DRAMATIC DECLINE IN POWER DEMAND

Monthly Power News Commentary: March 2020

India

Demand

The lockdown announced to control the Covid-19 pandemic has effected an adverse impact on electricity demand and cash flows of discoms. The shutdown has impacted the industrial and commercial establishments and stoppage of passenger railway services. This has hit the electricity demand, given that these segments constitute about 40 percent of the all-India electricity demand, according to rating agency ICRA. The Union power ministry has issued directions to the CERC to provide a moratorium of three months to discoms. The power generation companies are already suffering delays in payments by discoms across most of the States, with a payment due of more than ₹850 bn as of November 2019 at all-India level. India’s electricity use fell to the lowest in nearly five months on the first day of a nationwide lockdown to prevent the spread of the coronavirus, government data showed, with monthly power consumption likely to fall for the first time in four months. National electricity demand fell to 2.78 bn kWh on 25 March, the first day of the three-week total shutdown. That was nearly 20 percent below the average of 3.45 bn kWh per day in the first three weeks of March, a Reuters analysis of government data showed. If demand continues at these reduced levels, India’s electricity consumption for March is set to decline at the fastest pace year-on-year since October, when power use fell at its steepest in over 12 years due to a broad economic slowdown. While electricity usage contracted nationally, consumption actually rose slightly in some states, raising concerns that the shutdown may not have been fully observed in all areas, although officials said higher temperatures may have contributed. According to initial analysis the rise in power usage in populous states such as Uttar Pradesh and Bihar may have been due to the use of household air conditioners and other appliances. States such as Odisha and Jharkhand also showed slight increases in power usage, but these are mineral rich regions and mining remains an essential service. Power consumption in Patna has marginally declined with the closure of commercial and industrial establishments due to the 21-day lockdown. According to the energy department the city’s peak power demand has declined by 13.61 percent since 22 January when the country observed ‘janata curfew’ to prevent spread of coronavirus. Maximum power demand in the city was 311 MW in the evening hours against 360 MW, a day before the of ‘janata curfew’. According to Patna Electricity Supply Unit there was slight fluctuation in power demand in the city, mainly because of closure of malls, restaurants, hotels and coaching classes, hostels, educational institutes (schools and colleges) and industrial units.

Electricity price in the spot or current market plunged to a three-year low of 60 paise/kWh as shutdown of factories and businesses due to a nationwide lockdown wiped away power demand by as much as 20 GW. According to data from the IEX, the previous low of minimum spot electricity price was recorded at 52 paise/kWh in 2017 which rose to ₹1.72/kWh in 2018 and then dipped to 94 paise/kWh in 2019 before touching a three-year low of 60 paise/kWh in 2020 for supply. The power demand from industrial units and discoms was down by 40 percent and 42 percent, respectively, on the IEX. Spot power demand has fallen almost 40 percent leading to a 30 percent drop in rates as big consumers like malls, markets and offices are being shut to combat the spread of coronavirus. Prices at the IEX have fallen to ₹2/kWh as demand was much lower than the supply offered in the spot market. Total demand in the second and third week of March fell almost 3 percent year-on-year, according to data collated by the National Load Despatch Centre. Demand had risen in January and February. According to trade settled for delivery, power generators offered to supply 425 mn units of power, but they managed to sell only 100 mn units. Ind-Ra has recently revised its outlook for the power sector to ‘negative’ for FY21 from ‘stable-to-negative’, triggered by muted growth in electricity demand. It estimated a continued muted outlook for thermal plants capacity utilisation and expects it to remain below 60 percent for FY21.

Just before the virus outbreak demand for power seemed to be on the upswing. India’s electricity supply rose 7.1 percent during February, provisional government data showed, marking the second straight month of growth after five straight months of decline. Power supply rose to an average of 3.62 bn kWh per day in February, up from 3.38 bn kWh last year, an analysis of daily load despatch data from POSOCO showed. POSOCO releases provisional load despatch data every day. Higher electricity supply could mean a rise in power demand, as electricity deficit in India is marginal. Electricity demand is seen by economists as an important indicator of industrial output. India’s annual electricity demand in 2019 grew at its slowest pace in six years, according to the CEA amid a broader economic slowdown that resulted in a fall in sales of everything from cars to cookies, prompting some large-scale industries such as the automobile sector to slash jobs. Power demand in the country grew 2.1 percent in April-February this fiscal to 1190.74 bn kWh from 1166.08 bn kWh the same period a year ago, Parliament was informed. During 2018-19, the power demand grew 5 percent to 1274.59 bn kWh from 1213.32 bn kWh in the previous fiscal. The power demand grew 6.2 percent in 2017-18. The electricity supply grew 2.2 percent to 1184.67 bn kWh in April- February this fiscal from 1159.17 bn kWh in the same period of 2018-19. Similarly, power supply grew 5.2 percent at 1267.52 bn kWh in 2018-19 from 1204.69 bn kWh in 2017-18. The power supply grew 6.1 percent in 2017-18 year-on-year.

In the light of the dramatic decrease in demand, Ind-Ra has revised its outlook for the power sector outlook to negative for FY21 from stable-to-negative. It has been triggered by muted growth in electricity demand and rising discom dues due to limited improvement in financial profile of discoms since the launch UDAY. Ind-Ra believes the discom resolution plans have provided lower-than-anticipated benefits, and hence the focus could shift to the privatisation of discoms, either through the franchisee model or the licensee model. Ind-Ra expects the renewable capacity addition to remain slow in FY21, on account of lower equity internal rate of returns generated by operational plants, limited domestic long-term funding availability post non-banking financial company crisis, continued poor health of discoms, and continuing infrastructure challenges on land acquisition and evacuation infrastructure. Around 16 GW of under-construction capacity has not seen any resolution till date and is likely to remain a challenge, due to the issues related to the settlement of past capex dues.

The Madhya Pradesh government is likely to pay ₹5.8 bn to private power companies in 2020-21 without buying a single unit of power. At least that’s what the ARR submitted before MPERC indicates. As per the ARR submitted by discoms before MPERC for 2021, they have said that due to surplus power and after meeting the requirements of the state, they will “back down” power of producers. ‘Backing down’ means not buying the power that the state is entitled to under PPA. Discoms will ‘back down’ on four of the nine private power producers with which MP has signed PPAs — Torrent Power, BLA Power, Jaypee Bina Power and Essar Power STPS. This means, as per estimates for 2021, discoms will not purchase a single unit of power from these producers. Power producers are paid in two ways — fixed charge and variable charge. If the charges are fixed, they will have to be paid even if the procurer doesn’t take any power.

Distribution Concessions

Consumers won’t have to pay additional charges on the online payment of electricity bills, informed the UPPCL. Now, these additional charges levied by the bank will be paid by the UPPCL. And the consumers can call on 1912, in case of any inconvenience. The Maharashtra government announced an average of 8 percent electricity tariff cut for the next five years to help businesses and people tide over the COVID-19 crisis. While the industry has been given the highest benefits, farmers will have to contend with a 1 percent reduction in electricity costs. All the revisions are for a period of five years. For the consumers served by private sector discoms Adani Energy and Tata Power in the financial capital, industrial units will have their power rates slashed by 18-20 percent, commercial establishments by 19-20 percent and residential ones by 10-11 percent. The MERC has approved a move to cut tariffs by an average of 7-8 percent as part of the move, which is first such measure in the past 10-15 years. Industrial consumers in the state, excluding the capital Mumbai, will enjoy a tariff cut of 10-12 percent, while residential ones will see their rates go down by 5-7 percent. According to MERC the announcement has been made after extensive consultations with all the stakeholders and also made it clear that the revised tariffs will not be limited to the next one year alone. In its first budget, the Delhi government has decided to carry on with its reforms in the power sector while earmarking ₹28.20 bn for giving electricity subsidies to consumers in the financial year 2020-21. The government will continue with the zero-power bill scheme for consumers using up to 200 units every month and a subsidy of ₹800 for those consuming 201-400 units. Since last August, these benefits are being offered, making Delhi the first state to offer free electricity up to 200 units. The government will continue to offer 100 percent subsidy to the anti-Sikh riot victims for up to 400 units and the special subsidy scheme for lawyers’ chambers on court premises.

Enhancing the ambit of the DBTE scheme under ‘Paani Bachao Paise Kamao’, the Punjab government has decided to bring farm contractors who cultivate the land on lease under it by changing the eligibility criteria. According to government calculations, each farmer trying to reap the benefit of the scheme is paid a sum ₹48,000 annually against the power used at their tubewells. Farmers are issued bills and in case one uses less power, one gets to keep the remaining amount of subsidy paid in cash by the government. The government had launched the DBTE in July 2018 as a pilot project at six feeders in four districts of the state. Presently, more than 250 feeders have been brought under the scheme, with around ₹1.6 million paid to farmers on power saved by them. Till now, only the actual landowners were eligible for this scheme, but with the latest circular issued by the PSPCL, farm contractors who cultivate land have also been made eligible to get the benefits of this scheme. Besides, the government has also decided that any farmer who owns more than one power connection and decides to opt for the scheme will have to opt for this scheme for all connections running on his name. According to the PSPCL, a large chunk of cultivable land in Punjab is being tended by farm contractors and therefore the state government decided to make them eligible for this scheme.

The Bihar Electricity Regulatory Commission reduced the retail tariff by 10 paise/kWh for all categories of consumers of the state for the financial year 2020-21. The Commission has reduced 10 paise/kWh in the electricity tariff rate across all categories of consumers which include rural, urban, commercial and industrial ones. The distribution loss trajectory for the North Bihar Power Distribution Company and the South Bihar Power Distribution Company for 2020-21 has been fixed as 15 percent. Industry bodies welcomed the Commission’s order to reduce power tariff but said they were expecting more reduction in tariff.

Industries in Marathwada region have expressed displeasure about the withdrawal of power subsidy of ₹1/kWh from this month onwards. The sudden withdrawal of subsidy has brought an increase in monthly expenses of industries. The industrial slowdown, financial year-end, coronavirus outbreak and now power bill hike has made things harder. Industrial associations in Aurangabad district have also voiced their opposition to the proposed hike of power tariffs by state utility Mahadiscom from 1 April.

A committee has been formed to study the proposal of providing free electricity to the public upto a limit in Maharashtra. The state government is considering a proposal to provide electricity for free to the people whose monthly electricity consumption is under 100 units. The state government is also considering making electricity cheaper for industrial use.

Regulation and Governance

All AIPEF demanded that the PPA signed with Adani Power by Madhya Pradesh government should be cancelled as the power is already surplus in the state and power utilities are already paying thousands of crore as fixed charges without getting any power from private power generators. The proposal for construction of 1320 MW thermal plant by Adani was submitted in February and within one and half month not only the proposal has been accepted but PPA has also been signed. AIPEF said that in Madhya Pradesh average power demand in the state is 9000 MW and maximum demand is 14500 MW whereas the state has already signed power purchase agreements worth 21000 MW. AIPEF said that the Madhya Pradesh government has violated the Tariff Policy of India by awarding the project and signing PPA without competitive Bidding. As per policy all future requirement of power should continue to be procured competitively by distribution licensees except in cases of expansion of existing projects. Madhya Pradesh government should also clarify whether the approval of state power Regulator was taken before signing PPA.

In an attempt to make power consumers pay their electricity bills on time, the power department has set a target of cracking down on at least 25 defaulters every day to recover the dues in Bareilly district of UP. According to the information from the power department, there are 182,000 consumers in urban areas and 112,000 in rural areas in Bareilly district. Thousands of these consumers have outstanding bills. According to Madhyanchal Vidyut Vitran Nigam Ltd for recovering power dues, linesmen deputed on feeders will be entrusted with the task of recovering electricity dues from at least 25 power consumers every day in urban and rural areas. Disconnection of supply to consumers who have run up bills up to ₹10,000 or more was initiated earlier. The limit has now been reduced to ₹3,000.

The government’s pilot scheme to reduce power generation cost, which saved about ₹27.5 mn per day in the April-December 2019 period, has been allowed to run till 31 May 2020. The pilot scheme, Security Constrained Economic Despatch, currently involves 52 coal-based power plants with a cumulative capacity of 58,060 MW, and their tariffs are decided on the ‘cost-plus’ basis (no competitive bidding) by the CERC. While most participating plants in the pilot belong to NTPC Ltd, few private power units such as Reliance Power’s Sasan unit and Tata Power’s Mundra station are also part of it. The pilot scheme reduced fuel costs by ₹8.45 bn in April–December 2019. Though the weighted average variable cost comes to ₹1.89/unit, the lowest cost can be ₹1.12/unit and the highest can go up to ₹8.15/unit. The total power generating cost in this period was about ₹540 bn. The CERC has extended the implementation period of the scheme to allow the POSOCO, the national load despatch centre, to run the scheme designed to explore the possibility of minimising costs without major structural changes in the existing system. The electricity regulator in September 2019 had allowed the pilot to run till FY20-end.

UP government has extended the deadline for two schemes till 31 March, under which defaulting power consumers, including farmers, have more time to clear their dues. The schemes are Asan Kist Yojana, which was introduced for defaulters for up to 4 kW load, and Kisan Asan Kist Yojana, which is meant to give relief to private tubewell consumers. Since harvesting season of the rabi crop is approaching, the deadline extension would be helpful for farmers. The power department has collected a large amount through Asan Kist Yojana, which started on 11 November 2019, however, a large number of consumers are still left and, for them, extension of the scheme’s deadline from 29 February to 31 March may turn out to be a boon. Despite heavy power generation cost (₹7.35/kWh), the department is supplying cheaper power to private tubewell consumers, farmers, and below-poverty line consumers, among others, as the deficit is covered by the grant received from the government. While the current rate for private tubewell consumers on an average is ₹1.21/kWh; for BPL consumers (for first 100 kWh), ₹3/kWh; and for domestic rural metered consumers (for first 100 kWh), ₹3.35/kWh. The defaulters, availing the facility, will have to pay 5 percent of the arrears due till 31 October 2019, or ₹1,500 along with their up-to-date power bills beginning from November 2019. Defaulters may pay their arrear in one go or in 24 or 12 instalments (24 instalments for defaulters of rural area and 12 instalments for urban area). The penalty for arrears up to 31 October 2019, would be waved off if the arrears and future bills are paid in time.

At a time when the installed capacity of generating electricity in Maharashtra is the highest in the country, the distribution losses of all power utility firms in the state has dipped over three years, states the state economic survey report. It adds that distribution losses dipped for Maharashtra State Electricity Distribution Company Ltd from 14.7 percent in 2016-17 to 12.2 percent in 2019-20. The losses were also low for the BEST undertaking in Mumbai, which recorded a distribution loss of 4.3 percent in 2019-20.

Electricity Trading

The volume of power traded at IEX, the country’s largest online electricity platform, jumped 57 percent to 4,516 mn units in February this year. IEX said the increase in trade volume was mainly due to distribution utilities opting for replacement of their costlier power with exchange-based procurement. The day-ahead market traded 4,289 mn units during the month with the average market clearing price at ₹2.91/kWh registering a 6 percent decline over the price of ₹3.08/kWh in the corresponding period. Apart from this, the volumes in the TAM grew 168 percent on a year-on-year basis to 226 mn units indicating the increasing preference of TAM contracts by the distribution utilities for meeting their intra-day to weekly requirements.

The CERC has postponed implementation of real-time power trading by three months to1 June following requests from the industry. It was scheduled to start from 1 April. Real-time power trading involves selling and buying power at the exchanges for same-day delivery. Trading on electronic platforms would be done every alternate 30 minutes for electricity to be wheeled after 1 hour 15 minutes. For the first time, any generator, including renewable power companies, would be allowed to sell power through the platform. According to plans, 48 trading slots will be available during the day for entities to sell or buy. At present, trading is done on a day-ahead model, where trading on a certain day is done for delivery the next day. The trading window remains open for two hours – from 10 am to 12 noon.

Technology

India needs to establish a manufacturing base of smart electricity meters to ensure adequate supply and should ensure that there are multiple players in the segment, Parliamentary Standing Committee on Energy has said in its latest report. The budget for 2020-21 allocated ₹220 bn for the power and renewable energy sector. The move is aimed at giving the consumers the right to choose suppliers and the rates. Implementation of smart meters programme is expected to address the issue of financial health of discoms. The committee highlighted the advantages of smart meters over conventional meters. Though the cost of smart meter is nearly three times more this extra cost could be recovered in a six-and-a-half year time frame, the committee said. The panel has recommended that henceforth only smart meters should be installed by power ministry under Saubhagya scheme to avoid duplicity of work. Energy Efficiency Services Ltd has announced the completion of installation of 1 mn smart meters across India under the centre’s Smart Meter National Programme. The company has set a target to install 250 mn smart meters over the next few years.

Following the advisory by Central and state government over coronavirus outbreak, Adani Electricity said the power utility firm encourages its customers to stay indoors and facilitates digital payment modes, self-help payment Kiosk, drop boxes in society to stay indoors and maintain social distancing. Adani has also informed the MERC about steps taken to mitigate the pandemic effect. Customers can access bill information through the Adani Electricity mobile app, register no supply complaints by giving a missed call on 18005329998 and pay bills through online payment modes such as Paytm, Google Pay, Amazon Pay, PhonePe, BHIM, MobiKwik and FreeCharge. In the light of consumer and employee safety, other services, which include human interface such as meter reading, billing, bill collection, release of new connections are discontinued until 31 March 2020.

The power transmission capacity of UP grew by 8000 MW in the past three years. The transmission capacity jumped from 16,500 MW in 2016-17 to 24,500 MW at present. High transmission capacity will allow the government to bear the peak demand electricity load of up to 24,500 MW. Also, the total transmission capacity — indicative of power import load from outside the state — has been increased from 8,700 MW to 13,400 MW. In the wake of the upcoming summer season, the department has ordered completion of 20 under construction transmission sub-stations by March end. In order to fix responsibility of the regional officers of the UPPCL for bringing down the alarming transmission and distribution losses in the state and for correct billing, will also tour all over the state from 11 March.

Rest of the World

Africa

Nationwide power cuts across South Africa of up to 4,000 MW will last indefinitely, state power firm Eskom said, as repairs take longer than anticipated. The latest blackouts, referred to locally as load shedding, were triggered by breakdowns at a score of generating units, including at Koeberg nuclear plant in Cape Town. Eskom has been battling repeated problems with its coal-fired power stations, prompting power cuts and dragging the economy into its second recession in as many years. Mining and manufacturing data due later are expected to reflect the impact of unreliable power supply. The African Development Bank has signed for the release of $200 mn to Nigeria for the expansion of the country’s power transmission infrastructure. It was gathered in Abuja that the fund signed by the bank’s management would be used under the Nigeria’s Transmission Expansion Programme. The bank had offered to provide additional support to the country’s power sector. South African energy regulator Nersa invited public comments on government plans to increase power generation capacity, clearing the first of many hurdles for the country to boost electricity supplies. Nersa asked for comments by 14 April on a short-term plan to procure 2,000 MW of power, and comments by 7 May on longer-term procurement plans outlined in the country’s 2019 Integrated Resource Plan. South Africa’s Electricity Regulation Act requires public participation before officials can procure more power. Africa’s most industrialised economy has experienced several rounds of debilitating power cuts over the past year due to capacity constraints, but officials have been slow to secure new power supplies. The outages helped pushed the economy into recession in the final quarter of last year.

Europe

European baseload power prices for year-ahead delivery hit near two-year lows in wholesale trade, tracking the fall in leading oil, coal and carbon emissions contracts. The equivalent French year-ahead contract lost 2.6 percent to €38.20/MWh. Power consumption is expected to slip by 220 MW day-on-day in Germany to 67.4 GW. Demand will fall by 2.9 GW to 53.6 GW in France. The European Investment Bank has signed a €250 mn ($284 mn) loan agreement with TenneT Holding to help finance a new high-voltage transmission line in the Netherlands, the German-Dutch grid company said. The loan will be used to help finance the construction of a 380 kV transmission line to enable the transfer of offshore wind energy to users in the Netherlands and elsewhere. The new connection will help avoid congestion on the high voltage grid once the wind farms are in operation and will help transfer electricity from them. Uzbekistan has signed more than $2 bn worth of strategic agreements with Saudi developer ACWA Power to boost electricity generation and develop technical expertise. The deals include a 25-year power purchase agreement worth $1.2 bn which will see ACWA build and operate a gas-turbine power plant in the country. The project, on which Tashkent invited bids, will boost Uzbekistan’s total capacity by 12 percent.

French power grid operator RTE said it would implement a continuity plan to allow its network to continue running while the government steps up measures to curb a coronavirus outbreak. RTE is to adopt working from home for many of its personnel, with staff only to work on site for vital functions, it said. The plan would be adapted depending on developments in the outbreak and grid safety maintained. A general shift to working from home and an easing in industrial production had reduced power demand, RTE said. French power grid operator RTE said it would implement a continuity plan to allow its network to continue running while the government steps up measures to curb a coronavirus outbreak. RTE is to adopt working from home for many of its personnel, with staff only to work on site for vital functions, it said. The plan would be adapted depending on developments in the outbreak and grid safety maintained. A general shift to working from home and an easing in industrial production had reduced power demand, RTE said. French state-controlled power group EDF said it now expected its 2020 core earnings to be at the lower end of forecasts, as it deals with the impact of the coronavirus outbreak. It said that the impact of the current crisis on its 2021 power generation performance could not be precisely assessed at this stage. European wholesale power prices have tumbled to their lowest levels since February 2018, tracking the fall in prices across the global energy complex led by oil and carbon emissions prices.

Norway is postponing a decision on whether to allow companies to construct a new subsea power cable between it and Scotland. Known as NorthConnect and partly owned by Swedish energy group Vattenfall, the project is controversial as some Norwegian lawmakers fear rising grid costs and power prices as output from wind turbines and hydropower dams is exported. Planning for the €2 bn ($2.17 bn) project is still going on, but the government needs more data on the market impact from other power cables that are currently being built before a decision can be made. Publicly owned grid operator Statnett is already building two subsea cables, to Germany and Britain, which are due to start operating this year and next, respectively. While power could flow both ways depending on supply and demand, Norway expects to be a net exporter in most years as prices tend to be higher in major European nations than at home. Vattenfall and Norwegian power producer Statkraft have previously called on the government to approve the new cable as producers have been struggling with the relatively low Nordic electricity prices.

Italy’s Terna will spend a record €7.3 bn ($8.3 bn) on its power grid over the next five years to beef up connections and deal with the growing shift toward green energy and decarbonisation. Terna, one of the world’s biggest power grid players, said it would be spending €4 bn to streamline its domestic network and strengthen cross-border connections with a view to making Italy an energy hub for the Mediterranean. Terna, which expects its regulated asset base to grow 5 percent a year to €19.7 bn, makes most of its money from returns set by the regulator to help it improve its high-voltage transmission grid. It said the main focus in the plan would remain the domestic grid but said it would continue operating power assets in Brazil, Uruguay and Peru while also looking for selected growth opportunities elsewhere.

USA

The US electric industry may ask essential staff to live on site at power plants and control centers to keep operations running if the coronavirus outbreak worsens, and has been stockpiling beds, blankets, and food for them, according to industry trade groups and electric cooperatives. The contingency plans, if enacted, would mark an unprecedented step by power providers to keep their highly-skilled workers healthy as both private industry and governments scramble to minimize the impact of the global pandemic that has infected more than 227,000 people worldwide. The Great River Energy cooperative which runs 10 power plants serving 1.7 mn customers in Minnesota, said it is preparing for the possibility of sequestering staff essential to running its operations.

S America

Brazil’s government is considering an emergency loan package for energy distributors struggling with lower energy use and facing lost revenues because of the coronavirus outbreak. Also, Brazil’s mines and energy ministry is indefinitely postponing projects to auction off energy transmission and generation assets planned for this year because of the coronavirus. The coronavirus outbreak will also delay the privatization of utility Eletrobras. The coronavirus has led to widespread lockdowns of non-essential businesses in Brazil, while citizens are being told to stay home. That is causing lost income for many hourly and informal workers in Brazil, who could be unable to pay their electricity bills.

| CERC: Central Electricity Regulatory Commission, discoms: distribution companies, mn: million, bn: billion, kWh: kilowatt hour, kW: kilowatt, MW: megawatt GW: gigawatt, IEX: Indian Energy Exchange, FY: Financial Year, POSOCO: Power System Operation Corp Ltd, CEA: Central Electricity Authority, Ind-Ra: India Ratings and Research, UDAY: Ujwal Discom Assurance Yojana, ARR: Annual Revenue Requirement, MPERC: Madhya Pradesh Electricity Regulatory Commission, PPA: power purchase agreement, UP: Uttar Pradesh, UPPCL: UP Power Corp Ltd, MERC: Maharashtra Electricity Regulatory Commission, DBTE: direct benefit transfer for electricity, PSPCL: Punjab State Power Corp Ltd, AIPEF: All India Power Engineers Federation, BPL: below poverty line, TAM: term ahead market, MWh: megawatt hour, US: United States |

NATIONAL: OIL

Petroleum dealers seek 'stimulus package' from oil companies

13 April. Consortium of Indian Petroleum Dealers (CIPD), which represents the interests of the dealers of around 60,000 retail outlets across the country, has sought a 'stimulus financial package' from oil marketing corporations -- BPCL (Bharat Petroleum Corp Ltd), IOC (Indian Oil Corp) and HPCL (Hindustan Petroleum Corp Ltd). The package, to be offered for 120 days, is to compensate for the expenditures being incurred by the outlets, which are functioning round-the-clock to meet emergencies, during the lockdown. The retail outlet dealerships have remained open during the ongoing crisis, to meet the needs of the police, ambulances, municipal corporations, gram panchayats, district collectors, state governments and emergency of citizens, even postponing leaves and holidays of staff, CIPD president M Narayana Prasad said. The oil marketing corporations need to recompense by way of reimbursement, as 'stimulus financial package' as dealer margins based on government-approved charges. According to him, dealer margins work on 'litre sales', whose original volume has been curtailed below 10 percent during this crisis, while cost and expenditures remains constant.

Source: The Economic Times

India’s 2019/20 fuel demand growth worst in over two decades

13 April. India’s annual fuel demand grew 0.2 percent in 2019/20, its worst growth rate in over two decades, dragged down by a hefty 17.8 percent decline in local consumption in March as steps taken to prevent the spread of COVID-19 dented transport fuel sales. Consumption of refined fuels, a proxy for oil demand, totalled 16.08 million tonnes (mt) in March, data from the Petroleum Planning and Analysis Cell (PPAC) of the oil ministry showed. Falling refined fuels sales in March points to sluggish industrial activity in Asia’s third largest economy, which according to some analysts is forecast to grow at 1.5-2 percent in 2020/21, its lowest in decades. Due to restrictions on movement and travel advisories, India’s consumption of diesel, petrol and aviation turbine declined massively during March. Consumption of diesel, which normally accounts for two-fifths of overall refined fuel consumption, declined 24.2 percent in March from a year earlier, its deepest decline since April 1998. PPAC do not provide monthly growth numbers for before April 1998. Sales of gasoline, or petrol, used by automobiles fell by 16.4 percent from a year earlier, its worst slide since March 1999, the data showed. Jet fuel consumption declined by 32.4 percent as the lockdown has hit air travel. Cooking gas or liquefied petroleum gas (LPG) sales rose about 1.9 percent to 2.31 million tonnes (mt), and naphtha sales rose 15.7 percent to 1.39 mt.

Source: Reuters

IOC gets 1st shipload of oil from UAE to fill strategic reserves

13 April. India is capitalizing on low global oil prices to fill its underground strategic oil reserves, with the first shipload of 1 mn barrels of crude oil from the UAE (United Arab Emirates) arriving at Mangalore as part of efforts to shore up supplies to meet any supply or price disruption. While the 5.33 million tonnes (mt) of emergency storage -- enough to meet its oil needs for 9.5 days -- was built in underground rock caverns in Mangalore and Padur in Karnataka and Visakhapatnam in Andhra Pradesh by the government, state-owned oil firms have been asked to buy oil at cheaper rates from the market and fill them up. The storages at Mangalore and Padur are half-empty and there was some space available in Vizag storage as well. These will now be filled by buying oil from Saudi Arabia, the UAE and Iraq. Oil Minister Dharmendra Pradhan, who attended the office for the first time since the nationwide lockdown was imposed, reviewed the reserve filling plans. The Strategic Petroleum Reserve entity of India (ISRPL) built the underground storages as insurance against supply and price disruptions. It allowed foreign oil companies to store oil in the storages on condition that the stockpile can be used by New Delhi in case of an emergency.

Source: Business Standard

Ujjwala beneficiaries get 85 lakh LPG cylinders in April: Centre

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Seventy percent fall in oil demand illustrates extent of economic slowdown!

< style="color: #ffffff">Bad! |

12 April. Pradhan Mantri Ujjwala Yojna (PMUY) beneficiaries have received 85 lakh LPG (liquefied petroleum gas) or cooking gas cylinders in April 2020. The demand for LPG by PMUY (Pradhan Mantri Ujjwala Yojana) consumers increased in the country after the centre announced free LPG cylinder refills for them under the Pradhan Mantri Garib Kalyan Yojana (PMGKY). This move was undertaken to support them during the Covid-19 outbreaks. According to centre’s relief package, free LPG Refills are to be provided to Ujjwala beneficiaries over the period of three months, from April to June 2020.

Source: The Hindu Business L ine

IOC begins night shift in 2 Assam bottling plants for production ramp-up

12 April. Expecting a 70 percent hike in LPG (liquefied petroleum gas) demand in Assam in April due to the government’s policy to give three free cylinders to PMUY (Pradhan Mantri Ujjwala Yojana) beneficiaries over a three- month period, Indian Oil Corp (IOC) said it has introduced night shift in two of its major bottling plants to "handle the additional load". The free cooking gas cylinders was part of the package announced by the finance minister to deal with the economic impact of the lockdown imposed to curb spread of coronavirus. While the rise in demand has been estimated at 57 percent across the country for the current month compared to March, it is pegged at 70 percent for Assam and 45 percent for the northeastern region, the oil ministry said. Priority is being given to LPG customers under the PMUY since the government has decided to provide three 14.2 kilogram (kg) cylinders free of cost during April, May and June to the poor.

Source: Business Standard

World’s biggest lockdown slashes oil demand by 70 percent in India

9 April. Oil demand in the world's third-biggest consumer has collapsed by as much as 70 percent as India endures the planet's largest national lockdown, according to officials at the country's refiners. The estimate for the current demand loss is a stark reminder of the challenge facing oil producers as they haggle over a deal to cut supply and prop up the global energy industry. Consumption for the entire month could average about 50 percent below last year’s levels but that's based on India's three-week lockdown ending 15 April as planned. India consumed 4.48 mn barrels a day of oil in April 2019, including about 690,000 barrels a day of gasoline and 1.8 mn barrels of diesel, according to government data. Indian Oil Corp (IOC) declared force majeure for some April crude shipments as it slashed processing rates at most of its refineries by as much as 30 percent. Before this, HPCL (Hindustan Petroleum Corp Ltd) and Mangalore Refinery and Petrochemicals sought refuge under the clause as plunging demand filled up storage, while BPCL (Bharat Petroleum Corp Ltd) was said to be considering a similar move.

Source: NDTV

NATIONAL: GAS

ONGC gas output drops 15 percent as shut factories refuse to take supplies

13 April. ONGC (Oil and Natural Gas Corp) has been forced to cut natural gas production by over 15 percent as factories shut down following the unprecedented nationwide lockdown have refused to take supplies. Oil and Natural Gas Corp (ONGC), which produced 64.3 million metric standard cubic meter per day (mmscmd) prior to the lockdown imposed on 25 March, has reduced the flow to 53.4 mmscmd, sources aware of the development said. Gas sales are down to 40 mmscmd against 50 mmscmd previously. The difference between production and sales is due to the fact that some of the gas is also used by ONGC for internal consumption purposes such as power generation and re-injection into wells. The company received requests from customers for a reduction in gas supplies while some supply reduction requests have been lodged with the gas transporter GAIL (India) Ltd.

Source: Business Standard

GAIL sells US LNG cargo loading from Cove Point in May

8 April. GAIL (India) Ltd has sold a liquefied natural gas (LNG) cargo for loading from the Cove Point terminal in Maryland in the United States (US) in May. It sold the cargo on a free-on-board basis at around $1.50 to $2 per million British thermal units (mmBtu). The Indian importer has 20-year deals to buy 5.8 million tonnes a year of US LNG, split between Dominion Energy’s Cove Point plant and Cheniere Energy's Sabine Pass site in Louisiana.

Source: Reuters

India’s LNG imports jumped 68 percent in February as energy companies take advantage of low prices

8 April. India’s liquefied natural gas (LNG) imports jumped 68 percent to 3,453 million metric standard cubic meter (mmscm) in February this year compared to the corresponding month a year ago, as gas-based power plants, oil refineries and gas marketing companies take advantage of low spot LNG prices, according to the oil ministry data. The overall increase in LNG imports during FY20 has not come at the cost of inflating the country’s trade deficit, data showed. According to data published by the oil ministry’s statistical arm, the value of India’s LNG imports during the April-February period last financial year decreased 7.36 percent to $8.8 bn, as compared to $9.5 bn recorded in the corresponding period a year ago. India’s LNG imports during the April-February period of financial year 2019-2020 increased 17 percent to 30,812 mmscm, as compared to the corresponding period a year ago. According to K Ravichandran, Senior Vice-President at ICRA, gas marketing companies and LNG terminal operators would have procured bulk LNG cargoes as spot LNG prices fell substantially, adding that the demand for natural gas had been robust in 2019-2020 prompting companies to lock-in more shipments in anticipation of healthy demand.

Source: The Economic Times

NATIONAL: COAL

CIL’s production moderates to keep pace with demand

13 April. Coal India Ltd (CIL) has moderated its production in April keeping in mind the demand and fire hazard threats at mine pitheads and power plant stockyards in summer months. In the first 11 days of April, the average daily production stood at 1.3 million tonnes (mt) as against 2.7 mt for the month of March. Cumulative production in this month was 14.50 mt and an offtake of 14.70 mt indicated that the miner was producing in line with demand. For the new fiscal (FY21), the company had earlier set a production target of 710 mt based on previous goals. Coal stocks in the country stand at 120 mt. The company has extended the time limit for payment of coal, booked by its customers, by two more weeks till 21 April from 7 April announced earlier. CIL has extended the validity period for lifting of coal under all auctions without any penalty. Earlier, failure to lift the ordered quantity of coal within a stipulated time attracted forfeiture of earnest money deposit under auction schemes. Now, this clause has been done away with till the closure of the lockdown period to non- regulated sector as well. The company closed fiscal 2019-20 with annual coal production of 602.14 mt achieving 91 percent of the target. It had recorded an all time high of 84.36 mt coal output during March the last month of FY20.

Source: Business Standard

Coal Minister asks Chief Ministers to not import coal, source domestic fuel

12 April. Coal Minister Pralhad Joshi has written to Chief Ministers of all states asking them to not import the dry fuel and take domestic supply of fuel from CIL (Coal India Ltd), which has the fossil fuel in abundance. The development comes at a time when there is a drop in power demand in the country in the wake of the lockdown imposed to contain the deadly coronavirus. The Minister asked the states to take the domestic supply of coal from CIL which has ample availability of the dry fuel. Joshi announced several relief measures for consumers of CIL, including the power sector, in the wake of situation arising from coronavirus, according to the coal ministry. The ministry approved relaxation in quantity of coal for linkage consumers.

Source: The Economic Times

India’s coal import drops over 27 percent to 16 mt in March

8 April. India’s coal import in March stood at 15.74 million tonnes (mt), down 27.5 percent over last year, due to restrictions imposed at various ports in the wake of coronavirus outbreak in the country. The country had imported 21.72 mt of coal in March last year, according to a provisional compilation by mjunction services based on monitoring of vessels' positions and data received from shipping companies. However, the country’s coal import registered an increase of 3.2 percent to 242.97 mt in 2019-20. Of the total imports in March 2020, non-coking coal was at 11.73 mt, against 16.94 mt imported in February 2020. Coal Minister Pralhad Joshi had earlier said the Centre will stop the "substitutable import" of coal in the next three to four years.

Source: The Economic Times

NATIONAL: POWER

Power connections not to be terminated for failure to pay bill during lockdown, instructs Uttarakhand CM

14 April. Uttarakhand Chief Minister (CM) Trivendra Singh Rawat issued directives for relief measures related to electricity bill payment and directed that power connections will not be terminated due to non-payment amid coronavirus lockdown. Rebate in delay surcharge will be given to private category consumers who pay their bills before 30 June, a decision which is likely to benefit 20,000 farmers. The financial burden of ₹36.4 mn from this decision will be borne by the state government. Consumers belonging to all categories can also avail rebate of 1 percent on the online payment of their electricity bills by the due date.

Source: Business Standard

TAIPA urges Centre for nonstop power supply to telecom towers

13 April. The Tower & infrastructure Providers Association (TAIPA) has urged the union power ministry to ensure uninterrupted electricity supply to telecom towers across the country during the lockdown period. It asked the ministry to advise all the state governments and state electricity companies for ensuring availability of '24x7' uninterrupted electricity supply for telecom tower operations. TAIPA said that no penalty should be charged or any coercive action such as disconnection should be taken on account of any delay in electricity bill payment of telecom towers since bill receiving and collection and payment is impacted due to lockdown. Further, it sought a grace period of at least 45 days for telecom infrastructure companies to pay electricity bills.

Source: The Economic Times

Sterlite Power commissions Gurgaon Palwal transmission project in Haryana

13 April. Transmission solutions provider Sterlite Power said it has commissioned ₹10.27 bn worth Gurgaon Palwal Transmission Project in Haryana. This project is expected to enhance the power capacity of Gurugram and Palwal areas in Haryana by nearly 2,000 MW, the company said. The project will evacuate 2,000 MW to Haryana Vidyut Prasaran Nigamensuring access to reliable power for more than 3 mn households in the state. The project consists of four 400 kilovolt (kV) double circuit transmission lines with total length of 143 km, three gas Insulated Substations (GIS) at Prithla, Kadarpur and Sohna Road, two bay extensions at Dhanonda and a LILO connecting the 400 kV DC Gurgaon-Manesar transmission line. The company had won this project through tariff-based competitive bidding process and executed it under the build, own, operate and maintain (BOOM) model. Sterlite Power has projects of over 13,315 circuit kilometre (km) and 23,885 megavolt-ampere (MVA) in India and Brazil.

Source: Business Standard

Centre mulls more steps to keep cash-strapped discoms afloat

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Demand collapse will slow down discom revival!

< style="color: #ffffff">Ugly! |

11 April. The government may soon announce more steps -- like cheaper working capital and lower tariff -- for power discoms (distribution companies) to ensure uninterrupted electricity supply during the lockdown to contain COVID-19. The power demand has came down by almost one third during the lockdown. The demand met was down by about 29 percent at 121.38 GW on April 10 compared to 170.52 GW on the same day last year. The demand was down mainly due to lower requirements from industry and state power discoms. The peak power demand met is the actual highest energy supply during the day across the country. The discoms are facing liquidity crunch and therefore the efforts of the central government would be to provide them working capital at lower interest rates. Besides, the government may direct central and state power regulators to reduce tariff for the discoms.

Source: The Times of India

Maharashtra electricity company clears dues of ₹40 bn to IPPs

10 April. The Maharashtra State Electricity Distribution Company (MSEDCL) has paid the entire ₹40 bn dues to the independent power producers (IPPs) to help the power generators negotiate the liquidity crunch due to lockdown in the country. MSEDCL raised ₹40 bn from the State Bank of India (SBI) in the last week of March to pay the power suppliers who had receivables pending for up to six months. Power demand in India has fallen over 26 percent since 24 March, the day the lockdown was announced. Maharashtra State Power Generation Company (MAHAGENCO) around ₹70 bn, which it plans to pay in due course along with ₹2 bn of wind power producers’ outstanding loans, which is held up for some outstanding issues. According to the PRAAPTI portal, the discoms (distribution companies) at the national level owe power producers close to ₹963.60 bn as of February end.

Source: The Financial Express

Delhi: Get rebate on power bill with self-reading

9 April. In a bid to encourage people to pay their bills on time, Delhi Electricity Regulatory Commission has announced a new rebate scheme. People can avail 0.5-1 percent rebate depending on when they are making the payment and an additional ₹20 per bill for taking self-reading and sending it to the distribution company.

Source: The Economic Times

Discom collections to be hit amid Lockdown: Ind-Ra

9 April. Amid lockdown to contain coronavirus infection, bill collections of discoms (distribution companies) would have a significant impact and their power purchase cost may increase, a report by India Ratings (Ind-Ra) has said. The report listed various factors such as low demand from industrial consumers; higher-than-expected aggregate technical and commercial (ATC) losses; higher dependence on direct collections from consumers compared to subsidy and inability to increase tariffs immediately, which would impact cash flow of discoms. Ind-Ra expects payments to gencos (generating companies) remain uneven even after June 2020, based on the collection ability of the discoms. The overall situation could result in leverage increasing across the sector because of an increase in working capital borrowings. Ind-Ra had earlier stated its opinion that the pandemic could lead to the thermal plant load factor (PLF) falling below 55 percent for FY21, closer to the technical minimum standards, on account of a gradual ramp-up in industrial load and the already muted electricity demand witnessed in the pre-COVID scenario. Ind-Ra highlighted that a low plant capacity utilisation for the plants under long-term PPAs (power purchase agreements) would result in an overall increase in the tariff because the fixed cost recovery is linked to the plant availability factor.

Source: Business Standard

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

MNRE to promote local manufacturing, export hubs for renewable energy

14 April. In a bid to minimise the impact of COVID-19 pandemic on the heavily import-dependent domestic solar industry, the Ministry of New and Renewable Energy (MNRE) has asked state and port authorities to identify land sites suitable for renewable energy manufacturing and export services hubs. MNRE secretary Anand Kumar had said that the ministry would provide full support to companies planning to expand or set-up bases in India for manufacturing and export of services in the renewable energy sector. Many solar industry executives have been saying that the pandemic and its resultant lockdown will impact their business operations in the future. Hence, this step comes as a relief as far as local manufacturing of renewables is concerned. The ministry has also extended the deadline for the approved list of models and manufacturers by six months to provide some relief to renewable energy firms that are under stress due to the COVID-19 crisis. The earlier deadline was 31 March.

Source: The Economic Times

States may soon get hydro power purchase targets

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Hydro power purchase targets will incentivise production of carbon free electricity!

< style="color: #ffffff">Good! |

14 April. The Centre will soon make it mandatory for states to meet part of their electricity requirement from hydro power plants, a reward to these projects that saved the country’s grid collapse during the nine-minute lights switch off call by Prime Minister Narendra Modi on 5 April. The power ministry is soon likely to notify guidelines giving states hydro power procurement targets on the lines of renewable energy purchase obligations. The move comes soon after nine-minute lights-off feat when the grid survived 32 GW demand drop for a few minutes backed by flexible generation from hydropower resources. The notification is pending since March last year when the Union cabinet approved measures to promote hydropower, which included declaring all such plants as renewable generation, tariff rationalisation measures and budgetary support for flood moderation and enabling infrastructure. The trajectory for hydro power obligation will be notified for discoms (distribution companies) up to 2030, against 2-3 years in case of renewable energy projects.

Source: The Economic Times

Chhattisgarh initiates move to check power plants emission

11 April. Responding to the health impact assessment study highlighting increased vulnerability to coronavirus among people living near coal-fired plants, the Chhattisgarh government has directed the concerned authorities to initiate action towards emission control. The latest scientific study done by Chhattisgarh State Health Resource Centre (SHRC). The cross-sectional study highlighted that people residing near thermal power plants were more prone to respiratory illnesses and diseases like coronavirus. Chhattisgarh Minister of Revenue, Disaster Management and Rehabilitation Jaisingh Agrawal instructed the departments concerned to take action to control the emissions and improve the situation in the region. At a time when government authorities are mostly in denial when it comes to public health impacts of coal plants, experts feel the minister’s letter has set-up a good precedent.

Source: The Times of India

REC board okays incorporation of 7 SPVs to facilitate evacuation of renewable energy

9 April. State-owned shadow banking firm REC Ltd said its board has approved a proposal to incorporate seven power transmission projects which would facilitate evacuation of renewable energy. These projects will evacuate clean energy from Maharashtra, Madya Pradesh, Karnataka and Rajasthan. RECTPCL (REC Transmission Projects Company Ltd) auctions these transmission projects and hands over the incorporated entities to successful bidders for development and operation. The seven transmission projects are allocated by the power ministry. These seven SPVs (special purpose vehicles) include a transmission system for evacuation of power from RE projects in Osmanabad area (1 GW) in Maharashtra. Besides, the board has also approved three transmission systems for evacuation of power from RE projects in Rajgarh (2,500 MW) SEZ in Madhya Pradesh; in Gadag (2,500 MW), Karnataka -- Part A and in Bidar (2,500 MW), Karnataka. These projects also include three transmission system-strengthening schemes for evacuation of power of 8.1 GW each from solar energy zones in Rajasthan.

Source: The Economic Times

MNRE’s decision to remove tariff caps can revive investments: CRISIL

9 April. The Ministry of New and Renewable Energy (MNRE)’s decision to remove tariff ceilings from renewable energy tenders would give the sector a much-needed leg-up and boost investments, according to ratings and research agency CRISIL. Renewables capacity addition had dropped to about 9 GW) in financial year 2018-19 (FY19), compared with 11 GW to 12 GW over FY17 and FY18, and remained subdued through FY20 as well. The ratings agency, however, expected solar’s weighted average tariff to remain in the current ₹2.50 to ₹2.60 per unit range as lower module cost, larger scale of projects, and continued tendering activity in the segment would continue to pique competition among players.

Source: The Economic Times

States with highest growth in solar, wind capacity also those worst-hit by coronavirus

8 April. India’s top 10 worst-hit states in terms of confirmed coronavirus cases also happen to be those which registered maximum addition of solar and wind energy generation capacity in 2019. There is no causal link between the geographical spread of coronavirus infections and renewable energy capacity addition. An analysis shows how the growth of the renewable energy capacity is at risk owing to the lockdown imposed across states. The analysis that superimposed the two data sets, obtained from government records, shows states such as Tamil Nadu, Karnataka, Rajasthan, Andhra Pradesh and Madhya Pradesh -- with some of the highest coronavirus infections -- added a total of 4,880 MW of solar and 24,949 MW of wind capacity last year. Tamil Nadu, which added 1,213 MW of solar and 9,286 MW of wind capacity during 2019-20 up to December is also the state with the second-highest number of confirmed cases as on 7 April, 2020. Rajasthan, which is also among the top coronavirus infected states, had added 1,617 MW solar capacity and 4,299 MW wind capacity during 2019-20. In case the worst hit states impose longer lockdown periods it can result in an extended hit to the growth of the solar and wind energy capacity. In terms of solar photovoltaic (PV) installations, too, the states with the highest capacity additions in 2019 were those with the highest number of infections, according to research and consultancy firm Wood Mackenzie. It said that India could face over 21.6 percent or 3 GW of solar PV and wind installations being delayed as a result of the lockdown.

Source: The Economic Times

INTERNATIONAL: OIL

US shale oil output to drop by record 194k bpd in April: EIA

14 April. US (United States) shale oil output is expected to drop by 194,000 barrels per day (bpd) in April, most on record, to about 8.7 mn bpd, according to the US Energy Information Administration (EIA), as producers slash drilling activity after oil prices plunged. Shale production has been sliding for several months, but the declines are expected to accelerate as demand has fallen by roughly 30 percent worldwide due to the coronavirus pandemic. Numerous producers, including US majors Exxon Mobil Corp and Chevron Corp, have announced plans to rein in spending and are forecasting reduced output in coming months. April’s decline is forecast to be followed by fall in May by 183,000 bpd to 8.53 mn bpd, which would be the lowest since June 2019, and a sixth straight month of declines, the EIA said. Crude oil prices dropped by more than 65 percent in the first quarter as demand plummeted due to the coronavirus pandemic and supply ballooned due to a price war between Saudi Arabia and Russia. Output at every shale formation is expected to fall in May, with the biggest drop forecast in the Permian, the biggest US basin, the EIA said.

Source: Reuters

OPEC, Russia approve biggest-ever oil cut to support prices amid coronavirus pandemic

12 April. OPEC (Organization of the Petroleum Exporting Countries) and allies led by Russia agreed to a record cut in output to prop up oil prices amid the coronavirus pandemic in an unprecedented deal with fellow oil nations, including the United States (US), that could curb global oil supply by 20%. Measures to slow the spread of the coronavirus have destroyed demand for fuel and driven down oil prices, straining budgets of oil producers and hammering the US shale industry, which is more vulnerable to low prices due to its higher costs. The group, known as OPEC+, said it had agreed to reduce output by 9.7 mn barrels per day (bpd) for May and June, after four days of talks and following pressure from US President Donald Trump to arrest the price decline. OPEC+ sources said they expected total global oil cuts to amount to more than 20 mn bpd, or 20 percent of global supply, effective 1 May. OPEC had the same figure in its draft statement but removed it from the final version. The biggest oil cut ever is more than four times deeper than the previous record cut in 2008. Producers will slowly relax curbs after June, although reductions in production will stay in place until April 2022.

Source: Reuters

US President agrees to help Mexico meet global oil cut target

10 April. US President Donald Trump said he would help Mexico contribute to global oil output reductions, in a surprise move that could break an impasse among the world’s major oil producers over cutbacks aimed at stabilizing crude prices. The US reductions will amount to 250,000 barrels per day (bpd), according to Trump and Mexican President Andres Manuel Lopez Obrador. Trump said the cuts would depend on the approval of other oil-producing nations. Oil prices have cratered under the pressure of a price war and the devastating economic impact of the coronavirus global pandemic. Trump had previously warned Saudi Arabia that it could face sanctions and tariffs if it did not reduce production enough to help the US oil industry. Trump said he had not made assurances to Saudi Arabia that the United States would not bail out US oil producers. Lopez Obrador said Mexico was pressed to make cuts of 400,000 bpd, or 23 percent of current output, before the group lowered the target to 350,000 bpd. Lopez Obrador said Trump offered to help before Mexico announced it would cut output by only 100,000 bpd.

Source: Reuters

Japan urges G20 energy summit to address importance of stable oil prices

10 April. Japan hopes a Group of 20 energy ministers summit later will address the importance of stable oil prices and supply after OPEC (Organization of the Petroleum Exporting Countries) and its allies agreed to make record production cuts, Japan’s Economy, Trade and Industry Minister the country’s industry minister Hiroshi Kajiyama said. The OPEC and associated producers including Russia, a group known as OPEC+, struck a deal to cut output by 10 mn barrels per day from May to try to offset a collapse in global fuel demand caused by the coronavirus pandemic. But oil prices tumbled on doubts that the OPEC+ deal would be enough to stabilise oil market markets.

Ecuador scrambles to contain oil spill in Amazon region

9 April. Ecuadorean authorities were scrambling to limit the environmental impact of a crude oil spill in the country’s Amazon region, where pipeline bursts prompted by a landslide caused crude to enter the Coca river. The energy ministry said that it had placed barriers around the spill in an area home to several indigenous communities and near the source of drinking water for the city of El Coca, with some 45,000 residents. Ecuador produces some 530,000 barrels per day (bpd) of crude, the cash-strapped country’s main source of export revenue. The government has said the incident will not affect crude exports or domestic fuel supply.

Source: Reuters

Venezuela gasoline shortages worsen as US tells firms to avoid supply

8 April. Gasoline shortages in Venezuela are worsening after US (United States) officials have told foreign firms to refrain from supplying the fuel to the sanctioned South American nation and only provide diesel. Since late 2019, US officials have asked most of Venezuela’s fuel suppliers to avoid sending gasoline to the crisis-stricken nation. In the latest round of calls in early March between US officials and oil firms, they repeated the ban, despite worsening humanitarian conditions in the country. The US Treasury Department sanctioned Venezuela’s Petróleos de Venezuela (PDVSA) over a year ago as a measure to oust socialist President Nicolas Maduro, who Donald Trump’s administration considers a dictator usurping power. The restriction on crude oil-for-gasoline swaps with Venezuela is being maintained as the country’s own once-formidable refining industry collapses, with almost no gasoline produced in recent months, leading to chronic shortages across the country. Both Repsol and Eni said they send PDVSA diesel, not gasoline, as part of their swaps. In March, Eni delivered two diesel cargoes, while Repsol sent one and Rosneft did not send any, according to internal PDVSA documents seen by Reuters and Refinitiv Eikon data. Fuel shortages began well before the sanctions because of plunging refining in Venezuela, which has a total capacity of 1.3 mn barrels per day (bpd) of crude processing. Of that, PDVSA only refined 101,000 bpd of crude in March, according to an internal PDVSA document, increasing the crisis-stricken nation’s dependence on imports.

Source: Reuters

INTERNATIONAL: GAS

China’s GCL, Shell sign preliminary deal on LNG trading JV

14 April. GCL Oil & Natural Gas Co Ltd has signed a framework agreement with Royal Dutch Shell to explore setting up a joint venture (JV) based in eastern China to market and trade liquefied natural gas (LNG), the privately owned Chinese company said. The proposed JV would secure LNG supplies from Shell and market the fuel to a receiving terminal which GCL is planning in Jiangsu province, GCL said. GCL, a subsidiary of private energy and power firm GCL (Group) Holding, is one of over a dozen Chinese gas terminal developers outside state giants China National Offshore Oil Company, PetroChina and Sinopec Corp that have so far dominated the LNG sector. China is the world’s No.2 LNG importer. GCL is planning three receiving terminals along China’s east coast - Yantai in Shandong province, Rudong in Jiangsu and Maoming in Guangdong - with a total annual handling capacity of 14.5 million tonnes. Among them, the 5 million tonnes per annum (mtpa) Yantai project was first to have won state regulatory approval, in January, and GCL aims to start constructing the facility this year. The Yantai terminal, at an estimated cost of $1.1 bn, would start up in 2023.

Source: Reuters

INTERNATIONAL: COAL

Poland’s biggest coal producer PGG asks workers to take pay cut as coronavirus hits

14 April. Poland’s biggest coal producer, PGG, said it asked unions to accept a cut in hours and pay of up to 20 percent for three months, which would make the state-run company eligible for government help during the new coronavirus crisis. Poland relies on coal for almost 80 percent of its electricity production, but lockdown measures, which have shut schools, restaurants, cinemas, some factories and reduced railway transportation, have led to a decrease in electricity usage that the company puts at 10-12 percent.

Source: Reuters

Nearly half of global coal plants will be unprofitable this year

8 April. China and other countries could be planning to build more coal plants to stimulate their economies in the wake of the novel coronavirus pandemic but nearly half of global coal plants will run at a loss this year, research showed. China has over 1,000 GW of coal-fired power, accounting for about 60 percent of the country’s total installed generation capacity and around 100 GW under construction. London-based environmental think tank Carbon Tracker analysed the profitability of 95 percent of coal plants in operation or planned around the world. China, which produces and consumes about half the world’s coal, might be considering building more coal plants to stimulate its economy in the wake of COVID-19, after the National Energy Administration announced it was ready to relax rules on coal power investment. Nearly 60 percent of China’s existing coal plant fleet is running at an underlying loss.

Source: Reuters

INTERNATIONAL: POWER

US power demand falls to 16-year low as coronavirus cuts use by companies

9 April. US (United States) electricity demand last week plunged to a 16-year low as offices shut and industrial activity slowed sharply with government travel and work restrictions to slow the coronavirus spread, according to analysts and the Edison Electric Institute (EEI) trade group. Energy traders noted power use also declined as mild weather kept heating demand low across much of the country. EEI said power output fell to 64,896 gigawatt hours during the week ended 4 April. That was down 5.7 percent from the same week in 2019 and was the lowest in a week since April 2004. The US Energy Information Administration (EIA) projected economic slowdown and stay-at-home orders would reduce electricity and natural gas consumption in coming months. EIA said it expected power sales to the commercial sector to drop by 4.7 percent in 2020 as many businesses close, while industrial demand will fall by 4.2 percent as factories shut or reduce output. Electricity sales to the residential sector, meanwhile, will only decline about 0.8 percent in 2020, EIA projected, as reduced heating and air conditioning use due to milder winter and summer weather is offset by increased household consumption as many folks stay home. EIA said it expects total US power consumption to decline by 3 percent in 2020 before rising almost 1 percent in 2021.

Source: Reuters

German main 2021 power price seen falling 24-33 percent due to coronavirus spread

8 April. Europe’s wholesale electricity market benchmark price could fall by around €10 to €14 a megawatt hour (MWh) due to shifting demand and supply as well as turbulent oil markets amid the coronavirus crisis. The German annual delivery price for round-the-clock power in 2021, Europe’s key price to gauge the market, may fall by an average €10.2 per MWh, from a reference price of €42.21 ($45.88) on 31 December 2019, before major news of the rapid global outbreak of the virus, Berlin-based Energy Brainpool said. German industry group BDEW noted that power demand was down 9 percent on that in the first week of March, before the lockdown.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

US underestimates methane emissions from offshore oil industry

14 April. Offshore oil and gas drilling operations in the US (United States) Gulf of Mexico emit far more methane than government estimates suggest, according to a study released by the University of Michigan. Drilling platforms emit about half a teragram of the planet-warming gas each year, according to the study, which claims to be the first to use aircraft to take direct samples of emissions during normal operations. By contrast, the US Environmental Protection Agency (EPA)’s Greenhouse Gas Inventory report last year found Gulf offshore platforms emitted about 0.33 teragram of methane, according to calculations by the Michigan researchers. The oil and gas sector is the largest single source of US methane emissions. The researchers said their study found that EPA’s estimates for emissions from shallow-water operations focused on natural gas were particularly low.

Source: Reuters

Ten EU countries urge bloc to pursue 'green' coronavirus recovery

10 April. Sweden, the Netherlands, Italy, Spain and six other countries urged the European Union (EU) to adopt a “green” recovery plan, as fears grow that the economic hit caused by the coronavirus pandemic could weaken action on climate change. The 10 countries want to see increased investment to support renewable energy, sustainable transport, energy efficiency and other steps to back the EU Green Deal’s goal of net zero greenhouse gas emissions by 2050.

Source: Reuters

Singapore considers solar energy imports to cut emissions

9 April. Singapore is considering importing solar electricity as the city-state looks to diversify its energy supply and meet its goal of cutting net greenhouse emissions to net zero by the second half of the century. The South-east Asian country, one of the sunniest cities in the world, generates about 95 percent of its power from imported natural gas with solar energy being its most viable renewable energy option, Singapore’s electricity regulator said. The Energy Market Authority (EMA) aims to achieve a solar target of at least two gigawatts of peak power by 2030, up from the 260 megawatt-peak in the second quarter of 2019.

Source: Reuters

EBRD to help Estonia’s Enefit Green expand solar energy in Poland

9 April. The European Bank for Reconstruction and Development (EBRD) said it will provide a €40 mn ($44 mn) loan to Estonia’s Enefit Green to help the company develop solar energy in coal-reliant Poland. Poland generates almost 80 percent of its energy from coal, but under European Union pressure to reduce carbon emissions the government has encouraged investment in solar panels. Poland has increased its installed capacity to produce solar power by 175 percent in the past year to almost 1.3 GW, as the government launched a number of incentives for individuals and smaller companies to invest in solar energy.

Source: Reuters

Global solar PV installations set to drop 18 percent in 2020

9 April. As the world economy faces severe economic disruption due to the Coronavirus pandemic, global solar PV (photovoltaic) installations are expected to drop 18 percent from 129.5 GW to 106.4 GW in 2020, according to consultancy firm Wood Mackenzie. It said the pandemic will have a significant impact on the global solar PV market and the construction and development is slowing as countries around the world enforce unprecedented lockdowns.

Source: The Economic Times

DATA INSIGHT

Renewable Energy Capacity Trends & Wind Power

| Wind Power Capacity Additions (in GW) |

| 2017-18 |

1.865 |

| 2018-19 |

1.48 |

| 2019-20 (Apr-Feb) |

2.043 |

| Cumulative Capacity of Wind Power till Feb 2020 |

37.7 |

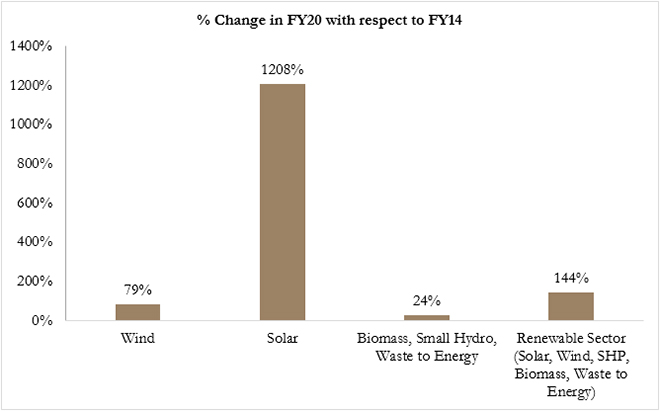

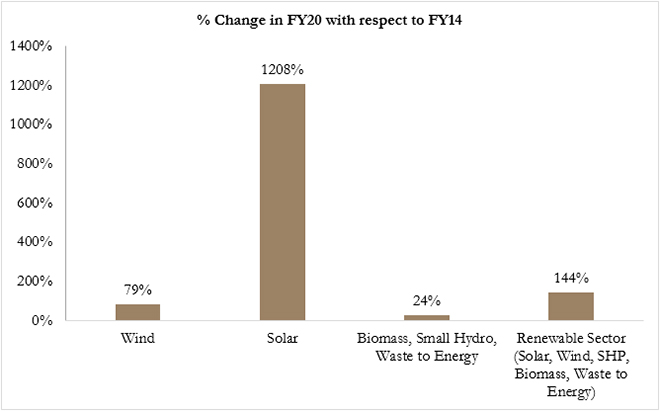

Renewable Capacity Growth by Sources

Source: Lok Sabha Questions

Source: Lok Sabha Questions

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: Lok Sabha Questions

Source: Lok Sabha Questions PREV

PREV