HIGHER TAX ON OIL PRODUCTS SUSTAINS REVENUE

Monthly Oil News Commentary: May 2020

India

Taxing Petroleum Products

When nations around the world have passed on the benefit of plunging oil prices to consumers, the Indian government has kept petrol and diesel prices at levels prevalent when crude prices had touched an all-time high of $107/bbl few years back. Petrol was priced at ₹71.41/litre and diesel at ₹55.49/litre when international oil prices touched an all-time high of $107.09 per bbl. Currently, the cost of crude is $36.29/bbl, but diesel is priced at ₹65.39/litre and petrol at ₹71.26/litre in Delhi. Excise duty on petrol was ₹9.48/litre when the government took office in 2014 and that on diesel was ₹3.56/litre. At present, this incidence is ₹32.98/litre on petrol and ₹31.83/litre diesel - a result of successive duty hikes.

Petrol and diesel prices in New Delhi were hiked by ₹1.67 and ₹7.10 /litre as the state government implemented a steep hike in VAT on both the fuels. Price of diesel witnessed the steepest hike with the state government increasing the VAT on the fuel to 30 percent from 16.75 percent earlier. Diesel prices in New Delhi increased to ₹69.39/litre from ₹62.29/litre. While, VAT on petrol was hiked to 30 percent from 27 percent earlier, leading to an increase in the retail price of the fuel to ₹71.26 per litre. Fuel prices across other major cities including Mumbai, Chennai and Kolkata remained unchanged, continuing a 50-day freeze on petrol, diesel prices across the country. The current hike in VAT on petrol and diesel along with the corona cess on liquor will earn ₹3 bn revenue in a month for the Delhi government. During normal circumstances, the Delhi government generates revenue of ₹50 bn from excise and ₹300 bn in VAT and GST every year. In order to make up for the lost revenue due to lockdown, the government has announced steep hike in auto fuels, increasing the VAT by almost double on diesel and similar for petrol.

The UP government approved a hike in the prices of petrol and diesel. The UP government has increased the price of petrol by ₹2/litre, and that of diesel by ₹1/litre. The move follows the Centre’s decision to increase excise duty on petrol by a record ₹10/litre and ₹13/litre for diesel. The hike, however, did not push up fuel prices as global oil prices have dropped to a nearly two-decade low.

Tamil Nadu government will be beefing up its revenue with the increase in VAT on petrol and diesel by ₹25 bn. According to the state government the VAT increase has resulted in a retail price hike of ₹3.25/litre of petrol and ₹2.50/litre of diesel. The government said the VAT was increased so that the state revenue is protected as and when the global oil prices come down and the interests of consumers would be protected when there is a hike in the global oil prices. The Consortium of Indian Petroleum Dealers has demanded a financial stimulus package from the OMCs as their members are incurring losses due to the Covid-19 induced lockdown.

Petrol and diesel prices in Chandigarh will go up by nearly ₹3/litre with the UT administration announcing a hike in VAT on fuel by 5 percent. The tax hike will generate an additional revenue of ₹1 bn for the UT administration in 2020-21. After the revision in prices, petrol in the city now costs ₹68.62/litre, a hike of ₹2.8, and diesel ₹62.02/litre, an increase of ₹2.72. Before the increase in the tax, the price of petrol and diesel in Chandigarh was ₹65.82 and ₹59.30/litre, respectively. VAT on petrol has been hiked from 17.45 percent to 22.45 percent. Similarly, the tax on diesel has been raised from 9.02 percent to 14.02 percent. Despite an increase in VAT, the fuel prices in Chandigarh continue to be lower than that of Punjab. Prices of petrol and diesel in Mohali stood at ₹72.58/litre and ₹64.05/litre, respectively.

Indian industry is raising the pitch to bring petrol and diesel under the GST but states are not willing to get on board. State finances are collapsing due to the adverse impact of the Covid-19-induced lockdown. Industry body ASSOCHAM said sooner petrol and diesel are brought under the GST, better it would be for the Indian economy. According to ASSOCHAM governments, both at the Centre and States have been over-dependent on petrol and diesel for revenue. In any case, the crude oil prices have crashed to unprecedented lows, without the pump prices being reduced, against the spirit of the market-driven pricing policy.

Demand

India’s petroleum product demand is expected to fall by eight percent to 4,597,000 bpd in 2020, IEA said as part of its May oil market report. The country’s petrol demand is projected to fall by 350,000 bpd in the second quarter of 2020, primarily due to mobility restrictions. The agency has projected petrol demand to fall 60 percent y-o-y in April as well as May, as compared to the year ago period. Diesel demand is projected to contract by 690,000 bpd in the second quarter of 2020 and demand for ATF and kerosene is projected to decline by almost 40 percent in April-May, as roughly half of the kerosene demand is used as jet fuel and will be severely impacted by airline restrictions, IEA said. Overall, India’s oil demand is expected to fall to 4.60 mn bpd in 2020, as compared to 5.01 mn bpd recorded in 2019. The agency expects domestic crude oil production to continue to decline in 2020. According to the report, crude oil production will remain subdued in the coming months and is projected to decline to 0.75 mn bpd in 2020, as compared to 0.80 mn bpd recorded in 2019.

India’s fuel demand is recovering fast in May after falling at a record pace in April following the easing of lockdown that has permitted more vehicles on the roads and increased factory activity. The diesel and petrol sales by state oil companies have fallen by 28 percent and 47.5 percent, respectively, in the first fortnight of May from a year earlier, according to industry executives. This is a sharp improvement from April, when the sale of diesel and petrol had declined by 56.5 percent and 61 percent, respectively. State companies control nearly 90 percent of domestic fuel sales. A staggered easing of nationwide lockdown has got many factories humming back to life and more goods trucks and passenger cars on the roads, driving up demand for fuel. An expected further easing of the lockdown curbs may boost fuel demand in the second fortnight of May. Jet fuel sales, however, are barely recovering as passenger planes are still barred from flying. Jet fuel sales fell 87 percent in the first fortnight of May from a year earlier. In April, it had declined by 91.5 percent. The sales of LPG, used mainly for cooking in the country, has jumped 24 percent in the first fortnight of May from a year earlier, further improving its scorching growth pace of the past many months. The LPG sales in the first half of April was 21 percent higher though for the full month reduced to just 12 percent mainly because dealers slowed taking delivery towards the end of the month in anticipation of a sharp reduction in cooking gas prices at the beginning of May. Increased fuel demand has come as a big relief to refineries, which are now increasing their run rates. IOC said its refineries have raised capacity utilization to 60 percent from 45 percent last month and plan to raise it further to 80 percent by end-May. A demand collapse and overflowing storage had forced all refiners to cut capacity utilization. None of the refineries were shut down though some came very close to it.

The lockdown measures in place to combat the Covid-19 pandemic in the country are expected to significantly impact India’s oil demand in April. According to projections made by WoodMcKinsey, in 2020 India’s oil demand is expected to decline seven percent to 350,000 bpd on a y-o-y basis. Diesel, which accounts for the largest share of India’s oil demand, has been impacted more in terms of volumes during the period and the demand for the fuel is expected to decline by 1.2 mn bpd in April. Private refiners like Nayara Energy and Reliance Industries Ltd will have to reckon with low demand from international export destinations as global stockpiles of crude and petroleum products are very high, according to WoodMac.

India has regained 65 percent of its appetite for fuel and demand will reach nearly pre-pandemic levels next month as economic activities pick up pace after the government’s announcement of a stimulus package and staggered easing of Corona restrictions. This compares well with fuel consumption in China, the world’s second-largest oil consumer and the pandemic’s epicentre, reaching 90 percent of the pre-Corona level after losing 40 percent of the demand in February. A rebound in fuel demand indicates India is getting back to work and the world’s third-largest energy market is poised to regain its position as the global demand centre. Latest industry data show petrol sales rising 7.5 percent and diesel sales jumping 72 percent in May following the government’s move to ease lockdown curbs to allow from 20 April. Jet fuel sales grew 6-7 percent and LPG 4 percent during this period as only select cargo and repatriation flights took to the skies and domestic cooking fuel demand tapered off after the initial panic-buying triggered by the lockdown and commercial consumption was yet to return.

Production

The government is stitching together a package of measures to help domestic oil producers pull through the price crash and the uncertainty in the global oil market as heavy losses on each bbl they pump threaten the commercial viability of projects. A relief package has become crucial for the survival of companies such as ONGC as the price crash since March has turned oil production into a loss-making proposition. For example, the total cost of a bbl of oil produced by ONGC works out to $45 after including royalty, cess and other levies. So at $35/bbl closing price of global benchmark Brent, ONGC actually loses $10/bbl. Brent had on April 22 crashed to 21-year low of $16/bbl. ONGC pays 10-12.5 percent royalty to the Centre on oil produced from offshore areas. State governments charge 20 percent royalty on the price of oil produced from onland fields. Then there is 20 percent ad-valorem OID cess on the price that producers get. OID cess has increased from $3 to $13 over the years and causing a financial stress to current and new projects. The cess is levied as excise duty under the Oil Industries (Development) Act of 1974. The cess is levied on crude oil from nominated blocks and pre-NELP exploratory blocks only. The OID cess was raised from ₹2,500 per tonne to ₹4,500 per tonne in March 2012. The price of the Indian basket of crude oil stood at around $110/bbl then. With the fall in global crude oil prices in mid-2014, companies asked for reduced levy and converting it into 8-10 percent ad-valorem. The government had changed the cess to 20 percent ad-valorem in March 2016.

ONGC awarded 49 marginal producing oil and gas fields to seven companies under a government plan to raise production from these acreages that are not economical for the state-run flagship explorer. The awarded fields make up 13 onshore contract areas spread across Gujarat, Andhra Pradesh, Tamil Nadu and Assam, the company said in a statement but did not identify the winners. The winners were selected through an international competitive bidding for 17 onshore contract areas. ONGC had invited bids for partnership to raise production from 64 marginal fields that were given to the company by the government without bidding. Being small in size, these fields are uneconomical for a large company for ONGC. ONGC had invited bids in June last year. The fields are being given on revenue-sharing basis, with the revenue being shared on incremental production over and above the baseline production under BAU. The selected contractors will not be required to reimburse any expenditure on the fields already incurred by ONGC. These contracts will be for a period of 15 years, with an option to extend by five years.

Vedanta Ltd’s plans to sell a minority stake in its Indian oil unit have stalled after a collapse in crude prices. The Mumbai-listed company was seeking to raise more than $1 bn by selling at least 20 percent of its Cairn Oil & Gas business. The crash in energy prices and the Covid-19 pandemic have made it difficult for potential investors to gauge Cairn’s business outlook. While the stake sale talks could resume when oil prices stabilize, Vedanta may also explore other fundraising options to reduce its debt.

Imports

Indian energy companies have deferred some cargoes and spot bookings but not cancelled any long-term contracts for procuring LNG or crude oil supplies. India has 5.3 mt of strategic storage capacity.

LPG

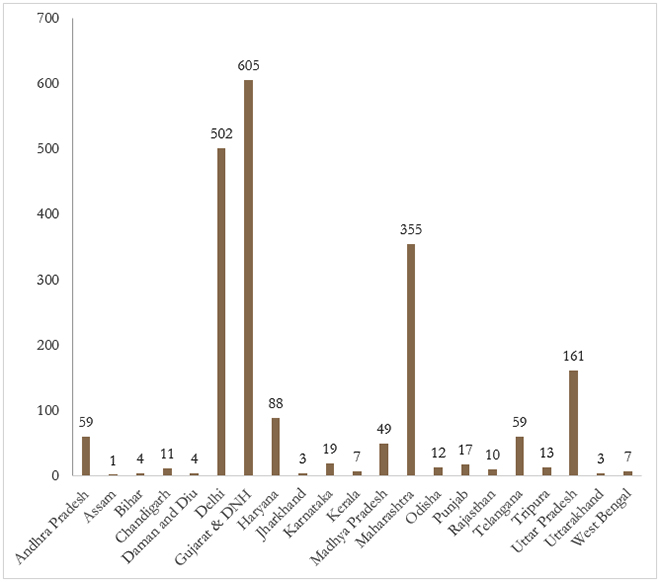

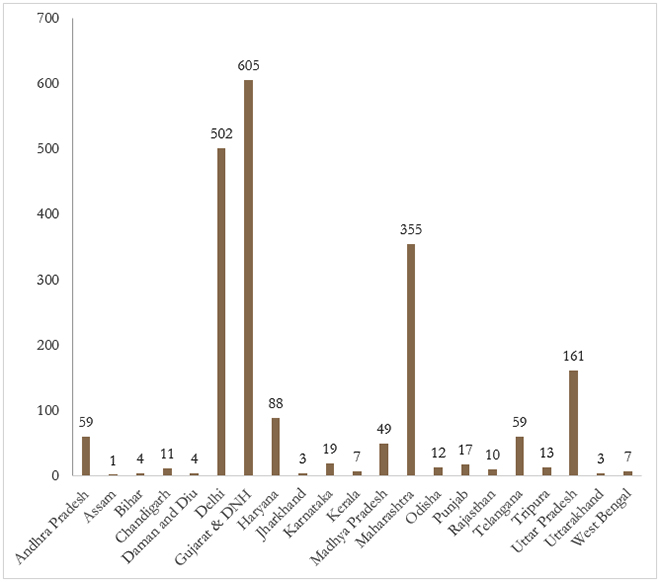

India’s LPG penetration reached 97.5 percent as on 1 April 2020, as compared to 94.3 percent recorded in the same month last year, according to a PPAC report. LPG penetration, the share of population with LPG connections, stood at 56 percent in April 2015. The country’s active LPG domestic consumers have almost doubled in the last five years, from 148.6 mn in April 2015 to 278.7 mn in April 2020. The number of non-domestic LPG consumers increased from 2.11 million in 2015 to 3.34 mn on 1 April 2020. Of the 278.7 mn active LPG consumers, 29 percent or 80.1 mn LPG consumers are beneficiaries of PMUY. PMUY, launched in May 2016, is aimed at safeguarding the health of women and children by providing free LPG connections to the woman beneficiary of poor families. The scheme was initially started for families below the poverty line, but was later extended to families above the poverty line and certain other categories. According to region-wise data by the report, northern states including Chandigarh, Delhi, Haryana, Himachal Pradesh, Jammu and Kashmir, Punjab, Rajashtan, Uttar Pradesh and Uttarakhand reported the highest LPG penetration, with all states posting more than 100 percent LPG coverage. While, eastern states including Bihar, Jharkhand, Odisha, West Bengal and Andaman and Nicobar islands collectively posted the lowest LPG coverage at 84 percent as on 1 April 2020. OMCs sold nearly 23.1 mt of LPG in 2019-2020.

Around 4,000 free LPG cylinders were distributed among beneficiaries under the centrally-run Ujjwala scheme in Doda district of Jammu and Kashmir. However, some BPL families claimed that they have not received the free refills till date, a charge denied by the concerned agency. Indane gas, a subsidiary of Indian Oil Corp, said it has reached a large section of the Ujjwala subscribers with free refills despite the lockdown.

The price of non-subsidised LPG market-price cooking gas was cut by over ₹160/cylinder. Non-subsidised LPG price was cut by a record ₹162.50/cylinder in the wake of a slump in benchmark international rates due to falling oil demand. A 14.2 kg LPG cylinder will now cost ₹581.50 in Delhi, down from ₹744, as per the price notification issued by state-owned oil firms. In Mumbai, it will now be available for ₹579/cylinder, compared to ₹714.50 earlier.

BPCL has transferred money directly to the accounts of 93,000 PMUY beneficiaries in Uttarakhand to help them get three free refills of LPG. PMUY beneficiaries are to be given three free LPG refills between April-June under the package announced by the government after the outbreak of the Covid-19 pandemic. Money was transferred directly to the accounts of 93,000 out of a total of 98,759 active PMUY customers in Uttarakhand during the month of April, BPCL state head Vineet Singh said. Free LPG refills have also been provided to 79.5 percent of these customers already and the process to reach out to the rest is on.

Strategic Reserves

India is looking at storing some low priced US oil in facilities there as its local storage is full. India’s plan could be similar to a move by Australia, which said it would build up an emergency oil stockpile initially by buying crude to store in the US Strategic Petroleum Reserve to take advantage of low oil prices. India which is the world’s third biggest oil consumer and importer, had already filled its 5.33 mt of strategic storage and parked about 8.5-9 mt of oil on ships in different parts of the world, primarily in the Gulf. Indian refiners have also filled their commercial tanks and pipelines with refined fuel and oil. Stored oil and products amounted to about 20 percent of India’s annual needs. India imports more than 80 percent of its oil requirements. India plans to build new strategic storage to expand capacity by 6.5 mt. India was keen to have participation from global investors in building these facilities. India’s fuel demand nearly halved in April to its lowest level since 2007 as a nationwide lockdown and travel curbs to combat the spread of novel coronavirus eroded economic activity. So far in May India’s petrol and diesel demand is about 60-65 percent of what it was in the same month last year and in June fuel consumption will return to the same level as June 2019.

Refining

With the rising consumption of petrol and diesel, state-run refiners IOC and BPCL have ramped up capacity utilisation at their refineries — the former to 60 percent and the latter to 52 percent. Petrol and diesel usage in the first 10 days May was up 68 percent and 74 percent, respectively, from the corresponding period in April. Domestic consumption of petroleum products in April, when the lockdown to contain the spread of coronavirus was implemented throughout the month, fell 46 percent y-o-y to 18.3 mt. Throughout the lockdown period, the company had kept all its refinery units on ‘hot standby’, which means the units were ready for scale-up whenever petrol and diesel demand picks up. The total refining capacity of the country is 249.4 mtpa and of this 69.2 mtpa is run by IOC. According to provisional data by the government’s PPAC diesel usage fell 54.8 percent y-o-y to 3.3 mt in April, while demand for the ATF fell 91.3 percent to 56 thousand tonne in the month. Petrol consumption fell 60.4 percent to 973 thousand tonne in April. Consumption of bitumen, mostly used in road construction, dropped 72 percent y-o-y to 196 thousand tonne. Rising consumption in May is a positive development for the Union government, which has sharply increased auto fuel taxes by ₹10/litre on petrol and ₹13/litre on diesel earlier this month. In mid-February, the Centre had hiked the tax on both these fuel by ₹3/litre. To shore up more revenues, at least 14 states have also hiked their own taxes on fuels since the start of Covid-19 lockdown. According to analysts, marketing margins for OMCs have gone down to the extent the duties have been increased by the government.

IOC is close to winning its first contract to supply diesel, jet fuel and gasoline in the second half of this year to Bangladesh Petroleum Corp. IOC mostly stays away from participating in the term tenders for fuel exports as the refiner sells most of its fuel in the local market, besides supplying its retail outlets in Nepal and Bhutan. Bangladesh Petroleum had sought bids for imports of 870,000 tonnes of gasoil with sulphur content of no more than 500 parts per million, 120,000 tonnes of jet fuel, 20,000 tonnes of 180-centistoke high sulphur fuel oil and 30,000 tonnes of 95-octane gasoline in a tender issued. IOC emerged as a lowest bidder for supply of up to 430,000 tonnes of diesel and 50,000 tonnes of jet fuel during July-December and 30,000 tonnes of gasoline through two equal size parcels in August and November. IOC placed premiums to Middle East quotes of $2.60/bbl for diesel and $4.48/bbl for gasoline.

Indian refiners have stored about 32 mt of oil in tanks, pipelines and on ships, taking advantage of low oil prices to help the nation cut its import. India, the world’s third biggest oil importer, buys over 80 percent of its oil needs from overseas markets. The nation has annual refining capacity of about 250 mt. However, travel restrictions and curbs on industrial activity to stem the spread of Covid-19 have hit fuel consumption and crude processing in the country. India has also diverted some of the state refiners’ excess oil to fill the 5.03 mt strategic petroleum reserves, helping companies which are struggling to find storage avoid charges for delays in offloading fresh cargo deliveries. The companies have parked 7 mt of oil in floating storage and 25 mt in pipelines and storage tanks as oil prices plunged, he said. The nationwide lockdown, among the world’s strictest, is being relaxed in some areas with fewer infections, although it will last until 17 May. The measure was adopted and extended twice. Indian demand for gasoil and gasoline started to recover in the second half of April.

IOC’s mountain of debt, which has grown a third in a year to ₹1,160 bn, will start diminishing on an expected revival of fuel demand after the easing of lockdown and as benefits of cheaper crude start flowing in. Gross debt at IOC, the nation’s largest refiner and fossil fuel retailer, has risen from ₹864 bn at the beginning of 2019-20 to ₹1,160 bn at the start of 2020-21, the company said. The debt had actually fallen at the end of December 2019 to ₹757 bn, according to the oil ministry data. About 50 percent jump in debt in the January-March quarter came following the weakening of demand due to the coronavirus pandemic, dividend outflow and delay in fuel subsidy transfer by the government. In April too, IOC and other refiners borrowed heavily to meet their expanded working capital needs. Just on 30 April, IOC sold commercial papers worth ₹70 bn. Besides, the government has begun transferring fuel subsidies to state refiners, which would further improve cash position. In April, the government paid IOC about ₹17 bn of the ₹130 bn due on account of cooking gas and kerosene subsidy for the year 2019-20. The pandemic hasn’t altered IOC’s capital spending plan of ₹260 bn for the current fiscal year. The government has eased nationwide lockdown in much of the country, which is expected to recover demand that had fallen by a record 61 percent and 56 percent for petrol and diesel, respectively, in April from a year earlier.

IOC the country’s largest fuel retailer, intends to operate its oil refineries at 80 percent capacity by end of May in anticipation of increased demand during the month. With the demand for petroleum products gradually picking up, IOC has re-started several process units at its refineries that were down due to the lockdown. The refineries were operating at full capacity before the lockdown but had to curtail throughput and bring operations down to nearly 45 percent of capacity by the first week of April in response to a steep decline in demand. IOC has also resumed manufacturing of petrochemical intermediates in anticipation of increased demand.

Retailing

According to Fitch ratings standalone credit profiles of India’s oil marketing companies are at greater risk of downward revision due to the coronavirus-induced drop in demand and refining margins and their continued investments. However, the Issuer Default Ratings of IOC, BPCL and HPCL which are driven by sovereign linkages through the state’s direct or indirect ownership, will remain stable. According to Fitch the FY20 financial profiles of the three companies were likely to have been affected by large inventory losses due to the steep fall in crude oil prices in the last fortnight of March 2020 and by weakened demand during the period. Fitch cut its FY21 forecast for industry-wide GRM by around 35 percent as it expects product cracks (or margins) to remain weak until global economic growth recovers materially from the coronavirus crisis. It expected FY21 GRMs to remain at around FY20 levels excluding inventory losses in March 2020, due to weak product spreads, which are expected to improve gradually from the second half of FY21 as demand gradually recovers. The squeeze on GRMs should be partly offset by the reduced value of refining fuel losses due to low crude oil prices. FY21 should also see lower subsidy accrual on LPG sales given the fall in international LPG prices.

CGPDDA has sent a letter to oil marketing companies seeking help for fuel retailers. The association has said that petrol pump owners are facing losses and they need support from the companies or the government for their survival. The letter states that the oil companies have recovered their inventory losses and the central as well as the state governments too have increased their taxes and duties to cope up with the loss of revenue. CGPDDA has sought compensation or support from the government for their losses.

Pune-based energy distribution startup, Repos Energy plans to manufacture and sell around 3,200 mobile petrol pumps in the current financial year. The company said it also plans to get on board over 1,200 operators from across the country during FY20-21. The startup is backed by Ratan Tata, Chairman Emeritus of Tata Group, who came on board as a mentor along with Tata Motors who have helped in making these Repos Mobile Petrol Pumps safe and efficient.

Policy & Governance

Government may revive plan for further consolidation in the public sector oil companies by allowing mergers between producing, marketing gas transportation and consultancy companies leaving just few large integrated entities in operation. The expected move is in line with the announcement to privatise most non-core public sector enterprises while leaving just one or maximum of four in core strategic sectors and allow private investments in all areas. So, after 2018 merger of PSU oil refiner and retailer HPCL with upstream major ONGC the government may now look at creating another public sector integrated 'oil behemoth' by considering merger upstream oil producer Oil India Ltd with IOC. Moreover, after proposed split of gas transportation company GAIL (India) Ltd into two, one of the entities in gas marketing may also be considered for merger with IOC. Public sector oil refiner IOC has also in the past shown its interest to buyout government equity in BPCL but PSUs are not allowed to bid for BPCL that is currently tried for strategic sale to the private sector global companies. Sources indicated that IOC’s case for BPCL may also be considered if proposed bidding for BPCL fails to evince requisite interest.

Rest of the World

Global Demand Trends

A fifth of global demand for oil will disappear this quarter. All three of the major forecasting agencies now agree that the world faces its biggest-ever slump in oil consumption, after governments imposed movement restrictions on billions of people to combat the coronavirus. The scale of the demand hit means that despite producers implementing unprecedented output cuts, stockpiles will soar this year. The IEA, OPEC and the US EIA have all updated their oil market forecasts in the past week and they have come into much closer alignment in their views of the depth of demand destruction. The pessimistic stance adopted last month by the IEA has now become the consensus view — the world will use about 1.7 bn bbls less oil this quarter than it did during the same period last year. In reports, the EIA and OPEC both saw demand falling by about 12 mn bpd in the second quarter, compared with the same period last year. The IEA alone forecast a drop in excess of 20 mn bbls a day. It has since become a little more optimistic, as lock-downs are eased and businesses gradually begin to reopen. But the other two forecasters have moved sharply in the opposite direction, seeing much more demand destruction than they did a month ago and catching up with the IEA’s more pessimistic view on oil consumption. Even if oil demand returns to pre-virus levels in 2021, which remains an optimistic view, oil producers will remain under pressure while excess inventories are drawn down.

Russia

Russia’s oil output in the first five days of May fell to 8.75 mn bpd close to its production target of 8.5 mn bpd for May and June under a global deal to cut crude supplies. Global oil demand declined by around 30 percent and the fall has eased since then. However recovery to pre-crisis levels would not be achieved quickly. A group of leading oil producers known as OPEC+ including Russia and Saudi Arabia agreed to cut crude supplies to combat the fallout from the coronavirus, which has hit economic activity and demand for fuel around the world. Under the global pact, Russia has pledged to reduce its crude oil output in May and June by 2.5 mn bpd from a baseline of 11 mn bpd. In April, the month before the deal came into force, Russia produced an average 11.35 mn bpd. Russia raised oil and gas condensate output in April to 46.45 mt or 11.35 mn bpd from 11.29 mn bpd in March, before it makes cuts this month under a global supply pact. The OPEC Russia and other allied producers, a group known as OPEC+, agreed to cut their combined oil output by about almost 10 mn bpd, or 10 percent of global supply in May and June to tackle the economic fallout from the new coronavirus. The US, Norway, Canada and Brazil may add cuts that would bring the total reduction to 20 mn bpd, or 20 percent of global supply, although the coronavirus crisis has driven down demand by as much as 30 percent, driving down prices. Russia is expected to cut its oil production by 2.5 mn bpd from a baseline of 11 mn bpd in May and June. Russia’s mid-sized oil producer Tatneft said it produced 1.994 mt of oil in April, down from 2.442 mt in March. Russia’s energy ministry sees global oil demand and supply balancing in the next two months, it said. Leading oil producers are due to hold an online conference in around two weeks on how to further police joint efforts to steady a global oil market hammered by overproduction and a demand drop linked to the coronavirus pandemic. The ministry said supply has already dropped by 14 mn to 15 mn bpd thanks to the OPEC+ deal and output cuts in other countries. Russian oil production volumes were near the country’s target of 8.5 mn bpd for May and June.

USA

The US has dispatched a shipment of oil to Belarus, which is seeking to diversify its supplies after a price dispute with Russia, the Belarusian government said. The 80,000-ton shipment is expected to arrive at the Lithuanian port of Klaipeda in June and from there will sent by rail to Belarus. Belarusian President Alexander Lukashenko accused the Kremlin of using oil supplies as leverage to push for an eventual merger of the two countries. Russia and Belarus later reached a compromise agreement and Russian state oil company Rosneft said it expected to ship about 9 mt to Belarus this year - about half the amount Belarus had bought in previous years.

Exxon Mobil has relaunched the sale of its stake in Azerbaijan’s largest oilfield. The move was drawing interest from large Asian oil and gas companies seeking to capitalize on the recent collapse in oil prices. The top US oil and gas company first tried to sell its 6.8 percent stake in the Azeri-Chirag-Gunashli field in the Caspian Sea in 2018, as rival Chevron launched the sale of its own 9.57 percent stake in the field. Exxon’s process, run by Bank of America Merrill Lynch, was recently relaunched despite oil prices halving to around $30/bbl after a historic collapse in oil consumption due to coronavirus-linked lockdowns that restricted people’s movement.

Middle East & Africa

Oil futures climbed in early trade, boosted by an unexpected commitment from Saudi Arabia to deepen production cuts in June to help drain the glut in the global market that has grown as the coronavirus pandemic crushed fuel demand. Saudi Arabia said overnight it would cut production by a further 1 mn bpd in June, slashing its total production to 7.5 mn bpd, down nearly 40 percent from April. The UAE and Kuwait committed to cut production further, promising to cut another 180,000 bpd altogether.

Saudi Aramco, the world’s largest oil exporter, has cut the volume of crude it will supply to at least three buyers in Asia by 10-30 percent for June. The cuts were made against volumes that the buyers had nominated for June-loading supplies. The move came after Saudi Arabia announced it would voluntarily deepen oil output cuts by additional 1 mn bpd from June to an output level of 7.492 mn bpd, the lowest in almost two decades. The announcement followed a deal struck by OPEC and its allies including Russia to cut output by an unprecedented 9.7 mn bpd in May and June to reduce excess supply and support prices. Market sentiment regarding the tightening of Aramco’s crude supplies propped up Asia’s spot market for Middle East sour crude as some sellers doubled or even quadrupled their offers from the last trade levels. Saudi Arabia’s crude oil exports in May are expected to drop to about 6 mn bpd, the lowest in almost a decade, and domestic refining output is likely to fall as the coronavirus crisis hits demand. The world’s top oil exporter will cut crude production by 23 percent to about 8.5 mn bpd in May and June, under a supply reduction pact with OPEC+ alliance to shore up prices hammered by demand destruction due to the coronavirus-related lockdowns. Saudi crude oil exports for May are expected to be about 6 mn bpd, with Asia taking about 4 mn bpd. Exports to the United States are seen at less than 600,000 bpd. Saudi refineries, which usually process about 2.4 mn bpd of crude, were likely to use less as product demand falls.

BPGIC has leased oil storage facilities in the UAE to France’s Total, industry sources familiar with the matter said, as global crude storage rapidly fills up. The company is leasing six storage tanks in the UAE emirate of Fujairah for six months and this could be renewed for another six months. The tanks, which store oil products, have already received initial cargoes. Global oil storage is filling swiftly as lockdowns to halt the spread of the coronavirus pandemic hammer consumption, driving down global demand for crude and its products, such as gasoline, diesel and jet fuel, by as much as 30 percent. UAE-based BPGIC, established in 2013, plans to expand its storage capacity for crude and oil products to around 3.5 mcm from 1 mcm.

Iran said it will retaliate if the US takes action against fuel deliveries to Venezuela. Describing Iran-Venezuela trade relations as legal Iran said that any coercive measures by the US are a threat to freedom of shipping, international trade and free flow of energy.

An English court threw out a $1.1 bn case Nigeria had brought against Royal Dutch Shell and Eni related to a dispute over the OPL 245 oilfield, saying it had no jurisdiction, a court document showed. The Nigerian government filed the case in 2018 at a commercial court in London alleging payments made by the companies to get the OPL 245 oilfield licence in 2011 were used for kickbacks and bribes.

Asia

At least three more ships loaded with gasoline are now anchored off Malaysia and Singapore, Asia’s top oil trading centre, taking the total volume of petrol sitting in the region to more than 280,000 tonnes (2.4 mn bbls). Oil demand across the world has slumped as governments restricted people movements to curb the spread of the coronavirus, prompting sellers and traders to store all types of excess oil onboard ships. Ship tracking data from Refinitiv Eikon showed the gasoline onboard Trafigura’s ships came from India and South Korea, while Equinor is storing gasoline from its refinery in Norway. According to data intelligence firm Kpler, the volume of clean petroleum products - gasoline, diesel and jet fuel - being stored at sea around Singapore is on the rise. A total of 10.73 mn bbls of these fuels were contained on floating storage vessels, an increase of 97 percent from 5.44 mn bbls on 28 April, Kpler said. Kpler said that 2.55 mn bbls of gasoline are now on the water, on top of nearly 1.96 mn bbls of jet fuel, two types of oil products that are not traditionally stored on ships unlike diesel.

Asian refining margins for jet fuel turned positive for the first time in a month and European margins rose to the highest level in three weeks, bolstered by deep supply cuts and an uptick in flights in regional markets. The jet fuel refining margin in Singapore flipped to $1.83/bbl above Dubai crude, in positive territory for the first time since 20 April. Measures imposed to curb the spread of the coronavirus have caused jet fuel demand to plunge since February, leading to refining losses of as much as $7.23/bbl on 5 May. China Aviation Oil has been bidding for jet fuel cargoes in the Singapore physical trade window this month, scooping 245,000 bbls, which represents half of the traded volumes in an otherwise subdued market. In Europe, refinery shutdowns, particularly in the Mediterranean, had led to a reduction in prompt jet fuel cargo offers, propping up prices. A number of refineries have cut their jet fuel runs in favour of diesel and gasoline production, which still have stronger margins.

China

Chinese financial investors betting on a rebound in oil prices are filling commercial storage tanks held by the Shanghai futures exchange just as fast as the exchange can find them. Despite a more than doubling of storage capacity over the past six weeks to 57 mn bbls, with tanks sourced from state and private refiners, nearly all existing storage is set to be filled by end-June. The flood of purchases has come from companies little-known to the oil industry which have been bidding up Shanghai futures, China’s only oil futures contract, since early April when global oil prices slumped as Covid-19 hammered demand. The buying pushed Shanghai crude futures prices above global benchmark Brent, encouraging state companies like Sinopec, PetroChina and Zhenhua Oil to deliver Middle East crude into the contract.

S America

The replacement rate of proven oil and gas reserves estimated by Mexican national oil company Pemex soared in 2019 compared to the previous year, according to the firm’s annual filing with the US SEC. Pemex’s 2019 replacement rate, a measure of new discoveries compared to ongoing production, jumped to 120.1 percent due to new discoveries and revisions. Loss-making and heavily-indebted Pemex has been dealt a further blow in recent months by the drastic drop in oil prices. But its replacement rate was helped by discoveries of six new fields, four of them in shallow water in the Gulf of Mexico, both with gas and crude. As of March, the most recent figures available, Pemex’s crude production averaged 1,992 mn bpd, including with partnerships. But 1,745 mn bpd without partners. The oil company expects to produce an average of 1,867 mn bpd of crude in 2020, according to the document sent to the SEC. Pemex announced first-quarter losses of $23.6 bn (562.13 bn peso), likely the company’s biggest ever quarterly loss as the Covid-19 pandemic cratered demand for crude oil globally.

Europe

The Norwegian government has sharply cut its crude oil price forecast and the expected cash flow it will receive from the oil and gas industry after global demand plunged, its revised 2020 fiscal budget showed. Norway is Western Europe’s largest oil and gas producer, with the industry accounting for about 40 percent of its exports and about a fifth of the state’s revenues. Brent crude fell below $16 a bbl on 22 April, its lowest level in more than two-decades, although it has started to rebound amid production cuts and some signs of demand picking up as countries ease Covid-19 related lockdowns. Norway expects net cash flow from the oil industry to the government of 97.8 bn crowns ($9.53 bn) this year, down from the 245 bn predicted in the original draft budget in October. The Norwegian Oil and Gas Association, an industry lobby group, said the government’s proposal was not sufficient to spur investment in new projects however, and called on parliament to do more. The government cut its oil price assumption for 2020 to 331 Norwegian crowns ($32.17) per bbl from a forecast of 476 crowns last October. It assumes the oil price will be only slightly higher at 353 crowns per bbl in 2021. Norway has agreed to cut its oil output from June until December, following the cuts agreed by the OPEC+ group of oil producing nations, which also affects the state’s income.

A consortium led by Spain’s Repsol including Germany’s Wintershall DEA and Thailand’s PTTEP have discovered two deepwater oil fields in the Gulf of Mexico. Mexico has slammed the breaks on the energy market liberalization and has pursued a more nationalist energy agenda that limits the participation of the private sector. The consortium said that the find was in the Polok-1 and Chinwol-1 wells, located in Block 29 of the Salina Basin, off the southeastern states Veracruz and Tabasco. The consortium said it would evaluate the data from the two wells to prepare an exploration plan that will better determine the size of the finds to be presented before the end of the year to the regulator, the National Hydrocarbons Commission.

| VAT: Value Added Tax, bbl: barrel, mn: million, bn: billion, GST: Goods and Services Tax, UP: Uttar Pradesh, OMCs: Oil Marketing Companies, UT: Union Territory, ASSOCHAM: Associated Chamber of Commerce and Industry of India, bpd: barrels per day, IEA: International Energy Agency, ATF: aviation turbine fuel, LPG: liquefied petroleum gas, IOC: Indian Oil Corp, ONGC: Oil and Natural Gas Corp, OID: oil industry development, NELP: New Exploration Licensing Policy, mt: million tonnes, PMUY: Pradhan Mantri Ujjwala Yojana, BPL: Below Poverty Line, kg: kilogram, BPCL: Bharat Petroleum Corp Ltd, US: United States, y-o-y: year-on-year, mtpa: million tonnes per annum, PPAC: Petroleum Planning and Analysis Cell, HPCL: Hindustan Petroleum Corp Ltd, FY: Financial Year, GRMs: gross refining margins, CGPDD: Central Gujarat Petrol and Diesel Dealers’ Association, PSU: Public Sector Undertaking, EIA: Energy Information Administration, OPEC: Organization of the Petroleum Exporting Countries, BPGIC: Brooge Petroleum and Gas Investment Company, UAE: United Arab Emirates, SEC: Securities and Exchange Commission |

NATIONAL: OIL

India’s petrol, diesel sales improve in May, full recovery months away

1 June. India’s gasoline and gasoil sales jumped sharply in May compared with April, in a recovery from historic lows after a partial easing of the lockdown imposed to curb the coronavirus pandemic, provisional sales data from state fuel retailers showed. But industry analysts expect a full-scale recovery to pre-Covid-19 consumption levels in India to be months away as the monsoon season approaches while manufacturing activities remain low and transportation demand takes a hit in some parts of the country. State-retailers’ gasoline sales in May rose by about 83 percent from April to about 1.6 million tonnes (mt). Sales of gasoil, which accounts for about two-fifths of the country’s overall fuel sales, rose by about 69 percent in May compared with April to 4.8 mt, data showed. However, gasoline and gasoil sales in May are still down by about 36 percent and 31 percent respectively from a year earlier, after contracting more than 50 percent in April year on year. State companies Indian Oil Corp (IOC), Hindustan Petroleum Corp Ltd (HPCL) and Bharat Petroleum Corp Ltd (BPCL) own about 90 percent of the retail fuel outlets in India. Sales of liquefied petroleum gas (LPG) rose 13 percent in May from a year ago while jet fuel declined by 85 percent during the same period. Fitch expects India’s 2020 diesel demand to decline by 14 percent from a year ago, and sees a full-scale recovery in fuel demand in 2021-2022.

Source: The Economic Times

Petrol, diesel to cost ₹2 more as Maharashtra hikes cess

1 June. Petrol and diesel prices will increase by ₹2 from 1 June, following the state government decision to hike the cess levied on the two fuels. Petrol price in the city will increase to ₹78.31 per litre from ₹76.31. The diesel retail rate will go up to ₹68.21 per litre from ₹66.21. Besides the 26 percent and 24 percent Value Added Tax (VAT) on petrol and diesel, respectively, the state government levies a cess on the fuels. The government issued a notification increasing the cess for petrol to ₹10.12 per litre from ₹8.12. The cess on diesel is to rise to ₹3 per litre from ₹1. A member of an association of petrol dealers said that after the rate changes the price of diesel in the state would be higher than in neighbouring states like Karnataka. Tax collection from petrol and diesel had dipped heavily in the Covid-19 lockdown over the past few months.

Source: The Economic Times

India oil import bill falls 10 percent to $101 bn in FY20

29 May. At least in the oil sector, the global health emergency posed by the spread of the novel coronavirus has come to the country’s advantage. India’s oil import bill has fallen close to 10 percent in FY20 as the increasing spread of coronavirus and demand squeeze globally has depressed the crude oil prices to about 30 a barrel now against a high of over $ 70 a barrel in September and again in January this year. According to provisional data from Petroleum Planning and Analysis Cell (PPAC), in FY20 India’s oil import bill slipped to $ 101.4 bn from a level of $ 111.9 bn in previous fiscal FY19. The lower import bill last year came even as quantum of imports increased marginally to 227 million tonnes (mt) from 226.5 mt reported in the previous fiscal. The fall has come mainly on account of generally lower crude oil price in FY20 with the sharp decline of over 50 percent witnessed in March. The low oil price of around $20 a barrel in April, and expectation that crude may average between $30-40 a barrel in FY21, country’s oil import bill could reach its all time low levels in many many years in current fiscal. The potential is it could fall to $ 64 bn in FY21, the same as FY16 when crude prices slipped below $26 a barrel. Crude production in India has stagnated around 35 mt for the past decade. In FY19, domestic crude production has dropped to 34.2 mt from 35.7 mt in the previous year and it has further dropped to 32.2 mt in FY20. Despite best efforts of the government, domestic oil production has not increased.

Source: The Economic Times

Government extends BPCL privatisation bid deadline to 31 July

28 May. The government has for the second time extended the deadline for bidding for privatisation of India’s second-biggest oil refiner Bharat Petroleum Corp Ltd (BPCL) by over a month to 31 July. While the Cabinet had in November last year approved the sale of government’s entire 52.98 percent stake in BPCL, offers seeking Expression of Interest (EoI), or bids showing interest in buying its stake, were invited only on 7 March. The EoI submission deadline was 2 May, but on 31 March it was extended up to 13 June. BPCL will give buyers ready access to 14 percent of India’s oil refining capacity and about one-fourth of the fuel market share in the world’s fastest-growing energy market.

Source: Business Standard

BPCL launches LPG booking via WhatsApp

27 May. The second-largest national oil marketing company Bharat Petroleum Corp Ltd (BPCL) announced a new customer-friendly initiative with the launch of cooking gas or LPG (liquefied petroleum gas) booking through Whatsapp across the country. BPCL, which was on the sell-off block last fiscal, has over 71 mn LPG customers, making it the second-largest player after Indian Oil Corp (IOC). WhatsApp booking can be done on BPCL Smartline number -- 1800224344 -- from the customer’s mobile number registered with the company. The company is palling introducing new features like LPG delivery tracking and taking feedback from customers in the days to come apart from creating safety awareness. BPCL already allows customer to book LPG through other channels like IVRS, missed call, apps, and website among other digital channels apart from its 6,111-strong large distributors.

Source: The Economic Times

Domestic O&G companies may soon get cess and royalty relief

27 May. ONGC (Oil and Natural Gas Corp)’s per-barrel production cost is in the range of $35-40 and global crude prices have been trading at below this rate for a long time. The government is considering to lower the cess and royalty for domestic oil and gas (O&G) companies, with indigenous production becoming increasingly un-remunerative due to the huge fall in global crude prices. ONGC has now come under additional pressure with the recent slide in global crude prices. It is set to ‘adopt a balanced approach towards capital spending’, and expects the government to take favourable policy measures to boost the company’s performance. ONGC’s per-barrel production cost is in the range of $35-40 and global crude prices have been trading at below this rate for a long time. The price of domestic gas has also been slashed 26 percent to $2.39 per million metric British thermal units (mmBtu), whereas ONGC’s output cost is around $3.8-6.6 per mmBtu in various fields. The cess on crude production (value) is 16.7 percent, while royalty charged is 15 percent.

Source: The Financial Express

NATIONAL: GAS

CNG price in Delhi hiked by ₹1 per kg

2 June. CNG (compressed natural gas) price in the national capital and adjoining cities was hiked by ₹1 per kg to make up for the additional cost incurred to keep stations coronavirus ready. Indraprastha Gas Ltd (IGL), the firm that retails CNG to automobiles and piped natural gas to household kitchens, revised CNG price in the national capital “from ₹42/ kg to ₹43/ kg, w.e.f. 6 am on 2 June 2020”. The company had last cut CNG price by ₹3.2 per kg and piped natural gas rate by ₹1.55 per unit from 3 April. The nationwide lockdown imposed from 25 March saw fuel sales drop by as much as 90 percent but relaxations thereafter have not helped demand recover to pre-Covid levels. Despite the drop in sales, the company continued to incur expenditure on paying salaries, fixed charges for power connections, maintenance of equipment and rent. CNG rate in Karnal district of Haryana was hiked to ₹50.85 per kg (kilogram) and that in Rewari to ₹55 a kg from ₹54.15.

Source: Hindustan Times

Indian Oil buys LNG cargo for late June delivery

1 June. Indian Oil Corp has bought a liquefied natural gas (LNG) cargo for delivery in late June. IOC bought the cargo from Emirates National Oil Company (ENOC) at about $2 per million metric British thermal units (mmBtu) for delivery into Dahej on 28 June.

Source: Reuters

Probe blames safety lapses for deadly India gas leak

1 June. A committee appointed by India’s top environmental court has blamed "gross human failure" and lack of basic safety norms for a gas leak in a South Korean-owned chemical factory that killed 12 people and sickened hundreds. The committee said the tanks from which the gas leaked 7 May at the LG Polymers plant in Vishakhapatnam, a port city in Andhra Pradesh state, were outdated and lacked temperature sensors.

Source: The Economic Times

Oil Minister dedicates 56 CNG stations to the nation

29 May. Oil Minister Dharmendra Pradhan dedicated 56 CNG (compressed natural gas) stations to the nation. These stations are spread over 11 states and Union Territories (UTs). He said that the country is moving towards gas based economy. The number of PNG stations has gone up from 25 lakh to 60 lakh; 28 thousand industrial gas connections have risen to 41 thousand, and number of CNG vehicles has gone up from 22 lakh to 34 lakh. He said that it is a matter of satisfaction that besides the Public sector, private companies are whole-heartedly taking part in the expansion of gas infrastructure in the country. He said that the government has already started mobile dispensers for diesel, and would like to expand the same for petrol and LNG. He said that people would be able to get the home delivery of the fuel in future.

Source: The Economic Times

NATIONAL: COAL

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Use of domestic coal will improve terms of trade!

< style="color: #ffffff">Good! |

Government increases tenure of coking coal supply for non-regulated sector

2 June. The government has increased the tenure of coking coal supply to up to 30 years under the coal linkage granted in auction for non-regulated sector like steel. The development comes at a time when Coal India Ltd (CIL), which accounts for over 80 percent of the domestic fuel output, is connecting with non-regulated sector for domestic coal which is available in abundance in the country. The country on the one hand has abundance of domestic coal, while on the other hand there is a slump in demand of the dry fuel. To boost coal demand, the government has announced a slew of measures like increased supply for linkage consumers. It has also announced several relief measures for CIL consumers, including the power sector. Coal Minister Pralhad Joshi had earlier written to state Chief Ministers asking them not to import the dry fuel and take the domestic supply from CIL. The Centre had asked generating companies, including NTPC Ltd, Tata Power, Reliance Power to reduce the import of the dry fuel for blending purposes and replace it with domestic coal.

Source: The Economic Times

Coal India’s May sales driven sharply lower by slump in power demand

1 June. Coal India Ltd (CIL)’s sales fell 23.3 percent in May as utilities refrained from purchases amid record stockpiles and tepid demand because of a nationwide lockdown to curb the spread of the coronavirus. Offtake by customers, such as power generators, fell to 39.95 million tonnes (mt) in May, down 23.3 percent year on year, though that represented a slight improvement from the 25.5 percent fall in April. May production fell 11.3 percent to 41.43 mt, compared with a 10.9 percent fall the previous month.

Source: Reuters

17 independent power producers to forgo imported coal for domestic supply

31 May. Responding to the Centre’s new scheme to reduce import of coal, 17 independent power producers have applied to forgo their imported coal quantity, replacing it with supply from Coal India Ltd (CIL). Adani Power, GMR Energy, Avantha Power, Lalitpur Power, and Vedanta are some of the private companies that have applied for the ‘import substitution’ scheme of the Centre. These units totalling 22,450 MW have cumulatively requested for 17.9 million tonne (mt) of coal from CIL to substitute their imported capacity. This quantity is over and above the amount of coal these units already get from CIL under the fuel supply agreement (FSA).

Source: Business Standard

No approval for coal mining in sanctuary: Assam

30 May. A day after the Gauhati High Court admitted a public interest litigation petition challenging the National Board of Wildlife’s approval for coal mining in an elephant reserve in eastern Assam, the State government asserted that it has not approved mining in the area. The sanctuary, often referred to as ‘Amazon of Assam’ because of its sub-tropical rainforest, and the Saleki Proposed Reserve Forest where mining has been approved, is a part of the Dehing Patkai Elephant Reserve straddling Tinsukia, Dibrugarh and Sivasagar districts.

Source: The Hindu

Bright spark for PSPCL as Centre removes ‘washed coal’ condition

28 May. Punjab State Power Corp Ltd (PSPCL) has got a major relief as the Union government has done away with ‘washed coal’ condition for power plants. With this, the PSPCL will save at least ₹4 bn per annum, besides it gets a breather in a contempt petition filed by private thermal plants, seeking ₹28 bn coal washing charges from the corporation. It will bring down the power-generation cost in Punjab. Private power plants and PSPCL were caught in a legal battle over coal washing charges.

Source: Hindustan Times

Mahanadi Coalfields posts 42.6 percent growth in top soil removal

27 May. Coal India Ltd (CIL)’s Odisha-based subsidiary Mahanadi Coalfields Ltd (MCL) reported a 42.6 percent growth in top soil removal from coal seams during the current fiscal up to 25 May 2020 against the corresponding period last year. Highest among all coal producing companies, the subsidiary cleared 27.51 million cubic metres of top soil and extraneous matter till 25 May, compared to 19.29 million cubic metres during the previous corresponding period — a volume increase of 8.22 million cubic metres. Despite lukewarm demand for the dry fuel from the consuming sectors, amid Covid-19 slowdown, MCL managed to produce 20.54 million tonnes (mt) of coal up to 25 May this year, the highest among all coal companies of CIL.

Source: The Economic Times

NATIONAL: POWER

Tata Power starts managing power distribution in central Odisha

2 June. Tata Power has taken over the management of Central Electricity Supply Utility (CESU) after receiving the letter of intent from Odisha Electricity Regulatory Commission (OERC) for distribution and retail supply of electricity in Odisha’s five circles. These five circles are Bhubaneshwar, Cuttack, Puri, Paradeep and Dhenekal. As per the order issued by the Odisha Electricity Regulatory Commission (OERC) on 28 May, Tata Power will hold 51 percent equity with management control and the GRIDCO will have remaining 49 percent stake. Tata Power has committed to improve and modernise the distribution system in the five circles. The priority of the company is to improve reliability, reduce aggregate technical and commercial losses and offer good customer service. As per the agreement, the company will retain all the existing employees of CESU and will govern them by their existing policy structure. Tata Power said it will provide better opportunities and facilities to the employees to update their knowledge and skills along with exposure to best practices and cutting edge technologies as a part of change management in CESU. Tata Power has received a license for 25 years. With CESU, Tata Power aims to expand its consumer base to 50 lakh consumers from the present base of 25 lakh across Mumbai, Delhi and Ajmer.

Source: The Economic Times

In biggest reform, Government proposes to end power tariff differentiation among consumers

2 June. India proposes to end tariff differentiation between electricity consumers by charging them as per their consumption rather than on the basis of the end use of power. The Centre expects the proposal, along with other proposed National Tariff Policy amendments, will be the biggest consumer-centric reforms. Domestic power tariffs are low in India, while the industrial tariffs are among the highest in the world due to cross subsidisation. The Tariff Policy proposes six categories of consumers on voltage basis against the present 50-60 categories and sub-categories. The other proposals of the tariff policy include laying service standards for power distribution companies (discoms) including 24x7 power supply, penalising gratuitous load shedding and ban on passing on more than 15 percent of commercial losses to consumer tariffs.

Source: The Economic Times

Lakhs of power sector workers protest against Electricity Amendment Bill 2020: AIPEF

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Draft Electricity Amendment Bill equalises the unequal!

< style="color: #ffffff">Bad! |

1 June. Lakhs of power sector employees and engineers are protesting against the Electricity Amendment Bill 2020 and the government’s move to privatise power distribution companies in union territories, according to AIPEF (All India Power Engineers Federation). Finance Minister Nirmala Sitharaman had announced the government’s plan to privatise power distribution utilities in union territories. The power ministry circulated a draft Electricity Amendment Bill 2020 on 17 April 2020. According to AIPEF, power sector employees and engineers exercised their democratic right by wearing black badges and holding gate meetings in all the states and UTs (Union Territories), including Punjab, Haryana, Uttar Pradesh, Maharashtra, Gujarat, Assam, Telangana, Tamil Nadu, Andhra Pradesh, Kerala, West Bengal, Karnataka, Chhattisgarh, Jammu & Kashmir, Ladakh, among others. After the Bill is passed, farmers will have to pay a monthly power tariff of ₹5,000-6,000, while subsidized domestic consumers will have to pay at least ₹8-10 per unit for consumption of up to 300 units per month. The Bill has been notified by the power ministry at a time when all forms of meetings, interactions, discussions and protests are choked. Access to affordable electricity is a right and not a luxury and burdening farmers and BPL (below poverty line) consumers with high rates is a retrograde step.

Source: The Economic Times

Power consumption dips 14 percent to 103 bn units in May due to coronavirus lockdown

1 June. Power consumption in May declined by 14.16 percent to 103.02 bn units compared to 120.02 bn units a year ago, mainly due to low demand amid coronavirus-induced lockdown. However, the slump in power consumption has narrowed down in May to 14.16 percent from 22.65 percent recorded April in this year. The entire month of April had witnessed low power demand due to Covid-19 lockdown. According to power ministry data, the total electricity consumption was 103.02 bn units in May this year compared to 120.02 bn units in same month year ago. The peak power demand met in May stood at 166.42 GW, which was 8.82 percent less than 182.55 GW in the same month a year earlier. Similarly, the peak power demand met in April stood at 132.77 GW, 25 percent less than 176.81 GW in the same month a year earlier.

Source: The Economic Times

Indian Energy Exchange launches real time electricity market

1 June. Indian Energy Exchange has launched the much-awaited Real-Time Electricity Market (RTM) on its platform effective 1 June 2020. The real time market is an endeavour by the regulator, CERC (Central Electricity Regulatory Commission), to make the power market dynamic by enabling trade in electricity through half-hourly auctions. There will be 48 auction sessions during the day with delivery of power within one hour of closure of the bid session. The market will greatly aid the distribution utilities to manage power demand-supply variation and meet 24x7 power supply aspirations in the most flexible, efficient, and dynamic way.

Source: Business Standard

Industrial consumers in West Bengal drag power utilities to court over fixed charges

1 June. A section of industrial power consumers has taken a legal recourse against the utilities in West Bengal after their plea for relief on the fixed charges among other demands in the lockdown was rejected. The West Bengal Electricity Regulatory Commission had also paid no heed to their demands, when they approached the regulator, the high-tension power consumers claimed. The state governments such as Maharashtra, Punjab, Gujarat and Uttar Pradesh have offered some benefits to their industrial consumers and announced rebates on load-factor in electricity bills, Steel Re-Rolling Mills' Association of India chairman Vivek Adukia said. The fixed charges are an amount that consumers pay monthly to stay connected to grid, while the variable charges are calculated on the basis of units consumed. The iron and steel sector was the worst-hit as they are required to pay huge amount on account of the electricity bills, though the mills remained shut for 4-5 weeks during the lockdown. The distribution companies, however, said they cannot provide relief on fixed charges as it is a part of the current contracts and have similar agreements with the power producers. The Centre is expected to issue guidance to the central power companies including NTPC Ltd, NHPC Ltd and Power Grid Corp of India Ltd (PGCIL) advising them to defer fixed charges on electricity not drawn by distribution companies and offer rebates.

Source: The Economic Times

Power demand in Maharashtra rises to 20 GW a day

30 May. The daily peak power demand across the state has increased to over 20,000 MW from 15,000 MW with industry and commercial users resuming operations in green and orange zones. The peak power demand was 21,288 MW and the daytime demand was around 20,356 MW, according to MAHAGENCO (Maharashtra State Power Generation Company) data. During lockdown, daily power consumption was around 15,000 MW. MSEDCL (Maharashtra State Electricity Distribution Company Ltd) may face problems in cross-subsidy to low-end power users, live farmers, as revenue collection from industry and commercial users has dipped in last three months.

Source: The Economic Times

No discontinuation of free power to farmers: Punjab CM

30 May. Categorically rejecting allegations about withdrawal of free power to Punjab’s farmers, Chief Minister (CM) Amarinder Singh said his government is ready to forego the portion of fiscal deficit enhancement offered by the Centre, but would not compromise with the farmers' interest at any cost. Asserting that the free power facility for farmers would continue to exist till his government is in power, the CM said his government will take loans to bridge the fiscal deficit, and the government of India cannot dictate the terms of a sovereign loan being taken by a state government.

Source: The Economic Times

NTPC keen to buy Reliance Group’s Delhi power distribution units

28 May. India’s largest electricity generator NTPC Ltd said it was interested in buying a majority stake in Reliance Group’s power distribution assets in Delhi. Reliance Infrastructure owns a majority stake in BSES Yamuna (BYPL) and BSES Rajdhani (BRPL), which are joint ventures with the government of Delhi. The Reliance Group has been looking to cut debt by selling stakes in some of its companies. It sold its Mumbai electricity distribution business to Adani Transmission in 2018.

Source: Reuters

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

NTPC forms JV to set up waste to energy project

2 June. NTPC Ltd said it has incorporated a joint venture (JV) firm NTPC EDMC Waste Solutions for developing and operating waste to energy project. In its endeavour to transform solid waste to energy, the NTPC has collaborated with municipalities of East Delhi Municipal Corp along with Kawas, Varanasi, Indore and Mohali. The municipal solid waste is segregated and recycled to utilise combustion fraction for power generation, production of methane gas and the residue is used for construction purpose.

Source: The Economic Time

Solar manufacturers extend support to government’s Atma Nirbhar Bharat Abhiyan

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Self-reliance in solar manufacturing will reduce competiveness of sector!

< style="color: #ffffff">Ugly! |

2 June. India’s leading solar manufacturers have extended support to the government’s Atma Nirbhar Bharat Abhiyan and sought the Prime Minister’s support to provide a level-playing field for realising the full potential of the sunrise sector. Industry players such as Vikram Solar, Webel Solar, and Renewsys said the government should support manufacturing units located in Special Economic Zones (SEZs). About 63 percent of cell manufacturing capacity and 43 percent of module manufacturing facilities in India are located at the SEZs.

Source: The Economic Times

India added 989 MW solar capacity in Q1 2020

1 June. India added only 989 MW of solar power generation capacity in the first quarter (Q1) of 2020 due to Covid-19 disruption, taking the total installed capacity to 37,916 MW by 31 March 2020, according to the report titled ‘India Solar Compass Q1 2020’ by clean energy consultancy Bridge to India. It said that 1,864 MW of utility scale solar capacity was scheduled to be commissioned in Q1 2020. According to the report, the new capacity addition was split 70:30 between utility scale solar – 689 MW and rooftop solar – 300 MW. It said that the total utility scale, rooftop solar, and off-grid solar capacity stood at 32,176 MW, 5,740 MW and 978 MW, respectively, while the total project pipeline stood at 28,972 MW as on 31 March 2020. According to the report, rooftop solar has also been hit badly with only 300 MW of estimated capacity addition in the busiest quarter of the year. Power demand had begun to inch up gradually in January and February but then fell by as much as 25-30 percent towards the end of March as the lockdown took effect. It said that if demand remains depressed then renewable power prospects would be seriously affected. Despite the execution slowdown, tender issuance in Q1 was high with SECI (Solar Energy Corp of India) issuing 9,414 MW of tenders. Total tender issuance and auctions during the quarter stood at 14,293 MW and 8,241 MW, respectively, the report said.

Source: The Economic Times

2 MW solar plant commissioned at INS Kalinga

30 May. In tune with the initiative of the Union government to promote solar power and objective to achieve 100 GW of solar power by 2022 as part of the National Solar Mission, a 2 MW solar photovoltaic plant was commissioned at INS Kalinga here by Vice Admiral Atul Kumar Jain, Flag Officer Commanding-in-Chief, Eastern Naval Command (ENC). The plant, which is the largest in the ENC and has an estimated life of 25 years.

Source: The Hindu

NHPC to develop 155 MW hydro, 50 MW solar projects in Ladakh

30 May. NHPC Ltd is planning to develop three hydropower projects with a total capacity of 155 MW in Ladakh along with a solar project of 50 MW capacity. NHPC has commissioned 45 MW Nimmo Bazgo in Leh and 44 MW Chutak hydropower projects in Kargil. NHPC’s board had approved the proposal to foray into solar power business. Until now it was mainly into hydropower generation.

Source: The Economic Times

India overtakes Japan with fifth-largest hydropower capacity in the world

29 May. India has overtaken Japan becoming the nation with the fifth-largest hydropower production capacity in the world with its total installed base now standing at over 50 GW, behind Canada, US (United States), Brazil and China, according to International Hydropower Association (IHA). The London-based global hydropower trade body has just published the 2020 Hydropower Status Report and Covid-19 Policy Paper. According to data put out in the report, global hydropower installed capacity reached 1,308 GW in 2019, as 50 countries completed greenfield and upgrade projects, including pumped storage. IHA said hydropower’s flexibility services have been in high demand during the Covid-19 crisis, while plant operations have been less affected due to the degree of automation in modern facilities. IHA said the Covid-19 pandemic has underlined hydropower’s resilience and critical role in delivering clean, reliable and affordable energy.

Source: The Economic Times

ZunRoof launches ₹660 per month residential solar rooftop plan in Delhi

29 May. ZunRoof, a residential solar rooftop company, launched its monthly payment plan for installation of new residential rooftops in Delhi at ₹660 per month. All homeowners in Delhi who have roof rights for their house are eligible to apply for this plan. It said that the plan will be rolled out in other cities soon. ZunRoof will charge a nominal processing fee of ₹10,000 per kilowatt (kW). While the monthly payments will be spread over seven years, which would begin only after net metering is implemented, to allow homeowners to save cash from day one and pay for the solar rooftop installment from monthly savings.

Source: The Economic Times

Adani sees Covid-19 as opportunity for faster transition to clean energy

28 May. Billionaire Gautam Adani said Covid-19 had an immediate economic impact but the pandemic presents an opportunity to design a new and faster transition to a low-carbon future as he expects the price of solar modules to drop further. He said the urgency of a green revolution in the energy sector has gained greater importance in view of Covid-19 challenges. In January, Adani had said that his group is aiming to become the world’s largest solar power company by 2025 and the biggest renewable energy firm by 2030. Adani said the price of solar modules has dropped 99 percent over the past 40 years. Adani said the International Renewable Energy Agency (IRENA) forecasts that employment in the clean energy sector, currently at 12 mn in 2020, could quadruple by 2050, while jobs in energy efficiency and system flexibility could grow by another 40 mn.

Source: The Hindu

Tata Power plans to add 700 MW in renewable energy

27 May. Tata Power has enhanced its renewable portfolio by 7 percent to 3,883 MW and plans to add 700 MW in the near future to take the capacity to 4,600 MW. More than a third of Tata Power’s portfolio comes from clean energy. Of the 3,383 MW, 932 MW comes from wind and 1,705 MW comes from solar alone.

Source: The Hindu

INTERNATIONAL: OIL

US shale producers begin restoring output as oil prices turn higher

2 June. US (United States) shale oil producers are reversing production cuts as prices recover from historic lows, underscoring shale’s ability to quickly adjust to pricing and posing a challenge to OPEC (Organization of the Petroleum Exporting Countries) as it considers extending production curbs. US producers began cutting output in March as oil prices collapsed due to a supply glut and falling demand due to the Covid-19 pandemic. US oil companies are forecast to pare their output by as much as 2 mn barrels per day (bpd) this year, with half coming from shale fields, as prices tumbled below the cost of production. The OPEC and allies meet to consider extending an agreement to cut a record 9.7 mn bpd to offset the lost demand from the coronavirus outbreak. Analysts are easing estimates of overall US production cuts, which have ranged up to 2 mn bpd by December. Oil firms reduced planned spending on production this year by an average of a third, leading to output and job cuts across the energy sector. Consultancy Rystad Energy estimates US production will pare 1.3 mn to 1.35 mn bpd in June, down from the 1.65 mn bpd cut it had initially expected.

Source: Reuters

Nigeria launches licensing round for marginal oilfields

1 June. Nigeria has launched its first licensing round for marginal oilfields in nearly 20 years, the Department of Petroleum Resources said, despite court rulings that barred some of the fields from being auctioned. Marginal fields are smaller oil blocks that are typically developed by indigenous companies. The new licensing round is the first marginal field round since 2002, which the country hopes will boost oil output and bring in much-needed revenues from fees associated with the licences.

Source: Reuters

Turkey may start oil exploration under Libya deal in 3-4 months: Energy Minister

29 May. Turkey may begin oil exploration in the eastern Mediterranean within three or four months under a deal it signed with Libya that was condemned by others in the region including Greece, Energy Minister Fatih Donmez said. Turkish Petroleum, which had applied for an exploration permit in the eastern Mediterranean, would begin operations in areas under its license after the process was completed.

Source: Reuters

Middle East rich most cautious after oil plunge, Covid-19 crisis: Barclays

29 May. High net worth individuals in the Middle East have become the most risk averse among wealthy investors in emerging markets after being hit by the oil price crash, according to an executive at Barclays private bank. Salman Haider, Barclays Private Bank’s head of global growth markets, said risk sentiment was also down in Russia, another oil-rich economy, while appetite was subdued in India.

Source: Reuters

OPEC delivers three quarters of record oil cut in May

29 May. OPEC (Organization of the Petroleum Exporting Countries) oil output hit the lowest in two decades in May as Saudi Arabia and other members started to deliver a record supply cut, a Reuters survey found, although Nigeria and Iraq are laggards in making their share of the reduction. On average, the 13-member OPEC pumped 24.77 mn barrels per day (bpd), the survey found, down 5.91 mn bpd from April’s revised figure. OPEC and its allies agreed to an output cut to offset a slump in demand and prices caused by the coronavirus crisis. An easing of government lockdowns and lower supply have helped oil prices more than double compared with a 21-year low below $16 a barrel in April. OPEC and its allies, known as OPEC+, agreed to cut supply by a record 9.7 mn bpd from 1 May. OPEC’s share, to be made by 10 members from their October 2018 output in most cases, is 6.084 mn bpd. So far in May, they delivered 4.48 mn bpd of the pledged reduction, equal to 74 percent compliance, the survey found.

Source: Reuters

Oil prices fall as US fuel demand remains weak

29 May. Oil prices edged lower after US (United States) inventory data showed lacklustre fuel demand in the world's largest oil consumer while worsening US-China tensions weighed on global financial markets. Data from the Energy Information Administration (EIA) showed that US crude oil and distillate inventories rose sharply. Fuel demand remained slack even as various states lifted travel restrictions they had imposed to curb the coronavirus pandemic, analysts said. Saudi Arabia and some OPEC (Organization of the Petroleum Exporting Countries) members are considering extending record production cuts of 9.7 mn barrels per day beyond June, but have yet to win support from Russia.

Source: The Economic Times

INTERNATIONAL: GAS

Coronavirus demand destruction cuts US LNG exports to 13-month low

2 June. The amount of natural gas flowing on pipelines to US (United States) liquefied natural gas (LNG) export plants plunged to a 13-month low in June, a signal of weak worldwide demand due to government lockdowns to stop the spread of the new coronavirus. Worldwide LNG prices collapsed to record lows in Europe and Asia in recent weeks due to oversupply of natural gas, even though consumption has remained stronger than that of travel restriction-depressed gasoline. The amount of gas flowing to US LNG export plants fell to 3.7 billion cubic feet per day (bcfd) and was on track to fall further, according to Refinitiv data. US gas futures at the Henry Hub in Louisiana have traded higher than European benchmarks since the end of April and were expected to remain more expensive through at least September. Cheniere Energy Inc’s US LNG export terminals at Sabine Pass in Louisiana and Corpus Christi in Texas saw the biggest fall in flows. LNG feedgas flows hit a record 8.7 bcfd in February before most government-imposed lockdowns. Analysts at Energy Aspects said they expect around 125 US cargoes to be shut-in this summer.

Source: Reuters

Prices may be rising for world’s cheapest gas in Venezuela