (chemicals, primary aluminium, cement, iron and steel, pulp and paper, glass, and refining). On the other hand the United States is likely to see an increase in its share of exports on account of its relative energy price advantage over Europe and Japan.

WEO 2013 also points out that the emerging economies in Asia would see a larger (compared to the USA) increase in the share of exports with domestic demand growth as a key driver. India is expected to increase its global market share in energy intensive industries such as chemicals and ferrous metals by 2035. The share of GDP spent on fossil fuel imports is expected to decline in all regions including India but India is likely to spend as much as 2.2 % of its GDP in purchasing power parity (PPP) terms on fossil fuel imports even by 2035. The European Union is the only region with a higher share at 2.3% of GDP (PPP) on energy imports.

So far, rising energy prices combined with relatively low short term price elasticity of household energy demand has increased the share of energy expenditure in household income across regions but a fall is expected by 2035 in most regions except India. In the EU, the share of energy expenditure is expected to fall from the current 8% to about 5% and in the United States and Japan it is likely to fall from about 6% to 3%. In India the share of energy expenditure in household income is expected to increase from the current 2% to about 4% by 2035 on account of increasing energy access and subsidy phase out for electricity and natural gas. Overall the share of energy expenditure in household income is expected to converge at 3-4% of household income by 2035. In Indian households, energy consumption efficiencies are likely to increase but the large scale shift from non-commercial to commercial energy is likely to nullify these gains.

One observation that must be made at this point is that India is not likely to gain significantly from the changes in global energy competitiveness and consequently not gain from the opportunities that these changes are likely to present. Though India will demonstrate one of the highest growth rates in energy intensive sectors such as chemical and non-ferrous metals and increase its share of the global market, its relative position with regard to other major exporters such as the EU and China is not likely to change. In general, energy competitiveness of India is likely to be low especially when energy price is seen in PPP terms. The WEO 2013 observes that each dollar of industrial value added involved about 135 grammes of oil equivalent with a value of $ 0.07 or 7% in 2012. If industry in India has to pay 50% more than the world average for its energy its overall cost will be 3.5% higher assuming all other production costs are equal. In some sectors energy is a major input that goes into production and consequently high energy prices is a major handicap in competitiveness. The good news (or the bad news in terms of gaining from the change in the energy competitiveness landscape) is that the Indian economy is not reliant on energy intensive manufacturing which means that the impact of a change in competitiveness relatively low. But the bad news (or the good news) is that energy consumption in India is likely to increase significantly given the exceptionally small base from which India is starting with or without energy intensive manufacturing. High energy prices will have an impact on economic growth, development and on access to energy.

India’s persistent trade deficit to which energy imports make a big contribution is a drag on economic growth and manufacturing activity as each dollar spent on imports that is not matched by a dollar of exports slows overall demand within the economy. The question we should ask now is this: what can India do to improve its energy competitiveness given that it faces the prospect of increasing energy prices and increasing energy imports? For answers let us take a deeper look at the United States which was at the same point roughly a decade ago. The key to the increase in energy competitiveness of the United States is the increase in domestic energy production and the consequent low energy prices. The low price is not entirely on account of efficiency, technology and so on. Though abundance of supply has contributed to the fall in price, it is also partially the result of historical trade barriers that prevent the export of natural gas and crude. The competitiveness derived from low energy prices has resulted in the possibility of a manufacturing revival in the United States. Estimates suggest that by 2015 the United States would have a cost advantage of 5-25% over Germany, Italy, France, UK and Japan in a range of industries including plastics, rubber, machinery, electrical equipment, computers and electronics. Another study suggests that one million manufacturing jobs may be created in the United States solely due to the advantage of low gas prices and the consequent demand for products associated with the production of gas. These projections could be debated but the fundamental logic of low energy prices enhancing economic competitiveness stands.

The fairy tale of riding on the shale gale towards greater energy competitiveness is so compelling that many energy observers are commenting on the prospects of replicating the shale gas revolution in their respective nations (including many in India). But the idea that one can has to find shale gas to replicate America’s success in energy competitiveness is not sound. A comparison of industrial energy prices in major energy consuming regions quoted in WEO 2013 shows that India and the United States had the same price of natural gas in 2012 (at market exchange rates) even though the reason for the low price in India is the control on gas prices. Rather than increase energy competitiveness it has produced only the negative outcome that generally goes with low energy prices. It has inhibited domestic production. We can see this happening both in the United States and in India. Liberal economists in USA are calling for the removal of trade barriers that prevent export of gas and crude. Ironically India has tied its domestic gas price to that of the United States (and other global gas markets) in such a way that when USA starts exporting gas (to India along with other regions) it is likely to increase rather then reduce the price of domestic gas in India.

More interestingly the analysis in WEO 2013 shows that India had one of the lowest prices for coal in 2012 and yet one of the highest price for electricity (once again at market exchange rates) that it generated with that cheap coal. Only high tax / high primary fuel import countries such as Japan and the EU had higher electricity prices. In theory, we can mine coal and generate electricity efficiently to gain energy competiveness and easily blow away the shale gale especially when the labour competitiveness component is added. But the question is who in India is likely to take a long term view and think through these possibilities?

Views are those of the author

Author can be contacted at [email protected]

POWER

Regulators – Helpless, Politics – Hopeless, Utilities – Clueless and Consumers – Cashless!

Ashish Gupta, Observer Research Foundation

|

T |

he problems of the coal and the power sector are well known among the important stakeholders. There is no need for rocket-science to resolve the issues. The only thing that is required is the will! Though the picture of the power sector is always presented as gloomy it is not the case in the entire sector. Not everyone in the value chain is losing the money especially the generation and the transmission sector concerned.

Indeed the distribution link is weak and discoms are struggling with the financial woes but the situation has been created due to governance issues. We all know that the fault arises not from the regulatory side but from the government side. The various ministries have created the myth of an independent regulator among the stakeholders while retaining duality in responsibility. On the one hand the Government lays down policies and on the other hand it also exercises ownership over the companies. But it is put down differently on paper! The government created regulators under the Electricity Act and through executive directives so as to introduce openness and transparency. But now they do not want to give any power to the regulatory bodies that they have set up. Apart from the electricity regulator who has some autonomous power, the picture is quite gloomy for Petroleum and Natural Gas Regulatory Board (PNGRB), Directorate General of Hydrocarbons (DGH), Atomic Energy Regulatory Board (AERB) and the impending Coal Regulator.

Well, the above position only reflects one set of the problems. The other major problem is how to arrive at the reasonable electricity tariffs? It is a complicated task to describe power sector but as it is remunerative source of revenue for the Central (15 % tax) and the State Government (20 % tax). And yet the sector does not recover cost of service. In competitive bids quoting of low tariffs by power producers for the life of the plant is highly irrational especially when they do not know what future holds. The tariff quoted for such a long period does not concur with the banks’ lending norms which limit the period to twelve years. The logical bid must quote tariff for twelve years and thereafter revise it depending upon the existing situation. This kind of mechanism works well both for the banks and the power producers.

Coming to the setting of the tariffs at the distribution level, the regulator approves the tariff after taking into account the average revenue requirement of the utility. It is a highly complicated job as the regulator has to maintain a balance between the reasonable tariffs and infusion of competition.

Well the concept of the reasonable tariff is quite vague as it differs from stakeholder to stakeholder. For a common man it should be reduced, for utilities it should be cost reflective and for the regulator it should be affordable. There is no consensus though all of them are correct from their respective positions. Politics makes it more difficult! Since the problem is known and we have to live with it, blaming the other party is the only feasible option left for the concerned stakeholders.

Coming to the competition issues, it is only a paper tool used for creating the delusion of competition for retail electricity consumers. Interestingly, Coal India is criticised for enjoying a monopoly position but when it comes to private distribution companies the same is praised on the grounds of efficiency. How can the treatment be so different for the public sector company and a private utility which is actually enjoying the same status? The question here is: does the private distribution utility take advantage of its dominant position. The question will be left open for the sharp minds to answer. Furthermore the transfer cost to another utility has been increased by a huge margin making open access only a concept on paper. According to the regulator we are on the right track in implementing the Electricity Act and the timing is just not right for open access.

As observed earlier, rocket-science is not required to solve problems. A genuine will is the need of the hour. The political masters must be kept away from the regulator and the regulator who succumbs to political pressure must be shown the door. Sometimes regulators are appointed arbitrarily with regulators not knowing anything about the sector. Fortunately those days are over and now the regulators are more experienced and knowledgeable on the sector. One very important thing that is missing is autonomy that is curbed by politics. This practice must be stopped and the renewed power sector must be unveiled. Political leaders must note that this is the only way forward!

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT

Domestic LPG: Subsidy versus Direct Benefit Transfer

Akhilesh Sati, Observer Research Foundation

As on Dec 2013

|

State* |

No. of Transactions (to Aaadhar linked Bank Accounts) |

Cash transfers (in Rs. Crore) |

|

Andhra Pradesh |

18713012 |

956.86 |

|

Chandigarh |

156011 |

7.76 |

|

Daman and Diu |

28020 |

1.34 |

|

Goa |

804206 |

40.39 |

|

Gujarat |

11216 |

0.51 |

|

Haryana |

343605 |

16.58 |

|

Himachal Pradesh |

1225273 |

62.53 |

|

Jharkhand |

226200 |

11.48 |

|

Karnataka |

2891926 |

141.36 |

|

Kerala |

6738423 |

322.53 |

|

Madhya Pradesh |

1107151 |

55.34 |

|

Maharashtra |

4360607 |

210.4 |

|

Odisha |

37210 |

1.78 |

|

Pondicherry |

685730 |

34.56 |

|

Punjab |

2195436 |

110.39 |

|

Rajasthan |

281469 |

12.9 |

|

Tamil Nadu |

228215 |

10.84 |

|

West Bengal |

230292 |

11.03 |

|

Total |

40,264,002 |

2,008.58 |

*State-wise data for 184 Districts covered till Phase V of DBTL Scheme.

Source: Press Information Bureau (for MoPNG Dec30, 2013 & Feb. 03, 2014)

DBTL achievement since its launch (1st June 2013) was over six percent of the total under recoveries as of Dec 2013

NEWS BRIEF

NATIONAL

OIL & GAS

Upstream

Cairn India turns its focus to gas in Rajasthan

February 10, 2014. After making a success of discovering and producing oil from its Rajasthan field, Cairn India is now turning its focus to gas. The Vedanta group company, which is now close to breaching the 2-lakh barrels of oil equivalent per day (boepd) output mark, is stepping up efforts to monetise the gas reserves in the southern part of the block and in the Rageshwari field. The company said that based on first estimates, the reserves could be bigger than that in the Cambay Basin CB 0S2 field, which held 300 billion cubic feet of gas. Drilling is currently on in Rageshwari and in new deep gas prospects in the southern part of the Rajasthan block. It is also close to the developed gas market of Gujarat. Last month’s notification of the new gas pricing guidelines which will see prices doubling from the present $4.2 per mmbtu starting April 1 has made development of the new gas prospects attractive for Cairn. The gas will be piped out through a new pipeline that will be built parallel to the existing oil pipeline that extends to the Gujarat coast. When it sought approval for the existing Barmer-Boghat (Gujarat) pipeline which evacuates the Rajasthan crude, Cairn had, with foresight, secured Right of Use of such width as to enable it to lay another parallel pipeline in future. The existing oil pipeline, which was originally built to transport 1.75 lakh boepd, is now moving close to 2 lakh boepd. Thanks to drag reducing additives used by Cairn, which are chemicals that form a coating on the pipeline and help reduce friction, the quantum of oil transported has increased. (www.thehindu.com)

Jammu-Pak border might have oil & gas, says ONGC

February 7, 2014. After years of exploration in the Himalayan region, Oil and Natural Gas Corporation (ONGC) is yet to find anything in the fragile mountainous regions of Jammu & Kashmir and Himachal, despite drilling in several areas. However, its senior officials say their studies indicate chances of huge oil and gas reserves on the 100-km Bhimbargali-Naushera border belt in Jammu’s Poonch and Rajauri districts, where oil exploration has become a major challenge for security reasons. Pakistan has found around 50 oil wells across the border. The centre at present allocates blocks to oil companies through a bidding process. On the other hand, ONGC had been drilling regularly elsewhere in Jammu and Himachal Pradesh, where it has not been able to strike any gas or oil. Recently, it drilled 5,000 metres at the Kasauli block in Himachal Pradesh; it is set to drill in one more block in the Jwalamukhi area, shortly. ONGC spends around ` 100 crore for drilling one block. ONGC’s studies show that there are chances of finding oil and gas in the Bhimbargali-Naushera belt in Jammu and Kashmir. (www.business-standard.com)

Essar Oil plans expansion in Tier II Indian cities

February 11, 2014. Essar Oil, India's second largest private refiner, is keen to diversify its retail presence by launching petrol pumps in cities where land cost is not exorbitant. Essar's interest in expanding retail operations follows regular increases in diesel prices and free pricing of petrol by state firms, which had pushed out private competition by retailing fuel below market rates with the help of state subsidies. Monthly increases in diesel prices by about 50 paise has narrowed the gap between the state-set and market prices of diesel. Essar Oil' profit after tax for the third quarter rose 63% to ` 52 crore. Its Vadinar Refinery, India's second biggest, processed 4.86 million tonnes of crude, which was lower than 5.14 million tonnes in the corresponding period last year, due to a planned seven-day shutdown in November. The refinery processed 98% of heavy and ultra heavy crude in its crude diet, which is the highest ever. (economictimes.indiatimes.com)

HPCL's Vizag refinery resumes full operations

February 6, 2014. Hindustan Petroleum Corp Ltd (HPCL) is operating its 166,000-barrel-per-day (bpd) Vizag refinery in Southern India at full capacity from January 25. HPCL had partly shut the plant in August after a fire in the cooling tower. Apart from its Vizag refinery, HPCL also operates a 130,000 bpd plant in western Maharashtra state. It also has a stake in the 180,000 bpd Bathinda refinery in northern India, which is operated by Hindustan-Mittal Energy Ltd. (economictimes.indiatimes.com)

Transportation / Trade

ONGC to sell additional gas to SEIL

February 5, 2014. Oil and Natural Gas Corp (ONGC) will sell an additional 15,000 cubic meters per day of gas to Steel Exchange India Ltd (SEIL) for its captive power plant at Kothepeta. ONGC will supply gas from its Kammapalem field in Rajahmundry to Andhra Pradesh's largest private steel manufacturer. The total gas allocation now stands at 75,000 cubic meters per day. SEIL has facility to generate up to 12 MW of power at its Kothapeta plant, SEIL said. Presently SEIL is supplying the unutilised power up to 9 MW to APTRANSCO. (economictimes.indiatimes.com)

IOC may buy minority stake in Canada shale gas & LNG project for $1 bn

February 5, 2014. Indian Oil Corp (IOC) plans to acquire a minority stake in a Canadian shale gas and liquefied natural gas project for about $1 billion. The Cabinet is expected to approve it this month. The company is in advanced talks of negotiations for the assets that include a 10% stake in Progress Energy Resources Corporation. Oil Secretary Vivek Rae had convened an urgent meeting at the headquarters of IOC to discuss the proposal. Rae heads an empowered committee of secretaries that examines and recommends IOC's overseas acquisitions before seeking Cabinet Committee on Economic Affairs (CCEA)'s approval. Secretaries of finance, foreign, law, department of public enterprises and Planning Comission are its other members. IOC may rope in other oil companies to acquire Canadian shale gas and LNG assets of Progress Energy. Malaysian oil major Petronas had acquired Progress Energy for about $5.2 billion. Progress Energy has shale gas assets in northeastern British Columbia and its sister concern, Pacific NorthWest LNG is planning to build an LNG export facility on Canada's west coast. Petronas recently sold a 3% interest in Progress Energy's gas assets and the LNG export facility to Petroleum Brunei. (economictimes.indiatimes.com)

BP seeks licence to sell jet fuel in India

February 5, 2014. BP Plc, Europe's second-largest oil company, has applied for licence to retail jet fuel or ATF at airports in India. Having invested close to $8 billion in India's oil and gas sector, BP is eligible for a licence to retail petrol, diesel and ATF but the London-based firm is keen to enter the aviation space for now. BP made the application for ATF retailing. Fuel retailing in India is permitted to companies who have invested ` 2,000 crore in oil and gas infrastructure in the country. ATF sale is a deregulated sector and any company which is able to tie-up logistics can enter the sector. While jet fuel bunkering at most of the airports in the country are owned and controlled by state-owned firms, the refuelling infrastructure at new airports being built by private firms is bid out and allows third party access to the infrastructure. The third party access to the storage and refuelling infrastructure at the airports would allow BP access but the challenge would be to arrange for logistics to carry the fuel from refinery or port of import to the airport because unlike state-owned firms, BP does not own pipelines to transport it. India had in 2002 allowed private companies entry into fuel retailing subject to the minimum investment criteria. Reliance Industries, Essar Oil and Royal Dutch Shell got licences and opened petrol pumps. However, RIL shut pumps and other companies went slow on expansion as government gave huge subsidised to state-owned firms, practically making it impossible for private companies to compete. (economictimes.indiatimes.com)

Policy / Performance

ONGC, Oil India seek to buy Indian Oil stake at lower price

February 11, 2014. An Empowered Group of Ministers (EGoM) is likely to meet soon to consider Oil and Natural Gas Corp's (ONGC) request to buy a 5 per cent stake in Indian Oil Corp (IOC) from the government at a lower price. ONGC and Oil India Ltd (OIL) each want to buy a 5 per cent stake in IOC from the government at the six-month average traded price and not at the current rate. The ultimate decision will be taken by an EGoM headed by Finance Minister P Chidambaram. The purchase of the 10 per cent stake that the government wants to disinvest in IOC was recently deliberated by the boards of ONGC and OIL. Oil Secretary Vivek Rae said that the 10 per cent stake will be split equally between ONGC and OIL. The government expects to raise between ` 4,800-5,000 crore through its 10 per cent stake divestment in IOC. ONGC already holds an 8.77 per cent stake in IOC. The Cabinet had originally cleared the 10 per cent stake sale in IOC through an offer for sale. However, the Finance Ministry had to finally resort to the block deal route on account of stiff opposition from the Petroleum Ministry. The oil ministry was of the view that IOC shares should not be sold at current prices because they do not reflect the right valuation of the company. (economictimes.indiatimes.com)

Price fixing of petro products done as per expert advice: Moily

February 11, 2014. Rejecting Arvind Kejriwal's allegation on gas pricing issue, Petroleum Minister M Veerappa Moily hit back at the Delhi Chief Minister and said that price fixing of petroleum products is done as per expert advice. The Minister also said he took special interest to ensure that the CNG and PNG prices are reduced. He was reacting to Kejriwal's announcement that Delhi Government would file criminal case against former Petroleum Minister Murli Deora, Veerappa Moily, industrialist Mukesh Ambani and others on gas pricing issue. Kejriwal said the Anti Corruption Branch (ACB) of Delhi Government has been asked to probe the matter based on a complaint filed by former Cabinet Secretary TSR Subrmanian, former Navy Chief Admiral Tahiliani and eminent lawyer Kamini Jaiswal besides a former Expenditure Secretary. The Minister said India is importing 73 to 75 per cent of the petroleum product, which requires more than $165 and $170 billion. (economictimes.indiatimes.com)

Gujarat govt pulls back consent for NELP-X blocks

February 10, 2014. In a setback to the latest oil and gas block auction round, the Gujarat government has withdrawn clearance for the 9 areas falling in the state that are part of the offerings under 10th round of New Exploration Licensing Policy (NELP). The central government, which as per the Constitution is the owner of both offshore and onland hydrocarbon resource, last month unveiled 46 blocks for offering in NELP-X the first auction round in two years. (economictimes.indiatimes.com)

Govt orders RIL to stop LPG retailing

February 10, 2014. The government has asked Reliance Industries Ltd (RIL) to stop retailing locally produced liquefied petroleum gas (LPG), casting a shadow on the company's vast network that supplies cooking gas to 1 million customers, mostly in rural areas, and 134 auto LPG outlets. The sale violated an oil ministry directive, called the LPG control order, that mandates that all cooking gas produced in India must be supplied to state-run oil retailing companies, which are forced to import a part of the requirement. The oil ministry had accused RIL of selling LPG produced in its Jamnagar, Hazira and Patalganga plants to retail customers in violation of it order. RIL's subsidiary LPG Infrastructure India Ltd (LIIL) is undertaking parallel marketing of LPG and has substantial customers. It told the ministry that the move to prohibit the company from marketing gas would deprive its rural customers of the fuel. Its customers are mostly in rural areas of Gujarat, Maharashtra, Rajasthan and Madhya Pradesh. The company is also marketing auto LPG in markets, which are not served by outlets of state oil companies. (economictimes.indiatimes.com)

Oil Ministry seeks ` 260 bn as fuel subsidy for Q3

February 10, 2014. The Petroleum Ministry has asked for ` 26,000 crore as fuel subsidy for the third quarter of this financial year, but the finance ministry is inclined to provide only ` 10,000 crore cash support. Fuel retailers lost ` 39,725 crore on selling diesel, kerosene and domestic cooking gas (LPG) at government controlled rates in October-December 2013. Upstream companies Oil & Natural Gas Corp and Oil India Ltd will make good ` 15,937.59 crore, or about 40 per cent, of this amount. For the rest, the oil ministry wants cash subsidy. Without the government subsidy, state-owned fuel retailers Indian Oil Corp (IOC), Hindustan Petroleum (HPCL) and Bharat Petroleum (BPCL) will report losses in the third quarter. HPCL is scheduled to report its earnings while BPCL results are due on February 12, followed by IOC on February 13. The finance ministry is willing to give only ` 10,000 crore of subsidy support for now and wants the rest to be carried forward to the next financial year. The government provided ` 17,772 crore of cash subsidy in the first half of the current financial year. Fuel retailers sell diesel and cooking fuel at rates below the cost of production. The losses they incur are met by way of cash subsidy and support from upstream firms. For Q3, ONGC's share of the burden will be ` 13,764.11 crore, while OIL will bear ` 2,173.48 crore. GAIL India did not pay any subsidy in Q3. ONGC's liability is near the record ` 13,796.04 crore it shelled out in Q2. IOC's share of the support provided by the two exploration companies would be ` 8,261.30 crore. BPCL would get ` 3,971.31 crore and HPCL ` 3,704.98 crore. During April-September, IOC, BPCL and HPCL together lost ` 60,907 crore in revenue on selling diesel and cooking fuel. Of this, ONGC made good ` 26,417.82 crore, OIL ` 4,215.76 crore and GAIL ` 1,400 crore. ONGC's subsidy burden in Q3 would be about 10 per cent higher than the ` 12,433 crore paid in the same period of the previous financial year. (economictimes.indiatimes.com)

CNG price slashed by ` 14.90 per kg, cooking gas by ` 5 per unit

February 8, 2014. Indraprastha Gas Ltd (IGL) has cut the price of compressed natural gas (CNG) by 30% and made piped gas to households 20% cheaper as the sole supplier in the national capital region passed on the benefits of cheaper gas to consumers. This follows the government's decision to give city gas firms their entire requirement from domestic fields, eliminating the need to import costly liquefied natural gas (LNG). CNG in Delhi has fallen to ` 35.20 per kg from ` 50.1 per kg while piped gas is down to ` 24.50 per standard cubic meters (scm). In Noida, Greater Noida and Ghaziabad the new CNG price is ` 40.15 per kg from ` 56.7 per kg and piped gas would now cost ` 26.20 per scm. This would be the lowest ever price band for IGL in the past two years. (economictimes.indiatimes.com)

CAG asks oil ministry to explain delay in KG-D6 audit

February 7, 2014. The Comptroller & Auditor General (CAG) of India has asked the oil ministry to explain the delay in approving audited accounts of Reliance Industries-operated KG-D6 block since 2008-09, which the company said is affecting investor confidence. While Reliance accused the Directorate General of Hydrocarbons (DGH) for raising minor issues to stall the approval processes despite the company submitted audited accounts long back, DGH has blamed the oil ministry. DGH said it had finished scrutinizing audited accounts of the KG-D6 block for 2008-09 and 2009-10 about three years ago and had forwarded the same to the oil ministry for its approval. DGH, which is the technical arm of the oil ministry and initially scrutinizes accounts of oil and gas fields before sending them to the ministry for final approvals, could verify accounts for only 2008-09 and 2009-10. RIL blamed DGH for delays in clearing accounts for 2008-12. RIL was unable to ramp up output from the field pending approvals of its investment plans in the block. Now, it is able to raise the output gradually. DGH and Oil ministry said CAG is continuously issuing memos related to expenditure and output. Recently, it has sought their explanation on reasons for allowing the contractor to overspend and build access infrastructure. (economictimes.indiatimes.com)

Oil Ministry's U-turn: Regulator nod needed for CNG stations

February 6, 2014. In a U-turn on setting up of CNG selling stations, the Oil Ministry has said only those firms that are authorised by oil regulator can set up outlets to retail compressed natural gas (CNG) to automobiles. The ministry had, in September, held that Petroleum and Natural Gas Regulatory Board (PNGRB) approval is not needed for setting up CNG selling stations and companies were free to set up CNG pumps across cities. The ministry had on September 16, 2013 issued an order saying "no authorisation from PNGRB is required for setting up of a CNG station." Order which was issued to GAIL India Ltd came as a surprise as PNGRB had since 2009 been issuing licences to entities for city gas distribution (CGD) networks, essentially for retailing CNG to automobiles and piped cooking gas (piped natural gas or PNG) to households. The fresh directive of February 5 too has been issued to GAIL Chairman. The ministry said the September 16 letter was in response to GAIL writing to the Oil Secretary asking if in terms of PNGRB Act, 2006, CNG stations are integral part of CGD network or not. The directive had come as a blow to PNGRB which had in October 2013 invited bids for issuing licences for retailing CNG and piped cooking gas in 14 cities including Bengaluru, Pune and Amritsar. Bids were due on February 11 but the regulator has extended the deadline by three months to May 12. This is the fifth round of CGD bidding, with the previous fourth round that was announced in September 2010, scrapped in November 2011. PNGRB had invited bids in 2009 for 13 cities in first two rounds. It hasn't been able to award most of the cities offered in third round because of litigations. (economictimes.indiatimes.com)

Fossil fuel subsidies must go: Mayaram

February 5, 2014. India cannot afford fossil fuel subsidies in perpetuity and there is clear understanding that these must go, Economic Affairs Secretary Arvind Mayaram said. Mayaram's comment assumes significance as it comes days after the government raised the supply quota of cheaper cooking gas cylinders to 12 per year from nine. The increased supply, being implemented on Congress Vice-President Rahul Gandhi's directive, would raise the government's subsidy burden by around ` 5,000 crore. India is the fourth largest consumer of energy and this is when a very large number of Indians do not have access to energy, he said. (economictimes.indiatimes.com)

Govt keen on investment despite South Sudan unrest: Khurshid

February 5, 2014. Damage to Indian-invested oil facilities in war-torn South Sudan will not deter New Delhi from future business opportunities in the region, its foreign minister said in Khartoum. ONGC Videsh Ltd, a partner in two joint oil production companies in South Sudan, announced that the firms had temporarily halted operations because of deteriorating security. The Indian firm has also invested in oil pipelines in Sudan. Since mid-December, soldiers loyal to South Sudan President Salva Kiir have been battling rebel troops and militia who back his sacked vice president Riek Machar. India had about $2.3 billion invested in Sudan's petroleum sector before South Sudan's independence in July 2011. The exact value north of the border after the separation is difficult to determine. South Sudan split with about 75 per cent of united Sudan's oil production but pipelines and the Red Sea export terminal remained in the north. India is one of the world's five biggest emerging economies and oil is its biggest import. Its demand is expected to grow at 2.7 per cent a year up to 2040 -- well above the global rate of 1.7 per cent. Khurshid said he had visited Iraq and Saudi Arabia to push energy ties, and he told energy firms to be more adventurous in searching for global oil supplies. Sudan is the final stop on his regional tour that included Morocco and Tunisia. In Khartoum, he said that India is evaluating the petroleum potential of two blocs in Sudan. He was to meet later with executives of the oil firm, followed by talks with Sudan's Oil Minister Makawi Mohammed Awad. Khurshid praised the patience and wisdom which he said Sudan has shown in dealing with the South Sudan war. Khartoum belongs to an East African bloc which brokered a shaky ceasefire deal last month. India sees two-way trade with Sudan reaching $1 billion (741 million euros) by the end of the 2013-2014 financial year, Khurshid said during the first-ever visit to Sudan by an Indian foreign minister. The two nations, both formerly ruled by Britain, have long-standing ties. India is the second-largest exporter to Sudan after China, which is also a major investor in the Sudan-South Sudan oil sector and in Africa generally. (economictimes.indiatimes.com)

BN Talukdar appointed as DG Hydrocarbons

February 5, 2014. The Government of India has appointed former Director Explorations and Development, Oil India Limited (OIL), BN Talukdar, as the Director General, Directorate General of Hydrocarbons, Ministry of Petroleum and Natural Gas. Talukdar has over 37 years of experience in the petroleum industry. He was associated with all exploration, development, reservoir management and drilling activities of OIL. He has also served as Director in-charge for all the overseas operating concessions for the oil exploration major. Prior to joining Oil India Limited in 1977, he worked in the Reservoir Engineering Division of ONGC. He has to his credit a number of oil and gas discoveries for Oil India Limited with his unconventional way of thinking and approach. He has to his credit a number of advanced technologies including the horizontal drilling technology. (www.assamtribune.com)

POWER

Generation

OTPCL deposits ` 1.8 bn as pvt land cost for 2.4 GW plant

February 11, 2014. Odisha Thermal Power Corporation Ltd (OTPCL), a 50:50 joint venture between Odisha Mining Corporation (OMC) and Odisha Hydro Power Corporation (OHPC), has deposited ` 184.52 crore for acquisition of private land for its 2400 MW (3x800) power plant proposed at Kamakhyanagar in Dhenkanal district. The power purchase agreement (PPA) for sale of entire power to be generated by the OTPCL power station has been executed with Gridco, the state owned power trading firm. The Tentuloi coal block in Talcher coalfields with reserve of 1234 million tonne has been allocated for the power plant. Annual requirement of coal is 12.62 million tonne per annum. The state government has sought consultancy support from NTPC Ltd for the power plant. It has been decided that OTPCL will form its own project management team with skeletal manpower consisting of personnel having project implementation experience in large coal-based power plants. (www.business-standard.com)

Tata Power commissions 10 kW micro hydro project in Maharashtra

February 10, 2014. Tata Power said it has commissioned the 10 kW micro hydro project at Bhira village in the state. The low-head micro-hydro turbine, installed in the tailrace of the 150 MW Bhira hydro power station in Maharashtra, utilises the existing flow rate available to generate supplementary clean energy to manage its auxiliary loads. The micro unit was successfully synchronised to the grid, the company said. (economictimes.indiatimes.com)

JSW Energy shuts Barmer power plant due to fuel shortage

February 8, 2014. Sajjan Jindal-promoted JSW Energy has shut its thermal power plant in Barmer due to non-availability of fuel. Raj West Power, a wholly owned unit of JSW Energy, shut down the 8x135 MW power station at Barmer for about one month "due to nonavailability of lignite under the fuel supply agreement," the company said. The company is exploring various options to secure fuel to ensure that the plant gets back to operations at the earliest. The Barmer plant achieved full capacity of 1,080 MW in March 2013. (economictimes.indiatimes.com)

Patel Engineering consortium lowest bidder for 1 GW hydel project

February 7, 2014. A consortium of Patel Engineering, Turkey's Limak and BHEL has emerged as the lowest bidder for a 1,000 MW hydel project in Jammu & Kashmir. The 1,000 MW Pakal Dul hydro electric project, having four units of 250 MW, is located in Doda district of J&K. Four parties participated in the bidding process and the consortium comprising the company, Limak and BHEL quoted lowest price of ` 8,904 crore, Patel Engineering said. Chenab Valley Power Projects Pvt Ltd- a joint venture floated by NHPC, JKSPDC (J&K State Power Development Corp) and PTC India - had invited tenders for implementing the project. In the project, NHPC and JKSPDC would have 49% stake each while PTC India would hold the remaining shareholding. Patel Engineering also said it has bagged new construction projects worth ` 1,110 crore. (www.business-standard.com)

Transmission / Distribution / Trade

TPDDL, BSES Rajdhani, BSES Yamuna move larger HC bench against CAG audit

February 7, 2014. Three private discoms moved the Delhi High Court (HC) against a single judge bench order refusing to stay the city government's decision asking CAG to audit their accounts. A bench of Chief Justice N V Ramana and R S Endlaw, fixed the intra-court appeal of Tata Power Delhi Distribution Ltd (TPDDL) and Reliance Anil Dhirubhai Ambani Group firms, BSES Rajdhani Power Ltd and BSES Yamuna Power Ltd, on February 14. Advocate Prashant Bhushan, who earlier represented Delhi government in the case, said these three petitions be also transferred to another bench which is going to hear a PIL on a similar issue and which had also decided the matter pertaining to CAG audit of telecom firms. The discoms had moved the court against the January 7 decision of the Aam Aadmi Party-led government ordering CAG audit, saying the top auditor is not empowered to scrutinise accounts of private companies. The three private firms had come into being in 2002 when the then Delhi government decided to privatise power distribution. Delhi discoms are a 51:49 per cent joint venture between private companies and Delhi government. (economictimes.indiatimes.com)

Three bid for Mumbai power distribution permit

February 7, 2014. Leading power utilities including Torrent Power, Reliance Infrastructure, GMR, GVK and CESC stayed away from filing expressions of interest (EoI) for a distribution licence in the area currently serviced by Tata Power. The Maharashtra Electricity Regulatory Commission (MERC) has received only three EoIs – from Tata Power, Maharashtra State Electricity Distribution Company (MahaVitaran) and Kolkata-based India Power Corporation. MERC had invited EoIs as Tata Power's licence period is valid up to August 15 this year. The last date to submit the EoI was January 31. (www.business-standard.com)

Power struggle between Reliance discoms and Delhi govt turns ugly

February 5, 2014. The standoff between the Anil Ambani group's distribution firms and the Kejriwal government intensified further as the discoms said the threat to terminate their licenses was illegal and arbitrary, while the chief minister himself stepped in and alerted the lieutenant governor about the brewing "ugly" situation. NTPC fueled fire saying it would show no leniency to BSES discoms, which had defaulted thrice, while Tata Power, that also supplies parts of Delhi, had consistently paid their bills on time. Delhi's power regulator PD Sudhakar said that he had called the discoms for meeting, in which they said they would try to ensure smooth supply to the city. The Delhi government has already asked the regulator to terminate the licenses if they carry out their threat to blackout large parts of Delhi on the grounds that they have no money to purchase electricity from NTPC and other suppliers. Kejriwal wrote to Lieutenant Goveror Najeeb Jung about "this most serious matter" as the government may have to step in to control the ugly situation which may be created by the three discoms. Union Power Minister Jyotiraditya Scindia said the discoms must pay up, but he refused to intervene in the tussle. Reliance Infra controlled BSES Yamuna and BSES Rajdhani said the Kejriwal government's step was a huge setback to reforms and said it was surprising that government nominees did not discuss the matter in the board meeting. Delhi government holds 49% stake in BSES discoms and Tata Power Delhi Distribution. (economictimes.indiatimes.com)

Planning Commission prepares Cabinet note on coal for captive power plants

February 11, 2014. The Planning Commission has circulated a Cabinet note seeking to implement the recommendations of the B K Chaturvedi Committee to ensure coal supply for captive power plants (CPPs). The note for consideration of the Cabinet Committee on Investment (CCI) suggests that the Coal Ministry sign initial pacts as envisaged to provide coal to consumers, including CPPs, which cannot be covered with letters of assurances or fuel supply agreements. The Chaturvedi panel also suggested that the Coal Ministry should provide coal to CPPs already commissioned, including those likely to start by March 2015, by making minor adjustments in supplies to other consumers. The CCI had earlier directed that an inter-ministerial group (IMG) under the Member (Energy) of the Planning Commission identify projects in sectors other than power that require coal for captive power plants. The Planning Commission constituted the IMG under the chairmanship of Chaturvedi. The eight-member panel includes representatives from the coal, power, steel and mines ministries. The Chaturvedi Committee was asked to identify CPPs in sectors other than power, assess their coal needs in the 12th and 13th Plan periods and suggest ways to provide coal to them. This was in the light of the Coal Ministry's policy to consider captive power plants non-priority coal consumers. The IMG estimated that coal-based captive power plants would add about 10,000 MW of capacity during the 12th Plan period (2012 to 2017) and would require about 20 million tonnes of the fuel. It also suggested options to make available the additional 20 million tons of coal. Captive power plants have been growing at a fairly aggressive pace in the country. In March 2013, the total installed capacity of captive plants in the country was about 39,375 MW. During the first year of the 12th Plan, they added 3,925 MW, of which 2,255 MW was coal-based. According to Indian Captive Power Association, out of the 39,375 MW captive power capacity at the end of the 11th Plan, the coal-based capacity was 22,615 MW. (economictimes.indiatimes.com)

Meghalaya for power exchange to meet shortfall

February 11, 2014. Power-starved Meghalaya has decided to go in for a power exchange arrangement with the 726 MW gas-based plant at Palatana to overcome the shortfall of power demand in the state, Meghalaya Power minister Clement Marak said. The demand for power is above 600 MW while the installed capacity in Meghalaya is only 310 MW. Presently, Meghalaya is getting around 38 MW from ONGC Tripura Power Company Limited at Palatana in Tripura. Meghalaya, which was once a power-surplus state, has now become power-deficit. The state generates only over 46 MW from Umiam Hydro Electric Project and Myntdu-Leshka Hydro Electric Project. The Umiam Hydro Electric Project, which has an installed capacity of 185 MW, is currently generating a mere 40 MW, while the 126 MW Myntdu-Leshka Hydro Electric Project is generating merely 6 MW, the power minister said. The minister said the shortfall in power supply in the state was also due to power regulation by the NHPC Limited, shutdown of the Kopili Hydro Electric Project by North Eastern Electric Power Corporation Limited, and also because of the low water level of the two reservoir of Umiam Hydro Electric Project and Myntdu-Leshka Hydro Electric Project. (www.business-standard.com)

37 hydropower projects in ecologically sensitive Lahaul & Spiti

February 11, 2014. The Himachal government has allotted 37 hydropower projects with capacity of 2,292 MW in tribal district of Lahaul and Spiti with fragile ecology. However, only four projects with 6.40 MW have been commissioned and the remaining 33 projects are still in initial stage of survey and investigations and implementation agreements have not been signed, power minister Sujan Singh Pathania said. Pathania said that Local Area Development Committees had not been constituted so far and as such no meeting of these committees had taken place. He informed that Larsen and Toubro (L&T) has been allotted 420 MW Reoli Dugli hydropower project while Seli Hydroelectric Power Company has been allotted the 400 MW Seli project on Chenab River, near Shulling village. Residents of Lahaul Valley had knocked the doors of union environment and forests ministry in 2012, protesting against the upcoming hydropower projects on Chenab River basin. (economictimes.indiatimes.com)

Uttarakhand seeks power to clear additional hydro projects

February 11, 2014. After the June 2013 floods and widespread destruction, the Uttarakhand government was widely criticised for illegal constructions and increasing hydro-power projects across its river beds. However, the state has sought permission from the Centre to increase its mandate for clearing an additional 50 hydro projects and also removal of eco-sensitive zones in the region. According to laws, the state government can clear hydro-power projects up to 2 MW on its own, beyond which it will need the Centre’s consent. According to a top official at the Ministry of Environment and Forests (MoEF), the state government has asked the ministry to increase the mandate for clearance up to 25 MW. This would lead to clearance of at least 50 more hydro projects. The Uttarakhand government plans to have a total of 336 hydropower projects with total capacity of 27,189 MW. The largest number (122) of such projects are in the Alaknanda basin, and the largest capacity is proposed to be in the Sharda basin at 12,450 MW. The state wants caps for clearances to be increased to 25 MW in Bhagirathi basin. (www.business-standard.com)

West Bengal govt clears hurdle for NTPC project

February 11, 2014. The West Bengal government decided to allot an additional 98 acre land and provide coal linkage with riders to NTPC's proposed 1,600 MW plant, clearing two major hurdles for the project. This would help remove uncertainty over implementation of the proposed project at Katwa in Burdwan district, Chief Minister Mamata Banerjee said after a Cabinet meeting held outside Kolkata for the first time. Stating that NTPC had around 500 acre which was acquired by the previous Left Front government, Banerjee said it was decided to give an additional 98 acre from government held land so that there was no pressure on land owners. When implemented, the project would be big gain for the state, she said. Stating that West Bengal was a power surplus state, she said a power bank has been set up and excess generation could be given to other states. NTPC had said that unless 150 acre of land was provided by the state government it was not possible to go ahead with the project. (economictimes.indiatimes.com)

Power Ministry mulls ` 60 bn subsidy to discoms for cheap power

February 10, 2014. Power Ministry has initiated the process of sourcing gas for fuel-starved power projects and has proposed ` 6,000 crore subsidy for distribution companies so that they can sell electricity at lower rates to consumers. However, power plants running on gas from Reliance Industries' KG-D6 basin will have to wait for the fuel as any additional gas from those fields has been reserved for the beleaguered Dabhol project in Maharashtra till March 2015. The Ministry of Power has circulated a Cabinet note on the issue of gas availability to the fuel-starved power projects. The note, which was circulated by the ministry, states that the Central government will give subsidy to the electricity distribution companies for buying expensive power and selling it at a discount. This support will be for the APM (administered pricing mechanism) gas-based plants which will be hit by price increase from April, 2014. The subsidy will enable the discoms to sell power at ` 5 per unit by getting the government subsidy for two years. The Power Ministry has proposed that any additional gas after meeting the requirement of the urea plants will be given to Ratnagiri Gas and Power Private Ltd. RGPPL was set up to takeover and revive the assets of Dabhol Power Company Project. NTPC and GAIL hold 32.86 per cent each in RGPPL, Maharashtra State Electricity Board has 17.41 per cent holding and the remaining 16.87 per cent is held by the financial institutions. Other power plants (apart from RGPPL) which are dependent on KG-D6 gas and are right now getting nothing will be able to get natural gas only in FY'16. For the power plants that are ready but have no gas, the Power Ministry has proposed a financial relief package which comes with a rider. (economictimes.indiatimes.com)

SC orders NTPC not to cut power supply to BSES till March 26

February 8, 2014. The Supreme Court (SC) averted impending blackouts in the capital by ordering power major NTPC not to cut supplies to the Anil Ambani group's distribution arms, which have defaulted on payments saying low tariffs had impoverished them. In a case that could shape the future of regulation and reform in power distribution and private sector's involvement in the fund-starved sector, a bench comprising Justices SS Nijjar and AK Sikri asked the state-run power major to keep electricity flowing until March 27, when the case will come up for hearing. It also asked discoms to pay ` 50 crore in two weeks as a part payment of dues. The discoms BSES Rajdhani and BSES Yamuna owe nearly ` 700 crore to NTPC. The discoms are at war with NTPC that wanted to penalise them by snapping supplies. They have also crossed swords with Delhi's Kejriwal government, which has asked the regulator to terminate their licences if they fail to supply electricity. The bench issued notices to all parties in the case, including other suppliers such as NHPC, Damodar Valley Corp, Satluj Jal Vidyut Nigam, PowerGrid, transmission firms, Delhi's regulator, the Union power ministry and also Delhi's chief secretary. (economictimes.indiatimes.com)

Govt cannot directly regulate power tariff: Scindia

February 6, 2014. There is no provision for government to directly regulate electricity tariff and rates are determined by regulatory commissions, Power Minister Jyotiraditya Scindia said. Scindia said tariff of distribution companies are determined by the State/Joint Electricity Regulatory Commissions (SERCs/JERCs) based on the principles enunciated under the Electricity Act, 2003 and policies framed thereunder. However, through appropriate policy framework and programmes, the government is promoting efficiency in generation, transmission and distribution business as also supporting strengthening of the distribution infrastructure, he said. Electricity tariff for generation and transmission companies owned or controlled by the central government is regulated by the Central Electricity Regulatory Commission (CERC). In the case of generation, supply and transmission within the state, the tariffs are determined by respective state regulatory authorities. The Minister said that Section 61 of the Electricity Act provides for guiding principles which the appropriate commission is required to consider for specifying the terms and conditions of tariff. (www.business-standard.com)

Delhi govt reaching out to power companies for replacing discoms

February 6, 2014. The Kejriwal government raised the pitch in its battle with Delhi's power distribution companies by reaching out to companies to replace the incumbents but an appellate tribunal intervened and asked the regulator not to pass an order on termination without its consent. The Delhi government had begun exploratory talks with several distribution companies from across the country, which can step in if licenses of BSES Yamuna and BSES Rajdhani of Anil Ambani's Reliance group are terminated.

Companies from Gujarat, Maharashtra and West Bengal have responded, without identifying them. Apart from the Tatas and Reliance Infrastructure of the Anil Ambani group that supply electricity in Delhi and Mumbai, companies involved in distribution in other regions include CESC in Kolkata, Torrent in Ahmedabad, Gandhinagar, Surat, Agra and Bhiwandi, GTL in Maharashtra and DPSC in West Bengal and Bihar. Delhi Power Secretary Puneet Goel wrote to the regulator to cancel the electricity distribution licenses of private discoms, which are unable to supply reliable power to the consumers in view of lack of funds. Subsequently, Arvind Kejriwal himself wrote to Lt Governor Najeeb Jung saying that there may not be any option with electricity regulator but to revoke licenses of discoms and take over their operation. (economictimes.indiatimes.com)

INTERNATIONAL

OIL & GAS

Upstream

Baytex Energy to acquire Aurora Oil to add shale production

February 8, 2014. Baytex Energy Corp. agreed to buy Aurora Oil & Gas Ltd. for C$1.8 billion ($1.63 billion) in cash to expand its U.S. shale portfolio, in the Canadian heavy-crude producer’s biggest purchase. The acquisition, which will allow Baytex to add output from the Eagle Ford shale formation in Texas, follows purchases by the producer in North Dakota’s Bakken and Three Forks shale formations. It will boost the Calgary-based company’s production of higher priced light oil, in lieu of the heavy oil that currently accounts for 75 percent of output. The purchase may signal an imminent rise in deals in the Canadian oil and natural gas industry as company valuations are low and there’s a need to replace production. Increasing output from shale formations such as the Eagle Ford has helped U.S. oil production rise to the highest level since 1988. The nation is set to propel past Saudi Arabia as the world’s largest supplier in 2015. Eagle Ford oil production in the first 11 months of last year was up more than 4,000 percent from 2010, according to the Railroad Commission of Texas. Oil and gas companies are forecast to spend $23 billion in the area in 2014, $5 billion less than last year because of increased efficiency, consultants Wood Mackenzie Ltd. said in a report. (www.bloomberg.com)

Norway’s biggest oil find in decades may yield 70 pc recovery rate

February 7, 2014. Norway’s Johan Sverdrup discovery, the country’s largest oil find in decades, could achieve a recovery rate of as much as 70 percent, according to the field’s operator, Statoil ASA. Current resource estimates for Sverdrup, which may be Norway’s biggest since Statfjord in 1974 and the third-largest ever, don’t take into account a 70 percent recovery rate. Discovered in two parts by Lundin Petroleum AB in 2010 and Statoil in 2011, Sverdrup renewed optimism in Norway’s oil industry after a decade of falling output from aging North Sea fields. The oil discovery could supply as much as 25 percent of Norway’s oil production 10 years from now, the Norwegian Petroleum Directorate said. Statoil estimated in December that Sverdrup holds as much as 2.9 billion barrels of oil equivalent even as it cut its resource estimate and delayed the start of output by a year. (www.bloomberg.com)

Magnolia expects strong production growth amid more drilling

February 7, 2014. Onshore US-focused junior producer Magnolia Petroleum said that it expects strong production growth in 2014 as drilling activity increases on its already-producing US leases. Magnolia has received a large number of proposals from operators such as Devon Energy, Newfield Exploration, Chesapeake Energy and Kodiak Exploration to drill increased-density wells across its portfolio of producing leases. (www.rigzone.com)

Production from KBM fields off Peninsular Malaysia to peak at 13k bopd

February 5, 2014. Malaysia's brown field services provider for the upstream petroleum industry Petra Energy Berhad reported that the country's firm Petroliam Nasional Berhad (Petronas) had announced the first oil production from the Kapal, Banang & Meranti (KBM) Cluster fields, offshore Peninsular Malaysia which commenced Dec. 16, 2013. The KBM Cluster is an eight-year development project with Kapal being in its first development and production phase. The Kapal field facilities consist of one mobile offshore production unit (MOPU), one storage tanker with approximately 600,000 barrels capacity, one drilling rig with an attached well bay module and two flexible flow lines. According to Petronas, through this mobile offshore production concept, there is plan to continue determining the potential production from the three KBM fields. The initial production rates from the cluster were over 10,000 barrels of oil per day (bopd), with peak production reaching 13,000 bopd. (www.rigzone.com)

Downstream

Flint Hills North Pole refinery shutting amid ‘enormous’ costs

February 5, 2014. Flint Hills Resources LLC will begin to permanently halt operations in May at the North Pole refinery, Alaska’s largest by capacity, citing poor economics and “enormous” costs for cleaning up soil and groundwater. The subsidiary of Koch Industries Inc. will take the extraction unit at the refinery near Fairbanks out of service on May 1, ending gasoline production, and shut the No. 2 crude unit by June 1, ceasing the output of jet fuel and all other refined products, the Wichita, Kansas-based company said. It will continue to sell fuels at terminals in Anchorage and Fairbanks. The announcement follows the shutdown of the refinery’s No. 1 crude unit in early 2012 because of what Flint Hills described at the time as “challenging economics” and rising crude prices. Cleaning contaminated soil and groundwater has further compounded costs, the company said. Flint Hills will sell refined products at the terminals in Alaska using fuel shipped by rail or truck from refiners in the state and “other potential sources”. The refinery has 720,000 barrels of tank storage capacity that’s linked to the company’s North Pole terminal. (www.bloomberg.com)

Repsol's Cartagena refinery to undergo maintenance in June-traders

February 5, 2014. Repsol's 220,000-barrels-per-day (bpd) Cartagena refinery in southern Spain will undergo one month of maintenance in June, traders said. The turnaround will affect 100,000 bpd of the plant's capacity. (www.downstreamtoday.com)

French oil refiners blame US, Asia, Mid East for near $1 bn loss

February 5, 2014. The French refining sector lost 700 million euros ($945 million) last year, French oil lobby UFIP said, as cheap U.S. fuel imports and more competitive plants in Asia and the Middle East ate away at European refiners' margins. French refineries have also seen their traditional African markets for gasoline exports dry up as refiners in the United States take the market. The cost of energy accounts for 30 percent of U.S. refiners' operating costs, against 60 percent for their European counterparts, UFIP said. Total, Europe's biggest refiner, said it expected to lose about 500 million euros in its French refineries in 2013. French oil products demand fell 0.7 percent to 75 million tonnes in 2013, the tenth consecutive year of decline and the same level as in 1984, according to UFIP. Demand is unlikely to pick up in coming years, as a planned carbon tax and other green levies are expected to boost fuel prices at the pump from next year. French drivers can expect the price of diesel, the most widely used fuel in France, to be inflated by 0.61 euros per litre in 2015 by the new measures compared to 2014, UFIP said. (www.downstreamtoday.com)

Transportation / Trade

Harper sees Keystone approval, with or without Obama

February 10, 2014. As far as Stephen Harper is concerned, history and economics carry far more weight in Canada-U.S. relations than whoever happens to occupy the White House at a given moment. That’s why Canada’s prime minister remains relatively unperturbed about the drawn-out Keystone XL pipeline review, maintaining its approval is “inevitable.” In a wide-ranging interview on energy policy in his Ottawa office last month, Harper described how historical and economic forces and broad-based support for resource development determine whether projects like Keystone get built, rather than short-term political calculations. If Barack Obama doesn’t approve the pipeline, another president will. Harper has been openly critical of Obama for repeatedly “punting” on Keystone and interfering with a long-standing and mutually beneficial energy relationship forged in war and codified in peace. After Japan attacked Pearl Harbor in 1941, the U.S. War Department quickly secured agreement to build a 600-mile (965-kilometer) pipeline across Canada’s north to supply a military base in Fairbanks, Alaska. Almost five decades later, former Prime Minister Brian Mulroney incited the wrath of nationalists by accepting in the historic 1988 Free Trade Agreement between the two countries that Canada would not reduce supplies of oil to the U.S. in times of shortages. Energy security would be a continental affair, with Canada enjoying market access while the U.S. gained security of supply. Today, Canada ships 99 percent of its oil exports to the U.S., and U.S. companies are the largest foreign investors in Canadian oil and gas. Over the past two decades, more than half of the $103 billion in foreign acquisitions by U.S.-based oil and gas companies have been of Canadian producers. Harper’s energy policy is informed by convictions that global demand for oil is surpassing supply, market forces override politics and the western world would rather buy energy from stable democracies like Canada. He also harbors an aversion to government intervention in the industry -- including policies to curb carbon emissions -- while being focused on the economic growth potential of further energy development. (www.bloomberg.com)

Italy companies to build LNG terminal to lower energy costs

February 7, 2014. Companies aiming to lower their energy costs plan to build a liquefied natural gas (LNG) terminal in northeastern Italy capable of importing 800 million cubic meters of LNG per year. The terminal is to be built in the port of Monfalcone, in Italy's northeastern region of Friuli Venezia Giulia. A consortium of 12 companies dubbed Smart Gas Monfalcone plans to spend 110 million euros to build the facility which is expected to operate from 2018. Plans to build a series of LNG plants in Italy, including Gas Natural's 8 billion cubic metre terminal not far from Monfalcone, have been held up due to a permitting process that gives local authorities extensive powers. Italy uses natural gas to fuel more than 40 percent of its power generation and has three LNG terminals, two of which are under-utilised and one of which has not started taking shipments. (www.downstreamtoday.com)

Rosneft to export extra 9 million tonnes of oil to China this year

February 6, 2014. Russia's biggest oil producer Rosneft will export an additional 9 million tonnes (180,000 barrels per day) of oil to China this year and is continuing talks to increase eastbound crude supplies further, the company said. President Vladimir Putin has made cooperation with energy-hungry Asia a priority for Russian companies as their business with fragile European economies falters and as nascent deposits in East Siberia are being developed. The company, which supplied over 300,000 bpd to China, would increase deliveries by 2 million tonnes to China National Petroleum Corp (CNPC) via a spur of the East Siberia-Pacific Ocean (ESPO) pipeline. It would also ship 7 million tonnes to CNPC via Kazakhstan in 2014. State-controlled Rosneft, for the first time revealing its plans for supply to China this year, said it was still in talks with China's top refiner Sinopec over additional oil flows in the coming decade. By increasing its oil deliveries to China, Rosneft has sent ripples through the global trading community and raised fears of undersupply to Europe, where refineries are suffering from high oil prices and low margins. China has already outstripped Germany as Russia's largest buyer of oil with pipeline shipments totalling around 1.949 million in January, according to the Russian Energy Ministry. Russia expects to export up to 5 million tonnes of oil to Germany in the first quarter. Rosneft plans to further ramp up oil flows to China and has signed a memorandum with Sinopec with a view to supply it with 10 million tonnes of oil in the next 10 years. The company is still in discussions with Sinopec over a final oil-supply agreement. (www.reuters.com)

Salazar: Build Keystone XL oil pipeline

February 6, 2014. Former Interior Secretary Ken Salazar says he believes the Keystone XL oil pipeline from Canada should be built. Salazar said that the pipeline could be built safely, as long as conditions are imposed. Those conditions would require the pipeline operator to meet tough environmental standards and even pay for conservation programs along the pipeline route. Salazar said that the pipeline could be a "win-win" project that benefits U.S. energy security while boosting conservation efforts in Montana, South Dakota and other affected states. Salazar's comments follow a State Department report that raised no major environmental objections to the $7 billion pipeline. The pipeline would carry oil from western Canada to refineries along the Texas Gulf Coast. (www.downstreamtoday.com)

Spectra Energy to expand pipeline systems in New England

February 6, 2014. Spectra Energy and Spectra Energy Partners announce the Atlantic Bridge project, a proposed expansion of its Algonquin Gas Transmission and Maritimes & Northeast Pipeline systems, to connect abundant North American natural gas supplies with markets in the New England states and Maritime provinces. Algonquin and Maritimes & Northeast recently executed an agreement with Unitil Corporation to participate as an anchor shipper in the project. Unitil is a natural gas distribution company that serves parts of Massachusetts and New Hampshire and is the largest distributor in Maine. The announcement coincides with the beginning of an open season to invite other customers to join the Atlantic Bridge project for additional natural gas service by 2017. The expansion will increase pipeline capacity by 100,000 to in excess of 600,000 dekatherms of natural gas per day, depending upon additional market commitments across the region. (www.downstreamtoday.com)

Policy / Performance

Hedge funds boost diesel bets with supply at decade low

February 11, 2014. Hedge funds are the most bullish on diesel in almost five months as the coldest January in 20 years boosted demand and cut U.S. supply to the lowest in a decade. Prices for diesel, traded as a proxy for heating oil, rose to the highest since 2012 as frigid weather spread across the U.S. Northeast, leading to curbs on natural gas pipelines that boosted oil demand. Refineries beginning seasonal maintenance may cut production this month, further reducing stockpiles near New York Harbor that are already the lowest since May 2003. Diesel jumped at the end of January on speculation that inventories near New York, the delivery point for Nymex contracts, would drop further from 15.7 million barrels, which was the lowest since April 2008, according to the Energy Information Administration (EIA), the statistical arm of the U.S. Energy Department. (www.bloomberg.com)

Kuwait approves $12 bn bids for clean fuels project

February 10, 2014. Kuwait has approved bids worth a total of $12 billion for major upgrades at two oil refineries, the state-run oil company said. The Clean Fuels Project is a specification upgrade and expansion of Kuwait's largest refineries as part of the Gulf state's economic development plan, which has faced delays partly due to political instability. A consortium led by Japan's JGC Corp won a tender for work worth KD1.361 billion ($4.82 billion) at the 460,000-barrels-per-day (bpd) Mina Ahmadi refinery, Kuwait National Petroleum Company said. (www.arabianbusiness.com)

Iran plans to offer better oil exploration terms than Iraq

February 10, 2014. Iran will offer international companies better oil contracts than OPEC-rival Iraq as the Islamic republic seeks long-term investment to revive its energy industry, a government adviser said. The fifth-largest Organization of Petroleum Exporting Countries (OPEC) member is discussing limits to its nuclear program to remove Western sanctions against its financial and energy businesses. Iran is developing new hydrocarbon contracts that are “in line” with international practice and law and will offer more flexible terms than those Iraq uses, said Mehdi Hosseini, who leads the oil ministry’s committee on the accords. Iraq, Iran’s neighbor to the west, has emerged as a global energy investment hub over the last five years, offering oil and gas production rights and attracting companies such as BP, Shell and Exxon Mobil Corp. along with producers from Russia, China and Africa. Iran will resume negotiations with world powers over its nuclear activities on Feb. 18, after reaching a preliminary deal in November. The two sides seek a comprehensive accord to ensure Iran’s nuclear program is non-military, as the Tehran government says, and end international sanctions against it. The nation needs as much as $150 billion in investment over the next five years to develop its oil and gas, and Iranian officials expect most of the money to come from foreign companies, Hosseini said. The central government of Iraq, which overtook Iran as OPEC’s second-biggest producer in 2012, pays investors a fixed fee for any oil they produce. Iraq’s semi-autonomous Kurdish region offers production-sharing agreements, which many foreign companies prefer as more lucrative. Iran will give a preview of its new investor contract to a domestic audience at a two-day conference in Tehran starting Feb. 22, Hosseini said. International representatives are welcome and some European and Asian companies have expressed interest in the event, he said. Hosseini reiterated that Iran plans to introduce the new contract at a conference in London in late June or early July. Iran has oil reserves of 157 billion barrels and gas reserves estimated at 1,187 trillion cubic feet, according to BP’s Statistical Review published in June 2013. (www.bloomberg.com)

Lukoil in talks with Iran on post-sanctions return

February 8, 2014. OAO Lukoil, Russia’s second-biggest oil producer, is in talks with Iran’s Oil Ministry about returning to the Islamic Republic to develop assets, Moscow’s envoy to Tehran said. Russian Ambassador Levan Dzhagaryan said Lukoil was ready to resume work in Iran’s oil and gas sector after economic sanctions are removed. Moscow-based Lukoil abandoned its work in Iran in March 2010, citing pressure from U.S.-imposed economic sanctions. Lukoil Chief Executive Officer Vagit Alekperov said that the company was ready to resume work in Iran after sanctions on its oil industry had been removed. Dzhagaryan also called for stronger cooperation between Iran and Russia on gas exploration in the Caspian Sea. Lukoil was a minority partner in the Statoil ASA-led Anaran project and took a $63 million impairment in December 2009 due to the inability to invest in further development amid the threat of U.S. economic sanctions. (www.bloomberg.com)

Russia offers stake in 10 exploration blocks to ONGC

February 7, 2014. Russia’s Rosneft, the world’s largest listed oil company by output, has offered stake in 10 exploration blocks to the foreign investment arm of India’s Oil and Natural Gas Corp (ONGC), the south Asian nation’s junior oil minister said. India, the world’s fourth-largest oil importer which meets about 80% of its crude needs through overseas purchases, is scouting for oil and gas assets abroad to meet rising local demand and to feed its expanding refining capacity. Rosneft has offered 9 offshore blocks in Barents Sea Offshore and one in Black Sea for joint exploration to ONGC Videsh Ltd (OVL). OVL is in the process of acquiring data on oil and gas blocks offered in the latest exploration licensing round in Tanzania, a hotspot for natural gas exploration. GAIL (India) Ltd is also scouting for business opportunities in Tanzania. (www.livemint.com)

Pakistan hopes to sign cut-price gas deal with Qatar