-

CENTRES

Progammes & Centres

Location

At least in the oil sector, the global health emergency posed by the spread of the novel Coronavirus and Saudi Arabia declaring a price war, is coming to India’s advantage. India oil import bill is expected to fall by a sharper 10 percent in FY20 as the increasing spread of Coronavirus and now the fallout of talks between OPEC and Russia has depressed the crude oil prices to about $30/barrel now against a high of over $70/barrel in September and again in January this year. For FY21, the import bill could slip to half of current levels at $64 bn witnessed in FY16 when crude had fallen to $26/barrel for some time. According to oil ministry’s PPAC the country’s oil imports is projected to fall to 225 mt in FY20 against 227 mt in FY19 while the import bill would reduce 6 percent to $105 bn from $112 bn worth of imports in previous fiscal. However, this calculation is based on average crude price of $64/barrel for April-December of current fiscal while the January-March import has been worked on the basis of crude price of $66/barrel. It is worth noting that crude oil prices slipped to below $60 and now around $30/barrel from highs witnessed in first week of January. This would bring big savings on oil imports that generally surge in the later part of the financial year. Crude production in India has stagnated around 35 mt for past decade. In FY19, domestic crude production has dropped to 34.2 mt from 35.7 mt in the previous year.

The government hiked excise duty on petrol and diesel by a steep ₹3/litre each to garner about ₹390 bn additional revenue as it repeated its 2014-15 act of not passing on gains arising from slump in international oil prices. Retail prices of petrol and diesel will not be impacted by the tax changes as state-owned oil firms adjusted them against the recent fall in oil prices and the likely trend in the near future. According to a notification issued by the Central Board of Indirect Taxes and Customs, special excise duty on petrol was hiked by ₹2 to ₹8/litre in case of petrol and to ₹4/litre from ₹2 in case of diesel. Additionally, road cess was raised by ₹1/litre each on petrol and diesel to ₹10. With this, the total incidence of excise duty on petrol has risen to ₹22.98/litre and that on diesel to ₹18.83. The tax on petrol was ₹9.48/litre when the Modi government took office in 2014 and that on diesel was ₹3.56/litre. Petrol and diesel prices, which are changed on a daily basis, were cut by 13 paise and 16 paise respectively as oil companies adjusted the excise duty hike against the drop in prices that warrants from international rates slumping the most since the Gulf war. Petrol now cost ₹69.87/litre in Delhi and a litre of diesel comes for ₹62.58. The government had between November 2014 and January 2016 raised excise duty on petrol and diesel on nine occasions to take away gains arising from plummeting global oil prices.

PHD Chamber of Commerce and Industry has urged the government to reduce excise duty and VAT on petrol and diesel by 25 percent to bring down the prices by ₹9 to 10/litre. According to PHD Chamber of Commerce and Industry this can be a boon for the Indian economy as inflationary conditions will be benign and price cost margin of the businesses will improve. International crude oil prices have declined significantly from $63.27/barrel as on 6 January 2020 to around $20-25/barrel by end of March. Petrol prices in India (Delhi) decreased from ₹75.69 to ₹70.59/l during the same period. The significant 50 percent fall in international crude oil prices has only resulted in 7 percent decline in the domestic petrol prices. The build-up of petroleum product prices because of various taxes, duties and commissions (fixed excise duties at ₹19.98/litre and VAT at ₹15.25/litre in Delhi) is so high that any significant crude oil price decline is also not reflected in the prices of petroleum products in India. At this juncture, the chamber suggested to reduce excise duties and VAT on petroleum, diesel and allied products by at least 25 percent to bring down the prices of petroleum products, which will be a big relief to the industry, boost and kick start economic growth while reviving the spirit in the economy.

India plans to take advantage of low prices for oil from Saudi Arabia and the UAE to top up its strategic petroleum reserves. Global oil prices have fallen around 40 percent in March as the impact of the coronavirus pandemic has destroyed demand, while supplies are growing following Moscow’s refusal to back deeper output cuts at a meeting of the OPEC and its OPEC+ allies. The oil ministry has written to the finance ministry to release about ₹48 to 50 bn ($673.7 mn) to buy oil in 8-9 very large crude carriers for filling the storage. India, the world’s third biggest oil importer and consumer, imports about 80 percent of its oil needs and has built strategic storage at three locations in southern India to store up to 36.87 mn barrels of oil or about 5 mt to protect against supply disruption. ISPRL, a company charged with building of strategic storage, has signed an MoU with the UAE’s national oil company ADNOC for the lease of half of its 2.5 mt Padur facility. The leases allow the national oil companies to store their oil, some of which will cater for India’s strategic needs, while they can sell the rest to Indian refiners. Padur has four compartments that hold about 4.6 mn barrels each. The ISPRL has already leased half of the 1.5 mt capacity in Mangalore storage to ADNOC, which has stored about 5.5 mn barrels of Das oil in the cavern, while ISPRL has retained the remainder. India has also filled its 1.03 mt Vizag facility with Basra oil from another OPEC producer Iraq. While India is primarily taking advantage of low prices as a consumer nation, US government aimed to help US energy producers struggling to cope with the price fall by announcing he would take advantage of low prices to fill up the nation’s emergency reserve.

ONGC, the country’s largest petroleum explorer, expects oil and gas production to decline in a range between 3 percent and 4 percent in the current financial year ending March 2020. The company’s oil production during the first nine months (April-December) of the current financial year declined 4.3 percent to 17.53 mt. ONGC had also announced oil production will witness a marginal increase by 2024, from the current annual levels of 23-24 mt. Existing oil wells operating in the Cauvery Delta can continue operations but there will be no more fresh allocations as a new law passed in the Tamil Nadu Assembly protects five districts in the Cauvery Delta from natural resource mining that may harm farming. The Tamil Nadu Protected Agricultural Zone Development Act 2020 was passed in the Assembly even as the DMK staged a walkout. According to documents from the ministry of petroleum and natural gas, there have been 28 petroleum mining licences rolled out for extraction to ONGC, covering an onland acreage of 3,516 sq km. The oil ministry has also allotted four exploration and mining licences to private and joint venture players covering over 410 sq km.

Oil India Ltd, the country’s second-largest national oil explorer, announced it has signed an agreement with Numaligarh Refinery for sale and purchase of crude oil. The Crude Oil Sales Agreement will come in effect from 1 April, 2020 to 31 March 2025, that is, for a term of five years, Oil India said. The agreement is expected to streamline sale and purchase transactions of crude oil produced from fields in the North East India.

US oil supplies to India have jumped ten-fold to 250,000 bpd in the last few years. Indian imports of US oil were 25,000 bpd a couple of year ago, and have now risen to 2,50,000 bpd. US is India’s sixth largest oil supplier. India began importing crude oil from the US in 2017 as it looked to diversify its import basket beyond the OPEC nations. It bought 38,000 bpd of crude oil from the US in 2017-18 and another 124,000 bpd in 2018-19. In the first six months of current fiscal (2019-20), US supplied 5.4 mt of crude oil to India. Iraq is India’s top crude oil supplier, meeting close to one-fourth of the country’s oil needs. It sold 26 mt of crude oil to India during April to September. India, which is 83 percent dependent on imports to meet its oil needs, bought 111.4 mt of crude oil from overseas during April-September. Saudi Arabia has traditionally been India’s top oil source, but has been relegated to the second spot, exporting 20.7 mt of crude oil in the first six months.

IOC has made it mandatory for its LPG refill delivery staff to carry with them weighing scales and leak detectors to ensure customers get a full cylinder, without any leaks. Domestic cylinders will have their empty weight printed on them and gas agencies should fill it with 14.2 kg LPG. The gross weight of the cylinder should be arrived at by adding empty weight and weight of the LPG — 14.2 kg. IOC has urged LPG consumers to pay for refills online so that there is no scope for delivery persons to demand tips. Each dealer gets ₹60 per cylinder as commission and the delivery person gets ₹20 from the dealer. IOC is also on the verge of sending out text messages which will have details of subsidy amount that gets refunded. IOC is looking to set up an LPG bottling plant in Mizoram, besides upgrading 100 retail outlets across the Northeast in the next financial year. The company is currently in talks with the Mizoram government for setting up the bottling plant in the state. The company would upgrade 100 retail outlets across the Northeast at an estimated cost of about ₹500 mn in the next financial year. IOC is also looking to commission at least nine retail outlets in Mizoram in the forthcoming fiscal.

The LPG penetration in Karnataka is 'absolutely 100 percent' according to IOC. In 2014, LPG penetration in the State was only 68 percent. The 100 percent LPG penetration in the state will help women in rural areas to make their kitchens smokeless. By 31 March, the IOC would commission the ₹100 mn Vapour Recovery System at the Devanagonthi terminal on the city outskirts which would ensure that vapour does not go out in the air when tankers are being filled with fuel. IOC has started mobile fuel dispensers, delivering fuels at the doorsteps.

India has eliminated subsidy on kerosene through small fortnightly price increases for nearly four years amid low oil prices, enabling savings for the government at a time when it is facing a revenue shortfall, thus raising expectations of a quick end to cooking gas subsidy that’s also being cut gradually. The government instructed state-run oil companies to price kerosene at market rates after regular price revisions obviated the need of subsidy for kerosene sold through public distribution system. Kerosene prices fell by 0.23 paise a litre this month, the first fall since July 2016 when oil companies started raising prices by 25 paise a fortnight following a directive from the government. Kerosene prices more than doubled to ₹36.38/litre last month in Mumbai from ₹15.02 in July 2016. Price fell to ₹36.15/litre in March. The subsidy on kerosene in the current financial year would be about ₹19.50 bn, according to the government’s estimates. In just three years, consumption of kerosene has halved. It fell to 4,152 thousand kilolitre in 2018-19 from 8,537 thousand kl in 2015-16. Consumption during April-January 2020 declined 29 percent from that a year ago. State-run oil companies have also been raising cooking gas prices by ₹4 per 14 kg cylinder every month, lowering subsidy bill for the government. Subsidised cooking gas prices have risen by about ₹70/cylinder in eight months. The recent oil price collapse is expected to sharply cut cooking gas subsidy. If prices stay at current levels and companies continue to raise prices, cooking gas subsidy can quickly vanish. The cooking gas subsidy for the current fiscal is expected to be ₹230 bn, as per the government’s estimates.

Indian refining companies are snapping up rare crude grades as the coronavirus outbreak curtails China’s demand for processing with prices for some grades falling by as much as 15 percent. Chinese refiners have slashed output by at least 1.5 mn barrels a day in February, or over 10 percent, after the virus outbreak hit domestic fuel demand, leading to swelling stocks. Refiners in India, the world’s third-biggest oil importer, rarely get the opportunity to buy suitable grades from areas like the Mediterranean and Latin America due to higher freight rates. However, shipping rates have plunged by nearly half since the virus outbreak, and after the US partially lifted sanctions on part of Chinese shipping firm COSCO.

Sell-off-bound BPCL has procured 500 mn barrels of distress crude (five shiploads) at a discount of $3-5/barrel to the already low prevailing price following order cancellations by coronavirus-hit China. Since the outbreak of the epidemic, crude prices have plunged over $15 a barrel to around $30 now as large parts of China, the largest importer and consumer of crude, are under Beijing-ordered lockdown and millions of factories are closed. Meanwhile BPCL has been the biggest customer of US crude since the last two years, when that country lifted the ban on exporting crude for the first in decades. India is the fourth largest export destination for US crude now, while LNG import from the US is also increasing progressively ever since import started in March 2018. India is now the fifth largest destination of US LNG exports. Bilateral hydrocarbon trade has increased exponentially during the past three years touching $7.7 bn mark in FY19, accounting for 11 percent of total two-way trade.

RIL has bought 2 mn barrels of additional Saudi oil in a very large crude carrier for loading in April. Saudi Aramco, the world’s top oil exporter, has slashed its selling price for April and announced plans to raise output to a record 12.3 mn bpd. It was not immediately clear which crude RIL will replace with the additional Saudi barrels. The refiner, one of the biggest buyers of Venezuelan oil, is preparing to wind down purchases from the Latin American nation from April under pressure from US sanctions.

Petrol pump owners are a worried lot as sales of petrol and diesel have come down by 20-40 percent in the past fortnight amid fears of Covid-19 outbreak. Petrol and diesel prices have been cut by ₹1.34 and by ₹1.28 respectively in the past one week due to fall in crude prices in the international market. The sale of diesel in Bihar plunged from 43,191 kilolitre in the first week of March (1 to 7) to 34,314 kilolitre in the second week. World market price of crude oil has declined to $37 per barrel from $51 per barrel.

India will switch to the world’s cleanest petrol and diesel from 1 April as it leapfrogs straight to Euro-VI emission compliant fuels from Euro-IV grades now - a feat achieved in just three years and not seen in any of the large economies around the globe. India will join the select league of nations using petrol and diesel containing just 10 parts per mn of sulphur as it looks to cut vehicular emissions that are said to be one of the reasons for the choking pollution in major cities. According to IOC almost all refineries began producing ultra-low sulphur BS-VI (equivalent to Euro-VI grade) petrol and diesel by the end of 2019 and oil companies have now undertaken the tedious task of replacing every drop of fuel in the country with the new one. State-owned oil refineries spent about ₹350 bn to upgrade plants that could produce ultra-low sulphur fuel. This investment is on top of ₹600 bn they spent on refinery upgrades in the previous switchovers. But oil marketing companies switched over to supply of BS-VI grade fuels in the national capital territory of Delhi on 1 April 2018. The supply of BS-VI fuels was further extended to four contiguous districts of Rajasthan and eight of Uttar Pradesh in the National Capital Region on 1 April 2019, together with the city of Agra. The new fuel will result in a reduction in nitrogen oxide in BS-VI compliant vehicles by 25 percent in petrol cars and by 70 percent in diesel cars.

With oil erasing over a third of its value this week after a messy breakup of the OPEC+ alliance, OPEC members were bleeding over half a billion dollars a day in lost revenue. For the most part, oil is a top income source for members of the OPEC and such a dramatic fall in prices will put strain on their economies, some of which such as Iran and Venezuela, are already on the brink. OPEC had been pushing for expanding the existing cuts with its allies, known as OPEC+, by an additional 1.5 mn bpd to over 3 mn bpd until the end of the year. For some nations, including one the group’s richest members Saudi Arabia, fiscal budget break-even oil prices were already much higher than the oil price before the most recent collapse. A panel of OPEC and its allies recommended cutting oil output by an extra 1 mn bpd signaling that Russia and Saudi Arabia were moving closer to a deal to prop up prices which have been hit by the coronavirus outbreak. Saudi Arabia and some other OPEC members have been pushing for deeper cuts as crude prices have plunged 20 percent since the start of the year but had struggled to persuade Russia to support the additional reduction. The OPEC, Russia and other producers already have a deal in place to cut output from 1 January by 2.1 mn bpd, a figure that includes additional voluntary cuts by Saudi Arabia. But that has not been enough to counter the impact of the virus on China, the world’s biggest oil importer, and on the global economy, as factories are disrupted, fewer people travel and other business slows, curbing oil demand.

Saudi Arabia, which holds the presidency of the G20 economic powers this year is expected to coordinate on oil prices to avoid economic disruption for other countries. Oil companies are expected to pass on the price cut to consumers at the pump. The sharp drop in oil prices has added to stress in the financial markets, which were already in correction territory as investors re-evaluate profit and growth perspectives in light of the coronavirus outbreak. Sales of petroleum products are slumping in Japan as the coronavirus outbreak worsens in the world’s fourth-biggest importer of crude, but the country’s biggest refiners say they are not planning to cut production. Oil product sales, including gasoline and jet fuel, slumped more than a quarter, the most recent period for which figures are available. Jet fuel sales sunk nearly 80 percent as Japanese and global airlines cancelled flights to China and other destinations. Japan’s refinery run rate was at 82.2 percent, compared with 84.3 percent the previous week. Idemitsu and other Japanese refiners were cutting runs due to lower demand and margins.

Saudi Arabia will supply additional oil volumes next month to all customers in Europe who asked for an increase following a deep cut to Saudi official selling prices. European oil refiners including Total, BP, Shell, Eni, and SOCAR have all had allocations for additional Saudi crude oil supplies in April confirmed. Oil prices have weakened more widely, with Brent crude on track for its worst week since the 2008 financial crisis as investors fretted over the impact of the coronavirus on demand and plans by producers to boost output. Saudi Arabia said it would boost its oil supplies to a record high in April, raising the stakes in a standoff with Russia and effectively rebuffing Moscow’s suggestion for new talks. The clash of oil titans Saudi Arabia and Russia sparked a 25 percent slump in crude prices, triggering panic selling on Wall Street and other equity markets that have already been badly hit by the impact of the coronavirus outbreak. The current US administration will benefit from lower gasoline prices at the pump in elections but it will also be concerned by the potential for bankruptcies in the US shale industry, which plays an increasingly important economic role.

Top oil exporter Saudi Arabia is expected to make the deepest cuts to its monthly OSPs to Asia since 2012, tracking declines in Middle East benchmarks and weak refining margins as the coronavirus outbreak has cut demand. Large Saudi crude price cuts for a second straight month indicate that Asia, the world’s fastest growing demand centre for oil, is swamped with supplies after the spreading virus led to run cuts at Chinese refineries. Asian refiners will also begin shutdowns in April for spring maintenance further dampening crude demand. The April OSP for Arab Extra Light crude was expected to fall by $1.90 to $3 a barrel. Saudi crude OSPs are usually released around the fifth of each month, and set the trend for Iranian, Kuwaiti and Iraqi prices, affecting more than 12 mn bpd of crude bound for Asia. State oil giant Saudi Aramco sets its crude prices based on recommendations from customers and after calculating the change in the value of its oil over the past month, based on yields and product prices. Saudi Aramco will shut its largest oil refinery for five to six weeks from 1 June. The 550,000 bpd Ras Tanura refinery on the shores of the Gulf supplies over a quarter of the kingdom’s fuel supply. The plant will shut down completely to connect new units and refit older units to produce cleaner fuels. The company is undertaking a $2.4 bn overhaul of Ras Tanura to reduce the sulphur content of the gasoline and diesel the refinery produces.

Iran said that the oil market was facing a surplus and needed to be balanced. Saudi Arabia and other OPEC members are seeking to win support from Russia for the output cuts. Russia will resist against a cut in production “until the last moment” according to Iran. Iran’s crude oil exports were reduced by more than 80 percent after US withdrew from a multilateral nuclear deal with the Islamic Republic in 2018 and reimposed sanctions. Iran’s oil production capacity increased by 6,000 bpd after a platform was installed at the offshore Salman field in the Gulf. With the installation of the S1 platform at Salman oilfield, Iran’s oil output has increased by 6,000 bpd with estimated value of the additional output at $240,000 a day.

The UAE followed Saudi Arabia in promising to raise oil output to a record high in April, as the two OPEC producers raised the stakes in a standoff with Russia that has hammered global crude prices. The extra oil the two Gulf allies plan to add is equivalent to 3.6 percent of global supplies and will pour into a market at a time when global fuel demand in 2020 is forecast to contract for the first time in almost a decade due to the coronavirus outbreak. Oil prices have almost halved since the start of the year on fears OPEC states would flood the market in its battle with Russia after Moscow rejected OPEC’s call for deep output cuts and a pact on cutting output that has propped up prices since 2016 collapsed. But Russia said it would not reverse its decision as it still believed cutting output would make no sense if the virus hit demand deeper than expected. Saudi Arabia, which has already announced it would hike supplies to a record 12.3 mn bpd in April, said it would boost production capacity for the first time in more than a decade. Russia said Saudi plans to raise output was “not the best option” and said Moscow was still open to dialogue with OPEC.

According to Goldman Sachs the oil market could see a record surplus of about 6 mn bpd by April, considering a bigger- than-expected surge in low-cost output, while a slump in demand was “increasingly broad” triggered by the coronavirus outbreak. Brent was set for its biggest weekly loss since 2008 as oil prices plummeted this week after top producer Saudi Arabia slashed its selling prices amid a price war with Russia and pledged to unleash more supply onto a market already reeling from falling demand due to the virus. The jump in inventories could also force some inland high-cost producers to shut production, since storage logistics may be stretched. The demand loss due to the fast-spreading coronavirus outbreak is pegged at about 4.5 mn bpd, though it also pointed to some signs of improving Chinese oil demand. The accumulation of oil inventories over the next six months could be similar to a build up over 18 months in 2014-16. Global demand growth, on the other hand, would see a reduction of about 310,000 bpd in 2021 and comfortably offset any fast supply response from high cost producers, especially with the shale output now forecast to drop by 900,000 bpd in the first quarter of 2021.

According to US energy historian Daniel Yergin it could be a long time before pressure is eased on sinking oil markets as the coronavirus causes public events and schools to close while global oil producers flood markets with crude. With global oil demand already sinking due to the spread of coronavirus, Saudi Arabia and Russia launched a war for market share, flooding global markets with crude. The US administration officials have been mulling several ways to support energy producers including buying oil at current low prices to stash in the Strategic Petroleum Reserve, which is held in caverns along the Texas and Louisiana coasts. Yergin discounted efforts to lay out a case that Saudi Arabia and Russia were dumping oil on global markets. Yergin said it would be hard to prove that anyone was putting out oil below market value, and in any case it would not be an overnight fix. He expected energy company consolidation to accelerate.

Venezuela’s oil exports rose 9 percent in February from the previous month, as some buyers rushed to take cargoes ahead of the expiration of a wind-down period as part of new US sanctions on PDVSA and its trade partners. Washington imposed tough sanctions on PDVSA in 2019 and launched a strategy of “maximum pressure” this year to oust Venezuela’s President, Nicolas Maduro, extending sanctions to PDVSA’s main trade partner, Rosneft Trading, while making threats on other customers. Prior to sanctions, the US was the biggest buyer of Venezuela’s oil. Exports increased to 1.046 mn bpd from 960,000 bpd in January. The US Treasury gave buyers of Venezuelan oil until the end of May to wind down purchases. PDVSA and its joint ventures exported 31 cargoes of crude and fuel last month. The country’s fuel imports decreased almost 8 percent in the same period to 163,000 bpd. India was the largest direct destination for Venezuelan oil in February with some 234,000 bpd shipped to refineries there, followed by Cuba with about 100,000 bpd. US said that Washington would go after customers of Venezuelan oil, including in Asia, as well as intermediaries helping Caracas hide the origin of its oil.

The US imposed sanctions on Rosneft Trading SA as it emerged as a key intermediary for the sale of Venezuelan oil. India and China are the important buyers of Venezuelan oil, with India importing about 342,000 bpd for Venezuela in 2019, according to tanker data. Rosneft units take Venezuelan oil as repayment for billions of dollars in loans extended to Venezuela in recent years. Other firms taking Venezuelan oil as repayment of loans or late dividends - including US oil major Chevron Corp and Spain’s Repsol SA - have not been sanctioned by Washington.

Russia’s budget deficit could reach 0.9 percent of GDP in 2020 at current oil prices. The country’s economy has been hit by a slump in global oil prices and the spread of the coronavirus, with the latter was having the bigger effect as it complicated transportation, tourism and trade. Russia has a rainy-day National Wealth Fund made up of oil revenues accumulated in previous years. The finance ministry expects oil companies to add 500 bn roubles to the fund this year.

China said it will cut the retail ceiling prices for gasoline by 1,015 yuan ($144.79) per tonne and diesel by 975 yuan, the biggest reduction since Beijing launched the pricing mechanism in 2013. The cuts, which track plunging global oil prices amid the coronavirus outbreak, the NDRC said. China has set a floor for retail prices at $40/barrel. The cuts represent a 13.9 percent reduction in gasoline prices and a 15.5 percent drop in diesel prices. The NDRC said that the pricing mechanism for refined oil products will not be changed at the moment but would be opened to the market in the future, depending on the progress of Chinese market reforms.

Asian refiners may curtail jet fuel output by partially reducing processing as the fuel’s value versus diesel plunged after the US said it would ban European travellers to prevent the spread of the coronavirus. The regrade, which is the price difference between jet fuel and diesel with a sulphur content of 10 ppm fell to a discount of $3.86/barrel, the lowest since 13 August 2015. As a result of the US ban, jet fuel demand may drop by between 200,000-250,000 bpd, split between the US and European markets over the 30-day ban. Refiners may deal with the lower jet fuel value by cutting their processing runs to make less of the fuel, which is typically produced during the initial distillation of crude into products. Companies have already been cutting rates to deal with surplus aviation fuel because airline travel has declined as countries ban travel to halt the coronavirus spread. Jet fuel in Singapore was at $40.97/barrel, down 49 percent this year, while 10ppm diesel was at $44.82, down 45 percent.

Indonesia state oil and gas company PT Pertamina plans to import more crude oil as global price tumble, Ego Syahrial. Indonesia’s energy ministry has given Pertamina a crude import quota of 50 mn barrels this year, around 30 mn barrels lower than requested. Pertamina imported 87 mn barrels of crude last year. Pertamina plans to spend $7.8 bn in investment this year, up 84 percent from a year earlier, to boost upstream output.

Mexico hinted at the country’s “willingness” to cut crude oil output in a bid to support prices, but it was unclear whether any new voluntary curbs might go beyond already falling production. Saudi Arabia failed to secure Moscow’s support for deeper production cuts at a meeting of the OPEC and its allies, known as OPEC+. Brazil’s oil company Petrobras cut fuel prices at refineries in the country for the first time oil price collapse. The oil company, which has a near refining monopoly in Brazil, reduced gasoline prices by 0.16 real per liter and cut diesel prices by 0.125 real per liter.

Norway’s Equinor ASA has abandoned plans to explore for oil in the deep waters off Australia’s south coast, saying it was not “commercially competitive”, following in peers’ footsteps in a move hailed as a big win by green campaigners. Equinor’s decision, announced, comes after Chevron Corp, BP Plc and Karoon Energy Ltd all walked away from promising exploration acreage in the Great Australian Bight, which industry consultants Wood Mackenzie have estimated could hold 1.9 bn barrels of oil equivalent. Oil companies eyeing the Great Australian Bight have long battled opposition from green groups concerned about potential damage to fishing towns, whale breeding grounds and an unspoiled coastline. Australian regulators had approved Equinor’s drilling plan in December, despite vocal opposition. But Equinor said that following a review of its global exploration portfolio it had decided there were better exploration opportunities elsewhere. Poland’s biggest refiner, the PKN Orlen said it would reduce fuel prices at its petrol stations due to lower oil prices and to help fight coronavirus spread. This is the effect of not only cheaper crude oil. Lower fuel prices would be beneficiary for people who have to use cars, including the military, police, firemen and doctors who are directly involved in fighting the epidemic.

Somalia has agreed an initial roadmap with a Shell/Exxon joint venture to explore and develop potential offshore oil and gas reserves. Somalia signed petroleum legislation into law to help open up a new frontier market in Africa as the strife-torn country hopes new petroleum finds will help transform its economy. In October Shell and Mobil, which had a joint venture on five offshore blocks in Somalia prior to the toppling of dictator Mohamed Siad Barre in the early 1990s, agreed to pay the government $1.7 mn for historic leasing of the blocks.

| FY: Financial Year, mn: million, bn: billion, OPEC: Organization of the Petroleum Exporting Countries, PPAC: Petroleum Planning and Analysis Cell, mt: million tonnes, VAT: Value Added Tax, sq km: square kilometre, UAE: United Arab Emirates, ISPRL: Indian Strategic Petroleum Reserves Ltd, MoU: Memorandum of Understanding, ADNOC: Abu Dhabi National Oil Company, US: United States, ONGC: Oil and Natural Gas Corp, bpd: barrels per day, LPG: liquefied petroleum gas, IOC: Indian Oil Corp, kg: kilogram, BPCL: Bharat Petroleum Corp Ltd, LNG: liquefied natural gas, RIL: Reliance Industries Ltd, OSPs: official selling prices, GDP: Gross Domestic Product, ppm: parts per million, NDRC: National Development and Reform Commission |

24 March. Indian Oil Corp (IOC) said demand for LPG (liquefied petroleum gas) cylinders across the North East (NE) has shot up due to panic-buying in anticipation of lockdown in the states to combat the coronavirus outbreak. The company appealed to people not to resort to panic-buying as LPG cylinders will available even during the lockdown period. The demand of LPG cylinders across the seven Nort Eastern states has shot up due to panic-buying among customers due to the anticipated lockdown in the states to curb the outbreak of the COVID-19 pandemic, IOC said. Domestic LPG being covered under the Essential Commodities Act, 1955, will continue to be made available in the market. All the 11 operating LPG bottling locations across the North East are currently operating in full capacity and will continue to do so, IOC said.

Source: The Economic Times

23 March. Finance Minister Nirmala Sitharaman took authorisation to raise excise duty on petrol and diesel by ₹8 per litre each in future as Parliament passed the Finance Bill, 2020, that also allowed pension funds to be treated like sovereign wealth funds. First, the Lok Sabha passed the Finance Bill, 2020, without a discussion and then the Rajya Sabha returned it without a discussion, all in a matter of few hours. Sitharaman moved an amendment to the Finance Bill, 2020, to raise the limit up to which the government can raise special excise duty on petrol and diesel to ₹18 per litre and ₹12 per litre, respectively. The government had on March 14 raised excise duty on petrol and diesel by ₹3 per litre each to raise an additional ₹390 bn in revenue annually. According to a notification issued by the Central Board of Indirect Taxes and Customs, special excise duty on petrol was hiked by ₹2 to ₹8 per litre in case of petrol and to ₹4 a litre from ₹2 in case of diesel. Additionally, road cess was raised by ₹1 per litre each on petrol and diesel to ₹10. With this, the total incidence of excise duty on petrol has risen to ₹22.98 per litre and that on diesel to ₹18.83. The tax on petrol was ₹9.48 per litre when the Modi government took office in 2014 and that on diesel was ₹3.56 a litre. The government had between November 2014 and January 2016 raised excise duty on petrol and diesel on nine occasions to take away gains arising from plummeting global oil prices.

Source: Business Standard

< style="color: #ffffff">QuIck Comment< style="color: #ffffff">Saving on oil import bill will assist in combating economic crisis! < style="color: #ffffff">Good! |

23 March. With the spread of the Coronavirus denting global oil prices, India, that imports 80 percent of its crude oil needs, is likely to save a whopping $45 bn on oil imports next financial year, according to Confederation of Indian Industry (CII). A $1 decline in the price of crude oil reduces the country’s import bill by $1.5 bn. The report on the State of the Economy and Coronavirus Impact also noted that the Union government has increased the excise duty and cess on both petrol and diesel cumulatively by ₹3 per liter.

Source: The Economic Times

22 March. Indian Oil Corp (IOC), the nation’s biggest oil firm, has begun the supply of the world’s cleanest petrol and diesel across the country with all its 28,000 petrol pumps dispensing ultra-low sulphur fuel a good two weeks before the 1 April deadline. Other fuel retailers, Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL), are also progressively supplying BS-VI grade fuel and the entire country will switch to the cleanest fuel. The government had set 1 April as the deadline for starting supply of Euro-VI emission compliant fuels. With this India joins the select league of nations using petrol and diesel containing just 10 parts per million (ppm) of sulphur in an attempt to cut vehicular emissions that are said to be one of the reasons for the choking pollution in major cities. IOC Chairman Sanjiv Singh, whose firm controls roughly half of the country’s fuel market, said almost all the company's refineries began producing ultra-low sulphur BS-VI (equivalent to Euro-VI grade) petrol and diesel by the end of 2019 and thereafter the mammoth exercise was undertaken to replace every drop of fuel in the country with the new one. India adopted Euro-III equivalent (or Bharat Stage-III) fuel with a sulphur content of 350 ppm in 2010 and then took seven years to move to BS-IV that had a sulphur content of 50 ppm. From BS-IV to BS-VI it took just three years. State-owned oil refineries spent about₹ 350 bn to upgrade plants that could produce ultra-low sulphur fuel. This investment is on top of ₹600 bn they spent on refinery upgrades in the previous switchovers. The supply of BS-VI fuels was further extended to four contiguous districts of Rajasthan and eight of Uttar Pradesh in the National Capital Region (NCR) on 1 April 2019, together with the city of Agra. BS-VI grade fuels were made available in seven districts of Haryana from 1 October 2019. The new fuel will result in a reduction in NOx (nitrogen oxide) in BS-VI compliant vehicles by 25 percent in petrol cars and by 70 percent in diesel cars. India adopted a fuel upgradation programme in the early 1990s. Low lead gasoline (petrol) was introduced in 1994 in Delhi, Mumbai, Kolkata and Chennai. On 1 February 2000, unleaded gasoline was mandated nationwide.

Source: Business Standard

22 March. According to an official notification released by the Rajasthan government, the Value Added Tax (VAT) on petrol and diesel prices will see a hike of 4 percent. VAT on diesel prices will increase from 22 percent percent to 26 percent, whereas VAT on petrol will be increased from 30 to 34 percent. Rajasthan Chief Minister Ashok Gehlot has ordered a total lockdown in the state till 31 March, barring essential services, amid increasing coronavirus cases in the country. The central government had hiked excise duty on the fuel.

Source: Livemint

20 March. The Karnataka State Federation of Petroleum Dealers (KSFPD), Bengaluru in response to a call given by Prime Minister Narendra Modi to observe nationwide ‘Janata Curfew’ on 22 March to control and contain spread of coronavirus, has requested its dealer members to suspend sales in all retail outlets from 6am to 6pm on that day. PM (Prime Minister) Modi urged the nation to observe Janata Curfew from 7am to 9pm. KSFPD said there will be on staff available at each of the outlets to cater to emergencies like police, ambulance, fire and any such services under the district administration. There are nearly 4800 retail outlets of oil marketing companies across the state and around 300-odd private retail outlets. Each of these retail outlets on an average dispenses about 4 kilolitres (4000 litres) of petroleum products – motor spirit (petrol) and diesel – each day, KSFPD said. The sales could be a fraction of the daily average sales given that it will be restricted to above specified category of vehicles, KSFPD said.

Source: The Economic Times

19 March. The government may use the current low oil prices to further increase excise duty on petrol and diesel to raise additional resources required for keep rising deficit under check and meet additional expenditure needs arising from COVID-19 outbreak, a State Bank of India report said. It said that crude at $30/barrel could potentially lower the petrol and diesel prices by ₹10-12 /litre from their present prices assuming excise had stayed at the previous level. But government may limit fall in retail price of the two petroleum products to increase excise duty on them further.

Source: The Economic Times

19 March. The petrol dealers across Mumbai metropolitan region have requested that they be allowed to operate petrol pumps for just one shift - 8 to 10 hours - to minimise risk of their staff getting infected with coronavirus. They want this one-shift operation till 31 March.

Source: The Economic Times

18 March. Hindustan Petroleum Corp Ltd (HPCL) said it has commissioned its first petrol pump in Bhutan as it makes a foray into the Himalayan Kingdom. HPCL, a subsidiary of Oil and Natural Gas Corp (ONGC), commissioned its first retail outlet in Bhutan in partnership with State Trading Corporation of Bhutan (STBCL), a Government of Bhutan entity, the company said. HPCL owns 16,194 out of 68,032 petrol pumps in India.

Source: Business Standard

18 March. Tamil Nadu Chamber of Commerce & Industry has condemned the union government for increasing excise duty and taxes on fuel instead of passing on the benefits of drop in crude oil price in the international market. Chamber president N Jegatheesan and secretary J Selvam said that the special excise duty hike on petrol and diesel has added to the woes for the industry and the people such as stagnation of the economy, Covid-19, rising unemployment, stock market crash and weakening Indian rupee.

Source: The Economic Times

18 March. The price of subsidised cooking gas or liquefied petroleum gas (LPG) has been hiked by ₹35.55 per cylinder in the last five months, Oil Minister Dharmendra Pradhan said. As per government policy, LPG all over the country is available only at market price. However, households are entitled to buying 12 cylinders of 14.2 kilogram (kg) each at a subsidised rate in a year. The government transfers the subsidy amount directly into the bank accounts which the beneficiaries use to buy LPG at the market price. The subsidised LPG price has gone up by ₹35.55 per cylinder since October. He said domestic subsidised LPG in Delhi was priced at ₹538.95 per cylinder on October 1, 2019, and this month it costs ₹574.50. While non-subsidised or market priced LPG has varied from month to month based on benchmark international rates, subsidised LPG prices have been raised every month by ₹4 per cylinder plus taxes. These rates, however, are no longer published by the oil market companies. He said non-subsidised LPG cylinder costs ₹805.50. Household consumers are getting a subsidy of ₹231 per 14.2 kg cylinder, he said.

Source: Business Standard

18 March. Royal Dutch Shell’s Indian arm Shell Energy India Private has signed a pact with Inox India for door-step delivery of liquefied natural gas (LNG) from its terminal in Gujarat through road to customers who are not connected to pipelines. Shell Energy owns and operates an LNG terminal in Hazira, which has a capacity of 5 million tonnes per annum (mtpa). INOX India, which specialises in cryogenic liquid storage, distribution and re-gasification solutions, will create distribution infrastructure, including logistics and receiving facilities to deliver LNG from this unit to customers. The door-step delivery model will reduce the dependence on pipelines and give companies access to a larger market. Inox, under its brand ‘GoLNG’, has a fleet of 20 transport tankers that have collectively logged more than 6.5 mn kilometre (km) and distributed around 100,000 tonnes of LNG, primarily from state-run oil marketing companies, to its consumers spread all over the country. With the tie-up with Shell, it aims to scale up this capacity. Under the arrangement, a customer would have two agreements — one with Shell Energy for buying LNG, the other with Inox for getting the LNG using its network, referred to as “virtual pipeline. Energy majors are looking at door-step delivery of fuel to expand their market and overcome infrastructure models. On one hand, bigger players like Reliance Industries Ltd (RIL) and state run-OMCs (Oil Marketing Companies) are eyeing this segment, on the other, there are startups, which have entered this space, primarily for sale of diesel.

Source: The Economic Times

18 March. Vedanta’s upstream arm Cairn Oil and Gas (O&G) is planning to drill 35 hydrocarbon wells and 10 hydrocarbon processing facilities at its Kaza block in Andhra Pradesh at a cost of ₹6.50 bn, the company said. It expects production of up to 30,000 barrels of oil per day and 30 million metric standard cubic feet (mmscfd) of gas through development of the processing facilities in the block. The onshore block situated in the Krishna district was awarded to Cairn last year under the discovered small field round. It had won more than 51 blocks under the recent O&G bidding auctions held by the government in the last four years, and intends to spend close to $800 mn in the exploration phase on these blocks.

Source: The Economic Times

24 March. Coal India Ltd has postponed its annual stock measurement from 1 April to 15 April, following advisory issued by the government and cancellation of train movement due to threat posed by outbreak of pandemic COVID-19. Every year, the company engages an external agency to take stock of inventory at some 360-odd mines operated by its seven coal producing subsidiaries. This time, following spread of Coronavirus, the exercise will be completed on 27 April. According to a notice issued by the company, physical stock measurement is to be completed within seven days, by 22 April. Reports will have to be submitted to subsidiaries by 25 April and final report has to be submitted to Coal India by 27 April. Coal India is also working on the possibility of using drone to measure its inventory to accumulate data faster.

Source: The Economic Times

22 March. With the coal production in all its 18 opencast and 27 underground mines coming to a halt for 24 hours, from 6 a.m. to 6 a.m., in response to the ‘Janata Curfew’ call given by Prime Minister Narendra Modi, the Singareni Collieries Company Ltd (SCCL) plans to achieve the target appear to have become increasingly difficult. The public sector coal company has produced 64.4 million tonnes (mt) of coal during 2018-19 and the company management had fixed a pragmatic target of 66 mt for 2019-20. However, production of coal has been less than that was achieved during the August-February period of the current fiscal, compared to the same period last year, mostly due to heavy rains in August and September. Although the production has been halted for a good cause, as an attempt to break the chain of coronavirus spread, the chances of achieving the target for this fiscal appear bleak. The company has achieved 58.1 mt of coal production till February-end. With less than nine days time left in the current financial year, achieving 7.9 mt production for the month of March appears a huge task now with the average daily production coming to 2.55 lakh tonnes during the month. Except for the first four months of the current fiscal, the monthly coal production by Singareni has been lesser in the range of 3.93 percent to 17.1 percent during the August-February period of 2019-20 compared to the

< style="color: #ffffff">QuIck Comment< style="color: #ffffff">95 percent of power fund spending on subsidies will leave nothing for upgrading infrastructure in Delhi! < style="color: #ffffff">Ugly! |

same period a year before. The daily average production fell to as low as 1.29 lakh tonnes in July last and the maximum of 1.9 lakh tonnes was achieved in May last.

Source: The Hindu

21 March. Coal India Ltd’s single-day production peaked to a new high of 3.17 million tonnes (mt) on 20 March. The figure surpassed the biggest single-day output of 3.14 mt in March last year, the company said.The company said the output could have been even higher, but for a disruption at the Lingaraj mine of MCL (Mahanadi Coalfields Ltd).

Source: Business Standard

24 March. The Central Electricity Regulatory Commission (CERC) has postponed implementation of real-time power trading by three months to1 June following requests from the industry. It was scheduled to start from 1 April. Real-time power trading involves selling and buying power at the exchanges for same-day delivery. Trading on electronic platforms would be done every alternate 30 minutes for electricity to be wheeled after 1 hour 15 minutes. For the first time, any generator, including renewable power companies, would be allowed to sell power through the platform. According to plans, 48 trading slots will be available during the day for entities to sell or buy. At present, trading is done on a day-ahead model, where trading on a certain day is done for delivery the next day. The trading window remains open for two hours – from 10 am to 12 noon.

Source: The Economic Times

24 March. In its first budget, the third AAP (Aam Aadmi Party) government has decided to carry on with its reforms in the power sector while earmarking ₹28.20 bn for giving electricity subsidies to consumers in the financial year 2020-21. The government will continue with the zero-power bill scheme for consumers using up to 200 units every month and a subsidy of ₹800 for those consuming 201-400 units. Since last August, these benefits are being offered, making Delhi the first state to offer free electricity up to 200 units. The government will continue to offer 100 percent subsidy to the anti-Sikh riot victims for up to 400 units and the special subsidy scheme for lawyers’ chambers on court premises.

Source: The Economic Times

< style="color: #ffffff">QuIck Comment< style="color: #ffffff">Fall in spot power demand signals trying times for power trade! < style="color: #ffffff">Bad! |

24 March. Spot power demand has fallen almost 40 percent leading to a 30 percent drop in rates as big consumers like malls, markets and offices are being shut to combat the spread of coronavirus. Prices at the India Energy Exchange (IEX) have fallen to ₹2 as demand was much lower than the supply offered in the spot market. Total demand in the second and third week of March fell almost 3 percent year-on-year, according to data collated by the National Load Despatch Centre. Demand had risen in January and February. According to trade settled for delivery, power generators offered to supply 425 mn units of power, but they managed to sell only 100 mn units. India Ratings and Research has recently revised its outlook for the power sector to ‘negative’ for FY21 from ‘stable-to-negative’, triggered by muted growth in electricity demand. It estimated a continued muted outlook for thermal plants capacity utilisation and expects it to remain below 60 percent for FY21.

Source: The Economic Times

22 March. Industries in Marathwada region have expressed displeasure about the withdrawal of power subsidy of ₹1 per unit from this month onwards. The sudden withdrawal of subsidy has brought an increase in monthly expenses of industries. The industrial slowdown, financial year-end, coronavirus outbreak and now power bill hike has made things harder, Marathwada Association of Small Scale Industries and Agriculture (MASSIA) secretary Manish Agrawal said. Industrial associations in Aurangabad district have also voiced their opposition to the proposed hike of power tariffs by state utility Mahadiscom from 1 April.

Source: The Economic Times

22 March. Following the advisory by Central and state government over coronavirus outbreak, Adani Electricity said the power utility firm encourages its customers to stay indoors and facilitates digital payment modes, self-help payment Kiosk, drop boxes in society to stay indoors and maintain social distancing. Adani has also informed the Maharashtra Electricity Regulatory Commission (MERC) about steps taken to mitigate the pandemic effect. Customers can access bill information through the Adani Electricity mobile app, register no supply complaints by giving a missed call on 18005329998 and pay bills through online payment modes such as Paytm, Google Pay, Amazon Pay, PhonePe, BHIM, MobiKwik and FreeCharge. In the light of consumer and employee safety, other services, which include human interface such as meter reading, billing, bill collection, release of new connections are discontinued until 31 March 2020.

Source: The Economic Times

21 March. The Bihar Electricity Regulatory Commission (BERC) reduced the retail tariff by 10 paise per unit for all categories of consumers of the state for the financial year 2020-21. The Commission has reduced 10 paise per unit in the electricity tariff rate across all categories of consumers which include rural, urban, commercial and industrial ones. The distribution loss trajectory for the North Bihar Power Distribution Company and the South Bihar Power Distribution Company for 2020-21 has been fixed as 15 percent, BERC Chairman S K Negi said. Industry bodies welcomed the Commission’s order to reduce power tariff but said they were expecting more reduction in tariff.

Source: The Economic Times

19 March. Residents of Paradol village in Chhattisgrah complaint that they are receiving electricity bills every month even as the village doesn’t have a power supply. Villagers here live in mud houses and cook in dark. They said that despite of repeated complaints to the authorities nothing has been done to resolve their grievances. Notaby, with an aim to provide last mile electrical connectivity and ensure electrification of all the willing rural and urban households, the Prime Minister had launched Pradhan Mantri Sahaj Bijli Har Ghar Yojana, also known as Saubhagya Scheme in September 2017.

Source: The New Indian Express

22 March. Sales of Renewable Energy Certificates (RECs) rose over 64 percent to 21.42 lakh units in February compared to 13.02 lakh in the same month a year ago owing to high demand, according to official data. Renewable Energy Certificates (RECs) are a type of market-based instrument. One REC is created when one megawatt hour of electricity is generated from an eligible renewable energy resource. According to official data, a total of 14.91 lakh RECs were traded on Indian Energy Exchange (IEX) in February compared to 10.59 lakh in the same month last year. Power Exchange of India (PXIL) recorded sale of 6.51 lakh RECs in the month under review against 2.43 lakh in February 2019. The IEX data showed that both non-solar and solar RECs witnessed good demand, with buy bids exceeding sell bids. There were buy bids for over 17 lakh RECs in the month against sell bids for over 12 lakh RECs for the month of February 2019. Overall demand for RECs was high as the total sell bids at both power exchanges was over 25 lakh units against sell bids of over 23 lakh units. Under the renewable purchase obligation (RPO), bulk purchasers like discoms, open access consumers and capacitive users are required to buy certain proportion of RECs.

Source: The Economic Times

20 March. Despite its preoccupations with coronavirus vigil, Kerala has maintained its focus on the 1,000 MW Soura solar project. The Kerala State Electricity Board (KSEB) has floated bids for setting up 150 MW of grid-tied residential rooftop solar project. Bids were floated to empanel contractors for design, supply, installation, testing and commissioning and 25-year maintenance. Earlier, the KSEB had awarded 46.5 MW of rooftop solar capacity in a recently-conducted auction to Tata Power, Waaree Group and Inkel. The 1,000 MW Soura solar power project includes 500 MW of rooftop solar power plants in houses, schools, hospitals and commercial establishments. Highways will also have solar panels. In irrigation canals and dam reservoirs, more floating solar power plants will be installed. The idea is dovetail together 500 MW rooftop solar, 200 MW ground-mounted solar, 100 MW floating solar, 150 MW solar park and 50 MW of canal-top solar.

Source: The Financial Express

20 March. The Ministry of New and Renewable Energy (MNRE) is confident the target of achieving 100 GW of solar power generation capacity by 2022 will be met and concerted efforts are being made to sort out issues, it has told a Paliamentary panel. The Parliamentary Standing Committee on Energy in its latest report had expressed dissatisfaction with the performance of the ministry for continuously missing on its yearly solar energy capacity addition targets. To this, MNRE said it was confident of achieving the target by 2022 and has worked out the detailed plan. The ministry, however, added that developers were facing constraints related to land acquisition, evacuation infrastructure, non-conducive state policy for development of solar and business environments. MNRE also informed that 9,000 MW of solar capacity is likely to be commissioned in 2020-21. The MNRE said the budgetary allocation to meet the 2020-21 solar targets is sufficient and that it is confident of achieving the 100 GW target.

Source: The Economic Times

19 March. Tata Power said it has expanded its rooftop solar service to 90 cities across the country. The big rollout from Tata Power comes at a time when consumers across all major categories including commercial, industrial, residential and public sector are adopting solar energy as a reliable and sustainable solution to meet their energy needs that also holds tremendous potential to save costs. Tata Power launched customisable rooftop solar solutions on a pan-India basis in September 2018, as pee the company.

Source: The Economic Times

19 March. Gujarat Urja Vikas Nigam Ltd (GUVNL), the holding company of all the power utilities in the states, has floated a tender for 700 MW capacity solar power projects to be set up in Dholera solar park. The selected companies will set up solar power projects in Dholera park on Build-Own-and-Operate (BOO) basis in line with the provisions of the tender conditions and the standard power purchase agreement (PPA). GUVNL is re-tendering the 700 MW capacity which remained unallocated in solar tenders invited in January last year. A pre-bid meeting was also held at that time. The company has also given an option to bidders to raise queries before 3 April 2020. The deadline for submission of interest is 18 April. The opening of the financial bid and reverse e-auction will start on 27 April.

Source: The Economic Times

18 March. The government is planning to issue solar tenders of 20 GW)capacity till June 2021 in order to achieve the National Solar Mission’s target of installing 100 GW grid-connected solar power capacity by 2022, Power and Renewable Energy Minister R K Singh said. The government has formulated and is implementing various schemes for promotion, development and deployment of solar power in the country to meet the targets. Under the National Solar Mission, the solar park scheme for setting up solar parks and ultra mega solar power projects targeting over 40,000 MW projects is underway. Apart from this, other schemes such as for setting up of grid-connected solar photovoltaic power projects with viability gap funding, and the government’s flagship PM-KUSUM are being implemented, among others. According to data reported on SPIN portal of the Ministry of New and Renewable Energy, till 13 March 2020, rooftop solar power plants of an aggregate capacity of 1,922 MW have been installed in the country of which 346 MW have been installed in the residential sector, Singh said.

Source: The Economic Times

19 March. With travel restrictions and quarantine obligations being announced daily around the world on the back of the spread of Coronavirus, global oil demand is set to dip 2.8 percent, or 2.8 mn barrel per day (bpd) in 2020 on a year-on-year basis. Total oil demand in 2019 was approximately 99.9 mn bpd, which is projected to decline to 97.1 mn bpd in 2020. The month of April is expected to take the biggest hit, with demand for oil falling by as much as 11 mn bpd year-on-year. Road fuel demand in 2019 is estimated to have reached 49.7 mn bpd. Prior to the coronavirus the firm expected this demand segment to grow to 50.3 mn bpd in 2020, but it is now seen reaching only 48.6 mn bpd. Almost all of this reduction will occur due to decreased road traffic in the first half of 2020. In China alone, demand for gasoline and diesel road fuel was down by about 1.5 mn bpd in February.

Source: The Economic Times

19 March. The US (United States) Department of Energy said it will buy up to 30 mn barrels of crude oil for the Strategic Petroleum Reserve by the end of June as a first step in fulfilling President Donald Trump’s directive to fill the emergency stockpile to help domestic crude producers. The reserve, in caverns on the Texas and Louisiana coasts, has 77 mn barrels of available capacity. The first 30 mn barrel purchase will be for both sweet and sour crude oil and will focus on buying from small and midsize producers with less than 5,000 employees, the energy department said. The funding for the full 77 mn barrel purchase would have to be mandated by new stimulus legislation. Energy Secretary Dan Brouillette said that the department has asked Congress for about $3 bn. Brouillette said a second round of purchases for the reserve could occur in 60 to 90 days. The department will buy up to 11.3 mn barrels of sweet crude and up to 18.7 mn barrels of sour crude. The delivery date is from 1 May to 30 June and proposals are due by March 26, it said. The reserve can receive up to 685,000 barrels per day of crude, the department said.

Source: Reuters

19 March. Saudi Aramco will continue reducing operations at its local refineries in April and May to boost the state energy company’s potential to export crude oil. Saudi Arabia, the world’s top oil exporter, said it had directed Aramco to keep supplying crude at a record rate of 12.3 mn barrels per day (bpd) in the coming months. Exports were set to top 10 mn bpd from May, it said. It plans to raise its oil production capacity to 13 mn bpd. Worldwide, refineries are slowing output and contemplating extensive maintenance because of travel restrictions put in place in response to the coronavirus pandemic. Gasoline demand in the United States (US), the world’s largest oil consumer, is plunging. International flights are being grounded worldwide, slamming jet fuel demand.

Source: Reuters

18 March. Royal Dutch Shell has booked a supertanker to store 2 mn barrels of oil at sea to park mounting global stocks. Shell had booked a very large crude carrier (VLCC), which can store up to 2 mn barrels of oil, for a five-month charter. Refinitiv data showed the hire cost paid was $40,000 a day. Shell had provisionally booked at least three supertankers to store crude oil at sea. The glut of oil in world markets has prompted efforts by oil players to find storage options including both on land and offshore on tankers.

Source: Reuters

18 March. Israel’s Oil Refineries reported zero profit in the fourth quarter (Q4) for the second straight year and said it had so far not seen a big impact to the company from the coronavirus outbreak. Its revenue in the quarter fell 13 percent to $1.55 bn. Israel’s Oil Refineries said the only hit to its sales has been in jet fuel sales in Israel, which comprise just 8 percent of the total fuel sector output. It said that stricter measures in Israel, in which citizens were ordered to stay at home as much as possible, could lead to a significant drop in demand for diesel and gasoline. It said that the company has been sharply reducing its net financial debt and long term commitments. In 2019, net debt fell by $113 mn to $855 mn.

Source: Reuters

24 March. UAE (United Arab Emirates)’s Sharjah National Oil Company (SNOC) said that the impact of the coronavirus outbreak will delay the startup of production at its Mahani gas exploration project by up to two months. SNOC and Italian energy giant Eni announced in January the discovery of Mahani, a new find of natural gas and condensate onshore in Sharjah, and the first in the Emirate since the early 1980s. The delay is expected to be no more than a month or two, SNOC CEO (Chief Executive Officer) Hatem AlMosa said. ENI has announced it is reviewing all of its projects in the region due to current global market conditions, but a senior executive said there will be no impact on the Mahan project. Separately, SNOC awarded a Moveyeid Gas Storage Surface Facility Project to Petrofac Facilities Management International Limited. The project, valued at $40 mn, comprises a new high-pressure compressor facility, a high-pressure pipeline and flow lines to four existing wells in Moveyeid Field. SNOC said it will continue to evaluate the need for expanding the storage and delivery capacity of the project beyond 2023.

Source: Reuters

19 March. Liquefied natural gas (LNG) shipments from the United States (US) to Asia are set to increase, while cargoes heading to main buyers in Europe will fall as the coronavirus outbreak has started to affect demand across the region, according to trade and shipping sources and analysts. Three to four LNG tankers which loaded from the US are expected to arrive in Asia, compared with only one, ship tracking data from Refinitiv Eikon and Kpler showed. Six US LNG cargoes are due to arrive in Asia, according to data intelligence firm Kpler. At least one LNG tanker, the BW Brussels, has diverted its course to Thailand instead of France as initially scheduled, Kpler analyst Rebecca Chia said. Gas demand in Europe has been hit by lower industrial output and power demand due to the spread of the coronavirus. Overall LNG shipments to Asia are expected to increase this week, mainly led by a boost from China, the world's second-largest LNG importer, as industrial demand is set to increase with people returning to work amid a slowdown in the number of virus cases in local transmission. The oil price plunge has boosted demand for long-term oil-linked cargoes into Asia, and especially in China, traders said. Majority of LNG cargoes are purchased on a long-term basis and these are mainly signed on a Brent-linked basis. China’s top LNG buyer China National Offshore Oil Corp declared force majeure on some imports, while earlier this month PetroChina suspended some gas imports including LNG.

Source: The Economic Times

18 March. The Indonesian government will lower gas prices for power plants from 1 April to $6 per mn metric British thermal units (mmBtu), the Energy and Mineral Resources Ministry said. Power plants managed by state utility company PT Perusahaan Listrik Negara have paid an average of $8.4 per mmBtu for gas this year. The power plant gas price cut follows a gas price cut for industrial buyers announced. The government said the price of natural gas for industries would be cut to a maximum of $6 per mmBtu from 1 April.

Source: Reuters

23 March. Russian businessman Albert Avdolyan has reached an agreement to buy a 49 percent stake in the major Elga coal project in Russia from Russian lender Gazprombank, the bank said. Avdolyan’s company A-Property is still in talks to buy the remaining 51 percent in the project from Russian steel and coal producer Mechel. For Mechel, Elga is the biggest growth asset, but it confirmed that it was in talks to sell it to reduce the debt burden. Elga, one of the world’s biggest coking coal deposits, requires further investments to develop. Mechel’s net debt stood at 400 bn rubles ($5 bn) at the end of 2019, mainly to Gazprombank and another bank, VTB.

Source: Reuters

20 March. Gutted factories, rusting pickaxes and crumbling homes that will soon be abandoned dot the scarred hills in Mentougou -- home to Beijing's last coal mine slated to close this year as the city battles choking smog. One of China’s oldest mining towns, it has powered the capital for nearly 300 years. But more than 270 coal mines in the area have been shut down over the past two decades, as China has scrambled to cut carbon emissions and switch to renewables. According to Beijing Jinmei Group, the state-owned enterprise that owns the mines near the capital, the government-mandated closures will mean the loss of 6 million tonnes (mt) of coal production capacity and the "resettlement" of more than 11,000 workers, mostly migrants. Miners suffering from lung diseases after inhaling coal dust are also stuck in this dilapidated town southwest of Beijing, because their government health insurance only covers treatment from hospitals in the area. China accounts for half of the world's demand for coal and almost half of its production. But the country is switching to greener sources of energy to fight chocking smog and reverse the environmental damage from its coal addiction.

Source: The Economic Times

20 March. The coal industry’s main US (United States) lobby group has asked for sweeping financial assistance to help mining companies weather the economic fallout of the coronavirus, according to a letter to President Donald Trump and the leaders of Congress. The request adds the ailing coal industry to a long list of businesses vying for a bailout to counter the impact of the global pandemic, which has infected more than 227,000 people worldwide, decimated travel and forced massive disruptions in daily life around the world. In the letter, the National Mining Association asked Trump, House of Representatives Speaker Nancy Pelosi and Senate Majority Leader Mitch McConnell to ensure that "coal companies have access to the necessary cash flow they need to continue operations." The coal industry has sought several federal interventions to help it reverse a slide in demand over the past decade as aging plants retire.

Source: The Economic Times

18 March. Mitsubishi UFJ Financial Group sold off its $85 mn loan to Glencore’s Wiggins Island Coal Export Terminal (WICET) in Australia to a hedge fund at about 52 cents on the dollar. The costly decision at a time of extreme market volatility extinguishes MUFG’s exposure to the coal-related asset ahead of the bank’s financial year-end on 31 March. WICET, the world’s most expensive coal terminal, is owned by Glencore Plc and four partners, including New Hope Corp, China’s Yancoal, Coronado Global Resources, and Baosteel arm Aquila Resources. The coal terminal is funded entirely by debt backed by port fees.

Source: Reuters

18 March. Indonesia’s government will revoke rules requiring exporters of coal and palm oil to use national shipping companies for the shipments, Luhut Pandjaitan, Coordinating Minister for Maritime and Investment Affairs, said. Indonesia, the world’s biggest thermal coal exporter, in 2018 issued regulations requiring its coal and palm oil exporters to use domestic shipping companies starting in May.

Source: Reuters

23 March. French state-controlled power group EDF said it now expected its 2020 core earnings to be at the lower end of forecasts, as it deals with the impact of the coronavirus outbreak. It said that the impact of the current crisis on its 2021 power generation performance could not be precisely assessed at this stage. European wholesale power prices have tumbled to their lowest levels since February 2018, tracking the fall in prices across the global energy complex led by oil and carbon emissions prices.

Source: Reuters

20 March. The US (United States) electric industry may ask essential staff to live on site at power plants and control centers to keep operations running if the coronavirus outbreak worsens, and has been stockpiling beds, blankets, and food for them, according to industry trade groups and electric cooperatives. The contingency plans, if enacted, would mark an unprecedented step by power providers to keep their highly-skilled workers healthy as both private industry and governments scramble to minimize the impact of the global pandemic that has infected more than 227,000 people worldwide. The Great River Energy cooperative which runs 10 power plants serving 1.7 mn customers in Minnesota, said it is preparing for the possibility of sequestering staff essential to running its operations.

Source: Reuters

18 March. South African energy regulator Nersa invited public comments on government plans to increase power generation capacity, clearing the first of many hurdles for the country to boost electricity supplies. Nersa asked for comments by 14 April on a short-term plan to procure 2,000 MW of power, and comments by 7 May on longer-term procurement plans outlined in the country’s 2019 Integrated Resource Plan. South Africa’s Electricity Regulation Act requires public participation before officials can procure more power. Africa’s most industrialised economy has experienced several rounds of debilitating power cuts over the past year due to capacity constraints, but officials have been slow to secure new power supplies. The outages helped pushed the economy into recession in the final quarter of last year.

Source: Reuters

18 March. European baseload power prices for year-ahead delivery hit near two-year lows in wholesale trade, tracking the fall in leading oil, coal and carbon emissions contracts. The equivalent French year-ahead contract lost 2.6 percent to €38.20 per MWh (megawatt hour). Power consumption is expected to slip by 220 MW day-on-day in Germany to 67.4 GW. Demand will fall by 2.9 GW to 53.6 GW in France.

Source: Reuters

22 March. Slovenia’s only nuclear power plant, Krsko, has not been affected by a large earthquake which hit neighbouring Croatia early but authorities said it had started inspecting systems and equipment as a normal preventive action. The nuclear power plant continues to operate at full power, Slovenian Nuclear Safety Administration director Igor Sirc said.

Source: Reuters

22 March. Bulgaria will give more time for shortlisted investors to file binding bids for its Belene nuclear power project after measures over the coronavirus outbreak have limited access to the project’s data room, Energy Minister Temenuzhka Petkova said. Russia’s Rosatom, China’s CNNC and Korea Hydro & Nuclear Power Co had to file their offers to invest in the estimated €10 bn ($10.7 bn) project by the end of April. French energy company EDF’s Framatome and US (United States) group General Electric, which had both offered to provide equipment for the 2,000 MW project and arrange financing, will also be part of the process.

Source: Reuters

20 March. Wind and solar energy companies called on Congress to pass tax incentives that would help the sector avoid project delays and keep financing flowing amid a pandemic that has choked off supply chains and slowed construction. In a letter to House and Senate leadership, seven clean energy trade groups asked lawmakers to extend deadlines that would allow their projects to qualify for generous wind and solar federal tax credits despite delays caused by the spread of the coronavirus across the globe. The American Wind Energy Association, which signed the letter, said disruptions caused by the spread of the virus could put 35,000 jobs at risk and jeopardize $43 bn in investment. Solar projects currently qualify for a tax credit of 26 percent that is scheduled to fall to 22 percent next year. If firms start construction or spend 5 percent of a project’s capital cost by the end of this year they are eligible for the 2020 credit. Wind projects can claim a tax credit worth 1.5 cents for every kilowatt hour of electricity produced if they break ground before 1 January 2021.

Source: Reuters

20 March. Italy’s Saipem has reached an agreement with Norway’s Equinor to develop technology to build floating solar power farms close to the coast, the energy contractor said. The agreement is between Saipem’s high-value services unit Moss Maritime and the Norwegian energy firm. Saipem, a market leader in subsea construction for the oil and gas industry, is looking to develop new lines of business to boost order books, including floating renewable energy farms.

Source: Reuters

18 March. China’s greenhouse gas emissions rose 2.6 percent in 2019 despite a fall in the share of coal in the country’s energy mix, driven by a rise in energy consumption and greater use of oil and gas, a research group said. Total greenhouse gas emissions in China last year were estimated at 13.92 billion tonnes (bt) of carbon dioxide equivalent, the Rhodium Group, an independent research firm said.

Source: Reuters

| Year | Price (₹/Litre) | % Change (w.r.to previous year) |

| PETROL | ||

| 2016-17 | 64.61 | 4.9 |

| 2017-18 | 69.2 | 7.1 |

| 2018-19 | 75.37 | 8.9 |

| DIESEL | ||

| 2016-17 | 53.24 | 13.3 |

| 2017-18 | 58.78 | 10.4 |

| 2018-19 | 68.22 | 16.1 |

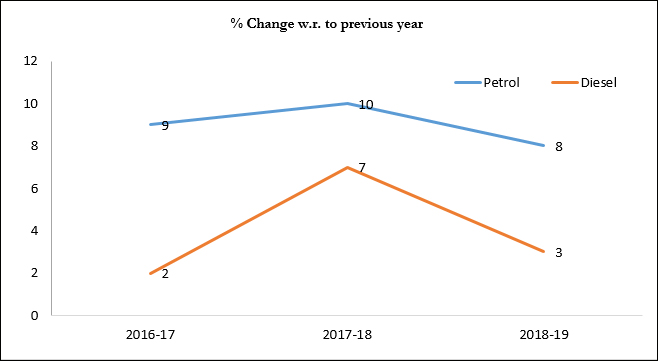

Growth in Consumption of Petrol & Diesel

Source: Rajya Sabha Questions

Source: Rajya Sabha QuestionsThis is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.